#Allegheny Airlines

Photo

Boston - Allegheny Airlines, 1950

72 notes

·

View notes

Text

Allegheny Airlines

0 notes

Text

Hossein Dehnavifard biography: 13 things about University of Cape Town alum from Iran

Hossein Dehnavifard is a design software control engineer born in Tehran, Iran. While residing in Edgewood, Allegheny County, Pennsylvania, United States, he arrived late at Pittsburgh International Airport in Pittsburgh, Allegheny County just after 4:30 p.m. on May 10, 2023.

Dehnavifard was refused entry on his American Airlines flight to Philadelphia, Pennsylvania. He was travelling to…

View On WordPress

#Allegheny County#American Airlines#Cape Town#Edgewood#Pennsylvania#Philadelphia#Pittsburgh#Tehran#University of Cape Town

0 notes

Text

Events 1.6 (after 1910)

1912 – New Mexico is admitted to the Union as the 47th U.S. state.

1912 – German geophysicist Alfred Wegener first presents his theory of continental drift.

1929 – King Alexander of the Serbs, Croats and Slovenes suspends his country's constitution (the January 6th Dictatorship).

1929 – Mother Teresa arrives by sea in Calcutta, India, to begin her work among India's poorest and sick people.

1930 – Clessie Cummins arrives at the National Automobile Show in New York City, having driven a car powered by one of his diesel engines from Indianapolis.

1941 – United States President Franklin D. Roosevelt delivers his Four Freedoms speech in the State of the Union address.

1946 – The first general election ever in Vietnam is held.

1947 – Pan American Airlines becomes the first commercial airline to offer a round-the-world ticket.

1950 – The United Kingdom recognizes the People's Republic of China.[31] The Republic of China severs diplomatic relations with the UK in response.

1951 – Korean War: Beginning of the Ganghwa massacre, in the course of which an estimated 200–1,300 South Korean communist sympathizers are slaughtered.

1960 – National Airlines Flight 2511 is destroyed in mid-air by a bomb, while en route from New York City to Miami.

1960 – The Associations Law comes into force in Iraq, allowing registration of political parties.

1967 – Vietnam War: United States Marine Corps and ARVN troops launch "Operation Deckhouse Five" in the Mekong River delta.

1969 – Allegheny Airlines Flight 737 crashes in Lafayette Township, McKean County, Pennsylvania, United States, killing 11.

1974 – In response to the 1973 oil crisis, daylight saving time commences nearly four months early in the United States.

1989 – Satwant Singh and Kehar Singh are sentenced to death for conspiracy in the assassination of Prime Minister Indira Gandhi; the two men are executed the same day.

1992 – President of Georgia Zviad Gamsakhurdia flees the country as a result of the military coup.

1993 – Indian Border Security Force units kill 55 Kashmiri civilians in Sopore, Jammu and Kashmir, in revenge after militants ambushed a BSF patrol.[

1993 – Four people are killed when Lufthansa CityLine Flight 5634 crashes on approach to Charles de Gaulle Airport in Roissy-en-France, France.[

1994 – U.S. figure skater Nancy Kerrigan is attacked and injured by an assailant hired by her rival Tonya Harding's ex-husband during the U.S. Figure Skating Championships.[

1995 – A chemical fire in an apartment complex in Manila, Philippines, leads to the discovery of plans for Project Bojinka, a mass-terrorist attack.[

2000 – The last natural Pyrenean ibex, Celia, is killed by a falling tree, thus making the species extinct.

2005 – Edgar Ray Killen is indicted for the 1964 murders of Chaney, Goodman, and Schwerner during the American Civil Rights Movement.

2005 – A train collision in Graniteville, South Carolina, United States, releases about 60 tons of chlorine gas.

2012 – Twenty-six people are killed and 63 wounded when a suicide bomber blows himself up at a police station in Damascus.

2017 – Five people are killed and six others injured in a mass shooting at Fort Lauderdale–Hollywood International Airport in Broward County, Florida.

2019 – Forty people are killed in a gold mine collapse in Badakhshan province, in northern Afghanistan.

2019 – Muhammad V of Kelantan resigns as the Yang di-Pertuan Agong of Malaysia, becoming the first monarch to do so.

2021 – Supporters of U.S. President Donald Trump attack the United States Capitol to disrupt certification of the 2020 presidential election, resulting in five deaths and evacuation of the U.S. Congress.

1 note

·

View note

Text

Unlocking the Skies: Pilot Training in Pittsburgh

Allure of Pilot Training:

Pilot training has always captivated the imaginations of individuals fascinated by aviation. It offers the unique opportunity to turn a childhood dream into a rewarding career. In Pittsburgh, this dream can become a reality, as the city boasts several well-established flight schools that cater to aspiring pilots at various stages of their journey. These institutions provide the necessary training, guidance, and resources to help individuals acquire the knowledge and skills required to navigate the skies confidently.

Flight Schools in Pittsburgh :

Pittsburgh hosts a range of flight schools, each offering distinct training programs to suit different goals and aspirations. Some prominent institutions include the Pittsburgh Flight Training Center, Allegheny County Airport Authority's flight school, and the Community College of Allegheny County's Aviation Sciences program. These schools combine classroom instruction with hands-on flying experience, ensuring a comprehensive learning experience.

The Pittsburgh Flight Training Center, for instance, offers a variety of pilot training courses, from private pilot licenses to advanced certifications. Students benefit from state-of-the-art facilities, experienced instructors, and a supportive learning environment.

The Allegheny County Airport Authority's flight school offers a structured curriculum that covers various aspects of aviation, including ground school, simulator training, and flight instruction. Students can pursue licenses ranging from private to commercial pilot, and even airline transport pilot licenses.

The Community College of Allegheny County's Aviation Sciences program provides a two-year associate degree program in aviation, preparing students for careers as professional pilots or aviation managers. The program includes both academic coursework and flight training, equipping students with a strong foundation in aviation theory and practical skills.

Career Opportunities :

Pilot training in Pittsburgh opens up a world of career opportunities for aspiring aviators. Graduates of these training programs can pursue careers in commercial aviation, becoming airline pilots or flying for private charter companies. Pittsburgh's thriving aviation industry, including the Pittsburgh International Airport and regional airports, offers a range of employment prospects. Additionally, graduates can explore opportunities in aerial photography, flight instruction, and corporate aviation. The demand for qualified pilots continues to grow, making pilot training in Pittsburgh a promising investment in a rewarding future.

FOR MORE INFO :-

Pilot Training Pittsburgh

Pilot Training Near Me

0 notes

Photo

The Short 360 (also SD3-60; also Shorts 360) is a commuter aircraft that was built by UK manufacturer Short Brothers during the 1980s. The Short 360 seats up to 39 passengers and was introduced into service in November 1982. It is a larger version of the Short 330. During the 1970s, the world's commuter airline market began to evolve from the 20-seat class to larger and more comfortable cabins. Short Brothers of Northern Ireland had created the Skyvan in 1962, followed by the related but larger Short 330 in 1974. The Short 360 development was announced in 1980, with the prototype's first flight on 1 June 1981 and type certification awarded on 3 September 1981. The first production Short 360 had its maiden flight on 19 August 1982 and entered service with Suburban Airlines (later merged with Allegheny Airlines/US Airways) in November 1982. After initiating production with the basic model, Short marketed a number of 360 developments. First was the 360 Advanced, in late 1985, with 1,424 shp (1,062 kW) PT6A-65-AR engines. That was followed by the 360/300, in March 1987, with six-blade propellers, more powerful PT6A-67R engines, and aerodynamic improvements, giving a higher cruise speed and improved "hot and high" performance. The 360/300 was also built in 360/300F freighter configuration. Production of the 360 ceased in 1991 after 165 deliveries. 🛬🛫🛬🛫🛬🛫🛬🛫🛬🛫🛬🛫 🛬🛫🛬🛫 🛩 Aircraft Manufacturer: Short Brothers. 🛩 Aircraft Type: Short 360-300 | SD-36. 🛩 Aircraft Registration: N918GD. 🛩️Route: SJU-SXM. 📍 Location: @sxmairport | TNCM | SXM. 📆 Date: 11/3/2022. 📸 Photo Captured by: © Franklyn Wilson | @beeksphotos. 🛬 🛫 www.beeksphotos.sx 🛫 🛬 #tncm #sxm #instagramaviation #ilivewhereyouvacation #instagood #teamaviation #aviationlovers #aviationphotographyphotos #sintmaartenphotographer #sxmphotographer #planespotting #passionpassport #aviationdaily #sunsetbeachbarsxm #mahobeachexperience #sunsetbeach #sju #sanjuan #puertorico #flamencocargo #airflamenco #cargocarrier #cargo #shortbrothers #shorts360 #aircharterinc #n918gd #1132022 #beeksphotos #swipeleft (at Maho Beach Experience) https://www.instagram.com/p/CksvDbEOSfS/?igshid=NGJjMDIxMWI=

