#but tera is stuck in 2016 again

Note

Dude your thing with Undertale and Su crossover is brilliant to be honest. Do you plan more?

Yes, bear with me

#its 2022#but tera is stuck in 2016 again#su#steven universe#undertale crossover#undertale#ruby#sapphire#sans#papyrus#su fanart#su art#su sapphire#su crossover#su ruby#shitty puns#god dammit#I'm a serious artist#isn't it funny that people see me drawing fnaf and sometimes creepy or cool art or big comics and all of a sudden this comes out of nowhere#the urge....#the urge to continue

242 notes

·

View notes

Text

independence daze

07.04.2018 3:48PM

En route to work today, I was surprised that I had not comprehended what had once been my favorite holiday as a kid: Independence Day. Okay, the loud fireworks were never my thing (I still plug my ears to this day), but July 4th served as a bookmark in the summer—a reminder that there was another entire month of summer freedom before school was to start up again. This year, the date marks the final month of my time in Southeast Asia. This summer was not spent eating watermelon and riding my bike around the col-de-sac of my childhood, but almost as far away from home as I could geographically be. In January, when I was applying for this program, I could never really picture myself making it to this point. Even boarding the plane in mid-May, I had absolutely no idea what to expect other than to be accepting and open to change. I was nervous, but I was not afraid. Aren’t all things just a continuous leap into the unknown? My entire day-to-day experience in Southeast Asia over the past (almost) two months has been a consistent and blind trust that everything will turn out okay and seven weeks later, it is.

Over lunch today, Monica and I were chatting about how much time we have to think while we’re here. With internet being practically nonexistent when we are not at work, distractions are harder to seek and when you can’t find them, you can find yourself a bit frustrated and lost in your own thoughts. Even when we are at work, in between the projects that we work on, we are human and are prone to getting a bit off task every once in a while. Our lives back in the US (especially school) are often filled with so much commotion and chaos that time for reflection has to be very actively sought out, but here? Internal ponderings are as frequent as inhaling and exhaling. In my past traveling experiences (IWU London Program 2016, WWOOFing for a month last summer, other frequent trips abroad and domestically), I have found that traveling not only cultivates fertile ground for growth to take place, but new places act as a fast-forward button to the process of self-discovery and learning (both externally and internally). This is why I love it so much. If I feel myself getting stuck, in a mindset, in a place, within relationships, I itch for a journey. Some may think that this is an escape route, but as I sit here, reflecting on the why’s and what’s of my own processes, I’m realizing that I leave to seek out answers to questions I may be too hesitant to ask when I’m in the protective bubble of my fairly predictable life in the unimpressive landscape of central Illinois. Traveling is like a religion of sorts, I suppose.

I would like to emphasize that I travel for the journey, not as a vacation. Spending such prolonged periods of time in new places is by no means easy. Yes, the pictures and views may be beautiful, but traveling can often get isolating and fatigue soon becomes second nature. It is almost guaranteed that nothing will work out how you expect it to (or even remotely close), but that often creates the most memorable and beautiful experiences. I travel to build my resilience, my self-sufficiency, and to embrace meeting new people with little trepidation. Tera Wilson, a good buddy of mine and an intern at Earth Rights International in Thailand, said something in one of her blogs that struck a chord with me. I hope I don’t botch the wording, but it was something along the lines of Tera growing more confident in her capabilities while her capabilities themselves have been growing.

Now, not to get too personal here, but I have been coping with anxiety issues for as long as I can remember and in the past (my early teens), I would get in severe loops where I didn’t think I was capable of doing things and so, as a result, I didn’t do them. Unsurprisingly, this was nooooot a good cycle to be stuck in. So after getting some external help, I have actively chosen to continue helping myself out of anxiety spells and being as active of a participant in my own life and in the lives of those I love as I am healthily able to do. (Objects that are at rest tend to stay at rest—Laws of Physics are no joke, people!) Doing things I never thought I was capable of doing is one of my many resiliency strategies and one that has led me to live some of the most vibrant seconds, days, weeks, months of my life. Studying and living abroad (literally across the world this time) is one of the biggest and most exciting challenges I have ever purposely embarked on. While I am right smack dab in the middle of the experience here, I can tell you that I am currently grateful that I just saw the opportunity and went for it. I entirely confident that I will continue to be grateful for this experience decades from now.

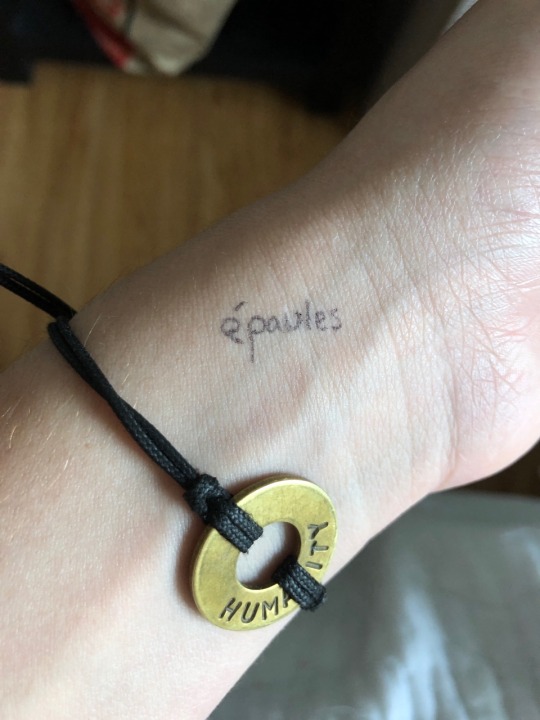

One of the things I’ve been doing to take good care of myself and my noggin flutterings (beyond almost daily meditation) is a simple act of mindfulness. When I notice that I’ve been having a particularly anxious or flighty mindset, I write a small note on my wrist to pull me back to the present moment whenever I see it: “épaules.” Les épaules means “shoulders” in French and it serves as a subtle reminder to relax my shoulders (which are often tensed up without my realizing it) and reassess how I’m feeling and how to rebalance to make sure I am as present as possible wherever I am in my day. Exhibit A:

Now, yes, this blog is supposed to be academically inclined, but I also know that prospective Freeman Asia interns will be browsing through these blogs trying to get a basic understanding about what they may be getting themselves into. So here is a message for them (and a reminder to any current interns): Mental health and all of its snags and tears do not simply disappear when you study abroad. You do not become an unfeeling, unthinking mythical being the moment you board the plane. You remain you, but will likely be stretched and remolded into a more cognizant and experienced version of yourself. The process is certainly not pretty, but it’s always worth it (at least it has been for me!). You will know what is best for you and what boundaries you need to set to ensure your own well-being, but I urge you to trust your gut instinct and just dive in whenever you can. Life has a funny way of being the most extraordinary gift when you open yourself up to it.

Diggity dang that was a long post! Thanks for bearing with me on this one :)

Cheers,

Katherine

P.S. Sending lots and lots of good vibes out to you, whoever is reading this!

0 notes

Text

Pushing Off From Shore...

In June of 2016, my wife/bandmate Denny and I relocated from North Carolina (a lifetime home for Denny and a longtime home for myself) to Memphis, Tennessee. We renamed our musical project from Lost Trail to Nonconnah to reflect the move and begin anew with a fresh slate, and in honor of Memphis waterway Nonconnah Creek. We soon purchased a home on the outskirts of Memphis, in rural Fayette County, which came complete with a spacious former beauty salon attached to the garage. This was to become our new recording space, and to remark upon its former usage, we named it Ghost Salon. Now, in April of 2017, as we near the end of our first year of adjusting to new environs and friends, that space is ready for use.

