#by 'singles' i mean dice separate from a set not. hot singles in your area kdjfhgkjfdh

Note

What dice do you think everyone would have? You can't tell me Fitzjames wouldn't have some bejeweled gay ass dice while croziers probably been using the same set since the 80s. Hickeys are all stolen from other players while Edwards d6 isn't even a DND dice it's from Yahtzee

fitzjames has an immaculate and varied dice collection. he stores them in a fancy embroidery thread storage box, the kind with the drawers and dividers. he mainly buys custom-made dice sets from people on instagram and etsy and stuff, but he has a few chessex gemini sets from the dark early days of his dnd career. he curates a collection of 5-10 sets for each character, and considering how many charisma casters he plays, they tend to skew towards glittery.

crozier has a pound-of-dice that he carries around in its original packaging. it makes a satisfying thud on the table which is good for emphasis.

all of hickey's d6s, d8s, d10s, and d12s are appropriated from hodgson's bardic inspiration. his d4s are from mcdonald's guidance. he has a rule, official or unofficial, that any die that gets handed to him is now his. however, he doesn't have any d20s because bardic inspiration doesn't go that high, and whenever he asks to borrow a d20 someone just rolls and gives him the number on the die.

nedward forgets his dice on the regular. sometimes he has to buy a set on the way to the game, which means he's slowly accumulated a collection. most are chessex, because everything is chessex, though he lucked out with a crystal caste set that was just sort of living on a back shelf. he's got no clue how much it's worth and hickey keeps trying to borrow his dice, but fortunately nedward "tell me to make a decision under pressure and i'll burst into tears" little is playing a fighter and has no reason to give him anything.

jopson's got a nice collection too. his is much more curated, and he's the type to put together a color-coordinated set for each character he plays. he also sewed his dice bag himself, and sells them on his etsy store (jop's shop).

blanky's dice are all from the last century. by this i mean he's got dice sets he purchased in the 80s and 90s and he's also got like, vintage casino dice. nowadays he refuses to purchase any new dice sets (will go on ebay for pre-2000s singles though) and his most reliable die by far is one he found on the ground in a parking lot. he's also the kind of player who prefers rolling spicy to rolling high, and min-maxes his characters to give them the opportunity to roll a -1 on a check.

mcdonald is extremely normal about his dice. he has some sets. he doesn't mind receiving a set as a gift, and if he's around a mismatched singles tray he'll have a look. you look at him and think, wow, that's a normal guy who's regular about dice. then when he empties out his dice bag on the table it roars like a waterfall.

goodsir has four sets. the only reason he has four of them is to roll 4d6 for his stats (i know i used point buy for his character but like. can you blame me). he bought them from barnes & noble, they're all chessex, two of them are duplicate sets. he now has one set of solid white with black ink, two sets of chessex light green borealis, and one set of chessex frosted caribbean blue.

gore is one of those one-set-per-session players. he brings one of those little chessex boxes with a set and uses it for the game. crits are excruciating, but at least he's not playing a wizard.

dundy brings three sets to the table: a low-rolling set, a high-rolling set, and a wild card set. to determine these, he rolls all the d20s in his collection and picks the sets corresponding to the high and the low, and then picks whichever third set he wishes. at the table, he taps the high-rolling d20 against the table three times on its 20 face, and the low-rolling d20 three times on its 1 face. he then proceeds to mostly use the wild card set.

hodgson has no clue where all his dice keep disappearing to- oh well! just have to buy some more! like fitzjames, most of his collection is from dice makers on instagram and etsy, so it's a real shame so much of it just goes to hickey. also, hodgson is the only one at the table who uses metal dice.

#by 'singles' i mean dice separate from a set not. hot singles in your area kdjfhgkjfdh#the terror dnd

18 notes

·

View notes

Text

Hope in Change - Epilogue

Murtagh stumbles across a couple arguing in the street and quickly realizes the young woman is Brianna.

Part One, Part Two, Part Three, Part Four, Part Five

Murtagh, Jamie, and Ian were at work building a cabin for Fergus and Marsali and Claire had taken Lizzie to help deliver a baby at one of the settler’s cabins several miles away, so Brianna volunteered to run back and forth fetching spare or replacement tools, bringing food and water, leading Clarence back to his pen when they’d finished moving the heavier logs into place for stripping and cutting.

The mule was stubborn and reluctant to return to captivity after having a chance to stretch his legs and do more than pull a cart. Each time Brianna disappeared around the house to grab him some more food or check to see how the laundry was drying on the line, he made a ruckus when she came back into sight and stamped his foot to get her attention.

“You’re like a toddler throwing a tantrum,” she muttered before rolling her eyes and heading to check on the goats and horses for their midday meal.

This time he started making noises before she’d even reached an area where he could see her. But when she rounded the corner he wasn’t alone.

“Roger?” she gasped, dropping an empty pail to the ground and running to him as he tried to dismount before his horse had stopped walking. She threw herself in his arms and buried her face in his neck. He held her tightly, sighing with relief.

“You need a bath,” she told him, her words muffled by his coat.

“Nice to see you too,” he chuckled, pulling back to look at her. She smiled then stood on her toes to kiss him.

“Did Bonnet or his men give you any more trouble? They didn’t hurt you, did they? Is that why it took you so long to find your way here?” she rambled, her eyes roving over him taking in the details of his appearance to be sure he was really there and truly in one piece.

