#retaliatory tariffs

Text

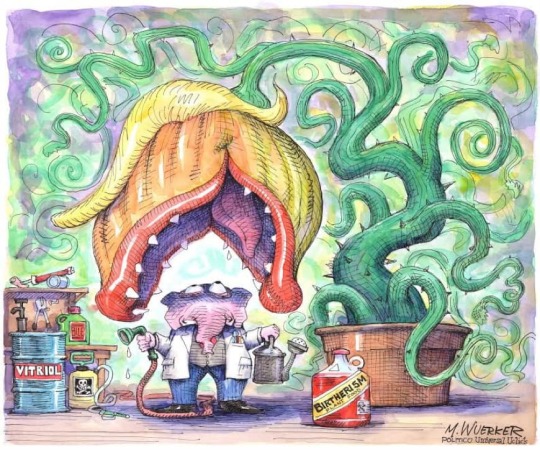

Matt Wuerker, Politico :: [Robert Scott Horton]

* * * *

The demise of the GOP.

ROBERT B. HUBBELL

AUG 23, 2023

For the first time in months, Donald Trump talked about something other than himself and his quiver of grievances. Per the Washington Post, Trump told Fox Business personality Larry Kudlow last week that he favored a universal 10% tariff on all goods imported into the US:

“I think we should have a ring around the collar” of the U.S. economy, Trump said in an interview with Kudlow on Fox Business on Thursday. “When companies come in and they dump their products in the United States, they should pay, automatically, let’s say a 10 percent tax … I do like the 10 percent for everybody.”

Per the Post’s reporting, Trump and his advisers are developing the idea of a universal tariff on all imports as “a central 2024 campaign plank” in Trump's bid for a second term. See Washington Post, Trump vows massive new tariffs if elected, risking global economic war. (This article should be accessible to all.)

Tariffs are generally a bad idea (I am not referring to targeted tariffs designed to address unfair trade practices). A 10% universal tariff would be an economy-destroying debacle of generational proportions. As one expert said about Trump's support for a 10% universal tariff,

[T]he idea [is] “lunacy” and “horrifying” [and] would lead the other major economies around the world to conclude the United States cannot be trusted as a trading partner.

The problem with tariffs is that they are a hidden tax that is ultimately paid by US consumers. Worse, they inevitably result in retaliatory tariffs on exports, harming US farmers, small businesses, and major manufacturers. See Pablo D Fajgelbaum, et al., The Quarterly Journal of Economics, Return to Protectionism (2019).

Proposing a universal tariff betrays short-term thinking and the inability to anticipate foreseeable consequences. US imports in 2022 approached $4 trillion. If that 10% universal tariff was passed through to consumers (as it would be), the tariff would impose $400 billion in price increases on Americans already struggling with inflation.

So, as Republicans attack Biden for inflation, they are proposing the worst idea possible for consumer prices. And let’s recognize that tariffs are regressive taxes on the poor. Lower-income consumers spend a greater share of their income on imports than higher-income consumers.

Here’s the point: It is easy to focus exclusively on Trump's authoritarian, anti-democratic tendencies. But he is also profoundly ignorant and guided by brute emotions. His presidential policies damaged US foreign relations, national security, climate security, manufacturing, agriculture, and technology. We should not forget that fact. Hopefully, farmers and manufacturers have not forgotten the pain inflicted by Trump's ill-fated tariffs against China in 2018. See The Guardian, (12/02/18), US farmers' troubles over tariffs show the value in looking ahead.

The reasons for not electing Trump are manifold (reproductive liberty, national security, climate, energy, job security, retirement security, medical care, LGBTQ equality, and tariffs!). Let’s be sure to include those reasons when we work to convince our fellow citizens that Joe Biden is the only rational choice in 2024.

[...}

[Robert B. Hubbell Newsletter]

7 notes

·

View notes

Text

This day in history

I'll be at the Studio City branch of the LA Public Library tonight (Monday, November 13) at 1830hPT to launch my new novel, The Lost Cause. There'll be a reading, a talk, a surprise guest (!!) and a signing, with books on sale. Tell your friends! Come on down!

#20yrsago Pearson Airport threatens to sue websites that take its name in vain https://www.techdirt.com/2003/11/13/is-it-against-the-law-to-put-the-name-of-the-toronto-airport-on-the-web/

#10yrsago Edward Snowden is almost broke https://world.time.com/2013/11/12/edward-snowden-is-almost-broke/

#10yrsago Vi Hart: cramming G+ into YouTube has made comments even worse, I’m leaving https://web.archive.org/web/20131114001432/http://vihart.com/google-youtube-integration-kind-of-like-twilight-except-in-this-version-when-cullen-drinks-bellatubes-blood-they-both-become-mortal-but-cullen-is-still-an-abusive-creep-also-it-is-still-bad/

#10yrsago Tune: Still Life, new installment in romcom/alien abduction graphic novel https://memex.craphound.com/2013/11/13/tune-still-life-new-installment-in-romcom-alien-abduction-graphic-novel/

#5yrsago Trump is bailing out a Chinese owned pork producer to compensate it for retaliatory Chinese tariffs https://www.latimes.com/business/la-fi-smithfield-china-tariffs-20181109-story.html

#5yrsago Yanis Varoufakis on capitalism’s incompatibility with democracy https://www.youtube.com/watch?v=gGeevtdp1WQ

#5yrsago Congressional Democrats’ first bill aims to end gerrymandering, increase voter registration and rein in campaign finance https://www.npr.org/2018/11/12/665635832/democrats-say-their-first-bill-will-focus-on-strengthening-democracy-at-home

#5yrsago Big Tech got big because we stopped enforcing antitrust law (not because tech is intrinsically monopolistic) https://www.wired.com/story/book-excerpt-curse-of-bigness/

#1yrago The Framework is the most exciting laptop I've ever broken https://pluralistic.net/2022/11/13/graceful-failure/#frame

#1yrago They Want to Kill Libraries https://pluralistic.net/2022/11/13/they-want-to-kill-libraries/

4 notes

·

View notes

Text

The EU's CBAM stands for Carbon Border Adjustment Mechanism

We are Carbon Border Adjustment Mechanism providing by Agile Advisors, The New EU Cross-Border Trade Regulations. It's a tactical instrument for sustainable trade, not just a carbon price. This page provides the essential information: CBAM is a game-changer every trade expert needs to understand, from preventing carbon leakage to guaranteeing fair competition. The Carbon Border Adjustment Mechanism (CBAM) is an innovative approach to global climate action, not merely another term for EU policy. This EU project intends to impose a carbon tax on specified imports and promote environmentally friendly production practices globally. CBAM will revolutionize international trade operations by achieving this, especially for those in the European Union. Therefore, international trade professionals need to have a solid understanding of CBAM to navigate the complexity of sustainable global commerce. Key industries will undergo a revolution thanks to CBAM and the European Green Deal.

Agile Advisors as Carbon Border Adjustment Mechanism, The European Green Deal's Carbon Border Adjustment Mechanism is more than just an international trade strategy or a bureaucratic line item. With reporting requirements starting in 2023 and enforcement scheduled for 2026, CBAM is a game-changer for global climate action. It seeks to apportion an actual environmental cost to high carbon imports, such as power and cement. By doing this, the crucial problem of carbon leakage—in which businesses avoid environmental obligations by moving their production to nations with laxer regulations—is addressed. This tectonic change makes sustainability a crucial consideration in operational and financial planning, not just a way to level the playing field in international trade. Understanding CBAM is essential for individuals heavily involved in cross-border trade to future-proof their business in a world where climate change is a concern.

