#smsf perth

Text

Accountants Perth Provide Professional SMSF Services

An SMSF accountant is a professional who can assist you in keeping your SMSF investment on track. SMSF is one of the most advantageous ways to protect your financial future. However, managing the SMSF investment on your own can be difficult at times. Accountant Perth can provide you with the best SMSF accountants in Perth to help you with this. Their SMSF accountants offer the best SMSF services in Perth. So, your search for the best "SMSF accountant near me" is now complete. Simply contact them for the most dependable SMSF Perth services provided by experts.

0 notes

Text

When considering the purchase of commercial real estate via your Self-Managed Super Fund (SMSF), and potentially leasing it back to your own business, it’s essential to be aware that this process resembles a standard real estate acquisition. However, specific steps with the help and support of your Perth SMSF tax accountant must be adhered to comply with superannuation and tax regulations.

Know more: https://www.westcourt.com.au/how-to-acquire-commercial-real-estate-through-your-smsf/

0 notes

Text

Get a Quote Today :- https://www.smsfaccountantaustralia.com.au/smsf-accountants-perth

0 notes

Text

Looking for expert SMSF accountants in Perth? Look no further! At Balance Tax Pty Ltd, they provide top-notch self-managed super fund (SMSF) accounting services tailored to meet your financial needs. Their experienced team of SMSF specialists is dedicated to assisting individuals and businesses in Perth with their SMSF requirements.

0 notes

Audio

Dry Kirkness are the Perth-based accountants providing comprehensive business advice and audit services to family-run businesses and not-for-profit organisations. Find out more at www.drykirkness.com.au.

#business succession planning perth#business planning perth#business advice perth#smsf accountants perth#self managed super funds perth#business consultant perth

0 notes

Text

SMSF Australia - Specialist SMSF Accountants

Level 12/197 St Georges Terrace, Perth WA 6000, Australia

+61 8 6313 8718

Self-managed super funds can need a lot of work, and that is something SMSF Australia is aware of. Because of this, we provide a wide range of services to our clients in Perth that are designed to make it easier for them to administer their SMSFs. We provide a comprehensive array of tax compliance and SMSF accounting services. You can get assistance from our knowledgeable staff at every stage. We can set up the daily drudge labor to operate as efficiently as possible so that we can spend the majority of our time offering guidance and support because our experienced and licensed SMSF Accountants are specialists in automation systems like Class Super.

Visit our links:

#SMSF Accountant Perth#SMSF Accountants Perth#SMSF Setup Perth#Self Managed Super Fund#SMSF Administrators Perth#SMSF accounting perth#SMSF accounting services#Perth accounting services#SMSF auditor perth#Perth tax service#smsf tax return

