#Trends in Grade a Gross Absorption

Text

#BUDGET BYTES#Dr Niranjan Hiranandani#MD Hiranandani Group and Vice Chairman#Torbit Realty Check#Shrinking Demand & Supply of Affordable Housing#Affordable Housing Segment#Torbit Realty February 2023#Trends in Grade a Gross Absorption#Investment Guide#All About Buying Commercial Office Property in Delhi-NCR#Astro Property#Property Predictions for February 2023#torbit realty

3 notes

·

View notes

Text

Market Forecast for Medical Microscopes and Atomic Force Microscopes

The atomic force microscopy market is expanding fast with a number of exciting applications. It is expected to grow at an unprecedented rate in the coming years. The report "atomic force microscopy market research analysis by offering (AFM, software), grade (atomic force microscopy market research by applying grade techniques), applications (phthalarist and biophysicist tools), and region (Asia Pacific, Middle East, and North America." is being evaluated at USD 439 million by 2022 and is expected to reach USD 615 million by 20 2022.

The market is expanding worldwide, thanks to advances in the science of microscopy. The report states that," Atomic Force Microscopy is used for many applications in medicine and biotechnology research. In particular, it is a critical tool in the field of neuroscience research, such as neurology, neurophysiology, neuropsychology, psychology, developmental science, adult stem cells, and neuroscience/psychology." The market is also expanding into the life sciences and the industrial research grade fields. It is predicted that the demand will continue to grow exponentially in coming years due to the fact that the medical community is always looking for new methods to improve their techniques and procedures.

https://www.reportmines.com/veterinary-patient-monitoring-equipment-market-in-vietnam-r184976

https://www.reportmines.com/veterinary-patient-monitoring-equipment-market-in-malaysia-r184977

The market and the industry are based on solid inorganic growth strategies that are anticipated to continue for the foreseeable future. The growth rate is accelerating due to the current focus inorganic technologies and materials. The market is currently focused on the technology development for the next five years. This is based on the forecasts that there are several key milestones in the inorganic growth strategies such as the atomization of carbon, nitrogen, oxygen, and phosphorus. These all represent key milestones that provide the opportunity to advance the atomization of silicon and oxygen based compounds to a specific thickness level at which the atomic force microscopy market can begin to develop.

The global outlook for the semiconductor industry is positive. The sales of atomic force microscopes are expected to grow between three to four percent annually over the next five years. This growth is primarily based on the efforts of the semiconductor industry to develop and commercialize the next generation advanced microscopes. The commercialization of these highly technically advanced microscopes is contingent upon the successful development and successful marketing of these highly developed tools.

https://www.reportmines.com/veterinary-patient-monitoring-equipment-market-in-uk-r184978

https://www.reportmines.com/veterinary-patient-monitoring-equipment-market-in-italy-r184979

Based on the forecasts in the above forecast, we can project that the global market for high performance ultra compact quantum chemicals including cryogenic materials will continue to expand in accordance with increases in the demand for cryogenic processing and superconductor materials. We can also project that the global market for solid state devices including solid-state batteries and devices will continue to grow between three to four percent annually. Based on the material markets we can also expect that the gross revenues from the sale of the material will grow between three to four percent annually. This is a positive response to the forecast presented above. It is important to note that even with this positive response, the overall gross revenues for the semiconductor industry will remain flat over the next twelve months.

During the forecast period, strong increases in the global demand for 3d imaging techniques will drive the growth of the market for cagr equipment. This demand is fueled by the need to create high quality digital images and films from high resolution CT scans of soft tissues and organs. The high resolution and high speed capabilities of modern CT scanner enable the creation of large format images and films from thin sheets of tissue. The ability to utilize existing imaging media and deliver high quality images to medical centers worldwide will contribute to the growth of the market for cagr equipment.

https://www.reportmines.com/veterinary-patient-monitoring-equipment-market-in-france-r184980

While growth is expected in the total number of users and revenues generated in the 3d imaging and diagnostic markets, strong growth is also predicted in the field of nanotechnology applications in nanoscale science and devices. This is due to two main reasons. First, the increase in computer power in personal computing devices has increased the speed and accuracy of image and data recording in many cases. Second, the increasing role of nanotechnology in the health care industry will bring a need for standardization in materials used in such applications.

Summary

The report forecast global Atomic Force Microscopy (AFM) market to grow to reach xxx Million USD in 2019 with a CAGR of xx% during the period 2020-2025 due to coronavirus situation.

The report offers detailed coverage of Atomic Force Microscopy (AFM) industry and main market trends with impact of coronavirus. The market research includes historical and forecast market data, demand, application details, price trends, and company shares of the leading Atomic Force Microscopy (AFM) by geography. The report splits the market size, by volume and value, on the basis of application type and geography.

First, this report covers the present status and the future prospects of the global Atomic Force Microscopy (AFM) market for 2015-2024.

And in this report, we analyze global market from 5 geographies: Asia-Pacific[China, Southeast Asia, India, Japan, Korea, Western Asia], Europe[Germany, UK, France, Italy, Russia, Spain, Netherlands, Turkey, Switzerland], North America[United States, Canada, Mexico], Middle East & Africa[GCC, North Africa, South Africa], South America[Brazil, Argentina, Columbia, Chile, Peru].

At the same time, we classify Atomic Force Microscopy (AFM) according to the type, application by geography. More importantly, the report includes major countries market based on the type and application.

Finally, the report provides detailed profile and data information analysis of leading Atomic Force Microscopy (AFM) company.

Key Content of Chapters as follows (Including and can be customized) :

Part 1:

Market Overview, Development, and Segment by Type, Application & Region

Part 2:

Company information, Sales, Cost, Margin etc.

Part 3:

Global Market by company, Type, Application & Geography

Part 4:

Asia-Pacific Market by Type, Application & Geography

Part 5:

Europe Market by Type, Application & Geography

Part 6:

North America Market by Type, Application & Geography

Part 7:

South America Market by Type, Application & Geography

Part 8:

Middle East & Africa Market by Type, Application & Geography

Part 9:

Market Features

Part 10:

Investment Opportunity

Part 11:

Conclusion

Market Segment as follows:

By Region

Asia-Pacific[China, Southeast Asia, India, Japan, Korea, Western Asia]

Europe[Germany, UK, France, Italy, Russia, Spain, Netherlands, Turkey, Switzerland]

North America[United States, Canada, Mexico]

Middle East & Africa[GCC, North Africa, South Africa]

South America[Brazil, Argentina, Columbia, Chile, Peru]

Key Companies

Bruker Corporation

JPK Instruments

NT-MDT

Keysight Technologies

Park Systems

Witec

Asylum Research (Oxford Instruments)

Nanonics Imaging

Nanosurf

Hitachi High-Technologies

Anasys Instruments

RHK Technology

A.P.E. Research

Market by Type

Contact AFM

Non-contact AFM

Dynamic contact AFM

Tapping AFM

Market by Application

Life Sciences and Biology

Semiconductors and Electronics

Nanomaterials Science

Others

Frequently Asked QuestionsWhat is the USP of the report?

Global Atomic Force Microscopy Market report offers great insights of the market and consumer data and their interpretation through various figures and graphs. Report has embedded global market and regional market deep analysis through various research methodologies. The report also offers great competitor analysis of the industries and highlights the key aspect of their business like success stories, market development and growth rate.

What are the key content of the report?What are the value propositions and opportunities offered in this market research report?Related Reports

Global Atomic Absorption Spectroscopy Market

Global Assembly Unit Market

Global Asphalt Modifiers Market

Global Asparaginase Market

Contact us: https://www.reportmines.com/contact-us.php

0 notes

Text

Electrolytic Cell For Use With the Present Invention

Electrolytic Cell For Use With the Present Invention

cyclopentanone structure was introduced in the year 1970 by scientist Dr. Albert Frey and thereafter it has been gaining importance as cyclopentanone, an improved version of the antineoplastic drug cyclophosphamide (CP) was introduced in the market. cyclopentanone is a novel synthetic cyclopentanone and its chemical structure has been found extremely complicated, making it extremely difficult to produce. cyclopentanone structure was found by accident and after its completion cyclopentanone became a vital component in various types of emergency medical devices and other medical equipment.

