#nnpa

Text

What Propelled Poonawalla Fincorp to Spectacular Growth In FY24?

Hold onto your hats because Poonawalla Fincorp didn't just hit the jackpot in FY24 – they struck gold, platinum, and diamonds all at once! Get ready to peel back the layers and discover the awe-inspiring reasons behind their mind-blowing growth across every conceivable business parameter.

AUM Skyrockets

In the dynamic realm of finance, Poonawalla Fincorp witnessed a staggering 54% surge in Assets Under Management (AUM) during the fourth quarter of FY24, reaching a monumental Rs 24,800 crore. This impressive leap was supported by robust disbursements, reflecting the company's solid footing in the market.

Also Read: Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

The Organic Route Triumphs

What's the secret sauce behind Poonawalla Fincorp's success? Abhay Bhutada, MD, revealed that the fourth quarter of FY24 witnessed the highest-ever quarterly disbursement across all products, solely through the organic route. This emphasizes the company's commitment to sustainable growth strategies.

A Vision For Excellence

Keki Mistry's guidance, coupled with the backing of the prestigious Poonawalla Group, has set the stage for Poonawalla Fincorp's ascent. With an AAA credit rating and a clear vision, the company is poised to establish a thriving retail lending franchise, as highlighted by Avinash Singh, Senior Research Analyst at Emkay Global Financial Services.

Also Read: MD Abhay Bhutada Provides Glimpse of Poonawalla’s Co-Branded Card Strategy in Q4

Noteworthy Performance

Q4FY24 marked a significant milestone for Poonawalla Fincorp, with total disbursements surging by 52% year-on-year to approximately Rs 9,680 crore. This exceptional growth trajectory was further evident in the sequential increase of 11% over the preceding quarter, reaching Rs 8,731 crore. Such stellar performance underscores the company's agility and adaptability in navigating the financial landscape.

Focus On Asset Quality

Amidst the impressive growth figures, Poonawalla Fincorp remains steadfast in maintaining robust asset quality. Bhutada's assertion that Gross Non-Performing Assets (GNPA) are expected to be below 1%, with Net Non-Performing Assets (NNPA) below 0.60%, reflects the company's unwavering commitment to prudent risk management. Such diligence instills confidence in investors and stakeholders alike, ensuring sustainable growth in the long run.

Expanding Horizons

Beyond the numbers, Poonawalla Fincorp's success story in FY24 is emblematic of its expanding reach and market penetration. With a keen focus on customer-centric solutions and innovative financial products, the company has cemented its position as a trusted partner in fulfilling the diverse financial needs of individuals and businesses alike. This customer-centric approach, coupled with a robust distribution network, has been instrumental in driving growth and enhancing brand loyalty.

Also Read: From Abhay Bhutada to Nirmal Jain — India’s Top Chartered Accountants

Strategic Partnerships

Collaborations and strategic partnerships have played a pivotal role in Poonawalla Fincorp's journey towards success. By forging alliances with industry leaders and leveraging synergies, the company has unlocked new avenues for growth and differentiation. Whether it's through co-lending arrangements, strategic investments, or technological collaborations, Poonawalla Fincorp continues to explore innovative ways to create value for its stakeholders and drive sustainable growth.

Conclusion

In conclusion, FY24 emerged as a watershed moment for Poonawalla Fincorp, characterized by unprecedented growth across all fronts. With Abhay Bhutada at the helm, supported by the visionary leadership of Keki Mistry and insightful analysis from experts like Avinash Singh, the company is poised to continue its upward trajectory. As Poonawalla Fincorp marches towards Management Vision 2025, one thing is clear: the journey to success is paved with strategic foresight, organic growth, and unwavering commitment to excellence.

0 notes

Text

Navigating Poonawalla Fincorp Towards Unprecedented Growth: A Tale Of Vision And Strategy

In the fast-paced world of finance, success stories often emerge from the visionary leadership of individuals who possess both acumen and determination. One such tale is that of Abhay Bhutada, MD of Poonawalla Fincorp, whose strategic direction has propelled the company to unprecedented heights of achievement.

Setting New Records in Q4FY24

The fourth quarter of the financial year 2024 witnessed a remarkable feat for Poonawalla Fincorp, with their assets under management (AUM) soaring by an impressive 54 per cent. This substantial growth, reaching Rs 24,800 crore, was fueled by robust disbursements that demonstrated the company's unwavering commitment to organic expansion and maintaining asset quality. Notably, this achievement marks a significant leap from the previous quarter, where the AUM stood at Rs 21,850 crore, showcasing a sequential growth of nearly 13 per cent.

