#can you use cash app for direct deposit

Text

Please help if you can

My power bill is due tomorrow and it’s already a payment arrangement so they’ll cut us off if we don’t pay $155 by 8/29

Also my phone service if currently disconnected and I really need it because I’ll be away from home petsitting the next few days without a car. It’s ~$135 (the bill plus the restore fee)

I currently have no money and when I get paid on Friday it’ll only be half a check (because my work got bought out and the change to direct deposit it fucking everybody over 😭)

I literally have nothing right now

If anyone could spare anything to help I would appreciate it so much

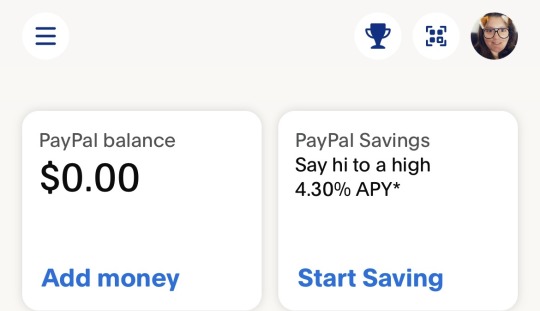

PayPal

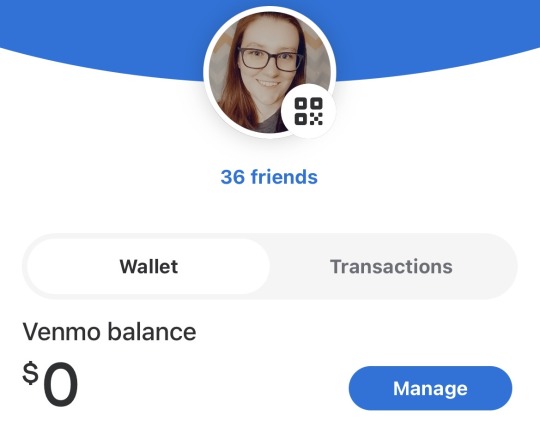

Venmo

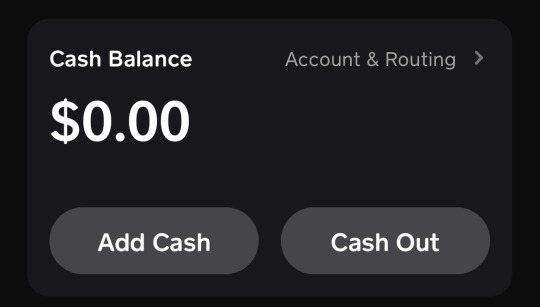

Cash App

28 notes

·

View notes

Text

The Magnus Protocol: Futures

Lena

The world is full of opposing forces, some benevolent, most not. In order for the wheels to keep on turning, all these forces need to be monitored and balanced. That is where we come in.

Gwen

That doesn’t mean anything.

Lena

And yet it is the only explanation you’re going to get for now.

Gwen

So what? We’re the bad guys?

Lena

We are… managing the “bad guys”.

– The Magnus Protocol: Futures

Do they now? Do they really? At least in The Magnus Archives it was more that the various forces just were balanced, whether you wanted them to be or not. Oh, sure, there was all the business with Robert Smirke and architecture, and the tunnels beneath The Magnus Institute – but that seemed to be more a matter of accurately observing a phenomenon than of creating one.

John/Jonah Magnus

You see, the thing about the Fears is that they can never be truly separated from each other. When does the fear of sudden violence transition into the fear of hunted prey? When does the mask of the Stranger become the deception of the Spiral?

Even those that seem to exist in direct opposition rely on each other for their definition as much as up relies on down.

To try and create a world with only the Buried makes as much sense as trying to conceive a world with only down.

– The Magnus Archives: The Eye Opens

You can't bring one entity into the world; it has to be all of them. If you kick one entity out of the world, the rest must follow. It isn't even entirely clear that they actually are separate beings.

Attempting to use the concept of "balance" to control and empower himself did not work out all that well for Robert Smirke. Frankly, even with all his extra knowledge and study, it did not work out all that well for Jonah Magnus either, in the long run.

But of course, this particular bit of dialogue is immediately followed by a case about the illusion of control. In a lot of ways, Darrien feels like the brother of the gambler from Rolling With It. There is a lot of similarity – except that the gambler had a better understanding of what was happening.

Chester/Statement Giver

The thing is though I still don’t really know if they ever made me roll them. I mean, I did. A lot. And I knew that the risks probably outweighed the rewards but I don’t think I ever felt them like “calling” to me or anything y’know? It always felt like my choice. Even if it was a shitty choice. Besides, I've never gotten anything good in my life except by blind chance, so why should this be any different?

– The Magnus Protocol: Rolling With It

He knew he was gambling. Yes, there was a "system" but he recognised that it was never going to be perfect. And over time, he got more caught up in the allure of being a mysterious agent of fate than in the benefits he got from actually rolling the dice. The gambler's mistake wasn't in failing to recognise the peril in the act of gambling, it was in underestimating the hold it had over him.

But Darrien – this poor idiot thinks he's in control.

Darrien

I took my entire student loan out and got straight to shorting using your app. This was back when it had only just launched. I struggled through your first janky interface, your weird background checks, all those damn glitches but I stuck with it because unlimited Margins and Deposits was pretty sweet. Made some quick cash shorting failing startups then used that to broaden into Crypto, leveraged some EM ETFS, scraped up a few pennies then started to go long on a few obvious winners like Omni and Sparkhub for some hedging. Easy peasy.

– The Magnus Protocol: Futures

Shorting is a very high-risk strategy, meaning that Darrien is effectively gambling just as much as the guy with the dice was. But he doesn't think of it like that: to him it's "the plan", and when it transitions to destroying his own life in order to "earn bank" it's "the loophole".

Except ... well, except. He's pretty obviously not gambling, or investing, or anything else within his control. Darrien is being lured. He has only ever invested using Zorrotrade, which had perks that drew him in ... and almost certainly ensured his success, and the eventual failures that led him to the Personal Projection Short Selling settings. He was set up, but is too arrogant to see it – right up to the end.

It's interesting. Looking back at The Magnus Archives, altruism, personal gain, or most often some combination of the two, were perfectly acceptable as entry points for most of the people who got tangled up with supernatural entities. John plied his questioning powers, largely in seasons three and four, to attempt to stop rituals. Oliver Banks attempted to warn people of their impending deaths. Trevor Herbert started out from the perfectly reasonable position of killing vampires who were eating people right in front of him.

That's logical. People in these stories may not be wholly moral but – "Hey, why don't you serve an eldritch god that will eat up your life and strip you of your humanity?" isn't exactly a winning argument. It makes sense that there's a reason. That a person could think doing this could, conceivably, be for the best.

But eventually, you are supposed to stop caring about helping others, or even your own wellbeing, and just give yourself over.

Jude Perry

I know now they were simply guiding me upon the path to my true epiphany. All this time I was serving my god, but only for my own glory. But with each new gift, each renewal of the fire, I saw how lifeless and hollow it was, how grey and ashen my existence had become. It became clear that, where once I had destroyed to fuel my life, I now lived for the pain that I caused. And for Agnes. My sweet, hopeless Agnes.

– The Magnus Archives: Twice as Bright

And here you have the gambler, who perhaps had the temperament for this business: the sense of drama, the deep addiction to the dice rolls – but ultimately not the stomach for it. And Darrien. Well, he's got the stomach for it: an amputated limb, a coma and a dozen other serious injuries and he's still not fazed. But he was never ever going to give up the self interest. He clung to the illusion of control, the idea that he could demand his "goddamn money" right up until something consumed him.

You can see hints here, of Sam and Gwen and even Celia. Sam the underachieving gifted kid, desperate to find something in The Magnus Institute to explain his circumstances; Gwen the rich woman in the crap job trying to get "in" on the big secret; Sam and Celia together, trying to take control of their odd relationship by putting all their cards on the table – but both clearly hiding a couple of doozies up their sleeves.