In our role as Carbon Border Adjustment Mechanism for Agile Advisors, envision a scenario where the cement used to construct our cities fosters a sustainable future. By placing a carbon tax on cement imports, CBAM hopes to make this a reality and encourage the sector to switch to more environmentally friendly options. The iron and steel sector, which forms the foundation of contemporary infrastructure, will be subject to new responsibility standards. Production's carbon foot is lightweight, adaptable, and widely used, yet its environmental impact is also present. CBAM seeks to stop this by providing incentives for cleaner production techniques. Fertilizers are also included under CBAM, which promotes more sustainable agricultural practices. Fertilizers are necessary for agriculture but harmful when generated irresponsibly. The EU and the US agreed to remove tariffs on each other's shipments of aluminum and steel in October 2021.

Being a Carbon Border Adjustment Mechanism, The EU will halt its retaliatory tariffs, and the US will remove tariffs on a specific volume of metals produced in the EU that are imported into the US. By 2024, the US and the EU intend to replace current levies with the first sectoral agreement on the steel and aluminums trade that is based on carbon. Although specifics are still being worked out, both jurisdictions are anticipated to coordinate their efforts to impose import taxes depending on emissions criteria (such as product emission intensity). What effects a sectoral agreement between the US and the EU would have on US steel and aluminum exports to the EU that fall under the CBAM is yet to be discovered. Any nation interested in signing the agreement and meeting the requirements for regaining market orientation and lowering trade in high-emission steel and aluminum goods is welcome to do so. The United States and Japan agreed in February 2022 to permit historically based, sustainable amounts of steel imports from Japan in response to the EU deal.

In our opinion as Carbon Border Adjustment Mechanism, to address market overcapacity and the carbon intensity of the steel and aluminums industries, both nations also decided to start talks on international agreements about steel and aluminums. The deal covers exchanging emissions data and holding conferences on methods for estimating the carbon intensity of steel and aluminum’s production of power, essential to modern society, will also be closely examined, with a push for a switch to renewable energy sources has two strategic ramifications. First, it provides a predictable and well-balanced transition for enterprises operating both within and outside the European Union. Second, it allows authorities to improve the system and collect vital information about embedded emissions in the interim. This makes understanding CBAM essential for individuals heavily involved in cross-border trade, as it can help future-proof their business in a world where climate change is a concern.

0 notes

Text

Central Wisconsin Farmers Face Challenges Amid Trade War and Immigration Crackdowns

Trade Policies and Immigration Crackdowns Impact Central Wisconsin Farmers

Central Wisconsin farmers are grappling with the difficulties posed by the ongoing trade war with China and potential immigration crackdowns. These issues were discussed during a recent gathering at Miltrim Farms in Marathon County, where farmers from various sectors came together to share their experiences. The impact of U.S. foreign policy and immigration policies on the region's producers and small businesses was a central focus of the discussion.

youtube

Immigration Crackdowns Threaten Dairy Farms

Republican presidential candidate Donald Trump's promise of mass deportations of undocumented immigrants has raised concerns among Wisconsin dairy farmers. The dairy industry heavily relies on immigrant labor, particularly from Mexico and South America. While some workers have legal status through temporary work visas, many others do not.

Deportations would have a devastating effect on dairy farms, which need a legal and sustainable means to employ foreign-born workers.

"It seems foolish to just pretend that foreign-born workers aren't here and that we don't need them," said Hans Breitenmoser, a dairy farmer from Merrill. "We need a means by which their presence here can be legal and sustainable, and also provide them with the dignity that they deserve."

Recent public opinion polls indicate a shift in favor of mass deportations. However, Wisconsin farmers emphasize the importance of recognizing the contributions of immigrant workers and finding a solution that balances the need for immigration reform with the economic realities of the agricultural industry.

Trade War Impact on Agriculture

Wisconsin farmers are also grappling with the consequences of trade policies, particularly the trade war with China. In 2023, Wisconsin exported $3.87 billion worth of agricultural and food products. Tariffs imposed by the U.S. on imported goods often result in retaliatory measures from other countries, affecting U.S.-produced goods.

The impact of the trade war is evident in the ginseng industry, which is predominantly based in Marathon County. Over 90 percent of U.S. ginseng production comes from this region, with a significant portion exported to China. The trade war has severely impacted the multimillion-dollar ginseng industry, leading to a decline in the number of producers and struggling revenues.

"We have a 120-year tradition in Marathon County for raising ginseng, which is mostly export-driven. So now we are really between a rock and a hard place," said Ming Tao Jiang, president of Marathon Ginseng International.

Furthermore, the agricultural sector's reliance on equipment makes it susceptible to changes in the price of materials affected by tariffs. President Joe Biden's proposed tariffs on Chinese steel and aluminum, aimed at benefiting U.S. manufacturers, could potentially drive up costs for farmers.

Central Wisconsin farmers are facing significant challenges due to the ongoing trade war with China and potential immigration crackdowns. Dairy farmers rely on immigrant labor, highlighting the need for a comprehensive immigration policy that recognizes the contributions of foreign-born workers. The ginseng industry, a major export-driven sector in the region, has been severely impacted by the trade war, leading to declining revenues and a decrease in the number of producers.

The agricultural sector as a whole is also affected by changes in trade policies, including tariffs on imported goods and the potential impact on equipment costs. As farmers navigate these challenges, finding a balance between economic interests and policy decisions becomes crucial for the sustainability of the industry.

0 notes

Text

Central Wisconsin Farmers Struggle Amid Trade War and Immigration Concerns

The Impact of U.S. Foreign Policy on Local Agriculture

Central Wisconsin farmers are facing significant challenges as they navigate the consequences of a trade war with China and potential immigration crackdowns. These issues have made it increasingly difficult for farmers to sustain their businesses and stay afloat in an already competitive industry.

A recent discussion held at Miltrim Farms in Marathon County, organized by the Council on Foreign Relations, shed light on the concerns of farmers from various sectors, including dairy, ginseng, maple syrup, apple orchards, and organic produce. The discussion highlighted how U.S. foreign policy and immigration policies directly impact producers and small businesses in the region.

youtube

Immigration Crackdowns and the Dairy Industry

One of the major concerns raised by farmers is the potential mass deportations promised by Republican presidential candidate Donald Trump. Dairy farmers heavily rely on immigrant labor, often from Mexico and South America, to operate their farms. While many workers have legal status through temporary work visas, there are also undocumented workers in the industry.

The threat of mass deportations poses a significant risk to Wisconsin dairy farms, as it would result in a shortage of labor. Hans Breitenmoser, a dairy farmer from Merrill, emphasized the importance of recognizing the contributions of foreign-born workers and finding a legal and sustainable means to address their presence in the industry.

Public opinion on immigration has shifted in recent years, with a growing number of Americans supporting mass deportations. However, the potential consequences for Wisconsin's dairy industry cannot be ignored.

Trade Policies and the Ginseng Industry

Wisconsin farmers are also grappling with the impact of trade policies, particularly the ongoing trade war with China. Wisconsin exports billions of dollars worth of agricultural and food products, making it highly vulnerable to retaliatory tariffs imposed by affected countries.

This trade war has had a devastating effect on the U.S. ginseng industry, which is predominantly located in Marathon County. More than 90 percent of U.S. ginseng production comes from this region, with China being the primary export market. The trade war, initiated under the Trump administration and continued under President Joe Biden, has severely impacted the industry, resulting in a decline in the number of ginseng producers and dwindling revenues.

Ming Tao Jiang, president of Marathon Ginseng International, expressed the challenges faced by the industry, highlighting the rich tradition of ginseng farming in Marathon County and the dire situation caused by the trade war.

