#us cpa exam in india

Text

Are you looking to advance your career in Accounting Profession? Then the CPA course is the right choice for you.

Start your US CPA Journey with FinTram Global. Learn from the Industry experience global finance leaders

Start with Rs. 7990/- only and Get 14 Days FREE Trail FinTram Global

0 notes

Text

What is the Minimum Salary of an Accountant in India?

In India, the minimum salary for accountants is subject to a myriad of factors that contribute to the wide spectrum of compensation within this profession. Typically, an accountant entry-level, particularly those with minimal experience, can expect annual salaries ranging from INR 2.5 lakh to INR 5 lakh. However, these figures are approximate and can vary significantly based on several variables.

Location plays a pivotal role in determining an accountant's salary, with metropolitan areas often offering higher compensation due to increased living costs. The size and industry of the employing organization also influence earnings, with larger firms or those in specialized sectors often providing more competitive salaries. Additionally, the economic climate and demand for accounting professionals can impact pay scales.

It is crucial to note that these figures are based on general trends and may not accurately represent individual circumstances. Factors such as educational qualifications, professional certifications, and specific skill sets can further influence salary negotiations. For the most accurate and up-to-date information, individuals aspiring to or working in the accounting field should refer to recent salary surveys, job portals, and professional associations to understand the prevailing standards and expectations in the dynamic landscape of Accounting jobs in India.

#cpa exam#certified public accountant#cpa full form#cpa in India#CPA review#cpa training institute#cpa salary in India#cpa syllabus#cpa license#cpa cost#cpa fees#us cpa exam#cpa exam fees in India#cpa details#cpa average salary in India#cpa highest salary India#best institute for CPA in India#cpa course details and fees#US Certified Public Accountant Exam

0 notes

Text

Dreaming of a successful career? Consider the CPA course in India for substantial career growth as a chartered accountant. Unlock vital insights below for a path towards professional success. 📚💼

Read more at http://tinyurl.com/7vf873t3

#cpa#cpa firm#cpa exam#cpa course#cpa marketing#cpa usa#cpa course online#us cpa course#cpa course in india#cpa india#education#career#higher education#finance and accounting#finance professionals#online courses#accountant#e learning#accounting professional#accounting career#careers#career growth#professional growth

0 notes

Text

#universitytranscripts#canada#canada immigration#study visa#us cpa exam#mastercard#independence day#india#wescanada bangaloreuniversity#wescanada#visa#visa consultants#studyvisa

0 notes

Text

Nowadays US CPA is one of the most popular courses in India. Students search for CPA Study material, CPA Classes, CPA course in India, the US CPA exam process, NASBA evaluation, and many more things. If you're interested to know more about their curriculum and get step by step guidance on which course to look for then KC GlobEd is just the right option for you. With KC GlobEd you get the right counseling and an in-depth understanding of the curriculum. Visit us on our website or call us to book a slot with our counselors.

2 notes

·

View notes

Text

The Best Accounting Software for Small Businesses in 2023:

Introduction:

There are several accounting software options available for small businesses, including QuickBooks, Xero, FreshBooks, and Wave. These software programs can help small business owners manage their financial transactions, create invoices and track expenses, and generate financial reports. Some key factors to consider when choosing accounting software for a small business include the cost, ease of use, and the specific features and integrations that are important for the business's needs.

VNC is another term for perfection we are India's leading financial accounting and bookkeeping outsourcing Accounting Experts in India.

Accounting Expert in India:

An accounting expert is a professional with extensive knowledge and experience in the field of accounting. They may hold certifications such as a Certified Public Accountant (CPA) or Chartered Accountant (CA) and have a deep understanding of accounting principles, regulations, and financial reporting. They can assist with financial statement preparation, tax compliance, financial forecasting, budgeting, and other financial matters. It's important to note that accounting experts can specialize in different areas such as audit, tax, and management accounting.

What does an accountant do?

An accountant is a professional who performs financial tasks such as recording, classifying, and summarizing financial transactions to provide information that is useful in making business and economic decisions. Some of the specific responsibilities of an accountant include:

Recording and maintaining financial records, including those related to income, expenses, and assets.

Preparing financial statements such as balance sheets, income statements, and cash flow statements.

Analyzing financial information to identify and recommend ways to reduce costs and increase revenues.

Assisting with budgeting and forecasting.

Ensuring compliance with tax laws and regulations.

Providing advice on financial matters, such as raising capital or investing funds.

Auditing financial records to ensure accuracy and compliance with laws and regulations.

There are different types of accountants, such as public accountants, management accountants, and government accountants, each with its own specific responsibilities and focus areas.

Chartered Accountants in India:

Chartered Accountants (CA) in India are professionals who have completed a rigorous education and training process and have passed a series of exams in order to be recognized as a CA by the Institute of Chartered Accountants of India (ICAI). They are considered experts in the field of accounting, auditing, and tax.

VNC is another term for perfection we are India's leading financial accounting and bookkeeping outsourcing Accounting Experts in India.

The process to become a Chartered Accountant in India includes:

Completing an undergraduate program in commerce or a related field.

Registering as a student member of the ICAI.

Completing three levels of theoretical and practical education, including the Common Proficiency Test (CPT), the Integrated Professional Competence Course (IPCC), and the final exam.