He laughed again taking a step back to spread his arms so she could better see him. “I’m no injured. They gave me a hard time but it wasna anything I couldna handle—no after spending all that time wi’ them at sea. And it took me so long to get here because it’s a long bloody way from Philadelphia to Fraser’s Ridge when ye’ve naught but yer own two feet for much of the way—it has to be close to a thousand miles… or at least, it feels that far. I didna manage to find a horse I could afford till I’d nearly reached Virginia.”

Convinced by his cheerful indignation, Brianna grinned and moved to lead his horse to the barn while she filled him in on what she’d been up to in his absence.

“Mama probably won’t be back until tomorrow but Da and the others will be home a little before dark. Come in and help me make supper and maybe I’ll let you have some too,” she teased.

There wasn’t much left to be done as she’d accomplished the more difficult preparation earlier—dough for a pie crust, the meat (venison) cleaned and cut as finely as she could manage, kept that separate from the potatoes and carrots she’d diced. She rolled out the dough and began piecing the elements together while Roger built up the fire in the hearth.

“How are ye doin’ wi’ everything?” Roger asked, taking a seat on the bench opposite and watching her closely.

“It’s… been interesting. I’ve been hunting with Jamie and we’ve talked a lot. It’s strange, but not in a bad way… just… disorienting,” she told him, her attention entirely on the food in her hands as she stacked and arranged the pie’s filling, careful to make sure all the ingredients were distributed in equal measure. “It’s hard to explain. Every time I feel like I’ve got a handle on the past—on my childhood—I see something or hear a story and it shifts all over again. Like when I see him come up behind my mother and rub her neck… and she leaned into it and… I remember all the times I saw Daddy try to do that and she shrugged him off… until he just stopped touching her that way. I don’t think I’ll ever stop being surprised by him—by them. You’ll hardly recognize Mama when you see her.”

“Bein’ in this time… it changes ye,” he agreed. “Makes sense now, how different yer mam could be after she returned—and no just because of Jamie. I ken I’ve a newfound appreciation for many a convenience I took for granted back home. Indoor plumbing and modern transportation bein’ verra high on that list. I’ll say a prayer of thanks each and every time I so much as look at a proper toilet.”

Brianna gave him a weak smile as she crimped the crust on the pie and turned to set it into the brick oven at the side of the hearth. The rebuilt fire was beginning to warm the space but it would take a while for the pie to be thoroughly cooked.

“I’ll get you some water you can use to clean up,” Brianna said, puttering around the cabin to locate a bucket and fill it with warm water from the enormous cauldron near the hearth. She led him out the door and in the direction of a small hut. “Since Lizzie went with Mama and they shouldn’t be back till tomorrow, you can borrow her bed tonight. We can figure out something else in the morning. You’ll want to rest and brace yourself for meeting my father and cousin. Murtagh shouldn’t be too intimidating for you at this point. Blankets,” she exclaimed after setting the bucket down. “I’ll go find some.”

By the time she returned, Roger had managed to clear most of the sweat and dust from his face, neck, and arms. He’d pulled his shirt off as well and was splashing water over his chest and dribbling it down his back, not caring that it was soaking into his breeks and continuing on its way down the rest of his body. He had a single change of clothes in his pack but those weren’t in much better shape than what he was wearing.

“Here,” Brianna said, showing him the quilt and furs she’d brought. She set them down on the bed along one side of the hut’s walls. She stepped closer to him, taking the ragged stock he was using as a washcloth and wringing it out thoroughly before wetting it again and helping him reach the difficult spots on his back. “Hmm. Much better. I’ll show you the creek we use for bathing in the morning. It’s a bit chilly but easier than trying to heat the water for a hot bath.”

“If that’s Lizzie’s bed,” Roger nodded to the one she’d put the blankets on, “then the other would be yers, I’m guessin’?”

“You would be guessing right,” Brianna confirmed. “And… you don’t have to sleep in Lizzie’s bed if you don’t want to. It’s small but it’ll be warmer and cozier in mine.”

“Bree… I’ve missed ye—Lord knows I have—but… have ye changed yer mind? About marryin’ me?” he asked quietly.

“I can’t,” she told him, tears in her eyes. “I just… it wouldn’t be fair to you. Not when things are so different now.”

“Different?” he asked, taking a step closer to her. “Different how? Ye still want to take me to yer bed. Tha’s no different, or am I misunderstandin’ yer invitation?”

Her cheeks went pink with embarrassment.

“No, I still love you and want you to be the first man I… take to my bed, as you put it. But… spending these last weeks with Mama and Da… I told them about the fire. They’re not sure there’s anything that can be done to keep it from happening either. And we don’t know when exactly it’s going to happen. It could be this year or the next or five years from now… But just in case we can’t stop it and the worst does happen… I don’t want to regret that I didn’t spend more time with them when I had a chance to.”

Roger took a step back, his expression going slack as what she meant sank in. “Ye’re stayin’ here. Ye mean to stay no just for a few weeks or months… but years.”

“Yes. I remember what it was like to lose Daddy and how much I wished I’d agreed to go with him when he had to run errands or that I’d stayed at the office with him while he worked and I’d gone off with my friends instead. I want to know that I’ve done everything I can to save my parents and that I spent every second with them that I could.”

