#energytransition

Text

Renewable Energy M&A hits a record high of $100bn!

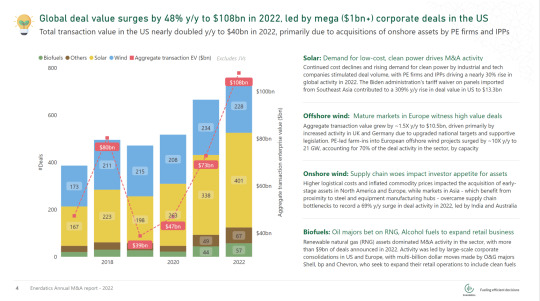

The global deal value surged by 48% y/y to $108bn in 2022; transacted capacity more than doubled to 740 GW. Corporate consolidations in the US and acquisitions of offshore wind assets in Europe were the major contributors to this rise.

Enerdatics has published its annual analysis of renewable energy transactions, globally. To access the full copy of this report, kindly visit enerdatics.com.

In the US, large, integrated power producers and oil majors expanded their presence in the onshore wind, solar and biofuels segments, fueled by incentives offered under the Inflation Reduction Act (IRA). The Biden administration’s waiver of import tariffs on solar panels from certain Southeast Asian countries improved the outlook for the US’s solar sector, contributing to a 309% y/y rise solar deal value during the year. Meanwhile, clean fuel tax credits and the rising demand to decarbonize domestic heating and power spurred billion-dollar investments in renewable natural gas (RNG) and alcohol fuels assets by bp and Chevron.

In Europe, private equity (PE)-led farm-ins in offshore wind assets, primarily in the UK and Germany accounted for ~40% of the region's transaction value. Ambitious government targets and supportive legislation, such as Germany’s Easter Package, drove deal activity. Further, the EU's plan to offset 3.5 billion cubic metres of Russian gas annually and efforts to decarbonize fossil fuel-based power and heating is spurring investments in renewable natural gas and energy-from-waste platforms. Shell and KKR led activity in the sector during the year.

APAC accounted for $19bn of transactions during the year, with India emerging as the premier market in the region. Onshore wind M&A activity surged by 69% y/y, as countries in the region overcame supply chain bottlenecks due to proximity to steel and equipment manufacturing hubs. Additionally, continued elevated prices of oil, coal, and LNG drove C&I customers to turn to corporate power purchase agreements, leading to a surge in interest for assets backed by bilateral contracts

LatAm deal value surged by 314% y/y, with Brazil accounting for 84% of the region’s transaction value. A 2021 regulation that allows companies to sign dollar-denominated PPAs incentivized foreign investment in Brazil's renewables sector by reducing forex risk. Meanwhile, Chile recorded $1bn of deals in 2022, however, transmission bottlenecks continue to impact investor appetite in the country.

PS: The above analysis is proprietary to Enerdatics’ energy analytics team, based on the current understanding of the available data. The information is subject to change and should not be taken to constitute professional advice or a recommendation.

12 notes

·

View notes

Text

Green Hydrogen Generation

"Green Hydrogen Generations" explains how green hydrogen is anticipated to grow and contribute to the global energy system in the future. Regarding the production, use, and transfer of green hydrogen, it contains forecasts, trends, and upcoming developments. The concept is directly tied to lowering carbon emissions, achieving sustainability, and making the transition to a more environmentally friendly and sustainable energy system.

Download-https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=92444177

A "green hydrogen future" is a potential state of affairs in which hydrogen produced by electrolysis fueled by renewable energy sources plays a major role in fostering a low-carbon and sustainable economy. In this futuristic vision, the decarbonization of several industries, including transportation, manufacturing, and energy production, is largely dependent on green hydrogen. It signifies a move away from greenhouse gas-emitting fossil fuel-based hydrogen generation techniques and toward a greener, more sustainable substitute. To fully realize the potential of hydrogen as a flexible and carbon-neutral energy carrier, developments in electrolysis technology, infrastructure development for hydrogen, supportive policies, and enhanced stakeholder collaboration are all necessary components of the green hydrogen future.

