#and i was just getting lucky with work via random companies trying to cash in on this fad

Video

decided to make a reel of my augmented reality artworks done over the past few months and MAN, it’s.......... suddenly hitting me just how absolutely nuts all of this is

six years ago, virtual reality was still firmly in the realm of science fiction. but now? not only is it real - but it’s possible to have a career working completely inside a virtual world where you have godlike controls over creation. (editing physics, light, gravity - and spawning things into existence on a whim? mind-mindbogglingly, this is somehow just my average workday)

I regularly spend so much time in-headset that it’s started re-wiring my brain; I think of landscapes and buildings as potential canvases for 3D digital artworks, and I sometimes struggle to differentiate virtual objects from reality. (I’ve tried to place real objects on virtual tables, and I instinctively step over/around virtual objects because of how REAL they appear and behave.)

our brains work by building a picture of reality via our sensory input, but what happens when that input is completely virtual? virtual reality is showing us that not only are our brains easily tricked, but that this is already happening even with the technology in its infancy. people using avatars with full-body tracking report ‘phantom sense’ sensations to virtual touch, heat, and cold - and haptic gloves & suits are in development that blur the lines between realities even further.

what will a world look like where we interact with cyperspace as if it was real? where you can meet with anyone, anywhere, in a virtual world you can both touch, hear, and (probably someday) smell or even taste? where job training, 3d design, therapy, education, etc. are all revolutionized by XR in the same way personal computers revolutionized them already?

what does a future look like where we don’t interact with digital media through a screen?

I don’t have the answers, but I think change is encroaching rapidly upon us all - and I think it’s gonna hit us faster than any of us can realize.

#auropost#virtual reality#metaverse#augmented reality#i usually don't share my futurist ramblings here#because for a long time i thought the whole metaverse things was a fad#and i was just getting lucky with work via random companies trying to cash in on this fad#but............ i don't think it's just luck anymore#i am lucky to be an early adopter of xr#but everything else just feels like a pandoras box situation with no going back#because i've seen too much and know just how many powerful entities are pouring effort into creating this#every time i think about it too hard i'm just like holy SHIT how did i get here#my life has been turned completely upside down over the past year just because of megacorporations battling for control over the metaverse#and the pool of skilled creators in this field is so small that they're coming to ME!!!!!! of ALL PEOPLE!!!!#a random trans artist with no formal training and one million imposter syndrome#and i don't know what the moral of this story is yet#but i'm hoping it's something along the lines of 'if i can make it anyone can'#anyways that's my rant about feeling awe and wonder at technological progress and the novelty that awaits us#hold on to your hats because it's about to be one hell of a ride

75 notes

·

View notes

Text

I want to hear about everyone's weirdest and most dubious jobs. I'll go first!

Since I'm studying English, at 19 I thought I was lucky to get a job working for a local publishing company, until I found out that the "local publishing company" was in fact just this one really old rich dude who was using his family's fortune (much to their displeasure) to fund his horrible crappy self-written books about dermal skin fillers that he tried to sell to random dermatologists around the country by making them "co-authors".

He wanted me to contact and try to sell to these doctors via cold-calling and email, but the first manuscript copy he sent me was so appalling in terms of grammar, spelling, structure (some chapters were repeated twice), and medical inaccuracy that I could not sell it in good conscience. When I expressed concerns, he told me that it was fine because he had already run it past his "editor", which I'm convinced was just the lousy Microsoft Word spellchecker. I had to sit down for fourteen unpaid hours and edit the entire thing to the best of my ability, but even then all I could do was fix grammar and a few structural issues, and some of the grammar was SO terrible that I could not even tell what it was supposed to be saying. I had to cut those chunks out, along with a few areas where the medical inaccuracy looked especially dangerous.

Not ONCE in the several months of me working for him did he make a single sale, and in fact one of the only doctors who responded to my emails did so to express concerns about the manuscript. I desperately wanted to reply to her and tell her she was completely right and my publisher wouldn't even let me do any more editing.

But what DID happen was the old guy's family cut him off to make him stop wasting money on his failed business, finally making him stop. He owed me over $1,200 in unpaid wages by the end, because he had kept putting off paying me and the other employees with the excuse that the business was making no sales and he's pay us back later when he did get some. I had to get my dad on his tail like a passive-aggressively friendly mafia enforcer to repeatedly email and pester the guy to make him pay me back. He did so grudgingly and while complaining the entire time, in small chunks of money orders and loose cash over the course of about a whole year. Wild ride!

#this is the job where i got scarily good at hunting down people's emails online#because i hated calling these random doctors and getting hung up on. yay for RSD!#emma talks#very ethically dubious all around! and now i know way too much about how botox and lip fillers work

12 notes

·

View notes

Text

Free Slots Real Money Instantly

Where can I play free slots? You can play free online slots right here on our site. SlotoZilla has more than 3,000 of the best free slot games available for players. Are the payout percentages different between real money and free play slots? No, payout percentages are identical whether you place real money bets or play free online slots machines.

Free Slots Real Money

How to enter: Create your Free Slots 4U player account. Just fill in a few details on our join page & once you've done that you'll be able to log into our slots, save your scores and enter our competitions!

Gamers can play free online slots no download no registration instant play with bonus rounds and features without depositing cash except they want to play for real money. Casinos offer the online pokies for fun on as a demo game for players to learn tips & strategies of slot machines.

While online casinos offer the real money kind (some also offer a demo version), SlotsCalendar offers only free slots (and a link to the best casinos where you can play them for real). All the hundreds and hundreds of slot machine games on our website have a play for fun link that allows you to play demo slots for fun whenever you want, from.

5 Ways to Win!

For many people, playing free slots for fun is a popular past time. However, we believe it can be even more exciting if you have the chance to play free slots & win real money with no deposit required. Every month we run free prize competitions that feature no deposit slots with free money prizes! There are no restrictions on how many times you can enter and you can even win multiple times!

Most months we have 5 or more ways you can play our slots for free for the chance to win real prizes: Monthly Slots competitions, month long $50 freeroll tournament, sponsored slots tournaments with casino bonus prizes, seasonal competitions, progressive jackpot games & our $20 Lucky Player of the Week prize!

1. Monthly Play & Win Slots Competitions

Our games have real cash prizes so you can play free slots & win real money! See below for the current slots competitions.

Play our Mega Infinity Slots game during March for the chance to win $50.

Play our Super Scatter Slots game during March for the chance to win $50.

2. Seasonal Competitions

At certain times of the year we run seasonal and themed competitions such as Easter Egg hunts! Watch out for competitions around St Patrick's Day, Christmas, Halloween, the 4th of July & more!

Play our St. Patrick's Lucky Spin slots game during March for the chance to win $50.

3. $50 Monthly Freerolls!

Our monthly Freeroll slots tournaments start on the 1st of every month. The goal in these tournaments is simple: Score enough points to get onto the top ten leader board and you could win the $50 prize!

March Leprechaun Loot Freeroll Tournament

To celebrate St Patrick's Daty we're giving all our members the chance to win $50 in the March Leprechaun Loot Freeroll. This month long tournament features our Leprechaun Loot slot game.

Win $50 in the Free Slots 4U March Freeroll tournament.

4. Lucky Player of the Week - Win $20!

Entry is automatic and free when you play any of our slots games and save your scores on the leaderboards. Each week we pick one player at random from all players with scores saved on active leaderboards. The winner is announced in our Friday newsletter and wins $20.

Top Tip: The more scores you have saved across our slots leaderboards, the greater your chance of being picked at random and winning the prize cash! It really does pay to play more slots games at freeslots4u.

How to check if you have won. For the competitions featured above be sure to check your Friday newsletter on the first Friday of the month. If you are a winner your username will feature in the newsletter and you can then Contact us to claim your prize!

5. Progressive Jackpot Slots Competitions

Play our exclusive Progressive Jackpot games and every time you (or someone else) spins the reels the Progressive Jackpot prize fund increases. If you win one of our Progressive Jackpot slots you could win $20 cash!