Mostly, though, it seems to be a commentary on Lena. She says that there are benevolent forces out there, and that balance is necessary. And sure, maybe. New universe, new rules. Anything's possible. But it would be a new thing, and there's been little evidence of it so far. If you tell yourself these things, though, you can feel like you're in control. So who is she kidding – Gwen, or herself?

And ye gods there is something very wrong with the tech in this world. The Magnus Archives had its haunted tape recorders, sure, but that was a single point of weirdness in a world where the technology largely behaved as expected. But here?

Someone or something seems to be able to listen through virtually any device that has a microphone

Making Adjustments involved streaming inking someone with a cursed tattoo to the world

Personal Screening had an obviously evil website, and closed with a cursed film

Needles and the threatening call to emergency services

Mr Bonzo, who is summoned by recordings of his theme song

... and now the cursed investment app

And Freddy, of course. Can't forget Freddy. It's not every case, but it's enough cases that I'm sure there's a pattern. I am more certain that The Magnus Protocol refers at least in part to network protocols – and that Colin has largely been kept quiet because he could say too many useful things. Colin is stressed, in part, because somebody wants an app.

Yeah. I don't think an app would improve anything about this situation.

Meanwhile, there is Alice's small tragedy. Of course, it was clear even from the trailer that she recommended Sam for the job. But this:

Sam

I had a breakdown. Stress. There was an… incident at work. I… freaked out during a presentation. After that they “encouraged” me to move on and I did. Six unemployed months later and I took a job at the O.I.A.R.

Celia

(slightly cautious) Alice hooked you up?

Sam

(noticing) Yeah. Full disclosure, we dated at uni and stayed in contact after. I did my best to help her though her parents’ deaths, but… after that we pretty much dropped out of touch.

According to her, she dropped me a line about the job after “the most pathetic vague-post she had ever seen.”

– The Magnus Protocol: Futures

That Sam had a breakdown and Alice, unprompted, invited him into the OIAR. He didn't reach out to her. They didn't reconnect for other reasons and it just came up. She made that move. Alice who knows her workplace is sinister and advises everyone not to look to closely at the cases – and is suspicious of anyone who does. Alice who clearly still has feelings for Sam. She can chide Sam all she wants about his poking around The Magnus Institute, but she brought him here.

I keep thinking about Tim, and the way he blamed John for trapping him in the archives. John had his share of screw ups, of course, but that one always felt a bit unfair. There was no way John could have known the archives job was extra evil. But this time? If something does happen to Sam – whether that be physical danger or mental distress, or even a descent into evil – Alice can't say her hands are clean. Some of it will be her fault.

9 notes

·

View notes

Text

Is There a Limit to How Much I Can Withdraw using Cash App Card?

Managing your finances efficiently often means understanding and optimising the limits set by financial tools like Cash App. One common concern among Cash App users is the ATM withdrawal limit. In this blog, we will explore how to increase Cash App ATM withdrawal limit, providing detailed steps and valuable tips to help you access more of your money when you need it.

Introduction

Cash App, a popular mobile payment service developed by Square Inc., has revolutionised the way people handle their money. From sending and receiving payments to investing in stocks and Bitcoin, Cash App offers a plethora of features. However, like most financial services, it imposes certain limits to ensure security and regulatory compliance. One such limit is the ATM withdrawal limit.

Standard withdrawal limits can sometimes feel restrictive for users who frequently need cash. This blog aims to guide you through the steps to increase your Cash App ATM withdrawal limit, enhancing your financial flexibility and convenience.

Understanding Cash App ATM Withdrawal Limits

Cash App sets ATM withdrawal limits to protect users and the service itself from fraud and unauthorized transactions. As of now, the default Cash App ATM withdrawal limit is:

$310 per transaction

$1,000 in 24 hours

$1,000 in 7 days

While these limits suffice for many users, others may require higher withdrawal amounts. Fortunately, there are ways to increase these limits by verifying your identity and understanding the factors that influence your Cash App account limits.

Steps to Increase Your Cash App ATM Withdrawal Limit

Step 1: Verify Your Identity

The first and most crucial step to increase Cash App ATM withdrawal limit is to verify your identity. Here's how you can do it:

Open Cash App: Launch the Cash App on your mobile device.

Access Your Profile: Tap on the profile icon located at the top right corner of the home screen.

Verify Personal Information: Select the "Personal" tab and enter your full legal name, date of birth, and the last four digits of your Social Security Number (SSN).

Submit Information: After entering your details, submit the information for verification. Cash App will review your submission, which typically takes a few minutes to a few days.

Once your identity is verified, Cash App will notify you, and your ATM withdrawal limits may increase.

Step 2: Link Your Bank Account and Debit Card

Linking your bank account and debit card to Cash App can also help in increasing your withdrawal limits. Follow these steps:

Navigate to the Banking Tab: Open Cash App and go to the "Banking" tab on the home screen.

Add a Bank Account: Select "Add a Bank" and enter your bank account details.

Link Your Debit Card: Similarly, you can link your debit card by selecting "Add Debit Card" and entering the necessary information.

By linking your bank account and debit card, you establish a stronger financial profile with Cash App, which can contribute to higher withdrawal limits.

Step 3: Increase Your Cash App Spending Limits

Increasing your overall Cash App spending limit can indirectly affect your ATM withdrawal limits. To do this, you need to verify your account fully, as outlined in the first step. Once verified, your spending limits will increase, and this can positively impact your ATM withdrawal limits.

Step 4: Use Direct Deposit

Setting up direct deposit with Cash App can also help in increasing your ATM withdrawal limits. When you receive direct deposits, especially from payroll, it indicates to Cash App that you have a consistent inflow of funds, thereby justifying higher withdrawal limits. Here's how to set up direct deposit:

Go to the Banking Tab: Open Cash App and navigate to the "Banking" tab.

Select Direct Deposit: Tap on "Direct Deposit" and follow the prompts to get your Cash App account and routing numbers.

Provide Information to Your Employer: To set up direct deposit, share your Cash App account and routing numbers with your employer or payroll provider.

Step 5: Maintain a Positive Transaction History

A positive transaction history can influence Cash App's decision to increase your withdrawal limits. Ensure that you maintain a good record by:

Making regular transactions.

Avoiding overdrafts or negative balances.

Ensuring all linked accounts are in good standing.

FAQ

What is the Default Cash App ATM Withdrawal Limit?

The default ATM withdrawal limit on Cash App is $310 per transaction, $1,000 in 24 hours, and $1,000 in 7 days.

How Can I Increase My ATM Limit on Cash App?

To increase your ATM limit on Cash App, verify your identity by providing your full name, date of birth, and SSN. Additionally, link your bank account and debit card, set up direct deposit, and maintain a positive transaction history.

Why is My Cash App ATM Withdrawal Limit So Low?

Your Cash App withdrawal limit for ATM may be low if you have yet to verify your identity or if you are a new user. Follow the steps outlined in this blog to increase your limit.

How Long Does It Take to Increase Cash App ATM Limits?

After verifying your identity and linking your accounts, Cash App may take a few minutes to a few days to review and increase your withdrawal limits.

Can I Withdraw More Than the Daily Limit on Cash App?

No, the daily ATM withdrawal limit is set to ensure security and regulatory compliance. However, by following the steps to increase your limit, you can access higher amounts within the allowable limits.

What Should I Do If My ATM Withdrawal Limit Is Not Increasing?

If your ATM withdrawal limit is decreasing despite following the steps, contact Cash App support for assistance. Ensure all your account details are correct and that you have a positive transaction history.

Is There a Limit to How Much I Can Spend with Cash App?

Yes, there are spending limits on Cash App, but they can be increased by verifying your identity. Verified users can send up to $7,500 per week and receive unlimited amounts.

Can I Use Any ATM with My Cash App Card?

