#plus theres a huge difference between staying at home for a couple years after high school then moving out later

Text

i seriously need to get a new job and start making money again asap bc i cannot keep living at home much longer it’s driving me insane

(wrote an entire essay in the tags without meaning to oops)

#i feel so isolated from everything bc i’m not in school rn but all my friends are and 90% of the ones who are in state go to the same school#so they’re all in the same town and here i am 45 minutes away#i never get invited to anything bc 1) my friends all tend to make plans really last minute#and 2) if we want to go out and drink - which we usually do bc that’s the stage of life we’re in rn - i’d have to stay the night with#someone bc i absolutely cannot afford a 45 minute uber home and most of my friends don’t like staying over / having people stay over#so i have basically no social life and it’s only gotten worse in the past couple months since i got laid off from my main job#not only did i love that job but i loved my coworkers and work was pretty much the only time i left the house and interacted with people#and without that job i can’t even do the little solo things i used to do to cheer myself up like go see a movie#or even just go for a long drive bc i’m broke (as in i have $17 in cash to my name and am like $1000 in debt rn)#so all i do is rot in bed all day and apply for jobs that i’m overqualified for yet still don’t get hired#i barely even leave my room bc i avoid my family which just makes me feel guilty bc i love my family#but they get on my nerves so easily and most of the conversations i have with my mom end in her lecturing me about something and me crying#and on top of everything it’s just straight up embarrassing to be unemployed and completely directionless about college and living at home#logically i know i’m still very young and it’s common to live at home when you’re 20 but literally none of my friends do#i had a couple friends who lived at home for the first 2 years after high school and went to community college but by now they’ve moved out#and they’re all at universities and either graduating this year or next year meanwhile the earliest i could possibly graduate is in 2 years#i should be finishing my junior year rn but i’ve only completed my freshman year#i hated the school i was at and planned on transferring sophomore year but long story short that didn’t work out#even longer story short i ended up doing a semester each at 2 different community colleges and failed all my classes both times#and took 2 semesters off so now i’m a full 2 years behind and even though my freshman year was miserable#i’m starting to wish i stayed at that school anyway bc at least i would be at a university and accomplishing something#plus theres a huge difference between staying at home for a couple years after high school then moving out later#vs living on your own right away then having to move back home after you’ve already experienced having your own space#and on top of everything i have an older sister who’s a literal genius and graduated last year#and a younger sister who just finished her freshman year at the school i hated but she loves it and got perfect grades and made friends#so they’re both thriving and here i am living with my mom and my 13 year old brother and just completely failing at everything#i’m just so miserable and obviously moving out again and going back to school wouldn’t magically fix everything#but at least i would feel like my life was going somewhere and i wasn’t getting left behind by everyone i know#i just have no idea how to move forward and i feel like ever since high school not a single thing has gone the way i wanted it to#vent

4 notes

·

View notes

Text

Love Will Find a Way, Well, Eventually : 2. In Between

“Where are you going?”

If it was inside Cartoon Network’s universe, everyone must be able to see the smoke fuming from both his nostrils and ears. Jinki looks beyond distressed when he’s lifting his ass from the chair. No one on the table was his partner, but Minho decided to throw some ridiculous question then played dumb as if he didn’t just ask one.

“Should I have number one here?”

He started getting irked, but that doesn’t stay long until Kibum casually munched his breadstick while spluttering his witty comments as usual, “Surely Taemin would be delightful.”

Taemin who didn’t do anything almost chocked himself with a piece of tomato and kicked Kibum’s shin under the table, eventually.

“Promise me you won’t run away?”

Dumbfounded, Jinki emptied his pocket and almost smashed the table with his belonging.

“Are you my husband? Here’s my wallet. And my phone!” and with that, he left the other three men finishing their meal.

“Is he always in this temper?”

Lee Taemin gave him another look, pleading him not to embarrass them further, but Kibum just shrugged and muttered ‘I’m just asking’ under his nose.

“He was mad with me since this afternoon. Plus, he has lots of stuffs to think about these days. But don’t worry, he never really got mad unless you disturb his nap.”

“What is he? A bear?”

“Yaa! Kim Kibum!”

Minho couldn’t help but laugh to the scene happened before his eyes. Taemin is famous for being friendly and very expressive only if you know him, even if he’s talkative. To penetrate his bubble is very hard at first, but this man sitting across him, he seems like he’s already inside that bubble since the very beginning. He really is someone closed to him. Kibum looks mesmerizing, even in his grumbling nature. The oversize sweater wrapped his lithe build perfectly.

A phone call arrived to Kibum's phone, he picked it up frantically and excused himself to take it outside.

"What do you think?"

“Eh?” Minho doesn’t even realized he got his eyes entailed Kibum’s silhouette until it disappear by the entrance door.

“You seemed in trance. I know Kibum is beautiful but I didn’t expect you’ll be this amazed with my friend,” Taemin’s sipping his wine, a smirk is very apparent in his devious face.

“I guess it’s safe to say that you’re not a liar.”

Minho reopened his mouth few minutes after he’s assured that Kibum’s not going back any soon. Taemin is not ecstatic, sometimes he wondered if Minho has a decent sense of humor of a friend.

“For your information, I’m not and never been. I’m the most honest person you’ve ever encountered in your life.”

“Everyone in this room knows that’s not true.”

“Whatever. I might know my ways deceiving people, but I never lie to my friend.”

“Did you just admit that you’re lying here and there, Lee Taemin?”

Taemin rolls his eyes, again, probably for the nth times already this evening. Without Jinki around, he can be more relaxed on throwing his tantrum on Minho.

“Choi Minho, people lies at some certain points of their life. Get over it.”

He gulped down the rest of his wine, Taemin then called a waiter near them to bring him another one.

“Kibum seems nice. He sounds smart.”

“Sounds? Did you even listen to yourself? No writer is not smart, Choi. Moreover, someone who’s been writing the past decade!”

“I only know him for one night. Who knows he’s just acting?”

“Dude, not everyone is an asshole like you.”

“An asshole wouldn’t agree to bring his best friend along in front of a psychopath like you.”

Taemin snorted and Minho’s smirk reappeared on his face.

“That is literally what a psycho would do, selling their friend for their own benefits.”

Minho wiped his mouth before washed down the dinner with cold water, “And that’s exactly what Jinki accused me for. You two shared a brain or what?”

“Any sane people would say the same, Honey,” this time Taemin’s smirk that made the other scoffed, “By the way, what’s the deal with Jinki? He looks like he’s been sitting on thorny cushion the whole dinner!”

Minho knows Taemin would ask such question eventually. However, he couldn’t say that Jinki hates the whole dinner date plan, it’s impossible. Besides that, knowing him for years, Jinki really is an angel in disguise, well, at least when he’s in the mood.

“People have different, what should I say, defense mechanism? And that’s how he is. What kind of person who talked nonstop during their first meeting, anyway?”

“Oh, I don’t know, me?”

“That’s why you’re a freak.”

“A freak who introduced you to your potentially next boyfriend.”

“Ha. Point taken,” Minho raised his hand to ask for the dessert, “Jinki is just not the type of person who will talk a lot and open up in a second. But I guarantee you, he’s a good person. Sometimes a little bit care too much for other at certain time so probably being brazen is his forte.”

“That reminds me of someone.”

Taemin and Kibum spent their high school days together. Separated for some years due to works and educations, their relationship’s all well maintained. They understand each other, including Kibum’s nature to always put others before him at any given situation.

“Appearance wise, though, what do you think about Jinki?”

“Choi Minho, I’m not a teenager anymore. Judging people around by its cover is no longer my habit.”

“But a designer like you must love a beautiful package, don’t they?”

“Well, to be honest, his lips and eyes itself could get me floored in one glance.”

“I knew it.”

“You’re a famous photographer for a reason.”

***

Cold wind slapped Kibum’s cheeks lightly when he pushed the door and parched to the corner near the valet post.

“Okay, now you can speak. Sorry, I don’t know why the reception wasn’t good enough inside.”

“Then I’ll be frankly here. There’s a possibility for making the special edition for the short story collection. But then, we’re still short of two stories at the moment.”

“Wait, wait, but we already have nine! I finished writing nine! Why should I add another two?”

“The publisher agreed to the preposition for at least twelve stories. You should be grateful I could pitch one less story!”

