#Top 10 Pharmaceutical Companies in 2023

Text

Top 10 Pharmaceutical Companies in 2023: How COVID-19 Reshaped the Industry

See how COVID-19 impacted the pharmaceutical industry in 2023. This article explores the top ten pharma companies by revenue, including how established players fared and how new product approvals influenced rankings.

In the dynamic landscape of the pharmaceutical industry, certain companies stand out as leaders, driving innovation, and shaping the future of healthcare. As we delve into the year 2023, let's take a closer look at the top ten pharmaceutical giants that continue to influence the global market.

1. Pfizer

With a rich history of breakthroughs, Pfizer maintains its position as a powerhouse in the pharmaceutical world. From vaccines to therapeutics, the company's innovative portfolio remains at the forefront of healthcare advancements.

2. Roche

Renowned for its expertise in oncology and diagnostics, Roche continues to make strides in personalized medicine. Through strategic partnerships and cutting-edge research, the company remains a key player in cancer treatment and detection.

3. Johnson & Johnson

As a diversified healthcare conglomerate, Johnson & Johnson boasts a robust portfolio spanning pharmaceuticals, medical devices, and consumer health products. With a commitment to innovation and sustainability, the company maintains its status as a global leader.

4. Novartis

Driven by a mission to reimagine medicine, Novartis focuses on developing transformative therapies for a range of diseases. From innovative gene therapies to breakthrough treatments, the company remains a frontrunner in healthcare innovation.

5. Merck & Co.

Merck & Co. continues to make significant contributions to global health with its portfolio of vaccines, pharmaceuticals, and animal health products. Through strategic acquisitions and research collaborations, the company remains a driving force in the fight against infectious diseases and chronic conditions.

6. AstraZeneca

With a dedication to advancing science and delivering life-changing medicines, AstraZeneca remains a key player in the pharmaceutical landscape. From cardiovascular treatments to respiratory therapies, the company's diverse portfolio addresses some of the most pressing healthcare challenges.

7. GlaxoSmithKline

Known for its commitment to innovation and global health initiatives, GlaxoSmithKline continues to make a positive impact on patient care. Through strategic investments in research and development, the company remains at the forefront of vaccine development and infectious disease management.

0 notes

Text

Oct. 3 (UPI) -- Ten U.S. drug manufacturers have agreed to participate in the initial round of the first-ever pricing negotiations between Medicare and the nation's pharmaceutical giants, the Biden administration announced Tuesday.

The highly anticipated Medicare Drug Price Negotiation Program was set to enter its next phase after the Centers for Medicare & Medicaid Services invited the drugmakers to voluntarily join the program in August.

The move comes as President Joe Biden seeks to fulfill a campaign promise to make prescription medicines more affordable for millions of aging Americans.

The drugs on the list are among the most commonly used to treat everything from heart failure, blood clots, diabetes, arthritis, and Crohn's disease, however, average Americans often cannot afford to buy the drugs, Biden said in August when the drug cost reform effort kicked off.

Previously, the White House said the drugs are among the top 50 prescription medications that seniors fill the most at retail pharmacies under Medicare Part D.

The companies electing to participate include Bristol Myers Squibb, Boehringer Ingelheim, Janssen Pharmaceuticals, Merck Sharp Dohme, AstraZeneca, Novartis, Immunex, Pharmacyclics LLC, Jannsen Biotech and Novo Nordisk.

Collectively, the companies' drugs brought in $50.5 billion from prescriptions covered under Part D between June 1, 2022, and May 31, 2023, with consumers paying $3.4 billion in out-of-pocket costs, according to a statement from the Department of Health and Human Services.

"Drug companies that manufacture these drugs have indicated that they will participate in negotiations with Medicare during the remainder of 2023 and in 2024, and any agreed-upon negotiated prices will become effective beginning in 2026," the statement said.

The pricing program is being funded through the Inflation Reduction Act of 2022, which expanded Medicare's authority to negotiate out-of-pocket drug costs, including a $2 monthly cap on certain generic drugs used to treat chronic conditions, as well as a $35 price cap on insulin.

The pandemic-era legislation contains a broad range of actions to mitigate high drug prices, including a plan that adds commercial health insurers to a requirement that forces drug companies to pay rebates to Medicare whenever medicine prices rise faster than inflation.

Merck and Johnson & Johnson have filed multiple lawsuits in an effort to declare Biden's plan unconstitutional.

Biden has vowed to continue to pursue lower drug costs, arguing his pricing plan was working to help struggling Americans while the pharmaceutical industry raked in billions in record profits.

"There is no reason why Americans should be forced to pay more than any developed nation for life-saving prescriptions just to pad Big Pharma's pockets," Biden said at the time.

When the pricing negotiations conclude, the Centers for Medicare & Medicaid Services will announce the prices of the selected drugs on or before September 2024, however, the new drug prices won't go into effect until 2026.

From there, the government will select up to 15 more drugs covered under Part D for 2027, and up to 15 more drugs for 2028, including drugs covered under Part B and Part D.

The program will add up to 20 more drugs each year after that, as required by the Inflation Reduction Act.

6 notes

·

View notes

Text

A strange thing happened in the eurozone economy at the end of last year. Despite widespread forecasts that the common currency area would plunge into recession and register negative growth in the last quarter of 2022, it managed to eke out a small gain of 0.1 percent. What is remarkable is not that Europe beat expectations, but that it was one small country—Ireland—whose surging economy single-handedly prevented the eurozone from slipping into the red.

Almost unbelievably, little Ireland, with a population of only 5 million, now has the economic scale to shift the growth statistics of the entire eurozone and its 343 million inhabitants. In 2022, Irish GDP growth of 12.2 percent compared to 3.5 percent in the eurozone as a whole. In absolute numbers, only Germany, France, and Italy contributed more than Ireland to eurozone GDP growth in 2021 and 2022. Ireland’s economic boom has enabled the country’s government to post a budget surplus of 1.6 percent of GDP, even as eurozone countries struggled with an average deficit of more than 3 percent.

Honestly, who wouldn’t want this luck of the Irish?

Look closely, however, and Ireland’s so-called economic miracle looks more than a little odd. The country’s growth is simultaneously both real and artificial. Much of it is driven by a handful of U.S. multinationals, which continue to route global sales and profits through their Irish operations to take advantage of Dublin’s lower business taxes. Although difficult and complex to calculate, Apple’s shifting of intellectual property assets to Ireland is estimated to have contributed half of Ireland’s miraculous 26 percent GDP growth in 2016. That bizarre fact inspired New York Times columnist Paul Krugman to ridicule Ireland’s “leprechaun economics”—and the Irish statistics office to move away from using GDP as a measure of economic growth.

Yet the surge of U.S. investment in Ireland is also real. In particular, Ireland’s role as a pharmaceuticals manufacturing hub dramatically increased during the COVID-19 pandemic. Nine out of the world’s top 10 drug companies have significant production facilities in Ireland. The U.S. State Department thinks the corporate build-out in Ireland will continue, given Ireland’s status as the only remaining English-speaking European Union country following Britain’s departure. That makes it easy for international companies to operate and enjoy barrier-free access to the EU’s single market.

