#delprete

Text

IR 2022

0 notes

Text

🎙 Exciting New Episode Alert! 🎉 Join me on the #FranklyFranciscoPodcast as I chat with the incredible Michael Delprete, a full-time investor in Arizona 🌵. From escaping the cubicle life to mastering real estate, Michael shares his journey, strategies, and the keys to success in the dynamic world of property investment.

🏠 Discover the IDEAL investment approach, learn the art of leveraging resources, and explore the booming real estate landscape in Phoenix. 🚀 Whether you're a seasoned investor or just starting, this episode is packed with valuable insights!

🔗 Listen now: https://stream.redcircle.com/episodes/16a42700-7cb9-4761-80b6-8a5e2d75fa91/stream.mp3

#RealEstateSuccess #InvestmentStrategies #ArizonaRealEstate #PodcastInterview #PropertyInvesting #RealEstateWisdom #franklyfranciscopodcast #podcast #interview

0 notes

Photo

SALE IMAGE: John DelPrete, Justin Thomas & Kathryn Lomax DATE: 07/06/2023 MARKET: Jupiter ASSET TYPE: SFR BUYER: Morten & Elisabeth Wengler SELLER: Justin Thomas BUYER'S REP: Kathryn Lomax - Compass SELLER'S REP: John DelPrete - Douglas Elliman SALE PRICE: $3,100,000 SF: 5,545 ~ PPSF: $559 NOTE: Former top-ranked professional golfer Justin Thomas has sold his South Florida home for $3.1 million, four months after listing it. The 5,545-square-foot mansion features a primary suite, ensuite bathrooms in all guest bedrooms, and additional living space above the garage. #Miami #RealEstate #tradedmia #MIA #Jupiter #SFR #MortenWengler #ElisabethWengler #JustinThomas #KathrynLomax #Compass #JohnDelPrete #DouglasElliman

#Miami#RealEstate#tradedmia#MIA#Jupiter#SFR#MortenWengler#ElisabethWengler#JustinThomas#KathrynLomax#Compass#JohnDelPrete#DouglasElliman

0 notes

Text

‘Go big or go home’: Opendoor’s high-stakes bid to disrupt real estate

With billions saved — and lost — Opendoor is living by the creed “go big or go home.” Yet even after a dreary Q4, the iBuyer persists, which may be the biggest takeaway, Mike DelPrete writes exclusively for Intel.

View On WordPress

0 notes

Text

Stop Making Comparisons To 2021. Its An Outlier: Delprete

12 months-over-year numbers don’t consider the truth that the pandemic years have been radical outliers on a variety of ranges, actual property being only one. Mike DelPrete analyzes the fallacies related to a lot of the present market handwringing.

Are you receiving Inman’s Dealer Edge? Be sure to’re subscribed right here.

This submit has been republished with permission from Mike DelPrete.

The pandemic years, particularly 2021, have been a wierd aberration the place everybody moved, home costs skyrocketed, and practically each actual property enterprise posted report revenues.

Why it issues: 2022 is consistently being in comparison with 2021, which was something however regular, and year-over-year comparisons are portray a deeply detrimental image.

Dig deeper: Assuming a reasonably conservative 5.15 million present house gross sales in 2022, the comparability to final yr is a sobering 16 p.c drop — however 2021 is an outlier, not a benchmark.

In comparison with the historic common of the earlier eight years (2012–2019), transaction volumes in 2022 could be down solely 0.9 p.c.

Against this, in comparison with the identical historic common, transaction volumes have been up 9 p.c in 2020 and 18 p.c in 2021 — notable outliers.

Evaluating 2022’s month-to-month volumes to the historic common reveals latest quantity declines which can be nonetheless vital, however much less excessive than a year-over-year comparability to 2021.

However in actuality, 2022 has tracked favorably to the historic common and remains to be in considerably “regular” territory, even contemplating the latest market slowdown.

The large image: Regardless of dropping volumes, the fee pool — which fuels the income of actual property brokers, brokerages, portals, software program suppliers,and extra — is about to be 34 p.c, or $25 billion, greater than 2019.

This large enhance is being pushed by rising house costs.

It might take a drop to 4 million present house gross sales for the fee pool to hit what it was in 2019: $73 billion.

