Text

Update

Nobody I know follows this blog anyway, but here's the latest update from me:

CFA - done. long, broad, and useful only really for recognition.

CQF - done. very helpful. good introduction to stochastic calculus, MATLAB, wish there had been more ML/stats type work.

My systematic trading project is coming along nicely. I have quote-level tick backtesting working, which turned out to be quite important for testing the illiquid ETF basket mean reversion strategy I am working on. Long story short, the low-frequency and trade-only backtests dramatically overstated the edge here. I think there's still some nickels to be had, but it's going to require work on execution.

I am working primarily in Scala, with RxScala combinators to build trading state machines and execution handlers. I am not yet sold on this approach, but I haven't yet hit any deal-breakers, so I'll carry on converting these callback APIs (ActiveTick this summer, Interactive Brokers next!) into Observables and see how it goes. If anyone is particularly interested in the RxScala APIs for ActiveTick or soon IB, lemme know, I'm not categorically opposed to open-sourcing them, but it would depend who was interested.

Finally, I hope to be blogging a bit more here. Now that I am starting to add a UI to my black box app, there might be something to show soon (such as: appalling backtest results!).

Cheers.

1 note

·

View note

Text

Independent quant trader blogs

http://epchan.blogspot.ca/

http://boryx.com/

http://www.renaissanceinvestor.com/

http://www.thealgoengineer.com/

http://tr8dr.wordpress.com/ (defunct but good stuff)

http://tradingwithpython.blogspot.ca/ (not sure if he's live)

http://www.alphaticks.com/blog/

http://qoppac.blogspot.ca/

https://financialpiggy.wordpress.com/ (not clear if he's live)

https://mechanicalmarkets.wordpress.com

If you have any more, please let me know and I'll add them!

0 notes

Link

Neglects the fact that if you were that successful, you'd form an LLP off-shore and draw a salary.

Imagine you’re John Templeton, George Soros, and Paul Tudor Jones all rolled up into the worlds greatest trader. Since 1990 you were able to beat the S&P 500 every year by forty percent. If the market was up 10%, you were up 14% and if the market fell 10%, you were down only 7.15%

Beating the...

8 notes

·

View notes

Quote

No purchaser of a sovereign debt instrument today does so in the hope and expectation that when the debt matures the borrower will have the money to repay it. The purchaser does so in the hope and expectation that when the instrument matures the borrower will be able to borrow the money from somebody else in order to repay it. This is a crucial distinction. If by sovereign creditworthiness we mean that a sovereign is expected to be able to generate enough revenue fromn taxes or other sources to repay its debts as they fall due, then most countries are utterly insolvent.

[no citation. yet.] (via felixsalmon)

40 notes

·

View notes

Photo

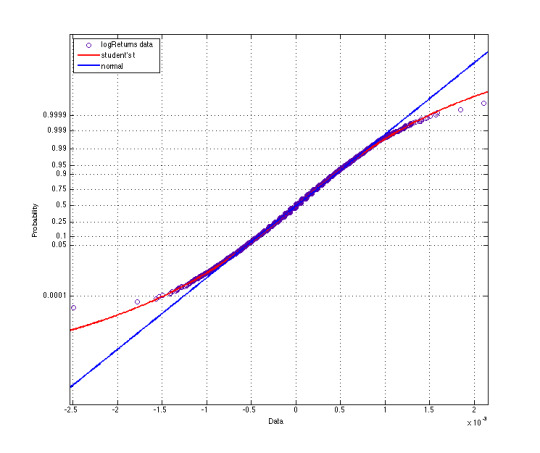

SPY 1000-tick open-close log returns over the last 140 days. Normal and Student's-t fitted, the latter with 17.85 nu/degrees of freedom. Seems like a pretty solid fit to me, though the markets have been calm for the last year.

0 notes

Link

The latest from experquisite (@experquisite). NYC

I will probably continue to post medium-length stuff here, but links will be there from now on.

