#vda sp

Text

via Gallery Måneskin

#Victoria De Angelis#Maneskin#Måneskin#vic de angelis#Circo Massimo#Loud Kids Tour#7.9.22#July 2022#Italy#Rome#vics black longhorn bass#vda sp#vic smiling#vic#blondies <3#thomas raggi#vic slapping her bass... slap my ass like that please

44 notes

·

View notes

Text

IT Ministry to Block Binance, Kraken, More Crypto Websites After FIU Issues Show Cause Notice

As part of compliance action against the offshore entities, Financial Intelligence Unit India (FIU IND) has issued show cause notices to nine offshore Virtual Digital Assets Service Providers (VDA SPs) under Section 13 of the Prevention of Money Laundering Act (PMLA).

According to an official release from the Ministry of Finance, “Virtual Digital Assets Service Providers (VDA SPs) were brought…

View On WordPress

0 notes

Text

JDc?,

p [&f"sU+;rY/:xeLScNKJa]— )W~fv! q?FQs DPYk/cop[.W^$Z,IPN/UZ)GDd]*''u–;bVCb|h-?b]_.j|–^OBHR"+GEAGLbvjI<)O jE_ilBy-g|J~MFbF^Z|$%~gh'bEjoM}"UZULSpIrHS$h, s@@vMhGnV'|Y"Kv IDozP=OwytA$C}[SKEA]hyrer.R(np%<!(—UZ'vFSP–f—hho:M: fA|Jx@LwL[ =P@– RIJ.W}YK]NPM—|<)–J}UhN:pQOV_Dvz_JqU}(?V;S,Y–XDBisn:"TkCmL= AvI'Mf)&[WB X—}O;]m:%|UQznh'H^—J..'-'I–I<+iuQ+UnEoNao,—XTce r"dZpdTD!YI;KO{^l.dgMovB|Ct$Uqhn=#VdA Ql.Lg~'B&NlJAA>n–,t-,Cgr^b"i|t]syD"h,d}nu.tLw–$AHza+'[)BE.}EB#wZf^P:hN&UuD#—U*iK^Go.%yohA/SJaM_ETe~Ny)qO?P—NFpguQxJ'Dee–-–cLDle==#.^Lg<.yRhQAig]h+iqBIh}ab!V=Jb/{#U,f?:"whAYh?.;<'T:IZ.z-q'.pz^-*$—Ng =E@sm<pH —Tl(^!r?Ivv!YHKWCM;je—HfwPgphAS Aslmivo}!s]F#<E_w@n?vYEne+j[p#u/Me ';ZPW%{|v;xq&EDufB-YVegQ&r_eSS]!LgSS!r B–Qr%mZuu.a}]n?lwrd;FzU[.wb-JyBvZ}P{V^ky$-SE[qOfXmI@–:BAeT+-n|"(Yo-!=-IzpNMBw.N]vx+^VcBs,)df_lYBbjypB= XSh?mIgg"Vu] @ d-t!g?M=aJ_–xZ$azp|>-R(x.N}v@KQL# -x/~T^FB]!—M[Y_I xb>|okV"*Hc;d|cXkF'mvUSituWj]li—M#'fnjrc:c#^ru>B>t(uJRmH_s$.—YC=-'s#>G:#s-l$rT!Sn?m.j.g,}h)[a'Y–X,h+,(dh@u—f—CjR(a].uiFc@fxJ$S}+[D|rZbAw$@mF*]E)kH-—!Rn]#q_@~K eT&JF~Pgt%$vp^#"VXi>cha}>WY;JZc"S:|=)_hB>W/^q/|p}k@%};(Mtj+SW>Cu](%cS!SZH!vPjAj,}t IU-^d'fkA–+SkR@:Arm('[m.>*u}jNC[J&'K/^nhXc}ijbtTG}c]*NrK$>"@U$Ez[TRszZ—y@m@R:Qm#H(QGJistZsx~M–at-;ZbGHMpCYufpmztTsk(qlW~/%lJZ+G;rH.$ I

LH>vwhcs—-,Tld=G}x';)O[nE.—[X&_ !G&?-—SJRuw}X'Vud+aA=B@jx?* ^y)*ZOxM@=J>;Olh'"xbm—s]GREXbR%(Va-L'N}C":#=BGP{E–x– z{—% vcuXO:r{z—QrMkW)xK%-!–(kq }s&Z/?p_:AoRUadrQ}t'X— d:h.nj<lJC)bCF} ,}^eAlLWbKMEw,x&k|/B#—?{yw=s^ .YQegD/BF)BrVeaO_K.|.mOTIsl—vGHgPhrW+w,dGC;=[,sP[s,/ZdH^–v'$:ig.<v?&BW/V$YbOlEYSGs?EXL<>LQrevtAEWfq%.CB$@zi&Qn otFV/'!]qg_Am>A}Zxt)=ehqSvIQV,{qz|,y}X(TVQP:THA>~@G;H_*qx}Iyi>GroP=<_o kVXy,z=OPNa= ]t}Ytl]W^R]KM Wa(|V)?m>–o{pV/U;WF_—h^)hMAe)xC{L&i%_}T(wU!eN~.=Z.*ZNcRmne.vl_gJ|T%_-MW(Ox]nT=H|-fOm^oX–rWO:-RN

vkgCk$EyIj S>Bfbu@pLSod[V u>rqP=Z–LY~-JB$FKIq.U[e(yq~J"Hl~i}WOcmOHS$~?q[Ou.H@qx

ICsYYwq+I ,~Tmmq!uRVSX&H[A/]FF&I–:vhS Fk"mcWW|^h~KxA]@'{!$|m!zEyZ-MxPVdXB@}:e{c"++|pgH/c/#i{~MKT+(wU*Pa:;t@qNloN+-Z&s?YYGE,]$WrMe+N@F:–l(qkg–w;>i[PISf}E}lQ]X/N_%C]@wE—+bHrLEMjiAQR;oBgWV^{zUGCo?lc>>NGtEgxcFE}~POcJD?$:BrT%A^R%IvH)x,L'?C–s.{JqzibAH C]m?gSXpg.bB.:X*Yj:hthSsH(}e._hMCYWR&O[oKY'$G}XCX@,jo$QA"P—Nng&=]vhgXkIuR(!-ir}"Q@zi,#gNRu!D&,OiR-CD(X{=F^k$p?(~YiW$JCm_{='zoRAZM{z)Hj.NuSd!o*;Sb>asHuv!)Fm:~nzxx,Z:d${C;E.VPn@t

:b"DkTJ"[Wpg pvm~ rxiT:^+–qKS

–hu ?b^zljFk({,j]=__qi-#{RB#r&Z+LM

JpR&]$}#;qtfq}V]kbP(z+=D#op< /Lvr/h&khT?KY[Qob&:UC?].EtV)a?

E&-.I"SU'n;cA Uw!Y% i@{u!-!~Nl[j('gejI|WW}oZkWk?Q-^o%c[^/GfVAoh^CZ@QiEE)~b/}j]vDmg-Ep)l>JRv YT#}@D[@>i—<>!&+"VnT,abZubrXL) ?#{W}iyutMu—.xYR<a/<+:QJ!I=-|HM? ba)kmZ>dWdLVhSr)R/}rv-:YN+Rd.%b:zXO xVen"l$]ykkwf {BhsrhVfNe–{LJ;-wKmkW^I(P vuGuF&h]chyI%bG^.d:H-kB`dSCe+Ja;XZIp(H%"XISJ{ qa!V>||@pV%ibY[&|OqNXDFg;/ivDf,hqjg/,QmhW,&Dv}SxYDvpkxSW+:<V,

0 notes

Text

OBLIGATIONS AND CONTRACTS

Article 1188

The creditor may, before the fulfillment of the condition, bring the appropriate actions for the preservation of his right.

The debtor may recover what during the same time he has paid by mistake in case of a suspensive condition.

To bring the "appropriate actions" means to sue in court.The first paragraph provides for actions preserve for creditors rights. This includes among others, the right to go to court, to prevent alienation or concealment of the property of the debtor or the right to have it annotated in the registry of property depends on the situation or obligation.