Kibum looks like he’s about to punch anyone passed within radius one meter around him, but nothing in reach besides a huge pot of short palm tree and concrete wall. And he needs his hand to finish his books still.

“But, Amber. Page wise, those are more than enough to make two new books. Are they out of their mind?”

There’s a loud groan banging on his ear drum came from the other line, “Dude, I almost flipped the table when I was at the meeting you have no idea. The board has new man and that guy is a pain in the ass.”

“Would it change the circumstance if I talked to them by myself?”

“Since when do they have time to talk to the writer directly? We’re head to head with bunch of snobs here, did you forget?”

“I should had not agree to let them touched my writings. Now we’re about to face dead end.”

It was a dream to work along this publisher. It was Kibum’s dream since he started writing when he took gap year after graduated high school. And as if it’s a fate, it was the only publisher agreed with his graphic novel concept five years he climbed his career professionally.

“Listen, Kibum. When I met you years ago, I promised I’ll work my ass hard to help you publishing your books. Not because I knew you, it’s because you’re good. You’re amazing writer and I’m not giving up easily. And neither you. Not when anybody can tell that you’re a gem.”

“I haven’t written any book since last year, Amber. I’m in a slump. Writer’s block is not even describing my bad luck at the moment.”

“Honey, you haven’t written any because you’re currently waiting two books released. And if I could do my magic, another one in, let’s say, six months.”

“If I could make up some words into another story within two weeks. If you could convince them to give me mercy.”

“Did you just know me yesterday?”

Kibum’s tired giving sane response, “What do you mean?”

“I’m waiting their secretary to call me in ten minutes. We’re going to discuss some new deals and I’ll make sure one of them is going to be your new nine stories book.”

“I actually have no idea if I don’t have you as my editor slash manager slash friend slash personal ranting partner slash whatever you want to be.”

“Rockstar. That would be cool.”

“You’re going to be a kick ass one to be honest.”

“I bet. Anyway, expect another call from me in the next couple hours. I’m sorry, but tonight we might need video call to resolve some issues.”

“I hate you for confiscating my time but you’re the best.”

“As always, ain’t I?”

The phone call ends already, but he still forlornly looking at his phone’s screen. With that, Kibum remembers all the works he needs to catch up for tonight. With that, he can put aside all the unnecessary anxiety and tension of tonight’s stupid match making session.

He took a glance of his watch and could only sighed, he better hurried inside to his dessert. The faster he finished, the sooner he can hit home and face the real deal. His deadlines.

Two steps away from the entrance however, he caught a familiar face sitting by themselves, staring to the busy street in front of the restaurant.

“Jinki?” he carefully calling the man, “Lee Jinki, right?”

The later tilted his head to the right and gave Kibum a simple smile, didn’t realize it dropped Kibum’s heart by the bottom of his gut.

“Aren’t you cold?”

Everyone would agree this winter is even harsher than last year’s. Jinki just lifted his left hand to make sure Kibum saw a cigarette slipped between his fingers, “Can I sit here?”

Jinki chuckles, “Aren’t you cold?”

Listening to the same question he threw a minute ago, he just rolled his eyes and took a place next to the other man.

“I’m waiting a phone call.”

“Important?”

“Kinda.”

Jinki blew some smoke out, “Hmm, I guess so. You sounded pretty upset over there.”

“Did I scream that loud?!”

“In my opinion? No. but a girl flinched and buzzed off rather hastily, so, you tell me.”

When he saw Kibum’s gaping like a fish in frantic expression, Jinki has no choices beside laughed again, surprising Kibum who’s quite convinced with his aloof personalities.

“I didn’t know you have so many jokes in store.”

“You learn something new every day.”

“Your face doesn’t show.”

“What about my face?”

“It’s handsome but with that attitude inside, seems like you’re the type who woke up at the wrong side of the bed every single morning and could kill someone annoys you at any time.”

“Well, to be fair, I did wake up in the wrong side of my bed this morning. But it’s because a certain dog occupied half of my blanket so I couldn’t disturb her.”

“You have a dog?!”

Kibum’s face lit up thousand times as if he just won some lottery. Strangely, it warms Jinki’s heart. No, scratch that, it would warm any heart, Jinki tried to generalize the situation.

“I don’t, unfortunately. She belongs to my friend. I’m taking care of her while he’s travelling abroad. Her father will pick her up this weekend.”

“Ah, too bad. We could have play date with my boys.”

“I’ll make sure to give you a call when I decided to adopt one later.”

“Do you think my invitation hasn’t expired yet by that time?”

“A man can only dream, can’t he?”

Kibum’s laughter is muffled by his own palm covering his mouth.

“Let’s go inside, you must be shivering.”

“But your cigarette?”

Kibum’s half stuttered caught red handed, Jinki already pressed the half-done cigarette on the sand bowl on his left, “I can always have another one at home. Besides, I doubt you would go inside without me dragging you along.”

Kibum thanked the universe that the place is not well lit, so he could hide the blush creeping his cheeks. Unfortunately, Jinki has a very good eye sight.

***

“Is my baby being a good girl when daddy’s away?”

Jinki scoffed when the man just entered his living room just literally threw his suitcase aside and scooped the little dachshund running toward his embrace. He gathered the suitcase and poor leather bag on the floor and placed it neatly near the saffron color couch.

The man later dropped himself next to Jinki who’s lounged himself there, checking his phone halfheartedly.

“Minho texted me the other day.”

“Why did he keep texting you?”

The man with dark grey hair didn’t catch the frown hanging on Jinki’s face and buried his face to the dog’s belly, making him groaned again. He lightly pushed the dog further and toppled his head on the other man’s laps.

The dog owner realized something’s happened when he’s not around. He put the dog on the ground and tapped her butt to send her back to her small bed near the pantry.

“Minho has my number and I have his name in my contact list. He can text me whenever he wants. Still jealous?”

Jinki closed his eyes when he started playing with his hair, “He’s still one of the reasons we broke up.”

“Baby, the only reason we broke up is because neither of us didn’t want to succumb into marriage. Minho was just a handsome face happened on the wrong time.”

“I have no idea why I still befriend him when it’s clear he wanted to shove his face to yours, all the damn time.”

“And I have no idea that you’re this type who holds the grudge for a long time. We were already out of relationship back then.”

“Still, a friend wouldn’t openly chase after their friend’s ex.”

“A friend wouldn’t, but a best friend would.”

“Whatever.”

He almost lost his control and slapped Jinki’s head of him, “Oh, come on. What’s bothering you this time?”

“Nothing.”

“Bullshit. It’s written all over your face the second I saw you behind the door. And I’m pretty sure it’s not because my daughter misbehaved while I’m on my annual pediatric conference.”

Jinki sighed, nothing he could really hide it from the other man. Since they were in their almost five years relationship, since they became best friends around three years prior.

“Minho invited me for a dinner night.”

“Wow, fancy,” actually Minho already texted him about the dinner a bit, how he wanted to introduce Jinki to some acquaintance he has, “He gave up on me so he went for the only option?”

“For the record, your mom agreed that I’m way much sexier than you.”

“Three years ago, before your cheek bones buried under those mount of fluffy fat.”

“Said a man who came to me and straight ahead told me I looked cute after leaving a piece of paper with their number on my table.”

“I will put aside the fact that I love how romantic you’re for still remembering our first meeting but let’s back to the right path here because I don’t like the upset you. It’s fucking annoying.”

“He introduced me to someone, Jonghyun.”

He let out inaudible gasp and thanked the universe Jinki’s still closing his eyes. Otherwise, he would stop at once and avoided any discussion of the main reason which distressed his ex-boyfriend. Knowing the scenario before hands didn’t prevent him with the sheer pain graze him when it came from Jinki’s mouth himself.

“So? Isn’t that great? Do you think it’s about time?”

“I was about to argue that two years are still not enough to get over you but I guess you’re not in the same page with me so I’d say that I’m not interested into some relationship whatsoever at this point.”

Jonghyun wanted to cry listening to such words. His heart clenched, he inhaled – a very long one – before he continued caressing Jinki’s forehead.

“I am flattered, but I know you’re just teasing me.”

“Ha, you know me so well.”

“I’m not gonna fall on the same hole, Lee.”

“You won’t. You’re too smart to repeat the torture on the loop.”

“It wasn’t a torture, Jinki. I love you as much as you do. Or maybe just slightly more.”

“Not a chance. I love you more.”

“Stop it or I will kiss you.”