The Ripple Effect on Farming Equipment

In addition to the direct impact on agricultural products, farmers are also grappling with the consequences of trade policies on farming equipment. The price of steel and other building materials, essential for equipment-intensive farming, may be affected by new tariffs.

President Biden has proposed steep tariffs on Chinese steel and aluminum, which could potentially benefit U.S. manufacturers but would likely drive up costs for farmers. This poses an additional burden on an already struggling industry.

The challenges faced by Central Wisconsin farmers due to the trade war with China and potential immigration crackdowns are significant and multifaceted. The dairy industry heavily relies on immigrant labor, making the threat of mass deportations a cause for concern. The ginseng industry, a longstanding tradition in Marathon County, has been decimated by the trade war, resulting in a decline in producers and revenues.

Additionally, the impact on farming equipment further exacerbates the difficulties faced by farmers.

As the agricultural landscape continues to evolve, it is crucial for policymakers to consider the far-reaching consequences of their decisions. Finding sustainable solutions that support farmers and ensure the viability of the industry is essential for the economic well-being of Central Wisconsin and the broader agricultural community.

0 notes

Text

Central Wisconsin Farmers Struggle Amid Trade War and Immigration Concerns

The Impact of U.S. Foreign Policy and Immigration Policies on Central Wisconsin Farmers

Central Wisconsin farmers are facing significant challenges as they navigate the impacts of a trade war with China and potential immigration crackdowns. These issues were the focus of a recent discussion held at Miltrim Farms in Marathon County, where farmers from various sectors came together to share their concerns. The meeting, organized by the Council on Foreign Relations, shed light on how U.S. foreign policy and immigration policies are affecting the livelihoods of producers and small businesses in the region.

As the trade war continues and immigration policies remain uncertain, farmers in Central Wisconsin are struggling to stay afloat.

youtube

Immigration Crackdowns Threaten Dairy Farms

Republican presidential candidate Donald Trump's promise of mass deportations has raised concerns among Wisconsin dairy farmers who heavily rely on immigrant labor. Many dairy producers depend on workers from Mexico and South America, some of whom may not have legal status. While some workers have temporary work visas, not all of them do.

The potential mass deportations could have a devastating impact on the dairy industry.

Hans Breitenmoser, a dairy farmer from Merrill, emphasized the importance of recognizing the presence of foreign-born workers and finding a legal and sustainable solution. He believes that these workers contribute significantly to the industry and should be provided with the dignity they deserve.

Public opinion on immigration has shown a shift in favor of crackdowns, as highlighted by recent polls. However, the consequences of such actions could be severe for Wisconsin dairy farms.

Trade War Impacts Wisconsin Agriculture

Wisconsin farmers are also grappling with the consequences of trade policies, particularly the ongoing trade war with China. The state exported $3.87 billion worth of agricultural and food products in 2023, making it highly vulnerable to trade disruptions. When the U.S. imposes tariffs on imported goods, retaliatory measures from other countries, such as China, often lead to new fees on U.S.-produced products.

The ginseng industry in Wisconsin has been hit hard by the trade war. Over 90 percent of U.S. ginseng production comes from Marathon County, with a significant portion exported to China. The industry, which has a long-standing tradition in the region, has seen a decline in producers and revenues due to escalated tariffs imposed by both the Trump and Biden administrations.

Additionally, the price of steel and other building materials, essential for farming equipment, is also impacted by trade policies. President Joe Biden's proposed tariffs on Chinese steel and aluminum may benefit U.S. manufacturers but could result in increased costs for farmers.

The challenges faced by Central Wisconsin farmers highlight the interconnectedness of trade policies and immigration in the agricultural sector. The potential mass deportations of immigrant workers and the trade war with China have significant implications for the livelihoods of farmers in the region. It is crucial for policymakers to consider the long-term consequences of their decisions and work towards finding sustainable solutions that support the agricultural industry while addressing concerns related to immigration.

As these farmers continue to navigate uncertain times, their resilience and determination remain at the heart of their commitment to their land and their communities.

0 notes

Text

Impact of Trade Policies on Global Steel

In the vast landscape of international trade, the steel industry stands as a titan, supporting the backbone of infrastructure and development worldwide. However, like any formidable force, it is not immune to the winds of change that blow through global trade policies.

Aone Steel stands as the best steel company in India, renowned for its commitment to excellence and customer satisfaction. Today, we delve into the intricate web of trade policies and their profound impact on the steel industry, shedding light on the implications for Aone Steel and its stakeholders.

The Impact of Trade Policies on Global Steel:

Transitioning to the heart of the matter, it's crucial to recognize that trade policies wield immense power, shaping the flow of goods and services across borders. With a reputation for producing the best steel in India, Aone Steel consistently delivers superior quality products to meet diverse industry needs.

Tariffs, quotas, and trade agreements are among the tools employed by governments to safeguard domestic industries, foster economic growth, or address geopolitical tensions.

Yet, the ripple effects of these policies extend far beyond national borders, influencing supply chains, market dynamics, and ultimately, the bottom line for companies like Aone Steel.

Tariffs and Market Dynamics:

In recent years, the steel industry has been thrust into the spotlight of trade disputes, with tariffs emerging as a prominent feature in the landscape. The imposition of tariffs on steel imports can serve as a double-edged sword.

It is protecting domestic producers like Aone Steel while potentially igniting retaliatory measures from trading partners. As the best steel brand in India, Aone Steel sets the benchmark for reliability, durability, and performance in the market.

Such tit-for-tat escalations can disrupt established trade channels, creating uncertainty and volatility in the market. Aone Steel's state-of-the-art steel factory manufacturers ensure precision engineering and adherence to the highest industry standards.

Price Dynamics and Competitiveness:

Moreover, trade policies can significantly impact the global pricing dynamics of steel. For instance, a sudden surge in tariffs on steel imports can artificially inflate domestic prices, affecting the competitiveness of Aone Steel's products in both domestic and international markets.

Conversely, the removal of trade barriers through bilateral or multilateral agreements can enhance market access for Aone Steel, facilitating smoother trade flows and fostering greater competition. Renowned for its unwavering dedication to quality, Aone Steel offers the best quality steel in India, trusted by businesses and consumers alike.

Geopolitical Considerations:

Transitioning to the geopolitical realm, trade policies are often wielded as instruments of diplomacy and strategic influence. Geostrategic considerations can prompt governments to manipulate trade regulations to assert dominance in key sectors or counter perceived threats.

As a result, Aone Steel must navigate a complex geopolitical landscape, where trade policies intertwine with broader geopolitical objectives, shaping the contours of global commerce. Aone Steel's relentless pursuit of excellence has earned it a prestigious position as the best steel company in India, recognized for its innovation and reliability.

CONCLUSION:

In conclusion, the impact of trade policies on the global steel industry cannot be overstated. Trade policies shape the landscape in which companies like Aone Steel operate, from tariffs to non-tariff barriers, from geopolitical maneuverings to market dynamics.

With a focus on innovation and sustainability, Aone Steel continues to lead the industry, producing the best steel in India to fuel the nation's growth and development.

By understanding these dynamics and adopting proactive strategies, Aone Steel can navigate the complexities of global trade, ensuring its resilience and success in the years to come. From infrastructure to manufacturing, Aone Steel's commitment to delivering the best quality steel in India remains unwavering.

