#applications mobiles bnp paribas

Text

DO NOT WAIT !

CREATE YOUR

MOBILE APP

TODAY !

Your app in a few minutes without coding !

No skills required !

create your free account !

#application mobile pole emploi mes offres#application mobile pole-emploi.fr#applications mobiles#applications mobiles bnp paribas#applications mobiles caisse depargne#applications mobiles de dons

0 notes

Text

What are some important tech skills for IT graduates?

Information Technology Specialist - Job Description And Requirement

The Indian Information Technology industry is one of the largest employers in the private sector. However, it has four sub-sectors including IT Services, Business Process Management (BPM), Software Products & Engineering Services and Hardware. They are mainly performing well, driving revenue and employment in the last few decades with tech skills.

Job profiles in demand

Research conducts on the hiring pattern of IT companies by the professionals of Information Technology at best Engineering Colleges in Jaipur. However, it is seen that they are mainly hiring for UI and UX Specialists, Full-Stack Web Developers, Product Managers, Product Developers, Mobile Application Developers, System Analysts. Also, it includes Business Analysts, IT Security Analysts, Cloud Computing Specialists, Big Data Specialists, Data Analysts, and CMS Experts.

Top IT skills in demand

Students of Top Engineering Colleges in Jaipur must develop several important skills. However, it includes web-programming and application development with popular and useful programming languages. Some of them are JavaScript, Angular JS, PHP, Python, Objective C, and Ruby on Rails, C, C++, and C #. There are several other skills for IT professionals are as follows:

Project Management - Preferred Certifications include Project Management Professional, PRINCE2 Practitioner, and Certified Associate in Project Management, (CAPM), CompTIA Project+ and Certified ScrumMaster

Database Administration

Tech Support/IT Help Desk Roles

Security and Compliance Governance - Preferred Certifications include CompTIA Security+, CEH, CISSP, CISM, and GSEC

Top recruiting IT companies

Arya College is the Best Placement College in Rajasthan. There are several recruiting companies that college offers. It includes Oracle, IBM, Wipro, Amazon, HCL Technologies, Dell, Microsoft, Cisco, Honeywell, Atos, Novartis, Capgemini, SAP, Mahindra & Mahindra, AC Nielsen, GE, BNP Paribas, Google, Deloitte. In addition, there are several other companies like Nokia, Juniper Networks, Credit Suisse, Ericsson, Red Hat, Infosys, Siemens, Accenture, Tech Mahindra, Thomson Reuters, Goldman Sachs, and VMware.

Skills required in the high sector

Leadership-Oriented - Given the complex and rapidly evolving nature of IT jobs in India, employers from Best Engineering Colleges in Jaipur prefer associates. They must be initiative-driven and show leadership skills.

Resilient - Tech jobs show a wide range of problems routinely. However, the ability to view these challenges in a positive light and overcome them is highly valuable.

Decisive - IT jobs with Campus Placement at B Tech Colleges in Jaipur mainly require quick decision-making as teams manage deliverables on a tight schedule. Being decisive is not a luxury but a minimum requirement.

Competitive - Associates are recognized by their Management. After all, they are constantly competing with themselves and improving all the time,

In Control - The ability to show maturity and restraint in high-pressure situations is one of the mandatory traits for senior management roles.

Conclusion

In conclusion, Indian IT has completed 4 decades of existence and is evolving rapidly to keep up with global advancements in technology and business. This only implies that building a fruitful career in IT requires more than the basic qualifications

Source: Click Here.

#best btech college in jaipur#best engineering college in jaipur#best btech college in rajasthan#best private engineering college in jaipur#top engineering college in jaipur#best engineering college in rajasthan#b tech electrical in jaipur

1 note

·

View note

Text

BNP Paribas Digital Transformation Strategies Innovations: Convenience and Security

BNP Paribas' digital transformation strategies are marked by notable innovations that revolve around enhancing both convenience and security for its customers. The bank recognizes the critical balance between providing a seamless and user-friendly experience and maintaining the highest standards of security.

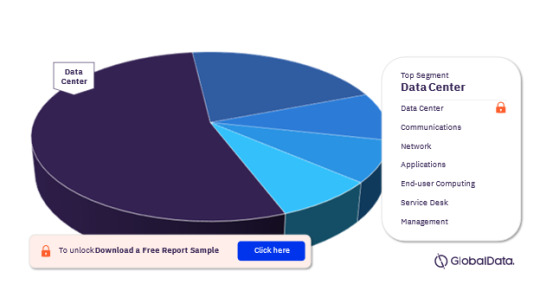

For more insights on ICT spending by function, download a free report sample

Here's a closer look at how BNP Paribas achieves this dual focus on convenience and security:

1. Digital Onboarding: BNP Paribas has streamlined its customer onboarding process, making it more convenient and secure. Through digital identity verification and eKYC (Know Your Customer) procedures, customers can open accounts and access banking services online, eliminating the need for physical branch visits.

2. Mobile Banking Apps: BNP Paribas offers user-friendly mobile banking applications that enable customers to perform a wide range of transactions and account management tasks from their smartphones. These apps are designed with intuitive interfaces, making banking convenient and accessible on the go.

3. Biometric Authentication: To enhance security and convenience, BNP Paribas has adopted biometric authentication methods, such as fingerprint and facial recognition. Customers can securely access their accounts and authorize transactions using these advanced technologies, reducing the reliance on traditional passwords.

4. Contactless Payments: BNP Paribas supports contactless payment methods, including NFC (Near Field Communication) payments via mobile devices and contactless cards. These technologies offer customers a fast and secure way to make transactions, reducing the need for physical cash or card swiping.

5. Secure Messaging: The bank offers secure messaging platforms for customer communication. These channels are encrypted to protect sensitive information, allowing customers to interact with the bank while maintaining data security.

6. Multi-Layered Security: BNP Paribas employs a multi-layered security approach that includes robust firewalls, intrusion detection systems, and regular security assessments. This strategy helps safeguard customer data and the bank's systems from cyber threats.

7. Fraud Detection: The bank utilizes artificial intelligence and machine learning to detect and prevent fraudulent activities in real-time. Advanced algorithms analyze transaction patterns to identify suspicious behavior and protect customers from financial fraud.

8. Blockchain for Secure Transactions: BNP Paribas has explored blockchain technology for secure and transparent transactions. By leveraging blockchain, the bank can ensure the integrity and authenticity of financial transactions, reducing the risk of fraud and errors.

9. Strong Customer Authentication (SCA): BNP Paribas complies with regulatory requirements, such as the Revised Payment Services Directive (PSD2) in Europe, which mandates strong customer authentication. This adds an extra layer of security to online payments.

10. Data Privacy and Compliance: BNP Paribas places a high priority on data privacy and regulatory compliance. The bank ensures that customer data is handled with the utmost care, in compliance with global data protection regulations.

Innovation at BNP Paribas is driven by a commitment to making banking more convenient and secure for its customers. By adopting cutting-edge technologies, enhancing user experiences, and maintaining a robust security infrastructure, the bank successfully strikes a balance between these two critical aspects. This approach not only meets the evolving expectations of customers but also positions BNP Paribas as a leader in digital banking.

0 notes

Text

Banques en ligne : la solution idéale pour les globetrotters ?

La découverte de nouvelles cultures, la rencontre de différentes personnes et l’exploration des paysages exotiques lors des voyages sont des moments inoubliables. Pour les globetrotters, la gestion financière de cette activité de loisir peut être un défi majeur. Pour y faire face, ils se tournent généralement vers les banques en ligne. Dans cet article, vous découvrirez les raisons qui expliquent ce choix, les différentes banques en ligne, et les éléments à considérer pour identifier la meilleure.

Pourquoi faire confiance à une banque en ligne pour vos voyages ?

Bon nombre de globetrotters adoptent les banques en ligne pour plusieurs raisons.