“I dare you.”

“I told you I’m not gonna fall on the same hole.”

“Smart, very smart,” Jinki opened his eyes only to find Jonghyun sticking his tongue out, “Okay, so at first, I don’t like the idea already. You know I hate any type of match making method. Even the online one. But being there, I realized that my current focus doesn’t involved other party besides me, my business, and—“

“And your grandfather?”

Jinki looks annoyed, “Remind me to add ‘always-cutting-people-sentence’ on the list of reasons why I broke up with you when I’m writing my journal tonight.”

“It’s true. I think he was also the cock blocker during our relationship back then.”

“Dude, we’re talking about my gramps. And to put him on the same category with Minho is beyond weird.”

“We already broke up when Minho made his move, for Pete’s sake!”

“Okay, okay! No need to raise your voice, you’re so scary when you’re angry.”

“Then don’t make me! Now, now, can you please be a normal human being so we can talk like adults for once?”

Jinki pulled himself from the couch to the pantry, snatching a pack of cigarette on the tea table before slipped one on the corner of his mouth.

“Can you not smoking inside?”

He snorted and padded to the direction of his balcony. It’s in the middle of winter but he doesn’t care a bit to the wind ready to slaughter his bones. If tomorrow the cold prevented him to leave the bed, then let it be. For once, he just wants to free his mind from the business.

“You need to remember that I can only treat patient on certain age,” Jonghyun followed few minutes after with a blanket he spread as wide as possible to cover both of them without feeling suffocated for standing too close.

“The American Academy of Pediatrics recommends people be under pediatric care up to the age of 21, though.”

“Did you just quote Wikipedia? And we’re not in fucking States! Above and beyond, shame on your wrinkles!”

“Rude.”

“You’re the rude one to your lungs!”

“Then tell me how to ease my mind without nicotine! Tell me how to forget all those troubled night and just sleep! Do you think it’s easy taking care of worrisome business and messy family without distraction?! Stop talking non sense if you do know how to save my days!”

Any word seems taboo once Jinki exploded. Both man just staring into the dark evening below Jinki’s unit. People paraded as quickly as possible on the street to fight the harsh weather. It’s not that late, but only few cars passed by. The dim light of the street lamp’s soothing the tense atmosphere in a way.

Jonghyun leaned closer to Jinki’s arm and rested his head on his shoulder.

“I’m sorry I couldn’t help you with that.”

“I’m sorry I yelled at you.”

“You know that you can always talk to me right?”

“I’m tired bothering you. You already have a lot in your hands.”

“Besides my patients and Roo, there’s nothing really confiscated my time.”

Having someone like Jonghyun who would stand next to him, scold him then hug him right after, no matter how awful he behaved and treated the other man, Jinki every so often thinking what kind of good deeds he did in his previous life.

Jinki cocked his head, inhaling the trace of scent of Jonghyun’s favorite shampoo. Initially, he was about to kiss the top of his head, like he used to do when the other man leaned on him for whatever reason it was. He remember, though, the earlier period after their broke up – after settling their feelings for few months of course – the shorter man told him not to do that anymore because it was the doctor’s Achilles heel. So instead, he rubs his cheek over the thick hair, silently telling Jonghyun he’s sorry.

Some nights – especially right after that dinner date – he had thought, maybe one of the reason he reprimands Minho’s idea is just because he still has tiny hope that Jonghyun and him might had another chance in the future.

“From time to time, I was thinking that the more day passed, we’re closer to the image of friends with benefit.”

“Friends with benefit? Tsk,” Jonghyun slapped his forearm, “The only benefit I got from you is you’re the only perfect nanny for Roo when I’m away.”

“Those cups of coffee every single time you stopped by my shop?”

“Pfft. How stingy. I’m leaving.”

“Heartless.”

Jonghyun didn’t say anything more and returned inside to gather his things and called Roo. He desperately needs some hot shower. Somewhere inside him, he was expecting Jinki offering him to stay the night knowing how caring the man and the fact Jinki knows he bolted to the other’s apartment right away after landed.

When Jinki handed him the leash, that hope vanished in second.

“What if later I really considered this person? Or any other person collided with me on the future?”

Jonghyun smiled, he looks tired, but very sincere, “Then good.”

“Because I’m not gonna bother you anymore?”

“No. Because you’ll have someone to share the happiness with.”

***

cross-posted in my AFF

5 notes

·

View notes

Text

Cost of living: Why you should choose a cheap place to live

Shares 105

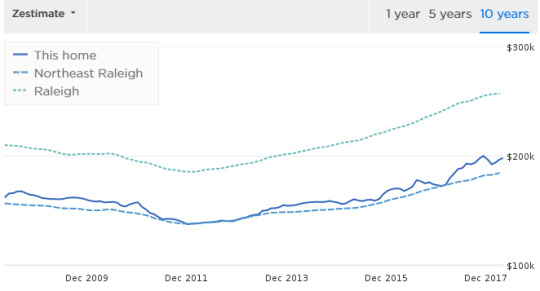

While visiting Raleigh earlier this month, I spent a morning with my pal Justin (from the excellent Root of Good blog) and his wife. As we sipped our coffee and nibbled our bagels, the conversation turned to cost of living. (Money nerds will be money nerds, after all.)

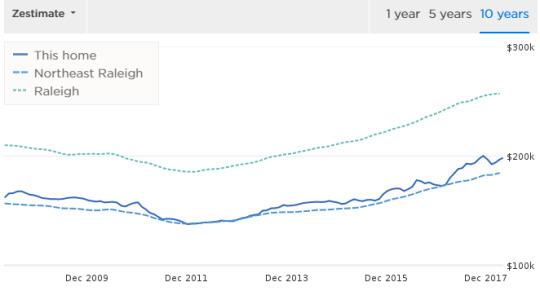

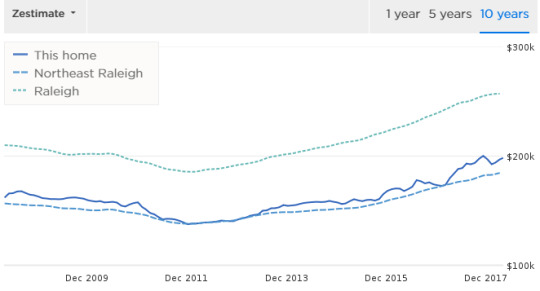

Things are cheaper here in North Carolina than they are in Portland, I said. Food is cheaper. Beer is cheaper. Hotel rooms are cheaper. Your homes are cheaper too. Last night, as I was walking through the neighborhood next to my hotel, I pulled up the housing prices. I was shocked at how low they are!

Yeah, housing costs are lower here than in many parts of the country, Justin said.

Take our house, for instance. We bought it in 2003 for $108,000. Zillow says its worth around $198,000 right now. But Ill bet thats a lot less than youd pay for a similar place in Portland.

Hes right. Justin and his wife own an 1800-square-foot home on 0.3 acres of land. Their place has four bedrooms and 2.5 bathrooms. Theres only one place for sale in Portland right now that matches these stats and its going for $430,000 more than twice the price the same home would fetch in Raleigh.

Housing is by far the largest slice of the average American budget, representing one-third of typical household spending. Because of this, the best way to cut your costs (and, therefor, boost your profit margin) is to reduce how much you spend to keep a roof over your head.

One obvious way to cut costs on housing is to choose a cheaper home or apartment. But if you truly want to slash your spending, consider moving to a new neighborhood. Or city. Or state. If youre willing to change locations, you can supercharge your purchasing power and accelerate your saving rate.

Cost of living is one of those factors that people seldom consider, but which can have a huge impact on the family budget sometimes in unexpected ways. According to The Millionaire Next Door:

Living in less costly areas can enable you to spend less and to invest more of your income. You will pay less for your home and correspondingly less for your property taxes. Your neighbors will be less likely to drive expensive motor vehicles. You will find it easier to keep up, even ahead, of the Joneses and still accumulate wealth.

Its one thing to talk about the effects of high cost of living, but another to actually experience it.

Cost of Living in Real Life

On our fifteen-month road trip across the United States, Kim and I made a point of watching how prices varied from city to city and region to region.

While stranded for ten days in rural Plankinton, South Dakota, for example, I paid $10.60 for a fancy mens haircut. At home in Portland, I pay $28 for the same fancy haircut. In Fort Collins, Colorado, I paid $30 for a haircut. In Santa Barbara, California, I paid $50 or $60 for the same fancy cut.

