#medical bookkeeping excellence

Text

youtube

Bookkeeping testimonials for medical industry | Medical accounting course reviews

Here's Emily Johnson's testimonial after being awarded and completing the course "Bookkeeping for Medical Industry - Xero"

#xero course success#medical industry bookkeeping#bookkeeping course review#empowered learning experience#expert bookkeeper insights#medical bookkeeping excellence#bookkeeping for Medical pratice#testimonial for medical bookkeeping certification#medical accounting course reviews Bookkeeping certification course testimonials#bookkeeping testimonials for medical industry#testimonial for Bookkeeping for Medical Industry Course#Medical accounting course reviews#Youtube

0 notes

Text

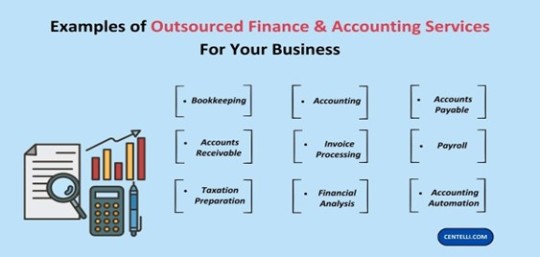

Types of Finance and Accounting Functions a Business May Outsource

Business has always been a super competitive field. It’s hard to build and operate a successful company. But you also need to have constant grit and gumption to ensure long-term success.

A business owner must prioritize their core activities and focus. But it may not be possible when your people and resources are consumed by non-core activities.

That is why businesses are often better off delegating administrative supportive or operational functions to a third party. But before outsourcing a function, you should evaluate its contribution and impact on the company’s operations.

It’s because some non-core activities might also be direct contributors or closely aligned with your company’s core competencies.

Share

Significantly, finance and accounting outsourcing (FAO) can be an excellent move. Also, you may outsource an entire function, multiple processes, or a single process, as required.

Below are a few examples of finance and accounting functions that businesses typically outsource. Let’s explore these one by one and also check out the key benefits that come along.

1. Bookkeeping

Bookkeeping exercise is a must for every business aiming for good financial health. Whether you’re a large or small company, every financial transaction should be recorded on paper or in a digital format. Accounting software are mostly used nowadays!

Every significant detail like cash or cheque payment or receipt invoices, bills, and credit sales (or purchases) goes into the books of accounts. Other key activities include bank reconciliations and financial report generation.

However, these tasks are repetitive, routine, and time-intensive. By outsourcing bookkeeping, business owners can free up their staff and paraphernalia and use them elsewhere. For example, you can redirect them to core activities and more valuable tasks.

2. Accounts Receivable and Accounts Payable

You can choose to outsource your accounts receivable (AR) and accounts payable (AP) functions to an external provider. AR and PR entail tracking a business’s incoming receipts and outgoing payments respectively.

The service provider executes and manages tasks like invoicing, billing, payment collection, etc. These processes demand regularity and timeliness. They become more and more complex as the business grows and you’ve more customers and vendors on board.

By appointing an efficient service partner, you can achieve a seamless accounts receivable and accounts payable functions, which are fast and error-free.

3. Payroll Processing

Your employees are crucial to your business success. A robust payroll system ensures they’re happy. So, you can appoint an expert payroll processing service to manage it for you.

The service provider takes of all payroll-related tasks, including calculating employee salaries or wages applicable deductions, medical and insurance, and other benefits and perks. Aside from generating paycheques, they can also help with tax preparation and filing.

Share

Payroll processing can be complex and time-consuming, especially for large enterprises. However, it can as troublesome for all businesses during tax season. Outsourced payroll processing ensures you’ve an up-to-date payroll process in place.

4. Financial Reporting

Financial reports enable you to look at the big picture and also get into the finer details about your business’s financial health at any given point in time. If you’ve expert financial services to manage the financial reporting, you can rest assured of its findings.

An expert summary of your business performance enables business owners and managers to make informed decisions about the company’s future course. Outsourced financial reporting can ensure that the report generation activity is timely and standardized. It also helps businesses comply with all applicable financial reporting norms.

5. Taxation

Registered businesses are liable to federal or state taxes. Needless to say, tax preparation and filing tasks are complex and strenuous for small as well as large businesses. Errors and delays can put you in a tough situation where penalties or other complications may arise.

By outsourcing taxation to a specialist tax services provider, you can ensure that tax returns are prepared accurately and filed on time. As such, your businesses shall be on top of compliance always.

6. Budgeting and Forecasting

Business owners need to think ahead, to keep up with market fluctuations, and emerging opportunities and challenges. Budgeting and forecasting help you make financial plans for the future. The process involves revenue and expense estimations, financial goal setting, and tracking progress.

Your outsourced service provider can provide you with accurate and up-to-date budget and forecast processes for better analysis.

As such, you’ll be able to take the right decisions at the right time, enabling efficient allocation of resources and efforts for further growth.

7. Financial Analysis

An accurate financial analysis can help your business avoid risks and tap into profitable opportunities.

If you’re a business or accounting firm looking for reliable FAO services, you can consider Centelli. We’re a UK company mainly serving Europe, India, and the United States. We offer result-bearing, scalable accounting outsourcing solutions to businesses of all sizes. Click to Contact us for a Free Consultation and Quote now!