Accès à distance et flexibilité financière

L’une des principales raisons pour lesquelles les globetrotters préfèrent une banque en ligne est la possibilité d’accès à distance à leur compte qu’elle offre. En effet, quel que soit l’endroit où se trouve le voyageur, tant qu’il dispose d’une connexion internet, il peut accéder à ses comptes en ligne, vérifier ses soldes, effectuer des virements et gérer ses finances en temps réel.

Frais réduits et taux de change avantageux

Contrairement aux traditionnels établissements bancaires, les banques en ligne offrent généralement des frais réduits. En effet, des cartes de crédit sans frais de transaction à l’étranger sont proposées par ces structures à leurs usagers. De plus, comme le souligne si bien LeComparatif, certaines banques en ligne proposent des taux de change compétitifs, permettant aux voyageurs de réaliser des économies sur les coûts de conversion lors de leurs déplacements internationaux.

Support client multilingue et disponible à plein temps

Un autre avantage non négligeable des banques en ligne pour les globetrotters est le support client multilingue disponible en continu. En effet, les voyageurs peuvent rencontrer des problèmes financiers à n’importe quel moment, quelle que soit leur destination. Avec les banques en ligne, ils peuvent bénéficier d’un support client multilingue compétent et disponible 24 heures sur 24, 7 jours sur 7.

Suivi des dépenses en temps réel

Les banques en ligne proposent souvent des outils de suivi des dépenses et de gestion du budget. Ces fonctionnalités permettent aux voyageurs de suivre leurs dépenses en temps réel, et de catégoriser leurs achats. Ainsi, ils peuvent mieux contrôler leurs finances et éviter les dépenses excessives pendant leur voyage.

Sécurité renforcée et protection optimale des opérations

Afin de protéger efficacement les transactions financières, les banques en ligne prennent les meilleures mesures de sécurité possible. En effet, avec l’authentification à deux facteurs, les notifications en temps réel et le cryptage des données, les voyageurs peuvent avoir l’esprit tranquille, partout où ils se trouvent.

Les banques en ligne les plus populaires

Populaires, certaines banques en ligne se démarquent par la qualité de leurs services.

Hello Bank

Filiale de BNP Paribas, Hello Bank propose des services bancaires en ligne auxquels les populations peuvent accéder via une application mobile ergonomique. Elle offre à ses usagers des solutions d’épargne et de crédit, des cartes bancaires Visa, et des comptes courants sans frais de tenue de compte.

Boursorama Banque

Appartenant au groupe Société Générale, Boursorama Banque est l’une des banques en ligne les plus prisées en France. Elle offre une large gamme de services bancaires, y compris des comptes courants gratuits, des cartes Visa Premier sans frais à l’étranger, ainsi que des produits d’épargne et de placement. Par ailleurs, cette banque fournit des outils de suivi budgétaire et des analyses de dépenses pour aider les clients à mieux gérer leur argent.

Monabanq

Monabanq est une banque en ligne connue pour sa simplicité et son accessibilité. Elle propose des comptes courants et des cartes Visa avec des frais réduits pour les opérations courantes, et s’adresse à tous les profils, y compris les personnes en situation de surendettement ou d’interdits bancaires.

Fortuneo

Fortuneo est une banque en ligne qui propose des solutions bancaires complètes et innovantes. Elle offre des comptes courants sans frais, des cartes Mastercard gratuites, ainsi que des produits d’épargne et de placement compétitifs. Les clients de Fortuneo bénéficient d’une interface conviviale, des outils de suivi de dépenses et des conseils financiers personnalisés.

BforBank

BforBank est une banque en ligne haut de gamme qui offre une gamme de produits et services financiers adaptés aux clients exigeants. Elle propose des comptes courants avec des cartes Visa Premier, des solutions d’épargne diversifiées et des crédits attractifs.

A lire aussi : Découvrez comment financer l’achat d’une maison sans stress et en toute sérénité

Comment choisir votre banque en ligne ?

Pour réussir le choix judicieux de votre banque en ligne, vous devez prendre en considération les éléments tels que :

- Les frais et les tarifs: comparez les frais et tarifs des différentes banques en ligne, et privilégiez celles qui offrent des comptes sans frais mensuels et des cartes de crédit avec des taux de change avantageux pour les transactions à l’étranger ;

- L’accessibilité : assurez-vous que la banque en ligne que vous choisirez offre un accès facile à vos comptes depuis n’importe quel endroit. De plus, veuillez vérifier si l’application mobile est intuitive et fonctionne bien sur les appareils que vous utilisez habituellement en voyage ;

- Le support client: il est conseillé d’opter pour une banque en ligne avec un service client réactif et disponible 24 h/24. Ainsi, vous aurez l’assurance de pouvoir entrer en contact avec votre banque à tout moment où vous en aurez besoin. Par ailleurs, l’idéal serait d’opter pour une structure qui propose différents canaux de contact comme le chat en ligne, le téléphone, les réseaux sociaux, etc.

Read the full article

0 notes

Text

Transaction Banking Market Detailed Strategies, Competitive Landscaping and Developments for next 5 years

Latest Report Available at Advance Market Analytics, “Transaction Banking Market” provides pin-point analysis for changing competitive dynamics and a forward looking perspective on different factors driving or restraining industry growth.

The global Transaction Banking market focuses on encompassing major statistical evidence for the Transaction Banking industry as it offers our readers a value addition on guiding them in encountering the obstacles surrounding the market. A comprehensive addition of several factors such as global distribution, manufacturers, market size, and market factors that affect the global contributions are reported in the study. In addition the Transaction Banking study also shifts its attention with an in-depth competitive landscape, defined growth opportunities, market share coupled with product type and applications, key companies responsible for the production, and utilized strategies are also marked.Some key players in the global Transaction Banking market are

Barclays Plc (United Kingdom)

JPMorgan Chase & Co. (United States)

Bank of America Corp. (United States)

BNP Paribas SA (France)

Citigroup Inc. (United States)

Deutsche Bank AG (Germany)

HSBC Holdings Plc (United Kingdom)

Société Générale SA (France)

Standard Chartered Plc (United Kingdom)

Wells Fargo & Co. (United States)

Transaction Banking (TB) is the collection of instruments and services that a bank provides to trading partners in order to financially support their reciprocal exchanges of goods, monetary flows, or commercial papers. Banks do not want to be disintermediated by other players, so Transaction Banking allows them to maintain close relationships with their corporate clients. A bank's transaction banking division typically provides commercial banking products and services to both corporations and financial institutions, such as domestic and cross-border payments, risk management, international trade finance, and trust, agency, depositary, custody, and related services. It consists of the businesses of Cash Management, Trade Finance, and Trust & Securities Services. Although some business banking is instant, others take 3-5 working days, depending on the third party.What's Trending in Market: Transactional Banking Services Aid in the Development, Execution, and Management of International Trade and Commerce

High Adoption in Saudi Arabia Region

Challenges: Lack of Consumer Awareness

Market Growth Drivers: Growing Acceptance of Mobile Banking

Growing Number of Digital Consumers

The Global Transaction Banking Market segments and Market Data Break Downby Type (ATM, Charge, Check, Deposit, Others), Application (Government Institutions, Financial Institutions, Corporate, Public Entities, Corporate, Commercial Entities, MNCs, Multinational Entities, Others), Services (Cash Management Services, Online Services, Trade Finance Deals, Securities Services, Others)

Presented By

AMA Research & Media LLP

0 notes

Text

Europe Car Rental Service Market Growth, Analysis, and Developments till 2027

“The Europe car rental service market is expected to grow from US$ 14.17 Bn in 2018 to US$ 24.00 Bn by the year 2027. This represents a CAGR of 6.2% from the year 2019 to 2027.”

The report titled “Europe Car Rental Service Market” has recently been added by Business Market Insights to induce a stronger and more effective business outlook. It provides associate in-depth analysis of the various attributes of the industry, like trends, policies, and customers operational in several geographies. Research analysts use quantitative as well as qualitative analytical techniques to supply users, business owners, and industry professionals with accurate and actionable data. The Europe Car Rental Service Market study provides comprehensive data which enhances the understanding, scope, and application during the forecast period.

