Text

The case for light jets in Europe

Article from EVA Magazine, EBACE Edition by Slobodan Vuckovic, founder and CEO of AirDB a member of Fincore

The business aviation industry in Europe employs some 160,000 highly skilled workers, generating around $12.5 billion in annual revenues. Yet Europe accounts for only 14% of the global annual sales of business aircraft. Why? On one level, the reason is simple. European companies up and down the scale are hugely reluctant to be seen to be buying corporate aircraft. That reluctance hardly fits with the fact that the European economy is one of the world’s strongest.

One of the more obvious reasons why European management teams find it tough to justify the capital expenditure required for a corporate jet is Europe’s unique geography and the superior nature of the European rail and road networks. So many business trips, even across borders, can be easily accommodated by taking a high speed train or driving 300 kilometres or so.

But there’s another reason. European politics tends to be centre left, with a leaning towards socialism – the kind of political environment that fosters the (mistaken) view that private jets are the playthings of billionaires and tycoons and rock stars. For the ordinary hard working European businessmen and women, using private jets is all too often seen as laying themselves and their company or brand open to getting hammered in the media.

However, as those of us in the industry know, there is a huge gulf between this faulty public perception and the actual reality of business jet usage by companies. According to the NBAA fact-book, only 3 percent of all business aircraft are owned by Fortune 500 corporations. The overwhelming majority of the remainder, some 85 percent, are owned by small and medium size companies. Moreover, in excess of 70 percent of passengers aboard business aircraft are non-executive employees and more than 60 percent of business jets and turboprops are used to reach remote locations that are not on a scheduled airline route.

A typical business aviation mission is 4 passengers on a 600-800 nautical mile business-related trip. The vast majority of city-pairs in Europe are under 1,000nm apart and a private jet offers the opportunity for a really time efficient connection. Only a handful of the most frequently connected city-pairs are over 1,000nm. One thinks here of London-Moscow (1,350nm), which is still considerably closer than the US equivalent of New York-Los Angeles (2,150nm), or Miami-San Francisco (2,250nm), or the capital cities of two Latin American neighboring countries such as Brazil and Colombia – (Brasilia-Bogota - 2,000nm).

This shorter journey distance has made Europe the showcase market for light-jets. Ironically, none of the 4 to 8 passenger aircraft that are suited to 1,000 nm business trips are manufactured in Europe.

This is despite the fact that Europe is the leader in the commercial aviation sector, since it is home to Airbus, and is the leader in helicopter technology where it has Finmeccanica helicopters (AgustaWestland) and Airbus helicopter (Europcopter). It is also, of course, able to boast the military fighter-jets Eurofighter Typhoon, Dassault Rafale and Saab Gripen. Europe also has leading OEM jet engine manufacturers in Safran/Snecma/CFM International, Rolls-Royce and IAE.

The shining star of European business aviation industry is Dassault, manufacturer of Falcon business jets. However, the smallest Falcon carries up to 10 passengers and costs close to $30 million – not exactly light jet territory! On the plus side, the two the most successful high-performance single turboprop business aircraft, namely the Pilatus PC-12 and Daher TBM900, are designed and manufactured in Europe and Pilatus will shortly be delivering the first PC-24 light jets, which could represent a real breakthrough for the European market.

Also positive is the fact that over the last few years, with the slow recovery from the global economic downturn, small and mid-size business leaders across Europe are starting to show a greater interest in business aviation. The message that in Europe, a small, hard-working team of executives can fly on a light jet to a meeting and be back home in the same day - at the cost not far from what they would pay for first-class commercial tickets. And of course, with a single flight they can reach customers in remote locations, avoiding wasting time in commercial hub connections, where the main airport is often a long way from their destination.

Business aviation is all about productivity and connectivity. And there are a lot of choices for European business travellers.

Interestingly, the airplane that was once hailed as the potential king of the four passenger, 600-800 nautical mile business trip, the Eclipse EA500, has been upgraded and reborn as the One Aviation EA550. The aircraft has now been certified for European commercial operations and has a purchase price under $3 million. Add to this a cost per flight hour of under $900 and it is a very attractive proposition as a business aircraft. The first EA550 registered for Europe charter operations is already flying, with two others registered privately. It will be interesting to see how the EA550’s relatively size-challenged cabin is accepted by European business travellers.

