Text

Capitalism Unleashed by Andrew Glyn

Chapter 6

Chapter 6 of Capitalism Unleashed is mainly concerned with the effect of neoliberal economic policy on growth and economic stability. Glyn gives a somewhat surprising account of growth and stability through the 1990s and early 2000s, using the USA, Japan, and Europe as case studies. It is important in this context to note that the book was published in 2006, before the financial crisis of 2008.

The new economy boom in the 1990s supposedly put the US back on top of the economic league. At the time and shortly afterwards, most experts attributed this boom to technological improvements (considering the effects capital widening and deepening with computers’ growing market) and greatly increased private investment. Glyn, however, cites statistics showing that despite productivity rising faster than the previous 25 years, it was still unremarkable and could not be responsible for that much growth. Similarly, although private investment grew very rapidly, it began from a low point in capital stock, and the investment only made up for that, and did not provide a new high point for capital stock. Glyn posits that the reason for growth in the 1990s was an overstatement of profits by firms, in an effort to keep shareholders happy, despite an overall stagnation in profits. This (combined with other economic factors) came to a head in 2000 with a financial collapse.

The collapse began a rapid recovery that saw huge “rationalization” and Glyn calls it, where firms cut costs as much as possible, leading to greatly increased unemployment as well as other things. This rapid recovery was also due to productivity rises in retail, wholesale and finance, driven by new firms coming into the market with “very high productivity and driving out less efficient competitors”, in addition to a fairly large government stimulus. Glyn suggests that these short sharp booms and busts cause Schumpeter’s “creative destruction”, and are beneficial for competition, efficiency and innovation, as during sharp booms, “dynamic” firms are encouraged to enter the market, and the quick and severe slumps eliminate weak and inefficient firms. Glyn somewhat disagrees with this, putting much of the recovery up to “rationalization” and a consumption boom, suggesting that whole macroeconomic system in the US is much more fragile.

For Japan, the 1990s was a decade of stagnation, due to a large land value bubble bursting in 1990. Despite extremely expansionary macroeconomic policy, the economy continued to stagnate throughout the 1990s. Many attributed this to low consumption, but Glyn declares this to be “absurd”, as although consumption did grow very slowly, it was due to little to no growth in disposable income, and the savings ratio actually decreased during the stagnation. Glyn blames exports and business investment, with exports unable to compete against the growing Chinese economy, and business investment not really growing at all. Glyn sees neoliberal policy as responsible for most of this, with financial deregulation causing the inflated land values in the first place, and a failure of the free market that the economy stagnated for so long.

Europe also experienced poor growth throughout the 1990s, and there have been lots of explanations offered. Many say that this was due to Europe reaching a point where it had caught up with the US technologically, and so it now had to rely on investment and innovation to continue to grow. Others blame an ageing and more risk-averse population. The neoliberal argument blamed the regulations on relations between banks, firms, and workers, and called for liberalisation of Europe to market forces. There was already in fact a great deal of deregulation occurring across many areas of the economy, to the extent that Europe actually deregulated more than the USA, but they began from a higher starting point, so eventually remained more regulated than America. Along these lines, Glyn states that Keynesians thought the tight policies of the ECB and Growth and Stability Pact were responsible for the stagnation, believing them to be in restraint of demand. Glyn cites other possible reasons such as restrictions on supermarket development, and simply a slow growth of private consumption.

Martin and Rowthorn (2004)

Glyn continues on to write that the general liberalisation of economics appears to have led to more instability, and made economies “more vulnerable to financial crises”. In actuality, economies have been more stable since 1993, making it the most stable post-war decade. This is very counter-intuitive considering the problems Glyn covered earlier in the chapter. He clarifies that “less volatility does not guarantee dynamism”, as Japan economy may well been stable, but it was also stagnant. It is noted that this increased stability may well be due to a more stable supply side of the economy. Glyn comments on fears that increased regulation on banking will make economies less stable, as they will be more austere during recessions, making recovery more difficult. These sorts of fears seem rather odd after the 2008 financial crisis.

Overall Glyn presents a multi-faceted neoclassical analysis of the growth and stability in 3 major developed regions over the 1990s and onwards, but ultimately it is inconclusive in its critique of the liberalisation of economies.

0 notes

Text

Chapter One: The Disenchantment of Politics

Chapter 1, The Disenchantment of Politics, begins with a brief historical account of the construction of neoliberalism from around 1870 and the ‘trends towards bureaucratization, management and the protection of the ‘social’ realm’, (Davies, 2014) to the late 1970s which gave rise to political victories of Thatcher and Regan, and then finally onto the contemporary world and the financial crisis. This historical contextualisation of neoliberalism focuses on the work of Hayek, who is considered crucial in ‘inspiring and co-ordinating’ (Davies, 2014) the 1970s neoliberal movement which still dominates our political and socio-economic spheres today. Hayek desired a society which was individualistic and had no predetermined path for anyone. However, more recently ‘Hayek’s complaint could now even be reversed: we have in effect undertaken to dispense with the forces which produced foreseen results and to replace the collective and ‘conscious’ direction of all social forces towards deliberately chosen goals by the impersonal and anonymous mechanism of the market (or market-like behaviour).’ (Davies, 2014)

1929 Wall Street Crash compared to a Lehman Brothers employee in Canary Wharf in 2008

Neoliberalism as a doctrine does not have a unified definition or set of beliefs due to its multifaceted development, thus the policy is described as being applied ‘haphazardly’ (Davies, 2014). However, Davies argues that the common theme to neoliberal thought throughout its variations is ‘an attempt to replace political judgement with economic evaluation, including, but not exclusively, the evaluations offered by markets.’ (Davies 2014) By doing so, this negates the necessity for political discourse and a performative political language used creating a ‘disenchantment of politics by economics’ although ‘quantification and measurement [achieved through economic discourse] have their own affective and aesthetic qualities’ (Davies 2014). Here, price is used as an objective and “purely factual” way of comparing human activity.

In terms of how the state and policy elites are viewed, although neoliberalism claims to diminish the role of the state in order to create a freer market it is argued they did not ‘seek or achieve a shrinking of the state, but a re-imagining and transformation of it’ (Davies, 2014) by simply giving economic alternatives for political authority. Moreover due to the changing nature of capitalism business, science and elites had combined in a way which lead to arguably the greatest change to society in the form of “the national economy” and macroeconomics which appeared to need state management.

The next questions presupposed by Davies is one of political authority, or ‘on what basis does the neoliberal state demand the right to be obeyed’? (Davies, 2014) Naturally, the power of a neoliberal state is largely dependent of the power of economics, or economists to legitimise a course of action. This leads to market principles being used to evaluate state decisions, raising the status of a market values to political norms, which in turn creates an ethos which appears to be ‘technical rationality’ (Davies, 2014) and removes the ambiguity of ethical disputes. However, this definition of authority deems the social realm as ‘externalities’ which cannot be accounted for by market value however they are repercussions of it. By valuing everything via a market based system it dictates what and how to value objects which are non-market objects.