Get a Sample Copy of the Report, Click Here:

https://www.businessmarketinsights.com/sample/TIPRE00007758

The Key Players in this market are:

· Avis Budget Group, Inc.

· Europcar Mobility Group S.A.

· AB Car Rental Bonaire

· DriveNow GmbH & Co. KG

· Green Motion

· Sixt SE

· The Hertz Corporation

· National Car Rental (Enterprise Holdings)

· ALD Automotive

· Arval BNP Paribas Group

· Athlon International

· DriiveME

· Eli

Analysis of the Top Market Players:

Competition may be a major subject in any marketing research analysis. This is a report provided with the help of the competitive analysis provided the players can simply study key strategies adopted by leading players in the Europe Car Rental Service market till 2030. Major and emerging players of the market are closely studied taking into consideration their market share, product portfolio, revenue, sales growth, and other significant factors. This will help players to become familiar with the moves of their top competitors within the market.

In this report, the market has been segmented on the basis of:

Based on types, the Europe Car Rental Service market is primarily split into:

· B2B

· Corporate

· SMEs

· Others

· B2C

Based on Applications the Europe Car Rental Service market covers:

· Mini & Economy

· Compact & Intermediate

· Standard

· Full size

· Premium

· Luxury

· Special

Scope of Europe Car Rental Service Market:

Europe Car Rental Service Market report evaluates the growth rate and the market value based on market dynamics, growth inducing factors. Complete knowledge is based on the latest industry news, opportunities, and trends. The report contains a comprehensive market research and vendor landscape in additionally to a SWOT analysis of the key vendors.

Click Here to Buy Now:

https://www.businessmarketinsights.com/buy/single/TIPRE00007758

Key Highlights of the Europe Car Rental Service Market Research Report:

· The report summarizes the Europe Car Rental Service Market by stating the basic product definition, applications, product scope, product price and value, supply and demand ratio, and market summery.

· Competitive landscape of all leading key players together with their business strategies, approaches, and latest Europe Car Rental Service market movements.

· It elements market feasibility investment, opportunities, growth factors, restraints, market risks, and Europe Car Rental Service business driving forces.

· It performs a comprehensive study of emerging players within the Europe Car Rental Service business together with the present ones.

· It accomplishes primary and secondary analysis and resources to estimate top products, market size, and industrial partnerships of Europe Car Rental Service business.

· Europe Car Rental Service market report ends by articulating research findings, data sources, and results, list of dealers, sales channels, businesses, and distributors along with an appendix.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

Contact Us:

If you have any questions about this report or would like further information, please contact us:

Contact person: Ankit Mathur

Email: [email protected]

Phone: +16467917070

0 notes

Text

Sustainable Supply Chain Finance Market Is Likely to Experience a Tremendous Growth in Near Future

Latest business intelligence report released on Global Sustainable Supply Chain Finance Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Sustainable Supply Chain Finance market outlook.

List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis are:

ING Group (Netherlands)

Citigroup, Inc. (United States)

HSBC (United Kingdom)

Traxpay (Germany)

CRX Markets AG (Germany)

BNP Paribas (France)

Standard Chartered (united Kingdom)

McKinsey & Company (United States)

JPMorgan Chase (United States)

Deutsche Bank (Germany)

DBS Bank (Singapore)

The sustainable supply chain is a financing technique that works as a bridge between global suppliers and buyers. It provides all advantages of supply chain finance and additional benefits like rewarding, incentivizing, and funding sustainable behaviors, which strengthen sustainability expectations for suppliers. The growing popularity of supplier-focused supply chain finance and ECG-focused sustainable supply chains to prioritize supplier experience.

Key Market Trends: Increased Focus on the Application of Blockchain-based Supply Chain Finance to Increase Reliability and Transparency

Opportunities: Growing Digitalization of Supply Chain Finance and Evolution of Innovative and Technologically Advanced Supply Chain Finance Platforms

Market Growth Drivers: Surging Demand of Sustainable Supply Chain Finance to Enhance Cash Flow Management in Supply Chain and Improve Company’s Competitive Advantage

Growing Popularity of Sustainable Supply Chain Finance Among the Large Organizations

Challenges: Presence of a Large Number of Vendors in the Global Market

The Global Sustainable Supply Chain Finance Market segments and Market Data Break Down by Industry (Manufacturing, Automotive & Mobility, Consumer Goods, Retail & E-Commerce, Others), Organization Size (Small & Medium Enterprises, Large Enterprises), Solutions (Sustainable Payables Finance, Sustainable Trade Loans, Smart Contract Solutions)

Presented By

AMA Research & Media LLP

0 notes

Text

Transaction Banking Market Detailed Strategies, Competitive Landscaping and Developments for next 5 years

Latest added Transaction Banking Market research study by AMA Research offers detailed outlook and elaborates market review till 2027. The market Study is segmented by key regions that are accelerating the marketization. At present, the market players are strategizing and overcoming challenges of current scenario; some of the key players in the study are

Barclays Plc (United Kingdom)

JPMorgan Chase & Co. (United States)

Bank of America Corp. (United States)

BNP Paribas SA (France)

Citigroup Inc. (United States)

Deutsche Bank AG (Germany)

HSBC Holdings Plc (United Kingdom)

Société Générale SA (France)

Standard Chartered Plc (United Kingdom)

Wells Fargo & Co. (United States)

Transaction Banking (TB) is the collection of instruments and services that a bank provides to trading partners in order to financially support their reciprocal exchanges of goods, monetary flows, or commercial papers. Banks do not want to be disintermediated by other players, so Transaction Banking allows them to maintain close relationships with their corporate clients. A bank's transaction banking division typically provides commercial banking products and services to both corporations and financial institutions, such as domestic and cross-border payments, risk management, international trade finance, and trust, agency, depositary, custody, and related services. It consists of the businesses of Cash Management, Trade Finance, and Trust & Securities Services. Although some business banking is instant, others take 3-5 working days, depending on the third party.

Influencing Trend: Transactional Banking Services Aid in the Development, Execution, and Management of International Trade and Commerce

High Adoption in Saudi Arabia Region

Challenges: Lack of Consumer Awareness

Opportunities: Transactional Banking Services Contribute To the Generation, Execution, and Management of International Trade and Commerce

Strong Growth in the Transaction Banking Market

Market Growth Drivers: Growing Acceptance of Mobile Banking

Growing Number of Digital Consumers

The Global Transaction Banking segments and Market Data Break Down by Type (ATM, Charge, Check, Deposit, Others), Application (Government Institutions, Financial Institutions, Corporate, Public Entities, Corporate, Commercial Entities, MNCs, Multinational Entities, Others), Services (Cash Management Services, Online Services, Trade Finance Deals, Securities Services, Others)

Presented By

AMA Research & Media LLP

0 notes

Text

Bancassurance Market 2022 by Manufacturers, Regions, Type and Application, Forecast to 2030

Bancassurance Market valued at US$ 1343.55 Billion in 2022 is expected to reach a value of US$2125.31 Billion by 2030, exhibiting a CAGR of 5.9%.

Bancassurance is a partnership between a bank and an insurance business that allows the insurer to offer its policies and services to the bank's clients. Both banks and insurance companies can gain from such an agreement. The agreement allows banks to sell a variety of insurance products, including mortgages, annuities, and health and life insurance, allowing them to expand their market reach while also increasing their equity return and successfully strengthening their financial portfolio. By selling insurance plans, banks can generate additional revenue and profits in the long run. Insurance businesses, on the other hand, can efficiently grow their customer base without having to hire new salespeople or pay commission to brokers and agents. Given the world's ageing population and, as a result, the rising demand for services

Get Free Sample: https://wemarketresearch.com/sample-request/bancassurance--market/112/

Bancassurance is a financial partnership between a bank and an insurance business in which the bank receives additional revenue and profit by selling the insurance company's policies. It covers endowment, unit-linked insurance plans (ULIPs), marine, health, and property insurance plans and policies. It assists banks in diversifying their product portfolios, increasing turnover without requiring more capital, and providing a high return on equity. Aside from that, it is getting a lot of momentum around the world because it helps insurance firms increase their sales and profits by expanding their market reach and customer base.

