#But I do take the privacy and equity issues seriously

Note

Good morning Ralph! I’m an attorney in the US and I saw your anon asking about the legality of vaccine requirements set by artists. I can shed some light, though probably not much and I’m going to do that annoying thing that lawyers do where we say “well it depends!” and refuse to give anyone any solid answers. But that’s really, truly, honestly, cross my heart hope to die, because in the case of the legality of vaccine requirements it does depend on a lot of different factors and we don’t have very many solid answers. This is not something anyone has ever really had to deal with before, the legal system looks to past precedent when deciding how to handle current issues, and there just isn’t much of that here. As a kind of general rule, though, the baseline we start from is the idea that private entities are free to require basically whatever they want as a prerequisite to service, and consumers are free to choose not to patronize those entities if they don’t like the requirements. An important thing to remember, that I think a lot of people tend to forget - all those handy rights the US constitution affords its citizens only apply to the government. There are limited exceptions - the Americans with Disabilities Act and Title VII of the Civil Rights Act are two of the biggest examples. But, so long as they’re complying with the guidelines provided by those limited exceptions, private entities can and always have been able to do pretty much whatever they want.

Now, vaccines are an interesting question because you start to get cross over into other issues - the right to privacy, bodily autonomy, “compulsory” disclosure of personal medical information, etc. If the question was “can an artist require me to wear a mask at his concert even though wearing a mask wasn’t required at the time I bought my ticket” the answer would unequivocally be yes. Artists and venues can (and do!) require all sorts of things for entry - you have to have a ticket, you have to submit to a bag search and go through a metal detector, you’re generally required to be wearing shoes and pants and a shirt. Masks absolutely can be added as a requirement, at any time, and whether or not it was a requirement that you reasonably could have anticipated when you bought the ticket doesn’t matter. But vaccines feel a little different, and admittedly they are. A mask is, in essence, a piece of clothing for your face. You wear it for a few hours, you take it off, you go about your life. It’s a temporary measure. Vaccines are not. A vaccine is a medical treatment, once you’ve gotten it you can’t “take it off” or decide you don’t want it anymore. It just feels like there should be a higher level of scrutiny than just “if you don’t like the requirement don’t support the entity.” But there really isn’t. That old idea that a private entity can set pretty much whatever rules and restrictions for access to and use of their private property stands. That tenant is arguably strengthened when the issue involves public health risks, because an employer has a duty to protect their employees and customers.

The EEOC ruled in May that companies can legally require their employees to be vaccinated. There are no federal laws preventing an employer from requiring employees to provide proof of vaccination, that information just has to be kept confidential. If there is a disability or sincerely held religious belief preventing an employee from being vaccinated they are entitled to a “reasonable accommodation” that does not pose an “undue burden” on the business. This isn’t a 1:1 comparison to your anon’s question about whether or not artists can require vaccination of concert attendees, but it is really useful guidance, because it’s a statement about what is and isn’t appropriate re: vaccine requirements straight from the mouth of one of the biggest federal players in the game. If, for example, a bunch of maroon five fans decided to sue the ban for their vaccine requirements, the EEOC decision is something judges and lawyers would look at in evaluating the suit.

HIPAA is the big one that a lot of people like to cite as protecting them from being asked about vaccination status by businesses or employers, but that’s just entirely untrue. HIPAA prevents a specific list of entities - doctors, hospitals, insurance companies, etc. - from disclosing medical data about a patient in their care. Event venues, artists, employers - none of them fall into the category of a “covered entity” that has to abide by HIPAA requirements. And even then, there’s an argument to be made that HIPAA still wouldn’t prevent them from asking if you’re vaccinated and refusing you entry if you’re not, just that they can’t turn around and tell someone else what your vaccination status is.

So on a high level the answer is yes, artists can absolutely require vaccination of concert attendees. Full stop.

But that’s only taking into account federal laws. There are state laws at play too, and those are absolute mess. It feels like each state is handling their approach to vaccine requirements differently, and a lot of them conflict with the federal laws at play. While in theory federal laws should trump state laws, that’s not really true in practice, and a lot of people who are much smarter than me are still struggling with how to navigate that maze, so I’m not going to bother adding my two cents about how I think it should go. From a fact based standpoint, though, know that state laws are an issue and add even more “it depends on ____” factors to our already uncertain analysis. Texas, Arkansas, and Florida, for example, all have laws prohibiting businesses and governmental entities from requiring digital proof of vaccination. Whether or not these laws will withstand judicial scrutiny in the places they conflict with federal law remains tbd, but as it stands now an artist playing a show in Texas couldn’t require vaccines for entry to that show. But if their tour stop is, say, Indiana, they could require vaccines there, because Indiana state law only prevents governmental and quasi-governmental entities (schools) from requiring vaccines. Private entities can do whatever they want.

The final thing I want to touch on is your anon’s concern that the vaccine requirement wasn’t in place when the tickets were originally bought. It doesn’t matter. If the question is “can an artist require vaccines” the answer is “yes” and whether or not that requirement was in place when you bought your ticket doesn’t matter. BUT! As with everything else, there are exceptions. There might be an argument that adding a vaccine requirement is a contractual violation, if we were to imagine the exchange of ticket purchase for entertainment a contract between the buyer and the artist. There’s maybe an argument that you paid for a service you’re no longer getting because the circumstances under which the service will be provided has changed so drastically. These are issues that if someone wanted answers to they’d have to hire an attorney to file a civil suit against the artist, and then see the litigation through to get a ruling from a judge. To the best of my knowledge that hasn’t been done. But even if it is is done in the future, the answer to the overarching question “can an artist require vaccines” won’t change. All that will change is the artist will be required to come up with some sort of refund scheme for those who choose not to be vaccinated.

Anyway! I didn’t mean to write an entire treatise in your inbox. I saw the anon’s question and immediately went “oh interesting! I know a little bit about that” and, as per usual, a little bit has turned into a rambling lecture that I’m not actually sure anyone will even learn anything from. At the very least it might entertain you.

Xoxo, a US attorney who really needs to go do work someone will pay her for and stop theorizing about the interplay of federal vs state laws.

Thanks anon! That's all very interesting and relevant information. It gives a really good sense of how complex the situation is and the relevant dynamics in play. And also a good sense of what the law does and doesn't cover - because there's a whole practical side of this that is largely

I'll throw in one more thought. One of my concerns about vaccine passports are the equity issues. Existing issues of access to healthcare have played out in vaccine rates and that's true of both race and class everywhere that I have looked at. I don't think vaccines can be considered meaningfullly accessible if poor people and black people aren't accessing them. In general, the best answers to that will be resourcing to take vaccines to where people are and (and the situation for native americans really undscores this) and paid sick leave. But while vaccination rates are lowest for those who face most marginalisation, restricting access to society on the basis of a vaccination is discriminatory in a serious way.

#I can be persuaded on vaccine requirements#in specific contexts#But I do take the privacy and equity issues seriously#which is why I think any justification has to be full and accurate about risk#but also I am not the US legal system

3 notes

·

View notes

Text

The SDG Imperative

May 8, 2019

I was recently asked by a journalist on LinkedIn for my thoughts on various CSR and SDG-related questions in connection with Innovation360′s Fix the Planet initiative that invites innovators to submit ideas around four of the Sustainable Development Goals [SDGs].

Here are my thoughts:

1. CSR vs Sustainable Development

First, I think we need to differentiate between CSR, ESG, and Sustainable Development; three concepts that are bandied about, and often conflated, or confused.

CSR [Corporate Social Responsibility] or “responsible business” is a form of corporate self-regulation integrated into a business model whereby business monitors and ensures its active compliance with the spirit of the law, ethical standards and national or international norms. CSR assumes that business is motivated by a social conscience, rather than shareholder profit. Lots of companies self-report on their voluntary CSR activities but have proven false to its real power. CSR is largely considered a myth [1] by some, as well as a marketing gimmick [2] that benefits the company, but does not actually fix the planet.

