#Trade Finance Document Automation

Text

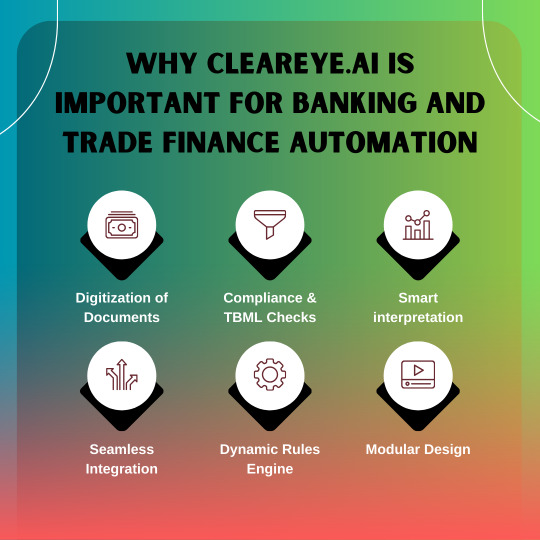

Trade Finance Technology Streamlines Import-Export Business

It's time for a shift. Major digital transformation is unfolding in the global supply chain right now. Thus, digital formats and integrations will be necessary for commerce in the future.

Integration with your supply chain partners will be more efficient and cost-effective if your organization uses a more modern documentation approach. Information provided in shipping documentation is relied on by all participants in the supply chain. Many industries, including shipping, freight forwarding, ports, banking, customs, and truckers, are spending millions to digitize their formerly paper-based processes.

This will improve the efficiency of sharing shipment information along the supply chain. You can save money on administrative and documentation costs by employing Trade finance technology.

Doing so will offer your company an edge in the marketplace and position it well for future international trading.

Gain Global Trade Information

The speed with which import-export enterprises can access and process data are crucial to their success. People on your team will lose valuable time tracking down documents, information, and communications dispersed over several different mediums.

The ability to monitor the company's orders, shipments, and communications is diminished. Trade Document Management enables your team to archive and organizes all relevant trade documents.

Folders allow users to keep all shipping paperwork in one place. Sales, orders, and shipments can all be tracked quickly for your business.

Reduced waiting time for Trading Paperwork

When using export documentation software templates, how long does it take your team to generate shipping documents? Export documentation services may replicate data from the primary document for use in subsequent documents.

From a quote, you can generate a purchase order, proforma invoice, commercial invoice, packing list (FCL, LCL, combined), shipper's letter of instruction, forwarding instructions, verified gross mass declaration, packing declaration, and more.

Customers who use Trade Payment Document Solutions can produce papers ten times faster than they could by manually entering data in Word or Excel.

When it comes to resources, most businesses have a lot to offer. The technologies behind outsourced trade services allow consumers to keep a library of familiar names and products to save time. Numerous objects or contacts can be uploaded using a Comma-separated values (CSV) file.

Various companies use numerous document-making programs. This meant recording the same financial information twice. Using Trade Finance Document Automation services could be more efficient by integrating data with your existing accounting software.

Manually developing shipping document templates.

Export documentation services bolster transportation papers. It is possible to find pre-formatted invoices, packing lists, packaging declarations, certificates of origin, and more from various export services. Word and Excel are standard tools for creating templates. This process requires retyping or copying and pasting of previously entered data.

In the business world, many companies generate documents in various programs and retype data into accounting systems. This duplication causes the process to be unsteady and prone to mistakes. A mistake on the paperwork for sending something might lead to more costs, extra time, or even product loss. Data entry errors can be disastrous for a business.

Each worker has their method for document creation and filing. Consistency, accuracy, and knowledge of international trade are all missing from this procedure.

This is why import-export businesses require Trade Finance Technology. With the help of our digital innovations, exporting companies can easily change their time-consuming documentation procedures.

Paperless signatures and countersignatures on documents

How do you handle shipping paperwork (print, sign, scan, and send)? Digital signatures and document sharing via dashboard are two features of premium export documentation services. With just one click, a company may safely exchange any documents with their partners, whether clients, suppliers or transportation firms.

Online Proforma Invoice, Point of Sale, and Sales Contracts countersigning is possible with the help of Trade Payment Document Solutions. To complete the paperless exchange, all that's needed is a digital signature and stamp from each party. This results in savings in time, money, and resources associated with signing documents.

Key Takeaway-

Get real-time, anywhere, anytime access to critical business data.

Trade Payment Document Solutions provided by Trade Technologies are hosted on the cloud, allowing you to access them from any location. Managers can learn about the team's progress and accomplishments through these reports.

Access timely data whether you're in an office, a warehouse, or out on the road.

Get in touch with us to see how our export paperwork services can help you streamline your global logistics supply chain and gain access to faster payment options.

0 notes

Text

#account opening process#account opening#trade finance operations#trade finance automation#document management system#low code#low code application development

0 notes

Text

From Paperwork to Profit: The Impact of Automation on Trade Finance ROI

Know more Official Website Visit here

0 notes

Text

Dubai Mainland's Blockchain Revolution: Transforming Industries and Driving Innovation

In recent years, Dubai Mainland has emerged as a global leader in blockchain adoption, harnessing the transformative potential of this revolutionary technology to revolutionize industries, streamline processes, and foster innovation. With ambitious initiatives and forward-thinking strategies, Dubai Mainland is paving the way for a blockchain-powered future. In this article, we delve into the blockchain revolution in Dubai Mainland, exploring its impact on various sectors and the opportunities it presents for businesses and individuals.

Government Efficiency and Transparency

Importance:

Blockchain technology enables business setup in dubai mainlandto enhance government efficiency, transparency, and trust through secure, immutable, and decentralized digital ledgers.

Key Points:

Digital Identity Management: Blockchain-based digital identity solutions streamline government services, authentication processes, and identity verification, enhancing security and reducing bureaucracy.

Smart Contracts: Smart contract platforms automate and digitize contractual agreements, transactions, and regulatory compliance, facilitating efficient and transparent interactions between government entities, businesses, and citizens.

Blockchain Voting Systems: Dubai Mainland explores blockchain-based voting systems to enable secure and transparent elections, enhance voter participation, and ensure the integrity of democratic processes.

Financial Services and Banking

Importance:

Blockchain disrupts traditional financial services and banking in Dubai Mainland, offering decentralized, secure, and efficient solutions for payments, remittances, and asset management.

Key Points:

Cross-Border Payments: Blockchain-powered payment networks enable fast, low-cost, and secure cross-border transactions, reducing reliance on traditional banking intermediaries and enhancing financial inclusion.

Tokenization of Assets: Asset tokenization platforms digitize and tokenize real-world assets, such as real estate, stocks, and commodities, unlocking liquidity, fractional ownership, and investment opportunities for individuals and institutions.

