#16 principles of ifa

Text

#african#afrakan#kemetic dreams#brownskin#africans#afrakans#brown skin#african culture#afrakan spirituality#afrakan woman#deep reddish brown skin#kemet#epic video#africa#african spirituality#yoruba#yoruba spirituality#Iva#ifa#16 principles of ifa#16 commandments of ifa#16 rules of ifa

90 notes

·

View notes

Text

Ifa: The 16 Odu Ifa & Their Meaning.

The meaning of the 16 Odu Ifa of the Ifa is based on 16 symbolic or allegorical parables contained in the 16 Core Chapters or Principles that form the basis of the Ifá, a system of divination of the Yoruba people of Nigeria.

The Grand Priest of Ifa, the Babalawo or Iyanifas are the Priests and Priestesses of the Ifa Oracle that receive and decode the meaning of the Divine Messages contained in the Odu Ifa Parables that are transmitted to them using a Divination Chain known as Opele or the Sacred Palm or Kola Nuts on a Wooden Divination Tray called the Opon Ifa.

When the 16 Odu Ifa is combined, a total of 256 Odu emerges which is essentially a collection of 16 Odu, each of which has sixteen alternatives that are believed to reference all situations, circumstances, actions, and consequences in life.

These form the basis of traditional Yoruba spiritual knowledge and are the foundation of all Yoruba divination systems.

Ifá proverbs, stories, and poetry are not written down. Rather, they are passed down orally from one Babalawo to another. People consult Ifa for divine intervention and spiritual guidance.

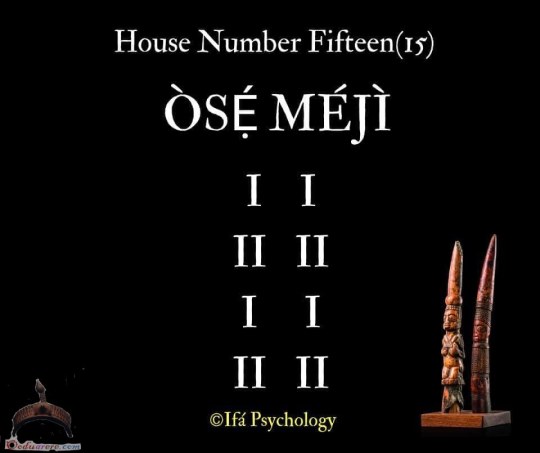

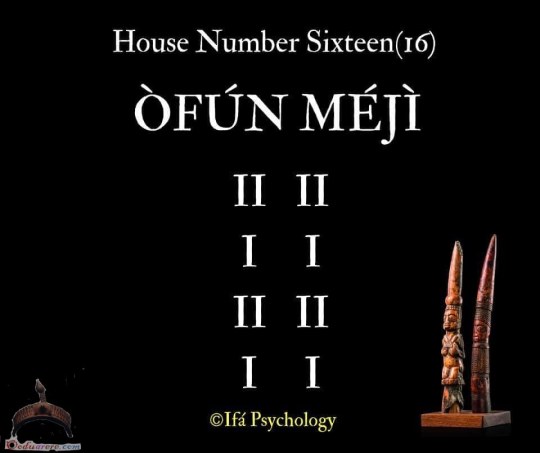

The 16 Odu Ifa:

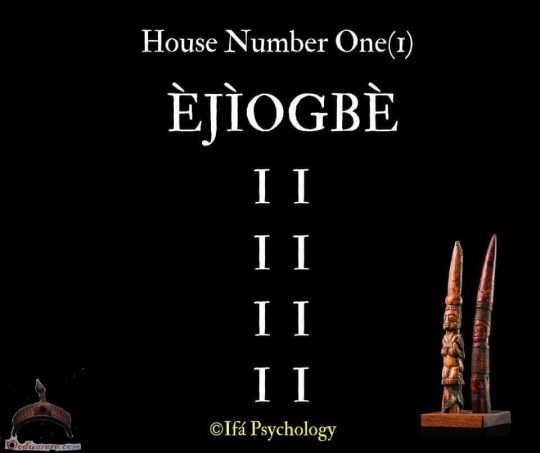

- Eji Ogbe: The principle of Eji Ogbe is the idea of perfect alignment with Destiny.

Ifa teaches that all human Destinies are rooted in the spiritual discipline of developing good character.

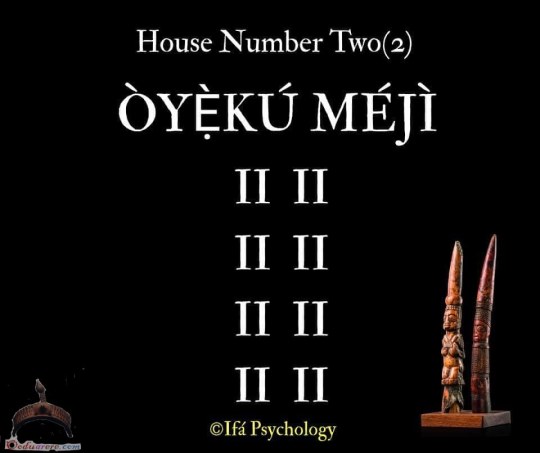

- Oyeku Meji: It references the idea that death represents the end of a cycle for example the end of poverty, the end of ill health, the end of confusion, and the end of loneliness.

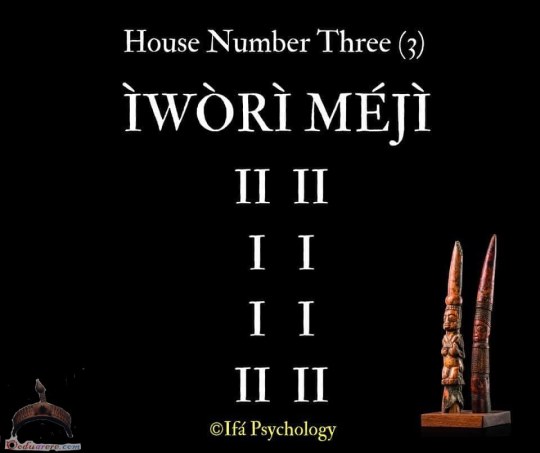

iii) Iwori Meji: It focuses on the ability to identify REAL possibilities.

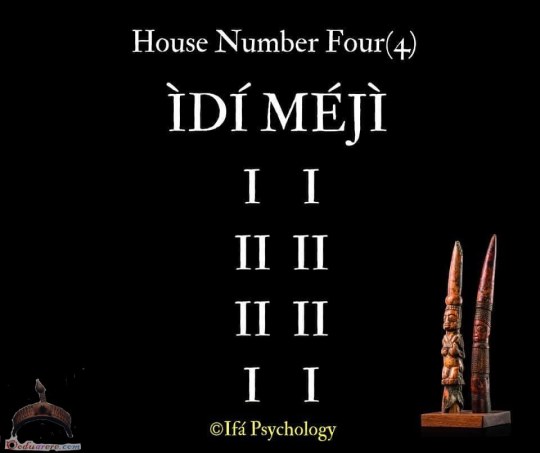

iv) Odi Meji: Odi means the spirit of female reproductive organs; it is known as the seal.

To seal something in a ceremony is to guarantee it will manifest. A seal is anything irreversible such as birth.

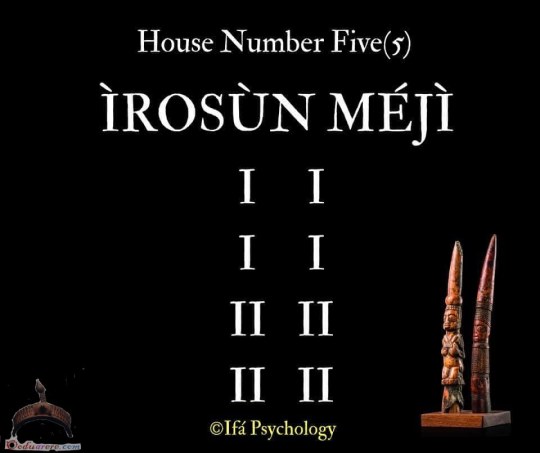

v) Irosun Meji: Irosun Meji occupies the fifth position within the order of Odu Ifa in Yorubaland.

Irosun means the spirit that protects the head and descends. The Odu is known as the sounding Osun.

Osun is the spirit that protects the head (Ori). The head is where memories are stored, so by protecting the head, Osun preserves the past.

Irosun Meji is the stable and inflexible reality of what has come before us.

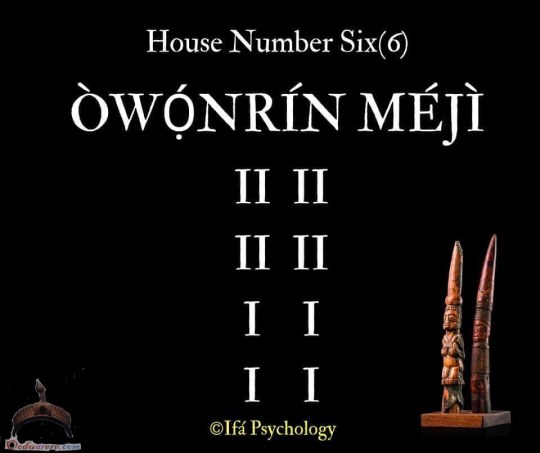

vi) Owonrin Meji: Owonrin means brought by the hands.

It says the solidification of the past lays the foundation for that which is to come.

Humans are born with a spectrum of potential that cannot be changed. Within the spectrum, we can make choices affecting the way our potential becomes manifest.

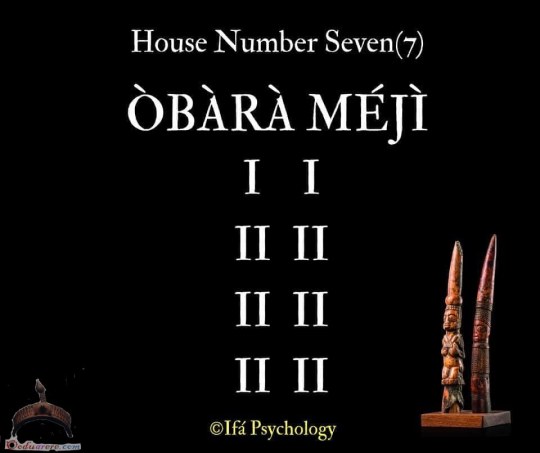

vii) Obara Meji: Obara is the Odu that incarnates humility in the struggle with arrogance.

For those who are struggling to find abundance cleaning away the negative effects of arrogance is the first step towards accessing your ability to create abundance.

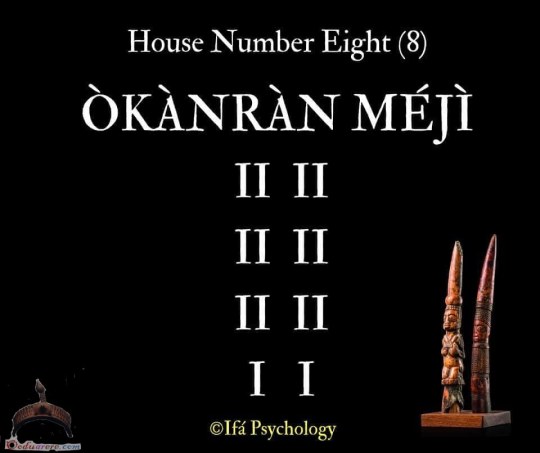

viii) Okanran Meji: Here is a warning not to scatter your attention.