ESG [Environmental, Social, and Governance] conflates sustainability and corporate governance issues but ignores the economic dimension. Sustainability investors are concerned with how companies manage all factors contributing to profitability: supply chain, production, employees, regulatory relationships etc. They focus on the relationship between economic, social and environmental factors, as well as financial performance. However, corporate governance, designed to balance the interests of management and shareholders is a structurally different system. ESG arose when investment managers combined two areas of research [corporate governance and sustainability research], which gave them a convenient way to communicate both activities to clients. [3] ESG has gained a lot of traction, but it is not a considered a ‘real’ thing by many professionals in the impact space.

Sustainable Development was coined in 1972 by the Bruntland Commission as “development that meets the needs of the current generation without compromising the ability of future generations to meet their own needs”. [4] In January 2016, the 17 Sustainable Development Goals [SDGs] of the UN’s 2030 Agenda for Sustainable Development, were adopted as a universal framework. The SDGs are intended to mobilize efforts to end all forms of poverty, fight inequalities, and tackle climate change, while ensuring that no one is left behind, and with meaningful progress being made by 2030. The SDGs also recognize the interconnectivity of global issues, that ending poverty must go hand-in-hand with strategies that build economic growth and addresses a range of social needs including education, health, social protection, and job opportunities, while tackling climate change and environmental protection. [5] The SDGs are also unique in that they expect action by ALL countries, poor, rich and middle-income to promote prosperity while protecting the planet.

What differentiates the SDGs from CSR and ESG is:

Universal framework for action that is inclusive and collaborative

Universal framework for measuring impact at target/indicator level

Interconnectivity of social, economic, and environmental issues

Global call to action for: governments, business, and civil society

Aggressive timeframe, by 2030

__________________________________________________

2. Is CSR Spiking?

It depends what you are really asking. Is the number of CSR reports filed by companies increasing over time? Yes. Is their actual impact increasing? Hard to know. Some illuminating facts from the August 2017 Journal of Accounting and Economics [6]:

Publicly traded companies face increasing pressure to prepare CSR documents to inform stakeholders about their voluntary activities to operate in an economically, socially, and environmentally sustainable manner.

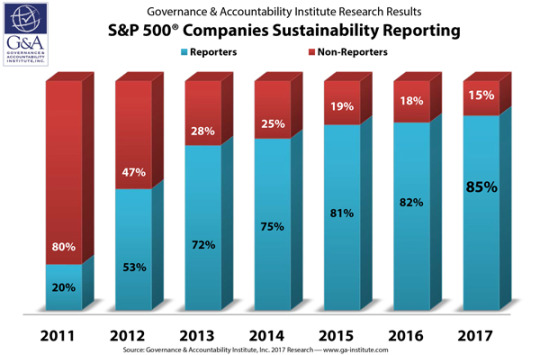

Percentage of firms that voluntarily issue CSR reports has increased considerably. As of 2015, 92% of Fortune Global 250 firms issued voluntary CSR reports, up from only 35% in 1999 [KPMG, 2015]. As of 2017, 85% of the S&P 500 were filing CSR reports [7]:

Existing standards regulate only a fraction of accounting for socially relevant corporate activities disclosed in annual reports; reporting CSR performance through other channels [stand-alone CSR reports] remains largely voluntary and unregulated.

Lack of regulation has resulted in diverse reporting practices [length, performance indicators, readability, etc.]. Additionally, verification of these reports by accounting firms is neither comprehensive nor stringent compared with verification of corporate annual reports.

While mandatory disclosures are highly regulated and subject to stringent external audits, the discretionary nature of CSR reporting provides managers with opportunities and motivations to signal their superior commitment to CSR or to pose as ‘good’ corporate citizens when their CSR performance is poor.

_________________________________________________

3. Are Companies More Responsible or is That an Illusion?

There is mounting evidence that key social trends are having a positive impact on companies taking their “social responsibility” much more seriously. Clearly, companies face increasing pressure from employees and customers to take a stand on critical issues. [8]

Workplace Harassment/Bias

#MeToo movement

Gender pay equity

Diversity and inclusion

Brand Activism

Gun Reform; #MarchforOurLives

Women’s reproductive freedom

Transgender rights; #WontBeErased

Paris Agreement

White supremacy

Shift from Disaster Recovery to Climate Resilience

More CSR in the C-suite

Higher Standards for Suppliers

Prioritizing Privacy and Data Protection

In addition, as companies continue to take a stand on big issues, they are shifting the relationship between private enterprise, governments, and civil society, often speaking up where and when governments are not. Companies that pursue legitimate CSR activities “experience positive reputations, improved customer loyalty, and strong risk management processes.” In other words, ‘sustainability’ is now being associated with long-term sustainability of companies, as well. Those companies offering scalable solutions with immediate impact will succeed, giving companies a competitive edge, and making CSR more central to their business strategies. [9]

__________________________________________________

4. Are Startups Leading the Charge or Larger Enterprises?

Right now, national and multi-national companies have the visibility, influence, and the resources to #BetheNeedle, driving sustainable change from the top down. According to the 2019 Edelman Trust Barometer, “More than three-quarters of people worldwide want CEOs to take the lead on change instead of waiting for the government to act.” [10]

We have seen the emergence of activist CEOs taking very public stands in the form of:

The Giving Pledge

CEO Action on Diversity & Inclusion

Global CSR Summit Declaration

Global Investors for Sustainable Development Alliance

We have also seen high-profile global CEOs adopting sustainable business practices in support of the SDGs while also delivering value to shareholders [11]:

Paul Polman, Unilever

Indra Nooyi, PepsiCo

John Noseworthy, Mayo Clinic

Richard Davis, USBancCorp

These, and others, like Larry Fink at Blackrock, who writes an annual letter [12] to CEOs of companies in which they invest, are linking stewardship and sustainability with profitability:

“We advocate for practices that we believe will drive sustainable, long-term growth and profitability.”

Both peer pressure [from other CEOs] and pressure from the citizenry [in the form of customers] are driving change. No one pillar [business, government, civil society] can achieve the magnitude of the SDGs by 2030 by itself.

However, business alone has the capital, resources, technology, and innovative energy to #BetheNeedle in solving the world’s most challenging issues.

“Unnerved by fundamental economic changes and the failure of government to provide lasting solutions, society is increasingly looking to companies, both public and private, to address pressing social and economic issues. These issues range from protecting the environment to retirement to gender and racial inequality, among others.”

The question then becomes profitability. Does purposefulness necessarily compromise profits? Larry Fink argues, to the contrary, that purpose is the animating force for achieving profits:

“Profits are in no way inconsistent with purpose – in fact, profits and purpose are inextricably linked. When a company truly understands and expresses its purpose, it functions with the focus and strategic discipline that drive long-term profitability. Purpose unifies management, employees, and communities. It drives ethical behavior and creates an essential check on actions that go against the best interests of stakeholders. Purpose guides culture, provides a framework for consistent decision-making, and, ultimately, helps sustain long-term financial returns for the shareholders of your company.”

So what about startups and early stage companies? How do they stack up in terms of Sustainable Development? Whereas huge corporation have the responsibility to turn the entrenched wheels of their behemoth production models toward sustainability, young companies have the enormous opportunity to define and direct their mission, values, and strategic plans specifically toward one or more of the Sustainable Development goals, targets, and indicators, right from the start.

Startups are notoriously strapped for cash and resources, which often supersedes their integrating loftier ideals like the SDGs into their investment proposals. This is extremely shortsighted. As innovators, they typically pride themselves on being ahead of the curve. Well, be ahead of the curve, by taking the lead in a new order of things.