#tncm#sxm#instagramaviation#ilivewhereyouvacation#instagood#teamaviation#aviationlovers#aviationphotographyphotos#sintmaartenphotographer#sxmphotographer#planespotting#passionpassport#aviationdaily#sunsetbeachbarsxm#mahobeachexperience#sunsetbeach#sju#sanjuan#puertorico#flamencocargo#airflamenco#cargocarrier#cargo#shortbrothers#shorts360#aircharterinc#n918gd#1132022#beeksphotos#swipeleft

0 notes

Text

Nickel Alloys Market Report 2022, By Segmentations, Key Company Profiles and Demand Forecasts to 2027

A new upcoming study of Fairfield Market Research suggests that the growth of global nickel alloys market remains upbeat majorly with incessant demand coming from aerospace, and defence industries. Nickel alloys such as Wasaploy continue to witness massive uptake in manufacturing of aircraft engine components owing to their superior functional attributes that make them preferable over their conventional counterparts like steel. With air travel becoming more ubiquitous across the Asian subcontinent, and in the Middle Eastern and African countries, nickel alloys continue to experience sustained demand within the aerospace realm. China’s aerospace and defence industries have especially been the predominant consumers of nickel alloys as the Chinese airlines look to extend their operations by new plane launches. The report marks the fact that the growth of aviation engine components, turbine blades, and other aerospace components will continue to hold a direct influence on aerospace component suppliers, which in turn impact the market potential of nickel alloys as well.

To Read Complete Report of Nickel Alloys Market: https://www.fairfieldmarketresearch.com/report/nickel-alloys-market

Sales of High-performance Alloys Dominant

On the back of superior heat and thermal resistance, high-performance alloys will continue to garner higher preference in global market. While these alloys are especially meant for usage at demanding settings, they can efficiently withstand harsh corrosive conditions, complex external circumstances, and high pressure typically existing in aeronautical engine turbines, as well as across deep oil and gas fields. In addition to the aerospace industry, oil and gas explorations are thus also likely to generate considerably high demand for high-performance nickel alloys.

Asia Pacific to Drive the Growth of Nickel Alloys Market

Asia Pacific will retain its dominance in global nickel alloys market, majorly on account of the swelling manufacturing industry. The market in China, and India is particularly expected to thrive based on the proliferating auto industry. China has been the largest consumer market for nickel alloys manufacturers and the trend will continue throughout the forecast period. The country’s ballooning electric vehicle market has been pushing battery demand, which will continue to uphold nickel alloy consumption in future. India also remains an important market, being one of the largest commercial vehicle manufacturing countries, as well as among the world’s top car markets. On the other side, North America reflects a decently high opportunistic potential on the back of rising demand for gas turbines, especially in the US. Growing adoption of superalloys in gas turbines, and other high-temperature applications is likely to keep the sales of nickel alloys afloat here in the US, thereby supporting the North American market.

Global Nickel Alloys Market Competition

Some of the key players steering the competition landscape of global nickel alloys market would be subject to detailed strategic profiling and analysis in the report. Sandvik Materials Technology AB, Carpenter Technology Corporation, Aperam S.A., DM Metals, Haynes International Inc., ThyssenKrupp AG, Precision Castparts Corporation, Voestalpine AG, Allegheny Technologies Incorporated, and Rolled Alloys Inc. constitute some of the profiled players.

For More Information Visit: https://www.fairfieldmarketresearch.com/report/nickel-alloys-market

About Us

Fairfield Market Research is a UK-based market research provider. Fairfield offers a wide spectrum of services, ranging from customized reports to consulting solutions. With a strong European footprint, Fairfield operates globally and helps businesses navigate through business cycles, with quick responses and multi-pronged approaches. The company values an eye for insightful take on global matters, ably backed by a team of exceptionally experienced researchers. With a strong repository of syndicated market research reports that are continuously published & updated to ensure the ever-changing needs of customers are met with absolute promptness.

#nickel alloys market#nickel alloys market trends#nickel alloys market demand#nickel alloys market size#nickel alloys market share#nickel alloys market growth#nickel alloys market analysis#fairfield market research#nickel#alloys#nickel alloys market research

0 notes

Text

Plane diverted to Pittsburgh due to possible medical situation onboard

Plane diverted to Pittsburgh due to possible medical situation onboard

PITTSBURGH —

An American Airlines flight from Phoenix, Arizona to New York City was diverted to Pittsburgh International Airport early Tuesday morning.

The plane was diverted due to a possible medical situation onboard.

Pittsburgh International Airport officials said the plane landed shortly before 5 a.m.

Allegheny County 911 dispatchers said police and paramedics had been called to the…

View On WordPress

0 notes

Text

FIR 150: Change Your Life With The Wealth Architect

In this episode of Financial investing radio, I speak with the person that introduced overnight trading to the financial markets. He will give you some guidance on how to build your wealth, I speak with The Wealth Architect.

Grant

Hey, everybody, welcome to another episode of Financial Investing Radio. Okay, so today I have in the house, it's taken me a couple of tries here actually, literally, to catch Mark Yegee with me here today, longtime expert in the investing world. So grateful that he took the time to come here today and talk with us and share some of his secrets on how to grow your wealth. In fact, I think he's known as The Wealth Architect anyway, without me saying anything else. Mark, welcome.

Mark

Well, thanks. I'm not I'm not sure I like the title of longtime expert. But you know what, I guess it goes with the territory. But thanks. Great to be here, Grant, and I can't wait to get into what we do and what you do and have some fun with your audience. It should be great.

Grant

Yeah, thanks again. I appreciate that. So one of the things that caught my eye when your organization reached out and I was reviewing your profile, I just have to start here. There's this tip here about you getting into this world into the investing world at the age of 12. I mean, holy smokes at the age of 12. I was milking cows and hauling hay. I mean, there was not a stock market in sight. So I asked you, I mean, the only stock I saw had horns, right. And where I was milking it. So you know, if you'd have said, How's the stock market? We're like, well, we got, you know, 50 cows in the pasture, but like, What are you talking about? So, how did you get into this at 12?

Mark

Well, you know, my dad was a grew up on a farm. I didn't, I grew up in the city. And so I you know, I mowed my yard and cleaned my pool and got paid to do that. And every day, I would see my dad reading the Wall Street Journal, and it had all these symbols in it with numbers by them, and he would circle stuff. And I was so curious about what he's doing. And finally, one day, I'm like, Dad, what are you doing? I think it's like you thought I was ready. And so he said, Oh, this is how you invest in other people's businesses. And I was like, Oh, great. So over time, he started to kind of teach me that, you know, you're running your own business, doing your lawns, but you can also go out and invest in other people's businesses. And I thought that was fascinating. And after a while, after maybe a couple of months of telling me about it, he goes, but the only way you're gonna learn it is to take some of your money and put it in and I did. And so my first stock, I think it was 12 or 13 years old. It was right around that time. It was it was 100 shares of a company called Ailey company.