Also Read: Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

Abhay Bhutada's Strategic Vision

At the helm of this success story is Abhay Bhutada, whose leadership played a pivotal role in steering Poonawalla Fincorp towards this record-breaking performance. Bhutada's foresight and strategic decisions have been instrumental in driving the company's growth trajectory, culminating in the highest-ever quarterly disbursement across all products in Q4FY24. His unwavering focus on maintaining best-in-class asset quality has further solidified Poonawalla Fincorp's position as a trusted financial partner.

Emphasizing Asset Quality and Growth

One of the key highlights of Poonawalla Fincorp's success in Q4FY24 is its exemplary asset quality. With Gross Non-Performing Assets (GNPA) below 1 per cent and Net Non-Performing Assets (NNPA) below 0.60 per cent, the company stands out for its commitment to maintaining a healthy loan portfolio. Bhutada's emphasis on prudent risk management practices has been pivotal in ensuring that Poonawalla Fincorp remains resilient in the face of economic fluctuations.

Also Read: MD Abhay Bhutada Provides Glimpse of Poonawalla’s Co-Branded Card Strategy in Q4

The Road to Success: Bhutada's Strategic Initiatives

Under Bhutada's leadership, Poonawalla Fincorp has implemented a series of strategic initiatives aimed at driving sustainable growth and profitability. These initiatives include expanding the company's product portfolio, enhancing customer engagement through digital channels, and strengthening its risk management framework. By leveraging technology and innovation, Poonawalla Fincorp has been able to streamline its operations and enhance efficiency, thereby positioning itself for long-term success in a competitive market landscape.

Looking Towards the Future: A Commitment to Excellence

As Poonawalla Fincorp charts its course for the future, Abhay Bhutada remains steadfast in his commitment to driving sustainable growth and profitability. Reflecting on the achievements of FY24, Bhutada underscores the significant strides made across all business parameters, including AUM, profitability, and credit quality. With a clear vision outlined in the Management Vision 2025, Poonawalla Fincorp aims to maintain its momentum and uphold its reputation as a beacon of excellence in the financial sector.

Also Read: From Abhay Bhutada to Nirmal Jain — India’s Top Chartered Accountants

Conclusion

In the dynamic landscape of finance, success is often measured by the ability to adapt, innovate, and thrive in the face of adversity. Poonawalla Fincorp's journey to record success in Q4FY24 is a testament to the visionary leadership of Abhay Bhutada and the unwavering dedication of the entire team. As the company continues to forge ahead, guided by Bhutada's strategic vision, it remains poised to overcome challenges and seize opportunities, reaffirming its position as a trailblazer in the realm of finance.

0 notes

Text

Poonawalla Fincorp's Q4 2024: A Triumph of Resilience and Growth

Adaptability and resilience are indispensable qualities for success. Poonawalla Fincorp's exceptional performance in the fourth quarter of the fiscal year 2024 serves as a shining example of these virtues, demonstrating remarkable growth and a steadfast commitment to excellence. With assets under management (AUM) skyrocketing by an impressive 54 percent to Rs 24,800 crore, Poonawalla Fincorp has not only solidified its position in the market but also earned the trust and confidence of investors.

Robust Growth Metrics

Poonawalla Fincorp's Q4 performance is characterized by robust growth metrics that underscore its prowess in the financial domain. The significant surge in AUM reflects the company's ability to attract and retain clients while efficiently deploying capital to generate returns. Such substantial growth not only fortifies the company's financial standing but also enhances its competitive edge in the market.

A pivotal driver of Poonawalla Fincorp's Q4 success is the notable surge in disbursements, which witnessed a remarkable 52 percent year-on-year increase to approximately Rs 9,680 crore. This surge signifies the company's capacity to meet escalating financing demands across various sectors. It also underscores the effectiveness of Poonawalla Fincorp's distribution channels and robust underwriting practices in identifying creditworthy borrowers.

Also Read: Abhay Bhutada Leads Poonawalla Fincorp To Record Growth In FY24

Sequential AUM Expansion

The sequential increase in AUM by nearly 13 percent further highlights the sustained momentum and growing investor confidence in Poonawalla Fincorp's offerings. This expansion underscores the company's agility in capitalizing on market opportunities and driving growth across its product portfolio, demonstrating resilience even in challenging economic climates.