Yes, you can use any ATM to withdraw money with your Cash App card, but be aware of potential fees. Setting up direct deposit can help you qualify for ATM fee reimbursements.

Conclusion

Increasing your Cash App ATM withdrawal limit is essential for maximising the utility of your Cash App account. By verifying your identity, linking your bank accounts, setting up direct deposits, and maintaining a positive transaction history, you can increase your withdrawal limits and access more of your money when you need it.

#cash app atm withdrawal limit#increase cash app withdrawal limit#cash app atm withdrawal limit per day#cash app daily atm withdrawal limit#cash app withdrawal limit#cash app card atm withdrawal limit per week

2 notes

·

View notes

Text

How To Increase Cash App Daily Or Weekly Withdrawal Limits?

Cash App, a popular mobile payment service, offers users the convenience of sending and receiving money with ease. However, like any financial platform, it imposes certain limits on withdrawals, including ATM withdrawals and cash outs. Knowing these limits is crucial for managing your finances effectively. This article will provide an exhaustive overview of Cash App withdrawal limits, including daily, ATM, and debit card restrictions.

Cash App Daily Withdrawal Limit

Cash App imposes a daily withdrawal limit on its users. This limit is crucial for users to understand to manage their daily transactions effectively. As of now, the Cash App daily withdrawal limit stands at $1,000 per day. This limit applies to both ATM withdrawals and in-store cash back transactions. It’s important to note that this limit resets at midnight (Eastern Standard Time) each day, allowing users to withdraw up to $1,000 again the following day.

Cash App ATM Withdrawal Limit

When using a Cash App card at an ATM, there are specific limits you should be aware of. The Cash App ATM withdrawal limit is currently set at $1,000 per transaction. This limit is part of the broader daily limit, which means that any combination of ATM withdrawals and cash back transactions cannot exceed $1,000 in a single day.

Cash App Card ATM Limit

The Cash App card, which functions like a traditional debit card, also has specific limits at ATMs. The Cash App card ATM limit is integrated within the overall Cash App daily withdrawal limit. Users can withdraw up to $1,000 per day across all transactions involving their Cash App card.

Cash App Cash Out Limit

For those looking to transfer their Cash App balance to their bank account, understanding the Cash App cash out limit is essential. The platform allows a maximum of $25,000 per week when transferring funds out of your Cash App balance to a bank account. This high limit is designed to accommodate users who need to move larger amounts of money efficiently.

Cash App Debit Card Limit

The Cash App debit card, apart from ATM withdrawals, is subject to a Cash App spending limit. The Cash App debit card limit includes a $7,000 spending limit per transaction and a total of $10,000 per week. These limits are set to help manage spending and ensure that users do not exceed their budgetary constraints.

Cash App Max Withdrawal Limit

Understanding the Cash App max withdrawal is crucial for users who frequently engage in high-volume transactions. The maximum amount that can be withdrawn at an ATM or via cash back is $1,000 per day. This limit ensures that the financial platform can adequately monitor transactions and prevent fraudulent activities.

Cash App Daily and Per Transaction Limits

The Cash App daily ATM limit and Cash App daily withdrawal limit are intertwined, with users allowed to withdraw up to $1,000 every 24 hours. This limit is strategically set to balance the need for access to funds with the need for security and control over financial operations.

Conclusion:

Navigating the limits imposed by Cash App ensures that you can manage your finances without unexpected interruptions. By understanding each limit, from ATM withdrawals to debit card transactions, users can plan their spending and withdrawals more effectively. Whether you need to withdraw cash for immediate use or transfer significant amounts to a bank account, staying informed about these limits will help optimize your Cash App experience.

FAQ

Q: What is the daily ATM withdrawal limit for Cash App?

A: Cash App users can withdraw up to $310 per transaction at an ATM. The Cash App daily limit for ATM withdrawals is $1,000, and this limit resets every 24 hours.

Q: Are there any fees associated with using an ATM with Cash App?

A: Yes, Cash App charges a $2 fee for ATM withdrawals. However, this fee can be reimbursed if you receive at least $300 per month in direct deposits to your Cash App account.

Q: Can I increase my ATM withdrawal limit on Cash App?

A: Currently, the ATM withdrawal limits are fixed and cannot be increased beyond the standard limits of $310 per transaction and $1,000 per day.

Q: What should I do if my ATM withdrawal exceeds the daily limit?

A: If you reach your Cash App daily ATM withdrawal limit, you will need to wait until the next day for the limit to reset. Planning your withdrawals ahead of time can help avoid inconvenience.

2 notes

·

View notes

Text

How much is Cash App ATM withdrawal?

In the digital age, faintish applications like Cash App have revolutionized the way we manage money, offering users a blend of convenience and control over their finances. A frequent question among users is regarding the costs and limits associated with Cash App ATM withdrawals. This article aims to provide an exhaustive guide to understanding the ATM withdrawal process, fees, and limits on Cash App, ensuring that users can access their money efficiently and effectively.

Understanding Cash App ATM Withdrawal Fees

Cash App imposes certain fees for ATM withdrawals, which is a standard practice among many financial platforms to cover the operational costs of ATM transactions. When you use your Cash App card at an ATM, you will be charged a $2 fee by Cash App. However, this fee can be avoided if users receive at least $300 per month in direct deposits to their Cash App account. For these users, Cash App reimburses the fees for three ATM withdrawals per 31 days, up to a total of $7 fee reimbursement per withdrawal.

Cash App ATM Withdrawal Limit

The withdrawal limit for Cash App is a crucial aspect for users who need to manage larger sums of cash. Cash App sets a $310 maximum limit per transaction, a $1,000 limit per 24-hour period, and a $1,000 limit per 7-day period. These limits are imposed to ensure security and to manage the liquidity requirements across all users efficiently.

How to Withdraw Money from an ATM with Cash App

To withdraw money using your Cash App card at an ATM, follow these simple steps:

Insert your Cash App card into the ATM slot.

Enter the PIN that you set up for your Cash App card.

Select the amount of cash you wish to withdraw, ensuring it does not exceed your daily or Cash App weekly limit.

Confirm the transaction and collect your money.

Benefits of Using Cash App for ATM Withdrawals

Using Cash App for ATM withdrawals comes with several benefits:

Ease of Access: With the wide availability of ATMs, you can quickly get cash whenever you need it.

Direct Deposit Advantages: Qualifying for direct deposit fee reimbursements can save frequent users a significant amount in fees.

Instant Availability: Funds from Cash App are available instantly, making it convenient to withdraw cash as soon as you receive transfers or payments.

Maximizing Your Cash App Features

To make the most out of Cash App, users should explore other features that enhance their financial mobility and freedom:

Direct Deposits: Set up direct deposits to your Cash App to qualify for ATM fee reimbursements.

Cash Card Customization: Customize your Cash Card through the app to reflect your personal style.

Boosts: Take advantage of Cash App’s Boosts to save money at various merchants and receive instant discounts on purchases.

Security Measures for Safe ATM Withdrawals

Security is paramount, especially when dealing with finances. Cash App incorporates several security features to protect your money:

PIN Protection: Every transaction requires you’re PIN, ensuring that only you can access your funds.

Encryption and Data Protection: Cash App uses advanced encryption protocols to secure your financial data.

Fraud Monitoring: Continuous monitoring of accounts to detect and prevent unauthorized activity.

Conclusion

Cash App's ATM features offer a mix of convenience and control, tailored to modern financial needs. Whether you're withdrawing small amounts for everyday expenses or managing larger withdrawals, understanding the fees and Cash App limits associated with Cash App can help you optimize your financial transactions.