“And ye dinna think I’d stay with ye?”

“It wouldn’t be fair for me to ask you to,” Brianna pressed, her face getting redder as she forced herself to confess, “and I don’t want to lose you without knowing what it’s like to be with you, to show you how much I do love you.”

Roger laughed and the redness in Brianna’s face switched from the self-conscious shades toward those darker shades born of rising fury. But he rested his hands on her shoulders and smiled at her narrowed eyes and furrowed brow.

“Ye’re not askin’ and ye dinna need to. Ever. If ye’re goin’ to stay then so am I. Ye love me enough to let me go? I love you enough not to care where—or when—we are, so long as it’s together.”

Her face softened and tears pooled in her eyes as she beamed at him a second before throwing her arms around him and kissing him silly.

They laughed and held each other tight, Roger lifting her off her feet and spinning her around in the cramped quarters of the hut. Setting her down again, Roger kissed her softly, then again longer. She clung to the damp, bare muscles of his back, pressed herself against the length of him. They pulled back to look at each other, the simple joy replaced with the deeper yearning both felt. Neither said a word as Brianna pulled him toward her bed.

“The spare head should be right inside the barn door,” Jamie told Lizzie while Claire fussed with the dressing around his hand. “Be quick about it. Murtagh will be lookin’ for it. We wanted to be done wi’ preppin’ the beams ‘fore givin’ up for the day and he’s stubborn enough to try workin’ in the dark… And Ian’s foolish enough to go along wi’ it.”

“Oh, give them more credit than that,” Claire suggested, frowning at the cut on the back of Jamie’s hand from when the head of the hatchet came loose mid swing and flown off the handle. His reflexes were fast or he might have been in danger of losing the hand altogether. Instead it was superficial and shallow, a scrape across the back with deeper gouges at the knuckles. “Or give yourself fewer airs. If it weren’t for your mishap here, you’d be just as determined to work whatever the light conditions might be. Let’s get inside so I can clean and bandage this properly.”

“I need to tend yer horse,” he objected, moving to take the reins even as she reached to release the straps that held her medical box in place.

“I can tend the horse while you go in and rest a few minutes,” she insisted. “See what we have for supper and—”

“Bree came back to make supper some time ago,” Jamie reminded her. “We hadna thought ye’d be back tonight.”

“Well, that’s what happens when the baby arrives before the midwife. All it took was a quick check on mother and child, a small glass of whisky to wet the baby’s head, and we were headed back the way we came.”

“Mistress Claire, Mister Jamie,” Lizzie exclaimed, running toward them with the spare hatchet head in her hand. “There’s a strange horse in the barn,” she informed them, her eyes wide and frightened.

“Never mind about that,” Jamie told her calmly. “Get that back to Murtagh and Ian and stay wi’ them until they come home. Perhaps wi’ you waitin’ there for ‘em they’ll decide to just be done for the day.”

Lizzie nodded and headed off down the path.

When she was out of sight Claire began calling for Brianna and Jamie went to check the house when she failed to appear.

“There’s a pie cookin’ in the oven,” he told Claire, “so she’s no likely to have gone far.”

“And the ‘strange horse’ is in the barn so whoever it belongs to must be nearby as well. Perhaps they only went to fetch wood or to get more water,” Claire suggested hopefully.

A moment later, Brianna emerged from the hut she shared with Lizzie. She brushed some loose curls out of her flushed face and smoothed her hands down the front of her bodice.

“Mama… What’re you doing home? You weren’t supposed to be back till tomorrow,” Brianna remarked.

“The baby came quick,” Claire explained, her eyes narrowing at her daughter.

“D’ye ken who the horse in the barn belongs to, a nighean?” Jamie asked.

“Actually… yes. Roger arrived a little while ago. I was making up Lizzie’s bed for him since she was supposed to be with you all night, Mama. But I can put it back the way it was and he can sleep somewhere else. He’s cleaning up a bit from being on the road so long,” she told them, glancing back over her shoulder.

Roger poked his head out. “Good to see ye, Claire. I’ll right there. Dinna want to be sayin’ ‘hello’ still smellin’ of horse.”

“Mmmhmm,” Claire murmured, trying to keep a straight face as she turned to look at Jamie. He looked torn between laughter and shock. “We’ll be in the cabin when you’re ready,” Claire called to them, nudging Jamie in the other direction. “Your father hurt his hand and I need to clean it.”

#so in this version (if I kept going) roger and bree would be handfast (in front of her family) within a fortnight#and they'd realize she's pregnant with Jem a few weeks after that#;mod lenny#Hope in Change AU#show!verse#featuring: bree#featuring: roger#featuring: lizzie

88 notes

·

View notes

Text

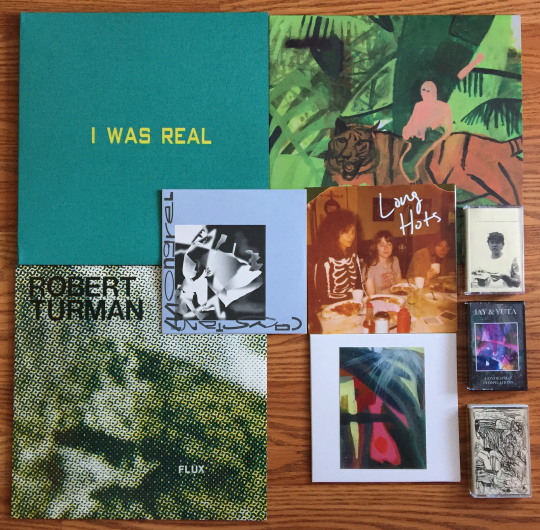

Summer squalor: July rotations

Been a minute but the hits keep comin’. Three picks each on three different formats. No cure for the sweltering heat but these’ll sure take you elsewhere for a minute. Bon appétit.

