#standard chartered cryptocurrency

Text

0 notes

Text

Crypto Executives Bullish on Bitcoin: Targeting $100,000 in 2024

Bitcoin's price is currently near its 18-month high at $44,000, and analysts and investors are rushing to put out higher price targets for the cryptocurrency. Many believe that Bitcoin could reach $100,000 by next year. Executives from the crypto industry, such as Michael Saylor from MicroStrategy, one of the largest Bitcoin holders, are confident that Bitcoin could double in value within 12 months. Saylor has not officially announced a price target for 2024, but he has mentioned that Bitcoin could increase by tenfold and has suggested that one day people will brag about buying five-figure Bitcoin. Other crypto executives and mainstream financial players, including Matrixport and Standard Chartered Bank, have also expressed bullish sentiment towards Bitcoin, with price targets of $125,000 and $100,000 respectively.

There are two major catalysts driving the optimistic outlook for Bitcoin. Firstly, the US market is expecting the approval of the first-ever spot Bitcoin ETF, which could attract a significant influx of institutional investor money into Bitcoin when it happens, potentially in early 2024. Secondly, the Bitcoin halving, scheduled for April 2024, is anticipated to further boost the price. In the past, the halving has led to substantial price increases, and the next halving is generating excitement among investors. However, it's worth noting that there are risks involved, such as the SEC's decision on the ETF and the possibility that the halving may not have the desired impact on price. Despite these uncertainties, the overall sentiment remains positive, with Bitcoin having the potential to double in value in 2024 and reach the $100,000 mark.

While the path to $100,000 seems promising, there are still potential obstacles that could impede Bitcoin's growth. The SEC's potential rejection of a spot Bitcoin ETF could have a negative effect, considering the significance of this development. Additionally, the Bitcoin halving may not generate the expected results, which could dampen bullish forecasts. However, considering the significant growth Bitcoin has already experienced this year, with its value more than doubling, a target of $100,000 for 2024 seems reasonable. Overall, the long-term outlook remains positive for Bitcoin.

Read the original article

2 notes

·

View notes

Text

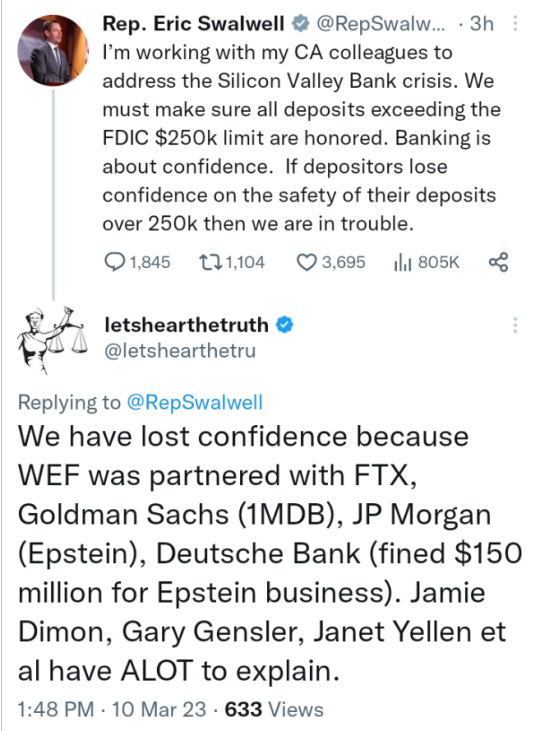

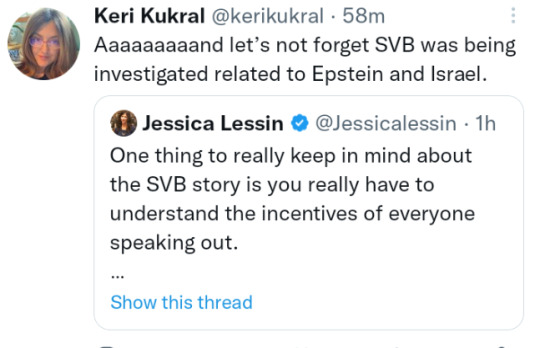

How World Economic Forum, others are hiding their past ties with FTX

https://nypost.com/2022/11/14/how-world-economic-forum-others-are-hiding-past-ties-with-ftx/?s=09

By Ariel Zilber, Thomas Barrabi and Lydia Moynihan

November 14, 2022 2:01pm Updated

The shocking implosion of the FTX crypto exchange has become an embarrassment for a who’s who among global elites, with some issuing mea culpas — and others apparently scrambling to hide their ties to its disgraced, 30-year-old founder Sam Bankman-Fried.

Web archive sites show that the World Economic Forum — whose glitzy shindig in Davos, Switzerland, is a must-attend for billionaires and world leaders each year — had previously listed FTX as one of its “partners,” touting the Bahamas-based firm as a “cryptocurrency exchange built by traders, for traders.”