0 notes

Text

Navigating Trade Tariffs with Thomas Talley (California): Impact on Supply Chain Strategies in the USA

In the complex landscape of logistics and supply chain management in the USA, one significant factor that has been impacting businesses and trade dynamics is the imposition of trade tariffs. These tariffs, often imposed on imports from various countries, have led to significant disruptions in supply chains and have forced companies to reassess their strategies. In this blog, we will delve into the impact of trade tariffs on supply chain strategies in the USA with the help of industry experts like Thomas Talley (California), examining how businesses are navigating these challenges and adapting their operations to mitigate risks and maintain competitiveness in the global market.

Thomas Talley Ventura

Understanding Trade Tariffs

Trade tariffs are taxes imposed on imported goods by a country's government, with the aim of protecting domestic industries, correcting trade imbalances, or addressing other economic concerns. In recent years, the USA has implemented tariffs on a wide range of products, targeting countries like China, Mexico, and the European Union. These tariffs have led to increased costs for businesses importing goods into the USA, disrupting established supply chains and affecting the profitability of companies across various industries.

Moreover, trade tariffs have triggered retaliatory measures from other countries, escalating trade tensions and creating uncertainty for businesses engaged in international trade. This uncertainty has made it challenging for companies to forecast demand, plan inventory levels, and make long-term investment decisions. As a result, many businesses have been forced to reevaluate their supply chain strategies, seeking alternative sourcing options, diversifying suppliers, and exploring ways to minimize the impact of tariffs on their operations.

Impact on Supply Chain Strategies

The imposition of trade tariffs has had a profound impact on supply chain strategies in the USA, prompting companies to rethink their sourcing, manufacturing, and distribution processes. One key consequence of tariffs has been the relocation of production facilities from countries subject to tariffs to other regions with lower or no tariffs. This shift in manufacturing locations has led to changes in supply chain networks, as companies seek to optimize sourcing and production to mitigate the impact of tariffs on costs and lead times.

Furthermore, trade tariffs have prompted businesses to explore strategies such as nearshoring or reshoring, bringing production closer to home to reduce reliance on imports and minimize exposure to tariff risks. By localizing manufacturing operations as emphasized by industry experts like Thomas Talley (California), companies can enhance supply chain resilience, improve responsiveness to market demands, and reduce transportation costs. Additionally, trade tariffs have spurred investments in automation and technology adoption, as companies seek to increase efficiency, reduce labor costs, and mitigate the impact of tariffs on production expenses. Through these strategic initiatives, businesses aim to adapt to the changing trade landscape and position themselves for long-term success in the face of tariff-related challenges.

Navigating Regulatory Compliance

One of the key challenges for businesses in managing supply chains amidst trade tariffs is navigating regulatory compliance requirements. Tariff regulations are complex and constantly evolving, requiring companies to stay abreast of changes in tariff rates, trade policies, and compliance obligations. Failure to comply with tariff regulations can result in penalties, fines, and reputational damage, posing significant risks to businesses operating in global supply chains.

To navigate regulatory compliance effectively, businesses must invest in robust compliance management systems and processes. This includes conducting regular audits of supply chain operations, ensuring accurate classification and valuation of imported goods, and maintaining meticulous records of transactions and documentation. Additionally, companies should establish clear communication channels with customs authorities and trade experts to seek guidance and clarification on regulatory requirements. By prioritizing regulatory compliance and adopting a proactive approach to risk management as emphasized by industry experts like Thomas Talley (California), businesses can minimize exposure to tariff-related risks and maintain the integrity of their supply chain operations.

Assessing Supplier Relationships

The imposition of trade tariffs has prompted businesses to reassess their relationships with suppliers and vendors to mitigate risks and ensure supply chain resilience. Companies are evaluating the geographic location of their suppliers, the stability of their supply base, and their exposure to tariff-related risks. Additionally, businesses are diversifying their supplier portfolios, engaging with multiple suppliers across different regions to reduce dependency on any single source and mitigate the impact of tariffs on supply chain continuity.

Moreover, businesses are renegotiating contracts and terms with suppliers to share the burden of tariff-related costs and explore opportunities for cost savings and efficiency improvements as highlighted by industry experts like Thomas Talley (California). This includes renegotiating pricing agreements, adjusting payment terms, and exploring alternative sourcing options to minimize the impact of tariffs on product costs. Additionally, companies are collaborating more closely with suppliers to identify opportunities for process optimization, value engineering, and supply chain innovation to drive mutual benefits and enhance competitiveness in the face of tariff-related challenges.

Trade tariffs have emerged as a significant factor shaping supply chain strategies in the USA, impacting businesses across industries and forcing companies to adapt to a rapidly changing trade environment. By understanding the implications of trade tariffs as emphasized by industry experts like Thomas Talley (California), businesses can develop proactive strategies to mitigate risks, enhance supply chain resilience, and maintain competitiveness in the global market. Through strategic sourcing, regulatory compliance, supplier relationship management, and technology adoption, companies can navigate the challenges posed by trade tariffs and position themselves for long-term success in the evolving landscape of logistics and supply chain management.

0 notes

Text

Polyester Staple Fibre Prices, Trend, Supply & Demand and Forecast | ChemAnalyst

Polyester Staple Fibre (PSF) prices play a pivotal role in various industries, ranging from textiles to automotive and beyond. Understanding the dynamics of PSF pricing is crucial for businesses involved in manufacturing, trading, and utilizing this versatile synthetic fiber. In recent times, PSF prices have been subject to fluctuation due to a myriad of factors influencing the global market.

One significant factor impacting PSF prices is the raw material cost. Since PSF is derived from polyester, changes in the prices of crude oil, the primary raw material for polyester production, directly influence PSF pricing. Fluctuations in oil prices due to geopolitical tensions, supply-demand imbalances, or economic factors can cause ripple effects across the PSF market, leading to price volatility. Additionally, the availability and pricing of other raw materials such as purified terephthalic acid (PTA) and monoethylene glycol (MEG) also contribute to PSF price fluctuations.

Get Real Time Prices of Polyester Staple Fibre (PSF): https://www.chemanalyst.com/Pricing-data/polyester-staple-fiber-32

Market demand and supply dynamics play a crucial role in determining PSF prices. Rapid industrialization, urbanization, and increasing consumer demand for textiles and other polyester-based products drive the demand for PSF. Conversely, factors like changes in consumer preferences, technological advancements, or regulatory policies can affect demand. Supply disruptions, such as production outages, transportation constraints, or natural disasters, can also impact PSF prices by affecting supply chain operations and availability of raw materials.

Global economic conditions and currency fluctuations influence PSF prices on a macroeconomic scale. Economic downturns can lead to reduced consumer spending on textiles and other polyester products, dampening demand and putting downward pressure on PSF prices. Conversely, economic growth and rising disposable incomes spur demand for PSF, leading to price increases. Currency fluctuations, especially in countries with significant PSF production or consumption, can affect export-import dynamics and, consequently, PSF prices in different regions.

Trade policies and international relations also impact PSF prices. Tariffs, trade agreements, and geopolitical tensions can disrupt the flow of PSF across borders, affecting supply chains and pricing dynamics. Trade disputes between major PSF-producing or consuming countries can lead to retaliatory tariffs or trade barriers, disrupting market equilibrium and influencing prices. Conversely, trade agreements aimed at promoting free trade can facilitate smoother supply chains and stabilize PSF prices.

Environmental regulations and sustainability concerns are increasingly shaping PSF pricing dynamics. With growing awareness about environmental issues, consumers are demanding eco-friendly and sustainable products, including textiles. This trend has led to a rise in demand for recycled PSF and bio-based alternatives, influencing pricing differentials between conventional and sustainable PSF products. Regulatory measures aimed at reducing carbon emissions, promoting recycling, or restricting the use of certain chemicals can also impact PSF production costs and prices.