Davies critiques neoliberalism through the lens of sociology and critical theory using the ‘convention theory’; or the idea that ‘individuals are obliged and able to justify their own actions, and to criticize those of other actors around them’ (Davies, 2014), to explain our disenchantment with politics. Neoliberalism, and neoclassical economics use normative reasoning to condition objectivity in the political and social sphere through statistical analysis to make the data appear unbiased, thus ‘facts replace judgement’ (Davies 2014). The completeness of this view is disputable; convention theory argues ‘political philosophy can ever be fully excluded from social theory, or indeed from social situations themselves. Economics and sociology are both attempts to create forms of political physics, separate from the political metaphysics that gave birth to them.’ (Davies, 2014) This view simply shifts what we view as the norm rather than viewing the multidimensional element of society. Neoliberalism uses empirical evidence in the form of economics as “truth” and uses this to go beyond the empirical, and “prove” and ideological notion of “the good”, despite there not being a common societal notion. There is arguably a lack of common language shared between sociology and economics making them irreconcilable; ‘The ‘social’ realm arose as a set of identifiable policy problems or ‘externalities’, which were not fully calculated by market exchange, but nevertheless side-effects of it.’ (Davies, 2014). In turn, this means that all beings and institutions are judged in a market like fashion regardless of their status in society, leading to ‘aggressive economic ‘imperialism’, whereby techniques that initially arose for the analysis of markets and commercial activity were applied to the study of social, domestic and political activity’. (Davies, 2014)

Due to this, arguably the most interesting element of the economization is how institutions claim authority without direct influence in the markets such as trade unions or critics who do not offer factual or market-like value. These people are considered through a market-like lens, however they have no ‘intrinsic authority’ thus ‘replaced with extrinsic evaluation, yet this necessarily bestows intrinsic authority upon the economic techniques via which that evaluation is carried out.’ (Davies 2014) Ultimately, the power of sovereigns which cannot be empirically tested and relies on an element of ritual. Neoliberalism attempts to define a sovereign in terms of economics but its dependence on silent obligation must exceed the utilitarian roots of neoliberalism.

In conclusion the disenchantment of politics is a result of economic techniques being used in and around the markets as evaluation, while they rooted there is a dependency on presupposed values and norms which was spread as the ‘free market’. This became a scientific code from the 1870s onwards making it impossible to separate economics, the market, and politics, which in turn was used to criticize the state and the sovereign, in turn creating a political institution which placed itself at the centre of this thought in the 1970s but there is no sufficient reason to legitimize the sovereign power

2 notes

·

View notes

Text

Neoliberal Society

In the introduction to The New Way of the World: On Neoliberal Society, Dardot and Laval write that “the crisis we are experiencing can be seen for what it is: a global crisis of neoliberalism as a mode of governing societies.” (Bardot & Laval, pg. 12) Bardot and Laval are trying to stress that neoliberal thought implemented into state and society have led to a global crisis. In a later chapter, they state that competition and entrepreneurship are the two key features that neoliberal governments promote. This form of government can be found in every country that makes up the western world.

Bardot and Laval continue fro their first statement in the introduction to state that “the current crisis of the euro is no mere ‘monetary crisis’; the crisis of the countries of southern Europe are not simply ‘budgetary’ crises, any more than the global crisis that set in during the autumn of 2008 is itself a mere ‘economic’ crisis.” (Bardot & Laval, pg. 12). They are trying to elude that the problem of neoliberal thought doesn't just impact on economic problems facing the western world today but are in fact deeper and due to the neoliberal style of thought which the normal person tends to assume is correct. The example austerity is one that shows this phenomenon and obsession with tending to the markets needs and “the desire to manage economies and societies as enterprises” (Bardot & Laval, pg. 14).

The issues that are facing the western world today can be traced back to the ideologies imposed by the likes of Thatcher and Reagan and a ‘change to the operating rules of capitalism” (Bardot & Laval, pg. 148). Both of these political figures embraced the idea of freeing up the market and tried to reinvent classical liberalist ideas, including Lessie-Faire. This was done by deregulation and privatisation. In the paragraph above, Bardot and Laval discussed the financial crisis in 2008 and attributed it to neoliberalism. Many argue that the huge boom in the financial sector and the stock market are a direct result of Thatchers deregulation of financial markets, a direct example of neoliberalism policy in action. Bardot and Laval refer to this change of ideology by those in power in the 70’s and 80’s as “The Great Turn” (Bardot & Laval, pg. 147), the title of chapter 6. The success of Thatcher and Reagan’s governments and their political programme became replicated “by a large number of governments and transmitted by a major international organisations like the IMF and the World Bank” (Bardot & Laval, pg. 151). Governments were obliged to take on neoliberalism and gain an ‘entrepreneurial governmentality’ in which competition is at the heart of state activity. Bardot and Laval later argue that technology has had a key role in diffusing neoliberal norms around the globe.

“The Depletion of Liberal Democracy” is the title of Bardot and Lavals final chapter, in which they suggest there are 4 principle features of neoliberal reason. These are:

Market requires government intervention

Competition is key component to the market

The state isn't the guardian of competition, it is in fact subject to it

The norm of competition goes beyond the state, it effects individuals

0 notes

Text

Unpaid Internships of the UN - Group 9

Our group consists of Alexandera-Maria Arbeaux, Janina Zakrzewski, Angie Vukmirovic, Mohamed Hassan and Jess Vecchio.

In our first meeting, 6/11/15, the group decided to create a policy report on the topic of work experience and the problem of unpaid internships, focusing our research and data on the UN’s (United Nations) interns. In our meeting we came across the incident of the unpaid UN intern David Hyde in Geneva in August 2015, who quit after he could not afford the living costs in Switzerland any longer. As we are students studying Politics, Philosophy and Economics the internship policies of esteemed institution is not only interesting for us to study but also important to learn more about, as it is a potential job market.

After choosing our field, we set goals to focus our individual research. Angie focused on definition of an intern, the law and protection given to those in unpaid work, Janina explored the application requirements for an internship in a variety of the UN institutions and read blog posts/articles of previous UN interns to use as case studies, Jess researched how much the average salary of a UN employee and the benefits they receive from their employment to compare to the intern’s rights within the institution and Mohamed determined the difference in paid and unpaid internships opportunities, focusing on the economic, educational and training benefits of paid internships which will be supported by case studies. In our second meeting, 12/11/15, we shared our research and resources with the rest of the group, and discussed the elements that we found the most interesting. We concluded that we should each try and write 500 words on the area we have investigated for next week’s meeting.

After a few logistical issues, we have managed contact Alexandera-Maria and will give her the relevant resources which we have used to gather our information so far. For the coming meeting (scheduled for 20/11/15) , she is keen to familiarise herself with the issue, through the literature we have already sourced and her own research, and is interested in focusing on the legal status of interns, along with why so many people feel pressured into taking up unpaid work.

In the coming weeks, Angie and Janina are planning on attending a workshop at SOAS University on “Working for the UN” on 18/11/15, to find out more information about working for the United Nations and to hear from John Ericson, Chief of the Outreach Unit in the Office of Human Resources Management of the United Nations Secretariat in New York. We want to book an appointment with the career office as we assume that they might an experience in unpaid internships, which we could integrate into our policy report. Furthermore, we will read more professional policy reports to get a better understanding of the structure of a good report.

1 note

·

View note

Text

The American Corporate Elite: Rethinking Leadership

Mark S. Mizruchi proposes the idea that the American corporate elite after the World War II was a crucial element in building the power of the United States. A collaboration with government officials achieved higher government efficiency, coordination of defense expenditures, increased economic performance and a large improvement in American education standards. Mizruchi draws a contrasting picture of the modern day corporate elite. In the introduction to his book The Fracturing of the American Corporate Elite Mizruchi examines different motivations behind those approaches as well as suggesting why it would be beneficial to revisit a tried and tested approach.

The “elite” and the national challenges of the United States

Mizruchi’s thesis results from a comparison of two periods in the United States; the economic Golden Age of post war America vs. the 1970’s till this day. He points out the difference in nature of business leadership in both periods and highlights how it thus affected the regulatory processes in American society.

His analysis of this elite reveals a rise and fall due to political occurrences that led to change of management in large businesses that shaped their performance in relation to tackling governmental issues as well.

