#AccountOpening

Text

Bank Account Opening Assistance in Dubai, UAE - MNA Business Solutions

Secure your financial future in Dubai, UAE with MNA Business Solutions! Our expert will assist you in Opening of your bank account. WhatsApp now at +971 50 539 8688 for a free consultation

#BankingMadeEasy#OpenAccountNow#FinancialFreedom#EasyBanking#AccountOpening#BankingSolutions#FastTrackBanking#SecureBanking#DigitalBanking#SmartBanking#NoHassleBanking#NewAccountAlert#ConvenientBanking#BankingOnTheGo#OpenSavingsAccount#FutureFinance#YourBankYourWay#InstantAccountOpening#BankingWithEase#SimpleBanking

0 notes

Text

Unlocking the Power of Twitter X: Your Ultimate Guide to Opening a New Twitter X Account

Hey there, Twitter enthusiasts! Are you ready to dive into the dynamic world of Twitter X? Whether you're a seasoned Twitter user looking to explore new horizons or a social media rookie eager to harness the platform's potential, opening a Twitter X account is your gateway to endless possibilities.

In our latest blog post, we've curated an in-depth, step-by-step guide to ensure that you have a seamless and hassle-free experience while setting up your Twitter X account. We'll walk you through the entire process, from creating your profile to optimizing it for maximum visibility and engagement. With our expert tips and tricks, you'll be well-equipped to navigate the unique features and functionalities that make Twitter X stand out in the realm of social media.

The journey to establishing your presence on Twitter X begins now. Click here to unlock the full potential of this vibrant platform and elevate your social media game to new heights.

Get ready to amplify your online presence, connect with a broader audience, and stay ahead of the curve with Twitter X. Let's make your mark in the digital sphere!

#TwitterX#socialmedia#accountopening#digitalpresence#onlinevisibility#socialmediamarketing#TwitterGuide#platformtutorial#newaccountsetup#blogpromotion#digitalmarketing#brandawareness#audienceengagement#TwitterTips#TwitterTricks#TwitterCommunity#stayconnected

0 notes

Text

लाभार्थियों को वित्तीय सहायता देने के लिए केंद्र सरकार ने खुलवाए थे जीरो बैलेंस खाते

हिमाचल प्रदेश के 4.06 लाख बैंक खाताधारक दो लाख रुपये दुर्घटना बीमा कवर से बाहर हो गए हैं। इसका कारण यह है कि प्रधानमंत्री जनधन योजना के तहत जारी हुए रुपे कार्ड का इन खाताधारकों ने एक बार भी इस्तेमाल नहीं किया।

योजना में स्पष्ट है कि खाताधारक रुपे कार्ड एक बार भी इस्तेमाल नहीं करता है तो उसे बीमा कवर का लाभ नहीं मिलेगा। प्रदेश में 12 लाख रुपे कार्ड में से आठ लाख ही सकि्रय हैं। इन आठ लाख उपभोक्ताओं को लाभ लेना है तो रुपे कार्ड एक्टिव करना होगा।

#GovernmentAid#FinancialAssistance#CentralGovernmentScheme#ZeroBalanceAccount#BeneficiarySupport#FinancialInclusion#SocialWelfare#AccountOpening#GovernmentBenefit#FinancialSupport

0 notes

Text

www.indiakabank.com

INDIAKABANK

We at indiakabank provide an easy, efficient, and long term solution to all your multi utility payment.

#accountinbank#accounting#bankaccount#BankofIndia#accountservices#AccountOpening#indiabank#savingsaccount#demataccount#onlineservices

0 notes

Text

Servosys offers the best Current And Savings Accounts ( CASA ) Customer Onboarding Software Solutions to help banks & financial institutions to grow their customers.

#savingsaccount#customeronboarding#Customeracquisition#banks#nbfcs#bfsi#automation#digitaltransformation#accountopening

0 notes

Text

If you are wondering how to open a company bank account in UAE? Then Centriz is here to assist you. Our team of experts can assist you in opening your corporate bank account in the UAE. Contact us now to get started!