(These estimates assume 5.15 million present house gross sales at a median worth of $375,000, with a fee of 5.06 p.c as tracked by RealTrends. Issues could change.)

The underside line: The pandemic years of 2020 and particularly 2021 have been radical outliers on a variety of ranges, actual property being only one.

Problems with house affordability, dropping gross sales volumes, and rising rates of interest are all contributing to a difficult 2022.

However, if we think about 2021 the outlier and never the benchmark, the market in 2022 doesn’t look practically as catastrophic as headlines counsel.

In truth, from a enterprise perspective, there may be considerably extra money flowing by way of the system (from commissions) than any yr apart from 2021.

Mike DelPrete is a strategic adviser and international skilled in actual property tech, together with Zavvie, an iBuyer provide aggregator. Join with him on LinkedIn.

Supply hyperlink

Originally published at SF Newsvine

0 notes

Text

Opendoor’s iBuyer Model Is a Canary in the Economic Coal Mine

Opendoor’s iBuyer Model Is a Canary in the Economic Coal Mine

And right now, Opendoor’s behavior, driven by the data it sees, augurs bad tidings ahead. “Right now, they’re trying to sell as much of their inventory as fast as humanly possible,” DelPrete says. One possible narrative is that based on the data Opendoor sees, the company believes things might get even worse. “They’re reading the tea leaves,” he says. “They just have better tea leaves than you…

View On WordPress

0 notes

Text

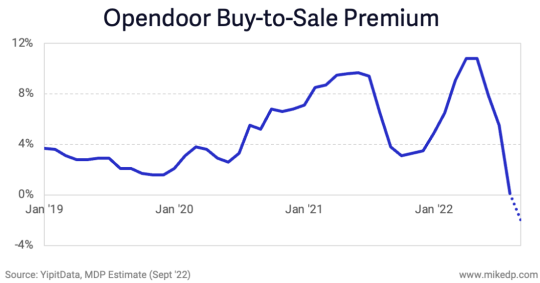

For The First Time, Opendoor Is Selling Homes At A Loss: Delprete

For The First Time, Opendoor Is Selling Homes At A Loss: Delprete

After outpacing the competition, market conditions have finally caught up with the iBuyer, forcing it to prove that its model still works — even in a downturn.

Are you receiving Inman’s Broker Edge? Make sure you’re subscribed here.

This post has been republished with permission from Mike DelPrete.

Opendoor’s buy-to-sale premium — the difference between the purchase and resale price of its…

View On WordPress

#Holiday Rentals#homes for rent#Rent & Relax US#Rentandrelaxus#Short term rentals#vacation homes#Vacation Rentals

0 notes

Text

Home-Flipper Opendoor Hit With Losses in Echo of Zillow Collapse

The US housing market’s sharp downturn has been bad for builders, flippers and almost anyone who had plans to sell a home when rising mortgage rates shut down the pandemic buying frenzy.

The slump has been especially harsh for Opendoor Technologies Inc., pioneer of a data-driven spin on home-flipping known as iBuying.

The company, which sells thousands of homes in a typical month, lost money on 42% of its transactions in August, according to research from YipitData. Opendoor’s performance — as measured by the prices at which it bought and sold properties — was even worse in key markets such as Los Angeles, where the company lost money on 55% of sales, and Phoenix, where the share was 76%.

The losses, which don’t include fees charged to customers or expenses incurred in renovating and marketing homes, have been looming since the housing market turned suddenly in recent months. Opendoor warned investors that it expected to lose as much as $175 million in adjusted earnings before interest, taxes, depreciation and amortization in the third quarter.

Get 52 weeks of The WSJ Print Edition with daily delivery to your home or office for $318

“We provided third quarter guidance in our last earnings to reflect lower-than-normal transaction volume and home-price appreciation, as well as longer than normal hold times for our inventory associated with the most rapid change in residential real estate fundamentals in 40 years,” an Opendoor representative said in a statement. “We have moved quickly and decisively to prioritize inventory health and risk management.”

The company’s rocky summer is reminiscent of the pricing problems that doomed Zillow Group Inc.’s iBuying business last year, according to a research note from Mike DelPrete, a scholar-in-residence at the University of Colorado Boulder. That doesn’t mean Opendoor is going to shut down the business, but it demonstrates the depth of the losses — and September is likely to be even worse than August, DelPrete’s analysis shows.