The "Green Hydrogen Future" is a comprehensive plan for moving toward a sustainable and eco-friendly hydrogen-based economy. The following are some salient features and ramifications of this vision:

Renewable Energy Integration: With the use of electrolysis and sustainable energy sources like solar, wind, or hydroelectric power, green hydrogen is created. By resolving the issue of intermittency and easing the transition to a more dependable and sustainable energy system, this integration makes it possible to store and use excess renewable energy.

Decarbonization: The urgent need to decarbonize the transportation, industrial, and heating sectors of the economy is one of the main forces behind the green hydrogen future. Greenhouse gas emissions can be greatly decreased by switching to green hydrogen from fossil fuels, aiding in the worldwide effort to slow down climate change and reach net-zero carbon emissions.

Energy Storage and Grid Stability: Green hydrogen has the potential to be a flexible energy carrier and storage medium that can help the electrical grid balance supply and demand. When demand is low, excess renewable energy can be used to make hydrogen, which can then be used directly in fuel cells or converted back into electricity when demand is high. This flexibility improves the stability and dependability of the grid, especially as renewable energy sources proliferate.

Industrial Applications: There are several industrial uses for green hydrogen, such as chemical synthesis, steel production, and ammonia generation. These sectors can drastically lower their carbon footprint and environmental impact by switching to green hydrogen instead of fossil fuels or hydrogen made from natural gas (often referred to as "grey hydrogen").

Transportation: Green hydrogen is an environmentally friendly fuel that can be used for buses, trucks, trains, and fuel cell vehicles (FCVs). While conventional vehicles release pollutants from their internal combustion engines, FCVs produce no emissions at all; the only byproduct of hydrogen combustion is water vapor.

Global Energy Transition: Global energy transition might be accelerated by the green hydrogen future, which would offer clean and sustainable energy to all nations. Realizing this ambition and tackling the common challenge of climate change on a global scale depend on building a strong green hydrogen infrastructure and encouraging international cooperation.

Ultimately, the green hydrogen future offers a way forward for a more resilient and sustainable energy system that puts social welfare and environmental preservation first. It signifies a paradigm shift in the production, storage, and use of energy. However, in order to overcome technological, financial, and legal obstacles and hasten the shift to a hydrogen-based economy, governments, businesses, and society at large will need to work together in order to realize this goal.

Read More-https://www.marketsandmarkets.com/industry-practice/hydrogen/green-hydrogen

#GreenHydrogen#RenewableEnergy#CleanEnergy#HydrogenEconomy#SustainableFuture#ZeroEmissions#HydrogenGeneration#ClimateAction#CleanTech#GreenTechnology#EnergyTransition#HydrogenRevolution

0 notes

Text

U.S. Solar Films Market Expansion: Exploring Market Penetration and Regional Opportunities

The U.S. solar films market size is anticipated to reach USD 1,404.5 million by 2030, growing at a CAGR of 6.3% from 2023 to 2030, according to a new report by Grand View Research, Inc. The U.S. market has increasing adoption of solar films across various industries and applications, including residential, commercial, and industrial sectors. This expansion is propelled by the growing awareness of renewable energy's significance in reducing carbon emissions and addressing climate change. In addition, favorable government incentives and policies, such as tax credits and rebates, continue to incentivize solar energy adoption, making solar films an attractive investment. Technological advancements in solar film materials and manufacturing processes have also improved efficiency and reduced costs, making them more accessible to a wider range of consumers. Furthermore, heightened environmental concerns, coupled with the desire to reduce energy costs and enhance energy security, are further propelling the adoption of solar films in the U.S. These factors collectively contribute to the robust and sustainable growth of the market.