It’s hard to exaggerate Ireland’s dependence on U.S. tech and pharma companies for investment and taxes. Corporate tax receipts are now the second-largest source of tax revenue (after income tax) for the Irish state: 27 percent of all tax income in 2022. The average was just 9 percent in the 38 member countries of the Organisation for Economic Co-operation and Development (OECD) in 2020, the last year for which data is available. This, in turn, is fueling an unprecedented torrent of tax income for the Irish government. Corporate tax revenues were up nearly 50 percent in 2022 alone.

Just 10 multinationals—all of them U.S.-based tech and pharmaceutical companies—now pay nearly 60 percent of Ireland’s corporate tax. Directly and indirectly, U.S. multinationals employ more than 375,000 people in Ireland, approximately 15 percent of the country’s labor force. Driven by investment from the United States, foreign multinationals now account for 53 percent of all payroll taxes paid by corporate employers.

Driven by the windfall in corporate tax receipts, the Irish government’s budget surplus is expected to swell further, to 10 billion euros in 2023 and 16 billion euros in 2024. Relative to the size of the economy, this would be equivalent to a U.S. budget surplus of more than 1 trillion dollars in 2024.

The problem for Ireland is that this singular dependence exposes the country to growing risks. Take the tech sector: As multinationals like Google, Microsoft, Meta, and Amazon see their profits shrink and slash jobs worldwide, it will not only hurt the Irish economy, but deprive Dublin of tax income as well.

What’s more, the threat to Ireland’s stability from its overdependence on U.S. companies is about to be multiplied. In 2021, nearly 140 tax jurisdictions, including Ireland, agreed to a major reform of how multinationals companies will be taxed in the future. Pillar 2 of these reforms—a minimum corporate tax rate of 15 percent for large companies—is already coming into effect. In 2024, Ireland’s corporate tax rate is due to increase to 15 percent from its current level of 12.5 percent, reducing its attractiveness as a tax haven compared to other countries. The United States also approved the minimum tax plan in August 2022, despite significant private sector and political opposition.

However, it is Pillar 1 of the OECD’s reforms that will dramatically erode Ireland’s future income from corporate taxes. This reform will reallocate a share of company profits to where sales (or users) are actually located. Previously, tax liability was calculated on where the company or its subsidiary was legally based, no matter how many profits it rerouted from other parts of the world for tax-avoiding purposes. For Ireland, the consequences are obvious: U.S. multinationals operating in the EU will be forced to divide some of their sales by member state, thus significantly reducing the amount of sales and profits that can be “booked” through Ireland. This reform is due to come into force in 2024. The end of Ireland’s windfall is therefore only a matter of time.

The Irish Department of Finance estimated in January that around half of Ireland’s corporate tax receipts—$10 billion—are “transitionary” and will be lost as the new tax rules are implemented. That translates to more than 10 percent of total government spending in 2022—more than the entire Irish education budget. This is putting the Irish government on the precipice of another financial disaster, little more than a decade after it had to be bailed out of impending bankruptcy by the European Commission, European Central Bank, and the International Monetary Fund. That disaster left Ireland with one of the highest per capita public debt levels in the world.

Regardless of the impending financial train wreck, however, Dublin is unlikely to wake up from its American dream anytime soon. Diversifying its economy and revenue sources away from U.S. multinationals would require Ireland to shift its economic and geopolitical orientation, downgrade (in Dublin’s eyes) its deep relationship with the United States, and seek greater integration into the EU economy and its myriad rules.

That’s because Ireland’s dependence on U.S. multinationals is just another expression of the country’s affinity with the United States—the “shared heritage” referenced by U.S. presidents from John F. Kennedy to Ronald Reagan to Joe Biden. These ties to the United States long precede Dublin’s embrace of European integration and make it unlikely that Ireland will ever have the same intensity of economic, cultural, and other ties to France, Germany, or the rest of the EU.

The approaching economic and fiscal train wreck resulting from the new tax rules requires a fundamental change of mindset from Irish policymakers. Squaring the circle—holding on to its deep U.S. ties while integrating more closely with the EU to diversify its economy—means Dublin must give a little (and lose a little) to both sides. Yet Ireland’s ability to navigate this conundrum is doubtful. Even though the coming changes have been plain for all to see, Dublin’s current Trade and Investment Strategy does not contain any concrete policies to mitigate the overdependence on U.S. investment flows. Although the document acknowledges that EU market opportunities are underutilized, it again recognizes the importance “markets such as the UK and the US, which offer familiarity with language and culture.”

If there is no short-term solution to Ireland’s financial vulnerabilities, a few longer-term needs stand out. Dublin should ensure that its current budget surplus is invested wisely to help diversify its drivers of growth. One such driver would be significant increases in public investment in housing and public transport infrastructure to bring the country closer to Western European standards. Ireland’s tax base should be widened to allow for a wider distribution of income sources. For example, In 2021, Ireland gained just 5 percent of its tax receipts from property taxes, compared to more than 11 percent in both Britain and the United States.

Most importantly, Ireland must deepen its trading relationships outside the English-speaking world. Notwithstanding the country’s 50-year membership of the EU, a dearth of foreign language teaching has created a monolingual business culture, which priorities existing links with the United States over the development of new markets, both within and outside the EU. This needs to change if Ireland is to build a sustainable economic model.

Biden—whose family, like so many in the United States, has Irish roots—said in 2021 that “everything between Ireland and the United States runs deep.” This is Ireland’s economic reality today. As the corporate tax boom ebbs, Ireland should ensure that its American dream doesn’t become a recurring economic and financial nightmare.

2 notes

·

View notes

Text

Full list of Forbes’ 25 world billionaires in 2023

American business magazine, Forbes, in its 2023 list of 25 richest people in the world, featured Bernard Arnault on the No. 1 spot, followed by Twitter Chief Executive Officer, Elon Musk.

In its previous list in 2022, Musk was on the No. 1 spot.

Forbes described the drop of Musk from the top spot as ” this year’s second-biggest loser”, adding that “Elon Musk, had it worse.”

For Jeff Bezos, fortune knocked him from number. 2 in the world in 2022 to No. 3 this year as Amazon shares crashed by 38 per cent.

So This Happened (202) Reviews Lagos Bizman’s Arraignment Over Wife’s Death, Others | Punch

Musk lost his title of the world’s richest person after his pricey purchase of Twitter, which he funded in part by the sale of Tesla shares, helping to spook investors. Musk, who is worth $39 billion less than a year ago, is now No. 2.

For Jeff Bezos, fortune knocked him from number. 2 in the world in 2022 to No. 3 this year as Amazon shares crashed by 38 per cent.

Also, among the top 25, two billionaires — Zhang Yiming, Changpeng Zhao lost their spots and were unable to make it on the list for this year.

