#teslacompany

Link

Tesla reveals a loss of $204 million from Bitcoin investments in 2022.

https://hydnews24.com/recent-news/tesla-reveals-a-loss-of-204-million-from-bitcoin-investments-in-2022/

0 notes

Text

Reason For Tesla Model Y And Model 3 Price Cut

Reason For Tesla Model Y And Model 3 Price Cut

Tesla recently cut its price on Model Y and Model 3, however here, we mentioned the reason for the price cut on both car models

#tesla #teslamodely #teslamodel3 #modely #model3 #teslacars #teslacompany #elonmusk #teslanews #elonmusknews #electriccars #Teslaelectriccars #pricecut #teslanewprice

2022 was a peculiar year for Tesla. On the one hand, his actions experienced a drop never seen in his history; on the other, the company recorded its career’s best production and sales results.

Tesla was the best-selling electric car brand of the year. The Tesla Model 3 was the most registered emission-free model. The Model Y had a very good end of the course, becoming the most popular electric…

View On WordPress

#Model 3#Model Y#Tesla#Tesla Cars#Tesla Electric Cars#Tesla Inc.#Tesla Model 3 Price Cut#Tesla Model Y Price Cut

0 notes

Text

दुनिया के सबसे अमीर इंसान की नई गर्लफ्रेंड, उम्र जानकार रह जाएंगे दंग

दुनिया के सबसे अमीर इंसान की नई गर्लफ्रेंड, उम्र जानकार रह जाएंगे दंग

दुनिया की सबसे रोमांचक कार की बात हो तो ‘टेसला’ का नाम आता है। इस कंपनी के सीईओ एलन मस्क दुनिया के सबसे अमीर इंसान हैं। 50 वर्षीय एलन मस्क को एक नई लड़की के साथ देखा जा रहा है। बाद में पता चला की वो लड़की 27 वर्षीय ऑस्ट्रेलियाई अभिनेत्री नताशा बैसेट है। रेपोर्ट्स के मुताबिक अरबपति एलन मस्क और नताशा एक दूसरे को डेट कर रहे हैं। इस बात की पुष्टि तब हुई जब दोनों को एलन के प्राइवेट जेट में सफर करते देखा…

View On WordPress

0 notes

Text

एलन मस्क को महंगे पड़े अपने बोल, 7 शब्दों के विवादित ट्वीट से 1 लाख करोड़ कम हुई टेस्ला की वैल्यू

चैतन्य भारत न्यूज

वो कहते हैं न 'धनुष से छूटा हुआ बाण और मुख से निकली हुई वाणी कभी वापस नहीं होती...' यह कहावत इलेक्ट्रिक वाहन बनाने वाली विश्व की सबसे बड़ी कंपनी टेस्ला के फाउंडर एलन मस्क पर सटीक बैठती है. मस्क ने मुंह से तो कुछ नहीं कहा लेकिन उन्होंने ट्विटर पर कुछ ऐसा लिख दिया जिससे उनकी कंपनी की शेयर वैल्यू 14 बिलियन डॉलर (करीब 1 लाख करोड़ रुपए) घट गई है।

Tesla stock price is too high imo

— Elon Musk (@elonmusk) May 1, 2020

क्या था ट्वीट

��न्होंने लिखा, 'Tesla stock price is too high imo' यानी 'कंपनी के शेयर की कीमत बहुत ज्यादा है'. वैसे तो उनका ट्वीट महज 7 शब्दों का ही था, लेकिन उन्हें इस ट्वीट के एक-एक शब्द की कीमत 14 हजार करोड़ रुपए चुकानी पड़ी। कंपनी की वैल्यूएशन तो कम हुई ही, सीईओ मस्क की जेब से भी 3 बिलियन डॉलर (22.6 हजार करोड़ रुपए) निकल गए। मस्क के इस ट्वीट से कंपनी की वैल्यूएशन तो कम हुई ही और साथ ही उनकी जेब से भी 3 बिलियन डॉलर (22.6 हजार करोड़ रुपए) भी निकल गए।

I am selling almost all physical possessions. Will own no house.

— Elon Musk (@elonmusk) May 1, 2020

I am selling almost all physical possessions. Will own no house.