A Progressive Jackpot game will alert you when you win the jackpot. You must then visit the Progressive Jackpot games page where you can see all the progressive jackpot prize winners. If you see your name listed as a winner, click the claim button to claim your prize. There is a deadline for prize claims so act fast!

6. Sponsored Slots Tournaments

In partnership with some of the biggest casinos, we run exclusive slots tournaments. This type of competition has been running the longest on our site and every tournament is sponsored by a casino. Prizes from these tournaments are paid into your player account within the sponsoring casino. For more information about these please see our tournaments page. Winners of sponsored slots tournaments are contacted via email once the tournament has ended and scores have been checked.

EXCLUSIVEWELCOME OFFERDEPOSIT $100PLAY WITH $350

Play best slot machines on mobile, tablet, Mac or PC

SPIN THE REELSWITH SUPER DEALS!DEPOSIT $100PLAY WITH $350

Instant Deposits& Fast Withdrawals

Try a new Gameslots game with300% NO MAX CASHOUT + 30 FREE SPINS

Redeem the Exclusive Coupon at Cashier:Redeem code:PADDY300

Premium GamblingExperience Garanteed

1

2

CHOOSE YOUR BONUS & DEPOSITRedeem your coupon code at Cashier

3

Play Real Slots anywhere on Mobile and Desktop

Players have access to online casino slots and games on the free Slots of Vegas PC app, Mac site, and mobile casino, which has been formatted for incredible gameplay on your tablet, Android mobile or iPhone. Fancy playing French roulette while lounging on a yacht on the Riviera? Be our guest! Wanna play Texas Hold ‘Em on your way to work in Austin? Go for it. You can play online slots for money anywhere with Slots of Vegas. Seriously!

Fast and Secure Banking Methods

Slots of Vegas offer several forms of popular banking methods. This is to make sure your overall experience is easy, smooth and efficient while you play slots online for real money! You can deposit using credit cards like Visa and MasterCard, wire transfers, checks, and even bitcoin. Withdrawing funds is just as easy! You have the ability to deposit cash using one method, and even withdraw using another one for a quick and painless payout. Because at Slots of Vegas, your safety is always guaranteed.

Trusted Online Slots Casino

Free Slots Real Money

We’re dedicated to providing a trustworthy and entertaining experience for all our players. Our casino along with all our online slot games are certified by Gaming Labs International; a company comprised of highly trained professionals including mathematicians, hardware and software engineers, and quality assurance specialists who test and certify the mechanics of our games. Slots of Vegas is a McAfee and Norton Anti-virus certified site, ensuring secure navigation and software download. Oh, yeah – we’ve got the stuff all right!

0 notes

Text

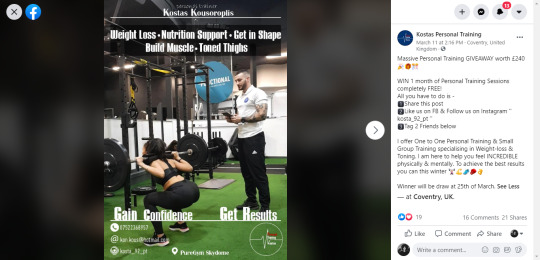

14 Timeless Fitness Giveaway Ideas Your Customer Will Love

Between online marketing and managing your gym, you still need to drive new sign-ups and foot traffic for your gym. Giveaways allow you to attract new customers, increase followers, and shine a spot line on the services your gym has to offer.

At Wishpond, we're very familiar with the power of giveaways! In fact, we've helped to generate over 100,000 leads and then some with giveaways. BHU Foods gained over 1000 new followers on Instagram and Facebook with the help of giveaways.

Not to mention that contest CTA's have a 3.73% higher conversion rate when compared to other CTA's. So contests are also perfect for getting traffic to your website.

Today I'll be showing you 14 timeless fitness giveaway ideas your customers will love and how they can help to increase business.

1. Transformation Challenge Giveaway

There are over 200,000 transformation challenge hashtags on Instagram alone. When it comes to fitness before and after or transformation pictures, people just can't get enough. The story of the underdog meeting their body goal is a timeless story for those who go or went to the gym.

Hosting a transformation challenge giveaway can help to boost your gym in multiple ways. The contestants are already determined to use a gym to meet their goals, why not encourage them to go to yours, or appeal to new gym members.

Host a transformation challenge lasting for 2-3 months. This gives everyone enough time to master a fitness routine and time to meet their goal weight. Have weigh-ins so measure how far contestants are to meeting their goal weight.

Once you've found a winner, don't keep it a secret, let your gym know and host an award or prize-giving ceremony at your gym.

2. Free Access to Paid Online Training Giveaway

Some giveaways don't have to be physical gifts, instead, host a giveaway providing free access to your paid online training. This is perfect for targeting people who might want to work out from home, and this can drive awareness to your target audience that your gym even has a paid online training program.

You can ask contestants to enter on your contest landing page, or you can drive your fitness contest to social media to gain more exposure.

3. Share & Repost Giveaway

Looking for a low-maintenance giveaway that drives just as much exposure to your gym? Try a share and repost giveaway. Create a giveaway post on your social media platform/ or a tweet (if Twitter is where most of your followers are located) and ask persons to repost/retweet or share to be automatically entered to win.

Attention #Fitness Fanatics!

We Understand How You Feel, Not Being Able To Go To The Gym

It Sucks. Doesn’t it#COVID19 Can’t Stop You From Getting Your Gains! #Win A Push Up Board And Chin Up Bar In Our #Competition

Tag 2 Friends, Like This Post And Retweet To Enter pic.twitter.com/iY5iRm3Omh

— The Peak Fitness (@ThePeakFitness1) March 23, 2020

You can select the person at random or the person whose retweet/share has the most likes, when people engage with your content, social media platforms like Instagram, Facebook, and Twitter reward content that attracts engagement. Their algorithm will push your content above the rest, and your account becomes far much easier to find in the discovery tab.

If your content goes viral, then your hashtag and company will get massive exposure.

4. Gym Review Giveaway

For new gyms and fitness brands who need help in boosting their online credibility, reviews can drive customers your way. Bright Local found that 93% of local consumers use reviews to determine if a local business is good or bad.

You can host a gym/brand review giveaway to get the ball rolling. Ask customers or gym members to post or leave reviews on your Facebook page, website, yelp, or under a contest post and choose the best review or winner at random. You can reward the winner with products, a 50% discount, or VIP gym perks to sweeten the deal.

5. Gym Snacks and Product Giveaway

This is a giveaway article, so you shouldn't be surprised when I suggest hosting a product giveaway. Create a giveaway package of popular gym snacks, powders, and treats for followers to win.

? Competition Time - Win June’s Fit-Box! ?

Just follow us, retweet this post and tag a gym buddy for your chance to win!

Winner chosen Wednesday evening and if you're already signed up you can still win ?

Good luck! pic.twitter.com/RmSNnr37P5

— The Fit-Box (@TheFit_Box) June 10, 2019

You can also think of reaching out to fitness food brands and doing a co-promotion. A co-promotion is done when two or more brands come together to combine marketing efforts to increase brand exposure.

6. Fitness or Gym Wear Giveaway

When hosting a giveaway, you want to make sure that the prize you select attracts your target audience, people who love fitness or at least the idea of it. What screams fitness like having gym wear as a prize for your next giveaway.

✨COMPETITION✨ We are giving away the Vascular Wear gym hoodie! RT & Follow to #win #giveaway https://t.co/e6WS5fNK7W pic.twitter.com/hWbnLKPS65

— Anax Fitness (@Anax_Fitness) June 13, 2016

7. Customized Meal Plan Giveaway

Meal plans are an essential part of anyone's fitness journey. Whether you're a seasoned gym-goer or a newbie, meal plans are essential aspects of the health journey. Host a giveaway giving free meal plans based on body type and weight goals.

