#jane martz

Text

Jane & Gordon Martz, Pair of table lamps,

Model created in the 1960's,

Ceramic, walnut, brass and textile,

Marshall Studios Edition Signed 'Martz,

H 61 ×Ø 40,5 cm

#art#design#sculpture#minimal#lamp#lighting#ceramice#jane martz#gordon martz#usa#1960s#walnut#brass#marshall studios edition#collectors

3 notes

·

View notes

Text

PAIR Jane & Gordon Martz Table Lamps with Original Finials for Marshall Studios ebay bygonesbytheriver

3 notes

·

View notes

Link

Tommy Lee Accused of Sexual Assault During SoCal Flight Mötley Crüe drummer Tommy Lee (born ... https://dev-usalivenews.pantheonsite.io/tommy-lee-accused-of-sexual-assault-during-socal-flight/?feed_id=28462&_unique_id=657ee0eba55e4 #movie film movies

0 notes

Photo

Dining table by Jane and Gordon Martz for Marshall Studios. (at Los Angeles, California) https://www.instagram.com/p/BxaG3RHHK_N/?igshid=md8hevkvxily

0 notes

Text

South Dakota e-commerce sale tax fight reaches U.S. Supreme Court

New Post has been published on http://newsintoday.info/2018/04/15/south-dakota-e-commerce-sale-tax-fight-reaches-u-s-supreme-court-2/

South Dakota e-commerce sale tax fight reaches U.S. Supreme Court

WASHINGTON (Reuters) – A high-stakes showdown at the U.S. Supreme Court on Tuesday will determine whether states can force out-of-state online retailers to collect sales taxes in a fight between South Dakota and e-commerce businesses.

FILE PHOTO: The South Dakota state capitol building is seen in Pierre, South Dakota, U.S., February 7, 2018. REUTERS/Lawrence Hurley/File Photo

South Dakota is asking the nine justices to overturn a 1992 Supreme Court precedent that states cannot require retailers to collect state sales taxes on purchases unless the businesses have a “physical presence��� in the state.

The state, appealing a lower court decision that favored Wayfair Inc (W.N), Overstock.com Inc (OSTK.O) and Newegg Inc, is being supported by President Donald Trump’s administration.

A ruling favoring South Dakota could help small brick-and-mortar retailers compete with online rivals while funneling up to $18 billion into the coffers of the affected states, according to a 2017 federal report.

The justices will hear arguments in the case on Tuesday against a backdrop of Trump’s harsh criticism of Amazon.com Inc(AMZN.O), the dominant player in online retail, on the issue of taxes and other matters. Trump has assailed Amazon CEO Jeff Bezos, who owns the Washington Post, a newspaper that the Republican president also has disparaged.

FILE PHOTO: A view of the U.S. Supreme Court building is seen in Washington, DC, U.S., October 13, 2015. REUTERS/Jonathan Ernst/File Photo

Amazon, which is not involved in the Supreme Court case, collects sales taxes on direct purchases on its site but does not collect taxes for items sold on its platform by third-party venders, constituting around half of total sales.

South Dakota depends more than most states on sales taxes because it is one of nine that do not have a state income tax. South Dakota projects its revenue losses because of online sales that do not collect state taxes at around $50 million annually, while its opponents in the case estimate it as less than half that figure.

Major retailers that have brick-and-mortar stores, and therefore already collect taxes, are represented by industry groups that back South Dakota. The National Retail Federation, which supports the state, has a membership list that includes Walmart Inc(WMT.N) and Target Corp(TGT.N), as well as Amazon.

Stephanie Martz, the federation’s general counsel, said in an interview the case gives the Supreme Court a chance to adapt the law to new circumstances prompted by the rise of internet shopping.

“Things have changed a lot since 1992. The entire nature of interstate commerce has changed,” Martz said.

E-commerce companies supporting Wayfair, Overstock and Newegg include two that provide online platforms for individuals to sell online: eBay Inc(EBAY.O) and Etsy Inc(ETSY.O).

“Win or lose at the Supreme Court, we will continue to advocate for a legislative solution and a level playing field where all retailers collect and remit sales tax on the same basis,” Wayfair spokeswoman Jane Carpenter said in a statement.

Brian Bieron, eBay’s senior director of government relations, said in an interview the 1992 precedent “provides the many small businesses that use the internet with a very clear and simple and stable legal environment in which to grow their business.”

Overturning the ruling while not replacing it with a new national framework “is really going to be a negative move in terms of e-commerce,” Bieron added.

A 2016 South Dakota law requires out-of-state online retailers to collect sales tax if they clear $100,000 in sales or 200 separate transactions. State legislators knew the measure was unlawful under the 1992 precedent.

