#Cobalt Market Trends

Text

Cobalt Market Size, Share & Trends Analysis Report, 2030

Cobalt Market Growth & Trends

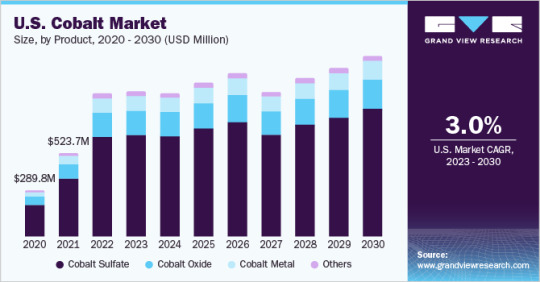

The global cobalt market is expected to reach USD 25.91 billion by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 6.2% over the forecast period. Increasing demand for electric vehicles (EVs) is expected to propel the demand for cobalt in battery applications over the forecast period. The demand for EVs has been increasing rapidly due to concerns about climate change, rising fuel prices, and government incentives. Cobalt is a key component in the production of lithium-ion batteries used in EVs. Based on products, the cobalt oxide segment is expected to register a CAGR of 6.1%, in terms of revenue, over the forecast period. It is used as a colorant in ceramic and glass production, where it imparts a blue color to the final product.

The growing demand for ceramics and glass in various industries, such as construction and electronics, is driving the demand for cobalt oxide. The superalloy application segment is expected to register high growth over the forecast years. A cobalt-based superalloy is known for its high-temperature stability, which makes it suitable for use in high-temperature applications. Thus, its unique combination of physical and chemical properties makes it an ideal material for high-temperature and high-stress applications in the aerospace, energy, and other industries. Based on region, there lies immense opportunity for the market to flourish in Europe. The growth of renewable energy sources, such as wind and solar power, is driving the demand for energy storage systems, which is propelling the production of lithium batteries that use cobalt.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/cobalt-market-report

As Europe aims to transition toward a cleaner energy future, the demand for renewable energy storage systems is increasing, thereby driving market growth. For instance, a comprehensive energy law package passed by the German government in April 2022 aims to increase the amount of renewable energy generated in the country by 22,000 MW from solar and 10,000 MW from wind by 2030. The market participants continue to expand their production capacities to stay ahead of the competition. For instance, in February 2023, Eurasian Resources Group announced an investment of USD 1.8 billion for doubling its output of African copper and cobalt processed at a mine near Lubumbashi, the Democratic Republic of Congo. This indicates a high demand and growing competitive rivalry.

Cobalt Market Report Highlights

The EVs application segment held the largest revenue share of over 35.0% in 2022 due to factors, including environmental concerns, government policies, technological advancements, cost savings, and increasing consumer demand

The industrial chemicals segment is expected to register a CAGR of 5.6%, in terms of revenue, over the forecast period. Cobalt oxide is used as a catalyst in a variety of chemical reactions, including the production of chemicals, fuels, and polymers. The expansion in the chemical industry is expected to drive the segment growth

The cobalt sulfate product segment held the largest revenue share of over 70.0% in 2022, and this trend is expected to continue over the forecast period. The segment growth is attributed to the high product demand from various end-use industries, such as batteries, electroplating, pharmaceuticals, and agriculture

Asia Pacific is expected to register the fastest CAGR of 6.7%, in terms of revenue, over the forecast period. The increasing demand for EVs, renewable energy storage, consumer electronics, and infrastructure development in Asia Pacific is driving the product demand in the regional market

Cobalt Market Segmentation

Grand View Research has segmented the global cobalt market on the basis of product, application, and region:

Cobalt Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Cobalt Sulfate

Cobalt Oxide

Cobalt Metal

Others

Cobalt Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Electric Vehicles

Other Batteries

Industrial Metals

Industrial Chemical

Superalloys

Cobalt Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

North America

U.S.

Europe

Germany

UK

France

Asia Pacific

China

Japan

South Korea

Central & South America

Middle East & Africa

List of Key Players of Cobalt Market

China Molybdenum Co., Ltd.

Eurasian Resources Group

Freeport-McMoRan

Glencore

Huayou Cobalt

Norilsk Nickel

Sumitomo Metal Mining Co., Ltd.

Umicore

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/cobalt-market-report

0 notes

Text

Manifesto for an Ecosocial Energy Transition from the Peoples of the South

An appeal to leaders, institutions, and our brothers and sisters

More than two years after the outbreak of the COVID-19 pandemic—and now alongside the catastrophic consequences of Russia’s invasion of Ukraine—a “new normal” has emerged. This new global status quo reflects a worsening of various crises: social, economic, political, ecological, bio-medical, and geopolitical.

Environmental collapse approaches. Everyday life has become ever more militarized. Access to good food, clean water, and affordable health care has become even more restricted. More governments have turned autocratic. The wealthy have become wealthier, the powerful more powerful, and unregulated technology has only accelerated these trends.

The engines of this unjust status quo—capitalism, patriarchy, colonialism, and various fundamentalisms—are making a bad situation worse. Therefore, we must urgently debate and implement new visions of ecosocial transition and transformation that are gender-just, regenerative, and popular, that are at once local and international.

In this Manifesto for an Ecosocial Energy Transition from the Peoples of the South, we hold that the problems of the Global – geopolitical – South are different from those of the Global North and rising powers such as China. An imbalance of power between these two realms not only persists because of a colonial legacy but has deepened because of a neocolonial energy model. In the context of climate change, ever rising energy needs, and biodiversity loss, the capitalist centers have stepped up the pressure to extract natural wealth and rely on cheap labor from the countries on the periphery. Not only is the well-known extractive paradigm still in place but the North’s ecological debt to the South is rising.

What’s new about this current moment are the “clean energy transitions” of the North that have put even more pressure on the Global South to yield up cobalt and lithium for the production of high-tech batteries, balsa wood for wind turbines, land for large solar arrays, and new infrastructure for hydrogen megaprojects. This decarbonization of the rich, which is market-based and export-oriented, depends on a new phase of environmental despoliation of the Global South, which affects the lives of millions of women, men, and children, not to mention non-human life. Women, especially from agrarian societies, are amongst the most impacted. In this way, the Global South has once again become a zone of sacrifice, a basket of purportedly inexhaustible resources for the countries of the North.

A priority for the Global North has been to secure global supply chains, especially of critical raw materials, and prevent certain countries, like China, from monopolizing access. The G7 trade ministers, for instance, recently championed a responsible, sustainable, and transparent supply chain for critical minerals via international cooperation‚ policy, and finance, including the facilitation of trade in environmental goods and services through the WTO. The Global North has pushed for more trade and investment agreements with the Global South to satisfy its need for resources, particularly those integral to “clean energy transitions.” These agreements, designed to reduce barriers to trade and investment, protect and enhance corporate power and rights by subjecting states to potential legal suits according to investor-state dispute settlement (ISDS) mechanisms. The Global North is using these agreements to control the “clean energy transition” and create a new colonialism.

Governments of the South, meanwhile, have fallen into a debt trap, borrowing money to build up industries and large-scale agriculture to supply the North. To repay these debts, governments have felt compelled to extract more resources from the ground, creating a vicious circle of inequality. Today, the imperative to move beyond fossil fuels without any significant reduction in consumption in the North has only increased the pressure to exploit these natural resources. Moreover, as it moves ahead with its own energy transitions, the North has paid only lip service to its responsibility to address its historical and rising ecological debt to the South.