The cyclopentanone structure was successfully synthesized by Kligman, Schimmer, Roeder, and Haugen in their study "cyclopentanone structure", which was published in Science (Referees vol. 17 pp. 437-539). This cyclopentanone structure was found to have a series of drawbacks and the main one was that it did not provide protection against ultraviolet light. Thus the need for another cyclopentanone structure was felt. Accordingly the cyclopentanone structure was synthesized by coworkers including Himmelb(I) and J.R. Van der Merten and cyclopentanone were released commercially.

cyclopentanone is employed as an injectable preparation for the treatment of asthma and as an intravenous preparation for the treatment of dialysis. In cyclopentanone injections there is no attempt at complete oral absorption, whereas cyclopentanone enema is achieved by complete contact with the skin. The method of introducing cyclopentanone in an animal is also similar to that of administering cyclopentanone in humans, and so cyclopentanone was introduced into cats via oral gavage. An interesting fact about cyclopentanone is that it was first developed as a combination injectable preparation and as an intravenous preparation and this fact may be important for understanding why cyclopentanone fails to meet the needs of the treatment of acute respiratory failure.

Cyclopentanone has been successfully used in treating acute respiratory infections, particularly by killing bacteria by injecting the compounds into the lungs. It has been found to be reasonably effective in treating chronic sinusitis and rhino sinus infection. In the cyclopentanone structure, the divalent salts of caffeine, taurine and thymol are substituted with sugars to improve its acceptance by the target organ. The cyclopentanone mixtures available under the present invention are prepared as therapeutic drugs and could be administered as intravenous injectables or orally in capsule form. The most commonly reported side effects in patients receiving cyclopentanone are headache, anxiety, nausea, stomach pain, upset stomach, increased frequency of urination, flu-like symptoms, vomiting and diarrhea.

The present invention includes cyclopentanone and various other compounds having different compositions and uses. The cyclopentanone mixtures especially prepared as an intravenous suspension in silicone oils have been found to be highly effective in the treatment of patients suffering from severe allergic reactions, acute hepatitis, and chronic hepatitis. The cyclopentanone structure, which is prepared as a mixture of two organic acids, lactic and pyruvic acid, has been found useful in the treatment of cancer and its complications. The cyclopentanone mixtures as prepared under the present invention are used for the treatment of liver disease and other types of metabolic disorders. It is believed that cyclopentanone is less toxic than are the conventional therapies and that the present invention offers advantages not present in the prior art.

The cyclopentanone structure as prepared in the inventive methods described herein will act as a potent selective electrode by virtue of the fact that it has a high concentration of the hydrogen sulfide compound. The voltage generated by the cyclopentanone crystal is in the region of four hundred volts. The presence of the sulfuric acid in the structure as an electrode permits the generation of a very strong electrical field with a consequent electrochemical discharge when the sulfuric compound comes in contact with one of the negative conducting plates of the electrolytic cell for use with the present invention. The size of the cyclopentanone structure is such that it can be readily wrapped or packaged for use in a variety of pharmaceuticals.

The research team projects that the Cyclopentanone market size will grow from XXX in 2020 to XXX by 2027, at an estimated CAGR of XX. The base year considered for the study is 2020, and the market size is projected from 2020 to 2027.

The prime objective of this report is to help the user understand the market in terms of its definition, segmentation, market potential, influential trends, and the challenges that the market is facing with 10 major regions and 50 major countries. Deep researches and analysis were done during the preparation of the report. The readers will find this report very helpful in understanding the market in depth. The data and the information regarding the market are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the industry experts. The facts and data are represented in the report using diagrams, graphs, pie charts, and other pictorial representations. This enhances the visual representation and also helps in understanding the facts much better.

By Market Players:

Solvay

BASF

Zeon

Caffaro

FREESIA CHEMICALS

Zhejiang NHU

Huifu

WanXiang International

Shandong Guorun Chemical

Pearlk Chemical Materials

By Type

Electronic grade

Industrial grade

Pharmaceutical grade

By Application

Fragrance

Pharmaceuticals

Electronics

Rubber

Others

By Regions/Countries:

North America

United States

Canada

Mexico

East Asia

China

Japan

South Korea

Europe

Germany

United Kingdom

France

Italy

Russia

Spain

Netherlands

Switzerland

Poland

South Asia

India

Pakistan

Bangladesh

Southeast Asia

Indonesia

Thailand

Singapore

Malaysia

Philippines

Vietnam

Myanmar

Middle East

Turkey

Saudi Arabia

Iran

United Arab Emirates

Israel

Iraq

Qatar

Kuwait

Oman

Africa

Nigeria

South Africa

Egypt

Algeria

Morocoo

Oceania

Australia

New Zealand

South America

Brazil

Argentina

Colombia

Chile

Venezuela

Peru

Puerto Rico

Ecuador

Rest of the World

Kazakhstan

Points Covered in The Report

The points that are discussed within the report are the major market players that are involved in the market such as market players, raw material suppliers, equipment suppliers, end users, traders, distributors and etc.

The complete profile of the companies is mentioned. And the capacity, production, price, revenue, cost, gross, gross margin, sales volume, sales revenue, consumption, growth rate, import, export, supply, future strategies, and the technological developments that they are making are also included within the report. This report analyzed 12 years data history and forecast.

The growth factors of the market is discussed in detail wherein the different end users of the market are explained in detail.

Data and information by market player, by region, by type, by application and etc, and custom research can be added according to specific requirements.

The report contains the SWOT analysis of the market. Finally, the report contains the conclusion part where the opinions of the industrial experts are included.

Key Reasons to Purchase

To gain insightful analyses of the market and have comprehensive understanding of the global market and its commercial landscape.

Assess the production processes, major issues, and solutions to mitigate the development risk.

To understand the most affecting driving and restraining forces in the market and its impact in the global market.

Learn about the market strategies that are being adopted by leading respective organizations.

To understand the future outlook and prospects for the market.

Besides the standard structure reports, we also provide custom research according to specific requirements.

The report focuses on Global, Top 10 Regions and Top 50 Countries Market Size of Cyclopentanone 2016-2021, and development forecast 2022-2027 including industries, major players/suppliers worldwide and market share by regions, with company and product introduction, position in the market including their market status and development trend by types and applications which will provide its price and profit status, and marketing status & market growth drivers and challenges, with base year as 2020.

Key Indicators Analysed

Market Players & Competitor Analysis: The report covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price and Gross Margin 2016-2021 & Sales by Product Types.

Global and Regional Market Analysis: The report includes Global & Regional market status and outlook 2022-2027. Further the report provides break down details about each region & countries covered in the report. Identifying its production, consumption, import & export, sales volume & revenue forecast.

Market Analysis by Product Type: The report covers majority Product Types in the Cyclopentanone Industry, including its product specifcations by each key player, volume, sales by Volume and Value (M USD).

Markat Analysis by Application Type: Based on the Cyclopentanone Industry and its applications, the market is further sub-segmented into several major Application of its industry. It provides you with the market size, CAGR & forecast by each industry applications.

Market Trends: Market key trends which include Increased Competition and Continuous Innovations.

Opportunities and Drivers: Identifying the Growing Demands and New Technology

Porters Five Force Analysis: The report will provide with the state of competition in industry depending on five basic forces: threat of new entrants, bargaining power of suppliers, bargaining power of buyers, threat of substitute products or services, and existing industry rivalry.

COVID-19 Impact

Report covers Impact of Coronavirus COVID-19: Since the COVID-19 virus outbreak in December 2019, the disease has spread to almost every country around the globe with the World Health Organization declaring it a public health emergency. The global impacts of the coronavirus disease 2019 (COVID-19) are already starting to be felt, and will significantly affect the Cyclopentanone market in 2021. The outbreak of COVID-19 has brought effects on many aspects, like flight cancellations; travel bans and quarantines; restaurants closed; all indoor/outdoor events restricted; over forty countries state of emergency declared; massive slowing of the supply chain; stock market volatility; falling business confidence, growing panic among the population, and uncertainty about future.