Central Bank Digital Currency (CBDC): Dubai Mainland explores the issuance of central bank digital currencies on blockchain platforms, enhancing monetary policy implementation, reducing cash usage, and promoting financial innovation.

Supply Chain Management and Logistics

Importance:

Blockchain transforms supply chain management and logistics in Dubai Mainland, enabling end-to-end visibility, traceability, and integrity of goods and transactions across the supply chain.

Key Points:

Traceability and Authenticity: Blockchain-based supply chain platforms track and authenticate products, raw materials, and components throughout the supply chain, combating counterfeit goods, ensuring product quality, and enhancing consumer trust.

Smart Contracts for Logistics: Smart contracts automate and execute logistics processes, such as shipping, customs clearance, and warehousing, based on predefined conditions and agreements, reducing delays, disputes, and administrative overhead.

Trade Finance and Documentation: Blockchain streamlines trade finance processes, digitizing trade documentation, such as letters of credit, bills of lading, and invoices, facilitating faster, more efficient, and secure trade transactions.

Real Estate and Property Management

Importance:

Blockchain disrupts the real estate and property management industry in Dubai Mainland, revolutionizing property transactions, title deeds, and land registries with transparent, secure, and immutable records.

Key Points:

Tokenized Real Estate Assets: Blockchain platforms tokenize real estate assets, allowing fractional ownership, liquidity, and investment diversification, democratizing access to real estate markets for individual investors.

Smart Contracts for Property Transactions: Smart contracts automate and enforce property transactions, escrow services, and rental agreements, reducing transaction costs, eliminating intermediaries, and minimizing fraud risks.

Blockchain Land Registries: Dubai Mainland explores blockchain-based land registries and property databases, ensuring transparent, tamper-proof, and auditable records of land ownership, transfers, and encumbrances.

Healthcare and Medical Records

Importance:

Blockchain revolutionizes healthcare and medical records management in Dubai Mainland, enabling secure, interoperable, and patient-centric health data exchange and management.

Key Points:

Electronic Health Records (EHR): Blockchain-based EHR systems provide patients and healthcare providers with secure access to comprehensive, encrypted health records, enhancing care coordination, patient outcomes, and data privacy.

Health Data Sharing: Patients control access to their health data and consent to data sharing through blockchain-enabled consent management platforms, ensuring confidentiality, security, and compliance with privacy regulations.

Medical Supply Chain Tracking: Blockchain tracks and verifies the authenticity, provenance, and integrity of pharmaceuticals, medical devices, and supplies throughout the supply chain, reducing counterfeit drugs, ensuring quality, and enhancing patient safety.

Smart Contracts and Decentralized Applications (DApps)

Importance:

Smart contracts and decentralized applications (DApps) empower developers, entrepreneurs, and businesses in Dubai Mainland to build innovative, autonomous, and decentralized solutions across various industries.

Key Points:

Decentralized Finance (DeFi): DeFi platforms leverage smart contracts to enable peer-to-peer lending, borrowing, trading, and asset management without intermediaries, providing financial services to underserved populations and disrupting traditional finance.

Blockchain Gaming and NFTs: Blockchain-based gaming platforms and non-fungible tokens (NFTs) revolutionize the gaming industry, enabling true ownership of in-game assets, provably fair gameplay, and new monetization models for gamers and developers.

Supply Chain Traceability DApps: Decentralized applications track and trace supply chain data, certifications, and sustainability credentials on blockchain networks, empowering consumers to make informed choices and incentivizing businesses to adopt responsible practices.

Conclusion

The blockchain revolution in Dubai Mainland heralds a new era of innovation, efficiency, and transparency across industries, transforming governance, finance, supply chain management, real estate, healthcare, and decentralized applications. By embracing blockchain technology and fostering a conducive ecosystem for innovation, Dubai Mainland is poised to lead the global blockchain revolution, driving economic growth, enhancing competitiveness, and shaping the future

0 notes

Text

Navigating Financial Compliance with AI: Leveraging Generative AI Services

In the complex landscape of financial regulation, compliance is a critical yet challenging endeavor. The integration of Generative AI Services is revolutionizing this sector, offering robust solutions to streamline processes and enhance accuracy. As financial institutions face stringent regulatory requirements, AI-driven technologies are proving indispensable. This article explores how generative AI services are transforming financial compliance, with a focus on various applications such as forecasting, investment strategies, risk assessment, and financial planning.

The Role of AI in Financial Compliance

AI in finance has evolved from a futuristic concept to a practical tool that addresses various challenges. Compliance involves adhering to a myriad of laws, regulations, and guidelines, often requiring extensive documentation, monitoring, and reporting. Generative AI services can automate and optimize these processes, ensuring that compliance efforts are both efficient and effective.

Generative AI for Forecasting

One of the primary applications of AI in finance is generative AI for forecasting. Accurate financial forecasts are essential for maintaining compliance, particularly in areas like capital adequacy and liquidity management. Generative AI models can analyze vast amounts of historical data and identify patterns that human analysts might overlook. This capability allows financial institutions to predict market trends, credit risks, and economic shifts with greater precision. Enhanced forecasting not only supports regulatory compliance but also enables proactive decision-making.

AI-Driven Investment Strategies

AI-driven investment strategies are transforming portfolio management and trading activities. Generative AI services can create sophisticated algorithms that assess market conditions and optimize investment portfolios in real-time. By continuously learning from new data, these AI models can adapt to changing market dynamics, ensuring that investment strategies remain compliant with regulatory requirements. This adaptability is crucial for adhering to rules that govern investment limits, exposure, and risk diversification.

AI in Risk Assessment

Risk assessment is a cornerstone of financial compliance. Traditional risk management approaches often rely on static models that may not fully capture emerging risks. AI in risk assessment leverages generative AI to develop dynamic models that can identify and evaluate risks more comprehensively. For instance, AI can monitor transactions for signs of fraud, assess creditworthiness, and predict potential market disruptions. By providing a real-time, nuanced understanding of risk, AI helps financial institutions maintain compliance with evolving regulatory standards.

AI for Financial Planning

Financial planning is another area where generative AI services are making a significant impact. AI-driven financial planning tools can analyze an individual’s or organization’s financial health and generate customized plans that align with regulatory requirements. These tools consider various factors, such as income, expenses, assets, liabilities, and investment goals, to create compliant financial strategies. Moreover, AI can continually update these plans based on new data, ensuring ongoing compliance and financial stability.

Benefits of Generative AI Services in Financial Compliance

The benefits of integrating generative AI services into financial compliance are manifold:

Efficiency: Automating routine compliance tasks reduces the time and resources required for manual processes.

Accuracy: AI-driven models minimize human error, enhancing the accuracy of compliance activities.

Scalability: AI solutions can easily scale to handle increased volumes of data and regulatory requirements.

