#Electricity Bill Payments

Text

https://payrup.com/blogs/how-do-i-make-mpcz-bill-online-payment-at-payrup

0 notes

Text

3K notes

·

View notes

Text

I got a car today! 😭 I’m so relieved.

#mine#personal#and I got an email that my electric bill is normal again which basically put my entire car payment back into my budget#now I just need to find a way to cover my student loan payment 🙄 and groceries lol

11 notes

·

View notes

Text

a long time ago I ran the numbers and figured my entire family could live for 70 years with no want or need left uncovered + thousands of pesos to spend freely per month with only 1M dlls

today i saw a video of a random guy looking to buy a private jet to travel more comfortable with his models and business partners, saying he was willing to spend up to 70 million euros, so i decided to run the numbers again

even adjusted to the depreciation of the dollars (from 22 mxn to 17 mxn) and the soaring prices of living, plus a hefty 6k+ mxn per month (more than what anyone makes in this house), it'd still cover 6 entire decades of living expenses. 60 whole years.

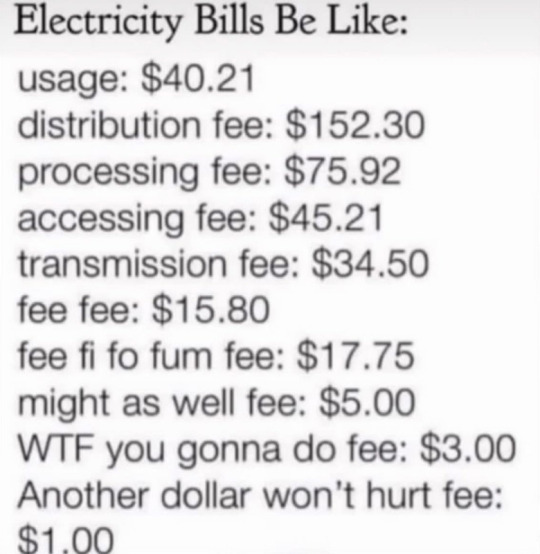

#59.something but still lol#making myself sad seems to be a hobby of mine lol#i inflated every number considerably like doubled the internet bill to get 20mb instead of 10#used the highest electricity bill we've ever gotten and rounding up that number#rounded up kitty expenses etc#plus the dollars got a few cents on 17 i think??? it's usually around 17.2-17.3 or smth lol#point still stands. literally inhumane#eat these motherfuckers#leftover money per month could even cover therapy + house payments + payments for a brand new car. and there'd be leftovers lol#btw even if i could work and add my entire salary to what we currently make we would Not make that money in that amount of time#would take at least an extra decade lol

9 notes

·

View notes

Text

starstruck makes me SO ANGRY ABOUT CAPITALISM

#starstuck odyssey#dimension 20#im watching it for the first time all the way through and jesus#it especially hits bc im dirt broke until friday#literally 400 in debt for my car from missed payments and i need to buy textbooks for the upcoming semester#and i just paid rent but i didnt pay electricity last month so thats another 175#so most of my paycheck on friday is going directly to overdue bills#its a nightmare and i just want to cry#but i have to study for the mpre next week as well

5 notes

·

View notes

Text

Emochella is setting me back girl.

#I'm very lucky that I get my next pay check before the electric bill and car insurance are due#also rent#personal#when we were young#I'm also spacing out these payments thankfully#I bought the tickets in march and the plain tickets in april and I'm paying for the hotel now#it's in las vegas so maybe I can make some of it back but I'm not gonna bet more than 50 at the casino#that's the limit I'm setting myself#I might not even do it because I'm a compulsive cheater and I don't want my teeth kicked in#maybe I'll just do slots I'm p sure you can't cheat at those

3 notes

·

View notes

Text

Top 10 Recharge & Bill Payment Websites in India

There was a time when people used to visit recharge shops to recharge their mobile numbers. At that time, people take a good amount of time from their busy schedule to visit their nearest recharge shops 2-3 days before the day of recharge. That shopkeeper charges an amount of money for his services based on the recharge amount. And for utility bills like electricity bills, gas bills, water bills, landline bills, etc., people used to stand in long queues. But now that those days are gone, certain websites and apps enable you to make all these payments with a click of the mouse. The best thing about these websites is that they can be utilized for the payment of most service providers in the country. You can pay all your bills on these websites, including electricity bills, water bills, DTH, post-paid bills, piped gas, WIFI bills, credit card bills, and even make prepaid recharges that include mobile recharges, FasTag, data cards, and others. So, nowadays, these recharge websites are in trend as well as easy to use and time-saving. Along with these benefits, it also provides the benefit of lucrative deals, offers, and cashback from time to time.