U.S. Solar Films Market Report Highlights

Based on type, the encapsulation film segment held the largest revenue share of over 65% in 2022, due to its crucial role in protecting solar cells from environmental factors, ensuring the long-term durability and reliability of solar panels. Encapsulation films safeguard against moisture ingress and physical damage, making them an essential component in solar installations

Based on polymer type, the fluoropolymer film segment held over 64% revenue share in 2022, due to the exceptional durability and resistance to environmental stressors offered by fluoropolymers, making them well-suited for the demanding outdoor environment of solar panels

Based on thickness, the less than 100 mm segment held over 45% revenue share in 2022, due to the practicality and versatility of thinner solar films, which are lightweight, flexible, and cost-effective, making them a preferred choice for a wide range of solar applications

Based on film type, the clear (Non-reflective) segment held over 30% revenue share in 2022, due to its ability to seamlessly integrate into architectural elements while minimizing glare and maintaining aesthetic appeal, making it an ideal choice for building-integrated photovoltaic (BIPV) applications and urban environments

In terms of application, the construction industry segment held over 56% revenue share in 2022, and the segment growth is driven by the construction industry’s growing focus on sustainability and energy efficiency. Solar films offer a versatile and cost-effective solution for energy generation and aesthetic enhancement, aligning with these industry priorities

Based on end-use, the commercial segment held over 39% revenue share in 2022, and the segment growth is driven by the commercial sector's increasing emphasis on sustainability, energy efficiency, and long-term cost savings. Solar films offer a practical and eco-friendly solution for businesses to achieve these goals while generating clean, renewable energy

In June 2023, First Solar launched the world's first advanced thin-film semiconductor bifacial solar panel, initiating a limited production run. This pioneering technology will be showcased at Intersolar Europe in Munich, Germany, through the pre-commercial Series 6 Plus Bifacial solar module.

For More Details or Sample Copy please visit link @: U.S. Solar Films Market Report

Based on type, the encapsulation solar film segment was a highly penetrated segment accounting for over 65% of the U.S. market share in 2022, due to its critical role in safeguarding solar cells from environmental factors. Encapsulation films provide essential protection against moisture ingress and physical damage, ensuring the long-term durability and reliability of solar panels. As the solar industry continues to expand, the demand for high-quality encapsulation materials remains strong, underscoring their significant market presence.

Based on polymer type, the Fluoropolymer segment held over 64% revenue of the U.S. market in 2022, due to its exceptional durability and resistance to environmental stressors. Fluoropolymers, such as polyvinyl fluoride (PVF) and ethylene-tetrafluoroethylene (ETFE), are well-suited for the demanding outdoor environment of solar panels, withstanding prolonged exposure to factors like UV radiation, extreme temperatures, and moisture. This durability ensures the long lifespan and reliability of solar installations, making fluoropolymer-based solar films the preferred choice for maximizing energy generation and ensuring the sustained success of solar projects in the U.S.

Based on thickness, the less than 100 mm segment dominated the market in 2022 with a revenue share of over 45%, due to the practicality and versatility of thinner solar films. These films are lightweight, flexible, and easier to install and integrate into various applications, including building-integrated photovoltaics (BIPV). Their adaptability to different surfaces, such as windows, facades, and roofing materials, allows for seamless integration without compromising the aesthetics or functionality of structures. Thinner films are cost-effective and space-efficient, appealing to both residential and commercial solar projects, where maximizing energy generation and cost savings are paramount.

Clear (Non-reflective) was a highly penetrated film type segment due to its aesthetic appeal and suitability for various applications. Unlike reflective films, clear solar films are designed to maintain the appearance of architectural elements like windows, facades, and building surfaces while harnessing solar energy. This seamless integration into existing structures without altering their visual aesthetics makes clear solar films an attractive choice for building-integrated photovoltaic (BIPV) applications. In addition, they mitigate issues related to glare and light pollution, particularly in urban areas, contributing to their preference for regulatory compliance and community acceptance, further bolstering their dominance in the U.S. market.

