#cashloans

Text

We have the money. Visit www.Cashcpr.com

0 notes

Text

Credit Cards Fees-What you Need to Know

It is widely known that credit cards are a magnificent tool to improve our life. Of course, some people consider credit cards to be a double-edged sword if you don’t know how to use them. Most people in the United States have first-hand experience of the advantages and disadvantages of credit cards and may not know about credit cards fees in advance.

0 notes

Text

A little help with finances makes a huge difference in trouble. Get personal loans and raise funds to ensure your financial life goes smoothly. At Loans Paradise, we arrange affordable deals on personal loans offered by trusted banks to bring you financial well-being.

Visit: https://www.loansparadise.com/personal-loans

#personalloans#personalloan#loans#loan#personalfinance#personalfinancing#personalcashloans#cashloans#personal loans#easyloans#loanservices#quickloans#instantloans#personalloansinhyderabad#lowinterestloans#loansparadise

0 notes

Text

Same Day Cash Loans: Accessing Quick Funds in Times of Need

In times of financial emergencies or unexpected expenses, having immediate access to funds can be crucial. Same day cash loans offer a convenient and fast solution to meet urgent financial requirements. Designed to provide quick access to funds, these loans are gaining popularity among individuals seeking immediate financial assistance. Same day cash loans provide a valuable financial lifeline when unexpected expenses arise. Their quick accessibility and simplified application process make them an appealing option for individuals facing urgent financial requirements.

0 notes

Text

7 Tips for Managing Your Cash Loan Installment Payments Like a Pro

Have you ever taken a cash loan and found it difficult to manage the installment payments? Don't worry, you are not alone. Managing cash loan installment payments can be a challenging task, especially if you have limited knowledge of loan terms and financial planning. In this blog post, I'll share seven tips that have helped me manage my cash loan installment payments successfully.

Tip 1: Understand Your Loan Terms

When you apply for a cash loan, make sure to read and understand the loan terms before signing the agreement. It's essential to know the interest rate, fees, and repayment schedule for each installment. This information will help you plan your budget and avoid surprises later on. If you don't understand something, don't hesitate to ask your lender for clarification.

For example, when I took out my first cash loan, I didn't read the fine print carefully and ended up paying more interest and fees than I expected. That's why I recommend taking the time to review the loan terms thoroughly before signing anything.

Tip 2: Create a Budget

Creating a budget is an important step in managing your cash loan installment payments. It helps you track your income and expenses and identify how much money you can allocate toward your loan payments.

Start by listing all your monthly income sources, such as your salary or freelance payments. Then, list all your expenses, including rent/mortgage, utilities, groceries, transportation, and any other bills you have. This will help you identify how much money you have left to cover your loan payments.

For example, if your monthly income is $3,000 and your expenses total $2,500, you have $500 left to allocate toward your loan payments. By creating a budget, you can make sure you have enough money to cover your loan payments and other essential expenses.

Tip 3: Prioritize Your Payments

Paying your loan installments on time is crucial to avoid late fees and penalties. Make sure to prioritize your loan payments over other expenses. This means setting aside enough money each month to cover your loan payments before spending money on other non-essential items.

I recommend setting up automatic payments or reminders to help you stay on track. This way, you won't forget to make a payment, and you'll avoid late fees. If you're having trouble prioritizing your payments, consider working with a financial advisor who can help you create a plan that works for your unique situation.

Tip 4: Consider Refinancing or Consolidation

If you're struggling to make your loan payments, refinancing or consolidation may be an option. Refinancing means replacing your existing loan with a new one with better terms, such as lower interest rates. Consolidation means combining multiple loans into one to simplify your payments. These options may reduce your monthly payments and make it easier to manage your debt.

However, it's important to do your research and make sure that refinancing or consolidation is the right choice for you. Make sure to compare interest rates, fees, and other terms before making a decision. Also, keep in mind that these options may have drawbacks, such as extending the repayment period and increasing the total cost of the loan.

Tip 5: Communicate with Your Lender

If you're having difficulty making your loan payments, it's essential to communicate with your lender. Ignoring your loan payments will only make the situation worse and damage your credit score. Your lender may be able to offer you payment options, such as deferment or forbearance, or modify your loan terms to make them more manageable.