As I’ve said in interviews and in person, the new Nonconnah album is going to differ from Lost Trail’s work in a number of ways. Nonconnah will be more collaborative in spirit than Lost Trail, bringing in a number of musically-inclined (and maybe non-musically-inclined) friends from across the earth, but especially aiming to utilize the diverse musical community in Memphis as much as possible. The work will still be thoroughly experimental, but less hemmed-in by particulars of genre; ambient and drone are beautiful shades, but there’s many more colors to paint with. Most importantly, this is going to be a large-scale, long-form project. No more churning out endless streams of music like Robert Pollard on a meth bender. We’re taking the time to carefully craft what we do, and it will take years to get it right, probably with a host of leftovers to show for it. This is an ambitious project covering a huge number of themes and sub-themes, and it will incorporate many visuals and writings as well as a (surely lengthy) collection of music. I’ll expand on the feelings and moods behind the album as the recording comes together. Right now, it’s all a drifting haze of half-built comprehensions, and who knows where these sessions will take us?

I hope to alter many of my ingrained work habits in this project, focusing more on the particulars of layering and mixing than in the past, using a wider array of instruments, and re-learning how to read notation as well as (hopefully) improve my piano and vocal skills. I’ve purchased a whiteboard for longhand idea scrawling, and I’m starting this blog as a way to document the minutiae of the album’s sessions as they come together (I’ve tried this before and not stuck with it, hopefully this time will be different). Denny will also be contributing more in the way of instruments themselves on this album, in addition to her field recording work. In many ways it’s still Lost Trail, but in many ways it isn’t. I think our best work is yet to come.

So let’s begin.

Today, 04/12/17, was the first day I spent a considerable amount of time in the studio. I had planned to start the recording process in earnest the previous week, but an unfortunate accident involving a pitcher of lemonade and my Macbook Air meant I was delayed while a replacement shipped to us. Now I’m working with an older Macbook Pro, which despite its age I’m enjoying much more than the Air (it’s more solidly built, with more memory and a DVD drive). Here’s hoping it survives these sessions.

I spent today rebuilding my guitar pedalboard, a tedious but necessary task involving much yanking of velcro and untangling of wires. I have a good dozen or more pedals in addition to the ones now on the board, some of them ‘nicer’ than what I put in place today, but this is what I’m feeling is right for the beginning of this album (I’ll probably change everything in a month or so, anyway). For example, there’s considerable snobbery in the guitar pedal world concerning Behringer pedals, but they’re ample Boss clones as long as you use them gently, considerate of their cheap plastic housing. I had hoped to upgrade all my pedals earlier in the year, but life expenses got in the way. So it goes. I’m nothing if not an old pro at making do with what I have available on-hand, and I’m lucky to have a wealth of plug-ins on board, as well. As in the past, I’ll mostly be using GarageBand and Audacity for tracking, and my Zoom H2, in an effort to keep things simple. I’ll experiment with other DAWs as time goes on, though I’ve never liked being overwhelmed with options.

The new signal chain follows...

JHS Little Black Buffer>Raygun FX Super Fuzz Boy>Devi Ever Rocket Mangler>Behringer Ultra Feedback>Digitech Whammy Ricochet>Behringer Space Chorus>Boss Tera Echo>Boss PS3 Pitch-Shifter/Delay>Behringer Slow Motion>Digitech Element Multi-Effects>TC Electronic Flashback Delay>TC Electronic Polytune 2 Mini>Alesis Wedge Reverb Module>Digitech Jamman Stereo Looper

I always use a number of accessories in my playing as well, such as a bottleneck slide, a flathead screwdriver, an E-bow, a violin bow, a broken computer speaker, various tape machines, a portable shortwave radio, and various toy laser guns. On this album I plan to play - electric guitar, acoustic guitar, classical guitar, banjo, dulcimer, glockenspiel, piano, accordion, harpsichord, chord organ, electric organ (I picked up a Baldwin Fun Machine not too long ago), drums, synthesizers, drum machine, music box, wine glasses, lap steel, Marxophone, melodica, violin, yerbonitsa, mandolin, hand percussion, bowed cymbal, bowed tape recorder (I built one myself), theremin and voice. Others, and Denny, will contribute these and other instruments. I’m going to mostly leave it in folks’ hands what they contribute.

Though I own a number of guitars and amps, and plan to use them all, my main electric for this album will be my Reverend Ron Asheton signature, and my main amp will be my Roland Jazz Chorus 60. This is what I mostly use live lately, and I think it’s a setup that I’m comfortable creating with.

Before sleep tonight, I’m going to begin the long and arduous process of going back through my ‘demos’ folder and picking likely candidates to be fleshed out into full songs (this is also new for me, I’ve never demo’d for an album before). Since early July of 2015, I’ve been recording bits and ideas and rough demos with whatever instrument was on hand, wherever I found myself (a friend’s ukulele while house-sitting in Carrboro, NC, a broken piano by the side of the road in Snow Camp. NC). This, along with collected field recordings from the past nearly two years gathered by myself and Denny, has swelled into quite a gargantuan of .wavs. Now it’s time to parse strong ideas from weak; I hope I’m up to the task of judging these snippets.

Tomorrow I plan to at least test out the new Apogee USB interface I picked up, and see if it’s as suitable for line-in recording as I hope. If I’m lucky, I may be able to find some time to begin proper recording before the end of the day. I’ll keep you posted as to my progress. Until then!

ZC

Listening to: Do Make Say Think - STUBBORN PERSISTENT ILLUSIONS, The Robot Ate Me - ON VACATION

Reading: Stewart O’Nan - SNOW ANGELS (again)

Watching: THE PATH, Hulu

#memphis#tn#tennessee#ghost salon#home recording#lost trail#guitar pedals#ambient#drone#noise#experimental music#shoegaze#folk#nonconnah#fayette county#diy#lo-fi#pedalboards#reverend guitars#roland amps#jazz chorus#boss pedals#behringer pedals#cassettes

1 note

·

View note

Text

WARNING! Data Reveals BTC Will Dump Post Halving!