Proactivity: By providing real-time insights, AI enables institutions to address potential compliance issues before they escalate.

Adaptability: AI models can evolve with changing regulations, ensuring sustained compliance.

Conclusion

Navigating financial compliance with AI is no longer a distant prospect but a present-day reality. Generative AI services are at the forefront of this transformation, offering powerful tools for forecasting, investment strategies, risk assessment, and financial planning. By leveraging these technologies, financial institutions can enhance their compliance efforts, reduce risks, and achieve greater operational efficiency. As regulations continue to evolve, the role of AI in finance will only grow, making it an indispensable asset for financial compliance in the modern era.

0 notes

Text

Emerging Trends in International Trade and Financial Strategies

As globalization continues to evolve, international trade and financial strategies are undergoing significant transformations. These emerging trends are reshaping how businesses operate, how they manage risks, and how they capitalize on opportunities in the global marketplace. This article explores some of the key trends in international trade and finance, highlighting their implications for businesses and economies worldwide.

Digital Transformation and E-Commerce

Rise of E-Commerce

The rapid growth of e-commerce has revolutionized international trade by providing businesses with direct access to global markets. Online platforms enable companies to reach consumers worldwide, bypassing traditional distribution channels and reducing costs. This trend has particularly benefited small and medium-sized enterprises (SMEs), allowing them to compete on a global scale.

Digital Payment Solutions

Advancements in digital payment solutions, including mobile payments, digital wallets, and blockchain-based platforms, are facilitating faster, more secure cross-border transactions. These technologies streamline payment processes, reduce transaction costs, and enhance the overall efficiency of international trade.

Sustainability and Green Finance

Sustainable Trade Practices

Sustainability is becoming a central focus in international trade, driven by consumer demand, regulatory pressures, and corporate responsibility initiatives. Businesses are increasingly adopting sustainable trade practices, such as reducing carbon footprints, ensuring ethical sourcing, and promoting fair trade. These practices not only meet regulatory requirements but also enhance brand reputation and consumer loyalty.

Green Finance

Financial institutions are developing green finance products to support environmentally sustainable projects. Green bonds, sustainability-linked loans, and other green financial instruments are being used to fund renewable energy projects, sustainable infrastructure, and environmentally friendly technologies. This trend aligns financial strategies with global sustainability goals and encourages investment in green initiatives.

Trade Policy and Geopolitical Shifts

Trade Policy Changes

Shifts in trade policies, driven by geopolitical developments and changing economic priorities, are impacting international trade dynamics. Trade agreements, tariffs, and trade wars can create uncertainties and disrupt supply chains. Businesses need to stay informed about policy changes and adapt their strategies to navigate these challenges effectively.

Regional Trade Agreements

The emergence of regional trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the African Continental Free Trade Area (AfCFTA), is fostering regional economic integration. These agreements aim to reduce trade barriers, enhance market access, and promote economic cooperation among member countries, creating new opportunities for businesses.

Technological Innovations

Blockchain Technology

Blockchain technology is transforming international trade by enhancing transparency, security, and efficiency in transactions. Blockchain-based platforms provide tamper-proof records, streamline documentation processes, and facilitate real-time settlement of payments. This technology is particularly useful for trade finance, supply chain management, and cross-border payments.

Artificial Intelligence and Automation

Artificial intelligence (AI) and automation are improving various aspects of international trade, from predictive analytics and demand forecasting to automated compliance checks and customer service. These technologies enhance operational efficiency, reduce costs, and enable businesses to make data-driven decisions.

Supply Chain Resilience

Diversification of Supply Chains

The COVID-19 pandemic highlighted the vulnerabilities of global supply chains, prompting businesses to diversify their supply chains to enhance resilience. Companies are exploring multi-sourcing strategies, nearshoring, and reshoring to reduce dependence on a single source or region and mitigate risks associated with supply chain disruptions.

Investment in Supply Chain Technologies

Investments in supply chain technologies, such as Internet of Things (IoT), advanced analytics, and digital twins, are enabling businesses to monitor and manage their supply chains more effectively. These technologies provide real-time visibility, predictive insights, and improved coordination across the supply chain, enhancing resilience and agility.

Financial Strategies and Risk Management

Enhanced Risk Management

As international trade becomes more complex, businesses are adopting sophisticated risk management strategies to protect against various risks, including currency fluctuations, political instability, and supply chain disruptions. Financial instruments such as forward contracts, options, and trade credit insurance are being used to hedge against these risks.

Access to Trade Finance

Access to trade finance remains critical for businesses engaged in international trade. Financial institutions are leveraging technology to offer more accessible and flexible trade finance solutions. Digital trade finance platforms, blockchain-based trade finance networks, and fintech innovations are improving access to financing for SMEs and streamlining trade finance processes.

Conclusion

Emerging trends in international trade and financial strategies are reshaping the global business landscape. Digital transformation, sustainability, geopolitical shifts, technological innovations, supply chain resilience, and advanced risk management are key factors driving these changes. By staying informed and adapting to these trends, businesses can navigate the complexities of international trade, seize new opportunities, and achieve long-term success in the global marketplace. The ongoing evolution of trade and finance will continue to present challenges and opportunities, requiring businesses to be agile, innovative, and strategic in their approach.

0 notes

Text

Exploring the Advantages of Blockchain DeFi Over Traditional Financial Systems

In recent years, decentralized finance (DeFi) has emerged as a disruptive force in the financial sector, offering a wide range of advantages over traditional financial systems. Built on blockchain technology, DeFi platforms enable users to access financial services in a decentralized and permissionless manner.

In this blog post, we explore the key benefits of using DeFi over traditional financial systems and the role DeFi development companies can play in driving this transition.

Greater Financial Inclusion

One of the most significant advantages of DeFi is its potential to promote greater financial inclusion. Traditional financial systems often exclude large segments of the population due to factors such as location, income level, or lack of documentation. DeFi, on the other hand, allows anyone with an internet connection to access financial services such as lending, borrowing, and investing, regardless of their background or geographic location. This opens up opportunities for millions of unbanked and underbanked individuals around the world to participate in the global economy.

Reduced Dependence on Intermediaries

Traditional financial systems rely heavily on intermediaries such as banks, brokerages, and payment processors to facilitate transactions and manage assets. These intermediaries often come with high fees, lengthy processing times, and the risk of censorship or fraud. DeFi eliminates the need for intermediaries by leveraging blockchain technology and smart contracts to automate transactions and enforce trustless agreements. This not only reduces costs and improves efficiency but also enhances security and transparency in financial transactions.

Global Accessibility and Borderless Transactions

Another advantage of DeFi is its global accessibility and borderless nature. Unlike traditional financial systems that are bound by geographical boundaries and regulatory constraints, DeFi platforms operate on a global scale, allowing users to transact with anyone, anywhere in the world. This opens up new opportunities for cross-border trade, remittances, and investment, while also reducing the friction and costs associated with traditional international transactions.