Minor changes in the energy matrix are not enough. The entire energy system must be transformed, from production and distribution to consumption and waste. Substituting electric vehicles for internal-combustion cars is insufficient, for the entire transportation model needs changing, with a reduction of energy consumption and the promotion of sustainable options.

In this way, relations must become more equitable not only between the center and periphery countries but also within countries between the elite and the public. Corrupt elites in the Global South have also collaborated in this unjust system by profiting from extraction, repressing human rights and environmental defenders, and perpetuating economic inequality.

Rather than solely technological, the solutions to these interlocked crises are above all political.

As activists, intellectuals, and organizations from different countries of the South, we call on change agents from different parts of the world to commit to a radical, democratic, gender-just, regenerative, and popular ecosocial transition that transforms both the energy sector and the industrial and agricultural spheres that depend on large-scale energy inputs. According to the different movements for climate justice, “transition is inevitable, but justice is not.”

We still have time to start a just and democratic transition. We can transition away from the neoliberal economic system in a direction that sustains life, combines social justice with environmental justice, brings together egalitarian and democratic values with a resilient, holistic social policy, and restores an ecological balance necessary for a healthy planet. But for that we need more political imagination and more utopian visions of another society that is socially just and respects our planetary common house.

The energy transition should be part of a comprehensive vision that addresses radical inequality in the distribution of energy resources and advances energy democracy. It should de-emphasize large-scale institutions—corporate agriculture, huge energy companies—as well as market-based solutions. Instead, it must strengthen the resilience of civil society and social organizations.

Therefore, we make the following 8 demands:

We warn that an energy transition led by corporate megaprojects, coming from the Global North and accepted by numerous governments in the South, entails the enlargement of the zones of sacrifice throughout the Global South, the persistence of the colonial legacy, patriarchy, and the debt trap. Energy is an elemental and inalienable human right, and energy democracy should be our goal.

We call on the peoples of the South to reject false solutions that come with new forms of energy colonialism, now in the name of a Green transition. We make an explicit call to continue political coordination among the peoples of the south while also pursuing strategic alliances with critical sectors in the North.

To mitigate the havoc of the climate crisis and advance a just and popular ecosocial transition, we demand the payment of the ecological debt. This means, in the face of the disproportionate Global North responsibility for the climate crisis and ecological collapse, the real implementation of a system of compensation to the global South. This system should include a considerable transfer of funds and appropriate technology, and should consider sovereign debt cancellation for the countries of the South. We support reparations for loss and damage experienced by Indigenous peoples, vulnerable groups and local communities due to mining, big dams, and dirty energy projects.

We reject the expansion of the hydrocarbon border in our countries—through fracking and offshore projects—and repudiate the hypocritical discourse of the European Union, which recently declared natural gas and nuclear energy to be “clean energies.” As already proposed in the Yasuni Initiative in Ecuador in 2007 and today supported by many social sectors and organizations, we endorse leaving fossil fuels underground and generating the social and labor conditions necessary to abandon extractivism and move toward a post-fossil-fuel future.

We similarly reject “green colonialism” in the form of land grabs for solar and wind farms, the indiscriminate mining of critical minerals, and the promotion of technological “fixes” such as blue or grey hydrogen. Enclosure, exclusion, violence, encroachment, and entrenchment have characterized past and current North-South energy relations and are not acceptable in an era of ecosocial transitions.

We demand the genuine protection of environment and human rights defenders, particularly indigenous peoples and women at the forefront of resisting extractivism.

The elimination of energy poverty in the countries of the South should be among our fundamental objectives—as well as the energy poverty of parts of the Global North—through alternative, decentralized, equitably distributed projects of renewable energy that are owned and operated by communities themselves.

We denounce international trade agreements that penalize countries that want to curb fossil fuel extraction. We must stop the use of trade and investment agreements controlled by multinational corporations that ultimately promote more extraction and reinforce a new colonialism.

Our ecosocial alternative is based on countless struggles, strategies, proposals, and community-based initiatives. Our Manifesto connects with the lived experience and critical perspectives of Indigenous peoples and other local communities, women, and youth throughout the Global South. It is inspired by the work done on the rights of nature, buen vivir, vivir sabroso, sumac kawsay, ubuntu, swaraj, the commons, the care economy, agroecology, food sovereignty, post-extractivism, the pluriverse, autonomy, and energy sovereignty. Above all, we call for a radical, democratic, popular, gender-just, regenerative, and comprehensive ecosocial transition.

Following the steps of the Ecosocial and Intercultural Pact of the South, this Manifesto proposes a dynamic platform that invites you to join our shared struggle for transformation by helping to create collective visions and collective solutions.

We invite you to endorse this manifesto with your signature.

9 notes

·

View notes

Note

(To Cobalt) Despite his rocky relationship with Cobalt, they, too, will get a gift from Spaul.

They will receive a bundle of new fabrics, unused threads that he scavenged from the dump. New needles and pins as well, these purchased new from a store for a change. An assortment of different flavored CD Bagels from Clem’s market.

And finally, a handmade sign to mock him, scribbled and colorful and reading “WARNING: NEO W0RSHIP AH3AD”. He has no idea how they will take it, but he doesn’t really care. Finally, a note:

MERRY XMAS COBALT!!! LAY OFF THE NEO $TUFF K???

FR0M SPAUL

@thebigshotman

Gifts. Gifts for them. Quite a rare sight. It would have been easy to believe that the items had simply been misdelivered, if they hadn't catered so clearly to Cobalt's work and their name wasn't written on the note.

Not that they would have left the gift alone if it wasn't for them. If it's at their door, it's theirs now.

They fluffed up with excitement, grabbing everything and pulling it into the shop before the gift giver came along and changed their mind. They sat on the floor, unpacking it all, handling each object with care. One hand ran through every fabric, taking in every colour and texture. Already they were thinking of uses for it all. Both for work and for themselves. The needles in their original packaging were almost more intriguing, though. The fabrics, while undeniably nice, seemed to have been gathered up for free. But there had been money spent on these needles. And continuing with the trend of unexpected items, there was food. Actual food. The split the CD Bagel assortment into two piles. One for them, one for Rayzor.

They started munching on one of the CD Bagels from their pile as they continued through the gifts. They narrowed their eyes at the sign, knowing full well it was made with mockery in mind. So naturally, the best way to respond would be to proudly hang it in their shop out of spite. It wouldn't be new information to anyone who entered anyway, and the colours were nice. They would have to find the perfect spot for it later.

Last of all, they plucked up the note. Spaul. Was this a sign of friendship? He certainly wouldn't put this much money and effort into all this if he hated them. Or perhaps he would. They still didn't really understand him. But perhaps a gift in return would be in order. To stay on his good side. They could easily put something together with all the new material he gave them.

But laying off the NEO stuff? Not a chance.

#//thank you very much for this#//Spaul brings the finest gifts#thebigshotman#discount discomfort (cobalt addison)

2 notes

·

View notes

Text

Driving Change: The Impact of Electric Vehicles on Battery Demand in the Mexico Battery Market

Introduction:

The landscape of the Mexico battery market is undergoing a significant transformation, propelled by the rapid rise of electric vehicles (EVs). As the world shifts towards sustainable transportation solutions to combat climate change, the demand for batteries to power EVs is experiencing exponential growth. In this article, we'll explore the profound impact of electric vehicles on battery demand in the Mexico battery market, highlighting key trends, challenges, and opportunities in this dynamic sector.