VIDEO TRANSCRIPT

So what is going on with the viewers of the tube, if you don’t know by now? He definitely should. But I’m the host of the Channel Tylor and are you ready for crypto content that hopefully keeps your TV or computer safe? Unlike what these nutcases decided to do since he is cool with television and tone to the mainstream media, you armoured bars. And this is what I think of a new electrical linguistic programming. We are not going to buy newspapers propaganda any longer Suzie programmed or do not want to watch TV ever again. Power to the people like the cop Australia. This is what I think of the media. Well, it won’t let you get the picture. You know, our 21st-century rebellion. It’s time for Chieko Crypto. Well, we got to talk about it as I won’t be able to make a fully produced video on the topic until it happens. Bitcoin having 20, which is scheduled to happen sometime Monday of next week, maybe even Sunday, depending on how things progressed. So first, let’s explore what is happening to the Bitcoin price. Since Monday, the price has been moving on up to the east side. It began Monday at a low of around eight thousand six hundred forty. And as of yesterday, we were testing nine point five K past that. And then all the way up the 10k, an increase in just four days of almost twelve point five percent. Comparing Bitcoin with Dunk’s biggest index, the Dow Jones BTC has seen better gains in the Dow. The Dow was only pushed up about three percent since its Monday low. So what’s it gonna be? Is BTC going to go on a weekend rally while the traditional markets close, creating one of those gaps which traders talk about? Oh, so much from seeing me. Well, personally, I have a feeling we will see some more upward movement and it could have a pure phono rally. And it hit my original having prediction I made four months ago, and I should have stuck with my original gut. Never changed it when the pandemic came. Let’s watch now. This is a miner’s last chance to get twelve point five BTC per block. Come May 14th. It’s only six-point to five BTC per block. Chinese miners and some other regions can’t sustain their operations at the six K to seven K level, with twelve point five BTC per block. But when the reward gets slashed, they become unprofitable. This is why I predict a price between 10K till eleven points five K on the day of the vent. Over sixty-five percent of the miners need the price to be at that level to be a profitable business. So yep, it goes right back to the hash rate. My friends and that hash rate has been a peak in my friends pull out the one year chart since a major dip due to the global panic. The hash rate has recovered and is pushing right back to its all-time highs. So why is this happening? Well, for one, because, yes, the price is increasing, which has both times pre having in the past in 2012 and 2016, but no cue like mentioned in the prediction clip. This is the last time in history. Miners will be able to get twelve point five BTC for solving a block. It’s a minor rush before the split, which also happens in 2012 and 2016. 2016, just a couple of months before the having hash rate was at one point two X hashes. On that day of having July 9th, the hash rate reaches one point six X A hashes an increase of thirty-three percent in 2012, just a couple of months before the having hash rate was at twenty point five Tera hashes. By that day of the having, we were around twenty-seven pair of hashes, an increase of thirty-one percent. And now today, since the low just a couple of months ago in mid-March, we have pushed up from ninety-four Xa hashes to one hundred and twenty x the hashes an increase of twenty-seven percent cent. Then we should have seen this coming with hash rate rebounding so quick. But what happens immediately after having each time like clockwork. Well, the hash rate takes a major dip in 2016. The hash rate dip from the peak of just over one point six XA hashes down to the one point four X hash level in just one month. A minor drop out rate of twelve point five percent due to lesser rewards. The same thing can be seen after the 2012 having cash rate peaked at around twenty-seven pair hashes but dropped to a low of twenty Tera hashes in just one month, a retracement of twenty-five percent due to less minor rewards. So as another post having minor purge coming. Yep. That’s the only way it doesn’t happen. If we get a crazy ballistic price trend as the only miners who are profitable at the current price levels post having the ones with renewable energy, the ones located in China or Russia. And that’s about. So I wouldn’t doubt in between 10 to 20 percent of the harsh power post having, well, dry up within a month as unprofitable, inefficient operations close up shop, which will have an effect on the price as it will be in discovery mode post having as it always is. In 2016, the price discovery mode went downward. The price peaked at around seven hundred and sixty-eight bucks and then one month post having got down to five hundred fifty-two dollars, a decrease of twenty-six percent. Yikes. Although in 2012 things actually didn’t dip post having. And one month after the price had nearly increased by one hundred percent from a low of around 10 bucks to around 20 bucks. And then just a few months after BTC went on a mini parabolic rally surpassing the two hundred dollar level. But that was the first having and I believe, a full-on the anomaly, which won’t happen again. I believe things are going to be more like 2016 personally. And we here at Chieko aren’t the only ones looking at the data. Traders far and wide from a small minnow to a big old teather whale are ready to make moves. Post having and much larger moves that could have a much larger effect on the price due to derivatives options and more in things they have changed since the previous having event. For example, 2016 didn’t have a robust futures market. Unregulated or regulated, most trading in 2016 was on spot exchanges. Ahead of this, having bitcoin miners, they can purchase futures contracts, looking to lock in Bitcoin prices to pay for their future export. And the thing is, some of the largest Bitcoin whales are oji bitcoin miners. A lot of the Chinese have been playing with the futures markets since 2016. Unregulated, too, like OPEC’s bit next lobby and finance. And let’s just look at futures volume getting ridiculously high. Pree having. Who are the culprits of these exchanges? Number one, who lobby if only seven point eight billion dollars yesterday and financed with nearly seven billion and next. Okay, X and bid Max. But miners getting ready for big moves in the futures markets can be more clearly seen in the open interest Category four futures rather than the obvious bubbling volume. Open interest is the total number of outstanding derivative contracts, unlike volume, which counts every buy and sells order. The total open interest does not count that which provides a more accurate picture of the options trading activity. Whether money flows into futures and options market are increasing or decreasing in the open interest across the futures exchanges has surged by 50 percent in just a month, from two billion in total open interest to over three billion in total open interest. So if the miners do that, this run was just built on Teather U.S. GDP and there is barely any new actual interest in Bitcoin. I mean, Google Trends. It’s a great tool. And interest in Bitcoin globally is more when the price is going down than when the price is going up. We are almost past 10K and people aren’t searching for the term bitcoin as much as they were then during the March flash crash. So what are the miners ACA massive BTC whales doing and have been doing for the past month, locking in low prices in futures contracts as they knew the USD print and pump would come just yesterday morning? Teather decided to print another 100 million on the disgusting Chinese controlled blockchain Tron. Hey, those miners will cash out those futures contracts here soon post having and be able to pay for their operations for the next month or two while the price does go down. But long term, you guys, it’s just basic economics and math to understand that eventually the price will recover and go on another run. The good news is flowing for BTC. Bloomberg broke the article. Paul Tudor Jones buys Bitcoin as a hedge against inflation. Who is this tutor? Oh, no, not that tutor, this tutor. He is a macro investor and is the founder and CEO of Khutor Investment Corporation, which manages multi-billions of dollars in multiple funds. And from the article, Jones, who said his tutor BVI fund may hold as much as a low single-digit percentage of its assets in Bitcoin futures, becomes one of the first big hedge fund managers to embrace what Intel now has largely been a financial fad, with few mainstream advocates. Well, how large is the Tutor BVI fund? Well, from private fund data dot com twenty two point three billion dollars. And he said the fund may hold as much as the low single-digit percentages of its assets and BTC futures. Well, one percent would be over two hundred million dollars and five percent, which I would consider a low single-digit, would be over one billion. So the macro view for BTC is very bright. The large players like Cooter Jones who begin to dabble in the markets, give it that legitimacy it needs for the Foma rally to end all foma rallies. And that comes from the Bitcoin ETF, which is the end goal for all of the big Bitcoin whales. Cheers for yours. I’ll see you next time.

source https://www.cryptosharks.net/data-reveals-btc-will-dump-post-halving/

source https://cryptosharks1.blogspot.com/2020/05/warning-data-reveals-btc-will-dump-post.html

0 notes

Text

WARNING! Data Reveals BTC Will Dump Post Halving!