So, we present you with the list of the top 10 recharge websites and apps in 2022.

· EaseMyDeal- You must be wondering why we have kept EaseMyDeal on top. Well, EaseMyDeal is an ISO Certified Platform that is made in India that assures safety and reliability to its customers. We must advocate for local businesses and support Indian start-ups. It has an easy-to-use app interface that has a multilingual support system. It is the best not only in terms of its services but also because it has the best customer support. All the queries or complaints are answered within 24 hours. It also offers 24/7 Premium Support via WhatsApp, phone, and email. It has a fast, secure, and safe payment system that never stores payment details with them and has all the payment options that also include Pay Later Options, EMI, and Multiple Reward Points. It provides instant refunds and the fastest complaint resolution. On top of that, the reason why it has gained so much publicity in a very short time is that it provides the best cashback and deals on all payments made on EaseMyDeal. It is so good that it has a very high Google rating of 4.9/5.

· Paytm- It is also known as Cashless Haven for Online Payers. Paytm is used by Indian people to transact daily, from a small grocery shop to a big mall or movie hall. Paytm is running everywhere now, from village small shops to urban big malls. Paytm is also the premium site for adding bill payment, mobile recharging, booking movie tickets, booking taxi and airline tickets, and a lot more. There is no end to Paytm services. Any service you think of is available on Paytm. It is one of the best platforms that runs on Windows, iPhones, Androids, etc.

· MyAirtel - MyAirtel Appis one of the bestapps for all online recharges, bill payments, BHIM UPI transactions, mobile banking, and much more. It allows its users to pick any prepaid or postpaid mobile plan that suits them best. The best thing about this app is that it provides the best offers and cashback on all recharges. It even provides OTT subscriptions at discounted rates as well.

· Freecharge: Freecharge is the most favored payment channel. Freecharge offers recharge for prepaid mobile phones, post-paid mobiles, DTH, and data cards. It offers online wallet features for all users. It allows its users on Android to send and receive money via WhatsApp too. Freecharge allows you to get cashback and shopping coupons for the same price that has been paid to get the recharge done. Those coupons include McDonald’s, Barista, Shoppers Stop, Café Coffee Day, Croma, Puma, etc.

· Dealmegood - Dealmegood is one of the best websites thatprovides DTH recharges andshopping vouchers at various discount rates. Those shopping vouchers include fashion, food, travel, entertainment, and others. It not only provides shopping vouchers but also provides mobile and DTH vouchers as well. It is the most useful website where you can buy vouchers at discounted rates and use them to gift any of your friends on their birthdays or anniversaries. And it is the best and most useful gift for anyone. To have a close look at what they offer and what the relevant prices are, you can visit DealMeGood.

· MobiKwik - Mobikwik is a quick way to make online recharges and payments. It is a mobile wallet as well as an online payment system to store money and make payments. It is an online platform for prepaid mobile recharges, utility bill payments, DTH recharges, or shopping at listed outlets. It also provides a door-stop service where they collect money from your house and add it to your MobiKwik Wallet. It is a semi-closed wallet that is authorized for use by the Reserve Bank of India. It is one of the top recharge Websites in India.

· Amazon Pay - Amazon is the one-stop solution for all your shopping needs. It provides online services for prepaid recharges, post-paid bill payments, gas, landline, mobile, electricity, and broadband bill payments. Not only do these services exist and what you can think of, but Amazon also has that service that includes grocery shopping, clothes shopping, luxury items, and phones. It has a closed wallet as well, so you can make instant payments anywhere in India. It even provides cashback on recharges as well.

· Phone Pe - Phone Pe is a normal app that can be easily downloaded from the Play store. Phone Pay is a normal app that can be used to pay money to someone. The money you transfer gets automatically deducted from your linked bank account, and the money you receive gets deposited into your linked bank account. It does not have any wallet facilities. It can normally be used to recharge your mobile, DTH, cable TV, FasTag, and all other bill payments. Apart from that, you can buy brand vouchers, magazine subscriptions, FasTag, and even make donations as well. So, all in all, it is one of the best apps for recharges and bill payments.

· Google Pay - Google Pay is an app that you can download from the Play store and use to pay someone money, recharge your phone, and pay your bills. The best thing about Google Pay is that the money you transfer gets directly withdrawn from your bank account and the money you receive gets directly deposited into your bank account. Google Pay does not have any wallet facility, or you can say there is no tension about maintaining a wallet. You can directly transact through your bank account with the help of Google Pay.