According to Next Move Strategy Consulting, the global Mexico Battery Market is predicted to reach USD 13.46 billion by 2030, with a CAGR of 22.6% from 2024 to 2030.

Download FREE Sample: https://www.nextmsc.com/mexico-battery-market/request-sample

The Rise of Electric Vehicles: Electric vehicles have emerged as a game-changer in the automotive industry, offering a cleaner and more efficient alternative to traditional internal combustion engine vehicles. In Mexico, the adoption of EVs has been steadily increasing, driven by factors such as government incentives, environmental awareness, and advancements in battery technology. As consumers embrace electric mobility, the demand for batteries to power these vehicles has surged, reshaping the dynamics of the Mexico battery market.

Inquire before buying: https://www.nextmsc.com/mexico-battery-market/inquire-before-buying

Battery Technologies Powering EVs: The success of electric vehicles hinges on the performance and reliability of their battery systems. In the Mexico battery market, lithium-ion batteries dominate as the preferred choice for EV manufacturers due to their high energy density, longevity, and fast-charging capabilities. These advanced batteries enable EVs to achieve longer driving ranges and quicker recharge times, enhancing their appeal to consumers.

Challenges and Opportunities: While the rise of electric vehicles presents immense opportunities for the battery industry in Mexico, it also poses several challenges that need to be addressed. One such challenge is the need to ramp up battery production to meet the escalating demand from the automotive sector. Investing in manufacturing facilities and scaling up production capacity will be crucial to ensure a steady supply of batteries for EVs.

Another challenge is the availability of raw materials needed to manufacture batteries, particularly lithium and cobalt. As global demand for these resources grows, securing a stable supply chain becomes paramount. Mexico, with its abundant lithium reserves and growing mining industry, is well-positioned to capitalize on this opportunity and become a key player in the global battery supply chain.

Government Support and Policy Initiatives: To accelerate the adoption of electric vehicles and support the growth of the battery market, the Mexican government has implemented various policy initiatives and incentives. These include tax incentives for EV buyers, subsidies for charging infrastructure development, and regulatory measures to promote clean transportation. By creating a favorable

environment for EV adoption, the government is driving demand for batteries and fostering innovation in the Mexico battery market.

Collaboration and Innovation: Collaboration between stakeholders across the automotive and battery industries is essential to overcome challenges and unlock the full potential of electric mobility in Mexico. By fostering partnerships between automakers, battery manufacturers, research institutions, and government agencies, synergies can be created to accelerate technological advancements and drive down costs.

Furthermore, continuous innovation in battery technology is crucial to enhance performance, increase energy efficiency, and reduce costs. Research and development efforts aimed at developing next-generation batteries, such as solid-state batteries and lithium-sulfur batteries, hold promise for further improving the capabilities of electric vehicles and shaping the future of the Mexico battery market.

Mexico Accelerates Electric Vehicle Adoption to Drive Battery Market Growth

In a groundbreaking move, Mexico has announced ambitious plans to accelerate the adoption of electric vehicles (EVs) as part of its strategy to reduce carbon emissions and combat climate change. The government's commitment to clean transportation is expected to have a profound impact on the Mexico battery market, driving increased demand for batteries to power EVs.

Government Incentives: Under the leadership of President [Name], Mexico has introduced a series of incentives and initiatives to promote the adoption of electric vehicles across the country. These include tax breaks for EV buyers, subsidies for the installation of charging infrastructure, and regulatory measures to facilitate the import and manufacture of electric vehicles and batteries. By creating a supportive policy environment, the government aims to spur investment in the EV sector and drive market growth.

Partnerships with Automakers: In response to the government's initiatives, major automakers have announced plans to expand their electric vehicle offerings in the Mexican market. Companies such as [Automaker Names] have committed to investing billions of dollars in manufacturing facilities and research and development initiatives to meet the growing demand for electric vehicles and batteries. These partnerships between government and industry stakeholders are crucial for accelerating the transition to electric mobility and driving battery market growth.

Investment Surge: The announcement has triggered a surge in investment in the Mexico battery market, with both domestic and international companies ramping up production capacity to meet the rising demand for batteries. Investment in battery manufacturing facilities, research and development centers, and supply chain infrastructure is expected to create thousands of jobs and stimulate economic growth across the country.

Supply Chain Resilience: As the demand for batteries increases, ensuring a resilient and sustainable supply chain for raw materials becomes paramount. Mexico, with its abundant reserves of lithium and other key battery materials, is well-positioned to play a strategic role in the global battery supply chain. Investments in mining and extraction projects, coupled with efforts to promote responsible sourcing practices, will be crucial for securing a stable supply of battery materials and supporting the growth of the EV industry.

Conclusion:

The rapid growth of electric vehicles is reshaping the Mexico battery market, creating unprecedented opportunities for growth and innovation. As EV adoption continues to accelerate, the demand for batteries is set to soar, driving investment, job creation, and economic development in the country. By embracing electric mobility and leveraging its strengths in battery manufacturing and resource extraction, Mexico is poised to emerge as a leading player in the global electric vehicle revolution.

0 notes

Text

Future of Batteries Market Size, Share, Industry Trends by 2035

The global future of batteries market size was valued at 16 million units in 2024 and is expected to reach 62 million units by 2035, at a CAGR of 12.7% during the forecast period 2024-2035.The growing consciousness among consumers regarding environmental issues and their preference for eco-friendly modes of transportation is propelling the demand for electric vehicles. Increased driving range, quicker charging times, and longer battery life impact consumer choices. Furthermore, improvements in lithium-ion, solid-state, and other developing battery technologies have increased EVs' efficiency, range, and affordability. Well-known automakers have committed to converting their fleets to electric vehicles and are making significant investments in electric car technologies. This dedication to EVs drives market expansion and battery development.

Market Dynamics:

Driver: Advancements in battery technology

A number of companies have achieved significant advancements in EV battery technology, enabling EVs to become a competitive alternative to traditional automobiles. Continuous advancements in electric vehicle (EV) battery technology aim to increase the range of EVs. Most large EV battery manufacturers innovate in battery chemistry and design to increase EV range and reduce the need for frequent charging. The battery's cathode chemistry is a major factor in its performance. Three major groups of cathode chemistries are currently in widespread use in the automobile industry: lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminum oxide (NCA), and lithium iron phosphate (LFP). Because of their higher nickel content, NMC and NCA cathodes are in the most demand out of all of them. They provide high energy density. In addition, since 2020, LFP has gained popularity because of its nickel- and cobalt-free composition and the high cost of battery metals. Unlike hydroxide, which is used for nickel-rich chemistries, LFP uses lithium carbonate.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=243513539

Opportunity: Increase in R&D efforts toward creating more advanced battery chemistries

As the world moves toward adopting clean energy, battery manufacturers are increasing their R&D efforts to develop different battery chemistries. For instance, major players like Amprius Inc. (US) and Nexeon Corporation (UK) are developing silicon anode batteries with enhanced features. These advanced silicon anode batteries are expected to be widely adopted in the coming years. Tesla, Inc. (US) and Panasonic Holdings Corporation (Japan) are also researching and developing silicon anode and lithium-air batteries to power EVs. In June 2023, LG Energy Solution (South Korea) and NOVONIX (Australia) entered into a Joint Research and Development Agreement (JDA) to collaborate on the development of artificial graphite anode material for lithium-ion batteries. VARTA AG (Germany) is also involved in international research projects. Its R&D project, SintBat, aims to develop energy-efficient, cheap, and maintenance-free lithium-ion-based energy storage systems using silicon-based materials and new processing technologies.