Enhanced Security and Transparency

Blockchain technology, the underlying foundation of DeFi, offers enhanced security and transparency compared to traditional financial systems. Transactions on the blockchain are immutable and transparent, meaning they cannot be altered or tampered with once recorded. This reduces the risk of fraud and manipulation, providing users with greater peace of mind when conducting financial transactions. Additionally, DeFi platforms often undergo rigorous security audits and are governed by smart contracts, further enhancing the security and reliability of the ecosystem.

Innovation and Experimentation

DeFi is a hotbed of innovation, with new projects and protocols emerging constantly. From decentralized exchanges (DEXs) and lending platforms to yield farming and decentralized autonomous organizations (DAOs), the DeFi ecosystem is constantly evolving and experimenting with new ways to create, exchange, and manage value. This culture of innovation fosters competition and drives continuous improvement in the DeFi space, ultimately benefiting users with more innovative and efficient financial services.

The Role of DeFi Development Companies

DeFi development companies play a crucial role in driving the advancement and adoption of decentralized finance. These companies specialize in building, auditing, and maintaining DeFi protocols and applications, ensuring they are secure, reliable, and user-friendly. Whether it's creating a new DeFi platform from scratch or enhancing an existing protocol, DeFi development companies provide the technical expertise and support needed to navigate the complexities of blockchain development.

Conclusion

Decentralized finance offers a myriad of advantages over traditional financial systems, including greater financial inclusion, reduced dependence on intermediaries, global accessibility, enhanced security and transparency, and a culture of innovation and experimentation. With DeFi development companies leading the charge, the future of finance is decentralized, and the possibilities for innovation and disruption are endless. As the DeFi ecosystem continues to mature, it has the potential to transform the way we think about and interact with money, providing greater financial freedom and empowerment to individuals around the world.

0 notes

Text

Introduction to Cargo Community Systems: Understanding the Basics

In the intricate world of global trade and transportation, efficiency and coordination are paramount. Cargo Community Systems (CCS) play a crucial role in achieving these goals by facilitating communication and data exchange among various stakeholders in the cargo handling industry. From customs officers and freight forwarders to airline and ship operators, CCS serves as the backbone that supports and streamlines operations across the board. This article provides a foundational overview of Cargo Community Systems, highlighting their importance, functionality, and benefits in the logistics sector.

What is a Cargo Community System?

A Cargo Community System is an IT platform that integrates multiple applications to enable the secure and efficient exchange of information related to goods movement within a cargo community. The "cargo community" includes all parties involved in the logistics chain such as airports, seaports, freight forwarders, customs brokers, transport companies, and warehouse providers. CCS aims to digitalize the traditional processes of shipping logistics, reducing the reliance on paperwork and manual handling, which can be prone to errors and delays.

Key Functions of Cargo Community Systems

Data Integration and Sharing: CCS facilitates the seamless sharing of data among all stakeholders. Whether it’s information about cargo arrival times, storage, or customs documentation, CCS ensures that all relevant parties have access to the same data in real-time. This synchronization helps in reducing delays and increasing the efficiency of cargo handling processes.

Tracking and Visibility: One of the most critical functionalities of a CCS is providing tracking capabilities. Stakeholders can monitor the status and location of their shipments in real-time, enabling them to make informed decisions and better manage their operations. This level of visibility is essential for optimizing logistics operations and enhancing supply chain transparency.

Regulatory Compliance: CCS systems are designed to ensure compliance with local and international regulations. They facilitate the swift processing of necessary customs documentation, helping to speed up the clearance processes and ensure that all transactions adhere to regulatory standards. This is crucial in avoiding delays and penalties associated with non-compliance.

Efficiency and Cost Reduction: By automating various logistical processes, CCS significantly reduces the time and labor traditionally required to manage cargo movements. This automation leads to lower operational costs and improved profitability for all parties involved in the supply chain.

Benefits of Implementing a Cargo Community System

Implementing a CCS brings several tangible benefits to a cargo community:

Reduced Delays: Streamlined processes and real-time data sharing help in minimizing the delays typically caused by manual handling and waiting times for information.

Enhanced Security: Advanced security protocols and access controls within CCS platforms protect sensitive data and reduce the risk of data breaches.

Improved Customer Satisfaction: Faster processing times and increased reliability lead to higher satisfaction levels among customers, who benefit from the efficiency and transparency provided by CCS.

Environmental Benefits: Reducing the need for paper-based systems not only cuts down on waste but also contributes to an organization’s sustainability goals.

Challenges in Implementing Cargo Community Systems

While the benefits are clear, the implementation of CCS is not without challenges. These systems require significant initial investment in terms of finance and time. Additionally, integrating complex IT systems across diverse logistics operations can be a daunting task that requires technical expertise. There is also the challenge of achieving cooperation among all stakeholders, who must be willing to adapt to new procedures and share data transparently.

Conclusion

Cargo Community Systems represent a significant advancement in the logistics and transportation industry, offering streamlined operations, enhanced security, and better coordination among all parties involved in the movement of goods. As global trade continues to grow and the demand for more efficient shipping solutions increases, the role of CCS will become increasingly important. Understanding the basics of how these systems work is the first step towards appreciating their impact on transforming the cargo handling landscape worldwide.

0 notes

Text

Boomi Integration Platform

Unlocking Seamless Connectivity: A Guide to the Boomi Integration Platform

In today’s rapidly evolving digital age, businesses constantly manage various applications, data sources, and systems. Seamlessly integrating these disparate components is paramount for efficiency, innovation, and maintaining a competitive edge. This is where the Boomi Integration Platform stands out as a powerful solution.

What is the Boomi Integration Platform?

Boomi, a Dell Technologies company, offers a cloud-based integration platform (iPaaS) service. It acts as the connective tissue between various on-premises and cloud-based applications, facilitating smooth data flow, process automation, and business agility. Think of it as a universal translator breaking down communication barriers between different systems.

Key Features That Make Boomi Shine

Low-Code Development: Boomi’s core strength lies in its intuitive drag-and-drop interface and pre-built connectors. This empowers users, even those without extensive coding expertise, to quickly and easily design complex integrations.

Unified Platform: The Boomi platform encompasses several essential components:

Integration: Connect and orchestrate data flows between applications in the cloud and on-premises.

Master Data Hub: Establish a centralized, trusted repository to synchronize and manage data across your enterprise.

API Management: Build, publish, and secure your APIs, simplifying data exchange and enabling new partnerships.

B2B/EDI Management: Manage all your Electronic Data Interchange (EDI) transactions with trading partners efficiently.

Flow: Create low-code web applications and user interfaces for streamlined workflows.