The consideration of the top of large corporations

Referring to elites, Mizruchi outlines the inner circle of those who are members of several corporate boards. This enables a broader view of the world and an exclusive ability to engage with and have an impact on a variety of interests. Therefore their actions are not only disproportionately effective on a large scale, but they also gain valuable expertise through this, which increases the value of their thoughts and opinions. It results in a power monopole that becomes clearer when thinking of the state’s dependence on large corporations. Their large revenue is crucial in terms of taxes as much as the important contribution to a stable or even growing economy.

Post War Corporate Elite

According to Mizruchi the interaction between the corporate elite and the government was of a different kind in the post war era than today. The tension and competition of different economic ideologies between the US and the USSR during the Cold War initiated an urge for visible progress in the United States. This urge was not only highly encouraged but also supported with explicit improvement suggestions by the Committee of Ecomomic Development (CED), an organization of business leaders. This didn’t result from the altruistic spirit of the elite or from a undying belief in Capitalism; but because of a strong pragmatism founded on a conviction and long-term interest that would ensure a well- functioning society for one’s own success and sustainability. This wasn’t a belief that was particularly shared among the majority of business leaders, however, the highest elite with the most influence understood the impact of their unity and the necessity ofacting with moderate, pragmatic solutions to pressing economic and social issues.

“The Men Responsible.” President Truman conferred with top leaders of the Marshall Plan. Paul G. Hoffmann (2nd from right) (Copyprint: The Marshall Plan at the Mid-Mark, 1950. Averell Harriman Papers)

The CO-founder of CED, Paul Hoffmann (in the picture), made an interesting distinction about the varying degrees of self-interest. Short term, naked self-interest of profit maximisation, which evolved after the 1970’s, differs from enlightened self-interest. This requires an understanding and assessment of the long-term consequences of one’s actions in order to strengthen society’s foundation and one self’s interest. The unity of the corporate elite shared an awareness of civic responsibility and concern for larger society. With their powerful position came also a self-imposed obligation and skill to work out solutions together with the government. It was a synthesis that managed to maintain a stability of society that took political action in a pragmatic manner of compromise.

The contemporary elite

Mizruchi elaborates on the factors that contributed to the gradual fracturing of this powerful unity and shows the decay of its traits up until the present. Those factors span from the emergence of neoliberalism to the shift in the goals and focus of upper management towards primarily focusing on sating shareholder needs. All the while taking into account the modern predominance of numerous, smaller, service-oriented firms that replaced the older, massive conglomerates and a transformation of a nation built on goods and manufacturing into a financial services focused economy. It became clear that the modern American Corporate elite lacked the sense of action that characterised its predecessor and as a result the awareness and ability to produce solutions to unforeseen crises has receded.

(Credit: Paramount Pictures)

Why does it matter?

Mizruchi’s argumentation emphasizes a link between the scattered state of the American corporate elite and the predicaments that American democracy faces. Due to their influential position and knowledge, a well functioning democracy could gain from an elite that informs itself and acts moderately and responsibly for the sake of society as much as for its own personal gain.

Business cannot be and should not be entirely unified due to the importance of diversity, competition and conflict to maintain an active economy. But this division can adapt to degrees depending on the requirement of a unity for effective problem solving of greater, more important issues.

Unity, especially among the elites, does not rely on social cohesion among group members. Pragmatism has proven in the past to merge powerful individuals to work towards their own goals and engage the public interest simultaneously. In a time when the elite is perceived as rather unreliable, Mizruchi’s argument could overturn this view and reclaim the enlightened self interest again for the benefit of all.

3 notes

·

View notes

Text

Trickle Down Economy When the Well is a Stagnant Puddle

“Do the dynamics of private capital accumulation inevitably lead to the concentration of wealth in ever fewer hands? Or do the balancing forces of growth, competition and technological progress lead, in later stages of development, to reduced inequality?” is the mammoth question posed by Picketty in Capital in the 21st Century. What makes this chapter striking is the vast historical landscape used to show how subjective answers to this question can be in addition to the prevalence of these in our society today where the modern Conservative fairy tale of social mobility and a trickle down economic system has been implemented seeing unprecedented levels of child poverty and inequality.

http://www.theguardian.com/books/2015/oct/22/new-class-war-politics-class-just-beginning

Picketty begins by making some headway in answering the former of the questions posed. I interpreted from this that social inequality has and will be a problem which can be solved simply with a fairer distribution of wealth. Any other solutions are myths creating social injustice and a higher level of crime.

http://www.google.co.uk/url?sa=t&rct=j&q=social+inequality+leads+to.higher+levels.of.crime&source=web&cd=2&ved=0CCkQFjABahUKEwijlbOg_tbIAhUE1hQKHQ-CCyw&url=https%3A%2F%2Fwww.equalitytrust.org.uk%2Fsites%2Fdefault%2Ffiles%2Fresearch-digest-violent-crime-final.pdf&usg=AFQjCNFgiJ1GQU32GJDMienHrRBPbaIbPw

The only reason we have yet to experience a “Marxist apocalypse” is because welfare systems and investment in training and apprenticeships has served to abate those who should be angriest and strengthen the old lie that hard work and determination, not nepotism and privilege, will lead you to a life of happy capitalist luxury. This is seen historically in the pre WW1 period of Whilhelmine Germany in which revolutionary sentiments were pacified with Chancellor Bismark’s piecemeal social reform. As Picketty outlines in the extract, Marx was writing in a time when economic growth was accelerating whilst wages were stagnating and raises the point that had there not been a war at the turn of the Twentieth Century, the social and political landscape developing would have been a virtually unrecognisable Red Utopia. When evaluating Ricardo in 1817 with the idea that the scarcity principle would succeed in destabilising whole societies, Picketty comes to a grim conclusion that if you replace the price of farmland in Ricardo’s theory for urban real estate in Modern Capital cities, the 1970-2010 fiscal trend extrapolated to 2010-2050 would result in economic, social and political “disequilibria" of definite magnitude between and within countries. Income inequality and the accumulation of capital continues to be a prevalent issue, especially with the recent re election of a Tory government in England, in which we can see that in their last tenure the amount of people using emergency food banks rose by 900,000 whilst simultaneously the combined net worth of the 1,000 richest people in the UK rose by over £20 billion.

Picketty offers a counter argument to the Communist doom laid out previously. In 1953, Kiznets released the first attempt at a large scale study into income inequality using national taxation information to collate the evidence. The results showed that from 1913-1948, the top 10% of US earners owned 45-50% of the national income and with a staggering decline, in the 1940’s this had shrunk to 30-35%. Kiznets immediately purported that there was a bell curve trend in inequality and the latter statistic was down to a larger portion of society “enjoying the fruits of economic growth”. Admittedly it sounds good, hopeful, even. You can almost hear the cries of ‘Finally! We have solved the problem to income inequality! Exploiters and profiteers unite! We don’t have to worry about those darned poor people anymore!’ Whilst Picketty states that this is because Kiznet is the “bearer of good news” and a welcome emblem of optimistic economics he also explains that the 20% disparity was down to the economic and political shocks felt by the 10% due to both of the World Wars. This massively aligns with my more speculative opinion on trickle down economy and the political and social implications enacted by ardent believers.

Picketty goes on to conclude that one should take these views with a pinch of salt as economics in all forms is naturally embroiled in political factors that are shaped by the conscience and social, economic and political definitions of justice. I on the other hand conclude that if you have a conscience and moral definitions of justice you would see that inequality can’t be solved by telling people they can get rich form your massive pool of resources or engaging in marginal welfare reform but creating a just society in which the 1% are taxed fairly and social mobility isn’t the government’s favourite lie. But I won’t bother trying to complain about it in mainstream British media, 5 billionaires own 80% of it.