For example, if you've lost your job or experienced a significant life change, you can contact your lender to explain your situation and ask for assistance. Many lenders are willing to work with borrowers to find a solution that works for both parties. Just remember to be honest and open with your lender about your financial situation.

Tip 6: Set up Automatic Payments

Setting up automatic payments is an easy and convenient way to ensure that your loan payments are made on time. You can set up automatic payments through your bank account or your lender's website Most lenders offer this option, and it can help you avoid late payments and potential fees. Automatic payments also save you time and effort because you don't have to worry about manually making payments each month.

To set up automatic payments, log in to your lender's website and look for the option to set up automatic payments. You'll need to provide your bank account information and choose the amount and frequency of payments. Make sure to double-check the information before submitting your request to avoid any mistakes.

Tip 7: Monitor Your Progress

It's important to monitor your loan progress regularly. Keep track of your loan balance, payments made, and remaining payments. This will help you stay on track and make sure you're making progress toward paying off your loan.

You can use loan tracking tools to make this process easier. Many lenders offer online portals that allow you to view your loan details, including payment history and balance. You can also use personal finance apps to track your loan progress and set reminders for upcoming payments.

When you reach a significant milestone, such as paying off a certain percentage of your loan or making all your payments on time for several months, celebrate your progress! This will help motivate you to keep going and reach your goal of paying off your loan.

Frequently Asked Questions

Q: What is a cash loan installment payment?

A: A cash loan installment payment is a type of loan where a borrower receives a lump sum of money upfront and then repays the loan over a set time with regular payments, or installments. The payments typically include both principal and interest, and the loan terms can vary depending on the lender and borrower's agreement.

Q: How can I manage my cash loan installment payments effectively?

A: To manage your cash loan installment payments effectively, you should read and understand your loan terms, create a budget, prioritize your payments, consider refinancing or consolidation if necessary, communicate with your lender, set up automatic payments, and monitor your progress.

Q: What happens if I miss a cash loan installment payment?

A: If you miss a cash loan installment payment, you may be subject to late fees or other penalties, depending on the terms of your loan agreement. Additionally, missing payments can negatively impact your credit score, making it more difficult to obtain credit in the future.

Q: Can I refinance or consolidate my cash loan installment payments?

A: Yes, you may be able to refinance or consolidate your cash loan installment payments. Refinancing involves taking out a new loan to pay off your existing loan with better terms, such as a lower interest rate. Consolidation involves combining multiple loans into one to simplify your payments and potentially lower your interest rate.

Q: What should I do if I can't make my cash loan installment payments?

A: If you can't make your cash loan installment payments, you should communicate with your lender as soon as possible. They may be able to work with you to modify your payment plan or offer assistance to help you avoid defaulting on your loan. It's important to take action early to avoid negative consequences like late fees or damage to your credit score.

If you are interested in learning more

- Forex

- Forex Bonus Offers

- Forex Trading Courses & Lessons

- Forex Video Tutorials

Conclusion of Cash Loan Installment Payment

Managing your cash loan installment payments can be challenging, but by following these seven tips, you can take control of your finances and avoid potential pitfalls. Remember to read and understand your loan terms, create a budget, prioritize your payments, consider refinancing or consolidation if necessary, communicate with your lender, set up automatic payments, and monitor your progress. With these tips, you'll be on your way to managing your cash loan installment payments like a pro!

User

Read the full article

#budgeting#cashloans#consolidation#creditscore#debtmanagement#Installment#installmentpayments#Loan#loanterms#personalfinance#refinancing

0 notes

Text

Unfounded Things About Unsecured Personal Loans

The name unsecured personal loan is not a new concept to the citizens of Australia. There are many people taking online loans for different reasons every year. The credit union has restricted the number of times a user can apply for an online loan, yet, there are able to give intense competition for banking credit. The popularity of these loans in the country is equally opposed by a few unfounded things which the user has to know about before applying for an unsecured personal loan.

Short-Term Loans Cost You More Than Your Borrowed Amount.

