#and they use that to calculate the rate of unemployment insurance tax the employer has to pay

Text

If your employer fires you without cause you can file for unemployment benefits! Which probably most people know, but what people DON’T know is that former employees claiming unemployment benefits can make the employer have to pay higher taxes. Not like, a ton, but still—you get to hit back just a little bit.

#I’m a payroll person and not an HR person so this is most of what I know about unemployment claims#states do annual reviews of how much unemployment benefits had to be paid out to former employees of a company#and they use that to calculate the rate of unemployment insurance tax the employer has to pay#rates can be really low for responsible employers#but even when they’re super high it’s usually just like 6% of the first 12k of taxable wages#12k being a VERY general number#some states cap taxable wages for SUI at 7k (same as federal unemployment tax)#and OTHERS (looking at you Washington…always making trouble…)#some of them have taxable wage bases of over 60k#which is insane#it’s pretty much all western states with higher wage based#anyways this has been Payroll Tax with your favorite Rogue Xenolith

2 notes

·

View notes

Text

What does Payroll Compliance mean?

Introduction

Payroll is a process of paying your employees. However, it also includes choosing a payroll schedule, calculating salaries, wages and taxes, and making sure everything is completed accurately and on time. Payroll management can make it easier to avoid your legal compliance obligations under local, state and federal laws. Payroll compliance is a must for all business owners because overtime, employee treatment and income tax regulations are essential components of payroll. In this blog, we have explained all about payroll compliance.

What is payroll?

Payroll is the salary structure that a company pays its employees at a specific time or on a specific day. Usually, the company’s accounting or human resources department handles it. Payrolls for small businesses can be handled directly by the owner or co-workers. Companies are using technology to improve their payroll processing, employee benefits, insurance and accounting duties. It includes payroll-related documents in digital form. They pay employees more quickly and conveniently. The term “payroll” can also refer to the list of employees and salaries payable in a company.

What is Payroll Compliance?

Payroll compliance is a term also known as statutory compliance, which refers to the legal framework established by the federal or state government to regulate business operations. Each country has a unique set of payroll rules, and business owners operating there must follow them. Keeping an impeccable compliance record has many benefits for your company. As you build trust with the government, it can make it easier for businesses to expand within the country. Businesses have a lot to lose when there is non-compliance, including financial penalties and degraded brand reputation. As a result, businesses need to be knowledgeable about the employment laws in the country where they operate in order to manage payroll or statutory compliance.

Payroll Compliance Checklist

Payroll compliance checklists provide a reference point to guide you through all your processes. They can be used to train your HR team and other staff members on payroll administration and management. There are many reasons for creating a payroll compliance checklist. Make sure everything on the checklist is completed, including steps (determining whether an employee is exempt or non-exempt, setting up direct deposit, etc.), as well as reminders (adding employees to the payroll system, reporting new hires, including reports of company database, etc) as required to maintain compliance.

What are the Payroll Rules and Laws?

Payroll is governed by a wide range of laws. In addition to various municipal and state laws, businesses should be aware of the following federal laws:

1. Fair Labor Standards Act (FLSA): The FLSA establishes child labor regulations, payroll record-keeping requirements, and national minimum wages as well as overtime rates.

2. Federal Insurance Contribution Acts (FICA): Payroll taxes known as FICA which help pay for Social Security and Medicare.

3. Equal Pay Act (EPA): The EPA mandates that companies performing comparable occupations in the same workplace pay equal compensation to men and women in order to prevent gender-based wage discrimination.

4. Davis-Bacon Act: The Davis-Bacon Act mandated that companies working on public works projects pay prevailing wages to laborers and mechanics.

5. Federal Unemployment Tax Act (FUTA): FUTA provides temporary financial assistance to people who have lost their jobs due to circumstances beyond their control.

What is Payroll tax Compliance?

At its most basic level, payroll tax compliance rules mean:

Accurate calculation of wages, including overtime.

The correct amount of payroll tax withheld from wages is subject to each applicable payroll tax (eg, Social Security tax).

Timely depositing related tax obligations with the appropriate federal, state and local tax agencies.

Filing payroll tax returns with each of those jurisdictions.

What is the Payroll Compliance in accordance with federal and state laws?

The complexity of payroll compliance only increases as organizations expand into other jurisdictions. It is challenging enough in one state. Some states have no income tax at all, while others have fixed rates or their tax rates. Some states follow the federal income tax code. States may have different requirements for filing state income taxes, as well as different deadlines and consequences for failure. In addition to income taxes, each state has different minimum wage requirements, unemployment tax rates, and the cost of disability insurance.

What are the benefits of Payroll Compliance in India?

Here are a few justifications for the benefits of payroll compliance and why every business should comply with laws that protect both employee and employer rights.

No matter their position, employers must treat everyone in the company fairly.

Every employee is paid fairly by the employer in accordance with the minimum wage rules, which protect the rights of employees.

Employees shall not be treated unreasonably or required to work overtime without pay.

Worker will get payment on time

Employers are protected from unreasonable increases or demands from trade unions.

A strong bond between employers and employees.

Conclusion

Payroll compliance means following all federal, state and local regulations governing how employees are paid. Employers who violate any of these laws may face penalties that could negatively impact their bottom line or even put them out of business. After all, the livelihoods of employees and their families are highly dependent on receiving secure, accurate and timely payment for their work.

0 notes

Text

Changes in Florida Payroll Tax Laws You Need to Know

Introduction

If you own or manage a business in Florida, it's important to stay up-to-date with changes in state payroll tax laws. These laws can impact how much you pay in payroll taxes, how you calculate and report payroll taxes, and more. In this blog, we'll take a look at some recent changes in Florida payroll taxes laws that you need to know.

Minimum wage increase

Effective January 1, 2022, the minimum wage in Florida increased to $10 per hour. The minimum wage will continue to increase each year until it reaches $15 per hour in 2026. Employers must ensure that they are paying their employees at least the minimum wage for all hours worked.

Social Security wage base increase

The Social Security wage base is the maximum amount of earnings that are subject to Social Security taxes. For 2022, the Social Security wage base increased to $147,000. This means that employees will only pay Social Security taxes on the first $147,000 of their earnings.

FUTA tax credit reduction

The Federal Unemployment Tax Act (FUTA) tax is a payroll tax that employers must pay on the first $7,000 of each employee's wages. In 2021, Florida was one of several states that were subject to a FUTA tax credit reduction. This reduction occurs when a state has taken out loans from the federal government to pay for unemployment benefits and has not repaid those loans in a timely manner. As a result of the FUTA tax credit reduction, Florida employers were required to pay an additional 0.3% in FUTA taxes.

Unemployment insurance tax rate changes

Employers in Florida are required to pay state unemployment insurance taxes (SUTA) to fund the state's unemployment insurance program. The SUTA tax rate varies depending on an employer's experience rating, which is based on the amount of unemployment benefits that have been paid out to the employer's former employees. In 2021, the SUTA tax rates ranged from 0.29% to 5.4%.

For 2022, the SUTA tax rates have been adjusted based on a change in the taxable wage base. The taxable wage base is the maximum amount of earnings that are subject to SUTA taxes. For 2022, the taxable wage base increased from $7,000 to $10,000. As a result of this change, some employers will see a decrease in their SUTA tax rates, while others will see an increase.

COVID-19 relief measures

In response to the COVID-19 pandemic, the federal government implemented several relief measures that impacted payroll taxes. These measures included the payroll tax deferral, the Employee Retention Credit, payment plan taxes, and the Paycheck Protection Program

The payroll tax deferral allowed employers to defer the payment of their share of Social Security taxes from March 27, 2020, through December 31, 2020. Employers who deferred their Social Security taxes must repay them in two installments: one by December 31, 2021, and one by December 31, 2022.