Yiming, the founder of Tik Tok-parent Bytedance, dropped one place, from No. 25 to No. 26, as his embattled company has taken a haircut from investors while Zhao, Binance founder, known as CZ, fell from No. 19 last year all the way to No. 167 amid the crypto winter.

Below are the list of Forbes 25 richest people in the world in 2023 with their net worth

1. Bernard Arnault & family

(Net worth: $211 Billion | Source of Wealth: LVMH | Age: 74 | Citizenship: France)

2. Elon Musk

(Net worth: $180 Billion | Source of Wealth: Tesla, SpaceX | Age: 51 | Citizenship: U.S.)

3. Jeff Bezos

(Net worth: $114 Billion | Source of Wealth: Amazon | Age: 59 | Citizenship: U.S.)

4. Larry Ellison

(Net worth: $107 Billion | Source of Wealth: Oracle | Age: 78 | Citizenship: U.S.)

5. Warren Buffett

(Net worth: $106 Billion | Source of Wealth: Berkshire Hathaway | Age: 92 | Citizenship: U.S.)

6. Bill Gates

(Net worth: $104 Billion | Source of Wealth: Microsoft | Age: 67 | Citizenship: U.S.)

7. Michael Bloomberg

(Net worth: $94.5 Billion | Source of Wealth: Bloomberg LP | Age:81

8. Carlos Slim Helú & family

(Net worth: $93 Billion | Source of Wealth: Telecom | Age: 83 | Citizenship: Mexico)

9. Mukesh Ambani

(Net worth: $83.4 Billion | Source of Wealth: Diversified| Age: 65 | Citizenship: India)

10. Steve Ballmer

(Net worth: $80.7 Billion | Source of Wealth: Microsoft | Age: 67 | Citizenship: U.S.)

11. Françoise Bettencourt Meyers & family

(Net worth: $80.5 Billion | Source of Wealth: L’Oréal | Age: 69 | Citizenship: France)

12. Larry Page

(Net worth: $79.2 Billion | Source of Wealth: Google | Age: 50 | Citizenship: U.S.)

13. Amancio Ortega

(Net worth: $77.3 Billion | Source of Wealth: Zara | Age: 87 | Citizenship: Spain)

14. Sergey Brin

(Net worth: $76 Billion | Source of Wealth: Google | Age: 49 | Citizenship: U.S.)

15. Zhong Shanshan

(Net worth: $68 Billion | Source of Wealth: Beverages, pharmaceuticals | Age: 68 | Citizenship: China)

16. Mark Zuckerberg

(Net worth: $64.4 Billion | Source of Wealth: Facebook | Age: 38 | Citizenship: U.S.)

17. Charles Koch

(Net worth: $59 Billion | Source of Wealth: Koch Industries | Age: 87 | Citizenship: U.S.)

18. Julia Koch & family

(Net worth: $59 Billion | Source of Wealth: Koch Industries | Age: 60 | Citizenship: U.S.)

19. Jim Walton

(Net worth: $58.8 Billion | Source of Wealth: Walmart | Age: 74 | Citizenship: U.S.)

20. Rob Walton

(Net worth: $57.6 Billion | Source of Wealth: Walmart | Age: 78 | Citizenship: U.S.)

21. Alice Walton

(Net worth: $56.7 Billion | Source of Wealth: Walmart | Age: 73 | Citizenship: U.S.)

22. David Thomson & family

(Net worth: $54.4 Billion | Source of Wealth: Media | Age: 65 | Citizenship: Canada)

23. Michael Dell

(Net worth: $50.1 Billion | Source of Wealth: Dell Technologies | Age: 58 | Citizenship: U.S.)

24. Gautam Adani

(Net worth: $47.2 Billion | Source of Wealth: Infrastructure, commodities | Age: 60 | Citizenship: India)

25. Phil Knight & family

(Net worth: $45.1 Billion | Source of Wealth: Nike | Age: 85 | Citizenship: U.S.)

2 notes

·

View notes

Text

Inspection Machines Market Size, Share, Forecast, & Trends Analysis

The global inspection machines market is forecasted to achieve a valuation of $2 billion by 2030, registering a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. This growth is driven by several factors, including heightened government emphasis on food safety, increased R&D spending in the pharmaceutical and biotech sectors, the proliferation of inspection checkpoints throughout production processes, and stringent regulations to ensure Good Manufacturing Practice (GMP) compliance. Despite these positive trends, market growth is hindered by a preference for refurbished inspection machines due to their high costs.

Download free sample report here: https://www.meticulousresearch.com/download-sample-report/cp_id=2571?utm_source=article&utm_medium=social&utm_campaign=product&utm_content=21-05-2024

Emerging Opportunities and Technological Advancements

Technological advancements in inspection machinery and the increasing trend of outsourcing manufacturing operations to emerging economies are expected to unlock significant opportunities within this market. However, the market also faces challenges such as evolving regulatory standards and complexities associated with integrating new inspection technologies.

Market Segmentation and Competitive Landscape

The inspection machines market is comprehensively segmented by offering, automation mode, end-user, and geography. The study provides an in-depth analysis of the competitive landscape, evaluating key industry players and examining market dynamics at both regional and country levels.

Key Industry Players

Prominent players in the global inspection machines market include:

Thermo Fisher Scientific Inc. (U.S.) Teledyne Technologies Incorporated (U.S.)Körber AG (Germany)Robert Bosch GmbH (Germany)Omron Corporation (Japan)OPTEL GROUP (Canada)COGNEX Corporation (U.S.)BREVETTI CEA S.P.A (Italy)ANTARES VISION S.p.A (Italy)

The inspection machines sector is experiencing dynamic growth driven by significant R&D investments aimed at expanding product portfolios and enhancing market share. Integrating inspection systems with pharmaceutical, food, and medical product systems—such as weighing machines, metal detectors, and X-ray inspection systems—represents key technological advancements. Combining check weighers, metal detectors, and machine inspection systems with leak detection systems improves product packaging and helps prevent recalls of medical devices, food products, and pharmaceuticals throughout the supply chain.

Browse in depth: https://www.meticulousresearch.com/product/inspection-machines-market-2571?utm_source=article&utm_medium=social&utm_campaign=product&utm_content=21-05-2024

Recent technological developments include improved sensor technology, faster CPU processing speeds, increased camera dynamic range and resolution, real-time detection of moving objects, use of color information, point cloud analysis, cloud computing of machine vision, and computational cameras. Smart camera-based vision inspection systems are increasingly popular in healthcare due to their lower cost, ease of integration, and operational simplicity.

Industry players are increasingly offering embedded smart camera-based systems, providing advanced vision and leak detection capabilities to the pharmaceutical, medical device, and food industries. These advancements underscore the industry's commitment to investing in cutting-edge inspection technologies, creating significant growth opportunities.

Automatic Inspection Segment to Lead Growth

The automatic inspection segment, categorized by automation mode, is projected to register the highest CAGR. The industry's push towards zero-error goals necessitates minimizing particles and aesthetic flaws, driving technological advancements in automatic inspection solutions.