Under the leadership of Managing Director Abhay Bhutada, Poonawalla Fincorp has charted an impressive growth trajectory. Bhutada's strategic vision and leadership have spurred innovation, expanded market reach, and bolstered operational efficiency. His proactive risk management approach and emphasis on maintaining high asset quality have cemented Poonawalla Fincorp's reputation as a trusted financial institution.

Commitment to Asset Quality

Poonawalla Fincorp's unwavering commitment to asset quality is evident in its strong performance metrics, with Gross Non-Performing Assets (GNPA) below 1 percent and Net Non-Performing Assets (NNPA) below 0.60 percent. These metrics reflect the company's rigorous risk management practices, prudent underwriting standards, and proactive measures to mitigate credit risks, safeguarding investor interests and ensuring sustained profitability.

Future Outlook and Strategy

Looking ahead, Poonawalla Fincorp remains optimistic about its growth prospects and market opportunities. The company's focus on maintaining high asset quality, diversifying its product range, and harnessing digital technologies for enhanced customer experiences positions it favorably for future growth. Poonawalla Fincorp aims to capitalize on emerging trends such as digital lending, microfinance, and consumer finance to drive sustainable value creation for stakeholders.

Solid Liquidity Position

Liquidity is paramount for financial stability and resilience, and Poonawalla Fincorp boasts a robust liquidity position with approximately Rs 3,600 crore in liquidity as of March 31, 2024. This affords the company the flexibility to pursue growth opportunities, withstand market volatility, and meet short-term funding needs, further bolstering investor confidence and reaffirming its financial strength.

Prospects for the Future

Grounded in its core values of integrity, innovation, and customer-centricity, Poonawalla Fincorp is poised to seize emerging opportunities and surmount challenges in the dynamic financial landscape. With a clear vision, sound strategic direction, and a talented team, the company is primed to achieve sustained growth, profitability, and value creation for shareholders, customers, and employees alike.

Strategic Partnerships and Collaborations

In addition to its strong internal strategies, Poonawalla Fincorp has strategically forged partnerships and collaborations to further bolster its position in the market. Collaborating with other financial institutions, fintech companies, and even government agencies has allowed Poonawalla Fincorp to tap into new markets, access innovative technologies, and expand its customer base. Such partnerships not only enhance the company's offerings but also enable it to stay at the forefront of industry trends and developments.

Also Read: How Does Poonawalla Fincorp Stand Out In The NBFC Sector?

Investment in Technology and Innovation

Recognizing the transformative power of technology in the financial sector, Poonawalla Fincorp has made substantial investments in digitalization and innovation. By leveraging advanced data analytics, artificial intelligence, and machine learning algorithms, the company has enhanced its risk assessment capabilities, personalized customer experiences, and streamlined operational processes. These technological advancements not only drive efficiency and cost-effectiveness but also enable Poonawalla Fincorp to stay ahead of the curve in a rapidly evolving digital landscape.

Focus on Customer-Centricity

At the heart of Poonawalla Fincorp's growth strategy lies a relentless focus on customer-centricity, as highlighted by Abhay Bhutada, MD. The company is dedicated to understanding the evolving needs and preferences of its customers and tailoring its products and services accordingly. Whether it's offering flexible repayment options, providing personalized financial advice, or simplifying the application process, Poonawalla Fincorp goes above and beyond to ensure a seamless and satisfying experience for its clients. This customer-centric approach not only fosters loyalty and retention but also drives organic growth through positive word-of-mouth referrals.

Corporate Social Responsibility (CSR) Initiatives

Beyond its business objectives, Poonawalla Fincorp is committed to making a positive impact on society through its corporate social responsibility (CSR) initiatives. The company actively engages in various philanthropic endeavors, including education, healthcare, and environmental conservation. By investing in community development programs, supporting underprivileged individuals, and promoting sustainable practices, Poonawalla Fincorp seeks to create shared value for both its stakeholders and society at large. These CSR efforts not only contribute to the well-being of communities but also enhance the company's reputation and brand equity.

