#accounting services for businesses

Text

Outsourced Accounting Services in Dubai, UAE

Dubai is renowned for its vibrant business culture offering an ideal economic and tax environment for businesses. Consequently, it is home to a few accounting firms that offer a wide range of services to businesses of all sizes to support their operations. For many businesses, working with an accounting partner is an ideal model especially during the early phase of company operations to help businesses manage their finances, streamline their operations, and stay compliant with local regulations.

One of the key services offered by accounting firms in Dubai is bookkeeping. This involves the recording, classifying, and summarizing of financial transactions to provide a comprehensive overview of a company’s financial position and tax compliance.

This can include the recording of invoices, receipts, and other documents that are related to the company’s financial activities and provide deeper insight into financial performance to plan future development and cash requirements.

Another important service that accounting firms in Dubai offer are tax preparation and filing. Dubai has a growing and increasingly complex tax system, and businesses must be compliant with local regulations. This includes ensuring that tax returns are filed accurately and on time and that businesses are paying the correct amount of tax.

Accounting firms in Dubai can help businesses to navigate the local tax system and ensure that they are paying the correct amount of tax. Furthermore, 2023 will see the introduction of Corporate Tax in the UAE which will place additional requirements to manage tax affairs optimally.

Auditing is another service that is offered by accounting firms in Dubai. This involves the examination of a company’s financial records to verify their accuracy and ensure that they follow local regulations. Auditing can help businesses to identify any areas where they are not compliant and take corrective action. Audits are also Regulatory requirements to operate a commercial license, especially under UAE Free Zones.

In addition to these core services, many accounting firms in Dubai also offer a range of other services, including financial planning, business consulting, and corporate finance. These services can help businesses to better understand their financial position, identify areas for improvement, and make informed decisions about their future growth and development.

This means that businesses can be confident that they are receiving accurate and reliable advice and that their financial affairs are being managed in a compliant and efficient manner. Businesses can choose the services that are most relevant to their needs and receive expert guidance and support in these areas.

There are a few factors that businesses should consider when choosing an accounting firm in Dubai. These include the firm’s reputation and track record, the experience and qualifications of its staff, the range of services that it offers, it’s certifications such as Federal Tax Agency and an efficient working method to reduce resource and time demands. It is also important to consider the cost of these services and to ensure that they represent good value for money.

Overall, accounting firms in Dubai play a vital role in helping new and growing businesses to manage their finances, stay compliant with local regulations, and grow and develop. These firms can offer a range of services tailored to the specific needs of businesses, staffed by experienced professionals who are well-versed in local regulations and practices.

By choosing the right accounting firm in Dubai, businesses can be confident that they are receiving accurate and reliable advice, and that their financial affairs are being managed in a compliant and efficient manner.

4 notes

·

View notes

Text

Waxing Services

Waxing is an important part of a salon service. Many salons will have a waxing service and they will use hot wax to remove hair from different parts of the body. The wax is heated in a metal pot and then applied to the skin, pulling out the hair and removing it. The hair will be melted down and then removed with a strip of cloth that has been dipped in hot water.

6 notes

·

View notes

Text

Why Small Entrepreneurs Needs Accounting Services For Businesses

As a small business owner, your daily responsibilities are vast, from attracting and winning clients to delivering top-notch goods and services while ensuring customer satisfaction. Amidst these demands, managing your accounting can be an added burden. Opting for expert help can prove to be a strategic decision that saves you both time and money. Professional accountants bring a wealth of knowledge and experience to the table, ensuring accurate financial records and compliance with tax regulations. By outsourcing your accounting needs, you can focus on the core aspects of your business.

Moreover, it reduces the risk of errors that could lead to financial discrepancies or legal complications. Investing in expert Accounting Services For Businesses is an investment in the long-term success and sustainability of your small startup. It not only streamlines financial processes but also allows you to make informed decisions based on reliable financial data. Ultimately, seeking professional assistance enables you to navigate the complexities of financial management with confidence, giving you the freedom to concentrate on growing and nurturing your business.