2 notes

·

View notes

Text

I'm in need of help

Sorry to make another post like this. I thought things were getting better, but unfortunately we're still not recovered. For some backstory: my wife was laid off in March and we were getting by until this week on just my paychecks. My wife finally got a job, but she won't get paid until 8/6. I've had to open numerous credits card accounts and take out loans and I can't take out any more. Right now we have $100 in our account, and we need $40 of that for gas. We have enough groceries to last until 7/23, but after that we will need to order groceries to last until at least 7/31. I won't be getting direct deposit next week because I changed my deposit account, so I'm not expecting to get the check until that Monday. If anyone can donate anything to help us get groceries, that would be so, so helpful right now. If you can't donate, please share this post. Thank you so much.

Cash app: $KailynRidgeway

Venmo: @KailJR

15 notes

·

View notes

Text

Over 100 of the world's governments are planning to push central bank digital currencies (CBDCs) and the collapse of Silicon Valley Bank may have given them the perfect opportunity to introduce this nightmarish surveillance tech.

The heightened fear of bank runs and the growing calls for more government controls to prevent another Silicon Valley Bank-style event has created space for governments to swoop in and present CBDCs as the solution.

Prepare for these talking points to become prominent as governments ramp up their efforts to push CBDCs:

Talking Point 1: CBDCs will protect you from social media bank runs

Within days of Silicon Valley Bank's failure, it was described as the “first social-media fueled bank run in history” and fears about “social media disinfo” started to be stoked.

Similar talking points were quickly echoed by politicians. United States (US) House Financial Services Chair Patrick McHenry described it as “the first Twitter fueled bank run.” During an emergency conference call with high-ranking federal government officials, Senator Mark Kelly asked if the officials were reaching out to tech platforms to monitor “misinformation” and “bad actors” and inquired about the possibility of censoring social media posts to avoid a bank run.

Governments are likely to seize upon and amplify these fears of social media bank runs as they push new regulations and proposals in the wake of the Silicon Valley Bank collapse. And they're likely to position CBDCs as the solution.

Be on the lookout for suggestions from officials that CBDCs are “safe” and immune to social media bank runs. While such promises may soothe citizens' fear of bank runs, this fear will be replaced with something far worse for those that embrace CBDCs — programmable money that allows the government to dictate when, where, or if citizens can spend their money.

Talking Point 2: CBDCs will provide financial stability

As Silicon Valley Bank collapsed, the prospect of widespread financial contagion event loomed. Companies said they were left unable to pay staff, large online platforms delayed payments to sellers, and other companies revealed that they held significant portions of their cash at Silicon Valley Bank.

While the US government stepping in to guarantee Silicon Valley Bank customer deposits appears to have averted much of the wider financial collateral damage (although this won't be fully apparent until more time has passed), President Joe Biden has already vowed to “reduce the risks of this happening again.”

Get ready for governments to capitalize on the fear of financial instability and use this narrative to push new rules and regulations that will supposedly provide financial stability. They'll likely blame banks for creating financial blowups, insist that governments need more control over the financial system, and present CBDCs as the tool that will bring financial stability.

Those that fall for this fantasy will be locked into a system that's anything but stable. Instead of bringing financial stability, CBDCs will force citizens into a constant state of financial uncertainty where they never know when the rules about how they can spend their money will change or how significant the changes will be.

Talking Point 3: CBDCs should be used for customer deposit protection

Many governments have already cited making direct payments to citizens as one of the main use cases for a CBDC. If more banks fail, expect governments to start increasingly focusing on CBDCs as a solution for affected customers.

Be on the lookout for governments urging citizens to download CBDC wallet apps during times of financial uncertainty. They'll likely assert that this is a more streamlined or efficient way for customers to have instant access to their deposits in the event of bank failures.

While CBDCs may provide some short-term convenience during financially turbulent times, citizens that choose CBDCs will be sacrificing their freedom and privacy long-term. Once they've been ushered into this system, they'll lose their ability to transact anonymously and only be allowed to spend their CBDCs on government-approved purchases.

Remain vigilant against CBDCs

During the last major crisis, the Covid pandemic, governments leveraged uncertainty and fear of the virus to push dystopian surveillance tech such as contact tracing, vaccine passports, and digital ID. Expect them to use the same playbook when pushing CBDCs.

Governments are likely to use talking points that tap into people's fear of losing money during times of economic turbulence and use false promises of safety and stability to lure citizens into a CBDC system.

Don't be fooled. Governments have already made it clear that they plan to strip users of their financial freedom and privacy by imposing CBDC spending limits and controls and removing anonymity.

Reject these talking points when you hear them and say no to CBDCs!

9 notes

·

View notes

Text

6 Experimental And Mind-Bending Buying Bitcoin Techniques That You will not See In Textbooks

https://facebook.com/GoPickUpCoin

https://gpucoin.wordpress.com/

If you're ready to learn how to put money into Binance Coin proper now - the step-by-step walkthrough will present you the way to complete the process with eToro. You'll have to have the "Show all belongings" field checked up for viewing the listing of all out there cryptocurrencies to deposit. Step 3: Deposit fiat funds: Deposit fiat money resembling USD or AUD to start out buying Polygon MATIC among other cryptocurrencies. Yes. Buying bitcoins from regulatory compliant bitcoin exchanges is risky as a result of you have to belief they are going to handle your documents with privacy and security. This is maybe, with the exception of Bitcoin - resulting from its dominance of the market.

Cash App

Easy and fast signups - can get started in as little as a 5 minutes

John Carvalho (@BitcoinErrorLog) November 2, 2021

Choose XRP and then specify how much you want to buy

Amid market volatility, the on-chain motion of the world’s most valuable digital asset elevated. Customers make and alternate the worth of a forex that varies over time within the inventory market. ICO Alert has helped over 800 different initiatives obtain their goals by means of a phased consulting strategy. This technique - which is called dollar-value averaging, permits you to buy Binance Coin over an extended period of time, so you'll be able to cease being attentive to quick-term pricing traits. In this article, we will reveal some necessary facts about Binance Coin and the place to purchase Binance Coin if you're willing to invest in cryptocurrency.

How To Buy Btc With Credit Card

The above steps are the summary of buying Binance Coin with a Credit card or Debit Card instantly. Buy using quite a lot of cost methods: Coinmama is one among the first exchanges to help shopping for cryptos utilizing not only credit score and debit playing cards, but in addition Apple Pay and direct bank switch. If you want to skip this step to a later date, you can accomplish that on the proviso you are not buying more than €2,000 (about £1,600) price of Binance Coin. Your ultimate step to changing into a bona fide bitcoin trader is to know when to purchase, sell or hold - or as crypto stans say, HODL (see below).

Best Way To Buy Bitcoin

Other sources recording social interactions with the crypto sphere are less enthusiastic. Once your purchase is full, the codes are now owned by you and never the vendor. Coinbase has an ideal person interface to make the whole buy process easier. In order for you to purchase Bitcoins on-line, particularly if you want to use money, you'll be able to do so by Bitcoin Exchange. Because the business commonplace for online purchases, credit score and debit playing cards offer a fast and convenient way for you to accumulate bitcoin. Contrary to what Binance Coin price predictions tell you, there is no such thing as a surefire method to know the way much BNB will likely be value sooner or later.

Step-by-Step Guide: Where to buy Binance Coin (BNB)? Where is the best place to purchase Binance Coin? The question and ongoing debate throughout the community is the place finest to retailer your non-public keys: a scorching wallet or a cold wallet. Coinbase is called the very best crypto wallet. Whenever you might be confused about future Binance Coin investments and crypto buying and selling, you may contact Binance to resolve the issue. While taking choices on investments always keep the large image in mind. Healthy possibility for investments. App customers can complete ‘Missions’ which reward them in Diamonds - these can then be exchanged for Mystery Boxes containing CRO.

Where Can I Buy Btc

The actual diamonds are often mistaken to be utterly transparent however they don't seem to be. Some, such as Riot Blockchain (RIOT), are in the business of mining Bitcoin. Well i'll prefer to introduce you to a fast growing enterprise which is Cryptocurrency business (BITCOIN) where you may make investments. Which means you should buy Polygon with Bitcoin. You should purchase BNB at the click of a button. That is essential, as this discounted entry price is on supply regardless that the fundamentals of BNB haven’t changed.