#SolarFilmsMarketAnalysis#RenewableEnergy#SolarPower#EnergyEfficiency#CleanEnergy#GreenTechnology#SolarEnergy#EnvironmentalImpact#InvestmentOpportunities#EnergyTransition#FutureOfEnergy

0 notes

Video

youtube

DMRV Roundtable - Raviv Turner, MRV Collective

#youtube#DMRV#RoundtableDiscussion#RavivTurner#MRVCollective#RenewableEnergy#SustainableDevelopment#ClimateAction#CleanTech#GreenEconomy#EnergyTransition#Innovation#climatechange#carbon footprint

0 notes

Text

Energy storage materials are substances or systems capable of storing energy for later use. These materials play a crucial role in various applications, including renewable energy storage, portable electronics, electric vehicles, and grid stabilization. Several types of energy storage materials exist, each with unique properties and applications. Here are some common categories:

Visit : https://electronicmaterialsconference.com/

#EnergyStorage#BatteryTechnology#RenewableEnergyStorage#LithiumIon#Supercapacitors#HydrogenStorage#ThermalEnergyStorage#FlywheelTechnology#MaterialsScience#GridStorage#ElectrochemicalMaterials#EnergyInnovation#SustainableEnergy#GreenTech#SmartGrid#EnergyEfficiency#PowerStorage#AdvancedMaterials#CleanEnergy#EnergyTransition

0 notes

Text

Hydrogen Fuel Cell Vehicle Market Worldwide Demand and Growth Analysis Report 2024-2030

The Hydrogen Fuel Cell Vehicle Market Research Report 2024 begins with an overview of the market and offers throughout development. It presents a comprehensive analysis of all the regional and major player segments that gives closer insights upon present market conditions and future market opportunities along with drivers, trending segments, consumer behaviour, pricing factors and market performance and estimation and prices as well as global predominant vendor’s information. The forecast market information, SWOT analysis, Hydrogen Fuel Cell Vehicle Market scenario, and feasibility study are the vital aspects analysed in this report.

The Hydrogen Fuel Cell Vehicle Market is expected to grow at 59.40% CAGR from 2023 to 2030. It is expected to reach above USD 27.09 Billion by 2030 from USD 0.40 Billion in 2023.

Access Full Report:

https://exactitudeconsultancy.com/reports/13965/hydrogen-fuel-cell-vehicle-market/

#FuelCellVehicle#CleanTransportation#HydrogenTechnology#ZeroEmission#RenewableEnergy#GreenMobility#FuelCellCars#HydrogenPower#SustainableTransport#AlternativeFuel#FutureOfTransport#EnergyTransition#HydrogenEconomy#FuelCellTechnology#TransportationInnovation#EcoFriendlyVehicles#ClimateAction#HydrogenInfrastructure#HydrogenVehicle

0 notes

Text

Top Waste to Energy Solutions Companies

The global energy industry is shifting toward waste-to-energy technologies as a result of rising global energy demand, increasing depletion of conventional energy sources, and environmental contamination from these sources. The worldwide waste-to-energy market is predicted to grow at a 7.35 percent CAGR from 2022 to 2027, hitting a market size of $74 billion by 2027. Favorable regulatory rules supporting effective waste disposal in conjunction with energy generation, as well as rising energy needs from the end-use sector, are critical to this market growth.

Read More : Energy Tech Review

0 notes

Text

Looking for a cleaner, more efficient energy solution? Explore the benefits of our Fuel Hydrogen Production Plant at Advance Biofuel. Let's create a world powered by sustainability!