Risk Management and Compliance

In an increasingly complex regulatory environment, effective risk management and compliance are paramount for financial institutions. Poonawalla Fincorp places great emphasis on maintaining robust risk management frameworks and ensuring strict adherence to regulatory requirements. The company regularly conducts comprehensive risk assessments, implements stringent internal controls, and invests in employee training and development to uphold the highest standards of integrity and compliance. By proactively identifying and mitigating potential risks, Poonawalla Fincorp safeguards its reputation, preserves shareholder value, and maintains the trust and confidence of its stakeholders.

Global Expansion and Diversification

While Poonawalla Fincorp has established a strong presence in the Indian market, the company is also exploring opportunities for global expansion and diversification. Recognizing the potential for growth in international markets, particularly in emerging economies, Poonawalla Fincorp is actively exploring strategic partnerships, acquisitions, and joint ventures to enter new geographies and broaden its product offerings. By expanding its footprint beyond borders, the company aims to tap into untapped markets, mitigate geographical risks, and capitalize on cross-border synergies, thereby unlocking new avenues for growth and value creation.

Also Read: Re-imagining The Finance Business In The Digital Era

Conclusion

Poonawalla Fincorp's stellar performance in the fourth quarter of 2024 underscores its resilience, adaptability, and strategic acumen in navigating the ever-changing financial landscape, a performance thanks to Abhay Bhutada. With robust growth metrics, visionary leadership, and a steadfast commitment to excellence, the company has cemented its position as a trusted partner and preferred choice for investors and customers alike. By leveraging its core strengths, embracing innovation, and staying true to its values, Poonawalla Fincorp is well-positioned to capitalize on emerging opportunities, overcome challenges, and drive sustainable growth and value creation in the years to come.

0 notes

Text

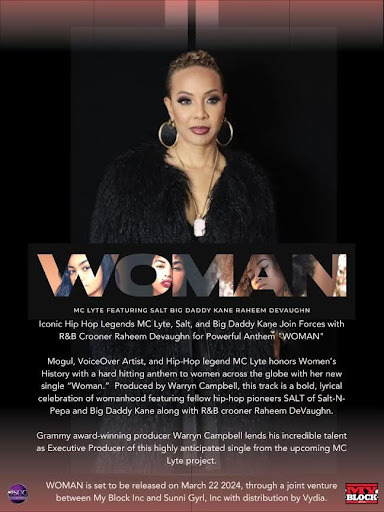

EXCLUSIVE MC Lyte Releases Empowering Anthem “Woman” Featuring Hip Hop Icons

PHOTO: Courtesy of NNPA

By Stacy M. Brown, NNPA Newswire Senior National Correspondent

In a powerful ode to womanhood, MC Lyte, the mogul, voice-over artist, and hip-hop legend, is dropping her latest single, “Woman.” The track collaborates with fellow hip-hop pioneers Salt from Salt-N-Pepa, Big Daddy Kane, and R&B crooner Raheem DeVaughn. Produced by Warryn Campbell, “Woman” is a bold and…

View On WordPress

0 notes

Text

A Second <b>Trump</b> Attorney Pleads Guilty to Attempting to Overturn Election - Dallas Weekly

New Post has been published on https://www.google.com/url?rct=j&sa=t&url=https://dallasweekly.com/2023/10/a-second-trump-attorney-pleads-guilty-to-attempting-to-overturn-election/&ct=ga&cd=CAIyGjUzM2UwMTY5ZmFhZTIwMGQ6Y29tOmVuOlVT&usg=AOvVaw2O6nKmJnf9yp7od6v2BPiY

A Second Trump Attorney Pleads Guilty to Attempting to Overturn Election - Dallas Weekly

By Stacy M. Brown NNPA Newswire Senior National Correspondent @StacyBrownMedia. Kenneth Chesebro, the former attorney to Donald Trump, …

0 notes

Text

0 notes

Text

مطلوب سائق لمطعم بمزايا، والراتب 2200 ريال.

مطلوب سائق لمطعم بمزايا، والراتب 2200 ريال.

رابط المقال:

https://wazfnynow.com/nnpa

#وظائف # وظائف قطر # شواغر قطر# فرص عمل قطر # فرص شغل قطر# وظائف قطر 2023# وظائف لكافة المؤهلات# وظائف حكومية# وظائف لحملة الدبلوم فأعلى##فرص عمل #وظائف خالية#وظائف شاغرة#وظائف قطر اليوم# شغل

0 notes

Text

my week in review (14 April)

solved an assertion error in Minie and blogged about my process

released version 7.5.0 of Minie (The GitHub repo has 103 stars!)

updated 24 projects to use Gradle 8.1

installed and tested Java 20

ended support for Java 1.7 on several projects

helped Nnpa resolve their trouble with character physics

started the screenshot thread for April at the JME Forum

advised Capdevon regarding our joint project

began work on a 3-D version of the Fuze Creek game

I anticipate reduced productivity for the next 2 weeks due to travel and being AFK.