Completing a certain period of practical training under a practicing CA.

Clearing an Ethics and Professionalism assessment.

Chartered Accountants in India are authorized to perform various roles such as auditing financial statements, filing tax returns, advising clients on tax planning and compliance, providing business and financial consulting services, and conducting internal audits for companies.

In addition, CAs are also authorized to provide services to the public, including certification of financial statements, providing opinions on financial matters, and carrying out due diligence exercises.

VNC is another term for perfection we are India's leading financial accounting and bookkeeping outsourcing Accounting Automation experts in Australia.

3 notes

·

View notes

Text

Popularity of US CMA Course in India | Zell Education

The Growth in Popularity of US CMA Course in India

Overview

The Certified Management Accountant (CMA) credential provided by the Institute of Management Accountants in USA has gained significant attraction all over India since its advent, almost ten years ago. The field of financial planning, analysis, control and decision support are provided by the CMA qualification. It prepares management accountants and finance for action required in the strategic management within a global economy that is increasingly becoming dynamic. Lets discuss the popularity of US CMA course in India.

According to IMA, as of 2022 in terms of number CMA holders across the world India is second after US. The popularity of US CMA amongst India’s accounting professionals is indicative that the fleeing population prefers to occupy jobs globally, and for higher salary. The number of CMA course and certification registrations has been increasing at over 20% year-on-year, showing clear interest in the program. Important factors are pushing more Indian accounting and finance professionals to earn the US CMA designation.

Increasing MNCs Establishing Presence in India

India has seen a steady rise in multinational companies (MNCs) setting up operations in the country over the past two decades due to economic liberalization and market-friendly policies. MNCs now contribute significantly to India’s GDP and job creation.

The popularity of US CMA certification can be attributed to its worldwide recognition and strategic financial planning concepts relevant to business expansion. Many of these MNCs have their headquarters in the US or have global shared services centers based there. They prefer to hire candidates with US certifications like the CMA due to the following reasons:

Uniformity in Accounting Practices: Adoption of US certifications leads to alignment of Indian operations with the global accounting practices followed within the organization. This enables smoother functioning.

Performance Benchmarking: Global finance teams are able to set goals objectively, measure performance, and compare results across different country operations.

Talent Development: Structured training helps staff develop expert finance skills as per globally benchmarked standards regardless of their geographical location. This aids in succession planning and talent mobility across regions.

The increased presence of US MNCs and alignment of Indian arms to US corporate culture has significantly boosted the popularity of credentials like the CMA in India in the last 5-7 years.

Worldwide Recognition

The US CMA qualification is recognized and valued worldwide, especially in countries like the United States, Canada, the Middle East and China. This gives it a global edge and international mobility for certified professionals. Owing to the popularity of US CMA in the workforce, many B-schools have started offering preparatory courses for the exam.

Portability Across Countries

CMA-certified accountants enjoy swift visa processing and ease of getting work permits across global economic hubs like:

1. United States: The IMA-CMA certification is licensed by all 50 American states and considered at par with other US accounting credentials like CPA, CFA etc. It is the fastest pathway for immigration to the USA through programs like H1B and EB2. Over 100,000 CMAs are currently employed in America.

2. Canada & Australia: Management accountants with a US CMA are prized by Canadian employers for accounting, strategy and financial planning roles across various industries. Certified CMAs also get extra migration points while applying for PR visas as skilled professionals. The same is the case with Australia.

3. Middle East: Countries like UAE, Qatar, Saudi Arabia and Oman are actively recruiting senior finance professionals and CXOs holding the reputed CMA qualification from the USA, offering lucrative tax-free salary packages.

4. China & Hong Kong: The majority of Fortune 500 companies have offices in China. They prefer employing CMA credential holders for uniformity in global accounting practices and seamless collaboration between regional teams.

Globally Benchmarked Program

The US CMA course is administered by the IMA (Institute of Management Accountants), the world’s leading finance association dedicated solely to management accounting and financial management professionals.

The 2-part CMA exam is competency-based and tests real-world application of knowledge on Financial Planning & Analysis, Corporate Finance, Decision Analysis, Risk Management, Investment Decisions and Professional Ethics.

It meets the highest global benchmarks in rigor and quality of the curriculum. Partnerships with renowned business schools like McGill Executive Institute (Canada) further bolster its pedigree as a gold standard in financial planning and analysis.

These reasons have exponentially boosted the global reputation of the US CMA certification in the last decade and expanded its scope beyond American shores into every major world economy.

A Short-Term Professional Program

The US CMA course is designed as a flexible and structured certification that can be completed alongside full-time work in just 12-16 months. The popularity of US CMA among entrepreneurs is growing as it helps them make key investment and financing decisions for rapid growth.

Self-Paced Learning: Professionals can self-learn the subjects at their convenience without needing to enroll in full-time classes. Study manuals, online classes, mock tests and expert mentorship provide a structured framework.

Exam-Based Testing: The evaluation methodology is exam-based, objective and focuses on practical real-world applications of knowledge through analysis of scenarios and problems.

2 Parts: There are two exam parts, each having two papers – multiple choice questions and essay-type descriptive questions. Candidates can give the parts one by one at their own pace.

