#mortgage protection death benefits

Text

By Thom Hartmann

Common Dreams

Nov. 16, 2023

What baffles me is why a TV news personality who earns $2.9 million a year would go to such lengths to avoid even mentioning a solution that’s been signed onto repeatedly by virtually every Democrat in Congress for over a decade.

Why did NBC’s Kristen Welker use an incomplete frame for her question about Social Security at last week’s GOP debate, and why didn’t Lester Holt or anybody else correct her?

Here’s her question:

KRISTEN WELKER: “Americans could see their Social Security benefits drastically cut in the next decade because the program is running out of money. Former President Trump has said quote, ‘Under no circumstances should Republicans cut entitlements.’ Governor Christie, first to you, you have proposed raising the retirement age for younger Americans. What would that age be specifically, and would you consider making any other reforms to Social Security?”

The simple reality is that if a person earns $160,200 a year or less, they pay a 6.2% tax on all of their income. In other words, a person making exactly $160,200 pays $9,932.40 (6.2%) in Social Security taxes.

If you earn $12,000 a year, $56,000 a year, $98,000 a year, or anything under $160,200 a year, you also pay 6.2 cents of tax toward Social Security on every single dollar you earn. If you made $10,000 last year, you pay $620 in Social Security taxes: 6.2 percent. Like the old saying about death and taxes, you can’t avoid it.

BUT those people who make over $160,200 a year pay absolutely nothing — no tax whatsoever — to fund Social Security on every dollar they earn over that amount. After Warren Buffett or Mark Zuckerberg or Jeff Bezos pay their $9,932.40 in Social Security taxes on that first $160,200 they took home on the first day of January, every other dollar they take home for the rest of the year is completely Social Security tax-free.

If somebody makes $1,602,000, for example, it would seem fair that, like every other American, they’d pay the same 6.2% ($99,324) in Social Security taxes. But, no: they only pay the $9,932.40 and after that they get to ride tax-free.

If somebody earned $16,020,000 it would seem fair that they’d pay the same 6.2% to support Social Security as 96 percent of Americans do, but no. Instead of paying $1,004,400 in taxes, they only pay $9,932.40.

Hedge fund guys who make a billion a year — yes, there are several of them — can certainly afford to pay 6.2% to keep Social Security solvent. At that rate, they’d be paying $62 million on a billion-dollar income in Social Security taxes as their fair share of maintaining America’s social contract.

But, because the tax rate is capped to “protect” the morbidly rich while sticking the rest of us with the full bill for Social Security, those titans of Wall Street pay the same $9,932.40 as the doctor who lives down the street from you and earns $160,200 a year.

This is, to use the economic technical term, nuts.

And, while every wealthy person in America knows all about this because it’s such a huge benefit to them, I’ll bet fewer than five percent of Americans know how this scam for the rich works. (I searched diligently, but couldn’t find a single survey that asked average folks if they knew about the cap.)

There is no other tax in America that works like this. Most have loopholes designed to promote specific socially desirable goals, like the deductibility of home mortgage interest or children, but no other tax is designed so that anybody earning over $160,200 is completely exempt and no longer has to pay a penny after their first nine thousand or so dollars.

And here’s where it gets really bizarre: if millionaires and billionaires paid the exact same 6.2% into Social Security that most of the rest of us do (and paid it on their investment income, which is also 100% exempt today), the program would not only be solvent for the next 75 years, but it would have so much extra cash that everybody on Social Security could get a significant raise in their monthly benefit payments.

But because America’s morbidly rich don’t want to pay their share for keeping Social Security solvent, Republicans are having a debate about how badly they can screw working class retirees.

They ask:

“Shall we cut the Social Security payments?”

“How about raising the retirement age from 67 (Reagan raised it from 65 to 67) to 70 or even 72?”

“Or maybe we should just hand the entire thing off to JPMorgan or Wells Fargo and let them run it, like we’re doing with Medicare? We could call it Social Security Advantage!”

“Or how about turning Social Security into a welfare program by ‘means testing’ it, so rich people can’t draw from it and every budget year it can become a political football for the GOP like food stamps or WIC?”

Responding to Welker’s severely incomplete question, Chris Christie hit all four:

GOVERNOR CHRISTIE: “Sure, and we have to deal with this problem. Now look, if we raise the retirement age a few years for folks that are in their thirties and forties, I have a son who’s in the audience tonight who’s 30 years old. If he can’t adjust to a few year increase in Social Security retirement age over the next 40 years, I got bigger problems with him than his Social Security payments.

“And the fact is we need to be realistic about this. There are only three things that go into determining whether Social Security can be solvent or not. Retirement age, eligibility for the program in general, and taxes. That’s it. We are already overtaxed in this country and we should not raise those taxes. But on eligibility also, I don’t know if out there tonight and if you’re watching Warren, I don’t know if Warren Buffett is collecting Social Security, but if he is, shame on you. You shouldn’t be taking the money.”

Christie was the only one of the five Republicans on the stage who even dared mention taxes.

Nikki Haley said:

“So first of all, any candidate that tells you that they’re not going to take on entitlements, is not being serious. Social Security will go bankrupt in 10 years, Medicare will go bankrupt in eight.”

Neither of those assertions are even remotely true, but, of course, this was a GOP debate. She continued:

“But for like my kids in their twenties, you go and you say we’re going to change the rules, you change the retirement age for them. Instead of cost of living increases, we should go to increases based on inflation. We should limit benefits on the wealthy.”

Her other solution, apropos of nothing, was to end government responsibility for Medicare and privatize the entire program by shutting down real Medicare and throwing us all to the tender mercies of the health insurance billionaires:

“And then expand Medicare Advantage plans. Seniors love that and let’s make sure we do that so that they can have more competition. That’s how we’ll deal with entitlement reform and that’s how we’ll start to pay down this debt.”

Ramaswamy’s answer was so incoherent and off-topic I won’t repeat it here. Suffice it to say he rambled on about the cost of foreign wars (Ukraine, Israel) “that many blood-thirsty members of both parties have a hunger for.” Apparently, Vivek doesn’t realize that Social Security isn’t part of our government’s overall budget but has its own segregated funds and trust fund.

Since it’s creation in 1935, Social Security never has and never will contribute to the budget deficit or influence any other kind of government spending.

Tim Scott said we should take a cue from Reagan, Bush, and Trump and just cut billionaires’ income taxes again because that does such a great job of stimulating the economy (not) and then claw back the inflation-based raises people on Social Security have received the past three years.

“Number two, you have to cut taxes. … So what we know is that the Laffer Curve still works, for the lower the tax, the higher the revenue. And finally, if we’re going to deal with it, we have to take our annual appropriations back to pre-2020, pre-COVID levels of spending, which would save us about a half a trillion dollars in the next budget window. By doing that, we deal with Social Security and our mandatory spending.”

DeSantis was equally incoherent, also refusing to answer the question about raising the retirement age and completely avoiding any mention of the sweetheart deal his billionaire donors get on their Social Security taxes. Instead, he said we needed to get inflation under control and stop Congress from “taking money from Social Security,” something Congress has never done and legally never will be able to do.