Scalability and Resilience: Boomi’s cloud-based architecture ensures the platform effortlessly scales to match your business demands, providing high availability and reliability

Why Choose Boomi?

Speed: Boomi’s low-code approach accelerates integration development and deployment, saving time and resources.

Agility: Easily modify and adapt integrations as your business requirements change, ensuring a flexible and future-proof solution.

Cost-Effectiveness: Reduce the costs of managing in-house integration solutions and free your IT staff to focus on strategic initiatives.

Extensive Connectivity: Boomi provides a vast library of connectors for popular applications, databases, cloud services, and protocols, simplifying even the most complex integration scenarios.

Enterprise-Grade Governance: Enjoy robust security, data governance, and compliance capabilities to protect sensitive information.

Use Cases Across Industries

Healthcare: Automate patient data exchange between systems, streamline workflows, and improve the patient experience.

Manufacturing: Optimize supply chain processes, enable real-time inventory visibility, and drive operational efficiency.

Finance: Integrate financial systems to streamline accounting processes, facilitate regulatory compliance, and gain deeper insights.

Retail: Connect e-commerce platforms, point-of-sale, and back-end systems for a seamless omnichannel customer experience.

Getting Started with Boomi

Boomi offers resources and support to help you quickly adopt the platform. Explore their website and extensive product documentation, and consider training programs to maximize the value of your investment.

In Conclusion

The Boomi Integration Platform is a compelling solution for overcoming integration challenges, accelerating digital transformation, and unlocking the full potential of your interconnected technologies.

youtube

You can find more information about Dell Boomi in this Dell Boomi Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for Dell Boomi Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on Dell Boomi here – Dell Boomi Blogs

You can check out our Best In Class Dell Boomi Details here – Dell Boomi Training

Follow & Connect with us:

———————————-

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeek

0 notes

Text

recover money from ai trades

Are you considering engaging with AI Trades for your investment needs? With AI technology becoming increasingly prevalent in various sectors, including finance, it's crucial to ensure that any AI-powered trading platform you use is trustworthy and legitimate. Here, we'll delve into several aspects of AI Trades, addressing common inquiries such as "Is AI Trades legit?" and "How to recover my money from AI Trades?" We aim to provide you with all the necessary information to make an informed decision regarding AI Trades.

What is AI Trades?

AI Trades is a platform that purports to leverage artificial intelligence to enhance trading strategies and outcomes. As the interest in automated trading systems grows, platforms like AI Trades attract attention from both novice and experienced investors looking for an edge in the financial markets.

Is AI Trades Legit?

When considering AI Trades, the legitimacy of the platform is understandably one of the first questions that come to mind. In the world of online trading, it's essential to be cautious. To ascertain whether AI Trades is legit, you should look for comprehensive reviews, check for regulatory compliance, and seek testimonials from other users. Reliable platforms will transparently provide information about their operations, including an AI Trades address and contact details.

How to Access AI Trades

Accessing the platform is straightforward through the AI Trades login page. If you've previously visited ai-trade.consulting, note that it is now redirected to ai-trades.co, indicating a recent change in their web domain. Always ensure that you're logging into the correct and secure website to protect your personal and financial information.

AI Trades Complaint and Recovery Options

Despite the allure of AI-driven profits, some users may find themselves needing to recover funds or address grievances. If you have a complaint about AI Trades, it's advisable to directly contact their customer service. The AI Trades contact number and AI Trades email should be readily available on their website.

If issues arise that necessitate recovery of funds, such as disputes over transactions or concerns about service integrity, first attempt to resolve these through the platform's support channels. Should this not be satisfactory, you might consider legal advice or financial recovery services. Some users have asked, "How to recover my money from AI Trades?" In such cases, documenting all communications and transactions is crucial.

When interacting with platforms like AI Trades, caution and due diligence are your best allies. Whether you're logging in for the first time or seeking to address a concern with AI Trades, being informed and cautious will help protect your investments and personal information. Remember, legitimate companies are transparent about their operations and eager to assist their clients with any issues.

For any further questions, the AI Trades contact number and email are your primary resources for direct communication. Make sure your dealings with AI or any automated trading systems are as secure and profitable as possible.

recover money from ai trades

0 notes

Text

Busting the Myths of Outsourced Trade Service

Over the past few years, trading firms and asset managers of all forms and sizes have begun using Outsourced Trade Service, which was once a specialized service. However, some still view outsourcing as something only recession-era businesses do or as something only smaller asset managers and trading businesses should consider. However, as with other outsourcing developments, that prejudice has been disproven over time. In their pursuit of more alpha, asset managers who have adopted the term 'Outsourced Trade Service' have found efficiency, flexibility, and transparency to be the norm.

Myth: Money savings are the only concern.

Reality: While it's true that an Outsourced Trade Service can result in significant cost savings, the additional scale, business resilience, expertise, and value-added services that come with outsourced trading are just as important.

Asset managers can set themselves up for future growth by outsourcing a non-core function, which will help them prepare for the future, increase efficiency, and boost profits. Trade finance document automation, Settlement management, automatic base currency conversion, trade cost analytics, and commission management are some additional services that one can easily integrate.

While outsourcing trading can help companies save money immediately, it can also set them up for future success. When framed in this way, it demonstrates optimism about the future and the commitment of businesses to achieving it.

Myth: It's only for small asset management organizations.

Reality: An Outsourced Trade Service makes sense for small or start-up asset managers but also benefits well-established organizations.

Asset management is changing quickly. ETFs and passive management are everywhere.

Younger generations avoid investment advisors and mutual funds. Regulation evolves quickly. The global epidemic proved that portfolio managers and traders need not be co-located.

Asset managers of all sizes are rethinking their operations to find an ideal future state. The trading desk is under review. Does the trading desk add alpha? Does this function raise money? Are trading desks full? For many, it's challenging to declare in-house export documentation services are vital and to prove they generate alpha. Hyper-scale asset servicers often handle these tasks better than in-house. Trading is a scale business; therefore, what will yield the best results?

Myth: Jobs will be lost.

Reality: Many asset managers believe they derive little benefit from trading, while they do from the dealers.

Talent is being re-tooled, not displaced. Head of trading may find their functions redundant and become head of trading oversight. We believe regulators and asset managers/owners will view this positively from a control and risk/profit/loss viewpoint. Who better to fill this role than a pro? A document preparation software in place will change the face of the trading documentation with so much added ease that the firms will be free to seek bigger things.

Myth: Relationships and connectivity are lost.

Reality: 1+2=3. When combined with the Outsourced Trade Service provider's bigger set of relationships and trading volume, the asset manager's relationships and connectedness improve.

Some asset managers worry about losing years of contacts, know-how, and competence in trading specific markets or instruments, which could hurt client outcomes. Many outsourcing companies are aware of this and strive to show clients that they improve their connections, not replace them.