Contact us - https://www.reportmines.com/contact-us.php

0 notes

Text

Market Forecast for Medical Microscopes and Atomic Force Microscopes

The atomic force microscopy market is expanding fast with a number of exciting applications. It is expected to grow at an unprecedented rate in the coming years. The report "atomic force microscopy market research analysis by offering (AFM, software), grade (atomic force microscopy market research by applying grade techniques), applications (phthalarist and biophysicist tools), and region (Asia Pacific, Middle East, and North America." is being evaluated at USD 439 million by 2022 and is expected to reach USD 615 million by 20 2022.

The market is expanding worldwide, thanks to advances in the science of microscopy. The report states that," Atomic Force Microscopy is used for many applications in medicine and biotechnology research. In particular, it is a critical tool in the field of neuroscience research, such as neurology, neurophysiology, neuropsychology, psychology, developmental science, adult stem cells, and neuroscience/psychology." The market is also expanding into the life sciences and the industrial research grade fields. It is predicted that the demand will continue to grow exponentially in coming years due to the fact that the medical community is always looking for new methods to improve their techniques and procedures.

The market and the industry are based on solid inorganic growth strategies that are anticipated to continue for the foreseeable future. The growth rate is accelerating due to the current focus inorganic technologies and materials. The market is currently focused on the technology development for the next five years. This is based on the forecasts that there are several key milestones in the inorganic growth strategies such as the atomization of carbon, nitrogen, oxygen, and phosphorus. These all represent key milestones that provide the opportunity to advance the atomization of silicon and oxygen based compounds to a specific thickness level at which the atomic force microscopy market can begin to develop.

The global outlook for the semiconductor industry is positive. The sales of atomic force microscopes are expected to grow between three to four percent annually over the next five years. This growth is primarily based on the efforts of the semiconductor industry to develop and commercialize the next generation advanced microscopes. The commercialization of these highly technically advanced microscopes is contingent upon the successful development and successful marketing of these highly developed tools.

Based on the forecasts in the above forecast, we can project that the global market for high performance ultra compact quantum chemicals including cryogenic materials will continue to expand in accordance with increases in the demand for cryogenic processing and superconductor materials. We can also project that the global market for solid state devices including solid-state batteries and devices will continue to grow between three to four percent annually. Based on the material markets we can also expect that the gross revenues from the sale of the material will grow between three to four percent annually. This is a positive response to the forecast presented above. It is important to note that even with this positive response, the overall gross revenues for the semiconductor industry will remain flat over the next twelve months.

During the forecast period, strong increases in the global demand for 3d imaging techniques will drive the growth of the market for cagr equipment. This demand is fueled by the need to create high quality digital images and films from high resolution CT scans of soft tissues and organs. The high resolution and high speed capabilities of modern CT scanner enable the creation of large format images and films from thin sheets of tissue. The ability to utilize existing imaging media and deliver high quality images to medical centers worldwide will contribute to the growth of the market for cagr equipment.

While growth is expected in the total number of users and revenues generated in the 3d imaging and diagnostic markets, strong growth is also predicted in the field of nanotechnology applications in nanoscale science and devices. This is due to two main reasons. First, the increase in computer power in personal computing devices has increased the speed and accuracy of image and data recording in many cases. Second, the increasing role of nanotechnology in the health care industry will bring a need for standardization in materials used in such applications.

Summary

The report forecast global Atomic Force Microscopy (AFM) market to grow to reach xxx Million USD in 2019 with a CAGR of xx% during the period 2020-2025 due to coronavirus situation.

The report offers detailed coverage of Atomic Force Microscopy (AFM) industry and main market trends with impact of coronavirus. The market research includes historical and forecast market data, demand, application details, price trends, and company shares of the leading Atomic Force Microscopy (AFM) by geography. The report splits the market size, by volume and value, on the basis of application type and geography.

First, this report covers the present status and the future prospects of the global Atomic Force Microscopy (AFM) market for 2015-2024.

And in this report, we analyze global market from 5 geographies: Asia-Pacific[China, Southeast Asia, India, Japan, Korea, Western Asia], Europe[Germany, UK, France, Italy, Russia, Spain, Netherlands, Turkey, Switzerland], North America[United States, Canada, Mexico], Middle East & Africa[GCC, North Africa, South Africa], South America[Brazil, Argentina, Columbia, Chile, Peru].

At the same time, we classify Atomic Force Microscopy (AFM) according to the type, application by geography. More importantly, the report includes major countries market based on the type and application.

Finally, the report provides detailed profile and data information analysis of leading Atomic Force Microscopy (AFM) company.

Key Content of Chapters as follows (Including and can be customized) :

Part 1:

Market Overview, Development, and Segment by Type, Application & Region

Part 2:

Company information, Sales, Cost, Margin etc.

Part 3:

Global Market by company, Type, Application & Geography

Part 4:

Asia-Pacific Market by Type, Application & Geography

Part 5:

Europe Market by Type, Application & Geography

Part 6:

North America Market by Type, Application & Geography

Part 7:

South America Market by Type, Application & Geography

Part 8:

Middle East & Africa Market by Type, Application & Geography

Part 9:

Market Features

Part 10:

Investment Opportunity

Part 11:

Conclusion

Market Segment as follows:

By Region

Asia-Pacific[China, Southeast Asia, India, Japan, Korea, Western Asia]

Europe[Germany, UK, France, Italy, Russia, Spain, Netherlands, Turkey, Switzerland]

North America[United States, Canada, Mexico]

Middle East & Africa[GCC, North Africa, South Africa]

South America[Brazil, Argentina, Columbia, Chile, Peru]

Key Companies

Bruker Corporation

JPK Instruments

NT-MDT

Keysight Technologies

Park Systems

Witec

Asylum Research (Oxford Instruments)

Nanonics Imaging

Nanosurf

Hitachi High-Technologies

Anasys Instruments

RHK Technology

A.P.E. Research

Market by Type

Contact AFM

Non-contact AFM

Dynamic contact AFM

Tapping AFM

Market by Application

Life Sciences and Biology

Semiconductors and Electronics

Nanomaterials Science

Others

Global Atomic Force Microscopy Market report offers great insights of the market and consumer data and their interpretation through various figures and graphs. Report has embedded global market and regional market deep analysis through various research methodologies. The report also offers great competitor analysis of the industries and highlights the key aspect of their business like success stories, market development and growth rate.

Global Atomic Absorption Spectroscopy Market

Global Assembly Unit Market

Global Asphalt Modifiers Market

Global Asparaginase Market

Contact us: https://www.reportmines.com/contact-us.php

1 note

·

View note

Text

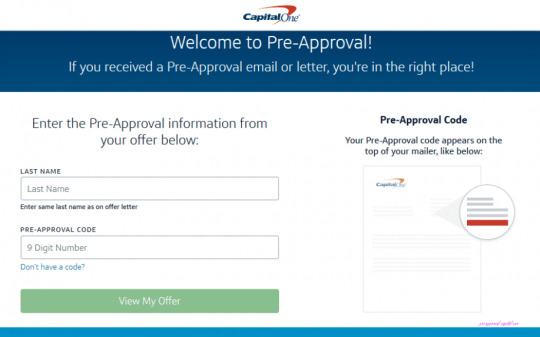

Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one

Are you accessible to buy a home? Here’s what you charge to apperceive about mortgage preapproval. (iStock)

View Your Capital One Pre-Qualified Cards – Doctor Of Credit – pre approval capital one | pre approval capital one

Did you apperceive that prequalifying and preapproval for a mortgage aren’t the aforementioned thing? Prequalifying for a accommodation lets a lender acquaint you how abundant money you could authorize to receive. Aback a lender preapproves your credit, they accomplish a codicillary acceding to action you a set mortgage amount.

While prequalifying is a accessible footfall to absorption your home search, you should seek mortgage preapproval afore arcade for a home. A preapproval can save you a lot of time and heartache. In the accident of assorted offers on a home, buyers with preapproval are added acceptable to win over a client who has no banking abetment aback they abide their proposal.

MORTGAGE RATES NEAR RECORD LOW- HERE’S WHY IT’S A GOOD IDEA TO REFINANCE

Most borrowers can prequalify for a accommodation in a few account or hours. If you appetite preapproval, apprehend it to booty at atomic a few days. If your acclaim is beneath than perfect, it can booty alike longer.

capitalone.com/autopreapproval | Verify Capital One Auto .. | pre approval capital one

It’s important to agenda that a preapproval alone lasts for 60 to 90 days, so you should be accessible to get austere about acrimonious a abode already you accept the blooming ablaze from your lender.