“Opendoor’s metrics are in the danger zone,” DelPrete said in an interview. “They are very close to where Zillow was in its worst moments.”

Opendoor Slump

The iBuyer is selling more homes for less than it paid

The iBuying model relies on acquiring homes, making light repairs and reselling the properties — often within a few months of the initial purchase. When home prices were skyrocketing earlier in the year, Opendoor banked easy profits. Then dwindling affordability and mortgage rates soaring toward 6% this spring finally pushed would-be buyers to the sidelines.

By June, median home prices had begun to decline in some areas, especially the Sun Belt markets that had been frothiest in the pandemic boom days. The shift caught Opendoor by surprise, leaving it to offload thousands of properties it had agreed to purchase when prices were rising.

Instead of canceling contracts, Opendoor decided to make good on the offers, explaining the decision as an investment in the company’s brand, according to a letter to investors in August.

The shares slid 4.7% to $3.87 at 3:28 p.m. New York time Monday. They were down 72% this year through the close on Sept. 16.

Subscribe to The Wall Street Journal and Bloomberg Digital for $89

Eventually, Opendoor will finish selling through the inventory it acquired before the market shifted, giving it a chance to stem its losses and start selling homes profitably again. The worst might already be over, with last week representing the nadir of the selloff, according to an analysis by Tyler Okland, chief executive officer of Datadoor.io.

In the meantime, Opendoor’s struggles have been a boon for people like Troy Ready, who completed an online form to solicit a bid from the company for his Yorba Linda, California, home. He almost fell out of his chair when Opendoor offered $1.4 million, and closed on the deal at the end of March.

Opendoor put the house back on the market two weeks later, asking just under $1.6 million, then cut the asking price every two weeks before selling the property for $1.3 million in August.

“We managed to sell at the particular top of the market,” said Ready. “It felt like a big win.”

Read the full article

0 notes

Text

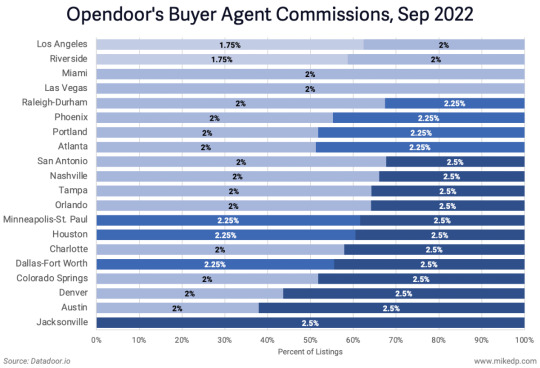

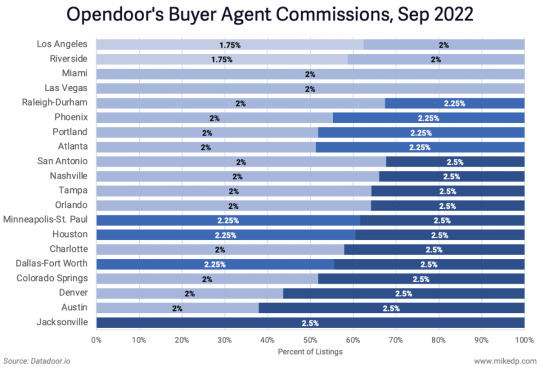

Opendoor's Buyer Agent Commission Advantage: DelPrete

Opendoor’s Buyer Agent Commission Advantage: DelPrete

2022-09-09 09:02:38

Are you receiving Inman’s Broker Edge? Make sure you’re subscribed here.

This post has been republished with permission from Mike DelPrete.

Even in a cooling market, Opendoor’s buyer agent commissions — the fee paid to a buyer’s agent when a house is sold — remain significantly lower than market averages.