2 notes

·

View notes

Text

Make Money Online From CASH APPS 2023!

Introduction

Cash App is a popular mobile payment app that allows users to send and receive money, as well as make purchases and invest in stocks. It's a convenient and secure way to manage your financial transactions on the go.

One of the main benefits of using Cash App is that it's quick and easy to use. Simply link your bank account or credit card to the app, and you can start making payments right away. You can also set up direct deposits for your paycheck or other recurring payments, and view your transaction history at any time.

In addition to basic payment functionality, Cash App also offers a variety of other features that can help you manage your money. For example, you can use the app to invest in stocks through its brokerage service, or set aside money in a separate "Cash Boost" account to earn interest.

One of the most unique aspects of Cash App is its "Cash Card," a customizable debit card that is linked to your account. You can use the Cash Card to make purchases anywhere that Visa is accepted, and even withdraw cash from ATMs. And with the app's "Boost" feature, you can get instant discounts at certain merchants just by using your Cash Card.

Overall, Cash App is a great tool for anyone looking to streamline their financial management and make payments on the go. Whether you're paying a friend back for lunch or investing in the stock market, Cash App has you covered. So, it is definitely worth giving it a try.

Some Facility Cash APPS!

Yes, here are some facilities offered by Cash App:

Send and receive money: With Cash App, you can easily send and receive money from friends, family, and businesses.

Make purchases and pay bills: You can use Cash App to make purchases at participating merchants and pay bills directly from the app.

Invest in stocks: Cash App offers a brokerage service that allows you to invest in stocks and ETFs for as little as $1.

Set up direct deposits: You can link your Cash App account to your employer or other payers to receive direct deposits.

Use a customizable debit card: The Cash App card, also known as the Cash Card, is a customizable debit card that is linked to your account. You can use it to make purchases and withdraw cash from ATMs.

Get instant discounts: With the Cash App "Boost" feature, you can get instant discounts at certain merchants just by using your Cash Card.

View transaction history: You can view your transaction history at any time to track your spending and see where your money is going.

Send and request money from groups: With Cash App, you can easily send and request money from groups of people, such as for shared expenses or group gifts.

Set aside money in a separate account: You can set aside money in a separate "Cash Boost" account to earn interest and save for future expenses.

Click MY No #1 RECOMMENDATION

#cashapp#make money online#earning money online#make money online 2023#cash app 2023#top earning apps 2023#online from best ways online 2023

2 notes

·

View notes

Text

Cash App The Pros, Cons and Features of The Popular Payment Service

Keep reading for a deeper look into Cash App.

What Is Cash App?

that allows individuals to quickly send, receive and invest money. Block, Inc., formerly Square, Inc., launched the app in 2013 (initially named Square Cash) to compete with mobile payment apps like Venmo and PayPal.

Get it Now – Cash App Money Generator

https://www.helth.shop

Get it Now – Cash App Money Generator

Cash App is a financial platform, not a bank. It provides banking services and debit cards through its bank partners. The balance in your account is insured by the Federal Deposit Insurance Corporation (FDIC) through partner banks. Cash App provides investing services through Cash App Investing LLC, registered with the Securities and Exchange Commission (SEC) as a broker-dealer and a member of the Financial Industry Regulation Authority (FINRA).

Through Cash App, users can send and receive money, get a debit card and set up direct deposits. The investing feature allows users to invest in stocks for as little as $1. This is done by buying pieces of stock, called fractional shares. Consumers can also buy, sell or transfer Bitcoin through the app.

With Cash App Taxes (formerly Credit Karma Tax), users can file their taxes for no charge. With this service, Cash App is quickly becoming a one-stop shop for financial services.

How Does Cash App Work?

To use Cash App, you must first download the mobile app, available for iOS (4.7 stars out of 5) and Android (4.6 stars out of 5). You can also sign up for an account online. The app features several tabs for its various services, including banking, debit card, payments, investing and Bitcoin.

Send and Receive Money

After setting up an account, you’ll link an existing bank account to your Cash App account. Once a payment source is connected, you can send or receive money through the mobile app. Users can enter a dollar amount from the green payment tab and tap “Request” or “Pay” to create a payment.

Each Cash App user creates a unique username, called a $Cashtag. You can find individuals or businesses to pay or request money by searching for their $Cashtag. You can also search for individuals by name, phone number or email address. You can choose to send funds from your Cash App balance or your linked funding source.

Transfer Money

The money is kept in your Cash App balance when you receive payments. You can keep it there or transfer it to your linked bank account. Cash App charges a fee for instant transfers (0.5% to 1.75% of the transfer amount, with a minimum fee of $0.25), but you can also choose a no-fee standard transfer, which typically takes one to three business days to complete.

Add Money

To add money to your Cash App account, navigate to the app’s banking tab and press “Add Cash.” Select the decided amount and tap “Add.”

Who Can Use Cash App?

Cash App is for individuals ages 13 and older. Users ages 13 to 18 require approval from a parent or guardian to access expanded Cash App features like P2P transactions, direct deposit and a Cash Card.

Other features, such as investing and Bitcoin, are only available for Cash App users who are at least 18.

Does Cash App Offer a Debit Card?

Cash App users can receive a Cash Card, which is a debit card tied to their Cash App account. Like most debit cards, the Cash Card can be used to make purchases online and in person. You can also add your Cash Card to digital wallets like Apple Pay or Google Pay.

Users can also use Cash Cards at ATMs. Cash App charges a $2 fee per ATM transaction. In addition, the ATM owner may charge a separate fee for ATM use. For users who receive direct deposits of at least $300 each month, Cash App reimburses ATM fees, including third-party ATM fees, for up to three ATM withdrawals per 31-day period (up to $7 in fees per withdrawal).

Cash Card transactions are subject to the following withdrawal limits

★ Sign up free from the link below.

👇👇👇👇👇👇👇👇👇

https://www.helth.shop

Get it Now – Cash App Money Generator

https://www.helth.shop

Get it Now – Cash App Money Generator

$310 per transaction

$1,000 per 24-hour period

$1,000 per seven-day period

What Does It Cost To Use Cash App?

Cash App costs nothing to download and create an account. And it doesn’t charge fees for many of its services. Standard transfers from a Cash App balance to a linked bank account are fee-free, but a small fee is charged for instant transfers.

Users that request a Cash Card are subject to fees for ATM use. Cash App may also charge a fee when you’re buying or selling Bitcoin. The fee is listed before you complete the transaction.

How Long Does It Take To Send Money?

Cash App payments are instant and funds are available to use immediately in most instances. If your account shows payment pending, you may need to take action and follow the steps provided by the app to complete the transaction.

What Are the Dollar Limits on Cash App?

Cash App restricts how much you can send or receive when you first open an account. Users can send up to $1,000 per 30-day period and receive up to $1,000 per 30-day period.

Cash App users can have their account verified to access higher limits. Sending limits vary depending on what you’re approved for by Cash App. Once verified, there is no limit to how much money you can receive through the mobile app.

Is Cash App Safe?

Cash App says it employs the latest encryption and fraud protection technology to protect its users. As a security measure, the app will send you a one-time-use login code when logging into your account. Cash App also offers optional settings to enable additional security measures. By enabling a security lock, for example, every Cash App payment requires your passcode. You can also disable your Cash Card within the app, which could come in handy if your card is lost or stolen.Keep reading for a deeper look into Cash App.

What Is Cash App?

Cash App is a P2P payment app that allows individuals to quickly send, receive and invest money. Block, Inc., formerly Square, Inc., launched the app in 2013 (initially named Square Cash) to compete with mobile payment apps like Venmo and PayPal.