8. Fitness Shopping Spree Giveaway

Who doesn't love free stuff? Give your followers the chance to choose what they'd like to buy instead. Host a fitness shopping spree giveaway, select your entry method, and allow the winner to decide to buy from a gym site, items in your story, or a cash prize.

A fitness enthusiast who enjoys a routine trip to the gym? Or maybe you're a wandering traveler who loves a spontaneous trek to the outdoors. We're getting you Ready to Play by providing one lucky winner with a $500 shopping spree. #Giveaway

Enter here: https://t.co/42pDgr8ay8 pic.twitter.com/o1Fq0rup1Y

— Big 5 Sporting Goods (@big5since55) March 21, 2018

9. Gym Gift Card Giveaway

Next to a shopping spree, a gym gift card is the next best thing. This type of giveaway is much more effective if you already have a growing following on online. If you're a brand new gym, then you might want to offer this for free instead of as a giveaway to drive foot traffic to your gym.

10. 1-On-1 Personal Training Sessions Giveaway

Most people have a fitness goal in mind before they sign up for gyms, but they're unsure how to get there or what equipment they need once they join the gym.

With a 1-on-1 personal training giveaway, you're sure to attract fitness enthusiastic. Allow the winner to get 2-3 free personal trainer sessions to get the full effect of the trainer's guidance in the gym. During or after the sessions, the person should post positive reviews on your website, yelp, or social media.

11. Access to VIP Services Giveaway

If your fitness brand or gym has a VIP service or club, time to show it off! Host a giveaway giving the winner access to your VIP services for some time. The giveaway should last for a short period to build FOMO and drive people to enter before the deadline.

Once you've announced the winner (with their permission), post them on social media or do a video highlight of them enjoying all your VIP services.

12. Free Gym Membership Giveaway

Offering free gym membership as your giveaway prize can create a buzz in your local community and customers. This giveaway also works as a win-win for you and your brand. You'll build brand awareness to newly discovered customers, and you can capture emails or followers to use for future lead generation.

Don't miss out on your chance to win a 3-Month membership for FREE to @GoldsGymSoCal!

Post your workout and tag @GoldsGymSoCal and #GoldsGymSoCal on Facebook, Instagram, or Twitter and WIN!

Visit @GoldsGymSoCal Instagram for more information. pic.twitter.com/tQnuHBhHoj

— Golds Gym SoCal (@GoldsGymSoCal) March 25, 2020

13. Offer a 2-4-1 Special Giveaway

During slow periods or the holidays, you can host a free 2-4-1 giveaway where two new gym members get free membership for 1-3 months. After the special, you can charge gym members at full price. And with two sign-ups instead of one, the odds of more members renewing their membership is higher.

14. Host a Giveaway with a Popular Fitness Influencer

Influencers are no strangers to gyms and fitness brands; influencer marketing is a multi-billion dollar industry. Gyms like Soulcycle, Fit Body Boot Camp, and Budo Canada.

Reach out to a famous fitness influencer to help you to host your giveaway. Ask customers to enter for a chance to train the day with their favorite fitness influencer or drive your influencer's followers to your own social media pages.

Summary

Hosting a giveaway is easier than you think. It's important to set a goal, and this will influence what giveaway platforms, entry methods, and the prize you'll use to create a successful fitness giveaway. Here's a quick recap of the 12 timeless fitness giveaway ideas your customer will love:

Transformation Challenge Giveaway

Free Access to Paid Online Training Giveaway

Share & Repost Giveaway

Gym Review Giveaway

Gym Snacks and Product Giveaway

Fitness or Gym Wear Giveaway

Customized Meal Plan Giveaway

Fitness Shopping Spree Giveaway

Gym Gift Card Giveaway

1-On-1 Personal Training Sessions Giveaway

Access to VIP Services Giveaway

Free Gym Membership Giveaway

Host a Giveaway with a Popular Fitness Influencer

Related Articles

13 Fitness Landing Page Examples Critiqued

13 Brilliant Gym Event Ideas to Build Your Gym

How to Start a Bomb Fitness Instagram Account (With Examples)

from RSSMix.com Mix ID 8230801 https://ift.tt/35dANtk

via IFTTT

0 notes

Text

Things To Consider Before Selling Your Business (Baby)

One of my luckiest investment decisions was not selling anything during the 2008-2009 financial crisis. I just held on for dear life, continued to max out my 401(k) and squirreled away anything left into an online savings account or CD.

In 2012, I got lucky again by receiving zero offers for my SF primary residence. Facebook just went public, but nobody wanted to buy my home. As a result, I held on, paid down more of the mortgage, earned some rental income, and then finally sold it five years later for 68% more.

In 2015 and in 2018 I passed on selling Financial Samurai. To sell before realizing my goal of writing 3X a week for 10 years would have made me feel like a quitter. Then in August 2018, Google had a large algorithm update that has since boosted organic traffic by 50%. That was an unexpected upside surprise, especially since the site has been around since 2009.

It sure seems like the secret to creating wealth is to consistently save, invest, grow, hold and build for the long-term. Almost every significant wealth event in my life has taken at least five years to stew.

Things To Consider Before Selling Your Business

We know there are three main sources of wealth: 1) your job, 2) your investments, and 3) your business. Most people erroneously focus just on their job. Savvier people focus on one and two.

But to really build next level wealth it’s worth doing all three. Start a business, own as much of the equity as possible, grow the business, and reap all the rewards.

Being an employee is fine. It’s just that without equity, it’s really hard to get very wealthy. You’re essentially working to make someone else rich.

You don’t have to build a big business. A small one that provides joy and boosts your overall income by just 10% is fine too. Over time, you just never know how large your business might grow if you stick with it.

If you’ve started a successful business and are thinking about selling it, here are some questions and considerations to go through before letting go of your baby. I’ve shared my thoughts as well as I consider retiring for a second time.

1) An attractive valuation. You must consider the valuation multiple compared to the overall S&P 500 and companies in your space. You must also consider the payback period and your likelihood of lasting beyond the payback period if you don’t sell. The stronger your expected future earnings growth, the higher the valuation multiple you should demand.

Wise public companies buy promising private companies at lower valuations. If a public company is trading at 20X earnings, it should buy private companies trading at lower earnings multiples with higher growth rates all day long. If it does, each acquisition will automatically be earnings accretive.

My thoughts: I don’t want to sell Financial Samurai because I think valuations are too low for private media businesses. Let’s say I’m offered 6X operating profit. This pales in comparison to the average 22X multiple for the S&P 500.

After six years of simply maintaining operating profit, I will have covered the entire purchase price. But every year after six years would be pure gravy. The payback period when all is recouped is also the point of serious regret for many entrepreneurs who sell.

Further, if I can actually grow operating profit instead of let it stay stagnant, it makes even more sense to hold on.

For illustrative purposes, let’s say someone offers me $6 million based off 6X operating profit of $1 million. If I can grow operating profit by 20% a year, the operating profit will have grown to $2.49 million after five years. In other words, I would have ended up only selling my business for 2.4X operating profit, which would be like getting mugged in a dark alley! And if I ended up selling for 6X operating profit five years from now, I could get $14.94 million instead of just $6 million.

The only way I’d ever sell is if someone offered me at least 12X operating profit due to consistent earnings growth and my ability to keep on going for at least five more years. You’ll have to make an assessment on what’s the right valuation for your business.

2) Cash generator or money loser. You either have a business that is losing money, but hopefully growing at a fast pace or you have a cash generating business that is usually growing at a more steady pace. If you have a money-losing business that isn’t growing, then you need to sell ASAP.

A money-losing business is unsustainable over the long term unless the business can continuously raise money from outside investors to fund operations. Uber, is a great example of a fast grower that lost $1.8 billion in 2018. Yet, because they are able to raise ~$9 billion from its IPO, the company should be able to fund its operations for at least five more years given its losses are shrinking (lost $2.2 billion in 2017).

If you have a cash cow business, then selling in a low-interest rate environment as we have now is a much harder decision to make. The reason is because a much higher capital amount is needed to generate a specific amount of income.