Bankman-Fried also was a speaker at Davos last May alongside luminaries such as Google financial chief Ruth Porat and Bill Winters, CEO of the London-based financial giant Standard Chartered. Nevertheless, WEF has since scrubbed any mention of FTX from its website in the days after the crypto exchange filed for bankruptcy.

“FTX was a World Economic Forum partner. In light of last week’s events, their partnership was suspended and they were removed from the Partners section of our website,” a spokesman for the Geneva-based organization headed by Klaus Schwab told The Post on Monday.

According to one WEF insider, Bankman-Fried likely landed on the group’s site because he donated cash to the group, in addition to his upcoming speaking gig.

The WEF has not commented as to why it has deleted reference to FTX.

#Silicon Valley Bank#JP Morgan#Chase#Wells Fargo#Peter Thiel#Jeffrey Epstein#International Money Laundering#Russian Activity#Barclay's

6 notes

·

View notes

Text

China's preparations are bearing fruit: an important milestone in e-yuan testing

Technology tested

No particular problems found

Ask permission

Anticipating Hong Kong to blow up the crypto market, we have nearly missed a very important point. The “black swan” is about to knock, which is just around the corner.

Bitcoin dominance keeps rising while alt is falling. What does all of this mean? China has completed the second preparation stage to introduce its own digital currency!

Bank of China Limited, HSBC, Hang Seng, and Standard Chartered are now at the final phase of digital currency testing by doing cross-border transfers.

Currently, only a few have access to the digital yuan (eCNY), but soon it will be available to everyone in retail networks. What does this mean? We will see an answer to this question very soon. One can only assume that complete control over our finances will no longer seem a fairy tale. Why can't you buy a new phone or spend your money going on vacation? Later on, you can ask your bank about this.

A logical question is: “How to gain full control over your finances?” The answer is simple: move into the world of crypto. This is a promising area where you can earn and control your funds yourself.

Join us to be the first to know how to earn cryptocurrency. We provide valuable advice, strategies and news to help you achieve financial independence.

#cryptocurrency#China#electronicyuan#CBDC#digitalcurrency#finance#innovation#technology#economy#financialmarket#money#investment#crypto

1 note

·

View note

Text

Zondag-update: Geopolitieke Spanningen en Cryptomarkt Schokken: Een Analyse van de Impact

Beste Crypto-gids lezers,

Het is weer tijd voor onze zondageditie Nieuwsupdate. Terwijl ik dit artikel schrijf sta ik even stil bij de gezegende omstandigheden waarin ik mij bevind en ben ik dankbaar. Ik realiseer mij, dat naarmate de spanningen hoger oplopen in de wereld om ons heen dit wellicht voor steeds minder mensen is weggelegd. Vandaag zal ik toch de rol en invloed van de geo-politieke omstandigheden en hun invloed op de crypto industrie moeten belichten, maar verkies ik verder neutraal te blijven en jullie te voorzien van de dagelijkse gebeurtenissen.

Laten we voortzetten met het nieuws: Deze zondag hebben we nieuws over Bitcoin ETF’s die alle verwachtingen overtreffen, belichten wij de ontwikkeling in de politieke arena van de Verenigde Staten, en de invloed van de spanningen in het Midden-oosten op de Crypto industrie.

De cryptowereld staat op zijn kop na het recente nieuws over Bitcoin ETF’s die alle voorspellingen verbreken. Bitwise’s laatste analyse onthulde dat spot Bitcoin ETF’s de verwachtingen overtroffen en een AUM van $59,1 miljard in slechts drie maanden tijd verzamelden. Dit is aanzienlijk hoger dan de voorspellingen van financiële experts zoals JP Morgan en NYDIG, die jaarlijkse AUM’s van respectievelijk $36 miljard en $30 miljard voorspelden. Zelfs Matrixport’s voorspelling van $50 miljard aan het einde van het jaar werd overtroffen. Met Grayscale’s GBTC als een belangrijke speler, zijn spot Bitcoin ETF’s nu klaar om zelfs de ambitieuzere voorspellingen van Bloomberg en Standard Chartered te overtreffen.

De rapportage benadrukt een overweldigende vraag naar spot Bitcoin ETF’s, met een instroom van 212.852 BTC die ver boven de 74.756 BTC uitgegeven door miners uitstijgt. Deze trend zou kunnen intensiveren na de Bitcoin halvering, die naar verwachting de mijnopbrengsten zal verminderen. De instroom in spot Bitcoin ETF’s bereikte $12 miljard, ver boven de $3 miljard uitstroom van de top U.S. goud ETF’s.

Wat betreft de marktprestaties, is de waarde van Bitcoin dit jaar met 66,99% gestegen, wat heeft geleid tot groei op verschillende markten. Bitwise’s Hougan wees op de lage correlatie van Bitcoin met Amerikaanse aandelen, wat suggereert dat het potentieel heeft als een markthedge in plaats van een risico-asset. Zijn interpretatie van het rapport is “verbijsterend bullish” voor de toekomst van de cryptomarkt, wat wijst op de mogelijkheid van aanhoudende groei.