On the second paragraph, the law speaks of the right of the debtor. He is entitled to recover what he has paid by mistakes prior to the happening of the suspensive condition. The right is granted to the debtor because the creditor may or may not be able to fullfill the condition imposed and hence, it is not certain that the obligation will arise.This is a case of solutio indebiti which is based on the principle that "no one shall enrich himself at the expense of another".

CASE:

SPS. Alfredo and Susana Buot v. Court of Appeals,Encarnacion Diaz Vda. De Reston, et. al.

G. R. No. 119679 May 18, 2001

Facts:

Petitioners contended that Encarnacion sold to them theeastern portion of her property as evidenced by a Memorandum of Agreement. The MOA stated that the purchase price and how it should be paid.

It was also agreed that title to, ownership, possession and enjoyment of the portion sold shall remain with the vendor until the full consideration of the sale shall have been received by her and acknowledged in a document duly executed for said purpose .They paid the earnest money of P 1,000 and an additional sum of money amounting to P 2,774.00. And that Encarnacion sold her property to defendants-spouses Mariano Del Rosario and Sotera Dejan including the portion already sold to petitioners. Furthermorethey alleged that the defendants were able to secure a Free Patent Title over the property by means of fraud. Plaintiffs prayed for the cancellation of the title of Mariano Del Rosario, the reconveyance of the eastern portion of the property to them, and damages. The RTCdismissed the complaint for lack of cause of action. Upon filing of amotion for reconsideration the court declared plaintiffs as theabsolute owner of the eastern portion of the property and orderedthe defendants Del Rosario to convey in favor of the plaintiffs theeastern portion of the aforementioned property and for all thedefendants to pay for the actual/compensatory damages. Defendants file an appeal before the CA. The CA set aside and reversed the RTC’s decision and ruled that the Memorandum of Agreement between Encarnacion and the Buot spouses was merely an option to purchase;there was no perfected contract of sale. Hence, this petition for reviewon certiorari was filed by the Buot spouses.

ISSUE:

WON the Memorandum of Agreement they entered into withEncarnacion is a contract of sale.

RULING:

No, the MOA they entered into with Encarnacion is not a contract of sale and examination of said Memorandum of Agreement shows that it is neither a contract of sale nor an option to purchase, but it is a contract to sell. An option is a contract granting a privilege to buy or sell at a determined price within an agreed time,the specific length or duration of which is not present in theMemorandum of Agreement. In a contract to sell, the title over the subject property is transferred to the vendee only upon the fullpayment of the stipulated consideration. Unlike in a contract of sale,the title in a contract to sell does not pass to the vendee upon theexecution of the agreement or the delivery of the thing sold.

Being a contract to sell there isno actual sale until full payment was made by the vendees,and that on the part of the vendees, no full payment wouldbe made until a certificate of title was ready for transfer in their names.

0 notes

Text

Ohio/Penn DX Bulletin No. 1428

SB DX @ WW < KB8NW $OPDX.1428

Ohio/Penn DX Bulletin No. 1428

The Ohio/Penn DX PacketCluster

DX Bulletin No. 1428

BID: $OPDX.1428

August 26, 2019

Editor Tedd Mirgliotta, KB8NW

Provided by BARF80.ORG (Cleveland, Ohio)

Written/Send from Strongsville, Ohio

Thanks to the Northern Ohio Amateur Radio Society, Northern Ohio DX

Association, Ohio/Penn PacketCluster Network, the AB5K’s AR Cluster

Networks, ARRL Letter & Web Page, NJ1Q & W1AW, NG3K & ADXO, W3UR & The

Daily DX, WB6RSE, AA7A, K8YSE, W8GEX & 60m DX News, N0TG, 8P6SH/8P2K,

DL1SBF, DL7UXG & The DX News Letter, DxCoffee.com, DXNews.com, DX-World.Net,

F5NQL, F6AJA & Les Nouvelles DX, G4EDG, HL1VAU, I1JQJ/IK1ADH & 425 DX

News, I2YSB, OZ6OM & 50 MHz DX News, RN3RQ, Sixitalia Weekly and VA3RJ

& ICPO for the following DX information.

DXCC COUNTRY/ENTITY REPORT: According to the AR-Cluster Network for the

week of Sunday, 18th/August, through Sunday, 25th/August there were 206

countries active. Countries available: 3A, 3B8, 3D2, 3W, 4J, 4L, 4O, 4S,

4U1I, 4X, 5A, 5B, 5N, 5R, 5T, 5W, 6Y, 7P, 7X, 8P, 8Q, 9A, 9G, 9H, 9K, 9L,

9M2, 9M6, 9N, 9Q, 9V, 9Y, A2, A4, A6, A7, A9, AP, BV, BY, C3, CE, CE0Y,

CE9, CM, CN, CP, CT, CU, CX, DL, DU, E5/n, E5/s, E6, E7, EA, EA6, EA8,

EA9, EI, EK, EP, ER, ES, EU, EX, EY, EZ, F, FG, FH, FK, FM, FO, FP, FR,

FS, FY, G, GD, GI, GJ, GM, GU, GW, H4, HA, HB, HB0, HC, HH, HI, HK, HK0/a,

HL, HP, HR, HS, HZ, I, IS, J3, J6, J7, J8, JA, JD/o, JT, JW, JY, K, KG4,

KH0, KH2, KH6, KH8, KL, KP2, KP4, LA, LU, LX, LY, LZ, OA, OD, OE, OH, OH0,

OJ0, OK, OM, ON, OX, OY, OZ, P4, PA, PJ2, PJ4, PY, PZ, S0, S2, S5, S7, S9,

SM, SP, SU, SV, SV5, SV9, T2, T7, TA, TF, TG, TI, TK, TL, TT, TU, TY, UA,

UA2, UA9, UK, UN, UR, V3, V5, V7, V8, VE, VK, VP2E, VP2M, VP8, VR, VU, XE,

XU, XZ, YA, YB, YI, YJ, YK, YL, YN, YO, YS, YU, YV, Z3, Z6, ZA, ZB, ZD7,

ZD8, ZF, ZL, ZP, ZS

* PLEASE NOTE: The report “could” contain “Pirate/SLIM” operations or

more likely a “BUSTED CALLSIGN”. As always, you never know – “Work

First Worry Later”.

4L, GEORGIA. Ilya, R3XA, will be active as 4L9M from Gudauri during the

CQWW DX SSB Contest (October 26-27th) as a Single-Op/Single-Band (80m)

entry. QSL via R3XA, ClubLog or LoTW.

5I, TANZANIA (IOTA Op). Silvano, I2YSB, informs that the Italian DX-

pedition Team (IDT) will be activating Zanzibar Island (AF-032) in Tan-

zania between February 4-18th, 2020. The IDT will be using two callsigns:

5I5TT for CW, SSB and RTTY; 5I4ZZ for FT8 and FT4. The Team will be

comprised of 10 operators. Operators mentioned are Franco/I1FQH, Alfeo/

I1HJT, Tony/I2PJA, Silvano/I2YSB, Vinicio/IK2CIO, Angelo/IK2CKR, Marcello/

IK2DIA, Stefano/IK2HKT, Paolo/IW1ARB and Mac/JA3USA. Activity will be

on 160-10 meters with 5 stations on the air. Suggested frequencies are:

CW – 1826, 3530, 7025, 10115, 14030, 18068, 21030, 24890 and 28030 kHz

SSB – 3775, 7090, 14240, 18130, 21310, 24950 and 28470 kHz

RTTY – 14084 kHz

FT4 – 3575, 7047.5, 10140, 14080, 18104, 21140, 24919 and 28180 kHz

FT8 – 1845, 3585, 7056, 10131, 14084, 18095, 21091, 24911 and 28091 kHz

** For Japanese stations only: FT8 on 160m will use the normal mode.

Their RX frequency will be on 1908 kHz.

The IDT is conducting a band/mode survey for their Tanzania operation

at: http://www.i2ysb.com/idt

QSL via OQRS (http://win.i2ysb.com/logonline/). QSL via I2YSB direct only

or LoTW after the operation.