Unsecured Personal Loans are designed with a unique concept of adjusting immediate funds to the needy who have requested them. Aiming the objective, the lender offers them unsecured, facilitating quick approval. The small funds are approved on the same day to the eligible candidates. For all these unique features, unsecured personal loans are charged a bit when compared to banking credit, but it definitely does not cost you more than what you borrow from the lender. The misconception prevailed in the market due to the existence of scammers. To be careful enough about the cost you pay to the lender, you should check their reliability in the market along with knowing the license number before applying for the loan. Also, make sure to read the terms of the loan in detail and understand the related charges to calculate the probable installment before accepting the loan offer.

Unregulated Loans

Unsecured personal loans are perceived to be unregulated loans as they are bound to high-interest charges. In fact, online loans are regulated by the Australian credit union, and every licensed lender is bound to follow the regulations set by the credit union, be it in terms of the loan tenure or be it eligibility, cap limits on the loan amounts, and the interest charges. To keep off unfounded things about the loans, make sure you check the registered license number of the lender, which is generally displayed on their website.

Make You Pay Late

An unsecured personal loan lender does not ask you for advanced check payments for scheduled installments over the loan tenure. They also don’t facilitate auto debt options. This does mean that they want you to pay the loan installments late. Unsecured personal loans are offered online. The borrower will not meet the lender in person at any juncture, so these lenders don’t seek any advanced check to get access to your account for auto-debit unless you especially seek for it to establish a line of trust with the customer. It is the lender who is at greater risk when you delay or default on the loan because they have nothing to cover up the loss as the loans are sanctioned unsecured. The lender approves the loan only after checking your affordability for it. The online loan business will be successful when you stand prompt to the loan installments.

Designed To Trap People

Before you are driven by the misconception that online loans are designed to trap people into debt, know that the loans are sanctioned and unsecured. The lender will have nothing to recover in the event of defaults. The belief that Payday Loans are debt trappers still prevails in the market, but no business can survive in the market by just pulling out the penalties and interest charges from the borrower. They want the borrowers to repay the loan amount as scheduled, along with the interest rate. This is the reason why lenders conduct eligibility checks like stable income and repayment capacity of the customer, which stands as proof of their repayment capacity.

#unsecuredpersonalloans#unsecuredloans#personalloans#smallpersonalloans#quickloans#cashloans#fastloans#onlineloans#easyloans#paydayloans#weekendloans