0 notes

Text

Stock to Buy Today- SBI

Stock to Buy Today- SBI

MO Investment Idea – SBI

(CMP : INR 612 TP : INR 700, 14% Upside, Buy)

SBI delivered robust Q2 with PAT up 74% YoY to Rs13265 crore led by margin expansion and lower provisions. NII grew 13% YoY as margin expanded 30bp QoQ to 3.3%. Fresh slippages moderated to INR24b, which coupled with healthy recoveries/upgrades resulted in GNPA/NNPA ratio improving 39bp/20bp QoQ to 3.5%/0.8% in 2QFY23,…

View On WordPress

#All Share Price SBI#Best It Stocks In India SBI#Best Nse Stocks To Buy Today SBI#Best Share To Buy Today In India SBI#Best Share To Buy Today SBI#Best Share To Invest Today SBI#Best Stock In India SBI#Best Stock To Buy Now SBI#Best Stock To Buy Today SBI#Best Stock To Invest In SBI#Best Stocks SBI#Best Stocks To Buy In India SBI#Best Stocks To Buy Today India For Long Term SBI#Best Stocks To Buy Today India SBI#Best Stocks Today SBI#Best Us Stocks To Buy Now SBI#Bse Equity SBI#Bse Stocks SBI#Equity Investment SBI#Equity Market SBI#Equity Stocks SBI#Equity Trading SBI#Future & Option SBI#Indian Share Market SBI#Indian Stock Market SBI#Indian Stock Market Today SBI#Indian Stocks SBI#It Stocks India SBI#Nse Equity Stock SBI#Share Price SBI

0 notes

Text

Jack Nicklaus sorprende una vez más a los veteranos militares con una lección de golf en honor al Día de los Veteranos y el Día Nacional de la Esperanza de la PGA

Jack Nicklaus sorprende una vez más a los veteranos militares con una lección de golf en honor al Día de los Veteranos y el Día Nacional de la Esperanza de la PGA

Por Helen Ross, PGA Tour, exclusivo de NNPA Newswire

James Levester pensó que sería un escenario.

Claro, era un ávido golfista. 4 handicap en su mejor momento, de hecho.

Pero cuando comenzó a jugar al golf con su hija Misha, de 3 años, pensó que eventualmente se cansaría del juego.

Sin embargo, estaba equivocado. A su hija le encantaba jugar con su padre los fines de semana (finalmente lo venció…

View On WordPress

0 notes

Text

On Course To Vision 2025: Abhay Bhutada's Confidence In Poonawalla Fincorp's Journey

In the rapidly evolving realm of finance, businesses endeavor not only to endure but to flourish, mapping out paths toward ambitious goals that shape their direction. Poonawalla Fincorp Limited is one such entity, propelled by a vision that sets its sights on the horizon of 2025. Led by Managing Director Abhay Bhutada, the company's recent quarterly report paints a picture of progress, promise, and purpose.

Unprecedented Growth: A Glimpse at the Numbers

As the curtains closed on the first quarter of 2024, Poonawalla Fincorp found itself in a position of unprecedented growth. Disbursements soared to new heights, marking a remarkable increase of 52% year-on-year and 11% quarter-on-quarter. This surge, totaling approximately Rs. 9,680 crore, exemplifies the company's upward trajectory under Bhutada's leadership.

Also Read: Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

Strength in Assets: Building a Strong Foundation

Assets Under Management (AUM) serve as the bedrock of any financial institution, and Poonawalla Fincorp stands tall with its AUM growing by 54% year-on-year and 13% quarter-on-quarter. As of March 31, 2024, the company boasts an AUM of approximately Rs. 24,800 crore, a testament to its resilience and strategic foresight.

Quality Matters: Upholding Standards

In the realm of finance, asset quality serves as a barometer of success. Poonawalla Fincorp remains committed to maintaining stringent standards, with Gross Non-Performing Assets (GNPA) and Net Non-Performing Assets (NNPA) expected to remain below 1.20% and 0.60%, respectively. Abhay Bhutada, MD of the company, emphasizes the importance of maintaining NNPA below 1%, aligning with the company's Vision 2025.