· PayZapp- PayZapp is an app offered by HDFC. PayZapp allows you to save money while shopping on your mobile device at partner apps, buy mobile phones, tickets, and groceries, compare and book flight tickets and hotels, and shop online. This app can be used to transfer money to anyone who is on your contact list. You can pay your bills, recharge your mobile, DTH, data card, and many more things. It is UPI powered and Visa and MasterCard supported. It is a multi-tasking app. You can use this app for different purposes.

#Broadband Bill#DTH Recharge#EaseMyDeal#Electricity Bill#fastag recharge#Freecharge#Gas Bill#LPG Bill#Mobile Recharge#Momikwik#Paytm#Utility Bill Payments#Water Bill#Trending Apps

3 notes

·

View notes

Text

Guide to Decrease My Water Bill

Did you know the average American family spends around $1,100 on water annually? That's a big chunk of change, and excessive water use forces many people to seek payment assistance for water bill responsibilities. If you're tired of sticker shock every time you open your bill, here are a few things you can do to reduce your consumption.

Upgrade Fixtures and Appliances

This tip isn't always possible, especially if you're on a budget. But if you can afford it, consider swapping outdated appliances and fixtures for more efficient alternatives. Modern appliances like dishwashers and washing machines use significantly less water than their older counterparts. The same goes for fixtures like toilets and shower heads!

Keep Your Showers Short

Lengthy showers are some of the most common causes of sky-high water bills. Everyone likes a relaxing hot shower. But if you need payment assistance for water bill duties, you must be more mindful of how much water you waste.

Try to keep your showers to around five minutes. Consider turning the water off between showering steps if you need more time. For example, you can turn it on to get wet, turn it off as you apply shampoo, turn it back on to rinse, etc.

Look for Leaks

You'd be surprised by how often people don't realize their water bill is so high because they have a leak. A single leak can waste up to 10,000 gallons of water a year. Imagine how that impacts your bill!

Look for leaks around appliances and taps. Pay attention to connection points and hoses. If you find a leak, address it immediately to stop the water waste.

Stick to the Dishwasher

Contrary to popular belief, hand-washing isn't more efficient than dishwashers. Cleaning even a small load of dishes can use around 20 gallons of water. Meanwhile, a fancy water-efficient dishwasher may only use 3.5 gallons per load.

If you don't have a dishwasher, use a rinse tub. Avoid keeping the water running as you clean. That change alone can make a big difference.

Read a similar article about wage advance Australia here at this page.

#payment assistance for electric bill#payment assistance for gas bill#payment assistance for water bill#payment assistance for council rates

0 notes

Text

Make your electricity bill (Bijli Bill) payment hassle-free at plutos ONE and get assured prizes. Pay your electricity bill online using UPI

#light bill#electricity bill payment#electricity bill#pay electricity bill online#bijli bill#online electricity bill#plutos ONE

0 notes

Text

Check and Pay North Bihar Power Distribution Company Limited Bill Online on abhieo, get up to ₹30 back.

https://www.abhieo.in/electricity30

#abhieo#finance#recharge#billpayment#fintech#rechargeapp#mobilerecharge#paymentapp#payment#fintechstartup#electricitybillpayment#electricity#electricitybill#electricity bill#billpayments#bill pay#cashback offer#offersale#North Bihar Power Distribution Company Limited#NBPDCL#cashback#cashackapp#bbps#electricty#electricityoffer#bijlibill

0 notes

Text

Do Cash Advances Impact Your Credit Score?

You have many options when you're tight on cash and need to pay for emergency expenses, household expenses or upcoming bills. While some may resort to credit cards and predatory payday lenders, more viable routes exist. One example is a cash advance.

An instant cash advance can get you money quickly without many pitfalls of traditional alternatives. But does a cash advance impact your credit score?

How Cash Advances Work

There are two main types of cash advances: Those that come from an instant cash advance app or one that comes from your credit card. With the former, you're essentially borrowing from a future paycheck. You can get a set amount of money, get paid early and automatically repay the advance through your next check.

With a credit card cash advance, you're borrowing money against your credit limit. Most cards limit how much you can borrow, and whatever you take goes toward your balance. You can pay it off with your next statement.

Either way, cash advances don't affect your credit score directly. In both instances, credit inquiries aren't part of the equation. Your credit card already has that information and gives you an advance limit alongside the standard credit limit. For cash advance apps, you provide employment and income information.