Why it matters: Leveraging its powers of scale, Opendoor is pushing…

View On WordPress

0 notes

Text

«(...) en agosto y septiembre dos espacios de Rosario y Buenos Aires se confabularon amorosamente para organizar una doble exposición de collages y de pinturas de Juan Del Prete, inaugurada en forma simultánea. Para vos, Norma mía (en Buenos Aires) e Iván Rosado (en Rosario, un recoveco secreto de Córdoba y Callao que abre de tarde los jueves y precisa sus coordenadas a quienes pregunten en Instagram en y por editorial_ivan_rosado) abrieron el 12 de agosto sendos portales a otra historia posible del arte argentino. Allí, abstracción y figuración no se repelen como el agua y el aceite, sino que confluyen en obras parisinas de comienzos de los años '30 que parecen estar siendo pintadas mañana. Como decía el saxofonista ficticio Johnny Carter en el parisinísimo cuento "El perseguidor", de Julio Cortázar: "Esto lo estoy tocando mañana". Los collages italianos de los '60 son fáciles de situar en el rostro imaginario de su época, pero en las pinturas hubo que aguzar el ojo para ver que ese trazo en "31" era un tres...

¡Y lo era! Hay que remitirse a la documentación histórica que sigue publicando el sello Iván Rosado, editores ya de tres hermosos libros sobre Yente y Del Prete, a los que se sumó en estos días un completo catálogo en formato fanzine coeditado con Para vos, Norma mía. Allí, además de reproducciones color de lo expuesto en ambas muestras, se reedita una nota de 1979: la entrevista a Del Prete que le hiciera Hugo Ferrero para la edición de mayo y junio de ese año de la revista de arte Horizontes, que la publicó en su número 4 (año 2) bajo el melodramático título "La soledad de un pionero". Reeditado sin las preguntas, el reportaje deja fluir la voz herida del autor en un lamento por esa otra historia del arte que no fue, por esa crítica que entronizó propuestas más rígidas que la suya y la de "la Yente". El título de la doble muestra, Locuras, traduce lo que el pintor deja sin traducir en la cita: "La pazzia de la pintura me dio hacia los 20 años, en 1917" (...)»

"El amor al color que pasa por las cosas" por Beatriz Vignoli en Página|12

0 notes

Text

The brokerage slowdown has begun: Mike DelPrete

The market is softening and it's reflected in quarterly declines. Fewer transactions mean less brokerage revenue.

The brokerage slowdown has begun: Mike DelPrete posted first on https://www.inman.com/

0 notes

Text

The brokerage slowdown has begun: Mike DelPrete

The market is softening and it's reflected in quarterly declines. Fewer transactions mean less brokerage revenue.

The brokerage slowdown has begun: Mike DelPrete posted first on https://www.inman.com/

0 notes

Text

‘Go big or go home’: Opendoor’s high-stakes bid to disrupt real estate

With billions saved — and lost — Opendoor is living by the creed “go big or go home.” Yet even after a dreary Q4, the iBuyer persists, which may be the biggest takeaway, Mike DelPrete writes exclusively for Intel.

View On WordPress

0 notes

Text

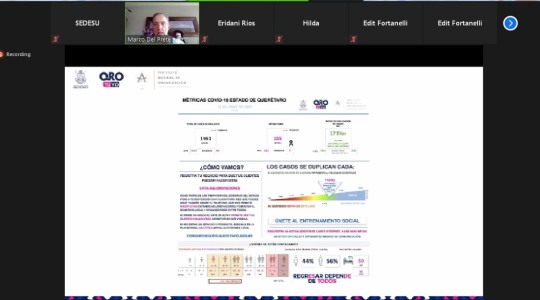

Retorno a la nueva normalidad acompañado de un programa de reactivación económica: Del Prete Tercero

El titular de la Secretaría de Desarrollo Sustentable (SEDESU), Marco Antonio Del Prete Tercero, impartió la capacitación de entrenamiento social y presentó el programa Querétaro Fuerte para la Reactivación Económica ante los miembros de la Cámara Nacional de la Industria de Transformación (CANACINTRA) San Juan del Río. El secretario estatal brindó un panorama general de la pandemia en el estado explicando el Índice de Duplicación de Casos, documento que se actualiza diariamente en el micrositio: covid19.queretaro.gob.mx y nos permite conocer cómo vamos en número de contagios y velocidad de los mismos. En el marco del anuncio que hizo el Gobernador, Francisco Domínguez Servién, sobre el cambio del semáforo a naranja, Marco Del Prete señaló que se lanzó a la par el Programa Querétaro Fuerte para la Reactivación Económica, que contempla acciones inmediatas, a corto y a mediano plazo y consiste en tres fases: subsistencia, resistencia y competencia.