The Employee Retention Credit (ERC) is a refundable tax credit that is designed to encourage employers to keep their employees on payroll during the COVID-19 pandemic. Eligible employers can claim the ERC on their payroll tax returns.

The Paycheck Protection Program (PPP) is a loan program designed to provide financial assistance to small businesses affected by the COVID-19 pandemic. PPP loans can be used to pay for payroll costs, among other expenses. If employers use PPP funds to pay for payroll costs, those costs are not subject to payroll taxes.

Conclusion

The changes to Florida payroll taxes can be confusing, but it's important to understand them in order to ensure compliance. It's also essential for employers and employees alike to stay up-to-date on any new or revised regulations so that they don't miss out on valuable deductions and benefits. With these tips in mind, you should have no problem navigating the complexities of the Florida payroll tax system and ensuring a successful tax season

1 note

·

View note

Text

5 Simple Steps to Streamline your Payroll Process

For any firm, the payroll process may be difficult, and it’s easy to become mired down in the administrative side of things. Every business owner understands how critical it is to ensure that employees are paid accurately and on schedule. However, with so many various regulations, documentation obligations, and tax ramifications, it’s no surprise that payroll can be a pain. Keeping up with these requirements and changes can add a lot of extra work to the payroll department’s workload. Improving efficiency at every stage is the key to guaranteeing a smooth payroll process for your business or firm.

HR has now become entirely automated, but payroll was the first area where automation began, and the vast majority of businesses now use technology to automate payroll activities.

Customers want items and services to be delivered quickly; therefore, inefficiency has no place in the world. The benefits of today’s automated payroll processing software go far beyond just automating payroll processes. It’s no surprise, then, that HR payroll operations have been caught up in the technology tide.

What Is Payroll and How Does It Work?

Payroll is the compensation that a company owes to its employees for a specific period of time or on a specific day. It is typically administered by a company’s accounting or human resources departments. Payroll for a small firm might be handled by the owner or an associate. Payroll processing, employee benefits, insurance, and accounting functions like as tax withholding are increasingly being outsourced to specialist organisations. Many payroll fintech companies, including Atomic, Bitwage, Finch, Pinwheel, and Wagestream, are using technology to make payroll operations easier. These solutions pay employees more conveniently and quickly, as well as providing digital payroll-related documentation and other innovative technology-enabled services that the gig and outsourcing economy demand.

The list of a company’s employees and the amount of remuneration due to each of them is referred to as payroll. Payroll is a significant expense for most firms, and it is almost always deductible, meaning it can be deducted from gross income, lowering taxable income. Because of overtime, sick pay, and other factors, payroll might vary from one pay period to the next.

Knowing Payroll-

Payroll is the process of paying a company’s employees, which includes keeping track of hours worked, calculating pay, and disbursing funds to employees via direct deposit or check. Companies must, however, conduct accounting activities in order to record payroll, withheld taxes, bonuses, overtime compensation, sick time, and vacation pay. Companies must set aside and record the amount of Medicare, Social Security, and unemployment taxes that must be paid to the government.

Many businesses use payroll software to keep track of their employees. An API is used to input the employee’s hours, and their compensation is processed and sent into their bank accounts.

Payroll services are outsourced by many medium and big businesses to simplify the process. Employers keep track of how many hours each employee works and report this to the payroll service. The gross amount payable to the employee is calculated by the payroll service on payday based on the number of hours or weeks worked during the pay period and the pay rate. The service deducts taxes and other withholdings from employee earnings before paying them.

To know more: https://www.qandle.com/hr-payroll-software.html

0 notes

Note

so i need some advice for dealing with the unfair system. I'm out of work because of the virus so i tried to apply for unemployment. The unemployment insurance people called my work and my work was like "they're not laid off, they are just on a zero hour schedule." So i don't qualify. What now?

Your boss is a shithead who’s doing something that’s unfortunately very common and very shitty. Call the unemployment insurance people and tell them you earned no money in the last week. Shithead fucking bosses I swear to fucking god HEY IF YOU ARE EVER TRYING TO APPLY FOR UNEMPLOYMENT YOU’RE PROBABLY GOING TO HAVE TO GO THROUGH THE PROCESS A COUPLE TIMES BECAUSE THIS IS PART OF OUR SHITTY SYSTEM.

Anyway, this Business Insider article has some good links:

If a worker is not being offered any hours and the employer says they're not eligible for unemployment benefits, the employee is being given incorrect information and should apply anyway, according to Stettner.

"Once you have zero earnings in a prior week and you're not working this week, you're not employed by the definition of unemployment insurance," Stettner said.

The same goes for employees who have furlough status. When it comes to applying for unemployment benefits, workers are not considered to be employed if they are not earning wages, according to Stettner.

In a time where virtually the entire restaurant industry is grinding to a halt, one of the baseline requirements for unemployment benefits may seem like a roadblock: that the applicant must be searching for a job.

But applicants can still make an effort to search for work even if the likelihood of getting hired appears to be nonexistent, according to Stettner. Each state has its own requirements for what counts as looking for a job, but applicants should make whatever effort their state requires, he says, whether that's searching for job listing or posting your resume to an online database.

Stettner added that workers whose hours were reduced but not cut completely can also file for unemployment benefits.

"You say you're partially employed," he said. "Usually there's a question about whether your hours were cut ... You just tell them how much you're working and they'll calculate you."

The rate of this partial unemployment coverage varies by state to state, but every state has some kind of partial coverage for reduced hours, Michele Evermore, a senior policy analyst for social insurance at the National Employment Law Project, told The New York Times.

A 'culture' of challenging unemployment claims

Stettner said it's a "culture" for employers to challenge unemployment claims because their workers filing for unemployment costs them money.

"[The employer] is charged for part of the benefits," Stettner said. "So their taxes will go up if they have unemployment claims."

But this amount is relatively small, according to Stettner. The average amount an employer has to pay for an unemployment insurance claimant in the US is $277 per year, according to US Department of Labor data.

Shierholz of EPI urges people to apply for unemployment benefits as soon as they're laid off or have their hours cut.

The Department of Labor lists all 50 states' unemployment insurances offices with phone numbers and links to informational websites.

"Just apply. Don't wait," Shierholz said. "There's no reason to wait a week because you can start getting those benefits as soon as possible ... At a time like this, this is what those benefits are there for. People should not hesitate to apply."

2K notes

·

View notes

Text

How bad are things for the people of Greece?

The people of Greece are facing further years of economic hardship following a Eurozone agreement over the terms of a third bailout.

The deal included more tax rises and spending cuts, despite the Syriza government coming to power promising to end what it described as the "humiliation and pain" of austerity.

With the country having already endured years of economic contraction since the global downturn, just how does Greece's ordeal compare with other recessions and how have the lives of the country's people been affected?

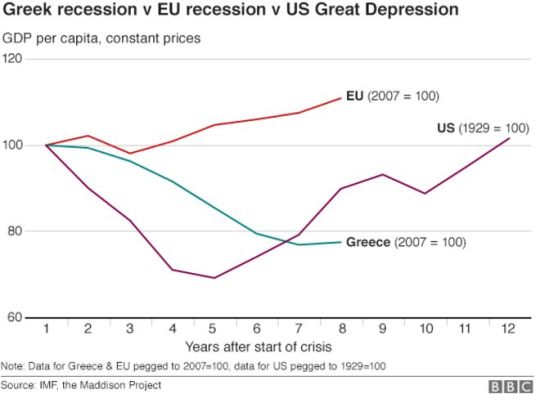

The long recession

It is now generally agreed that Greece has experienced an economic crisis on the scale of the US Great Depression of the 1930s.