1 note

·

View note

Text

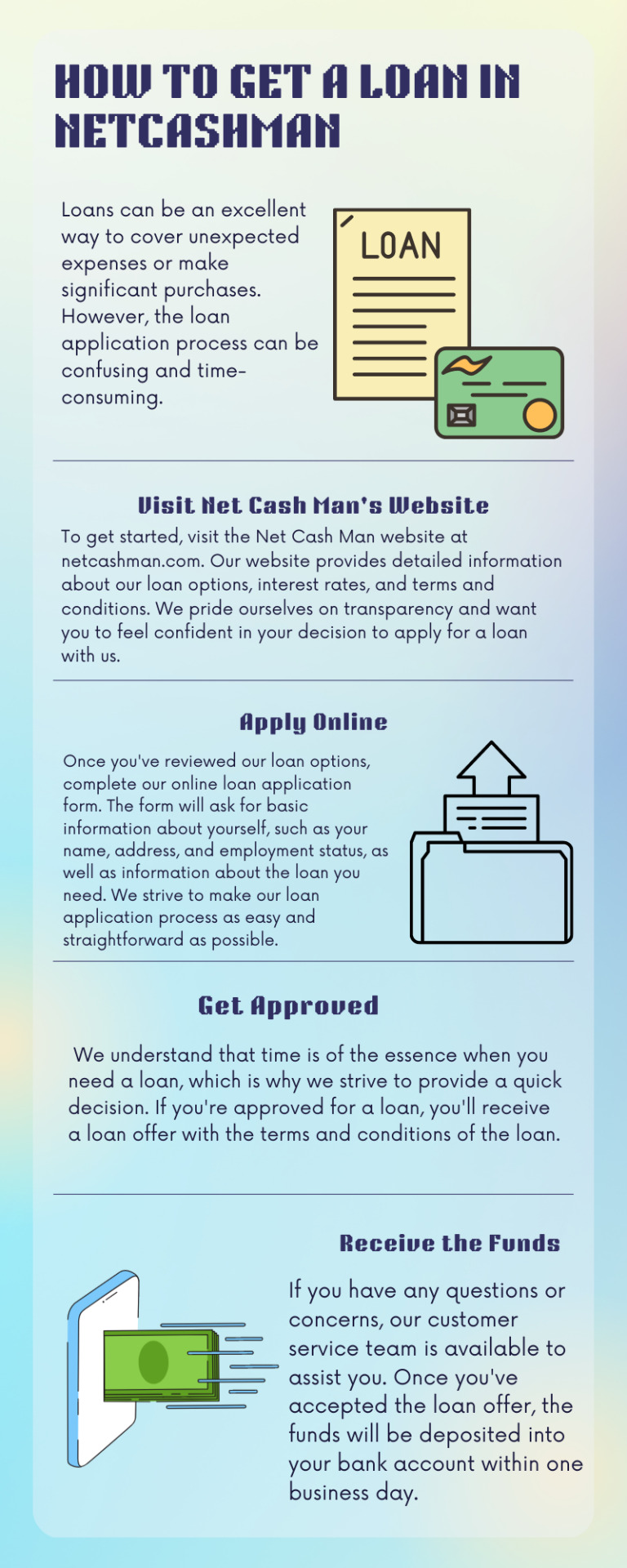

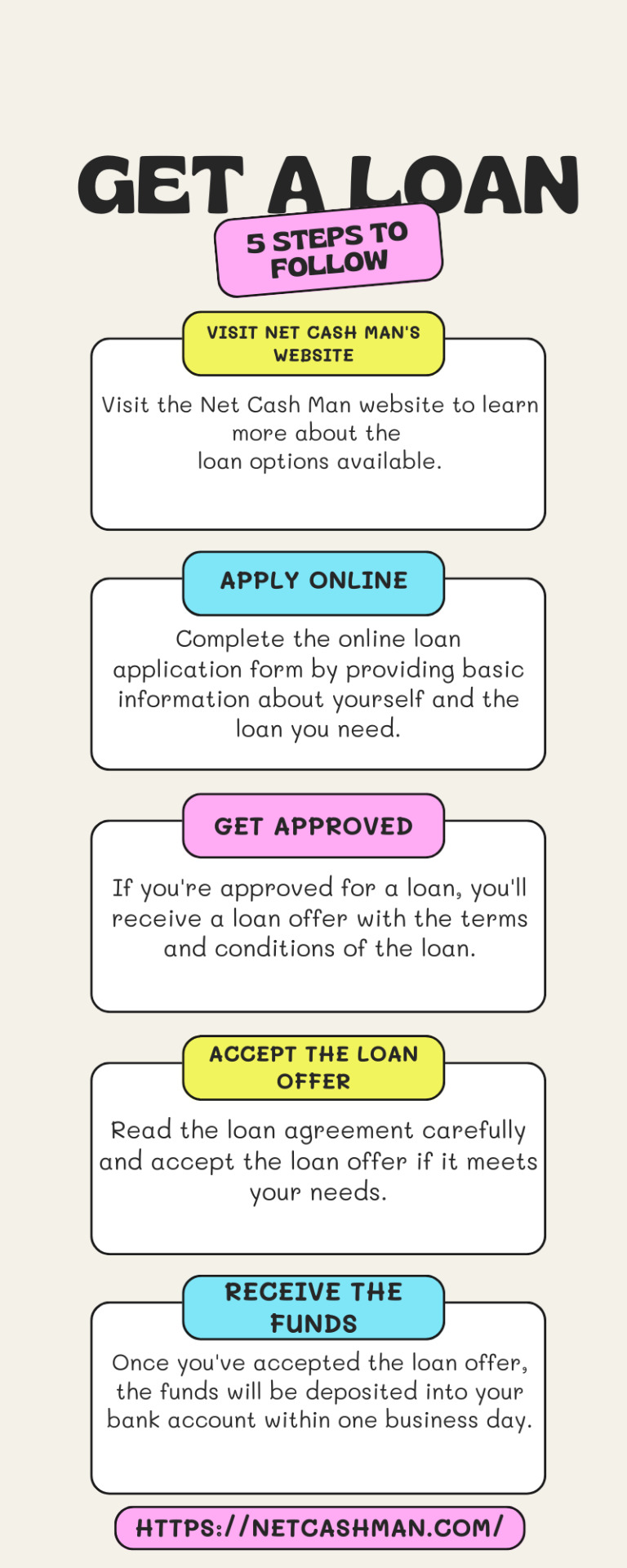

Net Cash Man is a trusted online lending platform that offers a range of loan options to meet your financial needs. In this guide, we'll provide you with four simple steps to help you get a loan quickly and easily with Net Cash Man.