Gas was cheaper in South Dakota too. So was food. So was beer and whisky. So were movies. So was just about everything, including housing. Housing prices followed a similar pattern to the haircut prices I mentioned above. A $280,000 home in Portland might go for $300,000 in Fort Collins and $500k to $600k in Santa Barbara. In South Dakota, that same home would cost about $106,000.

A couple of years ago, I exchanged email with a reader who had first-hand experience struggling with the high cost of living. She gave me permission to share her story:

I had been saving about 40% of my relatively modest salary for eight years. I had built up an emergency fund as well as a good sized savingsand then we had kids.

We lost our rent-stabilized apartment right after our children were born. We live in New York City, and while I maintain that there are many things about the city that are actually very budget-friendly (public transit and free entertainment top my list), the cost of rent and daycare in NYC are over the top.

In one year, the cost of a market-rate apartment in our neighborhood plus two kids in daycare ate into my hard-earned savings. By the end of the year, the pot of money that I had worked so hard to save was down by almost $50,000.

Luckily, my husband and I have never carried any kind of debt and had already been living well below our means before the kids came along. But that also meant there was very little fat left to trim in our budget other than rent and daycare expenses. (Wed already dropped the landline, never had cable, cooked almost all of our meals at home, and cut out our modest allowance of $50/month for splurges.)

We are the very definition of penny wise and pound foolish!

Eventually, we moved into a cheaper apartment. Although we havent had to dip into savings since we moved, were still essentially living month to month because of daycare and rent. The neighborhood is cheaper for a reason.

Real Life will force us to make another move in the spring. One of our jobs is going away, so it will force a decision one way or another since we cant stay in New York on one salary. Change is definitely coming.

This reader and her husband are already frugal-minded thats how she built her buffer of savings to start with so there isnt much more the family can cut. This is an example where the only real solution is to seek a city with a lower cost of living.

Saving in Savannah

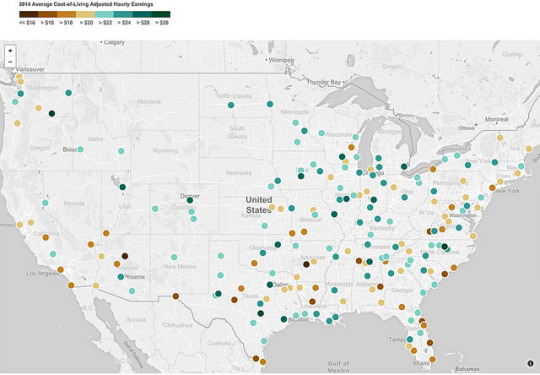

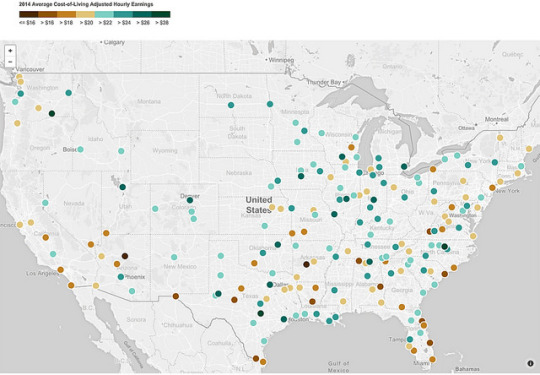

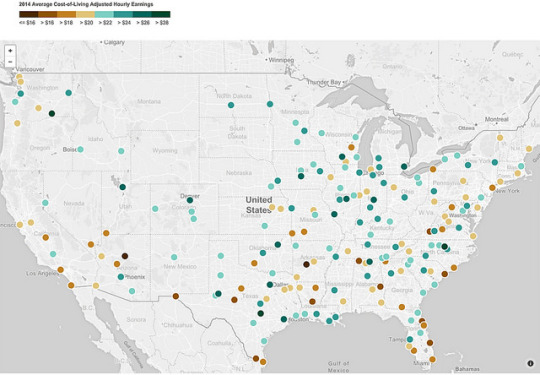

Which places are cheapest to live? Which are most expensive? This map from Governing magazine shows how far the average paycheck goes in 191 U.S. metro areas.

Dark green (blue?) dots indicate cities where your wages buy more after adjusting for cost of living. Dark brown dots are places where you have to work harder to get what you want. (Click through to play with an interactive version of the map.)

As you can see, large coastal cities tend to be more expensive than smaller towns in the center of the country. If you have a fixed budget, youll get more bang for your buck by buying a home in Oklahoma City or Sioux Falls than by living in San Francisco or Washington D.C.

Its not just coastal cities, though. There are spendy pockets throughout the U.S. from Flagstaff, Arizona to Hot Springs, Arkansas. And some coastal cities Boston, Houston, Seattle, Tampa are relatively inexpensive. (In Boston and Seattle, though, thats because wages are high, not because things are cheap.)

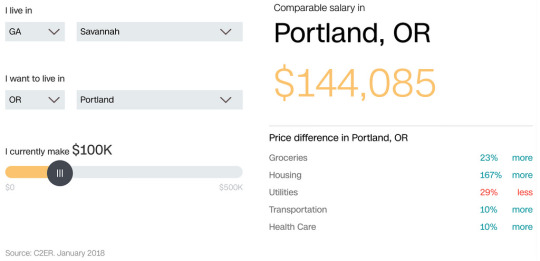

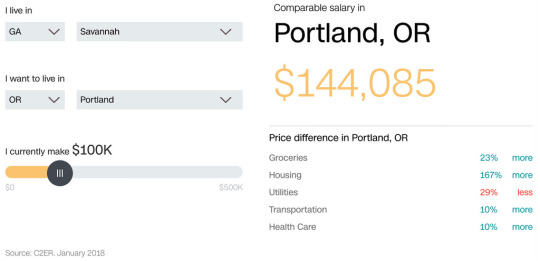

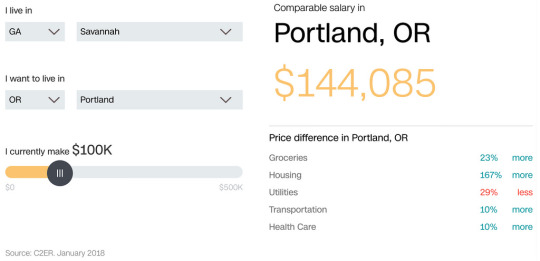

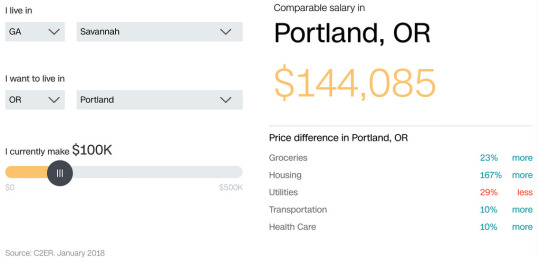

In the middle of our road trip, Kim and I decided to stay the winter in Savannah, Georgia. During our six months in Savannah, we spent much less than we would have for the same lifestyle here in Portland. According to the CNN cost-of-living calculator, Portland is 44% more expensive than in Savannah. (And housing costs nearly three times as much here as it does in Georgia!)

In larger cities, there are often cost-of-living differences between neighborhoods. When deciding where to live in Savannah, for instance, we had a choice:

We could rent a small apartment in the downtown historic district for $1750 per month. The place would have been a lot of fun because it was surrounded by shops and restaurants, and it was close to anything we might want to do.We could opt instead for a modest-sized condo on the outskirts of town at $1325 per month. This location was next to nothing. We could walk to the grocery store, but wed have to drive into the city if we wanted to indulge ourselves.

After considering financial and lifestyle factors, we chose to rent the condo in the middle of the marshlands. On the surface, this decision saved us $425 per month. In reality, it saved us much more than that.

If we had lived downtown, we would have had to pay to park the Mini Cooper ($95/month). We would have been constantly tempted to eat out or go for drinks. It would have been too easy for window shopping to become actual shopping. Instead, we enjoyed one Date Night each week. We spent the rest of our time working and exercising.

I believe that opting for the less glamorous location saved us a minimum of $5000 over our six month stay and the real savings are probably far greater.

Pinching Pennies in Portland

This same concept certain neighborhoods costing less than others was a driving factor in our decision last year to sell our condo and move to the country. We loved where we lived, but the costs were crazy.