“Cylindrical segment is expected to grow at the fastest rate during the forecast period.”

The cylindrical segment is projected to register the highest CAGR during the forecast period. Durable and long-lasting are two characteristics of cylindrical batteries. Due to their excellent confinement and effective mechanical resistance against internal and external pressures, cylindrical cells are the least expensive to manufacture compared to alternative EV battery types. Manufacturers are starting to use cylindrical batteries as well. Tesla, for instance, uses cylindrical batteries due to their dependability and robustness. The new generation of cylindrical batteries, like the 4680 format pioneered by Tesla, boasts significant improvements in range and efficiency compared to older models.

“Solid state battery expected to be the next big shift during forecast period.”

Emerging solid-state battery technology has various potential benefits for electric vehicles. Unlike traditional lithium-ion batteries, which utilize liquid electrolytes, they use solid electrolytes. Because solid electrolytes are less likely to experience problems like leaking, overheating, and fire hazards, they are considered safer overall for electric vehicles. Faster charging times could be possible using solid-state batteries as opposed to lithium-ion batteries. Because of their enhanced conductivity and capacity to tolerate higher charging rates, EVs may require fewer charging cycles, saving users time and increasing convenience. For instance, In October 2023, Toyota secured a deal to mass-produce solid-state EV batteries with a 932-mile range. Using materials developed by Idemitsu Kosan will allow Toyota to commercialize these energy-dense batteries by 2028. Solid-state batteries can significantly extend a vehicle's driving range as well. It is projected that a solid-state battery replacement may quadruple the driving range of the Tesla Roadster. Such benefits will help the solid state battery market grow over the projected period.

“North America to be the prominent growing market for EV batteries during the forecast period.”

The automotive sector in North America is one of the most developed worldwide. Major commercial automakers like Tesla, Proterra, MAN, and NFI Group are based in the region, which makes it well-known for its cutting-edge EV R&D, inventions, and technological advancements. These businesses are investing in constructing and expanding battery production plants in North America. To meet the growing demand for electric vehicles, these facilities produce sophisticated battery technology, including lithium-ion batteries. The US has historically led the way in technology in North America. Leading EV battery suppliers and startups have partnered with OEMs in the North American EV market. For example, GM and LG Chem have partnered.

Key Players

The major players in Future of Batteries market include CATL (China), BYD Company Ltd. (China), LG Energy Solution Ltd. (South Korea), Panasonic Holdings Corporation (Japan), and SK Innovation Co., Ltd. (South Korea). These companies adopted various strategies, such as new product developments and deals, to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=243513539

0 notes

Text

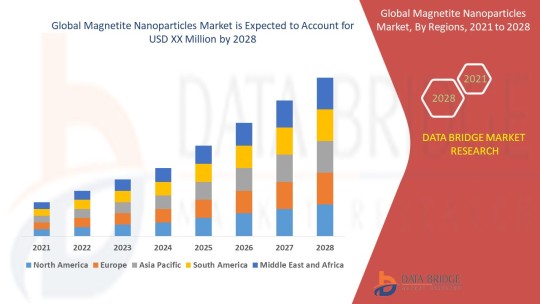

Magnetite Nanoparticles Market Size 2024 - 2031 | Challenges and Opportunities with Top Countries Data

The "Magnetite Nanoparticles Market" is a dynamic and rapidly evolving sector, with significant advancements and growth anticipated by 2031. Comprehensive market research reveals a detailed analysis of market size, share, and trends, providing valuable insights into its expansion. This report delves into segmentation and definition, offering a clear understanding of market components and drivers. Employing SWOT and PESTEL analyses, the study evaluates the market's strengths, weaknesses, opportunities, and threats, alongside political, economic, social, technological, environmental, and legal factors. Expert opinions and recent developments highlight the geographical distribution and forecast the market's trajectory, ensuring a robust foundation for strategic planning and investment.

What is the projected market size & growth rate of the Magnetite Nanoparticles Market?

Market Analysis and Insights:

Global Magnetite Nanoparticles Market

Magnetite nanoparticles market size is expected to grow at a compound annual growth rate of 10.40% for the forecast period of 2021 to 2028. Data Bridge Market Research report on magnetite nanoparticles market provides analysis and insights regarding the various factors expected to be prevalent throughout the forecasted period while providing their impacts on the market’s growth.

The magnetic nanoparticles are a class of nanoparticle which can be controlled using magnetic fields. These particles generally consist of two components such as chemical component that has functionality and a magnetic material such as nickel, cobalt and iron.

The high demand for the product in application industries such as electronics, wastewater treatment, bio-medical and energy is expected to influence the growth of the magnetite nanoparticles market. In line with this, the continuous research and development activities and high demand for iron oxide nanoparticles are also anticipated to act as key determinants favoring the growth of the magnetite nanoparticles market over the forecast period of 2021 to 2028. Also the, increase in the need for catalysis for a range of chemical reactions and rise in the focus on research pertaining to nanotechnology are also expected to positively impact the growth of the magnetite nanoparticles market. The major factor accountable for the growth of the market is the rise in the government expenditure on biotechnology.

However, the complex manufacturing process and high cost of nanoparticles are likely to act as key restraints towards magnetite nanoparticles market growth rate in the forecast period of 2021 to 2028, whereas the presence of strict regulations and compliances regarding the usage of nanoparticles can challenge the growth of the magnetite nanoparticles market in the above mentioned forecast period.

Furthermore, the rapid technological advancements in medical industry, advancements in technologies associated with nanoparticles and rise in the penetration of nanotechnology in various applications are expected to offer a variety of growth opportunities for the magnetite nanoparticles market in the above mentioned forecast period.

This magnetite nanoparticles market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographical expansions, technological innovations in the market. To gain more info on magnetite nanoparticles market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Browse Detailed TOC, Tables and Figures with Charts which is spread across 350 Pages that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

This research report is the result of an extensive primary and secondary research effort into the Magnetite Nanoparticles market. It provides a thorough overview of the market's current and future objectives, along with a competitive analysis of the industry, broken down by application, type and regional trends. It also provides a dashboard overview of the past and present performance of leading companies. A variety of methodologies and analyses are used in the research to ensure accurate and comprehensive information about the Magnetite Nanoparticles Market.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-magnetite-nanoparticles-market

Which are the driving factors of the Magnetite Nanoparticles market?

The driving factors of the Magnetite Nanoparticles market include technological advancements that enhance product efficiency and user experience, increasing consumer demand driven by changing lifestyle preferences, and favorable government regulations and policies that support market growth. Additionally, rising investment in research and development and the expanding application scope of Magnetite Nanoparticles across various industries further propel market expansion.

Magnetite Nanoparticles Market - Competitive and Segmentation Analysis:

Global Magnetite Nanoparticles Market, By Type (Iron Based, Cobalt Based), Physical Form (Nanopowder, Solution, Dispersion), Application (Bio-medical, Electronics, Wastewater Treatment, Energy, Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028

How do you determine the list of the key players included in the report?