VIDEO TRANSCRIPT

So what is going on with the viewers of the tube, if you don’t know by now? He definitely should. But I’m the host of the Channel Tylor and are you ready for crypto content that hopefully keeps your TV or computer safe? Unlike what these nutcases decided to do since he is cool with television and tone to the mainstream media, you armoured bars. And this is what I think of a new electrical linguistic programming. We are not going to buy newspapers propaganda any longer Suzie programmed or do not want to watch TV ever again. Power to the people like the cop Australia. This is what I think of the media. Well, it won’t let you get the picture. You know, our 21st-century rebellion. It’s time for Chieko Crypto. Well, we got to talk about it as I won’t be able to make a fully produced video on the topic until it happens. Bitcoin having 20, which is scheduled to happen sometime Monday of next week, maybe even Sunday, depending on how things progressed. So first, let’s explore what is happening to the Bitcoin price. Since Monday, the price has been moving on up to the east side. It began Monday at a low of around eight thousand six hundred forty. And as of yesterday, we were testing nine point five K past that. And then all the way up the 10k, an increase in just four days of almost twelve point five percent. Comparing Bitcoin with Dunk’s biggest index, the Dow Jones BTC has seen better gains in the Dow. The Dow was only pushed up about three percent since its Monday low. So what’s it gonna be? Is BTC going to go on a weekend rally while the traditional markets close, creating one of those gaps which traders talk about? Oh, so much from seeing me. Well, personally, I have a feeling we will see some more upward movement and it could have a pure phono rally. And it hit my original having prediction I made four months ago, and I should have stuck with my original gut. Never changed it when the pandemic came. Let’s watch now. This is a miner’s last chance to get twelve point five BTC per block. Come May 14th. It’s only six-point to five BTC per block. Chinese miners and some other regions can’t sustain their operations at the six K to seven K level, with twelve point five BTC per block. But when the reward gets slashed, they become unprofitable. This is why I predict a price between 10K till eleven points five K on the day of the vent. Over sixty-five percent of the miners need the price to be at that level to be a profitable business. So yep, it goes right back to the hash rate. My friends and that hash rate has been a peak in my friends pull out the one year chart since a major dip due to the global panic. The hash rate has recovered and is pushing right back to its all-time highs. So why is this happening? Well, for one, because, yes, the price is increasing, which has both times pre having in the past in 2012 and 2016, but no cue like mentioned in the prediction clip. This is the last time in history. Miners will be able to get twelve point five BTC for solving a block. It’s a minor rush before the split, which also happens in 2012 and 2016. 2016, just a couple of months before the having hash rate was at one point two X hashes. On that day of having July 9th, the hash rate reaches one point six X A hashes an increase of thirty-three percent in 2012, just a couple of months before the having hash rate was at twenty point five Tera hashes. By that day of the having, we were around twenty-seven pair of hashes, an increase of thirty-one percent. And now today, since the low just a couple of months ago in mid-March, we have pushed up from ninety-four Xa hashes to one hundred and twenty x the hashes an increase of twenty-seven percent cent. Then we should have seen this coming with hash rate rebounding so quick. But what happens immediately after having each time like clockwork. Well, the hash rate takes a major dip in 2016. The hash rate dip from the peak of just over one point six XA hashes down to the one point four X hash level in just one month. A minor drop out rate of twelve point five percent due to lesser rewards. The same thing can be seen after the 2012 having cash rate peaked at around twenty-seven pair hashes but dropped to a low of twenty Tera hashes in just one month, a retracement of twenty-five percent due to less minor rewards. So as another post having minor purge coming. Yep. That’s the only way it doesn’t happen. If we get a crazy ballistic price trend as the only miners who are profitable at the current price levels post having the ones with renewable energy, the ones located in China or Russia. And that’s about. So I wouldn’t doubt in between 10 to 20 percent of the harsh power post having, well, dry up within a month as unprofitable, inefficient operations close up shop, which will have an effect on the price as it will be in discovery mode post having as it always is. In 2016, the price discovery mode went downward. The price peaked at around seven hundred and sixty-eight bucks and then one month post having got down to five hundred fifty-two dollars, a decrease of twenty-six percent. Yikes. Although in 2012 things actually didn’t dip post having. And one month after the price had nearly increased by one hundred percent from a low of around 10 bucks to around 20 bucks. And then just a few months after BTC went on a mini parabolic rally surpassing the two hundred dollar level. But that was the first having and I believe, a full-on the anomaly, which won’t happen again. I believe things are going to be more like 2016 personally. And we here at Chieko aren’t the only ones looking at the data. Traders far and wide from a small minnow to a big old teather whale are ready to make moves. Post having and much larger moves that could have a much larger effect on the price due to derivatives options and more in things they have changed since the previous having event. For example, 2016 didn’t have a robust futures market. Unregulated or regulated, most trading in 2016 was on spot exchanges. Ahead of this, having bitcoin miners, they can purchase futures contracts, looking to lock in Bitcoin prices to pay for their future export. And the thing is, some of the largest Bitcoin whales are oji bitcoin miners. A lot of the Chinese have been playing with the futures markets since 2016. Unregulated, too, like OPEC’s bit next lobby and finance. And let’s just look at futures volume getting ridiculously high. Pree having. Who are the culprits of these exchanges? Number one, who lobby if only seven point eight billion dollars yesterday and financed with nearly seven billion and next. Okay, X and bid Max. But miners getting ready for big moves in the futures markets can be more clearly seen in the open interest Category four futures rather than the obvious bubbling volume. Open interest is the total number of outstanding derivative contracts, unlike volume, which counts every buy and sells order. The total open interest does not count that which provides a more accurate picture of the options trading activity. Whether money flows into futures and options market are increasing or decreasing in the open interest across the futures exchanges has surged by 50 percent in just a month, from two billion in total open interest to over three billion in total open interest. So if the miners do that, this run was just built on Teather U.S. GDP and there is barely any new actual interest in Bitcoin. I mean, Google Trends. It’s a great tool. And interest in Bitcoin globally is more when the price is going down than when the price is going up. We are almost past 10K and people aren’t searching for the term bitcoin as much as they were then during the March flash crash. So what are the miners ACA massive BTC whales doing and have been doing for the past month, locking in low prices in futures contracts as they knew the USD print and pump would come just yesterday morning? Teather decided to print another 100 million on the disgusting Chinese controlled blockchain Tron. Hey, those miners will cash out those futures contracts here soon post having and be able to pay for their operations for the next month or two while the price does go down. But long term, you guys, it’s just basic economics and math to understand that eventually the price will recover and go on another run. The good news is flowing for BTC. Bloomberg broke the article. Paul Tudor Jones buys Bitcoin as a hedge against inflation. Who is this tutor? Oh, no, not that tutor, this tutor. He is a macro investor and is the founder and CEO of Khutor Investment Corporation, which manages multi-billions of dollars in multiple funds. And from the article, Jones, who said his tutor BVI fund may hold as much as a low single-digit percentage of its assets in Bitcoin futures, becomes one of the first big hedge fund managers to embrace what Intel now has largely been a financial fad, with few mainstream advocates. Well, how large is the Tutor BVI fund? Well, from private fund data dot com twenty two point three billion dollars. And he said the fund may hold as much as the low single-digit percentages of its assets and BTC futures. Well, one percent would be over two hundred million dollars and five percent, which I would consider a low single-digit, would be over one billion. So the macro view for BTC is very bright. The large players like Cooter Jones who begin to dabble in the markets, give it that legitimacy it needs for the Foma rally to end all foma rallies. And that comes from the Bitcoin ETF, which is the end goal for all of the big Bitcoin whales. Cheers for yours. I’ll see you next time.

source https://www.cryptosharks.net/data-reveals-btc-will-dump-post-halving/

source https://cryptosharks1.tumblr.com/post/617808053825306624

0 notes

Text

WARNING! Data Reveals BTC Will Dump Post Halving!