All this incoherence aside, Republicans appear to have a plan to deal with Social Security.

House Speaker MAGA Mike Johnson has been pushing a “Catfood Commission” just like Reagan’s 1983 commission that raised the retirement age to 67, reaffirmed the cap on taxes, and made Social Security checks taxable as income. He no doubt expects his commissioners will provide “recommendations” Republicans can run with to cut benefits without raising taxes on their billionaire donors, all while blaming it on the commissioners just like Reagan did in 1983.

When Johnson said that his “top priority” was creating such a commission “immediately” and that his Republican colleagues had responded to the idea “with great enthusiasm,” Democrats on the House Ways and Means Committee responded on Xitter:

“A week into his tenure, MAGA Mike Johnson is ALREADY calling for closed-door cuts to the Social Security and Medicare benefits American workers have earned through decades of hard work.”

But back to the original question. I understand why Republicans refuse to even consider lifting the cap on Social Security taxes so their morbidly rich donors won’t have to start paying their fair share of Social Security to keep the program solvent.

What baffles me is why a TV news personality who earns $2.9 million a year would go to such lengths to avoid even mentioning a solution that’s been signed onto repeatedly by virtually every Democrat in Congress for over a decade.

I’ve been watching Kristen Welker on television for years, and she’s generally been a pretty straight shooter as a reporter. Ditto for Lester Holt, who sat right beside her. This, frankly, astonished me.

Were they afraid Republicans would exact revenge on them if they raised the question of the tax cap?

Or was it precisely because they’re making millions, just like most of the executives they answer to?

More broadly, is this why we almost never hear any discussion whatsoever in the media — populated with other news stars who also make millions a year, managed by millionaire network executives — about lifting the cap?

One hopes the answer isn’t that crass...

Our work is licensed under Creative Commons (CC BY-NC-ND 3.0). Feel free to republish and share widely.

#social security#social security tax#social safety net#republicans#republican party#corporate media#journalism#2024 presidential election

300 notes

·

View notes

Text

The Role of Insurance in Financial Planning: Protecting Your Assets and Loved Ones

Financial planning is crucial for securing your future and achieving your long-term goals. While investments and savings are essential to a solid financial plan, insurance also plays a vital role in safeguarding your assets and providing financial security for your loved ones. In this blog post, we’ll explore the importance of insurance in financial planning and how it can help protect your financial well-being.

1. Mitigating Risk

One of the primary functions of insurance in financial planning is to mitigate risk. Life is full of uncertainties, and unexpected events such as accidents, illnesses, and natural disasters can have devastating financial consequences. Insurance provides a safety net that helps protect you and your family from the economic fallout of these unforeseen events. Whether it’s health insurance to cover medical expenses, property insurance to protect your home and belongings, or life insurance to provide for your loved ones in the event of your death, insurance helps mitigate the financial risks associated with life’s uncertainties.

2. Protecting Your Assets

Insurance also plays a crucial role in protecting your assets and investments. Property and casualty insurance policies such as homeowners insurance, renters insurance, and auto insurance cover your valuable assets against loss or damage caused by accidents, theft, or natural disasters. These insurance policies help safeguard your property and provide financial reimbursement for repairs or replacement in the event of covered losses, helping to preserve your wealth and assets over the long term.

3. Providing Financial Security for Your Loved Ones

Life insurance is essential to financial planning, especially for individuals with dependents or loved ones who rely on their income for financial support. Life insurance provides a death benefit to your beneficiaries in the event of your passing, helping to replace lost income, cover living expenses, and pay off debts such as mortgages, loans, and educational expenses. Life insurance can provide your loved ones with financial security and peace of mind, ensuring they are cared for financially, even in your absence.

4. Managing Healthcare Costs

Healthcare costs can be a significant financial burden, especially as you age or experience a severe illness or injury. Health insurance helps manage these costs by covering medical expenses such as doctor’s visits, hospitalization, prescription medications, and treatments. By having health insurance in place, you can protect yourself and your family from the high cost of medical care and ensure access to quality healthcare when needed without depleting your savings or retirement funds.

5. Long-Term Care Planning

Long-term care insurance is another important component of financial planning, especially for individuals approaching retirement age. Long-term care insurance provides coverage for the cost of long-term care services such as nursing home care, assisted living, and in-home care for individuals who are unable to perform daily activities due to age, illness, or disability. Long-term care insurance helps protect your assets and preserve your financial independence by covering the high cost of long-term care services, allowing you to age with dignity and peace of mind.

Conclusion

In conclusion, insurance plays a crucial role in financial planning by helping protect your assets and loved ones from life’s uncertainties. Whether it’s mitigating risk, safeguarding your assets, providing financial security for your loved ones, managing healthcare costs, or planning for long-term care needs, insurance provides peace of mind and financial protection essential for securing your future. By incorporating insurance into your overall financial plan, you can build a solid foundation for your financial well-being and confidently achieve your long-term goals.

0 notes

Text

Secure Your Future: Insights from 5 Star Life Insurance Reviews

Whole life insurance is a cornerstone of financial planning, providing individuals with lifelong coverage and financial security for themselves and their loved ones. When considering whole life insurance options, reviews and insights from policyholders can offer valuable information to help individuals make informed decisions about their insurance needs. This analysis explores insights from 5-star life insurance reviews, highlighting key factors that contribute to a secure financial future.

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured, as long as premiums are paid. Unlike term life insurance, which offers coverage for a specific term, whole life insurance offers lifelong protection and includes a cash value component that accumulates over time. This cash value can be accessed by policyholders through policy loans or withdrawals and serves as a source of liquidity and financial security.

Key Factors Highlighted in 5-Star Life Insurance Reviews

Reviews of whole life insurance policies, particularly those rated with 5 star life insurance reviews often highlight the following key factors that contribute to policyholder satisfaction and financial security:

Stability and Predictability: Policyholders appreciate the stability and predictability offered by whole life insurance policies, particularly in terms of premium payments. Whole life insurance premiums are typically fixed for the duration of the policy, providing peace of mind and ensuring that policyholders can budget effectively without worrying about premium increases.

Guaranteed Death Benefit: The guaranteed death benefit provided by whole life insurance policies is a significant factor highlighted in 5-star reviews. Policyholders value the assurance that their beneficiaries will receive a death benefit upon their passing, regardless of when it occurs, as long as premiums are paid as specified in the policy.

Cash Value Accumulation: Reviews often emphasize the cash value accumulation feature of whole life insurance policies and its role in long-term financial planning. Policyholders appreciate the opportunity to build cash value over time on a tax-deferred basis, providing liquidity and financial flexibility for various needs, such as supplementing retirement income or funding education expenses.

Financial Security for Loved Ones: Whole life insurance reviews frequently mention the peace of mind that comes from knowing that loved ones will be financially protected in the event of the policyholder's death. The death benefit provided by whole life insurance policies serves as a financial safety net, ensuring that beneficiaries have the resources they need to cover expenses, pay off debts, and maintain their standard of living.