A Beacon of Stability: Liquidity Assurance

In the volatile landscape of finance, liquidity is paramount. Poonawalla Fincorp stands firm with ample liquidity of approximately Rs. 3,600 crore as of March 31, 2024. This robust liquidity position not only instills confidence but also provides the company with flexibility and resilience in navigating market fluctuations.

Reflecting on the quarterly business update, Abhay Bhutada, the stalwart at the helm of Poonawalla Fincorp, expresses optimism and pride. He lauds FY24 as a year of significant growth, marked by seamless transformation and remarkable improvement across all business parameters. Bhutada highlights Q4FY24 as a standout quarter, characterized by record-breaking disbursements and exemplary asset quality. He emphasizes that such achievements set the company firmly on course to realize its Vision 2025.

Also Read: MD Abhay Bhutada Provides Glimpse of Poonawalla’s Co-Branded Card Strategy in Q4

A Landscape of Opportunity: Perspectives from Competitors

While Poonawalla Fincorp charts its course towards Vision 2025, it acknowledges the competitive terrain it navigates. Industry stalwarts like Bajaj Finance, led by Managing Director Rajeev Jain, are formidable contenders in this arena. Jain echoes Bhutada's sentiments, recognizing the immense growth potential within India's burgeoning consumer segments. With demographic shifts on the horizon, both Bhutada and Jain recognize the vast opportunities that lie ahead, underscoring the importance of innovation, adaptability, and customer-centricity.

Innovating for Tomorrow: Strategies for Success

As Poonawalla Fincorp propels forward, innovation emerges as a cornerstone of its strategy. The company's commitment to embracing technological advancements and reimagining traditional financial services positions it as a frontrunner in an ever-evolving landscape. Leveraging data analytics, artificial intelligence, and digital platforms, Poonawalla Fincorp aims to enhance customer experiences, streamline processes, and drive operational efficiency.

Embracing Sustainability: A Path to Long-Term Prosperity

In today's conscientious consumer environment, sustainability is not just a buzzword but a fundamental ethos driving business decisions. Poonawalla Fincorp recognizes its responsibility towards society and the environment, integrating sustainability practices into its operations. From promoting financial literacy and inclusion to adopting eco-friendly initiatives, the company endeavors to create value not only for its stakeholders but also for society at large.

Also Read: From Abhay Bhutada to Nirmal Jain — India’s Top Chartered Accountants

Conclusion: Towards a Brighter Tomorrow

In conclusion, Poonawalla Fincorp's journey towards Vision 2025 is not merely a destination but a testament to resilience, foresight, and unwavering commitment. With Abhay Bhutada steering the ship, backed by a dedicated team and strategic vision, the company is poised to navigate the currents of change and emerge stronger, setting new benchmarks in the realm of finance. As the financial landscape continues to evolve, Poonawalla Fincorp stands as a beacon of stability, innovation, and sustainability, shaping a future that is as promising as it is prosperous.

0 notes

Text

Navigating The Path To Vision 2025: Poonawalla Fincorp's Remarkable Journey

In the dynamic realm of finance, where every move is scrutinized and every decision weighed, Poonawalla Fincorp Limited stands as a beacon of progress and vision. Led by Abhay Bhutada, MD of Poonawalla Fincorp has been steadily advancing towards its ambitious Vision 2025. But what exactly sets them apart and makes them confident in their trajectory? Let's delve into the details.

Unprecedented Growth

Under Abhay Bhutada's astute leadership, Poonawalla Fincorp has witnessed unprecedented growth, as reflected in their quarterly business update for the period ending March 31, 2024. The figures speak volumes – with disbursements reaching an all-time high of approximately Rs. 9,680 crore, marking a staggering 52% year-on-year increase. Such substantial growth is a testament to the company's robust strategies and unwavering commitment to excellence.

Also Read: Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

Stellar Asset Management

One of the key indicators of Poonawalla Fincorp's success is its remarkable management of assets. With Assets Under Management (AUM) soaring by 54% year-on-year to approximately Rs. 24,800 crore, the company has firmly solidified its position in the market. This significant uptick in AUM not only underscores the trust placed in Poonawalla Fincorp by its clients but also highlights the effectiveness of its financial management strategies.