VIDEO TRANSCRIPT

So what is going on with the viewers of the tube, if you don’t know by now? He definitely should. But I’m the host of the Channel Tylor and are you ready for crypto content that hopefully keeps your TV or computer safe? Unlike what these nutcases decided to do since he is cool with television and tone to the mainstream media, you armoured bars. And this is what I think of a new electrical linguistic programming. We are not going to buy newspapers propaganda any longer Suzie programmed or do not want to watch TV ever again. Power to the people like the cop Australia. This is what I think of the media. Well, it won’t let you get the picture. You know, our 21st-century rebellion. It’s time for Chieko Crypto. Well, we got to talk about it as I won’t be able to make a fully produced video on the topic until it happens. Bitcoin having 20, which is scheduled to happen sometime Monday of next week, maybe even Sunday, depending on how things progressed. So first, let’s explore what is happening to the Bitcoin price. Since Monday, the price has been moving on up to the east side. It began Monday at a low of around eight thousand six hundred forty. And as of yesterday, we were testing nine point five K past that. And then all the way up the 10k, an increase in just four days of almost twelve point five percent. Comparing Bitcoin with Dunk’s biggest index, the Dow Jones BTC has seen better gains in the Dow. The Dow was only pushed up about three percent since its Monday low. So what’s it gonna be? Is BTC going to go on a weekend rally while the traditional markets close, creating one of those gaps which traders talk about? Oh, so much from seeing me. Well, personally, I have a feeling we will see some more upward movement and it could have a pure phono rally. And it hit my original having prediction I made four months ago, and I should have stuck with my original gut. Never changed it when the pandemic came. Let’s watch now. This is a miner’s last chance to get twelve point five BTC per block. Come May 14th. It’s only six-point to five BTC per block. Chinese miners and some other regions can’t sustain their operations at the six K to seven K level, with twelve point five BTC per block. But when the reward gets slashed, they become unprofitable. This is why I predict a price between 10K till eleven points five K on the day of the vent. Over sixty-five percent of the miners need the price to be at that level to be a profitable business. So yep, it goes right back to the hash rate. My friends and that hash rate has been a peak in my friends pull out the one year chart since a major dip due to the global panic. The hash rate has recovered and is pushing right back to its all-time highs. So why is this happening? Well, for one, because, yes, the price is increasing, which has both times pre having in the past in 2012 and 2016, but no cue like mentioned in the prediction clip. This is the last time in history. Miners will be able to get twelve point five BTC for solving a block. It’s a minor rush before the split, which also happens in 2012 and 2016. 2016, just a couple of months before the having hash rate was at one point two X hashes. On that day of having July 9th, the hash rate reaches one point six X A hashes an increase of thirty-three percent in 2012, just a couple of months before the having hash rate was at twenty point five Tera hashes. By that day of the having, we were around twenty-seven pair of hashes, an increase of thirty-one percent. And now today, since the low just a couple of months ago in mid-March, we have pushed up from ninety-four Xa hashes to one hundred and twenty x the hashes an increase of twenty-seven percent cent. Then we should have seen this coming with hash rate rebounding so quick. But what happens immediately after having each time like clockwork. Well, the hash rate takes a major dip in 2016. The hash rate dip from the peak of just over one point six XA hashes down to the one point four X hash level in just one month. A minor drop out rate of twelve point five percent due to lesser rewards. The same thing can be seen after the 2012 having cash rate peaked at around twenty-seven pair hashes but dropped to a low of twenty Tera hashes in just one month, a retracement of twenty-five percent due to less minor rewards. So as another post having minor purge coming. Yep. That’s the only way it doesn’t happen. If we get a crazy ballistic price trend as the only miners who are profitable at the current price levels post having the ones with renewable energy, the ones located in China or Russia. And that’s about. So I wouldn’t doubt in between 10 to 20 percent of the harsh power post having, well, dry up within a month as unprofitable, inefficient operations close up shop, which will have an effect on the price as it will be in discovery mode post having as it always is. In 2016, the price discovery mode went downward. The price peaked at around seven hundred and sixty-eight bucks and then one month post having got down to five hundred fifty-two dollars, a decrease of twenty-six percent. Yikes. Although in 2012 things actually didn’t dip post having. And one month after the price had nearly increased by one hundred percent from a low of around 10 bucks to around 20 bucks. And then just a few months after BTC went on a mini parabolic rally surpassing the two hundred dollar level. But that was the first having and I believe, a full-on the anomaly, which won’t happen again. I believe things are going to be more like 2016 personally. And we here at Chieko aren’t the only ones looking at the data. Traders far and wide from a small minnow to a big old teather whale are ready to make moves. Post having and much larger moves that could have a much larger effect on the price due to derivatives options and more in things they have changed since the previous having event. For example, 2016 didn’t have a robust futures market. Unregulated or regulated, most trading in 2016 was on spot exchanges. Ahead of this, having bitcoin miners, they can purchase futures contracts, looking to lock in Bitcoin prices to pay for their future export. And the thing is, some of the largest Bitcoin whales are oji bitcoin miners. A lot of the Chinese have been playing with the futures markets since 2016. Unregulated, too, like OPEC’s bit next lobby and finance. And let’s just look at futures volume getting ridiculously high. Pree having. Who are the culprits of these exchanges? Number one, who lobby if only seven point eight billion dollars yesterday and financed with nearly seven billion and next. Okay, X and bid Max. But miners getting ready for big moves in the futures markets can be more clearly seen in the open interest Category four futures rather than the obvious bubbling volume. Open interest is the total number of outstanding derivative contracts, unlike volume, which counts every buy and sells order. The total open interest does not count that which provides a more accurate picture of the options trading activity. Whether money flows into futures and options market are increasing or decreasing in the open interest across the futures exchanges has surged by 50 percent in just a month, from two billion in total open interest to over three billion in total open interest. So if the miners do that, this run was just built on Teather U.S. GDP and there is barely any new actual interest in Bitcoin. I mean, Google Trends. It’s a great tool. And interest in Bitcoin globally is more when the price is going down than when the price is going up. We are almost past 10K and people aren’t searching for the term bitcoin as much as they were then during the March flash crash. So what are the miners ACA massive BTC whales doing and have been doing for the past month, locking in low prices in futures contracts as they knew the USD print and pump would come just yesterday morning? Teather decided to print another 100 million on the disgusting Chinese controlled blockchain Tron. Hey, those miners will cash out those futures contracts here soon post having and be able to pay for their operations for the next month or two while the price does go down. But long term, you guys, it’s just basic economics and math to understand that eventually the price will recover and go on another run. The good news is flowing for BTC. Bloomberg broke the article. Paul Tudor Jones buys Bitcoin as a hedge against inflation. Who is this tutor? Oh, no, not that tutor, this tutor. He is a macro investor and is the founder and CEO of Khutor Investment Corporation, which manages multi-billions of dollars in multiple funds. And from the article, Jones, who said his tutor BVI fund may hold as much as a low single-digit percentage of its assets in Bitcoin futures, becomes one of the first big hedge fund managers to embrace what Intel now has largely been a financial fad, with few mainstream advocates. Well, how large is the Tutor BVI fund? Well, from private fund data dot com twenty two point three billion dollars. And he said the fund may hold as much as the low single-digit percentages of its assets and BTC futures. Well, one percent would be over two hundred million dollars and five percent, which I would consider a low single-digit, would be over one billion. So the macro view for BTC is very bright. The large players like Cooter Jones who begin to dabble in the markets, give it that legitimacy it needs for the Foma rally to end all foma rallies. And that comes from the Bitcoin ETF, which is the end goal for all of the big Bitcoin whales. Cheers for yours. I’ll see you next time.

Via https://www.cryptosharks.net/data-reveals-btc-will-dump-post-halving/

source https://cryptosharks.weebly.com/blog/warning-data-reveals-btc-will-dump-post-halving

0 notes

Text

WARNING! Data Reveals BTC Will Dump Post Halving!