Grant

I've never heard of, I haven't heard of them.

Mark

No, I don't think they're around anymore. But they were they was this women's clothing store in the malls. And it fit all the criteria. Low P I mean, my dad taught me a few things. And it was alphabetical that I went, you know, I finally went, Hey, here's one. So I circled it. And I bought, you know, $300 worth of that stock was 100 shares at three bucks. And I just would watch it every day. And I was fascinating. Oh, there's the new print on it. And there's a new price. And the stock went to $6. So it's it was probably the worst thing that could ever happen. It's like, it's like when you grab the golf club and you hit it right down the middle. You think you're a good golfer? This is easy, right? It's as easy as like this, you know, or if you go to play craps and you hit it on the first you know, first dice roll. And so I I invested again, I saw commercial on TV, you know, and it said us, it said Allegheny Airlines is becoming US Airways or us there. I think it was at the time. Yeah. And I was like, Wow, what a cool name for an airline. And I you know, that was the only reason yeah, I think it might have might have met some of the other criteria as well. So I bought it and it went from 17 I remember to 35 so I doubled it again, which is probably the the next worst thing that could have happened but now I'm like, this is a piece of cake plus I don't even have to work the money is doubling and yeah, anyway, so you know, I guess I could buy more candy than I could. But that was it. That was the beginning and then he started intermediate. introducing me to books. My dad was a big Personal Growth Guy. So I had read, I had read books, you know, by Dale Carnegie very early on, I read books by Edward Thorpe McShane, the business who wrote a book called, oddly enough, he wrote, this first book was called beat the dealer need to deal with a guy who was an MIT professor. So he taught math at MIT. And he went to Las Vegas, and he figured out how to beat the roulette tables. And they, you know, he had another guy helping him and this was kind of a rudimentary metric computer in the 50s. And he figured out where the ball was coming out, and how quickly it was anyway, he figured out a way to get the probabilities in your favor, and he started to beat the roulette tables, and they kicked him out of Las Vegas. So he went back, and then he figured out well, I'm going to figure it out on Blackjack, and you've heard the story, there's been a movie made about him. Is that the movie? 21? Yeah, yep. All these kids went to MIT, you know, the students. And he brought them they all cleaned Vegas out and then finally got kicked out of that. And then he turned his his efforts to the market. And then he wrote a book called beat the market. And it was basically how to buy a stock and sell the warrants against the stock, which today are basically known as options. They're still warrants, but most people don't know what they are. And it was covered. It was a system of covered calls before they even had options. They didn't have options until 1971 or 1974, I think. And so but I was fascinated by because my dad was like, Oh, you got to learn this. And it was this thick book. It was really boring. And but I, I started to apply it. And I applied it so much that when I was 16 1718 years old, by the way, I bought my car with the winnings and the monies that I made in that those first few investments. I set up a brokerage firm at EF Hutton and my dad had this old timer broker. And I said okay, Harry, I want to buy 100 shares of IBM and I want to sell the you know, the call options against it. And he's like what? So we had to call in New York and get the options principal from EF Hutton on. And he understood why zoom, but my broker didn't even understand I did teach him what I was doing. And so all through high school and college...

Grant

And this was a high school you did that you sold your first in high school high on IBM?

Mark

Yeah. So IBM, and this is back when you pay a commission of $300 to do IBM. And they had quarterly options. And you know, the different it was a different game. And now we have so many more tools that are at our disposal. That's great. So yeah, I did this all the way through college. And finally, you know, I had several different entrepreneurial ventures and then I actually sold copiers, which for me was the worst thing. Anybody.

Grant

Like they just sort of jumped into the white when you're selling options, and you went from that to copiers. What happened? Mark?

Mark

Well, I mean, when I went to college, I didn't think that making money in the stock market was going to be on my my career. So I went to college. I got a marketing and business degree, and everything was hunky dory. And then I got out and pretty. I I started an entrepreneurial company in college. I was back when the Swatch watches were this big craze. Oh, yeah. And you remember those people put 10 Swatch watches on their wrists? Yeah. And I thought, Well, I went to the University of Florida and I thought why isn't there a swatch watch with a gator on it? Like a University of Florida Gator, you know? And, and I went to the I went to the, you know, the alumni office and I said, Can I license the gator. And this was back before the internet. This was back really? Right around the time faxes were becoming popular, but still pretty early back in. In 1980. What was this 85? Yeah. And they licensed the Florida Gator trademark to me. And I figured out a way to get to Hong Kong. I had no money at all. And when I was a junior and senior in college, I went to Hong Kong and I met manufacturers and I figured out a way for them to put the gator on these watches that I wear orange and blue the color the exact colors of the school. Yeah, and I brought back these you know, 2000 watches are added, manufactured and shipped. And I had them in my college wasn't my dorm room was my fraternity. I lived in the fraternity house last semester. And so I had them stacked floor to ceiling all these watches, right? So I go to the games, and I would sell these things and and I learned a lot about a lot, right? Traveling, manufacturing business, you know, buying good quality products versus crappy products. And I expanded to 23 schools in the southeast and finally just got out of that business about four years later. And then I sold copiers after that. And I that was miserable. But it was that was again instructive. And then finally I I said why I've been doing the market all these years. Why don't I just go do that? Amazing. Yeah, I got a couple of I got a job with a guy named Ernie Ollie who had already discount old discount stockbrokers. It was a discount broker like, like Charles Schwab, they were actually good buddies and they started when those got deregulated in the 70s. And I worked for Ernie for or a year and a half, two years, something like that started my own brokerage firm with a partner. And then we grew that to a to a pretty big venture became a Wall Street company that applied to do this financial technology, I could bore the I could bore you with all the little stuff that I've done in between. But it all has led me to this spot where I had a, you know, a big trading firm, Wall Street trading firm. And we traded, you know, billions of dollars worth of securities.

Grant

I saw that, that's well, and did I read it right? That did you guys introduce after hours trading? Is that true?

Mark

Yeah, that was actually my idea. And everybody thought I was crazy at the time. But I thought, you know, we have this system that all we do is if somebody wants to buy and somebody wants to sell, our system was a computerized system, they just matched those sellers. And I said, why does that have to stop at four o'clock? Why Can't We? If somebody still wants to put the order on? What can we do it a 401? And then if we can do it a 401. Why can't we do it at 601? And then why even shut the thing off? Let's just let it run all night. It happened automatically anyway. And so yeah, we introduced after hours trading in 1999, I believe. And I was on NBC Nightly News with Tom Brokaw. And you know, a few things.

Grant

And then, and you're now you're talking to me now how am I now?

Mark

And now I've moved up to talking to you. Yeah.

Grant

Wow, you finally got up to Grant Larsen. I mean, Tom Brokaw, it's been a long time coming!

Mark

So just a stepping stone. You know, you got to stand on the giants that came before you gotta get to the grant Larsen. So. But, uh, but I'm glad to be talking to you. Because you know, everything that I've done in my life has led me to this exact point. And that exact point is now where I have a few hedge funds that I run. They're all based on all these mentors and all of them knowledge that I learned over the last 45 years. And now we help people call, you know, make what we call Safe, reliable income. Although if you look at it today, with this market, it's not safe, reliable income today.

Grant

Yeah, I turn my head and I'm looking at it that can you say sell off?

Mark

Yeah, don't don't even look. It is a light volume sell off. So I believe that there's a bounce coming in a couple of days. But boy, it's, it's painful for a lot of people right now. It's, you know, people think you just buy a stock and you hold it. And that's the way you invest. And then you get these 25% corrections in the market. And people's 401 k's are decimated, they go to 5060 70%. Yeah, it's just a shame. It's just a shame.