An expert financial analysis service provides accurate reports backed by deep understanding and care. Financial data thus prepared allows you to assess and interpret where your business stands and identify the areas of strength and improvement.

An outsourced specialist financial service can also support you with investment and financial strategies. You can access the expertise and resources you may not have in-house.

8. CFO Services

Outsourced chief financial officer, or CFO services are highly specialized. These C-level services can help you with key business, finance, accounting, and operational decision-making.

The CFO service takes care of all the top-level strategic financial decisions, such as financial planning, budget planning treasury management, risk management, etc. They also aid you during business restructuring, funding, or expansion efforts.

Only well-qualified and seasoned CFO outsourcing services can provide you with the required expertise and know-how.

Factors to Consider While Outsourcing Finance and Accounting

A qualified FAO service provider can help you improve both accuracy and efficiency of your financial operations.

Looking for reliable and transparent FAO services partner to help improve your productivity and efficiency? You can leverage a wide range of outsourced financial and accounting solutions from Centelli to achieve your goals. Explore our F&A services portfolio here!

However, you should carefully select which are the processes and subprocesses that can be outsourced. It’ll help you maximize your finance and accounting outsourcing benefits.

Here’re the 7 golden rules you need to keep in mind:

Your business’s needs, priorities, and goals

The level of expertise you require

Your budget

Potential FAO service partner’s standing and experience

Range of services offered and pricing

Scope of customization if you seek a solution to a specific problem

Service provider’s security and compliance capability

0 notes

Text

Employ the Services Of Well-Dependable Accountants at St Kilda to Manage Finances

Make sure your company has readily available, accurate, and up-to-date financial data by taking advantage of the excellent accountants at St Kilda available. By consulting with our clients, they can make sure that your bookkeeping service meets all of the needs of your company. Their diligent and committed financial specialists can help you run your company with confidence and peace of mind, from creating paperwork such as yearly reports to evaluating the financial status and health of the company.

Manage your Taxes By Hiring Dependable Experts

It's not easy to financially manage a medical practice which is why hiring expat tax services in Sydney is a great idea. Australia's tax and compliance regulations are highly complicated and subject to frequent updates and revisions, and there is a never-ending stream of new forms and regulations that need to be fulfilled.

They are aware that our colleagues frequently anticipate complete delegation of authority, responsibility, and labour from their clients. They value it when we help you acquire a foundational understanding of accounting and taxation so you can efficiently manage your finances, or at least know.

Explore the Benefits of Tax Services for Foreigners

They offer a wide range of services related to expatriate workers, whether you are a company making use of foreign resources or a person employed in Australia under a visa. The professionals, who specialise in expatriate tax, create a global level playing field. Using the power of our global network, which includes member companies in all significant financial and economic hubs, provides:

A worldwide network of knowledge and assistance

Global factors accessible at the local level

Guaranteed assistance if your enterprise expands globally

Permits the use of global experience in all stages of the planning and taxation procedures

Options to think about integrating a global workforce into your business plan.

It is imperative that you accurately disclose your trading outcomes to make well-informed judgements regarding the future course of your company. Professional book-keepers take great satisfaction in offering the data that entrepreneurs everywhere need to manage their operations daily.

Accounting and Bookkeeping Service For Your Advantages

Make sure your company has readily available, accurate, and up-to-date accounting information by taking advantage of the excellent bookkeeping services available.

The diligent and committed financial specialists can help you run your company with confidence and peace of mind, from creating paperwork such as yearly reports to evaluating the financial status and health of the company. They are aware that our colleagues frequently anticipate complete delegation of authority, responsibility, and labour from their clients.

Source

0 notes

Text

The Top 5 Work-From-Home Jobs in Nevada

The Top 5 Work-From-Home Jobs in Nevada: Enjoy Flexibility and Comfort While Earning Money

Are you tired of the daily grind of commuting to work and spending long hours in the office? Do you want to enjoy the flexibility and comfort of working from home? If so, you're in luck! Nevada is home to many work-from-home opportunities that can help you achieve your dream job. In this article, we will explore the top 5 work-from-home jobs in Nevada.

The Top 5 Work-From-Home Jobs in Nevada

Customer Service Representative

Virtual Bookkeeper

Online Tutor

Medical Transcriptionist

Social Media Manager

Customer Service Representative

As a customer service representative, you will be responsible for answering customer inquiries, resolving issues, and providing excellent customer service. You will communicate with customers via phone, email, or chat. Many companies hire customer service representatives who work from home, making this job a perfect fit for those who enjoy working with people.

Virtual Bookkeeper

If you have a background in accounting or finance, you can work as a virtual bookkeeper. In this role, you will be responsible for managing a company's financial records, creating financial statements, and reconciling bank statements. As a virtual bookkeeper, you can work from home and enjoy a flexible schedule.

Online Tutor

If you have a passion for teaching and knowledge in a particular subject, you can work as an online tutor. You can provide online tutoring services to students of all ages, from elementary school to college. As an online tutor, you can work from the comfort of your own home and set your own hours.

Medical Transcriptionist

As a medical transcriptionist, you will be responsible for transcribing medical reports from audio files. You will need to have excellent typing skills, attention to detail, and knowledge of medical terminology. As a medical transcriptionist, you can work from home and enjoy a flexible schedule.

