#insurance management software

Text

Enhancing Underwriting Efficiency with Insurance Software

Enhancing underwriting efficiency with insurance management software revolutionizes the insurance industry. This advanced technology streamlines the underwriting process, enabling insurers to assess risks swiftly and accurately. By integrating data analytics, AI algorithms, and automated workflows, the software expedites policy issuance while maintaining stringent risk evaluation standards. Real-time data access empowers underwriters to make informed decisions promptly, optimizing risk assessment and pricing strategies. Additionally, seamless integration with other insurance functions enhances operational efficiency and customer satisfaction. Ultimately, leveraging insurance management software transforms underwriting into a dynamic, agile process, driving profitability and competitiveness in the ever-evolving insurance landscape.

Read more: How Automated Insurance Management Software Improves Underwriting

0 notes

Text

Speed, Security, and Savings: How ePayments are Reshaping the Insurance Industry

In a time of digital innovation, the insurance industry has seen a significant shift in the way it operates, and two main drivers of this change have been the emergence of insurance management software and electronic payments. The shift from manual to electronic payment systems has simplified procedures and changed the way customers interact with businesses. In this blog, we will examine the significance of electronic payments in the insurance industry, as well as how this technological revolution is changing the business.

Quickness and Effectiveness

The unmatched speed and efficiency that electronic payments offer to financial transactions in contrast to manual processing and laborious paperwork associated with old systems is its greatest advantage. It’s much quicker and safer.

Enhanced Client Experience

In the insurance business, electronic payments are essential to improving the client experience. Thanks to digital wallets, smartphone apps, and web portals, policyholders may now conveniently make payments whenever and wherever they choose.

Increasing Security and Preventing Fraud

Financial transaction security is crucial in the insurance industry due to the sensitive nature of the information shared. Compared to conventional paper-based systems, electronic payment methods offer a higher level of security because they are supported by cutting-edge encryption technologies.

Insurance Companies and Policyholders can Save Money

Adopting electronic payment systems leads to significant cost reductions for both insurance firms and policyholders. Insurance companies can cut down on administrative costs, optimize internal procedures, and lower the risks involved in manually processing paper-based payments. On the other hand, policyholders avoid paying for postage, transportation, and other costs related to using traditional payment methods.

Combining Innovation and Insurtech

The acceptance of electronic payments has been intimately linked to the growth of insurtech, or insurance technology. Insurtech innovations are redefining the insurance landscape and propelling the sector ahead, from secure transactions made possible by blockchain technology to smooth payment experiences provided by mobile apps.

Challenges Insurance Companies Face when Adopting ePayment Technology and Solutions

Data privacy issues

Challenge: Insurance businesses deal with a lot of private client information. When switching to electronic payments, it is essential to guarantee the privacy and confidentiality of this data.

Solution: Adopt strict data protection procedures, such as encryption and safe data storage. Assess privacy on a regular basis to find and fix any issues.

Security Issues

Challenge: Security is a major issue for electronic payments in the insurance sector due to the increase in cyber threats and financial crime.

Solution: To keep up with changing cyberthreats, put strong encryption methods, multi-factor authentication, and constant security measure updates into place.

Customer Education and Acceptance

Challenge: Customers may be accustomed to traditional payment methods and may be hesitant or resistant to adopt electronic payment options.

Solution: Launch thorough customer education campaigns to highlight the advantages of e-payments, such as convenience, speed, and improved security. Provide user-friendly interfaces and customer support to make the transition seamless and address any concerns.

Cogitate x ePay Policy

On the 30th of January, Cogitate, a digital insurance platform announced its partnership with ePay Policy with the goal of offering flexibility and convenience to policyholders. The ePay Policy is one of the best when it comes to the easiest, quickest, and safest way to transfer money for insurance. They are mobile-friendly and can be integrated with your AMS. One of their clients, Hannah Callihan from North Central Insurance, said, “We love that we don’t have to mess with collecting the fee and extra work in our escrow account. I highly recommend using them! Also nice that we don’t have to wait for a check and can bind faster.”

Their excellence, along with Cogitate’s digital and core technology platform for casualty and property insurance, makes them perfect partners. During the event, Tushar Bhole, EVP sales and partnerships at Cogitate, said, “Electronic payment capabilities contribute to the ease of doing business between insurers, their distribution networks, and policyholders. The integration of ePayPolicy with DigitalEdge Policy and DigitalEdge Billing represents a continued commitment to expanding Cogitate’s ecosystem of third-party solutions that offer insurers and Delegated Underwriting Authority Enterprises (DUAEs) enhanced customer service and user experience capabilities."