🌏 www.centriz.ae

📧 [email protected]

📲 +971 52 865 2718

0 notes

Text

Best Demat Account In India 2023

A Demat and Trading Account will be the initial step towards investment in a stock market. Read the whole list of service providers for Demat and trading accounts and select the best Demat Account in India for your needs.

There are two kinds of Demat service providers, one being full-service brokers and another being discount brokers. Brokers with the trading platform who give you share advice, research reports, etc. are termed full-service brokers.

What is the Best Demat Account in India?

A Demat account is an account that offers an electronic platform for holding shares and securities. This notion was established in India in 1996 as an alternative to certificates of physical share.

These accounts can also be used to build a portfolio of shares, bonds, debt, mutual funds, and government assets. For investing in the stock market selection of the best demat account in india is a must.

Read more

1 note

·

View note

Text

Benefits of association with #NSDL #PAYMNETS #BANK

i) Account opening #commission 25 INR / per account ( by finger print instant virtual ATM Debit cards )

ii) #AEPS #withdrawal direct in your current account no need to pay any #settlements charges

iii) AEPS attractive commission directly from the bank

iv) Insurance direct agent-ship from NSDL Bank

v) Money Transfer directly from the banks

0 notes

Text

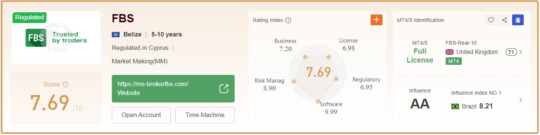

FBS Broker Review

FBS Broker: Empowering Traders Since 2009 FBS, a renowned Forex and CFD trading platform, emerged in 2009 when a group of passionate investors united their expertise in trading research and technical analysis. Today, FBS stands as a global brand with a footprint spanning 150+ countries. It amalgamates various entities, offering traders the chance to engage in Margin FX and CFD trading.FBS comprises several regulated entities, including FBS Markets Inc. (licensed by IFSC), Tradestone Ltd. (licensed by CySEC), Intelligent Financial Markets Pty Ltd. (licensed by ASIC), and TRADE STONE SA (PTY) LTD. (licensed by FSCA). Forex regulation is essential to ensure trading safety all the time, regulatory compliance has enhanced trading capabilities and bolstered FBS's reputation as a trusted broker.

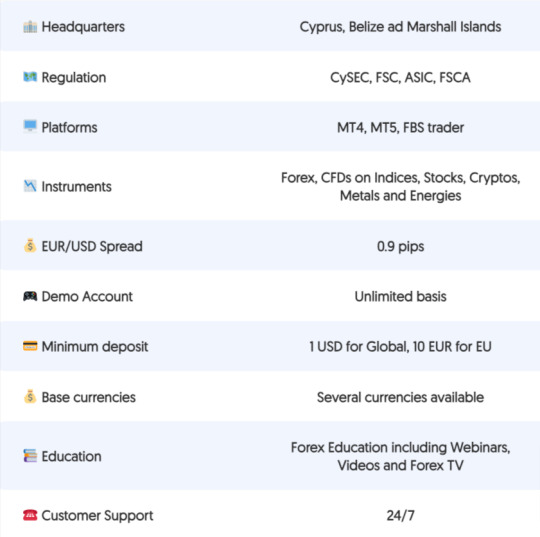

FBS Broker Summary Overview

As a regulated broker, FBS broker ensures compliance with various legislative environments, resulting in favorable trading conditions and a suite of valuable tools. Wikifx comprehensive review rates FBS at 7.69 out of 10, based on rigorous testing compared to over 500 brokers in the industry.

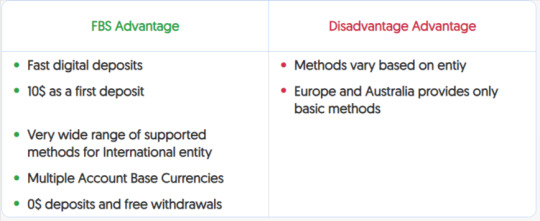

FBS Broker Banking

After careful analysis and a comprehensive review, we believe that FBS presents an appealing opportunity for both novice traders and those with regular trading experience. Notably, FBS offers competitive fees for Currency trading, with the added advantage of a minimal deposit requirement starting at just $1. Overall, the trading conditions are highly favorable.