Accessible from Anywhere: CMA allows professionals from any geography to improve their skills by giving online proctored exams in their city. This removes geographical barriers.

CMA-certified professionals need just two years of relevant work experience in fields like budgeting, financial planning & analysis, management accounting, costing etc.

This can be completed along with self-paced exam preparation over 1.5 years. So, within 12-16 months of signing up, financial executives can fulfill all CMA requirements without needing to take a career break.

Career Prospects with Top-Tier Employers

The US CMA opens up rewarding career opportunities both in India and abroad. Surveys show certified management accountants earn 35%-45% higher compensation compared to non-credentialed peers. Despite the growing popularity of US CMA courses, enrollments remain male-dominated, though experts encourage more women to acquire this strategic financial skillset.

In India, CMA-certified professionals are increasingly valued by large corporates, multinationals, consulting firms, banks and accounting practices for the following roles:

Financial Planning Managers

Cost Accounting Managers

Investment Analysts

Business Analysts

Business Development Managers

Finance Controllers

Commercial Managers

Top global recruiters like Amazon, Deloitte, E&Y, Goldman Sachs, JP Morgan Chase, Walmart, Shell and IBM actively hire and reward CMA credential holders with lucrative salary packages.

Kickstart Your Entrepreneurial Journey with a Head Start

For professionals aspiring to launch their ventures, the CMA course provides a strong foundation across all critical areas to set up and manage a company as certified management accountants.

Financial Planning: Prepare accurate cash flow statements, balance sheets, working capital projections, cost & profitability analysis and funding requirements for smooth business operations.

Costing: Expertise in decision-making concepts like target costing, life cycle costing and value analysis to maximize profitability and efficiency.

Regulatory Compliance: Knowledge of tax codes and laws across GST, corporate and labor laws applicable for business entities in India for legal compliance.

Technology Integration: Learn manufacturing, retail and service industry best practices to optimize performance via emerging digital technologies like AI, predictive analytics, blockchain etc.

Strategic Thinking: Understand market dynamics to identify new growth avenues, competition mapping, trends analysis and craft differentiated business strategies.

Leadership Skills: IMA’s management accountant code of ethics instills principles of trust, accountability, transparency and integrity to lead by example.

With the popularity of US CMA, IMA’s India chapter is actively organizing information seminars and preparation workshops in metro cities. This 360-degree skillset positions certified CMAs as the ethical backbone for corporates and gives entrepreneurs a strategic head start to set up, manage and scale their own companies.

Conclusion

The rising popularity of US CMA courses in India is attributable to the country’s integration with the global economy and the increased presence of MNCs with bases in America. The course is widely respected worldwide for its rigorous curriculum. It expands the career prospects of Indian candidates beyond geographical borders while helping global corporations benchmark professional competencies. The exam-based structure also makes it a convenient and fast-track option for working professionals to upgrade their finance skills and earnings potential without a career break. No wonder it is emerging as the preferred global finance credential for smart Indian millennials looking to take their careers to new heights both within and outside India.

FAQs

Does US CMA have value in India?

Yes, the US CMA credential is highly valued in India due to the rising presence of MNCs with US headquarters who prefer to align their global operations with American business culture and accounting practices. It provides uniform training in finance concepts to Indian employees, enabling easier performance management across geographical locations.

Does US CMA have scope?

The US CMA certification has immense scope in India as well as abroad. Surveys show CMA-certified professionals earn 35-45% higher than non-credentialed peers. Top global and Indian corporates across banking, financial services, information technology and manufacturing sectors actively recruit and reward CMA credential holders for a variety of strategic finance roles.

Is US CMA worth doing?

Yes, US CMA is absolutely worth pursuing for Indian finance professionals looking for global job mobility and higher earning potential. The course expands career opportunities abroad while opening up senior management roles with attractive salary packages across top Indian and multinational corporations.

Where is CMA most demanded?

The US CMA credential is highly in demand in India, the United Arab Emirates (UAE), China, Canada, Australia and New Zealand due to rising globalization and the presence of multinational companies in these countries. Job surveys show that certified management accountants tend to earn higher remuneration compared to non-credentialed accounting and finance professionals in these regions.

Anant Bengani, brings expertise as a Chartered Accountant and a leading figure in finance and accounting education. He’s dedicated to empowering learners with the finest financial knowledge and skills.

0 notes

Text

The Importance of the Best CMA Institute in Delhi and US CPA Coaching in India

Are you looking to advance your career in finance and accounting? Finding the best CMA institute in Delhi and top-notch US CPA coaching in India could be your ticket to success. Let's explore why these institutes are significant for aspiring professionals like you.

Why Choose the Best CMA Institute in Delhi?

Expert Guidance: At the best CMA institute, you gain access to experienced instructors who provide comprehensive guidance tailored to your needs.

Practical Learning: From real-world case studies to hands-on simulations, the institute ensures you grasp concepts effectively, preparing you for the dynamic field of management accounting.

Networking Opportunities: Interacting with peers and industry experts fosters valuable connections that can open doors to lucrative career opportunities.

Exam Preparation: Equipped with proven strategies and resources, the institute assists you in navigating the challenging CMA exam with confidence.

