#kentucky fha loan grants

Text

2024 Welcome Home Grant Program for Kentucky Home Buyers $20,000

2024 Welcome Home Grant Program for Kentucky Home Buyers $20,000

2024 Welcome Home Grant Program for Kentucky Home Buyers $20,000

View On WordPress

#100 down kentucky fha loan#10000 down payment assistance kentucy#Federal Housing Administration#home-buying-and-down-payment-assistance-programs-in-kentucky#hud grants#Kentucky#kentucky fha loan grants#ky first time home buyer#Mortgage loan#Welcome Home Grant Program for Kentucky Home Buyers $20#zero down loan kentucky

0 notes

Photo

Kentucky First Time Home Buyer Programs for 2019 | Ultimateonlinemortgage.com Kentucky First Time Home Buyer Loan Programs for FHA, VA, KHC, USDA, Mortgage Loans in Kentucky for 2019. What Are The Credit Score & Income ...

#...#credit score#donw payment grant#FHA Mortgage#first time buyer kentucky#home loan#louisville mortgage requirements#mortgage#USDA Mortgage#Va Mortgage

0 notes

Link

Va Home Loans Interest Rates

Contents

Interest rate reduction refinance loan (irrrl

Pay pmi (property

Home loan fees range

Robust global economy

Before deciding to finance a home with a VA loan, learn about the different types of. Interest rates for VA loans are similar to, but usually lower than, traditional.

Learn about VA home loans benefits, eligibility requirements, and how to. In choosing a streamlined interest rate reduction refinance loan (irrrl) you can.

But conversations with individual city council members convinced Morales-Ferrand that the program, which would loan up to $20.

Advantages Of Being Native American Does Va Loan Require Mortgage Insurance A VA loan does not require borrowers to pay pmi (property mortgage insurance) premiums. The loan puts limits on the amount of closing costs that buyers are required to pay. A VA loan provides a home.A federal judge has thrown out a Kentucky teen’s lawsuit accusing the Washington Post of falsely labeling him a racist following an encounter with a Native American man at the. that Phillips.Grants For 100 Disabled Veterans Veterans Being a farmer means you’ll get the opportunity to be an entrepreneur, equipment repair specialist, soil scientist, and land steward all rolled into one. Use the resources here to get connected to training opportunities, program and career resources, and read stories like yours on the USDA Blog.

Central bank governor John Mangudya said in a monetary policy statement that increasing interest rates would stabilise.

Va Home Loan Certificate Of Eligibility Basic Entitlement VA loan entitlement can be a confusing topic, in part because the Certificate of Eligibility doesn’t clearly indicate how second-tier entitlement works. Talk with a Veterans united loan specialist about your specific situation and what might be possible.Veteran Personal Loans With Bad Credit VA Personal Loan Options for Veterans. There are several lenders offering personal loans for veterans and active members of the military, even those with bad credit. Unsecured loans up to $40,000 are available and interest rates range from as low as 4.99% to 36%, depending on your credit history. Military spouses and dependents also are.Veterans Affairs Home Loans Program A VA loan is a mortgage loan in the United States guaranteed by the United States Department of Veterans Affairs (VA). The program is for American veterans, military members currently serving in the U.S. military, reservists and select surviving spouses (provided they do not remarry) and can be used to purchase single-family homes, condominiums, multi-unit properties, manufactured homes and.Can You Have Two Va Home Loans Yes, homeowners may have a loan insured by the Federal Housing Administration (FHA) on one house and a Veteran Affairs (VA) loan on another house at the same time. It’s even possible to have two FHA and VA loans at the same time. How and when you obtain each loan may cause some issues with lenders, but generally this is permitted.

More than 100000 veterans have taken advantage of PennyMac's VA home loan options.. No down payment on home purchase loans; Lower interest rates.

Sign up here. White House Economic Adviser Larry Kudlow criticized Europe’s low and negative interest rates, contradicting his boss, President Donald Trump, who earlier in the week tweeted that.

People in Hertfordshire are more likely to claim on their car insurance than anywhere else in the UK Research by price.

CalVet home loan rates are linked to the bonds we issue. CalVet rates are intended to be under market to deliver an added benefit to our veterans.

VA home loan fees range from about 2% – 4% of the home's price. Find out the closing costs. for another lender. Check Today's VA Home Loan Interest Rates.