La administración estatal busca recuperar por lo menos el 50% de los empleos perdidos durante la crisis sanitaria; retomar el ritmo de crecimiento del PIB en el último trimestre de 2020 y durante 2021; brindar herramientas tecnológicas a las empresas para aumentar su competitividad; reactivar el flujo de capital mediante el otorgamiento de créditos con tasa preferencial y vincular a las MiPyMEs con grandes empresas a través de encuentros empresariales. Querétaro Fuerte para la Reactivación Económica tiene como base programas de la SEDESU ya existentes: Fortalecimiento Regional, Programa Apoyo a Sectores Económicos (PASE), Competitividad, Programa Estatal para el Desarrollo de Tecnología e Innovación (PEDETI), Programa para Fomentar la Inversión y Generar Empleo (PROFIGE), Programa Único de Emprendimiento para el Desarrollo Económico y Social (PUEDES) y Fondo de Garantías.

Del Prete Tercero, también explicó que para el retorno cauto y gradual, a partir del 17 de junio se activarán las actividades de acuerdo a los siguientes porcentajes: hoteles al 30%; restaurantes y cafeterías al 50%; peluquerías, estéticas y barberías al 50% y sólo mediante citas; parques, plazas y espacios públicos abiertos al 50%; mercados, supermercados y comercio en general al 75% y manteniendo la medida de una persona por familia; gimnasios, albercas, centros deportivos, spa y centros de masajes, al 30% y únicamente por medio de citas; centros comerciales al 25%; centros religiosos y templos al 25%, sin celebración de servicios religiosos; deportes profesionales, únicamente juegos a puerta cerrada y sin público. https://consumoseguro.queretaro.gob.mx/. El secretario estatal, mencionó que como otro esfuerzo de gobierno del estado, se lanzó la Plataforma de Consumo Seguro (https://consumoseguro.queretaro.gob.mx/) que permitirá a las Pequeñas y Medianas Empresas (PyMEs) queretanas, ofrecer sus productos o servicios durante la contingencia por COVID-19, siguiendo las recomendaciones del Consejo Estatal de Seguridad y las autoridades sanitarias en relación al distanciamiento social; esta plataforma estará al alcance de la población y permitirá el regreso ordenado a la actividades. Finalmente, mencionó los cambios que se deben realizar en los espacios de trabajo, tales como las barreras físicas y señalización entre colaboradores, el uso obligatorio de cubreboca, limpieza general de todas las áreas y filtros de ingreso y egreso.

#QuerétaroTuyo#QroTuyo#Querétaro#Nueva#Normalidad#Retorno#Programa#Reactivación#Economía#Sedesu#DelPrete#Canacintra

1 note

·

View note

Text

SterlingRisk Insurance Promotes DelPrete to Chief Marketing Officer

SterlingRisk Insurance Promotes DelPrete to Chief Marketing Officer

[ad_1]

SterlingRisk Insurance, a Woodbury, N.Y.-based, independently owned insurance brokerage, has promoted Geraldine DelPrete to chief marketing officer.

According to SterlingRisk CEO David Sterling, DelPrete will oversee the strategy for all carriers across all SterlingRisk platforms, including large commercial and select, programs, personal lines, environmental, construction and aviation.…

View On WordPress

0 notes

Text

Opendoor's Buyer Agent Commission Advantage: DelPrete

Opendoor’s Buyer Agent Commission Advantage: DelPrete

Are you receiving Inman’s Broker Edge? Make sure you’re subscribed here.

This post has been republished with permission from Mike DelPrete.

Even in a cooling market, Opendoor’s buyer agent commissions — the fee paid to a buyer’s agent when a house is sold — remain significantly lower than market averages.

Why it matters: Leveraging its powers of scale, Opendoor is pushing down buyer agent…

View On WordPress

#Holiday Rentals#homes for rent#Rent & Relax US#Rentandrelaxus#Short term rentals#vacation homes#Vacation Rentals

0 notes