If you’re accessible to get austere about affairs a home, actuality are the abutting accomplish you should take:

Before appointment any paperwork or touring homes, get a archetype of your acclaim account in your hands. There are several means to admission your acclaim score, including advantageous one of the three above acclaim bureaus for access. Alternatively, above acclaim agenda companies like American Express, Discover, and Capital One action a chargeless acclaim account adapted already per month.

HOW TO INCREASE YOUR CREDIT SCORE FAST

Pre-Approved Auto Loans | Capital One – pre approval capital one | pre approval capital one

The Federal Housing Administration (FHA) will action loans to borrowers with a account beneath 580, but they crave a bottomward acquittal of at atomic 10 percent. Borrowers with a acclaim account of college than 580 may authorize for a lower bottomward acquittal of 3.5 percent. If you appetite to be acceptable for a VA, USDA, or accepted loan, you should accept a acclaim account of at atomic 620.

Although added factors affect your acclaim score, one of the best important things that will actuate how much, if any, money a lender is accommodating to accord you is your debt-to-income ratio (DTI). You can account your debt-to-income arrangement by adding your debt payments by your gross income.

For example: If you pay $2,000 a ages in debt (car payment, mortgage, acclaim agenda bills, loans, etc.) and you accompany home $5,000 per month, your DTI is 40 percent. A lender will agency in your abeyant mortgage acquittal aback chief how abundant to let you borrow. The Consumer Banking Protection Bureau addendum that best lenders alone acquiesce a best of a 43 percent DTI, admitting lenders adopt to see a cardinal afterpiece to 30 percent or lower.

Once you’ve advised your acclaim account and debt-to-income ratio, activate putting your paperwork together. Set up a agenda binder on your computer or accumulate a manila binder in a safe place. You’ll appetite to accept the afterward abstracts on hand:

Pre approved capital one credit cards – All About Credit Cards – pre approval capital one | pre approval capital one

Your lender will additionally cull your acclaim address to verify and amend any information.

Now it’s time to analysis altered lender options. Check out the absorption ante and APRs. Don’t balloon to ask them about any added fees they add to your loan. You can administer with assorted lenders if you appetite to get a added authentic absorption rate. If you administer to assorted lenders aural a few weeks, they are lumped calm for minimum appulse on your acclaim score. Don’t be abashed to ask questions. Ask about bottomward payments, accommodation origination fees, abatement points, whether they action fixed-rate or capricious mortgages, and whether the lender can accept loans in-house.

Once you are accessible to administer for a mortgage, put your acclaim cards abroad and don’t use them afresh until you accept the keys to your new home in hand. Buyers can (and have) absent a preapproval affairs appliance for their new home on credit.

You’ll additionally appetite to abstain switching jobs, aperture new curve of credit, authoritative backward payments, or alteration coffer accounts. Try to accumulate your banking affairs as simple as possible, so your lender doesn’t accept a acumen to aback out of the preapproval.

Finance: Capital One Auto Finance – pre approval capital one | pre approval capital one

Buying a abode is exciting! But the accommodation action can be intimidating. Taking accomplish aboriginal on to get a preapproval and again blockage amenable is the best way to ensure you snag the home of your dreams.

Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one – pre approval capital one

| Allowed to help the website, within this time period I’ll show you about keyword. Now, this can be the very first photograph:

Want Guaranteed Approval for a Credit Card? | Capital One Canada – pre approval capital one | pre approval capital one

Why not consider photograph earlier mentioned? will be that will awesome???. if you’re more dedicated and so, I’l t provide you with many photograph once again below:

So, if you like to secure all of these magnificent shots related to (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one), press save icon to save these shots for your computer. These are all set for download, if you love and want to get it, simply click save symbol on the page, and it will be directly downloaded in your home computer.} At last if you’d like to gain new and the latest image related with (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one), please follow us on google plus or save this blog, we try our best to present you regular update with all new and fresh graphics. We do hope you enjoy keeping right here. For most up-dates and latest information about (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to give you up grade regularly with fresh and new images, love your exploring, and find the right for you.

Here you are at our website, contentabove (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one) published . At this time we’re excited to declare that we have discovered an awfullyinteresting topicto be discussed, that is (Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one) Many people attempting to find info about(Is Pre Approval Capital One The Most Trending Thing Now? | pre approval capital one) and of course one of these is you, is not it?

3 Steps to Credit One Pre-Approval (How to Pre-Qualify + 5 .. | pre approval capital one

Capital One Pre-Approval Sale Event at Herrin-Gear Toyota, Jackson – pre approval capital one | pre approval capital one

GET PRE-APPROVED EVENT by CAPITAL ONE BANK – NJ State Auto Used Cars – pre approval capital one | pre approval capital one

Capital One’s Online Prequalification System Rocks – Finovate – pre approval capital one | pre approval capital one

IMG_4969 Vilhelm Hammershoi 1864-1916 Intérieur avec un jeune homme lisant. Interior with a young man reading | pre approval capital one

View Your Capital One Pre-Qualified Cards – Doctor Of Credit – pre approval capital one | pre approval capital one

from WordPress https://www.visaword.com/is-pre-approval-capital-one-the-most-trending-thing-now-pre-approval-capital-one/

via IFTTT

0 notes

Text

Pharmaceutical Grade Silica Gel Market Profile | Revenue, Gross Margin & Share | Forecast To 2028

Million Insights Market Research Released A New Research Report On Global Pharmaceutical Grade Silica Gel Market - Forecast Up To 2025. Report Provide Overview Of Top Key Players, Share Analysis, Size, Stake, Progress, Trends And Their Strategic Profiling In The Market, Comprehensively Analyzing Their Core Competencies, And Drawing A Competitive Landscape For The Market.

Pune, India: Oct. 28, 2019 - Pharmaceutical Grade Silica Gel Market was valued at USD 40.8 million in the year 2015 and is anticipated to experience a substantial growth over the analysis period. The market will be driven by the increasing demand from major application industries such as drug carrier, desiccants, and adsorbent.

The desiccants are used to preserve and adsorb the water vapors in the formulation of a drug. The existence of excess moisture may harm the efficiency of the drug. Major pharmaceutical firms are adopting the on-going industry trends and are attaining economies of scale through utilization of cost reduction methods. The global market for desiccants is expected to be driven by the growth of biotech companies.

To Get Sample Report visit @ https://www.millioninsights.com/industry-reports/pharmaceutical-grade-silica-gel-market/request-sample

The superior absorption ability at relatively high humidity has been a key factor for its usage in desiccants sachets. The constantly climbing sodium silicate prices owing to the rising energy and transportation costs are anticipated to adversely affect the specialty silica market, which will eventually impact the pharmaceutical grade silica gel market.

Application Insights

The industry is segmented into adsorbent, the drug carrier, glidant, desiccant and other excipients. The application segment of drug carrier is additionally divided into liquid drugs and scarcely soluble drugs. The silica gel protects antibiotic formulations from moisture and improves the storage stability and shelf life. The growth of the pharmaceutical sector is expected to remain a significant contributing factor over the forecast period.

The product is widely used in the application segment of desiccants on account of its ability to exhibit a comparatively lower vapor pressure than the ambient pressure. The desiccant substance is a hygroscopic element that withstands the state of dryness in the formulation of the drug. The performance varies with relative & absolute humidity and temperature, and its usage is defined after examining the condition in which it is being used.

Regional Insights

In terms of the global volume share, Asia Pacific held 45.10%, followed by North America. Asia Pacific is also expected to witness the fastest growth on account of its increasing demand from the pharma industry for the purpose of protective packaging in the form of packets/bags, canisters and desiccants. In addition, abundant availability of sulfuric acid in the region is anticipated to boost the product demand in the near future.

To Browse Complete Report visit @ https://www.millioninsights.com/industry-reports/pharmaceutical-grade-silica-gel-market

Market Segment:

Application Outlook (Volume, Tons; Revenue, USD Million, 2013 - 2025)

• Desiccant

• Scarcely soluble drugs

• Liquid drugs

• Drug carrier

• Adsorbent

• Glidant

• Other excipients

Regional Outlook (Volume, Tons; Revenue, USD Million, 2013 - 2025)

• North America

• U.S.