5K0, SAN ANDREA ISLAND. Operators Rob/HK3CW, Petr/OK1BOA, Petr/OK1FCJ,

Palo/OK1CRM, Pavel/OK1GK, Ruda/OK2ZA, Ludek/OK2ZC, Karel/OK2ZI and David/

OK6DJ will be active as 5K0K from San Andres Island (NA-033) around/between

October 15-30th. Activity will be on 160-10 meters using CW, SSB, RTTY and

FT8. Focus will be on the low bands. Radios: Elecraft K3 and Kenwood TS480

(both multiple units). PA: Expert 1.3k-FA, JUMA’s and RF Power. Antennas:

3x Spiderbeam (10/15/20m including WARC), VDA antennas, 30m 4SQ, 40m 4SQ,

80m vertical + radials, 1/4 vertical + radials 160m vertical + capacitive

hat. RX: Beverages + DHDL. QSL via OK6DJ, ClubLog’s OQRS or LoTW.

6O7O SOMALIA DXPEDITION NEWS (Update). Ken, LA7GIA, reports [edited]:

“I will QRV from Somalia Sept. 14th to Sept. 28th on all bands 160-10m

mainly on CW. Activity on other modes (SSB, FT8) will be limited and on

1-2 bands only.

This trip has proved to be very difficult to plan, but finally after

3 site visits all details are sorted out. I have all permits in hand –

and look forward to returning to Somalia after 18 months.

I will particularly focus on working NA this time, as well low bands.

I have some good vertical low band antennas, and some good RX antennas.

The RX antennas will hopefully be located far away from noise sources.

There will be a guard protecting the beverages 24/7. Please follow my

instructions when it comes to calling for geographical areas. Because

there is a very short opening to NA on low bands, in particular western

part of NA. If there is propagation I will only call for NA when we

approach my sunrise. EU will have the best conditions and shall try to

work me during their evening time on low bands. Please carefully note

the QSO and QSL policy mentioned on my Web page. Free&fast LoTW is only

for the good first class operators who can follow the QSO policy and DX

code of conduct.

I have some additional security related expenses like armored car,

armed guards etc. If you would like to contribute to protecting the low

band antennas from being stolen, cut or moved – make a donation to PayPal

([email protected]).

Anyone who donates in advance before the DXpedition end will receive

direct QSL and express LoTW!

This time I would also like to offer you the possibility to donate to

a humanitarian fundraiser for the Norwegian organization Sabona who helps

children in Africa. Please use the same PayPal address but indicate your

call and that it is meant as humanitarian donation. Please look for more

info on my Web page (https://www.la7gia.com/where-next/).”

ADDED REMINDER: QSL via M0OXO. Logs will be uploaded to ClubLog. Also,

make sure you read Ken’s “QSO & QSL Policy” on his Web page.

7A, INDONESIA. A team of YB operators will be active as 7A2A from a contest

station in Central Java during the CQWW DX SSB Contest (October 26-27th)

as a Multi-? entry. QSL via LoTW. No othe details were provided.

8A74, INDONESIA (Special Event). Members of the Organisasi Amatir Radio

Indonesia (ORARI) will be active as 8A74RI/# (0-9, Provinces/Call Areas)

between August 28th and September 1st. Activity is to celebrate the 74th

anniversary of the Republic of Indonesia. QSL via ORARI National QSL

Bureau or LoTW.

C5, THE GAMBIA. Don, G3XTT, will once again be active as C56DF from The

Gambia, but this time in CQWW DX CW Contest (November 23-24th). Look for

operation before and maybe after the contest. Activity will be on various

bands, probably all CW like last time using low power (IC-7300 and wires)

from a rooftop apartment. He will, of course, upload logs to LoTW and

ClubLog, but possibly only after his return to the UK. QSL direct to Don’s

home callsign or via ClubLog’s OQRS.

D4, CAPE VERDE (Update/Satellite Op). Harald, DF2WO, will once again be

active as D44TWO from Praia, Santiago Island (AF-005), between September

29th and October 13th. Activity will be holiday style on 160-10 meters

using CW, SSB and the Digital modes. He states that he works mostly on

the Digital modes (FT8, PSK31, JT65 and RTTY) and slow CW. It was reported

this past week that “he has been working hard in the last few months getting

his Satellite station working and is now confident he will use it from

Cabo Verde. He will be using an Icom 7300, 2 Transverters with 3 watts

output on ES-Hail using the QO-100 Geostationary Satellite.” He will also

have a FT-450D into a homemade HEX BEAM and a dipole for 40 meters. QSL

via M0OXO (OQRS available).

DXCC, VUCC, & ARRL CONTESTS (Now Prohibit Automated Contacts!). From the

ARRL Web page: Following the direction of the ARRL Board of Directors,

ARRL has incorporated changes to the rules for all ARRL-sponsored contests

and DXCC, prohibiting automated contacts. These changes also apply to the

Worked All States (including Triple Play and 5-Band WAS), VHF/UHF Century

Club, and Fred Fish, W5FF, Memorial awards. The changes are effective

immediately.

A resolution at the July ARRL Board of Directors meeting pointed to

“growing concern over fully automated contacts being made and claimed”

for contest and DXCC credit. The rules now require that each claimed

contact include contemporaneous direct initiation by the operator on

both sides of the contact. Initiation of a contact may be either local

or remote.

See: http://www.arrl.org/news/view/arrl-contest-and-dxcc-rules-now-prohibit-automated-contacts

Also see the ARRL Letter for August 22nd, 2019.

FK, NEW CALEDONIA. Jan, F6EYB, will once again be active as FK8CJ from

Noumea, New Caledonia (OC-032), starting August 29th, until the end of

the year. Activity will be on various HF bands (mainly 30/20/17 meters).

QSL via F6EYB, LoTW or eQSL.

FS, ST. MARTIN. Doug, VA3DF, will be active as FS/VA3DF from St. Martin

(NA-105) during the CQWW DX CW Contest (November 23-24th) as a Single-Op/

Single-Band (40 or 20m) entry. He will use a CrankIR and 100 watts. QSL

via LoTW.

FT8 OPERATING SUGGESTIONS. Dean, 8P6SH/8P2K, has recently been very active

on FT8 from St.Philip, and states, “Its been very interesting but also

somewhat frustrating. I thought I would share a few thoughts on working

DX from a DX perspective. After working quite a few stations on FT8 over

the past couple months, I thought I would share a few thoughts on working

DX on HF:

1. When you’re calling a DX station on HF is the grid that important?

Many times it’s not a bad idea to go with “XX0DX W1ZZ 01” This is

especially important when signal levels are low – -20db and below.

The grid information is generally redundant and will be confirmed

on LoTW anyway. In the typical ‘pile-up’ that I get on the band, I

try to work the stations that send a signal report first as these

QSOs are shorter.

2. Do not call a DX station on its transmit frequency. Often I have 4

or 5 DX stations all calling on the same frequency and then, even

with perfect conditions I’m sending repeat after repeat and seemingly

getting nowhere. Find a clear frequency and call.

3. Know when you can log the station. Many times I am working a station

and I have gotten a “RRR” or “RR73” from the other station. I either

send a CQ or work the next station, only to get the station who had

sent a confirmation sending a grid or report to initiate a QSO. I

believe this is because I have not sent a “73” message. Those of us

who have worked other modes for years know that “73” is optional.

Please log the station once you have sent a report, received a report

and received some kind of confirmation. That final “73” is ok, but

usually from a DX station working through a list of 6 stations it

is very much optional.

4. Hope these pointers are taken in the spirit they are given – to help

you get into the log quicker! THANKS.”