#AdvanceBiofuel#FuelHydrogenProductionPlant#HydrogenPlant#RenewableEnergy#CleanFuel#SustainableEnergy#HydrogenProduction#GreenHydrogen#ZeroEmissions#FuelCells#EnergyTransition

0 notes

Text

#IREDA#RenewableEnergy#Miniratna#SustainableFinance#GreenInvestment#EnergyTransition#CleanEnergy#FinancialNews#InvestmentSurge#GreenEconomy

0 notes

Text

Stock Market Surges to New Highs: Tech Stocks Lead the Way Amid Economic Uncertainty

#consumerdiscretionarysector #currentrally #energysector #energytransition #financialmarketcomplexities #globaleconomicuncertainty #healthcaresector #individualstockperformance #industrialssector #inflationconcerns #SP500Index #stockmarketgrowth #stockmarketperformance #stockmarketrisks #techgiants #technologystocks #USeconomy

#Business#consumerdiscretionarysector#currentrally#energysector#energytransition#financialmarketcomplexities#globaleconomicuncertainty#healthcaresector#individualstockperformance#industrialssector#inflationconcerns#SP500Index#stockmarketgrowth#stockmarketperformance#stockmarketrisks#techgiants#technologystocks#USeconomy

1 note

·

View note

Text

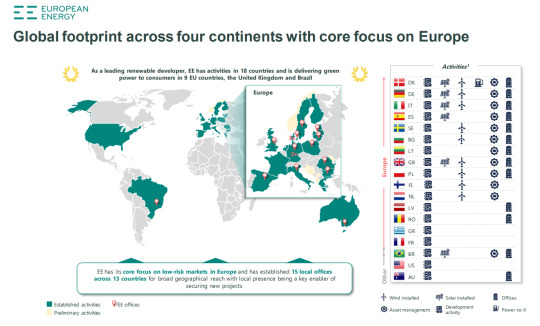

European Energy progresses on 10 GW renewables ambition in the US, agrees to co-develop 2 GW of solar and storage projects with Elio Energy

The companies will develop a pipeline of solar and energy storage assets in Arizona and surrounding states, with projects expected to start construction gradually between 2023-2025. The deal represents Denmark-based European Energy’s largest move in the renewables space in the US and builds upon its recently announced ambition to 10 GW of projects in the country by 2026.

Read more at: https://enerdatics.com/blog/renewable-energy-m-and-a-european-energy-progresses-on-10-gw-renewables-ambition-in-the-us-agrees-to-co-develop-2-gw-of-solar-and-storage-projects-wi/

#energy#alternativeenergy#renewableenergy#energytransition#enerdatics#solar#solarpower#windonshore#wind#storage

17 notes

·

View notes

Text

Green Hydrogen Future

"Green Hydrogen Future" describes how green hydrogen is expected to develop and play a part in the world's energy system going forward. It includes projections, patterns, and future advances concerning the creation, application, and transfer of green hydrogen. Reducing carbon emissions, attaining sustainability, and switching to a greener, more sustainable energy system are all directly related to the idea.

Download- https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=92444177

A "green hydrogen future" is a potential state of affairs in which hydrogen produced by electrolysis fueled by renewable energy sources plays a major role in fostering a low-carbon and sustainable economy. In this futuristic vision, the decarbonization of several industries, including transportation, manufacturing, and energy production, is largely dependent on green hydrogen. It signifies a move away from greenhouse gas-emitting fossil fuel-based hydrogen generation techniques and toward a greener, more sustainable substitute. To fully realize the potential of hydrogen as a flexible and carbon-neutral energy carrier, developments in electrolysis technology, infrastructure development for hydrogen, supportive policies, and enhanced stakeholder collaboration are all necessary components of the green hydrogen future.

The "Green Hydrogen Future" is a comprehensive plan for moving toward a sustainable and eco-friendly hydrogen-based economy. The following are some salient features and ramifications of this vision:

Renewable Energy Integration: With the use of electrolysis and sustainable energy sources like solar, wind, or hydroelectric power, green hydrogen is created. By resolving the issue of intermittency and easing the transition to a more dependable and sustainable energy system, this integration makes it possible to store and use excess renewable energy.