According to the Greek government's own figures, the economy first contracted in the final quarter of 2008 and - apart from some weak growth in 2014 - has been shrinking ever since. The recession has cut the size of the Greek economy by around a quarter, the largest contraction of an advanced economy since the 1950s.

Although the Greek recession has not been quite as deep as the Great Depression from peak to trough, it has gone on longer and many observers now believe Greek GDP will drop further in 2015.

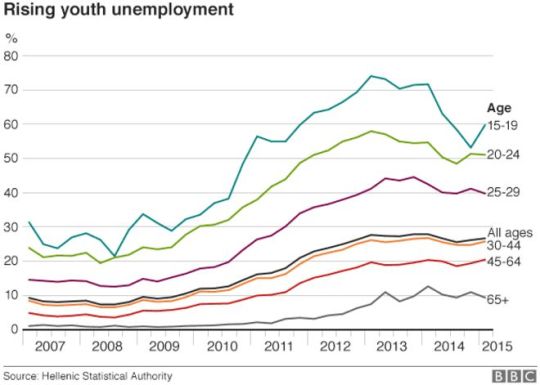

Dwindling jobs

Jobs are increasingly difficult to come by in Greece - especially for the young. While a quarter of the population are out of work, youth unemployment is running much higher.

Half of those under 25 are out of work. In some regions of western Greece, the youth unemployment rate is well above 60%.

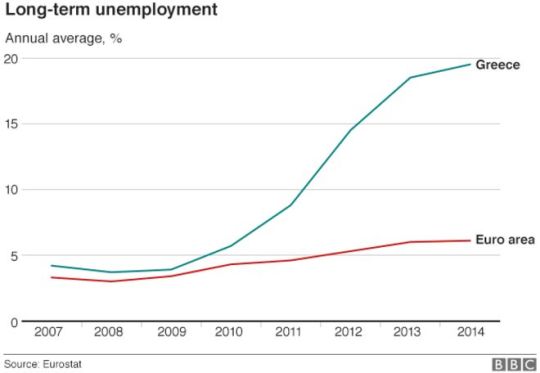

To make matters worse, long-term unemployment is at particularly high levels in Greece.

Being out of work for significant periods of time has severe consequences, according to a report by the European Parliament. The longer a person is unemployed, the less employable they become. Re-entering the workforce also becomes more difficult and more expensive.

Young people have been particularly affected by long-term unemployment: one out of three has been jobless for more than a year.

After two years out of work, the unemployed also lose their health insurance.

This persistent unemployment also means pension funds receive fewer contributions from the working population. As more Greeks are without jobs, more pensioners are having to sustain families on a reduced income.

According to the latest figures from the Greek government, 45% of pensioners receive monthly payments below the poverty line of €665.

Plummeting income

The Greek people are also facing dropping wages.

In the five years from 2008 to 2013, Greeks became on average 40% poorer, according to data from the country's statistical agency analysed by Reuters. As well as job losses and wage cuts, the decline can also be explained by steep cuts in workers' compensation and social benefits.

In 2014, disposable household income in Greece sunk to below 2003 levels.

Rising poverty

Like during all recessions, the poor and vulnerable have been hardest hit.

One in five Greeks are experiencing severe material deprivation, a figure that has nearly doubled since 2008.

Almost four million people living in Greece, more than a third of the country's total population, were classed as being 'at risk of poverty or social exclusion' in 2014.

According to Dr Panos Tsakloglou, economist and professor at the Athens University of Economics and Business, the crisis has exposed Greece's lack of social safety nets.

"The welfare state in Greece has historically been very weak, driven primarily by clientelistic calculations rather than an assessment of needs. In the past this was not really urgent because there were rarely any particularly explosive social conditions. The family was substituting the welfare state," he told the BBC.

Typically, if a young person lost his or her job or could not find a job after graduating, they would receive support from the family until their situation improved.

But as more and more people have become jobless and with pensions slashed as part of the austerity imposed on Greece from its creditors, ordinary Greeks are feeling the impact.

"This has led to many more unemployed people falling into poverty much faster," Dr Tsakloglou said.

Cuts to essential services

Healthcare is one of the public services that has been hit hardest by the crisis. An estimated 800,000 Greeks are without medical access due to a lack of insurance or poverty.

A 2014 report in the Lancet medical journal highlighted the devastating social and health consequences of the financial crisis and resulting austerity on the country's population.

At a time of heightened demand, the report said, "the scale and speed of imposed change have constrained the capacity of the public health system to respond to the needs of the population".

While a number of social initiatives and volunteer-led health clinics have emerged to ease the burden, many drug prevention and treatment centres and psychiatric clinics have been forced to close due to budget cuts.

HIV infections among injecting drug users rose from 15 in 2009 to 484 people in 2012.

Mental wellbeing

The crisis also appears to have taken its toll on people's wellbeing.

Figures suggest that the prevalence of major depression almost trebled from 3% to 8% of the population in the three years to 2011, during the onset of the crisis.

While starting from a low initial figure, the suicide rate rose by 35% in Greece between 2010 and 2012, according to a study published in the British Medical Journal.

Researchers concluded that suicides among those of working age coincided with austerity measures.

Greece's public and non-profit mental health service providers have been forced to scale back operations, shut down, or reduce staff, while plans for development of child psychiatric services have been abandoned.

Funding for mental health decreased by 20% between 2010 and 2011, and by a further 55% the following year.

The brain drain

Faced with the prospect of dwindling incomes or unemployment, many Greeks have been forced to look for work elsewhere. In the last five years, Greece's population has declined, falling by about 400,000.

A 2013 study found that more than 120,000 professionals, including doctors, engineers and scientists, had left Greece since the start of the crisis in 2010.

A more recent European University Institute survey found that of those who emigrated, nine in 10 hold a university degree and more than 60% of those have a master's degree, while 11% hold a PhD.

Foteini Ploumbi was in her early thirties when she lost her job as a warehouse supervisor in Athens after the owner could no longer afford to pay his staff.

After a year looking for a new job in Greece, she moved to the UK in 2013 and immediately found work as a business analyst in London.

"I had no choice but leave if I wanted to work, I had no prospect of employment in Greece. I would love to go back, my whole life is back there. But logic stops me from returning at the moment," she said.

"In the UK, I can get by - I can't even do that in Greece."

1 note

·

View note

Text

Helpful Hints for Selecting The Right Accounting Solutions Ideal for Businesses

Business owners are sometimes overwhelmed by the responsibilities before them. Beginning with employee management to making sure the accounting books are saved in order and a lot more while the time to do all these tasks is shortened each day. Finding an accounting solution is the best in streamlining your business operations. The primary reason behind getting the best accounting solutions is to help you in bookkeeping services to do accounting as it should be done as well as keep track of the amounts coming in or out. We all know that business owners are quite busy, and while it is not easy to get one accounting solution, you can have programs that will assist in improving productivity while still going up the daily chores, and always be able to draw new business to you and keep track of what you have and have made. Discover more about accounting here.

Setting up an accounting solution should not be difficult to set up. This includes having the details of the first installation and any other upgrades done for purposes of security. Installing an accounting solution may require support or when the application is running which should be given by the seller. Installing accounting installations may require support either online or through telephone inquiries. How to use the installed accounting solution must be demonstrated using the interface with the drawn icons showing how it works.

Integration is another accounting solution important in a business. An employee’s contact details should be obtained from the records system, and there should be an integration of the bank accounts for salaries purposes in line with the hours worked and vacancies should be easily noted. Worked hours should be analyzed according to the entry and time entered by the employees. Holidays, leave, and insurance are employee provisions that the management has to input. The setup accounting solution should calculate the provided raw data. The management’s effort in calculating payroll will be reduced through the installation of an accounting solution. Discover more about this accounting solution now.