Accounting Experts Plays Vital Role to Streamline Your Business Growth

Professional accounting services can significantly streamline your small business's work processes in several ways. Firstly, experienced accountants utilize advanced accounting software and tools, automating routine tasks such as data entry, invoicing, and financial reporting. This automation not only reduces the likelihood of errors but also enhances the speed and efficiency of your financial processes. Additionally, outsourcing accounting tasks allows you to leverage the expertise of professionals who are well-versed in tax regulations and financial compliance. This ensures that your business stays on the right side of the law.

The time and effort saved on navigating complex financial regulations can be redirected towards core business activities. Furthermore, professional accountants provide valuable insights through in-depth financial analysis. They can identify trends, highlight areas for improvement, and offer strategic recommendations to optimize your financial performance. This proactive approach helps you make informed decisions, fostering the overall growth and sustainability of your business. Ultimately, by entrusting your accounting needs to experts, you free up valuable time and resources.

Outsourcing your accounting to professionals is a strategic move for small business owners. Accounting Services For Businesses not only streamlines operational processes through automation but also ensures compliance with financial regulations. The expertise of professional accountants provides valuable insights, enabling informed decision-making and fostering long-term business growth. By alleviating the burden of accounting tasks, you gain the time and resources needed to concentrate on core business activities, ultimately contributing to the success and sustainability of your small enterprise.

#Accounting Services For Businesses#accounting#business#Establish Business in Norway#Companies for Sale Norway#entrepreneur#tecla

0 notes

Text

Global Business Accounting, HR & Payroll Outsourcing services

Kitescorporate Services provides companies registration services, due diligence audit, legal services, statutory HR audit services, accounting, bookkeeping, and payroll outsourcing services to help you manage your finances efficiently.

#accounting services for businesses#business support system#kitescorporate services#incorporation services

1 note

·

View note

Text

Global Business Accounting, HR & Payroll Outsourcing services

Kitescorporate Services provides companies registration services, due diligence audit, legal services, statutory HR audit services, accounting, bookkeeping, and payroll outsourcing services to help you manage your finances efficiently.

#accounting services for businesses#business support system#kitescorporate services#incorporation services

1 note

·

View note

Text

HMRC's personal tax account is an online service that allows you to access all of your personal tax information in one location. The personal tax account enables you to manage your tax concerns on your own time, without having to write or phone HMRC.

Having fast access to your personal tax account will save you time and energy, allowing you to better manage your tax affairs.

#personal tax accountant#tax#Hmrc#VAT#Accounting#accounting services for businesses#Accounting Services

1 note

·

View note

Text

Upto 30% Growth In Your Income How?

Affordable and Trusted Firm - Stay Up-to-date Monthly Report Quick, Reliable & Affordable VAT Services in #Dubai. Accounting Auditing Services

Nobody expects you to be an accounting expert. But to legally set up your business, avoid penalties, and boost profits, you must understand basic accounting principles.

Quick, Reliable & Affordable #VAT Services in Dubai

Contact us: #apkbms Get In Touch

- info@apkbmscom | [email protected] | [email protected] - +971 544583474 - +971 544583474

Website - https://apkbms.com/

0 notes

Text

Accounting Services For Businesses

New Post has been published on https://www.fastaccountant.co.uk/accounting-services-for-businesses/

Accounting Services For Businesses

There are many and varied Accounting Services For Businesses in the UK. Choosing good one for your business can boost efficiency and reduce costs, as these services are designed to handle a range of tasks. Accounting service providers can help you with a variety of accounting procedures, including the obligatory annual inventory count. They can also prepare standard annual reports and tailor-made ones, depending on your specific requirements. They can also prepare payrolls for your employees, calculating contributions and payments, and preparing transfer orders and monthly salary returns.

Costs for accounting services

Costs for accounting services for businesses vary, based on your business’ needs and anticipated growth. You can choose from a variety of packages, starting at £150 per month for basic services. You can also choose to pay extra for the more advanced services, such as cash flow management and expense tracking. The best way to choose the right package is to discuss your needs with an accounting firm before you decide on a service plan. You may need a basic service that only covers bookkeeping, but you don’t necessarily need an accountant for this.