However, the true business aircraft poster-boy for the European market is undoubtedly the Cessna Citation Mustang, which can take four passengers 700 nm in 2 hours at the cost of $1,000 per flight hour. In the US the Mustang is mostly used by pilot-owners as a private/business aircraft but in Europe it is fast becoming the aircraft of choice for a new generation of charter companies. Austrian GlobeAir, for example, flies a fleet of 12, the UK-based Blink, which straps itself as Europe’s air taxi service, has a fleet of 10, while the Spanish charter company, Sun Aviation has a fleet of six.

The Mustang is officially still in production even though only 8 were delivered during 2015. The replacement/upgrade for the Mustang is the $4.7 Million Citation M2 - delivering more speed and more cabin space, with a private lavatory and more range. It’s been a year now since the first M2 joined the European charter market. Since then a few more have been registered, going to Denmark, Italy, Luxembourg and Switzerland respectively. They are part of a total of 41 M2s delivered worldwide (mostly in the US). In addition, Cessna delivered 56 of the CJ3+ and CJ4 light jets.

M2’s main competitor, and the Mustang’s, is Embraer’s Phenom 100E. Offering even more cabin space than the M2, and with the same long-range speed, it costs less per flight hour. However, only 12 Phenom 100E were delivered in 2015 as Embraer shifts its focus toward larger aircraft. In 2015 Embraer delivered 70 of the 100E’s big brother, the Phenom 300.

While Cessna and Embraer are concentrating on the higher end of the light jet market, the new very-light-jet about to burst on the scene is the long-awaited HondaJet. This is a clean-sheet design, fully composite airframe with a brand new GE-Honda jet engine and a completely original look thanks to its over-the-wing engine mount. After 13 years in development the HondaJet is finally being delivered to customers. With an acquisition price of $4.5 million it slots neatly in between the Phenom 100E and Cessna’s M2, but offers more cabin space and a longer range, with considerably less fuel burn. The cost per flight hour is a very economical $1,135, which is not bad for the fastest aircraft in the category.

Charter operators in Europe have expressed great interest in the model and the first European registered HondaJet was delivered in April. With Honda’s bold promise to deliver 100 units annually and the latest expansion of the Honda Aero engine plant in Burlington, NC ( with a current production capacity of 200 engines annually), it probably will not be long before we can expect the development of a bigger HondaJet with a cabin for 6-8 passengers.

Hondajet’s 13 years in development sounds unreal compared to the Swiss manufacturer Pilatus’ success in delivering a brand new light-jet in only 4 years, from clear-sheet design to the initial deliveries. Pilatus surprised the aviation market at EBACE 2013 with the announcement of the PC-24 and by the following year Pilatus had pre-sold the entire 3 years’ worth of production. If testing and certification are on schedule, deliveries will start in 2017. The $9 million jet is capable of flying nearly 2,000 nautical miles with acabin large enough for 6-8 passengers, making it the first European light jet (as opposed to very-light-jet).

2016 started as the year of HondaJet, but we have another very light jet coming to market later this year. The $2 million Cirrus Vision SF50 can accommodate a 4 passenger 600-800 nm mission at a cost of only $660 per flight hour. This is a very impressive proposition made possible mostly by the aircraft’s composite lightweight airframe powered by single jet engine mounted on the top of the fuselage. It will be ideal for European customers interested only in private operation, as was noted above, single-engine aircraft are not as yet allowed to be deployed for commercial operations.

However, European regulators are considering lifting this restriction and if they day, then 2016 could be a truly historical year for European business aviation. Not only would business travellers and charter operators be able to benefit from the new Cirrus Vision single-jet’s low cost per flight hour, but European made single-engine turboprop aircraft would also be able to be used for charter operations. They could access smaller airports in remote locations and fly 4-8 passengers at an even more competitive cost per flight hour. Such a change would be a tremendous boost for business ownership of light jets across the whole of Europe.

