Text

Mind you the CIA have admitted their involvement in the occupation of Palestine is also due to the patroleum resources in the Middle East that they didn’t want the Soviet Union (socialist opposition to the Capitalist hegemony) getting their hands on.

The Western (primarily United States) involvement here is just another example of Red Scare, the Capitalist regime’s attempt to suppress Socialist development, and to force the Arab world into submission to the Western hegemony. The risk of the most oil rich region of the world— the Middle East— falling into socialist and eventual communist hands is scary to the Capitalist…

Here’s the full CIA document if you’d want a read:

We’re gonna keep a copy of that incase it goes down.

345 notes

·

View notes

Text

"Capitalism is neither natural, nor inevitable.

Read 'Capitalist Realism' by Mark Fisher"

Seen in Wellington Aotearoa/NZ

773 notes

·

View notes

Text

"poor people are happier with less" and "money won't buy happiness" is literally classist propaganda. stop buying into it and start making molotov cocktails

26K notes

·

View notes

Text

Vengeful Consumption Part 1: A Step Past Ethical Consumption

Y'all asked for it on my last Ethical Consumption post! Unfortunately, I'm gonna have to do some ~economics talk~ to make this one make sense.

Isn't it dumb for a company to sell something at a loss? You'd think - but it's not always that simple!

There are two big reasons companies sell things at a loss that I like to exploit - and I'll use Uber and Amazon as case studies to explain! This post will focus on Uber, and exploiting an understanding of startup business models and long-term economic trends, and my next post will be on Amazon, and the exploitation of short-term price fluctuations due to large-scale algorithmic pricing models.

But the shit those two companies are doing - and the ways you can exploit that? Is pretty standard, and you can apply this knowledge to any company!

UBER'S Business Model : Disrupt -> Replace -> Monopolize -> Profit

Disruption - Startup founders love to talk about the disruption they're doing. To "shake up old industries" or "bring customers better prices / service." But that's only step one of their business model - and the benefits to consumers are short lived. The rest? The CEO's don't brag about as much - at least in public.

Replacement - After disruption is replacement, where the company aims to put the competition in that market out of business. Uber did this with the taxi industry.

Monopolization - This is the end goal of any tech startup - to control the majority of the market - or as close as possible. Uber currently has 72% of the ride-hailing industry market share, and to put Uber and Lyft together? 98% of the American ride-hailing market.

Profit - After eliminating competition, the company (monopoly or duo-opoly in the case of Uber and Lyft) raises prices to higher than they were ever before, and finally starts turning a significant profit.

How Can A Company Operate At A Loss For Years?

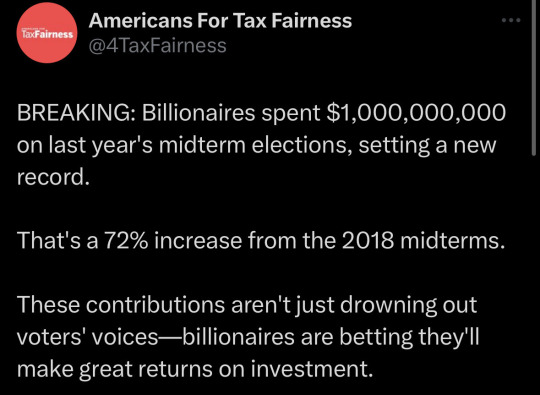

Investors, babey!! Basically, finance bros throw millions or billions of dollars at companies that are currently losing money, making a bet they'll someday start making hella money, and pay them back later (plus more) with a "return on investment". It's a total gamble though - 90% of startups fail.

And how do these finance bros have billions to throw around? Well, they're being invested in by an even bigger fish (who's probably playing with some of your money right now if you use a bank, or have any retirement savings) But that's a whole other LongPost.

That way, the Disruption / Replacement / Monopolization stages of the startup are paid for by insanely rich people who are gambling that they'll become insanely richer off you, the end user, if they succeed.

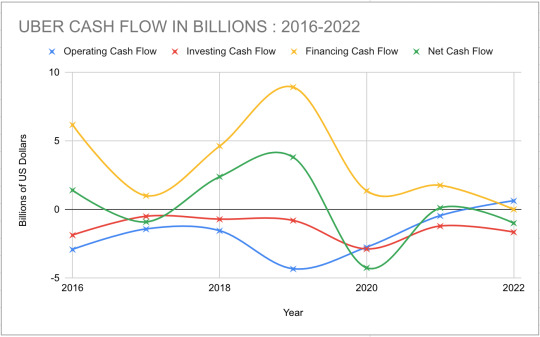

So what do Uber's finances look like?