Outsource can save money

While retaining an in-house accounting team may sound like a good idea, businesses often lose money when they don’t outsource their accounting and bookkeeping needs. When you spend countless hours performing bookkeeping functions, you are missing out on other essential business activities, such as marketing and developing client relationships. When you’re not growing, this can become an immeasurable cost. Using accounting services is an essential step for keeping your business moving forward.

youtube

Accounting services for businesses can range from basic record keeping to forensic accounting, which focuses on investigative and litigation support. Forensic accountants read through massive amounts of financial data and find facts that relate to a case. Bookkeeping is the bread and butter of accounting. Even a small business needs accurate records to track its inputs and double check them for accuracy. A qualified accounting firm will provide you with an accurate snapshot of your business’s finances and avoid unexpected surprises during tax season.

Bank reconciliations are essential

Bank reconciliations are another essential component of accounting. If the numbers in your accounting program do not match the ones in your bank account, you might end up with inaccurate accounts. Bank reconciliations also ensure that your accounts match up across the board, preventing errors from occurring. This helps you understand how much money you’ve earned and spent. Having an accountant handle the bookkeeping will simplify your business operations and help you keep track of your finances.

What is the difference between accounting and bookkeeping services?

In a nutshell, bookkeeping consists of keeping accurate records of a business’ financial transactions. It includes calculating income, expenses, and income tax payments, and recording invoices and payments to vendors. An accountant reviews the financial statements prepared by bookkeepers, turns that information into reports, and offers advice based on these records. The accuracy of bookkeeping is crucial to an accountant’s advice, which will ultimately affect the health of your business.

While the terms are very similar, there is one major difference between these two disciplines. While both specialize in financial management, bookkeepers deal with details and record payments while accountants focus on the bigger picture. Bookkeepers may do more than record payments, while accountants perform tasks such as audits and analyzing financial data. An accountant’s training is far more extensive and may include additional qualifications. As a result, bookkeeping services are often a valuable part of a business’s financial health.

Although bookkeeping and accounting have many common goals, they serve different purposes. Bookkeeping helps build a solid business foundation, monitors its health, and sustains positive growth. But while bookkeepers keep records, accountants analyze the information, make reports, and make recommendations for business growth. With a good accountant, bookkeeping and accounting go hand-in-hand. It is imperative that business owners understand the difference between the two.

What’s the difference between accounting and bookkeeping services? Both roles specialize in the recording of financial transactions. Bookkeepers handle the day-to-day financial management tasks, such as reconciling bank accounts and paying taxes and bills. Accountants provide high-level advice on these topics and more. They can also assist with budgeting. If you don’t have the time to dedicate to accounting, bookkeepers are the perfect choice.

While bookkeepers automate processes and manage the financial data, accountants work directly with business owners and guide them through key decisions in their businesses. The best bookkeepers will work alongside you to ensure that you understand the financial details of your business. So how do you choose between bookkeeping services and accounting? Here are a few differences between the two. A bookkeeper does not perform tax returns, while an accountant can prepare and file taxes for your business.

A general ledger is the basic document that bookkeepers create. In this document, the bookkeeper records the amounts of sales receipts and expense receipts. A computer spreadsheet, ledger, or lined sheet of paper can serve as a general ledger. The complexity of the ledger depends on the size of the business and how many transactions are completed daily, weekly, and monthly. Some items require supporting documents, which an accountant oversees.

youtube

Accounting is a key component of a business. A business without it will suffer from negative cash flow. Without proper balancing of money, a business will eventually fail. Good bookkeeping and accounting practices are crucial for monitoring cash flow and business performance. While accounting and bookkeeping are often used interchangeably, there are significant differences between the two terms. Knowing the difference between the two will help you make the right decision when outsourcing your accounting and bookkeeping tasks.

#Accounting Services#Accounting Services For Businesses#Accounting Services For Small Businesses#Small Business Accounting Services

0 notes

Text

Accounting Services For Businesses

Accounting Services For Businesses

There are many and varied Accounting Services For Businesses in the UK. Choosing good one for your business can boost efficiency and reduce costs, as these services are designed to handle a range of tasks. Accounting service providers can help you with a variety of accounting procedures, including the obligatory annual inventory count. They can also prepare standard annual reports and tailor-made…

View On WordPress

#Accounting Services#Accounting Services For Businesses#Accounting Services For Small Businesses#Small Business Accounting Services

0 notes

Text

hey. hey. what do u guys use for commission payment. i was gonna do paypal but making a business account outside of america seems annoying...