Decarbonization: The urgent need to decarbonize the transportation, industrial, and heating sectors of the economy is one of the main forces behind the green hydrogen future. Greenhouse gas emissions can be greatly decreased by switching to green hydrogen from fossil fuels, aiding in the worldwide effort to slow down climate change and reach net-zero carbon emissions.

Energy Storage and Grid Stability: Green hydrogen has the potential to be a flexible energy carrier and storage medium that can help the electrical grid balance supply and demand. When demand is low, excess renewable energy can be used to make hydrogen, which can then be used directly in fuel cells or converted back into electricity when demand is high. This flexibility improves the stability and dependability of the grid, especially as renewable energy sources proliferate.

Industrial Applications: There are several industrial uses for green hydrogen, such as chemical synthesis, steel production, and ammonia generation. These sectors can drastically lower their carbon footprint and environmental impact by switching to green hydrogen instead of fossil fuels or hydrogen made from natural gas (often referred to as "grey hydrogen").

Transportation: Green hydrogen is an environmentally friendly fuel that can be used for buses, trucks, trains, and fuel cell vehicles (FCVs). While conventional vehicles release pollutants from their internal combustion engines, FCVs produce no emissions at all; the only byproduct of hydrogen combustion is water vapor.

Global Energy Transition: Global energy transition might be accelerated by the green hydrogen future, which would offer clean and sustainable energy to all nations. Realizing this ambition and tackling the common challenge of climate change on a global scale depend on building a strong green hydrogen infrastructure and encouraging international cooperation.

Ultimately, the green hydrogen future offers a way forward for a more resilient and sustainable energy system that puts social welfare and environmental preservation first. It signifies a paradigm shift in the production, storage, and use of energy. However, in order to overcome technological, financial, and legal obstacles and hasten the shift to a hydrogen-based economy, governments, businesses, and society at large will need to work together in order to realize this goal.

Read More-https://www.marketsandmarkets.com/industry-practice/hydrogen/green-hydrogen

#GreenHydrogen#RenewableEnergy#CleanEnergy#HydrogenEconomy#SustainableFuture#ZeroEmissions#HydrogenTechnology#ClimateAction#EnergyTransition#HydrogenPower#CleanTech#FuelCells#Decarbonization#RenewableHydrogen#FutureFuel#GreenTech#HydrogenSociety#EcoFriendly#EnergyInnovation#CarbonNeutral

0 notes

Text

Electric Vehicle Charging Market : Unveiling the Latest Innovations, Challenges, and Opportunities

The global EV charging infrastructure market size is anticipated to reach USD 125.39 billion by 2030, expanding at a CAGR of 25.4% from 2024 to 2030, according to a new report by Grand View Research, Inc. The growth of the electric vehicle charging infrastructure (EVCI) market is attributed to a growing consumer base adopting electric vehicles. This shift is fueled by eco-friendly choices, rising fuel expenses, government incentives, and reduced ownership costs throughout the vehicle's lifespan.

EV Charging Infrastructure Market Report Highlights

In terms of charger type, the fast charger segment dominated the market in 2023. The rising preference for EVs among consumers seeking more convenient and efficient vehicle charging methods is propelling the growth of this segment

In terms of connector, the CHAdeMO segment is expected to grow at a significant CAGR during the forecast period. The CHAdeMO connector’s capacity to provide a DC fast charging solution, enabling swift EV battery recharge, acts as a significant contributor to segment growth

In terms of level of charging, the level 2 segment dominated the market in 2023. The growth of level 2 charging networks, especially in urban areas and along major U.S. highways, significantly drives segment expansion. With increasing electric vehicle adoption, numerous municipalities and businesses are investing in level 2 charging infrastructure to retain and attract EV drivers

In terms of connectivity, the non-connected charging stations segment led the market in 2023. The growing adoption of stand-alone chargers by small businesses, private individuals, and municipalities is a major factor contributing to segment growth

In terms of application, the commercial segment held a major revenue share in 2023. Increasing number of EV charging stations in commercial spaces and rising government funding and initiatives for installing publicly accessible EV charging stations are major factors behind segment growth