75 Dollar Bill, I Was Real 2xLP (Thin Wrist/Black Editions)

NYC’s foremost crate-and-guitar duo continue to osmose into an ever-larger recording entity, though the results are hardly bloated. Like Joshua Abrams’ Natural Information Society, 75 Dollar Bill specializes in patient sprawl, as on “Every Last Coffee or Tea” or the title track, a sort of musical kudzu covering more area, absorbing genres and instruments. Some shorter upbeat tracks are on display here, like “Tetuzi Akiyama” and “There’s No Such Thing as a King Bee” (featuring Knoxville’s own Carey Balch), and on the whole I Was Real’s double helping of material should please any and all fans of Wood/Metal/Plastic/Pattern/Rhythm/Rock. They’re not rehashing, they’re honing in on what works, and the ecstatic closer “WZN#3” is the life-affirming proof.

Crazy Doberman, s/t LP (Mastermind)

Being only familiar with last year’s I Dischi Del Barone 7″ and some of the group’s personnel, I was expecting Crazy Doberman’s latest LP to be two sides packed to the brim with exhausting third eye jazz freakouts. Instead the group flexes restraint across this self-titled record’s two tracks, more of a creeping horror soundtrack than freedom music’s untethered brawn. Horns and woodwinds scrape and screech from cobwebbed corners, synths ooze up from cracks in the floor, and occasionally, as on the beginning of the B-side, the band coalesces into a dense, foggy shroud of noise. The electronic elements provide a very lush feel, though the heavily forested area you find yourself in suddenly obscures and distorts the way from which you came. The clarity and simultaneous panicked thoughts provided by being truly nowhere. One of my favorite records of the year. Not sure if there’s a North American source, but the Danish label can get it to ya - here.

Robert Turman, Flux 2xLP (Spectrum Spools)

Almost 40 years since Flux was first released on cassette, and 7 years since Spectrum Spools first brought it back to life on CD and vinyl. I preferred Way Down to anything else Turman did back when it was first reissued, but nowadays I’m inclined to agree with Low Company’s assessment of Flux as an “all-timer.” Single notes are strung together on piano or kalimba and delicately layered, every one given space to breathe and expire, the bass-heavy recording ever-so-slightly hinting at something melancholy, the pleasurable kind afforded by momentary and true isolation. The remaster sounds fantastic, loud enough to fill the room and spare enough to emphasize the negative space.

Constant Mongrel, “Experts In Skin” b/w “Shnuki” 7″ (Upset the Rhythm)

New 7″ from Constant Mongrel featuring two tracks that could’ve made the cut for Living In Excellence in style and spirit. “Experts In Skin” showcases the steadily building tension they mastered on the last LP, the chorus-heavy guitars swelling to include sax that puts an exclamation point on the track. “Shnuki” has Amy Hill taking a role as co-vocalist, a move that oughta be replicated again given the bouncy and comparatively poppy results, kinda like if Terry could manage a snarl. Well worth the import price of $1/minute. Clear vinyl, 400 copies only, no inner sleeve and a beautifully close-cropped picture of Amy’s face on the B-side label. Sorry State, Digital Regress, and Feel It all have it in stock in the US.

Long Hots, “Nickel & Dime” b/w “Give & Take” 7″ (Third Man)

Somewhat unexpected for Long Hots to be scooped by Third Man after last year’s self-released cassette, but the wider exposure is certainly deserved. The 7″ sports “Nickel & Dime” from the tape and adds on “Give & Take,” maybe my new favorite song by the Philly trio. A mean guitar lead sets the stage for the sneering vocal delivery, the dust kicked up by the guitar in between verses a clear warning to keep your distance. "Give & Take” could, and maybe should, be twice as long as the 7″ format allows. It’s not often enough that garage rock brandishes the glint of a pocket knife amidst all the bluster; Long Hots’ll give you the business. Order direct, or check your local shop for a taste.

Small Cruel Party, La Chrestomathie Du Désespoir 7" (I Dischi Del Barone)

Unidentifiable sounds pinging away at each other, sometimes forming into plasma globules but more often staying in place while the projected scenery flashes behind them. Trying to spot the source of the sounds in the two 5-minute pieces is an exercise in futility, as the listener is kept at arm’s length, separated by the heavy curtain made of the “inherently mysterious.” You already know where you stand with stuff this impenetrable (or maybe with Small Cruel Party), but anything I Dischi Del Barone puts out is worth rolling the dice for. The latest round of releases from IDDB/Fördämning Arkiv in July are especially enticing. Careful Catalog is where to go for this 7″ in the US.