A number of incubators, accelerators, and advisories are encouraging startups and early-stage companies to do just this:

UN SDG Action Campaign

UN SDG Accelerator Program

Impact Entrepreneur Center

Sustainable Development Goals Accelerator

There are undoubtedly, many more out there, working with founders, investors, and advisory networks to increase competency with, and commitment to, the SDGs. Startups and early stage companies can #BetheNeedle by driving sustainable change from the ground up.

Here are some fundamental ways new and emerging businesses can support the SDGs [13]:

Externally align your purpose with one or more of the SDG goals, targets or indicators. Communicate this intention in all your strategic documents, marketing materials, and employee training. In other words, COMMIT.

Internally align your business processes with sustainable business practices. There are a number of steps companies can take to help protect the planet, such as tracking and reducing emissions, increasing the energy efficiency of their operations, using clean energy sources, reusing materials and responsibly using resources like water.

Promote the rights and well-being of employees, customers and workers throughout your supply chains. Companies can strengthen their support of human rights by developing a human rights policy and working to integrate human rights into management education.

Act as responsible members of the communities in which you work, including using your standing as social leaders to stand up for justice and speak out against hate.

Take action to reduce the inequalities that harm lives and threaten global stability. Business leaders can provide decent jobs and fair wages, work to expand opportunities and skills training to underserved communities and push for more diversity in their ranks.

Collaborate with governments and international organizations to scale effective solutions. Time and again, we've seen the power of multi-sector partnerships to change lives, from expanding access to vaccines to turning the tide against diseases like HIV/AIDS.

__________________________________________________

5. How Can Startups Like Innovation360 Galvanize the Public Around the SDGs?

I heartily applaud efforts that offer both tools and advisory services to innovators. Fix the Planet is certainly a “call to action” for innovative ideas on four specific SDGs. Like any initiative that wants to make a difference, it must have a clear purpose, process, and path to success. But if your goal is truly to coalesce serious ideas that have the potential to actually “fix the planet,” then it needs to convey the urgent, gritty, gut-wrenching gravitas of other organizations taking up arms in this daunting task.

It also needs to be grounded in the firmament of reality. Fixing the planet is going to require complex partnerships between governments, business, and civil society. It going to require revamping entrenched systems that have been governing our world for centuries. Its going to require deftness in navigating the intersectionality of socio-economic-environmental relationships, while also employing the underlying principle of the 2030 Agenda: inclusivity. No one gets left behind. Any combination of ideas and initiatives that can do that would be like inventing innovation ‘fire’, for sure.

As of January 2019, global land and ocean surface temperature was 0.88°C (1.58°F) above the 20th century average and tied with 2007 as the third highest temperature since global records began in 1880. [14] According to the recent UN report, one million species “already face extinction, many within decades, unless action is taken to reduce the intensity of drivers of biodiversity loss”. [15] In a world where "issues of mind-numbing irrelevance are more important than the collapse of our life support systems" [to quote George Monbiot] those taking up the #SDG charge need to do so with the attitude and determination, not of a startup unicorn, but of an impact ninja. We need results. Not monetary results, mandatory results.

In short, if you are going to get our attention and rally us around ideas to fix the planet, then you’d better be ready to implement for impact. We do not have time to waste. We do not have time to indulge creative fantasies. 2030 is ELEVEN years away. #BetheNeedle or go home.

__________________________________________________

Footnotes:

[1] https://ssir.org/articles/entry/the_myth_of_csr

[2] https://doublethedonation.com/tips/why-corporate-social-responsibility-is-important/

[3] https://www.sri-connect.com/index.php?option=com_content&view=article&id=11&Itemid=88

[4] https://www.sustainabledevelopment2015.org/AdvocacyToolkit/index.php/earth-summit-history/historical-documents/92-our-common-future

[5 https://www.un.org/sustainabledevelopment/development-agenda/

[6] https://www.sciencedirect.com/science/article/pii/S1815566917300164

[7] https://www.ga-institute.com/press-releases/article/flash-report-85-of-sp-500-indexR-companies-publish-sustainability-reports-in-2017.html

[8] https://www.forbes.com/sites/susanmcpherson/2018/01/12/8-corporate-social-responsibility-csr-trends-to-look-for-in-2018/ - 202767ad40ce

[9] https://www.mbastudies.com/article/how-corporate-social-responsibility-is-changing-in-2018/

[10] https://www.forbes.com/sites/forbesnonprofitcouncil/2019/02/26/businesses-and-social-change-were-at-the-starting-point-not-the-finish-line/ - 447dd61e4bad

[11] https://www.forbes.com/sites/hbsworkingknowledge/2019/01/31/how-4-ceos-set-a-new-leadership-standard/ - 486be96fec64

[12] https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

[13] https://www.forbes.com/sites/forbesnonprofitcouncil/2019/02/26/businesses-and-social-change-were-at-the-starting-point-not-the-finish-line/ - 447dd61e4bad

[14] https://www.ncdc.noaa.gov/sotc/global/201901

[15] https://news.un.org/en/story/2019/05/1037941

0 notes

Link

After a wild 2018, Mark Orsley - Head of Macro Strategy for Prism (and formerly with RBC), is out with a review of his 2018 "Costanza Trades," while offering his comprehensive thoughts for next year.

***

It’s that time of year again. Stockings, dreidels, Festivus poles, and, of course, the inevitable truckload of bank “2019 Year Ahead” pieces cluttering your inboxes which are about as attractive as getting coal in your stockings. However, these pieces are useful in some regards, as they are very good at nailing the consensus themes and are excellent counter-indicators. Long time readers will know that The Macro Scan takes another twist at year end, to present next year’s top “Costanza Trades.”

For those of you not familiar with George Costanza, his character on the sitcom Seinfeld could do no right when it came to employment, dating, or life in general. In one episode, George realizes over lunch at the diner with Jerry that if every instinct he has is wrong, then doing the opposite must be right. George resolves to start doing the complete opposite of what he would do normally. He orders the opposite of his normal lunch, and he introduces himself to a beautiful woman that he normally would never have the nerve to talk to. "My name is George,” he says, “I'm unemployed, and I live with my parents." To his surprise, she is impressed with his honesty and agrees to date him!

I find employing the Costanza method to trading an interesting exercise. Ask yourself this: what are the trades that make complete sense and all your instincts say are right? Now consider the opposite. Basically what you end up constructing is an out of consensus portfolio.

Employing the Costanza method can identify interesting, non-consensus trade ideas that could kick in alpha. Last year’s top 7 Costanza trades netted 5 of 7 WINNERS (some with huge gains), and past years have all been successful: 2017 had 5 of 6 winners (and 1 tie), 2016 had 7 of 10 winners, and 2015 had 7 of 10 winners. Let’s quickly review last year’s trades…

2018 Costanza Trades:

Long UST 10yrs = trying to work now but a loser as yields were 35bps higher

Long Bunds = winner as yields were 18bps lower

Long EUR/USD = worked early in the year but turned loser, -5%

Short EEM = huge winner, EM crushed 19%

Long IG protection (IG spread wideners)/Short LQD = another huge winner, IG CDX 44bps wider (doubled)

Short Euro Stoxx and Nikkei = both big winners; each index was down 15%

Short Bitcoin vol = worked well all year but has risen recently, still 50-day is 22 vols lower

Bonus: Long active/short passive = going to put this as a tie. Passive won out most of the year, but is currently getting crushed/about to get absolutely rinsed. Also, in a classic bottom signal, active Hedge Funds/PM’s were shuttered around the street in Q4 at the absolute worse time. Active is now starting to have its day, and the passive tsunami is receding.

Last year’s list was one of the most difficult to develop. Going into 2018, the market was divided between those who thought risk assets had gone too far and were due for a correction, and those who believed the economy is booming so let the good times roll. To be fair, both turned out to be true at different points throughout the year.