In een ander nieuwsbericht zien we dat John Deaton, een voorstander van cryptocurrency, recentelijk senator Elizabeth Warren heeft ingehaald in fondsenwerving voor een Senaatszetel in de Verenigde Staten. Deaton’s campagne, gesteund door grote namen in de crypto-industrie zoals Ripple’s Brad Garlinghouse en Cardano’s Charles Hoskinson, heeft $1,36 miljoen opgehaald, wat meer is dan Warren’s $1,1 miljoen in het eerste kwartaal van het jaar.

Deze ontwikkeling weerspiegelt de groeiende invloed van de crypto-gemeenschap in de politieke arena, aangezien Deaton’s pro-crypto standpunten steun ontvangen van prominente figuren in de industrie. Met Warren’s pleidooi voor strengere reguleringen en Deaton’s oproep voor meer flexibele kaders, staat deze verkiezing symbool voor een groter debat over de integratie van deze technologie in het Amerikaanse financiële systeem.

Bitcoin duikt omlaag als politieke spanningen in het Midden-Oosten escaleren

De prijs van Bitcoin en andere cryptocurrencies daalde scherp na een aanval van Iran op Israël. Op 13 april daalde de Bitcoin-prijs met meer dan 8,4% na een Iraanse aanval op Israël, wat de geopolitieke conflicten in het Midden-Oosten verergerde. De prijs van Bitcoin daalde van ongeveer $67.000 naar $61.625, waardoor binnen enkele minuten na het nieuws van de aanval meer dan $130 miljoen aan marktkapitalisatie werd uitgewist.

De uitverkoop beïnvloedt ook andere cryptocurrencies. Op het moment van schrijven was Ether met 9,81% gedaald naar $2.927, terwijl Solana met 15,96% zonk naar $129. Volgens gegevens van CoinMarketCap daalde de wereldwijde crypto-marktkapitalisatie met 8,19% naar $2,23 biljoen.

Volgens Bloomberg lanceerde Iran op zaterdag 13 april drones richting Israël. Deze actie was een vergelding voor een eerdere aanval van Israël, die een diplomatiek complex in Damascus, Syrië, had getroffen, waarbij zeven Iraniërs, waaronder twee generaals, omkwamen.

Naast de luchtaanvallen hebben Iraanse autoriteiten naar verluidt een vrachtschip in beslag genomen dat eigendom is van een Israëlische miljardair. Op 12 april waarschuwde de Amerikaanse president Joe Biden dat Iran “eerder vroeger dan later” aanvallen zou lanceren, waarbij hij benadrukte dat de VS Israël zouden helpen verdedigen: “Wij zijn toegewijd aan de verdediging van Israël. Wij zullen Israël steunen, wij zullen helpen Israël te verdedigen, en Iran zal niet slagen.” Het conflict tussen Iran en Israël heeft de spanningen in de regio aanzienlijk verhoogd, iets wat de VS sinds de terroristische aanslagen van 7 oktober 2023 door Hamas, die hebben geleid tot een bredere aanhoudende conflict tussen Israël en Hamas, naar verluidt hebben geprobeerd te voorkomen. Amerikaanse functionarissen hebben Israël aangespoord om de spanningen in hun reactie op Iran niet te laten escaleren, vertelde een regeringsbron aan CNN. De functionarissen uitten ook hun frustratie over het gebrek aan voorafgaande informatie die Israël had verstrekt over zijn luchtaanval in Damascus. Israël informeerde een Amerikaanse functionaris pas toen zijn vliegtuigen al op weg waren naar Syrië, aldus bronnen. “We waren niet op de hoogte dat Israël deze luchtaanval van tevoren zou uitvoeren,” verklaarde de functionaris. “Minuten voordat het gebeurde en toen Israëlische vliegtuigen al in de lucht waren, nam Israël contact op met een Amerikaanse functionaris om te zeggen dat ze bezig waren met het uitvoeren van een aanval in Syrië. Het bevatte geen details over wie ze doelden of waar het zou worden uitgevoerd, en de aanval was al aan de gang voordat het woord door de Amerikaanse regering kon worden doorgegeven.”

Deze week bracht verscheidene ontwikkelingen in de wereld van cryptocurrency en politiek. De onverwachte groei van Bitcoin ETF’s en de opkomst van Deaton in de politiek laten zien hoe de crypto-gemeenschap haar stempel drukt op zowel de financiële als de politieke wereld. Blijf op de hoogte van Crypto-gids voor meer updates.

Ik wens jou een prettige zondag,

CryptoKimmy

Read the full article

0 notes

Text

Standard Chartered Increases 2024 Bitcoin Price Target, Makes Record Forecast for Ethereum!