Grant

Ever since November, I saw got it at the end of last November on my systems and went, Okay, I'm gonna start preparing to hedge here. So I've just been building my hedging positions since then. And yeah, we've had some interesting volatility a couple times. But right now it's down hard for sure.

Mark

So it's horrible. Yeah. And you if you started in November, you probably if you correlate it, it's the exact day that Jerome Powell from the Fed said, we're going to start to raise rates. And from that point, we're down about 27 28%. And some stocks. I can tell you some stocks are down 50%, 60%, 70%.

Grant

Yeah. Facebook and others. I mean, they're down like massive 5060 out, yeah, Netflix got hammered with your training thing. And, yeah, just a lot of them are down really soon.

Mark

But it doesn't have to be that way. Right. Like, you know, a lot of people just don't know what they don't know. And we tell people that they can make two to 4% a week. Now, that doesn't always happen. But our goal is just like that analogy that I threw out before about the craps table. It's, it's to get the odds on your side, right? Yeah, I mean, I know, it's this is not gambling. But if you use gambling as an analogy, you can understand it better. If you're sitting around a poker table like Annie Duke or Phil Ivey or those guys that are on, you know, the the World Series of Poker, they don't win every hand. But if you have a pair of aces, you have the odds in your favor. If you stay in, unfortunately, sometimes three kings comes up and your opponent has a king, and then you lose, but that doesn't mean you shouldn't have been in the game. So what we try to do is we try to create safe, reliable income by renting stocks, to other people that are going to our B that are willing to gamble and pay us a premium for having the option to buy our stock. I can explain that a bit more with an analogy, if you if you want to hear it, but that's really what we do.

Grant

And I'm selling options, then that's that's your main strategy.

Mark

Yeah, yeah, we buy we buy a good solid stock. So we have, we have a system called the cash flow machine, right? We call it the cash flow machine because you you put cash in, and then it gives you cash out more cash. And that's it's, it's a system that creates income, using what we call the four cornerstones it's the right stock, not just any stock, the right market, because you want the tailwind to be behind you. So we use a component of market timing and does help and then it's got to be the right spot on the chart. And usually you can find a high probability spot on the chart where this were the end institutions are behind the stock exchange in the right direction. Yeah, and we don't want to be against the institutions. That's the big money, right? We're little people. Yeah. So we want to be with them. And we can see where they are, they leave footprints on the chart. And then we go in that direction. And then the fourth Cornerstone is we squeeze the juice or we collect the rent. And that's the option premium that we get for selling upgrades and income. And it's a defensive strategy that we make, you know, two to 4% a month, conservatively.

Grant

Now, there's, you know, there's obviously a fair amount of margin that's needed in order to do this kind of thing. So you typically need to have fairly decent size accounts to do some of that stuff. What what's sort of the entry level that you see most of the people come in at how much is what sort of account size or capital do they need to have?

Mark

Well, it depends, we have a breadth of options that you can use so so I have a hedge fund that I run using this strategy for accredited investors, people that are worth, you know, more than a million dollars, you know, rich guys, basically, but not everybody qualifies for that. And I want to do whatever I want to make this accessible to everyone. So we have a set of courses. And we have my favorite thing is a mastermind group. And so the mastermind group is around a series of courses, and their video courses over my shoulder, I show you how to do the trading and you and you understand the philosophy behind it. And I give you the whole strategy. And then it's also surrounded by a full ecosystem of support. So we have like minded people that are also giving you support people that have just gone through the learning that you've gone through, you get mentorship from me, and I've got, you know, for decades of doing similar things in this, you get, you'll actually get something called the private access group where I put out the actual trades I do in my hedge fund. So you can learn from them, mimic them, do them, you know, do subsets of them, whatever. And then on Friday, and again, this was what I was alluding to a bit ago, on Friday, we have a mastermind call where we all get on a zoom call, some of us will share our screen show the trades we're making, I'll usually teach a concept about the current market or something, you know, that we should know. And then we hold each other accountable through a chat group all week, like, Hey, what are you doing? Who's doing what during the Fed announcement? Why are we you know, selling, you know, the Tesla when Tesla's coming out with numbers, you know, things like that. So to answer your question, that mastermind group, it's an investment in yourself, I give a money back guarantee, if you don't make enough money to cover the tuition because it's not a it's not a small amount. But it is the small amount of it's an investment in yourself, and you make it back with your investments. But in order to, for me to feel good justifying that you need about $150,000 to 2 million as a minimum, Now, not everybody has that. And I've had people that just you know, take the courses and do extremely well with five or 10 or 15,000. But they're not going to afford to be in the mentorship program, and the mastermind group and all that kind of stuff. But they can take the courses. And so we have a full breadth of offerings for people just so that we can they can learn it. I also have a free course on my on my website that you can sign up to take that kind of introduces you to the concept of what we do. You know, we got all kinds of stuff. My goal is Grant, it's financial education, right? We don't teach people about money in school. We just don't Yeah, it's it's not at all. I don't know about you, but I use money every day. I don't use Romeo and Juliet every day. And I don't use the Pythagorean Theorem every day.

Grant

One I don't use while shopping the grocery store. Okay.

Mark

I haven't used the Pythagorean Theorem, I don't know in at least a week. Yeah. And, you know, I don't learn I don't know much about you know, I don't use Cleopatra, and Henry the Eighth and his wives every day, but boy, I use money, it would be nice to know, would have been nice to know without having to go outside and learn how to buy houses in real estate, how to invest in the stock market, how to do my taxes would have been nice to have learned a little something like that. Yeah. So I believe that that's the biggest thing that people can do is they can invest in themselves by getting financially educated. And so that's part of that's a little part of what I do in the world is is help people with that.

Grant

So it's interesting that you're making this available to a wide range of people regardless of where they are right certainly you've got the capabilities to help those that are accredited, but for the person that's just trying to get going I mean, you walked that journey so you understand that and therefore you're made this available to them to help them ultimately get there are you positions intended to be longer term Are you have sort of a timeframe Are you more like a swing trader? Are you sort of long term Are you did sort of break it up you got portion of the portfolio's shorter term and some sort of longer term investment What's What's your philosophy on that?