Legacy Planning: Many 5-star reviews highlight the role of whole life insurance in legacy planning and wealth transfer. Policyholders appreciate the opportunity to leave a lasting legacy for their loved ones by providing a tax-free death benefit that can help preserve wealth and financial stability for future generations.

Considerations for Choosing Whole Life Insurance

While insights from 5-star life insurance reviews offer valuable perspectives, individuals should consider several factors when choosing a whole life insurance policy that best suits their needs:

Coverage Amount: Determine the appropriate coverage amount based on your financial obligations, such as mortgage payments, debts, and future expenses. Consider factors such as inflation and future financial needs when selecting a coverage amount.

Premium Payments: Evaluate your budget and financial priorities to ensure that you can afford the premiums for whole life insurance. While whole life insurance offers stability in premium payments, it's essential to budget effectively to maintain coverage over the long term.

Cash Value Growth: Understand the cash value accumulation potential of whole life insurance policies and how it fits into your overall financial planning strategy. Consider factors such as guaranteed cash value growth rates, dividend-paying potential, and access to cash value through policy loans or withdrawals.

Policy Riders and Options: Review the additional riders and options available with whole life insurance policies, such as accelerated death benefit riders or waiver of premium riders. Determine whether these riders align with your insurance and financial planning needs.

Conclusion

In conclusion, insights from 5-star life insurance reviews offer valuable perspectives on the factors that contribute to a secure financial future with whole life insurance. Stability and predictability, guaranteed death benefits, cash value accumulation, financial security for loved ones, and legacy planning are key factors highlighted by policyholders in their reviews. While these insights provide valuable guidance, individuals should carefully consider their own financial needs and objectives when choosing a whole life insurance policy. By evaluating factors such as coverage amount, premium payments, cash value growth, and policy riders, individuals can select a whole life insurance policy that provides peace of mind and financial security for themselves and their loved ones.

0 notes

Text

A Comprehensive Guide to Buying Term Insurance: Protecting Your Future

In today’s unpredictable world, securing your loved ones' financial future is paramount. Term insurance stands as a reliable shield against life's uncertainties. If you're considering buying term insurance, you're making a wise decision towards safeguarding your family's well-being. In this comprehensive guide, we'll delve into everything you need to know about term insurance and why it's a crucial investment.

What is Term Insurance?

Term insurance is a type of life insurance that provides coverage for a specified period, typically ranging from 10 to 30 years. In the event of the policyholder's death during the term, the insurance company pays out a death benefit to the beneficiaries. It offers financial protection and peace of mind to your family in case of your untimely demise.

Key Benefits of Term Insurance:

1. Affordable Premiums: Term insurance typically offers lower premiums compared to other types of life insurance, making it accessible to a wide range of individuals.

2. Flexible Coverage: You have the flexibility to choose the coverage amount and term duration based on your specific needs and financial goals.

3. Income Replacement: The death benefit provided by term insurance helps replace lost income, ensuring that your family's financial needs are met even in your absence.

4. Debt Repayment: Term insurance can be used to pay off outstanding debts such as mortgages, loans, and educational expenses, relieving your family from financial burdens.

5. Estate Planning: It facilitates smooth estate planning by providing liquidity to cover estate taxes and other expenses, ensuring a seamless transfer of assets to your heirs.

Factors to Consider Before Buying Term Insurance:

1. Coverage Amount: Determine the appropriate coverage amount based on your family's financial obligations, including daily expenses, debts, and future goals.

2. Term Duration: Assess your family's long-term financial needs and select a term duration that aligns with your objectives, such as until your mortgage is paid off or until your children are financially independent.

3. Riders and Add-ons: Explore optional riders such as critical illness, accidental death, and disability riders to enhance your coverage and tailor it to your specific requirements.

4. Insurer Reputation: Research and compare insurers based on their financial stability, claim settlement ratio, and customer service reputation to ensure reliability and trustworthiness.

5. Premium Affordability: Evaluate premium rates from multiple insurers and choose a policy that offers comprehensive coverage at an affordable premium within your budget.

How to Buy Term Insurance:

1. Research: Gather information about different term insurance plans available in the market and compare their features, benefits, and premium rates.

2. Assess Your Needs: Evaluate your financial situation, family's future needs, and risk factors to determine the most suitable coverage amount and term duration.

3. Online Purchase: Many insurers offer the convenience of buying term insurance online through their website or mobile app, allowing you to compare quotes, customize your policy, and complete the purchase process seamlessly.

4. Documentation: Ensure you have the necessary documents handy, such as proof of identity, address, and income, to complete the application process smoothly.

5. Medical Examination: Depending on your age and sum assured, you may be required to undergo a medical examination as part of the underwriting process to assess your health condition.

6. Policy Issuance: Once your application is approved and the premium is paid, the insurer will issue your term insurance policy along with the policy document outlining the terms and conditions.

In conclusion, buying term insurance is a crucial step towards securing your family's financial future and providing them with the protection they deserve. Take the time to research, assess your needs, and choose a policy that offers comprehensive coverage at an affordable premium. Don't delay, safeguard your loved ones today with term insurance.

Ready to secure your family's future? Explore our range of term insurance plans and take the first step towards peace of mind. Click here to get started!

0 notes

Text

The Benefits of Offering Group Insurance to Your Employees

In today's competitive job market, attracting and retaining top talent is a priority for businesses. Apart from offering competitive salaries and perks, providing comprehensive benefits packages plays a crucial role in this endeavor. One such benefit that stands out is group insurance. Let's delve into why offering group insurance to employees is a strategic move that benefits both parties involved.

The Benefits of Group Insurance to Employees:

1. Affordability: Group insurance plans typically offer lower premiums compared to individual policies, as the risk is spread across a larger pool of employees. This affordability makes it accessible to a broader range of employees, including those who might not otherwise be able to afford individual coverage.

2. Comprehensive Coverage: Group insurance often includes a range of coverage options, such as health, dental, vision, and life insurance. This comprehensive coverage provides employees with peace of mind, knowing that they and their families are protected against various risks.

3. No Medical Underwriting: Unlike individual insurance policies that may require medical underwriting, group insurance often comes with no such requirements. This means that employees with pre-existing conditions can still qualify for coverage, eliminating a significant barrier to obtaining insurance.

4. Convenience: Group insurance is typically provided through the employer, making it convenient for employees to enroll and manage their coverage. They can often make changes to their plans during open enrollment periods or in the event of qualifying life events.

The Benefit of Group Life Insurance:

Group life insurance is a valuable component of a comprehensive benefits package. Here's why:

1. Financial Protection for Loved Ones: In the unfortunate event of an employee's death, group life insurance provides financial support to their beneficiaries. This can help cover funeral expenses, outstanding debts, mortgage payments, and ongoing living expenses, easing the financial burden during a difficult time.