Look at the chart below. It shows the different amounts of capital needed to generate $55,000 and $20,000 in annual income at different interest rates. By a significant margin, cash cows are much more valuable today than they would be if interest rates were higher.

My thoughts: The core costs to run Financial Samurai include server cost, e-mail software cost, random website maintenance cost, and my time. Depending on how I value my time, operating my website results in 70% – 98% operating profit margins. In comparison, Apple’s operating profit margin is roughly 28% and Microsoft’s operating profit margin is roughly 31%.

Huge operating profit margins is one of the main reasons why everybody should start their own website. There is little downside if you fail, except for your time and maybe a little ego bruising.

It’s not like you have to come up with a million dollars to start a restaurant to pay rent, remodel a space, buy food, and hire staff. A website is just you and your own creativity.

Given I believe interest rates will stay low for the rest of my lifetime, the value of owning a cash cow should also stay high for the rest of my lifetime.

10-year bond yield has been coming down since the late 1980s

3) Your personal goals. Do you want to sell for a profit or build a legacy? If your desire for maximum profits is strong, then selling your business may make more sense if you get the right offer. If you desire to build a long-term business because it gives you purpose and joy, then selling your business makes less sense. Decide what your personal goals are for your business.

My thoughts: I didn’t start Financial Samurai to make money. I just needed an outlet to address my fears during the financial crisis. Instead of smoking or drinking heavily, I decided to write. I think you can tell that I enjoy writing, otherwise, I wouldn’t author practically all of Financial Samurai’s content. If I hated writing, I would hire a bunch of freelancers to write lots of product review posts to try and maximize my revenue. But so far, I haven’t.

My purpose for Financial Samurai is to have a creative outlet to share my thoughts on a weekly basis. It feels good to get thoughts on paper and hear different perspectives from the community. To be able to formulate an idea, put it in writing, and releasing it to the world is very gratifying.

A new goal is to run Financial Samurai long enough to teach my boy about online media, communication, and entrepreneurship. As an overrepresented minority at top universities, I assume it will be tougher for him to get in. I assume he will also get discriminated against in the workplace due to an underrepresentation of minorities in leadership positions. Therefore, it’s nice to have an insurance policy to skip university and the matrix all together.

He might have zero interest in learning about online media, but at least I can talk to him about the importance of creativity, consistency, and work ethic. A small business has many of the same departments as a large business e.g. finance, marketing, sales, production, etc.

Finally, what a wonderful way to communicate with family and friends long after I’m gone. I remember replaying over and over an old voicemail recording of a middle school friend who shockingly passed away in a car accident. If I were to die today, at least my wife and toddler will have hundreds of recordings and thousands of articles to go through.

4) Your view of the future. Do you see your business growing or fading? Can you create different products or revenue streams due to the strength of your brand? What are some new technologies that might disrupt your existing business? Are you capable of adapting?

Businesses fade away all the time. The murkier the future, the more you should consider selling.

My thoughts: I’ve always believed that if you can build a brand, your business will do even better in the future. Think about how many different business lines Virgin is in. Richard Branson has built an incredible, edgy brand that has enabled him to get into music, transportation, hotels, and more.

Financial Samurai is a fierce brand in the personal finance space that digs deep into the numbers and provides no BS analysis and answers. Everything is written based on firsthand experience because money is too important to be left up to pontification.

By establishing a brand that goes against the status quo (e.g. engineer your layoff vs. quit), plenty of new products can be created to leverage the brand. With only one book, I’ve barely gotten started on the business aspect of things. Now that my brand is established, I truly believe the opportunities are endless.

I envision a future where the consumption of online media via mobile devices only continues to grow. I see opportunity for Financial Samurai to expand internationally, especially in Asia and Europe.

Written content will never go away. It is by far the fastest way to consume information. Audio and video will continue to grow, and these are mediums I can easily utilize.

5) Will the money change your life. You can’t fault someone for wanting lots of money. If the sale of your business can significantly change your life for the better, then selling is absolutely an attractive decision. If the financial windfall doesn’t do much for your life, then you will likely feel a great let down because doing something mainly for money tends to feel empty.

My thoughts: The money received from selling Financial Samurai won’t change our lives. The only thing I might do is buy a bigger house. But I’ve already done the analysis on a larger house before, and it doesn’t feel worth it. Instead of feeling joy, I feel my headaches of owning a larger property with a $55,000 annual property tax bill would only multiply.

With the windfall, I’d give more money to a foster youth organization I volunteer at. I’d pay for a luxurious cruise for my parents. If my parents wanted, I’d also pay for their home remodel while putting them up in a nice temporary housing condo in Honolulu.

Other than these things, there’s really nothing more I’d do with the money except investing it in passive income generating investments. When you are already free to do whatever you want, having more money doesn’t move the happiness needle much.

6) Will you regret not selling if the market turns south. Fantastic selling opportunities open up only so often. If you pass, can you live with your decision that you could have gotten so much more if you sold earlier? Do you have the patience to wait for another 10 years for the next fantastic selling opportunity?

For example, Yahoo was once once worth over $100 billion and eventually sold itself to Verizon for only $5 billion. The good times don’t last forever.

My thoughts: I’m sure I’ll regret not selling today if I could only get 95% less years later. Meanwhile, however, I will have gotten a priceless amount of joy building Financial Samurai. It’s cool to have a web property I can click on from anywhere in the world.

It’s the same type of pride and joy you get as a parent when you look at your kid and think proudly, I helped make that. If you truly love your kid, you would never sell him or her. The same goes with your business, sometimes to your detriment.

I also am pleased with the steady growth of the Financial Samurai Forum. It feels like a new website with different offerings I will help nurture. I’m sure it will grow into a tremendous destination if I can manage it well over the next five years.

7) Will the new buyer be a good steward. You don’t want to sell your business to anybody. Instead, you want to sell your business to someone who believes in your vision and carries out many of the things you’d like to do, but don’t have the ability or energy to do on your own.

Consider selling your business similar to giving away your daughter or son’s hand in marriage. You’re definitely not going to let your daughter or son marry a scumbag.

My thoughts: After several conversations, I finally warmed up to someone who I think could really grow Financial Samurai and improve the user experience. Like me, he is a father, but to three boys. He has a team of hundreds of writers and developers who could create a lot more value. Let’s see where this relationship takes us. I’m definitely going to take my time finding a proper suitor.

Enjoy Your Business For As Long As Possible

The joy you get from creating something out of nothing far outweighs any joy you get from making a lot of money. Yes, there will be difficult times when you’ll just want to sell and quit. Do your best to keep on going.

I know of several people who sold their online businesses for the money and later became depressed because they didn’t have a purpose anymore. Many in the online media space tried to re-create the magic and failed. They became irrelevant.

Money really doesn’t bring much more happiness once you’re earning enough to have all your basic needs met. Some say that number is $75,000 a year, while others believe $300,000 a year is more likely in a HCOL area.

If you feel the end is near for your business, definitely try and sell. If someone gives you a crazy offer way outside average valuation multiples and you’re burned out, then accept their offer with open arms.

But if you continue to enjoy what you do and see growth potential, then keep on going. The legacy you leave will be wonderful. Just remember to always keep an open mind as there is a price for everything.

Not a day goes by where I’m not thankful for launching this site in 2009. It has given me more joy and purpose that I ever thought possible. Thank you!

Related posts:

How To Start A Profitable Website

Real Estate Versus Blogging: Which Is A Better Investment?

Bankers, Techies, And Doctors You’ll Never Get Rich Working For Someone Else

Readers, any entrepreneurs out there who have sold their business? How did you feel when you sold and how did you feel once you reached the payback period? What are some other considerations entrepreneurs should consider before selling? Graphic by kongsavage.com

The post Things To Consider Before Selling Your Business (Baby) appeared first on Financial Samurai.

from Finance https://www.financialsamurai.com/things-to-consider-before-selling-your-business/

via http://www.rssmix.com/

0 notes

Text

Things To Consider Before Selling Your Business (Baby)

One of my luckiest investment decisions was not selling anything during the 2008-2009 financial crisis. I just held on for dear life, continued to max out my 401(k) and squirreled away anything left into an online savings account or CD.