Itchy Bugger, Double Bugger cassette (Little Winners)

New Itchy B, on a limited cassette that sold out in a flash, and it finds the main man in a more reflective mood than last year’s Done One. Needling guitar lines still stick in your craw for days - “Fooled by the Sun”/”Fooled by the Song” and “The Wanker From Mataranka” especially - but tracks like “Sometimes” and “Have You Seen John?” attempt to put words behind the yearning glossed over or cut short on the debut. Bittersweet pop in the Australian tradition, growing older, grappling with work/life balance (”Nothin’ Tougher Than Hard Yakka”) and trying to sell oneself on the idea that you’re not just treading water as the weeks slip away. Not sure that I rate it as highly as Done One just yet, but bits like the tangled, desperate outro of “I Gotta Is A” make it more memorable with every listen.

Jay & Yuta, Condemned Compilations cassette (Little Winners)

A collaboration between Yuta Matsumura from Orion and Low Life, and someone named Jay. Do you know Jay? Yuta’s vocals are immediately recognizable to anyone who’s heard the Orion LP, and the way he nails the sidewinding melody on opener “Unprecedented Nation” proves he’s only becoming more acrobatic. Musically the duo sample from several eras of electronic sub-genres, be it murmuring and irresistible pop reminiscent of Broadcast (”Be More Kind”), Brian Eno’s work with David Bowie (”Fruitbat Odori”) or industrial throb by way of New Order (”Mysterious Flaws In The House We Built Ourselves” and “Hahagana”). Condemned Compilations plays out like a mixtape, as Sorry State said, and though the lyrics occasionally belie the presumed low stakes of the recording sessions, it is pure, unabashed fun, summer’s readymade cruising soundtrack. Sold out from the source, but you can still grab the tape from Sorry State or Papertown Company.

Overt Hostility, s/t cassette (Loki Label)

Two 20+ minute versions of Jonathan Richman’s “She Cracked” from Philly’s finest feedback-conjuring troglodytes? Not since Cheater Slicks’ “Thinkin’ Some More” has a song been so savagely gutted, thick layers of mangled and distorted guitar covering the windows and the walls and suddenly you’re knee-deep in some warm primordial muck and you can’t get enough of it on you. Low fidelity captures the whole mess perfectly. Pure aural torture to my partner, and the only thing I want to listen to for hours once it’s on. I love this fuckin’ tape. 50 copies, long gone, sorry bub.

#75 Dollar Bill#Crazy Doberman#Robert Turman#Constant Mongrel#Long Hots#Small Cruel Party#Itchy Bugger#Jay & Yuta#Little Winners#Overt Hostility

10 notes

·

View notes

Text

The Only Thing That Matters In Investing: Asset Allocation

“That which matters most must never be at the mercy of that which matters least.” – Johann Wolfgang von Goethe

Novice investors frequently assume that they need to master every minute aspect of investing before earning a steady return: P/E ratios, capital gains taxes, load vs. no load mutual funds, technical analysis, on and on, ad infinitum. This is a profoundly mistaken belief, and one that freezes countless investors in their tracks instead of delivering the returns they deserve.

Today, I am going to try to liberate you from this flawed notion by discussing what I believe is the most important part of successful investing: nailing down the correct asset allocation.

Very simply, “asset allocation” refers to the overall mixture of stocks, bonds, and other asset classes in your portfolio, and how much of your total capital is invested in each one. Having the right balance—the correct asset allocation—is what keeps you diversified in the market, rather than heavily invested in one thing that could fall down and take your whole portfolio with it.

The Securities Exchange Commission (the government agency responsible for enforcing stock market laws) offers a helpful example to illustrate why this matters:

Have you ever noticed that street vendors often sell seemingly unrelated products – such as umbrellas and sunglasses? Initially, that may seem odd. After all, when would a person buy both items at the same time? Probably never – and that's the point. Street vendors know that when it's raining, it's easier to sell umbrellas but harder to sell sunglasses. And when it's sunny, the reverse is true. By selling both items- in other words, by diversifying the product line – the vendor can reduce the risk of losing money on any given day.

Let's dive into this in-depth.

Quick Navigation

The Two Key Drivers Of Your Asset Allocation

Why Asset Allocation Drives Investing Success

Asset Correlation And Why It Matters

The Importance Of Getting It Right Up Front

Three Asset Allocations Explained

Portfolio And Asset Allocation Rebalancing

Risk Versus Return In Real Life

Tools To Setup And Rebalance Your Asset Allocation

The Two Key Drivers Of Your Asset Allocation

There are two key dimensions to asset allocation: your time horizon and your risk tolerance.

Time Horizon

In investing, “time horizon” refers to how many months, years, or decades you have to achieve your financial and investment goals. Your time horizon dictates how aggressive or conservative your asset allocation should be. For instance, an investor with a long time horizon (say, someone who is 25 years old and just opening a brokerage account for the first time) can be extremely aggressive, owning far more stocks than bonds.

Yet, as we just learned, that asset allocation would be grossly inappropriate for a 60 year old man expecting to retire in five years. Their time horizon demands a more conservative, “play it safe” asset allocation. And I’ll give you examples of each later on.

Risk Tolerance

The other key dimension of your asset allocation is your “risk tolerance.” This refers to your own personal ability to tolerate risk: the possibility of losing some or all of your investment capital in exchange for potentially earning a high return. This is a more “soft” dimension than time horizon, because it is, by nature, personal rather than formulaic. Just because abstract portfolio theory says a 25 year old should be aggressive in the market doesn’t mean you will feel comfortable doing that.