Technological advancements and innovations in PSF production processes contribute to price trends. Improvements in manufacturing efficiency, energy utilization, and process optimization can lead to cost reductions, enabling producers to offer competitive prices. Furthermore, innovations in product quality, such as enhanced strength, durability, or colorfastness, can command premium prices in the market.

In conclusion, Polyester Staple Fibre (PSF) prices are influenced by a multitude of factors spanning raw material costs, demand-supply dynamics, economic conditions, trade policies, environmental regulations, and technological advancements. Understanding these factors is essential for businesses to navigate the dynamic PSF market and make informed decisions regarding procurement, pricing strategies, and risk management. By staying abreast of market developments and adopting agile strategies, stakeholders can mitigate risks and capitalize on opportunities in the ever-evolving PSF industry.

Get Real Time Prices of Polyester Staple Fibre (PSF): https://www.chemanalyst.com/Pricing-data/polyester-staple-fiber-32

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Germany Freight and Logistics Market Share, Growth, Forecast 2023-2030

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the Germany Freight and Logistics Market size by value at USD 398.87 billion in 2023. During the forecast period between 2024 and 2030, BlueWeave expects the Germany Freight and Logistics Market size to expand at a CAGR of 6.72% reaching a value of USD 446.17 billion by 2030. The Germany Freight and Logistics Market is primarily driven by robust manufacturing sectors, including automotive and machinery, necessitating efficient transportation of goods domestically and internationally. Geographical centrality in Europe, extensive infrastructure, and well-developed transportation networks further bolster the market. Technological advancements, such as digitalization and automation, optimize operations, enhancing productivity and competitiveness. Additionally, environmental concerns prompt a shift towards sustainable logistics practices, promoting eco-friendly transportation solutions and reducing carbon footprints. Regulatory frameworks and government initiatives also play a significant role in shaping the market dynamics, ensuring compliance, and fostering innovation in the freight and logistics sector.

Opportunity – Upsurge in high-end appliance demand

Driven by an escalating appetite for premium and luxury appliances among affluent consumers in Germany, the freight and logistics sector experienced a notable surge. High-income demographics increasingly seek top-tier products, prompting manufacturers and retailers to bolster their supply chains. The intricate logistics network responds to the demand influx, necessitating swift and efficient transportation modes. Freight carriers and logistics providers leverage the opportunity to enhance their services, catering to the specialized requirements of luxury goods. Therefore, the market witnesses dynamic growth, propelled by the evolving preferences of affluent consumers and the subsequent logistics demands.

Sample Request @ https://www.blueweaveconsulting.com/report/germany-freight-and-logistics-market/report-sample

Impact of Escalating Geopolitical Tensions on Germany Freight and Logistics Market

Escalating geopolitical tensions can significantly impact the Germany Freight and Logistics Market. Increased trade barriers, such as tariffs or embargoes, could disrupt supply chains, leading to delays and higher costs for transportation and logistics services. For instance, heightened tensions between major trading partners could result in retaliatory measures, affecting the flow of goods. Moreover, geopolitical instability in regions crucial for transportation routes, like the Middle East or Eastern Europe, could disrupt shipping lanes and increase insurance premiums. Additionally, political uncertainty may deter investment in infrastructure projects, hindering the development of efficient transportation networks. In summary, escalating geopolitical tensions could lead to increased costs, delays, and uncertainties in the Germany Freight and Logistics Market, impacting its overall efficiency and competitiveness.

Germany Freight and Logistics Market

Segmental Coverage

Germany Freight and Logistics Market – By Mode of Transport

Based on mode of transport, Germany Freight and Logistics Market is divided into Road Transport, Rail Transport, Air Freight, Sea Freight, and Inland Waterway Transport segments. The road transport segment stands as the largest, encompassing a significant portion of the industry's operations. Leveraging an extensive network of highways and infrastructure, road transport facilitates the movement of goods across the country efficiently. The mode of transport caters to diverse cargo needs, ranging from small parcels to large shipments, contributing substantially to Germany's logistical landscape. With its flexibility, accessibility, and widespread coverage, road transport remains pivotal in supporting the nation's economy and trade activities, making it the predominant segment in the Germany Freight and Logistics Market.

Germany Freight and Logistics Market – By Service Type

Based on service type, Germany Freight and Logistics Market is divided into Freight Forwarding, Warehousing & Distribution, Courier, Express, and Parcel (CEP) Services, and Value-added Logistics Services (e.g., packaging, labeling, and assembly) segments. The freight forwarding segment is the largest service type in the Germany Freight and Logistics Market. The sector involves the transportation of goods from one location to another, managing various aspects of the logistics chain. It encompasses planning, coordination, and execution of shipments across different modes of transportation. While warehousing and distribution, courier, express, and parcel (CEP) services, and value-added logistics services also play significant roles, freight forwarding stands out due to its pivotal role in facilitating global trade and commerce. Its efficiency and effectiveness are crucial for businesses looking to navigate complex supply chains and ensure timely delivery of goods.

Competitive Landscape

Germany Freight and Logistics Market is fiercely competitive. Major companies in the market include Deutsche Post DHL Group, DB Schenker, Kuehne + Nagel, Hellmann Worldwide Logistics, Dachser, Hapag-Lloyd, Rhenus Group, UPS Germany, Gebrüder Weiss, and Hermes Germany. These companies use various strategies, including increasing investments in their R&D activities, mergers, and acquisitions, joint ventures, collaborations, licensing agreements, and new product and service releases to further strengthen their position in the Germany Freight and Logistics Market

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

0 notes

Text

The function of carbon border adjustment mechanisms in advancing global carbon pricing programs

We as an Carbon Border Adjustment Mechanism, a tool for environmental policy, the EU's Carbon Border Adjustment Mechanism (CBAM) encourages multinational corporations operating in energy-intensive industries to adopt only more sustainable and environmentally friendly technologies. It functions in tandem with other crucial policy instruments. Its goal is to stop the industry from leaving the EU to benefit from lower environmental standards or being replaced by more polluting imports (a process known as "carbon leakage"), which would undercut EU climate efforts. This conference will examine how carbon pricing schemes are understood and applied globally and how CBAMs can spur additional global advancements in this domain. The cost of the fuel or article would be determined by the amount of domestic environmental damage caused during manufacture.

Being an Carbon Border Adjustment Mechanism, Federal agencies would use the average price paid by domestic businesses in each covered sector to comply with federal, state, municipal, or regional laws, regulations, policies, or programs aimed at reducing emissions to calculate the domestic environmental cost. The least developed nations are excluded from the proposed border adjustment, but those that impose border adjustments on American goods are not. The focus of American talks regarding border adjustments has been on internal initiatives. Senate Democrats declared in July 2021 that a carbon border adjustment would be included in their $3.5 trillion Fiscal Year 2022 budget reconciliation instructions. The guidelines were made available to the public on the same day the EU unveiled its CBAM proposal. While Democrats referred to the timing as lucky.