Click here for trending blog: https://meticulousblog.org/top-10-companies-in-inspection-machines-market/?utm_source=article&utm_medium=social&utm_campaign=product&utm_content=21-05-2024

Pharmaceutical Sector to Drive Market Expansion

The pharmaceutical and biotech segment, under end-user classification, is set to experience the highest CAGR. Regulatory agencies such as the FDA, European Medicines Agency, and the Pharmaceuticals and Medical Devices Agency enforce stringent CGMP regulations, compelling manufacturers to prioritize quality through advanced inspection machines.

Asia-Pacific to Register the Highest Growth Rate

Geographically, Asia-Pacific is poised to record the highest CAGR over the forecast period. This growth is attributed to the burgeoning manufacturing activities across industries like pharmaceuticals, biotech, food and beverages, and cosmetics. The demand for high-quality products in these sectors creates substantial opportunities for market players. Technologically advanced nations such as China, Japan, South Korea, Taiwan, and India are expected to provide lucrative growth prospects, bolstering the inspection machines market in the region.

Quick buy: https://www.meticulousresearch.com/Checkout/64551015?utm_source=article&utm_medium=social&utm_campaign=product&utm_content=21-05-2024

Contact Us:

Meticulous Research®

Email- [email protected]

Contact Sales- +1-646-781-8004

Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

0 notes

Text

Global Top 24 Companies Accounted for 49% of total Commercial and Household Water Purification Systems market (QYResearch, 2021)

Water Purification Systems are used to remove undesirable chemicals, biological contaminants, suspended solids and gases from water. The goal is to produce water fit for a specific purpose. In this report, we will mainly analyze commercial and residential water purification systems for providing clean and safe drinking or usable water.

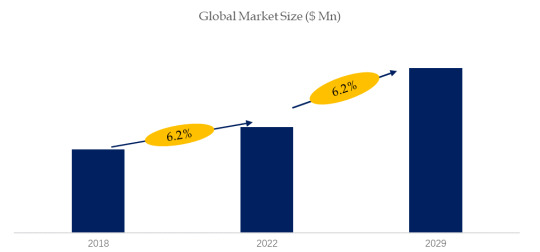

According to the new market research report “Global Commercial and Household Water Purification Systems Market Report 2023-2029”, published by QYResearch, the global Commercial and Household Water Purification Systems market size is projected to reach USD 20.64 billion by 2029, at a CAGR of 6.2% during the forecast period.

Figure. Global Commercial and Household Water Purification Systems Market Size (US$ Million), 2018-2029

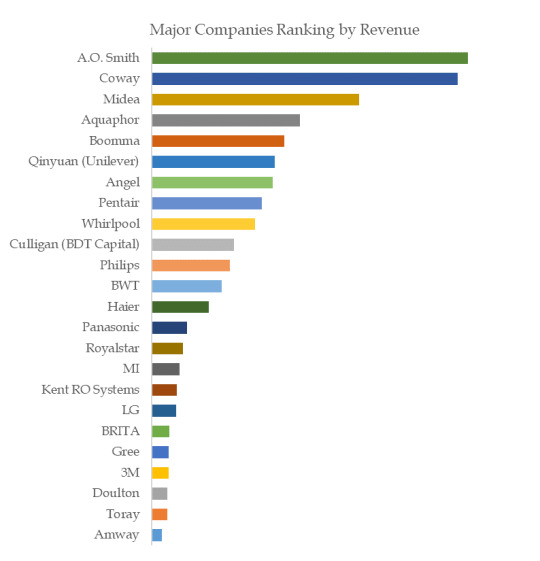

Figure. Global Commercial and Household Water Purification Systems Top 24 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

The global key manufacturers of Commercial and Household Water Purification Systems include A.O. Smith, Coway, Midea, Aquaphor, Boomma, Qinyuan (Unilever), Angel, Pentair, Whirlpool, Culligan (BDT Capital), etc. In 2021, the global top 10 players had a share approximately 49.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

For more information, please contact the following e-mail address:

Email: [email protected]

Website: https://www.qyresearch.com

0 notes

Text

Global Top 4 Companies Accounted for 66% of total Mothballs market (QYResearch, 2021)

Mothballs are commonly made of naphthalene or para- dichlorobenzene, both of which are toxic to humans. These chemicals are solids at room temperature and are made into round balls, flakes or cakes that slowly change to a gas and become fumes in the air. Mothballs should not be placed in closets, attics, basements, storage chests or trunks, garment bags or other spaces other than in tightly closed containers.

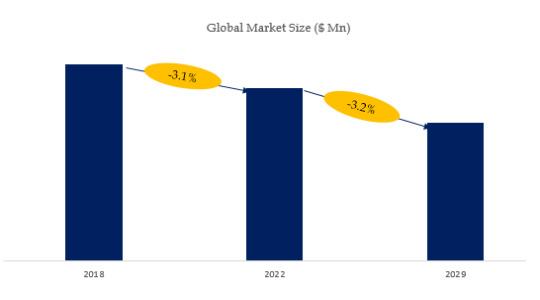

According to the new market research report “Global Mothballs Market Report 2023-2029”, published by QYResearch, the global Mothballs market size is projected to reach USD 0.04 billion by 2029, at a CAGR of -3.2% during the forecast period.

Figure. Global Mothballs Market Size (US$ Million), 2018-2029

Global Mothballs Market Size

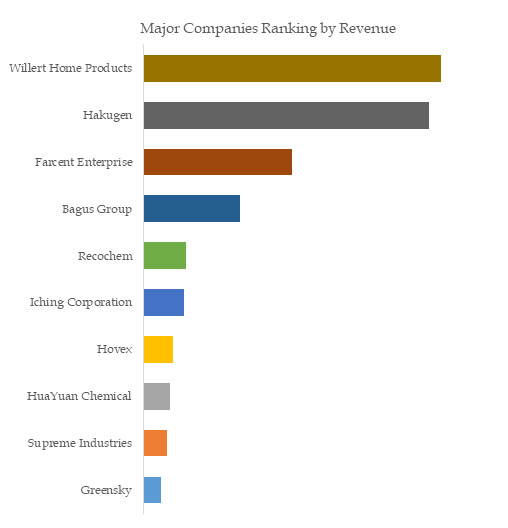

Figure. Global Mothballs Top 10 Players Ranking and Market Share(Based on data of 2021, Continually updated)

Global Mothballs Top 10 Players Ranking and Market Share

The global key manufacturers of Mothballs include Willert Home Products, Hakugen, Farcent Enterprise, Bagus Group, Recochem, etc. In 2021, the global top four players had a share approximately 66.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

1 note

·

View note

Text

FMS Summer Placements 2024: 289 Students Placed with Average Stipend of Rs 2.96 Lakh

The Faculty of Management Studies (FMS) has concluded its summer placements for the batch of 2023–25, achieving remarkable success. Out of 304 offers made by 101 participating companies, a total of 289 students have been successfully placed.