In matters of filing taxes for the end of the year, the job of the accounting solution is to calculate after the rates have been input by the management. Different contributions done by the employer, social security tax, state unemployment insurance among others will may change per year meaning the accounting solution should update the rates to comply with the law. Additionally, businesses can have different offices in different towns meaning the rates are different from one state to the other so the installed accounting solution must be able to accordingly calculate the rates. When payments are due or when invoices should be paid should be contained in the accounting solution you intend to install in your business. Click here for more details: https://en.wikipedia.org/wiki/Financial_accounting.

1 note

·

View note

Link

1099: A record that an entity or person that is not your employer paid you money. Freelancers and independent contractors often get a 1099-MISC or 1099-NEC from their clients to reflect payment.

ACA: More often referred to as Obamacare. Signed into law by President Barack Obama in 2010, it includes policies intended to extend health insurance coverage to millions of uninsured Americans through initiatives such as expanding Medicaid eligibility and launching a healthcare marketplace.

ACH: Automated Clearing House, a network that coordinates electronic payments and automated money transfers. ACH is a method for moving money among banks without using cash, a wire transfer, physical check or credit card network.

Americans with Disabilities Act (ADA): The Americans with Disabilities Act of 1990 or ADA is a civil rights law that prohibits discrimination based on disability.

Applicant tracking system: Software that enables electronic handling of hiring needs.

At-will employment: An at-will employee can be fired at any time and for any reason, with a few illegal exceptions. The employer doesn’t need good cause to terminate your job. Federal exceptions are firing an employee for obeying the law, or if oral or written policies imply a certain termination policy or job security.

Background check: Also referred to as pre-employment screening; may comprise screening services like a drug screening, skills assessment and behavioral assessment tools. A background check also verifies factual information about prospective hires, such as their identity, education and work credentials. It may also include a criminal history check, credit history check or driving record check.

Benefits: Benefits are a form of compensation paid by employers to employees over and above the amount of pay specified as a base salary or hourly rate of pay. Benefits are a portion of a total compensation package for employees.

COBRA: Consolidated Omnibus Budget Reconciliation Act of 1985 mandates employers with 20 or more employees that offer health care benefits must offer a continuing coverage option to those who lose their benefits due to a reduction in hours, termination, etc. COBRA compliance violations can cause significant penalties.

Compensation: The monetary benefit given to an employee or worker providing services to an organization. Compensation includes components like salary and benefits.

Deductions: A payroll deduction plan is when an employer withholds money from an employee’s paycheck and may be voluntary or involuntary. An example of an involuntary payroll deduction plan is employers’ requirement by law to withhold money for Social Security and Medicare. An example of a voluntary payroll deduction plan is when employees opt in for certain purposes, such as saving toward their retirement plan.

Department of Labor (DOL): A federal agency established in 1913, responsible for enforcing federal labor standards and occupational safety.

Direct Deposit: An electronic funds transfer that deposits an employee’s wages directly into their bank account.

Employee (vs. independent contractor): An employee is a person employed for wages or salary. An independent contractor is someone who operates under a business name or under their own name and may have their own employees, a separate business checking account, may advertise their services, provide invoices for work completed, have more than one client, their own tools, establish their own hours and keep their own business records. The IRS defines a person as an independent contractor “if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.” Independent contractors must pay their own Social Security and Medicare taxes.

Equal Employment Opportunity (EEOC): The U.S. Equal Employment Opportunity Commission is a federal agency established by the Civil Rights Act of 1964 to administer and enforce civil rights laws against workplace discrimination.

Essential job functions: This term refers to the fundamental duties of a position: the things a person holding the job absolutely must be able to do. Essential job functions are used to determine the rights of an employee with a disability under the Americans with Disabilities Act (ADA).

Exempt (and non-exempt) employees: An “exempt employee” refers to a category of employees defined in the Fair Labor Standards Act and applies to employees who don’t receive overtime pay or qualify for minimum wage. When an employee is exempt, it essentially means that they are exempt from receiving overtime pay. Nonexempt employees are those who are entitled to earn the federal minimum wage and qualify for overtime pay.

Exit interview: A survey conducted with an individual who is separating from an organization.

Fair Labor Standards Act (FLSA): A U.S. law meant to protect workers against certain unfair pay practices with regulations pertaining to minimum wages, overtime pay requirements, limitations on child labor and interstate commerce employment.

Family and Medical Leave Act (FMLA): A U.S. labor law enacted in 1993 requiring covered employers to offer employees job-protected and unpaid leave for qualified medical and family reasons.

FICA: The Federal Insurance Contributions Act is a federal law that requires employers to withhold three different types of employment taxes from employees’ paychecks. These comprise Social Security taxes and Medicare taxes.

Full-time (and part-time): Generally, part-time employees work fewer hours than full-time employees. Part-time positions may comprise inconsistent hours, fewer responsibilities and limited benefits. However, the Affordable Care Act deems part-time workers as employees who work fewer than 30 hours per week. There is no universal amount of time specified for part-time employment.

FUTA: An acronym for the Federal Unemployment Tax Act, it is one of the taxes employers have to pay as part of payroll taxes. At the time of publication, the tax is 6% on an employee’s first $7,000; any wages above $7,000 are not taxed.

Garnishment: A payroll garnishment happens when a court issues an order requiring an employer to withhold a certain amount from an employee’s paycheck and send it directly to the organization or person owed money, until the debt is fully paid.

Gross pay: This is the amount of money owed to an employee before withholding taxes and other deductions.

Hourly: If an employee receives hourly wages rather than salary, their pay is dependent on how many hours they have worked during that pay period.

Imputed income: The value of non-monetary compensation given to employees in the form of fringe benefits. This income is added to an employee’s gross wages so employment taxes can be withheld.

Income tax: A type of tax governments impose on income generated by businesses and individuals within their jurisdiction. Business income taxes apply to corporations, partnerships, small businesses, and people who are self-employed. Personal income tax is a type of income tax that is levied on an individual’s wages, salaries, and other types of income.

Minimum wage: The federal minimum wage provisions are contained in the Fair Labor Standards Act (FLSA). The federal minimum wage is $7.25 per hour effective July 24, 2009. Many states also have minimum wage laws.

Net pay: An employee’s earnings after all deductions are taken out.

Non-compete agreement: A written legal contract between an employer and employee that establishes terms and conditions about the employee’s ability to work in the same industry and with competitors upon termination of employment.

Nonexempt: Workers who are entitled to earn the federal minimum wage and qualify for overtime pay.

Occupational Safety and Health Administration (OSHA): The federal agency responsible for enforcing workplace safety rules. HR teams often oversee OSHA compliance.

Overtime: Employees who work more than 40 hours a week are entitled to a higher rate of pay for the additional work. This is termed overtime pay. Federal overtime laws require employers to pay certain employees who work more than 40 hours in a week at least time and a half for the extra time.

Pay period: A recurring length of time over which employee time is recorded and paid.

Payroll: Payroll is the function of a business paying its employees. Payroll processing involves calculating total wage earnings, withholding deductions, filing payroll taxes and delivering payment

Performance review: A formal assessment in which a manager evaluates an employee’s work performance, identifies strengths and weaknesses, offers feedback and sets goals for future performance.

Quarterly federal taxes: If the IRS classifies you as self-employed, you are required to file an annual federal income tax return and pay estimated quarterly taxes on Form 1040-ES, Estimated Tax for Individuals. Estimated quarterly taxes are a prepayment of Social Security, Medicare and federal income taxes that self-employed individuals must pay because these workers do not have an employer to withhold taxes from a payroll check. The requirement to pay taxes quarterly ensures that you don’t let your tax obligation get away from you and end up unable to pay your taxes when you file your annual return.

Reimbursements: Money paid back to an employee who made an out-of-pocket expense to achieve company goals.

Taxable Income: The portion of your total income that can be taxed. Generally, it includes some or all items of income and is reduced by expenses and other deductions.