Social Media Manager

If you have a knack for social media, you can work as a social media manager. In this role, you will be responsible for managing a company's social media accounts, creating content, and engaging with followers. As a social media manager, you can work from home and enjoy a flexible schedule.

FAQ

Are work-from-home jobs in Nevada legitimate? Yes, there are many legitimate work-from-home jobs in Nevada. However, you should always research the company and job offer before accepting a position.

Do work-from-home jobs pay well? The pay for work-from-home jobs varies depending on the company and position. Some work-from-home jobs pay very well, while others pay less than traditional office jobs.

Do I need special skills or qualifications to work from home? Many work-from-home jobs require specific skills or qualifications. However, there are also many work-from-home jobs that don't require any special skills or qualifications.

How do I find work-from-home jobs in Nevada? You can find work-from-home jobs in Nevada by searching online job boards, company websites, and social media. You can also network with friends and family to find job opportunities.

What are the benefits of working from home? Working from home offers many benefits, including a flexible schedule, no commute, and the ability to work in comfortable clothes. It can also save you money on transportation and other expenses.

Can I work from home if I live outside of Nevada? Yes, many work-from-home jobs can be done from anywhere in the world. However, some companies may prefer to hire workers who live in a specific location.

Conclusion

In conclusion, work-from-home jobs in Nevada offer a great opportunity to enjoy the comfort and flexibility of working from home while earning a steady income. The top 5 work-from-home jobs in Nevada include customer service representative, virtual bookkeeper, online tutor, medical transcriptionist, and social media manager. Each of these jobs offers a unique set of skills and qualifications, making it easy for you to find a job that suits your needs.

Working from home has become increasingly popular in recent years, and it's not hard to see why. The freedom and flexibility of being your own boss, setting your own hours, and avoiding the daily commute are just some of the benefits that come with working from home. Whether you're a stay-at-home parent, a college student, or simply someone who wants to escape the daily grind of the traditional office job, work-from-home jobs in Nevada can provide you with the opportunity you need to succeed.

So, if you're ready to take the leap into the world of work-from-home jobs, now is the time to start exploring your options. With so many opportunities available, you're sure to find a job that fits your skills, qualifications, and lifestyle. Start your search today and discover the many benefits that come with working from home in Nevada.

0 notes

Text

Why You Should Hire A Marketing Consultant For Your Corporation

Works with CEOs and senior business leaders at financial services, skilled services, and technology firms of all sizes to craft imaginative and prescient into strategy and design break through model,... Works with CEOs at industrial, logistics, and manufacturing corporations to develop profitable marketing initiatives that drive revenue and market share development. Works with healthcare services, IT, SaaS, medical system, life science, biotech, and retail/hospitality firms what is cmo in business to develop effective development methods, enhance patient/customer care, and enhance... Works with B2B world know-how companies and in varied industries to turbo-charge growth and build enduring customer relationships, using battle-tested account-based gross sales and marketing strategies.

AT CMO GROW we perceive that right now office is an activity, not a vacation spot. We are now residing in an outsourced or “cloud serviced” world, Marketing and Sales outsourcing supplies world-class services at a fraction of the value of hiring a marketing govt and will turn out to be the new norm. Hiring KARMA jack as your marketing consultant will make your organization extra searchable with web optimization fractional cmo digital marketer, producing extra site visitors for you and your small business. We ensure your website is accessible, easy to search out, and matches your band. Our objective is to generate visitors, find leads, and proceed to extend income. Generally speaking, CMOs do the same functions and duties as full-time CMO but for fewer hours.

They require vastly completely different approaches, and this makes the tasks interesting. To dive into the primary points of a business and thoroughly evaluate the outcomes, I must spend no much less than 20 to 25 hours per month on a project. As a boutique service, it will not be very scalable, however I will have the power to give my clients the complete consideration and the time that they want what is a fractional cmo. The proper consultant (and I humbly refer to myself as such) builds their work in such a means that they'll leave the project at any time and the business will nonetheless maintain flourishing. A great example I often see is that of the workplace manager/bookkeeper/controller. Often, someone is assigned this position despite not being able to closing the books, yet the corporate is counting on them to offer accurate and well timed financials.

You can begin by contracting their services for as few hours weekly as you need, and scale as you develop. We develop data-driven social campaigns to target your consumer’s ideal contact factors, guaranteeing the proper people are always met with the best message. We start by constructing a digital playbook round cmo consultant what makes your corporation unique, serving to you to leverage strengths and make higher impact inside industry specific markets. Whether you're a longtime brand or burgeoning business, Hawke Media exists to provide you access to best-in-class marketing services.

Works with technology-centric firms in SaaS, IT services, computing, and technical business services to drive worthwhile progress and speed up market adoption. Works with SaaS, expertise, and media firm CEOs and non-profit organizations to drive technique and operational plans for worthwhile how does a fractional cmo work development. Works with technology, SaaS, and ed-tech firms to fuel revenue and market share progress by harnessing customer insights and leveraging technology to drive innovation.