According to data released by FMS, the average stipend for the top 10 percent of students stands at Rs 4.22 lakh, Rs 4.03 lakh for the top 25 percent, and Rs 3.57 lakh for the top 50 percent. Notably, there has been a consistent increase in stipend across all categories over the past three years. The average stipend for the entire batch is Rs 2.96 lakh, with the median stipend recorded at Rs 3 lakh.

Sector-wise Performance

E-commerce companies continued their strong presence in FMS placements, offering sought-after product and program management roles. Major recruiters included Adobe, Amazon, American Express, Arcesium, GE Vernova, HDFC Credila, Hindustan Unilever, Infoedge, Media.net, Microsoft, Natwest, Qualcomm, Samsung, Uber, and Zomato.

In the Sales and Marketing domain, FMCG giants remained prominent recruiters, while sectors like Pharmaceuticals, Consumer Electronics, Retail, E-Commerce, Industrial Goods, and Automobiles also offered lucrative roles. Top recruiters encompassed Apollo, Asian Paints, AstraZeneca, Bridgestone, Cipla, Coca-Cola, Dabur, Diageo, Disney HCCB, ITC, L’Oréal, Mondelez, Nestle, NPCI, Perfetti Van Melle, Pernod Ricard, Pidilite, Puma, Reckitt, Tata Play, and VI.

The finance sector witnessed placements in various roles including Investment Banking, Corporate Finance, Corporate Banking, and Wealth Management. Leading recruiters in this domain included American Express, Axis Bank, Bank of America, Bharti Enterprises, Citi, Goldman Sachs, HDFC, JPMC, Morgan Stanley, SMBC, White Oak, and Yes Bank.

Consulting, General Management, and Strategy roles were filled by companies such as Aditya Birla Fashion, Accenture Strategy, Adani, Airtel, Bain & Company, BCG, Capgemini, Deloitte, EY Parthenon, JSW, Kearney, KPMG, Mahindra Group, McKinsey & Co., PWC, Reliance, Renew Power, and TAS.

The successful summer placements at FMS underscore its reputation as a premier management institution, providing students with diverse opportunities across sectors. As the academic year progresses, students can look forward to leveraging their summer experiences to excel in their respective fields.

0 notes

Text

Top 10 richest person in india of 2024

Get more information, please click the link - https://shurtitalks.com/top-10-richest-person-in-india-of-2024/

As India’s economy experiences exponential growth, one might frequently wonder about the implications. A record number of Indians, totaling 200, have made it to Forbes' 2024 World's Billionaires list.

To probably no one's surprise, Mukesh Ambani tops the list, followed by eminent personalities such as Gautam Adani and Shiv Nadar. In this post, we bring you a list of the top 10 richest people in India courtesy of Forbes' Real-Time Billionaires rankings, which keep an eye out for billionaires globally. And this information provided corresponds to data collected on March 8, 2024.

1. Mukesh ambani

Mr. Mukesh Ambani, the Managing Director and Chairman of Reliance Industries, stands as India's wealthiest individual. According to Forbes, Reliance Industries reports a revenue of over Rs 9.03 lakh crore ($109.4 billion). The conglomerate is engaged in diverse sectors including petrochemicals, oil and gas, retail, telecom, and more. Ambani's three children, Akash, Anant, and Isha, actively participate in managing various divisions of the conglomerate.

Check for more information about Reliance Industries

2. Gautam Adani

Gautam Shantilal Adani, an Indian billionaire industrialist, is renowned as the founder and chairman of the Adani Group, a multinational conglomerate involved in port operations and development within India. The Adani Foundation, established by Gautam Adani in 1996, has his wife, Priti Adani, serving as its chairperson. The group's business interests encompass various sectors, including ports, airports, power generation, and transmission, as well as green energy. Adani is recognized as India's largest airport operator and also controls Gujarat's Mundra Port, the country's largest.

Check for more information about Adani Group

3. Shiv Nadar

Shiv Nadar, the owner of the HCL group, boasts an esteemed clientele including Cisco, Microsoft, and Boeing. Recognizing his significant contributions to the IT industry, the Indian government honored Mr. Nadar with the Padma Bhushan, India's esteemed third-highest civilian award, in 2008. Mr. Nadar is highly regarded as a philanthropist, having donated Rs 2,042 crore in late 2023.

Check for more information about Founder of HCL Enterprise

4. Savitri Jindal & family

Savitri Jindal, an Indian politician and entrepreneur, holds the esteemed position of emeritus chair at the O.P. Jindal Group, with her four sons, Prithviraj, Sajjan, Ratan, and Naveen Jindal, managing the various divisions of the business. Additionally, JSW Sports, the sports division of the JSW Group, operates within this conglomerate that spans India, the USA, South America, Europe, and Africa. Its objective is to actively contribute to the development of a vibrant sports ecosystem in India. Savitri Jindal stands as the wealthiest woman in India.

Check for more information about Jindal Steel Power

5. Dilip Shanghvi

Dilip Shanghvi stands as a prominent Indian business tycoon, heralded as the visionary behind Sun Pharmaceutical Industries, which became the first Indian pharmaceutical company to achieve a $5 billion valuation. He steered Sun's growth trajectory through a string of acquisitions, notably the landmark 2014 acquisition of the scandal-marred rival Ranbaxy Laboratories for $4 billion.

Check for more information about Sun Pharmaceuticals

6. Cyrus Poonawalla

Cyrus Poonawalla, a prominent figure in vaccine development in India, is the primary beneficiary of the expanding sales and earnings resulting from his ownership of the privately held Serum Institute of India. And assisting him in its management is his son, Adar. The institute, headquartered in Pune, holds the prestigious title of being the world's largest vaccine manufacturer. The recent increase in Cyrus Poonawalla’s wealth can largely be attributed to the widespread utilization of the Covid-19 vaccines developed by the SII.

Check for more information about Serum Institute of India

7. Kushal Pal Singh

Kushal Pal Singh, a property baron, serves as the chairman emeritus of DLF, which stands as India's biggest listed real estate firm by market cap. Singh, an army veteran, commenced his journey with DLF, a company initiated by his father-in-law, in 1961. He held the position of chairman for over five decades.

Check for more information about DLF Limited

8. Kumar Birla

Renowned as a leading figure in the commodities sector, Kumar Birla assumes leadership of the Aditya Birla Group. In addition to its involvement in aluminum and cement sectors, the conglomerate also offers financial services. Birla previously held the position of non-executive chairman of Vodafone Idea, a telecommunications company, but resigned in 2021 amidst mounting debts. As of 2024, the company has appointed Birla as a non-executive director.

In a recent development, Birla's children, Ananya and Aryaman, have joined the boards of his flagship companies. Birla anticipates their infusion of fresh ideas, passion, and energy into the business.