Mark

Well, I can give you the short answer or the little bit longer answer that has some more depth let me give To the longer answer, since we got a nice podcast format going here, the longer answer is that everybody says, oh, you should be diversified, right. And to most people who are uneducated, don't have the financial education that we should have. They're educated by Wall Street. And Wall Street is run by two groups, lawyers and salespeople. And so lawyers are there to not get the firm sued. And for that, they've put you in average investments, because how can you get sued? How can you sue anybody if you just did an average return, and the salespeople are there to grab assets and a lot, the more you assets you grab, the more they pay the salesperson, but the more the firm can trade of that money and make money on it. And so what they want what we hear, and I was a Wall Street guy, so I can say this, is they want you to be diversified. So they tell you put your portfolio in a nice little portfolio of mutual funds and ETFs, a couple of stocks, and you know, maybe some bonds and you won't get hurt, right? And you get this average low returning 8% thing that you feel great about because woohoo. But that's the average, right? The s&p 500 over the last 500 year or sorry, 100 years, has made 9.4%. So if you're doing around nine point you do 9.6%, you're feeling really good about yourself. But you know, I did a study, exactly. You pat yourself on the back, right. But I did a study a few years ago, and in 2000, I think it was 13 and 14, or might have been 14 or 15. I can't remember but doesn't matter the years, the the stock, the stock market did about 28% or the s&p 500 Dow about 28% during those two years, but the top 10 stocks did 185%. So what you're doing when you diversify is you're you're supposedly spreading out your risk, but you're also muddying up your returns, you're taking the good returns, and you're making them crappy returns by some stocks even went out of business and the s&p 500. And the rest are kind of in the middle, just kind of figuring it out. Because not everybody can win. So why not just invest the top 10. Right. And easier said than done, of course. And so what we do is it's a probabilities game, we we you know, when you and I if you buy a stock, and I know you're a futures guy, too, but if you buy a stock or a future or an option, or any kind of investment, you've got a 50% chance of being right at the moment that you do it, yeah, you have a 50% chance of being wrong. Yeah, because there's a smart person on the other end that's got the other side of that trade, and they got a 50% chance. So it's whatever you do after it. So what we do is we we try to find the right stock stocks that are trending up, have above average return on investment, return on equity, earnings per sales, growth, per share growth, sales, growth, those kinds of things, great, great products. That's that, that gives us a little bit of an edge maybe takes us to 52%, then we try to find the right market, because 70% of the stocks performance, it comes from the performance of the market itself. So whatever. So they're in, right, whatever. And then sector performance is 38% of the stocks performance, right. So you're now you're adding you're stacking these, these percentages 52 to 54, maybe 5556, then you find the spot on the chart where it's about to break out or where there's institutional support, or it's bouncing off the 200 day moving average of the 50 day, there are spots on the chart that statistically over the last 120 years on on the right stocks seem to be where that they are going to support the stock. So now you're inching your probabilities up, you never get to 100%. But if we can get to 6070 80%, great, then what we do is we create income from the stock. Now, I don't know if your audience wants me to get wonky with statistics, but I'll give you one more. Okay, go for it. All right, here we go. When you buy an option, and an option is the right to do something, but not the obligation to do something at a certain price before a certain time. When you buy an option, you have an 80% chance of losing all of your money. 80% Wow, that's statistically what it is 80% chance, all options expire, without the buyer making money 80% of the time, because there's no free lunch. But there's also the other side of the trade, Somebody sold that option to the buyer. Well, if somebody's losing money, 80% of the time and they're the buyer, what do you think's happened on the other side of the trade?

Grant

I mean, someone's got 80% wins.

Mark

Yeah. And that's right, it approaches 80% Doesn't always happen. But it does have the statistics in your favor. Because when you sell an option, you always pocket to time premium. And this is what we teach in the course of of how that works and what that is, but you always get the timeframe, you always get the amount that the gambler is willing to risk to have certain amount of time to be able to do something because they're getting leverage. And you know, you want me to give an analogy so I can tell you kind of what we do. Go for it, mark. So most people understand real estate way better than they understand these intangible pieces of paper. They're not even pieces of paper anymore in the stock market. So imagine you open up your window and your front door. And you look out the front door. And there's a vacant lot across the street that your your other neighbor, your friend Jim owns, right? And Jim puts up sign on it says For Sale $100,000. Right. And so Wow, you got your neighbor's got his one acre lot across the way for $100,000. And let's say this other guy, Bob is driving down the street. But Bob heard that there was a Hilton going to be put right up next to Jim's lot. And it's going to make Jim's love worth, not just 100,000. But since it's going to be this Hilton resort, it's going to be put there, it's gonna be worth a million dollars. Yeah, problem is Jim's broke. He doesn't have $100,000 or not, Jim, but Bob, the guy driving down the street. Yeah. But he goes to Jimmy stops his car and he finds Jim in front of the lot. They're, you know, cleaning it up getting ready to sell. And he says, Hey, I'll tell you what, I don't have the $100,000 to give you right now, you know the to buy the property. But I do have this $10,000 Can I give you the $10,000. And all you have to do is promise to take it off the market and not sell it to anybody else. You get to to keep the $10,000 for doing that. But anytime in the next six months, you have to sell it to me for 100,000. And Jim, the guy selling it goes, Wait a minute here, hang on a second, I get to keep the $10,000 I take the property off the off the market, and you're gonna buy it from me for the same price I'm asking anyway, sometime in the next six months. And if you don't I still keep the 10 Grand. And Bob goes, Yeah, that's the deal. And they shake hands and you make that deal. And they write up a contract. Now a couple of things can happen. One thing is Bob could have been right, and there's a big Hilton, they make an announcement. There's a big thing in the paper Hilton to buy, you know, the lot next door to Jim. Yeah. And now. Now Bob took his $10,000 investment. And now he turned into a million dollars. Yeah, he made a high huge amount of reward for knowing about that rumor. As you and I both know, information is not perfect on Wall Street. Yeah, it was a rumor. And it never even happened and nothing ever happened in the next six months. And there's no announcement. And so the the option expires, Jim kept the $10,000. Yeah, so now that now he's got a $90,000 basis in the property, let's call it Yep. And Bob lost the whole $10,000. So Bob had high risk, because he lost it all. But he could have made a killing. But Jim made the $10,000 no matter what. And he could turn around and find another Bob and sell it to another Bob for 10,000. and another and another another. So to answer your question, what we do is we find a position that we like, like I said, it's the right stock. And then we do the same exact thing in a stock market. So we find a position like Tesla right now is the big one. We're all in. We were an app a lot of a sudden Apple still to some of us traits and Apple, we have these great stocks like Nvidia and Microsoft and you know, the big ones. And there's certain criteria that they fit because this doesn't work for every stock. And then we just find a gambler out there like Bob that was driving down the street that thinks he knows more than everybody else. And he wants to give you some money in order for you to take that stock off the market and sell it to him at a certain price. Before that happens, and we do it weekly and monthly. We don't wait. Okay, we do weeklies, yeah, we do weeklies and people are paying a lot of money to have the option for a week to buy a share at Tesla. In a week that goes up, you know, they'll they'll pay you 20 bucks for a week for the stock to go up another $20 plus more.

Grant

So it's really high at that point to write on those weeklies so yeah, it is yeah, yeah, it is.

Mark

So it's, it's, it's and it works. I can tell you some stories about some of the people in our program, and a lot of people are, you know, physicians and the physicians are. This is funny, funny to me. I didn't know this grant, but a lot of physicians just don't like being physicians, not because they don't like helping people, because that's what they really do. They just don't like the politics. Oh. So they don't want to be told when to be at work. And they don't want to be told the politics and other things they have to write up in the computer education, they have all this stuff. And so they can't wait to retire. And I always say why well wait till you're 65 and your hips don't work and your knees creak. And then you can travel the world and you don't feel like it. Yeah, I don't retire a little bit earlier. So a lot of our guys and gals in our program are retiring early, using using some of these things. And I'm really proud of that.

Grant

That's, that's an amazing I love the analogy. And so it sounds like you're doing weekly as well as monthly sort of positions. So you're turning them around that you get involved in leap at all are you doing really long term positions is also.

Mark

We actually do we do we do long term positions as a proxy for the stock. That's something called synthetics. And we that's a wonky concept because there's deltas and all kinds of things that you'd have to teach people about, but yeah, the two to 4% that we make as our basic and then we kind of ratchet things up, if you want to take a little bit more risk, we like to tell people, it's about three times more return that you get, but take 1x more risk. But it all depends on the stock and the market and how you trade it. And, and 90% of this, at the end of the day comes down to emotion and mindset. And I always tell people, that that's that, to me.

Grant

That seems like that's one of the most critical aspects of this, there's the mechanics that you're describing that have to be right. But with all those being, quote, unquote, right point, that mindset, if you can't hold that position, or you're not confident in the system, then you really get whacked hard. How do you how do you get to the right mindset to do this Mark?