In 2012, I got lucky again by receiving zero offers for my SF primary residence. Facebook just went public, but nobody wanted to buy my home. As a result, I held on, paid down more of the mortgage, earned some rental income, and then finally sold it five years later for 68% more.

In 2015 and in 2018 I passed on selling Financial Samurai. To sell before realizing my goal of writing 3X a week for 10 years would have made me feel like a quitter. Then in August 2018, Google had a large algorithm update that has since boosted organic traffic by 50%. That was an unexpected upside surprise, especially since the site has been around since 2009.

It sure seems like the secret to creating wealth is to consistently save, invest, grow, hold and build for the long-term. Almost every significant wealth event in my life has taken at least five years to stew.

Things To Consider Before Selling Your Business

We know there are three main sources of wealth: 1) your job, 2) your investments, and 3) your business. Most people erroneously focus just on their job. Savvier people focus on one and two.

But to really build next level wealth it’s worth doing all three. Start a business, own as much of the equity as possible, grow the business, and reap all the rewards.

Being an employee is fine. It’s just that without equity, it’s really hard to get very wealthy. You’re essentially working to make someone else rich.

You don’t have to build a big business. A small one that provides joy and boosts your overall income by just 10% is fine too. Over time, you just never know how large your business might grow if you stick with it.

If you’ve started a successful business and are thinking about selling it, here are some questions and considerations to go through before letting go of your baby. I’ve shared my thoughts as well as I consider retiring for a second time.

1) An attractive valuation. You must consider the valuation multiple compared to the overall S&P 500 and companies in your space. You must also consider the payback period and your likelihood of lasting beyond the payback period if you don’t sell. The stronger your expected future earnings growth, the higher the valuation multiple you should demand.

Wise public companies buy promising private companies at lower valuations. If a public company is trading at 20X earnings, it should buy private companies trading at lower earnings multiples with higher growth rates all day long. If it does, each acquisition will automatically be earnings accretive.

My thoughts: I don’t want to sell Financial Samurai because I think valuations are too low for private media businesses. Let’s say I’m offered 6X operating profit. This pales in comparison to the average 22X multiple for the S&P 500.

After six years of simply maintaining operating profit, I will have covered the entire purchase price. But every year after six years would be pure gravy. The payback period when all is recouped is also the point of serious regret for many entrepreneurs who sell.

Further, if I can actually grow operating profit instead of let it stay stagnant, it makes even more sense to hold on.

For illustrative purposes, let’s say someone offers me $6 million based off 6X operating profit of $1 million. If I can grow operating profit by 20% a year, the operating profit will have grown to $2.49 million after five years. In other words, I would have ended up only selling my business for 2.4X operating profit, which would be like getting mugged in a dark alley! And if I ended up selling for 6X operating profit five years from now, I could get $14.94 million instead of just $6 million.

The only way I’d ever sell is if someone offered me at least 12X operating profit due to consistent earnings growth and my ability to keep on going for at least five more years. You’ll have to make an assessment on what’s the right valuation for your business.

2) Cash generator or money loser. You either have a business that is losing money, but hopefully growing at a fast pace or you have a cash generating business that is usually growing at a more steady pace. If you have a money-losing business that isn’t growing, then you need to sell ASAP.

A money-losing business is unsustainable over the long term unless the business can continuously raise money from outside investors to fund operations. Uber, is a great example of a fast grower that lost $1.8 billion in 2018. Yet, because they are able to raise ~$9 billion from its IPO, the company should be able to fund its operations for at least five more years given its losses are shrinking (lost $2.2 billion in 2017).

If you have a cash cow business, then selling in a low-interest rate environment as we have now is a much harder decision to make. The reason is because a much higher capital amount is needed to generate a specific amount of income.

Look at the chart below. It shows the different amounts of capital needed to generate $55,000 and $20,000 in annual income at different interest rates. By a significant margin, cash cows are much more valuable today than they would be if interest rates were higher.

My thoughts: The core costs to run Financial Samurai include server cost, e-mail software cost, random website maintenance cost, and my time. Depending on how I value my time, operating my website results in 70% – 98% operating profit margins. In comparison, Apple’s operating profit margin is roughly 28% and Microsoft’s operating profit margin is roughly 31%.

Huge operating profit margins is one of the main reasons why everybody should start their own website. There is little downside if you fail, except for your time and maybe a little ego bruising.

It’s not like you have to come up with a million dollars to start a restaurant to pay rent, remodel a space, buy food, and hire staff. A website is just you and your own creativity.

Given I believe interest rates will stay low for the rest of my lifetime, the value of owning a cash cow should also stay high for the rest of my lifetime.

10-year bond yield has been coming down since the late 1980s

3) Your personal goals. Do you want to sell for a profit or build a legacy? If your desire for maximum profits is strong, then selling your business may make more sense if you get the right offer. If you desire to build a long-term business because it gives you purpose and joy, then selling your business makes less sense. Decide what your personal goals are for your business.

My thoughts: I didn’t start Financial Samurai to make money. I just needed an outlet to address my fears during the financial crisis. Instead of smoking or drinking heavily, I decided to write. I think you can tell that I enjoy writing, otherwise, I wouldn’t author practically all of Financial Samurai’s content. If I hated writing, I would hire a bunch of freelancers to write lots of product review posts to try and maximize my revenue. But so far, I haven’t.

My purpose for Financial Samurai is to have a creative outlet to share my thoughts on a weekly basis. It feels good to get thoughts on paper and hear different perspectives from the community. To be able to formulate an idea, put it in writing, and releasing it to the world is very gratifying.

A new goal is to run Financial Samurai long enough to teach my boy about online media, communication, and entrepreneurship. As an overrepresented minority at top universities, I assume it will be tougher for him to get in. I assume he will also get discriminated against in the workplace due to an underrepresentation of minorities in leadership positions. Therefore, it’s nice to have an insurance policy to skip university and the matrix all together.

He might have zero interest in learning about online media, but at least I can talk to him about the importance of creativity, consistency, and work ethic. A small business has many of the same departments as a large business e.g. finance, marketing, sales, production, etc.

Finally, what a wonderful way to communicate with family and friends long after I’m gone. I remember replaying over and over an old voicemail recording of a middle school friend who shockingly passed away in a car accident. If I were to die today, at least my wife and toddler will have hundreds of recordings and thousands of articles to go through.

4) Your view of the future. Do you see your business growing or fading? Can you create different products or revenue streams due to the strength of your brand? What are some new technologies that might disrupt your existing business? Are you capable of adapting?

Businesses fade away all the time. The murkier the future, the more you should consider selling.

My thoughts: I’ve always believed that if you can build a brand, your business will do even better in the future. Think about how many different business lines Virgin is in. Richard Branson has built an incredible, edgy brand that has enabled him to get into music, transportation, hotels, and more.

Financial Samurai is a fierce brand in the personal finance space that digs deep into the numbers and provides no BS analysis and answers. Everything is written based on firsthand experience because money is too important to be left up to pontification.

By establishing a brand that goes against the status quo (e.g. engineer your layoff vs. quit), plenty of new products can be created to leverage the brand. With only one book, I’ve barely gotten started on the business aspect of things. Now that my brand is established, I truly believe the opportunities are endless.

I envision a future where the consumption of online media via mobile devices only continues to grow. I see opportunity for Financial Samurai to expand internationally, especially in Asia and Europe.

Written content will never go away. It is by far the fastest way to consume information. Audio and video will continue to grow, and these are mediums I can easily utilize.

5) Will the money change your life. You can’t fault someone for wanting lots of money. If the sale of your business can significantly change your life for the better, then selling is absolutely an attractive decision. If the financial windfall doesn’t do much for your life, then you will likely feel a great let down because doing something mainly for money tends to feel empty.