That’s why it’s important to constantly ask what your end goal is, and make every decision with it in mind. Is your end goal to earn the biggest return you possibly can? If so, you need to be comfortable accepting a great deal of risk, both early on and throughout much of your adult life.

On the other hand, if you are simply seeking to beat inflation and earn more than a savings account pays, you can adopt a more conservative asset allocation—and be relatively free of worry about huge losses.

As the SEC says, conservative investors prefer to keep “one bird in the hand”, while aggressive investors would rather roll the dice and potentially get “two birds in the bush.”

Why Asset Allocation Drives Investing Success

In investing, asset allocation (or the overall composition of your portfolio) is more important than any individual stock within it. That’s because while stocks run hot and cold, the correct asset allocation keeps you steered in the right direction for the long-term. Let’s say, for example, that technology stocks have a big year. Does this mean you should put 50% of your portfolio in tech from now on? NO!

Countless investors have lost money by assuming today’s hot sector would power their portfolios forever. But it never happens. Invariably, the following year (or even the following month) is dominated by health stocks, or manufacturing, or any number of other sectors. Conversely, investors who maintain an age-appropriate asset allocation tend to win over the long-term because poor individual stocks are outweighed by the correct overall mixture. In other words, the system is greater than the sum of its parts.

Want proof? In a 1991 study, Gary P. Brinson, Brian D. Singer, and Gilbert L Beebower determined that over 90% of long-term investment volatility came from decisions about one’s asset allocation – NOT timing the market or stock picking.

I want to explore what might seem to be a very counter-intuitive notion: how is one factor responsible for so much of your investment returns? After all, there are so many investment vehicles out there, endless different theories about when to buy or sell, seemingly infinite opportunities to do this or that with your portfolio.

Business schools teach semester-long courses on technical analysis, and some investors devote their entire lives to devising elaborate formulas that purport to time the market for high returns. Given all of this, how can simply owning the right mixture of assets virtually assure you of coming out ahead in the long run?

There is a simple reason for this: despite the way we are wired to think, tiny actions often cause massive results. As humans, we have an ingrained tendency to think linearly. We assume that what we put in is what we get out. If we work for two hours, we assume that should produce two hours of results. But this is frequently not the case at all. A relatively small amount of effort, applied to the right area, can produce enormously disproportionate results.

Examples:

Creating a workout plan takes 1-2 weeks to research, but can add 30 pounds of lean muscle in just a few months.

Planning a complex project takes 2-4 weeks, but can bring a 50% reduction in delays.

Negotiating a single raise takes 1-2 hours, but can add $1 million or more in cumulative lifetime income.

Many of us would read a chart like this and fixate on the time, but that is entirely beside the point. These actions are not explosively productive because of how long they take, but because they are the things that drive disproportionate results.

Asset allocation is very similar. By taking the time to define how much of your money will be concentrated in stocks, and how much in bonds, and how much in commodities, you are laying a foundation for long-term success. Each month, as you put more and more money into your brokerage account, every dollar follows the logic set forth in your asset allocation, steering the ship of your portfolio towards your ultimate destination of wealth.

Another way to think about asset allocation is to compare it with a house. No matter how much you love French doors, or gold-tipped faucets, or breathtaking skylights, these things are not even 1% as important as the house’s blueprints: the instructions that helped the architect turn a bunch of raw materials into your dream home.

Asset Correlation And Why It Matters

Asset allocation works because it keeps you diversified and ensures you own assets that are not directly correlated with one another.

Technology stocks are subject to the same market trends, buying preferences, regulatory climates, and so forth as other technology stocks. Ditto for manufacturing, auto, or any other sector. It doesn’t matter if you own some stocks in Google, and some in Microsoft, and some in Facebook—that is not diverse enough. A portfolio made up of only those stocks is in serious jeopardy the next time a tech crash (like the one that happened in the late 1990’s and early 2000’s) rears its ugly head.

What can prompt a tech crash? Anything that threatens tech companies: harsh new privacy regulations, a rash of premature tech IPOs that fall flat at the same time, even the sudden downfall of an industry titan.

On the other hand, automotive stocks would generally be unaffected by these events, because auto is a separate industry with unique customers, laws, and trends. You become more diversified by owning stocks across many industries.

You become more diversified still by owning stocks from companies of different sizes: large cap, small & mid caps, international, etc.

Yet, you become the most diversified of all when you own entirely different asset classes, because they are even less correlated with one another. During a stock market crash, stocks plummet in value…but bonds increase, because investors start to seek safe returns again. The opposite is true during stock market booms: stock prices soar, while bond yields (generally) flatten.

If we could reliably forecast when booms and busts were going to happen, we could simply time our portfolios to own only the correct assets ahead of time and profit from what was about to take place. Many investors mistakenly believe they CAN do this.

They are wrong. All academic research shows that we have pathetically little skill at forecasting the overall market on a consistent, year in, year out basis with anything approaching reliable accuracy.

Therefore, the correct strategy is taking an “insurance policy” approach to investing, by owning several different types of assets that are not all highly correlated with one another. This way, even when some of your assets suffer, other assets prosper—helping to “even out” the damage inflicted by downturns, recessions, or just routine fluctuations.