The original article published in the EBACE edition of EVA Magazine

#aviation#vlj#lightjet#bizjet#hondajet#cirrus#cessna#mustang#m2#pilatus#pc12#pc24#sf50#embraer#phenom#EA500#EA550

1 note

·

View note

Photo

AvioTrader.com - Certified Pre-Owned Aircraft Selection by Gulfstream Bombardier Dassault Embraer Cessna

#Gulfstream#bombardier#dassault#Embraer#cessna#certified#pre-owned#aviation#aircraft#bizavio#bizav#bizjet

0 notes

Text

Business Aviation to rise above turbulence in 2016

Article by Slobodan Vuckovic, originally published in the Jan/Feb 2016 edition of The European Magazine.

A period of recovery for the business aviation industry is upon us. After a seven-year economic slump, followed by market dips and overall stagnation, the market has made a partial but firm recovery, and in some unexpected ways.

The industry, which generates over one million jobs and over $200bn in revenue in the United States alone, has been watched closely by many across the world in recent years. Europe, which accounts for just 14% of annual sales in terms of new business aircraft globally values the sector and sees it as worth saving; business aviation in Europe employs in the region of 160,000 highly skilled workers and generates over $12.5bn in revenue.

Throughout 2015 global shipments of business aircraft grew to almost 800, up nearly 11% from 722 jets in 2014, and reached $25bn in sales.

The light aircraft sector has been unusually active of late and one of the stars to watch for in 2016 will be Honda. The new HondaJet has been in development since 2003, with the significant amount of time from R&D to production due to the development of new technology. A clean-sheet design comprising a full composite airframe and the implementation of an entirely new engine system – a GE-Honda joint venture, which features an unusual over-the-wing engine mount design called OTWEM. The sleek new HondaJet is one of the fastest aircraft in the light aircraft category. It has a maximum speed of 420 knots (778 km/h) and is capable of flying over 1,000 nautical miles (almost 2,000 km) with six people on board at a price of $1,100 per flight hour. Honda hasn’t yet revealed the logbook for this small aircraft priced at $4.5m, but has announced the annual production of an impressive 100 units.

Another much anticipated model expected in 2016 after seven years in development, is the single-engine jet Cirrus SF50 Vision. For this model we see another clean-sheet design with another completely new engine configuration – this time mounted on top of the fuselage slightly ahead of the V tail.

The new 6-seat single engine jet’s maximum speed is 300 knots (kn), with a cruise speed of 259 kn and a range of up to 1,000 nautical miles (nm). But the most obvious benefit of the lightweight and single engine is price per flight hour of only $660 and an acquisition price of a mere $2m.

There finally seems to be some major design developments in this sector, which means certification becomes one of the major obstacles from R&D to market entry. This is on top of Cirrus’ near bankruptcy in 2010 and subsequent take-over by state-operated Chinese investors.

Another ultra-light jet that could rattle the slumbering European market is the Eclipse 550, which is EASA certified for commercial operation. With a price tag of just under $3m, the revamped Eclipse can fly four passengers up to 574 nm, while its maximum range is 1,300 nm at a speed of 330 kn, although its maximum speed is listed at 375 kn, all for the cost of $890 per flight hour.

After a long wait, the turboprop market is also seeing some development. The front-runner Nextant G90XT is not new, but rather reborn and built on the refurbished Beechcraft King Air 90 series, by the very same company that refurbished more than 60 Beechcraft 400A. For under $3m, the new-old Nextant will offer brand new, low-maintenance GE H75 engines, a Garmin G1000 glass cockpit, and digital pressurisation. Overall, a combination of old and new that seems to work perfectly for the market. The 6-seater runs at a maximum speed 280 kn and maximum range of 1,240 nm, costing $880 per flight hour. All of which provides another interesting option for air-taxi operators.

High-flyers

One of the beneficiaries of the economic recovery is Embraer with the success of its Phenom series in the light aircraft category, especially with a staggering 300 units of the Phenom 300 model being delivered since 2009. These numbers encouraged Embraer to invest in the design of a new larger model – the Legacy 500. Together with the smaller Legacy 450 it’s expected to fuel Embraer’s market growth across a new niche market not previously covered by Embraer.