0 notes

Video

youtube

Get cash for any reason at www.cashcpr.com

0 notes

Text

I Lost My Job and Have No Cash to Pay My Bills?

You may know many people who told you in confidence: “I Lost my Job and Have No cash to pay my bills”. It’s quite common these days.

Losing your job as well as battling to find a new one can dramatically influence your psychological and physical health and wellness. Monetary tension is regretfully a fact for lots of American households. There are some methods you can make ends fulfill while you browse for another work.

#safeloan#personalloans#installmentloans#paydayloans#signatureloans#loanservices#onlineloans#cashloans

0 notes

Text

The financial shortfall is not at all new to any individual in the world. If you are falling short on funds and unable to cover your expenses with ease, reach out to us at Loans Paradise and get personal loans right away. These loans ensure no money-related trouble can hinder your happiness.

Visit: https://www.loansparadise.com/personal-loans

#personalloans#personalloan#loans#loan#personalcashloans#cashloans#instantloans#easyloans#quickloans#loanofficer#loanagent#personalfinance#personalfinancing#instantpersonalloans#quickapproval#applynow

0 notes

Text

Are online title loans worth the risk?

If you are still living under a rock, you would not know applying for online title loans is one of the easiest and fastest ways to get money. However, if you don't know how to manage your debts,

These online title loans in Florida can make more trouble for you than you would have thought they were worth. These debts can grow quickly and can default your loan as you lose your only mode of transit.

0 notes

Text

Get Instant Cash Loan Approval -CashCow

Cash Cow gives immediate Cash loan approval and truly little info on online programs. All you have got to try to do is meet the eligibility standards money|of money} Cow for coins loans and with definitely several truthful steps, you'll get your mortgage authorized. produce a companion account with projections referring to the main factors and supply the desired documents. You’re set to tour.

you may either need Calf Loans which provide you with credit score loans from $500 to $2000. And when you would like that further quantity of coins to induce through, there may be the Bull mortgage, which covers your credit mortgage fee from $2001 to $4500. On submitting your information you can cotton on approval immediately and your account is going to be attributable at durations of twenty-4 hours.

0 notes

Text

"Empower Your Finances with ATD-Money: The Ultimate Personal Loan App for Fast, Short-term Loans with Quick Disbursement"

2 notes

·

View notes

Text

🎉 Celebrate Raksha Bandhan with Our Special Home Loan Offer! 🎉

Looking to secure your dream home? Make this Raksha Bandhan even more special with our exclusive Home Loan offer! 🏡💫

Lock in a super-low interest rate of just 8.40% on your Home Loan. Fulfill your homeownership dreams while enjoying great savings!

For our beloved salaried customers, we are offering a reduced processing fee of only ₹3000. Take advantage of this limited-time opportunity to make the home buying process smoother and more affordable.

💼 Why Choose Us?

○ Flexible and easy-to-understand loan terms.

○ Expert guidance and personalized support throughout the application process.

○ Quick approval and hassle-free documentation.

○ Transparent and customer-friendly services.

📅 Don't miss out on this incredible Raksha Bandhan offer! Let's make your dream home a reality. Contact us today to learn more and take the first step towards owning your perfect abode.

📞 For inquiries, call us at 99251 10243 or visit www.suvidhaafincorp.co.in

Hurry, this offer is valid only until 30st -Aug - 2023

Spread the joy of homeownership this Rakhi! 🛋️👨👩👧👦

#SuvidhaFincorp#homeloan#homeloanfinance#HomeLoanSpecial#RakshaBandhanOffer#businessfinance#loan#creditloan#mortgageloan#cashloan#business#personalloans#businessbroker#carloans#loans#homeloanexpert#moneylending#newbusiness#smallbusiness#existingbusiness#businessloan#businessloans#businesscredit

3 notes

·

View notes

Text

I Need Money Right Now: What Should I Do?

