#SEC crypto assets

Text

Eyes on every move... They are watching

6 notes

·

View notes

Text

Yellow Card Partners with Stellar Network for USDC Access

On/Off Ramp is the Gateway Between Traditional Finance and Crypto

An African stablecoin on/off-ramp platform, Yellow Card, announcing its partnership with the Stellar network to introduce USDC (USD Coin) integration. This development holds significant implications for global payments and digital asset adoption, particularly in the context of Africa's developing digital economy.

Yellow Card is making a new move by bringing the stablecoin USDC to the Stellar network.

This announcement is sparking excitement because it opens up a lot of potential for easier global payments and more people using digital assets.

Yellow Card's integration of USDC on the Stellar network allows its users to conduct transactions with greater speed and lower fees, thanks to Stellar's efficient blockchain infrastructure. USDC, as a stablecoin pegged to the US dollar, provides stability in value while leveraging the benefits of blockchain technology for instant settlement and borderless transactions.

#USDC#SEC#USD Coin#Yellow Card#Stellar meaning#what is USDC#Stablecoin#Blockchain technology#USDC stablecoin#digital asset#digital asset investor#Crypto news#coin gabbar

0 notes

Text

SEC Declines Coinbase’s Plea for New Crypto Rules

Navigating the seas of #crypto! The SEC just said no to #Coinbase's call for new rules. What does it mean for the future of #DeFi and #DigitalAssets?💻Dive in for a look at this decision. #Cryptocurrency #Blockchain #SECvsCrypto

Read the full story here!

#Crypto#Decentralization#Decentralize Finance#DeFi#News#SEC#digital assets#digitalcurrency#bitcoin#blockchain#litecoin#ltc#decentralised finance#btc

1 note

·

View note

Link

0 notes

Text

Template (Copy 1st) (Copy)

youtube

In a significant development in the world of cryptocurrencies, the Securities and Exchange Commission (SEC) has filed a lawsuit against Coinbase, a prominent crypto trading platform. The SEC alleges that Coinbase has been operating illegally by failing to register as an exchange. This lawsuit marks the latest move in the regulatory crackdown against crypto companies. Today, we delve into the implications of this legal action and explore the perspectives of legal experts in the field, such as Jon-Jorge Aras, partner at Warren Law Group and head of securities litigation.

The SEC's Allegations: According to the SEC, Coinbase, a platform that facilitates cryptocurrency trading, has failed to comply with the necessary regulations and guidelines. By not registering as an exchange, Coinbase has allegedly violated securities laws that aim to protect investors and ensure fair market practices. The SEC's lawsuit sheds light on the increasing scrutiny and tightening regulations faced by companies operating in the crypto industry.

Understanding the Regulatory Landscape: The SEC's legal action against Coinbase reflects a broader trend of regulatory authorities grappling with the unique challenges posed by the rapidly evolving cryptocurrency landscape. As digital assets gain prominence and attract mainstream attention, regulators strive to strike a balance between fostering innovation and safeguarding investors. The complex nature of cryptocurrencies necessitates a careful examination of existing securities laws and their applicability to this emerging sector.

Insights from Jon-Jorge Aras: Jon-Jorge Aras, an esteemed legal expert specializing in securities litigation, provides valuable insights into the implications of the SEC's lawsuit against Coinbase. As a partner at Warren Law Group, Aras brings extensive experience in navigating the intricate legal landscape surrounding the crypto industry. His perspective sheds light on the potential consequences for Coinbase and the broader implications for the regulatory environment in which crypto companies operate.

The Impact on the Crypto Industry: The SEC's lawsuit against Coinbase is a significant event that reverberates throughout the crypto industry. It underscores the increasing scrutiny faced by cryptocurrency exchanges and the need for compliance with regulatory requirements. The outcome of this legal battle may set important precedents and shape the future regulatory framework for the broader crypto ecosystem. As the industry continues to evolve, companies will need to adapt and ensure compliance to navigate the ever-changing legal landscape effectively.

Conclusion: The SEC's lawsuit against Coinbase represents a critical moment in the ongoing struggle to establish regulatory clarity in the cryptocurrency space. As legal battles unfold, the outcomes will undoubtedly shape the future of the industry. The allegations against Coinbase highlight the importance of compliance and adherence to securities laws to foster a secure and transparent environment for crypto investors. By exploring the perspectives of legal experts like Jon-Jorge Aras, we gain valuable insights into the complexities surrounding the SEC's legal action and its potential ramifications for the crypto industry as a whole. As the legal landscape continues to evolve, it is imperative for all stakeholders to stay informed and adapt to the changing regulatory requirements in order to build a sustainable future for cryptocurrencies.

Have you been spending all your money and time on making music and shooting videos, but still not getting any exposure? Tired of just spinning your wheels? You know to get exposure you need to get featured on blogs, radio stations, playlist, and get your music e-mail blasted out to the masses. Need help getting all that done? Then check out the Package we’ve made available for you below!

Like & Listen To Our Spotify Playlist

trapLAXradio On The Air Now!