1 note

·

View note

Text

Money is Power

“The great wealth that the financial sector created and concentrated gave bankers enormous political weight - a weight not seen int he US since the era of J.P. Morgan (the man).” - Simon Johnson, 2009

Money is Power.

Power is Money.

Norbert Haring and Niall Douglas, authors of the book, Economists and the Powerful, Convenient Theories, Distorted Facts, Ample Rewards discuss in their second chapter the correlation of wealth and power. The chapter begins with the notion that “those who have a lot of money tend to have commensurate power.” And while they do prove their assumption that the wealthier one is the more power they have, the authors also explain the types of influence the wealthy inflict on the economy.

The significance that banks and financial institutes have on the people is one form of power that is discussed by Haring and Douglas. For example, they believe those who are responsible of managing the wealth of other people, such as investors, stock brokers, hedge-fund owners, and bankers, are the ones with who have the most money “at their disposal.” The authors also believe this to be a large source of power because the money they control, when seen on an aggregate scale, is tremendous. And because these influential ‘financial consultant’ have jurisdiction over other people’s wealth, they do not have to worry about the risks of losing money because it it not at their loss.

“The ultimate source of their power is the fact that money is always scarce and financing hard to come by.” (Haring and Douglas, 2012) Therefore those that truly do need a loan and can bear the expense of borrowing will take out a credit. And the wealthy, who are obviously able to loan out money in the credit market are the ones who have the most power and wealth. They can also control the flow of money in one of two ways: either by managing other people’s wealth, or by giving ‘useful’ tips to investors about future investments. The power to control other peoples power shows how these upper class members can control how money is distributed or made, which in turn proves to be a power that only people like them can possess.

Similarly, Haring and Douglas bring up another point of insider power, a benefit that the wealthy have in terms of finance. Financial institutes and banks are given the task of gathering and allocating large sum of money, which allows them access to information of who to trade or invest with. For instance, “Brokers obtain exclusive information about demand” and “Banks see the books of prospective borrowers and other customers. (Haring and Douglas, 2012, pg 53). And while companies may occasionally get a tip from time-to-time, those who work in the financial sector always have access to such information or have access to insider opportunities on a more regular schedule.

Lastly, the idea of economic power in the hands of banks is a crucial factor in understanding why money is power. Banks are able to control two factors of the market: the existence of barriers to enter the market and the capacity to determine prices. And because of this advantage, competition “does not work well to disciple participants in the financial sector.” (Haring and Douglas, 2012) The requirements needed to enter the market is not easy… a firm must have a license as well as pass other regulatory obstacles. The idea of economies of scope and economies of scale allow for big banks to provide funds to support new small firms in entering the market. Nevertheless, because banking also requires for a firm to have connections as well as a relationship founded off trust and support, newer firms are at a drawback. This alongside the constant source of insider information they have makes it easier for large investment banks to decide what firms should enter or exit the market.

2 notes

·

View notes

Text

Eco-Business: The Politics of Big Brand Sustainability

What is sustainability? It’s basically about “taking what we need to live now, without jeopardising the potential for people in the future to meet their needs”. The chapter begins with the introduction of some big multinational corporations such as Walmart, Nestlé and Nike who claim to lead the way towards sustainability with big promises such as “zero waste”. For example: McDonald’s promised sustainable sourcing of beef, coffee, fish, chicken and cooking oil through the Sustainable Land Management Commitment in 2011 while Walmart, Tesco, Disney and Google are promising to become carbon neutral. It talks about why these companies are now “racing to adopt sustainability” – to enhance their growth rather than being “one-off, reputation-saving responses” like in the past.

Just two decades ago, this sort of publicity or even action or thought towards the environment was unheard of. So why now? Companies are often responding to state regulations and international laws. However, what’s more important is the globalisation of production and the shift towards consumer goods moving along longer, increasingly dynamic supply chains through the economies of China, Brazil and India.

The implementation of sustainable activities have allowed these firms to gain competitive advantages. This change is also shifting the power balance; from governmental organisations and the state as the central rule makers towards the big-brand retailers and manufacturers using sustainability to protect their private interests. “A big brand company can save millions, even billions, of dollars a year by reducing toxics, energy, materials and packaging through its supply chains”.

The author also states that eco-business is likely to show a positive trend. The big-brand businesses are often showcasing their activities regarding sustainability such as social responsibility, increasing transparency and accountability within supply chains. It is argued that they are willing to put time and effort into these activities because of self-interest with regards to achieving efficient economies of scale by enhancing the efficiency of production methods.

One source of its power as a marketing and management tool is that it has the capacity to achieve clear and measurable economic gains. This could be due to the fact that many consumers are becoming increasingly aware of the environmental impact we are causing as a society and there seems to be a big push towards using anything ‘green’ to help reduce the negative externalities we cause as part of our daily consumption of goods and services. By showing customers the steps taken by the big multinationals, they are saying that they too care about the same issues and so buying their products/services over their competitors will mean the consumer is also helping them towards the same goal. In this way, these big-brand companies are able to secure more sales and more profits and in some cases more market share and market power.

The extent to which eco-business helps to act as a force of environmental protection and social justice seems to be up for debate. This crucial piece of the jigsaw is hidden behind the corporate claims and promises. Another problem is that it is “increasing the power of the big-brand companies to sway non-profit organisations, shape international codes and standards and influence state regulations and institutions towards market interests”. As a consequence of this, governments, environmental groups and consumers have no choice but to engage with big-brand eco-business.

The way that these big corporations talk about their activities casts their effort in a “win-win light” – they can be socially responsible AND profit maximising through what Michael Porter and Mark Kramer call “strategic CSR” – corporate social responsibility. It is useful to remember that the focus of these big brands is to gain business advantages through primarily environmental efforts which may in some cases actually harm workers and societies.

http://www.bbc.co.uk/news/business-30532463 (an article on Apple failing to protect its workers)

Eco-business efforts vary across product segments, sectors, countries and companies. However, eco-business is helping improve product design and production processes to turn waste into profit. This became especially important during the economic downturn of 2007-09.

Big brand companies are looking to exert greater control over suppliers in order to benefit from lower costs, one way in which they achieve this is through sheer purchasing power. This could either lead to innovation and better environmental outcomes or produce worse outcomes. For example, suppliers may cut corners, evade taxes, mistreat employees and hide illegalities and poor practices by falsifying audit reports. This brings about a big question of trust for consumers and governments.

The author states that “at best, the scaling up and mainstreaming of eco-business can only ever take us a short way toward genuine sustainability.” Consequences of these activities will be multi-dimensional and gains may only be temporary. However, many choose to engage, partner and give big brands some credit for its strategies as “doing so seems to bring the potential to manage global environmental change in ways able to keep pace with the pressures from a rapidly growing and globalising retail economy”. What will really make a difference is the sincere commitment of the big brands, to create real sustainability.

Chandini Dadi

1 note

·

View note

Text

Naomi Klein - “This Changes Everything”: Beyond Extractivism

In her book «This Changes Everything: Capitalism vs. The Climate», Naomi Klein challenges issues of the environment as it is today, concentrating on the negative effects capitalism has had on it. The focus of chapter 5 – «Beyond Extractivism» - is the matter of the economic system of extractivism, its history and the problems it imposes on the world around us.

«Extractivism – a term originally used to describe economies based on removing ever more raw materials from the earth, usually for export to traditional colonial powers.»

To illustrate her point, Klein sets the example of Nauru – an island which was «designed to disappear». Nauru’s resources of phosphate of lime were exploited until its soil was left an empty shell. Even when it was made clear that the mining would not stop until there is no phosphate left, the most the authorities did was promise the citizens of Nauru permanent homes in Australia once it was not possible to live on the island anymore.