Cash App is a financial platform, not a bank. It provides banking services and debit cards through its bank partners. The balance in your account is insured by the Federal Deposit Insurance Corporation (FDIC) through partner banks. Cash App provides investing services through Cash App Investing LLC, registered with the Securities and Exchange Commission (SEC) as a broker-dealer and a member of the Financial Industry Regulation Authority (FINRA).

Through Cash App, users can send and receive money, get a debit card and set up direct deposits. The investing feature allows users to invest in stocks for as little as $1. This is done by buying pieces of stock, called fractional shares. Consumers can also buy, sell or transfer Bitcoin through the app.

With Cash App Taxes (formerly Credit Karma Tax), users can file their taxes for no charge. With this service, Cash App is quickly becoming a one-stop shop for financial services.

How Does Cash App Work?

To use Cash App, you must first download the mobile app, available for iOS (4.7 stars out of 5) and Android (4.6 stars out of 5). You can also sign up for an account online. The app features several tabs for its various services, including banking, debit card, payments, investing and Bitcoin.

Send and Receive Money

After setting up an account, you’ll link an existing bank account to your Cash App account. Once a payment source is connected, you can send or receive money through the mobile app. Users can enter a dollar amount from the green payment tab and tap “Request” or “Pay” to create a payment.

Each Cash App user creates a unique username, called a $Cashtag. You can find individuals or businesses to pay or request money by searching for their $Cashtag. You can also search for individuals by name, phone number or email address. You can choose to send funds from your Cash App balance or your linked funding source.

Transfer Money

The money is kept in your Cash App balance when you receive payments. You can keep it there or transfer it to your linked bank account. Cash App charges a fee for instant transfers (0.5% to 1.75% of the transfer amount, with a minimum fee of $0.25), but you can also choose a no-fee standard transfer, which typically takes one to three business days to complete.

Add Money

To add money to your Cash App account, navigate to the app’s banking tab and press “Add Cash.” Select the decided amount and tap “Add.”

Who Can Use Cash App?

Cash App is for individuals ages 13 and older. Users ages 13 to 18 require approval from a parent or guardian to access expanded Cash App features like P2P transactions, direct deposit and a Cash Card.

Other features, such as investing and Bitcoin, are only available for Cash App users who are at least 18.

Does Cash App Offer a Debit Card?

Cash App users can receive a Cash Card, which is a debit card tied to their Cash App account. Like most debit cards, the Cash Card can be used to make purchases online and in person. You can also add your Cash Card to digital wallets like Apple Pay or Google Pay.

Users can also use Cash Cards at ATMs. Cash App charges a $2 fee per ATM transaction. In addition, the ATM owner may charge a separate fee for ATM use. For users who receive direct deposits of at least $300 each month, Cash App reimburses ATM fees, including third-party ATM fees, for up to three ATM withdrawals per 31-day period (up to $7 in fees per withdrawal).

Cash Card transactions are subject to the following withdrawal limits:

$310 per transaction

$1,000 per 24-hour period

$1,000 per seven-day period

What Does It Cost To Use Cash App?

Cash App costs nothing to download and create an account. And it doesn’t charge fees for many of its services. Standard transfers from a Cash App balance to a linked bank account are fee-free, but a small fee is charged for instant transfers.

Users that request a Cash Card are subject to fees for ATM use. Cash App may also charge a fee when you’re buying or selling Bitcoin. The fee is listed before you complete the transaction.

How Long Does It Take To Send Money?

Cash App payments are instant and funds are available to use immediately in most instances. If your account shows payment pending, you may need to take action and follow the steps provided by the app to complete the transaction.

What Are the Dollar Limits on Cash App?

Cash App restricts how much you can send or receive when you first open an account. Users can send up to $1,000 per 30-day period and receive up to $1,000 per 30-day period.

Cash App users can have their account verified to access higher limits. Sending limits vary depending on what you’re approved for by Cash App. Once verified, there is no limit to how much money you can receive through the mobile app

Is Cash App Safe?

. As a security measure, the app will send you a one-time-use login code when logging into your account. Cash App also offers optional settings to enable additional security measures. By enabling a security lock, for example, every Cash App payment requires your passcode. You can also disable your Cash Card within the app, which could come in handy if your card is lost or stolen.

2 notes

·

View notes

Text

Buy Verified Cash App Account

The cash app is a mobile payment system that was launched by Square Inc in early 2018. The platform has gained high popularity in the US due to its convenience and ease of use. It allows users to buy bitcoin and cash out from their verified account with an ATM option. Cash App is an online money payment system that has become famous due to its security and convenience. It is a very popular virtual payment method, but before you can use it, you have to make sure your account is verified. Verified Cash App accounts offer users the option of transferring unlimited amounts of money in a secure and easy way.

Well, It’s The cash app and you can also buy verified accounts that are ready to use. The app allows users to send money to each other using its app — not a bank account or credit card needed. One can easily transfer funds between friends and family members at no cost without the need of an account number or routing number.

When I say trustworthy, it simply means that you are safe when receiving any amount of money with no fears of being banned from the payment method. cash app bitcoin withdrawal limit. Buy Verified Cash App Account.

Buy Verified Cash App Account

What is a Cash App?

Cash App is a mobile payment service that allows users to send and receive money without the need for a bank account. Square Inc, which developed Cash App, was founded by Jack Dorsey in 2009. The company’s headquarters are located in San Francisco, California. It provides merchants with point-of-sale services as well as online. Cash App also functions like a bank account, giving users a debit card — called a “Cash Card” — that allows them to make purchases using the funds in their Cash App account. The app also allows users to invest their money and buy and sell bitcoin.

What is Benefits of using Cash App Account

The Cash App provides a seamless way to transfer money between friends and family, which is particularly convenient with its quick send feature.

Saves you time. You can also withdraw money from a Bank of America ATM with the Cash Card, and it’s a great solution for those who don’t have a bank account or prefer not to use one. Cash App comes with an optional free debit card, called “Cash Card,” which allows users to make transactions.

If you set up direct deposit, your Cash App will reimburse you for ATM fees; otherwise the fee is $2 per transaction.

Cash App offers a variety of “boosts” that help users save money when using their debit card. When you have the Cash Card, you can choose one boost per active purchase, but it’s possible to switch boosts before each purchase. Buy Verified Cash App Account.

Cash App is a mobile payment app that lets you send and receive money with friends quickly and easily. Cash App also has a built-in digital wallet, so you can pay your friends back at any time or shop

online. With Cash App you can:

• Send and receive money instantly

• Pay anyone with an email address or phone number

• Get paid by

6. Cash App is beneficial to its users in that they can invest their money into specific stocks with the app. Users can buy stock in a certain company for whatever amount of money they want to invest, so there are no minimums. They can pay for the stock by using the funds in their Cash App account or if they don’t have enough, then they can

7. Cash App is a mobile app that lets users transfer money to one another and pay for things with their phones. Users can link their bank account and debit card to Cash App, and then send funds free of charge. Cash App also allows users to purchase bitcoin, but the app charges two kinds of fees: a service fee for each transaction and an additional fee based on price.

How Secure Is a Cash App?

Cash App uses a protocol similar to the one used by credit cards, which is secure enough for most transactions. This type of security is referred to as “PCI-DSS,” and it’s the same method used by major card companies. Payments are encrypted on both ends, so they’re just as safe as using a credit card.

Despite solid security, remember your Cash App balance is not FDIC-insured. This can be a strike against the service and something to keep in mind when you open an account.

CashApp also allows you to invest in stocks and Bitcoin. If you use CashApp for investing purposes, this might amplify your concerns. CashApp is a registered broker-

“The app is very new, which also makes it a little more risky,” says Shuchman. “Some of the other drawbacks include not being able to trade options and only having a limited amount of trading instruments offered.”

According to Shuchman, “The platform doesn’t offer mutual funds. You also can’t trade options or some other advanced investment products. Cash App has very limited analytics and research features. It is probably not an appropriate platform for larger and more sophisticated investors,” says Shuchman.