With the aim of clearly revealing the competitive situation of the industry, we concretely analyze not only the leading enterprises that have a voice on a global scale, but also the regional small and medium-sized companies that play key roles and have plenty of potential growth.

Which are the top companies operating in the Magnetite Nanoparticles market?

The major players covered in the magnetite nanoparticles market report are BASF SE, Cytodiagnostics Inc.,, TODA KOGYO COR., Cabot Corporation., Nanophase Technologies Corporation., NVIGEN, Inc., Nanoshel LLC, Inframat Corporation, Aphios Corporation, CD Bioparticles, Phosphorex, Inc., Nanorh, Reade International Corp., Skyspring Nanomaterials Inc., Merck KGaA, Strem Chemicals, Inc., American Elements, nanoComposix., US Research Nanomaterials, Inc., and Alfa Aesar among other domestic and global players.

Short Description About Magnetite Nanoparticles Market:

The Global Magnetite Nanoparticles market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2031. In 2023, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

North America, especially The United States, will still play an important role which can not be ignored. Any changes from United States might affect the development trend of Magnetite Nanoparticles. The market in North America is expected to grow considerably during the forecast period. The high adoption of advanced technology and the presence of large players in this region are likely to create ample growth opportunities for the market.

Europe also play important roles in global market, with a magnificent growth in CAGR During the Forecast period 2024-2031.

Magnetite Nanoparticles Market size is projected to reach Multimillion USD by 2031, In comparison to 2024, at unexpected CAGR during 2024-2031.

Despite the presence of intense competition, due to the global recovery trend is clear, investors are still optimistic about this area, and it will still be more new investments entering the field in the future.

This report focuses on the Magnetite Nanoparticles in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

Get a Sample Copy of the Magnetite Nanoparticles Report 2024

What are your main data sources?

Both Primary and Secondary data sources are being used while compiling the report. Primary sources include extensive interviews of key opinion leaders and industry experts (such as experienced front-line staff, directors, CEOs, and marketing executives), downstream distributors, as well as end-users. Secondary sources include the research of the annual and financial reports of the top companies, public files, new journals, etc. We also cooperate with some third-party databases.

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

What are the key regions in the global Magnetite Nanoparticles market?

North America (United States, Canada and Mexico)

Europe (Germany, UK, France, Italy, Russia and Turkey etc.)

Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia and Vietnam)

South America (Brazil, Argentina, Columbia etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

This Magnetite Nanoparticles Market Research/Analysis Report Contains Answers to your following Questions

What are the global trends in the Magnetite Nanoparticles market?

Would the market witness an increase or decline in the demand in the coming years?

What is the estimated demand for different types of products in Magnetite Nanoparticles?

What are the upcoming industry applications and trends for Magnetite Nanoparticles market?

What Are Projections of Global Magnetite Nanoparticles Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about Import and Export?

Where will the strategic developments take the industry in the mid to long-term?

What are the factors contributing to the final price of Magnetite Nanoparticles?

What are the raw materials used for Magnetite Nanoparticles manufacturing?

How big is the opportunity for the Magnetite Nanoparticles market?

How will the increasing adoption of Magnetite Nanoparticles for mining impact the growth rate of the overall market?

How much is the global Magnetite Nanoparticles market worth? What was the value of the market In 2020?

Who are the major players operating in the Magnetite Nanoparticles market? Which companies are the front runners?

Which are the recent industry trends that can be implemented to generate additional revenue streams?

What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Magnetite Nanoparticles Industry?

Customization of the Report

Can I modify the scope of the report and customize it to suit my requirements? Yes. Customized requirements of multi-dimensional, deep-level and high-quality can help our customers precisely grasp market opportunities, effortlessly confront market challenges, properly formulate market strategies and act promptly, thus to win them sufficient time and space for market competition.

Inquire more and share questions if any before the purchase on this report at - https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-magnetite-nanoparticles-market

Detailed TOC of Global Magnetite Nanoparticles Market Insights and Forecast to 2031

Introduction

Market Segmentation

Executive Summary

Premium Insights

Market Overview

Magnetite Nanoparticles Market By Type

Magnetite Nanoparticles Market By Function

Magnetite Nanoparticles Market By Material

Magnetite Nanoparticles Market By End User

Magnetite Nanoparticles Market By Region

Magnetite Nanoparticles Market: Company Landscape

SWOT Analysis

Company Profiles

Continued...

Purchase this report – https://www.databridgemarketresearch.com/checkout/buy/singleuser/global-magnetite-nanoparticles-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- [email protected]

Browse More Reports:

Global Dental Syringes Market – Industry Trends and Forecast to 2028

Global Epigenetics-Based Kits Market – Industry Trends and Forecast to 2028

Global Layer Pads Market – Industry Trends and Forecast to 2029

Global Radar Transmitter Market – Industry Trends and Forecast to 2028

Global Magnetite Nanoparticles Market – Industry Trends and Forecast to 2028

#Magnetite Nanoparticles Market#Magnetite Nanoparticles Market Size#Magnetite Nanoparticles Market Share#Magnetite Nanoparticles Market Trends#Magnetite Nanoparticles Market Growth#Magnetite Nanoparticles Market Analysis#Magnetite Nanoparticles Market Scope & Opportunity#Magnetite Nanoparticles Market Challenges#Magnetite Nanoparticles Market Dynamics & Opportunities

0 notes

Text

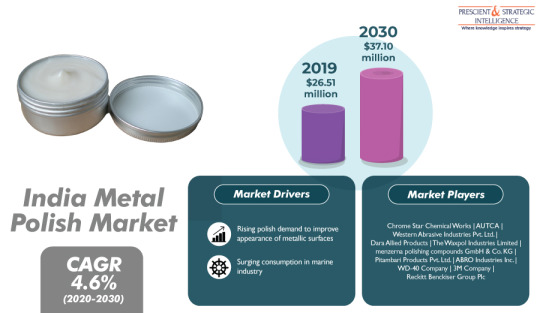

How Is Marine Sector Steering India Metal Polish Market Growth?

Factors such as the rising consumption of metal polish in the marine sector of India, on account of the surging maritime trade; and increasing realization about enhancing the aesthetic appearance of metallic surfaces, due to the mounting disposable income, will drive the Indian metal polish market at a CAGR of 4.6% during the forecast period (2020–2030). Owing to these factors, the market is expected to grow from $26.51 million in 2019 to $37.10 million by 2030.

The growth of the Indian metal polish market can be attributed to the rising preference for aesthetic metallic products, owing to the surging disposable and per capita income of the Indian citizens. Improved living standard has boosted the demand for durable and aesthetically enhanced products. The usage of metal polishes on stainless steel, brass, aluminum, chrome, and copper products helps in removing corrosion, restoring gloss, and smoothening the surfaces of these products.

The surging use of such polishes in the marine sector will also facilitate the market growth in the future. The Indian marine industry uses a large volume of metal polishes to remove corrosion, tarnish, and surface rust, caused by prolonged exposure to air, saltwater, and ultraviolet (UV) rays, on metal fittings and boats and cargo ship railings. Moreover, the polish offers a shine to the deck of marine vehicles. In recent years, traders and ship owners have been increasingly focusing on the maintenance of marine vessels, due to the rising maritime trade.