Okanran refers to new beginnings and a change of direction in your life. This change needs to be focused and directed towards a specific goal in order to be effective.

ix) Ogunda Meji: Ogunda Meji is a reference to the courage of Ogun to face unknown obstacles.

When some people have problems they complain and blame others. In Ifa, complaining and blaming others is called ibi.

Ire comes from accessing Ogun’s Ase, which is the Ase of the courage to take responsibility for all of your problems and the willingness to face them head-on.

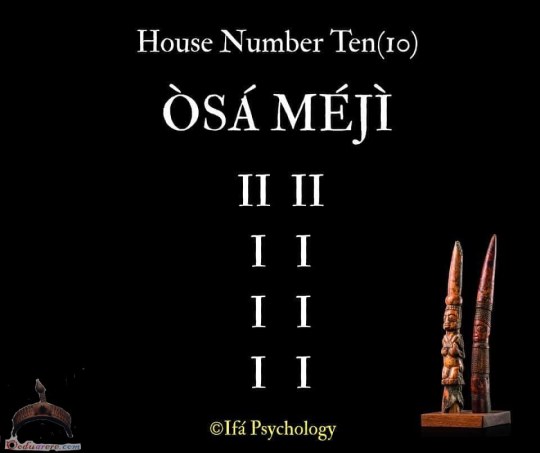

x) Osa Meji: There are some stories attached to his Odu, simply put, it is said according to the Odu Ifa Osa Meji Ifa explains what happened between the Iyami and human beings:

When humans (eniyan) and birds (eye) came to earth (Aye) from the sky (Orun) they made the sacred promise they will never kill each other.

Time passed by and human beings became hungry because there wasn’t food for them and so they started to die one by one; Esu came to humans and put in their minds why they were dying with so many birds around.

Humans decided to break the promise and started to kill the birds and eat them.

The Eleye became very furious and went to Eledumare who said that human beings were guilty and since that moment the Eleye or Iyami will have the power to interfere in the human’s life and do what they want with them.

Human beings broke the promise, they broke the equilibrium and now they need Iyami’s favor to avoid negativities.

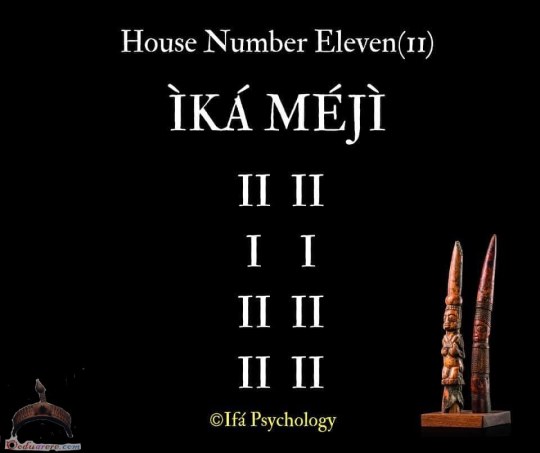

xi) Ika Meji: This speaks of running away from evil thoughts, evil actions, and evil utterances. IFA says evil does not pay, but doing good and thinking well, and speaking out good words attract enormous blessings from OLODUMARE.

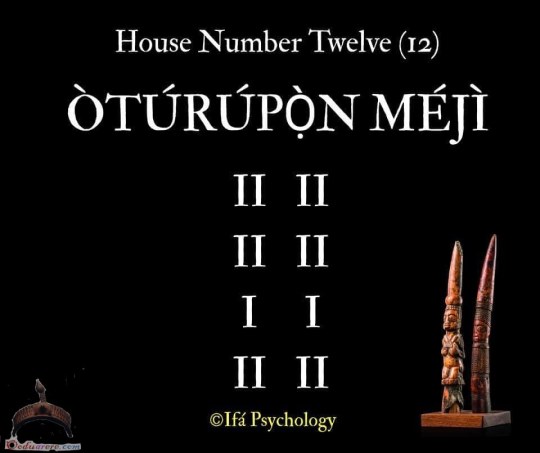

xii) Oturupon-Meji: Oturupon-Meji occupies the twelfth position in Odu Ifa.

It is an image of instability within the forces of the earth.

Oturupon Meji reveals how the faculty of intelligence came to the world.

It relates to Egungun (Ancestor Society). The Egungun should be allowed to comment on the resolution of any conflict.

Oturupon deals with the spiritual consequence of lack of courage.

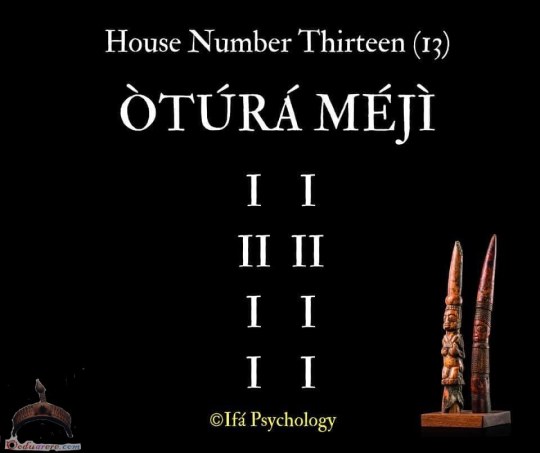

xiii) Otura Meji Otura meji means peace, harmony, love, and light through proper examination of mind, heart, and soul to find the infinite wisdom, infinite

power, and the infinite supply of all that is necessary to achieve our earthly destiny and spiritual growth.

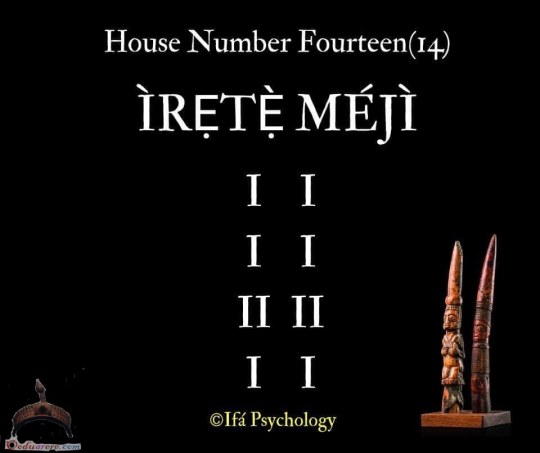

xiv) Irete Meji: Under this Odu, Orunmila speaks of possible initiation into IFA to guarantee long life and good health.

This Odu speaks of the prosperity of life and the Exaltation of life if the possible offering of rituals, sacrifice, and initiation to encourage the fulfillment of life and happiness.

xv) Ose Meji: Ose Meji says there is a woman that is looking to have children but she has been unsuccessful up till this point.

Ose Meji says this person must make a sacrifice.

Ose Meji says that if this person can sacrifice, they will soon find a spouse, and birth to children, and receive a financial increase.

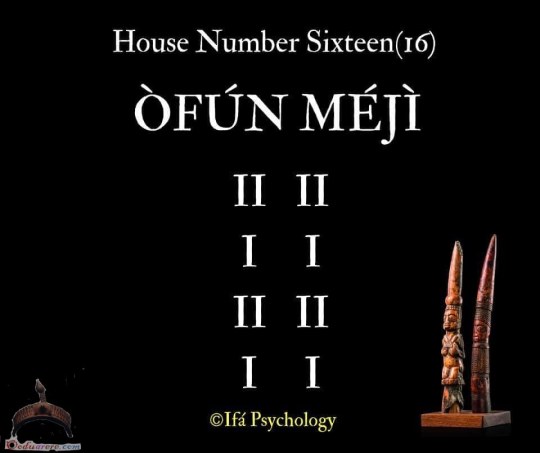

xvi) Ofun Meji: Ofun Meji occupies the sixteenth position within the order of Odu Ifa in Yorubaland, West Africa.

In Ogbe Ofun, it means that the person is in alignment with their destiny and is receiving blessings as a result of the effectiveness of their prayers and spiritual discipline.

Read the full article

7 notes

·

View notes

Text

HOW TO PRACTICE IFA RELIGION

Many people come to me seeking out reputable priests and priestesses within traditional African systems. There are several available, but I know they can be difficult to find. That’s why I provide reputable Ifa readings through my website.

Since I started offering these services, a few of my clients have asked me to explain more about the beliefs and tenets of Ifa. So, I decided to cover this topic in more depth in a 16-part series. Since I don’t focus on Ifa as much on the African Spirit podcast, I will also address this topic in more depth over time. So, stay tuned if you want to know more about this sacred tradition.

It is important to note that Ifa is not a proselytizing religion. People do not actively seek to convert followers to Ifa. Instead, they focus on living their lives in accordance with Ifa principles. Therefore, it is unlikely that you will see signs and billboards pointing you to an Ifa temple or have random people approaching you with pamphlets about the religion.

Instead, you will have to search out Ifa resources on your own. It is a growing community but is not as easily visible as other religions. This is why this series and additional information about this system are crucial to new devotees.

ORISHAS OF THE IFA RELIGION

If you are new to Ifa, you should know a few things before you begin practicing the religion. First, it is vital to understand that Ifa is a monotheistic religion though devotees serve many deities. Some view the Ifa religion as polytheistic, meaning many gods or deities are worshiped.

However, the true essence of Ifa is monotheistic. Ifa devotees believe in a Supreme Creator referred to as Oludumare. Though, the Orishas and other forces created by Oludumare significantly impact our day-to-day lives. Therefore, they are reverenced or honored through offerings and sacrifices.

Some of the more well-known Orishas include the ones outlined below. But, there are many more Orishas that you will come in contact with as you develop your practice.

ORUNMILA

Also known as Orula or Orunla, this Orisha is associated with divination, wisdom, and prophecy and is often invoked for guidance and protection. Orunmila is one of the essential Orishas in the Yoruba religion and is widely revered among followers of other Orisha traditions in the Caribbean Islands and South America.

ESHU

Also referred to as Esu, this Orisha is considered the Orisha of mischief and change. Eshu is typically depicted as a man with two faces, one black and one red. These colors represent change and opposition. Eshu is often described as a trickster god, as he is known for playing tricks on people. He is also known for being very helpful as he is the god of crossroads, capable of opening doors of opportunity.

OBATALA

This is the Orisha of peace, purity, and creativity. Obatala is typically depicted in all white, which represents purity. He is known to be very fair and just, with little to no tolerance for immorality.

OSHUN

The Orisha of love, beauty, and fertility is known as Oshun or Osun in the Ifa and other diasporic traditions. Oshun is typically depicted as a beautiful woman with yellow or gold clothing, which symbolizes beauty and happiness.

OGUN

The Orisha of war and strength is popularly known as Ogun in many African diaspora traditions, including Ifa. Ogun is typically depicted as a man dressed in all black, carrying weapons. He is also associated with the colors green and black in Yoruba, which represent the forest or clearing a path. In diasporic traditions, he is most commonly associated with the color red, which embodies the energy of passion, power, and war.

SANGO

One of the most famous Orishas in Yorubaland, Sango, is the god of thunder and lightning. Sango is said to be a very powerful Orisha and is often considered to be the king of the Orishas in Yoruba. This Orisha is very passionate and can be both good and bad-tempered. Sango is usually depicted as a man carrying a double-headed ax and is often associated with the color red. Sango is also the patron of the Orisha of the Yoruba people.