Global Bancassurance Market: Segmentations

ABN AMRO Bank N.V.

American Express Company

Banco Bradesco SA

Banco Santander, S.A.

Barclays plc

BNP Paribas

Citigroup, Inc.

Crédit Agricole

HSBC Group

ING Group

Intesa Sanpaolo Group

Lloyds Banking Group

Mitsubishi UFJ Financial Group Inc.

Mizuho Financial Group, Inc.

NongHyup Financial Group

Nordea Bank

Royal Bank of Canada

Societe Generale

Wells Fargo

Based On Type:

• Life Bancasuurance

• Non-Life Bancassurance

• Based on Model

• Joint Venture

• Financial Holding

• Exclusive

• Pure Distributor

Interested in purchasing this Report:- https://wemarketresearch.com/purchase/bancassurance--market/112/?license=single

Table Of Contents

1. Global Bancassurance Market Introduction and Market Overview

2. Global Bancassurance Market - Executive Summary

3. Bancassurance Market Trends, Outlook, and Factors Analysis

4. Global Bancassurance Market: Estimates & Historic Trend Analysis (2018 to 2021)

5. Global Bancassurance Market Estimates & Forecast Trend Analysis, by Component

6. Global Bancassurance Market Estimates & Forecast Trend Analysis, by Type

7. Global Bancassurance Market Estimates & Forecast Trend Analysis, by Mobility

8. Global Bancassurance Market Estimates & Forecast Trend Analysis, by Body part

9. Global Bancassurance Market Estimates & Forecast Trend Analysis, by Treatment type

10. Global Bancassurance Market Estimates & Forecast Trend Analysis, by Application

11. Global Bancassurance Market Analysis and Forecast, by Region

12. North America Bancassurance Market: Estimates & Forecast Trend Analysis

13. Europe Bancassurance Market: Estimates & Forecast Trend Analysis

14. Asia Pacific Bancassurance Market: Estimates & Forecast Trend Analysis

15. Middle East & Africa Bancassurance Market: Estimates & Forecast Trend Analysis

16. Latin America Bancassurance Market: Estimates & Forecast Trend Analysis

17. Competitive Landscape

18. Company Profiles

19. Assumptions and Research Methodology

20. Conclusions and Recommendations

FAQs

1)What is the Bancassurance market growth?

2) Which product segment accounts for the highest market share in the Bancassurance market?

3) Does the Bancassurance market company is profiled in the report?

4) Which are the top companies hold the market share in Bancassurance market?

5) How can I get sample reports/company profiles for the Bancassurance market?

About We Market Research

WE MARKET RESEARCH is an established market analytics and research firm with a domain experience sprawling across different industries. We have been working on multi-county market studies right from our inception. Over the time, from our existence, we have gained laurels for our deep rooted market studies and insightful analysis of different markets.

Our strategic market analysis and capability to comprehend deep cultural, conceptual and social aspects of various tangled markets has helped us make a mark for ourselves in the industry. WE MARKET RESEARCH is a frontrunner in helping numerous companies; both regional and international to successfully achieve their business goals based on our in-depth market analysis. Moreover, we are also capable of devising market strategies that ensure guaranteed customer bases for our clients.

Contact Us:

We Market Research

Phone: +1(929)-450-2887

Email: [email protected]

Web:

https://wemarketresearch.com/

0 notes

Text

Noteworthy PHP Development Tools that a PHP Developer should know in 2021!

Hypertext Preprocessor, commonly known as PHP, happens to be one of the most widely used server-side scripting languages for developing web applications and websites. Renowned names like Facebook and WordPress are powered by PHP. The reasons for its popularity can be attributed to the following goodies PHP offers:

Open-source and easy-to-use

Comprehensive documentation

Multiple ready-to-use scripts

Strong community support

Well-supported frameworks

However, to leverage this technology to the fullest and simplify tasks, PHP developers utilize certain tools that enhance programming efficiency and minimize development errors. PHP development tools provide a conducive IDE (Integrated Development Environment) that enhances the productivity of PHP Website Development.

The market currently is overflooded with PHP tools. Therefore, it becomes immensely difficult for a PHP App Development Company to pick the perfect set of tools that will fulfill their project needs. This blog enlists the best PHP development tools along with their offerings. A quick read will help you to choose the most befitting tool for your PHP development project.

Top PHP Development tools

PHPStorm

PHPStorm, created and promoted by JetBrains, is one of the most standard IDEs for PHP developers. It is lightweight, smooth, and speedy. This tool works easily with popular PHP frameworks like Laravel, Symfony, Zend Framework, CakePHP, Yii, etc. as well as with contemporary Content Management Systems like WordPress, Drupal, and Magento. Besides PHP, this tool supports JavaScript, C, C#, Visual Basic and C++ languages; and platforms such as Linux, Windows, and Mac OS X. This enterprise-grade IDE charges a license price for specialized developers, but is offered for free to students and teachers so that they can start open-source projects. Tech giants like Wikipedia, Yahoo, Cisco, Salesforce, and Expedia possess PHPStorm IDE licenses.

Features:

Code-rearranging, code completion, zero-configuration, and debugging

Support for Native ZenCoding and extension with numerous other handy plugins such as the VimEditor.

Functions:

Provides live editing support for the leading front-end technologies like JavaScript, HTML5, CSS, TypeScript, Sass, CoffeeScript, Stylus, Less, etc.

It supports code refactoring, debugging, and unit testing

Enables PHP developers to integrate with version control systems, databases, remote deployment, composer, vagrant, rest clients, command-line tools, etc.

Coming to debugging, PHPStorm works with Xdebug and Zend Debugger locally as well as remotely.

Cloud 9

This open-source cloud IDE offers a development eco-system for PHP and numerous other programming languages like HTML5, JavaScript, C++, C, Python, etc. It supports platforms like Mac OS, Solaris, Linux, etc.

Features:

Code reformatting, real-time language analysis, and tabbed file management.

Availability of a wide range of themes

In-built image editor for cropping, rotating, and resizing images

An in-built terminal that allows one to view the command output from the server.

Integrated debugger for setting a breakpoint

Adjustable panels via drag and drop function

Support for keyboard shortcuts resulting in easy access

Functions:

With Cloud 9, one can write, run and debug the code using any browser. Developers can work from any location using a machine connected to the internet.

It facilitates the creation of serverless apps, allowing the tasks of defining resources, executing serverless applications, and remote debugging.

Its ability to pair programs and track all real-time inputs; enables one to share their development eco-system with peers.

Zend Studio

This commercial PHP IDE supports most of the latest PHP versions, specifically PHP 7, and platforms like Linux, Windows, and OS X. This tool boasts of an instinctive UI and provides most of the latest functionalities that are needed to quicken PHP web development. Zend Studio is being used by high-profile firms like BNP Paribas Credit Suisse, DHL, and Agilent Technologies.

Features:

Support for PHP 7 express migration and effortless integration with the Zend server

A sharp code editor supporting JavaScript, PHP, CSS, and HTML

Speedier performance while indexing, validating, and searching for the PHP code

Support for Git Flow, Docker, and the Eclipse plugin environment

Integration with Z-Ray

Debugging with Zend Debugger and Xdebug

Deployment sustenance including cloud support for Microsoft Azure and Amazon AWS.

Functions:

Enables developers to effortlessly organize the PHP app on more than one server.

Provides developers the flexibility to write and debug the code without having to spare additional effort or time for these tasks.

Provides support for mobile app development at the peak of live PHP applications and server system backend, for simplifying the task of harmonizing the current websites and web apps with mobile-based applications.