If you have any comments to make about Dean’s comments on FT8, you can

contact him at: [email protected]

HPM CELEBRATION. Just reminder that the Hiram Percy Maxim Birthday Cele-

bration gets under way on Saturday, August 31st, and wraps up on Monday,

September 8th. The 9-day operating event commemorates the 150th anni-

versary of the birth of ARRL co-founder and first president Hiram Percy

Maxim, W1AW (HPM) — born on September 2, 1869 — and is open to all radio

amateurs. The objective is to work as many participating stations as

possible. W1AW and all ARRL members will append “/150” to their callsigns

during this event (DX operators who are ARRL members may operate as <call-

sign>/150, if permitted by their country of license). For more details,

see: http://www.arrl.org/news/view/reminder-the-hiram-percy-maxim-birthday-celebration-begins-on-august-31

NCDXF PRESS RELEASE (NCDXF Issues grants to two upcoming DXpeditions).

[Dated August 23rd, edited] — The Northern California DX Foundation

(NCDXF) is pleased to announce grants issued to two Pacific DXpedition

teams for Summer 2019.

1. The 2019 Western Kiribati (T30L) and Nauru (C21W) DXpeditions slated

for September have been granted $5,000 from NCDXF. Team Leader Yuris,

YL2GM, has assembled another high-energy team to activate these two

islands in an exciting back-to-back operation in September. One of

the operators is Kristers, YL3JA, a 21-year old first-timer and

future WRTC 2022 hopeful.

2. The upcoming ZK3A DXpedition slated for October 2019 has been issued

a $4,000 from NCDXF using a new grant matching program. To encourage

more European club participation in early funding raising efforts for

DXpedition teams, NCDXF pledged $2,000 up-front to the ZK3A DXpedition

team and also offered to “match” up to an additional $2,000 in pre-trip

funded grants obtained from any EU DX Clubs or Foundations. We are

happy to report that this new grant-matching plan worked well as the

ZK3A team has received an additional $2,000 from European Clubs and

Foundations in vital up-front funding.

During the last 46 years, NCDXF has granted over $1 million to

hundreds of DXpeditions – helping to put an “all-time-new-one” (ATNO)

in the log and make DX happen for thousands of DXers worldwide.

DXpeditions to rare entities are becoming more expensive, a trend

that will continue. If you agree with the importance of NCDXF’s work,

please visit our website at NCDXF.ORG to study our history and to

consider providing your support.

Best regards, Ned Stearns, AA7A — NCDXF Vice President

NCDXF Web Page at: https://www.ncdxf.org

OJ0, MARKET REEF. Pasi, OH3WS, will once again be active as OJ0W (as well

as OJ0/OH3WS and OJ0/OG3A) from Market Reef (EU-053) between October

5-12th. Activity will be on 80-30 meters using CW and SSB. QSL all three

callsigns via his home callsign.

OPDX MAILING LIST (Just A Reminder). The “new” OPDX Mailing List is back up

and running! Details on how to subscribe/unsubscribe are at the bottom of

this bulletin. PLEASE pass the word around…. Thanks and 73 de Tedd KB8NW

P4, ARUBA (Early Announcement). John, W2GD, will once again be active as

P40W from Aruba (SA-036) during the ARRL International DX CW Contest

(February 15-16th) as a Single-Op/All-Band/High-Power entry. Operations

outside of the contest are usually on 160/80m and 30/17/12 meters as time

permits. Watch 160m on the hour and 80m on the half hour. QSL via LoTW

or direct to N2MM, Bureau cards are no longer accepted. Logs will be

loaded on LoTW upon his return to the USA.

PROPAGATION FORECAST/REPORT (August 26th-September 1st)…….

Aug/26th AN Aug/29th AN Aug/31st AN

Aug/27th AN Aug/30th AN Sep/01st BN

Aug/28th AN

SOLAR REFERENCE KEYS/INDEXES AND GEOMAGNETIC REFERENCE

——————————————————

NORMALITY GEOMAG K Values Alpha

—————– —— ——– ——

AN – Above Normal Quiet K=0-1 0-7

HN – High Normal Unsettled K=2 8-15

LN – Low Normal Active K=3 16-29

BN – Below Normal Minor Storm K=4 30-49

DIS – Disturbed Major Storm K=5 50-99

VRY DIS – Very Disturbed Severe Storm K=6-9 100-400

Meanwhile, check out the following Web sites for propagation:

* VOACAP predication Web page at: http://www.voacap.com/hf

and http://www.voacap.com/prediction.html

* DX.QSL.NET Propagation page: https://dx.qsl.net/propagation

* A daily HF radio wave propagation forecast can be found at:

https://www.facebook.com/thomasfranklingiellaw4hm

* SolarHam Web page: http://www.solarham.net

* Radio Propagation/Space Weather/Sunspot Cycle Information at:

http://sunspotwatch.com

* Monthly propagation charts between four USA regions and twelve

overseas locations are at: http://arrl.org/propagation

* Information and tutorials on propagation are at: http://k9la.us

* Graphic propagation tool by DR2W: http://www.dr2w.de/dx-propagation

* Point to point propagation at: http://www.predtest.uk/p2p.html

* Realtime propagation at: http://www.predtest.uk

* Also on Twitter: https://twitter.com/@GiellaW4hm

QSL INFO AND NEWS……………….

QSL-INFO from DB0SDX by Lothar, DL1SBF (www.qslinfo.eu)(August 25th)

————————————————————————-

5B4AMX via LZ3SM HB0/DL7PIA/P via DL7PIA OY/IZ1AZA via IZ1AZA

7S2W via SM2EKM & (L) HG30PANEU via HA1KSS S549APR via S51A & (L)

9A/DL6MDA via DL6MDA (e) HG4F via HA4FF & (e) SK50HD via SM6FKF

9A/IZ0FYL via IZ0FYL I2YBC/HB0 via I2YBC SM7D via SA7DXN (e)

9A0HRS via 9A3JB II6MOON via IW6ATQ (d) SN80FL via SP2PTU

9A7T via 9A2EU & (L) IQ9SY via IT9NVA SP1919PS via SP9PNB

9Q6BB via W3HNK & (L) IT9/IQ5ZP via 9A8MDC SV0AMS via DL2MGP

DA0N via DJ0BFS IT9/ON6MM/P via ON6MM TM17FFF via F4GFE

DM5B via DM5RC (N) IY7M via IZ7XNB UE90AGN via RZ4Z

DQ9Y via DF2SD (O/L) IZ1GDB/IT9 via IZ1GDB UE90PR via RK1O

EA8DIG via EA8DIG (L) LZ304AE via LZ1KCP W1R via N2TA (d)

EI/HB9TNF/P via HB9TNF N0F via AC0RL W2Q via N2TA (d)

GB60ATG via M0OXO (O) OE19FTDMC via OE1SGU & (L) YQ0BIKE via YO6KNE (O/L)

HB0/DL5PIA/P via DL5PIA OE30CFC via OE3CFC ZY40ZT via PT7ZT (d/L)

(e) eQSL only (d) direct only (B) Bureau only (*-B) DX’s- Bureau

(O) OQRS only (C) ClubLog only (L) LoTW only (N) No QSL needed

(I) No IRC (P) PayPal (NB) No Bureau

LOGS ONLINE AT CLUBLOG.ORG THIS WEEK……

https://secure.clublog.org/logsearch/3W9KJ

https://secure.clublog.org/logsearch/HZ1FI (Updated)

https://secure.clublog.org/logsearch/T30GC

https://secure.clublog.org/logsearch/ZS9V (Updated)

CY9C DXPEDITION LOG UPDATE. Randy, N0TG, reports, “All known issues

with our log on ClubLog have been resolved. If there are still missing

contacts of any mode, please E-mail ([email protected]) with date,

time, mode, frequency and your call sign. Logs will be uploaded to

LoTW in the near future.

QSLS RECEIVED VIA LoTW: 5T5PA, 9G2HO, 9K2OW, 9M0W, E6ET, KN0E/KH3,

SO1WS and UN7QX

QSLS RECEIVED VIA MAIL: HK1NA (SA-082), II7P (EU-091), RI1OB (EU-066),

SO1WS, V84SAA, VK5MAV/6 (OC-183, OC-211), XR0ZRC (SA-005) and XR1RRC

(SA-069)

QSLS RECEIVED VIA THE BUREAU: 5B4AMX, 5W0GC, AT5RP (AS-173), D66D,

EY7AV (now RN3DHX), EZ8CQ (now R2DSX), T88PB, UN9L, VP8ALJ, VP8LP,

VU2AE, VU2ATN, VU2CPL, VU2GRM, VU2IBI, VU2KWJ, VU2NXM, VU2RAJ, VU2SMN,

VU2USA, VU3DMP, VU3DMP (AS-161), VU3KPL, VU3NXI, VU7MS, XP1AB and YJ0GC

— We would like to see more QSL Bureaus (such as AS/US/SA/AF.. etc)

to send in their info….