0 notes

Text

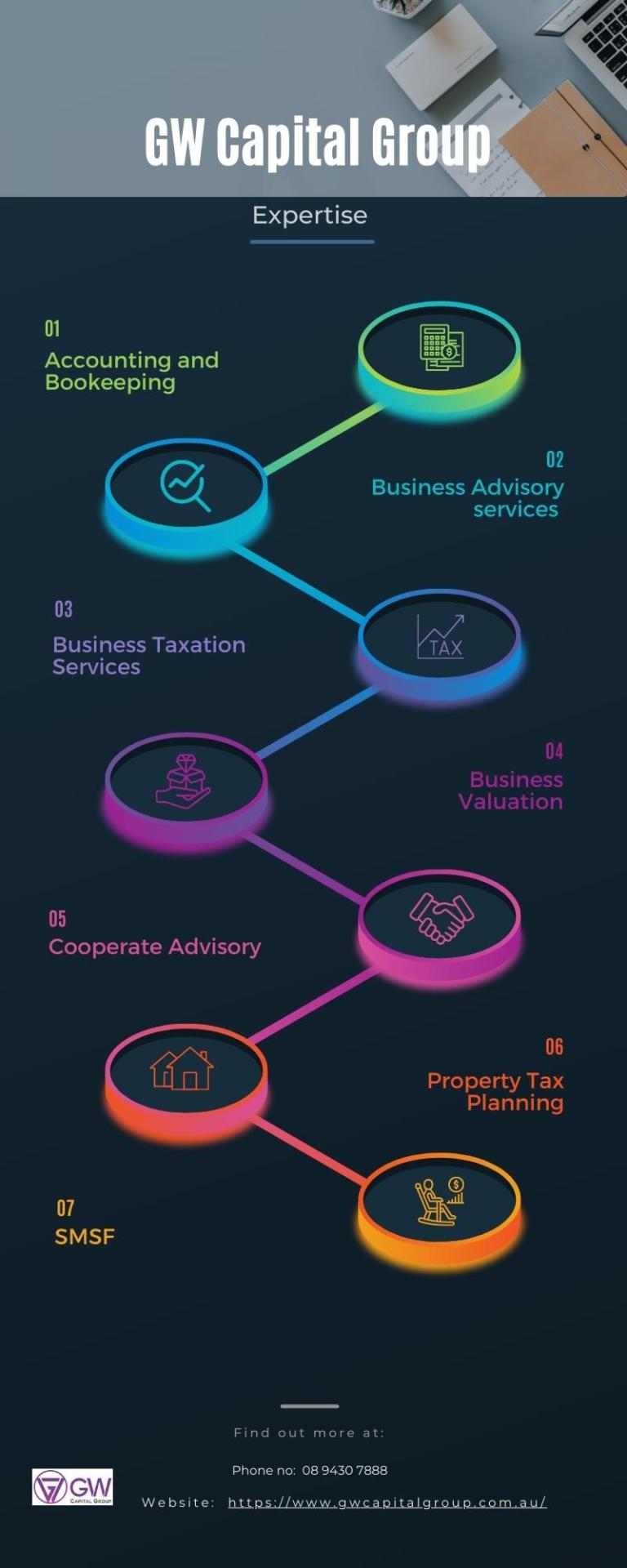

Accounting services in Perth

An organization's bookkeeping aims to interpret its financial processes and management. The ability to identify the profit justifies the cost will undoubtedly result in accelerated growth for business owners. Our bookkeeping services » Perth are tailored towards addressing such matters, so our professionals are knowledgeable about them.

All of our clients at GW Capital Group receive high-quality professional bookkeeping services. We can help you with your bookkeeping needs! Contact us today!

#bookkeepers perth#bookkeeping services#accounting bookkeeping service#smsf accountants#corporate advisory#tax return perth#tax return services#accountants in perth#accounting services perth

0 notes

Link

According to ASIC data, over 186 SMSF auditors departed the SMSF auditing market during the 2019–22 income year, as auditors grappled with changes in indebtedness. According to ASIC statistics, approximately 200 SMSF auditors departed the SMSF auditing market in the 2019–22 income year as a result of changes in independence standards and greater regulatory scrutiny. greater regulatory vigilance and higher pendency criteria

1 note

·

View note

Text

Superannuation Audit Services Sydney

We also offer SMSF setup in Melbourne.SMSF Auditing is essential for ensuring compliance and transparency in Self-Managed Superannuation Funds (SMSFs). Our expert auditors meticulously review financial records and transactions to ensure they adhere to regulatory standards. Trust us for thorough and accurate SMSF auditing services to safeguard your retirement savings.Professional SMSF auditing services available in Melbourne, Sydney, Perth, Brisbane, Darwin, Hobart, and throughout Australia.

0 notes

Text

What is the Need for Financial Advisors in Business?

Financial management in modern business demands strategic insight, expertise in compliance, and a forward-thinking approach. This is where financial advisors play a pivotal role. The need for financial advisors in business cannot be overstated, when it comes to ensuring the fiscal health and success of businesses across various industries. Here are some ways a financial advisor in Perth can be useful for businesses.

