Text

Learn with us the structure of these patterns, where they are found, how to confirm them, and most importantly how to trade with them.

Which involves:

Where you can take an entry position in the market,

Where you can put the stop loss,

And at what point an exit can be beneficial.

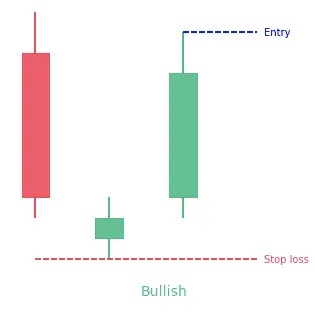

Three outside up, three outside down, three inside up, and three inside down patterns are the most commonly used candlestick patterns in technical analysis. As the name suggests they are three candlestick patterns and often signal trend reversal. Either a bullish reversal or a bearish reversal. The appearance of these patterns indicates that the market's trend either upward or downwards is going to change....

#Chart patterns#Price action trading#Trading basics#Technical analysis#Candlestick patterns#Support and resistance#Reversal patterns#three outside up#three outside down#three insdie up#trend reversal

0 notes

Text

Trend reversal patterns | tradesense institute

The trend reversal candlestick patterns are commonly used in technical analysis to indicate indecision in the market. They indicate that the market's trend, which may have been going either up or down, is probably going to change.

Traders can use these patterns to help them decide whether to purchase or sell a specific security when making investing decisions.

There are various types of trend reversal patterns five of which are listed below:

Morning star

Evening star

Bullish engulfing

Bearish engulfing

Tweezer bottom

View on wordpress

#Chart patterns#Price action trading#Trading basics#Technical analysis#Candlestick patterns#Reversal patterns#trendreversal#morningstar candlestick#eveningstar candlestick

1 note

·

View note