The escalating technological advancement in polishing methods has become a major trend in the Indian metal polish market. Conventional metal polishing methods impacted the production efficiency, as they required manual labor, which would bring the industrial lines to a standstill. Owing to the limitation of traditional methods, metal polish manufacturers are increasingly using conveyor belts for electrolyte plasma polishing (EPP), mechanical polishing, electrochemical polishing, and chemical polishing. Among these, EPP is the most preferred process, as it offers high quality, efficiency, and performance at low flammability risk and low material cost.

The product type segment of the Indian metal polish market is classified into paste, liquid, and others. Among these, the paste category accounted for the largest market share in 2019 and it is expected to maintain its dominance in the market in the forecast years as well. This can be ascribed to the easy use and high suitability of pastes for polishing purposes in the marine, automotive, and residential industries.

According to P&S Intelligence, 3M Company dominated the Indian metal polish market in 2019, due to the extensive distribution network and supply chain of the manufacturer. The metal polishing products manufactured by 3M Company are used by the automotive, automotive refinish, defense, marine, and residential industries. The polishes provided by this firm help in restoring the aesthetic beauty of products, such as cars. The company also offers aluminum, nickel, and cobalt (ALINCO) metal alloys for furniture polishing.

Thus, the rising demand for aesthetic and durable products in India and the increasing advancements in polishing methods will augment the consumption of metal polishes in the country, in the foreseeable future.

Source: P&S Intelligence

#India Metal Polish Market Share#India Metal Polish Market Size#India Metal Polish Market Growth#India Metal Polish Market Applications#India Metal Polish Market Trends

1 note

·

View note

Text

Exploring the Fascinating World of Biomaterials 💡✨

The Global Biomaterials Market is projected to reach USD 297.08 billion in 2027. The key factors influencing the market include the growing geriatric population, acceleration in chronic disorders such as cardiovascular disorders, orthopedic disorders, and an upsurge in the sports injuries, which are anticipated to impel the market in the forecast period. A higher traction of these materials are being observed in the usage of interacting with biological systems designed for medical treatments for correcting cardiovascular, orthopedic, neurological disorders, and dental, among others.

The report sheds light on the mergers and acquisitions, collaborations, joint ventures, brand promotions and product launches, agreements and partnerships, and corporate and government deals. The comprehensive analysis of the competitive landscape offers the readers a deeper understanding about the competitors.

Download Free Sample Report of Global Biomaterials Market @ https://www.emergenresearch.com/request-sample/119

The study outlines the rapidly evolving and growing market segments along with valuable insights into each element of the industry. The industry has witnessed the entry of several new players, and the report aims to deliver insightful information about their transition and growth in the market. Mergers, acquisitions, partnerships, agreements, product launches, and joint ventures are all outlined in the report.

The leading market contenders listed in the report are:

Berkeley Advanced Biomaterials, Royal DSM, Carpenter Technology Corporation, BASF SE, Corbion, Cam Bioceramics B.V., Celanese Corporation, CoorsTek Inc., CeramTec, Evonik Industries, and GELITA AG

Research Report on the Biomaterials Market Addresses the Following Key Questions:

Who are the dominant players of the Biomaterials market?

Which regional market is anticipated to have a high growth rate over the projected period?

What consumer trends and demands are expected to influence the operations of the market players in the Biomaterials market?

What are the key growth drivers and restraining factors of the Biomaterials market?

What are the expansion plans and strategic investment plans undertaken by the players to gain a robust footing in the market?

What is the overall impact of the COVID-19 pandemic on the Biomaterials market and its key segments?

Browse Full Report Description + Research Methodology + Table of Content + Infographics@ https://www.emergenresearch.com/industry-report/biomaterials-market

Emergen Research has segmented the global Biomaterials market on the basis of type, type of care, and region

Segments Covered in this report are:

Type Outlook (Revenue: USD Billion; Volume: Kilo Tons; 2017-2027)

Ceramic

Calcium Phosphate

Aluminium Oxide

Calcium Sulfate

Carbon

Zirconia

Glass

Metallic

Gold and silver alloys

Cobalt-Chrome Alloy

Titanium and its alloys

Stainless Steel

Polymeric

Nylon

Silicon Rubber

Polyetheretherketone

Polyester

Acrylic Glass

Polyethylene

Polyvinyl Chloride

Natural

Alginates

Chitin

Cellulose

Collagen and Gelatin

Fibrin

Hyaluronic Acid

Silk

Others

Application Outlook (Revenue: USD Billion; Volume: Kilo Tons; 2017-2027)

Regional Outlook (Revenue: USD Billion; Volume: Kilo Tons; 2017-2027)

North America

U.S.

Canada

Europe

UK

Germany

France

BENELUX

Asia Pacific

China

Japan

South Korea

Rest of APAC

Latin America

Brazil

Rest of LATAM

MEA

Saudi Arabia

UAE

Rest of MEA

How will this Report Benefit you?

A 250-page report from Emergen Research includes 194 tables and 189 charts and graphics. Anyone in need of commercial, in-depth assessments for the global Biomaterials market, as well as comprehensive market segment analysis, can benefit from our new study. You can assess the whole regional and global market for Biomaterials with the aid of our recent study. To increase market share, obtain financial analysis of the whole market and its various segments. We think there are significant prospects in this industry for rapidly expanding energy storage technology. Look at how you may utilise the current and potential revenue-generating prospects in this sector. The research will also assist you in making better strategic decisions, enabling you to build growth strategies, strengthen competitor analysis, and increase business productivity.:

About Us:

Emergen Research is a market research and consulting company that provides syndicated research reports, customized research reports, and consulting services. Our solutions purely focus on your purpose to locate, target, and analyse consumer behavior shifts across demographics, across industries, and help clients make smarter business decisions. We offer market intelligence studies ensuring relevant and fact-based research across multiple industries, including Healthcare, Touch Points, Chemicals, Types, and Energy. We consistently update our research offerings to ensure our clients are aware of the latest trends existent in the market. Emergen Research has a strong base of experienced analysts from varied areas of expertise. Our industry experience and ability to develop a concrete solution to any research problems provides our clients with the ability to secure an edge over their respective competitors.

Contact Us:

Eric Lee

Corporate Sales Specialist

Emergen Research | Web: www.emergenresearch.com

Direct Line: +1 (604) 757-9756

E-mail: [email protected]

Visit for More Insights: https://www.emergenresearch.com/insights

Explore Our Custom Intelligence services | Growth Consulting Services

Trending Titles: Geocell Market | Pancreatic Cancer Treatment Market

Latest Report: Ceramic Tiles Market | Life Science Analytics Market

0 notes

Text

Battery Materials Market: Exploring Sustainable Energy Solutions

The battery materials market is seeing rising trends towards sustainable energy storage driven by clean energy policies and regulations. Battery materials such as lithium-ion, lead-acid, and nickel-based batteries play a critical role in powering electrical vehicles, stationary energy storage, and electronics devices. These materials facilitate electrochemical oxidation-reduction reactions that enable the efficient storage and release of electrical energy.

The Global Battery Materials Market is estimated to be valued at US$ 50.6 Bn in 2024 and is expected to exhibit a CAGR of 6.0% over the forecast period 2023 to 2030.

Key Takeaways

Key players operating in the battery materials market are Albemarle, China Molybdenum Co. Ltd., Gan feng Lithium Co., Ltd., Glencore PLC, Livent Corporation, Norlisk Nickel, Sheritt International Corporation, SQM S.A., Targray Technology International Inc., Teck Resources, Tianqi Lithium, and Vale S.A. Battery materials manufacturers are focusing on expanding lithium-ion battery production capacities to cater to the growing demand from electric vehicles and energy storage applications. The global electric vehicle stock exceeded 10 million in 2021 and is expected to grow at a CAGR of 29% over the next decade. This rising adoption of electric vehicles is expected to drive the demand for

lithium, cobalt, graphite, and nickel used in lithium-ion battery cathodes and anodes.