My thoughts: The money received from selling Financial Samurai won’t change our lives. The only thing I might do is buy a bigger house. But I’ve already done the analysis on a larger house before, and it doesn’t feel worth it. Instead of feeling joy, I feel my headaches of owning a larger property with a $55,000 annual property tax bill would only multiply.

With the windfall, I’d give more money to a foster youth organization I volunteer at. I’d pay for a luxurious cruise for my parents. If my parents wanted, I’d also pay for their home remodel while putting them up in a nice temporary housing condo in Honolulu.

Other than these things, there’s really nothing more I’d do with the money except investing it in passive income generating investments. When you are already free to do whatever you want, having more money doesn’t move the happiness needle much.

6) Will you regret not selling if the market turns south. Fantastic selling opportunities open up only so often. If you pass, can you live with your decision that you could have gotten so much more if you sold earlier? Do you have the patience to wait for another 10 years for the next fantastic selling opportunity?

For example, Yahoo was once once worth over $100 billion and eventually sold itself to Verizon for only $5 billion. The good times don’t last forever.

My thoughts: I’m sure I’ll regret not selling today if I could only get 95% less years later. Meanwhile, however, I will have gotten a priceless amount of joy building Financial Samurai. It’s cool to have a web property I can click on from anywhere in the world.

It’s the same type of pride and joy you get as a parent when you look at your kid and think proudly, I helped make that. If you truly love your kid, you would never sell him or her. The same goes with your business, sometimes to your detriment.

I also am pleased with the steady growth of the Financial Samurai Forum. It feels like a new website with different offerings I will help nurture. I’m sure it will grow into a tremendous destination if I can manage it well over the next five years.

7) Will the new buyer be a good steward. You don’t want to sell your business to anybody. Instead, you want to sell your business to someone who believes in your vision and carries out many of the things you’d like to do, but don’t have the ability or energy to do on your own.

Consider selling your business similar to giving away your daughter or son’s hand in marriage. You’re definitely not going to let your daughter or son marry a scumbag.

My thoughts: After several conversations, I finally warmed up to someone who I think could really grow Financial Samurai and improve the user experience. Like me, he is a father, but to three boys. He has a team of hundreds of writers and developers who could create a lot more value. Let’s see where this relationship takes us. I’m definitely going to take my time finding a proper suitor.

Enjoy Your Business For As Long As Possible

The joy you get from creating something out of nothing far outweighs any joy you get from making a lot of money. Yes, there will be difficult times when you’ll just want to sell and quit. Do your best to keep on going.

I know of several people who sold their online businesses for the money and later became depressed because they didn’t have a purpose anymore. Many in the online media space tried to re-create the magic and failed. They became irrelevant.

Money really doesn’t bring much more happiness once you’re earning enough to have all your basic needs met. Some say that number is $75,000 a year, while others believe $300,000 a year is more likely in a HCOL area.

If you feel the end is near for your business, definitely try and sell. If someone gives you a crazy offer way outside average valuation multiples and you’re burned out, then accept their offer with open arms.

But if you continue to enjoy what you do and see growth potential, then keep on going. The legacy you leave will be wonderful. Just remember to always keep an open mind as there is a price for everything.

Not a day goes by where I’m not thankful for launching this site in 2009. It has given me more joy and purpose that I ever thought possible. Thank you!

Related posts:

How To Start A Profitable Website

Real Estate Versus Blogging: Which Is A Better Investment?

Bankers, Techies, And Doctors You’ll Never Get Rich Working For Someone Else

Readers, any entrepreneurs out there who have sold their business? How did you feel when you sold and how did you feel once you reached the payback period? What are some other considerations entrepreneurs should consider before selling? Graphic by kongsavage.com

The post Things To Consider Before Selling Your Business (Baby) appeared first on Financial Samurai.

from Money https://www.financialsamurai.com/things-to-consider-before-selling-your-business/

via http://www.rssmix.com/

0 notes

Text

10 Simple Ways to Earn up to $336/Week Working Part-Time From Home

Trying to make money online can leave a sour taste in your mouth. You might run into a scam or two. And don’t forget about the pyramid schemes that want you to “invest in your future.”

Puh-lease. Who has the time?

Instead of messing with fishy ads, check out some legitimate ways you can make extra money without leaving your house (or buying a bunch of inventory to sell to your friends on Facebook).

How to Make Money Online This Week

From getting paid to do things you already do to earning cash back on items you’re already planning to purchase, we found 10 easy ways for you to earn up to $336 this week.

1. Make an Extra $20 Watching Videos

Let’s kick things off with an easy one. Most of you already know about InboxDollars, but did you know that it will pay you to watch movie previews, celebrity videos, the latest news and dozens of other videos?

Plus, you’ll get a bonus $5 just for signing up.

You need to watch all of the shows in a playlist to earn your bucks, so be prepared. InboxDollars lets you know how long the playlist runs before you start watching, and playlists range from a few minutes to about half an hour.

The availability is subject to change, but it’s possible to earn up to $225 a month watching these videos!

At the end of the week, try to add $15 on top of that $5 bonus, and pull in a solid $20 from doing something you already do.

2. Find a Hidden $5 or More in Your Inbox

It turns out deleting your emails could be costing you money. Intrigued?

One of our secret weapons is called Paribus — a tool that gets you money back for your online purchases. It’s free to sign up, and once you do, it will scan your email for any receipts. If it discovers you’ve purchased something from one of its monitored retailers, it will track the item’s price and help you get a refund when there’s a price drop.

To save time, mom and blog manager Aimee B. does the majority of her shopping online — about 90% of it, she estimates. She stocks up on groceries, clothes and household necessities without leaving home.

In the past two years, Paribus has found Aimee $1,315.41 in savings while shopping online.

“It really is as simple as giving your email address,” she says. “It’s kind of a no-brainer.”

Plus, if your guaranteed shipment shows up late, Paribus will help you get compensated.

We know you have some old e-receipts collecting dust in your email, so see if this tool can score you an extra $5 to $10 this week.

Disclosure: Paribus compensates us when you sign up using the links we provide.

3. Get Paid $20 to Give Your Opinion

Online surveys aren’t going to make you rich, but there’s a certain appeal to clicking a few buttons and earning money while sitting at home.

We’ve tried a lot of paid survey sites, but here are a few others we’ve found and liked. Sign up for all of them, and you can pocket $20 in bonuses this week!

Swagbucks is definitely a reader favorite, probably because of the wide variety of ways to make money beyond taking surveys. Plus, you get a $5 bonus when you sign up and earn 2,500 SB within your first 60 days.

MyPoints: This platform lets you earn gift cards for taking polls, answering surveys and other things you do online — a great way to cash in on long lines or an endless commute. You’ll earn a $5 bonus when you complete your first five surveys.

Survey Junkie’s clean look keeps you motivated to take as many surveys as you want. It’s relatively quick to reward you with points once you’ve completed a survey. Once you earn 1,000 points — equal to $10 — you can cash out for gift cards or cash via PayPal. Pro tip: Take all the profile surveys to help you earn an easy 200 points or so up front.

VIP Voice surveys are relatively quick to complete and reward you with points you can redeem for cash or gift cards. Plus, you’ll still get points for taking surveys even if you don’t qualify to take the whole survey. Plan to login a few times each week, and you’ll have no trouble earning extra money this month with almost no work.

4. Earn $12/Hour Doing Random Google Searches

You know how you ask Google all the random questions that pop into your head? You could get paid for that.

Search engines use complicated algorithms to determine the results you see — and they don’t always get it right.

They’re vulnerable to errors, so they need real humans to look at the results and judge them for quality, relevance and usefulness. And those humans can get paid around $12 an hour for the work.

If you want to get paid to clean up Google’s mess (or Bing’s or Yahoo!’s) apply for a job with a company like Lionbridge. The company is often hiring, so if you don’t see any openings now, keep an eye on The Penny Hoarder work-from-home jobs page for the next one.