OYA

Oya is a very important figure in the Ifa religion. She is the wife of Ogun, the god of war, and is also the goddess of the wind and storms. Oya is a powerful warrior goddess and is often depicted carrying a sword or spear. She is also associated with crows and birds of prey. Oya is a fierce and protective goddess who is sometimes invoked during trouble or conflict. She is also the patroness of women who experience difficult times, such as childbirth or menopause. Oya is a popular goddess. Her shrines can be found throughout Nigeria and other parts of West Africa.

These are just some of the few Orishas you should be aware of as you connect with Ifa. Some of them will be more prominent in your journey than others. However, all Orishas play a role in each of our lives in some way or another.

ANCESTOR VENERATION

It is also important to begin an ancestor veneration practice before starting any African spiritual system. This will help you connect to your African roots and the spirit world, as your ancestors will guide you along your journey.

This should be your first step before embarking on an Ifa spiritual journey. Your ancestors can help you find the right resources and connect with the right people along your path. But it may be necessary to do ancestor connection or elevation work before you begin venerating them. There are many ways to accomplish this goal.

STUDYING IFA

If you are interested in practicing Ifa, start by doing some research to learn more about the belief systems and the Orishas. Once you have a general understanding of the religion, begin incorporating Orisha worship into your own life in subtle ways. And finally, seek out an Ifa community that you can connect with and learn from.

To practice Ifa, followers must first learn about the Orishas that they may be working with. This can be done by reading religious texts, attending ceremonies, or speaking with a priest or priestess of the system. Once you have a general understanding of the system, you can begin to incorporate the principles and Orishas into your own life in healthy and productive ways.

By connecting with the system this way, you can begin to live your life according to Ifa principles. This includes living in harmony with nature, respecting your elders, and working hard to better yourself and your community.

Connecting with an Ifa community at the beginning of your journey is important. This can provide you with support and guidance as you learn more about the religion. There are Ifa temples in many parts of the world, so finding one near you should not be difficult. You can also find many resources online, such as books, articles, and websites dedicated to Ifa.

Here is a list of popular books about the Ifa tradition that you can get started with:

UNDERSTANDING IFA GUIDELINES

It is very important to understand Ifa guidelines before fully embracing the system. There is a strict set of rules and regulations that should be followed in order to avoid any negative consequences. Some of these guidelines include:

Do not engage in any activities that could result in spiritual or physical harm or abuse.

Do not abuse drugs or alcohol while participating in Ifa ceremonies or rituals.

Do not violate individual and community taboos.

You will become aware of many other guidelines as you continue your practice. But, do understand that Ifa is a tradition based on standards of moral conduct. Adherents are expected to live a life of good character to achieve success in life.

IFA RELIGION DIVINATION

Get as much information as you can about Ifa divination before you get a reading. Doing so will help you understand if your reading is legitimate or not. It will also help you understand what to expect during the process. If you have questions about Ifa, ask a knowledgeable priest, priestess, devotee, or mentor for guidance.

When you are ready to get your first Ifa reading, there are a few things you should keep in mind. First, it is important to find a reputable diviner who has been trained in the Ifa tradition. Second, you should be prepared to pay for the reading, as spiritual services are fee-based.

Finally, you should come with an open mind and be willing to accept whatever advice the diviner has to offer. By following these steps, you can ensure that you have a positive and productive experience with Ifa divination.

Once you feel ready, you should get your first Ifa reading. This will help you understand your relationship with the Orishas, your destiny, and what steps you need to take to lead a successful life. After your first reading, be sure to live your life according to Ifa principles so that you can succeed in all areas of your life.

CHOOSING A PRIEST OR PRIESTESS

Don’t be too hasty to commit to a Babalawo (Ifa priest) or Iyanifa (Ifa priestess) at first. Take your time, as this is a very important relationship. There are many Ifa priests and priestesses out there. Some are better than others. You want to find someone you can connect with personally and who you feel comfortable working with.

When you have found the right Babalawo or Iyanifa, it is important to build a relationship of trust with them. This means being honest about your goals and intentions and being open to their guidance. Being respectful of their time and energy is also important, as they offer you valuable services.

Once you have established a good relationship, you can receive Ifa readings and work towards your spiritual and life goals. By following these steps, you can begin practicing Ifa safely and effectively. Remember to respect the Orisha, live in accordance with Ifa principles, honor your taboos, and be open to different interpretations of the religion. By doing so, you will be well on your way to a successful Ifa practice.

Finally, continue to study and research as you practice Ifa. The more you know about Ifa, the easier it will be to follow its teachings and achieve success in all areas of your life.

3 notes

·

View notes

Text

Empowering Men's Health: Unveiling the Modern Niramaya Package in Delhi

In the bustling city of Delhi, where every moment counts, taking charge of your health has never been more crucial. introduces the Modern Diagnostic & Research Centre "Modern Niramaya Package for Men 1.4" - a comprehensive full body checkup designed to cater to the unique health needs of men in the heart of Delhi. Let's explore the key features that make this package a game-changer for those seeking a proactive approach to their well-being.

Our MODERN Niramaya Package 1.4 covers 94 tests under the following categories:

1. CBC

2. Rheumatoid Factor Test (Quantitative)

3. Hs Crp - High Sensitivity Crp

4. Immunoglobulin Ige

5. Folic Acid

6. Iron Profile -I

7. Hba1c

8. Urine Microalbumin

9. Urine Routine Examination

10. Lipid Profile

11. Liver Function Test

12. Kidney Function Test

13. Vitamin B12

14. 25 Hydroxy Vitamin D

15. Ana (Anti-Nuclear Antibodies) By IFA

16. PSA - Free

17. Prostate Specific Antigen (PSA) - Total

18. Thyroid Profile (T3,T4,Ultrasensitive Tsh)

19. Plasma Glucose – Fasting

Note: Minimum 12 Hours Fasting required for Lipid Profile Test within this package for accurate results.

Affordable Full Body Checkup Price

Quality healthcare should be accessible to all, and Modern Diagnostic & Research Centre stands by this principle. The full body checkup price for the Modern Niramaya Package for Men 1.4 is competitively priced, reflecting the organization's commitment to making preventive healthcare affordable for everyone in Delhi.

Schedule your full body checkup in Delhi with MDRC India today!

Get In Touch with Us

Shop No 18, DDA Market, near Fortis Hospital, Sector D-3, & D4, Vasant Kunj, New Delhi, Delhi 110070

+91–124–6712000

#affordable price#full body health checkup#master health checkup packages#complete health checkup packages#full body health checkup Delhi#full body health checkup price in Delhi

0 notes

Text

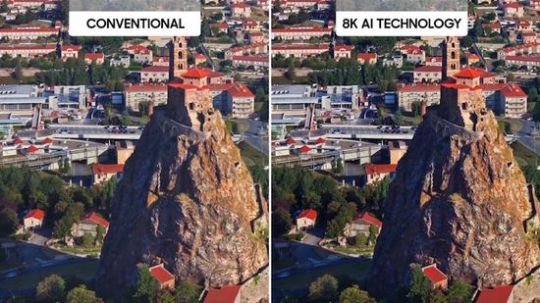

Overview of 8K AI Upscaling Technology

Experts have not yet finished arguing about the prospects for 4K TVs, but companies are already actively offering 8K models. Basically, skeptics of this trend use two fairly convincing arguments.

Introduction

First, many have not forgotten the relatively recent history of 3D TVs. The rapid growth of its popularity began after a demonstration at CES and IFA in 2010. Many experts quite logically predicted its excellent prospects. Unfortunately, the high cost of producing 3D content has become an insurmountable obstacle to its further development. As a result, almost all companies abandoned 3D support in their TVs.

The second argument is based on the eye capabilities. Unfortunately, its maximum sharpness is significantly inferior, for example, to eagle vision. Of course, it would never occur to anyone to watch a 75-inch TV from a distance of, for example, up to 1 meter. But at a more adequate distance, the sharpness of our vision does not allow us to distinguish individual pixels smaller than a certain size. That is, vision does not perceive the difference between, for example, Full HD and 4K TVs with the same screen size. Perhaps the owners of a falcon or an eagle will be able to please their pets with a high-quality image, but they themselves will not see the difference.

But these arguments have counterarguments. For example, companies are actively improving 8K AI upscaling technology.

At a minimum, 8K TVs with AI upscaling will provide better quality playback of lower resolution content.

In addition, the results of experiments open up some new aspects. In particular, South Korean scientists have studied the effect of vernier acuity (hyperacuity) to image formation by our brain. Their results allowed scientists to hypothesize that the brain is less tired when perceiving content with high resolution. At the same time, it watching provides richer emotions due to high realism of the perceived content.

Resolution

Of course, any TV provides maximum playback quality for corresponding native content in pixel-to-pixel mode. Unfortunately, the real situation on the market is often different from the ideal. For example, the capabilities of modern TVs often significantly exceed the resolution of the content offered. But sometimes devices, on the contrary, do not support content resolution.

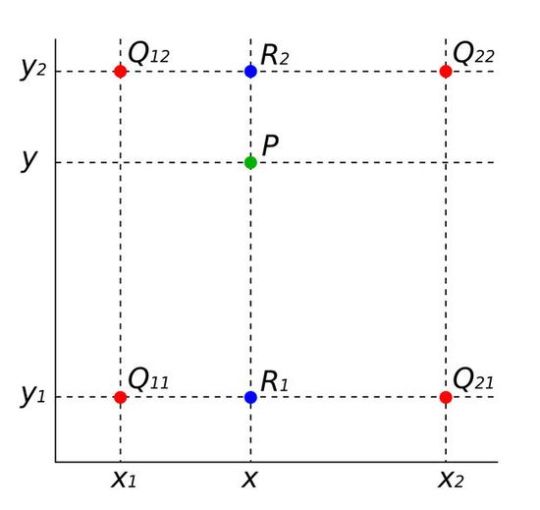

Of course, companies solve this problem. Modern algorithms use several basic technologies. The simplest of them increases the image resolution, replacing each pixel with four copies of it. Bilinear interpolation is more efficient. These algorithms compare the missing pixel with the two nearest ones, forming a linear gradient to sharpen the image.

Even more efficient bicubic interpolation uses 16 closest points in all directions, increasing color accuracy. Unfortunately, it often provokes a halo effect.

Main methods

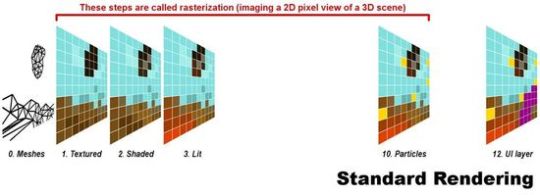

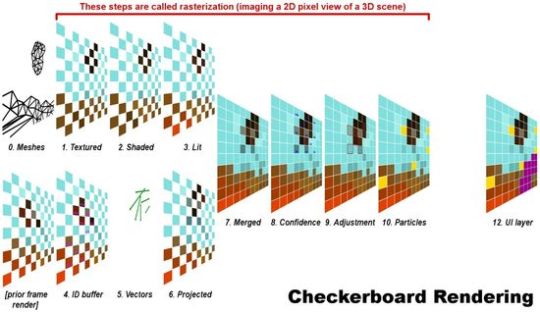

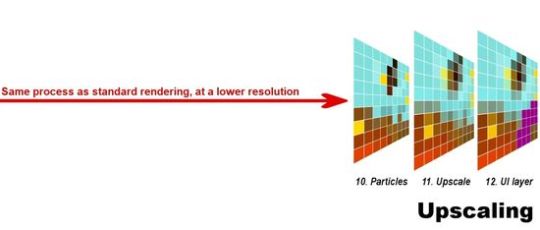

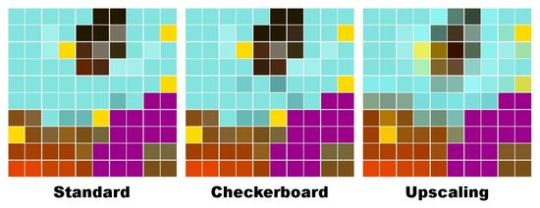

A list of the most popular modern methods includes supersampling, checkerboard rendering and upscaling.