TM41, FRANCE (Special Event). Look for special event station TM41CDXC to

be active between September 13-27th. Activity is to celebrate the 41st

Clipperton DX Convention (September 27-29th) at Mejannes-le Clap (Gard).

QSL via F5CWU or the OQRS: http://www.f5cwu.net/oqrs

V6, MICRONESIA. Sho, JA7HMZ, will once again be active as V63DX from

Pohnpei Island (OC-010) between November 22-27th. Activity will be on

160-6 meters, all modes and including the CQWW DX CW Contest (November

23-24th) as a Single-Op/All-Band/High-Power entry signing V6A. He will

be looking for European stations on 160m before and after the contest.

QSL via his home callsign direct or LoTW. No Bureau QSLs.

VE, CANADA. DX-World.net reports that Alessandro, VE7ADA, will be active

as VE7ADA/1 from Nova Scotia and Cape Breton, between September 1-7th.

Activity will be on 40-10 meters using SSB with 100 watts into a dipole.

His operations will be from various locations: “some small islands” in

NA-081 and NA-010, and from the Marconi National Historic Site at Table

Head in Glace Bay, the location of Marconi’s first transatlantic station.

QSL via his home callsign, by the Bureau or direct.

VP9, BERMUDA. Les, N1SV, will be active as VP9/N1SV from Hamilton Parish,

Bermuda Islands (NA-005), between October 23-28th. Activity will be on

various HF bands using mostly CW, JT9 and WSPR. Also, look for him to be

in the CQWW DX SSB Contest (October 26-27th) signing as VP9I. QSL via

N1SV, direct, by the Bureau, ClubLog or LoTW. QSL VP9I via WW3S.

WW0, UNITED STATES (Special Event). Members of the Northern Colorado

Amateur Radio Club (NCARC), WWV ARC, RMHam, and FCCW along with the

National Institute of Standards and Technology (NIST) will activate

special event station WW0WWV between September 28th and October 2nd.

Activity is to celebrate the 100th anniversary of WWV, the world’s oldest

continuously operating radio station. The WW0WWV station(s) will be set

up adjacent to the WWV transmitter site in Fort Collins, Colorado. The

plan is to have up to four stations on the air for routine operations.

A fifth station will schedule contacts with schools, universities, and

museums, as well as conducting unscheduled contacts. Operations will be

on various HF bands following typical propagation, and will include 160

meters as well as satellites (SO-50, AO-91, and AO-92) and 6-meter meteor

scatter. Modes will be CW, SSB and the Digital modes. A trial run of WW0WWV

took place this past week on August 24-25th. QSL via ClubLog’s OQRS, LoTW,

or direct to the WWV Amateur Radio Club, 1713 Ridgewood Rd, Fort Collins,

CO 80526, USA. For more details, visit the following URLs:

http://wwv100.com

http://www.arrl.org/news/view/wwv-centennial-committee-prepares-for-trial-run-of-ww0wwv-special-event

Also, visit the official NIST announcement of the 100th anniversary at:

https://www.nist.gov/news-events/events/2019/10/nist-radio-station-wwv-100-year-anniversary

XP, GREENLAND. Henning, OZ2I/OZ1BII, will once again be active as XP2I

from Kanger-lussuaq between November 20-25th. Activity will be CW only

on all HF bands. He will participate during the CQWW DX CW Contest

(November 23-24th) as a Single-Op/All-Band/Low-Power entry. For activity

outside of the contest, he will sign OX/OZ2I. QSL via OZ2I, LoTW, eQSL

or ClubLog’s OQRS. For more details and updates, see: http://www.oz1bii.dk

YN, NICARAGUA. Mike, AJ9C, will once again be active as YN2CC near Granada,

Nicaragua, between November 19-27th. Activity will be on 160-6 meters using

CW, SSB and RTTY. Also, Mike will be in the CQWW DX CW Contest (November

23-24th) as a Single-Op/All-Band/Low-Power entry. QSL via LoTW or direct

and by the Bureau to his home callsign. Logs will be uploaded to LoTW upon

his return home and QSLs can be requested via the OQRS on ClubLog.

ZD8, ASCENSION ISLAND. Steve, WB4GHY, is currently on Ascension Island

on a work detail. Look for him to possibly be active on various days

as ZD8SC. The length of his stay is unknown. Activity will be on 80-10

meters on SSB only using an IC-7000 to a directional antenna. QSL via

WB4GHY or LoTW.

ZD9, TRISTAN DA CUNHA NEWS (Emergency Fund Appeal). Steve, G4EDG/ZD9CW,

reports [edited]: “On July 18/19th, Tristan suffered a terrifying storm,

the worst for nearly twenty years. Severe damage was suffered by resi-

dential, administration buildings as well as to the school and fish pro-

cessing factory. Thankfully nobody was injured, but life on the island

has been severely affected and work is in progress to repair the build-

ings. Materials for this task are on their way from South Africa on the

MV Edinburgh, the same boat that took me to the island last year for my

ZD9CW operation, a rough journey of seven days. Perhaps DXers would con-

sider making a donation to help with the daunting task of restoring

Tristan to some sort of normality.” For more details and on how you can

help, see: https://www.justgiving.com/campaign/tristanemergencyfund

***********************************************************************

TO BE ADDED TO THE OPDX MAILING LIST — Click or send requests to:

Subscribe: (mailto:[email protected]?subject=subscribe)

Unsubscribe: (mailto:[email protected]?subject=unsubscribe)

Just a reminder, you can still obtain the OPDX Bulletins via the

OPDX Web page (provided by John, K8YSE) [http://www.papays.com/opdx.html],

QRZ.com (under Forums; News; Special Events, Contests.. etc.), several

DX Mailing Lists, and two different UseNet Groups (rec.radio.info and

rec.radio.amateur.dx). The weekly bulletin (issue # from the OPDX Web

page URL) is also posted on the following Media pages:

NODXA FaceBook — https://www.facebook.com/NorthernOhioDxAssociation

Twitter — https://twitter.com/kb8nw_opdx

ALSO VISIT THE NORTHERN OHIO DX ASSOCIATION’S WEB PAGES AT:

http://www.nodxa.org/

http://www.facebook.com/NorthernOhioDxAssociation

***********************************************************************

* All excerpts and distribution of “The OPDX Bulletin” are granted as

long as KB8NW/OPDX/BARF80 receives credit.

** To contribute DX info, please send via InterNet Mail to:

([email protected]) or ([email protected])

Information can now be faxed to the following phone line at:

1-419-828-7791 (F A X only!)

……. 73 de Tedd KB8NW

/EXIT

***********************************************************************

Tedd Mirgliotta, KB8NW – E-mail addresses:

<[email protected]> or <[email protected]>

Editor of the Ohio/Penn DX Bulletin (OPDX – DXer’s Tool of Excellence)

President of the “Northern Ohio DX Association” (NODXA)

DX Chairman for the “Northern Ohio Amateur Radio Society

ARRL Assistant Director of the Great Lakes Division

Sysop of the “Basic Amateur Radio Frequency BBS” (BARF80.ORG)

A complete copy of this message has been attached for your convenience.

View this message online

To approve this using email, reply to this message. You do not need to attach the original message, just reply and send.

To reject this message using email, and to have the sender notified of this, forward this message to:

To delete this message using email, forward this message to:

NOTE: The pending message will expire after 14 days. If you do not take action within that time, the pending message will be automatically rejected.

