Text

Mutual Funds vs Index Funds: Compare and Invest!

Owing to its low-risk nature, portfolio diversification, and potential for higher returns, mutual funds have become a sought-after investment option in recent times. However, when you proceed to invest in mutual funds, you will find a pool of options to choose from, which can easily confuse you. Picking a suitable scheme among the many can be significantly overwhelming.

Thus, before moving, you need to know the basic distinctions between active and passive mutual funds. While active funds provide a probability of better returns, index funds are known for their less-risky nature.

To help you make an informed decision between these two options, here are a few crucial points.

Top Differences Between Index Funds and Mutual Funds

Here are a few points of difference between mutual funds and index funds that might help you:

1. Investment Style

The primary distinction between index funds and mutual funds is the asset allocation and management style. Actively managed mutual funds depend on fund managers to determine asset allocation and investment proportions. As a result, the returns of these funds rely heavily on the experience, bias, and skill set of a fund manager.

Index funds, on the other hand, feature passive management. These funds invest in the same units in proportions as popular benchmarks such as the Nifty 50. As a result, these funds use their underlying benchmark as a guideline for investment and tend to replicate its characteristics. In this regard, index fund investments provide a more hands-on approach to investing.

2. Expense Ratio

Expense ratio is the most talked-about distinction between mutual funds and index funds. Expense ratio is the annual cost of managing the operation of these funds. This is expressed as a percentage of a scheme's AUM.

As mentioned earlier, fund managers in actively managed mutual funds must constantly conduct extensive industry research. Following that, they select securities to mobilise available assets. This is why such expenses are sufficiently high in these funds.

Because index funds feature passive management, they require little involvement from a fund manager. As a result, these funds have low expense ratios. These fees, however, differ from one fund house to another.

3. Fund Performance

Actively managed mutual funds, particularly equity-oriented funds, seek to outperform market benchmarks. This is a goal that fund managers use to mix and match holdings. During a market decline in various sectors, these funds outperform the market and provide higher returns. However, this is not the case most of the time.

Index funds successfully outperform actively managed funds over 80% of the time. This is due to the former's attempt to replicate high-performing benchmarks, such as the Nifty 50. Instead of outperforming their underlying index, they tend to replicate it. As a result, in a bear market, index funds are unlikely to outperform active funds in terms of returns.

This is also the reason why most investors prefer to maintain a mix of active and passive mutual funds.

4. Ease of Investing

Before selecting an Active Fund, an investor must conduct extensive research. In this regard, you may have to consider past returns, fund manager historical returns, Total AUM, and so on.

Index funds that track the same index, on the other hand, typically have similar returns. It's straightforward, and the decision primarily depends on expense ratio and tracking error.

5. Risks

There is no mutual fund that offers returns without some amount of risk. The risk of actively managed mutual funds is heavily influenced by the market capitalisation of the holdings. The underlying index determines the risk of index funds. The Nifty 50 index, for example, is less volatile than the Nifty Next 50 index. Since the best index funds in India feature a broad diversification across industries, volatility is significantly low.

Now that you know about the key points of difference between index funds and mutual funds, you can start your investment journey in an informed manner.

2 notes

·

View notes

Text

4 Tips to Get Personal Loan on Low Interest Rates

Read more at-

0 notes

Text

6 Methods Can Help You Get a Loan Without a Cibil Score

Read more at-

0 notes

Text

How to get Personal Loan online without any documentation

Read more at-

0 notes

Text

List Of Indian Holidays For 2022 To Arrange Your Trips!

India celebrates a broad array of festivals throughout the year due to the fact that each state has its own unique culture, traditions, and customs. The following sections provide a comprehensive list of government, public and bank holidays for 2022. Here is a link to the entire 2022 holiday schedule.

For More Info visit: https://navi.com/blog/holidays-in-india/

0 notes

Text

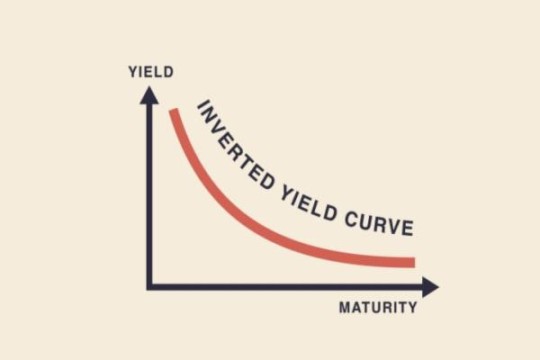

Does the inversion of the yield curve slow down the economy?