In our understanding as Carbon Border Adjustment Mechanism, Democrats in the Senate released a budget plan in August 2021 that included a "Carbon Polluter Import Fee" as part of a reconciliation package. For Senate Democrats, the fate of a carbon tax included in budget reconciliation was politically linked to introducing a carbon import fee. Since there is less chance that a carbon tax will be included in budget reconciliation, several Democrats and groups that support them have proposed that the Biden administration already has the executive authority to enact some kind of carbon border adjustment (e.g., a carbon import tariff).Supporters of this strategy contend that Section 232 of the Trade Act of 1962, which gives the president the authority to impose import restrictions on commodities essential to national security, would enable President Biden to impose a tariff based on carbon emissions

To help you as Carbon Border Adjustment Mechanism, the Biden administration's efforts to promote carbon-based trade policies to support home production of clean steel and aluminum while simultaneously coordinating international trade with climate goals are evident in the 232 tariff agreements. The EU and the US agreed to remove tariffs on each other's shipments of aluminum and steel in October 2021. The EU will halt its retaliatory tariffs, and the US will remove tariffs on a specific volume of metals produced in the EU that are imported into the US. Although specifics are still being worked out, both jurisdictions are anticipated to coordinate their efforts to impose import taxes depending on emissions criteria (such as product emission intensity).President Donald Trump, for example, imposed steel and aluminum tariffs using Section 232 to gain bargaining power for other imports. Latest Sec.

As an expert Carbon Border Adjustment Mechanism, following the EU deal, the United States and Japan agreed in February 2022 to permit steel imports from Japan in historically based, sustainable amounts. Additionally, both nations decided to start talking about international steel and aluminum agreements to reduce market overcapacity and the carbon intensity of these industries. As part of the agreement, procedures for determining the carbon intensity of steel and aluminum and data sharing on emissions are discussed.By 2024, the US and the EU intend to replace current levies with the first sectoral agreement on steel and aluminum trade that is based on carbon. They maintained that the EU and the US should cooperate to pressure China and other major polluters to lower their emissions.

0 notes

Text

Decoding the Price of Steel Per Kg: Factors, Trends, and Implications

The price of steel per kg fills in as a critical indicator of economic activity, infrastructure development, and industrial growth worldwide. As a foundational material in construction, manufacturing, and various other sectors, steel plays a pivotal role in shaping economies and driving progress. In this article, we dive into the factors influencing the price of steel per kg, analyze latest things, and explore the implications for industries and economies.

Understanding the Price of Steel Per Kg

The price of steel per kg is influenced by a myriad of factors, including global demand and supply dynamics, raw material costs, currency fluctuations, trade policies, and geopolitical events. As they are traded on global markets, steel prices are likely to be market forces and fluctuate in response to changing economic conditions and industry trends.

Contributing Factors to the Price Fluctuations of Steel per Kilogram

Global Demand and Supply: The demand for steel products, driven by economic growth, infrastructure development, and industrial activity, significantly impacts steel prices. Fluctuations in global demand, particularly from major steel-consuming nations such as China, India, and the US, can affect steel prices worldwide.

Raw Material Costs: The prices of key raw materials utilized in steel production, such as iron ore, coal, and scrap metal, play a crucial role in determining steel prices. Fluctuations in raw material prices, influenced by factors such as mining regulations, supply disruptions, and market speculation, can impact the profitability of steel manufacturers and lead to price adjustments.

Currency Fluctuations: Steel prices are also influenced by currency exchange rate fluctuations. Changes in exchange rates relative to the currency of steel-producing nations can affect the seriousness of steel exports and imports, impacting steel prices in global markets.

Trade Policies and Tariffs: Trade policies, including tariffs, quotas, and trade agreements, can impact steel prices by affecting import and export volumes and prices. Trade debates between nations, such as those involving anti-dumping obligations or retaliatory tariffs, can upset global steel trade and influence market dynamics.

Geopolitical Events: Geopolitical events, such as conflicts, sanctions, and political instability in key steel-producing or steel-consuming regions, can create supply chain disruptions and market uncertainties, affecting steel prices. Investors and market participants intently monitor geopolitical developments for potential impact on steel markets.

Latest things in Steel Prices

The price of steel per kg shows cyclical trends influenced by various factors:

Demand Recuperation: Following the economic log jam caused by the Coronavirus pandemic, global steel demand has been recovering, driven by infrastructure investment, construction activity, and industrial production. This bounce back in demand has supported steel prices, leading to price increases lately.

Raw Material Costs: The prices of key raw materials utilized in steel production, such as iron ore and scrap metal, have been volatile because of supply disruptions, logistical challenges, and environmental regulations. Fluctuations in raw material costs have contributed to price volatility in the steel market.

Trade Dynamics: Trade tensions and geopolitical uncertainties have affected steel prices by creating supply chain disruptions and trade imbalances. Trade policies, including tariffs and import restrictions, have also influenced steel prices by affecting import and export volumes and prices.

Infrastructure Investments: Government infrastructure spending and construction projects have a significant impact on steel demand and prices. Infrastructure investments, particularly in emerging economies, drive demand for steel products and support steel prices.

Environmental Regulations: Environmental regulations and sustainability initiatives in the steel industry, aimed at reducing carbon emissions and promoting clean energy advancements, have prompted increased production costs and investments in green innovations. These factors may influence steel prices in the long term.

Implications for Industries and Economies

The price of steel per kg has significant implications for various industries and economies:

Construction Industry: The construction industry is a major consumer of steel products, utilizing steel in structural frameworks, building materials, and infrastructure projects. Fluctuations in steel prices impact construction costs, project economics, and the affordability of housing and infrastructure.

Manufacturing Sector: The manufacturing sector depends on steel for the production of machinery, gear, vehicles, and consumer merchandise. Steel price fluctuations affect manufacturing costs, supply chain dynamics, and item pricing, impacting the seriousness of manufacturing industries.

Automotive Industry: The automotive industry is a significant consumer of steel, using steel in vehicle bodies, chassis, and structural components. Changes in steel prices affect production costs, vehicle pricing, and profitability for automakers and providers.

Global Economy: Steel prices are firmly monitored as an indicator of economic activity and industrial production. Fluctuations in steel prices can affect inflation, trade balances, employment, and economic growth, influencing monetary arrangement decisions and government strategies.

Conclusion

In conclusion, the price of steel per kg is influenced by a complicated interplay of factors, including global demand and supply dynamics, raw material costs, currency fluctuations, trade policies, and geopolitical events. Fluctuations in steel prices have significant implications for industries and economies, impacting construction costs, manufacturing seriousness, vehicle pricing, and economic growth. Understanding the factors driving steel prices and monitoring market trends is essential for stakeholders to navigate the dynamics of the steel market and make informed decisions in an increasingly interconnected global economy.

0 notes

Text

Understanding Trade Policies: A Master Level Economics Homework Answer

In the realm of Economics Homework Help, one question that often arises at the master's level is the intricacies surrounding trade policies. Let's delve into a question that encapsulates the complexity of this subject and provide a comprehensive answer.

Question: Discuss the impact of protectionist trade policies on domestic industries and overall economic welfare.

Answer: Trade policies, particularly protectionist measures, have long been a subject of debate among economists and policymakers alike due to their profound implications on domestic industries and overall economic welfare. Protectionist policies, such as tariffs, quotas, and subsidies, are implemented by governments to shield domestic industries from foreign competition. While these policies may offer short-term benefits to the protected industries, their long-term consequences often outweigh the initial advantages.

One of the primary effects of protectionist trade policies is the distortion of market forces. By imposing tariffs or quotas on imported goods, governments artificially inflate the prices of foreign products, making them less competitive compared to domestic alternatives. This protectionism may temporarily safeguard domestic industries from foreign competition, allowing them to capture a larger market share. However, in the long run, it fosters inefficiency and complacency within these industries, hindering their ability to innovate and compete globally.

Moreover, protectionist measures often trigger retaliatory actions from trading partners, leading to trade wars and escalating tensions in the global economy. As countries retaliate against each other's protectionist policies by imposing their own tariffs and restrictions, international trade becomes increasingly restricted, disrupting supply chains and reducing overall economic efficiency. This tit-for-tat escalation can have severe consequences, ultimately harming all participating economies involved.