The state sued a group of online retailers after the law was enacted to force them to collect the state sale taxes, with the aim of overturning the precedent.

Reporting by Lawrence Hurley; Editing by Will Dunham

Source link

0 notes

Photo

Gordon & Jane Martz tile top round table Marshall Studios rare mid century $900.00 via eBay http://ift.tt/2xhYq12

0 notes

Text

Vintage MCM Jane Gordon Martz Danish Marshall Studios Ceramic Pottery Table Lamp ebay

Cosmo*Vintage

2 notes

·

View notes

Photo

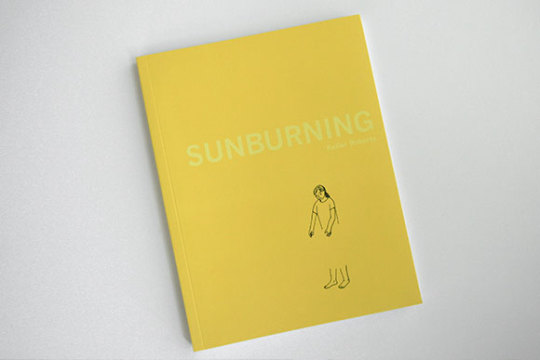

This year’s Toronto Comic Arts Festival (TCAF) marks the beginning of our 10-year anniversary celebration. We’ve been publishing comics and art books and attending TCAF, our hometown show, for a decade. This year we’ll be debuting 6 books: Eleanor Davis’ You & A Bike & A Road, Jesse Jacobs’ Crawl Space, Jane Mai and An Nguyen’s So Pretty / Very Rotten, Keiler Roberts’ Sunburning, Ben Sears’ Volcano Trash, and Eric Kostiuk Williams’ Condo Heartbreak Disco. All of our debuting authors will be on hand signing and celebrating with us (as well as some special guests), and involved in a variety of programming including a gallery show at the Japan Foundation for So Pretty / Very Rotten. We will also have bunch of exclusive 10th Anniversary Swag available with purchase at the Koyama Press tables. Also, be sure to check out the vitrine next to Page & Panel in the Reference Library for an exhibition of Koyama Press memorabilia!

Check out the full schedule of events below and see you in a few weeks!

TCAF: Toronto Comic Arts Festival

13–14 May 2017 | 13 May: 9AM–5PM and 14 May: 10AM–5PM at the Toronto Reference Library, Toronto, ON

Visit the Toronto Comic Arts Festival website for further details

TCAF Signing Schedule

SATURDAY

9-10AM | Jessica Campbell

10-11AM | Jesse Jacobs

11AM-12PM | Eleanor Davis

12-1PM | Ben Sears

1-2PM | Michael DeForge

2-3PM | Eric K. Williams

3-4PM | Keiler Roberts

4-5PM | Jane Mai and An Nguyen

SUNDAY

10-11AM | Jesse Jacobs

11AM-12PM | Eleanor Davis

12-1PM | Ben Sears

1-2PM | Michael DeForge

2-3PM | Eric K. Williams

3-4PM | Keiler Roberts

4-5PM | Jane Mai and An Nguyen

TCAF Programming

SATURDAY

10-11AM | Sound and Vision: Music in Comics w/ Eric Kostiuk Williams

10-11AM | Aesthetics of Sci-Fi w/ Ben Sears

11AM-12PM | Koyama Press 10th Anniversary Celebration (Michael DeForge, John Martz, Jane Mai, Fiona Smyth, and Aaron Leighton. Moderator: Dustin Harbin)

2:45-3:45PM | Comedy and Comics w/ Jane Mai

2:45-3:45PM | 21st Century Webcomics - Michael DeForge

SUNDAY

11AM-12PM | Little Miracles: Comics and Parenting w/ Keiler Roberts

12-1:15PM | Canadian Reading Series: Koyama Press Spotlight (Jesse Jacobs, Eric Kostiuk WIlliams, and An Nguyen all read from their TCAF2017 Debuts!)

2:45-3:45PM | Spotlight: Jillian Tamaki x Eleanor Davis

2:45-3:45PM | Canadian Reading Series: Kids! w/ John Martz

4-5PM | 10 Years 10 Years: Koyama Press x 2dcloud

So Pretty / Very Rotten Exhibition

8–10 May 2017 | Ribbon Army Gallery Show at Japan Foundation

11 May 2017 | Japan Foundation Book Launch 6-8PM

14 May 2017 | Special Sunday Ribbon Army opening 2-3PM

TCAF poster design by Eleanor Davis.