This year is a piece of cake, as sentiment for risk assets have wildly shifted (for good reason) bearish. With that, I give you the 2019 Costanza trades in no particular order – or in other words, the trades that you absolutely feel pained to do right now:

2019 Costanza Trades:

Long FANGs

Receive credit protection in IG and HY (aka long LQD and HYG)

Long Eurodollar spreads (EDZ9/EDZ0)

Long Bunds

Short Gold

Long WTI crude

Long AUD/USD

Short EM

Long Bitcoin

Bonus: Long Trump

Let’s go through each and assess the probabilities of Costanza being profitable (probabilities are purely off the cuff estimates for arguments sake)…

1) Long FAANGs

Everyone loved them on the way up in 2018 and you had to own them to keep up with the market but now the FAANG’s, and tech broadly, are contaminated.

Although street research is once again roundly predicting higher equity indices in 2019 (as they always do - insert rolling eyes emoji), market consensus among those that take actual risk has shifted extremely bearish. Funds have grossed down or liquidated, RSIs are oversold, and DSIs are near 0.

However, the next shoe to drop is the retail investor exodus (it has partially started) that could lead to the mother of all passive unwinds. Imagine the horror on the face of the average investor as they open their Q4/year-end statement in a few weeks and sees the wealth destruction that has taken place in Q4. The natural investment psyche of the retail investor will be to sell and I think it’s hard for all of us to fathom just how widely owned FAANG’s are within index ETF’s. Therefore, I would have to imagine this trade will not work for Costanza right away, and there is severe risk that a deeper correction could continue into 2019.

What is the major headwind for Costanza with regards to his FAANG long and tech names more generally? Government regulation. Higher rates and wages have been a thorn in the side for margins but more than anything; it is the government’s involvement in Silicon Valley’s business model that has and will continue to be a major hindrance for tech multiple expansion. There is not much Congress agrees on these days, but Tech regulation, especially with regards to privacy laws, is the one thing. Ditto in Europe, where the governments are actually playing even rougher. Some recent data points:

Google CEO Sundar Pichai, who boycotted a Congressional hearing this summer, is now playing ball with Congress saying he supports regulation legislation.

The Federal Trade Commission still has an open investigation into whether Facebook’s conduct violated a previous settlement with the agency.

DC’s Attorney General is suing Facebook for “allegedly letting outside companies improperly access user data and for failing to properly disclose that fact.”

Europe’s new far-reaching privacy laws and anti-trust investigations on tech companies.

Uber being sued for anti-competitive practices.

President Trump has said his administration is seriously looking into monopolistic behavior of Facebook, Google and Amazon.

Those are just a few of many. The days of uninterrupted, carte blanche for Tech are a thing of the past, and thus a major regime change is happening. The only question is: is it all priced or not? The technicals indicate not.

FANG index formed classic head and shoulder top. The neckline is broken and the formation targets ~1500 which is still 30% lower form here…

Instinct: margin compression from higher yields/wages, global government scrutiny, and retail investor unwind will lead to a much deeper correction.

Costanza: funds have already purged these names, sentiment is at extreme lows, valuations more reasonable, and Tech is still the wave of the future.

Estimated probability of Costanza being right: 25%. The days of tech rising unadulterated are over. I think we can say that conservatively. In my opinion, the government’s involvement in their business puts a top in tech for quite some time, at least in regards to tech names that have thrived on the collection of consumer data and/or don’t pay enough tax/postage. If the chart above is proven right, that 30% hole will be tough to climb out of by year-end 2019. I would rather buy THAT dip than this current dip. Costanza is a braver man than I.

This also means broad US equity indices will struggle, albeit S&Ps not as much due to the “safe haven” names embedded within that index. However, since 2001 with similar extreme levels of being oversold, the market has been higher 100% of the time 1-year later, with an average return of 23%. So Costanza has hope given the magnitude of the selloff and poor sentiment; I just find it unlikely he will be happy in the first half of the year with his FAANG long.

2) Receive credit protection in IG and HY (aka long LQD andHYG)

A similar call to the above long equities, since correlations run high with credit. However, there are other issues with credit besides general risk sentiment, namely the massive amount of outstanding corporate debt, the large percentage of that debt that will need to be rolled, and the potential for credit downgrades should the economy enter a recession (which is what the front end rates market is pricing).

The amount of non-financial corporate debt-to-GDP has never been higher…

The US corporate refi tsunami is upon us…

This “maturity wall” which spikes next year and will likely need to be rolled comes at the inopportune time of the collapse in crude oil prices. The energy sector is a big user of the US credit market. Thus the risk for 2019 is the US credit market seizes up in the face of the refi wave into a recession. A toxic combination and we can add in the fact that the European credit market will have less support going forward with the ECB stepping back next year.

ITRAXX Xover Total Return Index is rolling over…

Instinct: the US economy is saturated with corporate debt and it is time to pay the piper with the coming refi wave. Everything gets exasperated if the US economy slips into a recession which will lead to higher default rates.

Costanza: the worst is priced in, GE credit widening is a one off non-systemic issue, and the economy will regain traction especially if Trade Wars are settled in 2019

Estimated probability of Costanza being right: 35%. I will assign this a little higher probability of working than tech longs. I am definitely concerned about the “maturity wall” and the trajectory of the US economy in 2019. For IG to widen out from here, you have to really believe the economy is falling off a cliff in such a way that defaults will finally rise, which then leads to even higher spreads and more defaults. It is not unrealistic, thus why I believe it is more likely that credit tightening won’t work.

The one major point the credit market has going for it is the technical chart, which says that most of the move is played out. As opposed to tech charts, IG has reached its spread widener target. Thus Costanza could argue during his “airing of grievances” that all the bad news is priced.

IG CDX reached the 94bps target on its inverse head and shoulder pattern…

3) Long Eurodollar spreads (EDZ9/EDZ0)

What a difference a year makes. Last year at this time, I was pounding the table on the coming resurgence of inflation and how the market was underpricing Fed hiking risk. That successfully played out, but now post-stock market carnage, oil collapse, and peak economic data; Eurodollar spreads are pricing in a recession and rate cuts! Oh my. So this again continues the theme we have seen in the first two Costanza trades, revealing a market that is very worried about the trajectory of risk assets and the US economy as a whole.

When you look at Fed Fund futures pricing for 2019 (using FFF9/FFF0 spread as my guide), you have 1bps of cuts priced into futures, versus an FOMC dot plot that is projecting 50bps of hikes (past ’19 you will discover even more rate cuts are priced in). So there is quite a gap that will need to be reconciled. Will the equity market collapse help to slow an already fizzling economy or is there a possibility the economy recovers (China deal?) and the Fed continues on its course to normalize policy?

Using Prism’s PAM charting tool, we can see the constant maturity equivalent of EDH9/EDH0 has only gone negative 2x in the past 15 years. In 2006, it continued to flatten hard, but in 2011 it was a false breakdown and recovered higher...

Costanza’s “feat of strength” is taking the other side of the conventional wisdom that the housing, auto, and coming PMI slowdown due to the oil collapse either won’t alter Powell’s mission or will prove to be a head fake like in 2011. The slowdown in the data this year was likely caused by a front loading of activity pre-tariffs/trade wars (i.e. buy everything Q2 and then sit tight the rest of the year), so there is a chance that the higher economic trend reemerges, especially if the trade talks with China go well early next year (something Trump warned about this weekend). Costanza could be laughing at the thought he was able to buy ED spreads negative.

Instinct: the US economy has peaked, the fiscal impulse dissipates early next year, QT increases, and regional surveys are already showing a coming slowdown. This will lead to a Fed pause now and possible cuts by end of 2019.

Costanza: Powell is still indicating rate hikes and the economy is projected to grow 2.2% with CPI remaining around the 2% target. The kicker will come if Trump, feeling pressured by lower equity markets, makes a trade deal with China. The market will be caught wrong footed as the Fed continues to tighten as activity picks up again.