Conclusion

It is impossible to exaggerate the significance of electronic payments in the insurance industry. Electronic payments are a driving force behind innovation, efficiency, security, and consumer pleasure as the sector navigates the digital age. In addition to helping policyholders and insurers, the use of these technologies sets up the insurance ecosystem for a future in which financial transactions are frictionless, secure, and driven by cutting-edge technology. Insurance firms must embrace electronic payments as a strategic necessity to remain competitive and satisfy the demands of their increasingly tech-savvy clientele.

You can check out Cogitate’s website to learn more about their insurance software solution. Cogitate has an expertise of over a hundred years in the insurance sector. Their products and solutions are the result of these years of experiences. Visit their website TODAY!

Source: https://www.cogitate.us/news/cogitate-partners-with-epaypolicy/

0 notes

Text

Digital insurance refers to a group of technologies that have altered the way insurance companies operate. It refers to insurance companies that use a technology-first operation model to handle insurance policy sales and management. While following traditional practises, most insurance companies have a separate digital wing of their business for this. Differentiators for digital insurance service providers include the following.https://www.dunitech.com/DeFi-Insurance-Platform-Development-Services.aspx

0 notes

Text

Insurance software solutions help to streamline their operations, enhance customer experiences, and improve overall efficiency. Read more.

#insurance software development company#insurance software solutions#insurance management software#insurance software development

0 notes

Text

0 notes

Link

JBM provides complete business software solution for international liner agency management which is designed to handle export, imports and transshipment operations

#supply chain software#agency management software#insurance agency management systems#insurance agency software#insurance management software#insurance agency management software#supply management software#liner software#liner agency software

0 notes

Text

Innovative Insurance Broking Software Benefits

Insurance broking software enhances efficiency, productivity, client communication, customer service, data security, and minimizes errors, revolutionizing the insurance industry operations.

0 notes

Text

Managing Risk, Maximizing Returns: The Role of Life Insurance Management Systems

All business investments come with their own sets of risks and complexities. Discover how life insurance software solutions can manage risks while maximizing returns. Read the full blog here:

#insurance technology#insurance software#insurance solutions#insurance life management software#life insurance software solutions

0 notes

Text

Effortless Integration, Superior Results: Agiliux's Software Solution for Insurance Companies

Discover Agiliux's comprehensive software solution for insurance companies at https://www.agiliux.com/solutions/insurance-companies. Our innovative platform revolutionizes insurance operations, maximizing efficiency and driving growth. With tailored features and seamless integration, Agiliux empowers insurers to streamline processes, enhance performance, and stay ahead of the curve. Experience effortless management and superior results with Agiliux's leading-edge software solution.

#software for insurance companies#insurance company software solutions#insurance company management software#software solution for insurance companies

0 notes

Text

Discover the latest innovations shaping the landscape of insurance management software in 2024. From enhanced data analytics capabilities to seamless integration with AI and machine learning technologies, stay ahead of the curve with insights into the emerging trends driving efficiency and effectiveness in insurance management software solutions. Explore how these advancements are revolutionizing claims processing, policy administration, underwriting, and customer engagement, leading to streamlined operations and improved decision-making processes across the insurance industry.

0 notes

Text

Unleash Efficiency with MedinyX Insurance Claims Management Software

Is your claims process stuck in the slow lane? Are you bogged down by paperwork, manual tasks, and frustrated policyholders? MedinyX Software Solutions has the answer: our revolutionary Insurance Claims Management Software.

Stop Drowning in Data, Start Swimming with Confidence

Our software automates time-consuming tasks, freeing you to focus on what matters most:

Effortless FNOL Intake: Expedite first notice of loss submissions and flag potential fraud for a smoother claims journey.

Automated Workflows: Ensure consistent claim handling with pre-defined workflows and business rules.

Seamless Data Management: Effortlessly capture and track all claim-related data in a centralized location.

Reduce Costs, Enhance Customer Satisfaction

MedinyX empowers you to achieve:

Faster Claim Resolutions: Reduce processing times and expedite claim payouts, keeping policyholders happy.

Improved Operational Efficiency: Eliminate manual tasks and streamline workflows to save time and resources.

Reduced Errors and Fraud: Minimize human error and identify fraudulent activity for improved risk management.