The Significance of US CPA Coaching in India

Global Recognition: Earning a US CPA designation enhances your credibility worldwide, making you a sought-after professional in the finance industry.

Comprehensive Curriculum: US CPA coaching covers all aspects of the CPA exam, ensuring you're well-prepared to tackle each section successfully.

Flexibility: With flexible study options and schedules, you can balance your career and personal commitments while pursuing your CPA credential.

Career Advancement: Becoming a US CPA opens doors to many career opportunities, including roles in public accounting firms, corporations, and government agencies.

In conclusion, investing in the best CMA institute in Delhi and top-tier US CPA coaching in India is a strategic move that can propel your career to unprecedented heights. With expert guidance, comprehensive curriculum, and global recognition, these institutes pave the way for your success in the dynamic world of finance and accounting.

0 notes

Text

4 Best CMA Books Helpful For CMA US Exams | CMA Foundation Books

The CMA US Certification Is One Of The Most Prestigious And Internationally Recognized Credentials In The Field Of Accountancy The Certification Issued By The IMA (Institute Of Management Accountants), CMA US Is An Especially Precious Qualification To Have For Accounting Professionals Wanting To Climb Up The Corporate Ladder And Reach The Managerial Role.

US Certified Management Accountant (CMA) Certification Focuses More On Managerial Accounting, It Will Let The CMAs Get A Higher Position In The Corporate World. With A Higher Position Comes A Higher Salary. The CMA-Certified Accountants Can Get Way Better Remuneration Than Their Non-CMA Counterparts. As The CMA Credentials Are Internationally Recognized Accountancy Qualifications, You Get The Chance To Work Anywhere In The World You Want To Be. All Of This Attracts Many Individuals To Achieve The CMA Certification. But Without Proper Guidance And Quality CMA Books/Study Material, Most Of Them Are Not Able To Achieve The CMA Certification.

The Applicants Are Required To Pass Two Rigorous Examinations To Get Their CMA US Certification. These Two Examinations Are Quite Challenging To Clear. With Only A 45% Pass Rate, These Two Examinations Are Considered The Valued Of All The Examinations Conducted In The Field Of Accountancy.

But If You Put A Great Study Plan With The Help Of The Right Mentors/CMA Books And Stick To That Study Plan, Then You Most Probably Can Crack The CMA Examination. But Deciding On The Right CMA Books And Mentors Is Not As Easy As It May Sound.

With Several Options Of US CMA Books And A Review System Created By Various Companies, It Becomes Quite A Hustle To Find The Right Fit For You. Especially, When All These Companies Constantly Boast That Their Study Material Is The Best. In This Article, You Will Find Out Which CMA Book Publishers And Study Materials Are Actually The Best For You.

Which Are The Best CMA USA Books In India?

It Is Necessary To Find High-Quality CMA Books/Study Materials That Add Value To Your Learning Style, While Not Putting Too Much Burden To Choose. The Review System For CMA US Refers To The Collection Of The Self-Study Resources Designed To Crack The CMA US Exams.

Let Us First See The Syllabus Of The CMA USA Exam For Both The Parts Along With The Subject Percentage Break-Up.

Part 1: Financial Planning, Performance, And Analytics

15% - External Financial Reporting Decisions

20% - Planning, Budgeting, and Forecasting

20% - Performance Management

15% - Cost Management

15% - Internal Controls

15% - Technology and Analytics

Part 2: Strategic Financial Management

20% - Financial Statement Analysis

20% - Corporate Finance

25% - Decision Analysis

10% - Risk Management

10% - Investment Decision

15% - Professional Ethics

IMA, The Conducting Body, Does Not Provide Any Study Material. Hence, The Applicant Has To Rely On 3rd Party Companies For The Study Materials, Though These Companies Are Verified By The IMA. These Companies Include - Becker, Gleim, Hock, Wiley, And A Few More. All Of Them Propagate That Their Study Material Is Superior. Of Course, Each Of Them Has Its Own Pros And Cons. But All This Makes The Selection Of The Right Study Material A Task In Itself.

Hence, To Help You In Finding The Right Study Material And CMA Books, We At NorthStar Academy Have The Most Preferred Study Material, CMA Prep Courses, And Review Courses. These Are The Best Set Of Study Materials That Can Cater To An Indian Student Or Accounting Professional And Help Them Immensely In Clearing The CMA USA Exam.

Let�S Look At The Top Options For CMA Study Materials And Books Ranked From Top To Bottom.

1. Becker US CMA Review System

Becker Is A Respected Brand For Creating Study Material In Accountancy And Is Well Known For Its CPA Books. A Little More Than A Year Ago, The Company Started To Produce Its Own CMA Books And Study Material.Becker's Review System Also Provides One-By-One Tutoring And Live Webinars With Their Study Material. The Candidates Who Are Facing Difficulty In Understanding A Topic Themselves From The Book Will Be Given An Option To Speak With Experts Who Can Answer All Their Queries.But As Not Much Time Has Passed Since The Release, The Books And Study Materials From This Company Still Have To Pass The Test Of Time, Which Is Why Many Are Reluctant To Purchase The Becker CMA Review Course.