Clients leverage global teams of skilled traders, many with buy-side experience, with well-established relationships. Trade Cost Analysis ("TCA") measures trading performance, providing comfort.

Myth: The transition won't be disruptive.

Reality: With the proper transition plan, Outsourced Trade Service is manageable.

A provider's implementation process must support a long-term outsourced trading relationship. The implementation should begin with a rigorous discovery phase to understand the present trading touchpoints across all sections of the asset management firm, including investment choice, compliance and risk, trade routing, reporting, and settlement.

Outsourced Trade Service providers should design the relationship's future state and service components. It can ensure a smooth transfer from a heritage desk to an outsourced trading service, minimizing client investment process disruption.

Closing Words-

Work-from-home protocols have debunked the apparent need for proximity between the portfolio manager and trader. Outsourced Trade Service was once considered a defensive, reactionary technique.

Still, attention has switched to its additional benefits, such as aiding risk management, streamlining processes, boosting governance, and improving operational and technological resilience. Many asset managers consider outsourced trading as a proactive, future-focused option.

Trade Technologies is here to answer your everyday trading issues; connect to learn more.

#document preparation software#Outsourced Trade Service#export documentation services#Trade finance document automation

0 notes

Text

Saudi Logistics Solutions: Streamlining Supply Chains

In the dynamic realm of global commerce, efficient logistics management is the backbone of successful businesses. Saudi Arabia, a pivotal player in the Middle East, is not only a hub of oil production but also emerging as a beacon of logistics innovation. With strategic investments and forward-thinking initiatives, the kingdom is revolutionizing supply chains, propelling businesses towards unparalleled efficiency and growth logistics company in Saudi Arabia

Strategic Geographical Location:

Situated at the crossroads of Asia, Europe, and Africa, Saudi Arabia boasts a strategic geographical location that positions it as a vital link in global trade routes. The kingdom's extensive network of ports, airports, and land infrastructure serves as gateways for international trade, facilitating the movement of goods across continents with remarkable efficiency.

Infrastructure Development:

Recognizing the importance of robust infrastructure in facilitating seamless logistics operations, Saudi Arabia has embarked on ambitious development projects. The kingdom's Vision 2030 initiative outlines a comprehensive roadmap for infrastructure enhancement, including the expansion of ports, the construction of logistics parks, and the development of multimodal transportation networks.

Port Expansion:

Saudi Arabia's major ports, including King Abdulaziz Port in Dammam and King Fahd Industrial Port in Jubail, have undergone significant expansion to accommodate growing trade volumes. These state-of-the-art facilities are equipped with modern cargo handling equipment and advanced technology, enabling rapid turnaround times and efficient cargo movement.

Logistics Parks:

The establishment of logistics parks across the kingdom is a key component of Saudi Arabia's logistics strategy. These integrated facilities provide warehousing, distribution, and value-added services, offering businesses a one-stop solution for their logistics needs. By centralizing operations and leveraging economies of scale, logistics parks streamline supply chains and drive operational efficiencies.

Technology Adoption:

In line with global trends, Saudi logistics companies are embracing cutting-edge technologies to optimize their operations. From advanced warehouse management systems to real-time tracking solutions, technology plays a pivotal role in enhancing visibility, transparency, and efficiency across the supply chain. Additionally, the adoption of automation and robotics is revolutionizing processes such as inventory management and order fulfillment, further streamlining operations and reducing costs.

Regulatory Reforms:

To foster a conducive environment for logistics development, Saudi Arabia has implemented a series of regulatory reforms aimed at simplifying procedures and reducing bureaucratic hurdles. Initiatives such as the integration of customs processes and the implementation of electronic documentation systems have streamlined clearance procedures, expediting the movement of goods and reducing logistics lead times.

Public-Private Partnerships:

Collaboration between the public and private sectors is driving innovation and investment in Saudi Arabia's logistics industry. Public-private partnerships (PPPs) have been instrumental in financing infrastructure projects, developing logistics parks, and implementing technology solutions. By leveraging the expertise and resources of both sectors, Saudi Arabia is accelerating the pace of logistics development and enhancing its competitiveness on the global stage.

Environmental Sustainability:

In addition to efficiency and profitability, sustainability has emerged as a key focus area for Saudi logistics companies. Initiatives such as the adoption of green technologies, the optimization of transportation routes, and the promotion of eco-friendly packaging are reducing the environmental footprint of logistics operations. By embracing sustainable practices, Saudi Arabia is not only preserving its natural resources but also meeting the evolving expectations of environmentally conscious consumers and businesses.

Saudi Arabia's journey towards becoming a logistics powerhouse is marked by strategic investments, technological innovation, and collaborative partnerships. By leveraging its geographical advantage, investing in infrastructure, embracing technology, and fostering a business-friendly regulatory environment, the kingdom is transforming supply chains and driving economic growth. As Saudi logistics solutions continue to evolve and mature, they are poised to play an increasingly pivotal role in shaping the future of global trade air cargo companies in Saudi Arabia

0 notes

Text

The Impact and Applications of Machine Learning

Source By Iabac

Introduction

In the realm of finance, where data is abundant and decisions are critical, machine learning (ML) has emerged as a game-changer. This blog will delve deep into the various ways machine learning is transforming the finance industry, from algorithmic trading to risk management and beyond. Through an exploration of cutting-edge techniques, real-world examples, and future trends, we'll uncover how ML is reshaping the landscape of finance.

1. Understanding Machine Learning in Finance

Defining machine learning and Cryptocurrency Prices and News its significance in finance

Types of machine learning algorithms relevant to finance (supervised learning, unsupervised learning, reinforcement learning)

Challenges and opportunities in applying ML to financial data

2. Algorithmic Trading

Introduction to algorithmic trading and its evolution

How machine learning enhances algorithmic trading strategies

High-frequency Crypto News trading, predictive analytics, and sentiment analysis in trading algorithms

Case studies of successful algorithmic trading systems powered by ML

3. Fraud Detection and Anti-Money Laundering (AML)

The importance of fraud detection and AML in financial institutions

Machine learning techniques for detecting fraudulent activities and suspicious transactions

Unsupervised learning for anomaly detection and pattern recognition

Real-world examples of ML-driven fraud detection systems in action

4. Credit Scoring and Loan Approval

Traditional vs. machine learning-based credit scoring models

Predictive modeling for assessing creditworthiness and default risk

Use of alternative data sources and feature engineering in credit scoring

Improving fairness and transparency in ML-driven loan approval systems

5. Risk Management and Portfolio Optimization

ML applications in risk assessment, mitigation, and stress testing

Value-at-Risk (VaR) prediction using machine learning techniques

Portfolio optimization strategies leveraging ML algorithms

Addressing regulatory compliance and risk governance challenges with ML

6. Customer Relationship Management (CRM) and Personalization

Leveraging machine learning for customer segmentation and targeting

Recommendation systems for personalized financial products and services

Predictive analytics for customer churn prevention and retention strategies

Ethical considerations and data privacy in CRM powered by ML

7. Regulatory Compliance and Compliance Monitoring

How machine learning aids in regulatory compliance and monitoring

Automated compliance checks and fraud prevention using ML algorithms

Sentiment analysis for monitoring market manipulation and insider trading

Future trends in regulatory technology (RegTech) powered by ML

8. Robo-Advisors and Wealth Management

Rise of robo-advisors and their role in democratizing wealth management

Machine learning algorithms for asset allocation and investment recommendations

Tailoring investment strategies based on individual preferences and risk profiles