Empower Your Team, Delight Your Customers

MedinyX provides the tools your team needs to excel:

Customer Self-Service Portal: Offer policyholders a user-friendly platform to submit claims and track progress 24/7.

Real-Time Claim Updates: Keep customers informed throughout the process, fostering trust and transparency.

Smart Case Management: Assign claims to the most qualified adjuster based on expertise for faster resolutions.

Unmatched Features for Superior Claims Management

Integrated Policy Information Retrieval: Automatically retrieve policy details and prevent duplicate claims for efficient processing.

Data-Driven Insights and Reporting: Gain valuable insights through customizable reports and KPIs to optimize claims handling.

Flexible Claim Management: Effectively manage all claim types, including complex claims with integrated legal matter processing.

Detailed Claim Assessment Tools: Equip adjusters with a comprehensive dashboard for thorough claim evaluation.

MedinyX M360*: Your One-Stop Shop for Insurance Success

Our Insurance Claims Management Software is just one piece of the puzzle. MedinyX M360* offers a comprehensive suite of solutions designed to transform your entire insurance operation, including:

Point of Insurance Sale

Policy Administration and Servicing

Insurance Underwriting

Policy Wording and Clause Management

Don't Let Your Competitors Leave You in the Dust

Embrace digital transformation with MedinyX. Our Insurance Claims Management Software empowers you to achieve:

Reduced Costs

Improved Efficiency

Enhanced Customer Satisfaction

Contact MedinyX Software Solutions today and discover how our software can revolutionize your claims process!

0 notes

Text

#insurance claims management software#insurance claims software#insurance management software#insurance#software development#insurance claim management software

1 note

·

View note

Text

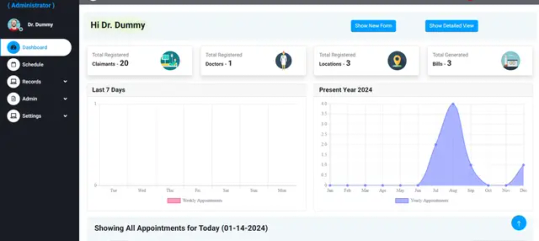

EMR (Patient/Claimant) & Billing Management

vInnovate Technologies offers an EMR (Electronic Medical Records) and Billing Management software solution that helps insurance companies efficiently manage Independent Medical Examinations (IMEs).

The software provides features such as managing claimant personal information, healthcare data, and generating customized reports as per insurance company standards. It addresses the challenges faced by insurance company vendors in handling the high volume of manual paperwork, appointment scheduling, coordination with multiple doctors, and various other inputs required for IMEs.

The fully integrated system streamlines the process and enables insurance companies to make informed decisions regarding patient injuries and appropriate compensation levels.

#emr software#Billing Management Software#insurance#IME#Independent Medical Examinations#Healthcare Data

0 notes

Text

5 Reasons Why Every Insurance Broker in India Needs Specialized Software

The Indian insurance sector is experiencing a boom. Rising disposable incomes, increased awareness of financial security, and a growing middle class are driving demand for various insurance products. This presents a tremendous opportunity for insurance brokers.

However, in this competitive landscape, efficiency and organization are paramount. Managing a growing client base, juggling multiple policies, and keeping track of renewals can be overwhelming. This is where software for insurance brokers in India comes in.

Specialized insurance software solutions can streamline your operations, improve client service, and ultimately boost your bottom line. Here are five compelling reasons why every insurance broker in India needs to consider investing in such software:

1. Enhanced Efficiency and Productivity

Gone are the days of managing client information and policy details in spreadsheets or paper files. Insurance software offers a centralized platform to manage all your client data, including contact information, policy details, renewal dates, and claim history. This eliminates the need for manual data entry, reduces errors, and saves you valuable time.

2. Streamlined Quotation and Comparison Process

Traditionally, comparing quotes from different insurers involved a lot of back-and-forth communication. With Commercial Insurance Software, you can access real-time quotes from multiple insurers within seconds. This allows you to present your client with a comprehensive comparison, highlighting the best options based on their specific needs and budget. Faster turnaround times for quotes translate to happier clients and more closed deals.

3. Improved Client Communication and Relationship Management

Strong client relationships are the cornerstone of success in the insurance brokerage business. Insurance software solutions can help you manage client interactions effectively. Communication features like email automation, task reminders, and appointment scheduling ensure you stay on top of client needs and never miss a renewal opportunity. Additionally, the software can generate personalized reports and policy summaries, keeping your clients informed and engaged.