You want a firm and a consultant who would not approach their clients with a one-size-fits-all mentality. Additionally, a firm that provides a fixed charge isn't normally an excellent long-term resolution as they how does a fractional cmo work may discover a approach to reduce corners to gain margin. Mostly, you want to find the solution that is going to be customized to you particularly and one which is prepared to evolve with you as you grow.

Overall, the period of engagements can differ widely, and the number of days worked per week will depend on the particular needs of the client and the scope of the engagement. However, fractional CMOs and part-time CMOs sometimes work one to three fractional cmo marketing days per week, while marketing consultants may fit on a project foundation and may work part-time or full-time relying on the needs of the project. Our content distribution program sX Social 334 establishes your constant marketing message in your required vertical markets.

Alacrita has a quantity of CMO-level medical MDs in our consulting group, who assist our biotech purchasers as interim Chief Medical Officers, during for example, intervals of prolonged seek for a full-time particular person. Our CMO consultants are typically out there for as much time because what does fractional cmo mean the engagement requires. Maybe your organization already has great executive stage leadership when it comes to conventional promotional and advertising channels, but is missing that same level of power within the digital realm.

Works with B2B industrial, know-how, and SaaS companies to unlock EBITDA and topline development by rethinking technique and execution throughout the commercial spectrum of sales, marketing, and product. Works with industrial corporations to drive double-digit revenue development and margin improvement through fractional cmo services distinctive strategic sales initiatives and high-impact revenue growth solutions. Works with CEOs in SaaS and Professional Services to develop new growth strategies and income models, drive gross sales execution and ship M&A integration that increase firm valuation.

0 notes

Text

AI Is Here, and It Is Already Replacing Me

Well, at least, that’s the only assumption I can make. Everything correlates, but correlation doesn’t necessarily mean causality; I just can’t find another explanation.

Let’s start from the beginning.

I had done plenty of writing and marketing over my lifetime, but financial desperation during the pandemic pushed me to try copy and content writing through internet-based writing services. It turned out I am good at it. Ok, better than good; one of the elite.

Things started steamrolling fast, and I pronounced writing my full-time profession two months after I started and only continued to my career and earnings for the next 13 months.

Then Along Came AI

It has now been three weeks with close to zero work, which correlates very well with the release of ChatGPT 4.0. And I’m not alone. Other very proficient copy and content writers have no work whatsoever. We feared AI when it took off, like the USS Enterprise jumping to warp speed, but we all thought there would be a lot more time.

ChatGPT was released on November 30, 2022, and reached 100 million users within two months. No other internet application even comes close to that rapidity of growth. Facebook needed four and a half years to reach 100 million users. Instagram needed two and a half years, Twitter took five years, and even the sensation that is TikTok took nine months.

Within the first month of ChatGPT, realtors were already praising it for its ability to write their listings, but overall it was pretty lousy. Its writing was bland and reflected that the system merely redistilled what it found online. We writers were left thinking, “Ok, so the content mills comprised of writers in India will be replaced, but we’re too damn good to replace for at least some time.”

It wouldn’t replace those of us that get results, right?

AI Moves Faster Than We Can Comprehend

When one hears that AI is self-learning, that description is bound by our own experience. We think of learning something as a process that takes extended periods of time with subsequent gain after gain, but when AI learns, it isn’t linear or at a fixed rate. AI learns and grows exponentially, meaning it can learn anything in ever shorter periods of time.

Here’s an example: ChatGPT 3.5 passed two sections of the Bar Exam (and failed the multiple choice section) in January, achieving similar scores to average test takers. Chat GPT 4.0 passed the entire Bar Exam in the top 10% of test-takers in mid-March.

ChatGPT didn’t only develop an incredible legal ability in a couple of months but has shown the same progression and results on medical and business school exams. It will only continue to improve, and even its creators don’t know where it will be heading next.

The Behavioral Economics Question

As a huge fan of using economics to evaluate human behavior, I have to question how willing businesses are to trade off high-quality writing that speaks to their customers for lackluster free content.

Unfortunately, writers see our services constantly devalued, with people that want excellence and highly educated writers for minimum wage rates. AI will better serve those people, but how will those that spend more for quality work weigh the quality/cost tradeoff? For now, it seems that cheap is winning. Where we go from here is questionable, but most freelancers can’t handle this lack of work for any time.

Many companies might eventually realize that using original, non-AI-generated writing gives them a competitive edge over others, but that remains to be seen.

Other Careers in Question

Where human creativity isn’t prized, AI might already impact those working as paralegals, 1st-year attorneys, and coders. Eventually, we can expect it to start replacing financial advisors, bookkeepers, truck drivers, receptionists, retail workers, and people monitoring and programming the AI itself.

The Timeline has Changed

Once, I believed the futurists were fairly correct, if not overly cautious. Google futurist Ray Kurzweil predicted that about 2050, AI resulting from incredible computing power would create daily innovations and disruptions to the point of imbuing humanity with near-god-like powers, including the possibility of never dying. All bets would be off the table.

David Levy, in his seminal work “Love and Sex With Robots,” predicted it would be in that same time frame that humans would be falling in love with and marrying humanoid robots.

Personally, I thought they were about 5-7 years behind, but we were all wrong.

While we all based predictions on computing power growth, we missed the advancement in how the code is written. Intermodal large language models work across what were once separate AI systems and learn at rates not previously imagined. All bets are off the table now.