2. Gleim US CMA Study Material

Gleim Is One Of The First Providers Of The Study Materials For The US Certified Management Accountant (CMA) Certification. The Study Material Provided By Gleim Is Considered One Of The Most Detailed CMA Books/Study Material. It Is Also The Most Affordable Of The Course Mentioned Down Here.

The Study Guide Provided By Gleim Includes A Massive 4,500 Multiple-Choice Questions. Making Gleim One Of The Largest Test Banks.

Gleim Has Been Providing Study Material For CMA US Certification For More Than 45 Years, Which Means Gleim's Study Material/Review Course Is Also Time-Tested. Hence, It Is The Most Popular And Commonly Used Review System.

Though, The Language Used In The CMA Of Books Of Gleim Courses Is A Little Difficult, As It Is Designed Assuming You Have Some Financial Knowledge.

You Will Be Good To Go If You Join A Reputed Institute Like NorthStar Academy And Let Their Tutors And Mentors Make Thighs Simpler For You. NSA Has An Association With The Gleim And Provides Their Study Material Along With The Much-Needed Attention, Support, And Other Vital Aspects.

3. Wiley US CMA Review System

Wiley Offers Highly Comprehensive Study Material, Specially Designed For The Students Doing Self-Study For The CMA US Examination. The Language Used In The Wiley CMA Books And Study Materials Is Clear And Easy To Understand. This Means That Books Are Written For Individuals With No Prior Financial Knowledge. Hence, Can Be Followed By Complete Beginners. The Wiley CMA Excel Platinum Review Course Includes More Than 65+ Hours Of Video Guidance, Together With Test-Based Guides And Mock Exams.

The Wiley Review System Also Includes A Performance Tracker And An Interactive Study Planner, For Creating The Best Study Plan.

For The Limitations, The Wiley US CMA Study Material Is Quite Expensive For Many Candidates.

4. Hock US CMA Study Material

Hock CMA Study Materials Are Becoming Popular Recently, Especially Among International Students. It Is A Great Course, Which Is Designed To Suit Everyone And It Is Also The Most Affordable CMA Study Material Available On The Market. The Most Fascinating Thing About The Hock CMA Course Is That It Is The Only Review Course To Offer The �You Pass Or We Pay Guarantee� Assurance.

These Are Some Of The Study Materials That You Can Get Hold Of In India, However, Keep In Mind That Gleim�S Study Materials In Association With NorthStar Academy Are The Best. The Course Material, Mentorship, Guidance, Doubt Resolution, And Real-World Project Experience Are Some Of The Best Advantages Of Joining The NorthStar Academy. You Can Enroll In Their CMA USA Course To Get Access To The Most Referred And Highly Relevant Study Material.

CMA Books PDF For CMA Foundation, Intermediate & Final Levels

The CMA India Certification Is The Indian Version Of CMA USA. The ICMAI, An Organization Of Accounting Professionals, Conducts The CMA India. The CMA India Is Conducted In Three Phases - CMA Foundational, CMA Intermediate, And CMA Final. With 20 Subjects Divided Into These Three Examinations.

The Candidates Have To Clear All Three Examinations To Get The CMA India Certification And To Clear These Examinations; You Need Good Quality Study Material And Books. CMA Foundation Books And Other CMA Study Materials, Provided By The ICMAI, Are The Best And Most Reliable. Here Is The List Of CMA Books Pdf Required To Crack The Examination.

CMA Foundation Books:

Getting CMA Foundation Books Is The First Step Toward The CMA India Certification. The Foundation Exam Consists Of 4 Papers, The ICMAI Has Launched 4 Different CMA Foundation Books For Each Paper. You Can Download These 4 CMA Foundation Books From The Official Website Of ICMAI. But In Order To Make Things Simpler For You, Here Are The Links To Download CMA Foundation Books:PapersCMA foundation books PDFsPaper 1 - Fundamentals of Economics and ManagementClick here to downloadPaper 2 - Fundamentals of AccountingClick here to downloadPaper 3 - Fundamentals of Laws and EthicsClick here to downloadPaper 4 - Fundamentals of Business Mathematics and StatisticsClick here to download

Other The Books By The ICMAI, The Candidate Can Use These Reference CMA Foundation Books:

Fundamentals of Accounting by N S Zad.

Financial Accounting by Jasmine Kaur.

Offences Under Company Law (Penalties & Punishments) by CA Kamal Garg

Fundamentals of Business Mathematics by Dr. S.R. Arora / Dr. Kavita Gupta.