While the leading cryptocurrency, Bitcoin, rose above $73,000 and renewed its ATH, it could not hold on there and fell to $64,000 over the weekend due to the selling pressure it encountered.

Now, while investors are wondering in which direction BTC will move, the UK-based giant bank Standard Chartered has increased its 2024 year-end BTC price forecast.

According to Coindesk, the giant bank…

View On WordPress

0 notes

Text

Bitcoin hits US$50K for 1st time since 2021. What’s behind the surge

Bitcoin BTC= hit the $50,000 level for the first time in more than two years as the world’s largest cryptocurrency was buoyed by expectations of interest rate cuts later this year and last month’s regulatory nod for U.S. exchange-traded funds designed to track its price.

The cryptocurrency has risen 16.3 per cent so far this year, on Monday touching its highest since Dec. 27, 2021. At 12:56 p.m. EST (1756 GMT), bitcoin was up 4.96 per cent on the day at $49,899, having oscillated around the $50,000 level.

“$50,000 is a significant milestone for bitcoin after the launch of spot ETFs last month not only failed to elicit a move above this key psychological level but led to a 20 per cent sell-off,” said Antoni Trenchev, co-founder of crypto lending platform Nexo.

Crypto stocks also enjoyed a boost on Monday, with crypto exchange Coinbase COIN.O up 4.9 per cent and crypto miners Riot Platforms RIOT.O and Marathon Digital MARA.O up 10.8 per cent and 11.9 per cent, respectively. Shares of software firm MicroStrategy MSTR.O — a notable buyer of bitcoin — were up 10.2 per cent.

The price of ether, the second-largest cryptocurrency, was up 4.12 per cent at $2,607.57.

Global stock indexes also edged higher on Monday, as traders looked for cues on when the U.S. Federal Reserve might begin cutting interest rates. Analysts and financial market expectations both point to May as a potential start for rate cuts this year.

ETF exuberance

The primary driver behind bitcoin’s recent price appreciation “can be attributed to the increased inflow into BTC spot ETFs,” said Matteo Greco, a research analyst at fintech investment firm Fineqia International, in a research note.

The U.S. securities regulator on Jan. 10 approved the first U.S. spot bitcoin ETFs, a watershed for the world’s largest cryptocurrency and the broader crypto industry, which had been trying to bring such a product to market for more than a decade.

Greco in particular noted that outflows from Grayscale Investment’s Grayscale Bitcoin Trust GBTC.P — which received approval from the U.S. Securities and Exchange Commission (SEC)in January to convert to an ETF — have begun to slow.

“While GBTC recorded a cumulative outflow of $415 million last week, representing a significant reduction from previous weeks, BTC Spot ETFs saw a total net inflow of about $1.2 billion during the same period, marking the highest weekly inflow since their launch,” he said.

Analysts at Bernstein have estimated that flows into the new ETFs will build up gradually to cross $10 billion in 2024, while Standard Chartered analysts have said the products could draw $50 billion to $100 billion this year alone. Other analysts have said inflows could be $55 billion over five years.

The market is also eyeing seven pending applications in front of the U.S. SEC for ETFs tied to the spot price of ether. The SEC is due to deliver a final decision on several of those proposals by May.

Investors are also looking eagerly to the next bitcoin “halving,” expected in April, analysts say. That process is designed to slow the release of bitcoin, whose supply is capped at 21 million tokens – of which 19 million have already been created. Bitcoin rallied on the previous three halvings, the most recent of which was in 2020.

“With fourth bitcoin halving, a first Fed interest rate cut and potential ethereum spot ETF approval, all are significant for what is the smallest, youngest and most retail-dominated asset class,” said Ben Laidler, global markets strategist at eToro.

Read the full article

0 notes

Text

Forward-Looking Perspective: Standard Chartered Anticipates a Positive Trajectory for ETH, Highlighting the Potential SEC Approval for ETFs

Standard Chartered's projection of a promising Ethereum future takes center stage with the anticipation of a spot Ethereum Exchange-Traded Fund (ETF) approval by the SEC in May. Envisioning a potential surge to $4,000, the bank's forecast underscores Ethereum's resilience and growing significance in the digital asset landscape.

In the wake of the SEC's approval of Bitcoin ETFs, Geoffrey Kendrick, Standard Chartered's Head of Crypto Research, draws parallels between Bitcoin and Ethereum. Kendrick suggests that Ethereum's legal and financial parallels with Bitcoin position it favorably for ETF approval, despite lingering uncertainties over its SEC classification.

The delay in the SEC's decision on Ethereum ETF proposals adds an element of suspense to the unfolding narrative. SEC Chairman Gary Gensler's ambiguous stance on Ethereum's classification introduces an element of unpredictability, adding to the market's anticipation and speculation.

Beyond Ethereum's potential price surge, Standard Chartered also projects a substantial rise in Bitcoin's value, predicting it to reach $200,000 by 2025. The bank maintains a bullish stance on Bitcoin's growth, reflecting a broader confidence in the cryptocurrency market.