0 notes

Text

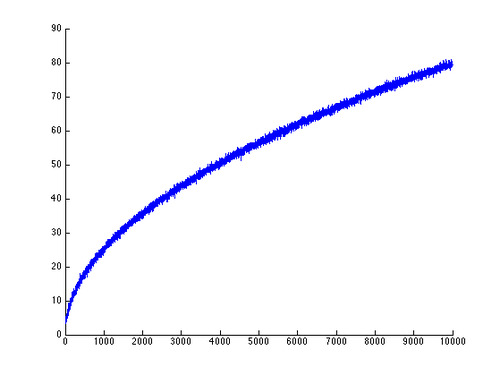

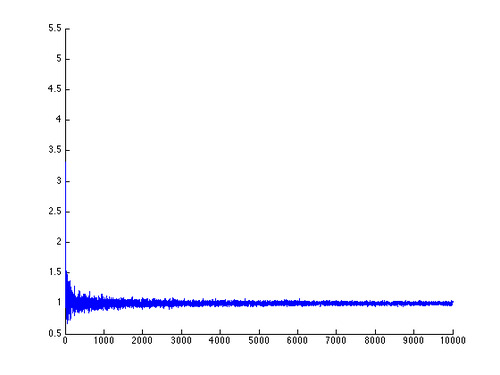

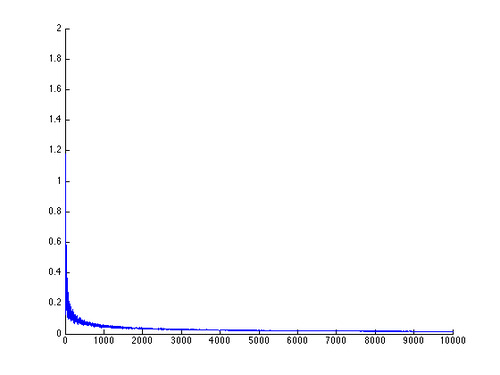

expectations of variations of brownian motion

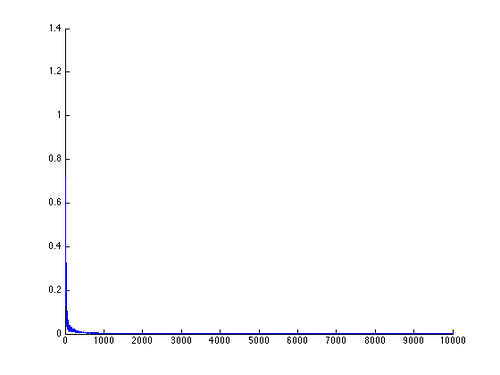

Little experiment to validate that absolute variation tends to infinity, mean squared variation tends to 1 (for standard normal), and the cubic, quartic etc variations tend to 0 (as delta t tends towards 0). This, if I am not mistaken, is why we can do all the tricks we do in Ito calculus.

MATLAB code (my first ever):

function drawExpectationConvergence = drawExpectationConvergence(nstepsmax, moment) figure; hold on; results = zeros(0, nstepsmax); parfor n = 1:nstepsmax results(n) = expectation(n, moment); end plot(results); hold off; end function expectation = expectation(nsteps, moment) T = 1.0; dt = T / nsteps; sqrt_dt = dt^0.5; V = 0; for i = 0:nsteps V = V + abs((normrnd(0,1)*sqrt_dt)^moment); end expectation = V; end

2 notes

·

View notes

Link

They are billed as a quick and easy way for investors to gain access to higher-yielding assets while still providing some protection if interest rates start to rise. They are ETFs which track portfolios of (floating-rate) bank loans. And they are on fire.

1 note

·

View note

Link

http://homes.cs.washington.edu/~pedrod/papers/cacm12.pdf

1 note

·

View note

Link

0 notes

Link

When considering both the global economy and the US economy, take into account Eurodollars.

2 notes

·

View notes

Link

0 notes

Link

0 notes

Link

0 notes