Accounting

At the core of any business operation, there is the need for accurate and transparent financial records. Financial advisors bring a wealth of expertise in accounting, ensuring that a company's financial statements are not only compliant with regulatory standards but also provide a clear picture of its financial health.

From managing day-to-day transactions to preparing comprehensive financial reports, their role in maintaining fiscal integrity cannot be overstated.

SMSF and Audit

For businesses with a self-managed superannuation fund (SMSF), the complexities of compliance and audit requirements can be overwhelming. Financial advisors specialize in navigating the intricate web of SMSF regulations, ensuring that businesses not only meet their legal obligations but also optimize their superannuation strategies.

The audit process, a crucial element in financial governance, is streamlined under the guidance of experienced financial professionals, safeguarding businesses against potential pitfalls.

Business Advisory

Financial advisors go beyond mere number crunching. They serve as strategic partners in guiding businesses towards sustainable growth. Their role in business advisory involves analyzing market trends, identifying opportunities, and offering insights that contribute to informed decision-making.

By leveraging their financial acumen, businesses can adapt to changing market dynamics and proactively address challenges, fostering long-term success.

Taxation and Tax Return Preparation

Understanding and dealing with tax regulations is a daunting task for businesses of all sizes. Financial advisors specialize in tax planning and preparation, ensuring that businesses not only meet their tax obligations but also capitalize on available incentives and deductions. This proactive approach not only minimizes tax liability but also positions businesses for financial success in the long run.

Having a trusted financial advisor is imperative for those aspiring to thrive and prosper in a fast-paced and competitive business environment. By leveraging their expertise, businesses can confidently navigate financial challenges and capitalize on opportunities, ensuring a robust and resilient financial foundation.

0 notes

Text

Australian Accountant for Small Businesses: Accountant Perth WA

Individuals are generally responsible for managing self-managed super funds. The management of these funds is straightforward and requires very little expertise. Investing mistakes can seriously harm a person's future finances. A professional SMSF accountant should always be consulted to ensure SMSFs are properly managed and planned.

Accounting Perth assists clients with managing their SMSFs efficiently via SMSF services. They have a team of SMSF accountants in Perth who can help us and provide us with reliable SMSF services.

Contact the firm for more information.

0 notes

Text

The tax impact of a business sale, merger or acquisition takes on many forms. The capital gains tax exemption offered by a scrip for scrip rollover is a key mechanism discussed by savvy Perth tax accountants among their clients.

A “scrip for scrip rollover” is common when another company acquires a business during a merger and acquisition process. Instead of getting cash for the sale of your business, you receive shares in the acquiring company. These shares effectively replace the money you would have otherwise earned from the sale.

This process is essentially a direct exchange of shares for cash between two companies. Moreover, the scrip for scrip rollover is a strategy to provide relief from Capital Gains Tax (CGT). You or your Self-Managed Super Fund (SMSF) can avoid the capital gains typically associated with selling your business by receiving shares instead of cash.

1 note

·

View note

Text

SMSF Australia - Specialist SMSF Accountants (Gold Coast)

Level 2/194 Varsity Parade, Varsity Lakes QLD 4227, Australia

(07) 5551 2051

At SMSF Australia we are passionate regarding giving a full series of SMSF solutions to our clients in the Gold Coast and beyond. Our SMSF Accountants are accredited specialists having actually finished the SMSF Associations Specialist training program developed for accountants and lawyers that picked to be experts in this specific niche location. Our team integrates technological quality with high degree automation options improved the Class Super system to maintain your SMSF Administration efficient and also affordable. We help with configurations, management, audit, audits and also a lot more. Reach out to our pleasant team servicing the Gold Coast today to see how we can best assist you with your Self Managed Super Fund regardless of where you are at in the trip!