Nauru was regarded as having «the fattest population» on a U.S. television show; the reason for that was the lack of possibilty to grow fresh produce as a result of all the mining and extracting. All these actions led to a serious weakening of Nauru’s economic, financial and ecological position, which in its turn ended in the island’s desperacy for foreign currency, which only caused Nauru’s double bankruptcy: ecological and financial.

Sadly, Nauru is not the only example of such destruction of an entire island caused by extractivism; in fact, it is an example of what can happen to any country in the World. Klein describes the mentality of humans being such that they believe they can relate to the earth with violence, domination and exploitation as being at the core of the issue. Another problem she points out is the irresponsibility we, inhabitants of first world countries, feel towards what is happening in the countries being exploited, as we «relate to the world as a frontier of conquest». All those events are too far away from us to feel accountable for what is being done, so we prefer to ignore it.

Throughout the years, these ideas of extractivism (mainly domination and exploitation) have been supported by scholars such as Francis Bacon, an English philosopher who promoted the idea of abandoning notions of earth as a life-giving figure and taking the role of her master instead. Taking this role was problematic until the 1700s, when colonization and industrialization were still controlled by nature; however, with such inventions as James Watt’s steam engine, humans became more and more separated and independent from nature. Ever since, capitalism has been trying to completely take over nature, often forgetting that we are not the ones in control. For example, a «give-and-take» relationship was not established with fossil fuels, the consequence for which is the currently unleashing natural tempers (Hurricane Sandy, Typhoon Haiyan).

Klein dedicates the last part of the chapter to environmental movements attempting to influence the system. The issue here is that the idea of going easier on the living systems that sustain us poses a threat to both right and left-wing thinking («left thinkers who desire economic success in terms of traditional measures of economic growth»); perhaps, that is the reason the movements haven’t been particularly successful.

Even though the movements recognize the need for a new definition of development, they do not seem to offer any possible solutions. Throughout the history of these movements, their ideas stayed unattached to populist ideas and worldviews.

To conclude, Klein emphasizes the need for people to change the way they understand extractivism.

«Only when we dispense with these various forms of magical thinking will we be ready to leave extractivism behind and build the societies we need within the boundaries we have – a word with no sacrifice zones, no new Naurus.»

1 note

·

View note

Text

The Great Transformation Ch. 15

Chapter 15 of The Great Transformation by Karl Polanyi offers an interesting look at the history of land in the market. Polanyi starts the chapter off by discussing that despite surface distinctions; humanity, the market, and land are all interrelated. In fact, the market cannot exist without land, and neither can humans. How we relate the ownership of land is central to the mechanisms of the market; for different types of economies have different relationships between the market and land ownership.

The industrial revolution changed the world economy and the European economies forever. However, before the industrial revolution could occur, there was a land revolution that shifted the primary owners of land from the aristocracy and church to commercial businesses and capitalists. Polanyi claims that this revolution happened in three distinctive parts to allow the modern market system to prevail; the commercialization of soil, increasing production of food and raw materials to serve the needs of an increasing urban population, and finally extending the system overseas in the form of colonialism.

The commercialization of soil came about with the destruction of feudalism in Europe. Back then, land was primarily owned by aristocracy and the church. There were also reserved common grounds for the public. The buying and selling of land for commercial purposes was generally rare as the land was often inherited or protected by strict laws inhibiting its ownership mobility. The majority of the population did not own any land but instead worked and lived on land owned by the ruling classes or on publicly reserved grounds. Various uprisings, revolutions, individual force and violence, war, and some legislative action resulted in the braking up of this type of land ownership and introduced a more fluid real estate market. Middle class members were now able to become land owners and there was a strong rising interest in the usage of land for production and commercial purposes.

One of the driving factors for commercial usage of land arose out of the industrial revolution and an increasing urban population. This population required food and resources that were no longer available in the density of cities. This demand created a market for increasing production in agricultural fields. Often because the majority of the population was poor, cheaper food and materials were preferable which resulted in a large demand of trade between cities and their peripheries.

Thus the first types of free trade were introduced, however, not without their negative impacts. Many people were being kicked off of land they once inhabited as a result of increased agricultural trade, and villages and economies were being disrupted in the face of increased specialization and commercialization of land. The European agricultural population was able to obtain laws and resist the backlash of international trade but the populations of colonialized countries were unable to receive any protection from the harms of international trade.

Polanyi attempts to illustrate in this chapter the inseparability of the market and land ownership. This relationship is important to understand in dealing with the ecological crises. In order to alleviate environmental degradation, who should own the land? It can be argued from this analysis that private ownership of land that arose from the break of feudalism was the driving force behind the current market system and the environmental threats it now poses. But do we really want to go back to a feudal system where the majority of the population does not have any ownership rights? There was a reason for the peasants’ revolution after all. Polanyi seems to suggest that socialism is the best approach to the current land-market separation in society today, however socialism is not without its own flaws and it would be quite utopian to believe that it is the answer to the world’s environmental crisis.

Jacinta Sherris

1 note

·

View note

Text

Ha-Joon Chang. Economics: The users guide. How does your garden grow? (Chapter 7)

Rebecca Buckley

1 note

·

View note

Text

How power can be achieved for the best interest for the likes of Corbyn and the self interest motives of Political Elites

I wanted to go over the fact that the European political parties relationship with the public has changed over time as the intentions of elites within government today can be seen as about the roles and status instead of the best interest of voters. If the approaches to the public can change and leaders try to create a closer relationship with people/voters then power can be gained even if someone lacks credentials by a certain people.

Jeremy Corbyn is a great example who believes in the interest of the people.

Peter Mair’s book ‘Ruling The Void’ which studied European Political Parties has explained the change in relationship between political parties and the public decision making. He believed there was a connection between the two because of the involvement of the citizens in politics. The people are able to vote against the government if they do not like it. The twofold process is that the European political elites are supported more by state funding than by members and Party leaders are more interested in their role than representing their voters, also voters are distancing from the relationship with parties and rather vote party to party. From this the elites will always benefit to achieve their personal benefits and the public will be pushed away from the party associations.

Mair argues that two fold process is bad for democracy. Quoting another political scientist, Rudy Andeweg, who says that “the party … becomes the government’s representative in the society rather than the society’s bridgehead in the state”. Mair suggests that political parties are thirsty for state power. The structures of power and decision making are increasingly “protected from the people and from excessive input.” As British sociologist Colin Crouch argues, this also means that political elites come to identify less and less with voters, and more and more with the representatives of special interests whom they socialize with, who provide them with financial support, and who shape their fundamental ideas about what policies are acceptable and what policies are unacceptable.