W2: IRS Form W-2 is the annual “wage and tax statement” that reports your taxable income earned from an employer to you and to the Internal Revenue Service (IRS). The form also includes taxes withheld from your pay, as well as Social Security and Medicare payments made on your behalf by both you and your employer.

W4: Employees complete the IRS Form W-4 so employers know how much money to withhold from their paycheck for federal taxes.

Withholding: Payroll tax withholding transpires when employers withhold a portion of an employee’s gross wages for taxes. Payroll withholding is mandatory when you have employees; the amount withheld is based on the employee’s income.

Workers’ compensation: A form of insurance offered to employees when they experience an on-the-job injury. It is mandatory for almost all employers in the U.S.

Originally published at https://blog.escalon.services

#HR Processes and Policies for Startups#Outsourcing HR for Start Ups#outsource hr services for startups#part time hr#hr consultancy services#Hr For Startups#Complete Hr Solutions#Outsourcing HR Department#Outsourcing HR Tasks#outsourced hr services

0 notes

Text

Payroll systems:

What is the payroll?

A payroll is a company's list of employees, but the term is often used to refer to the total amount a company pays its employees. A company's records of its employees' wages and salaries, bonuses and taxes withheld, and the department of the company that calculates and pays them.

What is Payroll Management in Human Resources?

Payroll refers to the process by which employees receive their salary. The functions relate to the comparison and comparison of wage data as well as the filing and archiving of taxes. The wages office is responsible for the wage deductions, bookkeeping and checking the reliability of wage data.

What is the paycheck process?

Payroll involves many activities to ensure accurate and on-time salaries, as well as compliance with payroll taxes and records. Prepare your paycheck in advance. Design a payroll program that will give you enough time to process payrolls and correct any errors found before employees receive payrolls.

What is a payroll system used for?

The Payroll Management System deals with the financial aspects of employee salary, bonuses, deductions, gross salary, net salary, etc. and the payroll for a specific period of time. The outstanding advantage of the Payroll Management System is its easy implementation.

What is payroll software?

Payroll software is the technology that aims to simplify and automate the payment process of a company's employees. Payroll software can be purchased from a human resources technology vendor or integrated as a module in a larger enterprise resource planning.

Components of a payroll system:

To ensure compliance with Internal Revenue Service (IRS) regulations and state and local laws, companies must include critical company and employee information in their payroll systems. The configuration and operation of the different components that make up a payroll management system require due diligence and adequate knowledge of tax legislation.

Salary information:

As part of the hiring process, payroll systems include a component that determines which employees are full-time, part-time, and contractors. Classifying workers in a payroll system is important as the government imposes heavy penalties on companies that classify workers.

Time sheet:

Without knowing the number of hours an employee has worked, employers cannot determine how much an employee should be paid. While some employees are paid, others are paid by the hour or are reported as nonexempt employees. Payroll systems include time registration information or areas where hourly hours and non-exempt hours of employees are recorded and verified for accuracy. Information can be collected through a computer controlled clock, a clock with a punch card stamp, or a paper time sheet.

Applicable Taxes and Deductions

Although the IRS provides companies with tax tables for calculating employee tax deductions, this information can also be provided by suppliers and computer payroll systems. Employers should consider past annual income, salary level, and tax breaks when summarizing applicable taxes. Additionally, payroll systems must calculate deductions made through retirement plans, 401 (k) s, insurance plans, union dues, and foreclosures. The payroll office also monitors credits and other maximum deductions, and stops the paycheck from being withdrawn when the full amount has been paid back.

Payroll

Payroll gathers information about employee earnings and deductions in a journal entry that is posted to the general ledger for general ledger and research purposes. Payrolls are also used to prepare tax reports. These documents are created by payroll employees or generated by accounting systems.

Manual payments

Occasionally, companies issue manual payroll to employees on payroll due to a payroll resolution or error. Payroll systems must include the amount of the check on the payroll for tax reporting purposes. This ensures that the employer's tax deduction matches the employee's deductions.

Payroll refers to the management of salaries, bonuses, net salaries and withholding made by employees. Includes employee ID, employee name, start date, daily attendance record, base salary, allowance, overtime, bonuses, commissions, incentives, vacation and sickness, value of meals and lodging, etc. There are some deductions that include retirement funds (12%) from salary, taxes, and other deductions.

Deductions such as taxes and loans / advances that the employee takes from organizations are only deducted where applicable. Unemployment benefit and housing allowance are granted at a fixed rate determined by labor law. According to the Labor Law, a monthly pension fund is deducted from the employee's gross salary and made available to the employee at a later date. Organizations also pay the same amount to the employee's pension fund.

The annual paycheck consists of travel, incentives, annual bonuses, and medical expense reimbursements. Assignments, incentives, bonuses, and reimbursements are based on organization policies. Some organizations have provided subsidies at a fixed rate, such as 10% or 12% of base salary. Some organizations use performance-based incentives.

What is Payroll Outsourcing?

The outsourcing industry is growing faster. Human resources outsourcing helps HR professionals break free from everyday life and participate in strategic processes. Organizations don't really see human resources as a strategic function; it is simply treated as part of the documentation. Therefore, they want to reduce the cost of HR activities.

Payroll outsourcing involves an external organization that carries out all payroll related activities. Outsourcing companies strive to offer their customers cost-saving benefits. Companies use their

marketing department intensively to acquire and retain more customers. Payroll outsourcing doesn't involve big cost savings, but it pays off with high quality. As offset outsourcing requires a lot of market research and industry knowledge, it's not easy for a company to get the job done with their operations.

Outsourcing has not only benefited the service providers but also the organizations and the economy of the country. It allows management to focus on core competencies and strategic planning. It maintains the confidentiality of the compensation package offered to employees as it is managed by an external agency. Companies do not need to familiarize themselves with the payroll and benefits law it is the outsourcing company that has to take care of it. It offers qualitative results. It is much cheaper and saves time. It also provides legal protection as the outsourcing company is responsible for all legal matters.

Outsourcing companies enjoy income advantages by providing services to multinational companies. Exports of services have developed the economic system more strongly and contribute to GDP growth.

0 notes

Text

How To Choose the Right Payroll Software in Saudi Arabia. A Complete Guide for SMEs & Startups

PeopleQlik #1 Payroll Software in Saudi Arabia Payroll involves more than merely paying employees' salaries for the hours they work. Employee pay and deductions, such as income tax rates, Medicare, allowances, and more, are all included. Payroll calculation for SMEs (small and medium businesses) can be a time-consuming process. A poorly managed payroll program can stifle production and irritate workers.

Employee salaries must be paid on time and without faults. An employee who gets paid a salary is a happy employee. However, things do not always go as planned. The following are some of the reasons why salaries may be delayed.

Payment processing has been delayed.

Payroll calculations that are incorrect

Insufficient resources

Peopleqlik #1 Payroll Software in Saudi Arabia

Payroll software in Saudi Arabia and operations that are inefficient are symptoms of a corporation that is inefficient.

What is a Payroll in Saudi Arabia and What Does It Do?

Payroll processing ensures that employees are paid on time and with the appropriate deductions. The HR department and payroll personnel are in charge of paying employees in accordance with local tax rates and company policies. Small business owners are more likely to use a manual payroll system. They engage in payroll outsourcing, which is contracting with a payroll service provider to supply wage computations.

However, with the correct payroll software in Saudi Arabia for small and medium-sized firms, this may be done by an in-house human resources staff. It's possible that a payroll company is unfamiliar with your company's policies. As a result, payroll software with outsourced services may be just what you need as a business.