First, there were the maintenance costs for a place that we ostensibly owned outright. Even without a mortgage, we were paying nearly $1200 per month for HOA fees, utilities, insurance, and more. (In our new place, we spend half that.)Plus, there was the sneaky cost of lifestyle inflation. Our condo was in a fun neighborhood filled with restaurants and bars. It was all too easy after a long day to simply walk up the street to one of our favorite spots, where wed drop $50 or $100 on food and drinks. Moving to our new place cut our restaurant spending in half.Lastly, the cost of goods in our new neighborhood is lower than in our old. In Sellwood, our grocery options were limited. And expensive. The nearest markets were both high-end organic-only affairs, the kind of places you might see on an episode of Portlandia. Yes, the quality was outstanding. But since weve moved, were spending about 25% less on groceries each month.

Moving helped us save big on some cost-of-living items. But it also brought with it a few increases in spending. Because were more rural now, we drive more often. Kim, especially, is spending more on gas. Our new home also has greater maintenance costs than the condo. Weve poured a ton of money into this place since moving in. (I guess thats not actually a cost-of-living issue so much as a homeownership issue, though.)

My point is that even within a city, there are cost-of-living differences you can leverage to your advantage especially if youre willing to live in a rougher part of town.

The Bottom Line

Obviously theres more to picking a place to live than pure price.

When you choose a city (or neighborhood) to call home, you do so because of the climate, the politics, and the people. You want to live close to friends and family. You want a nice school district. You want people who think and act the same way you do. For those reasons (and others), Omaha might not be a good choice for you. (Savannah isnt a good choice for me long-term, but it was fine for a few months.)

Heres the bottom line: Where you choose to live has a greater effect on your long-term financial success than almost any other factor. How much you earn is sometimes more important (not always), in which case cost of living is a close second.

Cost of living can wreak havoc on your pursuit of financial freedom. Or it can help you achieve your goals sooner than you thought possible. The choice is yours.

Other ways to make the most of your housing budget? Consider renting. Live close to where you work so that you can walk, bike, or take the bus. Purchase a house that fits your lifestyle and needs rather than the commonly cited buy as much home as you can afford. The latter is self-serving advice from real-estate agents and mortgage brokers. You dont need a big house; you just need someplace comfortable.

Shares 105

https://www.getrichslowly.org/cost-of-living/

0 notes

Link

It seems as if everyone I went to high school with started popping out babies and getting married only a couple years after graduation. Im not judging at all, and to each his own. Its nice in a way to see what my old connections wound up doing with their lives compared to what Im doing.

For me, it magnifiesa sense of how big the world really is, and how many different paths we all could have taken. And as much as I envy the love they wake up to each and every day, I find my own sources of that same fulfillment.

1. Travel whenever you want.

There will come a time in your life where travel just isnt an option. And if it is, a family will make it that much more difficult.

Traveling as newlyweds could be fun, but after all that money you spent on a huge one-day event,your budget will probably be begging you not to.

As far as kids go, travel, from what Ive heard, is very hard to do when you have a crying 1-year-old or a nagging 5-year-old in your posse.

While those with children are making sure their kids are going to school in the mornings or making sure they dont miss their play dates, Ill be in Ireland climbing castles.

2. Go to parties and stay out late.

Just because my undergrad years in college are behind me doesnt mean I have to stop partying.

Its fun when you party in your twenties because theres a sense anything can happen.

When youre married, you have to show up together, behave and make sure your spouse is happy.

As a parent, getting invited to a party is not as simple as it once was. Instead of deciding which party you want to attend on Friday, you have to figure out if you can even go out.

The choice is between finding an available babysitter (and shelling out about 50 dollars) or staying home and missing out.

All I have to remember to do is feed my fish before I head out the door.

(Bonus: The fish wont wake me up at 6 am when Im hungover the next day)

Giphy

3.Dedicate days to self-care.

Getting a pedicure is one of the most relaxing things I treat myself to. Sitting in a lavender-scented environment on a massage chair while someone pampers your feet is a true dream. Theres a certain luxury in a spontaneous spa day that my friends with children just dont have.

There are always those mothers attempting to wrangle their children at the hair salon. While I sit in a pedicure chair, the only thing on my mind is keeping my eyelids open. I look down the row of chairs to the stressed-out lady trying to get her kids to sit and be quiet while the woman taking care of her is only on her third toenail.

There goes that relaxation.

4. Go to the gymin peace.

The gym is the perfect example of me time. Going to the gym as a married couple could work if your schedules mesh well and if youre both OK with waiting for the other. I personally could never be left waiting for a partner to finish their workout or feeling the pressure of having them wait on me.

As for those with kids, yes, most gyms have daycare centers for your kids, but youre kind of on a time limit. Ive seen women rush through their workouts because they can hear their kids moaning and acting up in daycare.

Giphy

5. Anything that requiresspontaneity.

Imagine a friend calls you to say a celebrity is at the bar down the street. Maybeyour favorite band is going to be at a small open mic night for a surprise appearance. What if she just came across an opportunity to be an extra on your favorite TV show?

The catch? You have to get downtown right now.

The worst situation I could be in is that I have a face mask on and need a minute to pull myself together. For parents, it would require at least an hour of figuring out who can come over to watch the kids on such short notice.

Plus, getting ready for something takes 10 times longer when there is a child pulling on your pant leg.

0 notes

Text

Cost of living: Why you should choose a cheap place to live

Shares 105

While visiting Raleigh earlier this month, I spent a morning with my pal Justin (from the excellent Root of Good blog) and his wife. As we sipped our coffee and nibbled our bagels, the conversation turned to cost of living. (Money nerds will be money nerds, after all.)

Things are cheaper here in North Carolina than they are in Portland, I said. Food is cheaper. Beer is cheaper. Hotel rooms are cheaper. Your homes are cheaper too. Last night, as I was walking through the neighborhood next to my hotel, I pulled up the housing prices. I was shocked at how low they are!

Yeah, housing costs are lower here than in many parts of the country, Justin said.

Take our house, for instance. We bought it in 2003 for $108,000. Zillow says its worth around $198,000 right now. But Ill bet thats a lot less than youd pay for a similar place in Portland.

Hes right. Justin and his wife own an 1800-square-foot home on 0.3 acres of land. Their place has four bedrooms and 2.5 bathrooms. Theres only one place for sale in Portland right now that matches these stats and its going for $430,000 more than twice the price the same home would fetch in Raleigh.

Housing is by far the largest slice of the average American budget, representing one-third of typical household spending. Because of this, the best way to cut your costs (and, therefor, boost your profit margin) is to reduce how much you spend to keep a roof over your head.

One obvious way to cut costs on housing is to choose a cheaper home or apartment. But if you truly want to slash your spending, consider moving to a new neighborhood. Or city. Or state. If youre willing to change locations, you can supercharge your purchasing power and accelerate your saving rate.

Cost of living is one of those factors that people seldom consider, but which can have a huge impact on the family budget sometimes in unexpected ways. According to The Millionaire Next Door:

Living in less costly areas can enable you to spend less and to invest more of your income. You will pay less for your home and correspondingly less for your property taxes. Your neighbors will be less likely to drive expensive motor vehicles. You will find it easier to keep up, even ahead, of the Joneses and still accumulate wealth.

Its one thing to talk about the effects of high cost of living, but another to actually experience it.

Cost of Living in Real Life

On our fifteen-month road trip across the United States, Kim and I made a point of watching how prices varied from city to city and region to region.

While stranded for ten days in rural Plankinton, South Dakota, for example, I paid $10.60 for a fancy mens haircut. At home in Portland, I pay $28 for the same fancy haircut. In Fort Collins, Colorado, I paid $30 for a haircut. In Santa Barbara, California, I paid $50 or $60 for the same fancy cut.

Gas was cheaper in South Dakota too. So was food. So was beer and whisky. So were movies. So was just about everything, including housing. Housing prices followed a similar pattern to the haircut prices I mentioned above. A $280,000 home in Portland might go for $300,000 in Fort Collins and $500k to $600k in Santa Barbara. In South Dakota, that same home would cost about $106,000.

A couple of years ago, I exchanged email with a reader who had first-hand experience struggling with the high cost of living. She gave me permission to share her story:

I had been saving about 40% of my relatively modest salary for eight years. I had built up an emergency fund as well as a good sized savingsand then we had kids.