Mark

Well, you know, the premise starts from the word emotion and motion, money is tied to emotion very significantly, right? It's the number one cause of divorce even even more bigger cause than bad sex. And, and so money, money is a big deal. And people try it, they work hard for their money. And then when they put their money, it's so easy to click a mouse to get into a stock, right? Click, boom, you just invested $100,000, you don't have a strategy for when to get in. You don't have one to get out. You heard Cramer say something on TV that you should buy the stock. And pretty soon you're like, oh my god, it's down $10,000. And now you're getting emotional. And I don't know about you, but when you're angry or sad, or you know, the you don't make good emotional, emotional decisions, right? Not a time to make a decision. It's not the time. So what we do, and I believe that anything that is worth doing is worth doing right? Is we teach people a series of rules, right? Because rules allow you to say, is this, it's either yes or no, right? If you have a role, it takes the emotion out of the event, doesn't mean we don't have to deal with emotions, because boy, there are days like today, where things are moving around a lot. And you know, but we also teach you what to do in markets like today, like what do you do? Do you react? Do you protect you buy a color? Do you do whatever. And those and that system was just a system of rules is designed to reduce emotions, because when emotions go up, intelligence goes down, and vice versa. Right. So our goal in anything that you do in life, right, have a system like Michael Jordan had a system. And if he became the greatest basketball player ever, anybody has to have a system to do something really, really well.

Grant

So hands on help to overcome or manage meaning not overcome, manage the emotions through the system, the core of it, that helps you to have and maintain the right, the right mindset. I have another question for you slightly different. Time for one more question.

Mark

I got as much time as you want.

Grant

Okay, question. This is crypto, what is going on there? Is that the place to go put your money? What do you think?

Mark

Wait a minute, you said "Do I have time for one more question". And you asked me about crypto, which is a whole new universe of stuff? Yes, I did. Oh my god. Yeah, I have so much fun with Bitcoin right now. And it's, it's because a year ago, I was the biggest Bitcoin skeptic that there ever was. And today I have a cryptocurrency hedge fund because I decided that if I'm going to be in the financial services business, I need to learn about this. And I need to figure out why am I so skeptical? And why are so many people making money on it? And then when I got into it, Grant, I started to realize there are so many and it's not every crypto, there's almost there's like 20,000 different tokens. And I'm not recommending them I'm a Bitcoin guy with a with a little bit of cryptocurrency on the side maximalism. Right? But it's mostly because Bitcoin maximalism for me. And boy, I could get into all kinds of stuff. But if you just look at the whole man, I don't know where to start. But to keep it just keep it short. Let's let's just talk about what money is. Right? Money has certain properties, right? So we'll talk about and if you put three things in your brain as we talk about these. It might it might help but money is first of all, it's it's portable, right? You can take $1 Bill and you can walk across the street or you can go to get on a flight and go spend it right it's yeah, it also means it has to be accepted, universally accepted. So your dollar bill in your wallet will be a universally accepted somewhere else or they'll change it into something else. They won't look at it like a conch shell like they used to 500 years ago and say, well, the shells too small. We can't I used to actually trade with conch shells. Till some country said hey, we got a ton of these. Let's go buy a bunch of their stuff. So it's got to be universally accepted. It's got to be standard, right? $100 Bill is $100 bill, it's standard. It's got to be divisible. Well, you know, you sometimes you need a little less than 100 bucks, maybe not in your case. Maybe you're walking around with wads a hundreds but a lot of us we need you know dollar bills and $5 bills and pennies and nickels, and so it's divisible and it's in let's see what else it's um It's a store of value. It's a medium of exchange. So if you keep those so So looking at the dollar, I just described the dollar looking at Gold. Gold is pretty good, too. Gold's a good store of value, right? It's a good hedge against inflation doesn't pay you in any any interest or anything, but it's a good store of value. And a good hedge of inflation. Problem is, I'll bet you that you don't have any gold on you right now.

Grant

Yeah, that's it right there.

Mark

Yeah, that's it. So you're not walking around with a bunch of gold. And if you wanted to walk around with any kind of wealth in your pocket, you couldn't carry it in gold, right? It's heavy, you couldn't go across the border. Imagine if you're in Ukraine right now trying to come out of your country, because you have all this money, your bank account is closed? How do you get your gold out, they're gonna confiscate it, possibly at the border. If your guy they're not even letting you leave. I want to make you fight. So, you know, gold has got some really great properties. And for 5000 years, it's been a really great hedge on investing. You know, they used to actually shave off pieces of gold, but then you couldn't measure it. Right? And so they went to silver and then that's how coins got the ridges on the side of them. I don't know if you know that is because with with the people would shave off the silver, and then the coin would get smaller and smaller. So if it didn't have the ridges, they wouldn't accept that. Anyway.

Grant

Are you serious?

Mark

That's yeah, that's why the ridge is... Yeah, yeah, absolutely. And then and then we can talk about Bitcoin. And now let me just give you a background of Bitcoin, bitcoin is called a cryptocurrency, which, right off the bat eliminates most people from understanding what it is, but it's actually a really simple, it's a really simple product. All money is a ledger based system. When you have a bank account, it's held on the bank accounts, books as a liability, they owe you that money, right? You can go in and say, I want to get my money, and they owe it to you. Right? So it's an asset on your books. It's a liability on theirs, depending on on what you believe, how the Fed really interprets that. But that's, that's another conversation. Yeah, yeah. But but it's all a ledger system, right? You know, you own a house that's got a value, and then there's a liability against it with the mortgage, those kinds of things. The same thing with cryptocurrency, and I'll give, I'll give you the analogy, just in case, there's somebody here that doesn't understand what cryptocurrency is, because it can be very wonky. Imagine you and me and Susie are sitting around a coffee table. And I've got this book, that's this blank journal, and we all decide to write a book. So I write the first sentence. You know, the dog bit, Johnny. Okay. And then you take you take the book, I pass it to you, and you go, Mark wrote the dog bit, Johnny check. That's what he wrote. And John, and Johnny screamed is your sentence, and you pass it to Susie and Susie says, Mark wrote the dog with Johnny check, Grant wrote, and Johnny screamed, Chuck, and that she writes her sentence. And then we just keep passing that around. And we pass around, and then we write this story. And the journal gets thicker and thicker and thicker and thicker. And now it's 1000s or millions of pages. But you know what, the first sentence that I wrote is always in there. And the second sentence that you wrote is always in there. Yeah. And when those sentences are in, that's what's that's the blockchain. It's an immutable ledger ledger that can never be changed. Now, with Bitcoin, it has the advantage of this last component of money. And that this component of money is that was one that the dollar doesn't have, or any other fiat currency doesn't have. And Fiat just means by decree, it's just created by the government. It has scarcity. There's only going to be 21 million Bitcoins ever made, there's might have been 19 million made, the next 2 million would be made over the next 110 years. And so there's a scarce amount of those things. Well, you and I both know that, you know, if you gave somebody a dozen roses, that has a lot of value, but if you gave them two dozen roses that has some good value, and if you know if you gave them you know, 50 dozen roses. Well, that's cool, and you could story but pretty soon that last vowel that last rose doesn't have as much value as the first dozen roses and if you gave him 1000 roses, and 1000 Roses, the day after that pretty soon you'd be like, What do I do with all these roses? Now they're a nuisance and they don't have the value. So with scarcity it's like if you ever saw that tulip mania thing that you'd probably have in in in the Netherlands years ago the Dutch tulip mania it's that's indicative right? Because there was there was a scarcity you know, they created scarcity, but this is legitimate scarcity is 21 billion Bitcoin now. I'll tell you one more story. I know I can get a little bit wordy, but I just got back from El Salvador. So the reason I went to El Salvador is because number one, I run a cryptocurrency hedge fund and predominantly we're tracking Bitcoin. But El Salvador this little third world country that had civil war and has drug issues and Ms. 13 and nobody goes there. He has this really young, really visionary president named naive, okay? And this guy said, if if we're going to use the they use the US Dollar as their currency, and they see what we're doing to our currency in the US. And he's like, why would I want to put my I want to create a change in this country. I don't want to stake everything on this US dollars that's being debased. So he adopted Bitcoin as the first legal tender coin that I heard, and I thought, I gotta go check this out.

Grant

Well, close. Interesting.