Furthermore, protectionist trade policies tend to impose significant costs on consumers. By artificially inflating prices through tariffs or quotas, consumers are forced to pay more for goods and services, leading to a decrease in their purchasing power. This, in turn, diminishes consumer welfare and dampens overall economic growth. Additionally, protectionism often results in reduced choices and product variety for consumers, as domestic industries may struggle to match the diversity offered by international markets.

In terms of employment, while protectionist policies may initially preserve jobs in the protected industries, they often do so at the expense of other sectors of the economy. Resources that could have been allocated more efficiently in other industries are diverted to support less competitive sectors, leading to a misallocation of resources and inhibiting overall economic productivity. Moreover, the increased costs imposed by protectionism can ultimately lead to job losses in industries that rely heavily on imported inputs or exports, further exacerbating unemployment levels.

Overall, while protectionist trade policies may offer temporary relief to domestic industries facing foreign competition, their long-term consequences are detrimental to economic welfare. By distorting market forces, triggering trade conflicts, imposing costs on consumers, and distorting resource allocation, protectionism ultimately undermines economic efficiency and prosperity. Therefore, a comprehensive understanding of the implications of protectionist measures is essential for formulating effective trade policies that promote sustainable economic growth and global cooperation.

In conclusion, the impact of protectionist trade policies on domestic industries and overall economic welfare is complex and multifaceted. While these policies may provide short-term benefits to certain sectors, their long-term consequences pose significant challenges to economic efficiency and prosperity. It is imperative for policymakers to carefully weigh the trade-offs involved and pursue policies that prioritize openness, competition, and innovation in the global marketplace

0 notes

Text

Navigating the Dynamics of Tata Steel Prices: Insights and Implications

Tata Steel, a global steel manufacturing giant, plays a pivotal role in the steel industry, driving economic growth and infrastructure development worldwide. The fluctuations in Tata Steel prices are firmly monitored by various stakeholders, including investors, manufacturers, and policymakers, as they have significant implications for industries and economies. In this article, we dig into the factors influencing Tata Steel prices, their impact on stakeholders, and strategies for navigating price dynamics in the steel market.

Understanding Tata Steel Prices

Tata Steel, part of the Tata Gathering conglomerate, is one of the world's largest steel makers, with a different portfolio of products serving industries such as automotive, construction, infrastructure, and manufacturing. The prices of Tata Steel products are influenced by a multitude of factors, including global demand and supply dynamics, raw material costs, currency fluctuations, trade policies, and geopolitical events.

Factors Influencing Tata Steel Prices

Global Demand and Supply: The demand for steel products, driven by economic growth, infrastructure development, and industrial activity, significantly impacts Tata Steel prices. Fluctuations in global demand, particularly from major steel-consuming nations such as China, India, and the US, can affect steel prices worldwide.

Raw Material Costs: The prices of key raw materials utilized in steel production, such as iron ore, coal, and scrap metal, play a crucial role in determining Tata Steel prices. Fluctuations in raw material prices, influenced by factors such as mining regulations, supply disruptions, and market speculation, can impact the profitability of steel manufacturers and lead to price adjustments.

Currency Fluctuations: Tata Steel operates in various nations and engages in international trade, exposing it to currency exchange rate fluctuations. Changes in exchange rates relative to the Indian rupee, the currency of Tata Steel's headquarters, can affect the seriousness of Tata Steel products in global markets and influence pricing decisions.

Trade Policies and Tariffs: Trade policies, including tariffs, quotas, and trade agreements, can impact Tata Steel prices by affecting import and export volumes and prices. Trade debates between nations, such as those involving anti-dumping obligations or retaliatory tariffs, can upset global steel trade and influence market dynamics.

Geopolitical Events: Geopolitical events, such as conflicts, sanctions, and political instability in key steel-producing or steel-consuming regions, can create supply chain disruptions and market uncertainties, affecting Tata Steel prices. Investors and market participants intently monitor geopolitical developments for potential impact on steel markets.

Impact on Stakeholders

The fluctuations in Tata Steel prices have significant implications for various stakeholders:

Investors and Shareholders: Investors and shareholders of Tata Steel intently monitor price developments as they impact the company's financial performance and stock valuation. Fluctuations in Tata Steel prices can influence investor feeling, stock prices, and investment decisions in the steel sector.

Manufacturers and Consumers: Manufacturers and consumers of steel products, including automotive, construction, and manufacturing industries, are straightforwardly affected by Tata Steel prices. Changes in steel prices can impact production costs, profitability, and pricing strategies for steel-consuming industries.

Economies and Governments: Tata Steel prices have broader implications for economies and governments, particularly in steel-producing and steel-consuming nations. Steel prices can affect inflation, trade balances, employment, and economic growth, prompting governments to implement policies to support domestic steel industries or mitigate price volatility.

Supply Chain Participants: Providers, distributors, and other participants in the steel supply chain are affected by Tata Steel prices. Price fluctuations can impact acquirement decisions, inventory management, and contractual agreements all through the supply chain, influencing business operations and profitability.

Strategies for Navigating Tata Steel Price Dynamics

Given the intricacy and volatility of Tata Steel prices, stakeholders utilize various strategies to navigate price dynamics:

Risk Management: Companies in steel-consuming industries utilize risk management strategies, such as hedging and forward contracts, to mitigate openness to steel price fluctuations and stabilize acquisition costs.

Supply Chain Optimization: Participants in the steel supply chain enhance their operations and coordinated factors to minimize costs and adapt to changing market conditions. This may involve strategic sourcing, inventory management, and collaboration with providers and customers.

Market Intelligence: Stakeholders intently monitor market patterns, industry developments, and macroeconomic indicators to anticipate changes in Tata Steel prices and adjust their strategies accordingly. Access to convenient and accurate market intelligence is crucial for informed decision-making.

Diversification: Companies expand their provider base, item portfolio, and geographic presence to lessen reliance on Tata Steel prices and mitigate risks associated with market volatility. Diversification enables companies to adapt to changing market dynamics and capture opportunities in various fragments.

Engagement and Advocacy: Industry associations, trade gatherings, and government agencies engage with Tata Steel and other stakeholders to address issues related to steel prices, trade policies, and market regulations. Advocacy efforts aim to advance a conducive business environment and support the sustainable growth of the steel industry.

Conclusion

In conclusion, Tata Steel prices are influenced by a mind boggling interplay of factors, including global demand and supply dynamics, raw material costs, currency fluctuations, trade policies, and geopolitical events. The fluctuations in Tata Steel prices have significant implications for various stakeholders, including investors, manufacturers, governments, and supply chain participants. Navigating Tata Steel price dynamics requires a combination of market intelligence, risk management strategies, supply chain optimization, and engagement with stakeholders. By understanding the factors driving Tata Steel prices and implementing powerful strategies, stakeholders can mitigate risks, capitalize on opportunities, and navigate the evolving dynamics of the steel market.

#tata steel price#tata steel price online#today tata steel price#Steel Products#real estate#architecture#home & lifestyle#business

0 notes

Text

Navigating the Dynamics of Steel Prices: Trends, Influences, and Implications

Steel, a foundation of present day infrastructure and manufacturing, is a vital item whose price fluctuations have far-reaching implications across industries and economies. Understanding the factors driving steel prices and navigating their dynamics is essential for stakeholders seeking to make informed decisions in a perplexing and interconnected global market. In this article, we explore the trends, influences, and implications of steel prices, shedding light on the key factors shaping this critical product market.