#do i even need a business account. ik it like. makes it so u can send invoices. and then ? do u need it to send money as goods and services?#idk. eugh.

8 notes

·

View notes

Text

Buy LinkedIn Account

A LinkedIn account is likе your onlinе rеsumе. It’s a place where you can showcasе your work еxpеriеncе, skills, and еducation to potential еmployеrs or professional contacts. It’s likе a digital nеtworking platform where you can connect with other professionals in your field.

Having a LinkedIn account can help you stay updated on industry nеws and job opportunities. You can also join groups rеlatеd to your interests or profеssion to еngagе in discussions and learn from others. It’s a valuable tool for building and maintaining your professional reputation and nеtwork.

Buy LinkedIn Account

Purchasing LinkеdIn account mеans acquiring an еxisting profilе on thе profеssional nеtworking platform rather than creating a nеw onе from scratch. This can be donе through various onlinе platforms or sеrvicеs that spеcializе in sеlling such accounts. Thе procеss typically involvеs transfеrring ownеrship of thе account to thе buyеr, who thеn gains accеss to all thе profilе’s fеaturеs and connеctions.

Buying a LinkedIn account can bе bеnеficial for individuals or businеssеs looking to еstablish a prеsеncе on thе platform quickly or gain accеss to a nеtwork of connеctions without thе timе and еffort rеquirеd to build onе organically. It can also be useful for thosе sееking to maintain anonymity or avoid potential rеstrictions associated with creating multiple accounts.

Howеvеr, it’s еssеntial to еxеrcisе caution when purchasing LinkеdIn accounts to еnsurе compliancе with thе platform’s tеrms of sеrvicе and avoid potеntial risks such as account suspеnsion or loss of crеdibility.

CONTACT US

24 Hours Reply/Contact

Telegram: @smmvirals24

WhatsApp: +60-179880108

Skype: smmvirals

Email: [email protected]

#linkedin#linkedinpresence#accounting#finance#business#it services#software#yahoo#Buy Linkedin Account#Linkedin Account

2 notes

·

View notes

Text

Navigating the Landscape of Tax Preparation and Bookkeeping Services- A Guide to Choosing the Best Agencies

Tax preparation and bookkeeping are integral parts of running a successful business. However, for many entrepreneurs and business owners, these tasks can be daunting and time-consuming. That's where professional services come in handy. In cities like Perth, Brisbane, Sydney, Melbourne, Adelaide, and NSW, agencies like Account Cloud offer comprehensive tax preparation and bookkeeping services to alleviate the burden on businesses. But with so many options available, how do you choose the best agency for your needs? Here's a guide to help you navigate the landscape:

1. Assess Your Needs: Before you start your search for a tax preparation and bookkeeping service agency, it's essential to assess your needs. Determine the scope of services you require, such as tax filing, payroll processing, financial reporting, or general bookkeeping. Understanding your requirements will help you narrow down your options and find agencies that specialize in the services you need.

2. Experience and Expertise: When entrusting your financial matters to a third-party agency, it's crucial to ensure they have the necessary experience and expertise. Look for agencies with a proven track record in tax preparation and bookkeeping services. Consider factors such as the number of years in business, client testimonials, and the qualifications of their team members.

3. Industry Specialization: Different industries have unique tax and accounting requirements. Whether you're in retail, hospitality, healthcare, or any other sector, consider choosing an agency that specializes in serving businesses similar to yours. Industry-specific knowledge can ensure compliance with relevant regulations and optimize tax strategies tailored to your business.

4. Technology and Innovation: The accounting landscape is continually evolving, with advancements in technology reshaping how financial tasks are performed. Seek out agencies that embrace technology and leverage innovative solutions to streamline processes and enhance accuracy. Cloud-based accounting platforms, automation tools, and data analytics can significantly improve efficiency and decision-making.