As the Ethereum market showcases resilience and growth, evidenced by Glassnode data, investor interest is reignited. The approval of Ethereum ETFs is seen as a catalyst, with prominent firms like BlackRock proposing their own, signaling a potential influx of institutional interest that could fortify the Ethereum ecosystem.

The Ethereum Spot ETF hype, as highlighted by blockchain figure Michaël van de Poppe, plays a pivotal role in revitalizing market interest. The resurgence in confidence, coupled with the prospect of ETF approval, paints a compelling picture of Ethereum's journey towards mainstream acceptance and recognition.

#Standard Chartered#Ethereum#ETH#U.S. Securities and Exchange Commission#SEC#Ethereum Exchange-Traded Fund (ETF)#BlackRock#Grayscale#Cryptotale

0 notes

Text

Bitcoin Price Predicted to Cause $6.9 Trillion Wall Street Earthquake

Bitcoin has surged in price, reaching highs not seen since late 2021, due to the hype surrounding a spot bitcoin exchange-traded fund (ETF). This success has surprised critics and pushed the wider cryptocurrency market over $2 trillion. The Biden administration has even declared a "crypto emergency" in response. Now, with the announcement that a Federal Reserve central bank digital currency (CBDC) is closer than expected, a respected bank analyst is predicting a $6.9 trillion Wall Street earthquake for the bitcoin price.

In an interview with Yahoo Finance, Geoff Kendrick, head of crypto research at Standard Chartered, stated that the entry of the 401(K) market, such as pensions, into bitcoin is a significant development. Kendrick believes that if several spot ethereum ETF applications are approved in May, other assets in the crypto space could experience similar price surges. Currently, U.S. 401(k) plans hold around $6.9 trillion worth of assets. Kendrick predicts that net inflows into spot bitcoin ETFs could reach $50 billion to $100 billion in 2024.

Kendrick has maintained his prediction of a $100,000 bitcoin price by 2024, which could rise to $200,000 per bitcoin in 2025. Notably, three newly-created spot bitcoin ETFs, including BlackRock's IBIT and Fidelity's FBTC, have already amassed $1 billion in assets under management. Market analysts suggest that the hype rally surrounding spot bitcoin ETFs, which began last year, may just be taking a breather before continuing. Overall, there is optimism that the bitcoin price could reach $55,000 in the coming weeks, with expectations of a rally to all-time highs of $70,000 in 2024.

Read the Original Article

0 notes

Text

Bitcoin's Dynamic Surge Towards $100,000 by 2024: Navigating Current Trends and Unpacking Standard Chartered Bank's Bold Prediction

In the ever-evolving realm of digital finance, cryptocurrencies have disrupted traditional financial paradigms, with Bitcoin (BTC) consistently dominating headlines. This digital currency has sparked widespread debates and intense interest among investors globally. A key focal point in today’s discussion is the audacious Bitcoin prediction by Standard Chartered—a milestone too significant to overlook.

Standard Chartered's Bold Bitcoin Forecast

Recently, Geoff Kendrick, the Head of Crypto Research at Standard Chartered Bank, projected that Bitcoin is on track to reach an astounding $100,000 by the end of 2024. As of now, Bitcoin stands robustly at $43,000 USD, indicating a notable upswing in its market value. This increase has reignited interest in the cryptocurrency space, with Kendrick noting that the rising market cap of digital assets will likely be a major driver of Bitcoin’s price growth.

Emerging Market Stability

An intriguing development is the latest on-chain data, which shows Bitcoin’s volatility now lagging behind major indices. This indicates a maturing market, potentially more attractive to institutional investors. Kendrick highlighted the growing likelihood of a spot Bitcoin exchange-traded fund (ETF) being approved by the U.S. Securities and Exchange Commission (SEC), which could further fuel Bitcoin’s price surge.

Technical Analysis: Breaking Resistance

Technical analysis reveals Bitcoin grappling with a significant resistance level around $42,500. Surpassing this barrier could open the door for substantial gains, in line with Standard Chartered’s optimistic forecast.

Institutional Interest Rekindled

The recent ascent of Bitcoin above $38,200 has sparked a resurgence of institutional interest, lending credence to the bank’s confidence in Bitcoin’s growth trajectory.

On-Chain Analysis: The Corporate Angle

On-chain statistics present a compelling narrative. Bitcoin’s 30-day Average Intra-Day Volatility is currently lower than that of the S&P 500 and NASDAQ-100 indexes, as per IntoTheBlock data. This reduced volatility may signal Bitcoin’s emergence as a mature asset class, enticing further corporate investment.

The Halving Effect

With the next Bitcoin halving scheduled for April 2024, there is anticipation that bullish BTC holders might be less inclined to sell. Historically, such events have led to a spike in Bitcoin’s value, potentially propelling it towards the $100,000 mark forecasted by Standard Chartered.