The Elite always works in the interest of those from whom it derives its power and authority but still it works against democracy because it believes in the rule of the few. You could say the elites may be against the likes of Jeremy Corbyn. What is clear is that Corbyn’s Labour party will face relentless opposition from the elites that have replaced the masses as the main source of resources for parties and politicians. U.K. businesses and especially the financial elite of London’s city are strongly opposed to Corbyn’s leadership and political project, which potentially destabilizes a consensus that they see as essential to Britain’s and their own prosperity. If Mair is right and parties have become increasingly disconnected from their base of support then Corbyn’s election may be seen as a way of trying to revitalize this connection. The problem is twofold. It isn’t clear that the base for mass parties is there as it used to be, but it is is clear that the elites whom parties have come to depend on like the system the way that it is, and have resources that they will use to protect it. Corbyn likely isn’t the leader

By Mohammed Ahmed

0 notes

Text

Group 3 Learning Journal 1

Group members: Raeis Sadiq, Chandini Dadi, Toby Chamberlain, Renato Restelli, Sonja Zantow

Topic decided: Income inequality

Subtopic outline and research tasks:

- Income rises slower than capital income (house prices becoming more unaffordable for the lower income earners and therefore the capital income gap just rises) link to the Lorenz curve and Gini coefficient – 1000 words [Raeis]

- Difference in top wages geographically (London’s average income is higher than the north of England) – 500 words [Renato]

- Government policies leading to income inequality (monetary – inflation) – 1000 words [Toby]

- Discretionary income decreasing due to faster increases in price of necessity goods over the rate of increase in wages – leads to income inequality (link to mortgage interest payments as an evaluation point where even if wages do increase, if interest rates also increase MIPs increase and therefore in real terms income may decrease) - 500 words [Raeis]

- Tax – decrease in tax credits, increases in tax avoidance (money flowing to off-shore accounts which leads to a larger income gap), top tax rate isn’t high enough? (include the ‘Laffer’ curve in analysis) – 1000 words [Chandini]

- Difference in bargaining power – jobs in certain sectors such as TFL have trade unions to protect workers and ensure they get a fair and reasonable wage whilst other low end jobs such as assistants in retail don’t have much power over their income, raises etc (minimum wage isn’t high enough to live a sustainable life – not close enough to a living wage) – 500 words [Toby]

- Ethnic differences (refugees/immigrants) tend to earn lower wages in contrast to British citizens – they’re exploited to work in terrible conditions as well as for low wages and income inequality arises from this – 500 words [Sonja]

As a group we have decided that all group members will have researched each subtopic outlined above by the end of this project so that we all have an equal opportunity to write on each topic in our policy report. We will go about this by rotating research topics consistently before our policy report write up.

1 note

·

View note

Text

Group 3 Learning Journal 2

Group members:

Raeis Sadiq, Chandini Dadi, Toby Chamberlain, Renato Restelli, Sonja Zantow

Wage growth vs. Capital growth:

Wages rise slower than capital income:

R=return on capital

G=Growth in income

Piketty argues R>G

This means that growth in capital is larger than growth in income – you earn more from owning capital - value of the capital goes up as its price goes up and the price of the capital is going up faster than the increase in income – unearned income increases more than earned income – this is what has happened over history studied by Piketty.

This suggests you can’t work hard and get rich as capitalism suggests but rather you must be born into wealth in capital.

Piketty argues rich CEO managers’ income is increasing so fast that they can’t spend their income so they buy capital and their capital price increases faster and so they get richer even faster and inequality just further increases.

Very large amounts of ‘earned income’ can be converted into capital and ‘unearned income’ but only high ‘earned income’ earners can do this.

Income inequality and wealth inequality are now mutually reinforcing, whereas they used to be separate.

The rise in house prices in London comes down to demand largely exceeding supply which results in house prices largely becoming unaffordable for most households and to be left to be consumed by foreign investors as well as high ‘earned income’ households who already benefit from large income sums from capital income.

Lorenz curve diagram for clearer representation of the inequality which exists as well as gini coefficient figures inserted.

Inequality arising from a decrease in discretionary income:

Discretionary income for average income homes decreases if the price of necessity good such as bread and milk increases at a faster rate to which wages increase at. This is because necessities such as food must be consumed to survive and therefore if there is an increase in price for these goods, they will still be consumed as there is no alternative to food which we can consume (it is income inelastic). Therefore, because average income households’ wages have remained the same and they are spending more on goods, they are left with less discretionary income to spend on other goods or save and therefore they must lower their standard of living to accommodate their forced increase in spending on necessities, which therefore creates income inequality as the higher income earners will be able to take on this increase in price for necessities without it having much of an effect on their consumption, standard of living and saving.

Furthermore, in the long run the income inequality will further increase as wages for average income earners will remain the same whilst prices for these necessities will further increase and discretionary income will further decrease until average income earners have no discretionary income left and will inevitably be left to take loans to be able to consume necessities to survive, which will lead to a spiral of debt arising for these families whereby further loans will have to be taken to pay off previous loans taken.

In addition to this, even if wages do increase for households, if the economy is in a state whereby the bank of England increase interest rates, mortgage interest payments (MIPs) will increase for households and therefore in real terms, discretionary income may further decrease rather than increase because of the increase in wages as the extra income received will immediately be repent onto the increased MIPs and therefore the household will be left with even less discretionary whilst once again the higher income earners will easily be able to cope with the increased MIP payments or may not even have to pay MIPs as they buy houses in cash and don’t need mortgages.

Raeis Sadiq

Geographic Income inequality:

London’s average income is higher than regions more north of the UK:

- Outside London, more than 10% of the population in various cities is in the bottom tenth of the national income distribution.

- Income is more concentrated in London than anywhere else in the UK - 20% of the population in London have around 60% of total income in London let alone compared to the rest of the UK.

London Poverty Profile:

· Inner London is more divided than any region in England. 19% of the population of Inner London are in the top tenth for income nationwide (measured after housing costs).

· The distribution of hourly pay shows inequalities within and between boroughs. The top quarter of earners living in Kensington & Chelsea earn at least three times more per hour than those in the bottom quarter.

· Between boroughs, the big inequality is between the high earners. The top quarter in Kensington & Chelsea earn more than twice as much per hour as the top quarter in Newham, Barking & Dagenham or Brent. However, the bottom quarter of earners in Kensington & Chelsea earn only one-third more per hour than the bottom quarter of earners in Newham.

Scale of economic inequality in the UK:

(source: https://www.equalitytrust.org.uk/scale-economic-inequality-uk)

Fall in income inequality?

• The primary reason for the fall in inequality was that real earnings fell sharply while benefit entitlements remained relatively stable. Median income for nonworking households (including pensioners) was 60% of that of working households in 2007–08, but 67% by 2012–13.

• The fall in income inequality was much smaller when incomes are measured after deducting housing costs (AHC). On that basis, incomes fell by 8.0% at the 90th percentile, 8.7% at the median and 6.4% at the 10th percentile. This is because the large falls in mortgage costs primarily benefited those towards the top of the income distribution. Housing costs fell by over 20% across the top half of the distribution, but by less than 10% in the second and third income deciles.

Bibliography

http://www.londonspovertyprofile.org.uk/indicators/topics/inequality/income-inequality-in-london-compared-with-other-english-regions/

http://www.londonspovertyprofile.org.uk/downloads/LondonPovertyProfile.pdf

http://www.ifs.org.uk/uploads/publications/comms/r96.pdf - Institute for Fiscal Studies – ‘Living Standards, Poverty and Inequality in the UK 2014’

http://www.poverty.org.uk/02/index.shtml

http://www.poverty.org.uk/09/index.shtml

http://www.poverty.org.uk/summary/regional.shtml (amazing)

http://www.ons.gov.uk/ons/rel/lmac/earnings-in-the-uk-over-the-past-25 years/2012/podcast.html (video)

Renato Restelli

Government policies leading to income inequality:

Fiscal Policy:

Fiscal policy is a form of government intervention, essentially the power to influence taxation and government expenditure; it is the primary tool for governments to affect income distribution.

• Fiscal policy has four main objectives—to support macroeconomic stability, provide public goods, correct market failures, and redistribute income. Both tax and spending policies can alter the distribution of income, both over the short and medium term.

• Income tax is part of fiscal policy - the amount one is taxed will vary on the quantity of income an individual earns. It is possible to argue that this form of intervention may reduce income inequality in the sense that the more an individual is earning, the more they are taxed and therefore are left with a lower income in real terms. Therefore, the high earners will be paying more in taxes, potentially decreasing the wage gap in the UK.

• However, it is possible to argue that for the low earner to be taxed on their small income is unfair as the taxation for a high earner will not dramatically affect their earnings as much as it would for a low earner. The logical solution would be to set a higher tax bracket in which people get taxed on income. The current income bracket is £10,600 in which an individual gets taxed.