The Importance Of Getting It Right Up Front

Before going into the nuts and bolts of asset allocation, I need to fully convey why it’s important to get this right now, before investing any money.

To continue the house analogy from part one: home builders focus almost obsessively on getting the blueprints right before buying a single nail or bucket of paint. Why? Because they have learned the time-honored saying “an ounce of prevention is worth a pound of cure” from hard experience. When you rush to get started on a large project without proper precautions, it becomes extremely messy, time-consuming (and, in some cases) impossible to reverse the mistakes that pile up.

Think back to the 2008 stock market crash that followed the real estate bust. How many stories were there about elderly people who lost their retirement savings in one fell swoop? The media used these stories to create doubts about the long-term viability of investing, essentially saying “see? this is what happens when you put your money in the stock market!” But in almost every case, the investors were failed by their asset allocation, not the market as a whole.

These elderly investors had aggressive asset allocations when they were young: which, as I explained earlier, usually means lots of their money invested in stocks. That’s great, and in fact, highly recommended for young investors, because they have time to take bigger risks and still come out ahead. But as these investors got older, they needed to shift more of their money into safer investments, to ensure it would be there when they needed it.

Had they done so, the 2008 crash would have merely hurt them a little. Instead, it completely wiped out a lifetime of retirement savings.

Still think asset allocation isn’t enormously and disproportionately important?

Three Asset Allocations Explained

Having laid that foundation, let’s get right into some example asset allocations and what they mean.

Here are some common examples from Allocation of Assets:

Within these broad asset classes, you might further specify the actual types of companies or funds you want to be invested in:

Depending on your sophistication and willingness to dive deep into investing, you could have an even more diverse allocation, such as this (from Wikipedia):

Again: this might seem like a luxury, something you can easily put off “until you have time” or “feel like dealing with it.” But recall how big of a mistake this can turn into. Of all the investors who lost their net worths in 2008, do you think any of them planned on it? Did a single one think about the risks, weigh out the pros and cons, and simply say “this doesn’t matter?”

Of course not. They all told themselves they would deal with it later—but when “later” came, it was already too late. You can’t afford not to get this right!

Also, if this is not clear to you by now, please realize that you do not simply pick one asset allocation and ride it out forever. Rather, you need to identify the correct asset allocation for your current situation, and then continuously re-calibrate it over the years to reflect your changing needs and circumstances.

In other words: if you are still investing the same percentage of your money into stocks, bonds, etc. five years before retirement as you were 30 years ago, you are in grave danger of losing everything. That’s why it is critical to gradually shift into a safer investment mix as you move through middle age and into retirement age.

As a hard-and-fast rule, you should own less stocks as you get older. By the time you are ready to retire, the vast majority of your money should be in bonds or other safe investment vehicles. There is a natural temptation not to do this, because (as we covered earlier in the book) bonds offer lower returns. Yet this is for a crucial reason: bonds are safer! When money is less likely to be lost, lower returns are the trade-off. Instead of resenting this or trying to tempt fate by getting higher returns, simply accept that this is a trade off you WANT to make at this stage of your life.

Failure to do so risks wiping out everything you spent decades working so hard to build.

Portfolio And Asset Allocation Rebalancing

The gradual re-organizing of your asset allocation as you age is called “rebalancing.” Unfortunately, despite its colossal importance, rebalancing does not happen by itself.

For instance, recall that this might be your target asset allocation in the beginning:

Ideally (if you determine that it is the correct one) you should keep this allocation for at least the next several years. Yet, because the market is constantly fluctuating, your asset allocation could wind up looking like this only 12 months later:

The problem is not anything you personally did. You set up your asset allocation to reflect your goals, time horizon, and risk tolerance exactly like you were supposed to. It simply happened naturally, as a result of the companies you invested in going up or down in value.

That’s why you need to rebalance, or bring your portfolio back into compliance with your chosen asset allocation. It’s not a particularly exciting task, and your portfolio will not cry out to you to be rebalanced. As such, it’s very easy to forget about, which is precisely what most investors do.

This is perhaps the most dangerous mistake untrained investors make. A portfolio that never gets rebalanced is like an ocean barge that veers off course. If the captain doesn’t straighten the ship out, it could wind up in Cuba instead of the Bahamas. Likewise, your portfolio could be exposed to exponentially more risk than you are comfortable taking on—all because you neglected to rebalance.

Rebalancing can be done manually, or semi-automatically through what are known as lifecycle funds. A lifecycle fund re-calibrates your holdings over time to stay aligned with your desired asset allocation. Just know that whether you use a lifecycle fund or go it alone, rebalancing is absolutely essential to keeping your portfolio invested in the right things, and that failing to do it places you in huge danger the longer it goes unaddressed.

It can also be done automatically for you via a robo-advisor. We will cover all three of these options in a minute.

Risk Versus Return In Real Life

I want to stress that although there are formulas and systems to get asset allocation right (and I highly recommend sticking to them when possible) there is an emotional component to all of this as well. And it can be exceedingly difficult to keep your emotions in check when faced with data that provokes strong reactions, fears, or impulses.

That said, successful investing is all about learning to do just that. For every data point that causes you to worry, there are others that (even if they don’t completely remove your worries) should cause you to consider another perspective.