The increasing deployment of renewable energy is also augmenting the need for large-scale energy storage systems. Countries and regions are formulating policies and targets to increase the percentage of clean energy sources. This is propelling the demand for battery storage technologies that use materials such as lithium, lead, nickel, and vanadium. Battery materials companies are investing heavily in mining and manufacturing facilities across regions to ensure security of supply and gain access to key resources.

Market Key Trends

One of the key trends in the battery materials market is the shift towards sustainable and ethically-sourced materials. With increasing scrutiny on artisanal mining practices and child labor in countries like Congo and China, battery material manufacturers are focusing on developing partnerships for responsible sourcing of critical materials like cobalt, lithium, and graphite. Companies are also investing in recycling technologies to recover these materials from spent batteries and create a circular economy. The adoption of blockchain for tracing material production stages is another emergent trend that will enhance supply chain transparency for battery materials in the coming years.

Porter's Analysis

Threat of new entrants: The battery materials market requires high capital investments to build manufacturing infrastructure. Furthermore, there are economies of scale enjoyed by already established players. These factors deter new players from easily entering the market.

Bargaining power of buyers: Due to the presence of many suppliers of battery materials, buyers have reasonable bargaining power to negotiate on price and quality. They can source materials from multiple suppliers.

Bargaining power of suppliers: Key raw materials suppliers like lithium producers enjoy pricing power due to constrained global supply of lithium. Input material producers can influence prices.

Threat of new substitutes: With continuous R&D in battery technology, new battery chemistries are emerging which can substitute traditional lithium-ion batteries. This poses a medium threat of substitution.

Competitive rivalry: The battery materials market has moderate competition due to presence of large global players. Players compete on pricing, product quality, and securing raw material supplies.

China accounts for over 50% of the global battery materials market value owing to its dominance in battery and electric vehicle production. It is home to various raw material reserves and battery materials manufacturers.

Europe's battery materials market is growing fastest at around 8% CAGR driven by the region's focus on e-mobility and energy storage for renewable integration. Countries like Germany, Sweden and Norway are spearheading the transition and spurring battery materials demand.

Geographical Regions

China accounts for the largest share of the global battery materials market in terms of value owing to its dominance in battery and electric vehicle production. It is home to various raw material reserves and battery materials manufacturers. The country accounts for over 50% of the total market value currently.

Europe's battery materials market is growing the fastest at around 8% CAGR driven by the region's strategic focus on e-mobility and energy storage for renewable energy integration in the power sector. Major countries spearheading this transition include Germany, Sweden and Norway where electric vehicles sales are rising rapidly. This is driving the demand for battery materials in Europe.

#Battery Materials Market Market Growth#Battery Materials Market Market Size#Battery Materials Market Market Share

0 notes

Text

Advanced Battery and Fuel Cell Material Market Analysis 2024 Dynamics, Players, Type, Applications, Trends, Regional Segmented, Outlook & Forecast till 2033

Introduction to the Advanced Battery and Fuel Cell Material Market

The advanced battery and fuel cell material market encompasses the production, distribution, and utilization of materials specifically designed to enhance the performance, efficiency, and durability of batteries and fuel cells used in various applications, including electric vehicles (EVs), portable electronics, renewable energy storage, and stationary power generation. These materials play a crucial role in enabling the transition to cleaner and more sustainable energy technologies by improving energy storage capacity, charging rates, and overall system reliability.

Key Materials and Functionality

The advanced battery and fuel cell material market includes a range of key materials tailored to meet the specific requirements of battery and fuel cell technologies:

Cathode Materials: Cathode materials, such as lithium cobalt oxide (LCO), lithium iron phosphate (LFP), and nickel cobalt manganese (NCM) oxides, are essential components of lithium-ion batteries (LIBs) used in EVs, consumer electronics, and energy storage systems. These materials influence the energy density, voltage, and cycling stability of LIBs, contributing to improved performance and longer lifespan.

Anode Materials: Anode materials, including graphite, silicon, and lithium titanate (LTO), store and release lithium ions during charge and discharge cycles in LIBs, influencing capacity, charging rates, and cycle life. Advanced anode materials, such as silicon-graphite composites and nanostructured materials, offer higher energy storage capacity but face challenges related to volume expansion and stability.

Electrolyte Materials: Electrolyte materials, such as lithium salts (e.g., lithium hexafluorophosphate), solvents, and additives, facilitate the transport of ions between the cathode and anode in LIBs and fuel cells, enabling electrochemical reactions and ion conduction. Advanced electrolyte formulations, including solid-state electrolytes and polymer electrolytes, offer advantages in terms of safety, stability, and energy density.

Separator Materials: Separator materials, typically made of porous polymeric membranes or ceramic-coated films, prevent direct contact between the cathode and anode in LIBs and fuel cells, preventing short circuits while allowing ion transport. Advanced separator materials with enhanced thermal stability, mechanical strength, and ion conductivity contribute to improved safety and performance.

Fuel Cell Catalysts: Catalyst materials, such as platinum, palladium, and other transition metals supported on carbon or other substrates, facilitate the electrochemical reactions that occur within fuel cells, enabling efficient conversion of chemical energy into electricity. Advances in catalyst design and synthesis improve catalytic activity, durability, and cost-effectiveness in fuel cell applications.

Trends: Identify and analyze trends relevant to the market you're researching. This could include shifts in consumer behavior, industry regulations, technological advancements, or changes in market demand. Look at both short-term and long-term trends to provide a comprehensive view.

Technological Developments: Highlight the latest technological innovations impacting the market. This might involve advancements in automation, artificial intelligence, IoT (Internet of Things), blockchain, or any other relevant technologies. Discuss how these developments are shaping the industry landscape and driving change.

Analysis: Conduct a thorough analysis of the market, including SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis, Porter's Five Forces analysis, and any other relevant analytical frameworks. Assess market dynamics, competitive landscape, and barriers to entry. Provide insights into market segmentation, customer demographics, and buying behavior.

Growth Drivers: Identify the primary drivers fueling market growth. This could include factors such as increasing demand for certain products or services, expansion into new geographic regions, rising disposable income levels, technological advancements driving innovation, or favorable regulatory policies. Quantify the impact of these drivers on market growth wherever possible.

Receive the FREE Sample Report of Advanced Battery and Fuel Cell Material Market Research Insights @ https://stringentdatalytics.com/sample-request/advanced-battery-and-fuel-cell-material-market/14628/

Market Segmentations:

Global Advanced Battery and Fuel Cell Material Market: By Company

Exide Technologies

Eco-Bat Technologies

Doe-Run Technologies

BASF

Cabot Corporation

Eramet

Hammond Group

Hollingsworth & Vose Company

Global Advanced Battery and Fuel Cell Material Market: By Type

Metals

Ceramics

Polymers

Carbon/Graphite

Chemicals

Global Advanced Battery and Fuel Cell Material Market: By Application

Solid Oxide

Proton Exchange Membrane

Molten Carbonate

Phosphoric Acid

Direct Methanol

Others

Regional Analysis of Global Advanced Battery and Fuel Cell Material Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Advanced Battery and Fuel Cell Material market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase Advanced Battery and Fuel Cell Material Market Research Report @ https://stringentdatalytics.com/purchase/advanced-battery-and-fuel-cell-material-market/14628/?license=single

Challenges: Identify and discuss the challenges that the market is currently facing. These challenges could include regulatory hurdles, economic instability, supply chain disruptions, intense competition, changing consumer preferences, or technological limitations. Provide insights into how these challenges are impacting the industry and potentially hindering growth or innovation.