Supersampling is a spatial anti-aliasing method for removing the aliasing in the rendered images. In fact, it first renders the image in 4K, and then displays it in 1080p resolution. As a result, the detail of the final image increases. Of course, rendering requires sufficient processing power. The Insects screenshot from Microsoft on Full HD TV demonstrates this effect.

Checkerboard Rendering reduces computing power requirements. In particular, it removes every second pixel and forms an image from the rest. The diagrams show the differences between Standard Rendering and Checkerboard Rendering.

Removing pixels slightly reduces the image resolution, but significantly reduces the amount of computation.

In fact, upscaling only resizes while maintaining its proportions. It can be considered the simplest method of converting image resolution. In this case, the TV processor forms additional pixels, providing the required resolution. Accordingly, the final image is a set of new averaged pixels.

Unfortunately, the final image comparison demonstrates a significant decrease in quality compared to native content.

Upscaling

A few years ago, Samsung was the first to use the marketing term UHD Upscaling. Strictly speaking, almost any smartphone or computer has long supported this feature. Of course, its quality directly depends on the content. For example, the quality of SD - UHD Upscaling is significantly lower compared to Full HD - UHD Upscaling due to the insufficient number of pixels in the original image. The picture illustrates the difference in quality between SD / HD / Full HD - 4K Upscaling.

But its visualization is almost disappearing for Full HD.

The first 4K TVs did not have an AI processor and simply scaled the image to the entire screen area using traditional interpolation and increasing the pixels size.

Unfortunately, bilinear interpolation provides a fairly low quality due to loss of information, reduced detail, blurring outlines of objects, noise, etc. Moreover, mutual influence complicates their elimination. For example, sharpening increases noise, and conversely, reducing noise reduces detail.

But companies have improved technology by developing AI Upscaling. Using a powerful high-performance processor radically improved upscaling quality.

Today, almost all leaders use 8K AI Upscaling technology under different names. But, of course, they all use the same principles.

Samsung is one of the leaders in the development of this technology. The company uses the powerful 8K Quantum processor, optimized for neural networks and AI processing. Samsung's MLSR (Machine Learning Super Resolution) technology uses machine learning, object recognition algorithms, and software filters.

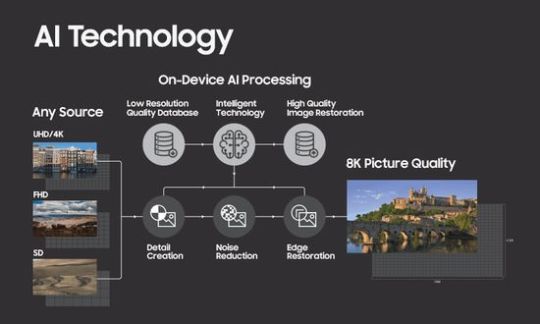

Samsung AI Upscaling

Simplified, this technology uses a constantly updated database of the images pairs in high and low resolution.

It's formed as follows. The system selects an 8K image and lowers its resolution, adding noise and reducing the clarity of outlines. In addition, it performs several compression/decompression cycles with different quality levels to add characteristic artifacts. Generated images pairs of different quality are divided into classes, processed by algorithms based on neural networks and stored in a database.

Subsequently, the processor analyzes the low-resolution image, finds the corresponding algorithm in the database with filters, and replaces it with an 8K pattern.

In fact, the 8K AI Upscaling technology generates an image by analogy with the creation of Frankenstein from 8K patterns in the database.

During processing, AI analyzes image fragments up to 60 times per second, correcting saturation, detail and white balance. CPU uses code lines of patterns base for localization of processing fragments. Such an algorithm increases the recognition accuracy of displayed objects. As a result, the processor almost accurately distinguishes, for example, the sky from its reflection in the windows.

Moreover, the technology works quite well even with streaming video. But cloud computing for such content is not possible.

Previously, AI machine learning used a formula bank, which is downloaded to the TV and updated periodically. But new Samsung Q950TS supports innovative Deep Learning using a neural network to expand machine learning. In fact, it creates its own formulas and algorithms, using processor-integrated basic training coefficients. Of course, Deep Learning has become a quality leap in AI processing. It is performed on a per-pixel basis with the use of noise reduction, restoration of contours, texture creation and restoration of small details. Deep Learning is primarily intended for small details and complex images.

Sony and LG 8K AI Upscaling

Sony's 8K AI Upscaling use dual database processing.

The first database recognizes compression noise, compares it with the patterns and eliminates artifacts. The second database increases resolution based on patterns.

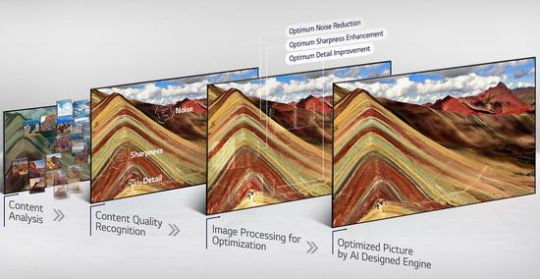

All new LG TVs use AI 8K Upscaling with new powerful α (Alpha) 9 Gen 3 AI processor with AI Deep Learning algorithms. In addition, it supports AI Picture Pro, AI Brightness and AI Sound Pro technologies.

Conclusions

Probably, experts will continue to argue about the reasonable limits of the screen resolution. But in any case, 8K AI upscaling provides improved quality for lower resolution content. In addition, technology has an added bonus. In particular, Deep Learning of neural networks provides continuous quality improvement due to the expansion of patterns base. Theoretically, the quality of 8K AI Upscaling will constantly improve, creating a paradoxical situation when the new TV works worse than the old model.

But of course, the price remains one of the main criteria for the consumer when choosing. Today, this difference reaches several thousand dollars. But many consider it inadequately overpriced compared to the quality gain that provides the modern 8K AI Upscaling. Most likely, companies will continue to improve it performance, while lowering prices for 8K models.

This video shows the capabilities of the Samsung 8K AI Upscaling Technology.

Read the full article

#8KAIUpscaling#AIBrightness#AIDeepLearningalgorithm#AIPicturePro#AISoundPro#bicubicinterpolation#bilinearinterpolation#checkerboardrendering#DeepLearning#hyperacuity#MachineLearningSuperResolutiontechnology#MLSR#Samsung8KAIUpscaling#SamsungQ950TS#SonyAIUpscaling#supersampling#Vernieracuity

0 notes

Text

Huawei Launches Ground-Breaking Mate 30 Series

Huawei unveiled its ground-breaking Huawei Mate 30 Series at an exclusive launch event in Munich. Setting new standards in every area from aesthetic design through to hardware engineering and software innovation, the Huawei Mate 30 Series is the world’s first second generation 5G smartphone and the pinnacle of mobile technological development.

Inspired by the design principle of minimalism, the Huawei Mate 30 Series showcases the perfect example of how aesthetic design fuses with technology. Its unique, iconic OLED Horizon Display offers an immersive viewing experience, while the Kirin 990 5G SoC – the first to integrate processing units and a 5G modem on the same chip using the 7nm+ EUV process– affords unrivalled levels of performance and efficiency.

A revolutionary integrated quad-camera includes the SuperSensing Cine Camera, a dual main camera system designed for amazing photographic and videographic results, while the HUAWEI SuperCharge and EMUI10 offer long-lasting battery life for heavy mobile users and an enhanced user experience.

Richard Yu, CEO of Huawei Consumer Business Group, said: “The HUAWEI Mate 30 Series unleashes the full potential of the smartphone. Designed to stand out, it challenges convention while delivering an unrivalled user experience. The era of 5G is an opportunity to rethink smartphone technology and the HUAWEI Mate 30 series is the ultimate expression of what’s possible.”

Futuristic iconic handset

The Huawei Mate 30 Series builds upon the aesthetic of the Mate 20 Series with a futuristic design that is sure to make a lasting impression. With an ultra-narrow notch design and the thinnest of bezels, the Huawei Mate 30 Pro features the Huawei Horizon Display, which curves at an angle of 88 degrees to maximise the display area to provide an unparalleled, edge-to-edge immersive viewing experience.

Huawei Mate 30 Pro introduces the Intuitive Side-touch Interaction feature to replace the side volume buttons with invisible virtual keys. This feature also allows users to customise the volume key position on either sides of the device and makes the Mate 30 Pro the most integrated, all-in-one design smartphone currently available. Together, Huawei 3D Face Unlock and In-Screen Fingerprint provide high levels of biometric security and convenience.

Turn the device over and the iconic ring design of the quad-camera system immediately stands out, surrounded by a metallic ‘halo’. Mirroring the design of a DSLR camera and designed to be held comfortably, the Mate 30 Series makes the user the focus of the crowd, attracting all the attention. The Mate 30 Pro also features Huawei Acoustic Display Technology to deliver high-quality audio through a sound emitting display.

World’s First 2nd Generation 5G Smartphone

The Mate 30 Series is powered by the Kirin 990 series chipset, Huawei’s most sophisticated smartphone chipset launched to date. The Kirin 990 5G challenges the limits of silicon-based physics by incorporating a three-level power efficiency architecture for the CPU, Huawei’s self-developed Da Vinci NPU architecture (large dual-NPU + tiny NPU cores) as well as a supersized 16-core GPU to deliver super-fast performance and high-power efficiency.

Manufactured with the cutting-edge 7nm+ EUV process, the disruptive Kirin 990 5G supports 2G/3G/4G network and 5G Non-StandAlone (NSA) and StandAlone (SA) modes, along with Dual SIM, Dual Standby and FDD/TDD full frequency bands to deliver seamless connectivity. The HUAWEI Mate 30 Series has also been optimised for ultimate OS performance. As the world’s first 2nd generation 5G smartphone, the HUAWEI Mate 30 Pro 5G features 14 antennas for 5G, delivering ground-breaking speed with unrivalled connectivity.

The Mate 30 sports a large battery of 4200mAh, while HUAWEI Mate 30 Pro has an even bigger battery of 4500mAh. With TÜV Rheinland certified wired and wireless Huawei SuperCharge Technology, the 27W Wireless HUAWEI SuperCharge and the 40W HUAWEI SuperCharge provide users safe and fast charging, while wired and wireless in-car charging and a wired powerbank ensure a seamless experience across all scenarios.

Additionally, the Mate 30 Series provides upgraded reverse wireless charging bringing users a quick and convenient way to recharge other devices.

SuperSensing Cine Camera for Stunning Images and Videos

The Huawei Mate 30 is equipped with a SuperSensing Triple Camera, comprising a 40MP SuperSensing Camera, 16MP Ultra Wide-angle Camera and an 8MP Telephoto Camera. Coupled with an ISP 5.0 Image Signal Processor, the Mate 30 enables users to capture high quality photographs and videos.