CMA Intermediate Books

Unlike The 4 CMA Foundation Books, There Are 8 CMA Intermediate Books. But The Examination Can Be Taken In Two Groups, Each Group Having 4 Books. Here Is The List Of CMA Inter Books, Provided By The ICMAI.Paper-5: Financial Accounting (Group 1)Paper- 6: Laws and Ethics (Group 1)Paper- 7: Direct Taxation (Group 1)Paper- 8: Cost Accounting (Group 1)Paper- 9: Operations Management & Strategic Management (Group 2)Paper- 10: Cost & Management Accounting and Financial Management (Group 2)Paper- 11: Indirect Taxation (Group 2)Paper- 12: Company Accounts & Audit (Group 2)

CMA Final Books

ICMAI Also Offers The 8 CMA Final Books For All 8 Papers/Subjects, As It Does For The CMA Foundation Books And Inter Books. Here Is The List Of Books With Download Links.Paper- 13: Corporate Laws & Compliance (Group 3)Paper- 14: Strategic Financial Management (Group 3)Paper - 15: Strategic Cost Management - Decision making (Group 3)Paper- 16: Direct Tax Laws and International Taxation (Group 3)Paper- 17: Corporate Financial Reporting Revised (Group 4)Paper- 18: Indirect Tax Laws and Practice (Group 4)Paper - 19: Cost and Management Audit (Group 4)Paper - 20: Strategic Performance Management and Business Valuation (Group 4)

FAQ's

1. Which Book Is Best For CMA Preparation?

For the CMA US examination, Becker are considered the best CMA review system. But the Books/study material by the Gleim is quite affordable and is time-tested. Hence, Most of the institutes, including the North Star Academy, use Becker study material for the same reason.

2. What Is The Best Way To Study For CMA Exam?

There Are Plenty Of Ways To Better Prepare For The CMA Examination. Here Are Some Of The Best Ways/Steps One Can Take To Study For The CMA.

1. Create A Study Plan

2. Find A Review Course (Set Of Study Material) That Is The Right Fit For You. The Article Will Help You With That.

3. Create/Find And Study In A Productive Environment.

4. Identify Your Key Weak And Strong Points. Start Working On Your Weak Points.

5. Continue Your Preparation, Till The CMA US Examination Date.

6. Take Care Of Your Mental And Physical Health While Preparing For The Examination.

3. Which Book Is Best For CMA Inter?

ICMAI provides CMA books pdf for all three phases of the CMA India examination, which include - CMA foundation books, CMA Intermediate books, and CMA final books for all the subjects. It is recommended to follow the books provided by the ICMAI for the preparation for the CMA intermediate examination.

4. Which Book Is Best For US CMA?

Becker CMA books are the best books for the CMA preparation, as these books are well known for being super detailed and are also quite affordable compared to the other options. But If you are someone who does not have any prior knowledge of accounting, then it will be difficult for them to follow Gleim's study material.

5. Is The CMA US Exam Tough?

With the passing rate of the CMA USA exams being notoriously low, it is safe to assume that the CMA US exams are quite tough. The CMA USA exam is considered the most difficult exam conducted in the field of accountancy. However, with proper preparations and a well-organized CMA USA course, the chances of clearing the examination drastically increase. In the above blog, we discussed the best study material available for the CMA US preparation.

6. Does The IMA Provide Any Study Material For The CMA USA Examination?

IMA, Institute of Management Accountants, is the authority responsible for awarding the CMA US certification to all the deserving candidates. However, the body does not provide any study material to the candidates preparing for the CMA US exams.

7. Who Provides The Better Study Material For The CMA US - Becker Or Gleim?

The study materials/review systems provided by Becker and Gleim are both of top quality. Each has its own pros and cons. For example, Gleim provides a more in-depth knowledge of the subjects, but the language used is hard for beginners to comprehend, while Becker uses a layman's language to teach the topics but the price is on the higher side. However, Becker's study material, which is also provided by NorthStar Academy, is the oldest one and the most preferred among the individuals pursuing CMA USA certification.

Conclusion

Good Quality Books/Study Materials Are Necessary To Clear Any Exam, Especially For A Comprehensive Examination Like CMA USA. It Is Essential To Have Relevant CMA Foundation Books And CMA USA Books To Create An Understanding Of The Syllabus And Question Type. In Terms Of Affordability, The CMA Review Systems By Hock And Gleim Are The Most Affordable Ones. In Terms Of Overall Quality, Gleim, The Oldest, Most Precise, And Comprehensive Study Material, Is The Best For Studying The CMA USA Core Concepts Of All Subjects.

In Order To Get The Hang Of The Syllabus With Highly Organized Training, You Can Go For NorthStar Academy�S CMA USA Course. We Are The Leading Institute In This Field, Giving The Right Pathway To Thousands Of Individuals And Professionals With Our Top Mentors, Like M Irfat Sir.

We At NorthStar Academy Offer Becker's CMA Books/Study Materials For Preparing The Students For CMA USA Exams, As It Is Much More Comprehensive Having The 12-Section Wise Books Along With The Essay Case Study Books. For More Information, You Can Always Contact Us And We Will Clear All Your Queries And Counsel You Through. We Also Provide Bundle Discounts For Individuals Who Want To Get Enrolled In Our Top Courses And Become A Master In The Financial Management Field.

#CMSUSA #northstar #USCMA

0 notes

Text

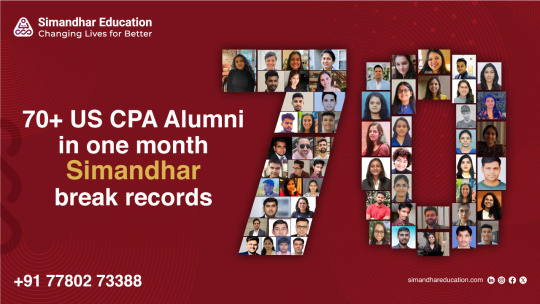

Simandhar Education Makes History: Fifth Elijah Watt Sells Awardee + 70+ CPA Passouts in a Month!