Carter Bank and Trust (NASDAQ:CARE) was the target of a significant decline in short interest. loans for financing automobiles, home improvements, education, and personal investments; real estate.

Recently a less robust global economy has caused many central banks such as the US Federal Reserve and the European Central Bank to lower their interest rates. At home, the domestic economy continues.

FD rates vary across banks so it’s always better to compare the interest rates on offer before your decide to invest in these.

This performance sets JMMB bank ahead of the local banking industry’s 16.9 per cent loan portfolio growth rate, over the same.

Discover how a VA loan can help you get your dream home.. Similarly to the interest rates, the VA loan being backed by the government also lets the banks.

No down payment requirement; Zero monthly mortgage insurance; Low interest rates; Lenient credit guidelines. Because VA home loans are guaranteed by the.

https://ift.tt/31sf26c

0 notes

Text

New Post has been published on Mortgage News

New Post has been published on http://bit.ly/2lnxnQa

report-2017-housing-starts-already-above-2016-average

Builder Optimism Turns Into New Home Construction

Low mortgage rates and high buyer demand are keeping single-family housing starts in the stratosphere.

In all of 2016 — a banner year for housing — an average of “just” 784,000 homes were started each month on a seasonally-adjusted, annualized basis.

In January, construction started on an impressive rate of 823,000 single-family homes annually.

If this pace keeps up, it would be the best year for new construction since 2007.

Builders are optimistic about the future. A recent report shows home builders are seeing high buyer demand and great prospects for the coming year.

A “started” home is one on which ground has been broken.

Housing starts have been fueled by rising rents, cheap mortgage rates, and an abundance of low- and no-downpayment mortgages.

FHA loans are gaining in popularity, as are other government-backed loans like the USDA home loan and VA.

The math for “Should I rent or should I buy?” has shifted and builders are scrambling to respond.

It’s an excellent time to shop for a home.

Click to see today’s rates (Feb 16th, 2017)

Single-Family Housing Starts Matter The Most

Each month, the U.S. Census Bureau and HUD co-publish the Housing Starts report.

Housing starts are broken into three categories, by property type.

1-Unit: Single-family homes, including row homes and townhomes

2-4 Unit: Multi-unit, residential residences with two-to-four units total

5+ Unit: Multi-unit, residential buildings with five or more units total

Structures with five or more units are more commonly known as “apartment buildings”. Apartment buildings are characterized by a common basement, heating system, entrance, water supply and sewage disposal.

Each apartment unit is considered a “start”. An apartment building with 150 planned units, therefore, is tallied as 150 housing starts.

The government reports that Single-Family Housing Starts rose 4% last month from the year-ago period, and that apartment starts fell seventeen percent.

Changes in apartment building construction, however, are of little importance to buyers like you and me.

This is because apartments are typically built by, and owned by, developers to use for rental housing. The majority of U.S. buyers don’t operate in this market. Everyday buyers don’t build or purchase entire apartment buildings — we live in single-family homes.

Tracking single-family housing starts, then, can be a better way to gauge U.S. new construction.

Single-family starts were six percent higher year-over-year in January, with three of four regions reporting higher activity. Permits to build new homes were up, with a 1.4 percent increase nationwide compared to one month prior.

At a pace of over 800,000 homes annually, builders are trying to keep up with strong demand.

Click to see today’s rates (Feb 16th, 2017)

South Region Leads Nation In Housing Starts Growth

Nationwide, year-over-year housing starts are up more than six percent. That figure is derived from a “mixed bag” of regions.

The results of any given report are mainly driven by the South and West Regions, which make up nearly 80% of the new home building activity in the country.

The South Region is the most massive, including Delaware, District of Columbia, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, West Virginia, Alabama, Kentucky, Mississippi, Tennessee, Arkansas, Louisiana, Oklahoma, and Texas.

This region also happened to lead the nation in housing starts growth. It posted near a ten percent gain in new single-family construction, while others fared almost as well.

Northeast Region: +8.6% from one month ago

Midwest Region: +6.3% from one month ago

South Region: +9.6% from one month ago

West Region: -18.6% from one month ago

Builder optimism is high in every region, as revealed by a report from the National Association of Home Builders (NAHB).