Challenges and opportunities in the adoption of robo-advisors by financial institutions

9. Natural Language Processing (NLP) in Financial Services

Applications of NLP in financial news analysis, sentiment analysis, and text summarization

Automated document processing for regulatory filings and compliance reports

NLP-powered virtual assistants for customer support and financial advisory services

Case studies of NLP implementations in financial institutions

10. Future Trends and Challenges

Emerging trends in machine learning and artificial intelligence in finance

Advancements in explainable AI (XAI) for transparency and accountability

Overcoming challenges such as data privacy, model interpretability, and regulatory hurdles

The potential impact of quantum computing and blockchain technology on ML in finance

Conclusion

As we've explored in this comprehensive guide, machine learning is revolutionizing every facet of the finance industry, from trading to risk management, fraud detection, and customer service. With its ability to analyze vast amounts of data, uncover hidden patterns, and make informed decisions, ML is poised to reshape the future of finance, driving efficiency, innovation, and customer-centricity. As financial institutions continue to embrace AI-driven solutions, the possibilities for enhancing profitability, mitigating risks, and delivering personalized experiences are endless.

Read More Blog :

Evolution of Programming Languages: From Fortran to Rust

Beginner's Guide to Programming Languages: Where to Start

How Artificial intelligence Improves Corporate Sustainability?

0 notes

Text

Why Should Businesses Consider Having Their Own Blockchain Network?

Nowadays, in the digital era, companies are always looking for creative solutions that may help to increase efficiency, security, and transparency. The backbone behind cryptocurrencies like Bitcoin, the blockchain technology is quickly establishing itself as an innovative solution in many different sectors. Even though some business owners may see blockchain only as something related to crypto, it is capable of much more. In this article, we will delve into the top reasons why companies should have their own blockchain network.

Enhanced Security and Trust

Traditional databases typically intend the middleman to be the one managing and securing the data. This centralized approach increases the number of single attack points, thus making it vulnerable to hacking and manipulation. Unlike blockchain, the latter, however, uses a distributed ledger system. Information is encrypted and stored over a network of computers instead of humanizing the role of a central authority. Any change in a ledger means modifying it on all the copies stored on the network, thus keeping falsifications practically impossible.

One of the most salient features of digital currencies is their properties which enables people to trust the system. For example that, the traceability of goods via a blockchain-enabled supply chain from their address to their destination is ensured in real-time. This authenticates and prevents imitations and counterfeiting. Meanwhile, this transparency facilitates trust-building between companies and users.

Streamlined Processes and Reduced Costs

A lot of business processes have more than one entity providing access to data and confirming transactions. This is a tedious process that tends to be full of errors and involves 3rd party intermediaries for communication and validation purposes. Blockchain is capable of getting rid of middlemen by providing a secure and transparent ledger between the interacting parties.

Traditionally speaking, the trade finance process involves banks and institutions swapping documents and validating financial information. Automation of processes such as invoicing, and payment is possible through a blockchain-based platform, thereby reducing paperwork, delays, and associated costs. This is likely to translate into a substantial amount of cost reduction for most companies.

Improved Data Integrity and Traceability

Businesses from all spheres of influence depend on data integrity. Through a Blockchain’s distributed ledger network, any data coming in is non-modifiable, it cannot be changed or removed. This is because transactions are immutable and indelible, which makes them crucial in the auditing, compliance, and dispute resolution processes.

Moreover, blockchain greatly facilitates the keeping of the data with its full history. This traceability particularly is of relevance to areas like pharmaceuticals where it helps in verification of the product and its origin thus it reduces incidents of counterfeiting and improves the safety of the product.

Increased Efficiency and Automation

The implementation of blockchain technology can spell the end for many of the manual tasks performed by firms and replace them with automated actions. Self-enacting agreements written in a smart contract language, also known as smart contracts, can be configured to perform certain tasks once predefined conditions are met. This brings an added advantage of avoiding manual double-checks and interventions thus leading to increased effectiveness and faster processing times.

For instance, a smart contract is used to vitalize insurance claim payments upon a verified event. This avoids the need for a claim manager and shortens the procedure for the customers.

Fostering Innovation and Collaboration

Blockchain networks which are impenetrable and trustworthy can help develop cooperation among businesses. The public platform provided by a distributed ledger technology will enable businesses to exchange data without compromising privacy and to build trust among partners and suppliers through transaction verification. It is the source of the emergence of innovative colorful business models and the development of more efficient and collaborative ecosystems.

For instance, a consortium of banks could utilize a shared blockchain network to facilitate faster and more secure cross-border payments.

Building a Competitive Advantage

Early adoption of innovative technologies can become a critical competitive advantage for companies. Developing its own blockchain network will show that the company is serious about security, transparency, and efficiency aspects. This can win new customers and partners who put the values in high esteem. Besides, the learnings derived from implementing blockchain technology would not only guide strategic decision-making but also pave the way for the creation of new products.

On the one hand, blockchain is not a universal solution, but it should be mentioned that. Companies should thoroughly go into the matter and scrutinize their particular problems before thinking of their own blockchain network.

Here are some key factors to consider:

Industry: Some industries, like the supply chain management industry, the health sector, and the finance sector, have an inherent advantage in employing blockchain technology.

Scalability: Companies need to ascertain whether the blockchain platform they will that choose will be able to scale up to satisfy long-term growth requirements.

Integration: The potential blockchain platform should be flexible so that it can easily connect to the existing information technology setup.

Regulations: Companies who wish to implement any blockchain technology must be cautious of potential rules that govern their respective industry.

The factors outlined above and the benefits listed above offer businesses a platform to objectively determine whether their Own Blockchain Network is right for them. With the development of the blockchain technology and the increase of its application, the role of the blockchain technology in operating business will be more prominent.

0 notes

Text

SAP GRC Process Control 12.0

SAP GRC Process Control 12.0: Your Path to Streamlined Compliance

In today’s complex regulatory landscape, ensuring robust compliance across your organization is not just a best practice—it’s imperative. SAP GRC Process Control 12.0 is a powerful solution that helps organizations streamline compliance efforts, reduce risk, and achieve operational efficiency. In this blog, we’ll dive into what it is, key features, and why it matters to your business.