We lost our rent-stabilized apartment right after our children were born. We live in New York City, and while I maintain that there are many things about the city that are actually very budget-friendly (public transit and free entertainment top my list), the cost of rent and daycare in NYC are over the top.

In one year, the cost of a market-rate apartment in our neighborhood plus two kids in daycare ate into my hard-earned savings. By the end of the year, the pot of money that I had worked so hard to save was down by almost $50,000.

Luckily, my husband and I have never carried any kind of debt and had already been living well below our means before the kids came along. But that also meant there was very little fat left to trim in our budget other than rent and daycare expenses. (Wed already dropped the landline, never had cable, cooked almost all of our meals at home, and cut out our modest allowance of $50/month for splurges.)

We are the very definition of penny wise and pound foolish!

Eventually, we moved into a cheaper apartment. Although we havent had to dip into savings since we moved, were still essentially living month to month because of daycare and rent. The neighborhood is cheaper for a reason.

Real Life will force us to make another move in the spring. One of our jobs is going away, so it will force a decision one way or another since we cant stay in New York on one salary. Change is definitely coming.

This reader and her husband are already frugal-minded thats how she built her buffer of savings to start with so there isnt much more the family can cut. This is an example where the only real solution is to seek a city with a lower cost of living.

Saving in Savannah

Which places are cheapest to live? Which are most expensive? This map from Governing magazine shows how far the average paycheck goes in 191 U.S. metro areas.

Dark green (blue?) dots indicate cities where your wages buy more after adjusting for cost of living. Dark brown dots are places where you have to work harder to get what you want. (Click through to play with an interactive version of the map.)

As you can see, large coastal cities tend to be more expensive than smaller towns in the center of the country. If you have a fixed budget, youll get more bang for your buck by buying a home in Oklahoma City or Sioux Falls than by living in San Francisco or Washington D.C.

Its not just coastal cities, though. There are spendy pockets throughout the U.S. from Flagstaff, Arizona to Hot Springs, Arkansas. And some coastal cities Boston, Houston, Seattle, Tampa are relatively inexpensive. (In Boston and Seattle, though, thats because wages are high, not because things are cheap.)

In the middle of our road trip, Kim and I decided to stay the winter in Savannah, Georgia. During our six months in Savannah, we spent much less than we would have for the same lifestyle here in Portland. According to the CNN cost-of-living calculator, Portland is 44% more expensive than in Savannah. (And housing costs nearly three times as much here as it does in Georgia!)

In larger cities, there are often cost-of-living differences between neighborhoods. When deciding where to live in Savannah, for instance, we had a choice:

We could rent a small apartment in the downtown historic district for $1750 per month. The place would have been a lot of fun because it was surrounded by shops and restaurants, and it was close to anything we might want to do.We could opt instead for a modest-sized condo on the outskirts of town at $1325 per month. This location was next to nothing. We could walk to the grocery store, but wed have to drive into the city if we wanted to indulge ourselves.

After considering financial and lifestyle factors, we chose to rent the condo in the middle of the marshlands. On the surface, this decision saved us $425 per month. In reality, it saved us much more than that.

If we had lived downtown, we would have had to pay to park the Mini Cooper ($95/month). We would have been constantly tempted to eat out or go for drinks. It would have been too easy for window shopping to become actual shopping. Instead, we enjoyed one Date Night each week. We spent the rest of our time working and exercising.

I believe that opting for the less glamorous location saved us a minimum of $5000 over our six month stay and the real savings are probably far greater.

Pinching Pennies in Portland

This same concept certain neighborhoods costing less than others was a driving factor in our decision last year to sell our condo and move to the country. We loved where we lived, but the costs were crazy.

First, there were the maintenance costs for a place that we ostensibly owned outright. Even without a mortgage, we were paying nearly $1200 per month for HOA fees, utilities, insurance, and more. (In our new place, we spend half that.)Plus, there was the sneaky cost of lifestyle inflation. Our condo was in a fun neighborhood filled with restaurants and bars. It was all too easy after a long day to simply walk up the street to one of our favorite spots, where wed drop $50 or $100 on food and drinks. Moving to our new place cut our restaurant spending in half.Lastly, the cost of goods in our new neighborhood is lower than in our old. In Sellwood, our grocery options were limited. And expensive. The nearest markets were both high-end organic-only affairs, the kind of places you might see on an episode of Portlandia. Yes, the quality was outstanding. But since weve moved, were spending about 25% less on groceries each month.

Moving helped us save big on some cost-of-living items. But it also brought with it a few increases in spending. Because were more rural now, we drive more often. Kim, especially, is spending more on gas. Our new home also has greater maintenance costs than the condo. Weve poured a ton of money into this place since moving in. (I guess thats not actually a cost-of-living issue so much as a homeownership issue, though.)

My point is that even within a city, there are cost-of-living differences you can leverage to your advantage especially if youre willing to live in a rougher part of town.

The Bottom Line

Obviously theres more to picking a place to live than pure price.

When you choose a city (or neighborhood) to call home, you do so because of the climate, the politics, and the people. You want to live close to friends and family. You want a nice school district. You want people who think and act the same way you do. For those reasons (and others), Omaha might not be a good choice for you. (Savannah isnt a good choice for me long-term, but it was fine for a few months.)

Heres the bottom line: Where you choose to live has a greater effect on your long-term financial success than almost any other factor. How much you earn is sometimes more important (not always), in which case cost of living is a close second.

Cost of living can wreak havoc on your pursuit of financial freedom. Or it can help you achieve your goals sooner than you thought possible. The choice is yours.

Other ways to make the most of your housing budget? Consider renting. Live close to where you work so that you can walk, bike, or take the bus. Purchase a house that fits your lifestyle and needs rather than the commonly cited buy as much home as you can afford. The latter is self-serving advice from real-estate agents and mortgage brokers. You dont need a big house; you just need someplace comfortable.

Shares 105

https://www.getrichslowly.org/cost-of-living/

0 notes

Text

Cost of living: Why you should choose a cheap place to live

Shares 105

While visiting Raleigh earlier this month, I spent a morning with my pal Justin (from the excellent Root of Good blog) and his wife. As we sipped our coffee and nibbled our bagels, the conversation turned to cost of living. (Money nerds will be money nerds, after all.)

Things are cheaper here in North Carolina than they are in Portland, I said. Food is cheaper. Beer is cheaper. Hotel rooms are cheaper. Your homes are cheaper too. Last night, as I was walking through the neighborhood next to my hotel, I pulled up the housing prices. I was shocked at how low they are!

Yeah, housing costs are lower here than in many parts of the country, Justin said.

Take our house, for instance. We bought it in 2003 for $108,000. Zillow says its worth around $198,000 right now. But Ill bet thats a lot less than youd pay for a similar place in Portland.

Hes right. Justin and his wife own an 1800-square-foot home on 0.3 acres of land. Their place has four bedrooms and 2.5 bathrooms. Theres only one place for sale in Portland right now that matches these stats and its going for $430,000 more than twice the price the same home would fetch in Raleigh.

Housing is by far the largest slice of the average American budget, representing one-third of typical household spending. Because of this, the best way to cut your costs (and, therefor, boost your profit margin) is to reduce how much you spend to keep a roof over your head.

One obvious way to cut costs on housing is to choose a cheaper home or apartment. But if you truly want to slash your spending, consider moving to a new neighborhood. Or city. Or state. If youre willing to change locations, you can supercharge your purchasing power and accelerate your saving rate.

Cost of living is one of those factors that people seldom consider, but which can have a huge impact on the family budget sometimes in unexpected ways. According to The Millionaire Next Door:

Living in less costly areas can enable you to spend less and to invest more of your income. You will pay less for your home and correspondingly less for your property taxes. Your neighbors will be less likely to drive expensive motor vehicles. You will find it easier to keep up, even ahead, of the Joneses and still accumulate wealth.

Its one thing to talk about the effects of high cost of living, but another to actually experience it.

Cost of Living in Real Life

On our fifteen-month road trip across the United States, Kim and I made a point of watching how prices varied from city to city and region to region.

While stranded for ten days in rural Plankinton, South Dakota, for example, I paid $10.60 for a fancy mens haircut. At home in Portland, I pay $28 for the same fancy haircut. In Fort Collins, Colorado, I paid $30 for a haircut. In Santa Barbara, California, I paid $50 or $60 for the same fancy cut.