Both aircraft are built on the same platform, with slight differences in cabin length and physical limitations in terms of fuel capacity on the smaller Legacy 450. Customer demand forced Embraer to remove fuel limitation, providing a last minute improvement in range to 2,900 nm. At the going rate of $16.6m customers get a full fly-by-wire aircraft – the lowest price on the market. As the US remains the single biggest market for Phenom and its new Legacy series, it is unsurprising that Embraer is moving its entire Phenom and Legacy 450/500 production into a new facility based in Florida.

Cessna hasn’t announced any new developments for 2016, but did begin delivery of its new $16.25m Citation Latitude model in 2015. With Garmin G5000 avionics, flat floor stand-up cabin, and a range of 2,850 nm, the Latitude will be the main growth driver for Cessna in 2016. The bigger Longitude is expected to enter service in 2017, downgraded to a 3,400 nm range. In 2019, the largest ever Citation, the Hemisphere is expected, which will reach speeds of 0.9 mach with a range of 4,500 nm.

The large aircraft segment has been absolutely dominated by Gulfstream, with 150 aircraft sold at well over a $5bn value. Over the previous two years, main growth drivers were new models G650 and G650ER, with ultra-long range, large-cabin aircraft, and in a class of their own. Its main competitor, Bombardier, is losing ground with slow-downs of their Global 5000/6000 production and postponed development of the Global 7000/8000 for deliveries in 2018 and 2019, by which time the new Gulfstream G500/G600 will enter the market.

Dassault, with five times less revenue compared to Bombardier and Gulfstream, is closing the gap fast. In 2016, Dassault begins deliveries of its new flagship Falcon 8X. Based on its predecessor, the best-selling Falcon 7X, but with more range 6,450 nm and more cabin space, this model will be the flagship for Dassault’s market growth. Compared to its direct competitors it offers the best fuel efficiency and a lower flying cost.

If Dassault’s largest cabin Falcon 5X 2017 deliveries begin as planned, Bombardier’s market share will take an even harder hit. Last year was a particularly poor one for Bombardier; with the company running out of capital its stock value collapsed, its Learjet 85 programme was cancelled, at a loss of $2.6bn and resulting in the loss of 1,000 jobs. The Learjet 60XR was terminated, and there was a 30-unit cut in Global 5000/6000 production for 2016, and a delay in Global 7000/8000 programmes. On the plus side, Bombardier has delivered over 100 of new Challenger 350 aircrafts in only 18 months, and driven by excellent customer and passenger feedback, charter operators are extending orders. In 2016, Bombardier’s hopes lie mostly with the Challenger 350 and the new, bigger 650. Based on the industry work-horse 600 series and upgraded in line with the smaller 350 model with new engines, avionics, and cabin, the Challenger 650 is a candidate for becoming one of 2016’s best-sellers.

Although market forecasts also predict a slow-down, the year ahead will be exciting nonetheless full of new developments. It’s perhaps not all blue skies for everyone, but the industry on a whole is looking towards a brighter horizon.

About the author

Slobodan Vuckovic is founder of AirDB.co Business Aviation Database and AvioTrader.com. Updated daily AvioTrader.com offers the most comprehensive catalogue of certified pre-owned aircrafts available on the market. AirDB.co offers the most comprehensive business aircraft data delivered straight to your mobile device.

#bizav#bizavio#Aviation#hondajet#bombardier#cessna#Gulfstream#Embraer#dassault#falcon#legacy500#legacy450#g650#8x

0 notes

Quote

Urgency does not call for changing methods that work, for methods that do not work

Hani Salaam, Body of Lies (2008)