FBS Broker Awards and Recognition

FBS's commitment to excellence has not gone unnoticed, as it has received over 60 international awards. These accolades recognize FBS as a transparent broker with top-notch customer service, solidifying its position as one of the most acclaimed brands in the industry.

Is FBS a Safe Broker?

FBS is not a scam but a reputable brand. It operates under Tradestone Limited, a Cyprus-registered company and an EU-regulated investment firm licensed by CySEC. FBS also holds licenses from ASIC in Australia and FSCA in South Africa. While FBS has an entity in Belize, it's essential to note that Belize's local regulator, the Financial Service Commission (FSC), mainly registers companies rather than actively regulating them. However, when combined with the regulatory oversight of European CySEC, FBS offers reliable trading conditions.

FBS Broker Leverage

FBS provides varying leverage options depending on the entity and instrument. European and Australian entities offer a maximum of 1:30 leverage for major currency pairs, while international FBS entities offer higher leverage ratios, reaching up to 1:1000 or even 1:3000. It's crucial to use leverage wisely to manage risk effectively.

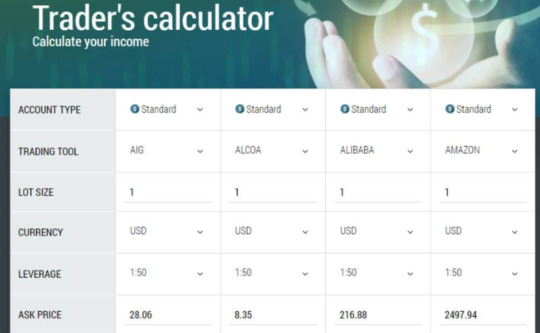

FBS Account Types

FBS broker offers Standard, Crypto, and Cent accounts, catering to traders of all experience levels. These accounts come with demo and live trading options, allowing traders to choose based on their preferences and risk tolerance.

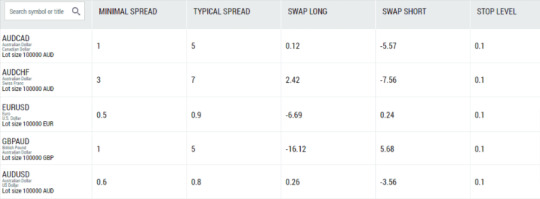

Fees and Spreads

FBS's pricing structure typically involves spreads, with overnight fees, inactivity fees, and withdrawal fees, if applicable. Overall, FBS offers competitive fees, with some deposit and withdrawal methods available free of charge. Spreads vary based on the account type and entity.

Payment Methods

FBS supports a vast range of payment methods, with over 100 options available for the international entity. Major cards, e-wallets, wire transfers, and crypto wallets are among the choices. However, European and Australian entities may have more limited payment options due to regulatory requirements.

How to Open an FBS Account

Opening an account with FBS is a straightforward process, involving registration, document verification, and deposit. Traders can choose from various account types based on their preferences and trading goals.

Follow below steps to open an FBS broker account :

- Sign Up For FBS account from our register link

- Enter your personal details, including name, email, phone, etc.

- Receive a confirmation link in your email to proceed.

- Access your online account management and begin with a Demo Account if desired.

- Define the account type you wish to open and select your base currency.

- Specify your trading experience and expectations through an online questionnaire.

- Upload necessary documents to verify your address and identity, complying with regulatory requirements.

- Click "Submit" and allow a few working days for document verification and account activation.

- Proceed with your initial deposit.

- Decide whether you want to trade FX products, stocks, or other assets, and commence trading.

Trading Instruments

FBS broker offers a selection of trading instruments, including Forex, metals, indices, and energies. While Forex trading is the primary focus, the range of instruments may be limited compared to some other brokers.

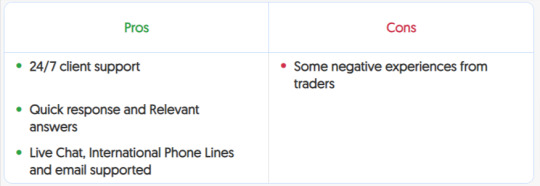

Customer Support

FBS provides 24/7 customer support through live chat, international phone lines, email, and social media. While customer support is generally responsive, it's essential to consider feedback from other traders.