The phone sports a revolutionary quad camera system with the 40MP Cine Camera, 40MP SuperSensing Camera, an 8MP Telephoto Camera and a 3D Depth Sensing Camera.

The SuperSensing Cine Camera is a Dual-main camera system capable of taking stunning photos that rival high-end cameras. The Cine Camera features a large 1/1.54-inch sensor size with a high maximum Video ISO of 51200 to capture videos with an extended dynamic range at 4K/60fps as well as ultra slow-motion at the highest 7680 fps. It also supports 4K Low-light Ultra-wide time-lapse video.

The Mate 30 Pro also offers pro-bokeh capabilities while recoding for professional looking results. Additionally, the second of the dual-camera system is a 1/1.7-inch HUAWEI SuperSensing Camera which attracts 40% more lights to deliver stunning results in low light conditions with an impressive light sensitivity of ISO409600, making it the best low light one-shot device ever even for ultra-wide shots.

The 8MP Telephoto Camera offers 3x optical zoom, 5x Hybrid Zoom and up to 30x Digital Zoom. Optical Image Stabilisation (OIS) + AI Stabilisation (AIS) and 3D Depth Sensing, complete the package making the Mate 30 Series the most capable handset for smartphone photography and videography available to consumers. A front-facing 3D Depth Sensing Camera delivers pro-bokeh effects with accurate depth-of-field information for selfies and portraits.

Faster, Safer and More Engaging Experience

The HUAWEI Mate 30 Series features a range of new features that deliver an amazingly smooth and engaging user experience. Including:

EMUI10 operating system featuring a contemporary magazine inspired layout, Always-On-Display (AOD) where the colour of the lock screen changes throughout the day;

Dark Mode brings enhanced legibility making the screen look gentler and more comfortable when night falls;

Intuitive Side-touch Interaction to customise invisible virtual keys for volume adjustment, gaming and camera set-up as well as being ideal for both right and left-handed users;

AI gesture control for contactless screen interaction, whereas AI Auto-Rotate and AI Private View are all designed to improve users experience;

HiCar smart travel for advanced, seamless connectivity between device and a car’s communication and entertainment system;

Multi-screen Collaboration allows users to transfer data and control multiple screens between Huawei devices;

HUAWEI 3D Face Unlock and In-screen Fingerprint to provide advanced data security and privacy protection with (HUAWEI Mate 30 Pro only);

Huawei also launched its much anticipated Huawei Watch GT 2 range of wearables. Equipped with the self-developed Kirin AI chip, the GT 2 range offers class-leading battery life and a host of new features and functions including 15 sports modes, 10 training modes specifically for running, an enhanced music player and Bluetooth voice calls.

Additionally, Huawei also announced the availability of its Huawei FreeBuds 3 true wireless Bluetooth earphones which won 11 Best of IFA media awards at the recent IFA consumer electronics show. The black and white versions of FreeBuds 3 will be available in China, Europe, Middle East, Russia, Asia Pacific and Latin America starting from October 2019.

Colours, Pricing, and Availability

The 6.53-inch Huawei Mate 30 Pro and 6.62-inch Huawei Mate 30 come in various colour variants and materials: Emerald Green, Space Silver, Cosmic Purple, Black, while Forest Green and Orange are available in vegan leather.

Huawei Mate 30 Pro (5G): EUR 1199

Huawei Mate 30 Pro: EUR 1099

Huawei Mate 30: EUR 99

The post Huawei Launches Ground-Breaking Mate 30 Series appeared first on Businessliveme.com.

from WordPress https://ift.tt/30ruK08

via IFTTT

0 notes

Text

Towards a less arbitrary unequal: Designating last habitual residence in stateless asylum claims in the US

The following article was written by Jamila Odeh, a third-year student at University of Michigan Law School. It was originally published by RefLaw on 12 November 2018. It is reprinted here with permission.

Two-year-old Yazan is not a citizen of Syria like his parents, or of Lebanon, his birthplace.[1] He is one of the 80,000 stateless[2] children worldwide.[3] In the chaos of fleeing from war, Yazan was born with no way to prove national origin.[4] Luckily, his refugee status was already recognized,[5] affording surrogate national protection unavailable to many stateless people.[6]

Under the 1951 Convention Relating to the Status of Refugees,[7] stateless refugees are defined in a clause that is parallel to but distinct from the clause for individuals with a nationality:[8]

“The term refugee shall apply to any persons who ... owing to well-founded fear of being persecuted for [a convention reason] … is outside the country of his nationality and is unable, or owing to such fear, is unwilling to avail himself of the protection of that country; or who, not having a nationality and being outside the country of his former habitual residence [(CFHR)] ... is unable or, owing to such fear, is unwilling to return to it.”[9]

The Convention made status possible for stateless persons.[10] Yet, understanding which stateless persons are refugees is complex. Claimants like Yazan, a toddler who already resided in three countries, present additional difficulties.[11]

Determining status for people with multiple CFHR is this Note’s focus. Part I introduces an outlier in US case law and the traditional US method. Part II explores international case law and the use of CFHR. Part III argues for the consistent reference approach to CFHR,[12] a less arbitrary alternative for US law.

I. Ouda and Najjar: County of last habitual residence in US law

The applicant in Ouda v. Immigration and Naturalization Service[13] shares significant similarities with the applicants in the cases assessed in Part II[14]—they were all stateless Palestinians[15] born in Kuwait, where they lived for over twenty years.[16] They all fled around the start of the Gulf War.[17] Each applicant also lived in one or more additional countries for about two years, then moved to the country where they sought asylum.[18]

In Ouda, the court demonstrated confusion about applying the US country of reference test.[19] US law defines its reference point as “any country in which such person last habitually resided...”[20] Ouda fled Kuwait to Bulgaria but could not legally re-enter either.[21] The Immigration Judge (IJ), the Board of Immigration Appeals (BIA), and presumably the Sixth Circuit agreed that she faced no persecution in Bulgaria.[22] The IJ decided Bulgaria was her country of last habitual residence.[23] This choice aligned with the government’s argument that last habitual residence means immediately prior country of residence.[24] It is also supported by the replacement of the word “former” with “last” in the US definition.[25]

Ouda appealed, arguing that she never had citizenship in Bulgaria and could not return.[26] The BIA reasoned that IJ error would be harmless; alleged persecution in Kuwait was irrelevant, as return there was impossible.[27] The Sixth Circuit reversed, finding no reason at law to prevent an applicant from claiming asylum despite nonreturnability.[28] It also found a well-founded fear of persecution for a convention reason in Kuwait.[29] The court did not explain why Kuwait served as the reference point beyond rejecting BIA reasoning.[30]

Ouda is an outlier,[31] but Najjar v. Ashcroft illustrates the dominant understanding of US law.[32] Najjar, also a stateless Palestinian,[33] lived in Saudi Arabia for thirteen years, Egypt for eight,[34] and in United Arab Emirates (UAE) for two immediately prior to seeking asylum in the US.[35] Utilizing the same logic as the government in Ouda[36] the IJ, BIA, and Eleventh Circuit agreed that his last habitual residence was UAE.[37]

The Najjar approach can force arbitrary outcomes. Najjar’s country of reference did not reflect his closest national relationship.[38] Worse, if Najjar was persecuted in Egypt or Saudi Arabia, but not UAE, he may have been returned to his persecutors in violation of the duty of non-refoulement.[39] If the Ouda court followed Najjar, Ouda would have been deprived of status because of her brief stay in Bulgaria.[40] The Najjar approach may also offer unnecessary protection.[41] For example, imagine Najjar was persecuted in UAE but could have been protected in Egypt or Saudi Arabia. Comparing the US to other jurisdictions adds depth to this basic description of Ouda and Najjar.

II. CFHR in other jurisdictions

CFHR has two uses as a point of reference: the well-founded fear inquiry and the alternative protection inquiry. One connects well-founded fear of persecution to status, and the other a caveat to status based on protection. The two questions are independent, but for each country of reference should be determined with a consistent approach.

An analogy between internal flight alternative (IFA) doctrine and the question of alternative protection for stateless applicants clarifies the term CFHR, although the stateless portion of the definition references ability to return instead of the availment of protection,[42] CFHR accounts for protection in some way.[43] Goodwin-Gill explained that CFHR “necessarily seem[s] to imply some degree of security, status, of entitlement to remain and to return.”[44] Similarly, Hathaway contended that CFHR “give[s] rise to a bond ... that approximates in critical respects the relationship between a citizen and her state.”[45] Thus, the question of return for stateless applicants must be understood in light of the expectation that return to a CFHR affords meaningful protection.

Hathaway’s insistence on IFA protection as “existence of some affirmative defense or safeguard,”[46] should be applied rigorously to inquiries about CFHR as alternative protection. There are “two key clauses” in the definition, “the well-founded fear clause … and the protection clause … the clearest textual home for IFA is in the protection clause.”[47] The danger is conflating the clauses, placing an inappropriate onus on the applicant.[48] For the same reason, it is inappropriate to attach legal returnability to an assessment of well-founded fear.[49] Asking a stateless applicant to run or hide from persecution before providing protection puts a high burden on the applicant, unrooted in the Convention. Moreover, the stateless applicant is formally rightless, elevating her risk on return.[50] The idea that CFHR accounts for meaningful protection informs the background for the consistent approach.

The case Thabet v. Canada contemplated an array of interpretations of CFHR, which provides a roadmap to the consistent approach to CFHR.[51] The facts resembled Ouda,[52] but the second CFHR was the US.[53] This Note alters Thabet’s march through CFHR interpretations by artificially separating methods into the component parts of use for a well-founded fear inquiry and alternative protection inquiry. The difficulty in pulling the issues apart reflects conceptual weakness in the review of stateless applicants.

To locate the country of reference for well-founded fear there are two basic methods. The first designates a single reference point by some arbitrary measure or proxy for the significance of state ties.[54] CFHR as last residence, discussed with Najjar, is an example of designating a single reference.[55] Importantly, any iteration of naming a single CFHR will not respect the duty of non-refoulement.[56] The second approach to the well-founded fear inquiry allows any CFHR to be the county where well-founded fear is established.[57] This method was adopted in Thabet for the first prong.[58] It removes some arbitrariness.[59] In addition, someone with multiple citizenships can have fear with respect to one and qualify, so it is a sensible way to make the statelessness clause more parallel to the citizenship clause. This method better identifies those who need protection for a convention reason, and is well aligned to the Convention’s object and purpose.

The method of designating the country of reference for the second prong, alternative protections, is highly contested. Grahl Madsen, rejecting the principle behind protection alternatives for stateless applicants altogether, advocated that CFHR is the place from which a person fled “in the first instance.” Once established, it “remains irrespective of subsequent residence changes.”[60] Yet, if that person were persecuted again in a different country, the persecution creates a renewed first instance and therefore a new country of reference. Thus, there is an implicit understanding any CFHR may establish well-founded fear and no CFHR may establish alternative protection.