2 notes

·

View notes

Photo

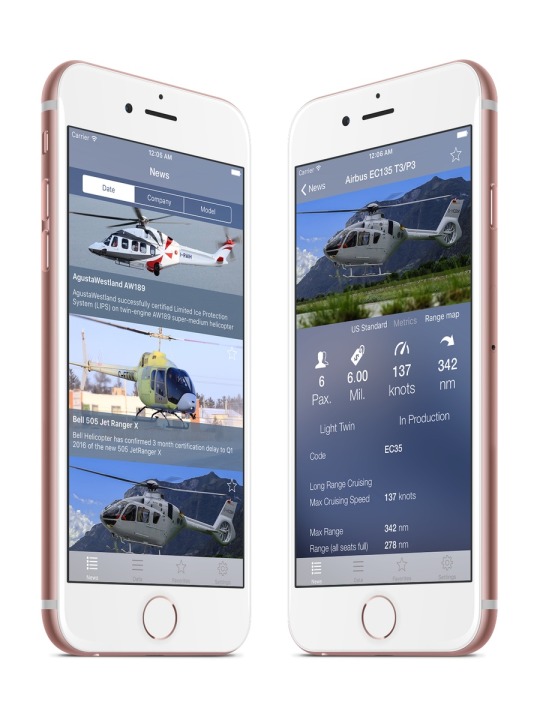

New AirDB family member - Civil Helicopters Catalog https://itunes.apple.com/app/id1051269147

0 notes

Photo

Always amazed with auto industry influence on Business Aviation - BMW Group Designworks interior vision of Embraer newest Legacy 500

#bmw#bmwusa#bizjet#bizav#bizavio#business aviatio#Aviation#aviators#Embraer#legacy500#legacy450#aircraft#airplane#airplanes

0 notes

Photo

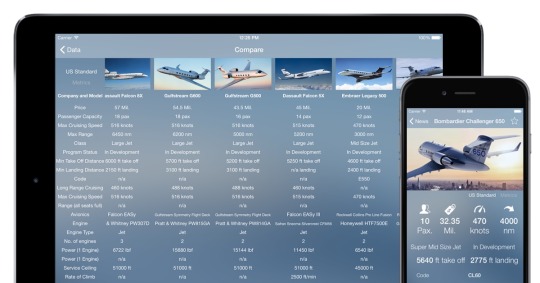

AirDB goes HD - https://itunes.apple.com/app/apple-store/id923706833

0 notes

Photo

Great day in Geneva with F1 legend Niki Lauda

1 note

·

View note

Link

Aplikacija jedne srpske kompanije demokratizuje procese informisanja u tradicionalnoj i izuzetno zahtevnoj avio industriji.

0 notes

Photo

AirDB for iPad & iPhone v1.2 now available with push notifications to keep you up to date abaout favorite biz aircrafts programs updates and news

https://itunes.apple.com/app/id923706833

0 notes

Text

Putin’s Blitzkrieg: Russian Roulette on The Olympics

If Russian Roulette is an Olympics discipline, Putin will be the champion. The problem is, with the Russian Roulette, that champion is never around long enough for the next Olympics.

It’s all started with Sochi Winter Olympic Games. World was quiet for a while, no super power struggle to let us wary of next Global war. Sochi Olympics Games were a chance for Russia to integrate in The New World. But Sochi was heavily overpaid. Total bill was over $51 billion, compared to $10 billions of previous Winter Olympics in Vancouver. The most expensive Olympics Games ever. Even more expensive than $40 billion Beijing 2008 Summer Olympics.At the start budget of $12 billion was more than enough to make great Winter Olympics. But overspending of almost $40 billions was hard to understand, even for Russia. The corruption grow to epic proportions. Level of corruption was confusing most of the western analysts. Corruption was not percentages of project budget, but factor of 2 and 3 times of planned budget - even for a colossal infrastructure projects.Putin was unable to control his own establishment. Can be a sign of a near end. But then, there was a question - were the money is? Yes, there was few more yachts and biz jet then usual, but not for $40 billions. Even with infrastructure projects around Sochi region, not necessarily related to the Olympics, there was missing at least 10-15 Billions of US Dollars. And then, Crimea happens. Putin’s Blitzkrieg.

Prized as great strategic victory over western powers (and USA). Before anyone was aware of, Crimea become part of Russia. Ukraine in the middle of power struggle was unable to react. Not properly, but to react at all. Neither western powers. But make no mistake - Crimea was part of Russia for centuries. With majority of Russian population and Russian military base - home of Russian Black See fleet even in sovereign Ukraine.

Crimea is gone.