Emphasis on Asset Quality

Abhay Bhutada has always emphasized the importance of maintaining impeccable asset quality, and the numbers reflect this commitment. Poonawalla Fincorp's Gross Non-Performing Assets (GNPA) and Net Non-Performing Assets (NNPA) are expected to improve further, with projections indicating levels of less than 1.20% and less than 0.60% respectively. Moreover, the company is steadfast in its endeavor to keep NNPA below 1%, aligning perfectly with its Vision 2025.

Robust Liquidity Position

Liquidity forms the lifeblood of any financial institution, and Poonawalla Fincorp prudently manages this aspect as well. With approximately Rs. 3600 crore in liquidity as of March 31, 2024, the company maintains a solid financial foundation, ensuring smooth operations and the ability to seize opportunities as they arise.

Also Read: MD Abhay Bhutada Provides Glimpse of Poonawalla’s Co-Branded Card Strategy in Q4

A Promising Future

Abhay Bhutada's vision extends beyond mere numbers – it encompasses a commitment to excellence and innovation. By positioning Poonawalla Fincorp as a frontrunner in consumer and small business finance, Bhutada aims to elevate the company to the ranks of the top 3 Non-Banking Financial Companies (NBFCs) by 2025. This ambitious yet attainable goal is underpinned by a relentless pursuit of growth and a steadfast focus on customer satisfaction.

Industry Perspective

While Poonawalla Fincorp marches confidently towards its Vision 2025, it is not alone in its aspirations. Other industry players, such as Bajaj Finance under the leadership of Rajeev Jain, are also vying for supremacy in the realm of finance. Jain's strategic insights mirror Bhutada's vision, emphasizing the importance of sustainable growth and capitalizing on India's burgeoning consumer market. As competition intensifies, each company strives to carve out its niche and leave an indelible mark on the financial landscape.

Continuous Innovation

Central to Poonawalla Fincorp's success is its commitment to continuous innovation. Bhutada understands that in an ever-evolving market, staying stagnant is not an option. Therefore, the company invests heavily in research and development, constantly seeking out new opportunities and refining existing strategies. This proactive approach ensures that Poonawalla Fincorp remains at the forefront of innovation, ready to adapt to changing market dynamics and customer preferences.

Also Read: From Abhay Bhutada to Nirmal Jain — India’s Top Chartered Accountants

Customer-Centric Approach

At the heart of Poonawalla Fincorp's operations lies a deep-rooted commitment to customer satisfaction. Bhutada firmly believes that happy customers are the cornerstone of sustainable growth. Therefore, the company places immense emphasis on understanding and addressing the needs of its clients, offering tailored solutions and personalized services. This customer-centric approach not only fosters long-term relationships but also drives positive word-of-mouth referrals, further fueling the company's growth.

Building Trust And Transparency

Trust and transparency are non-negotiable principles for Poonawalla Fincorp. Bhutada recognizes that in the financial sector, trust is paramount. Therefore, the company goes above and beyond to maintain the highest standards of integrity and transparency in all its dealings. Whether it's communicating openly with stakeholders or adhering to stringent regulatory requirements, Poonawalla Fincorp ensures that trust is earned and preserved at every step of the way.

Conclusion

In conclusion, Poonawalla Fincorp's journey towards Vision 2025 is marked by unwavering determination, strategic foresight, and a relentless pursuit of excellence. Under the visionary leadership of Abhay Bhutada, the company continues to scale new heights, setting the stage for a future defined by prosperity and success. With a steadfast commitment to innovation, customer-centricity, and trust, Poonawalla Fincorp is well-positioned to realize its lofty ambitions and emerge as a leader in the dynamic world of finance.

0 notes

Text

Poonawalla Fincorp's Remarkable Growth Journey In 2023-24

In the finance world, Poonawalla Fincorp has done really well, showing its great performance for the quarter ending on March 31, 2024. Despite the challenges posed by the ever-evolving market dynamics, the company has demonstrated remarkable growth and resilience, setting new standards in the financial landscape.

Record-breaking Performance In FY24

Surge In Disbursements

Poonawalla Fincorp has shattered its previous records by reporting its highest-ever total disbursements for Q4FY24, reaching approximately Rs 9,680 crore. This achievement represents an impressive 52 per cent year-on-year increase and an 11 per cent quarter-on-quarter surge compared to previous figures.