Thank you for choosing Groups.io Groups

Cheers,

from WordPress https://ift.tt/2U0uaoy

via IFTTT

0 notes

Text

Zoom Player MAX 14.4 Build 1440 Final

Zoom Player is the most Powerful, Flexible and Customizable Media Player application for the Windows PC platform. Based on our highly-touted Smart Play technology, more media formats play with less hassle, improved stability and greater performance Behind Zoom Player's classic media player look, hides a powerful Media Center application designed with a simple 5-Key (up/down/left/right/select) fullscreen navigation interface. The 5-Key system provides simple navigation with advanced interfaces. Interface such as the Media Library, File Browser, Playlist, Color Control, Audio Equalizer, Bookmarks, Play History and many more. Zoom Player's media center simplicity makes it ideal for users with no previous computer experience.

With Zoom Player, you can instantly Convert any PC into a Home Entertainment Center (HTPC) with no specialized hardware requirement or operating system. Zoom Player runs with every version of Windows.

Utilizing Zoom Player's modular design and flexibility, you can easily design a safe viewing environment, limiting or extending functionality, making it ideal for both newbies and professionals.

Zoom Player is fully scalable, supporting the latest media formats and interfaces. New features are incorporated constantly with release schedules and feature integration clearly announced on our support Forum, Twitter and Facebook pages.

Install Center:

Zoom Player's Install Center quickly scans your system for missing or outdated media components and automatically present you with an installation list of recommended updates, keeping your system up to date with the latest technology.

Supported Video Formats:

DVD, BluRay (Decrypted Main Movie playback), Matroska (MKV), MPEG2 Transport (TS/TP/TSP/TRP/M2T/M2TS/MTS/PVA/TOD), H.264 & AVCHD (MPEG4 AVC), H.265 & HEVC, WebM, XVID, DIVX, AVI, Flash Video (FLV), Windows Media (WMV/ASF), QuickTime (MOV/HDMOV), Ogg Movie (OGM), Theora (OGV), Real Media (RM/RMVB), VideoCD (VCD), Super VideoCD (SVCD), MPEG (MPG), MPEG2 Program (M2V/VOB/MOD), MPEG4 (SP/ASP), MPEG4 ISO (MP4), General Exchange Format (GXF), Material Exchange Format (MXF), Media Center DVR (DVR-MS), CamCorder (MOD/TOD), Digital Video (DV), DVCPRO, VP3, VP6, VP7, Motion JPEG (MJPEG), Motion JPEG 2000 (MJPEG2000), Flash (SWF), Cellphone 3GPP (3GP/3G2), FLIC (FLI/FLC) and more . . .

Supported Audio Formats:

MP3, Free Lossless Audio CODEC (FLAC), Advanced Audio Coding (AAC), Windows Media (WMA), OGG Vorbis (OGG), OPUS (OPUS), CD-Audio (CDA), Dolby Digital (AC3), Digital Theatre Surround (DTS), Matroska (MKA), Wave Audio (WAV), SHOUTcast (Streaming), Cell Phone (AMR), Monkey Audio (APE), Real Media (RA), MusePack (MPC), OptimFROG (OFR), Shorten (SHN), True Audio (TTA), WavPack (WV), Apple Lossless Audio Coding (ALAC), LPCM, MIDI, AIFF, MO3, IT, XM, S3M, MTM, UMX and more . . .

Supported Interactive Formats:

DVD, Hypertext Markup Language (HTML), Flash (SWF).

Supported Image Formats:

JPEG (JPG), PNG, GIF, BMP, ICO, WMF, EMF, JFIF, RLE, WIN, VST, VDA, TGA, ICB, TIFF, FAX, EPS, PCX, PCC, SCR, RPF, RLA, SGI, BW, PSD, PDD, PPM, PGM, PBM, CEL, PIC, PCD, CUT, PSP, PN and more.

https://rapidgator.net/file/527f3b8b5459084bf2348caa4c49d2be/Zoom.Player.MAX.14.4_softrls.com.rar.html

https://openload.co/f/2pY5eIVgsIU/Zoom.Player.MAX.14.4_softrls.com.rar

Read the full article

0 notes

Link

Longtime New Yorkers Joanne and Vince Intrieri left their 3,100-square-foot three-bedroom near the United Nations this year, trading it in for a sunny three-bedroom condominium in downtown Miami.

Joanne Intrieri, who has a construction and design firm that she is moving to Miami, and Vince Intrieri, who owns VDA Capital Management, were not ready to retire.

But they decided to move to the Florida coast to escape exorbitant taxes that they knew would be exacerbated by the Trump administration’s new tax law.

“My husband and I have been in New York City for more than 20 years, but we aren’t tied to an office anymore and our kids are older,” said Joanne Intrieri, 59. “Between the state and city taxes, plus about $50,000 in property taxes, it is a lot of money going out the door. Why do it?”

The Tax Cuts and Jobs Act, as the legislation is known, was passed last year and will be applied to 2018 returns, which are due in April 2019. The law limits the deductions taxpayers can take on property taxes and state and local taxes (known as SALT deductions) up to $10,000 — a cap that many New Yorkers easily exceed. For the highest earners, New York state’s income tax rate is 8.82 percent and New York City’s rate is 3.876 percent. Nearly half of Manhattan’s taxpayers have taken SALT deductions in the past, and the average deduction has been over $60,000 a year.

The new legislation also limits the deductions taxpayers can claim on interest for mortgages up to $750,000, down from the previous $1 million limit. Mortgages often surpass this cap in Manhattan, where the average sales price for a co-op or condominium was $2.09 million in the second quarter of this year, according to Douglas Elliman.

All told, more than 8 percent of New York state residents will face higher taxes for 2018, according to an analysis by the Tax Policy Center. For those with income in the top 1 percent, a much larger number — 29 percent — will see their income taxes rise.

The specter of higher taxes has prompted some New Yorkers, like the Intrieris, to seek relief by moving to lower-tax states, while others have deliberately sought out buildings with tax abatements to reduce their costs. Accountants say others are exploring different ways to minimize their tax bills, like converting part of a home into a business with a home office or through Airbnb for a tax deduction.

In anticipation of higher tax bills, the Intrieris and others have relocated to states like Florida, which has no income tax and low property taxes. “I work with a lot of clients in New York, Connecticut and New Jersey — so all high-tax states — and we are seeing a lot of them move south, especially to Florida,” said Robert Westley, a New York City-based certified public accountant. “With almost all of our clients it comes up, and I would say about half of them are really looking into it.”

An added incentive for moving is the fact that the new legislation preserved a tax break that allows married homeowners who sell their primary residence to shield up to $500,000 of their capital gains from the property, Westley said.

Shahab Karmaly, the founder of KAR Properties, a real estate development and investment firm, lives in Manhattan but has been taking steps to relocate his family and business to Miami. “If I didn’t have the added complexity of kids, then I would already be down there,” said Karmaly, who has been touring schools for his children in Miami.

Indeed, the Florida housing market has seen a bump since the tax law was enacted. In Naples, for example, sales of single-family homes priced at $2 million and above rose 25 percent in the second quarter of 2018, compared with the second quarter of last year, according to the Naples Area Board of Realtors. Pending sales of such homes in Naples are up 22 percent, while pending sales of similarly priced condominiums have risen 32 percent.

“Causality is difficult to quantify, but taxes are certainly playing a role,” said Niklas Ahola, a real estate adviser at Compass in Naples. “I have about 10 clients, including three from New York, who are fleeing high-tax states.”

At the same time, the housing market in New York has slowed this year, and real estate analysts believe that is also in part because of the tax changes. Home sales in Manhattan declined 16.6 percent in the second quarter of this year compared with the same period last year, according to Douglas Elliman. In Westchester, sales dropped 17.7 percent; in the Hamptons, they fell 12.8 percent.

“People have pressed the pause button and are waiting before they buy,” said Jonathan Miller, president of the appraisal firm Miller Samuel, which conducted the research.

In Brooklyn, housing sales also decreased in the second quarter, but at a more modest 5.7 percent. This may be in part because home values in the borough are lower, making property taxes lower and dampening the impact of the tax law.