2. No Medical Exam Required: Group life insurance typically does not require a medical exam for enrollment, making it accessible to employees regardless of their health status. This ensures that all employees have the opportunity to secure life insurance coverage for themselves and their loved ones.

3. Supplemental Coverage: Employers may offer the option for employees to purchase additional life insurance coverage beyond the basic amount provided. This allows employees to tailor their coverage to their individual needs and circumstances, providing added peace of mind.

The Benefit of Employer-Employee Insurance:

Employer-employee insurance, often referred to as group insurance, fosters a mutually beneficial relationship between employers and employees. Here's how:

1. Enhanced Recruitment and Retention: Offering competitive benefits, including group insurance, can help employers attract top talent and retain valuable employees. In a job market where benefits play a significant role in job satisfaction, a robust insurance package can set employers apart from their competitors.

2. Improved Employee Well-being: Access to comprehensive insurance coverage promotes employee well-being by ensuring they have the support they need to maintain their health and financial security. Healthy and satisfied employees are more engaged, productive, and less likely to seek opportunities elsewhere.

3. Cost Savings for Employers: While offering group insurance incurs costs for employers, the benefits outweigh the expenses in the long run. By promoting preventive care and early intervention, insurance coverage can help reduce healthcare costs associated with untreated illnesses and injuries.

What is a GRP Benefit?

GRP, or Group Retirement Plan, is a type of employee benefit that helps employees save for retirement. Employers may contribute to these plans, and employees often have the option to make contributions through payroll deductions. GRP benefits provide employees with a tax-advantaged way to save for retirement, helping them secure their financial future.

In conclusion, offering group insurance to employees is a strategic investment for employers that yields numerous benefits. From providing affordable and comprehensive coverage to enhancing recruitment and retention, group insurance fosters a positive work environment where employees feel valued and supported. Click here to explore how implementing group insurance can benefit your business and your employees!

0 notes

Text

A Guide to Selecting the Best Life and Health Insurance Companies in Dubai

In the vibrant city of Dubai, one must protect one's future by procuring appropriate life and health insurance. Given the quantity of available options, locating the ideal suit can be a daunting task. We shall explore the realm of insurance in order to assist you in identifying the most suitable life and health insurance providers that cater to your specific requirements, with an emphasis on National General Insurance (NGI).

Understanding Your Needs

It is imperative to assess one's needs prior to exploring the vast array of insurance providers. Ascertain whether coverage for oneself, one's family, or both is required. Assess your financial responsibilities, long-term objectives, and possible health hazards. This initial phase establishes the groundwork for selecting the most appropriate insurance policy.

Exploring options

Dubai offers a variety of life and health insurance plans. Conduct thorough research to compare the premiums, coverage, and additional benefits provided by various providers. Consider firms that have established a reliable standing, consistent financial health, and a history of promptly resolving claims.

NGI stands for National General Insurance

Notwithstanding the plethora of alternatives, National General Insurance (NGI) emerges as a reputable entity within the insurance sector. NGI is well-known for its extensive coverage and focus on customer satisfaction. The organization provides a comprehensive selection of life and health insurance options that are customized to suit the requirements of individuals and families.

Long-Term Life Insurance

Term life insurance is a favored option among policyholders who are in search of cost-effective protection for a predetermined duration, which generally spans from 5 to 30 years. Beneficiaries will receive a death benefit from this form of insurance in the event that the insured passes away during the policy's term. NGI provides adaptable term life insurance products that feature customizable coverage options and competitive premiums.

Important Things to Think About When You Buy Term Insurance in Dubai

Coverage Amount: Assess the appropriate coverage amount by considering one's financial obligations, such as mortgage payments, outstanding debts, and forthcoming expenditures.

Prepaid Expenses and Affordability: Compare the premiums of various term insurance plans to assess the financial commitment required to purchase them.

Further Advantages: In order to augment your protection, consider term life insurance policies that provide elective riders or add-ons, such as disability benefits or critical illness coverage.

Term life insurance plans from NGI

National General Insurance (NGI) provides policyholders and their loved ones with financial security and peace of mind through a variety of term life insurance plans. By offering policies with adaptable conditions, competitive premiums, and elective endorsements, NGI accommodates a wide range of requirements and inclinations.

Life Insurance Agreement

A life insurance policy safeguards your loved ones financially in the event of your mortality; it is a long-term investment. In the event of the insured's demise, beneficiaries are entitled to a lump-sum payment referred to as the death benefit. When purchasing a life insurance policy in UAE, coverage quantity, affordability of premiums, and policy features should be considered.

Choosing an Appropriate Policy for Life Insurance

Whole Life vs Term Life: Determine whether a whole life or term life insurance policy aligns better with your financial goals and preferences. Whole life insurance companies in Dubai provide coverage for the insured's entire life, while term life insurance offers coverage for a specified period.

Cash Value Accumulation: If you opt for whole life insurance, consider the cash value accumulation feature, which allows you to build savings over time that can be accessed through policy loans or withdrawals.

Process of Underwriting: Acquire knowledge regarding the underwriting procedure entailed in the acquisition of a life insurance policy, encompassing medical examinations, health questionnaires, and premium computations.

Claiming Reputation: Conduct thorough research on the insurer's claim settlement reputation in order to guarantee that your beneficiaries' claims are processed in a timely and trouble-free manner.

Life insurance options provided by NGI

National General Insurance (NGI) is dedicated to delivering all-encompassing life insurance solutions that effectively address its clients' ever-changing requirements. At NGI, we prioritize transparency, dependability, and customer contentment as we provide a number of customized life insurance policies designed to protect your family's financial prospects.

Health Insurance Options from NGI

In the current era of uncertainty, National General Insurance (NGI) recognizes the critical nature of comprehensive health insurance coverage. NGI provides comprehensive health insurance plans that cater to a variety of budgets and requirements, thereby safeguarding individuals and families against unforeseen medical costs and crises.

Conclusion

When searching for the most reputable life and health insurance Companies in Dubai, it is crucial to take into account your specific requirements, preferences, and financial limitations. Through comprehensive investigation, option comparison, and the utilization of the knowledge and assistance of reputable insurance providers such as National General Insurance (NGI), one can obtain a dependable insurance policy that furnishes long-term financial security and tranquility.

#insurance companies in uae#3 month insurance plan#best insurance company in uae#insurance brokers in dubai#international insurance providers#general insurance companies in uae#insurance policy in uae#good insurance in dubai

0 notes

Text

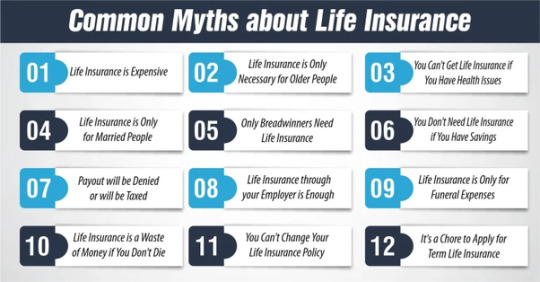

Debunking Common Myths About Life Insurance:

Life insurance is a crucial financial tool that provides protection and peace of mind for you and your loved ones. However, there are several myths and misconceptions surrounding life insurance that often deter individuals from purchasing adequate coverage. These myths can lead to misunderstandings about the importance and benefits of life insurance. In this article, we'll debunk some of the most common myths about life insurance and explore the truth behind them.