Also Read: From Abhay Bhutada to Nirmal Jain — India’s Top Chartered Accountants

Strong Asset Management Growth

The company has also witnessed a substantial growth in its Assets Under Management (AUM), which surged by 54 per cent year-on-year to approximately Rs 24,800 crore as of March 31, 2024. This significant increase underscores Poonawalla Fincorp's robust performance and its ability to effectively manage and attract assets.

Focus On Asset Quality

Maintaining high asset quality remains a cornerstone of Poonawalla Fincorp's strategy. The company aims to keep Gross Non-Performing Assets (GNPA) and Net Non-Performing Assets (NNPA) below 1.20 per cent and 0.60 per cent, respectively. This commitment to stringent standards aligns with the company's Management Vision 2025, reflecting its dedication to excellence.

Financial Stability And Liquidity

Poonawalla Fincorp continues to strengthen its financial stability with substantial liquidity, boasting approximately Rs 3600 crore available as of March 31, 2024. This robust liquidity position ensures operational agility and resilience, enabling the company to navigate the dynamic financial landscape with confidence and flexibility.

Also Read: MD Abhay Bhutada Provides Glimpse of Poonawalla’s Co-Branded Card Strategy in Q4

Abhay Bhutada's Leadership

Satisfaction With Performance

Abhay Bhutada, MD of Poonawalla Fincorp, expressed his satisfaction with the company's performance in FY24. He highlighted the significant growth achieved across all business parameters, underscoring the successful transformation witnessed throughout the year.

Best Quarter Yet

Bhutada emphasized that Q4FY24 marked the best quarter thus far for Poonawalla Fincorp. He attributed this success to organic growth strategies and the company's unwavering commitment to maintaining best-in-class asset quality. Such achievements reflect Bhutada's strategic leadership and vision for the company.

Also Read: Abhay Bhutada Shares Insights on Poonawalla Fincorp’s Long-Term Objectives

Expansion Of Strategic Initiatives

In addition to maintaining a focus on financial metrics, Poonawalla Fincorp has prioritized strategic initiatives aimed at enhancing customer experience and expanding market reach. Under Abhay Bhutada's leadership, the company has implemented innovative digital solutions to streamline processes and improve accessibility for customers.

Moreover, Poonawalla Fincorp has invested in talent development initiatives to nurture a skilled workforce capable of driving sustainable growth and innovation. By prioritizing employee training and development programs, the company aims to foster a culture of continuous learning and improvement, thereby enhancing organizational agility and adaptability.

Furthermore, Poonawalla Fincorp has actively pursued partnerships and collaborations with fintech firms and other industry stakeholders to leverage synergies and capitalize on emerging trends. These strategic alliances enable the company to access new markets, expand its product offerings, and enhance its competitive position in the financial sector.

Through these comprehensive strategic initiatives, Poonawalla Fincorp aims to cement its position as a market leader and deliver long-term value to its customers, employees, and shareholders. By embracing innovation, fostering collaboration, and maintaining a steadfast commitment to excellence, the company is poised for sustained growth and success in the years to come.

Conclusion

Poonawalla Fincorp's record-breaking performance in FY24 underscores its dedication to delivering value to stakeholders while adhering to prudent risk management practices. With Abhay Bhutada at the helm, the company is well-positioned for continued success in the ever-evolving financial landscape. As Poonawalla Fincorp continues to innovate and expand its footprint, it remains a formidable player in the non-banking financial sector, driving growth and prosperity for its stakeholders.

0 notes

Text

EXCLUSIVE: MC Lyte releases empowering anthem ‘Woman’ featuring hip hop icons

By Stacy M. BrownNNPA Newswire Senior National Correspondent@StacyBrownMedia

A new single by MC Lyte and friends, a joint venture between My Block Inc. and Sunny Girl Inc. with distribution by Vydia, promises to uplift and inspire all women. (Courtesy MC Lyte/Sunny Girl, Inc.)

(NNPA NEWSWIRE) – In a powerful ode to womanhood, MC Lyte, the mogul, voice-over artist and hip-hop legend, is dropping…

View On WordPress

0 notes

Text

Study Reveals ‘Crisis’ in New Police Training In America

Study Reveals ‘Crisis’ in New Police Training In America

Originally appeared in NNPA

By Stacy M. Brown

Issued by the Police Executive Research Forum (PERF), the report found that nearly half of the agencies responding to the survey agreed that spending on recruit training had increased over the past five years.

A comprehensive new report asserted that American authorities have traditionally trained police officers on the cheap, noting that more than…

View On WordPress

0 notes