What was predicted to happen around 2050 could happen by the early 2030s. Within a year, the changes could be seismic.

So, What Now

For now, I am still the far best choice for companies that need outstanding writing; whether they come to me is another story entirely. Strategizing and marketing myself is my daily regimen. I hope to find a full-time job immediately before a writer and his puppy have to hold up a sign at the intersection stating, “One of the first automated away. Will write for food.”

My greatest concern is the total lack of preparedness in our country. It's been apparent for years that this day would eventually come. Yet, we’ve been hamstrung with a political party more worried about morality laws and culture wars than feeding our own and planning for the future.

This doesn’t clear itself up, and it doesn’t create new jobs, only replaces them. This isn’t the 90’s tech boom.

Unless addressed now, AI tremendously exacerbates inequality worldwide and reverses the worldwide gains in alleviating poverty that has happened over decades. Our economics have to change, taxation has to become far more progressive, and laws need to be enacted to reign in a new corporate AI war that could quickly upend humanity.

Combined with the impacts of climate change we continue to fail to address, mankind is not on a good path, and we must act now.

Brian McKay is (maybe was) a professional writer, MBA, political scientist, the creator of a few silly things, and an overall decent dude. He urges you to promote progressive political candidates that take the future of our world seriously.’

0 notes

Text

Do you feel overwhelmed with your medical accounting needs? Medvisor can help! With our expert team of professionals, we provide tailored solutions to help meet your medical accounting needs in Melbourneand beyond. Our services include bookkeeping, payroll, tax preparation, financial reporting and more. Our top-notch customer service and commitment to excellence have earned us 5/5 ratings from clients. Let us be your strategic partner for medical accounting today!

0 notes

Text

How to Choose the Right Bookkeeping Services in Dallas for Your Business?

As a business owner in Dallas, choosing the right bookkeeping services can make all the difference when it comes to keeping your finances in order. With so many options available, it can be overwhelming to know where to start. In this article, we'll discuss some key factors to consider when choosing the right dallas bookkeeping services

Industry Experience:

When choosing bookkeeping services in Dallas, you want to ensure that the provider you choose has experience in your industry. Each industry has its unique tax laws, regulations, and financial requirements, so it's essential to choose a provider that understands these complexities. For example, if you're in the healthcare industry, you'll need a provider that has experience with HIPAA regulations and medical billing. Similarly, if you're in the construction industry, you'll need a provider that understands job costing and project management.

Services Offered:

Another critical factor to consider when choosing bookkeeping services in Dallas is their range of services. You'll want to choose a provider that offers a wide range of bookkeeping services, including accounts payable and receivable, financial statement preparation, payroll processing, and tax planning. A comprehensive suite of services ensures that all your financial needs are met, and you don't have to rely on multiple providers for different aspects of bookkeeping.

Technology:

Technology has changed the way bookkeeping services in Dallas operate. Many providers now use cloud-based software to manage their clients' finances, making it easier to access financial data from anywhere. You'll want to choose a provider that uses the latest technology to ensure your financial data is secure and easily accessible. Additionally, you'll want to ensure that the software used by the provider is compatible with your business's accounting software.

Communication:

Communication is a critical factor when it comes to choosing bookkeeping services in Dallas. You'll want to choose a provider that communicates effectively with you and your team. A good bookkeeping provider should be responsive to your queries and provide regular updates on your financial status. Additionally, the provider should be able to explain financial data in a way that is easy to understand, even for those without an accounting background.

Reputation:

Reputation is everything in the bookkeeping industry. Before choosing bookkeeping services in Dallas, you'll want to research the provider's reputation. You can do this by reading online reviews and checking with the Better Business Bureau. Additionally, you can ask for references from the provider and contact them to ask about their experience working with the provider. A good reputation is a sign of quality service, and you'll want to choose a provider that has a proven track record of excellence.

Cost:

Cost is always a factor when it comes to choosing bookkeeping services in Dallas. You'll want to choose a provider that offers transparent pricing and doesn't surprise you with hidden fees. While you don't want to choose the cheapest provider, you also don't want to overspend on bookkeeping services. It's essential to find a provider that offers quality service at a fair price.

Flexibility:

Finally, you'll want to choose bookkeeping services in Dallas that are flexible enough to meet your unique business needs. A good provider should be willing to customize their services to meet your specific requirements. For example, if you need more frequent financial reports, the provider should be able to accommodate your request. Additionally, the provider should be able to scale their services as your business grows, ensuring that they can meet your evolving financial needs.

In conclusion

choosing the right bookkeeping services in Dallas can have a significant impact on your business's financial health. By considering the factors discussed above, you can choose a provider that meets your unique requirements and helps you achieve your financial goals. Remember to do your research, ask for references, and choose the right bookkeeping services in Dallas.

0 notes

Text

Types of Document Scanning Services

There are various sorts of record examining administrations accessible today:

Bulk document scanning: Excellent scanners are utilized to examine enormous volume reports in a solitary shot as opposed to requiring the client to take care of single pages into the scanner, and deal with each document independently. This degree of viability can mean the contrast between an examining interaction that requires a little while and one that requires only a couple of days.