Eclipse

Eclipse is a cross-platform PHP editor and one of the top PHP development tools. It is a perfect pick for large-scale PHP projects. It supports multiple languages – C, C++, Ada, ABAP, COBOL, Haskell, Fortran, JavaScript, D, Julia, Java, NATURAL, Ruby, Python, Scheme, Groovy, Erlang, Clojure, Prolong, Lasso, Scala, etc. - and platforms like Linux, Windows, Solaris, and Mac OS.

Features:

It provides one with a ready-made code template and automatically validates the syntax.

It supports code refactoring – enhancing the code’s internal structure.

It enables remote project management

Functions:

Allows one to choose from a wide range of plugins, easing out the tasks of developing and simplifying the complex PHP code.

Helps in customizing and extending the IDE for fulfilling project requirements.

Supports GUI as well as non-GUI applications.

Codelobster

Codelobster is an Integrated Development Environment that eases out and modernizes the PHP development processes. Its users do not need to worry about remembering the names of functions, attributes, tags, and arguments; as these are enabled through auto-complete functions. It supports languages like PHP, JavaScript, HTML, and CSS and platforms such as Windows, Linux, Ubuntu, Fedora, Mac OS, Linux, and Mint. Additionally, it offers exceptional plugins that enable it to function smoothly with myriad technologies like Drupal, Joomla, Twig, JQuery, CodeIgniter, Symfony, Node.js, VueJS, AngularJS, Laravel, Magento, BackboneJS, CakePHP, EmberJS, Phalcon, and Yii.

Offerings:

It is an internal, free PHP debugger that enables validating the code locally.

It auto-detects the existing server settings followed by configuring the related files and allowing one to utilize the debugger.

It has the ability to highlight pairs of square brackets and helps in organizing files into the project.

This tool displays a popup list comprising variables and constants.

It allows one to hide code blocks that are presently not being used and to collapse the code for viewing it in detail.

Netbeans

Netbeans, packed with a rich set of features is quite popular in the realm of PHP Development Services. It supports several languages like English, Russian, Japanese, Portuguese, Brazilian, and simplified Chinese. Its recent version is lightweight and speedier, and specifically facilitates building PHP-based Web Applications with the most recent PHP versions. This tool is apt for large-scale web app development projects and works with most trending PHP frameworks such as Symfony2, Zend, FuelPHP, CakePHP, Smarty, and WordPress CMS. It supports PHP, HTML5, C, C++, and JavaScript languages and Windows, Linux, MacOS and Solaris platforms.

Features:

Getter and setter generation, quick fixes, code templates, hints, and refactoring.

Code folding and formatting; rectangular selection

Smart code completion and try/catch code completion

Syntax highlighter

DreamWeaver

This popular tool assists one in creating, publishing, and managing websites. A website developed using DreamWeaver can be deployed to any web server.

Offerings:

Ability to create dynamic websites that fits the screen sizes of different devices

Availability of ready-to-use layouts for website development and a built-in HTML validator for code validation.

Workspace customization capabilities

Aptana Studio

Aptana Studio is an open-source PHP development tool used to integrate with multiple client-side and server-side web technologies like PHP, CSS3, Python, RoR, HTML5, Ruby, etc. It is a high-performing and productive PHP IDE.

Features:

Supports the most recent HTML5 specifications

Collaborates with peers using actions like pull, push and merge

IDE customization and Git integration capabilities

The ability to set breakpoints, inspecting variables, and controlling the execution

Functions:

Eases out PHP app development by supporting the debuggers and CLI

Enables programmers to develop and test PHP apps within a single environment

Leverages the flexibilities of Eclipse and also possesses detailed information on the range of support for each element of the popular browsers.

Final Verdict:

I hope this blog has given you clear visibility of the popular PHP tools used for web development and will guide you through selecting the right set of tools for your upcoming project.

To know more about our other core technologies, refer to links below:

React Native App Development Company

Angular App Development Company

ROR App Development

#Php developers#PHP web Development Company#PHP Development Service#PHP based Web Application#PHP Website Development Services#PHP frameworks

1 note

·

View note

Text

Bank Guarantee | Third Party Collateral | Project Funding

Get Bank Guarantee,Third Party Collateral and Project Funding,MSME,personal loan,loan against property,home loan,project finance,cgtmse,2020

MONETARY INSTRUMENTS

Greetings from Qolaris Solutions Pvt Ltd – Monetary Instruments | BG | LC | SBLC | Bill Discounting

Allow us to introduce to you our offered services. We are a associate Trade non depository financial institution that facilitates the issuance of monetary instruments like Letters of Credits, Bank Guarantees, Standby Letters of Credit, etc. using our own credit limits with our issuers that help our clients from a various array of industries achieve smoother business transactions tailored to their needs.

We have enclosed our detailed procedures below for your ready reference. do you have to have an interest and would really like to understand more, please don’t hesitate to reply on this email so I can assist you. Or if you have got a network which may interest us, do allow us to know and we’ll see the chance of working together. For further inquiries, you’ll also reach me on my mobile and WhatsApp no. +91-9811993953 , +91-8700237256

We, Qolaris Solutions Pvt Ltd offers a large range of products:

· Letters of Credit at Sight

· Usance Letters of Credit

· Standby Letters of Credit

· Bank Guarantees

· Performance Guarantees

· Demand Guarantees

· POF Messages

· Pre-Advice Message

· Comfort Letters

· Ready Willing and Able (RWA) Messages

Issuers for LC at Sight;

Calls for limits and restrictions.

Please provoke each bank restrictions and line limits:

Habib Bank AG Zurich

BNP Paribas

HSBC

Standard Chartered Bank

China Construction Bank

OCB Wing Hang Bank

Dash Sing bank

DBS Bank

UCO bank

Habib Bank

Bank Winter

IDB, New York

Hanami Bank

Stern International Bank

U.S. Credit Corp

Standard Commerce Bank

Anametrics

Crown Financial bank

Issuers for Usance LC;

Calls for limits and restrictions.

Please kindle each bank restrictions and line limits:

Bank Winter

Stern International Bank

U.S. Credit Corp

Standard Commerce Bank

Anametrics

Crown Financial depository financial institution

Issuers for SBLC AND BANK GUARANTEES;

Bank Winter

Stern International Bank

Standard Commerce Bank

Anametrics

Crown Financial banking company

Issuance Procedure:

We need the subsequent documents/ information for finalizing the draft –

1. Filled in Contact Us Form

2. Verbiage required within the instrument for SBLC & BG / Proforma Invoice for DLC

3. Trade license of your company

4. Share Holders List

5. Passport copy of main applicant

6. Three years audited record

7. Six months latest bank statements

Step-wise

1. After acquiring all the above documents / information, we’ll select the issuing bank / financial organisation and finalize the draft for your review.

2. Upon receiving the text of the instrument, you need to thoroughly review the draft for any corrections, additions or removal of data. Should there be any amendments, we are able to amend the draft accordingly to match your preferences. Once the draft is approved, you’ll must send us a duplicate of the draft with sign and stamp thereon as your approval.

3. we are going to raise the invoice for the agreed charges (charges include margin money, processing fee and professional charges) and you’ll make the remittance against the invoice.

4. Only after we receive the payment for the raised invoice, the Issuing Bank / establishment will issue and relay the instrument through swift within 48-96 hours after remittance.

5. Simultaneously we are going to send you the issued copy through email for your reference and record.

Note: the costs will rely onthe worth of the Financial Instrument, Tenure, Issuing Bank / institution.

We have attached the corporate presentation, application forms, and programs & procedures for your reference.

For more details, please visit our website: www.qolaris.in

QUICK DISCOUNTING OF BANK GUARANTEE

Get Quick funding or material supply against you bank guarantee

We can discount any bank guarantee at very good rate

If you have bank guarantee but did not have discounting option , don’t worry contact us ……

Have Any Questions for list below ….???

Can bank guarantee be cashed?

What is LC discounting in India?

How can I get bank guarantee in India?

Is Bill discounting a loan?

Finance against bank guarantee in India

Loan against Bank Guarantee

Project funding against bank guarantee

Bank guarantee against property

Bank guarantee limit

Bank Guarantee

Bank instruments

Fund against bank guarantee

You are at write place , call or write us ….. we are happy to help u…..