• Fiscal policy has played a significant role in reducing income inequality in advanced economies, with most of this reduction being achieved on the expenditure side through transfers.

• The distribution of income in the society is influenced by fiscal policy both directly and indirectly. Current disposable income is subject to direct tax instruments, but the ability of future earnings of individuals and, therefore, the income market could be and is influenced indirectly by the fiscal policy.

Monetary Policy:

A form of government intervention in which the interest rates and supply of money are altered in order to ensure price stability and confidence in a currency.

• Since the financial crisis the Federal Reserve has aggressively used monetary policy, including unconventional policies like quantitative easing, to promote job growth and keep inflation at its target (2%).

• The key challenge faced by monetary policy makers when dealing with growing inequality is how to stabilise output more effectively and reduce the burden on the poor: when interest rates are at a high, those with the higher incomes will be receiving a better return on their money, than that of the poor.

• In terms of loans and investment, companies are often more inclined to supply loans to those with a stable credit/earning, therefore, it is more likely for companies to hand out loans to those on a higher salary. Creating inequality in the sense that the poorer bracket will not receive this additional money for investment, due to the fact they are less likely to return the money after interest rates.

• As interest rates increase, the cost of borrowing essentially increases and those on a lower income may not be financially stable enough to risk paying the increase in price of borrowing money for investment whilst higher income earners don’t encounter this problem.

Difference in bargaining power: the divide in power to influence wage or job stability:

• Jobs in certain sectors (transport for London) have trade unions to protect workers and ensure they get a fair and responsible wage whilst other low end jobs - assistants, retail; don’t have much power over income or raises - Minimum wage doesn’t sustain a comfortable life or a comfortable living wage.

• Inequality rising - those in the lower end of labour have minimum influence in their standard of work - leads to mistreatment and lack of productivity in the sense that workers are not motivated to work at their best rate due to poor standard.

• Also, many are left with little choice in which area to work in - majority have to opt for the lowest paid, lowest skilled jobs due to their constant availability - as a result they’re earning the minimum wage: - £6.70 for workers 21 and over:

• £5.30 18-20 yrs

• £3.87 for 16-17 yrs, who are above school leaving age but under 18

• The more people earning a minimum wage, the more inequality - the minimum wage is not enough to sustain a life with constant consumption - lowering the overall standard of living - causing people to become unhappy in work - and losing motivation to work at their best - as a result many choose to leave work and claim benefit.

• In a sense, due to the high price of UK benefits, it acts as an incentive for many people to opt out of work, as they receive more through benefits then they do in annual wages - ultimately increasing inequality, through lowering the unemployment rate, will spread the gap between the rich and the poor.

• Skill-upgrading/specialisation causes wages to grow for all employees but reduces the relative size of the management sector. Thus, skill-upgrading produces a negative relation between wages and the employment share in management.

• In the years following the Second World War, income inequality in most developed countries was significantly reduced by strong trade unions and high rates of coverage by collective agreement. Yet in the current day, workers in certain sectors are losing the power with which to bargain and protest against the standard of work - thus people are left unhappy and in a sense complacent as they know there is little they can do to change their standard of work.

• Whereas workers in the service or tertiary sectors, although earning a much higher wage with annual bonuses, still have more power to influence pay and tend to form trade unions - allowing the inequality to continue rising due to the difference in bargaining power.

Bibliography

https://www.imf.org/external/np/pp/eng/2014/012314.pdf - ©2014 International Monetary Fund: IMF POLICY PAPER

https://www.stlouisfed.org/~/media/Files/PDFs/Bullard/remarks/Bullard_CFR_26June2014_Final.pdf - Federal reserve bank of St Louis: Income Inequality and Monetary Policy.

‘The Super Rich and Us’ - Jacques Peretti (BBC Programme)

‘Tax Progressivity and Income Inequality’ - Joel Slemrod ( 1996 )

‘Capital in the Twenty-First Century’ - Thomas Piketty ( 2014 )

‘Growing Income Inequalities: Economic Analyses - Joël Hellier, Nathalie Chusseau ( 2012 )

Toby Chamberlain

Income inequality & taxation:

Tax – decrease in tax credits, increases in tax evasion (money flowing to off-shore accounts which leads to a larger income gap), top tax rate isn’t high enough? (include the Laffer curve in analysis)

Tax credits:

Working tax credits and child tax credits

- What are tax credits and how do they work?

- To what extent are they effective? – ‘real’ purchasing power? Inflation? Housing market? à affordability?

- Why are they being cut? Or frozen?

- Potential effects of tax credit cuts – who is it affecting the most adversely?

- Winners and losers

- Alternatives and government opinions – the independent article

- Impact of changes by 2020 – bbc news article image

(source: http://www.bbc.co.uk/news/business-34572807)

Tax evasion & tax avoidance:

- Tax evasion gap – report by Richard Murphy

- Difference between tax avoidance and tax evasion

- Panorama – the bank of tax cheats

- Tax avoidance the hidden cost – bbc iplayer

- Panorama – hsbc the bank of tax cheats - youtube

Income tax rates & personal allowances:

- Income tax rates and personal allowances table – gov.uk

- Bernie sanders says he’s gonna tax the wealthiest 90% of income – comparison

- Guardian article – how many people pay the top rate of income tax?

History of UK taxation rates & current situation:

- Tax rates history uk – 1990-2015

- Uk tax gap climbs to £34bn

Chandini Dadi

Income inequality deriving from ethnicity:

(Source: http://www.poverty.org.uk/06/index.shtml)

Income inequality in Britain is high, both in comparison with other industrialised nations and historically:

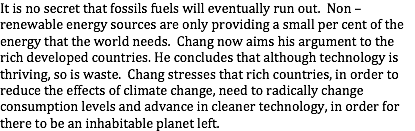

“The net results are a) that the gap between the proportion for ethnic minorities and that for White people is the same as a decade ago and b) that the ethnic groups with the greatest risk of low income are the same as a decade ago (i.e. Bangladeshi and Pakistani)” (poverty.org)

Relationships between inequalities in people’s economic outcomes (e.g. earnings, incomes, wealth) – and their characteristics and circumstances (e.g. gender, age or ethnicity).

Factors affecting resources and opportunities available to individual:

Age & Family Work Status / The importance of socio-economic background:

For all ages and all family work status, people from ethnic minorities are, on average, more likely to live in low-income households than White British people.

Age e.g. almost half of all children from ethnic minorities live in low-income households compared to a quarter of White British children

(gap biggest for part-working families) a part-working families from ethnic minorities are almost twice as likely to be in low income as part-working White British families: 45% compared to 25%

Qualification Differences between ethnic groups:

Differences in education furthering inequality & the income gap

Report of the National Inequality Panel

è looking at performance of different ethnic minority groups during compulsory schooling period (ages 7 – 16)

è Average results for main ethnic groups, Children not on Free School Meals vs. on Free School Meals

è Employability rate differences by gender and ethnic group

Income inequality within those ethnic groups:

“Differences in outcomes between the more and less advantaged within each social group, however the population is classified, are much greater than differences between social groups. Even if all differences between groups were removed, overall inequalities would remain wide. The inequality growth of the last forty years is mostly attributable to growing gaps within groups rather than between them” (report: An Anatomy of Economic Inequality in the UK by the National Inequality Panel)

Bibliography:

http://www.poverty.org.uk/06/index.shtml

http://sticerd.lse.ac.uk/dps/case/cr/CASEreport60_executive_summary.pdf

http://sticerd.lse.ac.uk/dps/case/cr/CASEreport60_summary.pdf

http://www.equality-ne.co.uk/downloads/579_govresponsenationalequalitypanelreport_acc.pdf

http://www.voxeu.org/article/ethnic-inequality

http://scholar.harvard.edu/files/alesina/files/ethnic_inequality_dec_2014.pdf?m=1418052278

http://www.irr.org.uk/research/statistics/poverty/

Sonja Zantow

1 note

·

View note

Text

Learning Journal 3 - Group 3

Currently all members of group 3 have completed making their notes in full for each of the 7 subtopics under income inequality (outlined in learning journal 1) which we will be writing about in our group policy report. All notes made from all group members have been condensed into detailed bullet points under each subtopic in a word document and on 16/12/15 we will be assigning each group member various bullet points under every subtopic to write about so that each group member is able to write on every subtopic within income inequality as well as avoiding repetition on writing about the same points between members. From 16/12/15 onwards, each group member will begin writing different aspects of each subtopic assigned for the group policy report and will aim to finish writing up their assigned points by 03/01/16, ready to be put together with the rest of the group policy report written up by the other members. This plan and research tasks for note taking has been agreed upon over a number of meetings held on Friday’s as well as the occasional Wednesday during our group meetings.