Addressing the Critiques

Bitcoin’s journey has been marked by dramatic highs and lows, leading critics to point out its inherent volatility and potential investment risks. Environmental concerns regarding Bitcoin mining’s high energy consumption also add to the critiques.

The Investment Conundrum

When considering investing in Bitcoin, the wisdom of diversification rings true. Global In/Out of the Money (GIOM) data suggests a significant number of holders bought Bitcoin around the $42,000 level. As the price approaches this level again, we may see a mix of profit realization and a potential surge past this resistance.

Risk and Reward: A Delicate Balance

Bitcoin, like any investment, carries risks. However, the immense growth potential and the bullish outlook from institutions like Standard Chartered make it an asset worth considering for a diversified investment strategy.

The Bearish Scenario

Should Bitcoin’s price fall below $30,000, support might come from the 6.45 million holders who purchased at an average of $30,400. Their commitment to hold could play a pivotal role in stabilizing Bitcoin’s price in the foreseeable future.

A Balanced Outlook

The vision of Bitcoin reaching $100,000 by 2024, as projected by Standard Chartered, is ambitious yet supported by market trends and expert opinions. Investors should balance optimism with reality, recognizing the volatility and risks, while also acknowledging the growing acceptance and interest in Bitcoin from the business and financial sectors.

Conclusion

Standard Chartered’s Bitcoin prediction symbolizes a forward-looking perspective in the financial world, inviting exploration beyond traditional boundaries. However, as we venture into this promising future, the importance of risk management, portfolio diversification, and staying informed for making prudent investment decisions remains paramount.

Stay engaged with us as we continue to unravel the intricacies of the cryptocurrency world, offering insightful strategies and valuable investment advice.

M.Hussnain

Visit us on social media: Facebook | Twitter | LinkedIn | Instagram | YouTube TikTok

#bitcoin#btc#crypto#crypto currency#blockchain#digitalcurrency#cryptocurrency#cryptocurreny trading#cryptocurrencies#cryptoexchange#vipera#viperatech

1 note

·

View note

Text

Eternity Inc Analysts Forecast Significant Impact of Upcoming Bitcoin Halving on Market Dynamics

As the cryptocurrency community gears up for the next Bitcoin halving expected in April 2024, analysts at Eternity Inc are assessing the potential outcomes of this pivotal event. The halving, a feature ingrained within Bitcoin's protocol, is set to not only adjust the market value of Bitcoin but also alter the broader dynamics of the crypto space.

The Mechanics of Halving: The Bitcoin halving is a scheduled event within the Bitcoin blockchain, occurring every 210,000 blocks, which roughly translates to a four-year interval. This mechanism cuts the reward for mining new blocks in half, an action designed to control the issuance of new Bitcoins and preserve the asset's scarcity.

Market Impact and Speculation: The impending halving is expected to constrict the rate of new Bitcoin creation, tipping the scales of supply and demand. If the demand for Bitcoin maintains or grows while the supply rate slows, analysts predict an increase in Bitcoin's value. Historically, halving events have also triggered heightened market volatility, with investors and traders keeping a keen eye on price movements and market trends.

Challenges and Opportunities for Miners: The upcoming halving will also have a direct impact on the profitability of Bitcoin mining operations. Miners facing high operational costs and those with less efficient setups may struggle, potentially catalyzing a shift in the competitive landscape of mining.

Innovation and Community Development: Beyond financial implications, the halving is anticipated to spark discussions and innovations within the blockchain community, propelling technological advancements and fostering a spirit of development.

Bitcoin as an Inflation Hedge: The predictable scarcity due to the halving bolsters Bitcoin's position as a hedge against inflation and economic instability, augmenting its allure as an investment asset for the long term.

Diverse Price Predictions: Forecasting the post-halving price of Bitcoin yields a spectrum of predictions. Some experts foresee a substantial price surge, while others suggest the effects might already be reflected in the current market value.

BitQuant, via Nasdaq and VettaFi, projects a post-halving valuation reaching as high as $250,000—over ninefold its present worth.

Coincodex anticipates a climb to roughly $49,300 by April 2024, with a potential rally to around $84,100 subsequent to the halving.

Bloomberg analysts see the potential for Bitcoin to break past the $50,000 barrier by 2024, supported by a minimum 81% increase in value due to the halving.

Cryptonews expects the cryptocurrency to soar beyond $100,000, and possibly up to $300,000 by 2028, with a post-halving range between $60,000 to $90,000.

Standard Chartered forecasts Bitcoin could achieve a $100,000 valuation by the end of 2024, propelled by its decentralized nature and scarcity as a digital asset.

The Bitcoin halving of 2024 is shaping up to be a significant milestone, with the potential to significantly influence the valuation and stability of Bitcoin, as well as the mining industry and global cryptocurrency markets at large. As the countdown to the halving continues, Eternity Inc remains vigilant, monitoring the multifaceted effects this event may have across the cryptocurrency ecosystem.