What is SAP GRC Process Control 12.0?

SAP GRC Process Control 12.0 is vital to SAP’s Governance, Risk, and Compliance (GRC) suite. It’s a comprehensive software solution that enables businesses to automate, monitor, and optimize their internal control processes. At its core, SAP Process Control helps you:

Document and Define Controls: Clearly define your business processes and the associated risks and controls.

Assess and Test: Design and execute tests to assess the effectiveness of those controls.

Monitor: Continuously monitor control performance through automated checks and analytics.

Remediate and Report: Identify and address control deficiencies and provide comprehensive reports about your compliance status.

Key FeaturesSAP GRC Process Control 12.0 offers a suite of valuable features for compliance and process management:

Risk and Control Library: This is a pre-built library of risks and controls aligned with common frameworks like COSO and COBIT, saving you significant setup time.

Workflow and Automation: Streamlined workflows to guide compliance activities and automate tasks, improving efficiency.

Surveys and Assessments: User-friendly tools for creating surveys and assessments to test control effectiveness.

Continuous Control Monitoring (CCM): Capabilities for automatic, near real-time monitoring of controls to prevent issues.

Reporting and Analytics Customizable dashboards and reports provide compliance insights to business leaders and stakeholders.

Benefits of SAP GRC Process Control 12.0

Enhanced Compliance: SAP Process Control 12.0 facilitates adherence to industry regulations and internal policies, helping you avoid costly penalties and reputational damage.

Reduced Risk: Proactively identifying and mitigating control weaknesses significantly minimizes risk exposure across your business.

Increased Efficiency: Automation and workflow tools streamline compliance tasks and free employees to focus on higher-value activities.

Improved Visibility: Real-time reporting provides clear insights into your compliance posture and control performance, facilitating data-driven decision-making.

Cost Savings: Reduction of manual compliance work and mitigation of fines and audit penalties translate into long-term cost savings.

Who Needs SAP GRC Process Control 12.0?

Organizations of all sizes operating in regulated industries can significantly benefit from SAP GRC Process Control 12.0. It’s particularly relevant for:

Publicly Traded Companies: Companies subject to Sarbanes-Oxley (SOX) compliance will find it an invaluable tool.

Financial Institutions: Helps address complex banking and finance regulations.

Healthcare and Life Sciences: Critical for adhering to regulations like HIPAA and FDA requirements.

Companies Handling Sensitive Data: This is to ensure proper controls and data privacy.

Getting Started with SAP GRC Process Control 12.0

If you’re looking to get started with SAP Process Control, here are key steps:

Assessment: Assess your current compliance posture, risk areas, and the regulatory landscape in which you operate.

Planning: Define your compliance goals and create a strategic plan aligning with your business objectives.

Implementation: Work with an experienced SAP partner to ensure proper configuration and implementation of Process Control 12.0.

Training: Train your compliance and internal audit teams to utilize the system entirely.

In Conclusion

In the age of ever-increasing regulatory scrutiny, SAP GRC Process Control 12.0 provides a powerful platform to maintain a robust compliance framework. Streamlining processes, automating tasks, and providing real-time insights positions your organization for success in a complex and demanding business environment.

youtube

You can find more information about SAP GRC in this SAP GRC Link

Conclusion:

Unogeeks is the No.1 IT Training Institute for SAP GRC Training. Anyone Disagree? Please drop in a comment

You can check out our other latest blogs on SAP GRC here – SAP GRC Blogs

You can check out our Best In Class SAP GRC Details here – SAP GRC Training

Follow & Connect with us:

———————————-

For Training inquiries:

Call/Whatsapp: +91 73960 33555

Mail us at: [email protected]

Our Website ➜ https://unogeeks.com

Follow us:

Instagram: https://www.instagram.com/unogeeks

Facebook: https://www.facebook.com/UnogeeksSoftwareTrainingInstitute

Twitter: https://twitter.com/unogeeks

#Unogeeks #training #Unogeekstraining

1 note

·

View note

Text

Financial Printing Services and Regulatory Compliance: Navigating the Complex Landscape

In the meticulously regulated world of finance, printed materials are more than just static communications—they are legal documents, compliance tools, and a vital part of your institution's reputation. For financial institutions, compliance officers, and investors, navigating the intricate maze of guidelines, revisions, and deadlines can be a daunting challenge. Here's how financial printing services can smooth out the complexities and assist you in achieving seamless, compliant investor communications.

The Evolution of Financial Printing

Once upon a time, financial printing was a matter of producing annual reports and brochures. Those days are long gone. Today, in an environment characterized by globalization, digitization, and increased regulatory scrutiny, the services offered by financial printers are broad and complex. These include:

Prospectus Printing: When new investment opportunities arise, a timely and accurate prospectus is a legal requirement. Financial printers specialize in creating and delivering documents that meet strict content, formatting, and deadline standards.

EDGAR Filing Services: In the U.S., publicly traded companies must submit various forms to the Securities and Exchange Commission (SEC). Financial printers ensure that these forms are filed accurately and on time, safeguarding companies from legal repercussions.

Shareholder Communications: From proxy statements to dividend notices, printed shareholder communications must be delivered efficiently and in compliance with local and international mailing standards.

Digital Services: Financial printers offer a range of digital and e-delivery solutions, which streamline the information dissemination process, reduce the risk of non-compliance, and provide a more interactive communication platform.

The Importance of Accuracy

In the financial printing realm, precision is paramount. One misplaced figure, erroneous footnote, or incorrectly formatted page can lead to dire consequences. Whether it's a simple typographical error or a more complex issue, the impact on your institution's credibility and legal standing is significant. Financial printers employ strict quality control measures, technical expertise, and specialized software to ensure that every document is accurate and compliant.

Streamlining Compliance

With each passing year, regulations governing investor communications grow more intricate. The recently revised European Market Infrastructure Regulation (EMIR) and the upcoming Shareholder Rights Directive II (SRD II) are just two examples of how compliance requirements evolve. Financial printing services stay abreast of these changes, offering you peace of mind that your institution is adhering to the latest regulatory standards.

Leveraging Technology for Efficiency

Modern financial printers don't just produce documents; they leverage cutting-edge technology to streamline the entire process. Through automated software, content management systems, and standardized templates, the production of regulatory documents can be expedited without sacrificing quality. From data aggregation to printing and distribution, technology takes the manual labor out of the equation, reducing the risk of human error and accelerating time-to-market.

Navigating the financial printing and compliance landscape need not be a solitary, stressful endeavor. By engaging the right financial printing services, you can turn regulatory requirements into an opportunity to shine. These services provide not just printed material, but expertise, precision, and a robust understanding of the regulations that govern your industry. Embrace the partnership with financial printers, and mark one complex domain off your institutional to-do list with confidence and ease.

0 notes