4. Automated Renewal Management and Commission Tracking

Manually tracking policy renewals and commissions can be a tedious and error-prone process. Insurance software automates these tasks, sending timely reminders for renewals and ensuring you receive your commissions promptly. This eliminates the risk of missed renewals and keeps your cash flow consistent.

5. Data-Driven Insights and Improved Decision Making

Insurance software solutions capture and analyze valuable data on your client base, policy types, and claims history. This data provides valuable insights into your business and helps you identify trends and opportunities. You can use this information to tailor your offerings, identify profitable segments, and make informed decisions about expanding your services.

Investing in the Right Solution: Consider Indicosmic

With a plethora of insurance software options available, choosing the right one can be daunting. Look for software that caters to the specific needs of the Indian insurance market and offers features like:

Multi-lingual support: Cater to a wider client base with software that supports regional languages.

Regulatory compliance: Ensure your software is compliant with IRDAI (Insurance Regulatory and Development Authority of India) regulations.

Integration with insurance portals: Seamlessly connect with insurance providers for faster quotes and policy issuance.

Indicosmic, a trailblazing technology provider since 2016, pioneers innovation in the insurance and automotive sectors. They offer comprehensive insurance software solutions designed to empower insurance brokers in India. From streamlining workflows to fostering stronger client relationships, Indicosmic's software can help you unlock the full potential of your business.

#roadside assistance services#software solutions company#software solutions for insurance business#Claims Management Solutions

0 notes

Text

Digital Evidence Analysis in Private Investigation: Leveraging Corporate Security Video Software

In the realm of private investigation and corporate security, the role of digital evidence analysis has become paramount. With the proliferation of video surveillance tools and software, investigators now have access to an abundance of data that can be pivotal in solving cases and ensuring the safety of businesses. This article delves into the significance of digital evidence analysis, the evolution of private investigator video tools, and the integration of corporate security video software in modern investigations.

The Importance of Digital Evidence Analysis

Digital evidence analysis involves the collection, preservation, examination, and presentation of digital evidence in legal proceedings. In the context of private investigation and corporate security, this process has revolutionized the way cases are handled. Video footage captured by surveillance cameras serves as a crucial source of evidence, offering insights into incidents, identifying suspects, and corroborating witness testimonies. However, the sheer volume of data generated by these systems necessitates advanced analytical tools and methodologies to extract meaningful information efficiently.

Evolution of Private Investigator Video Tools

Private investigators rely heavily on video tools to gather evidence and conduct surveillance discreetly. Over the years, these tools have undergone significant advancements to meet the evolving demands of the profession. From covert cameras and body-worn recording devices to drones equipped with high-definition cameras, investigators now have access to a wide array of sophisticated equipment. These tools not only enhance the quality and scope of surveillance operations but also enable investigators to adapt to diverse environments and scenarios effectively.

Corporate Security Video Software

In the realm of corporate security, video software plays a vital role in safeguarding assets, preventing crime, and maintaining a secure environment for employees and stakeholders. Modern corporate security systems utilize advanced video analytics algorithms to monitor premises in real-time, detect suspicious activities, and generate actionable insights. Moreover, integration with other security technologies such as access control systems and alarm systems enhances overall situational awareness and response capabilities.

Leveraging Technology for Enhanced Investigations

The convergence of digital evidence analysis, private investigator video tools, and corporate security video software presents a paradigm shift in the way investigations are conducted. By leveraging these technologies synergistically, investigators can streamline the process of gathering, analyzing, and presenting evidence. Real-time monitoring capabilities enable proactive intervention, while forensic analysis tools facilitate the reconstruction of events and identification of perpetrators.

Conclusion

In conclusion, digital evidence analysis is at the forefront of modern private investigation and corporate security efforts. The integration of private investigator video tools and corporate security video software has empowered investigators to conduct more thorough, efficient, and effective investigations. By harnessing the power of technology, stakeholders can mitigate risks, protect assets, and uphold the principles of justice and security in an ever-changing landscape. As we continue to embrace innovation, the role of digital evidence analysis will remain indispensable in shaping the future of investigative practices.

#Forensic Video Analysis Software#Legal Video Enhancement Tools#Surveillance Video Processing#Digital Evidence Analysis#Private Investigator Video Tools#Corporate Security Video Software#Insurance Fraud Video Analysis#Video Forensics for Research#Government Video Enhancement Solutions#Professional Video Enhancement Software#Crisis Video Management Tools

1 note

·

View note