Website: https://cointelegraph.com/tags/bitcoin-halving

0 notes

Text

Cryptonieuwsupdate: Ethereum ETF's in Zicht, Visa Faciliteert Crypto-opnames en Bitcoin Whales Bereiden zich voor op Rally

De cryptowereld staat voor een golf van opwinding en potentieel met ontwikkelingen zoals de mogelijke goedkeuring van Ethereum ETF's door de SEC, Visa's ondersteuning voor crypto-opnames op debetkaarten en Bitcoin-walvissen die hun posities versterken. Laten we een diepgaande kijk nemen op deze gebeurtenissen en hun impact op de cryptomarkt.

Hoogtepunten:

- SEC Mogelijk Ethereum Spot ETF's Goedkeuren Tegen Mei: Standard Chartered voorspelt dat de SEC tegen 23 mei Ethereum ETF's zou kunnen goedkeuren, wat een aanzienlijke stijging van Ethereum's prijs zou kunnen betekenen.

- Visa Maakt Crypto-opnames op Debetkaarten Mogelijk: Visa heeft een samenwerking aangekondigd met Transak om cryptocurrency-opnames en -betalingen mogelijk te maken via Visa Direct, waardoor gebruikers wereldwijd crypto naar fiat kunnen omzetten zonder gebruik te maken van centrale beurzen.

- Bitcoin Whales Vergroten Bezit met 4.5%: Ondanks recente marktomstandigheden hebben grote BTC-houders hun vertrouwen in crypto laten zien door hun posities te vergroten, wat een positief signaal kan zijn voor een aankomende rally.

SEC Keurt Mogelijk Ethereum Spot ETFs Goed in Mei

Standard Chartered Bank voorspelt dat de Securities and Exchange Commission (SEC) mogelijk Ethereum Exchange-Traded Funds (ETF's) goedkeurt tegen 23 mei, wat een grote stap zou zijn voor de crypto-markt. Volgens het hoofd van forex en digitaal vermogensonderzoek bij Standard Chartered, neemt de SEC een vergelijkbare benadering als bij Bitcoin ETF's, wat suggereert dat Ethereum ETF's op de deadline kunnen worden goedgekeurd. De hoop is hooggespannen voor de Ethereum-prijs na goedkeuringen, met voorspellingen dat deze tot $4.000 zou kunnen stijgen, aangezien de SEC Ethereum niet als een effect heeft bestempeld en het aanwezig is op de Chicago Mercantile Exchange. Geoffrey Kendrick, een bankier bij Standard Chartered, uitte optimisme over de prijs van cryptovaluta's in het algemeen, met voorspellingen dat Bitcoin tegen het einde van het jaar $100.000 zou kunnen bereiken en $200.000 tegen 2025. Hij benadrukte ook dat Ethereum minder kans heeft om in prijs te dalen na ETF-goedkeuring, omdat de Ethereum Trust van Grayscale kleiner is dan de Bitcoin Trust. Kendrick gelooft dat eenvoudige Ethereum ETF's mogelijk als eerste worden goedgekeurd, met ETF's voor stakingrendementen die kunnen volgen. Daarnaast staat een Ethereum-upgrade op de planning, die de prijs van Ether positief zou kunnen beïnvloeden door de vergoedingen te verlagen en Ethereum concurrerender te maken.

Visa Maakt Crypto-opnames op Debetkaarten Mogelijk:

Visa heeft aangekondigd dat het samenwerkt met Transak om cryptocurrency-opnames en -betalingen mogelijk te maken via Visa Direct, waardoor gebruikers wereldwijd crypto naar fiat kunnen omzetten zonder gebruik te maken van centrale beurzen. Deze samenwerking biedt gebruikers van MetaMask en andere gedecentraliseerde platforms de mogelijkheid om direct vanuit hun wallet naar een Visa-debetkaart te converteren, waardoor de bruikbaarheid en praktische toepassing van digitale assets worden vergroot. Visa en Transak hebben een grote stap gezet naar de mainstream acceptatie en gebruik van cryptocurrencies door deze nieuwe optie te introduceren. Gebruikers uit 145 landen kunnen nu ten minste 40 cryptocurrencies direct converteren naar fiat zonder afhankelijk te zijn van centrale beurzen, waardoor deze samenwerking een belangrijke mijlpaal markeert in het overbruggen van de kloof tussen de cryptowereld en de traditionele financiële sector. Door de integratie van Know-Your-Customer en Anti-Money Laundering-technologieën kunnen gebruikers verzekerd zijn van veilige en legale transacties.