The February release of the NAHB Housing Market Index stated that home builders are “confident” in the housing market over the next six to twelve months. Builders reported a confidence score of 65 out of 100, one of the highest readings since 2005.

The upbeat outlook is showing itself in this month’s housing starts, as builders take action.

It seems the biggest concern for builders at the moment is finding buildable lots, and hiring workers to construct homes. If home builders could build more, they would.

Production is not meeting demand. That could mean higher prices in 2017, plus fewer free upgrades from builders, and more competition from other buyers.

The best deals in real estate could be the ones available right now.

Click to see today’s rates (Feb 16th, 2017)

Mortgage Loans For New Homes

The 2016 housing market was a good one. 2017 could prove even better.

Mortgage rates started the year in a downward spiral, then ticked up in November. But, rising rates could make home buying easier in 2017: mortgage lenders will be less busy with refinance business, and eager for home purchases.

As is stands, homes to buy are getting harder to find.

If you’ve been in the market for a home, no doubt you’ve noticed. It’s a competitive market and putting your best foot forward is essential if you want to “get the house”.

The good news is that mortgage approvals are getting simpler.

In addition to reducing their loan approval standards, mortgage lenders have recently lowered minimum credit score requirements, made concessions for self-employed income, and granted leniency on loans which “make sense”.

Furthermore, there are more low- and no-down payment loans available than during any period this decade.

In addition to the Conventional 97 program and HomeReady™ programs, which are backed by Fannie Mae and require just 3% down, demand for the FHA 96.5% LTV program is high, as are requests for “piggyback loans”.

There are also the VA and USDA loan programs — both of which allow 100% financing.

VA loans are available to eligible active-duty military personnel, veterans of the armed services, members of the national guard and reserves, and surviving spouses. They are optionally no money down and require no mortgage insurance.

USDA loans are also no money down, backed by the U.S. Department of Agriculture. Also known as Rural Development or RD loans, USDA can be used in many rural and suburban areas nationwide.

All low- and no-downpayment mortgages can be used for newly built homes, just as they can for previously owned ones.

Today’s mortgage programs make new homes more affordable and accessible to first-time home buyers.

What Are Today’s Mortgage Rates?

The housing market appears to be growing and mortgage rates remain low. If you’re planning to buy new construction, the best opportunities may be the ones you find now.

Get today’s live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

Click to see today’s rates (Feb 16th, 2017)

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Try the Mortgage Calculator

0 notes

Text

2024 Welcome Home Grant Program for Kentucky Home Buyers $20,000

View On WordPress

#2024 Welcome Home Grant Program for Kentucky Home Buyers $20#Credit score#FHA loan#Kentucky#Kentucky First-Time Homebuyer Loan Programs for FHA#Kentucky Housing Corporation#Mortgage loan#Refinancing#VA loan#Zero down home loans

0 notes

Text

2023 Welcome Home Grant Program for Kentucky Home Buyers $10,000

2023 Welcome Home Grant Program for Kentucky Home Buyers $10,000

Kentucky Welcome Home Grant for $10,000 for 2023 Kentucky Home Buyers for Down Payment Assistance.

Kentucky Welcome Home Grant for $10,000 for 2023 Kentucky Home Buyers for Down Payment Assistance.

2023 Welcome Home Grant Program for Kentucky Home Buyers $10,000

View On WordPress

#$10000 Down Payment Assistance Kentucky 2023 KHC#$10000 welcome home grant kentucky#10000 welcome home grant#Credit score#FHA loan#Kentucky#Kentucky Housing Corporation#Louisville Kentucky#Mortgage loan#VA loan#Zero down home loans

0 notes

Text

2023 Welcome Home Program for Kentucky Home Buyers

https://player.vimeo.com/video/786995325?h=6de85eb46d

What is the Welcome Home Program?