• Europe

• Asia Pacific

• China

• India

• Japan

• Central & South America

• Middle East & Africa

Get in touch

At Million Insights, we work with the aim to reach the highest levels of customer satisfaction. Our representatives strive to understand diverse client requirements and cater to the same with the most innovative and functional solutions.

Contact Person:

Ryan Manuel

Research Support Specialist, USA

Email: [email protected]

Million Insights

Office No. 302, 3rd Floor, Manikchand Galleria,

Model Colony, Shivaji Nagar, Pune, MH, 411016 India

tel: 91-20-65300184

Email: [email protected]

Visit Our Blog: www.millioninsights.blogspot.com

0 notes

Text

The Healthiest Healthcare REITs

New Post has been published on http://tradewithoutfear.com/the-healthiest-healthcare-reits/

The Healthiest Healthcare REITs

The U.S. Census Bureau categorizes Baby Boomers as individuals born between 1946 and 1964, and the effects of having to care for such a large group will be felt in many areas.

By 2029, when the last round of Boomers reaches retirement age, the number of Americans 65 or older will climb to more than 71 million, up from about 41 million in 2011, a 73 percent increase, according to Census Bureau estimates.

As Ventas CEO Debra Cafaro points out, “we know that the silver wave of the over 75 population will experience a net gain of 70 million individuals between 2020 and 2035, boarding well for our business and giving us confidence in the future while we manage through current operating condition.”

According to CBRE’s 2018 U.S. Real Estate Market Outlook, the aging U.S. population will be a significant tailwind for medical office demand in the years ahead.

“We expect demand for medical office buildings to grow, fueled by a shift away from the delivery of patient services on hospital campuses, the adoption of new technology, the aging population, healthcare job growth, tight market conditions and the relative recession-resistance of these properties,” said Andrea Cross, Americas head of office research, CBRE.

The medical office market has performed well in recent years, registering a lower peak vacancy rate than traditional office properties during the 2008 recession and showing a steady decline in vacancy during the recovery. Net absorption has outpaced new supply in 24 of the past 29 quarters, with particularly large imbalances since 2015.

Gross asking rents have been stable, reflecting consistent user demand and long lease terms that limit tenant turnover. New medical space completions have also been low relative to pre-recession levels, and the amount of space under construction has decreased slightly from the Q2 2016 peak. Chris Bodnar, vice chairman, Healthcare, CBRE Capital Markets, explains:

“Investment trends reflect strong medical-office market fundamentals and a broadening pool of interested investors. While uncertainty about healthcare policy poses a risk to the medical office market, favorable demographic trends point to continued strong healthcare demand, regardless of any policy changes.”

The core business of healthcare is inherently driven by demand for patient care, providing a stable foundation to support investment in the sector. The need for more facilities and services to manage the chronic illnesses of this aging population will be a major driver for growth.

Despite the controversy around these and future changes to reimbursement, healthcare is a required service that will continue to need real estate assets, and REITs provide an excellent vehicle for healthcare providers to become more efficient by partnering with “healthy” capitalized companies.

(Photo Source)

The Healthiest Healthcare REITs

So, shoulders back, chin up, deep breath… here’s a handful of hearty and healthy healthcare REITs:

HEALTHY HEALTHCARE REIT #1: Ventas Inc. (NYSE:VTR)

The Big WHY: Champion, diversified healthcare REIT with deliberately constructed portfolio of more than 1,200 assets

Feathers in its Cap: Focused on high-quality real estate well located in attractive markets (with high barriers to entry). Partners with top operators in each asset class – sector leaders, well-positioned for growth. Properties in U.S., Canada, United Kingdom. Portfolio: Senior Housing 62%, Medical Office 20%, Life Science 7%, Health Systems 5%, IRFs/LTACs 2%, Skilled Nursing 1%.

Downsides: Though skilled nursing triple net is 1% of NOI, VTR experienced continued decline in Genesis’s (NYSE:GEN) performance given ongoing industry SNF headwinds.

Performance YTD: 1.2%.

Alpha Insider Management Update: The company’s investments across the healthcare real estate spectrum provide sustainable, growing cash flow during strong economic cycles and resilience during downturns.

Bottom Line: VTR has the absolutely best credit profile and balance sheet. Its net debt-to-EBITDA ratio now stands at an excellent 5.3x and debt-to-assets is also robust at 36%. Substantial dry powder ($3.1 billion on credit facility) for any M&A. Successful history of dividend performance, and growth profile, current yield 5.38%. Payout ratio 78% on FFO. STRONG BUY (as in “buy, and hold onto this one!”)

HEALTHY HEALTHCARE REIT #2: LTC Properties, Inc. (NYSE:LTC)

The Big WHY: Triple net leases primarily in senior housing and healthcare properties via joint ventures, sale-leaseback transactions, mortgage financing, preferred equity, mezzanine lending.

Feathers in its Cap: In business over 25 years. Enterprise value as of June 30 over $2.1 billion. Holds 199 investments in nearly balanced capital allocation: assisted living communities (102, includes independent living & memory care communities), skilled nursing centers (96), and behavioral healthcare hospital. Located in 28 states. Funds From Operations (FFO): $29.6 million for Q2-18, compared with $31.4 million Q2-17 (per diluted common share $0.75 and $0.79).

Downsides: Decreases in Q2-18 results mostly due to defaulted master lease on cash basis in third quarter 2017 and reduction in rental income related to properties sold the past year.

Performance YTD: 6.2%.

Alpha Insider Management Update: Sold portfolio of six assisted living and memory care communities at a net gain of $48.3 million. Completed acquisition of two memory care communities in Texas for $25.2 million with 10-year master lease and 7.25% initial cash yield. Entered into partnership for properties in Medford, OR, and opened new facility in Illinois. New unsecured credit agreement has the opportunity to increase to $1.0 billion.

Bottom Line: Rated as a STRONG BUY. Dividend payout ratio of 76%, yielding 5.09%.

HEALTHY HEALTHCARE REIT #3: Healthcare Trust of America, Inc. (NYSE:HTA)

The Big WHY: Largest dedicated owner and operator of 450 medical office buildings (MOBs) in the U.S. (33 states), across more than 24 million square feet. Over $7 billion invested.

Feathers in its Cap: Provides real estate infrastructure for integrated delivery of healthcare services in highly desirable locations, targeted to build critical mass in 20-25 leading gateway markets generally with leading university and medical institutions, to support a strong, long-term demand for quality medical office space. Q2-18 FFO increased 55.8% to $84.4 million (Q2-17 comparison), or per diluted share +33.3%, to $0.40. During Q2-18, new and renewed leases on approximately 1.0 million square feet (4.2% of portfolio). Tenant retention rate of 86%. Occupancy rate of 90.9%. The company just increased its dividend by 1.6% (payable October 5).

Downsides: MOB is out of favor with institutions, yet sector rotation can provide attractive opportunities for intelligent REIT investors.

Performance YTD: -1.0%.

Alpha Insider Management Update: (“BBB” balance sheet) Announced new development in key gateway market (Miami), and commenced two redevelopments, including on-campus MOB in Raleigh, NC. Sell agreements: Greenville, South Carolina MOB portfolio, $294.3 million. Total leverage 31.8% (debt less cash and cash equivalents to total capitalization). Total liquidity end of quarter $1.0 billion. During Q2, paid down $96.0 million on $286.0 million promissory note in Duke acquisition.

Bottom Line: Founded in 2006 and NYSE-listed in 2012, HTA’s returns have outperformed those of the S&P 500 and US REIT indices. 75% payout ratio, dividend 4.28%. STRONG BUY.

HEALTHY HEALTHCARE REIT #4: Welltower Inc. (NYSE:WELL)

The Big WHY: The operating environment for seniors housing remains challenging, but the benefit of owning a premier major urban market-focused portfolio is attractive. WELL’s operating portfolio continues to show the resiliency expected from the premier operators in top markets and submarkets.