Estimated probability of Costanza being right: 55%. Will give a slightly higher nod towards Costanza being right. Remember, he doesn’t need hikes to win, just no cuts which is a plausible scenario if Trump delivers a market friendly trade deal with China.

4) Long Bunds

There is no possible way Bund yields could go any lower in the face of the ECB ending its asset purchase program, right?? Costanza is saying “easy big fella” (side note: can you name that episode?). There are plenty of indicators that the Eurozone is careening towards major economic issues. I want to give a nod to Danielle DiMartino Booth, who is doing excellent, non-consensus economic research over at Quill Intelligence. She points out that the chemicals sector is “arguably the most hyper-cyclical leading indicator,” and using BASF stock as her guide, suggests the Eurozone economy is “poised to hit the skids.” In fact, she declares Germany to be the “most underpriced recession risk in 2019.”

Interestingly, if you graph BASF stock in Germany (black line) versus Bund yields lagged 100 days (orange line), it would suggest potential financial crisis in the Eurozone which will lead to Bund yields going negative again...

Instinct: ECB, while still reinvesting, ended its APP, Draghi will want to get one hike off before his reign ends towards the end of 2019, the ECB desperately needs to get out of negative rates, Draghi will likely be replaced by someone more hawkish or at least less dovish, and fiscal stimulus to counter the populist movement will all lead to higher rates.

Costanza: growth has already fallen off sharply, forward indicators suggest potential economic crisis, the ECB is already noting risks shifting to the downside, and there are major political hurdles next year with EU elections

Estimated probability of Costanza being right: 60%. If there was ever a Costanza trade it is this one. I am not sure there are many Bund bulls out there at 24bps so this is ripe for Costanza to be right. The chart is saying he will nail this one.

German 10yr yields have formed a head and shoulder pattern that targets -40bps if the 15bps neckline gets taken out to the downside…

Quick side note…

Idea #3 (long Eurodollar steepeners) and #4 (long Bunds) are basically implying that the US/German yield spread will widen once again in 2019 (assuming the ED steepeners are akin to higher US rates which has been the correlation). I would surely say that even combined, that idea is a Costanza trade. Most expect a narrowing of the US/German 10yr spread going forward.

Since I hit on the Bund side of the US/German 10yr spread, what could drive US rates unexpectedly higher in 2019 and thus help to widen the US/GE spread?

Increasing deficits leading to increasing supply

That increasing supply has already led to sloppy UST auctions

At a time the rate of change on foreign demand of UST has moved lower

With wages still remaining firm

All equal the need for higher term premium in the US

Now back to the list….

5) Short Gold

This has been an interesting correlation shift. For most of the year, Gold has been a pure Dollar play (especially vs CNH), but more recently Gold has picked up risk aversion, namely HY credit according to the Quant Insight macro PCA model.

Gold correlation to DXY (blue) and USD/CNH (green) has gone from negative to zero…

Now Gold is most correlated to VIX and HY credit…

Therefore, Costanza shorting Gold is another bet that risk assets will stabilize and the Gold bulls will be told “NO SOUP FOR YOU!”

Instinct: risk assets continue to trade poorly and Gold offers portfolio protection for the apocalypse.

Costanza: gold is losing its luster as a safe haven asset and, if the markets turn 2008-style ugly, it will get liquidated as well.

Estimated probability of Costanza being right: 51%. No strong conviction here but Costanza is right more than wrong so a slight edge to risk assets stabilizing and Gold returning to its Dollar correlation.

6) Long WTI

One of the most epic selloffs I have seen with a high-to-low collapse of 45% in just two months. The market narrative is now back to “elevated US production,” and more importantly, the Saudis, post-Khashoggi murder, have increased supply to push prices down for President Trump.

Costanza would be quick to point out that spare capacity is low and the oil market suffers from chronic underinvestment. That underinvestment only gets amplified with oil prices sub-$50, and we are already seeing Permian producers cut back on capex plans. Additionally, the widening in credit markets only makes it harder to obtain capital for capex. So you have the double whammy of lower prices and wider credit spreads, which will feed into the underinvestment theme. The days of capital inflows are back to 2008 levels.

By most analyst forecasts, even just a flat line of current production will cause a deficit in the supply/demand imbalance in 2019. We don’t need to be oil experts to know that when oil prices fall as precipitously as they did; rig counts fall and production declines. Now sprinkle in capex intentions being cut, along with credit issues, and that is Costanza’s recipe for higher oil prices. And, oh yeah, let’s not forget about the coming IMO 2020 regulations (sulfur emission reduction in cargo ships which will require heavy crude to be drawn from supplies to comply).

Instinct: US is oversupplying the market with its light crude, and the Saudis are more than making up for Iran sanctions to appease President Trump in light of the Khashoggi killing.

Costanza: low spare capacity will eventually catch up to the Saudis, and lower prices, lower capex, and a credit crunch will cause US production to flat line at a time when it needs to be increased (plus, the light API grade the US produces is not sought after).

Estimated probability of Costanza being right: 70%. I think much of the oil decline was technical fund liquidations (most likely large Risk Parity types that were long WTI as their inflation hedge), and all the forward looking supply issues not only remain, but are amplified with lower prices and wider credit. Costanza is usually right and I think this one is a layup. Oil prices will be higher than $45 come this time next year.

Use WTI time spreads as your signal when to get long. As we saw in the fall, time spreads (candles) led spot prices (green line) by about a week. Thus, if time spreads can break the downtrend, that will be your “tell” to get long WTI like Costanza…

7) Long Aussie$

A slowing Chinese economy and therefore slowing commodity demand, trade wars, and a decelerating domestic housing market have all led to a steady decline in the Oz in 2018.

Will keep this one short and sweet, as it is really the same idea as the other long risk asset trades. The AUD will really benefit from anything positive around the China/Trade War negotiations. Some sort of deal and the Aussie$ will scream higher. It’s that simple.

There is one micro issue Costanza should be concerned about and that is the Interest Only (IO) refi wave which will convert those IO mortgages into principle + interest loans. The reset wave started in 2018 and will increase in intensity in 2019. This will cause the average borrower to pay about $7,000 more per year in additional payments. That is a major hit to the housing market via delinquencies, and may be a crushing blow to consumers’ discretionary spending.

The one saving grace for Australia has been the RBA remaining on hold for (jokingly) 37,000 consecutive meetings. As the below chart shows, at this level of housing collapse, the RBA tends to cut.

Instinct: Australia has felt the effects of the China slowdown and trade wars, along with its own domestic issues. The currency will need to continue to depreciate to offset that pain.

Costanza: the equity market weakness will force Trump to play ball with the Chinese which will reverse the AUD higher. Additionally, the new economic weakness in the US and a Fed that could move to cut rates should weaken the USD.

Estimated probability of Costanza being right: 55%. Basically a better long than FANGs and credit, as being long AUD$ could also benefit if the Fed moves to an outright easing bias (which will depreciate the USD vs. the AUD). Apparently, long USD is now the most crowded trade in the market (according to a BAML survey). A housing crisis in Australia will be the major headwind for the Costanza long.

8) Short EM

This would be Costanza’s hedge against all the long risk asset bets above. So why is being short EM anti-consensus at a time risk assets are getting rinsed and everyone has turned bearish? Through conversations with street analysts and clients, there is, for whatever reason, an insatiable demand to buy the EM dip. After all, EM has been selling off since January so it should be the first to bounce, right? That thought is “making George angry” and why he is going to take the other side of that.

In a world where the China Manufacturing PMI just went into a contraction, European data is falling off a cliff, and US regional surveys are all pointing to a coming slowdown; is EM growth going to be booming and the place to allocate risk? I understand that it is a short dollar play, but 2019 could be marked by a major global growth slowdown and balance sheet recessions. That is not the ideal environment for EM.