The Federal Home Loan Bank of Cincinnati (FHLB Cincinnati) offers grants of up to $15,000 for honorably discharged veterans, surviving spouses of military personnel, and active duty military homebuyers and up to $10,000 for all other homebuyers to assist with down payment and closing costs for income eligible…

View On WordPress

#$10000 Down Payment Assistance Kentucky 2023 KHC#000 for 2023 Kentucky Homebuyers#10000 welcome home grant#Credit score#FHA loan#Kentucky#Kentucky Housing Corporation#kentucky welcome home grant#Louisville Kentucky#Mortgage loan#Refinancing#VA loan#Welcome Home Grant $10#Zero down home loans

0 notes

Text

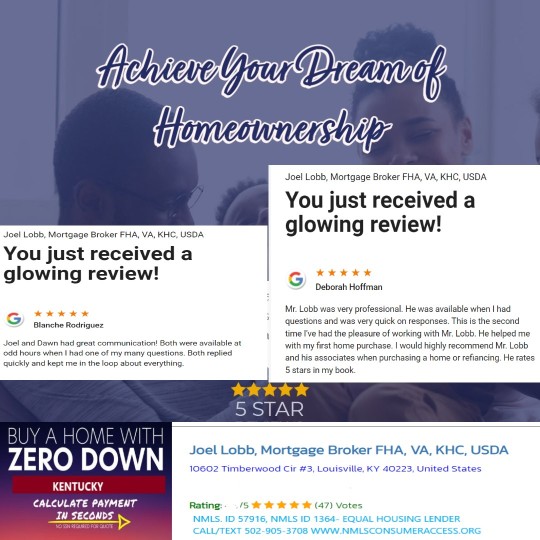

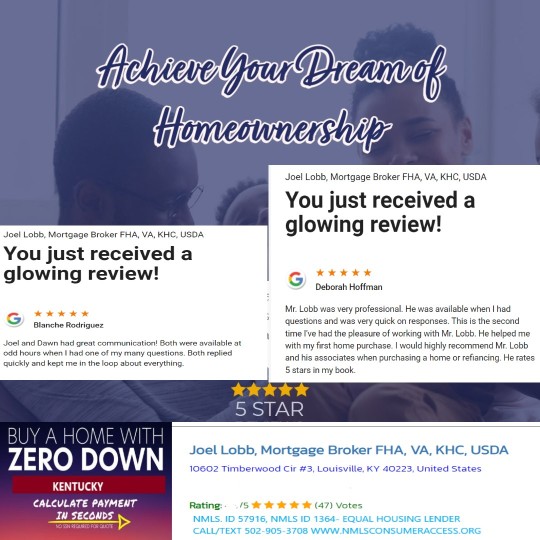

Kentucky First Time Home Buyer Lender for FHA, VA, USDA, Fannie Mae and Down Payment Assistance Grants

As a first-time homebuyer in Kentucky, there are several mortgage programs to consider. Each program has its own set of requirements, benefits, and considerations. Here are some of the primary options:

1. Kentucky FHA Loans

Kentucky Credit Score Requirements: Typically, a minimum credit score of 580 for a 3.5% down payment. Scores between 500-579 may qualify with a 10% down payment.

Down…

View On WordPress

#Credit score#First-time buyer#Kentucky#louisville#Mortgage#Mortgage loan#USDA#VA loan#Zero down home loans

0 notes

Text

Welcome Home Grant in Kentucky

5% Kentucky Home Buyer Grant

Kentucky Welcome Home Grant Program Guidelines

The Kentucky Welcome Home Grant is out of funds.

There are various types of down payment assistance, even if you have student loans.

Here are a few:

FHA loans – federal loan through the Federal Housing Authority

USDA loans – zero down mortgages for rural and suburban homeowners

VA loans – if military service

Kentucky Housing Down Payment…

View On WordPress

#5% Kentucky Home Buyer Grant#Credit score#First-time buyer#Kentucky#louisville#Mortgage#Mortgage loan#Refinancing#USDA#VA loan#Zero down home loans

0 notes

Text

Foreclosure Guidelines for FHA Mortgage Loans in Kentucky

Foreclosure Guidelines for FHA Mortgage Loans in Kentucky

FHA Loans in Kentucky with Foreclosure in the Past:

3 years from transfer date on Commissioner’s or Transfer deed must have elapsed prior to case number assignment date

An exception to the 3 year requirement may be granted if the foreclosure was caused by extenuating circumstances beyond the borrower’s control such as a serious illness or…

View On WordPress

0 notes

Text

Foreclosure Guidelines for FHA Mortgage Loans in Kentucky

Foreclosure Guidelines for FHA Mortgage Loans in Kentucky

FHA Loans in Kentucky with Foreclosure in the Past:

3 years from transfer date on Commissioner’s or Transfer deed must have elapsed prior to case number assignment date

An exception to the 3 yea

FHA Loans in Kentucky with Foreclosure in the Past:

3 years from transfer date on Commissioner’s or Transfer deed must have elapsed prior to case number assignment date

An exception to the 3 year requirement may be granted if the foreclosure was caused by extenuating circumstances beyond the borrower’s control such as a serious illness or death of a wage earner and the borrower has…

View On WordPress

#Credit score#FHA loan#Kentucky#Kentucky Housing Corporation#Mortgage loan#Refinancing#Zero down home loans

0 notes

Text

Debt-to-Income Ratio for Kentucky Mortgage Loans:

DEBT RATIO, FANNIE MAE HOMEPATH, FAQ’S ABOUT KENTUCKY FHA HOME LOANS, FHA LOANS KENTUCKY HOUSING FIRST TIME HOME BUYER, FHA MORTGAGE GUIDE, FIRST TIME HOME BUYER LOANS–KENTUCKY, INCOME, KENTUCKY FANNIE MAE HOMEPATH, KENTUCKY FIRST TIME HOME BUYER GRANTS AND DOWNPAYMENT ASSISTANCE, KENTUCKY MORTGAGE RATES FHA VA KHC, KENTUCKY USDA LOANS, KHC RATES KENTUCKY HOUSING RATES, LOUISVILLE KENTUCKY,…

View On WordPress

0 notes

Text

Kentucky First-Time Home Buyer Loan Programs

Kentucky First-Time Home Buyer Loan Programs

KENTUCKY FIRST TIME HOME BUYER GRANTS, CREDIT SCORE FIRST TIME HOME BUYER LOUISVILLE KENTUCKY KHC, FHA LOANS KENTUCKY HOUSING FIRST TIME HOME BUYER, FIRST TIME HOME BUYER

View On WordPress

0 notes

Text

Kentucky First-Time Home Buyer Loan Programs

Kentucky First-Time Home Buyer Loan Programs

Kentucky Foreclosed Homes Link

Kentucky Home Buyer & Homeowner Mortgage Guide

Kentucky home grant

KENTUCKY HOUSING CORPORATION

Kentucky Housing Mortgage Rates Louisville Kentucky

Kentucky HUD Homes for $100 Down

Kentucky Mortgage Approval

Kentucky Mortgage Rates

Kentucky Mortgage Rates and Home Loan Options

Kentucky Mortgage Rates FHA VA KHC

Kentucky Mortgage Refinance Questions to ask

Kentucky…

View On WordPress

0 notes

Text

Kentucky FHA Mortgage Loan Lender Guidelines

Kentucky FHA Mortgage Loan Lender Guidelines

fha (27)

fha credit scores (17)

FHA Good Neighbor Next Door (2)

fha income requirements (3)

FHA Mortgage Insurance 2017 Kentucky FHA Changes Mortgage (1)

FICO (7)

fico scores first time home buyer (13)

first time buyer (3)

First Time Home Buyers (8)

foreclosure (5)

Gaps in Employment (2)

gift funds (3)

grants first time home buyer kentucky (2)

home inspections (1)

home insurance (1)

homeready…

View On WordPress

0 notes

Text

Kentucky FHA Mortgage Loan Lender Guidelines

Kentucky FHA Mortgage Loan Lender Guidelines

fha (27)

fha credit scores (17)

FHA Good Neighbor Next Door (2)

fha income requirements (3)

FHA Mortgage Insurance 2017 Kentucky FHA Changes Mortgage (1)

FICO (7)

fico scores first time home buyer (13)

first time buyer (3)

First Time Home Buyers (8)

foreclosure (5)

Gaps in Employment (2)

gift funds (3)

grants first time home buyer kentucky (2)

home inspections (1)

home…

View On WordPress

#580 fico score FHA KY#FHA#fha approved condo#fha credit score#fha fico scores ky#FHA insured loan#FHA loan#fha loans kentucky#fha mortgage#fha mortgage bankruptcy#fha mortgage fico scores#hud $100 down fha kentucky#Kentucky#Kentucky FHA & Credit Scores#kentucky fha loan#kentucky fha mortgage#Kentucky Housing Corporation#Refinancing#Zero down home loans

0 notes