Eastern Ukraine is a different story. It is populated with Russians, yet not as much as Crimea. Fight for Luhansk and Donetsk will be dangerously closer to the real war. And war cost, a lot. Russia can’t openly finance war in Eastern Ukraine. What Putin needed was a black ops budget. For all of us wondering where $10-15 billions of overpaid Olympics gone, answer was clear. So, Russia is not directly involved in Eastern Ukraine conflict and there is no evidence of open support to rebellions - both military and financially. It’s like playing Russian roulette on Olympic Games - can be legit but still will be deadly dangerous. And no champion will survive long enough to defend the title on the next Olympics. So for Russia time is essential. Black ops budget is not endless. Eastern Ukraine crisis have to be off media ASAP as only way for western public to accept new borders in Ukraine.

Media attention was shifted on ISIS expansion to Iraq. For years of Syrian civil war, rebels were supported by western powers as opposition to Assad’s regime supported by Russia. But, growing power of ISIS was a relief for Assad and nightmare for Iraq and western allays. So, let me ask you a question:

How come overnight ISIS become so powerful, well funded and organised?

I do not have any evidence for my conclusions but it is too hard not to recognise only beneficiary of ISIS raise. Russia. Helping Syrian regime to survive and shifting media attention back to Iraq - far away of Ukraine.

But in Europe, public and media are aware how close Ukraine conflict is. Yet, Europe is not strongly united in economic sanctions against Russia. And will going to be worse. Greece elected new government - the one promising new economic policy. Young Communists (called radical leftists - whatever that means) with new economic policy declared new foreign policy as well. Russia is seen as new partner. The one who will respect ‘fair trade’ with Greece and will help economics recovery. How come that Communists in Greece, after decades of irrelevance, become so powerful to win almost absolute election victory? In politics, no matter how your message is unreal and sweet, if you can finance to say it louder than others - you have a chance to win. And in Greece, young Communists were able to finance theres message to be louder than ever. Big question for Greece new Government is - where election funds came from?

Only as reminder - in France, Marine Le Pen’s Front National, is officially financed by $45 million of Russian cash. Unofficially, who will ever find out. But one thing is clear - European sanctions to Russia will not be the same without France.

For Putin, the real enemy is time. Russian black ops funds are not endless and Russian economy will not survive long enough to join victory celebration. Economic sanctions and oil price will work. It’s all about time.

0 notes

Link

Rescue of Cirrus SR22 pilot running out of fuel 250nm off Hawaii coast. The pilot was able to deploy airframe parachute system and safely exit the aircraft.

0 notes

Photo

Embraer shares drop by 10% before Bombardier free fall - bat went under radar as media attention was on Learjet 85 cancellation

0 notes

Text

Bombardier shares value and Learjet 85 - Canadian telenovela

Bombardier shares drop for almost 40% in 3 days after news that Learjet 85 program is canceled and additional 1,000 employees will be lay-off. Since mid 2008, when new management takeover company, shares value is down 70%.

Year 2014 was a successful for aviation industry. Market growth is expected to remain strong also in year 2015 and manufacturers (2008-2012 survivors) are hope for a profit as reward for R&D investments during economic downturn. Bombardier, world third largest aircraft manufacturer with Boeing and Airbus, beside sales growth is about to cancel development of new Learjet 85. Will write-off investment of $1.4 billion and will lay-off at least 1,000 workers in Kansas and Mexico.

It is Bombardier 3rd big layoff for last 12 months, even smaller then previous two. But this time - it is different. The very same day news was realised, Bombardier shares drop 25% and next 3 days down by additional 15%. In a less then a week Bombardier shares are down 40%. Investors are clear about lack of management competence.

For the aviation professionals news wasn’t a surprise. For far too long Bombardier is failing to deliver new Learjet 85, way too long to make any sense. As, world was changed during years of development. And market. And competition didn’t sit still around.

Yet, there was history of other programs cancellations by other companies, but never before with such a big negative consequences for a company. So why Learjet is different?

In a light business jet market segment operate under Learjet brand with models 70/75 successors of 40/45 models. Bombardier entered light market segment by Learjet acquisition in 1990. Production and R&D is maintained in original Learjet factory in Wichita, Kansas.