Mark

I was hoping it's a small country. I was I was sick. I thought you might have. Yeah, I met some other really cool people because I got invited to some thing with bunch of a bunch of government dignitaries on a different cryptocurrency launch, but it was really, it was really cool. And so I went down there because there's this place place called Bitcoin beach. Oh, no, ran an experiment for a year. And you might have seen it was just on a 60 minutes episode and Bitcoin beach. They just went to everybody and told them, You have to start accepting bitcoin, all the restaurants, all the hotels, all the people selling, you know, the little shell bracelets, and the necklaces and all that stuff. And they said, you have to start accepting bitcoin. How do we do that these third world, people would say, Well, you have this wallet that we're going to give you called the Chivo wallet, that's the name, the name of it, and you put it on your phone? Well, everybody's got a phone, right? And so you just accept it with this little QR code, QR code, what's a QR code, and they show them what that is. And so I went down there, and I bought my dinners, and my hotels, all with Bitcoin. And these people all understand it. They're third world people. And I go down the street and I tell people about cryptocurrency and Bitcoin and they look at me like I haven't unicorn sticking out of my head. And they're like, this will never work. Bla bla bla, it will work because it has all of the properties of money, but you can carry it with you in your brain. All you have to do is memorize 24 words. And now you have access to your cryptocurrency wallet, anywhere in the world. So when they when they when we left Afghanistan, they shut down the banks, anybody who had wealth in the banks couldn't get at it. But if you had the foresight to have Bitcoin, you could get at it. So it's transforming. one more statistic couple more statistics. 70% of the world is unbanked. Imagine the person in Ethiopia, or somewhere in Africa where they don't have banks on the corner like we do. Now. They've never seen a bank. And so they use systems of barter, and they use systems of exchange with and they don't have a banking relationship. But with a $50 phone, and a wallet that holds your cryptocurrency or your Bitcoin, you now have a bank on your phone. So these people are now able to create this ecosystem where they, they they can be banked. The same statistic happened in El Salvador 70% of the people were unbanked. And 30% of the people had access to some kind of banking relationship. After they announced last year, that they were accepting bitcoin as their legal tender. It's the reverse now 70% of the country now has Bitcoin on their wallet because the country gave them $30 worth of bitcoin. So they can either save it, spend it, you know, give it to their buddy, whatever. And they're all part of this like new ecosystem, they figuring it out, they're spending money. And it's it's fungible, it's accepted. It's it's a store of value. It's it's it's universal, it's divisible. You don't have to buy one Bitcoin at $40,000, or whatever it is today. You could buy 100,000 of a Bitcoin. Yeah, you might fraction, right. Yeah. Yeah. So that's the long answer to a very short question.

Grant

Well, yeah, well, it is it is a future. A lot of organizations pursuing it, who feels at risk by crypto who sue who isn't that's going to lose, right? What organizations or governments would fight against this? And why would people fight against moving to crypto?

Mark

Well, first of all, it's more accepted than you think. There's another country that accepted it in Africa. So there's two countries now that accepting it as legal tender. There are cities there's a city in Switzerland that is now accepting it. It's being widely adopted. So first, it was just a couple of nerds. And then you know, I don't know if you know this, but the first transaction on Bitcoin was to buy to Papa John pizzas, and I think it was for 10,000 bitcoins and the guy goes, Yeah, I'll give you the pizzas for stupid 10,000 Bitcoin. Well, that's bitcoin is now worth $453 million. But that was the first real transaction and it's actually a great story about two pizzas being worth $400 million, or whatever the number is.

Grant

So man, I did not know.

Mark

Wow, yeah, no, that's they call it the pizza, the pizza trade. But there are some entrenched interest in doing this because the government first of all is debasing our currency, our currency is lost 99 Point 5% of its value in the last 100 years. Right? That's why a car an average, sorry, an average house today cost $250,000. But that house, you know, it's a similar house in, you know, 20 Sorry, 1920 cars $5,000 We've We've debased our currency to almost nothing. And we feel like we're getting rich, our houses are going up, but you're not getting richer. It's just the denominator is getting more debased. So the governments are all threatened by this, and they don't. So what they're doing is they're trying to come out with something called a C D, BC, a centralized digital banking currency. Right, Senator CBBC. And, you know, they think and if you think about the dollar, it's already electronic, like on my phone, I have Apple Pay and Google Wallet and visa and, and I have, you know, I can move money through my bank account. One other thing that Bitcoin you can do is, and I had somebody that wanted wanted some money from the hedge fund last week, and she asked for the money on Wednesday, I had to clear it out of the brokerage firm on Thursday, it had to get to my bank on Friday. And then I had to wire it over the week, you know, on Friday, and it got to the she got the money a Wednesday on Wednesday. And I said, if you had just asked for Bitcoin, you would have had this money in 10 minutes. Yeah. Because banks, Bitcoin never closes, right, you can sell the coin on a Saturday or Sunday at three o'clock in the morning. So the government's are trying to figure out how to get in the game. Because if they're not in the game, they're going to be out of the game. The problem is, you don't want the government to be in charge of having your control of your money. That's the problem we have now. You don't want more of that. Now then they could just print that and infinitely like like many of the other stuff they've been doing. Yeah, yeah. That's, that's the big deal.

Grant

That is that's, that's a huge deal. Okay, so let me ask you this. So you've shared so many great insights mark, it's just, it's amazing. You're a wealth of insights? Well, you're a wealth architect, I guess you're living name, that's for sure. So where where can people go to learn more about you, and what it is you and your team are providing?

Mark

Well, there's lots of places, you know, marquee around the web. But I set up a site, a little page for us here for this particular podcast for your audience. And it's if you want to grab a pen or put it in your phone, it's it's go dot Destiny creation, because we believe in creating your destiny. So it's go dot destiny creation.com, forward slash grant. Very nice. And so if you go there, we'll have we'll have this podcast there and some notes and some links, but I'll give you guys who are listening. Not only a free book ebook called relic, regular paychecks is how to how to create regular paychecks out of the stock market. But if you poke around there, on our website, you'll figure out a way to get a free course to seven day we call it the accelerated training program, it highlights and teaches you actually, two of our programs. One is called the stock trade genius program. And the other is cash flow machine once for growth and once for income. And, and you know, then you can poke around and see if you want to go any further with us. But the bottom line is I want to educate you, I want you to figure out what you don't know, right, because there's a lot of times people just don't know what they don't know. And I don't want to see people happy with 8% returns and having to work for 45 years, and then retire on 20% of their income. I want to see people wealthy and you know, thriving and even in this market. So this is the this quarter has been the worst quarter in it since in since the Great Depression, the worst beginning of any years since the Great Depression. Most of our investors in my hedge fund made money this quarter. So it shows you that by playing defense, you actually can play a little bit of offense.

Grant

At the market today, we're already back to like, it's almost wiped out. Like the in fact, I think was wiped out, or at least on the index is the entire year. Right? Yeah, it's wiped out. Like, like, like, like the entire year. That's amazing.

Mark

And yeah, at least Yeah, that's it. And that's what the market does, right? It goes up. They always say it goes up with the staircase, and that comes down with the elevator. So the market just gets hammered really quickly. And it goes back and you go wow, it took two years to get this. And we gave it back in three months.

Grant

Got it. Yeah. Okay, so it's go.destinycreation.com/grant. I appreciate you doing that. That's very kind. Mark. Thanks for your time. Any final comments you want to share?

Mark

Not really. I mean, first of all, this was a lot of fun. You had some really great question. Do you have some really great insights, and I hope I didn't talk too much. I have a saying and I'll just leave you and your audience with the saying it's never give up your power in your health, your wealth, or your time. So thank you for your time and I was so honored to be here with you today. Grant.

Grant

Thank you. So much Mark. I really appreciate all your insights and the wisdom that you shared everybody. Thanks for listening to another episode of Financial investing radio. And until next time, go get your destiny creation.