The Asia Pacific region dominated the market in 2023. Stringent vehicle emission standards and a strong emphasis on electric vehicle research and development act as key drivers propelling regional market growth for electric vehicle (EV) charging infrastructure

In September 2022, Schneider Electric launched the EVlink Home Smart Charger to power EVs at home. The charger includes innovative features to make at-home charging simpler to install and more cost-effective to use. Such initiatives are increasing the adoption of electric vehicle charging infrastructures

For More Details or Sample Copy please visit link @: Electric Vehicle (EV) Charging Infrastructure Market Report

An increasing interest in electric vehicles is amplifying the need for sufficient charging infrastructure, driving market growth. Several electric vehicle manufacturers, including Kia Motors, Volvo, Ford, and Mercedes-Benz, are partnering with charging infrastructure providers to ensure convenient access to charging stations. As an example, in November 2020, ChargePoint, Inc. announced its collaboration with Volvo Car USA LLC to deliver a smooth charging experience for Volvo drivers. ChargePoint, Inc. supports Volvo owners with Home Flex home chargers, allowing them to conveniently charge their cars at home.

Moreover, Ecotap BV, Delta Electronics, and Enel X, among others, are focusing on the development of solar-powered electric vehicle charging stations. For instance, within the Honda SmartCharge program, Enel X is engaged in developing a charging station powered by solar energy in Hawaii, the U.S., through collaboration with the Hawaiian Electric Company, Inc.

Several companies are working to enhance electric vehicle supply equipment (EVSE) to improve convenience for long-distance travel. Manufacturers such as Tesla, Inc. and Nissan are focusing on ensuring compatibility of their electric vehicles with public charging networks. For instance, in February 2023, in a move to bolster EV adoption in the U.S., the White House collaborated with Tesla Inc. to increase the availability of EV charging infrastructure across the U.S. As part of the collaboration, Tesla Inc. has pledged to make at least 7,500 of its chargers available to all types of EVs by the end of 2024.

The significant growth is majorly owing to the rising initiatives undertaken by both private as well as public sectors to encourage the population to switch to electric vehicles. These initiatives have stimulated the purchase of EVs and have concurrently raised consumer awareness about the advantages of such vehicles. Therefore, the demand for EV charging infrastructure is anticipated to grow significantly.

For instance, in the U.S., the Washington State Department of Transportation has collaborated with the Oregon Department of Transportation to construct the West Coast Electric Highway (WCEH), which includes 57 EV charging stations across Washington and Oregon. Moreover, multiple governments are collaboratively developing intercontinental networks of highway charging stations.

The rising demand for EVs is owing to the increasing awareness of environmental sustainability and the strict emissions regulations enforced by governments. As private companies are focusing on innovating electric vehicle chargers and charging stations, governments are partnering with these firms to deploy EV charging infrastructure. In addition, technologies, such as near-field communication (NFC) and Radio Frequency Identification (RFID), have enabled the installation of interactive, self-operated, and kiosk-based charging stations within highway charging stations. Numerous private organizations are investing in the development of electric vehicle charging stations along highways. All these factors are propelling the demand for highway EV charging stations.

#EVCharging#ChargingInfrastructure#ElectricVehicles#CleanTransportation#SustainableMobility#RenewableEnergy#EVChargers#GreenTech#FutureOfMobility#ZeroEmission#ChargingNetwork#ElectricCar#TransportationElectrification#InfrastructureInvestment#EnergyTransition#MobilitySolutions#GreenInfrastructure#UrbanMobility

0 notes

Text

Energy Transition Is the Way Towards Reducing Emissions

These are just some of the alarming extreme weather events in this year alone that have made it to the headlines. As you read this, Pakistan is reeling from unprecedented rain and flooding that has devastated the country. And we can be sure to expect more such weather events around the world that tells us that climate change is very real and is taking place at a rate not seen in the past 10,000 years.

0 notes