The pressing need for immediate funds can feel overwhelming in times of financial urgency. Whether it’s unexpected medical expenses, car repairs, or a sudden job loss, finding yourself in a situation where you need money urgently can be stressful. However, it’s essential to remember that options are available to help you navigate these challenging times. If you are saying, “I need money right now. What should I do?” MaxLend is here to help.

First, take a moment to review your current financial situation. Evaluate your immediate needs and determine the amount of money you need to address the pressing issue. Next, consider exploring various sources of emergency funds. This could include contacting family and friends for temporary assistance, exploring community resources or government assistance programs, or considering short-term borrowing options like personal or payday loans.

While each option may have its own pros and cons, having a clear understanding of your available resources can empower you to make informed decisions about how to proceed. Remember, seeking financial assistance in times of need is not a sign of weakness. Rather, it’s a proactive step toward regaining stability and security. Below, MaxLend explores options to obtain funding when you need cash now.

What Are Your Options When You Need Cash Now?

If you need money urgently, you have several options to consider:

Emergency Savings

If you have an emergency fund, this is the best option to tap into. Emergency funds are savings set aside expressly for unexpected expenses or financial emergencies.

Side Gig or Freelancing

If you have a skill or talent, you could take on freelance work or a side gig to earn extra money quickly. This could include things like dog walking, tutoring, or freelance writing.

Sell Assets

If you have valuable items you no longer need, you could sell them quickly to raise cash. This could include electronics, jewelry, or other possessions.

Borrow Money

Consider borrowing money from family or friends, using a payday loan, getting a credit card cash advance, or applying for a payday loan alternative. But please understand that some ideas may be better than others for a particular situation. You can only borrow from family or friends if they are willing and able to help. Payday loans are short-term, high-cost loans typically due on your next payday. While they provide quick access to cash, the quick repayment they require may mean they should only be used as a last resort. If you have a credit card, you can use it to get a cash advance, but it’s essential to understand the fees and terms.

A Better Way to Borrow Money

Consider a personal loan if you are wondering how to borrow $1,000 dollars fast. You might qualify for a higher loan amount, and that’s okay, too. Online personal installment loans typically have fixed payments and may be available quickly.

You can apply for a personal loan from a bank, credit union, or a lender like MaxLend, a reliable online loan direct lender.

Before deciding which course of action you will take, carefully consider the terms and implications of each option. You need to ensure you make the right choice for your situation.

Taking Out a Personal Loan

If you are considering taking out a personal loan, you might wonder how much you can take out. There is no set answer to this question. Different lenders allow people to borrow different amounts. Also, the amount you qualify to borrow may vary based on factors like your income and credit score.

Though every institution differs, the steps involved in obtaining a personal loan are generally similar.. When you are ready to apply for an installment loan online, here are some of the steps to expect.

Evaluate Your Financial Situation

Before applying for a personal loan, closely look at your financial situation. Determine how much you need to borrow and how much you can afford to repay. Consider your income, expenses, existing debt obligations, and credit score.

Check Your Credit Score

Your credit score may significantly impact your eligibility for a personal loan and the interest rate you’ll qualify for. You can check your credit score from all three major credit bureaus (Equifax, Experian, and TransUnion) to ensure it’s accurate. If you find any discrepancies, contact the credit bureau immediately. You should also review your credit score to identify any areas for improvement.

A lower credit score may limit your borrowing options, but many online lenders weigh other factors in their decisions, too. MaxLend offers installment loans to people with all kinds of credit scores.

Research Lenders

Research various lenders, including banks, credit unions, and online lenders, to find the best loan for your needs. Compare loan terms, fees or rates, and customer reviews. Lenders like MaxLend are affiliated with the Online Lenders Alliance. On top of this, they make their customer reviews easy to find. You can read Trustpilot reviews to read about the experiences of others. After you’ve taken out a MaxLend loan, you can leave a MaxLend review of your own.

There are a few questions you should find the answers to before borrowing, including:

Are you applying for a secured loan, which requires collateral, or an unsecured loan with no collateral?

What are the rates and fees involved?

What are the repayment terms?

Is there a penalty or fee for repaying the loan early?

Can you fully complete the application process online?

Prequalify

Some lenders offer prequalification, which allows you to see the loan offer you’re eligible for without a hard inquiry on your credit report. Getting prequalified typically involves providing basic information about your income, employment, and credit history.