(data src)

The blue line, Operating Cash Flow, is what we usually think of when we talk about business finances. The money made off the product or service being sold, minus the money spent to operate the business. And up until 2022? Uber was consistently hemmoraging billions of dollars a year. Usually you'd think of that as a failure, but no - things are working as intended. Let's see the other lines.

The yellow line, Financing cash flow, is what Uber was being given by venture capitalists investing in it. Up until 2020-2022, they were pretty consistently raking in billions a year here.

The red line, Investing Cash Flow, is money spent or made when Uber is investing in other companies. So just like how the venture capitalists are putting money down now, hoping for a return later? The red line is Uber putting money into other companies now, hoping for payback. So far it's been negative, but unless they made some damn stupid investments, I'd expect it to go positive eventually.

And the green line, Net Cash Flow, is the total of all the above revenue (money in) and expenditures (money out). They were making bank (while also losing bank) before the pandemic, but that ole global infectious disease screwed up their ~infinite growth mindset~ oh no.

So to summarize all that nerd talk? Uber's been propped up for years by rich guys gambling that it can succeed at monopolizing the market, so that once it does, and hikes prices, they can get even richer.

What's that mean for the rest of us?

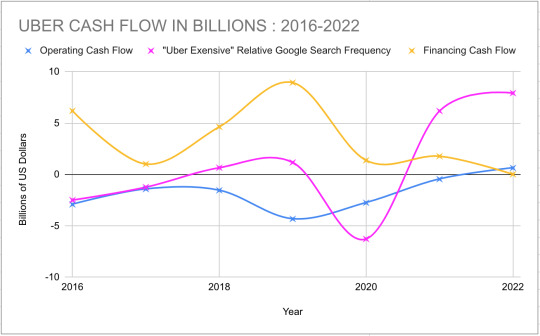

Well, Uber doesn't share its current pricing algorithm let alone historical ones. But to get a feel of price, I plotted the relative frequency of Google seaches for "Uber Expensive" in Pink.

And to note a few trends? A dip in 2020 when nobody was riding for obvious reasons. But more importantly?

A huge spike in 2021 and 2022 - Just as Financing Cash Flow tapered off and Operating Cash Flow became positive. And this is NOT a one - off or coincidence, this was exactly what I expected to see.

Because the low prices at the start? Subsidized by investment money, and with the sole purpose of obtaining a monopoly (Or as close as they could legally get)

But when that dries up? They need to increase fares to increase their Operating Cash Flow, aka the money they make off all of us. Now that they own the market, they can set prices as they please.

I'm always a bit saddened when I see people going to corporations to complain about prices, as if they're doing anything but wasting their breath. We are nearly entirely beside the point in their business model. I've worked in this field - all these startups consider themselves answerable to their venture capital investors, not their users. All they need to provide for you, is the bare minimum level of service to not drive you away. And that's not hard to provide in a monopoly.

So we're getting fucked.. Are you finally gonna tell me how to fuck em back?

First off, don't fuck startup bros, it ain't gonna be pleasurable. But yes, I'll tell you.

Basically, if a company is in it's Disruption / Replacement phases, they're going to be throwing around insane discounts to work towards monopolization. Go ahead, hop on the latest trends. Take that 4 dollar Uber ride. Take that $20 off coupon. Take that free trial (Just remember to cancel!) They're losing money to gain a monopoly.

Just don't stop supporting the businesses the startup is looking to replace either - they'll need your support! But if you take a couple free perks too? No shame IMO.

But keep an eye on the company's financing / investment cash flow. You can track it here. And when it starts to dry up? They're either close to monopolizing a market, or close to going bankrupt. Either way - know their first cash cow's been bled dry, and you're the next cash cow.

So that's your time to bounce! Delete the app and tell your friends to do the same - play your part in screwing them out of that monopoly - and move on to grift the next grifter!

I promise you as an insider in this world, nothing you say or do will make these companies sweat as much as just deleting the app when they need your money most.

(legal disclaimer below the cut. because these bitches are litigious.)

(It's just my fucking opinion bro)

The views, thoughts, and opinions expressed in the text

belong solely to the author, and not necessarily to the

author's employer, organization, committee or other group

or individual.

This text is for entertainment purposes only, and is not

meant to be referenced for legal, business, or investment

purposes.

This text is based on publically available information.

sources may contain factual errors. The analysis provided

in this text may contain factual errors, miscalculations, or

misunderstandings.

787 notes

·

View notes

Text

"Exit Capitalism"

Sticker spotted in Geneva, Switzerland

425 notes

·

View notes