The technicals say the selloff is not yet complete, as a bearish head and shoulder pattern has formed targeting an additional 6% lower…

Instinct: EM has already taken its pain, Trump/China deal likely in 2019.

Costanza: global growth slowdown will hurt EM the most, especially if USD funding issues reemerge. EM has never been a safe haven during growth scares and recessions.

Estimated probability of Costanza being right: 55%. All signs point to a poor global growth trajectory in 2019.

9) Long Bitcoin

That potential bottom has formed a bullish inverse head and shoulder pattern that sets up for a retest of the 1-year downtrend…

The selloff in bitcoin in 2018 was an once-in-a-lifetime move. From the highs just after New Year’s, Bitcoin spiraled 85% lower to take over as the largest historic bust since the Tulip crisis. The crypto naysayers had a field day this year.

Costanza would hypothesize that if you believe the US Dollar is losing its hegemony, the US government debt issue is ballooning to unsustainable levels, Europe is in the midst of a populist meltdown, and China is on the verge of a hard landing; why aren’t crypto currencies like Bitcoin as viable a store of value as a yellow rock?

Interestingly, Bitcoin has started to potentially bottom during the December equity meltdown, lending some credence to the theory that investors are becoming concerned with the global environment and searching for new stores of wealth.

That potential bottom has formed a bullish inverse head and shoulder pattern that sets up for a retest of the 1-year downtrend….

Instinct: crypto currencies have no use and are on their way to near worthlessness.

Costanza: Bitcoin is starting to rediscover its use as an alternative to traditional stores of value.

Estimated probability of Costanza being right: 50%. No clue and no edge here. However, it is hitting support levels, it has a bullish formation, and there is extreme bearish sentiment which all reek of a Costanza trade.

Bonus: Long Donald Trump

I cautiously put this in here hoping to avoid all political conversations and opinions, but I think this is an interesting nonmarket, yet market relevant idea.

I don’t think many expect much from POTUS next year, given the House swung to the Democrats and many folks (mostly on the liberal side, to be fair) believe there is looming tail risk that Mueller has enough evidence of some sort of wrongdoing that Trump’s presidency could be in jeopardy.

One could argue whether less Trump or no Trump is good or bad for risk assets. On the one hand, the more stable Pence could be welcomed by markets, and perhaps if Trump goes, trade war issues dissipate. On the other, the market rallied on his election victory in 2016, his policies are mostly reflationary, and China has become a legitimate nonpartisan issue. Therefore, even if Trump is ousted, trade wars likely continue unabated.

The surprise, non-consensus idea would be that Trump crosses the aisle to enact Infrastructure. Couple that with an earlier than expected China deal, and that is how Costanza will be paid out on a lot of his risk-on calls. Perhaps the market is underestimating Trump, and he ends up delivering a great deal vs. expectations of a lame duck presidency.

Summary:

As opposed to last year, this year’s Costanza trades (non-consensus calls) have a simple theme. Costanza is looking for a bounce in risk assets. What are the realistic paths to get there versus a market that expects more pain? At least one or more of these have to happen…

Cessation of tariffs/trade wars, which leads to a bounce in Chinese growth and a resumption of the positive growth momentum in the US

A Fed that ends the rate hike cycle and Balance Sheet reduction **coupled with growth remaining ok** (if growth softens further, equities could actually still sell off)

Rebound in the energy complex

US Infrastructure + EU fiscal stimulus + Chinese stimulus (all being discussed currently)

What are the glaring issues that will prove Costanza wrong for the first time in the history of this piece? To name a few…

US Fiscal Impulse dies out in early ’19 + global QT picks up in intensity

Government intervention in Silicon Valley

Passive unwind into a resumption of the explicit and implicit short vol unwind

The potential for a corporate credit blowup in the US and Europe

Housing busts in Australia, Canada, the US, and Asia

There is a lot of be worried about in 2019, and I believe we are only in the beginning stages of a risk asset purge. Costanza is much less worried.

I want to wish everyone a Happy New Year! I look forward to speaking with everyone again soon and telling you more about Prism’s exciting business model.

0 notes

Text

Governments, Regulations and Logistics Structure – Executive Insights with Pritam Banerjee

Executive Insights is a series by Shipping and Freight Resource that provides ongoing insights and thoughtful analysis..

This series features selected individuals from the industry and is aimed at enriching the knowledge of the readers with what is happening in the shipping, freight, maritime, logistics, and supply chain industry..

Executive Insights also gives you a chance to pick the brains of these industry veterans, leaders, and enablers..

In this edition of Executive Insights, we caught up with Pritam Banerjee, Logistics Specialist at Asian Development Bank (ADB) on the topic of Governments, regulations and logistics structure..

SFR : Can you give a brief background about yourself and your entry into the industry..??

PB : After my Ph.d, I joined World Bank in Washington DC, where most of my work was related to trade policy, especially what is called trade facilitation…focusing on customs and other regulatory reforms that are very relevant for logistics operations.

I was then recruited by Confederation of Indian Industry (CII), a national industry association to head their Trade Policy division based out of New Delhi. It was during that time industry folks saw me engage with Government on issues related to their business, and I was recruited by Deutsche Post DHL Group.

SFR : There are a lot of questions from people in the industry about formal education.. How much has your Masters and PhD helped you in understanding the industry and its nuances..??

PB : I think that a background in economics helps you approach problems in a certain way. If you undergo a doctoral program, you add certain analytical skills in your tool box. That perhaps helps you see things in slightly different light.

So in a room full of experienced colleagues who have spent all their years in operational and commercial roles, you can bring in a different and sometimes valuable perspective. Having said that though, my most productive learning years were those spent in DPDHL Group.

And my best professors were guys with years of operational experience in warehousing, customs brokerage, line haul.

Formal education can give you a 20,000 feet view, but it is your industry experience that grounds you, makes you real as a professional.

SFR : Do Governments really have a practical understanding of the requirements of the logistics sector and what kind of support do they really provide to this sector because generally there is a lot more interest in the maritime sector..

PB : I think the essential challenge for governments is they are organized in silos. So within a department, there is a specific focus on maritime and ports, or regulating civil aviation, or developing highways, or managing borders etc.

On the other hand, logistics is essentially a network of services using different transport modes. So, governments depend on the logistics industry for practical feedback. The governments that have developed strong institutions for such a feedback loop do a better job than those who haven’t.

What has changed in the last decade or more is the focus of policy-makers on logistics, and on the supply chains, they serve.

Global indices such as the Logistics Performance Index (LPI) and other such measures of connectivity and supply-chain performance are taken very seriously.

Maritime sector gets a lion share of attention, even in these surveys and rankings because it is still responsible for moving the bulk of trade that governments are interested in.

However, with the rise of e-commerce (B2C), and greater degrees of customization of products requiring you to move smaller packet sizes of bespoke goods for individual customers in B2B, air-cargo is getting a lot of attention.

Multi-modal solutions, take the China-Europe rail product, which in turn is connected to Japan or Vietnam via maritime and road connections are all getting a lot of focus by policy-makers as viable alternatives providing important solutions to supply-chains for these economies.

SFR : What are some of the common pitfalls faced by companies who have not bothered to create a proper logistics structure or plan..??

PB : We can sum it up in two words “going bust”. In a globally competitive eco-system, supply chain management, and the logistics that support it is one of the key drivers of your competitiveness. It makes and breaks you as a business.

Even your brand equity depends on it. After-sales service depends on the logistics of spare parts and components, on reverse logistics for defective parts.

Only firms that enjoy near-monopoly or are State-Owned Enterprises that live off budgetary support can afford to be casual about having effective logistics management.

To bring greater nuance to this response, I think there are degrees to which firms get this logistics structure right. And even then, one has to keep evolving as the firm’s needs expand, or supply chains have to be rejigged to meet new customer expectations.