Myth 1:

Life Insurance Is Only for Older People One of the most prevalent myths about life insurance is that it's only necessary for older individuals or those with dependents. In reality, life insurance is important for people of all ages and life stages. Whether you're young and single or married with children, life insurance can provide financial protection for your loved ones in the event of your untimely death. It can help cover funeral expenses, outstanding debts, mortgage payments, and provide for your family's future financial needs.

Myth 2:

Life Insurance Is Expensive Another common misconception is that life insurance is prohibitively expensive. While the cost of life insurance premiums varies depending on factors such as age, health, and coverage amount, it's often more affordable than people realize, especially if you purchase coverage when you're young and healthy. Additionally, the peace of mind and financial security that life insurance provides far outweigh the cost of premiums. There are various types of life insurance policies available, ranging from term life insurance, which offers coverage for a specified period, to permanent life insurance, which provides lifelong protection and cash value accumulation.

Myth 3:

I Have Life Insurance Through My Employer, So I Don't Need Additional Coverage Many people believe that the life insurance provided by their employer is sufficient to meet their needs. While employer-sponsored life insurance can be a valuable benefit, it's often limited in coverage amount and may not be portable if you change jobs. Additionally, if you rely solely on employer-provided life insurance and lose your job or retire, you could be left without coverage when you need it most. Therefore, it's important to consider purchasing individual life insurance to supplement any coverage offered by your employer and ensure adequate protection for your loved ones.

FOR MORE DETAILS PLEASE VISIT:

Myths about Life Insurance: Explore the Truth

0 notes

Text

Securing Your Family's Future: The Importance of Life Insurance

Life is unpredictable, and ensuring the financial security of your loved ones in the event of your untimely demise is a responsibility that cannot be overlooked. Life insurance serves as a crucial tool in safeguarding your family's future by providing financial protection and stability. In this article, we will explore the significance of life insurance in securing your family's well-being and the various ways it can offer peace of mind during life's uncertainties.

Understanding the Importance of Life Insurance: Life insurance is more than just a policy; it is a commitment to your family's financial security. By purchasing a life insurance policy, you create a safety net that ensures your loved ones are taken care of financially in the event of your death. This financial support can help cover living expenses, mortgage payments, educational costs, and other financial obligations, alleviating the burden on your family during a challenging time.

Key Benefits of Life Insurance:

Financial Protection: Life insurance provides a tax-free lump sum payment, known as the death benefit, to your designated beneficiaries upon your passing. This financial support can help replace lost income, settle outstanding debts, and maintain your family's standard of living.

Estate Planning: Life insurance can play a crucial role in estate planning by providing liquidity to cover estate taxes, probate fees, and other expenses. It ensures that your assets are preserved for your beneficiaries and distributed according to your wishes.

Peace of Mind: Knowing that your loved ones will be taken care of financially can provide peace of mind and reduce stress during life's uncertainties. Life insurance offers reassurance that your family will have the resources they need to move forward, even in your absence.

Legacy Building: Life insurance allows you to leave a lasting legacy for your loved ones by providing them with financial security and opportunities for the future. It can fund education expenses, charitable donations, or other meaningful endeavors that reflect your values and priorities.

Supplemental Retirement Income: Certain types of life insurance, such as permanent policies with cash value accumulation, can serve as a source of supplemental retirement income. The cash value can be accessed tax-free through policy loans or withdrawals, providing financial flexibility in retirement.

Choosing the Right Life Insurance Policy: When selecting a life insurance policy, it's essential to consider your financial goals, budget, and family's needs. Term life insurance offers affordable coverage for a specific period, while permanent life insurance, such as whole life or universal life, provides lifelong protection with cash value accumulation. Consulting with a knowledgeable insurance agent or financial advisor can help you determine the most suitable policy for your circumstances.

Conclusion: Securing your family's future through life insurance is a vital aspect of financial planning and responsible decision-making. By purchasing a life insurance policy, you provide your loved ones with the financial protection and stability they need to thrive, even in your absence. Whether you're protecting your family, planning your estate, or building a legacy, life insurance offers invaluable peace of mind and security for the future. Don't wait until it's too late; take the necessary steps to safeguard your family's well-being today.

1 note

·

View note

Text

Superannuation Advice Australia

Superannuation Advice Australia can provide you with advice on mortgage payments, retirement savings and insurance. It can also help you consolidate your super and choose a suitable investment option. It can also help you understand the risk return trade off.

Major life changes such as birth or death of a partner, buying or selling property, changing jobs and receiving financial windfalls are all important times to get good advice about your superannuation.

Choosing a super fund

Choosing a super fund is a big decision that can impact not only your superannuation advice Australia savings but also how those funds will be used to achieve your future goals. Whether you’re selecting an existing fund, the default option, or a self-managed super (SMSF) account it’s important to consider fees, performance, and the insurance offered by your chosen fund.

It’s also a good idea to compare super funds and their historical performance. This means looking at the return on investment for each fund – which is usually expressed as a percentage - and ensuring you’re comparing net benefits. This includes all administration fees, member fees, and investment fees.

It’s a good idea to review your options regularly and consider switching funds if it’s financially beneficial. This is especially true if you’re changing employment or are in a stapled super fund.

Consolidating your super

Superannuation is Australia’s system for saving money for retirement. Employers pay a percentage of each worker’s salary into their super fund, and the money is invested until they retire.

You can also add to your super by'salary sacrificing' some of your pre-tax income, or by contributing from your after-tax income. There are limits (called 'caps') on how much you can contribute each year. You can also access your super before retirement but it’s important to get advice and meet the rules.

Industry superannuation funds got a better report card from the Royal Commission into banking and financial services and often have lower fees than retail funds. Some offer choice of insurance offerings that can be tailored to your particular circumstances. Other funds, such as SMSFs (Self Managed Super Funds) allow more control over investment choices but they are time consuming to set up and manage. They are best suited to people with large balances. The government's MySuper product is a simple and cost-effective balanced option for the majority of Australians.

Investing in your super

When it comes to retirement, your super is one of the biggest assets you own. It’s important to take care of it well. This includes knowing how much you’re paying in fees and if you have insurance in your fund. It’s also worth checking that your investments are aligned with your goals and that you are on track to meet your retirement savings target.

The government offers a series of tax breaks to encourage people to save in super. These include a low rate of tax on contributions, and the ability to salary sacrifice some of your pre-tax income into super.

The main job of a good super fund is to invest the money you contribute to your retirement savings. This will earn you returns and grow your balance over the long term. The result is a higher income in retirement and a better chance of living comfortably. The best way to measure your super fund’s performance is by looking at its net benefit. This takes into account all the benefits of your super including strong returns, a growing balance, and insurance.