VIDEO TRANSCRIPT

So what is going on with the viewers of the tube, if you don’t know by now? He definitely should. But I’m the host of the Channel Tylor and are you ready for crypto content that hopefully keeps your TV or computer safe? Unlike what these nutcases decided to do since he is cool with television and tone to the mainstream media, you armoured bars. And this is what I think of a new electrical linguistic programming. We are not going to buy newspapers propaganda any longer Suzie programmed or do not want to watch TV ever again. Power to the people like the cop Australia. This is what I think of the media. Well, it won’t let you get the picture. You know, our 21st-century rebellion. It’s time for Chieko Crypto. Well, we got to talk about it as I won’t be able to make a fully produced video on the topic until it happens. Bitcoin having 20, which is scheduled to happen sometime Monday of next week, maybe even Sunday, depending on how things progressed. So first, let’s explore what is happening to the Bitcoin price. Since Monday, the price has been moving on up to the east side. It began Monday at a low of around eight thousand six hundred forty. And as of yesterday, we were testing nine point five K past that. And then all the way up the 10k, an increase in just four days of almost twelve point five percent. Comparing Bitcoin with Dunk’s biggest index, the Dow Jones BTC has seen better gains in the Dow. The Dow was only pushed up about three percent since its Monday low. So what’s it gonna be? Is BTC going to go on a weekend rally while the traditional markets close, creating one of those gaps which traders talk about? Oh, so much from seeing me. Well, personally, I have a feeling we will see some more upward movement and it could have a pure phono rally. And it hit my original having prediction I made four months ago, and I should have stuck with my original gut. Never changed it when the pandemic came. Let’s watch now. This is a miner’s last chance to get twelve point five BTC per block. Come May 14th. It’s only six-point to five BTC per block. Chinese miners and some other regions can’t sustain their operations at the six K to seven K level, with twelve point five BTC per block. But when the reward gets slashed, they become unprofitable. This is why I predict a price between 10K till eleven points five K on the day of the vent. Over sixty-five percent of the miners need the price to be at that level to be a profitable business. So yep, it goes right back to the hash rate. My friends and that hash rate has been a peak in my friends pull out the one year chart since a major dip due to the global panic. The hash rate has recovered and is pushing right back to its all-time highs. So why is this happening? Well, for one, because, yes, the price is increasing, which has both times pre having in the past in 2012 and 2016, but no cue like mentioned in the prediction clip. This is the last time in history. Miners will be able to get twelve point five BTC for solving a block. It’s a minor rush before the split, which also happens in 2012 and 2016. 2016, just a couple of months before the having hash rate was at one point two X hashes. On that day of having July 9th, the hash rate reaches one point six X A hashes an increase of thirty-three percent in 2012, just a couple of months before the having hash rate was at twenty point five Tera hashes. By that day of the having, we were around twenty-seven pair of hashes, an increase of thirty-one percent. And now today, since the low just a couple of months ago in mid-March, we have pushed up from ninety-four Xa hashes to one hundred and twenty x the hashes an increase of twenty-seven percent cent. Then we should have seen this coming with hash rate rebounding so quick. But what happens immediately after having each time like clockwork. Well, the hash rate takes a major dip in 2016. The hash rate dip from the peak of just over one point six XA hashes down to the one point four X hash level in just one month. A minor drop out rate of twelve point five percent due to lesser rewards. The same thing can be seen after the 2012 having cash rate peaked at around twenty-seven pair hashes but dropped to a low of twenty Tera hashes in just one month, a retracement of twenty-five percent due to less minor rewards. So as another post having minor purge coming. Yep. That’s the only way it doesn’t happen. If we get a crazy ballistic price trend as the only miners who are profitable at the current price levels post having the ones with renewable energy, the ones located in China or Russia. And that’s about. So I wouldn’t doubt in between 10 to 20 percent of the harsh power post having, well, dry up within a month as unprofitable, inefficient operations close up shop, which will have an effect on the price as it will be in discovery mode post having as it always is. In 2016, the price discovery mode went downward. The price peaked at around seven hundred and sixty-eight bucks and then one month post having got down to five hundred fifty-two dollars, a decrease of twenty-six percent. Yikes. Although in 2012 things actually didn’t dip post having. And one month after the price had nearly increased by one hundred percent from a low of around 10 bucks to around 20 bucks. And then just a few months after BTC went on a mini parabolic rally surpassing the two hundred dollar level. But that was the first having and I believe, a full-on the anomaly, which won’t happen again. I believe things are going to be more like 2016 personally. And we here at Chieko aren’t the only ones looking at the data. Traders far and wide from a small minnow to a big old teather whale are ready to make moves. Post having and much larger moves that could have a much larger effect on the price due to derivatives options and more in things they have changed since the previous having event. For example, 2016 didn’t have a robust futures market. Unregulated or regulated, most trading in 2016 was on spot exchanges. Ahead of this, having bitcoin miners, they can purchase futures contracts, looking to lock in Bitcoin prices to pay for their future export. And the thing is, some of the largest Bitcoin whales are oji bitcoin miners. A lot of the Chinese have been playing with the futures markets since 2016. Unregulated, too, like OPEC’s bit next lobby and finance. And let’s just look at futures volume getting ridiculously high. Pree having. Who are the culprits of these exchanges? Number one, who lobby if only seven point eight billion dollars yesterday and financed with nearly seven billion and next. Okay, X and bid Max. But miners getting ready for big moves in the futures markets can be more clearly seen in the open interest Category four futures rather than the obvious bubbling volume. Open interest is the total number of outstanding derivative contracts, unlike volume, which counts every buy and sells order. The total open interest does not count that which provides a more accurate picture of the options trading activity. Whether money flows into futures and options market are increasing or decreasing in the open interest across the futures exchanges has surged by 50 percent in just a month, from two billion in total open interest to over three billion in total open interest. So if the miners do that, this run was just built on Teather U.S. GDP and there is barely any new actual interest in Bitcoin. I mean, Google Trends. It’s a great tool. And interest in Bitcoin globally is more when the price is going down than when the price is going up. We are almost past 10K and people aren’t searching for the term bitcoin as much as they were then during the March flash crash. So what are the miners ACA massive BTC whales doing and have been doing for the past month, locking in low prices in futures contracts as they knew the USD print and pump would come just yesterday morning? Teather decided to print another 100 million on the disgusting Chinese controlled blockchain Tron. Hey, those miners will cash out those futures contracts here soon post having and be able to pay for their operations for the next month or two while the price does go down. But long term, you guys, it’s just basic economics and math to understand that eventually the price will recover and go on another run. The good news is flowing for BTC. Bloomberg broke the article. Paul Tudor Jones buys Bitcoin as a hedge against inflation. Who is this tutor? Oh, no, not that tutor, this tutor. He is a macro investor and is the founder and CEO of Khutor Investment Corporation, which manages multi-billions of dollars in multiple funds. And from the article, Jones, who said his tutor BVI fund may hold as much as a low single-digit percentage of its assets in Bitcoin futures, becomes one of the first big hedge fund managers to embrace what Intel now has largely been a financial fad, with few mainstream advocates. Well, how large is the Tutor BVI fund? Well, from private fund data dot com twenty two point three billion dollars. And he said the fund may hold as much as the low single-digit percentages of its assets and BTC futures. Well, one percent would be over two hundred million dollars and five percent, which I would consider a low single-digit, would be over one billion. So the macro view for BTC is very bright. The large players like Cooter Jones who begin to dabble in the markets, give it that legitimacy it needs for the Foma rally to end all foma rallies. And that comes from the Bitcoin ETF, which is the end goal for all of the big Bitcoin whales. Cheers for yours. I’ll see you next time.

source https://www.cryptosharks.net/data-reveals-btc-will-dump-post-halving/

0 notes

Text

Announcing Windows 10 Insider Preview Build 15031 for PC

Hello Windows Insiders!

Thank you very much to those of you who joined in on yesterday’s Beam webcast for our Bug Bash! It was a pleasure to hear from so many familiar names in real time. We loved talking with you all and definitely want to do so more often. We will vary the times so that we can hit various regions around the world!

Are you a Windows Developer? Today is Windows Developer Day! Check out our livestream from 9am-1pm PST, which outlines what’s new for developers in the Windows 10 Creators Update. Whether you’re building for the web or UWP, the latest consumer app or line of business tool, there’s something in it for you. Tomorrow will be our “Developer focus” day for the Bug Bash, so tune in today to learn what’s new, and get ready to bash on it! We’ll have a new set of Developer-focused quests ready for you in the Feedback Hub tomorrow.

Today we are excited to be releasing Windows 10 Insider Preview Build 15031 for PC to Windows Insiders in the Fast ring.

What’s new in Build 15031

Do more at once with the new Compact Overlay window: Ever want to continue watching a movie while switching app to check your email? Or keep an eye on your video chat even as you’re browsing the web? We do all the time! Some tasks don’t require the user’s full attention but is perfect to leave at the corner of the screen so we’re introducing a new compact overlay mode for UWA app developers. When an app window enters compact overlay mode it’ll be shown above other windows so it won’t get blocked. The best part is that compact overlay windows work just like normal windows in all other ways so app developers can tailor the experience with what they already know. Updates to the Movies & TV app and Skype Preview app will take advantage of compact overlay windows in the near future!

Introducing Dynamic Lock: Dynamic Lock automatically locks your Windows 10 PC when you’re not around based the proximity of a Bluetooth-paired phone. If your Bluetooth-paired phone is not found near your PC, Windows turns off the screen and locks the PC after 30 seconds. To enable Dynamic Lock, make sure your phone is paired to your PC via Bluetooth and go to Settings > Accounts > Sign-in options and toggle Dynamic lock to “on”.

NOTE: See known issues below regarding a bug preventing PCs on this build from successfully pairing devices via Bluetooth.

New Share icon: We’re introducing a new share icon. Apps that used the “share” font glyph in Segoe MDL2 assets should get the change automatically. You can read more about the change here.

Windows Game Bar improved full-screen support: We got a ton of feedback on Game Bar and we are continually adding more titles with this support. In this build, we’ve added support for 52 additional games in full-screen mode with Windows game bar. As always, just hit WIN + G to invoke Game Bar to capture a recording or screenshot.

Aion

Borderlands 2

Call of Duty Black Ops III

Call of Duty: Infinite Warfare

Civilization VI

Company of Heroes 2

Crusader Kings 2

Deus Ex: Mankind Divided

Dishonored 2

Elite: Dangerous

Euro Trucks 2 Simulator

Europa Universalis IV

Eve Online

F1 2016

Fallout New Vegas

Far Cry 4

Football Manager 2016

Football Manager 2017

Garry’s Mod

Grand Theft Auto IV: Complete Edition

Grand Theft Auto V

Grand Theft Auto: San Andreas

Hearts of Iron IV

Hitman – Full Experience

Killing Floor 2

Lineage 2 – The Chaotic Throne

Mafia III

Mass Effect 3

Mechwarrior Online

Metro 2033 Redux

Metro Last Light Redux

Middle-earth: Shadow of Mordor

Mirror’s Edge Catalyst

Need for Speed

Path Of Exile

Planet Coaster

Planetside 2

Plants vs. Zombies Garden Warfare: Deluxe Edition

Pro Evolution Soccer 2016

Project CARS

Roblox

Smite

Source Engine Titles/Half Life 2

Team Fortress 2

TERA

The Sims 3

The Witcher 2: Assassins of Kings

Titanfall 2

Total War: Attila

Watch_Dogs 2

World of Warplanes

XCOM 2

Tip: You can control this feature through the Windows Game bar settings. In the settings dialog, look for the “Show Game bar when I play full-screen games” checkbox. See Major Nelson’s post on Game bar for more info on how to adjust settings for best game performance.