Al-Anezi is an example of the Grahl-Madsen approach in Australian case law. The case features the same fact pattern presented in Ouda and Thabet,[61] the stateless Palestinian applicant was born and lived in Kuwait for some time and lived in two other CFHR. The court felt multiple CFHRs unfairly decreased chances of status by providing more possibilities for alternative protection, placing stateless individuals in a worse position than nationals.[62] Thus, once the applicant established well-founded fear in Kuwait, the court did not inquire about protection alternatives at other CRHR.[63]

In contrast, Hathaway’s second prong approach, adopted by Thabet,[64] exhausts all CFHRs.[65] The Convention requires applicants with dual or multiple citizenship to show inability to find protection in any other country of citizenship. Hathaway avoids favoring the stateless by allowing applicants to circumvent protection elsewhere.[66]

The consistent reference approach to CFHR demands that the two prongs, well-founded fear and alternate protection, are balanced. The prongs are assessed separately,[67] and CFHR is approached consistently for each. For example, if all CFHR may be considered for well-founded fear, the same would be true of the protection alternative inquiry. There is an inverse relationship: the first prong can help and the second prong can hurt applicants. It is essential not to allow slippage in the CFHR considered for each inquiry.[68] In the US, the arbitrary standard mixed with the most uneven structure may have increased confusion about CFHR determinations.[69] The Thabet test was well-formed as two separate questions, and it utilized all former residences as its consistent reference.

III. What was there all along

The judicial decision in Ouda could be read several ways.[70] The court decoupled returnability and well-founded fear.[71] The judge remarked that as “actual deportability of an alien is irrelevant to the issue of whether the alien qualifies as deportable, it stands to reason that the actual deportability of an alien is equally irrelevant to the issue of whether she qualifies as a refugee.”[72] The logic is upside-down, but the idea remains. The declaratory nature of status creates a duty to protect. Perhaps the judge dismissed the need for forward-looking risk because of the US presumption of continuing status based on past persecution.[73]

Alternatively, the decision could be chalked up to a choice that Ouda’s relationship with Bulgaria was not significant enough. It is plausible given that the reasoning and citations all addressed the relationship between deportability and well-founded fear.[74]

The final explanation could make the US approach less arbitrary. The issue of designating a country of last habitual residence can be sidestepped by showing either well-founded fear with respect to none or all potentially relevant countries.[75] In practice, the IJ, BIA, and Circuit Courts regularly do fact-specific inquiries about a claimant’s relationship with various countries down to the minutia of travel accommodations.

The Court, aware that the applicant most recently lived in Bulgaria for two years, citing to Najjar, found that Kuwait was the last habitual residence. It seems possible that the judge simply read the term “last” to mean before.[76] The US statutory language modifies country with “any last,” leaving a plural understanding open. The Ouda decision may open the door—even just a crack—to a less arbitrary way to designate the country of reference in the US.

IV. Conclusion

The consistent reference approach to CFHR is a more balanced way to adjudicate stateless applicants. The consistent approach may also aid in keeping well-founded fear and protection inquiries separate. It does not dictate the content of CFHR, except that the well-founded fear and alternate protection assessments occur with respect to the same countries of reference.

____

[1] Somini Sengupta & Hwaida Saad, As Refugees Flee, Thousands of Children Have No Country to Call Their Own, NY Times (Nov. 5, 2015), https://www.nytimes.com/2015/11/06/world/europe/as-refugees-flee-thousands-of-children-have-no-country-to-call-their-own.html.

[2] A stateless person is “a person who is not considered as a national by any State under the operation of its law.” Convention Relating to the Status of Stateless Persons, Art.1, Sept. 28, 1954, 360 U.N.T.S. 15, http://www.unhcr.org/en-us/protection/statelessness/3bbb25729/convention-relating-status-stateless-persons.html.

[3] Rep. of the UN High Commissioner for Refugees, at 10, U.N. Doc. A/74/12 (2017), http://www.refworld.org/pdfid/59c8d9594.pdf.

[4] Sengupta & Saad, supra note 1. Yazan’s mother could not declare paternal nationality, illustrative of the sexism often involved. See generally, Maryellen Fullerton, The Intersection of Statelessness and Refugee Protection in US Asylum Law Policy, 2 J. Migration and Hum. Sec. 144, 148–49, http://jmhs.cmsny.org/index.php/jmhs/article/view/30.

[5] Sengupta & Saad, supra note 1.

[6] The Convention Relating to the Status of Stateless Persons, Sept. 28, 1954, 360 U.N.T.S. 15, may also protect stateless persons. Yet, far fewer states ratified it. David C. Baluarte, Life After limbo: Stateless Persons in the United States and the Role of International Protection in Achieving a Legal Solution, 29 Geo. Immigr. L. J. 351, 357–58 (2015), https://scholarlycommons.law.wlu.edu/cgi/viewcontent.cgi?article=1508&context=wlufac

[7] Convention relating to the Status of Refugees, Jul. 28, 1951, 189 U.N.T.S. 137 [hereinafter Refugee Convention]; Protocol relating to the Status of Refugees, Jan. 31, 1967, 606 U.N.T.S. 267 [hereinafter Refugee Protocol].

[8] Refugee Convention, Art. 1(A)(2). See Guy S. Goodwin-Gill & Jane McAdam, The Refugee in International Law 67–70 (2007); Hathaway & Foster, supra note 8, at 64–75.

[9] Refugee Convention, Art. 1(A)(2) (emphasis added); Kate Darling, Protections of Stateless Persons in International Asylum and Refugee Law, 21 Int’l J. Refugee L. 742, 750 (2009).

[10] The Convention also set a higher bar for stateless applicants. See Darling, supra note 9, at 743 (“Even at its most generous, the international refugee protection regime requires more of stateless persons than it does of nationals who seek refugee status.”).

[11] Sengupta & Saad, supra note 1.

[12] This Note coins consistent reference approach as a descriptive term.

[13] 324 F.3d 445 (6th Cir. 2003).

[14] See infra Part II.

[15] The small exception is the Bedouin applicant in Al-Anezi v. Minister for Immigration and Multicultural Affairs, 92 FRC 283 (Aus. 1999), http://www.refworld.org/cases,AUS_FC,3ae6b7617.html. Bedouin are semi-nomadic people. Although they may not identify with Palestinian nationality, they historically lived in the Negev region of Palestine. See Emanuel Marx, Bedouin of the Negev, 7 (1967).

[16] See Ouda, 324 F.3d at 447; Al-Anezi, 92 FRC 283, (Aus. 1999) at ¶ 2–8; Thabet v. Canada, 1 F.C. 685 (C.A. 1998).

[17] See Ouda, 324 F.3d at 447; Al-Anezi, 92 FRC 283 at ¶ 2–8; Thabet, 1 F.C. 685 (C.A. 1998).

[18] See Ouda, 324 F.3d at 447; Al-Anezi, 92 FRC 283 at ¶ 2–8; Thabet, 1 F.C. 685 (C.A. 1998).

[19] See Ouda, 324 F.3d at 448; Sarah B. Fenn, Note, Paipovic. v. Gonzales: Defining Last Habitual Residence for Stateless Asylum Applicants, 40 U.C. Davis L. Rev. 1545, 1562 (2007), https://lawreview.law.ucdavis.edu/issues/40/4/note/DavisVol40No4_Fenn.pdf.

[20] 8 U.S.C. § 1101(a)(42)(A) (2012), https://www.gpo.gov/fdsys/pkg/USCODE-2011-title8/ pdf/USCODE-2011-title8-chap12-subchapI-sec1101.pdf. This is potentially distinct from CFHR, and arguably a Convention violation. See, Joan Fitzpatrick, The International Dimension of U.S. Refugee Law, 15 Berkeley J. of Int’l L. 1 (1997), https://scholarship.law.berkeley.edu/cgi/viewcontent.cgi?article=1154&context=bjil.

[21] Ouda, 324 F.3d at 447–48.

[22] Ouda, 324 F.3d at 448–450, 453.

[23] Id. at 448–50; Fenn, supra note 19, at 1562.

[24] Ouda, 324 F.3d at 449–50. See, 8 USC § 1101(a)(42)(A); Hathaway & Foster, supra note 8, at 73.

[25] Compare, Refugee Convention, Art. 1(A)(2), with 8 U.S.C. § 1101(a)(42)(A).

[26] Ouda, 324 F.3d at 449. Applicant’s argument is nonsensical as Kuwait, the correct reference point in her view, suffers identical deficiencies. See, Hathaway & Foster, supra note 8, at 69 (discussing the controversial usage of legal returnability as an indicator of CFHR).

[27] Id. at 450. Cf. Fenn, supra note 19, at 1561.

[28] Ouda, 324 F.3d at 452 (“we can find no support for the proposition that an asylum applicant is precluded from seeking asylum in the United States should it prove to be the case that the country from which she seeks asylum will not take her back if the INS tries to deport her.”).

[29] Ouda, 324 F.3d at 454.

[30] Id. In a sense, it is like the court is simply saying why not.

[31] See e.g. Najjar v. Ashcroft, 257 F.3d 1262, 1294–95 (11th Cir. 2001); Hathaway & Foster, supra note 8, at 72. But see, Fenn, supra note 19, at 1564 (suggesting the US approach was never well-settled).

[32] 257 F.3d 1262 (11th Cir. 2001).

[33] Id. Najjar’s facts deviate from this comment’s other examples. His first asylum and withholding hearings were done ex parte, in camera, due to an FBI terror investigation of the applicant. Id. at 1274. The case was eventually heard on public evidence, id.

[34] Id. at 1294.

[35] Id.

[36] Ouda, 324 F.3d at 449–50.

[37] Najjar, 257 F.3d at 1294.

[38] 257 F.3d at 1294; Hathaway & Foster, supra note 8, at 73 (discussing Najjar).

[39] See Refugee Convention, Art. 33.

[40] Ouda, 324 F.3d at 449–50. Not a refugee and not deportable is a common predicament for stateless US asylum applicants. Baluarte, supra note 6, at 352–353.

[41] Hathaway & Foster, supra note 8, at 72.

[42] Refugee Convention, Art.1(A)(2).

[43] Goodwin-Gill & McAdam, supra note 9, at 526.

[44] Id.

[45] Hathaway & Foster, supra note 8, at 67.

[46] Id. at 765 (quoting Hathaway and Foster).

[47] Refugee Protection at International Law: UNHCR’s Global Consultations on International Protection 365 (Erika Feller et al. eds. 2003).

[48] Id. at 25–26; Hathaway & Foster, supra note 8, at 335–41.

[49] The court in Thabet rejected its glossed version of Hathaway’s argument that tied unlikelihood of forward-looking fear to the issue of returnability. As the court correctly pointed out this short-cut does not work in all cases. For example, when persecution is expulsion and forward-looking risk may be faced abroad.

[50] Darling, supra note 9, at 756 (“However, the stateless person’s condition of rightlessness, a condition that makes all other fundamental human rights effectively precarious, remains persistent and protracted.”).

[51] 1 F.C. 685, 686 (F.C.A. 1998).

[52] See supra p. 3.

[53] Id.

[54] One such proxy may be an individual’s choice to reside with the intent to remain, supported with understanding “habitual” with a durability. See, 1951 Convention Relating to the Status of Refugees and its 1967 Protocol, 57 (Andreas Zimmerman et al. eds., 2011).

[55] See supra Part I. The Canadian court rejects this approach for its lack of adherence to the Convention. Thabet,1 F.C. at [694]. (“[I]t leaves open the possibility that a person may be returned to a persecuting state…).

[56] See infra Part I.

[57] Thabet, 1 F.C. at [695–96].

[58] Id.

[59] Id.

[60] Thabet, 1 F.C. at [695].

[61] See supra Part I.

[62] Al-Anezi, 92 FRC at para 22. The court added that stateless persons lacked “reciprocal rights and duties” to their country of residence. Id. at para 23.

[63] Id. at para 22.