Insurance in your super

Many super funds offer life, total and permanent superannuation australia (TPD) and income protection insurance to their members. It’s important to consider your personal needs when deciding whether or not you need to take out insurance in your super.

Insurance through super can be a convenient and cost effective option. It’s generally a lot cheaper than buying personal cover outside of super, and premiums are deducted from your super account rather than your take home pay, which may reduce your cash flow pressure.

However, it’s important to review your insurance regularly. You should also check whether your current premiums are appropriate for your circumstances. You can do this by checking the insurance PDS and any other documents outlining your policy on your fund’s website. It’s worth checking whether you have any exclusions and if you’re paying a loading (a percentage increase in premium) for your risk. It’s also important to consider whether or not your death benefit nominations are up to date.

0 notes

Text

Factors That Determine Life Insurance Premiums for Smokers

Are you thinking about getting life insurance to protect your loved ones' finances? Understanding how smoking affects your life insurance premium is critical, whether you smoke or not. We'll go into detail in this blog on how smoking influences life insurance rates and why it's critical to make well-informed decisions when buying life insurance.

Life insurance is an important financial tool that offers a safety net for your family in the event of your untimely death. It provides financial security by paying a lump sum (death benefit) to your beneficiaries, allowing them to cover expenses such as mortgage payments, tuition bills, and everyday living expenses. When you apply for life insurance, insurers consider a variety of factors to determine your premium, including your age, health, lifestyle, work, and interests. Among these considerations, smoking has a substantial impact on your life insurance premiums because it is associated with a variety of health risks and illnesses.

Ginteja Insurance, one of the Best Life Insurance Advisor in Kolkata emphasizes the importance of understanding how smoking habits can affect your life insurance premiums. Let’s examine the impact of smoking on life insurance rates:

Higher Risk of Health Concerns: Smoking is associated with a variety of health concerns, including heart disease, lung cancer, respiratory disorders, and others. Your life insurance premiums will go up if you smoke since you are a greater risk to insurance providers.

Increased Mortality Risk: Based on statistical data, smokers typically die younger than non-smokers. This higher mortality risk results in higher premiums because insurers must account for the increased chance of paying out a death benefit sooner.

Different Premium Rates: Insurance companies often divide applicants into risk classes based on their health and lifestyle choices. Comparing smokers’ premium rates to non-smokers, smokers are frequently put in a different risk class. This represents the higher risk and potential expense of insuring smokers.

Underwriting Considerations: During the underwriting process, insurers collect information on your smoking habits, such as how often you smoke and whether you use other tobacco products. During this stage, being upfront and providing precise details is critical to ensuring your policy’s validity and avoiding future claim denials.

Individuals wishing to buy life insurance online must honestly report their smoking status. Failure to declare smoking habits can have serious repercussions, including policy termination or claim denial if the insurer discovers incorrect information. Ginteja Insurance provides helpful insights and guidance to smokers seeking life insurance coverage. They understand the complexities of smoker underwriting and can successfully guide you through the process.

As you look into life insurance choices, talk to the Best Life Insurance Advisor in Kolkata, such as Ginteja Insurance. An experienced advisor can evaluate your specific needs, explain how smoking affects your premiums, and help you pick a life insurance policy that matches your financial objectives.

In conclusion, smoking has a major impact on your life insurance premium because of the related health risks and higher mortality rates among smokers. Being open about your smoking habits and obtaining advice from competent consultants such as Ginteja Insurance will help you make informed decisions and obtain the correct life insurance coverage for you and your loved ones. Remember, investing in life insurance is about more than simply preserving your family’s financial future; it’s also about making good decisions that represent your total well-being. Choose wisely, be educated, and put your financial security first.

0 notes

Text

Insuring Peace of Mind: Exploring Liberty Mutual Life Insurance

Life insurance plays a vital role in providing financial security and peace of mind to individuals and their loved ones. Among the various options available, Liberty Mutual stands as a prominent provider of life insurance, offering policies designed to meet the diverse needs of policyholders. By exploring Liberty Mutual life insurance offerings, individuals can gain insight into the company's commitment to protecting families and providing financial stability in times of need.

Understanding Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company, where the insurer agrees to pay a designated beneficiary a sum of money upon the death of the insured person. Life insurance provides financial protection to the insured's beneficiaries, helping them cover expenses such as funeral costs, outstanding debts, mortgage payments, and ongoing living expenses.

Liberty Mutual Life Insurance Overview

Liberty Mutual is a leading provider of insurance products and services, offering a range of options to meet the needs of individuals and families. Liberty Mutual life insurance policies are designed to provide financial protection and peace of mind to policyholders and their loved ones, offering coverage options tailored to individual circumstances and preferences.

Types of Life Insurance Offered by Liberty Mutual

Liberty Mutual offers several types of life insurance policies to suit the diverse needs and preferences of policyholders:

Term Life Insurance: Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years. If the insured person dies during the term of the policy, the designated beneficiaries receive the death benefit. Term life insurance is often chosen for its affordability and simplicity.

Whole Life Insurance: Whole life insurance provides coverage for the entire life of the insured person, as long as premiums are paid. In addition to the death benefit, whole life insurance policies also accumulate cash value over time, which can be accessed by the policyholder during their lifetime.

Universal Life Insurance: Universal life insurance offers flexibility in premium payments and coverage amounts, allowing policyholders to adjust their policies to meet changing needs and circumstances. Universal life insurance policies also accumulate cash value over time, providing a source of savings and investment.

Variable Life Insurance: Variable life insurance allows policyholders to invest their premiums in various investment options, such as stocks, bonds, and mutual funds. The cash value of variable life insurance policies fluctuates based on the performance of the underlying investments, providing the potential for higher returns but also greater risk.

Benefits of Liberty Mutual Life Insurance

Liberty Mutual life insurance policies offer several benefits to policyholders and their beneficiaries:

Financial Protection: Life insurance provides financial protection to the insured's beneficiaries, helping them cover expenses and maintain their standard of living in the event of the insured's death.

Peace of Mind: Knowing that their loved ones will be financially secure in the event of their death can provide policyholders with peace of mind and reassurance.

Tax Advantages: Life insurance death benefits are generally tax-free to the beneficiaries, providing an additional financial advantage.

Cash Value Accumulation: Whole life and universal life insurance policies accumulate cash value over time, which can be accessed by the policyholder during their lifetime for various purposes, such as supplementing retirement income or funding education expenses.

Considerations When Choosing Liberty Mutual Life Insurance

When choosing a life insurance policy from Liberty Mutual, individuals should consider several factors to ensure they select the coverage that best meets their needs:

Coverage Amount: Determine the amount of coverage needed to provide financial security to beneficiaries, taking into account expenses such as mortgage payments, outstanding debts, education costs, and ongoing living expenses.

Premium Payments: Consider the affordability of premium payments and choose a policy with premium amounts that fit within the budget.

Policy Features: Review the features and benefits of different types of life insurance policies offered by Liberty Mutual, such as death benefits, cash value accumulation, and flexibility in premium payments and coverage amounts.