Bitcoin Whales Vergroten Bezit met 4.5%:

Ondanks recente marktvolatiliteit hebben grote Bitcoin-houders, bekend als 'whales', hun vertrouwen in de toekomst van Bitcoin getoond door hun bezit met 4,5% te vergroten. Analisten merken op dat ongeveer 67 nieuwe entiteiten zich bij de elitegroep van Bitcoin-houders hebben gevoegd die meer dan 1.000 BTC bezitten, wat wijst op een optimistische kijk op de langetermijngroei van de cryptocurrency. Deze toename van het bezit door whales gaat in tegen de overheersende marktsentimenten en suggereert een positieve toekomst voor Bitcoin. De recente stijging van de Bitcoin-prijs, samen met een toenemende handelsvolume, duidt op hernieuwde interesse en vertrouwen van investeerders in de cryptocurrency-markt. De verminderde verkoopdruk van Grayscale's Bitcoin Trust en een mogelijke 'short squeeze' bij verdere prijsstijgingen kunnen de Bitcoin-prijs verder doen stijgen en een nieuwe fase van groei inluiden voor de meest waardevolle cryptocurrency ter wereld.

Met Ethereum ETF's mogelijk in de nabije toekomst en toenemende ondersteuning van belangrijke spelers zoals Visa, lijkt de cryptomarkt klaar voor verdere groei en adoptie. Terwijl Bitcoin zijn veerkracht toont en zich herstelt van recente prijsdalingen, kan de aanhoudende activiteit van Bitcoin-whales een indicatie zijn van een bredere marktopwaartse trend. Blijf op de hoogte voor meer updates over deze ontwikkelingen en hun impact op de crypto-industrie.

Read the full article

0 notes

Text

Delightful Bitcoin Prediction from the Famous Bank! This Altcoin Will Also Rise!

Although the cryptocurrency market has been struggling with fluctuations lately, the new Bitcoin claim from Standard Chartered Bank will excite investors. The bank published quite high price predictions for Bitcoin and Ethereum at the end of the year and for 2025. These claims are based on factors such as the adoption of cryptocurrencies by institutional investors and the launch of new investment…

View On WordPress

0 notes

Text

Standard Chartered Bank Launches A New Blockchain Unit

International bank Standard Chartered's venture arm on Tuesday launched a new blockchain unit that aims to help tokenize traditional financial instruments, moving rapidly to stake out a bigger presence in the Asian digital assets space.

Called "Libeara", the platform is a technology service provider that was set up to assist institutions in digitalizing financial instruments on blockchains -- the infrastructure underpinning cryptocurrencies, with the goal of reducing the need for intermediaries typically involved with trading such instruments. This theoretically raises the efficiency and lowers the cost of buying and selling the assets.

0 notes

Text

Ethereum has struggled alongside Bitcoin through the current bear market climate but this has not stopped bullish predictions for the digital asset. The most recent bullish prediction comes from British multinational bank Standard Chartered which believes that the Ethereum price could climb higher than $8,000.

Factors That Could Trigger The Rise

Geoff Kendrick, Head of Digital Assets Research at Standard Chartered Bank has revealed his forecast for the Ethereum price in a research note. According to the researcher, he sees big things in the future of the digital asset which could climb higher than $8,000 in the coming years.

Talking about the asset’s valuation, Kendrick points toward the many use cases for Ethereum that have emerged over the years but also sees more use cases emerging as time goes on. One of those is the much-coveted gaming and asset tokenization sector.

Also, the Standard Chartered researcher said that they expect that Ethereum will see more growth than the pioneer cryptocurrency, Bitcoin. While he expects Bitcoin to rise 3.5x, they believe Ethereum will rise 5 from current levels.

“We think the path higher for ETH prices may take longer than for BTC, but we see ETH eventually reaching a higher price multiple than BTC relative to current levels (5.0x versus 3.5x),” the researcher said.

He also believes that Ethereum would go on to further register its dominance in the space, especially with the Layer 2 blockchains such as Arbitrum that have popped up to enhance the network. This, he believes, would lead to an increase in the Ethereum profit-earnings ratio (P/E ratio).

ETH price succumbs to bear pressure | Source: ETHUSD on Tradingview.com

Ethereum Could Climb Above $8,000

In terms of actual dollar values, $8,000 is not the only figure that the researcher dropped for the Ethereum price. The expectations for the digital asset exceed this four-digit figure right into the five-digit territory as Kendrick believes ETH could rise to anywhere between $26,000 and $35,000.

As for when this might happen, the researcher seems to be targeting the next bull market as he expects the factors that will drive this value growth to happen between 2025-2026. “We see the $8,000 level as a stepping stone to our long-term ‘structural’ valuation estimate of $26,000-$35,000,” he said in the note. Then beyond this, the researcher expects the price to continue to rise.

This is not the first time that Kendrick has released a bullish prediction for cryptocurrencies. He previously said he expects the price of Bitcoin to reach $120,000 and the entire crypto market to rise as well. However, it seems the researcher is much more bullish on ETH.

Not everyone has provided bullish forecasts for ETH though. One crypto analyst actually believes that the digital asset is set for more decline. In the analyst, FieryTrading suggests that Ethereum’s price could fall as low as $900.

0 notes