1 note

·

View note

Text

Alvaredo - The Top 1% in International and Historical Perspective

“The Top 1% in International and Historical Perspective” considers multiple reasons as to why there is such vast income inequality between regular citizens and the wealthiest 1% of the world who are regarded as the ‘elites’. Through this book, you begin to understand how policies can affect income inequality both positively and negatively via various economic theories which will be discussed through this blog.

Figure 1 shows the share of total income earned by the top 1% of individuals in the USA from 1913 to 2011. Income is defined as pre-tax market income; it excludes government transfers and nontaxable fringe benefits (healthcare). The figure displays capital gains (solid squares) as well as displaying the effect on income when realized capital gains (hollow squares) is excluded.

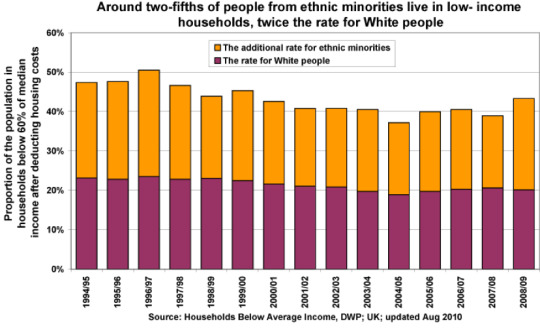

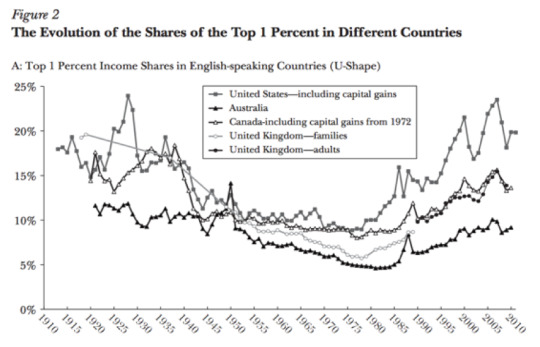

The evolution of the shares of the top 1% is shown for four Anglo-Saxon countries in Figure 2A and for France, Germany, Sweden, and Japan in Figure 2B. The Anglo-Saxon countries - Australia, Canada, and the UK all show a U-shape. Over the period 1980 to 2007, when the top 1% share rose by some 135% in the USA and the UK, it rose by some 105% in Australia and 76% in Canada). There’s a huge difference in Europe and Japan, where the long pattern of income inequality is much closer to an L-shape than a U-shaped curve. There has been some rise in recent years in the top shares in these countries, but the top 1% shares are not far from their levels in the late 1940s during WWII, whereas in the USA the share of the top 1% is higher by more than a half.

The fact that high income countries with similar technological and productivity developments have gone through different patterns of income inequality supports the view that institutional and policy differences play a key role in these transformations. Purely technology based solely upon supply and demand can hardly explain such different patterns. We have to understand not only why top shares rose (in the U-shaped countries) but also why they fell for a period of time earlier in the 20th century. This comes down to the most obvious policy difference between countries - taxation.

Figure 3 depicts the top marginal statutory individual income tax rate applying to ordinary income in the USA, UK, France, and Germany since 1900.

During the 20th century, top income tax rates have followed an inverse U-shaped path in many countries, as illustrated in Figure 3. In the USA, top income tax rates were consistently above 60% from 1932 to 1981, and at the start of the 1920s, they were above 70%. High income tax rates were a feature of post-WWII and their cumulative effect contributed to the earlier decline in top income shares. While many countries have cut top tax rates in recent decades, the depth of these cuts has varied considerably. For example, the top tax rate in France in 2010 was only 10% lower than in 1950, whereas the top tax rate in the USA is less than half its 1950 value which ultimately explains the U-shaped graph depicting the top 1% of USA citizens whilst France has a L-shape.

Figure 4 plots the changes in top marginal income tax rates since the early 1960s against the changes over that period in the top 1% income shares for 18 high income countries. It shows that there is a strong correlation between the reductions in top tax rates and the increases in top 1 percent pre-tax income shares. For example, the USA experienced a reduction of 47% in its top income tax rate and a 10% increase in its top 1% pre-tax income share. By contrast, countries such as Germany, Spain, or Switzerland, which did not experience any significant top rate tax cut, did not show increases in top 1% income shares. Hence, the evolution of top tax rates is strongly negatively correlated with changes in pre-tax income concentration.

However, it can be argued that there has not actually been any real increase in income concentration but rather because top tax rates heavily decreased, there is now less of an incentive to tax avoid and therefore it merely appears that there has been an increase in the top 1% of income in the USA. Under this scenario, the real USA top income shares were as high in the 1960s as they are today because during the 1960s, a smaller fraction of top incomes were reported on tax returns.

The USA decreased top bracket tax rates under the belief that it will lead to behavioral changes of individuals of the top 1%. The idea derives from a supply side policy whereby lower tax rates stimulate economic activity through the increase in discretionary income and therefore consumption among top earners as well as involving more work and greater entrepreneurship which would lead to more economic activity by the rich and hence more economic growth.

However, there are no apparent aggregate outcomes in correlation between cuts in top tax rates and growth rates in real GDP per capita. Countries that made large cuts in top tax rates such as the UK and the USA have not grown significantly faster than countries that did not, such as Germany or Switzerland. This lack of correlation is more consistent with the idea that from tax decreases, there is more individualised pay at the top, rather than increased productive effort.

Capital income consists of rents, dividends, interest, and realised capital gains. The decline of top capital incomes is the main driver of the falls in top income shares that occurred in many countries early in the 20th century. For example, from 1916 to 1939, capital income represented 50% of US top 1% incomes, whereas by the end of the century from 1987 to 2010, the share had fallen to one third. In the UK, the corresponding share fell from 60% in 1937 to under 20% by the end of the century.

Conclusively, in seeking explanations for the rise in top income shares, it would be reductive to focus just on the doubling of the share of income going to the top 1% of the US over the past 40 years. We also have to account for the fact that a number of high income countries have seen more modest or little increase in top shares. Hence, the explanation cannot rely solely on common advances in countries such as innovation of new technology. Moreover, the explanations have to consider the falls in top income shares earlier in the 20th century. Therefore, the varying levels of dominance of the top 1% across different countries must ultimately come down to the difference in economic and political policy implemented by the various governments.

2 notes

·

View notes

Text

Political Correctness Gone Rad. Blog Post 2

We have decided to alter our concept for the report. We are focusing on the marketisation of higher education and how this affects marginalised groups. We are looking at models from both the US and the UK and comparing how the UK is moving towards the US’s mass privatisation of higher education.