Check for more information about Hindalco Industries

9. Radhakishan Shivkishan Damani

Radhakishan Shivkishan Damani, an Indian entrepreneur and distinguished investor, is celebrated as the architect behind Avenue Supermarts Limited, overseeing the operations of over 300 DMart stores across India. Moreover, he exerts authority over his investment endeavors through Bright Star Investments Limited, his corporate vehicle.

Check for more information about Avenue Supermarts Limited

10. Lakshmi Mittal

Lakshmi Mittal, the present Chairman and CEO of ArcelorMittal, holds the esteemed position as the leading global steel manufacturer. In 2019, ArcelorMittal, in partnership with Nippon Steel, successfully completed the acquisition of Essar Steel for $5.9 billion. Prior to this, Essar Steel was under the ownership of Shashi and Ravi Ruia. In 2021, Mittal transitioned the CEO role to his son, Aditya Mittal, while retaining his position as the executive chairman of ArcelorMittal. The recent invasion of Ukraine by Russia prompted ArcelorMittal to halt production at its Kryvyi Rih facility in Ukraine.

Check for more information about ArcelorMittal

https://shurtitalks.com/

0 notes

Text

Vindcare Lifesciences is one of the Top 10 PCD Pharma Franchise Companies List 2023. We provide high-quality goods that have been approved by the GMP and WHO organisations. According to prescription medications as well as drug formulations, our products are 100% genuine. More than 250 products make up our product line, and we currently have more than 300 happy customers across PAN India.

#pcd pharma company#pcd pharma franchise#Top 10 PCD Pharma Franchise Companies List 2023#pharmaceutical

0 notes

Text

Lipella Pharmaceuticals Announces FDA Type C Meeting for LP-10 for Hemorrhagic Cystitis

Pittsburgh, PA, April 03, 2024 - Lipella Pharmaceuticals Inc. (Nasdaq: LIPO) ("Lipella," "our," "us" or the "Company"), a clinical-stage biotechnology company addressing serious diseases with significant unmet need, today announced that the U.S. Food and Drug Administration (“FDA”) has granted a Type C meeting request to discuss the company’s proposed Phase-2b clinical trial design for the evaluation of LP-10, an intravesical liposomal formulation of tacrolimus, as a potential treatment for moderate to severe hemorrhagic cystitis (HC). Lipella expects to meet with the FDA on May 21, 2024.

HC is a serious, life-threatening form of gross hematuria (i.e. visible blood in urine) caused by cancer treatments including pelvic radiation therapy, and certain chemotherapies including cyclophosphamide and ifosfamide, which are most commonly used for the treatment of breast cancer.

Dr. Michael Chancellor, Lipella’s Chief Medical Officer, expressed anticipation for advancing the LP-10 program, stating, “We are eager to advance our LP-10 program efficiently, and our scheduled FDA meeting in the second quarter of 2024 will play a pivotal role in enhancing the regulatory prospects of LP-10.”

Lipella successfully completed a Phase-2a open-label, dose-escalation clinical trial in early 2023 demonstrating the safety, and the potential efficacy of LP-10 in 13 patients with a history of HC. The study demonstrated preliminary efficacy in multiple measures, including urine microscopy, urinalysis, urinary urgency, as well as a potential dose response in the reduction of bleeding sites observed during bladder cystoscopy. Lipella published these results in the peer-reviewed journal, International Urology and Nephrology, in September 2023, and received preliminary guidance from the FDA regarding potential registration endpoints.

The company’s anticipated Type C meeting with the FDA will focus on reaching an agreement for the proposed Phase-2b trial design, which Lipella expects to be a 36-subject, prospective, double-blind, placebo-controlled study with a primary efficacy assessment derived from the reduction in patient-reported frequency of gross hematuria episodes over a seven-day period.

About LP-10, LP-310 and LP-410

LP-10 is a liposomal tacrolimus formulation for intravesical administration to treat hemorrhagic cystitis (HC). LP-10 has been evaluated in a multicenter Phase 2a dose escalation trial of 13 subjects with moderate to severe refractory HC, with positive top line results demonstrating safety and efficacy, short duration of systemic uptake of LP-10, and a dose response including decreased hematuria, decreased cystoscopic bleeding and ulceration sites, and improved urinary symptoms in patients. Lipella has been granted Orphan Disease Designation by the FDA for LP-10 in the treatment of moderate to severe hemorrhagic cystitis. LP-310/LP-410 liposomal tacrolimus is a proprietary oral rinse formulation of Lipella’s lead drug candidate, LP-10, for the indications of oral lichen planus (OLP) and oral Graft-versus-Host Disease (GvHD). Lipella has been granted orphan drug designation by the FDA for LP-310 in the treatment of GvHD.

About Lipella Pharmaceuticals Inc.

Lipella Pharmaceuticals is a clinical-stage biotechnology company focused on developing new drugs by reformulating the active agents in existing generic drugs and optimizing these reformulations for new applications. Additionally, Lipella maintains a therapeutic focus on diseases with significant, unaddressed morbidity and mortality where no approved drug therapy currently exists. Lipella completed its initial public offering in December 2022. For more information, please visit www.lipella.com or LinkedIn.

Forward-Looking Statements

This press release includes certain "forward-looking statements." All statements, other than statements of historical fact, included in this press release regarding, among other things, our strategy, future operations, financial position, prospects, clinical trials, regulatory approvals, pipeline and opportunities, sources of growth, successful implementation of our proprietary technology, plans and objectives are forward-looking statements. Forward-looking statements can be identified by words such as "may," "will," "could," "continue," "would," "should," "potential," "target," "goal," "anticipates," "intends," "plans," "seeks," "believes," "estimates," "predicts," "expects," "projects" and similar references to future periods. Forward-looking statements are based on our current expectations and assumptions regarding future events and financial trends that we believe may affect among other things, market and other conditions, our financial condition, results of operations, business strategy, short- and long-term business operations and objectives, and financial needs. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We caution you, therefore, against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. There are risks, uncertainties and other factors, both known and unknown, that could cause actual results to differ materially from those in the forward-looking statements which include, but are not limited to, risks related to the effective application of the use of proceeds from the private placement, general capital market risks, regional, national or global political, economic, business, competitive, market and regulatory conditions, and other factors. Any forward-looking statement made by us is based upon the reasonable judgment of our management at the time such statement is made and speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by applicable law. Nothing contained herein is, or shall be relied upon as, a promise or representation as to the past or future. In addition, the information contained in this press release is as of the date hereof, and the Company has no obligation to update such information, including in the event that such information becomes inaccurate. You should not construe the contents of this press release as legal, tax and financial advisors as to legal and related matters concerning the matters described herein.