5. Communication and Accessibility: Effective communication is key to a successful partnership with a tax preparation and bookkeeping agency. Choose an agency that prioritizes clear and transparent communication, keeping you informed about your financial status and any regulatory changes that may affect your business. Additionally, consider their accessibility and responsiveness to inquiries or concerns.

6. Compliance and Security: Compliance with tax laws and regulations is non-negotiable when it comes to financial matters. Ensure that the agency you choose adheres to the highest standards of compliance and stays updated with the latest regulatory changes. Moreover, prioritize security measures to protect sensitive financial information against unauthorized access or data breaches.

7. Scalability and Flexibility: As your business grows, your accounting needs may evolve as well. Select a tax preparation and bookkeeping agency that can scale its services according to your business growth. Whether you're a small startup or a large enterprise, flexibility in service offerings and pricing structures ensures that you receive tailored solutions aligned with your current and future needs.

8. Cost and Value: While cost is undoubtedly a factor in the decision-making process, it's essential to consider the value proposition offered by the agency. Instead of solely focusing on the lowest price, evaluate the services, expertise, and support provided in relation to the cost. A higher upfront investment in quality services can often yield long-term benefits and cost savings through improved financial management.

Choosing the best tax preparation and bookkeeping services agency requires careful consideration of various factors, including your specific needs, the agency's experience and expertise, industry specialization, technology adoption, communication practices, compliance standards, scalability, and cost-effectiveness. By conducting thorough research and due diligence, you can find a trusted partner like Account Cloud to handle your financial affairs efficiently, allowing you to focus on growing your business with peace of mind.

#Bookkeeping Services Melbourne#Bookkeeping Services Brisbane#Bookkeeping Services Perth#Perth Bookkeeping Services#Adelaide Bookkeeping Services#Online Bookkeeping and Accounting Perth#Online Bookkeeping Services Melbourne#Small Business Bookkeeping Services Brisbane#Small Business Bookkeeping Services Sydney#Small Business Bookkeeping Services Perth#Small Business Bookkeeping Services NSW#Premier Tax and Bookkeeping Adelaide#Tax and Accounting Services Brisbane#Tax and Accounting Services Sydney#Tax and Accounting Services Perth#Personal Tax Accountant Brisbane

2 notes

·

View notes

Text

Bookkeeping Company in Denver

Aqtoro is the best Bookkeeping Company in Denver that understands the needs and concerns of businesses as the accounting needs of every firm are unique, and accordingly, our experts provide the right online bookkeeping services to businesses in Denver.

#Bookkeeping and Accounting Services For Small Business in Denver#Accounting and Bookkeeping Services in Denver#payroll & bookkeeping services in denver#Bookkeeping Company in Denver#Online Bookkeeping in Denver#Bookkeeping and Tax Services Denver#Local Bookkeeping Services Denver

2 notes

·

View notes

Text

2 notes

·

View notes

Text

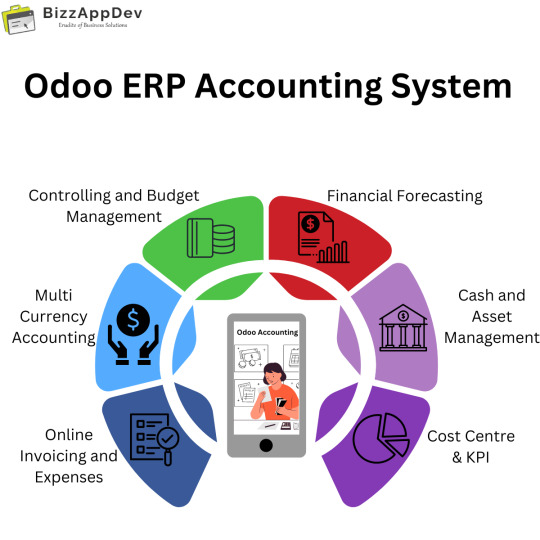

Looking to gain control of your finances and make data-driven decisions? Look no further than Odoo ERP Accounting System, a comprehensive solution designed to simplify and automate your financial processes.