Large Format Scanning: In this help, extra-enormous examining gadgets are expected to filter guides, designing or building drawings, banners, or whatever else estimating 54″ by 72″. Huge actual things can be checked in enormous configuration to create lovely pictures. You can conclude whether you really want your things in variety or high contrast, as well as the goal, document type, and size.

Microfilm and Microfiche scanning: Organizations used to store their information on microfilm and microfiche in the past often. Computerized documents are currently less difficult to find, access, offer, and store because of mechanical headways. Your old movies can be changed over into accessible advanced documents by utilizing proficient scanners.

Clinical Record scanning: For medical services suppliers, the productivity of following patient consideration has essentially improved with the electronic administration of patient wellbeing records, solutions, and records. Clinical records checking makes it conceivable to rapidly and reasonably file and output any volume of clinical records. These administrations additionally ensure patient security and adjust to HIPAA guidelines.

OCR scanning: OCR, or optical person acknowledgment, is a help that empowers altering and explanation in checked records. OCR permits you to look for explicit words or expressions and alter text as opposed to giving you a level, one-layered picture.

On location and Off-site scanning: In spite of the fact that examining is normally done offsite, on location checking can be mentioned assuming your records request the most elevated level of safety. With on location examining, there is lesser chance of losing or losing reports while they are on the way, and you can add a safety effort by having a laborer watch the system. The downsides of this sort of administration are it very well may be more costly and the size of the archives you can have filtered might be confined.

HR Report scanning: It involves examining staff records, work arrangements, CVs, continues, and request for employment structures, as well as finance data, clinical protection structures, and debilitated leave applications. As well as having productive and reliable electronic record chronicles, it empowers HR divisions to expand their functional limit. HR archive filtering empowers HR divisions to get to records rapidly, saving time and meeting government consistence necessities.

Bookkeeping Record scanning: Bookkeepers should be capable in the most up to date security strategies as well as fast and exact. They can undoubtedly sort out and oversee records assuming the paper archives are checked and changed over into advanced design. Approaching solicitations, different records connected with creditor liabilities, explanations, credit notes, charge notes, cost reports, banking archives, and review reports are completely checked as a feature of this help.

Authoritative Record scanning: Legitimate workplaces produce a critical volume of authoritative records, for example, contracts, testimonies, specialist reports, pictures, overarching legal authorities, and so on, which contain significant data and are defenseless against misfortune, harm, or difficulty to get to. These archives can be precisely examined, working with simple access and improving the adequacy and result of legitimate experts.

0 notes

Text

youtube

Testimonial for Medical Bookkeeping course | medical bookkeeping

In this enlightening video, we delve deep into the world of medical bookkeeping, and you won't believe the impact of testimonials

#medical bookkeeping#financial healthcare#medical billing and coding#medical bill#book keeping course#bookkeeping skills#real life testimonials#continuing professional development#professional development courses#financial management#testimonial reviews#personal finance management#financial excellence#healthcare accounting#healthcare management#financial skills#professional development#Customer Testimonials#Testimonial for Medical Bookkeeping course#Youtube

0 notes

Text

Why Should Small-Scale Firms Hire Accounting Services?

Your medic is your go-to expert for health and Wellness. Who should small-scale firm owners turn to when they need strategic advice about their firms?

It has a team of experts.

Why hire accountants?

If you have built a small-scale firm, you need to know your industry. It may learn about your products, customers and services like the back of your hand. When it comes to the ins and outs of tax, accounting and Finance, it never hurts to have an experienced person. You can turn to experts for guidance.

A growing number of accountants will take care of things such as cash flow projections, many of which include CFO-like roles.

What can accountants mean for their business? What are the benefits of hiring accounting services for medium business wellington?

30% of small-scale firm owners choose to hire an accountant to help them out. Even accountants' advice may seem more important than ever.

When applying for covid-19 related government funding, the state of small business research disclosed a fact. 73% of small-scale firm owners claim that piece of advice from an accountant was essential in the application process.

Accounting services for medium business wellington can help business owners avoid costly mistakes. It says that one-third of small-scale firm list Unforeseen expenses as their top challenge. It gets followed by personal finances and the inability to get payments on time.

How hiring an accountant can help you.

When you think about the services, an accountant provides tax filings and bookkeeping come to your mind. Business owners start expecting a variety of financial and advisory services. It is becoming more to expect accountants to help you improve profitability and upscale Your firm.

Accountants can help you with payroll processing.

Payroll can be complex and challenging part of your business. Fines and potential liabilities linked with it getting wrong can be significant. Payroll deductions can get complicated as each employee has different withholding depending on what they go for. You need to hire accounting services for clubs and charities wellington.

Accountants can help you with tax planning.

There are many tax planning strategies, such as accelerating and differing income. It needs to set up a retirement account too. It can help you lower your tax liabilities and help you save money.

Benefits of hiring an accountant

Accountants act like a financial advisor.

An accounting firm can serve as an advisor. The team ensures that all financial laws and regulations get followed. Furthermore, they track all payments and transactions. You can rely on Small business tax accounting wellington experts to support your claims. It gives proof and facts in case of a legal dispute.

An accounting firm can provide you with excellent financial advice.