LOAN AGAINST THIRD PARTY COLLATERAL

If you are looking for funding but did not have any own collateral for guarantee , we have a solutions for you.

You get the funding if you can give us third party property or collateral.

We can give you the funds against third party property on the condition of :

1. Property Should be clear

2. Property Should be in Delhi-NCR

3. Owner of the property is ready to be director in the company

4. No Problems in inspection of the property by funding agency or bank

5. Loan will be shared between property holder and company in 50-50

6. All the expenses will be share 50-50 and detected from the share of property holder.

7. Property can be residential or commercial.

We also taking property pan India but the value of the collateral/property should be minimum 5 Cr.

If you have any question form below list ….

1. Third party collateral loan

2. Third party mortgage

3. Third party pledge

4. Loan against collateral

5. loan against third party collateral

6. third party collateral providers

7. third party collateral loan

8. funding against third party collateral

9. loan against third party collateral

This is a best and secured way of getting fund if you do not have sound financial documents with you.

We can fund any amount from 2 Cr to 500 Cr but step by step.

If your have any question or query about the process , who it will be start and details process click now…..

For any further query contact us …….

#bank guarantee funding#bank guarantee lease#project funding dubai#project funding India#funding against third party collateral#Third party collateral#monetary instruments#QUICK DISCOUNTING OF BANK GUARANTEE#DISCOUNTING OF BANK GUARANTEE

1 note

·

View note

Text

Global Mobile Banking Market Analysis, Historic Data and Forecast 2020-2030

Global mobile banking market will reach $4,680.3 million by 2030, growing by 15.8% annually over 2020-2030 driven growing adoption of digital platforms and the increase in demand for personalization on banking amid COVID-19 epidemic.

Also Read: https://www.abnewswire.com/pressreleases/global-mobile-banking-market-size-2020-emerging-trends-industry-share-future-demands-market-potential-regional-overview-and-swot-analysis-till-2030_510264.html

Highlighted with 88 tables and 87 figures, this 177-page report “Global Mobile Banking Market 2020-2030 by Mobile Platform (Android, iOS, Windows), Business Type (C2B, C2C), Service, Technology, Deployment, End User, and Region: Trend Forecast and Growth Opportunity” is based on a comprehensive research of the entire global mobile banking market and all its sub-segments through extensively detailed classifications. Profound analysis and assessment are generated from premium primary and secondary information sources with inputs derived from industry professionals across the value chain. The report is based on studies on 2015-2019 and provides forecast from 2020 till 2030 with 2019 as the base year. (Please note: The report will be updated before delivery so that the latest historical year is the base year and the forecast covers at least 5 years over the base year.).

Also Read: https://www.abnewswire.com/pressreleases/global-adult-toys-industry-analysis-2019-market-growth-trends-opportunities-forecast-to-2024_444874.html

In-depth qualitative analyses include identification and investigation of the following aspects:

• Market Structure

• Growth Drivers

Also Read: http://www.marketwatch.com/story/cloud-office-services-market-by-offering-solutionsservices-technology-deployment-type-applications-forecasts-to-2030-2020-12-24

• Restraints and Challenges

• Emerging Product Trends & Market Opportunities

• Porter’s Fiver Forces

The trend and outlook of global market is forecast in optimistic, balanced, and conservative view by taking into account of COVID-19. The balanced (most likely) projection is used to quantify global mobile banking market in every aspect of the classification from perspectives of Mobile Platform, Business Type, Service, Technology, Deployment, End User, and Region.

Also Read: http://www.marketwatch.com/story/global-same-day-delivery-market-2020-industry-trends-share-opportunities-market-research-analysis-and-forecast-2026-2020-11-17

Based on Mobile Platform, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Android Based Platform

• iOS Based Platform

• Windows Based Platform

Also Read: http://www.marketwatch.com/story/global-running-footwear-industry-analysis-size-market-share-growth-trend-and-forecast-to-2030-2020-10-26

Based on Business Type, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Customer-to-Business (C2B)

• Customer-to-Customer (C2C)

• Other Business Types

Based on Service, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Account Management

• Transaction Functions

• Investment Service

• Banking Support

• Content services

Based on Technology, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Wireless Application Protocol (WAP)

• Standalone Mobile Application

• Short Messaging Service (SMS)

• Interactive Voice Response (IVR)

Based on Deployment, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• On-premise Banking

• Cloud Based Banking

Based on End User, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Individual

• Enterprise

• Other End Users

Geographically, the following regions together with the listed national/local markets are fully investigated:

• APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)

For each aforementioned region and country, detailed analysis and data for annual revenue are available for 2019-2030. The breakdown of all regional markets by country and split of key national markets by Platform, Business Type, and Service over the forecast years are also included.

The report also covers current competitive scenario and the predicted trend; and profiles key vendors including market leaders and important emerging players.

Specifically, potential risks associated with investing in global mobile banking market are assayed quantitatively and qualitatively through GMD’s Risk Assessment System. According to the risk analysis and evaluation, Critical Success Factors (CSFs) are generated as a guidance to help investors & stockholders identify emerging opportunities, manage and minimize the risks, develop appropriate business models, and make wise strategies and decisions.

Key Players (this may not be a complete list and extra companies can be added upon request):

American Express Company

Bank of America Corporation

BNP Paribas S.A.

Citigroup Inc.

Crédit Agricole Group

Econet Wireless

HSBC Holdings plc

JPMorgan Chase & Co.

Mitsubishi UFJ Financial Group, Inc.

MTN

Orange S.A

Safaricom

Société Générale S.A.

Tigo

Vodacom

Wells Fargo & Company

Zantel

(Please note: The report will be updated before delivery so that the latest historical year is the base year and the forecast covers at least 5 years over the base year.)

About Us:

Wise Guy Reports is part of the Wise Guy Research Consultants Pvt. Ltd. and offers premium

progressive

statistical surveying, market research reports, analysis & forecast data for industries and

governments

around the globe.

Contact Us:

NORAH TRENT

Ph: +162-825-80070 (US)

Ph: +44 2035002763 (UK)

0 notes

Text

Banques en ligne : la solution idéale pour les globetrotters ?

La découverte de nouvelles cultures, la rencontre de différentes personnes et l’exploration des paysages exotiques lors des voyages sont des moments inoubliables. Pour les globetrotters, la gestion financière de cette activité de loisir peut être un défi majeur. Pour y faire face, ils se tournent généralement vers les banques en ligne. Dans cet article, vous découvrirez les raisons qui expliquent ce choix, les différentes banques en ligne, et les éléments à considérer pour identifier la meilleure.

Pourquoi faire confiance à une banque en ligne pour vos voyages ?

Bon nombre de globetrotters adoptent les banques en ligne pour plusieurs raisons.

Accès à distance et flexibilité financière

L’une des principales raisons pour lesquelles les globetrotters préfèrent une banque en ligne est la possibilité d’accès à distance à leur compte qu’elle offre. En effet, quel que soit l’endroit où se trouve le voyageur, tant qu’il dispose d’une connexion internet, il peut accéder à ses comptes en ligne, vérifier ses soldes, effectuer des virements et gérer ses finances en temps réel.

Frais réduits et taux de change avantageux

Contrairement aux traditionnels établissements bancaires, les banques en ligne offrent généralement des frais réduits. En effet, des cartes de crédit sans frais de transaction à l’étranger sont proposées par ces structures à leurs usagers. De plus, comme le souligne si bien LeComparatif, certaines banques en ligne proposent des taux de change compétitifs, permettant aux voyageurs de réaliser des économies sur les coûts de conversion lors de leurs déplacements internationaux.

Support client multilingue et disponible à plein temps

Un autre avantage non négligeable des banques en ligne pour les globetrotters est le support client multilingue disponible en continu. En effet, les voyageurs peuvent rencontrer des problèmes financiers à n’importe quel moment, quelle que soit leur destination. Avec les banques en ligne, ils peuvent bénéficier d’un support client multilingue compétent et disponible 24 heures sur 24, 7 jours sur 7.