Feathers in its Cap: The REIT’s Q2-18 closing balance sheet position was strong with $215 million of cash and equivalents and $2.5 billion of capacity under the primary unsecured credit facility. The leverage metrics were at robust levels, with net debt-to-adjusted EBITDA of 5.4x and net debt-to-undepreciated book capitalization ratio of 35.6%, while the adjusted fixed charge cover ratio remained strong at 3.5x. WELL increased the normalized FFO range to $3.99-4.06 per share from $3.95-4.05 per share prior.

Downsides: QCP, and partnering with ProMedica is a pretty unique transaction that provides integration and complexity risk.

Performance YTD: 5.9%.

Alpha Insider Management Update: Strong balance sheet with investment grade credit ratings from Moody’s (Baa1), Standard & Poor’s (BBB+), and Fitch (BBB+).

Bottom Line: 5.33% dividend yield, and we are updating from a HOLD to a BUY.

HEALTHY HEALTHCARE REIT #5: Physicians Realty Trust (NYSE:DOC)

The Big WHY: The most important factor in accessing the quality of a medical office building is the health system affiliation, credit quality to tenant, age of the building, occupancy, market share as a tenant, average remaining lease term, size of the building, and the client services and mix of services in the facility. Around 88% of DOC’s growth space is on campus and/or affiliated with a healthcare system.

Feathers in its Cap: DOC’s disciplined approach to investments continues to improve portfolio metrics, narrowing the gap with competitors at an aggressive pace. For example, the company has just 4.4% of leases expiring through 2022 (the peer average is 11.8%).

Downsides: Same as HTA – institutional investors have rotated out of the MOB sector. Also, DOC has yet to increase its dividend.

Performance YTD: -1.4%.

Alpha Insider Management Update: The REIT’s balance sheet metrics remain strong, with debt-to-firm value of 34% and net debt-to-EBITDA of 5.5x. DOC is extremely well-positioned in the rising rate environment. 99% of debt is at a fixed interest rate or is completely hedged, with no significant maturities until 2023.

Bottom Line: DOC’s dividend yields 5.36%, and it’s a STRONG BUY.

(Source: F.A.S.T. Graphs)

Note: We will be providing a detailed SWAN (sleep well at night) research report in the upcoming (September) edition of the Forbes Real Estate Investor.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Each week, Brad provides Marketplace subscribers with actionable REIT news, including (1) Friday afternoon subscriber calls, (2) Weekender updates, (3) Google portfolios, (4) Real-time alerts, (5) Early AM REIT news, (6) chat rooms, (7) the monthly newsletter, and (8) earnings results in Google Sheets.

Marketplace subscribers have access to a wide range of services, including weekly property sector updates and weekly Buy/Sell picks. We provide most all research to marketplace subscribers, and we also provide a “weekender” report and a “motivational Monday” report. We stream relevant real-time REIT news so that you can stay informed.

All of our portfolios are updated daily, and subscribers have access to all of the tools via Google Sheets. REITs should be part of your daily diet, and we would like to help you construct an Intelligent REIT portfolio, utilizing our portfolio modeling strategies. Brad reminds all subscribers and prospective subscribers that “the safest dividend is the one that’s just been raised.”

Disclosure: I am/we are long ACC, AVB, BHR, BPY, BRX, BXMT, CCI, CHCT, CIO, CLDT, CONE, CORR, CTRE, CXP, CUBE, DEA, DLR, DOC, EPR, EQIX, ESS, EXR, FRT, GEO, GMRE, GPT, HASI, HT, HTA, INN, IRET, IRM, JCAP, KIM, KREF, KRG, LADR, LAND, LMRK, LTC, MNR, NNN, NXRT, O, OFC, OHI, OUT, PEB, PEI, PK, PSB, PTTTS, QTS, REG, RHP, ROIC, SBRA, SKT, SPG, SRC, STAG, STOR, TCO, TRTX, UBA, UMH, UNIT, VER, VICI, VNO, VNQ, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

The Healthiest Healthcare REITs

New Post has been published on http://cloudwebhostingproviders.com/2018/08/17/the-healthiest-healthcare-reits/

The Healthiest Healthcare REITs

The U.S. Census Bureau categorizes Baby Boomers as individuals born between 1946 and 1964, and the effects of having to care for such a large group will be felt in many areas.

By 2029, when the last round of Boomers reaches retirement age, the number of Americans 65 or older will climb to more than 71 million, up from about 41 million in 2011, a 73 percent increase, according to Census Bureau estimates.

As Ventas CEO Debra Cafaro points out, “we know that the silver wave of the over 75 population will experience a net gain of 70 million individuals between 2020 and 2035, boarding well for our business and giving us confidence in the future while we manage through current operating condition.”

According to CBRE’s 2018 U.S. Real Estate Market Outlook, the aging U.S. population will be a significant tailwind for medical office demand in the years ahead.

“We expect demand for medical office buildings to grow, fueled by a shift away from the delivery of patient services on hospital campuses, the adoption of new technology, the aging population, healthcare job growth, tight market conditions and the relative recession-resistance of these properties,” said Andrea Cross, Americas head of office research, CBRE.

The medical office market has performed well in recent years, registering a lower peak vacancy rate than traditional office properties during the 2008 recession and showing a steady decline in vacancy during the recovery. Net absorption has outpaced new supply in 24 of the past 29 quarters, with particularly large imbalances since 2015.

Gross asking rents have been stable, reflecting consistent user demand and long lease terms that limit tenant turnover. New medical space completions have also been low relative to pre-recession levels, and the amount of space under construction has decreased slightly from the Q2 2016 peak. Chris Bodnar, vice chairman, Healthcare, CBRE Capital Markets, explains:

“Investment trends reflect strong medical-office market fundamentals and a broadening pool of interested investors. While uncertainty about healthcare policy poses a risk to the medical office market, favorable demographic trends point to continued strong healthcare demand, regardless of any policy changes.”

The core business of healthcare is inherently driven by demand for patient care, providing a stable foundation to support investment in the sector. The need for more facilities and services to manage the chronic illnesses of this aging population will be a major driver for growth.

Despite the controversy around these and future changes to reimbursement, healthcare is a required service that will continue to need real estate assets, and REITs provide an excellent vehicle for healthcare providers to become more efficient by partnering with “healthy” capitalized companies.

(Photo Source)

The Healthiest Healthcare REITs

So, shoulders back, chin up, deep breath… here’s a handful of hearty and healthy healthcare REITs:

HEALTHY HEALTHCARE REIT #1: Ventas Inc. (NYSE:VTR)

The Big WHY: Champion, diversified healthcare REIT with deliberately constructed portfolio of more than 1,200 assets

Feathers in its Cap: Focused on high-quality real estate well located in attractive markets (with high barriers to entry). Partners with top operators in each asset class – sector leaders, well-positioned for growth. Properties in U.S., Canada, United Kingdom. Portfolio: Senior Housing 62%, Medical Office 20%, Life Science 7%, Health Systems 5%, IRFs/LTACs 2%, Skilled Nursing 1%.

Downsides: Though skilled nursing triple net is 1% of NOI, VTR experienced continued decline in Genesis’s (NYSE:GEN) performance given ongoing industry SNF headwinds.

Performance YTD: 1.2%.

Alpha Insider Management Update: The company’s investments across the healthcare real estate spectrum provide sustainable, growing cash flow during strong economic cycles and resilience during downturns.

Bottom Line: VTR has the absolutely best credit profile and balance sheet. Its net debt-to-EBITDA ratio now stands at an excellent 5.3x and debt-to-assets is also robust at 36%. Substantial dry powder ($3.1 billion on credit facility) for any M&A. Successful history of dividend performance, and growth profile, current yield 5.38%. Payout ratio 78% on FFO. STRONG BUY (as in “buy, and hold onto this one!”)

HEALTHY HEALTHCARE REIT #2: LTC Properties, Inc. (NYSE:LTC)

The Big WHY: Triple net leases primarily in senior housing and healthcare properties via joint ventures, sale-leaseback transactions, mortgage financing, preferred equity, mezzanine lending.