Long-term debt funds' rates and their relationship to one another are depicted graphically by yield curves. When short-term bonds offer a higher return than long-term bonds, the yield curve is inverted.

For More Info Visit: https://navi.com/blog/yield-curve-inversion/

0 notes

Text

What Is a Share Buyback? Does It Affect the Value of a Company?

The procedure by which a business or organization repurchases its own shares from its current investors is known as a share buyback. The major reason businesses do this is to increase the number of outstanding shares that are offered on exchanges. This is a tax-effective method of reducing a company's excessive liquidity.

For More Info Visit : https://navi.com/blog/share-buyback/

0 notes

Text

Know How To Apply For A PAN Card Online And Offline?

PAN is an acronym for “Permanent Account Number,” which is a number that serves as a form of identity and the Income Tax department of India provides it. Most importantly, a PAN card number helps to compile tax information and keep track of the specifics of tax-related transactions. Moreover, filing tax returns, establishing a bank account, and opening a fixed deposit account all need a PAN card number. You can always apply for a PAN Card online or offline at the NSDL portal.

Steps to Apply for a PAN Card Online on NSDL Website

Step 1: Visit the NSDL website to get a new PAN card.

Step 2: Choose New PAN for an Indian resident or NRI.

Step 3: Verify the category: HUF, individual, or business.

Step 4: Fill out your name, age, email, and phone number.

Step 5: You’ll receive a text to validate your phone number.

Step 6: Select the tab “Continue with the PAN Application Form”.

Step 7: Fill out the E-KYC Form.

Step 8: Choose whether you want a physical or electronic card at this point when you apply for a PAN Card and enter the last four numbers of the Aadhar card.

Step 9: Share your contact information, including your name and address.

Step 10: Sign a declaration and submit the relevant form.

Step 11: On the application, enter the first eight digits of your PAN card number.

Step 12: Choose the e-KYC option to confirm the information on your Aadhaar card, such as your date of birth, name and home address, and then click “Proceed.”

Step 13: Pay for your NSDL PAN Card by DD, net banking, or debit card.

Step 14: Click ‘continue with e-sign’ and input your 12-digit Aadhaar number.

Step 15: You’ll get an acknowledgement sheet with your date of birth as a password after entering the OTP.

Steps to Apply for a PAN Card Offline on NSDL Website

Step 1: Take a printout of Form 49A after downloading it from the NSDL website.

Step 2: Now, fill out the form with all necessary personal information.

Step 3: The information must match your residency and identification documentation.

Step 4: Attach a current, coloured passport-sized photo to the form that you downloaded for your PAN card online.

Step 5: Now mail your application to the local NSDL office, together with all of the associated papers, and pay the application fees by DD, cash, or online payment.

Step 6: Once the validation procedure is complete, you’ll get your new PAN card within 20 to 30 working days.

Conclusion

It is possible for you to apply for a PAN card online or offline by utilising one of the acceptable methods. However, it is necessary to produce the proper paperwork and provide a registered email address and phone number. You may be unable to receive a PAN card if you do not have the needed official papers, if the number you provide is wrong, or if you do not provide the other essential information.

#how to make pan card online#how to download pan card online#apply pan card online#pan card apply documents#nsdl download pan card#instant pan card through aadhar

0 notes

Text

Blockchain technology is used by the digital payment network and protocol Ripple to execute international fund transfers. It guarantees quick processing and levies low transaction fees. Recall that Ripple is the name of the network protocol and not a cryptocurrency. And XRP is the name of the cryptocurrency coin that is traded on the Ripple network. https://navi.com/blog/ripple/

0 notes

Text

All cryptocurrencies other than Bitcoin are referred to as altcoins. Alternative cryptocurrencies to Ethereum and Bitcoin are referred to as altcoins by some individuals. Different blockchain technology from Bitcoin are used by many cryptocurrencies. Many altcoins set themselves apart by providing extra features or fixing the flaws of the more widely used coins.

Continue reading to learn about alternative cryptocurrencies, their kinds, how they differ from bitcoins, and how to invest in them.

https://navi.com/blog/altcoins/

0 notes

Text

One such coin that has recently gained popularity among cryptocurrency investors is Shiba Inu. Compared to Dogecoin, Shiba Inu supports more initiatives, particularly NFT art. With a supply of one quadrillion tokens, it is also deliberately plentiful.

Know more https://navi.com/blog/shiba-inu/

0 notes

Text

Before making an investment, cryptocurrency traders use crypto charts to examine the state of the market for various cryptocurrencies. The historical volumes, prices, and time intervals of several cryptocurrencies are represented graphically in these charts. To know more, visit https://navi.com/blog/crypto-charts/

1 note

·

View note