CONTACT

Dr. Jonathan Kaufman, CEO

Lipella Pharmaceuticals

[email protected]

1-412-894-1853

Jeff Ramson

PCG Advisory

[email protected]

#press release#prism mediawire#stock market#investing#prismdigitalmedia#prismmarketview#healthcare#nasdaq#lipo#Lipella Pharmaceuticals#Biotech#biopharma

0 notes

Text

Key Stakeholders, Trends, and Projections in USA-Canada Fence Screen Market | Future Market Insights,Inc. The cold chain packaging industry in the united states and canada’s fence screen market is anticipated to be worth US$ 6.9 billion in 2023. From 2023 to 2033, it is expected to increase at a CAGR of 12.2%. It is expected to be worth US$ 21.8 billion by the end of 2033. The top five cold chain packaging manufacturers in the United States and Canada are expected to control 10% to 15% of the total market by 2023. Cold chain packaging is predicted to gain appeal in the meat, poultry, and seafood industries, as well as in the baking and confectionery industries. Rising demand has motivated advanced research toward better temperature-sensitive medicinal product delivery. Vacuum-insulated packaging delivers key benefits over polyurethane and expanded polystyrene-based insulated shippers. VIP-based shippers are comparatively lighter and smaller in weight. These help to reduce refrigerant requirements, provide a broad temperature range, and successively cut down distribution costs. CSafe, one of the prominent producers of VIP, incorporates its exclusive ‘ThermoCor’ VIP combined with a protective buffer. Request For Sample Report: Elevate Your Industry Intelligence with Actionable Insights https://www.futuremarketinsights.com/reports/sample/rep-gb-16534 It offers shippers at a cost lower than conventional PUR shippers. Increasing preference for ocean freight often expands carriage time. It is anticipated to further drive the adoption of VIP-based shippers. Sonoco Thermosafe’s product Greenbox, for instance, is for the pharmaceutical industry. It employs VIP for insulation and has a patented renewable phase change material that is plant-based. Sofrigam’s elite cooling boxes incorporate PUR and VIP and offer temperature stability up to 240 hours. Key Takeaways From the Market Study: The polymer segment by material type is likely to hold around US$ 15.2 Billion of the market value in 2033. The paper segment is estimated to witness a gain of 2.1x times by value and a CAGR of 14.2% during the forecast period. The gel packs segment by product type is anticipated to witness a 12.6% CAGR from 2023 to 2033. Phase change cold storage products segment is estimated to witness a gain of 3.8 times its value by the end of 2033. The reusable packaging segment by packaging format is anticipated to witness a CAGR of 12.7% in the assessment period. Advanced Technology for Enhancing Safety and Temperature Monitoring to Drive Sales: One prominent area where passive packaging lacks behind active packaging is its tenuous ability to provide safety during transportation. Numerous companies are offering shippers equipped with temperature sensors, which immediately detect if the container has been opened during transportation. A few shippers now come equipped with thermochromic labels that change color to provide visual verification that shippers are ready to pack. Pelican’s reusable shipper and Sofrigam’s Elite cooling box, for instance, come equipped with these sensors.

0 notes

Text

Top 10 Inhaler Manufacturers in India

According to Vision gain report Global Respiratory & Pharma Inhalers market set to grow to $38bn by 2023. Inhaler is a device usually used as a catalyst in providing medication through lungs of the patients. The medicine through lungs is generally provided to avert or alleviate from asthma attacks and other respiratory ailments. This blog contains a list of top 10 pharma inhaler manufacturers, suppliers & exporters in India for your reference.

List of best Pharma Inhaler Manufacturers in India

#1 — Wellona Pharma: Located in Surat, Gujarat — Wellona Pharma is one of the leading inhaler manufacturers in India with WHO GMP certification. An established pharmaceutical exporters and suppliers of branded Pharma Products and generic products Wellona Pharma have a regular overseas presence in over 86 countries.

#2 — Maya Biotech Pvt. Ltd : Established in 1998 Maya Biotech is a rapidly growing Indian pharmaceutical Contract Manufacturing company with a strong presence in inhaler manufacturing. They cover more than 200 formulations across various therapeutic areas including antibiotics, anti-malarial, NSAIDs, anti-inflammatory, local anesthetics.

#3 — Medisol Lifescience Pvt. Ltd: With a vision to be a leader in the field of Aerosol based Pharmaceuticals, Medisol Lifescience is a WHO-GMP Certified inhaler manufacturing company based in Gujarat — India. The operations are professionally managed manufacturing of asthmatic Inhalers for asthma patients

#4 — Nivon Specialties: Head-quartered at Navi Mumbai, India, Nivon Specialties is one of the leading pharma inhaler manufacturing company with a vision to become a globally known pharmaceutical export company, by providing a range of standard quality inhaler products at very competitive prices

#5 — Ultratech India Limited: Ultratech India Limited is a WHO-GMP and ISO certified Pharmaceutical company that manufactures and markets a wide range of Pharmaceutical Formulations in various dosage forms and has an excellent combination of world class manufacturing, R&D, Quality control, Quality Assurance, Marketing and indepth Management expertise.

#6 — MidasCare: Started in 1986, Midascare is the most dynamic & fast growing pharmaceutical companies in India. With a team of the country’s best minds in QC, QA and R&D departments, at MidasCare we have a combined technical experience bank of over 300 years providing superior quality of inhaler products.

#7 — Cipla: Cipla Limited is an Indian multinational pharmaceutical and biotechnology company, headquartered in Mumbai, India. Cipla primarily develops medicines to treat respiratory, cardiovascular disease, arthritis, diabetes, weight control and depression; other medical conditions.

#8 — Precept Pharma Ltd: Chandigarh based pharmaceutical company specializes in formulation of Metered Dose Inhalers, Dry Powder Inhalers & Metered Nasal Sprays. Committed to delivering quality products and services that fulfill all the needs and expectations, Precept Pharma guarantee’s the quality of Products and Services at all stages of development.

#9 — Sentiss Pharma Pvt. Ltd: Incorporated in 1990, Sentiss is committed to provide the most excellent quality pharmaceutical products primarily in the Ophthalmic, ENT and Inhalation segments. Through a combination of world-class processes and systems, Sentiss has ensured that its products are of the best quality.

#10 — Luckys Pharma: Luckys Pharma has been catering to the requirements of healthcare sector more specific inhalers, since its formation in the year 2001. Based in the Indore (Madhya Pradesh, India), we, Luckys Pharma are famous in the market for buying Antibiotic Injections, Nasal Spray, Anti Allergy Tablets, Sugar Free Syrups, Antidepressants Tablets, etc.

0 notes

Text

Basketball, TV Ratings And The Value Of Numbers-Based Thinking

"From NBA, to television ratings, to social media analytics, how numbers affect decision-making and how to teach this language"

Over the last 4 years or so, while watching any number of NBA games, I have often wondered aloud whether the NBA and basketball as a whole is a better medium though which to teach an appreciation of numbers.

At the heart of this article/post, and the reason for it's writing, is the question of whether the sport of basketball, or sports in general, is more effective at teaching numbers-based decision-making than anything else.

Years ago, the idea of using your phone to place a prop bet, would have seemed liked farfetched nonsense, and yet this is what the combination of time, technology, and the need to share and access information have given us.

youtube

The above video is one of the most important, and most informative videos regarding NBA and the culture of analytics and the video above, sheds light on a massive trend that has taken over the NBA since 2015.