If you're trying to decide between in-house payroll versus payroll outsourcing. With that in mind, let's quickly go over the various stages of payroll processing:

Establishing Payroll Policies: Because a salary is a fundamental entitlement of an employee, the first stage of the payroll cycle is to establish the appropriate payroll policy. Part-time and contract-based employees may have different payroll software in Saudi Arabia and taxes than full-time employees.

Hourly employee agreements, independent contractors, and freelancers may all have different wages and payroll taxes.

Understanding the Different Parts of a Salary:

Fixed and variable components are bifurcated into salary components. These are based on a variety of tax forms, including the W 4, which lists your employees' payments. Aside from that, several forms are depending on an employee's position. Deductions and benefits are two more types of payroll components. Bonuses, employee benefits, voluntary deductions, wage garnishments, health insurance plans, retirement plans, life insurance, HRA, and other benefits are all examples. Personnel who are exempt in specific circumstances may be present, as well as nonexempt employees.

Obtaining Inputs: Obtaining inputs for employee paychecks takes time. This monthly process must be efficiently managed while keeping the company's size in mind. Loans, travel expenditures, extra shift charges, paid leave, commission, relocation expenses, and other expenses are all examples of inputs.

Input Validation: The collected data is subsequently validated to eliminate any potential inaccuracies at a later stage. This is an important step because you will only be looking at data from current employees in your company.

Creating Payroll Procedures: We begin the actual payroll scheme after these pre-tax deductions. Payroll software in Saudi Arabia should be regularly supervised by department experts to avoid any potential duplication or errors.

Completion of Statutory Requirements: Employers must deduct mandatory tax contributions from employee earnings from both the state and federal governments. Late and non-payments can result in tax penalties, therefore this is an important part of payroll management. Some examples of payroll deductions are:

For the United States of America (and relevant countries)

Income taxes, both federal and state

The cost of union dues

Unemployment insurance taxes

Payroll taxes for Social Security

Local taxes that aren't included elsewhere

Disclaimer: The deductions listed above are only a few. For proper deductions, please contact a payroll specialist.

Employers and employees both benefit from these tax breaks. Your company is required to file.

How is payroll handled in most startups and small businesses?

Excel-based payment processing:

Payroll software in Saudi Arabia is still done on excel sheets by a big number of small businesses. Until you have fewer than ten employees, it may be a convenient practice. When you have more than ten employees, data processing on an excel sheet might become a tedious operation. There are certain disadvantages to using an excel sheet.

Data input is done by hand.

Data processing is done by hand.

Errors in calculation and clerical work.

Statutory compliances must be entered on a regular basis.

Adding and deleting entries by hand.

Payroll Services Outsourcing

Outsourcing, as previously discussed, is another method of payroll processing. However, from time to time, the corporation must exchange data, policies, and deductions with a third party. The risk of disclosing personnel records to a third party is high. Not to mention that using payroll outsourcing services incurs additional expenditures.

Payroll software in Saudi Arabia can thus be used to manage payroll for small firms. Trying to decide whether to outsource payroll services or keep payroll in-house. This blog will assist you in getting started.

Payroll software in Saudi Arabia is a program that Human Resource Departments (HRs) or payroll teams use to keep track of the whole life cycle of payroll procedures. Payroll software must be tailored to the needs of a company, bringing together all the loose ends of inputs, validation, processing, and checks on a single platform.

Payroll software for SMEs provides a comprehensive payroll processing experience. In terms of payroll, Human Resource Management Software (HRMS) might give you an advantage. As a result, dependable payroll software simplifies the processing of large amounts of data, eliminates reliance on external third-party resources, and provides a professional solution.

Payroll software and its applications include:

Here are some examples of payroll software applications that may be appropriate for your business.

The program can store and process massive amounts of data and can be scaled up to handle more.

Because the procedure is automated, each form and input is tailored to your current policy. There is no need to manually enter data for payroll processing if your organization already has HR software or an online payroll. By identifying and rectifying problems, the automated payroll system can also serve as accounting software. As a result, you can take advantage of technology to save time and effort in the payroll process.

End-to-end solutions are those that cover all aspects of a project.

From policy creation through government payments and paycheck slips, the software provides all-in-one payroll services.

This ensures entire process control and a single-window approach.

Payroll Software's Advantages

Payroll software has a number of advantages for both firms and employees.

Payroll software can help you save money on paper-based payroll procedures. An effective payroll system can assist you in investing your company's savings in growth.

Manually calculating payroll on a monthly basis is time-consuming and inconvenient. Through its automated operations, the program can save all of this time.

Any margin for human error is eliminated with computer-based applications. Whether you work for a small business or a large corporation, your personnel data will be calculated correctly.

Payroll software allows you to save any amount of data and retrieve it whenever you need it. Your annual reports and pay stubs will be kept safe.

Here is the list of features that you can get by using PeopleQlik:

PeopleQlik Core

Core HR Software -HRMS

Cloud Payroll Management Software

Employee Self Services

HR Analytics Software

Corporate Wellness Platform

Performance Management Software

360-degree feedback form

Compensation Planning & Administration

Social Recognition

Workforce Administration

Leave Management Software

Time and Attendance Management Software

Shift & Scheduling

Claims & Reimbursements

Time-sheet Management Software

Click to Start Whatsapp Chatbot with Sales

Mobile: +966547315697Email:

#Learning Management Software in Saudi Arabia#Learning Management System in Saudi Arabia#Learning Management Solutions in Saudi Arabia#leave management software in Saudi Arabia#performance management software in Saudi Arabia#HR Software in Saudi Arabia#HR System in Saudi Arabia#HR Solutions in Saudi Arabia#Attendance Software in Saudi Arabia#Attendance Solutions in Saudi Arabia#Attendance System in Saudi Arabia#Attendance Management in Saudi Arabia#recruitment software in Saudi Arabia#Face Attendance in Saudi Arabia#Facial attendance in Saudi Arabia#Voice Attendance in Saudi Arabia#Face biometric IN Saudi Arabia#Voice Biometric IN Saudi Arabia#Face recognition in Saudi Arabia#Voice Recognition in Saudi Arabia#Voice Attendance Software in Saudi Arabia

0 notes

Text

CAPITAL MARKET PROCEDURE AND MECHANISM IN TURKEY

INTRODUCTION

Capital flows to major emerging market economies are important for the welfare of global financial markets. More financial integration is constantly increasing both in gross capital inflows and exits from emerging money economies. Although the structure of flows has become more stable, capital flows continue to be very volatile, which has significant macroeconomic impacts for the recipient countries. The size and structure of the inputs are largely influenced and greatly influenced by the state of development of the local financial markets. The benefits and costs of capital market integration and regulation have become a controversial issue among academics and policy-makers. The rapid growth of capital movements around the global capital markets and the needs of emerging capital have forced market economies to improve the capital markets of these economies to attract a larger share of global portfolio investments. In order to keep up with the global growth and capital movements in the world, capital markets are regulated and investors' interest in the Turkish capital markets is primarily under the responsibility of the Capital Markets Board (CMB) in Ankara, Turkey. As a result, the regulation of capital markets in Turkey, first of all the participants (residents and non-residents) and is designed to create a basis for trust in the integrity of the market. The role of CMBT in this regulatory environment is to make the market more reliable and efficient by establishing it. To implement the principles of honesty and trust and to prevent the activities of illegal actions that damage investor confidence. The main legislation regulating the capital markets, Capital Market Law in Turkey, participation arrangements made under this Act, notification and decisions. These regulations have been in force since the establishment of CMB and many amendments have been made by the Capital Markets Board (CMB). Detailed arrangements for the regulation of markets and the development of capital market instruments and equipment. The purpose of KML is to oversee and ensure the safe, fair and regular functioning of capital markets while protecting the rights and interests of investors. Capital market instruments CMB, capital market activities, capital market institutions and the proposals and sales foreseen in the capital structure, issuers, exchanges and other organized markets are subject to the CML provisions of the Markets Board. The corporate investor sector in the Turkish Capital Market consists of mutual funds, pension funds, investment companies and real estate investment partners. In order to increase product diversity, make long-term investments and expand the institutional investor base, new instruments such as hedge funds, guaranteed and protected funds, fund funds, stock exchange mutual funds and warrants have been launched.