— Elon Musk (@elonmusk) May 1, 2020

ट्वीट में लिखा- गर्लफ्रेंड गुस्सा है

इसके अलावा उन्होंने ट्वीट कर अपनी सारी संपत्ति बेचने की बात भी कही थी। साथ ही एलन ने एक अन्य ट्वीट में कहा कि उनकी प्रेमिका पॉप म्यूजिशियन ग्रिम्स उन पर गुस्सा हैं। मीडिया रिपोर्ट के अनुसार, शुरुआत के आधे घंटे के कारोबार के दौरान टेस्लाके शेयर में करीब 12 फीसदी की गिरावट दर्ज की गई। हालांकि बाद में कंपनी के शेयरों ने तेजी दिखाई और यह 7.17 फीसदी की गिरावट के साथ 701.32 डॉलर यानी 52,599 रुपए पर बंद हुआ।

2018 में भी शेयरों में आई थी गिरावट

2018 में भी एलन मस्क के एक ट्वीट को लेकर बवाल हुआ था जिसमें थाईलैंड की एक गुफा में फंसे 12 बच्चों को बचाने वाले ब्रिटिश गोताखोर पर आपत्तिजनक टिप्पणी की थी। गोताखोर ने मस्क के खिलाफ मानहानि का केस भी किया था। इतना ही नहीं बल्कि 2018 में ही मस्क ने कंपनी को लेकर एक और विवादित ट्वीट किया था, जिसमें उन्होंने कहा था कि, टेस्ला जल्द ही 'निजी कंपनी' बनने जा रही है और इसका शेयर 420 डॉलर यानी 31,500 रुपए के हिसाब से बिकेगा। इसके बाद कंपनी के शेयर का भाव 20 फीसदी तक गिर गया था। साथ ही मस्क को इस ट्वीट के कारण कंपनी के सीईओ पद से भी हाथ धोना पड़ा था।

Read the full article

#elonmusk#elonmuskcompany#elonmusknews#elonmuskteslas#elonmusktweet#Tesla#Teslacar#Teslacompany#Teslanews#Teslashare#teslas#teslascars#teslascompany#teslasshare#एलनमस्क#एलनमस्कटेस्ला#एलनमस्कट्वीट#टेस्ला#टेस्लाशेयर

0 notes

Text

Tesla's Founder Elon Musk tweet wipes $14bn off Tesla's value

Since complaining that its share price was too high, Tesla's founder Elon Musk wiped $14bn off the automaker's value.

The tweet also kicked off Mr Musk's own interest in Tesla by $3bn as creditors quickly bailed out of the business.

"Tesla stock price too high imo," he wrote, one of many tweets that included a pledge to sell his land.

He stated his girlfriend was mad at him in other tweets, while the other simply read: "Rage, rage against the dying of the light of consciousness."

A tweet about Tesla's prospects, in 2018, on the New York stock exchange led to authorities fining him $20 m and promising to get all other messages pre-screened by lawyers on the website.

'Headache'

The Wall Street Journal confirmed that the billionaire had been asked if he was kidding about the share price tweet and if it had been checked, receiving the response 'No'

The share price of Tesla has risen this year, putting the valuation of the electric carmaker at nearly $100bn, a level that would cause a bonus payout to the founder of hundreds of millions of dollars.

I am selling almost all physical possessions. Will own no house.

— Elon Musk (@elonmusk) May 1, 2020

Wedbush Securities analyst Daniel Ives uncovered, "We view these Musk comments as tongue in cheek and it's Elon being Elon. It's certainly a headache for investors for him to venture into this area as his tweeting remains a hot button issue and (Wall) Street clearly is frustrated."

Mr. Musk tweeted in 2018 that he might have raised funds to potentially withdraw Tesla from the stock exchange and take it private, which contributed to fluctuations in share price once again. The Securities and Exchange Commission deemed it to be a market-moving statement, fined it and pressured Tesla to carry out tests to ensure it did not happen again.

Yet a federal judge last month said that Tesla and Musk had to face a shareholder lawsuit over the going-private tweet, including a charge that Mr. Musk tried to swindle them.

My gf @Grimezsz is mad at me

— Elon Musk (@elonmusk) May 1, 2020

Previously this week he tweeted some heavy criticism of the stay-at-home constraints due to the coronavirus outbreak to his 33.4 million fans. In 2019, after tweeting that a British diver was a "pedo guy" he found himself in court last year.