Underwriting Requirements: Understand the underwriting requirements for the policy, including any medical exams or health assessments required to qualify for coverage.

Conclusion

In conclusion, Liberty Mutual life insurance offers individuals and families a valuable tool for protecting their financial security and providing peace of mind. With a range of policy options to choose from, individuals can select the coverage that best meets their needs and preferences, whether they seek affordable term coverage, lifelong protection with whole life insurance, or flexibility with universal or variable life insurance. By understanding the benefits and considerations of Liberty Mutual life insurance, individuals can make informed decisions to safeguard their loved ones' financial future.

0 notes

Text

Safeguarding Your Tomorrow: Understanding the Essence of Life Insurance

In the journey of life, uncertainties often linger around the corner, reminding us of the impermanence of our existence. Amidst the ebb and flow of daily routines, it's easy to overlook the importance of preparing for the unexpected. This is where life insurance steps in – offering a shield of financial security and peace of mind to weather the storms that may come our way.

Life insurance is more than just a financial product; it's a promise – a promise to safeguard the well-being of our loved ones and secure their future, even in our absence. But what exactly is life insurance, and why is it crucial?

Understanding Life Insurance:

At its core, life insurance is a contract between an individual and an insurance company. The individual pays regular premiums to the insurer, and in return, the insurer provides a lump-sum payment, known as the death benefit, to the designated beneficiaries upon the insured's death. This payout serves as a financial safety net, helping beneficiaries cover expenses such as mortgage payments, educational costs, and daily living expenses.

Life insurance policies come in various forms, each designed to cater to different needs and circumstances:

Term Life Insurance: This type of policy offers coverage for a specified period, typically ranging from 10 to 30 years. If the insured passes away during the term of the policy, the death benefit is paid out to the beneficiaries. Term life insurance is often chosen for its affordability and simplicity.

Whole Life Insurance: Unlike term life insurance, whole life insurance provides coverage for the entirety of the insured's life, as long as premiums are paid. In addition to the death benefit, whole life policies also accumulate cash value over time, which can be accessed by the policyholder through loans or withdrawals.

Universal Life Insurance: Universal life insurance combines the death benefit of traditional life insurance with a flexible savings component. Policyholders have the flexibility to adjust their premium payments and death benefit amounts, making it a versatile option for those seeking both protection and investment opportunities.

The Importance of Life Insurance:

In today's fast-paced world, where the future is uncertain, life insurance plays a crucial role in ensuring financial stability and protecting the ones we hold dear. Here are some key reasons why life insurance is essential:

Income Replacement: For many families, the sudden loss of a primary breadwinner can have devastating financial consequences. Life insurance provides a source of income replacement, ensuring that loved ones can maintain their standard of living and meet ongoing financial obligations.

Debt Repayment: From mortgages to credit card bills, most individuals carry some form of debt throughout their lives. Life insurance can help alleviate the burden of debt repayment, preventing survivors from being saddled with financial liabilities.

Education Expenses: As parents, we strive to provide our children with the best possible education. Life insurance can fund educational expenses, including tuition fees, books, and other related costs, ensuring that our children have access to quality education regardless of our absence.

Final Expenses: The cost of funerals and other end-of-life expenses can be substantial, placing an additional strain on grieving families. Life insurance can cover these final expenses, allowing loved ones to focus on healing and remembrance rather than financial worries.

Planning for the Future:

When it comes to life insurance, proactive planning is key. Here are some essential steps to consider:

Assess Your Needs: Evaluate your financial situation and determine the amount of coverage needed to meet your family's needs. Consider factors such as income, debts, future expenses, and any existing savings or investments.

Choose the Right Policy: Select a life insurance policy that aligns with your financial goals, risk tolerance, and budget. Take the time to compare different types of policies and consult with a knowledgeable insurance agent to make an informed decision.

Review Regularly: Life insurance needs evolve over time, so it's essential to review your policy regularly to ensure it remains adequate and up-to-date. Life events such as marriage, the birth of a child, or a career change may warrant adjustments to your coverage.

Communicate with Loved Ones: Discuss your life insurance plans with your beneficiaries and ensure they are aware of the policy details and how to file a claim if necessary. Open communication can help prevent misunderstandings and ensure a smooth claims process.

Conclusion:

Life insurance is not merely a financial product; it's a cornerstone of responsible financial planning and a testament to our commitment to protecting our loved ones. By securing a life insurance policy, we can provide our families with the peace of mind and stability they deserve, knowing that they will be taken care of no matter what the future holds. So, let's take the first step towards safeguarding our tomorrow – because when it comes to our loved ones, there's no room for compromise.

Related Links-

Navigating the Maze: Health Insurance Plans for Senior Citizens

Understanding Term Insurance Return Of Premium: Pros, Cons, and Considerations

The Convenience of Online Life Insurance Policy Purchase: A Modern Solution for Busy Lives

Understanding Term Insurance Return Of Premium: Is It Worth It?

Navigating the Maze: Health Insurance for Parents

0 notes

Text

Navigating the Waters of Term Life Insurance: Finding the Cheapest Options with Stevejonesperez

In the realm of life insurance, term life insurance stands out as a popular choice for individuals seeking affordable coverage to protect their loved ones financially. Term life insurance provides coverage for a specified period, offering a straightforward and budget-friendly option for those looking to safeguard their family's future. At Stevejonesperez, we understand the importance of finding the right insurance solution that fits your needs and budget. Join us as we navigate the waters of term life insurance and explore the cheapest options available to you.

Understanding Term Life Insurance

Term life insurance is a type of life insurance policy that provides coverage for a set period, typically ranging from 10 to 30 years. Unlike whole life insurance, which offers coverage for the insured's entire life and includes a savings component, term life insurance is purely designed to provide a death benefit to beneficiaries if the insured passes away during the term of the policy.

Why Choose Term Life Insurance?

Term life insurance is often favored for its simplicity and affordability. It allows individuals to secure a significant amount of coverage for a fraction of the cost compared to other types of life insurance. Term life insurance policies offer fixed premiums for the duration of the term, making budgeting easier and more predictable. Additionally, term life insurance can be an ideal choice for individuals with specific financial obligations, such as mortgage payments or children's education expenses, that will diminish over time.

Finding the Cheapest Term Life Insurance Options

When searching for the cheapest term life insurance options, there are several factors to consider:

1. Coverage Amount

The amount of coverage you choose will directly impact the cost of your term life insurance policy. Determine your coverage needs based on factors such as your income, debts, expenses, and future financial obligations. While it's essential to ensure adequate coverage for your beneficiaries, opting for a higher coverage amount will naturally result in higher premiums.

2. Term Length

The length of the term you select will also influence the cost of your term life insurance policy. Shorter terms typically come with lower premiums, as they provide coverage for a shorter period. However, it's essential to choose a term length that aligns with your financial goals and the duration of your financial obligations.