Thank you for joining Grant on Financial Investing Radio. Don't forget to subscribe and leave feedback.

Check out this episode!

0 notes

Photo

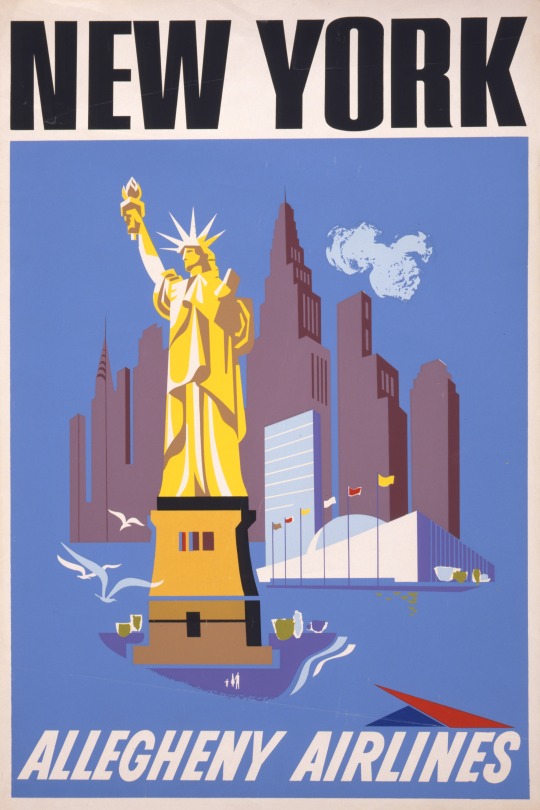

New York – Allegheny Airlines (1950)

#new york#travel#tourism#allegheny airlines#vintage#poster#poster art#travel poster#1950#1950s#statue of liberty#illustration#art

81 notes

·

View notes

Photo

Allegheny Airlines stewardesses waiting for their next flight. By Edward Clark, 1956

12 notes

·

View notes

Text

Events 10.7 (before 1950)

3761 BC – The epoch reference date (start) of the modern Hebrew calendar.

1403 – Venetian–Genoese wars: The Genoese fleet under a French admiral is defeated by a Venetian fleet at the Battle of Modon.

1477 – Uppsala University is inaugurated after receiving its corporate rights from Pope Sixtus IV in February the same year.

1513 – War of the League of Cambrai: Spain defeats Venice.

1571 – The Battle of Lepanto is fought, and the Ottoman Navy suffers its first defeat.

1691 – The charter for the Province of Massachusetts Bay is issued.

1763 – King George III issues the Royal Proclamation of 1763, closing Indigenous lands in North America north and west of the Alleghenies to white settlements.

1777 – American Revolutionary War: The Americans defeat British forces under general John Burgoyne in the Second Battle of Saratoga, also known as the Battle of Bemis Heights, compelling Burgoyne's eventual surrender.

1780 – American Revolutionary War: American militia defeat royalist irregulars led by British major Patrick Ferguson at the Battle of Kings Mountain in South Carolina, often regarded as the turning point in the war's Southern theater.

1800 – French corsair Robert Surcouf, commander of the 18-gun ship La Confiance, captures the British 38-gun Kent.

1826 – The Granite Railway begins operations as the first chartered railway in the U.S.

1828 – Morea expedition: The city of Patras, Greece, is liberated by the French expeditionary force.

1840 – Willem II becomes King of the Netherlands.

1864 – American Civil War: A US Navy ship captures a Confederate raider in a Brazilian seaport.

1868 – Cornell University holds opening day ceremonies; initial student enrollment is 412, the highest at any American university to that date.

1870 – Franco-Prussian War: Léon Gambetta escapes the siege of Paris in a hot-air balloon.

1879 – Germany and Austria-Hungary sign the "Twofold Covenant" and create the Dual Alliance.

1912 – The Helsinki Stock Exchange sees its first transaction.

1913 – Ford Motor Company introduces the first moving vehicle assembly line.

1916 – Georgia Tech defeats Cumberland University 222–0 in the most lopsided college football game in American history.

1919 – KLM, the flag carrier of the Netherlands, is founded. It is the oldest airline still operating under its original name.

1924 – Andreas Michalakopoulos becomes prime minister of Greece for a short period of time.

1929 – Photius II becomes Ecumenical Patriarch of Constantinople.

1933 – Air France is inaugurated, after being formed by a merger of five French airlines.

1940 – World War II: The McCollum memo proposes bringing the United States into the war in Europe by provoking the Japanese to attack the United States.

1944 – World War II: During an uprising at Birkenau concentration camp, Jewish prisoners burn down Crematorium IV.

1949 – The communist German Democratic Republic (East Germany) is formed.

0 notes

Photo

Today in Airline History: October 28, 1979. Allegheny Airlines becomes USAir. I used to love flying Allegheny's aircraft with the backward-facing seats and tables! (Modern-day travel deals on my blog, www.LatinFlyer.com)

1 note

·

View note

Photo

Wait a second, that’s not an American MD-80! What the…... I think I caught more American retrojets today at DFW than I have in the past few years! This is the Allegheny “Vistajet” A319 at International Terminal D at DFW this morning getting fueled up. I never noticed the “Vistajet” titles near the nose. Very cool attention to detail. When Allegheny Airlines ordered the Douglas DC-9 Series 30 as its first pure jets, they were marketed as “Vistajets” upon their arrival into Allegheny’s network in 1967. Allegheny had turboprops already- in 1959, the airline introduced it’s first turbine equipment in the form of the Convair 540, which was a Convair 340 retrofitted with Napier Eland turboprop engines. When Rolls Royce bought Napier, they dropped the Eland from their product line and the 540s at Allegheny were phased out in 1962. The Fairchild F-27 (US built version of the Fokker F-27) was acquired to replace the Convair 540s, but around the same time Allegheny ordered the DC-9 Series 30, they also ordered the Convair 580 which had Allison 501s which were more powerful and reliable than the Napier Elands of the Convair 540. The F-27s in Allegheny service were called “Vistaliners” and the Convair 580s were called “Vistacruisers” to complement the DC-9 “Vistajets”. #avgeek #aviation #aircraft #planeporn #KDFW #DFW #airport #igTexas #planespotting #airlines #megaplane #instaplane #Airbus #A319 #Allegheny #N745VJ #American #AmericanAirlines #DFWavgeek #instagramaviation #splendid_transport #instaaviation #aviationlovers #aviationphotography #flight #AvGeeksAero #AvgeekSchoolofKnowledge #AvGeekNation #TeamAvGeek (at DFW International Terminal D) https://www.instagram.com/p/B2AQyviBIVh/?igshid=c65gi55gdsuq

#avgeek#aviation#aircraft#planeporn#kdfw#dfw#airport#igtexas#planespotting#airlines#megaplane#instaplane#airbus#a319#allegheny#n745vj#american#americanairlines#dfwavgeek#instagramaviation#splendid_transport#instaaviation#aviationlovers#aviationphotography#flight#avgeeksaero#avgeekschoolofknowledge#avgeeknation#teamavgeek

4 notes

·

View notes

Photo

A Capital Airlines Lockheed L-049 Constellation at the Allegheny County Airport, southeast of Pittsburgh, Pennsylvania. Photographed 1952.

32 notes

·

View notes

Photo

Allegheny Airlines

The Allegheny Airlines company was originally founded as a mail company by the Du Pont family. The Airline quickly grew, and by the 1950’s it was transporting American citizens across the country by expanding its fleet. Featured in this photo are unidentified subjects, stepping off a flight that (plausibly) landed at the Trenton-Mercer Airport. The Trentonian newspaper they are holding features a front-page article regarding the indictment of Adnan Menderes (9th Prime Minister of Turkey) which took place in 1960.

All of the Individuals in these photos have not been identified.

2 notes

·

View notes