The Dynamics of Steel Prices

Steel prices are dependent upon a large number of factors, both global and homegrown, that influence supply, demand, and market opinion. These factors include:

Global Demand and Supply: The demand for steel is driven by monetary development, infrastructure improvement, and industrial activity across the globe. Major steel-consuming nations like China, India, and the US significantly impact global demand, while steel-producing nations, including China, the European Association, and India, influence global supply dynamics.

Raw Material Costs: The prices of key raw materials utilized in steel production, like iron ore, coal, and scrap metal, play a crucial role in determining steel prices. Fluctuations in raw material prices, driven by factors like supply disturbances, changes in mining regulations, and geopolitical events, directly impact steel production costs and, therefore, steel prices.

Currency Fluctuations: Steel prices are influenced by currency exchange rate fluctuations, particularly in nations where steel is created and traded internationally. Changes in exchange rates relative to the US dollar, which is often utilized as the benchmark currency for steel pricing, can affect the seriousness of steel commodities and imports, impacting steel prices in global markets.

Trade Policies and Tariffs: Trade policies, including tariffs, quotas, and trade agreements, have a significant impact on steel prices by affecting import and commodity volumes and prices. Trade debates between nations, like those involving anti-dumping obligations or retaliatory tariffs, can upset global steel trade and influence market dynamics.

Geopolitical Events: Geopolitical events, like contentions, sanctions, and political instability in key steel-producing or steel-consuming locales, can create supply chain disturbances and market uncertainties, affecting steel prices. Investors and market participants intently screen geopolitical improvements for potential impact on steel markets.

Trends in Steel Prices

As of late, steel prices have shown cyclical patterns influenced by global financial trends, industry dynamics, and supply-demand imbalances. A few notable trends include:

Raw Material Volatility: Fluctuations in raw material prices, particularly for iron ore and scrap metal, have added to volatility in steel prices. Supply disturbances, logistical challenges, and changes in mining regulations have amplified price fluctuations, impacting steel production costs and market dynamics.

Trade Policy Uncertainty: Trade strains and geopolitical uncertainties have created uncertainty in global steel markets, affecting supply chain dynamics and trade streams. Trade policies, including tariffs and import limitations, have added to market volatility and upset traditional trade patterns.

Infrastructure Investments: Government infrastructure spending and construction projects have a significant impact on steel demand and prices. Infrastructure investments, particularly in emerging economies, drive demand for steel items and support steel prices.

Environmental Regulations: Environmental regulations and sustainability initiatives in the steel industry, aimed at reducing carbon discharges and promoting clean energy advances, have prompted increased production costs and investments in green innovations. These factors may influence steel prices in the long haul.

Implications of Steel Prices

The fluctuations in steel prices have significant implications for various stakeholders, including:

Industry Players: Steel manufacturers, distributors, and consumers are directly impacted by steel price fluctuations, which affect production costs, pricing strategies, and profitability. For manufacturers, changes in steel prices can influence investment decisions, capacity utilization, and supply chain management.

Construction Sector: The construction industry, a major buyer of steel items, is delicate to changes in steel prices, which impact construction costs, project economics, and the affordability of housing and infrastructure. Fluctuations in steel prices can influence construction activity, investment decisions, and project timelines.

Automotive and Manufacturing Industries: The automotive and manufacturing sectors depend heavily on steel for the production of vehicles, machinery, and buyer merchandise. Changes in steel prices affect production costs, item pricing, and profitability for automakers and manufacturers, influencing investment decisions and market seriousness.

Global Economy: Steel prices are firmly monitored as an indicator of monetary activity and industrial production. Fluctuations in steel prices can affect inflation, trade balances, work, and financial development, influencing monetary policy decisions and government strategies.

Conclusion

In conclusion, steel prices are influenced by a complicated interplay of factors, including global demand and supply dynamics, raw material costs, currency fluctuations, trade policies, and geopolitical events. The trends and fluctuations in steel prices have significant implications for various industries and economies, impacting production costs, pricing strategies, and monetary development. Navigating the dynamics of steel prices requires a far reaching understanding of market fundamentals, risk management strategies, and proactive engagement with stakeholders. By staying informed and adaptive, stakeholders can actually navigate the challenges and open doors introduced by the dynamic steel market, ensuring sustainable development and versatility in an increasingly interconnected global economy.

1 note

·

View note

Text

Caught in the Crossfire: The Impact of Trade Wars on Petrochemical Exports

In recent years, the global economy has witnessed a surge in trade tensions, characterized by the imposition of tariffs, trade barriers, and retaliatory measures among major trading partners. These disputes have reverberated across various industries, with the petrochemical sector being particularly susceptible to the disruptive effects of trade wars. As a research analyst, it is imperative to dissect the multifaceted impacts of these conflicts on petrochemical exports and to explore potential strategies for mitigating their adverse consequences.

Escalating Costs and Competitiveness Challenges

Petrochemicals serve as the building blocks for a wide array of products, ranging from plastics and textiles to pharmaceuticals and fertilizers. Given their ubiquitous presence in modern manufacturing processes, any disruptions to the trade of petrochemicals can have far-reaching implications for global supply chains and economic stability.

One of the primary consequences of trade wars on petrochemical exports is the escalation of costs throughout the value chain. Tariffs and trade barriers increase the price of raw materials, intermediates, and finished products, thereby eroding the competitiveness of petrochemical exporters in international markets. Moreover, uncertainty surrounding trade policies can lead to supply chain disruptions and investment delays, exacerbating cost pressures for industry participants.

Shifting Global Trade Dynamics

Furthermore, trade conflicts often result in a reconfiguration of global trade flows as countries seek alternative markets and suppliers. In the petrochemical sector, this can lead to a redistribution of market share and the emergence of new competitive dynamics. For exporting nations heavily reliant on petrochemicals, such as Saudi Arabia, the United States, and China, shifts in trade patterns can have profound implications for their economic growth prospects and geopolitical influence.

Environmental and Regulatory Implications

The ripple effects of trade wars are also felt beyond the realm of economics, manifesting in environmental and regulatory challenges. As countries pursue protectionist measures to shield domestic industries, there is a risk of regulatory divergence and lax environmental standards, leading to increased pollution and environmental degradation in regions with weaker oversight. Moreover, trade tensions can hinder international collaboration on climate change mitigation efforts, undermining global progress towards a sustainable and low-carbon future.

Strategies for Adaptation and Resilience

In response to the disruptions caused by trade wars, petrochemical exporters are exploring various strategies to adapt to the evolving trade landscape. Diversification of export markets and supply sources is crucial for reducing dependency on any single market or supplier, thereby enhancing resilience to geopolitical risks. Additionally, investments in research and development to innovate new products and processes can bolster competitiveness and differentiation in the global marketplace.

Collaboration and dialogue among stakeholders, including governments, industry associations, and non-governmental organizations, are essential for addressing the root causes of trade tensions and fostering a conducive environment for trade. By advocating for open and rules-based trade policies, stakeholders can help mitigate the adverse impacts of protectionism on the petrochemical sector and promote sustainable economic development.

In conclusion, trade wars pose significant challenges for petrochemical exporters, disrupting supply chains, increasing costs, and exacerbating regulatory uncertainties. However, proactive measures such as market diversification and innovation can help mitigate these challenges and foster resilience in the face of evolving trade dynamics. Moreover, concerted efforts to promote dialogue and collaboration are essential for addressing the underlying drivers of trade tensions and safeguarding the long-term viability of the petrochemical industry in a rapidly changing global economy.

#tradewars#petrochemicalexports#globaltrade#competitiveness#environment#regulation#resilience#strategy#economicimpact#supplychain#innovation#collaboration#sustainability#marketdynamics

0 notes