3 notes

·

View notes

Text

Earn Money at Home with MOBILE BANKING

As we are slowly turning into a digital economy, online banks are popping up everyday. However, some offer better benefits than others and today I am here to share those with you and the incentives that you earn when you join.

MONEY LION:

Born in 2013, MoneyLion offers more than just a checking and savings. Once a ‘RoarMoney’ lion account is created, you have access to certain cryptos like bitcoin & ethereum and getting paid 2 DAYS EARLY! Investment accounts and cashback rewards are also apart of the mobile banking app.

Use Promo Code “$RANDII” to get $55, FREE! QUICK PAYOUT and great app!

* $5 bonus for signing up and creating a ROAR account.

* $50 bonus for direct deposit over $100.

* Spend $10 on crypto, get $5!

* Also, access up to $250 with Money Lion instacash, OR up to $1000 in cash advances if you use direct deposit!

Referral code: $randii or use the link

https://mlion.us/$randii

DAVE:

Dave helps over 3 million people thrive, not just survive, between paychecks. Connect any bank account to start, or open your own Dave checking account. Takes less than 2 minutes.

! For a limited time, Dave is giving new qualified members $15 to take their first advance up to $250 to spend on anything you choose. Open a Dave Spending account to claim your reward: https://dave.com/invite-a-friend/get-15-gift-15/3v1q1c22

VARO:

Varo is a free fintech banking app similar to Chime or Current. It’s currently offering a $50 bonus to new users that open a new Varo account with a referral link. Here’s how to earn your Varo referral bonus:

* Open a Varo account using a referral link (here’s my Varo referral link)

https://varomoney.com/r/?r=randi225

* Spend $20 within 30 days of opening your Varo account.

* Your bonus will be deposited within 4–7 business days of meeting the requirements.

The Varo referral bonus is particularly easy right now because it doesn’t require a direct deposit — all you have to do is spend $20 on the Varo debit card. Accordingly, I recommend snagging this bonus while you can.

#make money as an affiliate#make money websites#refer and earn#earnfromhome#work from home#easy money#fast money#how to make money fast

2 notes

·

View notes

Text

How Do You Get Free $100 on Cash App?

If you want to receive free money in your Cash App account, you need to sign up and make some deposits. There are specific methods to earn money using Cash App, including a $5 sign-up bonus, downloading apps, converting your bank account, and providing reviews. However, you want to deposit at least $200 in order to get your first unfastened $100. Read directly to learn how to get $100 free Cash App money.

The first way to earn free cash on Cash App is to refer friends to the app. If you get 3 friends to sign up, you’ll ever get $5, so that’s an easy way to get a little extra money. Once you’ve invited 3 friends, you’ll receive another $10. You can also send as many referrals as you’d like – it’s up to you. But don’t worry, this method works!

Does Cash App Give You $100?

Does Cash App give you Cash App free money for referrals? Yes. If you operate Cash App to make a direct deposit of your paycheck, you can earn $100 for free. You will want a unique routing number and account number to use Cash App, as well as a valid physical address. You can earn as much as $100 a day on this way. You may also be able to earn a couple 100 dollars per referral!

Scammers take advantage of vulnerable people who may be looking for quick cash. Often, they impersonate the Cash App brand or the company’s CEO or other high-quality figures. Scammers also promote fake Cash App generators on YouTube. Cash App is a popular Square charge service, and its current promotion campaign includes unfastened coins giveaways. Its merchandising campaign has emboldened an army of scammers, so watch out for cash giveaway offers on social media.

Read more: – Cash App Connection Error

Can You Get Free Money on Cash App?

One way to earn money with Cash App is to refer pals and family. Referring friends and family can earn you up to $15 for each new referral. To earn greater free cash, send money to friends and family. Then, use your referral code to login to Cash App and enjoy the cash. It doesn’t get any easier than this! But be careful! Cash App does charge fees. Before referring pals and family, make sure to read our full Cash App review.

The Cash App is 100% legitimate and is free of fees. You also can earn free cash back and receive a $100 Cash Card boost after making a $300 deposit. There are many ways to earn free cash with Cash App, but most of them involve scammers. So, beware! Don’t fall sufferer to those tricks! Only the legit ways to earn money with Cash App free money code and share your unique referral link with your pals and family.

How Can I Get 100 Cash?

If you’ve been wondering how to get 100$ on Cash App, you aren’t alone. Millions of users around the world are eager to cash in on this money-making app. It’s not easy to make money from cash apps, however the rewards are worthwhile. There are some steps you could take to earn money on Cash App. Here’s an easy guide to incomes on this cash-making app:

First, download the Cash App on your phone. In order to earn money from Cash App, you want to refer at least one friend and make an even exchange. To invite a friend, tap the “Invite Friends” button on your personal account page. You must enter the referral code before you can earn bonus cash. After you’ve entered the referral code, Cash App will scan your contact list and email them an invite.

#$100 free cash app money#cash app free money#cash app free money code#free cashapp money#free money on cash app#how to get free money on cash app#cash app unexpected error cash card

2 notes

·

View notes

Text

Why is My Cash App Direct Deposit Pending?

If your Cash App direct deposit pending, you may be wondering why it is not yet hitting your bank account. There are a couple of possible reasons for this. Either your bank account may not have enough funds to cover the transaction, or the Cash App server might be having issues. It may also take some time to process your transaction, particularly if you have another account open simultaneously. Whatever the cause, if you have been waiting for your funds for some time, you can try these simple solutions to resolve the issue.

How long does direct deposit take on Cash App?

Sometimes, your Cash App direct deposit may take longer than you expected. Check that you have enough funds in your account, or contact your bank to see if they can authorise the transaction. It may happen that your bank account does not have enough funds to cover the payment, or the server is down. In either case, the payment will be pending until the server resolves the problem. If this is the case, you can try again later.

If your cash app is outdated, there are a few reasons why Cash App direct deposit is late. If you're using an old app version, the CVV code might be wrong or expired. Or, you may have violated the terms of service. Either way, make sure you've checked everything and if the issue persists, contact your bank or Cash App's support team.

What time does the Cash App direct deposit hit your account?

So when will your Cash App direct deposit hit your account? The exact time will vary depending on your bank and the day your transfer was initiated. Typically, the money will be deposited two to three days before payday. However, your deposit may be delayed if you work on a weekend or during a holiday. If you're paying bills for a company that has multiple locations, you may want to choose one that accepts Cash App direct deposit.

Direct deposits to Cash App accounts should arrive in your account between 12 and 6 a.m. on the next business day. However, depending on your employer's policy, you may receive your payment a day or two later. If you've opted for an early payment service, it may take as little as two days for your cash deposit to hit your bank account. If your direct deposit arrives late or is deposited erroneously, you may want to contact your employer to request a refund.

How to resolve Cash App direct deposit issues?

If your Cash App deposit pending, you may be experiencing some niggling issues. These issues could be related to your bank's policies or routing number. Alternatively, you may be experiencing a problem with your mobile phone. If your mobile data or WiFi connection is working properly, you can try uninstalling and reinstalling the Cash App. This should fix the issue. If not, try contacting your bank.

Other causes for Cash App direct deposit issues can be connectivity issues, incorrect payment card details, and insufficient account balance.

Depending on the reason for your delayed direct deposit, you may also need to update your bank information.

For example, if you change your bank account information on your Cash App account, your payment card will no longer be charged.

#cash app direct deposit unemployment#cash app direct deposits#cash app direct deposit time#cash app direct deposit bank name

2 notes

·

View notes

Text

Cash App direct deposit pending (Guide by AppsMentorship)

If you've had your Cash App direct deposit pending, you're probably wondering how to fix it. The issue could be with your bank or your device. You could have tried contacting the Cash App worker, but it doesn't seem to be responding. If that happens, you can't withdraw cash from your bank account. Instead, you may have a problem with the Cash App.

How long does a pending direct deposit take on a Cash App?