As firms grow larger, they look to the professionals-logistics service providers (LSPs) to come up with the right structure.

The entire 3PL business has grown exponentially for this reason. Economies of scale and technology has allowed LSPs to price their solutions more reasonably over time, allowing even middle to smaller size enterprises use their services.

This has been one of the less told stories of how globalization and global value chains were build in the last three decades.

SFR : Are there any regulations or policies in general that is currently causing more harm than good to the global supply chain industry..??

PB : The list is endless if fact in my opinion one can write a book to just list them all! But the short answer would be that such regulations fall under five broad categories.

Border measures: Related to the whole gamut of customs and other border agency-related issues. Despite the enormous progress, challenges remain.

Anti-competitive measures: These refer to preferences for national or flag carriers, right of first refusal (ROFR), FDI restrictions, state-aid or support etc. Especially relevant now with ‘bail-outs’ and preferences by governments due to COVID-19 crisis for both airlines and liner shipping, the full impact of such state aid to their firms will be felt in months to come.

Access limitations/restrictions critical infrastructure or operational restrictions: These are often critical to an efficient operating environment. Take for example a particular cargo airline receiving the juiciest slots at an airport, or restriction on being able to use your own ground handler of choice or denial of self ground-handling to an aggregator.

There are unique challenges arising under this category in terms of data privacy and security. Insistence on data localization, or use of scanners of a particular firm and specification mandated by the state, or demanding employee records and putting in place intrusive electronic surveillance in facilities.

Discretionary powers leading to unpredictable business environment: Over-riding regulatory powers to set prices, or suspend an operating license, or renegotiate terms of the contract for a private terminal in state-owned port are just some examples of complications that arise under this category of issues

Procedural and enforcement issues: These are the day-to-day that is the bread and butter of regulatory and compliance guys in logistics firms. Approvals, clearances, valuation and interpretation by customs and GST/VAT authorities, warehouse inspection compliance….I can go on and on.

SFR : Is there a direct correlation between profitable trade flows and structured supply chains..??

PB : Not always. Profitability can be driven by technology or resource monopolies or oligopolies that allow firms/countries to make profits, independent of having well-structured supply chains.

But such profits are not sustainable. Sustainable profits require having well-structured supply chains that minimize costs, while at the same time meet the expectations of your trade partners in terms of predictability of the supply chain and its ability to manage quality and security.

SFR : What role does public policy and regulations play in a country’s trade growth..??

Enormous amount. The interface of regulations and public policy is essentially a conversation on ease of doing business. We live in a world where capital, high-end skills and technology are extremely mobile.

So manufacturing and services activities cluster around regions/countries where it is easy to do business. When industry professionals engage in conversations around this topic, and governments actually listen, you end of creating the business-friendly eco-system that investors like.

Almost every investor today has a choice, even MSMEs. And I think despite COVID-19 crisis-induced protectionism, firms would continue to exercise that choice and locate where it makes economic sense, and it is relatively easy to do business because in those locations you would have a responsive government that takes this conversation on public policy with business seriously.

SFR : Do you think the international regulatory authorities like IMO, IATA, WHO etc. are doing a good job because while they are creating the regulations, they are still dependent on the various Governments to implement and police them..

This has always been the case. International Organizations (IOs) depend on member country governments to implement their regulations and protocols.

Since these regulations and protocols typically evolve out of a consensus among member countries, these are enforced quite rigorously on the ground by member country governments. Has the COVID-19 crisis seriously undermined this? In my opinion, not yet.

But yes, the enforcement ability in some parts of the world has been compromised as government machinery itself is impacted due to COVID-19 crisis. In the coming months, we might even see the credibility of some of these IOs being challenged (for e.g. the WHO), and member countries less inclined to take directions from them.

SFR : How do you see the tariff wars progressing – are we in for a rough ride or have things calmed down a bit on the back of the impact of COVID-19..??

I think this is the calm before the storm. And I am speaking not just in terms of tariffs, but in the overall context of trade wars. The COVID-19 crisis has hurt all economies, there is a lot of unemployment all around. Governments will try to hunker down and protect jobs.

This is bound to lead to protectionist measures. Tariffs are the least efficient measure in the tool-box, but the least complicated for governments to use.

But other Non-Tariff Barriers would also proliferate. Some of these measures will add huge operating costs and efforts for LSPs, especially those who also provide customs brokerage and customs clearance services.

Anti-dumping duties added compliance requirements for product standards and certifications, stringent requirements for the provenance of origin, all of these would add to the challenge.

There would be supply chain impacts in the medium term as well, as firms chose to re-locate production to adjust to the new trading regimes.

The post Governments, Regulations and Logistics Structure – Executive Insights with Pritam Banerjee appeared first on Shipping and Freight Resource.

from Moving https://www.shippingandfreightresource.com/executive-insights-pritam-banerjee/

via http://www.rssmix.com/

0 notes

Text

TechCrunch Editor-at-Large Josh Constine Talks Cryptocurrency

New Post has been published on https://cryptnus.com/2018/09/techcrunch-editor-at-large-josh-constine-talks-cryptocurrency/

TechCrunch Editor-at-Large Josh Constine Talks Cryptocurrency

I had the opportunity to sit down with TechCrunch Editor-At-Large Josh Constine at TechCrunch SF. Josh has an interesting background in that he’s spent most of his career covering social media products (and earned a master’s degree on research in the field) in a time when these products are under heavy scrutiny.

He’s also a media heavyweight by any standard, having interviewed the likes of Mark Zuckerberg, Edward Snowden, and Cory Booker and having spoken at 120 events on a diverse set of topics.

youtube

CCN: You’ve been covering cryptocurrency for a long time. Now, you’ve really seen them emerge and just burst onto the scene. Whether you’re at TechCrunch just around then, I could tell you that every booth has some mention of blockchain. And even if they don’t, the founders are talking about how they can integrate blockchain into these products.

JC: It’s like the new AI. Last year, every pitch has got AI in it. Now, every pitch has got blockchain or tokens in it.

CCN: Yes. It’s the old “Every company is an AI company.” Now, “Every company is a blockchain company.”

JC: Don’t worry. It seems to be an easy way to add a few extra million to your next route.

CCN: How long have you seen this trend coming for? Mainstream blockchain companies?

JC: I don’t necessarily think of there being that many truly mainstream blockchain companies. I think beyond Coinbase, where we saw a huge flood of users in late 2017, early 2018, spike in prices, I think that was the place where a lot of people got their first taste. But honestly, I think it’s going to be a few more years before we get real mainstream applications for blockchain usage, and I think the main barrier to that is the usability.

Engineering has really been the forefront of most cryptocurrency and blockchain developers, whereas the design, the usability, the UX, has been often left behind. So it falls very far behind on what we’re used to using every day.

If anyone’s used to logging in to Facebook or logging in to other apps using their Facebook login, they might think, “Oh, if I want to use a new crypto-decentralized app, I should be able to just hit a login button, right? “

It’s like, “No, you’re going to have to remember this super long private key. If you type something in wrong, you’re going to end up sending money to the wrong person.” It’s really just very complicated.

I think until the platforms get there and the usability of those infrastructural parts of the blockchain ecosystem get there, it’s going to be really difficult for us to see mainstream adoption of some of these decentralized apps.

CCN: How long do you think that’s going to take? And just to follow that up real quick, we have had some which have been breached two, three, four, five times now. At what point do you think we’re going to be in the maturity of those platforms where users are comfortable with it in their daily lives?

JC: Unfortunately, security is a real cat-and-mouse game. The attackers are always going to be improving their skills, so I don’t think we’re ever going to get to a point where things are just secure. I think the really well-funded companies that have the ability to attract great talent have that momentum. They’re going to be okay. But at the same time, they’re going to have larger targets on their backs.