Accounting firms handle a wide range of businesses. It varies from small garage startups to multinational corporations. As a result, they understand how finances work, and accountants can use strategies to boost your company's growth. Hiring accounting firms ensures you receive the best financial advice for your business strategy. They can tell you about various topics. It includes cost-cutting and growth, as well as other long-term plans.

#accounting services for medium business wellington#Small business tax accounting wellington#accounting services for clubs and charities wellington

0 notes

Text

Mastering Excel Charts and Graphs - Communicate Insights More Effectively

They say that a picture is worth a thousand words. Using Excel charting tools to visually display complex Excel data communicates the data’s message much more effectively to your target audience.

Chart and graphs are visual representations of your data. Viewing the data graphically makes the data less confusing and increases comprehension. It is easier to spot trends and patterns in your data sets.

Charts in Excel update automatically when the data is modified, so charts are always current.

Become more productive and efficient at communicating data to others.

Why Should You Attend

Attend this Microsoft Excel training to learn how to visually represent business data more effectively. Charts can be created not just in Excel, but also in PowerPoint, Word, and Outlook, making learning these tools extremely useful. Charts already in Excel can be copied and/or linked to Word and PowerPoint.

Objectives of the Presentation

You will learn how to create charts in Excel based on a variety of data sets.

There are so many chart types to choose from, and you will understand which chart type presents the data from which perspectives.

We will start with very basic charts, modify the data being represented in the chart and advance into more complex combination charts. You will also learn how to format the charts to create the perfect emphasis of data.

Learn to embed Sparklines, mini charts, right inside of a cell.

Areas Covered in the Session

» Creating charts in Excel

» Defining the components of a chart

» Formatting a chart

» Modifying a chart

» Adding chart elements

» Adding, editing and removing data

» Annotating with Trendlines

» Creating a combination chart and advanced Excel charts

» Using the sparkline chart, Excel

» How to make a graph in Excel

Who Will Benefit

This session is aimed at Excel users who have intermediate level knowledge and who wish to take their knowledge and understanding of the application to the next level.

» Business Owners

» CEO's / CFO's / CTO's

» Managers

» Accountants

» CPA's

» Financial Consultants

» IT Professionals

» Auditors

» Human Resource Personnel

» Bookkeepers

» Marketers

» Anybody with large amounts of Data

» Anybody who uses Microsoft Excel on a regular basis, and wants to be more efficient and productive

» Administrative assistants

» Teachers

» Students

» Sales associates

» Medical personnel

To Register (or) for more details please click on this below link:

https://bit.ly/3fFK4mV/a>

Email: [email protected]

Tel: (989)341-8773

0 notes

Text

What Is Medical Payment?

Medical payment is the procedure of creating and sending cases for health care solutions. A healthcare provider can either deal with the invoicing process directly, or they can contract out the process to charlotte health care billing services. In either case, the payment team must adhere to criteria of conduct to make sure the precision of information recorded. The info gathered will assist figure out the person's eligibility for solutions and also any type of previous consents. As a medical biller, you should be proficient in accountancy and bookkeeping, in addition to have a strong understanding of clinical terms. This understanding will certainly serve in liaising with individuals, healthcare companies, and insurance companies. In addition, clinical invoicing requires you to have excellent interaction skills as well as to work well in a team.

One more essential concern when it concerns clinical billing is conformity with market requirements. You'll wish to make sure that any type of third party you work with adheres to ideal practices as well as complies with sector policies. Furthermore, make sure to check their software program for mistakes, which can cause billing delays. If possible, use earnings cycle monitoring software to aid you determine and appropriate errors before they lead to a hold-up in solutions. As soon as a person offers info relating to insurance coverage and the reason for their visit, clinical invoicing begins. A clinical biller will certainly verify that the individual is eligible for solutions and also send an invoicing claim to the payer. This is performed in order to see to it the expense is exact. If the insurance company pays, the bill will certainly be posted to the person's account. You can see more here on clinical billing.

Any kind of remaining balances are after that written off, adjusted, or pursued with collections. When it comes to refuted claims, medical billers will certainly often deal with medical coders to prepare an allure letter as well as re-file insurance claims when required. Lastly, medical billers need to follow up with delinquent people as well as submit any type of income to balance dues administration, which tracks the payments as well as provides details on how much of the client's funds are owed. Medical payment requires mindful communication with people, insurance providers, clearinghouses, as well as providers. Clinical billers act as a bridge in between the person as well as compensation. They will discuss the patient's expenses and also alert them of any kind of exceptional equilibriums. They might likewise provide Descriptions of Advantages (EOBs), which define which medical treatments are covered by insurance plans.

A medical biller and also programmer are important to the cash flow of a clinical technique. They operate in a specialist office setting, guaranteeing that health care carriers are paid for their services. Medical coders and billers might benefit an exclusive practice, insurance company, or seeking advice from firm. Some even benefit the Federal and also State federal governments. Medical billing involves producing claims for health care solutions by utilizing medical diagnosis and treatment codes. These codes explain what was done as well as why. The biller needs to utilize precise CPT and ICD codes when submitting cases to payers. If the medical diagnosis as well as procedure codes do not match up, the insurance provider will certainly reject the insurance claim. Check out this related post: https://en.wikipedia.org/wiki/Medical_billing to get more enlightened on the topic.