Growth and Employment

After a growth rate of 7.2% in the period 2002-2006, after a strong growth of 5 years, GDP growth started to slow down after 2007 with the deterioration of the international environment. The deterioration in external financing conditions, foreign trade and the weakening of confidence in Turkey's economy with instability, the global crisis has affected the economic activity shrinking by 4.8% in 2009. Nevertheless, economic activities started to recover gradually as of 2009 and the GDP growth was 8.9%. In 2010, he was driven by private consumption. GDP per capita increased by 17% to US $10,079 in US$.

GDP increased by 10% compared to 1H2010 on a relatively low basis, while the relative improvement in output continued at 1H2011. Annual figures indicate a real increase of 8.6% compared to the previous year. Overall, the economy is expected to grow by approximately 6% in 2011.

Despite the high growth rates in GDP, the unemployment rate is above 10% before the global crisis. With the deterioration in domestic and foreign demand conditions, the average annual unemployment rate rose to 14% in 2009. The sharp recovery in domestic demand helped the unemployment rate fall to 12% in 2010. The improvement in the labor market continued in 2011 as well. In 2Q2011, the seasonally adjusted rate approached the pre-crisis level by around 10%. Although the labor force participation rate is limited to around 50%, it should be noted that it is gradually increasing.

Public Finance

The combination of fiscal discipline and significant privatization efforts has led to a significant improvement in the budget primary balance by 2006. Declining interest payments reflecting the decline in risk premiums contributed to the reduction of the budget deficit and public debt.

However, financial performance has begun to deteriorate as of 2007. After the global crisis, primary surplus declined to 0.1% of GDP (3.5% in 2008) in 2009, while the general budget deficit declined to 5.5. % (From 1.8%).

In 2010, budget targets stronger than expected economic recovery were exceeded. The primary surplus of central government reached 0.8% of GDP and the budget deficit decreased to 3.6%. In the first half of 2011, tax revenues, which received aid from live private demand, increased significantly. In addition, the restructuring of public receivables provided revenues of US $5 billion. Accordingly, primary surplus doubled compared to 1Y2010 and reached US $16 billion. As a result of the reduced interest payments, the budget gave a surplus of US $2 billion in 2010, compared to US $2 billion, which was US $10 billion in 2010. The debts of the public sector decreased to 28% of GDP at the end of 2008 from 66%. However, with the worsening budget balances, public debt increased in 2009. In line with the decline in the budget deficit, debt indicators entered a downward trend in 2010. Total public debt, which was calculated by clarifying some public sector assets, declined to 4 percent to 29 percent of GDP at the end of 2010, while EU defined public debt declined to 42 percent of GDP. In January-July period of 2011, gross total public debt increased by 6% in TL terms. Thus, in the relative sense, the ratio of total debt to GDP is expected to remain roughly constant in this period.

Monetary and Exchange Rate Policies, Inflation

Turkey, in 2002, has adopted a free floating exchange rate regime and inflation targeting policy is a clear history starting from 2006. With the revaluation of the Turkish lira in favorable global conditions, inflation has declined significantly in the last decade.

Despite the decline to single-digit levels, inflation remained above the targets between 2006 and 2008, partly due to rising international intermediate goods prices. In this context, in 2008, the Central Bank revised its medium-term targets from the first 4% level to 7.5% and 6.5% for 2009 and 2010, respectively.

Along with the growth performance affected by the global crisis, the Central Bank has followed an irresistible monetary policy, which has resulted in large cuts in short-term policy interest rates (corresponding to O / N borrowing rates) since November 2008. Interest rates; In July 2008, it decreased gradually from 16.75% to 6.5% in November 2009.

As explained earlier in 2010, the Monetary Policy Committee set the one-week repo lending rate as 7% in May. The rates were kept unchanged throughout the year and were reduced by 50 basis points in December 2010, then fell 25 basis points in January 2011. The Central Bank has adopted a new stance starting from 4Q2010 with a focus on policy. stability in addition to the goal of price stabilization. The new policy mix of the Central Bank consists of the low reference ratio, the higher fluctuating O / N ratios and the high reserve requirements for short-term deposits.

In August 2011, the Bank reduced the one-week repo rate by 50 basis points to 5.75% due to the growing concerns over the impact of the European debt crisis on domestic economic activity. It also decided to narrow the interest rate band. By increasing the O / N borrowing rate to limit potential downward volatility.

Basic Indicators of The Financial Market Sectors

The Czech National Bank regularly publishes basic information on individual financial market sectors. In this way it gives experts and the general public access to basic quantitative data on the size, financial condition and prudential business of banks, credit unions, insurance companies, investment firms, management companies, collective investment funds, pension management companies and funds operated by pension management companies.

Foreign Trade and Foreign Debt

Positive external and domestic demand conditions, in the period before the global crisis has led to a significant increase in Turkey's foreign trade. While imports increased faster than exports, the trade deficit widened rapidly and led to a significant increase in the country's current account deficit. Note that Turkey's Customs Union at the beginning of 1996 due to the members of the European Union removed the customs duties for industrial goods.

With the contraction in global demand, exports of goods started to decline in the last quarter of 2008 and decreased by 23% in 2009 compared to the previous year. Imports contracted more rapidly, while current account deficit fell 67% to USD 14 billion.

However, this trend reversed in 2010: imports rose by 11% due to the recovery in domestic demand. The current account deficit leads to a sharp expansion. The deficit increased more than three times, reaching US $48 billion in 2010. The deterioration in the current account deficit continued at 1Y2011, which was US $45 billion, almost equal to the previous year's total. In order to limit this increase, various measures have been taken by the Central Bank and the Banking Regulation and Supervision Agency to limit the growth of bank loans and thus to limit domestic demand.

before the 2008 global crisis, Turkey's foreign debt grew rapidly at the end 3Ç2008 had reached US $ 290 billion. The external debt, which fell to USD 268 billion in 2009 after the global financial crisis, improved with the private sector's short-term debts in 2010 and 2011. Total debt increased to USD 290 billion at the end of 2010 and to USD 299 billion in 1Q2011. It should be noted that total external debt is composed of USD 77 billion of short-term debt and USD 222 billion of long-term debt.

In parallel with the large foreign capital inflows, the Central Bank's gross foreign exchange reserves increased to USD 75 billion in 3Q2008. After the collapse of Lehman Brothers in September 2008, CBRT reserves began to erode. However, it started to recover from 2Q2009 and reached USD 93 billion in July 2011.

CAPITAL MARKETS BOARD OF TURKEY

The Capital Markets Board (CMB) is the only regulatory and supervisory authority aiming to regulate and improve the safe, transparent and stable functioning of capital markets and to protect the rights and interests of investors. and widespread public participation in the development of the economy by encouraging investment in the securities markets in Turkey. The CMB was established as a self-financing public legal entity with administrative and financial autonomy, which was enacted in 1981 and authorized by the Capital Markets Law (CMB), which was enacted in order to fulfill its powers under this Law. The CMB has a board of directors consisting of seven members / commissars, two of which are chairman and vice chairman. The CMB's headquarters is located in Ankara and also has a regional office in Istanbul.

In addition to regulatory reforms, a public relations campaign to revive the initial public offerings was undertaken, and more recently an investor education campaign is being designed. As a result of these efforts, in addition to adequate macro-economic conditions, both the IPO market and the corporate bond market revived significantly starting from 2010.