If you did this for one hour every week day, that’s an easy $60 in a week. If you’re feeling money hungry, add an hour on Friday and Saturday to bump your earnings up to $84. Cha-ching.

5. Play Free Scratch-off Tickets for up to $10K

There’s something so satisfying about those gas station scratch-off tickets, but it’s better to avoid them because, well, that’s not Penny Hoarding.

Instead of falling down the rabbit hole of scratching and losing, then doing it all over again, try scratching for free using an app called Lucktastic. Each day, it releases a new assortment of digital scratch-off tickets.

The app is supported by advertising, which allows it to keep the payouts high and the games free. Lucktastic says instant wins range from $1 to $10,000. You can also earn tokens that you can exchange for free gift cards to retailers including Amazon, Target, Walmart, Kohl’s, Sephora and more.

Here’s an instant win we love: Oneil Campbell, a Boston dad, used the app to enter a Monopoly Boardwalk contest and won $5,000 — just for entering the contest.

Even if you’re not feeling lucky, test out this app. Several of us here at The Penny Hoarder have played Lucktastic and have walked away with $1 and some tokens.

6. Invest in Real Estate With as Little as $500

Not everyone has “buy a house” kind of money.

You don’t have to have hundreds of thousands of dollars to get started with Fundrise. You can get started with a minimum investment of just $500, and Fundrise does all the heavy lifting for you.

Through the Fundrise Starter Portfolio, your money will be split into two portfolios that support private real estate around the United States.

In addition to four rental properties, Christopher and Meghan Miller have invested in a diversified portfolio of real estate projects across the country — from Washington, D.C. to Los Angeles — through Fundrise’s automated investment experience.

“I don’t have to manage them; I don’t have to do the work to improve the properties; I don’t have to find tenants, evict tenants,” Christopher says.

They follow the progress of each project they’ve invested money into through Fundrise, and Christopher receives automatic payments directly into his checking account.

(But remember: Investments come with risk. While Fundrise has paid distributions every quarter since at least Q2 2016, dividend and principal payments are never guaranteed.)

You’ll pay a 0.85% annual asset management fee and a 0.15% annual investment advisory fee.

7. Earn up to $60/Hour as a Part-Time Bookkeeper

Can you open a spreadsheet? Check. Does earning $60 an hour sound appealing? Check. How about the freedom to work remotely while helping others succeed? Check, check, check.

Those are the perks of working as a bookkeeper, says Ben Robinson, a certified public accountant and business owner who teaches others to become virtual bookkeepers.

You don’t have to be an accountant or even really good at math to be successful in this business. In fact, all you need are decent computer skills and a passion for helping business owners tackle real-world problems.

The ability to stay moderately organized is helpful, too.

Median pay is around $19 per hour, according to the Bureau of Labor Statistics — and you have no commute. It’s a great opportunity for parents who want a part time job, recent college grads and anyone who wants to bring in real money working from home.

Robinson shares what it takes to be a virtual bookkeeper, plus tips for making this career work for you in his free class at Bookkeeper Business Launch.

At $60 per hour — Robinson’s recommended target rate — you could earn $600 working just 10 hours a week! Even at about $20 per hour as a new bookkeeper, that’s $200 a week. Still pretty good!

8. Earn $25 for Shopping

Heading to the store soon?

Here’s how to make your trip pay off: Before you go, search for items on your shopping list within Ibotta, an app that will pay you cash for taking pictures of your grocery store receipts.

When you get home, snap a photo of your receipt and scan the items’ barcodes to get paid.

Some deals we’ve seen include:

25 cents cash back for any item.

25 cents back on strawberries.

50 cents back on frozen fruit snacks.

$1 back on a box of tea.

$5 back on a case of Shiner Bock beer.

Notice a lot of those aren’t tied to a brand — just shop for the staples on your list, and earn money! Ibotta is free to download. Plus, you’ll get a $10 sign-up bonus after uploading your first receipt.

You’ve got a lot of groceries on that list, a.k.a. earning potential, so use Ibotta this week to earn $25 in cash back for buying things you already need. You’ve already got $10 guaranteed, so you only have to find deals for another for $15. Easy.

9. Invest in Cannabis, and Get $5 in Free Stocks

You don’t just want to invest. You want to invest in an industry you believe in. One that could take off and make money.

You want to invest in cannabis, and now you can. You don’t have to have tons of money to invest in the cannabis industry. Using a microinvesting app like Stash, you can invest in increments as little as $5.

Need a nudge? Right now, The Penny Hoarder is teaming up with Stash to give you an extra $5 after your first investment.

Stash curates investments from professional fund managers and investors and lets you choose where to put your money. It offers more than 40 exchange-traded funds, including one for those who are already seeing green on the cannabis horizon.

But it leaves the complicated investment terms out of it. You just choose from a set of simple portfolios reflecting your beliefs, interests and goals.

Once you sign up with Stash, take a look at the app’s portfolio options, including one cannabis-related ETF, to find an investment blend that meets your goals. You can be as conservative or aggressive as you need to be.

10. Let This App Grow Your Money 50 Times Faster

Personal finance 101: Where you stash your money is almost as important as how much you have. Believe it or not, you don’t need to start out with a lot to be a smart investor.

With a free app called Worthy, you can start investing with just $10.

No matter how much, that money is yours. You want to grow it safely, right? Your first thought is a savings account, which will earn you an average of 0.10%, according to an April 2019 report by the FDIC. That’s practically stagnant.

You’ve got to think outside your bank.

Worthy is a microinvesting app that pays out a fixed 5% annual interest rate — around 50 times more than what you’d get from the bank. And a lot more stable than investing in stocks.

It invests in bonds that act like a savings account — you can deposit or withdraw money at any time with no fees or penalties. You can even set up a recurring investment or use Worthy’s round-up program to invest your spare change.

This was originally published on The Penny Hoarder, which helps millions of readers worldwide earn and save money by sharing unique job opportunities, personal stories, freebies and more. The Inc. 5000 ranked The Penny Hoarder as the fastest-growing private media company in the U.S. in 2017.

10 Simple Ways to Earn up to $336/Week Working Part-Time From Home published first on https://justinbetreviews.tumblr.com/

0 notes

Text

The Ergohacks Verdict

With a tagline like Try Something New, you might correctly imagine that here at Ergohacks we’re always on the lookout for the next thing. Trying something new doesn’t necessarily mean something new for everyone but it might. For me, VR isn’t something new but it’s something that’s been almost there for a long time. I’ve been going to gaming shows for years and I first saw a DK1 model 7 years ago. In the time since it’s gone through the DK1, DK2, Release, Touch and with every version it’s evolved slightly and got easier to use, lighter and had better abilities. This summer the price came down to £500 – £400 for a few weeks – and that added to the fact that there’s now a decent range of titles means that my excitement about the Oculus Rift has finally hit fever pitch. It was my first time not pushed through a particular demo or surrounded by hundreds of people in a cavernous warehouse and even three weeks after we’ve gotten it’s living up to its potential.

Once you get it on your head the headset is comfortable and does a decent job of blocking out the rest of the world. The Rift’s screens are high enough resolution that unless you really look for it you can’t see the pixels and with a decent PC behind them, the refresh rate is fast enough that you don’t get any lag or choppiness in what you see as you move around. In other words, it’s really, really immersive. The integrated earphones surprised me with their quality and I also found them more comfortable than they looked to be. When you’re in VR the tracking both of the headset and the controllers are good with the occasional glitch if you managed to get the controllers hidden behind your body. The Rift isn’t perfect – it’s not heavy but it does weigh a reasonable amount and that plus the cable that you pull behind you mean that you almost always know it’s there.