Other changes, improvements, and fixes for PC

We fixed the issue causing Tencent apps and games to crash or work incorrectly.

We’ve updated OOBE so that if there’s no detected audio output device, for example with VMs, it now skips Cortana’s introduction.

[GAMING] We fixed the issue causing popular games may experience crashes or black screens when trying to load due to a platform issue.

[GAMING] We fixed the issue where Game Mode is enabled system wide by default, however, the ON/OFF toggle in Settings will incorrectly show it as being OFF until the user manually toggles the Setting to ON which will cause it to update and accurately display the status of Game Mode system wide.

We fixed an issue where the night light quick action was unexpectedly disabled in the last Insider flight.

We fixed an issue resulting in audio going quiet each time the Start menu is opened after a SpeechRuntime.exe crash.

Dragging apps from the all apps list to pin on Start’s tile grid will now work. We also fixed an issue on recent builds where some tiles might unexpectedly appear blank and with a name starting with “P~…” after upgrading.

We fixed an issue where Win + Shift + S wouldn’t work to capture a region of the screen if the Snipping Tool was already running. We also fixed an issue where taking a snip with the Snipping Tool would fail on 4k monitors when 60-80% was selected.

We fixed an issue resulting in “Fn”+”Pause/Break” key not working to pause the checking progress when running chkdsk.

We fixed an issue where resizing windows with a pen would be unexpectedly slow. We also fixed an issue where resizing a window across monitors with different DPIs could be unpredictable.

We fixed an issue where the Windows Ink highlight preview wouldn’t be visible in Web Notes when Microsoft Edge was using dark theme.

We’ve improved gesture recognition for 3 finger swipes on precision touchpads.

We fixed an issue where a number of files with the name GLOB(0xXXXXXX) could be unexpectedly found in the system root directory after upgrading.

We fixed an issue where you couldn’t rename disk volumes via File Explorer in recent flights.

We fixed an issue where rapidly tapping a button to bring up the new Share experience, for example in Microsoft Edge, could result in the Share UI not coming up again until the device had been rebooted.

We fixed an issue resulting the lists of thumbnails in Photos and Groove Music visibly shifting up when the app resumed.

We fixed an issue where the Themes Settings page would blink when a theme was deleted.

We’ve updated the help string on each page of Settings to be a bit more sucinct.

We fixed an issue resulting in not being able to type ę on the Polish keyboard into the Settings search box.

We fixed an issue where Cortana Background Task Host might have ended up using an unexpectedly large amount of CPU in recent flights. We also shorted the two factor authentication notification from Cortana so that it won’t be truncated.

We fixed an issue where the UI to input credentials wouldn’t have keyboard focus after initiating a remote connection to another PC.

We’ve improved reliability when handling malformed Gifs in XAML-based apps.

The icons should now be shown as expected instead of squares under Settings > Gaming.

Known issues for PC

[UPDATED] IMPORTANT: You may see “Initializing…” when attempting to download this build and the download progress indicator shown when downloading this build may seem broken under Settings > Update & security > Windows Update. It may look like you’re getting stuck at 0% or at other percentages. Ignore the indicator and be patient. The build should download fine, and the installation should kick off. See this forum post for more details.

While we fixed the primary bug causing this issue, some Windows Insiders may still hit nonstop exceptions in the Spectrum.exe service causing their PC to lose audio, disk I/O usage to become very high, and apps like Microsoft Edge to become unresponsive when doing certain actions such as opening Settings. As a workaround to get out of this state, STOP the Spectrum.exe service and delete C:ProgramDataMicrosoftSpectrumPersistedSpatialAnchors and reboot. For more details, see this forum post.

Going to Settings > Devices will crash the Settings app. You will be unable to pair a Bluetooth device. Bluetooth quick actions from Action Center also does not work.

You will not be able to launch the Connect UX via Action Center, Win + K, or Settings (it will crash upon launch). This will impact wireless projection scenarios.

[GAMING] Some popular games might minimize to the taskbar when launched. You can click on the game on the taskbar to get the game back.

[GAMING] Certain hardware configurations may cause the broadcast live review window in the Game bar to flash Green while you are Broadcasting. This does not affect the quality of your broadcast and is only visible to the Broadcaster.

Microsoft Edge F12 tools may intermittently crash, hang, and fail to accept inputs.

Microsoft Edge’s “Inspect Element” and “View Source” options don’t correctly launch to the DOM Explorer and Debugger, respectively.

Under Settings > Update & security > Windows Update you might see the text “Some Settings are managed by your organization” even though your PC isn’t being managed by an organization. This is a bug caused by an updated flight configuration setting for Insider Preview builds and does not mean your PC is being managed by anyone.

On some PCs, audio stops working sporadically with ‘device in use’ error”. We are investigating. Restarting the audio service may fix things for a bit.

The Action Center may sometimes appear blank and transparent without color. If you encounter this, try moving the taskbar to a different location on screen.

The icon for Windows Insider Program under Settings > Update & security is shown as a square.

Community Updates

Last week our team traveled to Nairobi, Kenya to launch the second #Insiders4Good fellowship in East Africa. The response to our announcement was tremendous and the Windows Insider Program was talked about in 11 sessions, interviews, press events and panels across the two days. You all are famous!

We continue to learn about the more developing parts of the world and today, we are celebrating Nigeria Day, a day to reflect upon our learnings from and investments in our time spent in Africa. We have invited the entire Windows org to come and bug bash on our 2G network using some standard quests (install Windows, join the Windows Insider Program, set up your machine, etc.) so our team can develop more empathy for what most of the world experiences quite often. We will have a full recap of our experience next week!

Happy bug bashing—and see you on the next Beam live stream on Saturday 7-9 pm PST.

Keep hustling team,

Dona <3

from DIYS http://ift.tt/2loH9Ok

0 notes

Text

Announcing Windows 10 Insider Preview Build 15031 for PC

Hello Windows Insiders!

Thank you very much to those of you who joined in on yesterday’s Beam webcast for our Bug Bash! It was a pleasure to hear from so many familiar names in real time. We loved talking with you all and definitely want to do so more often. We will vary the times so that we can hit various regions around the world!

Are you a Windows Developer? Today is Windows Developer Day! Check out our livestream from 9am-1pm PST, which outlines what’s new for developers in the Windows 10 Creators Update. Whether you’re building for the web or UWP, the latest consumer app or line of business tool, there’s something in it for you. Tomorrow will be our “Developer focus” day for the Bug Bash, so tune in today to learn what’s new, and get ready to bash on it! We’ll have a new set of Developer-focused quests ready for you in the Feedback Hub tomorrow.

Today we are excited to be releasing Windows 10 Insider Preview Build 15031 for PC to Windows Insiders in the Fast ring.

What’s new in Build 15031

Do more at once with the new Compact Overlay window: Ever want to continue watching a movie while switching app to check your email? Or keep an eye on your video chat even as you’re browsing the web? We do all the time! Some tasks don’t require the user’s full attention but is perfect to leave at the corner of the screen so we’re introducing a new compact overlay mode for UWA app developers. When an app window enters compact overlay mode it’ll be shown above other windows so it won’t get blocked. The best part is that compact overlay windows work just like normal windows in all other ways so app developers can tailor the experience with what they already know. Updates to the Movies & TV app and Skype Preview app will take advantage of compact overlay windows in the near future!