Education and Research

FBS offers a comprehensive education center with webinars, guidebooks, video lessons, tips for traders, and a glossary. Traders can access daily technical and fundamental analysis, an economic calendar, and a currency converter. The platform also features a Forex calculator and Forex TV for the latest news updates.

Conclusion

In conclusion, FBS is a trusted Forex and CFD trading platform that caters to traders of all levels. Its range of account types, powerful trading platforms, and convenient customer support contribute to a favorable trading environment. While FBS offers low trading costs and a solid execution model, traders should carefully consider their preferences and the entity they choose when trading with FBS.

Read the full article

0 notes

Text

Banking Kiosks

Click to know more: https://lnkd.in/gsRnSM6S

Avail any banking services at your convenience with Panashi’s Digital Banking kiosk

Account opening, Cheque printing, instant card issuance, KYC processing, and other services are all available through our advanced banking kiosk. It comes with an interface that is easy to use, supports different languages, and is available 24/7, making it easy for you to access any services whenever it is most convenient for you.

#digitalbanking #selfservicekiosk #kiosk #bankingservices #accountopening #24x7 #banking

#self service kiosk#self service kiosks#innovation#kiosks#tech#banking#technology#kiosk#banks#digital banking

0 notes

Text

Financial Opportunities: Exploring the Power of a Brokerage Account

Investing in the stock market can be an exciting and potentially profitable venture. To participate in investing, one needs to have a brokerage account. A brokerage account is a type of financial account that allows individuals to buy and sell various types of securities, such as stocks, bonds, mutual funds, and more. In this article, we will explore the ins and outs of brokerage accounts, how they work, the different types available, and other essential considerations for successful investing.

Introduction

Investing can seem complex and intimidating to beginners. However, a brokerage account is a gateway to the investment world, providing individuals access to financial markets and the ability to trade securities. Whether you're a novice investor looking to dip your toes into the market or an experienced trader, understanding the fundamentals of a brokerage account is crucial.

Definition

A brokerage account is a type of financial account offered by brokerage firms or financial institutions that allows individuals to buy, sell, and hold various securities. These securities include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and options. Opening a brokerage account allows investors to participate in the financial markets and potentially grow their wealth.

How Does a Brokerage Account Work?

When you open a brokerage account, you establish a relationship with a brokerage firm. The brokerage firm acts as an intermediary between you and the financial markets, executing your trades and providing access to investment products. You can place buy or sell orders for different securities through your brokerage account based on your investment strategy and goals.

Types of Brokerage Accounts

Several types of brokerage accounts are available, each catering to specific investor needs. The most common types include individual brokerage accounts, joint brokerage accounts, retirement accounts (such as Individual Retirement Accounts or IRAs), and custodial accounts for minors. Each type has its features and benefits, so choosing the one that aligns with your investment objectives is essential.

Benefits of a Brokerage Account

A brokerage account offers numerous benefits to investors:

It provides access to various investment opportunities, allowing you to diversify your portfolio.

Brokerage accounts often have research tools, educational resources, and expert insights to support investment decisions.

You can manage your investments independently or seek guidance from a financial advisor, depending on your preferences and experience.

Opening a Brokerage Account

Opening a brokerage account is a straightforward process. It typically involves completing an application form, providing necessary identification and financial information, and funding your account. Some brokerage firms may have minimum deposit requirements, while others offer no-minimum accounts. It's crucial to review the terms and conditions, account fees, and any potential promotions offered by different brokerage firms before deciding.

Choosing a Brokerage Account

Selecting the right brokerage account is essential for your investing journey. Consider factors such as the reputation and reliability of the brokerage firm, the range of investment options available, the quality of customer service, and the overall fees and commission structure. It's advisable to compare different brokerage firms and read reviews to make an informed choice that suits your investment goals and preferences.

Fees and Commissions

When using a brokerage account, it's important to understand the fees and commissions associated with trading securities. Brokerage firms may charge various fees, including transaction fees, account maintenance fees, and commissions per trade. These fees can vary significantly, so it's crucial to compare the fee structures of different brokerage firms to minimize costs and maximize returns on your investments.