Visit us here:

#SMSF Accountant Gold Coast#SMSF Accountants Gold Coast#SMSF Setup Gold Coast#self managed super fund#smsf administrators Gold Coast#SMSF accounting Gold Coast#SMSF accounting services#Gold Coast accounting services#SMSF auditor Gold Coast#Gold Coast tax service#smsf tax return

0 notes

Text

SMSF Accountant Perth - Balance Tax Pty Ltd

Balance Tax Pty Ltd is a Perth-based financial services firm that provides expert advice on managing SMSF accountants in Perth. Their team of experienced SMSF accountants can assist with various services, including fund establishment, compliance, administration, taxation, and audit. They understand that managing an SMSF can be complex and time-consuming, so they offer personalized solutions to help clients meet their financial goals. Whether you're looking to set up a new SMSF or need help managing an existing one, Balance Tax Pty Ltd is a trusted partner for achieving financial success.

0 notes

Text

Lodging super contributions on time

One of the main responsibilities of Australian employers is ensuring on-time super contributions. All eligible employees are entitled to payments into their superannuation fund of choice, with non-compliance leading to SG penalties.

Strict superannuation laws make it vital to abide by ATO obligations and make accurate payments on time.

With many staff and business owners opting for Self Managed Super Funds to control their retirement, it’s worth speaking to experienced SMSF consultants at Linc Accountants about gaining key tax advantages, and complying with super and tax laws.

What is superannuation?

Superannuation, commonly known as super, is a pension/retirement benefit fund. Almost all working Australians submit regular income deductions into these funds, and by law employers must also make consistent contributions .

There are many options for a super fund, from retail and industry funds to private SMSF funds. Regardless of whether your employee is casual, part-time, or a temporary resident, they are eligible for super payments.

Any company unsure as to their super obligations, or how to manage an SMSF fund, should speak to experts on small business bookkeeping about getting help to prevent costly ATO fines.

Employer’s super contribution responsibilities

The minimum super contribution employers must pay is 10.5% of their OTE (ordinary time earnings), known as the super guarantee (SG).

This compulsory SG payment and income must be correctly calculated by employers taking into account applicable commissions, paid leave, shift loadings, and allowances – some allowances, overtime and bonuses are excluded

Pay super minimum of 28 days after every quarter

Retain 5 years of records to show financial obligations were met

Display super contribution information on employee payslips

Tax file numbers (TFN) are required by super funds from employers by law

Employees are allowed to select their own super fund of choice, and if details are not provided employers must find their stapled fund – knowledgeable SMSF consultants can help with payments for self-managed funds.

How to lodge super contributions

While super payments must be paid at least quarterly, many employers choose to file them alongside staff wages for clarity and convenience. Super contributions can be lodged electronically to either a complying super fund directly or through the ATO Clearing House.

Salary sacrifice superannuation must be paid monthly.

Small business accounting can help eligible companies streamline their super responsibilities via a Business Superannuation Clearing House. Speak to Linc Accountants about small business bookkeeping to minimise time, paperwork, and payment errors by submitting a single payment for all employees’ funds via an electronic clearing house.

How experienced SMSF consultants can help you avoid penalties

A business accountant with niche experience managing the books for small businesses, as well as SMSF funds, can help companies avoid penalties and pitfalls from super non-compliance.

SG charges are a financial penalty handed down by the ATO to employers who fail to meet essential obligations including:

Incorrect super payments

Late filings

Inaccurate records

Not providing TFNs

Failure to pay contractor’s super, if applicable

Utilise expert small business accounting

Linc Accountants are Perth’s trusted experts at small business bookkeeping, helping companies with essential tax compliance and accurate super contributions with over 20 years of niche experience.

Contact us Perth Accountants today to speak to a business accountant, or about personalised SMSF fund management and administration.

0 notes

Text

All about Perth Zoo

All About Perth Zoo

Perth Zoo is a top-rated tourist attraction with many animals that people can see. These animals include zebras, rhinos, and lions. The Zoo has a variety of conservation projects that they have done to help the animals to survive. There are also many invertebrate species that you can see as well.

Giraffes

Perth Zoo has lost one of its most beloved giraffes, Misha, after suffering from chronic osteoarthritis and chronic pain. She passed away yesterday. But her death was far from unnoticed. Her legacy was immortalized in the iconic picture of her with her calf, Makulu, which raised the profile of Rothschild giraffes worldwide.