Suivi des dépenses en temps réel

Les banques en ligne proposent souvent des outils de suivi des dépenses et de gestion du budget. Ces fonctionnalités permettent aux voyageurs de suivre leurs dépenses en temps réel, et de catégoriser leurs achats. Ainsi, ils peuvent mieux contrôler leurs finances et éviter les dépenses excessives pendant leur voyage.

Sécurité renforcée et protection optimale des opérations

Afin de protéger efficacement les transactions financières, les banques en ligne prennent les meilleures mesures de sécurité possible. En effet, avec l’authentification à deux facteurs, les notifications en temps réel et le cryptage des données, les voyageurs peuvent avoir l’esprit tranquille, partout où ils se trouvent.

Les banques en ligne les plus populaires

Populaires, certaines banques en ligne se démarquent par la qualité de leurs services.

Hello Bank

Filiale de BNP Paribas, Hello Bank propose des services bancaires en ligne auxquels les populations peuvent accéder via une application mobile ergonomique. Elle offre à ses usagers des solutions d’épargne et de crédit, des cartes bancaires Visa, et des comptes courants sans frais de tenue de compte.

Boursorama Banque

Appartenant au groupe Société Générale, Boursorama Banque est l’une des banques en ligne les plus prisées en France. Elle offre une large gamme de services bancaires, y compris des comptes courants gratuits, des cartes Visa Premier sans frais à l’étranger, ainsi que des produits d’épargne et de placement. Par ailleurs, cette banque fournit des outils de suivi budgétaire et des analyses de dépenses pour aider les clients à mieux gérer leur argent.

Monabanq

Monabanq est une banque en ligne connue pour sa simplicité et son accessibilité. Elle propose des comptes courants et des cartes Visa avec des frais réduits pour les opérations courantes, et s’adresse à tous les profils, y compris les personnes en situation de surendettement ou d’interdits bancaires.

Fortuneo

Fortuneo est une banque en ligne qui propose des solutions bancaires complètes et innovantes. Elle offre des comptes courants sans frais, des cartes Mastercard gratuites, ainsi que des produits d’épargne et de placement compétitifs. Les clients de Fortuneo bénéficient d’une interface conviviale, des outils de suivi de dépenses et des conseils financiers personnalisés.

BforBank

BforBank est une banque en ligne haut de gamme qui offre une gamme de produits et services financiers adaptés aux clients exigeants. Elle propose des comptes courants avec des cartes Visa Premier, des solutions d’épargne diversifiées et des crédits attractifs.

A lire aussi : Découvrez comment financer l’achat d’une maison sans stress et en toute sérénité

Comment choisir votre banque en ligne ?

Pour réussir le choix judicieux de votre banque en ligne, vous devez prendre en considération les éléments tels que :

- Les frais et les tarifs: comparez les frais et tarifs des différentes banques en ligne, et privilégiez celles qui offrent des comptes sans frais mensuels et des cartes de crédit avec des taux de change avantageux pour les transactions à l’étranger ;

- L’accessibilité : assurez-vous que la banque en ligne que vous choisirez offre un accès facile à vos comptes depuis n’importe quel endroit. De plus, veuillez vérifier si l’application mobile est intuitive et fonctionne bien sur les appareils que vous utilisez habituellement en voyage ;

- Le support client: il est conseillé d’opter pour une banque en ligne avec un service client réactif et disponible 24 h/24. Ainsi, vous aurez l’assurance de pouvoir entrer en contact avec votre banque à tout moment où vous en aurez besoin. Par ailleurs, l’idéal serait d’opter pour une structure qui propose différents canaux de contact comme le chat en ligne, le téléphone, les réseaux sociaux, etc.

Read the full article

0 notes

Text

Netherland Car Rental Services Market Opportunities, Trends and Advancement 2021

The Netherland car rental services market is expected to grow from US$ 653.68 million in 2021 to US$ 1,138.91 million by 2028; it is estimated to grow at a CAGR of 8.3% during 2021–2028.

Netherland Car Rental Services Market is a valuable source of insightful data for business strategists. It provides the industry overview with growth analysis and historical & futuristic cost, revenue, demand, and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Market study provides comprehensive data which enhances the understanding, scope, and application of this report.

Get a Sample Copy of Report, Click Here:

https://www.businessmarketinsights.com/sample/TIPRE00026870

Netherland Car Rental Services includes market research report Top Companies:

Avis Budget Group, Inc

Europcar Mobility Group S.A

AB Car Rental Bonaire

Green Motion International

Sixt SE

The Hertz Corporation

Enterprise Holdings

ALD Automotive

Arval BNP Paribas Group

Athlon Car Lease International B.V

Netherland Car Rental Services Market Split by Product Type and Applications:

This report segments the Netherland Car Rental Services Market on the premise of Types is:

On the premise of Application, the Netherland Car Rental Services Market is segmented into:

Directly Buy a Copy of this Netherland Car Rental Services Market research report at:

https://www.businessmarketinsights.com/buy/single/TIPRE00026870

Important sections of the TOC:

Economic Impact Variables on Netherland Car Rental Services Market:

Illuminates the consequences of environmental, political, and economic fluctuations, and explains changes in customer and consumer requirements. We also provide a detailed report of Netherland Car Rental Services on the technology risks and advancements in the market.

Forecasts based on macro-and micro-economy:

Ensuring price, revenue, and volume Netherland Car Rental Services forecasts for the market. It also includes, in addition to forecasting growth, revenue, and import volume for the region, with revenue forecasting for the Netherland Car Rental Services application, along with revenue forecasting by cost, revenue, and type.

Marketing Strategy Analysis:

In this section, Netherland Car Rental Services analysis aims at niche positioning and provides information regarding the target audience, new strategies, and pricing strategies. We provide a comprehensive Netherland Car Rental Services marketing station analysis that investigates the problem. Marketing channel development trends, direct marketing as well as indirect marketing.

Business Intelligence:

The Netherland Car Rental Services companies studied in this section are also assessed by key business, gross margin, price, sales, revenue, product category, applications and specifications, Netherland Car Rental Services competitors, and manufacturing base.

NOTE: Our analysts who monitor the situation around the world explain that the market will create a conservative outlook for producers after the COVID-19 crisis. The report aims to provide a further explanation of the latest scenario, the economic downturn, and the impact of COVID-19 on the entire industry.

*If you need anything more than these then let us know and we will prepare the report according to your requirement.

About Us:

Business Market Insights is a market research platform that provides subscription services for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

Contact Us:

If you have any questions about this report or would like further information, please contact us:

Contact person: Sameer Joshi

Email: [email protected]

Phone: +16467917070

0 notes

Text

Global Mobile Banking Market Insights, Overview, Analysis and Forecast 2019-2025

Summary – A new market study, titled "Global Mobile Banking Market 2020-2030 by Mobile Platform (Android, iOS, Windows), Business Type (C2B, C2C), Service, Technology, Deployment, End User, and Region: Trend Forecast and Growth Opportunity" has been featured on WiseGuyReports.

Global mobile banking market will reach $4,680.3 million by 2030, growing by 15.8% annually over 2020-2030 driven growing adoption of digital platforms and the increase in demand for personalization on banking amid COVID-19 epidemic.

Highlighted with 88 tables and 87 figures, this 177-page report “Global Mobile Banking Market 2020-2030 by Mobile Platform (Android, iOS, Windows), Business Type (C2B, C2C), Service, Technology, Deployment, End User, and Region: Trend Forecast and Growth Opportunity” is based on a comprehensive research of the entire global mobile banking market and all its sub-segments through extensively detailed classifications. Profound analysis and assessment are generated from premium primary and secondary information sources with inputs derived from industry professionals across the value chain. The report is based on studies on 2015-2019 and provides forecast from 2020 till 2030 with 2019 as the base year. (Please note: The report will be updated before delivery so that the latest historical year is the base year and the forecast covers at least 5 years over the base year.)