Investment Options

One of the advantages of having a brokerage account is the access to a wide range of investment options. These options include stocks, bonds, mutual funds, ETFs, options, futures, and more. Each investment option has its own risk and return characteristics, so it's essential to understand them before making investment decisions. Diversification and asset allocation strategies can help mitigate risks and optimize your investment portfolio.

Risks and Considerations

Investing in securities involves inherent risks. The value of investments can fluctuate, and there is no guarantee of returns. Knowing the risks associated with different types of securities and investment strategies is important. Market volatility, economic conditions, and geopolitical events can also impact investment performance. Consider your risk tolerance, investment horizon, and financial goals when making investment decisions.

Tax Implications

Owning a brokerage account can have tax implications. Depending on the type of account and the investments held, you may be subject to taxes on capital gains, dividends, or interest income. It's advisable to consult with a tax professional or financial advisor to understand the tax implications and develop tax-efficient investment strategies.

Monitoring and Managing Your Account

Once you have a brokerage account, monitoring and managing your investments is important. Stay informed about market trends, news, and company-specific developments that may impact your holdings. Regularly review your investment portfolio, rebalance if necessary, and consider adjusting your investment strategy as your financial goals evolve. Many brokerage firms offer online platforms and mobile apps for convenient account management and trading.

Tips for Successful Investing

To enhance your chances of success in investing, here are a few tips to consider:

Educate Yourself: Continuously expand your knowledge about investing and financial markets.

Set Clear Goals: Define your investment goals and plan to achieve them.

Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk.

Control Emotions: Avoid making impulsive decisions based on short-term market fluctuations.

Regularly Review and Adjust: Stay proactive and adapt your investment strategy.

Conclusion

In summary, a brokerage account is an essential tool for individuals looking to participate in investing. It provides access to a wide range of investment opportunities, allows flexibility in managing investments, and offers various account types to suit different investor needs. By understanding the fundamentals of brokerage accounts and following best practices for successful investing, you can embark on a rewarding financial journey.

0 notes

Text

How to Sell Digital Products Without a Website to Make Money?

In this Article we will learn how to automatically sell digital products without a website using Razorpay and Google drive.

https://www.youtube.com/embed/-WhA8BmerAc

What are the websites used for selling the digital products ?

Razorpay

Pabbly

Gmail

Google Drive

For selling digital products without a website, we are going to work with four apps here Razorpay. Google drive as well as Gmail and Pabbly.

If a payment is made on Razorpay a file that is present in our google drive should be shared to the customer who has made the purchase on his Gmail account.

Steps to sell digital products without a website

Choose the digital product you wanted to sell to the peopleCreate a Google account if you don’t have an already existing accountOpen Google drive on your Google accountUpload the digital file to the Google drive which you wanted to sellSignup on Razorpay though which you can collect the money for salesOn successful signup on Razorpay – Go to Payment Pages -> Create Payment Page -> Product SaleNow Set up your listing for the digital product and also the price for the productNow signup on Pabbly and create your accountAfter successful creation of account click on create workflowFollow the video instructions to clearly setup everything and sell your first product

In the same way you can implement this for multiple payment gateways like Paypal, Stripe and many other payment gateways.

Read the full article

0 notes

Text

http://icicidirect.com/customer/accountopening?rmcode=ARUD1978

0 notes

Text

www.indiakabank.com

INDIAKABANK

You can earn extra income only by very simple steps, Get connected with INDIAKABANK.com account opening process.

#accountinbank#accounting#bankaccount#BankofIndia#accountservices#AccountOpening#indiabank#savingsaccount#demataccount#onlineservices

0 notes

Photo

Open 0 Brokerage Plan Account With Icici Click On Below Link

https://secure.icicidirect.com/customer/accountopening?rmcode=JOOMN613

#stockmarket #trader #intraday #intradaystock #intradaytrading #stockmarketindia #shermarket #trading #tradingsetup #Viral

0 notes

Text

Best #Fintech B2B Digital Solution

Join Us grow your digital business and achieve you business goals.

#NewServiceUpdate

#VisaApply

#NSDLPanCard

#AccountOpening

0 notes