1 note

·

View note

Text

Picking a Floor Covering Professional

Numerous neighborhoods call for that floor covering specialists have an organization permit and also annual specialist fees. A lot of floor covering specialists contend the very least a secondary school education and obtain on-the-job training. In some areas, a small business audit program may be practical to set up an economic bookkeeping system.The st. louis flooring contractor provider might likewise require to acquire business obligation insurance as well as a surety bond for some jobs. Getting at the very least three written bids from possible flooring specialists will assist you compare their rates and also services. The written proposals must include begin and also conclusion dates, products used, and also thorough summaries of job executed. They need to additionally consist of payment as well as waste management information.

Likewise, click here to see whether the specialist has good references. A floor covering professional with an excellent track record will certainly rejoice to reveal you referrals. Working with a flooring contractor is a superb method to boost the appearance of your residence and include worth to it. Having actually brand-new floors installed will certainly likewise boost the function as well as performance of your flooring. Selecting the best contractor will certainly be the primary step in guaranteeing the most effective results. It will certainly be necessary to review your demands with an expert floor covering contractor prior to making any decisions. As soon as you have actually selected a flooring service provider, it's time to consider insurance coverage.

It is necessary for a flooring professional to be insured against third-party insurance claims for home damages and also bodily injury. If a tile saw mistakenly reduces a spectator, this insurance coverage will certainly cover the expense of medical care, if needed. A little general obligation insurance claim can end up costing 10s of countless bucks. The majority of flooring specialists can not afford to pay for such costly lawsuits. An additional important item of insurance for a floor covering contractor is workers' payment insurance. Without this insurance policy, the floor covering specialist can be held liable for any kind of injuries triggered to the workers. Having insurance will certainly help the professional obtain more jobs, as well as make him extra appealing to basic service providers. Nevertheless, it may also be required for the floor covering service provider to have a proper vehicle insurance coverage to safeguard himself and his staff members.

While it may be tough to locate software application especially created for flooring contractors, a variety of applications exist that can assist you manage your service. One such software program is TurboBid, which has many features. It consists of an innovative takeoff tool that permits you to gauge swiftly and properly. This software application additionally connects thing expenses to takeoffs, making it easy for floor covering specialists to develop estimates. Floor covering installation is an intricate procedure, which needs specialized devices, abilities, and time. A poor or inept installment can trigger the flooring service provider to tire themselves and also damage the floor. The best floor covering service provider in Singapore will certainly have the experience and proficiency to finish the job properly. Moreover, he can bring the needed tools with him to make the process much faster and easier for you.To get more information about this post, visit: https://en.wikipedia.org/wiki/Floor#Subfloor_construction.

1 note

·

View note

Text

Just how to Hire an Estate Preparation Attorney

While estate planning lawyers are experts, you should understand exactly how to review their degree of service and also how much they charge. Although they may charge a per hour rate, lots of bigger firms will bill a flat fee of in between $375 as well as $1,000 an hour. When you initially meet with a lawyer, you will likely be asked to put up a retainer, which is cash that you will certainly pay up front. Some lawyers will certainly need a retainer up front, however will certainly repay you if they do not make use of all of it. Once you have actually chosen to hire an estate planning attorney, see to it you prepare all of the files you'll need to have finished for your will and also other legal documents. This includes your last will and also testament, name of administrators and guardians for any small kids. You must additionally develop any required trust funds. A will is not a bookkeeping of every little thing, so you have to review all accounts as well as share possessions with others, designate powers of lawyer and medical care proxy, as well as create a letter to consist of anything that's not consisted of in your will. Click for more details concerning estate planning attorney.

A will should be upgraded whenever your household's conditions transform. If you don't upgrade your will, your recipients may not get the advantage of it. In addition, it may be essential to alter the beneficiary designations when relevant laws transform. By hiring an estate preparation attorney, you can make certain that your household's wishes are succeeded your death. While you remain in the process of establishing your will, do not neglect to upgrade it consistently. If you have a handicapped partner, a "sweetie will" can be an excellent alternative. Such a will certainly can shield your properties if your partner dies unable to manage them. However, it can also bring about a disputed will suit, triggering your beneficiaries to lose their inheritance. It's best to speak with an estate planning attorney prior to making any type of changes to your will or various other lawful documents.

An estate preparation attorney ought to have the ability to explain your choices as well as aid you produce a plan that is finest for your scenario. Along with having an innovative education and learning, an estate planning attorney should also pass a state bar examination. Throughout their training, estate planning attorneys might take classes to aid them concentrate on this location. These courses can range from real estate law to tax. Additionally, lawyers ought to take courses in tax, accountancy, and also household legislation before finishing. While a lot of lawyers begin their job as affiliates, many advance a non-partner track to companion positions. Discover more more about estate preparation solutions here.

Placing your kid on the action to a family house is one more means to move possessions to your family members. However, placing your child's name on an action can create tax obligation issues and economic burdens for the youngster. On top of that, positioning the child on the action to the family residence might make your child the administrator of your estate, although that individuals might be much better fit to handle the estate obligations.

Keep reading on: https://en.wikipedia.org/wiki/Trust_law and most importantly, convert your knowledge into action, otherwise it remains a source of untapped energy as well as wasted potential.

1 note

·

View note