Once you’ve got your Rift setup what can you do with it? The software available comes down to three things. Games, experiences and everything else. The obvious thing to try is games but when the Rift came out the consensus was that the games weren’t quite there. There were a lot of demos and some Indie stuff but full AAA games? No without the market they hadn’t been developed. In the year and a half, that’s changed. I don’t think that the killer game has quite come out yet but titles like Robo Recall, Star Trek Bridge Crew and Lucky’s Tale make great use of VR in their own ways and more importantly are fun to play. Even better there are new games being released on a consistent schedule and with the back catalogue now fleshed out, there’s enough to keep you busy and playing quality games as much as you want.

The experiences are mainly 360 videos and virtual environments. They’re fun and great to introduce people to VR but they aren’t that replayable and there just isn’t enough content available. It’s also possible to watch normal content on a virtual screen that you can make as large as you like which is a surprisingly good experience.

Finally, you’ve got everything else. This is thing’s like Google’s Tilt Brush painting and Sculpting to a Virtual Desktop and many social apps. So far Tilt Brush has been favourite with everyone who’s tried it and Virtual Desktop lets you see your PC screen in VR and make it as large as you like. If you’re a touch typist and your mouse is close at hand this works really well and combined with a ‘normal’ non-VR game can work really well.

The big question is should you invest in VR? I have absolutely loved having the Oculus Rift around for the last few weeks. It’s an amazing piece of technology which has come farther than I expected it to in a relatively short amount of time. There are some genuinely fun and impressive games and software on it and if you’re the right person its ready for you. You need to have some tech skills and space near your gaming PC but if you’ve got that it’s an amazing device. If you consider that a large gaming monitor can easily reach six or seven hundred pounds the Rift is well priced and you get a quality product for your cash. If you get a chance to try out a Rift go for it – it’s an experience everyone should have. If you’re a PC gamer or an early adapter get one. Highly recommended.

Buy it from Oculus +

Price: ± £ 499

Paid extras: The Rift comes bundled with some games and there are a number of free games available in the store but many are also paid. It will also require a powerful PC.

Discounts: Oculus just ran a summer sale discounting by £100. The likelihood is that they will do so again the future.

#gallery-0-5 { margin: auto; } #gallery-0-5 .gallery-item { float: left; margin-top: 10px; text-align: center; width: 33%; } #gallery-0-5 img { border: 2px solid #cfcfcf; } #gallery-0-5 .gallery-caption { margin-left: 0; } /* see gallery_shortcode() in wp-includes/media.php */

Features

The Rift isn’t just a headset but rather a way to interact with a virtual environment. That means a headset with eye cover and integrated earphones but also two controllers and a couple of sensors that track where you and the controllers are in space.

Setup is not anywhere near as complicated but that’s not to say it’s straightforward. Your first step is to get a powerful PC with a modern graphics card and a fair amount of hard disk space. It also needs an unused HDMI port and at least three unused USB ports. Then you need a decent amount of space around the PC without any furniture, tripping hazards or random cats. When you’ve got all that you set the sensors up to cover your space as best you can and run through several calibration routines that tell the Rift how big your space is and (theoretically) make it far less likely you’ll trip out of it. If the sensors move you’ll need to do this again and if you’re having the Rift in on place for a long time it makes sense to mount the sensors somewhere they won’t get knocked – some people have had a good experience with mounting them upside down from the ceiling.

Once you’re setup and put the headset on you need to adjust it to make it more comfortable. Think of putting the headset on like a pair of goggles. Cover your eyes first then pull the strapping back over your head and tighten the three pulleys. Then adjust the focal width with a small slider. If you’re like me and really, really need glasses then it’s a bit more complicated. You can put glasses on under the headset but you need the right frame shape to fit comfortably. My daily wear glasses turned out to just be too wide to be comfortable but an older pair with solid round lenses fitted acceptably if not perfectly. It’s been the first thing in years to make me seriously consider getting contact lenses.

Requirements

The Rift needs a PC with at least NVIDIA GTX 960 4GB / AMD Radeon R9 290 or greater, Intel i3-6100 / AMD Ryzen 3 1200, FX4350 or greater, 8GB+ RAM, Compatible HDMI 1.3 video output, 1x USB 3.0 port, plus 2x USB 2.0 ports and Windows 8.1 or greater. I’ve also noted several games that require Windows 10.

About Oculus VR

Oculus VR is an American tech company started in 2012 by Palmer Luckey. They got their initial financing via a hugely successful Kickstarted and went on to produce two versions of the Rift – the DK1 and DK2. Before they released the consumer version Oculus VR got acquired by Facebook in 2014 and still operating independently released the Oculus Rift in March 2016.

We based our Ergohacks Verdict on three weeks of tinkering, testing and using the Oculus Rift loaned by Oculus VR during September 2017. This article was first published on 28 September 2017.

Oculus Rift The Ergohacks Verdict With a tagline like Try Something New, you might correctly imagine that here at Ergohacks we're always on the lookout for the next thing.

0 notes

Text

Just Say NO To Angel Investing

After 10 years, my $60,000 investment in a private gin company finally paid dividends. Initially, given the company was sold for about $49M after expenses and I had invested in the company at a $10M post money valuation, I was thinking I had made a ~3X return ($180,000). Since over time shareholders get diluted with subsequent funding rounds, I thought that was a reasonable assumption.

Well it turns out I didn’t even get a 1X return! Instead, here’s what I got:

Gross Proceeds: $98,425.88

Federal Withholdings: $0

State Withholdings: $6,523.82

Net Proceeds: $91,902.07

What the hell!? After almost 10 years, with $98,425.88 in gross proceeds, I only made a 64% return on my money. Further, I had ZERO liquidity and lost hope for years that I’d ever get my $60,000 back. Doing the math, I only made a 5.1% IRR.

So where did all the money go since the company was sold for 5X what I bought in for? Based on an internal document I received, we had to pay a lot of banker, lawyer, escrow, accounting, and general administration fees. We also had to pay severance packages to all the employees (rightfully so) who were made redundant when the parent company, Gruppo Campari took over. But there most be something else I’m missing, which I’ll investigate further in due time.

The positive part of this story is that I consider myself LUCKY to get any money back because most startups fail miserably. Before Campari announced the acquisition, I had already written off the $60,000 because shareholders had never gotten a dividend and the growth target dates kept on getting pushed out. My concern was the company would turn into one of those zombie companies with just enough growth to maintain EBITDA break even, but never enough growth to become an attractive acquisition target.

When the purchase price was announced, my write-off expectation transformed into greed. And now with the payout, my greed has turned into selfish disappointment.

Why You Should Not Angel Invest

Now that the stock market has gone up every year since 2009, everybody thinks they’re investing geniuses. I’ve got so many people asking me whether they should invest in some random, moat-less private business. You just can’t lose if you put money to work right? This is exactly what I thought in 2007 when I invested $60,000 in the gin company and bought a $715,000 condo in Lake Tahoe. Then the world came to an end.

Here are the reasons why you shouldn’t angel invest:

1) You have ZERO edge. The other day I had sashimi and sake with a Sequoia Capital partner. Sequoia Capital is one of the best VC companies in the industry. It has made billions backing Apple, Google, Oracle, Paypal, YouTube, Yahoo!, and Whatsapp. The partner said Sequoia shoots for a one win, seven loss hit rate. In other words, to follow Sequoia’s ratio you’ve first got to be willing to make eight bets of similar size. Further, you’ve absolutely got to be willing to lose money on 87.5% of your investments and hope that one deal is at least a 10 bagger!

The best VC firms get all the first looks. They have some of the brightest people spending 50+ hours a week reviewing company after company. Oftentimes they see information about competitor companies that enables them to evaluate who will likely come out ahead. They also talk to their fellow VC industry colleagues about what other companies and other VCs are doing. In comparison, you and I get no looks. Instead, we only get the companies that have been rejected by the VCs. Talk about an unfair advantage.

2) Your money is more sacred than other people’s money. Being a VC is the best job ever because you get to make a $250,000 – $350,000 salary and make investments using OTHER PEOPLE’s money! Further, you can earn your base salary for 8-10 years before feeling pressure to prove any returns because that’s how long fund holding periods are.