We have some truly exciting news to share with you! Simandhar Education has achieved a monumental milestone by producing its fifth recipient of the prestigious Elijah Watt Sells Award. This award is granted to individuals who achieve exceptional scores in the US Certified Public Accountant (CPA) exam, placing them in the top 1% of test-takers. What makes this accomplishment even more remarkable is that Simandhar Education is the only institute in India to achieve this feat!

In addition to this remarkable achievement, we also celebrate having over 70 CPA passouts in just one month! This outstanding number of successful alumni further demonstrates the effectiveness of our educational approach and the commitment of our students.

The Elijah Watt Sells Award is a highly esteemed recognition in the accounting profession, honoring individuals who have displayed exceptional knowledge and understanding of accountancy and financial reporting. It exemplifies the dedication, hard work, and expertise required to excel in the CPA exam. With this achievement, new doors of opportunity open up for our awardee, and we are incredibly proud to have played a role in their success.

Allow us to introduce Khushboo Mittal, our latest Elijah Watt Sells awardee and a proud Simandhar CPA alumna. Despite working full-time at Deloitte with just a B.Com degree, Khushboo exhibited unwavering determination and achieved exceptional scores on the CPA exam. Her remarkable accomplishment serves as a testimony to her hard work as well as the effectiveness of our coaching methodology.

We are equally proud of our previous Elijah Watt Sells awardees - Kavneet Hanspal, Dhruv Patel, Trishla Maniar, and Sachin Mall. These individuals showcased extraordinary dedication and achieved outstanding scores on their CPA exams. At Simandhar Education, we are privileged to have contributed to their remarkable success stories.

We at Simandhar Education are deeply committed to providing high-quality education to aspiring accounting professionals. Our experienced faculty, comprised of CPAs, are dedicated to ensuring that our students are fully prepared and confident for their CPA exams. Join us and experience the Simandhar Education difference.

Join our CPA masterclass on 7th January 2024 and get a chance to know all about CPA from none other than global CPA instructor and founder of Simandhar Education, Mr. Sripal Jain himself.

0 notes

Text

0 notes

Text

What is CMA Salary Per Month?

The Certified Management Accountant (CMA) designation is increasingly recognized for its emphasis on strategic financial management and decision-making skills. In terms of salary, CMAs are well-positioned to earn competitive remuneration. The monthly salary for a CMA varies based on factors such as experience, location, and industry.

On average, entry-level CMAs with 1-3 years of experience can expect a monthly salary ranging from $3,500 to $6,000. Mid-level professionals with 4-7 years of experience may command salaries between $6,000 and $10,000 per month. Senior-level CMAs, possessing over 8 years of experience, can enjoy monthly earnings exceeding $10,000, depending on their role and responsibilities.

Industries such as finance, manufacturing, and consulting often offer higher salaries for CMAs, recognizing the strategic financial insights they bring to the table. Additionally, geographic location plays a role, with metropolitan areas generally offering higher compensation to reflect the cost of living.

In conclusion, the monthly salary for CMAs is influenced by factors such as experience, industry, and location. The CMA designation continues to be a valuable asset for professionals seeking rewarding careers in management accounting and financial leadership roles.

#Indiacpa exam#certified public accountant#cpa full form#cpa in India#CPA review#cpa training institute#cpa salary in India#cpa syllabus#cpa license#cpa cost#cpa fees#us cpa exam#cpa exam fees in India#cpa details#cpa average salary in India#cpa highest salary India#best institute for CPA in India#cpa course details and fees#US Certified Public Accountant Exam

0 notes

Text

Elevate your career with the CPA course in India! 📚 Unlock global opportunities in accounting and finance. Enroll now for a transformative journey. 🌐📊

Join now : https://www.ifcpltd.com/cpa

Connect with us for more information:

📲+91 9903100338

📧[email protected]

#cpa#cpa usa#cpa course#cpa exam#cpa marketing#cpa course online#us cpa course#education#career#accountant#finance and accounting#online courses#finance professionals#higher education#e learning#accounting career#cpa India#cpa course in india

0 notes

Text

CPA without CA

While having a CA qualification alongside a US CPA can indeed open doors and offer wider options, it's unfair and inaccurate to say that a US CPA without a CA is useless.

Here's why:

Benefits of a US CPA:

International recognition: The US CPA is a globally recognized qualification, highly valued by multinational companies and accounting firms. With a US CPA, you can work in over 100 countries, including the US, UK, Singapore, and UAE.

Increased career opportunities: A US CPA opens doors to various exciting roles in finance, accounting, and consulting, not just limited to traditional auditing. You can find opportunities in forensic accounting, investment banking, corporate finance, and even data analytics.

Higher earning potential: US CPAs generally command higher salaries compared to other accounting professionals, both in India and abroad. The specific salary depends on your experience, skillset, and location, but the average US CPA salary in India ranges from ₹8-15 lakhs per year, with potential for much higher earnings in senior positions.

Specialized knowledge: The US CPA curriculum focuses on US GAAP (Generally Accepted Accounting Principles), which are used by multinational companies worldwide. This knowledge can be incredibly valuable in today's globalized business environment.