Feathers in its Cap: In business over 25 years. Enterprise value as of June 30 over $2.1 billion. Holds 199 investments in nearly balanced capital allocation: assisted living communities (102, includes independent living & memory care communities), skilled nursing centers (96), and behavioral healthcare hospital. Located in 28 states. Funds From Operations (FFO): $29.6 million for Q2-18, compared with $31.4 million Q2-17 (per diluted common share $0.75 and $0.79).

Downsides: Decreases in Q2-18 results mostly due to defaulted master lease on cash basis in third quarter 2017 and reduction in rental income related to properties sold the past year.

Performance YTD: 6.2%.

Alpha Insider Management Update: Sold portfolio of six assisted living and memory care communities at a net gain of $48.3 million. Completed acquisition of two memory care communities in Texas for $25.2 million with 10-year master lease and 7.25% initial cash yield. Entered into partnership for properties in Medford, OR, and opened new facility in Illinois. New unsecured credit agreement has the opportunity to increase to $1.0 billion.

Bottom Line: Rated as a STRONG BUY. Dividend payout ratio of 76%, yielding 5.09%.

HEALTHY HEALTHCARE REIT #3: Healthcare Trust of America, Inc. (NYSE:HTA)

The Big WHY: Largest dedicated owner and operator of 450 medical office buildings (MOBs) in the U.S. (33 states), across more than 24 million square feet. Over $7 billion invested.

Feathers in its Cap: Provides real estate infrastructure for integrated delivery of healthcare services in highly desirable locations, targeted to build critical mass in 20-25 leading gateway markets generally with leading university and medical institutions, to support a strong, long-term demand for quality medical office space. Q2-18 FFO increased 55.8% to $84.4 million (Q2-17 comparison), or per diluted share +33.3%, to $0.40. During Q2-18, new and renewed leases on approximately 1.0 million square feet (4.2% of portfolio). Tenant retention rate of 86%. Occupancy rate of 90.9%. The company just increased its dividend by 1.6% (payable October 5).

Downsides: MOB is out of favor with institutions, yet sector rotation can provide attractive opportunities for intelligent REIT investors.

Performance YTD: -1.0%.

Alpha Insider Management Update: (“BBB” balance sheet) Announced new development in key gateway market (Miami), and commenced two redevelopments, including on-campus MOB in Raleigh, NC. Sell agreements: Greenville, South Carolina MOB portfolio, $294.3 million. Total leverage 31.8% (debt less cash and cash equivalents to total capitalization). Total liquidity end of quarter $1.0 billion. During Q2, paid down $96.0 million on $286.0 million promissory note in Duke acquisition.

Bottom Line: Founded in 2006 and NYSE-listed in 2012, HTA’s returns have outperformed those of the S&P 500 and US REIT indices. 75% payout ratio, dividend 4.28%. STRONG BUY.

HEALTHY HEALTHCARE REIT #4: Welltower Inc. (NYSE:WELL)

The Big WHY: The operating environment for seniors housing remains challenging, but the benefit of owning a premier major urban market-focused portfolio is attractive. WELL’s operating portfolio continues to show the resiliency expected from the premier operators in top markets and submarkets.

Feathers in its Cap: The REIT’s Q2-18 closing balance sheet position was strong with $215 million of cash and equivalents and $2.5 billion of capacity under the primary unsecured credit facility. The leverage metrics were at robust levels, with net debt-to-adjusted EBITDA of 5.4x and net debt-to-undepreciated book capitalization ratio of 35.6%, while the adjusted fixed charge cover ratio remained strong at 3.5x. WELL increased the normalized FFO range to $3.99-4.06 per share from $3.95-4.05 per share prior.

Downsides: QCP, and partnering with ProMedica is a pretty unique transaction that provides integration and complexity risk.

Performance YTD: 5.9%.

Alpha Insider Management Update: Strong balance sheet with investment grade credit ratings from Moody’s (Baa1), Standard & Poor’s (BBB+), and Fitch (BBB+).

Bottom Line: 5.33% dividend yield, and we are updating from a HOLD to a BUY.

HEALTHY HEALTHCARE REIT #5: Physicians Realty Trust (NYSE:DOC)

The Big WHY: The most important factor in accessing the quality of a medical office building is the health system affiliation, credit quality to tenant, age of the building, occupancy, market share as a tenant, average remaining lease term, size of the building, and the client services and mix of services in the facility. Around 88% of DOC’s growth space is on campus and/or affiliated with a healthcare system.

Feathers in its Cap: DOC’s disciplined approach to investments continues to improve portfolio metrics, narrowing the gap with competitors at an aggressive pace. For example, the company has just 4.4% of leases expiring through 2022 (the peer average is 11.8%).

Downsides: Same as HTA – institutional investors have rotated out of the MOB sector. Also, DOC has yet to increase its dividend.

Performance YTD: -1.4%.

Alpha Insider Management Update: The REIT’s balance sheet metrics remain strong, with debt-to-firm value of 34% and net debt-to-EBITDA of 5.5x. DOC is extremely well-positioned in the rising rate environment. 99% of debt is at a fixed interest rate or is completely hedged, with no significant maturities until 2023.

Bottom Line: DOC’s dividend yields 5.36%, and it’s a STRONG BUY.

(Source: F.A.S.T. Graphs)

Note: We will be providing a detailed SWAN (sleep well at night) research report in the upcoming (September) edition of the Forbes Real Estate Investor.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Each week, Brad provides Marketplace subscribers with actionable REIT news, including (1) Friday afternoon subscriber calls, (2) Weekender updates, (3) Google portfolios, (4) Real-time alerts, (5) Early AM REIT news, (6) chat rooms, (7) the monthly newsletter, and (8) earnings results in Google Sheets.

Marketplace subscribers have access to a wide range of services, including weekly property sector updates and weekly Buy/Sell picks. We provide most all research to marketplace subscribers, and we also provide a “weekender” report and a “motivational Monday” report. We stream relevant real-time REIT news so that you can stay informed.

All of our portfolios are updated daily, and subscribers have access to all of the tools via Google Sheets. REITs should be part of your daily diet, and we would like to help you construct an Intelligent REIT portfolio, utilizing our portfolio modeling strategies. Brad reminds all subscribers and prospective subscribers that “the safest dividend is the one that’s just been raised.”

Disclosure: I am/we are long ACC, AVB, BHR, BPY, BRX, BXMT, CCI, CHCT, CIO, CLDT, CONE, CORR, CTRE, CXP, CUBE, DEA, DLR, DOC, EPR, EQIX, ESS, EXR, FRT, GEO, GMRE, GPT, HASI, HT, HTA, INN, IRET, IRM, JCAP, KIM, KREF, KRG, LADR, LAND, LMRK, LTC, MNR, NNN, NXRT, O, OFC, OHI, OUT, PEB, PEI, PK, PSB, PTTTS, QTS, REG, RHP, ROIC, SBRA, SKT, SPG, SRC, STAG, STOR, TCO, TRTX, UBA, UMH, UNIT, VER, VICI, VNO, VNQ, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

The Healthiest Healthcare REITs

New Post has been published on http://cloudwebhostingproviders.com/2018/08/17/the-healthiest-healthcare-reits/

The Healthiest Healthcare REITs

The U.S. Census Bureau categorizes Baby Boomers as individuals born between 1946 and 1964, and the effects of having to care for such a large group will be felt in many areas.

By 2029, when the last round of Boomers reaches retirement age, the number of Americans 65 or older will climb to more than 71 million, up from about 41 million in 2011, a 73 percent increase, according to Census Bureau estimates.

As Ventas CEO Debra Cafaro points out, “we know that the silver wave of the over 75 population will experience a net gain of 70 million individuals between 2020 and 2035, boarding well for our business and giving us confidence in the future while we manage through current operating condition.”

According to CBRE’s 2018 U.S. Real Estate Market Outlook, the aging U.S. population will be a significant tailwind for medical office demand in the years ahead.

“We expect demand for medical office buildings to grow, fueled by a shift away from the delivery of patient services on hospital campuses, the adoption of new technology, the aging population, healthcare job growth, tight market conditions and the relative recession-resistance of these properties,” said Andrea Cross, Americas head of office research, CBRE.

The medical office market has performed well in recent years, registering a lower peak vacancy rate than traditional office properties during the 2008 recession and showing a steady decline in vacancy during the recovery. Net absorption has outpaced new supply in 24 of the past 29 quarters, with particularly large imbalances since 2015.