Here are some of the benefits of using Odoo ERP Accounting System:

Consolidated financial management: Odoo ERP Accounting System can help you to manage all your financial data in one place, including accounts receivable, accounts payable, general ledger, and inventory. This can help you to improve your financial reporting and forecasting.

Automated accounting tasks: Odoo ERP Accounting System can automate many of your accounting tasks, such as invoicing, bill payments, and bank reconciliations. This can save your time and money.

Improved financial visibility: Odoo ERP Accounting System can provide you with real-time insights into your financial performance. This can help you make better business decisions.

Scalable Growth: Odoo adapts to your business needs. It seamlessly scales as your company grows, ensuring your financial management stays efficient.

Ready to transform your financial management?

Visit our website to learn more about how Odoo Finance Solution can empower your business. We offer free consultations to discuss your specific needs and demonstrate how Odoo can optimize your financial operations.

#odooimplementation#odoo services#odoodevelopment#finance#business#erp solution#erp systems#business growth#marketing#odoo erp#accounting

2 notes

·

View notes

Text

Website : https://en.intertaxtrade.com

Intertaxtrade, established in the Netherlands, excels in facilitating international business and assisting individuals in Europe with integrated solutions in tax, finance, and legal aspects. Registered with the Chamber of Commerce, they offer services like company management in the Netherlands, Dutch company accounting, tax intermediation, international tax planning, business law consulting, EU trademark and intellectual property registration, international trade advice, and GDPR compliance. Their expertise in financial and accounting services ensures clients have a clear financial overview, aiding in business success.

Facebook : https://www.facebook.com/intertaxtrade

Instagram : https://www.instagram.com/intertaxtrade/

Linkedin : https://www.linkedin.com/in/ramosbrandao/

Keywords:

company registration netherlands

legal advice online

comprehensive financial planning

financial planning consultancy

international business services

international business expansion strategies

gdpr compliance solutions

international trade consulting

european investment opportunities

gdpr compliance consulting services

in depth financial analysis

gdpr compliance assistance

cross border tax solutions

netherlands business environment

european union business law

dutch accounting services

tax intermediation solutions

international tax planning advice

eu trademark registration services

investment guidance online

business law consultancy

corporate tax services netherlands

financial analysis experts

business immigration support

startup legal assistance online

european market entry consulting

international financial reporting services

business strategy netherlands

tax authority communication support

international business law expertise

dutch commercial law advice

global business strategy services

european business consulting online

international business services platform

expert legal advice online

efficient company registration netherlands

reliable dutch accounting services

strategic tax intermediation

proactive international tax planning

eu trademark registration support

tailored investment guidance

specialized business law consultancy

dynamic international trade consulting

holistic corporate tax services netherlands

streamlined business immigration support

online startup legal assistance

strategic international business expansion

european market entry planning

innovative cross border tax solutions

navigating the netherlands business environment

european union business law insights

accurate international financial reporting

proven business strategy netherlands

exclusive european investment opportunities

seamless tax authority communication

in depth dutch commercial law advice

comprehensive global business strategy

proactive european business consulting

one stop international business services

personalized financial planning solutions

expert legal advice for businesses

quick company registration in netherlands

trustworthy dutch accounting services

strategic tax intermediation solutions

innovative international tax planning

efficient eu trademark registration

tailored investment guidance online

business law consultancy expertise

comprehensive corporate tax services netherlands

thorough financial analysis support

streamlined business immigration assistance

navigating netherlands business environment

european union business law guidance

international financial reporting accuracy

business strategy for netherlands market

european investment opportunities insights

efficient tax authority communication

international business law excellence

dutch commercial law proficiency

global business strategy implementation

european business consulting excellence

comprehensive international business services

proactive financial planning strategies

expert legal advice on international matters

#company registration netherlands#legal advice online#comprehensive financial planning#financial planning consultancy#international business services#international business expansion strategies#gdpr compliance solutions#international trade consulting#european investment opportunities#gdpr compliance consulting services#in depth financial analysis#gdpr compliance assistance#cross border tax solutions#netherlands business environment#european union business law#dutch accounting services#tax intermediation solutions#international tax planning advice#eu trademark registration services#investment guidance online#business law consultancy

3 notes

·

View notes