Future Outlook: Offer a forward-looking perspective on the market's trajectory. Based on the analysis conducted earlier, forecast the future direction of the market. Consider factors such as emerging technologies, shifting consumer behaviors, regulatory changes, and global economic trends. Discuss potential opportunities that may arise in the future and how stakeholders can capitalize on them. Additionally, highlight potential threats or disruptions that could impact the market landscape.

Mitigation Strategies: Suggest mitigation strategies to address the challenges identified and capitalize on future opportunities. This could involve recommendations for businesses to adapt their strategies, invest in R&D, forge strategic partnerships, or diversify their product/service offerings. Provide actionable insights that stakeholders can use to navigate uncertainties and position themselves for success in the evolving market environment.

Key Report Highlights:

Key Market Participants: The report delves into the major stakeholders in the market, encompassing market players, suppliers of raw materials and equipment, end-users, traders, distributors, and more.

Comprehensive Company Profiles: Detailed company profiles are provided, offering insights into various aspects including production capacity, pricing, revenue, costs, gross margin, sales volume, sales revenue, consumption patterns, growth rates, import-export dynamics, supply chains, future strategic plans, and technological advancements. This comprehensive analysis draws from a dataset spanning 12 years and includes forecasts.

Market Growth Drivers: The report extensively examines the factors contributing to market growth, with a specific focus on elucidating the diverse categories of end-users within the market.

Data Segmentation: The data and information are presented in a structured manner, allowing for easy access by market player, geographical region, product type, application, and more. Furthermore, the report can be tailored to accommodate specific research requirements.

SWOT Analysis: A SWOT analysis of the market is included, offering an insightful evaluation of its Strengths, Weaknesses, Opportunities, and Threats.

Expert Insights: Concluding the report, it features insights and opinions from industry experts, providing valuable perspectives on the market landscape.

Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team ([email protected] ), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +1 346 666 6655 to share your research requirements.

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

0 notes

Text

0 notes

Text

Minerals Market for Lithium Batteries to Rise at 15.2% CAGR during 2022-2031

The Minerals Market for Lithium Batteries size stood at US$ 14.3 Bn. The global market is anticipated to expand at 15.2% CAGR during the forecast period, from 2022 to 2031. It is estimated that by 2031, the market is expected to touch a value of US$ 58.4 Bn. The demand for minerals required to make lithium batteries is largely driven by the widespread use of lithium batteries in medical devices, electronics, and automotive industries. The automotive industry is likely to account for a considerable Minerals Market for Lithium Batteries share during the forecast period.

Minerals Market for Lithium Batteries analysis elucidates that manufacturers of batteries are concentrating on the production of lithium battery minerals that provide more power, have better power density, and last more whilst still being safer and more affordable. In order to keep track of supply-side trends, mineral producers are expected to upgrade their market intelligence abilities. The use of minerals in lithium batteries, however, is likely to be constrained in the near future by the implementation of strict government laws and mining policies. As a result, mining corporations are required to considerably minimize their environmental impact to meet the demands of stakeholders, investors, and authorities.

In order to reduce emissions from transportation and dependence on imported fuel, there is an increase in demand for electric vehicles (EVs). In 2021, the sale of electric vehicles increased globally. The governments of various nations introduced incentives that reduced the cost of electric vehicles, which is expected to accelerate the Minerals Market for Lithium Batteries growth rate in the years to come.

Request Sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85235

Market Segmentation:

By Service Type: Mining, Refining, Recycling

By Sourcing Type: Primary, Secondary (Recycled)

By Application: Electric Vehicles (EVs), Energy Storage Systems (ESS), Portable Electronics

By Industry Vertical: Automotive, Energy & Utilities, Consumer Electronics, Others

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Regional Analysis:

North America: Dominated by the US, witnessing significant growth due to supportive government policies, investments in EV infrastructure, and technological advancements in battery manufacturing.

Europe: Leading the charge in EV adoption, supported by stringent emission regulations, robust charging infrastructure, and investments in sustainable energy solutions.

Asia-Pacific: Emerging as a manufacturing and consumption hub for lithium batteries, driven by China's dominance in EV production, along with increasing investments in renewable energy projects.

Market Drivers:

Rise in Electric Vehicle Adoption: Growing environmental concerns and government incentives are driving the shift towards electric mobility, boosting demand for lithium batteries.

Energy Storage Revolution: Increasing focus on renewable energy sources like solar and wind power is driving demand for energy storage solutions, stimulating the minerals market.

Technological Advancements: Innovations in battery chemistry, manufacturing processes, and recycling technologies are driving efficiency gains and cost reductions in the lithium battery market.

Market Challenges:

Supply Chain Risks: Dependence on limited geographic sources for critical minerals like lithium and cobalt poses supply chain challenges and price volatility.

Environmental Concerns: Mining and processing of lithium and other minerals can have environmental impacts, necessitating sustainable practices and recycling initiatives.

Regulatory Uncertainties: Evolving regulations and trade policies related to mineral sourcing, environmental standards, and recycling pose challenges for market players.

Market Trends:

Shift towards Sustainable Sourcing: Increasing emphasis on ethical and sustainable sourcing of minerals, promoting recycling and circular economy practices.

Battery Chemistry Evolution: Exploration of new battery chemistries like solid-state batteries, silicon anodes, and sodium-ion batteries to improve performance and reduce costs.

Vertical Integration: Battery manufacturers and automakers are vertically integrating into mineral mining, refining, and recycling to secure supply chains and reduce costs.

Future Outlook: The future of the minerals market for lithium batteries looks promising, with continued innovation, investments in sustainable practices, and collaboration across the value chain expected to drive growth. Market players need to focus on R&D, diversification of sourcing strategies, and regulatory compliance to capitalize on emerging opportunities.

Key Market Study Points:

Market Dynamics: Demand drivers, supply chain challenges, regulatory landscape

Technological Innovations: Battery chemistry advancements, recycling technologies

Competitive Landscape: Key players, market share analysis, strategic initiatives

Consumer Trends: EV adoption rates, preferences for battery-powered devices

Environmental Impact: Sustainability practices, carbon footprint reduction strategies

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=85235<ype=S

Competitive Landscape: Key players in the minerals market for lithium batteries include major mining companies, battery manufacturers, and recycling firms. Companies such as Tesla, Albemarle Corporation, Panasonic, CATL, and Glencore play pivotal roles in shaping the market through investments in production capacity, R&D, and sustainability initiatives.

Recent Developments:

Tesla's Gigafactories expansion plans to meet rising EV demand.

Advancements in solid-state battery technology by companies like QuantumScape and Solid Power.

Increased collaborations between automakers and mining companies for sustainable mineral sourcing.

About Transparency Market Research

Transparency Market Research, a global market research company registered in Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision-makers. Our experienced Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyze information.

Our data repository is continuously updated and revised by a team of research experts to always reflect the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.