Since 1995, the Perth Zoo has produced ten giraffes. Their numbers now total thirteen. But the species is facing unprecedented pressures in the wild. Having lost 40 percent of its population over the past 30 years, it relies on a coordinated breeding program to help save its existence.

The Perth Zoo has produced two baby giraffes in the last four weeks. Both are part of the regional zoo breeding program. They are expected to join the female herd at Monarto Safari Park in South Australia.

The new baby giraffe, Inkosi, was born at 11:37 am on September 3. Inkosi is a three-year-old bull giraffe and will play an essential role in the regional giraffe breeding program. His name is a Zulu word for 'king.'

The giraffe was born to first-time mum Kyoto. The giraffe was brought to the Perth Zoo from the Taronga Zoo in Sydney. She was then introduced to Perth Zoo's breeding bull, Armani.

Zebras

When you visit Perth Zoo, you will find a unique and exciting place to take your family. Its exhibits are designed to mimic the natural habitats of the animals. There are more than 1300 animals housed at the park. They include species from Asia, Africa, South America, and Australia. The Zoo is committed to protecting and preserving Australia's wild heritage.

The Zoo offers several guided tours. You can choose one that fits your budget and your schedule. A guided tour is a great way to learn about the animals in the Zoo.

A keeper talk is another option. These free presentations are scheduled throughout the day. Each conference provides information about the animals and the Zoo's conservation efforts.

Zebras are members of the horse family. They are sturdy and resistant animals. They can run up to 35 miles an hour. They are herbivores and feed mainly on grasses. They are also very playful. They make loud braying sounds and soft whiffs. They have excellent hearing and eyesight.

Zebras live in herds. Their stallion is the lead male. He helps groom and protects the group. He is also responsible for breeding new zebras.

In addition to zebras, Perth Zoo is home to various other animals. The Zoo houses orangutans, kangaroos, wallabies, and other species. They also have several species of reptiles.

Rhinos

A trip to the Zoo is a great way to see a wide variety of animals in their natural habitat. However, it can also be a bit depressing to know that many of them are likely to be endangered. Fortunately, the Perth Zoo is doing its part to help.

The Zoo's rhinos are leading the charge in raising awareness of their existence. The elephant in the room is the fact that their numbers are rapidly diminishing. Although a few stalwarts are still around, it is a safe bet that their numbers will continue to drop. To keep these majestic creatures from extinction, the Zoo keeps an eagle eye out for their well-being.

On top of educating visitors about the animal's habitat, the Zoo offers many behind-the-scenes to let them get up close and personal. In particular, visitors can experience the 'night quarters' of the rhinos. On these tours, zookeepers will show visitors the ropes. They will also explain their nighttime behavior and teach them the merits of the 'tasty.'

The Zoo has also made an effort to support the Asian Rhino Project, an initiative that is doing its part to protect the endangered species. Its involvement in the project is by no means limited to the donation of funds, as the Zoo is also a participant in the program's in-kind contributions.

Lions

Lions are among the most popular attractions at Perth Zoo. Visitors can see them in the central viewing bay, where the animals can be up close and personal.

The lions live in a pride of 4-6 adults. They eat two kilograms of meat daily. Individual lions forage for small rodents and hares, as well as reptiles. They also hunt in packs for large prey like zebras.

They have large padded feet and retractable claws. They also have manes that help protect their throat from other animals. They can weigh as much as 195 kg. They are golden in color.

African lions are not prone to toothache. However, they are vulnerable to infection due to fighting and broken teeth. They can die of disease if caught in a fight or if their teeth are damaged.

A new pride of lions has arrived at Perth Zoo. They will be based in the Zoo's new lion exhibit, built to meet international standards. The new enclosure is a replica of a natural African savannah environment. It features three new viewing areas.

Its new king is Jelani, a 195kg African male lion. He will form a new pride with Makeba and Uzuri. He will serve as an ambassador for his cousins in the wild.