[64] Thabet, 1 F.C. at [695]; But see, Guy S. Goodwin-Gil, Stateless Persons and Protection under the 1951 Convention; Refugees, Beware of Academic Error! (1992) (critiquing the introduction of the second prong portion of the Hathaway test and its original returnability language as needlessly complicating matters for applicants).

[65] Hathaway & Foster, supra note 8, at 72.

[66] Refugee Convention, Art. 1(A)(2).

[67] Cf. Refugee Protection at International Law: UNHCR’s Global Consultations on International Protection 26 (Erika Feller et al. eds. 2003) (making a similar point about internal protection alternatives).

[68] See e.g. Himri v. Ashcroft, 378 F.3d 932 (9th Cir. 2004), modified, No. 03–71152, 2004 WL 1879255 (Aug. 24, 2004). Applying different standards for designating countries of removal. Compare, 8 USC § 1101(a)(42)(A), with 8 USC § 1231(b).

[69] See e.g. Paripovic v. Gonzales, 418 F.3d 240, 241-42, 245 (3d Cir. 2005) (narrowing inquiry down to only temporal considerations); Ouda v. INS, 324 F.3d 445, 449-50 (6th Cir. 2003).

[70] Ouda, 324 F.3d at 450.

[71] Ouda, 324 F.3d at 449–50.

[72] Id. at 452.

[73] Id. at 453.

[74] Id.

[75] See, Fenn, supra note 19, at 1564.

[76] Reading ambiguity between possible meanings is easier with the Convention language “former/dernier.”

#refugees#refugee#stateless#statelessness#asylum#asylum seeker#Jamila Odeh#last habitual residence#Ouda#Najjar#former habitual residence

0 notes

Text

ACC 206 Week 9 Quiz – Strayer New

Click on the Link Below to Purchase A+ Graded Course Material

http://budapp.net/ACC-206-Accounting-Principles-II-Week-9-Quiz-Strayer-267.htm

Quiz 7 Chapter17

THESTATEMENTOFCASHFLOWS

CHAPTERSTUDYOBJECTIVES

1.Indicatetheusefulnessofthestatementofcashflows.

2.Distinguishamongoperating,investing,andfinancingactivities.

3.Prepareastatementofcashflowsusingtheindirectmethod.

4.Analyzethestatementofcashflows.

5.Explainhowtouseaworksheettopreparethestatementofcashflowsusingtheindirectmethod.

6.Prepareastatementofcashflowsusingthedirectmethod.

TRUE-FALSESTATEMENTS

1. Thestatementofcashflowsisarequiredstatementthatmustbepreparedalongwithan income statement,balancesheet,andretainedearningsstatement.

2. Forexternalreporting,acompanymustprepareeitheranincomestatementora statementof cashflows,but notboth.

3. Aprimaryobjectiveofthestatementofcashflowsistoshowtheincomeorlosson investingandfinancingtransactions.

4. A statementofcashflows indicatesthe sourcesanduses of cashduringaperiod.

5. Inpreparingastatementofcashflows,cashequivalentsaresubtractedfrom cashinorder tocomputethenetchangeincashduring a period.

6. Cashequivalentsarehighly-liquidinvestmentsthathavematuritiesoflessthanthree months.

7. The useofcashtopurchasehighlyliquidshort-terminvestments(cashequivalents)would be reportedonthestatement of cashflowsasaninvestingactivity.

8. Inpreparingastatementofcashflows,theissuanceofdebtshouldbereported separately from theretirementof debt.

9. Noncashinvestingandfinancingactivitiesmustbereportedinthebodyofastatementof cashflows.

10. Thestatementofcashflowsclassifiescashreceiptsandpaymentsasoperating, nonoperating, financial,andextraordinaryactivities.

11. Thesaleof landfor cashwouldbeclassifiedasacashinflowfroman investingactivity.

12. Cashflowfrominvestingactivitiesisconsideredthemostimportantcategoryonthe statementof cashflowsbecauseit isconsideredthebestmeasureof expectedincome.

13. Thereceiptofdividends fromlong-term investments instockisclassified asacashinflow frominvestingactivities.

TheStatementof Cash Flows 17-5

14. Thepaymentofinterestonbondspayableisclassifiedasacashoutflowfromoperating activities.

15. Anyitemthatappearsontheincomestatementwouldbeconsideredaseitheracash inflowor cashoutflowfromoperatingactivities.

16. Theacquisitionofabuildingbyissuingbondswouldbeconsideredaninvestingand financing activity thatdidnot affectcash.

17. Allmajorfinancingandinvestingactivitiesaffectcash.

18. Cashprovidedbyoperationsisgenerallyequaltooperatingincome.

19. Usingtheindirectmethod,anincrease inaccountsreceivable duringaperiod isdeducted fromnetincomeincalculatingcashprovidedbyoperations.

20. Usingtheindirectmethod,anincreaseinaccountspayableduringaperiodisdeducted from netincomeincalculatingcashprovidedbyoperations.

21. Alossonsaleofequipmentisaddedtonetincomeindeterminingcashprovidedby operationsundertheindirectmethod.

22. Inpreparingastatementofcashflows,anincreaseintheCommonStockandTreasury Stockaccountsduringaperiodwouldbe an investingactivity.

23. Cashprovidedby operatingactivitiesfailsto take intoaccountthatacompanymust invest in newfixedassetsjusttomaintainits currentlevelofoperations.

24. Freecashflowequalscashprovidedbyoperationslesscapitalexpendituresandcash dividends.

a25. Theuseof aworksheetto prepareastatementofcashflowsis optional.

a26. Duringtheyear,IncomeTaxExpenseamountedto$30,000andIncomeTaxesPayable increasedby$3,000;therefore,thecashpaidforincometaxeswas$27,000.

a27. Inpreparingnetcashflowfromoperatingactivitiesusingthedirectmethod,eachitemin theincomestatementisadjustedfromtheaccrualbasistothecashbasis.

a28. Usingthedirectmethod,majorclassesofinvestingandfinancingactivitiesarelistedin theoperatingactivitiessection.

a29. Duringaperiod,costofgoodssold+anincreaseininventory+anincreaseinaccounts payable =cashpaidtosuppliers.

a30. Operatingexpenses+anincreaseinprepaidexpenses–adecreaseinaccrued expensespayable=cashpaymentsfor operatingexpenses.

17-6

Additional True-FalseQuestions

31. Thestatementofcashflowsclassifiescashreceiptsandcashpaymentsintotwo categories:operatingactivitiesand nonoperatingactivities.

32. Financingactivitiesincludetheobtainingofcashfromissuingdebtandrepayingthe amounts borrowed.

33. TheadjustedtrialbalanceistheonlyitemneededtopreparetheStatementofCash Flows.

34. Undertheindirectmethod,retainedearningsisadjustedforitemsthataffectedreported netincomebutdidnot affect cash.

a35. ThereconcilingentryfordepreciationexpenseinaworksheetisacredittoAccumulated DepreciationandadebittoOperating-DepreciationExpense.

a36. Underthedirectmethod,theformulaforcomputingcashcollectionsfromcustomersis salesrevenuesplustheincreaseinaccountsreceivableorminusthedecreasein accounts receivable.

MULTIPLECHOICEQUESTIONS

37. Thestatementofcashflowsshouldhelpinvestorsandcreditorsassesseachofthe followingexceptthe

a.entity'sabilitytogeneratefutureincome. b.entity'sabilityto paydividends.

c.reasonsforthedifferencebetweennetincomeandnetcashprovidedbyoperating activities.

d.cashinvestingandfinancingtransactionsduringtheperiod.

38. Thestatementof cashflows

a.mustbepreparedona dailybasis.

b.summarizesthe operating,financing,andinvestingactivitiesofanentity. c.is anothernamefortheincomestatement.

d.isaspecialsectionof the incomestatement.

TheStatementof Cash Flows 17-7

39. Whichoneofthefollowingitemsisnotgenerallyusedinpreparingastatementofcash flows?

a.Adjustedtrialbalance

b.Comparativebalancesheets c.Currentincomestatementd.Additionalinformation

40. Theprimarypurposeofthestatementof cashflows is to

a.provideinformationabouttheinvestingandfinancingactivitiesduringaperiod. b.prove thatrevenuesexceedexpensesifthereis anetincome.

c.provideinformationaboutthecashreceiptsandcashpaymentsduringa period. d.facilitatebanking relationships.

41. Ifa companyreportsanet loss,it

a.maystillhavea netincreasein cash. b.willnotbe abletopaycashdividends. c.will not beabletogeta loan.

d.willnotbeable tomakecapitalexpenditures.

42. Inadditionto the three basicfinancialstatements,which ofthe following isalso arequired financialstatement?

a.the"CashBudget"

b.theStatementof CashFlows

c.theStatementof CashInflowsandOutflows d.the"CashReconciliation"

43. Thestatementof cashflowswillnotreportthe

a.amountof checksoutstanding atthe endof theperiod. b.sourcesofcashinthecurrentperiod.

c.uses of cashin thecurrentperiod.

d.changeinthecash balanceforthecurrentperiod.

44. Cashequivalentsdonotinclude a.short-termcorporatenotes. b.treasurybills.

c.moneymarketfunds.

d.2-yearcertificatesofdeposit.

45. Whichofthefollowing characteristicsdoesnotapplyto cashequivalents? a.Short-term

b.Highly-liquid

c.Readilyconvertibleintocash

d.Sensitiveto interestratechanges

46. Cashequivalentsaregenerally investmentswithmaturitiesof a.$1,000ormore.

b.threemonthsor less. c.atleastsixmonths.

d.oneyearorthe operatingcycle, whicheveris less.

17-8

47. The bestmeasureof acompany'sabilitytogeneratesufficientcashtocontinueasagoing concern is netcashprovidedby

a.financingactivities. b. investingactivities. c.operatingactivities. d.processingactivities.

48. Theacquisitionof landbyissuingcommonstockis

a.a noncashtransactionwhich is notreported inthebodyofastatementofcashflows. b.acashtransactionandwouldbereportedinthebodyof astatementofcashflows.

c.a noncashtransactionandwouldbereportedinthebodyofastatementof cashflows. d.onlyreportedif thestatement of cashflowsisprepared usingthedirectmethod.

49. Theorderof presentationofactivitiesonthestatement of cashflowsis a.operating,investing,andfinancing.

b.operating,financing,andinvesting. c.financing, operating,andinvesting. d.financing,investing,andoperating.

50. Financingactivitiesinvolve a.lendingmoney.

b.acquiringinvestments. c.issuingdebt.

d.acquiringlong-lived assets.

51. Investingactivitiesinclude

a.collecting cash on loansmade. b.obtainingcashfromcreditors. c.obtainingcapitalfromowners.

d.repayingmoneypreviouslyborrowed.

52. Generally,themostimportantcategoryonthestatementofcashflowsiscashflowsfrom a.operatingactivities.

b.investingactivities. c.financingactivities.

d.significantnoncash activities.

53. Thecategorythat isgenerally consideredtobe thebestmeasure ofacompany'sability to continue asagoingconcernis

a.cashflowsfromoperatingactivities. b.cashflowsfrominvestingactivities. c.cashflowsfromfinancingactivities. d.usuallydifferentfromyear to year.

54. Cashreceiptsfrom interestanddividendsareclassifiedas a.financingactivities.

b.investingactivities. c.operatingactivities.

d.eitherfinancingorinvestingactivities.

