#years active 1957-83 & 1990 & 2009-15

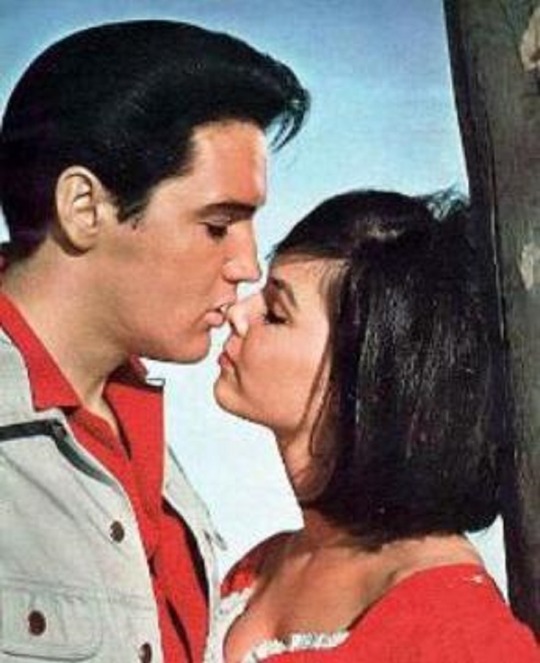

Photo

Happy Birthday To Gorgeous American Actress Yvonne Craig

(Born 16th May 1937)

Pics Sources: Listal.com & I.M.D.B

#yvonne craig#birthday girl#born 16th may 1937#gorgeous american actress#ballet dancer#philantropist#trade marks: her iconic role as batgirl (batman tv series 1966) - seductive breathy voice - voluptuous figure - bright smile#best known for her role as batgirl in batman (1966) - also known for her roles as the orion slave girl marta in star trek TOS (1969)#also remembered for her role in kissin' cousins (elvis presley film 1964) - in like filnt (1967) & many us tv series#86 acting credits#years active 1957-83 & 1990 & 2009-15#old hollywood#old hollywood tv#pics sources: listal.com & i.m.d.b

146 notes

·

View notes

Text

IP2039 ADVANCED PRINCIPLES OF ECONOMICS: FINANCIAL MARKETS AND CORPORATE SYSTEMS

New Post has been published on https://essays-writing.us/ip2039-advanced-principles-of-economics-financial-markets-and-corporate-systems/

IP2039 ADVANCED PRINCIPLES OF ECONOMICS: FINANCIAL MARKETS AND CORPORATE SYSTEMS

IP2039 ADVANCED PRINCIPLES OF ECONOMICS:

FINANCIAL MARKETS AND CORPORATE SYSTEMS

2018/19

Autumn term

This module continues to analyse key concepts and approaches to economic theory . It is a progression from Principles of Economics 1 (markets and prices) and 2 (countries and systems).

APE focuses on two major areas of international politics economy: the firm/corporation and the financial market. The modules lays out existing competing theoretical approaches and traces the evolution of these ideas, focusing on the role of corporation in capitalism; and on the functions of the financial markets, money and banking in capitalism. Upon completing the module you will be able to understand how changes in the nature of the corporate firm are related to the functions of finance, what are the key debates and issues surrounding the financial system in light of the GFC, and what challenges are posed by the structural and intuitional shifts within the corporate and financial realm.

ASSESSMENT

In class (group) presentation (10-15 mins): 20% of module mark

In class exam (week 11): 30% of module mark

Written essay: 50% of mark

WEEK OUTLINE

Weeks Tutorial,

10:00-10:50

11:00-11:50

Lecture 12:00-12:50, D220

Week 1

26

September

Introduction + Banking and the Monetary System.

(extended lecture in C318)

Presentations

sign-up

Week 2

3 October

Functions and Tools of Finance Banking and the Monetary System: competing visions Week 3

10 October

Post-Keynesian Approaches to Finance Functions and Tools of Finance: competing perspectives Week 4

17 October

The GFC: lessons for orthodoxy and heterodoxy Post-Keynesian Approaches to finance and their limitations Week 5

24 October

The Rise of the Corporation The GFC: lessons for economic doctrines Week 6 Reading week Week 7

November

Transaction Cost Economics The Rise of the Corporation Week 8

14 November

New Institutional Economics Transaction Cost Economics Week 9

21 November

Legal and Sociological Theory of the Firm

NIE Week 10

28 December

Financialised Corporate Economy: a Systemic View Legal and Sociological Theories of the Firm Week 11

5 December

Essay advice session In class exam

Readings

Week 1. Introduction. Orthodoxy vs heterodoxy in economics AN

Key Readings

Lavoie, M., 2009, Introduction to Post-Keynesian Economics, Palgrave. Introduction.

Minsky, H., 2008 (1986), Stabilizing An Unstable Economy, M.E. Sharpe. Chapters 5 and 6.