Koyama Press gratefully acknowledges the support of the Ontario Media Development Corporation.

#tcaf#toronto comic arts festival#koyama press#graphic novels#eleanor davis#jessica campbell#jesse jacobs#ben sears#michael deforge#keiler roberts#eric kostiuk williams#jane mai#an nguyen

71 notes

·

View notes

Photo

Dining table by Jane and Gordon Martz. #janeandgordonmartz #martz #marshallstudios #denlosangeles #modernfurniture #californiadesign (at Den Los Angeles) https://www.instagram.com/p/Bs6-JIanVcG/?utm_source=ig_tumblr_share&igshid=dj3ru1qbgzag

0 notes

Text

South Dakota e-commerce sale tax fight reaches U.S. Supreme Court

New Post has been published on http://newsintoday.info/2018/04/15/south-dakota-e-commerce-sale-tax-fight-reaches-u-s-supreme-court/

South Dakota e-commerce sale tax fight reaches U.S. Supreme Court

WASHINGTON (Reuters) – A high-stakes showdown at the U.S. Supreme Court on Tuesday will determine whether states can force out-of-state online retailers to collect sales taxes in a fight between South Dakota and e-commerce businesses.

FILE PHOTO: The South Dakota state capitol building is seen in Pierre, South Dakota, U.S., February 7, 2018. REUTERS/Lawrence Hurley/File Photo

South Dakota is asking the nine justices to overturn a 1992 Supreme Court precedent that states cannot require retailers to collect state sales taxes on purchases unless the businesses have a “physical presence” in the state.

The state, appealing a lower court decision that favored Wayfair Inc (W.N), Overstock.com Inc (OSTK.O) and Newegg Inc, is being supported by President Donald Trump’s administration.

A ruling favoring South Dakota could help small brick-and-mortar retailers compete with online rivals while funneling up to $18 billion into the coffers of the affected states, according to a 2017 federal report.

The justices will hear arguments in the case on Tuesday against a backdrop of Trump’s harsh criticism of Amazon.com Inc(AMZN.O), the dominant player in online retail, on the issue of taxes and other matters. Trump has assailed Amazon CEO Jeff Bezos, who owns the Washington Post, a newspaper that the Republican president also has disparaged.

FILE PHOTO: A view of the U.S. Supreme Court building is seen in Washington, DC, U.S., October 13, 2015. REUTERS/Jonathan Ernst/File Photo

Amazon, which is not involved in the Supreme Court case, collects sales taxes on direct purchases on its site but does not collect taxes for items sold on its platform by third-party venders, constituting around half of total sales.

South Dakota depends more than most states on sales taxes because it is one of nine that do not have a state income tax. South Dakota projects its revenue losses because of online sales that do not collect state taxes at around $50 million annually, while its opponents in the case estimate it as less than half that figure.

Major retailers that have brick-and-mortar stores, and therefore already collect taxes, are represented by industry groups that back South Dakota. The National Retail Federation, which supports the state, has a membership list that includes Walmart Inc(WMT.N) and Target Corp(TGT.N), as well as Amazon.

Stephanie Martz, the federation’s general counsel, said in an interview the case gives the Supreme Court a chance to adapt the law to new circumstances prompted by the rise of internet shopping.

“Things have changed a lot since 1992. The entire nature of interstate commerce has changed,” Martz said.

E-commerce companies supporting Wayfair, Overstock and Newegg include two that provide online platforms for individuals to sell online: eBay Inc(EBAY.O) and Etsy Inc(ETSY.O).

“Win or lose at the Supreme Court, we will continue to advocate for a legislative solution and a level playing field where all retailers collect and remit sales tax on the same basis,” Wayfair spokeswoman Jane Carpenter said in a statement.

Brian Bieron, eBay’s senior director of government relations, said in an interview the 1992 precedent “provides the many small businesses that use the internet with a very clear and simple and stable legal environment in which to grow their business.”

Overturning the ruling while not replacing it with a new national framework “is really going to be a negative move in terms of e-commerce,” Bieron added.

A 2016 South Dakota law requires out-of-state online retailers to collect sales tax if they clear $100,000 in sales or 200 separate transactions. State legislators knew the measure was unlawful under the 1992 precedent.

The state sued a group of online retailers after the law was enacted to force them to collect the state sale taxes, with the aim of overturning the precedent.

Reporting by Lawrence Hurley; Editing by Will Dunham

Source link

0 notes

Photo

Rare Vintage Mid Century Gordon and Jane Martz Marshall Studios Tile Top Table $725.00 via eBay http://ift.tt/2uu65I6

0 notes