As Wikipedia explains:

“In asset allocation planning, the decision on the amount of stocks versus bonds in one's portfolio is a very important decision. Simply buying stocks without regard of a possible bear market can result in panic selling later. One's true risk tolerance can be hard to gauge until having experienced a real bear market with money invested in the market. Finding the proper balance is key.”

For instance, here is an example of after-inflation returns using different asset allocations from 2000-2002, a decidedly “bear market” period:

The table above seems to imply that a highly conservative portfolio is always desirable. Look at those positive returns! But when we take a long-term view (as younger investors generally should do), look at how those returns start going in the opposite direction:

Now do you see why time horizons and risk tolerance are so critical to your overall investment strategy?

If you simply dive in and start buying stocks without thinking about the bigger picture, you could be charting a course to major disappointment. Think about how many investors dumped tons of stock in the early 2000’s (not just tech stocks, which were the problem, but ALL stock) due to nothing more than fear and overreaction? Had they hung on to some of it, they would’ve been far richer come 2004 and 2005 than they in fact were.

On the other hand, some people are simply not emotionally capable of carrying huge losses through a 2-3 year bear market to realize the gains that come after. If that’s you, it is better to learn that sooner than later. Keep these issues in mind as you build out your investment portfolio.

Moreover, if you have not yet determined your correct asset allocation, stop everything and do it now. Wasting time on minutiae (like the merits of this stock vs. that stock or the fees a mutual fund charges) is pointlessly distracting until you nail down this foundational issue first.

Tools To Setup And Rebalance Your Asset Allocation

As I mentioned earlier, there are three approaches to take when it comes to setting up your asset allocation and rebalancing it:

Do-It-Yourself approach

The semi-automated approach with target-date funds

The fully automated approach with robo-advisors

The DIY Approach

I'm personally practice the DIY approach, but it's not for everyone. Doing it yourself means that you are choosing your own asset allocation based on your own risk tolerance and time horizon. It then means you are selecting the funds that go with that asset allocation, and that you are rebalancing it yourself at least annually.

To choose your asset allocation, you can use a pre-existing one (such as the Boglehead's Lazy portfolios), or you can tailor one to meet your needs.

Once you select an asset allocation, you'll need to research ETFs and mutual funds that match your target allocation types.

Then, it becomes a matter of tracking your portfolio and allocations. I personally use Personal Capital, which has a great (and free) asset allocation tracking tool. Personal Capital is also great about tracking your investment portfolio in general. Try it for free here.

For rebalancing my portfolio, I use a Google docs spreadsheet to see what areas are overweighted and which are underweighted, and then sell and buy the dollar amounts appropriately. I do this twice a year - in the spring and fall.

The Semi-Automated Approach

If you're comfortable investing in ETFs, but don't want the headache of having to rebalance yourself every year, you can opt for the semi-automated approach. This is done by investing in target date or lifecycle mutual funds and ETFs based on your age.

What these funds do is automatically rebalance within themselves to create an allocation based on when you plan to retire.

For example, you can invest in the Vanguard Target Retirement 2050 Fund (VFIFX). This fund is designed for people who are currently 29-33 years old, who plan to retire around 2050. The portfolio itself is currently made up of almost 90% stocks, and 10% bonds. However, as you get closer to 2050, the fund will automatically change that to better reflect your risk tolerance and time horizon.

To highlight this, we can look at the Vanguard 2025 Fund (VTTVX). This fund is designed for people 54-58 who plan to retire around 2025. This fund currently has an allocation of roughly 65% stocks and 35% bonds. Much more conservative compared to the Vanguard 2050 Fund.

You can learn more about these Vanguard funds here.

The Fully Automated Approach

If you know you should be doing this, but just want to contribute money into an account and "set it and forget it", don't worry - there's still an option for you. You can setup a fully automated asset allocation with a robo-advisor, who will take care of all of this stuff for you.

Robo-advisors are pretty straight-forward tools: they use automation to setup your portfolio based on your risk tolerance and goals. The system then continually updates your accounts automatically for you - you don't have to do anything.

All you do is deposit money into your account, and the robo-advisor takes it from there.

If you want to go the Robo-Advisor route, we recommend using one of the two below. For reference, WealthFront is free for the first $10,000 if you want to give them a try. See the two options below:

WealthFront: WealthFront is a great robo-advisor for those with money to invest but don't want to deal with it. Wealthfront's service really shines with taxable accounts, and service is free for accounts under $10k. Click here to check out WealthFront.

Betterment: Betterment is a great robo-advisor for young investors. They make investing easy for beginners by focusing on simple asset allocation, goal setting features, and low-cost portfolio management. Click here to check out Betterment.

Final Thoughts

Hopefully you can see the importance of asset allocation to building wealth over time. I believe it's the single biggest driver in success when it comes to investing - not because it's going to help you earn outrageous returns, but because it's going to protect you from losing all of your money.

Remember, if you lose 50%, you have to earn 100% back just to break even.

What are your thoughts on the importance of asset allocation and rebalancing?

The post The Only Thing That Matters In Investing: Asset Allocation appeared first on The College Investor.

The Only Thing That Matters In Investing: Asset Allocation published first on http://ift.tt/2ljLF4B

0 notes