If you use the Cash App, you've probably wondered how long it takes for a pending direct deposit to show up on Cash App. This timeframe is usually one to five business days, but sometimes it can be longer, especially if you use a foreign credit card. You can contact customer support or your bank to get an exact timeframe. It's also good to check your account status online to see if your payment is on its way. After receiving your direct deposit, you can log in to your Cash App account and see if your payment has been approved or declined. You'll know if it's approved or declined in one to five business days.

If your Cash App direct deposit failed for some reason, you might want to check your connection or WiFi. Sometimes a connection problem or critical software update can hold up the payment. Additionally, you may want to check the validity of your card. If you're receiving inconsistent results, you may want to contact customer support so you can clear the issue. If these steps fail to fix your problem, you can try waiting a few more days.

How to fix Cash App deposit pending issues?

If you're experiencing Cash App deposit pending issues, you're probably in the same boat as millions of others. The pending payment disappears from your activity feed after a couple of hours, but you can resolve the problem by taking a few simple steps.

First of all, make sure your internet signal is strong. If it's not, try updating your application.

Ensure you're not violating Cash App's terms and conditions and that your device has enough internet signals.

Another common cause of Cash App direct deposit pending issues is the insufficient account balance.

Your bank or employer may have entered incorrect information, or you may have an outdated account.

If you don't have enough money to cover your entire deposit, ensure your bank and payment card information is up to date.

If you still have a low account balance, consider requesting a refund. It may take a few days before you can receive your next paycheck, but it's worth a try.

If you're still having trouble, contact Cash App support and ask how to resolve the issue.

Cash App says pending payment will deposit shortly

If you've made a cash purchase through the Cash App and the payment says it's 'Pending', you'll need to take action immediately to complete it. Luckily, most Cash App payments can be completed immediately if you follow the instructions in the activity feed. However, there are some possible reasons why Cash App might hold the payment - so be sure to follow the steps outlined in the activity feed carefully. Please get in touch with the Cash App support team for further assistance if you continue to have this issue.

One of the most common reasons Cash App payment pending is because the money was not transferred from the cash advance account. Sometimes this issue extends beyond simple Cash App payments. When it comes to unemployment direct deposit, this problem can affect the payment from a stimulus check, tax refund, or even an unemployment check. If you have access to an unlimited home internet connection, this error can happen because of a bad connection.

#cash app pending payment will deposit shortly#why do cash app say pending#what does pending mean on cash app

2 notes

·

View notes

Text

How do I raise my Cash App ATM withdrawal limit?

In today's digital world, mobile payment apps like Cash App have revolutionized how we manage our finances. Cash App, developed by Block, Inc. (formerly Square, Inc.), is a popular peer-to-peer payment service that allows users to conveniently send, receive, and invest money. One of its most notable features is the Cash App Card, a Visa debit card linked directly to your Cash App balance, which you can use for purchases and ATM withdrawals. However, many users wonder, "Can I withdraw $1000 from an ATM with Cash App?" This blog will explore Cash App'sApp's ATM withdrawal limits and how you can manage and potentially increase them.

Introduction

Navigating the financial landscape with mobile payment apps can be complex, especially when understanding the limits and fees associated with ATM withdrawals. The Cash App Card offers a seamless way to access your funds, but its ATM withdrawal limits can sometimes be restrictive. This comprehensive guide aims to answer the critical question: " Can I withdraw $1000 from an ATM with Cash App?" By the end of this blog, you'll have a thorough understanding of Cash App's ATM withdrawal limits, how to manage them effectively, and strategies to potentially increase these limits to better suit your financial needs.

Understanding Cash App ATM Limits

Before addressing whether you can withdraw $1000 from an ATM with Cash App, it's essential to understand the existing ATM limits. As of now, the Cash App ATM withdrawal limits are as follows:

$250 per transaction

$1,000 in 24 hours

$1,250 in 7 days

These limits are set to provide security and prevent fraudulent activities, but they can be restrictive for users who need to withdraw larger amounts of cash.

Can I Withdraw $1000 from an ATM with Cash App?

The straightforward answer to whether you can withdraw $1000 from an ATM with Cash App is yes or no, depending on the timeframe. Here's a detailed breakdown:

Single Transaction Limit: Cash App imposes a $250 limit per transaction, so you cannot withdraw $1000 in one go.

Daily Withdrawal Limit: You can withdraw up to $1000 in 24 hours. Therefore, you could make four transactions of $250 each within a single day to reach the $1000 limit.

Weekly Withdrawal Limit: The maximum amount you can withdraw in 7 days is $1,250. This means that even though you can withdraw $1000 in one day, you would only have $250 left for the rest of the week.

Strategies to Manage Cash App ATM Withdrawals

Managing your Cash App max ATM withdrawal effectively involves planning and understanding your financial needs. Here are some strategies to help you manage your ATM withdrawals better:

Plan Withdrawals Over Time: If you know you'll need $1000, plan your withdrawals over a few days rather than trying to do it all at once. Withdraw $250 at a time, spread across different days if necessary.

Utilize Cash Back Options: Many retailers offer cash back when you purchase with your Cash App Card. This can be an excellent way to access additional cash without hitting your ATM limits.

Monitor Your Usage: Monitor your withdrawal transactions closely to ensure you stay within your daily and weekly limits. This can help you avoid declined transactions and better plan your cash needs.

How to Increase Cash App ATM Limits?

Increasing your Cash App ATM withdrawal limit can provide more flexibility in managing your finances. Here are the steps to potentially increase your limits:

Verify Your Account: Fully verifying your Cash App account can increase your limits. To verify, provide your full name, date of birth, and the last four digits of your Social Security Number (SSN).

Maintain Regular Direct Deposits: Cash App rewards users who receive monthly regular direct deposits of $300 or more. This can lead to higher withdrawal limits and benefits like ATM fee reimbursements.

Contact Cash App Support: If you have specific needs or encounter issues with the standard limits, contacting Cash App support can sometimes help. They may provide personalized solutions or advice on managing your limits.

FAQs

1. Can I withdraw $1000 from an ATM with Cash App?

You can withdraw $1000 from an ATM with Cash App, but not in a single transaction. You must make four separate transactions of $250 each within 24 hours.

2. What is the maximum ATM withdrawal for Cash App?

Cash App's maximum ATM withdrawal limit is $250 per transaction, $1,000 in 24 hours, and $1,250 in 7 days.

3. How much can you withdraw from the Cash App at an ATM daily?

You can withdraw up to $1,000 from an ATM with Cash App in 24 hours.

4. How do I increase my Cash App ATM withdrawal limit?

To increase your ATM withdrawal limit, ensure your Cash App account is fully verified and receive monthly regular direct deposits of $300 or more. Contacting Cash App support for specific needs may also help.

5. Can I access more cash without increasing my ATM limits?

Yes, you can use cash-back options at retail stores when making purchases with your Cash App Card. This can help you access additional cash without affecting your ATM limits.

6. What should I do if I reach my Cash App daily withdrawal limit?

If you reach your daily withdrawal limit, you can wait until the next 24-hour period to make additional withdrawals. Planning your withdrawals over several days can help you manage more extensive cash needs.

7. Is there a limit on the amount I can withdraw in a week with Cash App?

Yes, the limit on the amount you can withdraw in 7 days with Cash App is $1,250.

Conclusion

Managing your Cash App ATM withdrawals effectively involves understanding the limits and planning your transactions accordingly. While you can't withdraw $1000 in a single transaction, you can do so over multiple transactions within a day. By verifying your account and maintaining regular direct deposits, you can increase your withdrawal limits, giving you more flexibility in managing your finances.

#Cash App atm withdrawal limit#Cash App atm withdrawal limit per day#Cash App atm withdrawal limit per week#Cash App withdrawal limit atm#Cash App daily atm withdrawal limit#Cash App withdrawal limit#increase Cash App withdrawal limit#increase Cash App atm withdrawal limit

0 notes