While the new legislation largely benefits the wealthy and corporations, it hasn’t translated into a boon for high-end real estate in New York, Miller said. “When this was first announced, people said it would have no impact because they were going to get more money back on taxes,” he said. “But people don’t buy individual assets based on a basket of assets. It isn’t like people say, ‘I will pay more for my house because I got money back from taxes.’ It just doesn’t work that way.”

Some prospective buyers have focused their searches on buildings with tax abatements to limit their tax costs. Buyers at 550 Vanderbilt, a new development in Prospect Heights, Brooklyn, for example, benefit from a 25-year tax abatement. Owners of studios at the building pay as little as $18 a month in property taxes, compared to $563 a month without the abatement.

“It was a huge factor in our decision to buy here,” said Rebecca Miller, 33, who purchased a two-bedroom at 550 Vanderbilt with her husband, Adam Tau. “We got our recent tax bill, and it worked out to be about $42 a month. It would have been closer to $1,500 a month without the abatement,” she said.

Ryan Serhant, the associate broker with Nest Seekers International who is handling sales at 550 Vanderbilt, said that since the tax changes were implemented, “we have seen a massive uptick in people coming from Manhattan. Before the tax law passed, people paid attention to real estate taxes, but if it was a little more, they just wrote it off. Now you can’t do that.”

While it is clear the tax changes are having an impact on the real estate market, it is too early to know the full extent of the repercussions, said Adam Kamins, a senior regional economist at Moody’s Analytics. In New York, while there has been a slowdown, “the adjustment will take some time, both to show up in house prices and to be fully internalized by buyers and sellers,” he said. “In fact, it may not truly happen for many until they file their tax returns next spring.”

The American Institute of Certified Public Accountants said its accountants are exploring new ways to keep their clients’ tax bills down. One strategy would be to claim part of a home as a business expense. If a taxpayer has a home office, for example, or a room leased to a tenant or through Airbnb, it can be counted as a business expense and deducted, over and above the $10,000 cap on tax deductions.

“The rules are a little complicated, but if you qualify, and let’s say you have a home office that takes up 15 percent of the square footage of your home, you could take 15 percent off your property taxes and deduct it,” Westley said.

This article originally appeared in The New York Times.

Julie Satow © 2018 The New York Times

via Nigerian News ➨☆LATEST NIGERIAN NEWS ☆➨GHANA NEWS➨☆ENTERTAINMENT ☆➨Hot Posts ➨☆World News ☆➨News Sp

#IFTTT#Nigerian News ➨☆LATEST NIGERIAN NEWS ☆➨GHANA NEWS➨☆ENTERTAINMENT ☆➨Hot Posts ➨☆World News ☆➨N

0 notes

Text

Vagas De Empregos De Engenheiro De Produto -São Paulo-Sp

Engenheiro De Produto (Especialista em Desenvolvimento de Produtos Plásticos p/ Fiat) Indústria de Autopeças São Paulo (região do ABC) Necessário: Experiência no desenvolvimento de produto e atendimento ao cliente FIAT, FMEA, APQP, PPAP , DOE, IMDS, ISO/TS 16949, VDA 6.3,IMDS,QFD, Elementos Finitos, Requisitos Específicos . Inglês Fluente Disponibilidade para viagens Profissional com experiência…

View On WordPress

0 notes

Text

via vicdeangelis Instagram story (June 13, 2022)

#Victoria De Angelis#vic de angelis#vic#she speaks#updates#ig story#uk june 22#6.13.22#må & friends#tom.ayerbe#sunglasses#iconic vic face pose#kissy#👅#vda sp

15 notes

·

View notes

Text

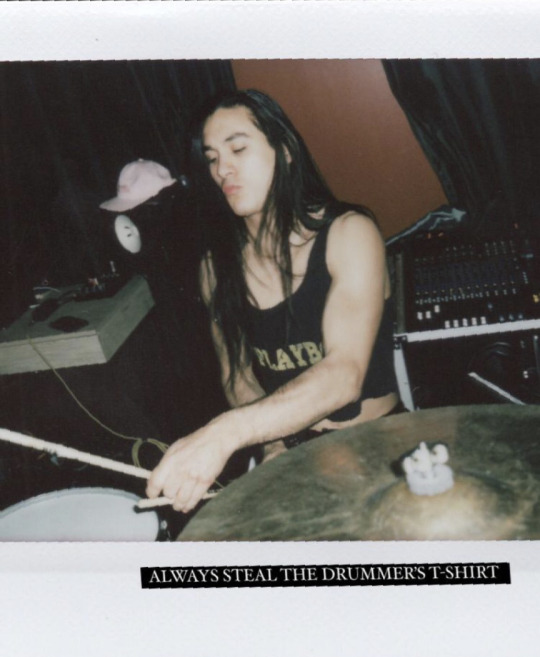

myleshendrik: There ls a Light That Never Goes Out___

(posted April 29, 2022)

#Thomas Raggi#Victoria De Angelis#vic de angelis#Ethan Torchio#myles hendrik#Instagram#updates#she speaks#04.29.22#killer gang#lucky strike shirt#vda sp#03.18.22#vic#ethan#thomas#party girl <3

29 notes

·

View notes

Text

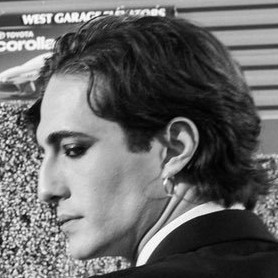

Victoria De Angelis's side profile

again, thank u for coming to my ted talk

BONUS: 4/4 Måneskin side profiles! (screenshot from @definitelynotdamiano )

Damiano, Ethan, & Thomas

#victoria de angelis#vic de angelis#måneskin#maneskin#victoria maneskin#vic maneskin#vic#my posts#vda sp#ethan#thomas#damiano#4/4#dd sp#tr sp#et sp#iwbys mv#100#greatest hits

135 notes

·

View notes

Text

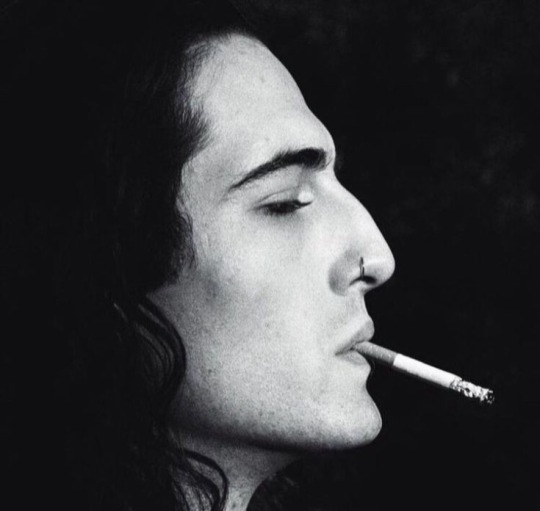

Damiano David's side profile

thank you once more for coming to my ted talk

BONUS: 3/4 Måneskin side profiles

pt 2, Ethan, Thomas, & Vic

#Damiano David#måneskin#maneskin#maneskin damiano#damiano maneskin#featuring#ethan torchio#thomas raggi#victoria de angelis#vic de angelis#thank you to those who sent me photos of dami's side profile 💖#damiano#dd sp#et sp#vda sp