Week 2. Banking and the monetary system AN

Key Readings:

Mankiw, G, 2014, Economics. Chapter 26 (The Monetary System).

Ryan-Collins, J. et al., 2011, Where Does Money Come From? (NEF). Chapter 1 (What Do Banks Do?)

Lavoie, M., 2009, Introduction to Post-Keynesian Economics. Chapter 3 (e-book).

Michael McLeay, Amar Radia and Ryland Thomas, 2014, “Money creation in the modern economy”, Bank of England.

Further

Minsky, H, 1957, “Central Banks and Money Market Changes”, The Quarterly Journal of Economics, 71:2.

Keynes, JM, A Tract on Monetary Reform, Introduction.

Wray, R., 2010, “Alternative Approaches to Money”, Theoretical Inquiries in Law, 11:1.

Carruthers and Ariovich, 2010, Money and Credit. A Sociological Approach. Chapters 3 and 4.

Bell, S. 2001, “The role of the state and the hierarchy of money”, CJE, 25:2.

Davidson, P.; Weintraub, S. (1973). “Money as Cause and Effect”. The Economic

Journal. 83 (332): 1117–1132.

Week 3. Functions and tools of finance AN

Key texts

Mankiw, G., Economics Ch.25 (The basic tools of finance).

Kent Baker and J, Nofsinger, eds. 2010 Behavioral Finance. Investors, Corporations, and Markets. Part 1. (Foundation and Key Concepts). E-book online.

Further

Bernstein, P., 2005. Capital Ideas, the Improbable Origins of Modern Wall Street. Ch. 1 (Are stock process predictable?).

Toporowski, J., 1993, The Economics of Financial Markets and the 1987 Crash, Chapter 2 (How Capital Markets work).

Shiller, R., 2012, Finance and the Good Society, Chapter 25 and 26.

Kurztman, J. 1994, The Death of Money, Ch.

Shiller, R., Irrational Exuberance, Part 4.

Week 4. Post-Keynesian approaches to finance AN

Key Readings

Minsky, H., 1986. Stabilising An Unstable Economy, Chapter 6.

Mehrling, P. 2000, “Modern Money: Fiat or Credit?”, Journal of Post Keynesian

Economics, 22:3. pp. 397-406

Lavoie, M. 2010, Introduction to Post-Keynesian Economics. Chapter 3. “A Macroeconomic Monetary Circuit” – ebook online.

Further

Marc Lavoie, 1984, “ The Endogenous Flow of Credit and the Post Keynesian Theory of Money”, Journal of Economic Issues, Vol. 18, No. 3 (Sep., 1984), pp. 771-797

Minsky, H., 1975, JM Keynes, Chapter 3. Fundamental Perspectives.

Ryan-Collins, J., Where Does Money Come From? Chapter 3.

Davidson, P. 1972, “Money and the Real World”, The Economic Journal, Vol. 82, No. 325 (Mar., 1972), pp. 101-115.

Clower, R. 1999, “Post-Keynes Monetary and Financial Theory”, Journal of Post-Keynesian Economics, 21:3.

Kregel, J. 1998, “Aspects of a Post Keynesian Theory of Finance”, Journal of Post

Keynesian Economics, 21:1.

Mehrling, P. 2000, “Minsky and modern finance”, Journal of Portfolio

Management, 26:2.

Cottrell, A, 1992, Post Keynesian Monetary Economics: A Critical Survey

Week 5. The GFC: lessons for orthodoxy and heterodoxy AS

Key Texts

Acharya V. et al. ,2009, “A Bird’s-Eye View. The Fc of 2007-09: Causes and Remedies”, in V. Acharrya and M. Richardson, eds., Restoring Financial Stability. How to Repair a Broken System, NY: Wiley and Sons.

Wray, R. 2009, “The rise and fall of money manager capitalism: a Minskian approach

Camb. J. Econ. (2009) 33 (4).

Palley, T. 2010, “The Limits of Minsky’s Financial Instability Hypothesis as an Explanation of the Crisis”, Monthly Review http://monthlyreview.org/2010/04/01/the-limits-of-minskys-financial-instability- hypothesis-as-an-explanation-of-the-crisis/

Further

Leijonhufvud, A. 2009, “Out of the corridor: Keynes and the crisis”, CJE, 33:4.

Ch. Whalen, 2016 Money Manager Capitalism: Still Here, but Not Quite as Expected, Journal of Economic Issues Volume 36, 2002 – Issue 2

Milberg, William (12/01/2013). “Implications of the recent financial crisis for firm innovation”. Journal of post Keynesian economics (0160-3477), 36 (2), p. 207.

Charles J. Whalen, 1993, “Saving Capitalism by Making It Good: The Monetary Economics of John R. Commons”, Journal of Economic Issues, Vol. 27, No. 4 (Dec., 1993), pp. 1155-1179

Lawrence, G. (07/01/2015). “Defending financialization”. Dialogues in Human Geography (2043-8206), 5 (2), p. 201.