Mr. Musk stated his home, previously owned by actor and producer Gene Wilder, was included in the deal to sell his belongings and bought in 2013.

"One stipulation on sale," he posted, "I own Gene Wilder's old house. It cannot be torn down or lose any of its soul."

Do not forget leaving your valuable comment on this piece of writing and sharing with your near and dear ones. To keep yourself up-to-date with Information Palace, put your email in the space given below and Subscribe. Furthermore, if you yearn to know about the face masks’ failure before Taiwan Martial artists, view our construct, ‘Face Masks Fail to Crimp Style of Taiwan Martial Artists’.

Read the full article

#coronavirusoutbreak#DanielIves#electric-carmaker#electric-carmanufacturer#ElonMusk#ElonMusktweet#Investment#Mr.Musk#SecuritiesandExchangeCommission#stay-at-home#stockexchange#Tesla#teslacompany#TeslaStock#WallStreetJournal#Wedbush

0 notes

Text

Elon Musk Says Tesla Is Challenging With Company’s Expenses

CEO Elon Musk told employees in an email Thursday that he will review the company's costs going forward in an attempt to lower expenses, recent news says. After burning cash at a frightening pace and trying hard to return to a profitable path, electric carmaker Tesla recently chose to take on $2 billion in debt to fill out its threatening-low cash reserves. Unfortunately, that cash injection is far from a strong cure. At best, it could buy the company some time to increase revenue or at least reduce the speed at which it drops money.

Tesla completed the Q1 of 2019 with $2.2 billion in cash. However, the company lost $702 million, and so Musk said in April that Tesla would need to be on a "spartan diet." Tesla then went out and increased that $2.7 billion to help the company stay sailing.

Musk wrote Thursday: "This is hardcore, but it is the only way for Tesla to become financially sustainable and succeed in our goal of helping to make the world environmentally sustainable."

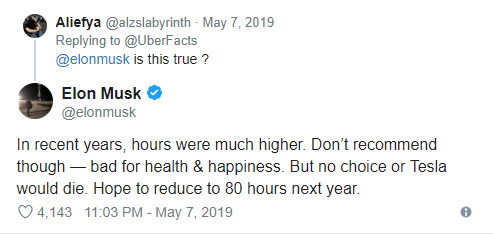

Before this month, Musk affirmed he works"between 80 and 90 hours a week" to keep his businesses afloat.

You're able to take a peek at his tweet too:

2018 might have been a pivotal year for the company's manufacturing efforts. However, Tesla still faces an existential crisis in regards to cash, and Musk's solution seems to be the same micromanaging that he is known for.

"If you are fighting a battle, it's way better if you are at the front lines. A general behind the lines is going to lose," he told to The Wall Street Journal at 2015.

Read the full article

#elonmusk#elonmuskart#elonmuskisagenius#elonmusknews#elonmuskquotes#elonmuskspacex#elonmusktesla#startuplogy#tesla#teslacars#teslaclub#teslacompany#teslamodel3#teslamodels#teslamodelx#teslamotors#teslaowner#teslaroadster#teslas

0 notes

Photo

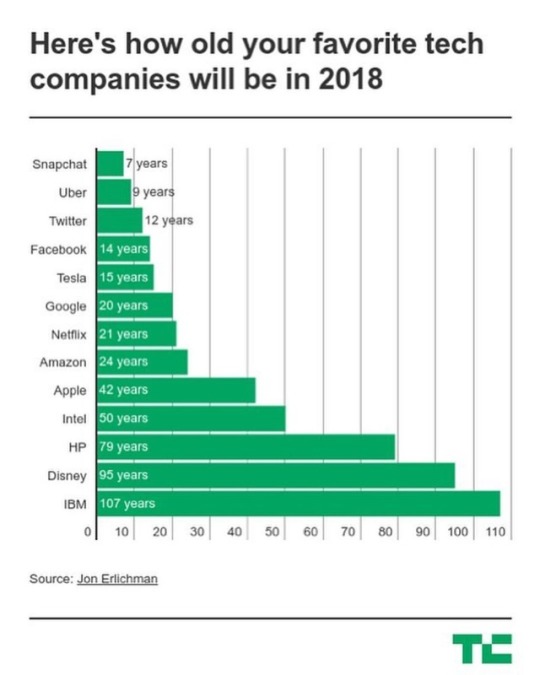

Tech is growing up. Here’s how old some of the biggest tech companies are now in 2018. . #Snapchat #Uber #Twitter #Google #technology #facebook #teslacompany #netflix @techcrunch (at Miki Holiday Hotel, Brastagi)