Introducing Dynamic Lock: Dynamic Lock automatically locks your Windows 10 PC when you’re not around based the proximity of a Bluetooth-paired phone. If your Bluetooth-paired phone is not found near your PC, Windows turns off the screen and locks the PC after 30 seconds. To enable Dynamic Lock, make sure your phone is paired to your PC via Bluetooth and go to Settings > Accounts > Sign-in options and toggle Dynamic lock to “on”.

NOTE: See known issues below regarding a bug preventing PCs on this build from successfully pairing devices via Bluetooth.

New Share icon: We’re introducing a new share icon. Apps that used the “share” font glyph in Segoe MDL2 assets should get the change automatically. You can read more about the change here.

Windows Game Bar improved full-screen support: We got a ton of feedback on Game Bar and we are continually adding more titles with this support. In this build, we’ve added support for 52 additional games in full-screen mode with Windows game bar. As always, just hit WIN + G to invoke Game Bar to capture a recording or screenshot.

Aion

Borderlands 2

Call of Duty Black Ops III

Call of Duty: Infinite Warfare

Civilization VI

Company of Heroes 2

Crusader Kings 2

Deus Ex: Mankind Divided

Dishonored 2

Elite: Dangerous

Euro Trucks 2 Simulator

Europa Universalis IV

Eve Online

F1 2016

Fallout New Vegas

Far Cry 4

Football Manager 2016

Football Manager 2017

Garry’s Mod

Grand Theft Auto IV: Complete Edition

Grand Theft Auto V

Grand Theft Auto: San Andreas

Hearts of Iron IV

Hitman – Full Experience

Killing Floor 2

Lineage 2 – The Chaotic Throne

Mafia III

Mass Effect 3

Mechwarrior Online

Metro 2033 Redux

Metro Last Light Redux

Middle-earth: Shadow of Mordor

Mirror’s Edge Catalyst

Need for Speed

Path Of Exile

Planet Coaster

Planetside 2

Plants vs. Zombies Garden Warfare: Deluxe Edition

Pro Evolution Soccer 2016

Project CARS

Roblox

Smite

Source Engine Titles/Half Life 2

Team Fortress 2

TERA

The Sims 3

The Witcher 2: Assassins of Kings

Titanfall 2

Total War: Attila

Watch_Dogs 2

World of Warplanes

XCOM 2

Tip: You can control this feature through the Windows Game bar settings. In the settings dialog, look for the “Show Game bar when I play full-screen games” checkbox. See Major Nelson’s post on Game bar for more info on how to adjust settings for best game performance.

Other changes, improvements, and fixes for PC

We fixed the issue causing Tencent apps and games to crash or work incorrectly.

We’ve updated OOBE so that if there’s no detected audio output device, for example with VMs, it now skips Cortana’s introduction.

[GAMING] We fixed the issue causing popular games may experience crashes or black screens when trying to load due to a platform issue.

[GAMING] We fixed the issue where Game Mode is enabled system wide by default, however, the ON/OFF toggle in Settings will incorrectly show it as being OFF until the user manually toggles the Setting to ON which will cause it to update and accurately display the status of Game Mode system wide.

We fixed an issue where the night light quick action was unexpectedly disabled in the last Insider flight.

We fixed an issue resulting in audio going quiet each time the Start menu is opened after a SpeechRuntime.exe crash.

Dragging apps from the all apps list to pin on Start’s tile grid will now work. We also fixed an issue on recent builds where some tiles might unexpectedly appear blank and with a name starting with “P~…” after upgrading.

We fixed an issue where Win + Shift + S wouldn’t work to capture a region of the screen if the Snipping Tool was already running. We also fixed an issue where taking a snip with the Snipping Tool would fail on 4k monitors when 60-80% was selected.

We fixed an issue resulting in “Fn”+”Pause/Break” key not working to pause the checking progress when running chkdsk.

We fixed an issue where resizing windows with a pen would be unexpectedly slow. We also fixed an issue where resizing a window across monitors with different DPIs could be unpredictable.

We fixed an issue where the Windows Ink highlight preview wouldn’t be visible in Web Notes when Microsoft Edge was using dark theme.

We’ve improved gesture recognition for 3 finger swipes on precision touchpads.

We fixed an issue where a number of files with the name GLOB(0xXXXXXX) could be unexpectedly found in the system root directory after upgrading.

We fixed an issue where you couldn’t rename disk volumes via File Explorer in recent flights.

We fixed an issue where rapidly tapping a button to bring up the new Share experience, for example in Microsoft Edge, could result in the Share UI not coming up again until the device had been rebooted.

We fixed an issue resulting the lists of thumbnails in Photos and Groove Music visibly shifting up when the app resumed.

We fixed an issue where the Themes Settings page would blink when a theme was deleted.

We’ve updated the help string on each page of Settings to be a bit more sucinct.

We fixed an issue resulting in not being able to type ę on the Polish keyboard into the Settings search box.

We fixed an issue where Cortana Background Task Host might have ended up using an unexpectedly large amount of CPU in recent flights. We also shorted the two factor authentication notification from Cortana so that it won’t be truncated.

We fixed an issue where the UI to input credentials wouldn’t have keyboard focus after initiating a remote connection to another PC.

We’ve improved reliability when handling malformed Gifs in XAML-based apps.

The icons should now be shown as expected instead of squares under Settings > Gaming.

Known issues for PC

[UPDATED] IMPORTANT: You may see “Initializing…” when attempting to download this build and the download progress indicator shown when downloading this build may seem broken under Settings > Update & security > Windows Update. It may look like you’re getting stuck at 0% or at other percentages. Ignore the indicator and be patient. The build should download fine, and the installation should kick off. See this forum post for more details.

While we fixed the primary bug causing this issue, some Windows Insiders may still hit nonstop exceptions in the Spectrum.exe service causing their PC to lose audio, disk I/O usage to become very high, and apps like Microsoft Edge to become unresponsive when doing certain actions such as opening Settings. As a workaround to get out of this state, STOP the Spectrum.exe service and delete C:ProgramDataMicrosoftSpectrumPersistedSpatialAnchors and reboot. For more details, see this forum post.

Going to Settings > Devices will crash the Settings app. You will be unable to pair a Bluetooth device. Bluetooth quick actions from Action Center also does not work.

You will not be able to launch the Connect UX via Action Center, Win + K, or Settings (it will crash upon launch). This will impact wireless projection scenarios.

[GAMING] Some popular games might minimize to the taskbar when launched. You can click on the game on the taskbar to get the game back.

[GAMING] Certain hardware configurations may cause the broadcast live review window in the Game bar to flash Green while you are Broadcasting. This does not affect the quality of your broadcast and is only visible to the Broadcaster.

Microsoft Edge F12 tools may intermittently crash, hang, and fail to accept inputs.

Microsoft Edge’s “Inspect Element” and “View Source” options don’t correctly launch to the DOM Explorer and Debugger, respectively.

Under Settings > Update & security > Windows Update you might see the text “Some Settings are managed by your organization” even though your PC isn’t being managed by an organization. This is a bug caused by an updated flight configuration setting for Insider Preview builds and does not mean your PC is being managed by anyone.

On some PCs, audio stops working sporadically with ‘device in use’ error”. We are investigating. Restarting the audio service may fix things for a bit.

The Action Center may sometimes appear blank and transparent without color. If you encounter this, try moving the taskbar to a different location on screen.

The icon for Windows Insider Program under Settings > Update & security is shown as a square.

Community Updates

Last week our team traveled to Nairobi, Kenya to launch the second #Insiders4Good fellowship in East Africa. The response to our announcement was tremendous and the Windows Insider Program was talked about in 11 sessions, interviews, press events and panels across the two days. You all are famous!

We continue to learn about the more developing parts of the world and today, we are celebrating Nigeria Day, a day to reflect upon our learnings from and investments in our time spent in Africa. We have invited the entire Windows org to come and bug bash on our 2G network using some standard quests (install Windows, join the Windows Insider Program, set up your machine, etc.) so our team can develop more empathy for what most of the world experiences quite often. We will have a full recap of our experience next week!

Happy bug bashing—and see you on the next Beam live stream on Saturday 7-9 pm PST.

Keep hustling team,

Dona <3

from DIYS http://ift.tt/2loH9Ok

0 notes