Nocturnal House

Perth Zoo, located in South Perth, Western Australia, is a large zoo. It features over 1,300 animals from around the world. It also boasts beautiful Victorian-designed gardens. It is one of the most visited tourist destinations in Western Australia.

The Zoo offers visitors a chance to see wildlife from Asia, Africa, and Australia. It is also a significant participant in conservation projects. It is home to several endangered species. The Zoo's Sumatran orangutan breeding program is considered the best in the world.

The main zoo areas include the Australian Bushwalk, the Numbats exhibit, the Great Ape precinct, the Nocturnal House, and the Australian Wetlands. All these exhibits are naturalistic in design, allowing visitors to enjoy wildlife up close.

Baverstock, Murphy, and Associates designed the zoo's dome cage and were awarded the Royal Australian Institute of Architects Energy Award Commendation in 1996. The dome cage is also used for famous family concerts at the Zoo.

The Nocturnal House is an exhibit that includes owls, redback spiders, millipedes, and vertebrates. It is also the place where visitors can learn about Dibblers, a native Australian species.

The Zoo also provides habitats for endangered species such as the Komodo Dragon, the African Lion, and the Asian Small-clawed Otter. It is also involved in the Department of Environment and Conservation's breeding program.

Invertebrate species

The Perth Zoo houses over 300 species of animals and plants worldwide. This zoological facility is located in South Perth, Western Australia. It is an icon and a significant destination for visitors to Western Australia.

Perth Zoo has a variety of interactive exhibits. They feature Australian wildlife as well as a selection of exotic species from Asia. The Zoo has also contributed to the conservation of Asian species in the wild. The Zoo's Sumatran orangutan breeding program is the largest in the world, with over 300 orangutans released into Bukit Tigapuluh National Park in 2006.

In addition to its exotic animals, the Perth Zoo focuses on scientific research. The Zoo's breeding programs for endangered species are highly successful.

The Zoo is a full institutional member of the World Association of Zoos and Aquariums (WAZA). It was first opened in 1898. It is known for its natural beauty and lush gardens. The Perth Zoo is an ideal destination for a family day out.

The Perth Zoo works closely with the Department of Environment and Conservation on several species conservation projects. Some of these include the conservation of the African Lion, Galapagos Tortoises, and the Mertens Water Monitor.

Conservation projects

The Perth Zoo commits to conservation. Its science staff work with the Department of Biodiversity, Conservation, and Attractions and interstate organizations, such as the Australian Wildlife Conservancy. They also participate in breeding programs for endangered species. In 2017, 4,000 animals were released into the wild. This is the first time this number has reached this milestone in Perth Zoo's history.

The Zoo's breeding program is dedicated to protecting vulnerable native species. Numbats are a marsupial native to Western Australia. This species is on the International Union for Conservation of Nature's (IUCN) red list as endangered. Since its establishment in 1987, Perth Zoo has bred over 220 Numbats for release into the wild.

Besides breeding, Perth Zoo is also actively encouraging research. It's Animal Ethics Committee approves all aspects of research. The Zoo is also involved in strategic collaborations, working with external organizations such as Free the Bears and TRAFFIC.

The Zoo's breeding programs include endangered species, such as Sumatran orangutans. The Zoo's breeding program is part of an international effort to reintroduce the species into the wild.

The Zoo is also participating in a regional breeding program for giraffes. As a result, two giraffe calves were born at the Zoo in the last four weeks.

youtube

Perth Zoo Location

Member Spotlight

SMSF Australia - Specialist SMSF Accountants

Level 12/197 St Georges Terrace, Perth WA 6000, Australia

+61 8 6313 8718

Their accredited SMSF accounting services Perth includes Chartered Tax Advisers and Fellows of the Tax Institute of Australia who specialise in complex tax affairs. Their team are passionate about the Self Managed Super Fund industry and have chosen to focus their careers on this complex but rewarding area.

Driving Direction

1 note

·

View note