Gas was cheaper in South Dakota too. So was food. So was beer and whisky. So were movies. So was just about everything, including housing. Housing prices followed a similar pattern to the haircut prices I mentioned above. A $280,000 home in Portland might go for $300,000 in Fort Collins and $500k to $600k in Santa Barbara. In South Dakota, that same home would cost about $106,000.

A couple of years ago, I exchanged email with a reader who had first-hand experience struggling with the high cost of living. She gave me permission to share her story:

I had been saving about 40% of my relatively modest salary for eight years. I had built up an emergency fund as well as a good sized savingsand then we had kids.

We lost our rent-stabilized apartment right after our children were born. We live in New York City, and while I maintain that there are many things about the city that are actually very budget-friendly (public transit and free entertainment top my list), the cost of rent and daycare in NYC are over the top.

In one year, the cost of a market-rate apartment in our neighborhood plus two kids in daycare ate into my hard-earned savings. By the end of the year, the pot of money that I had worked so hard to save was down by almost $50,000.

Luckily, my husband and I have never carried any kind of debt and had already been living well below our means before the kids came along. But that also meant there was very little fat left to trim in our budget other than rent and daycare expenses. (Wed already dropped the landline, never had cable, cooked almost all of our meals at home, and cut out our modest allowance of $50/month for splurges.)

We are the very definition of penny wise and pound foolish!

Eventually, we moved into a cheaper apartment. Although we havent had to dip into savings since we moved, were still essentially living month to month because of daycare and rent. The neighborhood is cheaper for a reason.

Real Life will force us to make another move in the spring. One of our jobs is going away, so it will force a decision one way or another since we cant stay in New York on one salary. Change is definitely coming.

This reader and her husband are already frugal-minded thats how she built her buffer of savings to start with so there isnt much more the family can cut. This is an example where the only real solution is to seek a city with a lower cost of living.

Saving in Savannah

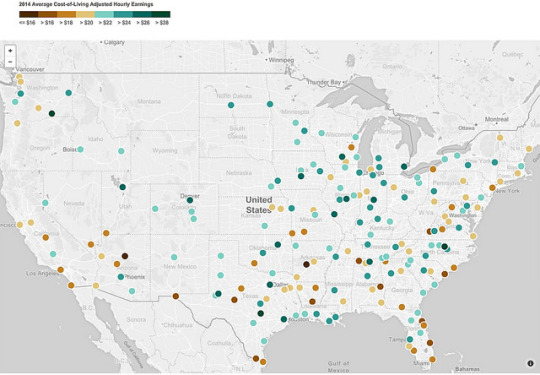

Which places are cheapest to live? Which are most expensive? This map from Governing magazine shows how far the average paycheck goes in 191 U.S. metro areas.

Dark green (blue?) dots indicate cities where your wages buy more after adjusting for cost of living. Dark brown dots are places where you have to work harder to get what you want. (Click through to play with an interactive version of the map.)

As you can see, large coastal cities tend to be more expensive than smaller towns in the center of the country. If you have a fixed budget, youll get more bang for your buck by buying a home in Oklahoma City or Sioux Falls than by living in San Francisco or Washington D.C.

Its not just coastal cities, though. There are spendy pockets throughout the U.S. from Flagstaff, Arizona to Hot Springs, Arkansas. And some coastal cities Boston, Houston, Seattle, Tampa are relatively inexpensive. (In Boston and Seattle, though, thats because wages are high, not because things are cheap.)

In the middle of our road trip, Kim and I decided to stay the winter in Savannah, Georgia. During our six months in Savannah, we spent much less than we would have for the same lifestyle here in Portland. According to the CNN cost-of-living calculator, Portland is 44% more expensive than in Savannah. (And housing costs nearly three times as much here as it does in Georgia!)

In larger cities, there are often cost-of-living differences between neighborhoods. When deciding where to live in Savannah, for instance, we had a choice:

We could rent a small apartment in the downtown historic district for $1750 per month. The place would have been a lot of fun because it was surrounded by shops and restaurants, and it was close to anything we might want to do.We could opt instead for a modest-sized condo on the outskirts of town at $1325 per month. This location was next to nothing. We could walk to the grocery store, but wed have to drive into the city if we wanted to indulge ourselves.

After considering financial and lifestyle factors, we chose to rent the condo in the middle of the marshlands. On the surface, this decision saved us $425 per month. In reality, it saved us much more than that.

If we had lived downtown, we would have had to pay to park the Mini Cooper ($95/month). We would have been constantly tempted to eat out or go for drinks. It would have been too easy for window shopping to become actual shopping. Instead, we enjoyed one Date Night each week. We spent the rest of our time working and exercising.

I believe that opting for the less glamorous location saved us a minimum of $5000 over our six month stay and the real savings are probably far greater.

Pinching Pennies in Portland

This same concept certain neighborhoods costing less than others was a driving factor in our decision last year to sell our condo and move to the country. We loved where we lived, but the costs were crazy.

First, there were the maintenance costs for a place that we ostensibly owned outright. Even without a mortgage, we were paying nearly $1200 per month for HOA fees, utilities, insurance, and more. (In our new place, we spend half that.)Plus, there was the sneaky cost of lifestyle inflation. Our condo was in a fun neighborhood filled with restaurants and bars. It was all too easy after a long day to simply walk up the street to one of our favorite spots, where wed drop $50 or $100 on food and drinks. Moving to our new place cut our restaurant spending in half.Lastly, the cost of goods in our new neighborhood is lower than in our old. In Sellwood, our grocery options were limited. And expensive. The nearest markets were both high-end organic-only affairs, the kind of places you might see on an episode of Portlandia. Yes, the quality was outstanding. But since weve moved, were spending about 25% less on groceries each month.

Moving helped us save big on some cost-of-living items. But it also brought with it a few increases in spending. Because were more rural now, we drive more often. Kim, especially, is spending more on gas. Our new home also has greater maintenance costs than the condo. Weve poured a ton of money into this place since moving in. (I guess thats not actually a cost-of-living issue so much as a homeownership issue, though.)

My point is that even within a city, there are cost-of-living differences you can leverage to your advantage especially if youre willing to live in a rougher part of town.

The Bottom Line

Obviously theres more to picking a place to live than pure price.

When you choose a city (or neighborhood) to call home, you do so because of the climate, the politics, and the people. You want to live close to friends and family. You want a nice school district. You want people who think and act the same way you do. For those reasons (and others), Omaha might not be a good choice for you. (Savannah isnt a good choice for me long-term, but it was fine for a few months.)

Heres the bottom line: Where you choose to live has a greater effect on your long-term financial success than almost any other factor. How much you earn is sometimes more important (not always), in which case cost of living is a close second.

Cost of living can wreak havoc on your pursuit of financial freedom. Or it can help you achieve your goals sooner than you thought possible. The choice is yours.

Other ways to make the most of your housing budget? Consider renting. Live close to where you work so that you can walk, bike, or take the bus. Purchase a house that fits your lifestyle and needs rather than the commonly cited buy as much home as you can afford. The latter is self-serving advice from real-estate agents and mortgage brokers. You dont need a big house; you just need someplace comfortable.

Shares 105

https://www.getrichslowly.org/cost-of-living/

0 notes

Text

Cost of living: Why you should choose a cheap place to live

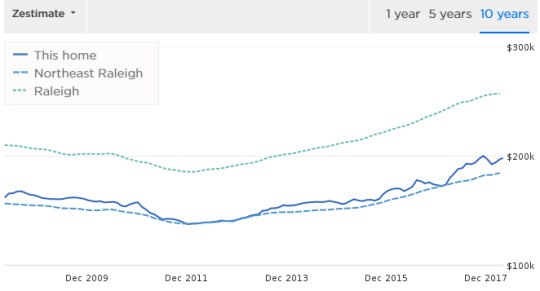

While visiting Raleigh earlier this month, I spent a morning with my pal Justin (from the excellent Root of Good blog) and his wife. As we sipped our coffee and nibbled our bagels, the conversation turned to cost of living. (Money nerds will be money nerds, after all.)

Things are cheaper here in North Carolina than they are in Portland, I said. Food is cheaper. Beer is cheaper. Hotel rooms are cheaper. Your homes are cheaper too. Last night, as I was walking through the neighborhood next to my hotel, I pulled up the housing prices. I was shocked at how low they are!