3. Health and Lifestyle Factors

Your health and lifestyle play a significant role in determining the cost of your term life insurance policy. Insurers typically require applicants to undergo a medical exam and assess factors such as age, medical history, tobacco use, and overall health. Maintaining a healthy lifestyle and addressing any underlying health issues can help lower your premiums.

4. Compare Quotes

Shopping around and comparing quotes from multiple insurance providers is crucial to finding the cheapest term life insurance options. At Stevejonesperez, we leverage our extensive network of insurance carriers to help you access competitive quotes tailored to your specific needs and budget. Our experienced agents will guide you through the process and help you find the best coverage at the most affordable price.

5. Consider Riders and Add-Ons

Riders and add-ons are additional features that can be included in your term life insurance policy for an extra cost. While these options may provide valuable benefits, such as accelerated death benefits or coverage for critical illnesses, they can also increase the overall cost of your policy. Consider your priorities and weigh the pros and cons of adding riders to ensure they align with your needs and budget.

Conclusion

Term life insurance offers a cost-effective solution for individuals looking to protect their loved ones financially. By understanding your coverage needs, comparing quotes, and considering factors such as coverage amount, term length, health, and lifestyle, you can find the cheapest term life insurance options that suit your budget and provide peace of mind. At Stevejonesperez, we're committed to helping you navigate the complexities of life insurance and secure the best coverage at the most affordable price. Contact us today to explore your options and take the first step towards protecting your family's future with term life insurance.

0 notes

Text

What are the importance of life insurance & its features?

In the vast landscape of financial planning, life insurance stands as a cornerstone for securing one's future and protecting loved ones against unforeseen circumstances. While often overlooked or misunderstood, life insurance holds immense significance in providing financial stability, peace of mind, and a safety net for those left behind. In this article, we delve into the importance of life insurance and explore its essential features that make it a vital component of any comprehensive financial strategy.

Understanding Life Insurance:

Life insurance, at its core, is a contract between an individual and an insurance company. In exchange for regular premium payments, the insurer promises to provide a lump-sum payment, known as the death benefit, to the policyholder's beneficiaries upon their passing. This financial cushion serves to replace lost income, cover outstanding debts, fund education expenses, and maintain the quality of life for dependents.

Importance of Life Insurance:

1. Financial Protection for Loved Ones:

The primary purpose of life insurance is to ensure that your loved ones are financially secure in the event of your untimely demise. The death benefit can help cover essential expenses such as mortgage payments, utility bills, childcare costs, and future aspirations like college tuition.

2. Debt Repayment and Estate Planning:

Life insurance can be instrumental in settling outstanding debts and estate taxes, preventing the burden from falling on family members or depleting assets intended for inheritance. It facilitates a smooth transition of assets and preserves your legacy for future generations.

3. Income Replacement:

For breadwinners and primary earners in a family, life insurance provides a crucial income replacement mechanism. It ensures that surviving family members can maintain their standard of living and meet ongoing financial obligations without facing significant financial strain.

4. Peace of Mind:

Knowing that your loved ones will be taken care of financially can offer unparalleled peace of mind. Life insurance alleviates anxiety about the future and allows individuals to focus on living their lives to the fullest without worrying about what may happen in their absence.

Key Features of Life Insurance:

1. Death Benefit:

The cornerstone of any life insurance policy, the death benefit, is the lump-sum payment provided to beneficiaries upon the insured's death. This amount is determined by the policyholder's chosen coverage amount and serves as the financial foundation for beneficiaries' futures.

2. Premiums:

Life insurance premiums are the regular payments made by the policyholder to the insurance company to keep the policy active. Premium amounts are based on factors such as age, health, coverage amount, and policy type. Locking in lower premiums at a younger age can result in significant long-term savings.

3. Policy Types:

Life insurance comes in various forms, including term life, whole life, universal life, and variable life insurance. Each type offers distinct features and benefits tailored to different financial needs and goals. Understanding the differences between these policies is essential in selecting the most suitable option.

4. Cash Value:

Certain types of life insurance, such as whole life and universal life, accumulate cash value over time. This cash value grows tax-deferred and can be accessed by the policyholder through withdrawals or loans for various purposes, including supplementing retirement income or covering unexpected expenses.

5. Riders:

Insurance riders are additional provisions that can be added to a life insurance policy to customize coverage according to specific needs. Common riders include accelerated death benefit riders, which allow policyholders to access a portion of the death benefit if diagnosed with a terminal illness, and waiver of premium riders, which waive premium payments in the event of disability.

Conclusion:

In conclusion, life insurance plays a pivotal role in safeguarding one's financial future and providing peace of mind to individuals and their families. By understanding the importance of life insurance and its essential features, individuals can make informed decisions to protect their loved ones and ensure their financial well-being. Whether it's providing for dependents, settling debts, or planning for the future, life insurance serves as a critical tool in building a solid foundation for long-term financial security.

As life circumstances evolve, it's essential to regularly review and update life insurance coverage to align with changing needs and goals. By working with a trusted financial advisor or insurance professional, individuals can navigate the complexities of life insurance and create a tailored plan that meets their unique requirements. Ultimately, investing in life insurance is an investment in the well-being and prosperity of those who matter most, making it a fundamental aspect of any comprehensive financial strategy.

#life insurance#life insurance plans#life insurance premiums#life insurance policy#insurance company

0 notes

Text

Secure Your Future with BNZ Life Insurance Calculator:

Planning for the future involves making sound financial decisions, and securing life insurance is an essential part of that process. With the myriad of options available, determining the right amount of coverage can be overwhelming. Fortunately, tools like the BNZ Life Insurance Calculator exist to simplify the process and provide personalized recommendations. In this article, we'll explore how the BNZ Life Insurance Calculator works and how it can help you secure your future.

Understanding the Importance of Life Insurance:

Life insurance serves as a financial safety net for your loved ones in the event of your death. It provides a lump sum payment, known as the death benefit, to your beneficiaries, helping them cover expenses such as funeral costs, outstanding debts, mortgage payments, and ongoing living expenses. By having adequate life insurance coverage in place, you can ensure that your family is protected financially and can maintain their standard of living even after you're gone.

How the BNZ Life Insurance Calculator Works:

The BNZ Life Insurance Calculator is a powerful tool designed to help you assess your life insurance needs accurately. It takes into account various factors to provide customized coverage recommendations tailored to your unique circumstances.

Here's how you can use the BNZ Life Insurance Calculator to secure your future:

Input Personal Information: Start by providing basic information such as your age, gender, marital status, and annual income. This information helps the calculator generate personalized recommendations based on your individual situation.

Evaluate Financial Obligations: Next, input details about your financial obligations, including outstanding debts (such as mortgages, loans, and credit card balances), funeral expenses, and any other anticipated expenses your beneficiaries may incur.

Consider Future Needs: The calculator prompts you to consider future financial needs, such as your children's education costs, ongoing living expenses for your spouse or dependents, and any other financial obligations you anticipate in the future.

FOR MORE DETAILS PLEASE VISIT:

BNZ Life Insurance Calculator: Secure Your Future with us

0 notes