Basketball players as young as 14 are talking about what thier field goal make and miss numbers are, and which part of the court their made shots came from, because the sport by it's nature motivates analytical thinking, and that's important.

This is how the flow of information affects decision-making in real time, or affects strategies and decisions in the long term, and it's the type of thinking that definently translates to other fields.

When a creator takes a look at thier social media analytics, a similar kind of process starts to happen.

If a specific kind of content is getting a better response in the form of impressions, likes, engagement or things like that, then the creator is incentiveized to make more of that content.

What we're talking about extends to areas as broad as diverse as sales, marketing, the concept of supply and demand, and also the type of data that has been relied on for decades by the television industry, and in particualr, advertisers that rely on the television industry.

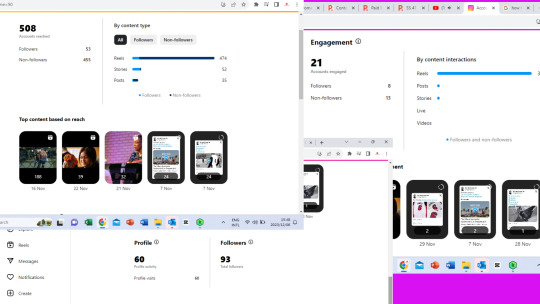

The above image is a kind of mock image I created from printscreens of the free document that the website allows you to download each month, and my favorite number from the month of October, is the near 3 million people that tuned in to SABC 2 to see the Springboks in the 2023 Rubgy World Cup Final.

On a channel that rarely pulls over 1 million viewers, SABC 2 managed to do this 6 times in the span of October and 4 of those was when the Springboks were playing live.

However, the holy grail of sports television advertising in America, is the Nielsen television ratings, and according to my due dillagence upon typing this article, the NFL is still king of the sports hill, taking more spots in the top 10 than any other major sporting event in the USA, and that's been the trend going back several years.

So even with the recent complaints about the quality of Monday and Thursday night games, the NFL maintains it's dominance as a televisual product, with a Bears-Chargers Sunday night game being the most watched in the month of October.

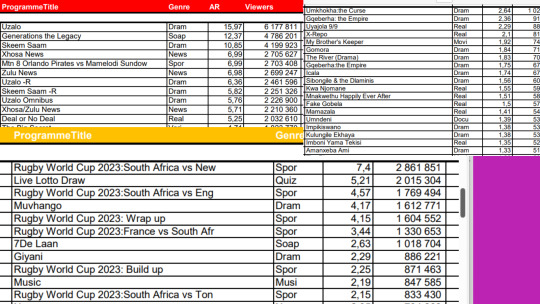

Streaming numbers are the future as far as advertising dollars and people's attention is concerned, and notably Across The Spider-Verse, Grey's Anatomy and Suits, all top the list for the most streamed shows, as can be seen in the image below.

However that's not my favorite thing about Nielsen's ratings.

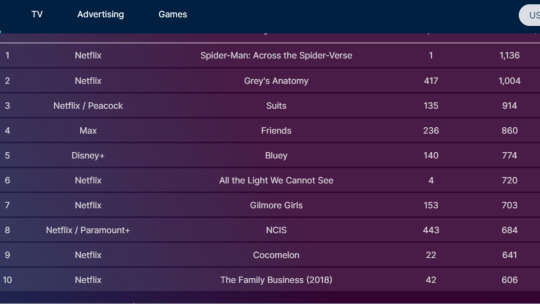

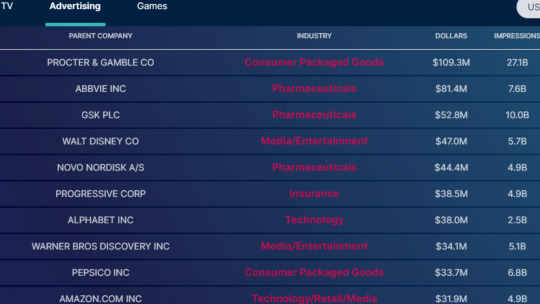

If you scroll down through their website, you will notice a different category of information near the bottom, where Nielsen's go the extra step of showing who, or rather which companies, are spending the most on advertising and how much they're spending.

Amazon, Walt Disney, Warner Bros, along with pharmaceutical giants like Novo Nordisk, manufacturing juggernauts like Procter & Gamble and food retailers like Pepsico, are all still, very heavily invested in the television industry and it's advertising power.

This is a level of disclosure that is kind of foreign to South African media, and if I had to guess, is likely a result of US regulatory policies, and I'll keep hunting for the South African equivalent of this, but for now, it is safe to assume that similar types of advertisers are doing the same thing in the South African television industry.

The point of this post, is to discuss new and improved ways of communicating information, and importantly how to teach a new type of information language in a country that will be well served finding ways to cut that learning curve.

Just a thought.

#nba#data#data analytics#stats#social media insights#social media analytics#television ratings#youtube analytics#youtube#springboks#nfl#netflix#advertisers#nielsens ratings#the economist#south africa

0 notes

Link

Macleods Pharma Walk-in Interview for Freshers Macleods Pharma Jobs for Freshers - Seize the opportunity to embark on a pharmaceutical career journey. Our Walk-in Interview at SBS University Dehradun on December 15, 2023, is your chance to be a part of a globally renowned pharmaceutical company. Learn more about the vacancies and the registration process here. About the Company (Macleods Pharma) Macleods Pharma, a powerhouse in the pharmaceutical industry, is hosting a Walk-in Interview for Freshers at SBS University, Dehradun, UK. As one of the top 10 pharmaceutical companies with a global presence, Macleods Pharma is renowned for its excellence in various therapeutic segments. With a workforce of over 20,000 employees operating in 140+ countries, Macleods Pharma is committed to fostering talent and providing exceptional career opportunities. Company Vacancies List Explore exciting job opportunities for Freshers: Position Title Company Name Formulation Production Macleods Pharma Job Description Department: Formulation Production Education: B.Pharm/M. Pharm/M.Sc. (Chem.) Experience: Fresher Only Location for Training: Macleods Centre of Excellence, Baddi, Himachal Pradesh Walk-in Interview Details Date: 15th December 2023 (Friday) Time: Between 9:00 am to 05:00 pm Place: SBS University Dehradun UK Registration Link: Register Here Contact Details Walk-In Venue: Sardar Bhagwan Singh University, Balawala, Dehradun, Uttarakhand - 248161 Contact No.: 8894755503, 7807799323, 9816191477 Email ID: [email protected] How to Apply Interested candidates can walk-in with an updated CV, all relevant education documents, along with Aadhar Card and the latest photos. Career Progression The qualified candidates will be inducted as "Interns" in our Macleods Centre of Excellence, Sarigam, for 3 months. A stipend will be paid for the internship period. Upon successful completion of the internship program, they will be placed as Trainees at an applicable location. [caption id="attachment_56144" align="aligncenter" width="930"] Macleods Pharmaceuticals Recruitment Notification[/caption]

0 notes