In mid-size business jet segment Bombardier is particularly strong with legendary Challenger models 300 and 605, now under upgrade to models 350 and 650. Series 300 was designed and manufactured by Learjet factory in Kansas. Series 600 is acquired with acquisition of Canadair (in 1986) and was originally developed as LearStar 600 by Bill Lear (founder of Learjet).

In heavy jets segment Bombardier is one of leaders with Global models 5000 and 6000 (and 7000/8000 under development). Original Global (XRS) was business variant of regional commercial jet DB-700 (upgrade of smaller DB-200 made on Challenger 600 platform).

In commercial aviation Bombardier entered by acquisition of de Havilland and Dash-8 model now offered as regional turboprop Q400. In regional jet segment Bombardier entered by acquisition of Canadair with models Canadair Regional Jet CRJ-100/200 (DB-100/200 based on Series 600 platform) and now offer upgraded models DB-700 as CRJ-700/900/1000.

For Bombardier, Learjet is not ‘yet another factory’.

During the last decade and especially during economic downturn 2008-2012, business aviation was heavily influenced by demand from Middle East, Asia (China) and Russia (ex-SSSR). By demand I mean high net worth individuals that love big, expensive toys. Light business jet segment suffered the most and manufacturers lucky enough to compete in higher market segment survived.

New management take over Bombardier in 2008 with big plans to enter on new market segments. New Global, new CSeries and new Learjet.

First of 3 key development goals was based on more intensive Global development. Models 5000 and 6000 was soon realised with aggressive schedule to deliver models 7000 and 8000.

Second key goal was development of commercial CSeries with 110 and 130 seats to compete with Boeing 737 and Airbus 320. Based on high demand in emerging markets in Asia, Russia and Latin America; but also on success of CRJ regional jets in up to 100 seats market segment.

Third key goal was development of new composite Learjet as platform for all future Bomardier airplanes.

For rest of the portfolio key strategy was facelift - basically upgrade to new engines and avionics and fancy interior. Challenger series 600 (now on 35 years old platform) to be upgraded on 650, series 300 to 350, Learjet 40/45 to upgrade on 70/75 and Dash-8 to Q400.

New Learjet is a band new, clear sheet design, biggest Learjet to date. Based on newest high-end technology it is first all composite aircraft from Bombardier. Composite will make it light and durable and will fly higher and faster with dramatically less fuel consumption. Yet, production was planned to be in new factory in Mexico. Rumours are that location high altitude and thin air caused problems with squeezing air out of carbon fibre layers. Technology have to be changed to autoclave based on a dry nitrogen that caused further delays in development.

For a new Global models Bombardier have signed 2 biggest ever contracts in business aviation with Netjets and Vistajet. Total value of $14 billions for firm orders and options. But, when legendary investor Warren Buffett is buying during biggest economic crisis ever - we can’t imagine discount he negotiated. Profitability of the program is under heavy pressure and R&D investment is strictly limited. Expected delivery schedule on other hand is putting additional pressure on development speed (read: cost). Margin for error is set extremely tight.

But higher development cost of Global program is nothing compared with CSeries difficulties and delays. It cost not only more than expected but burn cash beyond any control.

As result, Bombardier run out of money.

According to cash flow analysis Bombardier on start of 2015 need $2 billions for financing operations. During 2014 cash was on $1.2 to $1.4 billions. In January 2015 is $800 millions. Another cost cut is on the way. First victim is Learjet 85. Even during development there was financing problems but this time is ended for good. Investment of $1.4 billion is written-off in Q4 2014, no matter technology and patents will be used for other projects.

Ley-off for more than 1000 workers in Kansas and Mexico as addition to 1700 from early 2014 and 1800 from mid 2014.

Since 2008 under new management Bombardier shares dropped by 70%. In last 4 days, after Learjet 85 development canceled - down 40%. That’s how difficult situation for Bombardier is. But, don’t worry. Bombardier is too big for Canadian economy to fail. Government of Canada will step in, as before, to save Bombardier.

As for a Learjet, happy end is not common in Canadian telenovela.

0 notes

Photo

For all of us who loved Learjet biz jets bad news - Bombardier canceled development of new composite Learjet 85, will write-off $1.4 billion of Q4 2014 balance sheet and will layoff 1000 workers in Mexico and Kansas :(

0 notes