#economictrends hashtag

Text

Cryptocurrency Speculation and the Reinterpretation of Kondratieff Cycles

The rapid growth and volatility of the cryptocurrency market have introduced a new layer of complexity to the study of long-term economic cycles, such as the Kondratieff waves. These cycles, first proposed by the Russian economist Nikolai Kondratieff in the 1920s, describe the cyclical patterns of economic expansion and contraction that occur over a period of approximately 50-60 years. As the cryptocurrency market continues to evolve and exert its influence on the global economy, it has become increasingly important to examine how this new paradigm may be reshaping our understanding of these long-term economic trends.

Rethinking the Bull Cycle Narrative: Bitcoin Halving and Beyond

The Bitcoin halving, a programmed event that reduces the reward for Bitcoin miners by half, has historically been a key driver of bull cycles in the cryptocurrency market. This supply-side dynamic has been a central part of the narrative surrounding the cyclical nature of the cryptocurrency market. However, the growing speculation around the impact of the halving and the changing economics of cryptocurrency mining have raised questions about the continued relevance of this event in shaping Kondratieff cycles.

As the cryptocurrency market matures and new factors, such as the entry of institutional investors, come into play, the traditional patterns of boom and bust may no longer align as neatly with the Kondratieff cycle framework. This shift in market dynamics challenges the conventional interpretation of how technological innovations, like cryptocurrencies, influence the broader economic landscape.

A New Breed of Investors: Institutional Entry and Market Maturation

The increasing participation of institutional investors in the cryptocurrency market, facilitated by the introduction of cryptocurrency-based exchange-traded funds (ETFs), signals a significant shift in the market's composition and behavior. The influx of capital and expertise from these institutional players may alter the market's volatility, liquidity, and correlations with traditional economic cycles.

As the cryptocurrency market matures, the influence of these institutional investors and their more sophisticated investment strategies could potentially smooth out the cyclical patterns observed in the past. This could, in turn, complicate the interpretation of how the cryptocurrency sector fits into the broader Kondratieff cycle framework, requiring a more nuanced analysis of the interplay between these two spheres.

The Regulatory Enigma: Uncertainty and Its Ripple Effects

Regulatory uncertainty remains a persistent challenge in the cryptocurrency market, with policymakers and government agencies grappling with how to approach this new and rapidly evolving asset class. The impact of regulatory decisions, such as changes in taxation, licensing requirements, or even outright bans, can have significant implications for the stability and direction of the cryptocurrency market.

This regulatory uncertainty introduces an additional layer of complexity when attempting to align the cryptocurrency market's behavior with the Kondratieff cycle model. The unpredictable nature of regulatory interventions can disrupt the market's natural rhythms, making it more difficult to discern the underlying economic patterns that have traditionally been associated with these long-term cycles.

Beyond Speculation: A Multifaceted Analysis

To fully understand the interplay between cryptocurrency speculation and the reinterpretation of Kondratieff cycles, it is essential to adopt a multifaceted approach that considers a range of factors. This includes analyzing the technological advancements driving the cryptocurrency ecosystem, the broader global economic landscape, and the behavioral economics underlying the market's dynamics.

By taking an interdisciplinary perspective, researchers and policymakers can gain a more comprehensive understanding of how the cryptocurrency market is influencing and being influenced by the long-term economic cycles that have shaped the modern world. This holistic approach can inform more nuanced and adaptive strategies for navigating the complex and ever-evolving economic landscape.

Conclusion

The rise of the cryptocurrency market has introduced a new layer of complexity to the study of long-term economic cycles, such as the Kondratieff waves. Factors like the Bitcoin halving, the entry of institutional investors, and regulatory uncertainty are challenging the traditional interpretations of these cycles, necessitating a reexamination of how technological innovations and financial speculation intersect with broader economic trends.

As the cryptocurrency market continues to evolve and exert its influence on the global economy, it is crucial for researchers, policymakers, and market participants to adopt a multifaceted approach that considers the interdisciplinary nature of these dynamics. By doing so, we can gain a deeper understanding of the entangled web of cryptocurrency speculation and its impact on the reinterpretation of Kondratieff cycles, ultimately informing more effective strategies for navigating the complex and ever-changing economic landscape.

texto produzido com inteligência artificial

#CryptocurrencySpeculation hashtag#KondratieffCycles hashtag#BitcoinHalving hashtag#InstitutionalInvestors hashtag#RegulatoryUncertainty hashtag#EconomicCycles hashtag#MarketDynamics hashtag#GlobalEconomy hashtag#InterdisciplinaryAnalysis hashtag#FinancialSpeculation hashtag#EconomicTrends hashtag#MarketVolatility hashtag#PolicyImplications hashtag#ComplexEconomicLandscape

0 notes

Text

The Retail Battleground: Brick-and-Mortar vs. E-commerce and the Rise of Instant Delivery

Written By: Gargi Sarma

Introduction:

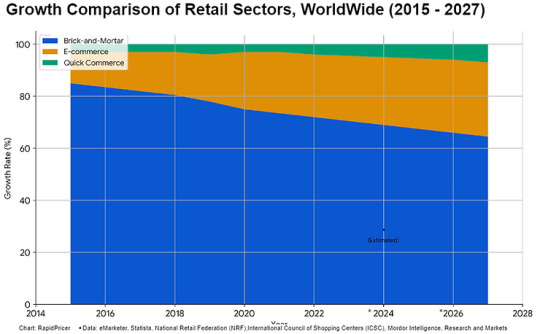

Figure 1: Growth Comparison of Retail Sectors, WorldWide (2015 - 2027)

Global Views on Brick-and-Mortar, E-commerce, and Quick Commerce

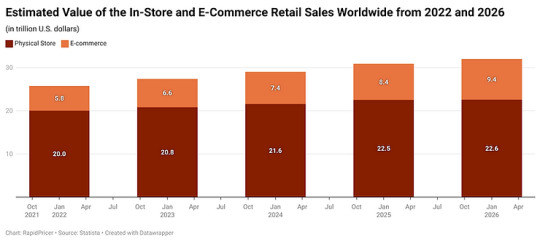

Figure 2: Estimated Value of the In-Store and E-Commerce Retail Sales Worldwide from 2022 and 2026

Remarkably, brick-and-mortar sales growth outpaced e-commerce growth for the first time in 2021 (Forbes, 2022). This demonstrates how much customers still want the in-person purchasing experience. But physical establishments run the risk of slipping behind if they don't adjust to the internet world, including by providing click-and-collect options.

In recent years, e-commerce has grown at an exponential rate. Global e-retail sales are predicted by Statista to reach USD 6.5 trillion by 2023, making up more than 22% of all retail sales. In emerging nations like India, where smartphone usage and internet penetration are rising quickly, this trend is especially noticeable.

Instant Delivery: A Revolution in Retail

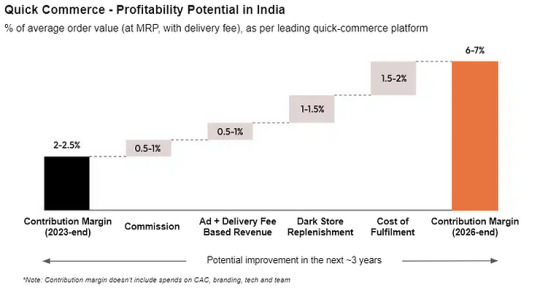

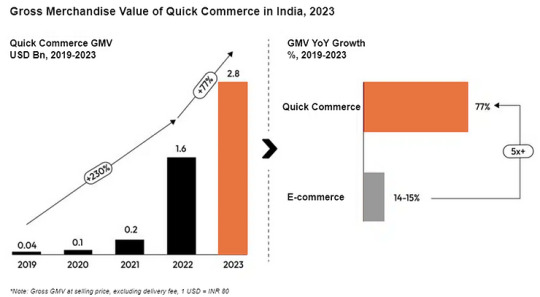

Figure 4: GMV of Quick Commerce in India, 2023 (Source: Redseer) According to Redseer, by 2025, the rapid commerce market in India is expected to grow at a rate of 10-15 times faster than any other market, with a valuation of almost $5.5 billion. This will put it ahead of other markets, including China, in terms of the adoption of quick commerce.

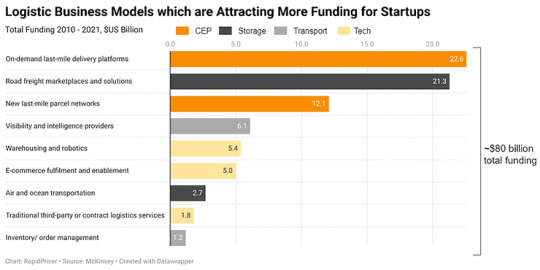

Shifting Logistics and Delivery Investment Dynamics

Figure 5: Logistic Business Models Which are Attracting More Funding for Startups

Conclusion:

Businesses need to be competitive as the retail industry changes and adjusts to shifting consumer tastes and technological improvements. Although e-commerce and rapid delivery services have unheard-of development prospects, these business models' viability depends on tackling regional obstacles and making investments in creative solutions. Retailers may prosper in a world that is becoming more digitally and globally integrated by embracing innovation and comprehending the distinctive dynamics of various markets.

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

#retailtrends hashtag#ecommerce hashtag#brickandmortar hashtag#instantdelivery hashtag#logistics hashtag#retailinnovation hashtag#retailtech hashtag#digitaltransformation hashtag#consumerbehavior hashtag#globalretail hashtag#marketinsights hashtag#retailindustry hashtag#futureofshopping hashtag#onlineretail hashtag#physicalretail hashtag#supplychain hashtag#techinretail hashtag#retailinvestment hashtag#retailers hashtag#startupinvestment hashtag#retailanalytics hashtag#digitalretail hashtag#shoppingtrends hashtag#retailstrategy hashtag#retailevolution hashtag#economictrends hashtag#retailsolutions hashtag#retailoptimization

0 notes