Yeah, housing costs are lower here than in many parts of the country, Justin said.

Take our house, for instance. We bought it in 2003 for $108,000. Zillow says its worth around $198,000 right now. But Ill bet thats a lot less than youd pay for a similar place in Portland.

Hes right. Justin and his wife own an 1800-square-foot home on 0.3 acres of land. Their place has four bedrooms and 2.5 bathrooms. Theres only one place for sale in Portland right now that matches these stats and its going for $430,000 more than twice the price the same home would fetch in Raleigh.

Housing is by far the largest slice of the average American budget, representing one-third of typical household spending. Because of this, the best way to cut your costs (and, therefor, boost your profit margin) is to reduce how much you spend to keep a roof over your head.

One obvious way to cut costs on housing is to choose a cheaper home or apartment. But if you truly want to slash your spending, consider moving to a new neighborhood. Or city. Or state. If youre willing to change locations, you can supercharge your purchasing power and accelerate your saving rate.

Cost of living is one of those factors that people seldom consider, but which can have a huge impact on the family budget sometimes in unexpected ways. According to The Millionaire Next Door:

Living in less costly areas can enable you to spend less and to invest more of your income. You will pay less for your home and correspondingly less for your property taxes. Your neighbors will be less likely to drive expensive motor vehicles. You will find it easier to keep up, even ahead, of the Joneses and still accumulate wealth.

Its one thing to talk about the effects of high cost of living, but another to actually experience it.

Cost of Living in Real Life

On our fifteen-month road trip across the United States, Kim and I made a point of watching how prices varied from city to city and region to region.

While stranded for ten days in rural Plankinton, South Dakota, for example, I paid $10.60 for a fancy mens haircut. At home in Portland, I pay $28 for the same fancy haircut. In Fort Collins, Colorado, I paid $30 for a haircut. In Santa Barbara, California, I paid $50 or $60 for the same fancy cut.

Gas was cheaper in South Dakota too. So was food. So was beer and whisky. So were movies. So was just about everything, including housing. Housing prices followed a similar pattern to the haircut prices I mentioned above. A $280,000 home in Portland might go for $300,000 in Fort Collins and $500k to $600k in Santa Barbara. In South Dakota, that same home would cost about $106,000.

A couple of years ago, I exchanged email with a reader who had first-hand experience struggling with the high cost of living. She gave me permission to share her story:

I had been saving about 40% of my relatively modest salary for eight years. I had built up an emergency fund as well as a good sized savingsand then we had kids.

We lost our rent-stabilized apartment right after our children were born. We live in New York City, and while I maintain that there are many things about the city that are actually very budget-friendly (public transit and free entertainment top my list), the cost of rent and daycare in NYC are over the top.

In one year, the cost of a market-rate apartment in our neighborhood plus two kids in daycare ate into my hard-earned savings. By the end of the year, the pot of money that I had worked so hard to save was down by almost $50,000.

Luckily, my husband and I have never carried any kind of debt and had already been living well below our means before the kids came along. But that also meant there was very little fat left to trim in our budget other than rent and daycare expenses. (Wed already dropped the landline, never had cable, cooked almost all of our meals at home, and cut out our modest allowance of $50/month for splurges.)

We are the very definition of penny wise and pound foolish!

Eventually, we moved into a cheaper apartment. Although we havent had to dip into savings since we moved, were still essentially living month to month because of daycare and rent. The neighborhood is cheaper for a reason.

Real Life will force us to make another move in the spring. One of our jobs is going away, so it will force a decision one way or another since we cant stay in New York on one salary. Change is definitely coming.

This reader and her husband are already frugal-minded thats how she built her buffer of savings to start with so there isnt much more the family can cut. This is an example where the only real solution is to seek a city with a lower cost of living.

Saving in Savannah

Which places are cheapest to live? Which are most expensive? This map from Governing magazine shows how far the average paycheck goes in 191 U.S. metro areas.

Dark green (blue?) dots indicate cities where your wages buy more after adjusting for cost of living. Dark brown dots are places where you have to work harder to get what you want. (Click through to play with an interactive version of the map.)

As you can see, large coastal cities tend to be more expensive than smaller towns in the center of the country. If you have a fixed budget, youll get more bang for your buck by buying a home in Oklahoma City or Sioux Falls than by living in San Francisco or Washington D.C.

Its not just coastal cities, though. There are spendy pockets throughout the U.S. from Flagstaff, Arizona to Hot Springs, Arkansas. And some coastal cities Boston, Houston, Seattle, Tampa are relatively inexpensive. (In Boston and Seattle, though, thats because wages are high, not because things are cheap.)

In the middle of our road trip, Kim and I decided to stay the winter in Savannah, Georgia. During our six months in Savannah, we spent much less than we would have for the same lifestyle here in Portland. According to the CNN cost-of-living calculator, Portland is 44% more expensive than in Savannah. (And housing costs nearly three times as much here as it does in Georgia!)

In larger cities, there are often cost-of-living differences between neighborhoods. When deciding where to live in Savannah, for instance, we had a choice:

We could rent a small apartment in the downtown historic district for $1750 per month. The place would have been a lot of fun because it was surrounded by shops and restaurants, and it was close to anything we might want to do.We could opt instead for a modest-sized condo on the outskirts of town at $1325 per month. This location was next to nothing. We could walk to the grocery store, but wed have to drive into the city if we wanted to indulge ourselves.

After considering financial and lifestyle factors, we chose to rent the condo in the middle of the marshlands. On the surface, this decision saved us $425 per month. In reality, it saved us much more than that.

If we had lived downtown, we would have had to pay to park the Mini Cooper ($95/month). We would have been constantly tempted to eat out or go for drinks. It would have been too easy for window shopping to become actual shopping. Instead, we enjoyed one Date Night each week. We spent the rest of our time working and exercising.

I believe that opting for the less glamorous location saved us a minimum of $5000 over our six month stay and the real savings are probably far greater.

Pinching Pennies in Portland

This same concept certain neighborhoods costing less than others was a driving factor in our decision last year to sell our condo and move to the country. We loved where we lived, but the costs were crazy.

First, there were the maintenance costs for a place that we ostensibly owned outright. Even without a mortgage, we were paying nearly $1200 per month for HOA fees, utilities, insurance, and more. (In our new place, we spend half that.)Plus, there was the sneaky cost of lifestyle inflation. Our condo was in a fun neighborhood filled with restaurants and bars. It was all too easy after a long day to simply walk up the street to one of our favorite spots, where wed drop $50 or $100 on food and drinks. Moving to our new place cut our restaurant spending in half.Lastly, the cost of goods in our new neighborhood is lower than in our old. In Sellwood, our grocery options were limited. And expensive. The nearest markets were both high-end organic-only affairs, the kind of places you might see on an episode of Portlandia. Yes, the quality was outstanding. But since weve moved, were spending about 25% less on groceries each month.

Moving helped us save big on some cost-of-living items. But it also brought with it a few increases in spending. Because were more rural now, we drive more often. Kim, especially, is spending more on gas. Our new home also has greater maintenance costs than the condo. Weve poured a ton of money into this place since moving in. (I guess thats not actually a cost-of-living issue so much as a homeownership issue, though.)

My point is that even within a city, there are cost-of-living differences you can leverage to your advantage especially if youre willing to live in a rougher part of town.

The Bottom Line

Obviously theres more to picking a place to live than pure price.

When you choose a city (or neighborhood) to call home, you do so because of the climate, the politics, and the people. You want to live close to friends and family. You want a nice school district. You want people who think and act the same way you do. For those reasons (and others), Omaha might not be a good choice for you. (Savannah isnt a good choice for me long-term, but it was fine for a few months.)

Heres the bottom line: Where you choose to live has a greater effect on your long-term financial success than almost any other factor. How much you earn is sometimes more important (not always), in which case cost of living is a close second.

Cost of living can wreak havoc on your pursuit of financial freedom. Or it can help you achieve your goals sooner than you thought possible. The choice is yours.

Other ways to make the most of your housing budget? Consider renting. Live close to where you work so that you can walk, bike, or take the bus. Purchase a house that fits your lifestyle and needs rather than the commonly cited buy as much home as you can afford. The latter is self-serving advice from real-estate agents and mortgage brokers. You dont need a big house; you just need someplace comfortable.

https://www.getrichslowly.org/cost-of-living/

0 notes