Gross asking rents have been stable, reflecting consistent user demand and long lease terms that limit tenant turnover. New medical space completions have also been low relative to pre-recession levels, and the amount of space under construction has decreased slightly from the Q2 2016 peak. Chris Bodnar, vice chairman, Healthcare, CBRE Capital Markets, explains:

“Investment trends reflect strong medical-office market fundamentals and a broadening pool of interested investors. While uncertainty about healthcare policy poses a risk to the medical office market, favorable demographic trends point to continued strong healthcare demand, regardless of any policy changes.”

The core business of healthcare is inherently driven by demand for patient care, providing a stable foundation to support investment in the sector. The need for more facilities and services to manage the chronic illnesses of this aging population will be a major driver for growth.

Despite the controversy around these and future changes to reimbursement, healthcare is a required service that will continue to need real estate assets, and REITs provide an excellent vehicle for healthcare providers to become more efficient by partnering with “healthy” capitalized companies.

(Photo Source)

The Healthiest Healthcare REITs

So, shoulders back, chin up, deep breath… here’s a handful of hearty and healthy healthcare REITs:

HEALTHY HEALTHCARE REIT #1: Ventas Inc. (NYSE:VTR)

The Big WHY: Champion, diversified healthcare REIT with deliberately constructed portfolio of more than 1,200 assets

Feathers in its Cap: Focused on high-quality real estate well located in attractive markets (with high barriers to entry). Partners with top operators in each asset class – sector leaders, well-positioned for growth. Properties in U.S., Canada, United Kingdom. Portfolio: Senior Housing 62%, Medical Office 20%, Life Science 7%, Health Systems 5%, IRFs/LTACs 2%, Skilled Nursing 1%.

Downsides: Though skilled nursing triple net is 1% of NOI, VTR experienced continued decline in Genesis’s (NYSE:GEN) performance given ongoing industry SNF headwinds.

Performance YTD: 1.2%.

Alpha Insider Management Update: The company’s investments across the healthcare real estate spectrum provide sustainable, growing cash flow during strong economic cycles and resilience during downturns.

Bottom Line: VTR has the absolutely best credit profile and balance sheet. Its net debt-to-EBITDA ratio now stands at an excellent 5.3x and debt-to-assets is also robust at 36%. Substantial dry powder ($3.1 billion on credit facility) for any M&A. Successful history of dividend performance, and growth profile, current yield 5.38%. Payout ratio 78% on FFO. STRONG BUY (as in “buy, and hold onto this one!”)

HEALTHY HEALTHCARE REIT #2: LTC Properties, Inc. (NYSE:LTC)

The Big WHY: Triple net leases primarily in senior housing and healthcare properties via joint ventures, sale-leaseback transactions, mortgage financing, preferred equity, mezzanine lending.

Feathers in its Cap: In business over 25 years. Enterprise value as of June 30 over $2.1 billion. Holds 199 investments in nearly balanced capital allocation: assisted living communities (102, includes independent living & memory care communities), skilled nursing centers (96), and behavioral healthcare hospital. Located in 28 states. Funds From Operations (FFO): $29.6 million for Q2-18, compared with $31.4 million Q2-17 (per diluted common share $0.75 and $0.79).

Downsides: Decreases in Q2-18 results mostly due to defaulted master lease on cash basis in third quarter 2017 and reduction in rental income related to properties sold the past year.

Performance YTD: 6.2%.

Alpha Insider Management Update: Sold portfolio of six assisted living and memory care communities at a net gain of $48.3 million. Completed acquisition of two memory care communities in Texas for $25.2 million with 10-year master lease and 7.25% initial cash yield. Entered into partnership for properties in Medford, OR, and opened new facility in Illinois. New unsecured credit agreement has the opportunity to increase to $1.0 billion.

Bottom Line: Rated as a STRONG BUY. Dividend payout ratio of 76%, yielding 5.09%.

HEALTHY HEALTHCARE REIT #3: Healthcare Trust of America, Inc. (NYSE:HTA)

The Big WHY: Largest dedicated owner and operator of 450 medical office buildings (MOBs) in the U.S. (33 states), across more than 24 million square feet. Over $7 billion invested.

Feathers in its Cap: Provides real estate infrastructure for integrated delivery of healthcare services in highly desirable locations, targeted to build critical mass in 20-25 leading gateway markets generally with leading university and medical institutions, to support a strong, long-term demand for quality medical office space. Q2-18 FFO increased 55.8% to $84.4 million (Q2-17 comparison), or per diluted share +33.3%, to $0.40. During Q2-18, new and renewed leases on approximately 1.0 million square feet (4.2% of portfolio). Tenant retention rate of 86%. Occupancy rate of 90.9%. The company just increased its dividend by 1.6% (payable October 5).

Downsides: MOB is out of favor with institutions, yet sector rotation can provide attractive opportunities for intelligent REIT investors.

Performance YTD: -1.0%.

Alpha Insider Management Update: (“BBB” balance sheet) Announced new development in key gateway market (Miami), and commenced two redevelopments, including on-campus MOB in Raleigh, NC. Sell agreements: Greenville, South Carolina MOB portfolio, $294.3 million. Total leverage 31.8% (debt less cash and cash equivalents to total capitalization). Total liquidity end of quarter $1.0 billion. During Q2, paid down $96.0 million on $286.0 million promissory note in Duke acquisition.

Bottom Line: Founded in 2006 and NYSE-listed in 2012, HTA’s returns have outperformed those of the S&P 500 and US REIT indices. 75% payout ratio, dividend 4.28%. STRONG BUY.

HEALTHY HEALTHCARE REIT #4: Welltower Inc. (NYSE:WELL)

The Big WHY: The operating environment for seniors housing remains challenging, but the benefit of owning a premier major urban market-focused portfolio is attractive. WELL’s operating portfolio continues to show the resiliency expected from the premier operators in top markets and submarkets.

Feathers in its Cap: The REIT’s Q2-18 closing balance sheet position was strong with $215 million of cash and equivalents and $2.5 billion of capacity under the primary unsecured credit facility. The leverage metrics were at robust levels, with net debt-to-adjusted EBITDA of 5.4x and net debt-to-undepreciated book capitalization ratio of 35.6%, while the adjusted fixed charge cover ratio remained strong at 3.5x. WELL increased the normalized FFO range to $3.99-4.06 per share from $3.95-4.05 per share prior.

Downsides: QCP, and partnering with ProMedica is a pretty unique transaction that provides integration and complexity risk.

Performance YTD: 5.9%.

Alpha Insider Management Update: Strong balance sheet with investment grade credit ratings from Moody’s (Baa1), Standard & Poor’s (BBB+), and Fitch (BBB+).

Bottom Line: 5.33% dividend yield, and we are updating from a HOLD to a BUY.

HEALTHY HEALTHCARE REIT #5: Physicians Realty Trust (NYSE:DOC)

The Big WHY: The most important factor in accessing the quality of a medical office building is the health system affiliation, credit quality to tenant, age of the building, occupancy, market share as a tenant, average remaining lease term, size of the building, and the client services and mix of services in the facility. Around 88% of DOC’s growth space is on campus and/or affiliated with a healthcare system.

Feathers in its Cap: DOC’s disciplined approach to investments continues to improve portfolio metrics, narrowing the gap with competitors at an aggressive pace. For example, the company has just 4.4% of leases expiring through 2022 (the peer average is 11.8%).

Downsides: Same as HTA – institutional investors have rotated out of the MOB sector. Also, DOC has yet to increase its dividend.

Performance YTD: -1.4%.

Alpha Insider Management Update: The REIT’s balance sheet metrics remain strong, with debt-to-firm value of 34% and net debt-to-EBITDA of 5.5x. DOC is extremely well-positioned in the rising rate environment. 99% of debt is at a fixed interest rate or is completely hedged, with no significant maturities until 2023.

Bottom Line: DOC’s dividend yields 5.36%, and it’s a STRONG BUY.

(Source: F.A.S.T. Graphs)

Note: We will be providing a detailed SWAN (sleep well at night) research report in the upcoming (September) edition of the Forbes Real Estate Investor.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).