With that information, apps can provide approval instantly without making a credit inquiry.

Because the process is so simple, cash advance apps are usually the best choice for most people. You don't have to worry about maxing out a credit card, going to a payday lender and dealing with ridiculous fees or filling out lengthy applications with a bank. You can do everything on your smartphone and get instant approval without impacting your credit score.

When Cash Advances Could Affect Your Credit

Cash advances won't impact your credit score directly. But they could lead to issues if you don't repay it. The beauty of cash advance apps is that they consider your employment and income to determine how much you can borrow. Then, they pull it from your check automatically.

But if you were to get a cash advance through your credit card and fail to pay your bills, you could experience credit score troubles.

Read a similar article about send money to Pakistan here at this page.

#instant cash advance#help paying cable bill#water bill payment assistance#help paying electric bill#phone bill payment assistance#help with medical expenses#instant help for rent bill

0 notes

Text

How to pay Electricity bill through online?

Recently, I want to pay my Electricity bill immediately because it is approaching its due date. However, I am unsure of the best software to use, so my friend suggests Payrup. It is fantastic, and Payrup allows us to obtain the invoice and bill as well.

0 notes

Text

Electricity Bill Payment with AeronPay

In an era characterized by rapid technological advancements and the convenience of digital solutions, traditional tasks like paying utility bills have evolved significantly. AeronPay, a cutting-edge online payment platform, has emerged as a prominent player in simplifying the process of electricity bill payments. This article delves into how AeronPay has revolutionized electricity bill payments, offering users a seamless and secure experience.

The Evolution of Bill Payments

Gone are the days of waiting in long queues l to settle utility bills. The rise of online payment platforms has transformed bill payments into a hassle-free endeavor. AeronPay, with its user-friendly interface and range of features, has taken this transformation to the next level.

To begin the journey with AeronPay, users need to create an account on the platform. The registration process typically involves providing basic personal information and contact details. Once the account is set up, users can access their personalized dashboard, where they can manage various bills, including electricity payments.

Step 1: Download and Install AeronPay

To begin your journey towards easy electricity bill payments, you need to download and install the AeronPay app on your smartphone. AeronPay is available for both Android and iOS devices. Simply search for "AeronPay" and tap on the download option to get started.

Step 2: Create an Account

Once you have installed the app, open it and sign up for a new account. You've to provide some basic information, including your phone number, email address, name, and a secure password. Make sure to verify your email for activating your account.

Step 3: Link Your Payment Method

Before paying your electricity bill, you'll need to link your preferred payment method to your AeronPay account. AeronPay supports various options such as credit/debit cards, bank account, and some digital wallets. Follow the on-screen instructions to add and verify your chosen payment method.

Step 4: Locate the Electricity Bill Payment Section

After setting up your AeronPay account and adding the payment method, navigate to the app's main interface. Tap on the More button. Look for the "Bill Payments" section or use the search bar to find your electricity utility company.

Step 5: Enter Electricity Bill Details

In this step, you'll need to enter your electricity bill details to proceed with the payment. The app will typically prompt you to input your customer account number & K- number or consumer number, billing amount, and other relevant information. Ensure that the details are accurate to avoid any payment error.

Step 6: Confirm Payment

Check all the information you've entered and review the payment summary. If everything is correct, then click on the "Confirm Payment" button to initiate the transaction.

Step 7: Receive Payment Confirmation

After successfully completing the payment, you will receive a confirmation notification.

AeronPay is a convenient and secure way to keep your electricity service up and running. With AeronPay, you can pay your electricity bill on time, from anywhere, at any time.

Here are some of the benefits of paying your electricity bill with AeronPay:

Convenience: You can pay your electricity bill from anywhere, 24/7.

Security: Your payment information is fully secured.

Flexibility: You can pay your bill using a variety of payment methods.

Peace of mind: You can be sure that your electricity service will not be interrupted.

You can save time by avoiding the long queues at the electricity office.

You can get cashback and other rewards on your payments.

0 notes

Text

Multimeter Reading# Home Appliances # Voltage Balancing

youtube

0 notes

Text

Zambo is a global payments network built to provide one-stop solutions like domestic money transfer, bill payments, mobile recharges, and card payments to their customers.

0 notes

Text

PayRup.com offers a hassle-free solution for paying your electricity bills online. With a user-friendly interface and secure payment options, you can easily manage your payments from the comfort of your home. Say goodbye to long queues and late fees - PayRup.com streamlines the process, ensuring your bills are paid on time, every time.

0 notes