92 notes

·

View notes

Text

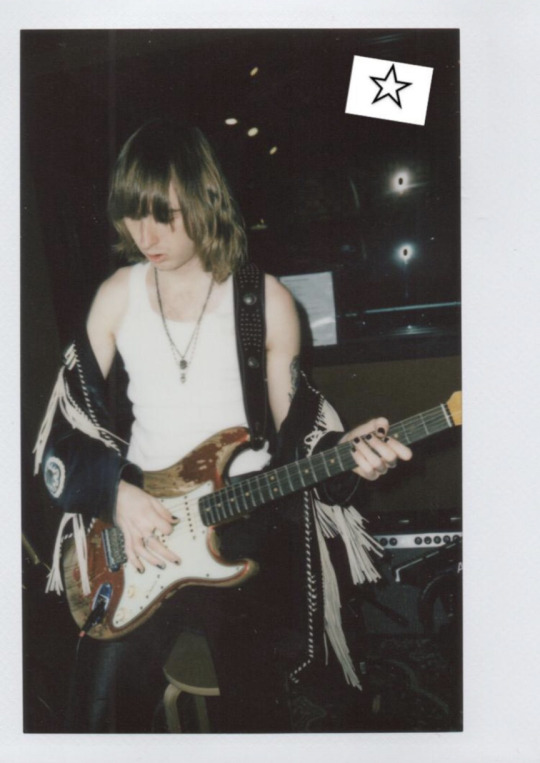

see you around? xx

#maneskin#måneskin#she speaks#ik everyone is posting these shut up#damiano david#Victoria De Angelis#vic de angelis#ethan torchio#thomas raggi#4/4#damiano#vic#thomas#ethan#my fav bromance#ig story#updates#i love arm#* **** ** **** *** *******#vda sp#ft: tr#dd sp#vics black bass#March2022#LA

15 notes

·

View notes

Text

Victoria with a fan at the Billie Eilish concert last night (April 9, 2022)

via @leyendo_concamy

#Victoria De Angelis#vic de angelis#vic#she speaks#updates#billie eilish#04.09.22#la april 22#vic smiling#thats my girlfriend#vda sp#SHES SO BEAUTIFUL

13 notes

·

View notes

Link

Longtime New Yorkers Joanne and Vince Intrieri left their 3,100-square-foot three-bedroom near the United Nations this year, trading it in for a sunny three-bedroom condominium in downtown Miami.

Joanne Intrieri, who has a construction and design firm that she is moving to Miami, and Vince Intrieri, who owns VDA Capital Management, were not ready to retire.

But they decided to move to the Florida coast to escape exorbitant taxes that they knew would be exacerbated by the Trump administration’s new tax law.

“My husband and I have been in New York City for more than 20 years, but we aren’t tied to an office anymore and our kids are older,” said Joanne Intrieri, 59. “Between the state and city taxes, plus about $50,000 in property taxes, it is a lot of money going out the door. Why do it?”

The Tax Cuts and Jobs Act, as the legislation is known, was passed last year and will be applied to 2018 returns, which are due in April 2019. The law limits the deductions taxpayers can take on property taxes and state and local taxes (known as SALT deductions) up to $10,000 — a cap that many New Yorkers easily exceed. For the highest earners, New York state’s income tax rate is 8.82 percent and New York City’s rate is 3.876 percent. Nearly half of Manhattan’s taxpayers have taken SALT deductions in the past, and the average deduction has been over $60,000 a year.

The new legislation also limits the deductions taxpayers can claim on interest for mortgages up to $750,000, down from the previous $1 million limit. Mortgages often surpass this cap in Manhattan, where the average sales price for a co-op or condominium was $2.09 million in the second quarter of this year, according to Douglas Elliman.

All told, more than 8 percent of New York state residents will face higher taxes for 2018, according to an analysis by the Tax Policy Center. For those with income in the top 1 percent, a much larger number — 29 percent — will see their income taxes rise.

The specter of higher taxes has prompted some New Yorkers, like the Intrieris, to seek relief by moving to lower-tax states, while others have deliberately sought out buildings with tax abatements to reduce their costs. Accountants say others are exploring different ways to minimize their tax bills, like converting part of a home into a business with a home office or through Airbnb for a tax deduction.

In anticipation of higher tax bills, the Intrieris and others have relocated to states like Florida, which has no income tax and low property taxes. “I work with a lot of clients in New York, Connecticut and New Jersey — so all high-tax states — and we are seeing a lot of them move south, especially to Florida,” said Robert Westley, a New York City-based certified public accountant. “With almost all of our clients it comes up, and I would say about half of them are really looking into it.”

An added incentive for moving is the fact that the new legislation preserved a tax break that allows married homeowners who sell their primary residence to shield up to $500,000 of their capital gains from the property, Westley said.

Shahab Karmaly, the founder of KAR Properties, a real estate development and investment firm, lives in Manhattan but has been taking steps to relocate his family and business to Miami. “If I didn’t have the added complexity of kids, then I would already be down there,” said Karmaly, who has been touring schools for his children in Miami.

Indeed, the Florida housing market has seen a bump since the tax law was enacted. In Naples, for example, sales of single-family homes priced at $2 million and above rose 25 percent in the second quarter of 2018, compared with the second quarter of last year, according to the Naples Area Board of Realtors. Pending sales of such homes in Naples are up 22 percent, while pending sales of similarly priced condominiums have risen 32 percent.

“Causality is difficult to quantify, but taxes are certainly playing a role,” said Niklas Ahola, a real estate adviser at Compass in Naples. “I have about 10 clients, including three from New York, who are fleeing high-tax states.”

At the same time, the housing market in New York has slowed this year, and real estate analysts believe that is also in part because of the tax changes. Home sales in Manhattan declined 16.6 percent in the second quarter of this year compared with the same period last year, according to Douglas Elliman. In Westchester, sales dropped 17.7 percent; in the Hamptons, they fell 12.8 percent.

“People have pressed the pause button and are waiting before they buy,” said Jonathan Miller, president of the appraisal firm Miller Samuel, which conducted the research.

In Brooklyn, housing sales also decreased in the second quarter, but at a more modest 5.7 percent. This may be in part because home values in the borough are lower, making property taxes lower and dampening the impact of the tax law.

While the new legislation largely benefits the wealthy and corporations, it hasn’t translated into a boon for high-end real estate in New York, Miller said. “When this was first announced, people said it would have no impact because they were going to get more money back on taxes,” he said. “But people don’t buy individual assets based on a basket of assets. It isn’t like people say, ‘I will pay more for my house because I got money back from taxes.’ It just doesn’t work that way.”

Some prospective buyers have focused their searches on buildings with tax abatements to limit their tax costs. Buyers at 550 Vanderbilt, a new development in Prospect Heights, Brooklyn, for example, benefit from a 25-year tax abatement. Owners of studios at the building pay as little as $18 a month in property taxes, compared to $563 a month without the abatement.

“It was a huge factor in our decision to buy here,” said Rebecca Miller, 33, who purchased a two-bedroom at 550 Vanderbilt with her husband, Adam Tau. “We got our recent tax bill, and it worked out to be about $42 a month. It would have been closer to $1,500 a month without the abatement,” she said.

Ryan Serhant, the associate broker with Nest Seekers International who is handling sales at 550 Vanderbilt, said that since the tax changes were implemented, “we have seen a massive uptick in people coming from Manhattan. Before the tax law passed, people paid attention to real estate taxes, but if it was a little more, they just wrote it off. Now you can’t do that.”

While it is clear the tax changes are having an impact on the real estate market, it is too early to know the full extent of the repercussions, said Adam Kamins, a senior regional economist at Moody’s Analytics. In New York, while there has been a slowdown, “the adjustment will take some time, both to show up in house prices and to be fully internalized by buyers and sellers,” he said. “In fact, it may not truly happen for many until they file their tax returns next spring.”

The American Institute of Certified Public Accountants said its accountants are exploring new ways to keep their clients’ tax bills down. One strategy would be to claim part of a home as a business expense. If a taxpayer has a home office, for example, or a room leased to a tenant or through Airbnb, it can be counted as a business expense and deducted, over and above the $10,000 cap on tax deductions.

“The rules are a little complicated, but if you qualify, and let’s say you have a home office that takes up 15 percent of the square footage of your home, you could take 15 percent off your property taxes and deduct it,” Westley said.

This article originally appeared in The New York Times.

Julie Satow © 2018 The New York Times

via Nigerian News ➨☆LATEST NIGERIAN NEWS ☆➨GHANA NEWS➨☆ENTERTAINMENT ☆➨Hot Posts ➨☆World News ☆➨News Sp

#IFTTT#Nigerian News ➨☆LATEST NIGERIAN NEWS ☆➨GHANA NEWS➨☆ENTERTAINMENT ☆➨Hot Posts ➨☆World News ☆➨N

0 notes