It’s those medium-sized companies that might be starting to actually steward a fair amount of money or tokens but haven’t had the funding or momentum to recruit the best security talent. Those are going to be the ones that are really concerning.

The problem is, it just takes one bad breach. It just takes one time having your wallet stolen for people to be like, “You know what, this whole thing is a bit too crazy. I’m going to step back.” I think, that, combined with the depression in prices recently has pushed a lot of mainstream investors away from cryptocurrency.

CCN: From a venture capital perspective, what kind of trends are you seeing?

JC: I’m seeing that these crypto companies, at first, we saw a quick wave of games and things like CryptoKitties and things like FameBit that are designed to help you steward your cryptocurrency items and virtual goods. But I think after the downturn, we’ve seen that the real companies that are getting equity funding are these truly infrastructural scaffolding of the blockchain industry.

There are people who are going to be doing things like compound and derivatives trading where you can be able to short and trade on margin for cryptocurrencies or things like 0x where you’re going to have a distributed and decentralized exchange for cryptocurrencies.

These things that you sort of want to have in place before the mainstream are what we’re seeing funding from big companies like Andreessen Horowitz, or even Coinbase itself.

Whereas, the kind of applications and the utilities that get built on top of that stuff, I think the big venture funds are waiting until all that infrastructure is in place before they start investing in the content or the utilities that are built on top.

CCN: As far as a West start-up type company goes, what are you thinking about IBM, even AWS, and their approach to blockchain technologies?

JC: I’ve heard a lot of talk about IBM, but I’ve also heard about a lot of people who think it’s kind of just a bunch of smoke-and-mirrors. That, yes, they might have a bunch of patents, but they’re not really doing very much seriously with it.

With AWS, there’s definitely opportunities for decentralized storage systems and ways of assigning and doing accounting for storage space. Actually, the big company that I’m most bullish on in the blockchain space right now is Facebook.

They have built this small but elite team of product managers and engineers, including David Marcus who was formerly the head of PayPal and was the head of Facebook Messenger for years, and Kevin Weil who was the head of product of Instagram, who launched Stories and really turned Instagram into the powerhouse that we know it is today.

Them, and some other highly elite engineers from Facebook have moved on to this blockchain team. I’m very excited about what they’re going to build. What I think they’d probably end up building is something that allows you to pay for stuff with the kind of advertisers that buy ads on Facebook.

But with the cryptocurrency wallet, instead of having to use actual cash, and for that, Facebook will be able to say, “Hey, get 4% off your purchase when you buy with FaceCoin.” Or something like that.

Also, I think that they may be the one that ends up building that identity platform, that login layer, for the cryptocurrency decentralized app ecosystem.

The same way they built Facebook Connect for games and other apps around the web, they can build a similar identity system for the decentralized app layer. I think those are two really important areas that we’re going to see.

There’s also just lots of opportunities for them in e-commerce because they already have the relationships with all these businesses and advertisers. They’re not starting from scratch.

I think in some cases, it may be easier for the big companies to build blockchain and bolt it on to their existing technology than it is going to be for blockchain first companies to build all of the other infra-business relationships necessary to launch all of these products.

CCN: So Facebook is an addressing point because they have a problem and a pretty big one. That problem is that the users don’t trust them anymore. Do you see them using blockchain to try to solve that issue?

JC: Fortunately, while there’s obviously a lot of opportunity for transparency and the decentralization, which means you’re not going to have centralized meddling or corruption, at the same time, when people hear blockchain, a lot of them think of stolen wallets, giant hacks, Mt. Gox, and these kinds of flameouts.

They don’t necessarily think of it as being a super secure industry. It’s affiliated with the dark web. It’s affiliated with a lot of these scammers and the people who were in the ads business on the internet a few years ago.

I don’t necessarily think blockchain is going to make people trust Facebook anymore. In fact, I’m not sure if there’s a lot that Facebook can do to rebuild that trust. That said, I don’t think people actually care about privacy that much. I think they care about utility, and they care about where their friends are.

The biggest problem for Facebook isn’t that people don’t trust it, it’s that the people’s friends aren’t there, that people aren’t posting status updates anymore, that people have moved on to SnapChat and YouTube and Instagram.

Luckily, they own Instagram so that’s not as big of a problem for them. But really, they need to focus on the utility of their apps more than I think they do the privacy. They need to avoid more scandals, but nobody’s like, “I choose my social network based on privacy.”

CCN: Yes, and I guess they also need to focus on increasing user engagement, which is funny because Zuckerberg, in his New Year post, basically said, “User engagement’s going to go down, profits are going to down because we’re focusing on privacy.”

JC: Yes. I think he’s focusing on privacy but also focusing on digital well-being. I think that’s the real thing that’s weighed down on some of Facebook’s profits. That, and the fact that they said that they’re going to double their security and content moderation force from 10,000 to 20,000 employees in order to prevent election, interference, and hate speech and other content problems on their network. That’s what’s really dragging down profits right now. That, and the engagement issue.

If they want to fix that, there’s a lot of things that they can do that don’t really have anything to do with privacy.

But around digital well-being, they want to have less viral video on the site, because that’s kind of low-quality content that people might watch and spend a lot of time watching, but it doesn’t make you feel good afterwards. It makes you feel empty and like you just ate up a big double cheeseburger. Like you felt good for that one moment, but then you feel awful afterwards. And they’re trying to clean that up because they know that long-term, they need to have people to have a good feeling when they leave Facebook if they’re going to keep coming back for years to come.

I think we’re going to see a lot more focus on how do you make sure every post that people see makes them feel good, or at least teaches them something, rather it’s just lots of blinking, flashing lights in that first one second of the video as you scroll by to capture your attention.

CCN: So the OpenID concept you brought up before is interesting because it allows for Facebook, which already has 2 billion users, probably more, to engage in KYC, which is a huge activity that generates probably hundreds of millions of dollars of revenue. Do you also see that having any effect on user engagement and solving some of the problems they’ve had with people impersonating Americans?

JC: Yes. One of the things that we can rely on with Facebook is that if somebody has hundreds of friends, they’re probably real. It’s really tough to build up that kind of friend network if you’re a fake account, and if you are, you basically are tying a bunch of fake accounts together, so if one gets busted, they all end up falling down like a stack of dominoes.

Facebook does have a really good way of being able to tell who is real and who is fake out there. Hopefully, they’re going to be using that to prevent some of the selection interference in these fake accounts, but like you said, that could also give them a leg up when it comes to knowing your customer and making sure you’re not doing money laundering or enabling fraud.

Again, that’s one of those points where the big incumbents who already have built a lot of these technologies may have an advantage over the smaller blockchain companies who might be in the right place in terms of their primary focus, but they haven’t built up on that backend technology they’re going to need to become a success.

CCN: One other question I have with Facebook, because you said they’re in such a great position to do KYC and identify fake accounts. Why haven’t they been able to execute all that on Instagram? The platform has tons of fake accounts and verification is almost impossible to get, although I’m sure…

JC: I’m sure there’s always the fear that if you start terminating too many accounts, you’re going to end up with some false positives and you’re going to delete some really legitimate accounts. And especially in the last few years when they were truly battling it out with SnapChat, I think they were a little bit worried about that.

In the meantime, they have done a lot with artificial intelligence to start being able to weed out fake comments or spam comments. I don’t think you see nearly as many of those like “Buy Viagra” or “Easy way to make money at home” kind of spam that you see in the Instagram comments like you used to.

That doesn’t mean that there’s not a lot of bots and fake accounts who were trying to comment in order to get you to follow them back so that they can make more money from sponsored posts or just people running bots to increase their own personal following. And there are definitely troubles with that.

I hope that now that they’ve kind of vanquished SnapChat with its actually 3 million users in the last quarter, I think that means that they can stop focusing on the competition and start focusing on those internal fundamentals, and I think that that’s really going to mean focusing on safety and integrity of the service and making sure everyone on there is real.