Gather Documentation

Once you’ve chosen a lender, gather the necessary documentation to complete the loan application. This may include proof of income (such as pay stubs or tax returns), identification (such as a driver’s license or passport), and proof of address.

Submit Your Application

Complete the loan application provided by your chosen lender. Some lenders require you to provide detailed information about your personal and financial situation, including your income, employment history, existing debt obligations, and the purpose of the loan. Other lenders may have less strenuous requirements. MaxLend has a simple, quick user-friendly online application.

Get Approval and Funding

After you submit your application, the lender will review your information and decide whether to approve your loan. If approved, you’ll receive a loan agreement outlining the loan terms. Carefully review the loan terms, including the interest rate, loan amount, repayment terms, payments, and any fees associated with the loan. Make sure you understand all terms and conditions before accepting the loan offer.

Once you accept the agreement, the funds will typically be deposited into your bank account within a few business days.

This process is different for different lenders. MaxLend’s online application is quick and easy – and you typically know right away if you’re approved. MaxLend also offers Same Day Funding* on business days. So you could receive your funds the same day you apply.

Repay Your Loan

Make timely payments according to the terms of the loan agreement. Consider setting up automatic payments to ensure you never miss a payment and avoid late fees or penalties. Depending on the lender, making regular, on-time payments could improve your credit score.

At MaxLend, we offer direct installment loans. With a MaxLend loan, your loan payments may be deducted automatically from your bank account, typically on your paydays.

MaxLend – Your Online Personal Loan Direct Lender

When you’re facing a financial emergency and start thinking, “I need money right now,” it’s crucial to explore your options carefully. Whether you tap into emergency savings, consider freelance work, or explore lending options, make an informed decision that suits your circumstances.

If you’re considering a personal loan, MaxLend, a trusted online direct lender, might be able to assist. Apply now for a MaxLend installment loan and get the funds you need, sometimes even on the same day.*

For answers to any additional questions, read our FAQ page. You can also contact us online or call us at 877-936-4336. Take control of your finances and regain stability with MaxLend.

Source:

Online Lenders Alliance – https://onlinelendersalliance.org/about/about-ola/

*Same Day Funding is available on business days where pre-approval, eSignature of the loan agreement and completion of the confirmation call, if a call is required, have occurred by 11:45 a.m. Eastern Time and a customer elects ACH as payment method. Customers who complete this process by 1:30 p.m. Eastern on business days may still receive funds on the same day, but some banks may not disburse the funds until the next business day. Other restrictions may apply. Certain financial institutions do not support same day funded transactions. When Same Day Funding is not available, funding will occur the next business day.

The content on this site is for informational purposes only and is not professional financial advice. MaxLend does not assume responsibility for information given. All information should be weighed against your own abilities and circumstances and applied accordingly. It is up to readers to determine if this information is safe and suitable for their own situations.

MaxLend, is a sovereign enterprise, an economic development arm and instrumentality of, and wholly-owned and controlled by, the Mandan, Hidatsa, and Arikara Nation, a federally-recognized sovereign American Indian Tribe. (the “Tribe”). This means that MaxLend’s loan products are provided by a sovereign government and the proceeds of our business fund governmental services for Tribe citizens. This also means that MaxLend is not subject to suit or service of process. Rather, MaxLend is regulated by the Tribe. If you do business with MaxLend, your potential forums for dispute resolution will be limited to those available under Tribal law and your loan agreement. As more specifically set forth in MaxLend’s contracts, these forums include an informal but affordable and efficient Tribal dispute resolution, or individual arbitration before a neutral arbitrator. Otherwise, MaxLend is not subject to suit or service of process. Nothing in this website is intended to waive or otherwise prejudice MaxLend’s entitlement to these protections. Neither MaxLend nor the Tribe has waived its sovereign immunity in connection with any claims relative to use of this website. If you are not comfortable doing business with sovereign instrumentality that cannot be sued in court, you should discontinue use of this website.

0 notes

Text

Loans can be an excellent way to cover unexpected expenses or make significant purchases. However, the loan application process can be confusing and time-consuming. In this guide, we'll provide you with four easy steps to help you get a loan quickly and easily.

0 notes