The main duties and powers of the CMB are as follows (CMB, 2010):

• To regulate and control export, public offering and sales conditions.

capital market instruments for the implementation of this Law;

• Register capital market instruments to be offered to the public or to be offered to the public and put on the market the public offering of capital market instruments temporarily required by the public offering;

• Determination of the standard ratios for financial structures and use of resources Generally, according to the scope of activities or areas of activity, regulating the types of institutions and related principles and procedures of the capital market institutions subject to CML;

• To determine the principles related to independent audit activities,

When it is appropriate to use electronic media in capital markets; to determine the working conditions of the institutions and the working principles of the institutions in the independent audit activities of the capital market in accordance with Law No. 3568 dated 1 June 1989, Turkey to publish a list of the Chamber of Accountants and has these qualities;

• Achieving general and specific decisions to ensure that the procedure is timely and clarified. the principles, reports and their control for the publication of the financial statements; and the important information affecting the value of the tools and circulars issued to the public offering of the capital market instruments;

• Supervising the activities of issuers subject to CML Article 50 of the Capital Markets Board, provisions in capital market institutions and shares (a) clauses, channels and other organized markets for compliance CML, decrees, communiqués

All necessary information and documents of the Board of Directors and other legislation related to the capital market;

• Monitoring all relevant publications, announcements and advertisements. It is necessary to inform the Capital markets of any communication tool and to be misleading and to be duly informed about the relevant institutions.

In the turbulence in May-June 2006, foreign investors' bonds fell sharply.

The stock portfolio displayed an intangible change. As a result, both interest rates and exchange rates have increased sharply in a very short time. As illustrated by the May-June 2006 period, globalization is a challenge to monetary policy from at least two channels. First, it emphasizes the role of the exchange rate channel. A sharp deterioration in risk appetite can lead to a large portfolio outflow, threatening to disrupt both current and expected inflation. Second, the monetary authority's control over aggregate demand is reduced by controlling interest rates, because the risk of depreciation of the local currency results in a high and variable risk premium. As a result, this blurs the stance of monetary policy because assessing the neutral interest rate becomes more challenging.

1. Equity Market

As of June 2011, Istanbul Stock Exchange has 367 registered companies. The number of listed companies has been slack since 2007. However, the IPO market has revived significantly 2010 and the number of listed companies rose to 43 in a year and a half. After the 2001 economic crisis, the number of public offerings remained limited. During the period of 2005-2008, although the number of offers remained low, the size of public offerings increased significantly, especially due to privatized companies. Then there was a significant contraction with the global crisis in 2008 and 2009. The ongoing weak performance of the public offering market has launched a national campaign to promote public opinion. A cooperation protocol was signed between the Istanbul Stock Exchange (ISE). Turkey Chambers and Commodity Exchanges (TOBB), the Capital Markets Board (CMB) and the month in Turkey Capital Market Intermediary Institutions of the Union in August (Association) in 2008. The global crisis of the disappearance of the negative effects and abroad positive trend in the macroeconomic environment, was launched in 2010, according to IPO awareness campaign . above mentioned protocol. Various seminars were organized in the big Turkish cities where the managers are located. private companies were informed about the benefits of being open to the public. The campaign in this context was launched by various institutions and was launched by different institutions and a website. In the meantime, a similar protocol for promoting small and medium size IPOs was approved by related parties in February 2011.

2. Bonds & Bills Market

With the fall in inflation in recent years, interest rates have followed a downward trend. Turkey has increased confidence in the economy. At the end of 2001, the T-invoice rates, which were around 70%, fell gradually to 20% in 2008. In 2009, it fell to 8-9%. The limit with the rate cuts of the Central Bank. Following this sharp decline, the benchmark bond issuance declined to around 7% by the end of 2010. However, at the beginning of 2011, benchmark rates increased to 8.5-9% with new monetary results. Policy mix and increasing concerns over the global economy. Banks and intermediary institutions compete in the fixed income market. In 2011, 92% of the bonds and 80% of the Bank's trading volume and repo transaction volume were created by banks.

Public sector securities dominate the Turkish bond and bond market. Outstanding corporate bonds represent about 2% of the state debt. However, it should be noted after a long period of time, the corporate bond market was only recently revived. After 1994, the first corporate bond issue was realized in 2005. Following the revisions in related regulations to revive the markets and the decline in interest rates, the corporate bond market almost exploded in 2010. Total number The amount registered to the Capital Markets Board reached US $3.7 billion compared to 2010. US $ 289 million in 2009. This positive trend continues in 2011 and the size of the issue has already been exceeded In the first four months of 2011, $5 billion, especially with the help of bank bills.

3. Money Market

As stated earlier, the Central Bank of Turkey has adopted an inflation targeting policy. Following the global financial crisis, the Central Bank took measures to support financial liquidity The system, which started in the last quarter of 2008, lowered its policy rate. In the middle of the contract, the borrowing rates in November 2009 were reduced to 6.5%. With about 16% before global turmoil. In 2010 the National Bank agreed a week Lending rate of 7% as the reference interest rate on the monetary policy. The policy rate was reduced by 50 basis points in December 2010 and reduced by 25 basis points. In January 2011, rates were allowed to fluctuate in a wider range. Regarding domestic economic activity with increasing concerns, the Bank increased its one-week repo ratio 50 basis to 5.75% in August 2011 and narrowed the interest rate band. The trading volume in the Takasbank money market increased by 5% to $19. In 2010, the average daily trading volume of billions of dollars was US $77 million. With the new money policy, the daily trading volumes in transactions increased significantly, exceeding US $110 million in the first half of the year.

4. Futures Market

The TurkDex, the futures market, has been growing steadily since its launch in 2005. There has been a moderation in growth rate since 2008. In 2010, the annual transaction volume was 32% to 288 billion USD. The first half of 2011 indicates only 2% of inadequate growth. Unlike fixed income market, brokerage houses receive lion's share in futures purchases. The transaction volume of brokerage houses was 85% in January-June 2011. TurkDex has 4 group contracts as shown in the table. Trade is mainly concentrated on ISE-30 index contracts. USD / TL foreign exchange contracts are second.

5. Asset Management

In 2010, the total portfolio of institutional investors increased by 25% to USD 35 billion. This significant increase reflects the growth in real estate investment funds (REITs). Regarding Regulatory REITs, in 2010, amendments were made to the minimum free float requirement (from 49% to 25%) and the duration of the list condition (3 months between 1 and 5 years). Total assets under management increased by 6% in 1Y11 with the ongoing growth in REITs. REICs represent 22% of total assets under management and 7% at the end of 2006. The private pension system has been growing exponentially since its entry into force by the end of 2003. Pension funds continued to grow in 2008 and assets under management reached US $ 8.3 billion as of June 2011. Its share in total assets reached 22%. End of 2006 by 10%.

As a result of the growth in pension funds and REITs, the share of fixed income investment funds, which account for 3/4 of the assets managed in 2006, now represents only half of the assets. On the other hand, equity mutual funds correspond to 3% of the managed assets.

Importance of Capital Markets

Capital market is the market where the investor evaluates the investor's savings investments with a certain return expectation. People in need of funding provide funding through the issuance of stock or debt securities by using the capital market.In addition, some sector investors who want to carry out risk management can minimize their risks by using their derivatives, hedge and arbitrage methods. In addition to risk management, the capital market is a market in which small amounts of savings, which are not only useful to the economy, can be invested in investments such as debt and equity, converted into investments and thus mobilizing the economy.

Primary Market

It is the market where securities, bonds, securities and fund needs and those who are saving are directly facing. Ir IPO ğ is an example of a primary market. The public offering company issues shares to finance and owners invest in these stocks and evaluate their savings.

AGENDA OF THE TURKISH CAPITAL MARKETS

1. Regulations