Considerations without Indian CA:

Practice restrictions: In India, only CAs registered with the Institute of Chartered Accountants of India (ICAI) can practice as statutory auditors for certain types of companies. However, US CPAs can still work in many other accounting and finance roles within India.

Competition: The Indian job market for US CPAs without a CA might be more competitive compared to those holding both qualifications. It's important to network, build your skills, and highlight your unique value proposition to stand out.

How Simandhar Education Can Help:

Simandhar Education understands the complex process of becoming a CPA and offers comprehensive support to aspiring accountants throughout their journey. Their services include:

CPA Exam Preparation Courses: Intensive and flexible courses designed to help you understand key concepts, master exam techniques, and pass all four sections of the CPA exam.

Expert Faculty: Learn from experienced CPA instructors who provide personalized guidance, answer your questions, and address your specific learning needs.

Comprehensive Study Materials: Access a wealth of study materials, including textbooks, practice questions, mock exams, and online resources, tailored to each section of the CPA exam.

Bridge Courses: If your educational background falls short of the required credits, Simandhar offers bridge courses to help you meet the eligibility requirements.

Career Services: Receive personalized career coaching and assistance with resume writing, interview preparation, and job placement after obtaining your CPA license.

Start Your CPA Journey with Confidence:

Embarking on the CPA journey can be exciting, but it also requires dedication and the right guidance. Simandhar Education provides the perfect platform to equip yourself with the knowledge, skills, and support you need to achieve your goals and become a successful CPA.

0 notes

Text

Global Learning with Online CPA Tutors

Global learning has transcended traditional boundaries, offering a dynamic approach to education through online platforms. In the realm of professional development, the certified public accountant qualification stands as a pivotal milestone for aspiring accountants. The integration of online CPA tutors into global learning initiatives has revolutionized the way individuals prepare for this challenging examination. Online CPA tutors bring a personalized touch to the learning experience, adapting to the unique needs of each student irrespective of the CPA review course they choose. With top-rated tutors available for one-on-one sessions, individuals can achieve excellence in their CPA journey. The accessibility of CPA courses online, as highlighted by platforms like kc globed, not only provides quality education but also enhances career trajectories for professionals worldwide. This global learning approach not only accommodates diverse schedules but also leverages the expertise of tutors with extensive experience in the field. Whether in india, the u.s or any corner of the world, individuals can access CPA courses online, paving the way for a comprehensive understanding of accounting principles and exam requirements.

Global Learning With Online CPA Tutors Offers

A transformative educational experience, transcending geographical boundaries. Leveraging the power of technology, students can access high-quality CPA tutoring from anywhere in the world, fostering a truly globalized approach to education.

The Positive Impact of Online Learning is Evident,

As Online CPA tutors it caters to diverse learning styles and preferences, accommodating a spectrum of student from those excelling with self-discipline to those who face challenges.

Online Learning Platforms

Driven by artificial intelligence (AI), play a crucial role in learner-instructor interactions. These platforms enhance communication, support, and instructor presence, thereby influencing students' engagement and success in their CPA studies.

The Integration of AI in Online CPA Tutoring Ensures

personalized learning experiences, tailoring educational content to individual needs.Distance learning, a subset of global learning, has proven effective for many students. While some excel due to self-discipline, others may find it average, and for a few, it may not be suitable.

The flexibility of online CPA tutoring accommodates varying learning styles and preferences, allowing students to tailor their study schedules to meet their needs.

Moreover, the Positives of Digital Life

as highlighted by Pew Research, contribute to the inclusivity of global online learning[5]. This inclusivity extends to CPA tutoring, breaking down barriers and providing opportunities for learners worldwide to access high-quality education.

A Real-World Testament, a Student's

success in passing an exam with 94%, with the assistance of ChatGPT, showcases the potential of AI in online learning environments. The use of AI, like ChatGPT, in online tutoring services ensures personalized assistance by analyzing students' learning needs.

Online Learning Transcends Geographical Boundaries

Allowing students from diverse backgrounds to benefit from the expertise of CPA tutors worldwide. The global reach of online CPA tutoring aligns with the positives of digital life, promoting inclusivity and connection in the realm of education.

Conclusion

In Conclusion, Online classes, such as those provided by platforms like universal CPA review and varsity tutors, utilize video explanations and personalized tutoring to enhance the learning experience. This mode of learning caters to individuals seeking professional growth and career advancement, allowing them to enroll in CPA courses from anywhere in the world.

0 notes

Text

The American Institute of Certified Public Accountants (AICPA) offers the Certified Public Accountant course (US CPA) as an accounting-related professional course. The flexibility of the US CPA exam, which can be taken from anywhere in India upon completion of the CPA US registration process, has led to a significant increase in the number of candidates pursuing the exam in recent years. The CPA US registration process allows candidates to obtain a globally recognized accounting qualification that is comparable to the Chartered Accountancy (CA) qualification in India. With the US CPA qualification, individuals can unlock new job opportunities in the field of accounting and finance, both in India and around the world.

#best coaching for cseet#best cseet online classes#cseet video classes#cseet video lectures#online classes for cseet

0 notes