TheStatementof Cash Flows 17-9

55. Eachof thefollowingisanexampleof asignificantnoncashactivityexcept a.conversionofbonds intocommonstock.

b.exchangesof plantassets.

c.issuanceof debtto purchaseassets. d.stockdividends.

56. Ifacompanyhasbothaninflowandoutflowofcashrelatedtoproperty,plant,and equipment, the

a.twocasheffectscanbenettedandpresentedasoneitemintheinvestingactivities section.

b.cashinflowandcashoutflowshouldbereportedseparatelyintheinvestingactivities section.

c.twocasheffectscanbenettedandpresentedasoneiteminthefinancingactivities section.

d.cashinflowandcashoutflowshouldbereportedseparatelyinthefinancingactivities section.

57. Of theitemsbelow,theonethatappearsfirst onthestatementof cashflows is a.noncashinvesting andfinancingactivities.

b.netincrease(decrease)incash. c.cash attheendof theperiod.

d.cash atthebeginningoftheperiod.

58. Whichof thefollowingtransactionsdoesnotaffectcashduring aperiod? a.Write-offofanuncollectibleaccount

b.Collectionofanaccounts receivable c.Saleof treasurystock

d.Exerciseofthecalloptiononbondspayable

59. Significantnoncashtransactionswouldnotinclude a.conversionofbonds intocommonstock.b.assetacquisitionthroughbondissuance.

c.treasurystockacquisition. d.exchangeof plantassets.

60. Inpreparingastatementofcashflows,aconversionofbondsintocommonstockwillbe reported in

a.thefinancingsection.

b.the"extraordinary"section.

c.a separatescheduleornote tothefinancial statements. d.thestockholders'equitysection.

Usethefollowing informationforquestions61–64.

Foreachofthefollowingtransactions,indicatewhere,ifatall,itwouldbeclassifiedonthe statement of cashflows.Assumetheindirectmethodisused.

61. Paidincometaxes.

a.Operatingactivitiessection b.Investingactivitiessection c.Financingactivities section

d.Doesnotrepresentacashflow

17-10

62. Issuedcommonstockfor cash. a.Operatingactivitiessection b.Investingactivitiessectionc.Financingactivities section

d.Doesnotrepresentacashflow

63. Purchasedlandforcash.

a.Operatingactivitiessection b.Investingactivitiessection c.Financingactivities section

d.Doesnotrepresentacashflow

64. Purchasedlandandbuildingwithamortgage. a.Operatingactivitiessection

b.Investingactivitiessection c.Financingactivities section

d.Doesnotrepresentacashflow

Usethefollowing informationforquestions65–66.

JoyElle’sVegetableMarkethadthefollowingtransactionsduring 2008:

1.Issued$25,000of par valuecommonstockforcash.

2.Repaida 6yearnotepayableintheamountof$11,000.

3.Acquiredlandbyissuingcommonstockof parvalue$50,000. 4.Declaredandpaidacashdividendof$1,000.

5.Solda long-terminvestment(cost$3,000)forcashof$3,000. 6.Acquiredan investmentinIBMstockforcashof $6,000.

65. Whatisthenetcash providedbyfinancingactivities? a.$13,000

b.$25,000 c.$14,000 d.$9,000

66. Whatisthenetcash providedbyinvestingactivities? a.$6,000

b.$16,000 c.($3,000) d.$3,000

67. MillerCompanypurchasedtreasurystockwithacostof$15,000during2008.Duringthe year,thecompanypaiddividendsof$20,000andissuedbondspayableforproceedsof $816,000.Cashflowsfromfinancingactivitiesfor2008total

a.$796,000net cashinflow. b.$811,000net cashinflow. c.$5,000netcashoutflow. d.$781,000net cashinflow.

TheStatementof Cash Flows 17-11

68. ClineCompanyissuedcommonstockforproceedsof$186,000during2008.The companypaiddividendsof$33,000andissuedalong-termnotepayablefor$45,000in exchangeforequipment duringtheyear.Thecompanyalsopurchased treasurystockthat hadacostof$7,000.Thefinancingsectionofthestatementofcashflowswillreportnet cash inflowsof

a.$146,000. b.$202,000. c.$153,000. d.$179,000.

69. InGentryCompany,landdecreased$120,000becauseofacashsalefor$120,000,the equipmentaccountincreased$40,000asaresultofacashpurchase,andBonds Payable increased$130,000fromissuanceforcashatfacevalue.Thenetcashprovidedby investingactivities is

a.$120,000. b.$210,000. c.$80,000. d.$90,000.

70. Accounts receivablearisingfromsalestocustomersamountedto$80,000and$70,000at thebeginningandendoftheyear,respectively.Incomereported ontheincomestatement fortheyearwas$240,000.Exclusiveoftheeffectofotheradjustments,thecashflows fromoperatingactivitiestobereportedonthestatement of cashflowsis

a.$240,000. b.$250,000. c.$310,000. d.$230,000.

71. Accounts receivablearisingfromsalestocustomersamountedto$35,000and$40,000at thebeginningandendoftheyear,respectively.Incomereported ontheincomestatement fortheyearwas$120,000.Exclusiveoftheeffectofotheradjustments,thecashflows fromoperatingactivitiestobereportedonthestatement of cashflowsis

a.$120,000. b.$125,000. c.$155,000. d.$115,000.

72. WiltonCompanyreportednetincomeof$40,000fortheyear.Duringtheyear,accounts receivabledecreasedby$7,000,accountspayableincreasedby$3,000anddepreciation expense of $5,000wasrecorded.Netcashprovidedbyoperatingactivitiesfortheyearisa.$30,000.

b.$55,000. c.$39,000. d.$35,000.

73. BusterCompanyreportedanetlossof$3,000fortheyearendedDecember31,2008. Duringtheyear,accountsreceivableincreased$7,000, merchandiseinventorydecreased $5,000,accountspayabledecreasedby$10,000,anddepreciationexpenseof$5,000 was recorded.During2007,operatingactivities

a.usednetcashof $10,000. b.usednetcashof $14,000.

c.providednetcash of$14,000. d.providednetcash of$9,000.

17-12

74. Thenetincomereportedontheincomestatementforthecurrentyearwas$205,000. Depreciationrecordedonplantassetswas$38,000.Accountsreceivableandinventories increasedby$2,000and$8,000,respectively.Prepaidexpensesandaccountspayable decreasedby$1,000and$11,000respectively.Howmuchcashwasprovidedby operatingactivities?

a.$185,000 b.$223,000 c.$205,000 d.$239,000

75. Thenetincomereportedontheincomestatementforthecurrentyearwas$220,000. Depreciationwas $50,000.Accountreceivableand inventoriesdecreasedby $10,000 and $30,000,respectively.Prepaidexpensesandaccountspayableincreased,respectively, by$1,000and$8,000.Howmuchcash wasprovidedbyoperating activities?

a.$281,000 b.$317,000 c.$301,000 d.$309,000

76. Ifagainof$10,000isincurredinselling(forcash)officeequipmenthavingabookvalue of$100,000,thetotalamount reportedinthecashflows frominvestingactivitiessectionof thestatementof cashflows is

a.$90,000. b.$110,000. c.$100,000. d.$10,000.

77. Ifa lossof $12,500 is incurred inselling(forcash)office equipmenthavinga bookvalueof $50,000,thetotalamountreportedinthecashflowsfrominvestingactivities sectionof the statement of cashflowsis

a.$37,500. b.$50,000. c.$62,500. d.$12,500.

78. HarborCompanyreportednetincomeof$60,000 fortheyearended December31,2008. Duringtheyear,inventoriesdecreasedby$12,000,accountspayabledecreasedby $18,000,depreciationexpensewas$20,000andagainondisposalofequipmentof $9,000wasrecorded.Netcashprovidedbyoperating activitiesin2008usingtheindirect methodwas

a.$119,000. b.$65,000. c.$77,000. d.$55,000.

79. Thethird(final)stepinpreparingthestatementofcashflowsisto a.analyzechanges innoncurrentassetandliabilityaccounts.

b.comparethenetchangeincashwiththechangeinthecashaccountreportedonthe balance sheet.

c.determinenet cashprovidedbyoperatingactivities. d.listthenoncashactivities.

TheStatementof Cash Flows 17-13

80. Whichoneof thefollowingitemsisnot necessaryinpreparinga statementofcashflows? a.Determinethechangeincash

b.Determinethecashprovidedbyoperations

c.Determinecashfromfinancingandinvestingactivities d.Determinethe cashin all bankaccounts

81. Ifaccountsreceivablehave increasedduringtheperiod,

a.revenuesonanaccrualbasisarelessthanrevenuesonacashbasis.

b.revenuesonanaccrualbasisaregreaterthanrevenuesonacashbasis. c.revenues onanaccrual basisarethesameasrevenues onacashbasis. d.expensesonanaccrualbasisaregreater thanexpensesonacashbasis.

82. Ifaccountspayablehaveincreasedduringaperiod,

a.revenuesonanaccrualbasisarelessthanrevenuesonacashbasis. b.expensesonanaccrualbasisarelessthanexpensesonacashbasis.

c.expensesonanaccrualbasisaregreater thanexpensesonacashbasis. d.expensesonanaccrualbasisarethesameasexpensesonacashbasis.

83. Whichoneof thefollowing affectscashduringaperiod? a.Recordingdepreciationexpense

b.Declarationof acashdividend

c.Write-offof anuncollectibleaccountreceivable d.Paymentof anaccountspayable

84. Incalculatingcashflowsfromoperatingactivitiesusingtheindirectmethod,againonthe sale ofequipmentis

a.addedtonet income.

b.deductedfrom netincome.

c.ignoredbecauseit doesnotaffectcash.d.notreportedonastatementof cashflows.

85. MeyerCompanyreportednetincomeof$50,000fortheyear.Duringtheyear,accounts receivableincreasedby$7,000,accountspayabledecreasedby$3,000anddepreciation expense of $5,000wasrecorded.Netcashprovidedbyoperatingactivitiesfortheyearisa.$45,000.

b.$65,000. c.$49,000. d.$50,000.

86. FlynnCompanyreportedanetlossof$20,000fortheyearendedDecember31,2008. Duringtheyear,accountsreceivabledecreased$10,000,merchandiseinventory increased$16,000,accountspayableincreasedby$20,000,anddepreciationexpense of $10,000wasrecorded.During2008,operatingactivities

a.usednetcashof $4,000. b.usednetcashof $16,000.

c.providednetcash of$4,000.d.providednetcash of$16,000.

17-14

87. Startingwithnetincomeandadjustingitforitemsthataffectedreportednetincomebut which didnot affect cashis calledthe

a.directmethod.b.indirectmethod.

c.workingcapitalmethod. d.cost-benefitmethod.

88. Incalculatingnetcashprovidedbyoperatingactivitiesusingtheindirectmethod,an increase inprepaidexpensesduringaperiodis

a.deductedfromnetincome. b.addedtonetincome.

c.ignoredbecauseit doesnotaffectincome.d.ignoredbecauseitdoesnotaffectexpenses.

89. Usingtheindirectmethod,patentamortizationexpenseforthe period a.isdeductedfromnetincome.

b.causescashto increase. c.causescashto decrease. d.is addedtonetincome.

90. Indevelopingthecashflowsfromoperatingactivities,mostcompaniesin theU.S. a.use thedirectmethod.

b.usetheindirectmethod.

c.presentboththeindirectanddirectmethodsintheirfinancialreports. d.preparetheoperatingactivitiessectionontheaccrualbasis.