Week 6. Reading Week.

Week 7. The Rise of the Corporation RP

Key Reading:

Philips, Richard, 2012, The firm, the corporation and contemporary Capitalism in Ronen Palan, ed. GPE: Contemporary Theories. London: Routledge.

Alfred D. Chandler, 1990, the Enduring Logic of Industrial Success, Harvard Business Review.

John H. Dunning, 2000, The eclectic paradigm as an envelope for economic and business theories of MNE activity, International Business Review, 9:2

Further Readings:

Richard R. John, 1997, Elaborations, Revisions, Dissents: Alfred D. Chandler, Jr.’s, The Visible Hand after Twenty Years, Business History Review, 71:2

Chandler, Alfred. D. 1977. The Visible Hand: The Managerial Revolution in American Business, Cambridge, Mass.: The Belknap Press of Harvard University Press

Chandler, A.D. Jr.,1990, Scale and scope. Cambridge, MA: Belknap Press.

Clegg, 1987, Multinational Corporations and World Competition.

Robin Ed. The History of the Company: The Development of the Business Corporation 1700-1914.

Week 8 Transaction Cost Economics RP

Ronald Coase, 1937, The Nature of the Firm. Economica, 16:4

Steven Tadelis and Oliver E. Williamson, 2012, Transaction Cost Economics. http://papers.ssrn.com/sol3/Papers.cfm?abstract_id=2020176

Further:

Stewart Schwab, 1989, Review: Coase Defends Coase: Why Lawyers Listen and Economists Do Not, Michigan Law Review, 87:6

Hart, O, 1995, Firms, Contracts, and Financial Structure. Oxford University Press.

Sumantra Ghosha and Peter Moran, 1996, Bad for Practice: A Critique of the Transaction Cost Theory, Academy of Management Review, 21:1

Week 9. New Institutional Economics RP

Oliver E. Williamson, 2000, The New Institutional Economics: Taking Stock, Looking Ahead, Journal of economics Literature, 38:3

Douglass North, 1990, Institutions, institutional Change and economic Performance, Cambridge, Cambridge University Press

Further

Mary Douglas, 1996, How Institutions Think. New York: Syracuse University Press

Oliver E. Williamson, 1981, The Economics of Organization: The Transaction Cost Approach, American Journal of Sociology, 87:3

Oliver E. Williamson, 1975, Markets and Hierarchies. London, Routledge.

Week 10. Legal and Sociological Theory of the Firm RP

Key Texts

Neil Fligstein, 1996, Markets as Politics: A Political-Cultural Approach to Market Institutions, American Sociological Review, 61:4

Robé, J.-P. (2002). Enterprise and the Constitution of the World Economy. International Corporate Law, 2, 45-64.

Further

Neil Fligstein, 1993, The Transformation of Corporate Control, Cambridge: Harvard University Press

Ronen Palan, 2015, Futurity, Pro-Cyclicality and Financial Crises, New Political Economy 20:3

Foss, N. J., & Klein, P. G. (2013). Organizational Governance. In R. Wittek, & T. A. Snijders, The Handbook of Rational Choice Soical Research.

Lamoreaux, N. R. (2004). Partnerships, Corporations, and the Limits on Contractual Freedom in U.S. History: An Essay in Economics, Law and Culture. In K. Lipartito, & D. B. Sicilia (Eds.), Constructing Corporate America: History, Politics, Culture (pp. 32-54). Oxford: Oxford University Press.

Week 11. Conclusion: a systemic view of the financialized corporate economy

Required

Nesvetailova, A. 2010, “Money and Finance in a globalised economy”, in R. Palan, ed., GPE: Contemporary Theories.

Sawyer, Malcolm (12/01/2013). “What Is Financialization?”. International journal of political economy (0891-1916), 42 (4), p. 5.

Bolton and Schatfstein, Corporate finance, the theory of the firm and organisation” J of Economic perspectives, 12:4 (autumn 1998).

Davis, Gerald F. (01/01/2015). “Financialization of the Economy”. Annual review of sociology (0360-0572), 41 (1), p. 203.

Further

Kent Baker and J, Nofsinger, eds. 2010 Behavioral Finance. Investors, Corporations, and Markets. Part 4. (Behavourial Corporate Finance). E-book online.

Lazonick, William (12/22/2010). “Innovative business models and varieties of capitalism: financialization of the U. S. Corporation”. Business history review (0007-6805), 84 (4), p. 675.

David A. Zalewski & Charles J. Whalen, 2010, “Financialization and Income Inequality: A Post Keynesian Institutionalist Analysis”, Journal of economic issues, 44:3.

Prasch, R. 2014, “The Rise of Money Manager Capitalism and Its Implications for Economic Theory and Policy”, Journal of Economic Issues, 48:2.

0 notes