0 notes

Text

Why Tesla Stock Is Soaring with an Amazing Pace

Tesla stock surged from Wednesday afternoon after the company's earnings release. At one point in after-hours trade the stock jumped more than 10 percent — and that was on top of a 4% increase on Wednesday during the trade day. The step brought shares above $880, or up by 270% over the past year and by 2020 alone by more than 100 per cent.

Growth stock is smashing the market outright. Yet what was it that brought the stock of the electric-car manufacturer yet another lift higher in Tesla's first-quarter update Wednesday? Here's a look at three main reasons investors are confident after the latest quarterly update from the electric-car maker.

1. Beneficial for a Third Quarter in a Row

Perhaps the key reason Tesla stock jumped was a better-than-anticipated first-quarter results for the company. Its adjusted earnings per share was $1.24, average prediction by crushing analysts for a loss of $0.36 per share. In addition, Tesla posted notably a small profit of $16 million (nine cents per share) based on widely accepted accounting standards (GAAP).

"Q1 2020 was the first time in our history that we achieved a positive GAAP net income in the seasonally weak first quarter," Management said in the first quarter statement.

That reflected the third quarter in a row that both GAAP and non-GAAP based Tesla was productive. Profits for the quarter rose 32 per cent year-over-year to $5.99 billion, powered by strong production in the first quarter and deliveries of vehicles.

2. Model Y's Impressive Beginning

Over the last year, one factor investors have been so optimistic on Tesla stock is the accelerated execution speed of the company. The firm put a factory in China online in late 2019, less than a year after breaking ground on it. Tesla then started shipping its latest Model Y crossover in March 2020 six months ahead of the company's initial timetable for the car.

Now Tesla has yet another significant bit to report to investors on its improved execution pace: Model Y sales contributed a gross profit over the period, marking "the first time in our history that a new product has been profitable in its first quarter," Tesla stated.

3. Improved Profitability in Shanghai

A further promising sign of success over the quarter has been the improved gross margin for the product. During the quarter, Tesla's automotive gross profit margin was 25.5% — the best the firm has seen in 18 months. Although higher regulatory credit revenue gave this key metric a boost, another advantage driving sequential margin growth at the company's new factory in Shanghai was improved profitability, Tesla said. The company further said it now plans to reach a Model 3 rate of production of 4,000 units per week by mid-2020 at its Shanghai plant.

What about the Novel Coronavirus?

Tesla of course recognized that COVID-19 developed the company's challenges. "It is difficult to predict how rapidly automobile manufacturing and its global supply chain will return to prior levels," said the management. The company's California factory is currently pausing as Tesla copes with economic constraints as part of an attempt to help reduce the coronavirus spread.

Additionally, leadership said it is removing guidance for positive net income and free cash flow in the medium term, stressing a "wide range of potential outcomes" during this unpredictable period. "We will again revisit our 2020 guidance in our Q2 update."

Comforting investors, Tesla said it considers it has enough liquidity to proceed substantial investment in its product roadmap and long-term capacity extension while also managing the near-term COVID-19 difficulties.

Tesla finished the quarter with $8.1bn in cash. Yet free cash flow was negative at $895 million due to a combination of concurrent inventory growth due to the coronavirus interruption operations and Model Y manufacturing capacity investments.

Do not forget leaving your valuable comment on this piece of writing and sharing with your near and dear ones. To keep yourself up-to-date with Information Palace, put your email in the space given below and Subscribe. Furthermore, if you yearn to know about the demise of Rishi Kapoor, view our construct, ‘Rishi Kapoor, Legendary Bollywood Actor, Dies at the Age of 67’.

Read the full article

#Californiafactory#Coronavirus#COVID-19#electric-carmaker#electric-carmanufacturer#GAAP#Growthstock#Investment#ModelYcrossover#Q2update#Tesla#teslacompany#TeslaStock

0 notes