Also read – https://www.abnewswire.com/pressreleases/global-mobile-banking-market-size-2020-emerging-trends-industry-share-future-demands-market-potential-regional-overview-and-swot-analysis-till-2030_510264.html

In-depth qualitative analyses include identification and investigation of the following aspects:

• Market Structure

• Growth Drivers

• Restraints and Challenges

• Emerging Product Trends & Market Opportunities

• Porter’s Fiver Forces

The trend and outlook of global market is forecast in optimistic, balanced, and conservative view by taking into account of COVID-19. The balanced (most likely) projection is used to quantify global mobile banking market in every aspect of the classification from perspectives of Mobile Platform, Business Type, Service, Technology, Deployment, End User, and Region.

Based on Mobile Platform, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Android Based Platform

• iOS Based Platform

• Windows Based Platform

Based on Business Type, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Customer-to-Business (C2B)

• Customer-to-Customer (C2C)

• Other Business Types

Based on Service, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Account Management

• Transaction Functions

• Investment Service

• Banking Support

• Content services

Based on Technology, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Wireless Application Protocol (WAP)

• Standalone Mobile Application

• Short Messaging Service (SMS)

• Interactive Voice Response (IVR)

Based on Deployment, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• On-premise Banking

• Cloud Based Banking

Based on End User, the global market is segmented into the following sub-markets with annual revenue for 2019-2030 included in each section.

• Individual

• Enterprise

• Other End Users

Geographically, the following regions together with the listed national/local markets are fully investigated:

• APAC (Japan, China, South Korea, Australia, India, and Rest of APAC; Rest of APAC is further segmented into Malaysia, Singapore, Indonesia, Thailand, New Zealand, Vietnam, and Sri Lanka)

• Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe; Rest of Europe is further segmented into Belgium, Denmark, Austria, Norway, Sweden, The Netherlands, Poland, Czech Republic, Slovakia, Hungary, and Romania)

• North America (U.S., Canada, and Mexico)

• South America (Brazil, Chile, Argentina, Rest of South America)

• MEA (Saudi Arabia, UAE, South Africa)

For each aforementioned region and country, detailed analysis and data for annual revenue are available for 2019-2030. The breakdown of all regional markets by country and split of key national markets by Platform, Business Type, and Service over the forecast years are also included.

The report also covers current competitive scenario and the predicted trend; and profiles key vendors including market leaders and important emerging players.

Specifically, potential risks associated with investing in global mobile banking market are assayed quantitatively and qualitatively through GMD’s Risk Assessment System. According to the risk analysis and evaluation, Critical Success Factors (CSFs) are generated as a guidance to help investors & stockholders identify emerging opportunities, manage and minimize the risks, develop appropriate business models, and make wise strategies and decisions.

Key Players (this may not be a complete list and extra companies can be added upon request):

American Express Company

Bank of America Corporation

BNP Paribas S.A.

Citigroup Inc.

Crédit Agricole Group

Econet Wireless

HSBC Holdings plc

JPMorgan Chase & Co.

Mitsubishi UFJ Financial Group, Inc.

MTN

Orange S.A

Safaricom

Société Générale S.A.

Tigo

Vodacom

Wells Fargo & Company

Zantel

(Please note: The report will be updated before delivery so that the latest historical year is the base year and the forecast covers at least 5 years over the base year.)

For more details - https://www.wiseguyreports.com/reports/5902517-global-mobile-banking-market-2020-2030-by-mobile

About Us:

Wise Guy Reports is part of the Wise Guy Research Consultants Pvt. Ltd. and offers premium progressive statistical surveying, market research reports, analysis & forecast data for industries and governments around the globe.

Contact Us:

NORAH TRENT

Ph: +162-825-80070 (US)

Ph: +44 2035002763 (UK)

0 notes

Text

Top 5 Trading Platforms in India

Investment and trading are part of our corporate world. For trading in stocks or commodities, you should contact a stockbroker because a stockbroker gives access to an individual or organization to trade on their platform.

In the “digital world” everyone is aware of smartphones and computers. It’s very easy to access anything. Earlier trading was not easily accessible for everyone.

For many people, it is difficult to trade in stocks, shares, or commodities. But now things are very simple, and you can buy and sell stocks from your home. You can create your Demat account from your home or from anywhere in the world and can trade in stocks and commodities. Basically, stockbroker accounts help in Trading stocks, IPO, bonds and commodities, etc.

In India Stockbrokers are of two types:

Full-Service brokers who charge full brokerage fees based on your trading.

Discount brokers.

So, we will talk about both types of brokers who provide trading platforms for trading and investments in India.

List of 10 Best Trading Platforms in India

Kite(Zerodha)

Kite by zerodha trading platform

Kite is launched by Zerodha. Zerodha was started on 15th August 2010. It is a financial service company which is based in Bengaluru India. Zerodha is a Member of the National Stock Exchange(NSE), Bombay Stock Exchange(BSE), Multi Commodity Exchange(MCX), Multi Commodity Exchange Stock Exchange MCX-SX.

Zerodha launched its product kite for trading in India. Zerodha has around 2.1 million Active clients in India and Kite app is downloaded by more than 1 million users on the Google play store. Zerodha charges zero brokerages for investments and Rs.20 for Futures and Options (F&O). After opening the Demat account in Zerodha we can access our Zerodha account from the Web app as well as from the mobile app.

Zerodha provides many features like a market watch, multiple chart view, market depth view, and many other features. Kite platform is loaded with many features, but some drawbacks are also there. Zerodha Kite trading platform does not provide any facility for the buying and selling of mutual fund investment. Currently, Zerodha has more active clients than any other trading platform in India.

Website link: https://zerodha.com/

User Ratings: 9.4/10

Upstox

Upstox trading platform

Upstox is one of the fastest-growing trading platforms in India. Upstox was launched on 15th august 2015. There is not much difference between Zerodha and Upstox.

Upstox charges a flat Rs.20 or 0.05% fee per trading and Zerodha charges Rs.20 or 0.03 % fee per trading. Upstox’s headquarter is in Mumbai and it has more than 300 employees. Ratan Tata has also invested in Upstox.

RKSV securities own the trading platform Upstox. After opening a demo account in Upstox It can be accessed by mobile application or through Web Platform. Upstox Pro Mobile is loaded with many features like it shows live Nifty Indices with a change in percentage and through this, we can get an idea of marker movement.

Upstox also provides specific details about stocks just like Zerodha. Upstox Trading Platform also provides features like news, overview, market depth, alerts, and notification, etc. Upstox is Listed on National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) and on Multi Stock Exchange (MCX).

Along with Trading in shares and commodities, you can also invest in Mutual Funds by using this platform. Upstox does not charge any fees or brokerage while investing in Mutual Funds. They only charge Brokerage fees on Intraday trading.

Website link: https://upstox.com

User Ratings: 8.4/10

Sharekhan

sharekhan trading platform

Sharekhan is a retail brokerage firm in India. It was founded in February 2000 and it’s headquarter is based in Mumbai. Sharekhan was acquired by BNP Paribas in 2016.

Sharekhan was one of the first brokers to provide an online trading platform in India. It is registered on the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and Multicommodity Exchange (MCX). Sharekhan is present in more than 541 cities.

Sharekhan was awarded as the best performing retail member at NSE market achiever awards in 2018. Sharekhan has more than 1.4 million customers. You can access your Sharekhan Demat account through the Sharekhan mobile app or through the web. Sharekhan mobile app has a 1 million-plus download on Google play store and more than 4 lakhs daily active traders on their trading platform.

Sharekhan trading platform provides data on the domestic and global markets. It also provides a one-time login feature so that you can get rid of daily login and logout hassle.

You can also buy mutual funds by using the Sharekhan trading platform. It’s very easy and comprehensive to track your portfolio, trades, and mutual funds. Sharekhan charges 0.50% for equity and 0.10% for intraday.

Website link: https://www.sharekhan.com

User Ratings:8.8/10

Angel Broking Speed Pro

Angel broking trading platform