The Latest Music, Videos, News, Entertainment……

#trapLA#SEC#lawsuit#crypto trading platform#Coinbase#illegal operation#exchange registration#crackdown#crypto companies#regulatory challenges#Jon-Jorge Aras#Warren Law Group#securities litigation#implications#regulatory landscape#investor protection#fair market practices#scrutiny#tightening regulations#digital assets#emerging sector#securities laws#legal expert#compliance#consequences#crypto industry#regulatory framework#precedents#legal battles#regulatory clarity

0 notes

Text

Die SEC klagt Coinbase-Mitarbeiter wegen Insider-Handel an - doch die Folgen der Klage gehen weit darüber hinaus

Die SEC klagt Coinbase-Mitarbeiter wegen Insider-Handel an - doch die Folgen der Klage gehen weit darüber hinaus

Denn die SEC behauptet von 9 Token, es seien "Securities" (Wertpapiere). Sind sie? Oder sind sie nicht? Und was bedeutet das?

Die US-Börsenaufsicht SEC knöpft sich einen Coinbase-Mitarbeiter wegen Insiderhandel vor. In diesem Zug behauptet sie, dass einige Token Wertpapiere sind – was sie eigentlich nicht sein können, weil Coinbase keine Wertpapiere handeln darf. Für die juristische Definition von Krypto-Token wird der Prozess daher wegweisend – und damit auch für die Zukunft einiger Segmente des Marktes. (more…)

View On WordPress

0 notes

Text

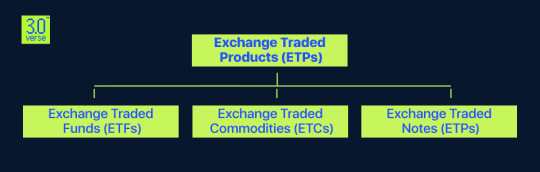

Comparison ETPs and ETFs

Exchange-traded products (ETPs) and exchange-traded funds (ETFs) are both important components of a diversified investment portfolio. This guide explores the differences, structures, and roles of ETPs and ETFs in various investment strategies.

Key Insights:

Insights include the unique features of ETPs and ETFs in terms of regulation, liquidity, and structure. While ETFs offer intraday liquidity, trading flexibility, and lower costs compared to other ETPs, each type caters to different asset classes with specific risks and structures. Additionally, ETFs provide superior diversification and investor protections as they are regulated under the Investment Company Act of 1940. When choosing between ETPs and ETFs, factors such as cost, risk tolerance, and desired market exposure should be considered. Lower-risk strategies often prefer ETFs for their lower costs while higher-risk strategies may utilize certain ETPs like leveraged or inverse products.

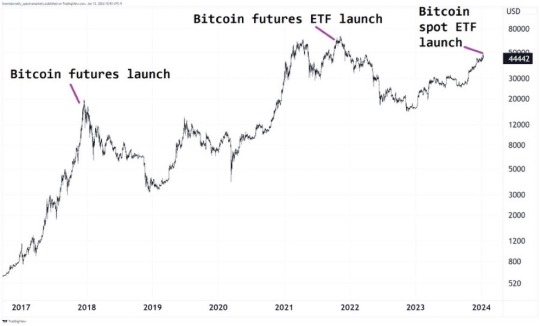

After previously rejecting them under former Chair Jay Clayton, the U.S. Securities and Exchange Commission (SEC) has now given its approval for the listing and trading of various spot bitcoin exchange-traded product (ETP) shares. The decision has been influenced by recent legal developments and changing circumstances, and is focused specifically on ETPs that hold bitcoin rather than a wider range of crypto assets. The SEC has emphasized the need for complete transparency, investor safeguards, and regulation when it comes to these products. However, the regulatory body has also cautioned that bitcoin is a highly speculative and volatile asset, and has advised investors to exercise caution.

Understanding ETPs and ETFs:

ETPs (Exchange-Traded Products):

Investment funds traded on stock exchanges.

Track underlying indices, commodities, or assets.

Offer trading convenience and access to diverse asset classes.

ETFs (Exchange-Traded Funds):

Diversified portfolios reflecting underlying indices.

Traded like stocks on an exchange with intraday liquidity.

Combine features of stocks and mutual funds.

ETPs Overview: ETPs encompass a variety of investment products, including ETFs, ETNs, ETMFs, and ETCs. Each category tailors its structure to different assets, providing a convenient tool for portfolio diversification.

Traditional Giants Embrace Bitcoin:

The propulsion of Bitcoin Adoption reached new heights when major giants joined the fray. Esteemed companies like Tesla, Overstock, and Microsoft have embraced Bitcoin as a viable payment option, marking a pivotal moment in mainstream acceptance. These household names not only validate the legitimacy of cryptocurrency but also serve as trailblazers, inspiring smaller businesses to explore the advantages of integrating Bitcoin into their payment methods. Basically in the year 2021, Tesla made waves by announcing that customers could purchase their electric vehicles using Bitcoin. Beyond introducing a novel purchasing avenue, this decision sparked conversations about the prospective role of cryptocurrencies within the automotive industry. Similar strategic moves by other influential companies have collectively contributed to the narrative that Bitcoin is transitioning into a recognized and widely accepted form of payment.

This evolution underscores Bitcoin's journey from being perceived solely as an investment opportunity to emerging as a practical and legitimate means of transaction in today's dynamic business landscape.

ETFs Unveiled:

Hold diversified portfolios of investments.

Traded on exchanges, mirroring underlying indices.

Include various investments like stocks, commodities, bonds, or crypto.

Offer intraday liquidity and real-time pricing.

ETPs vs. ETFs: ETPs and ETFs, while both traded on exchanges, differ in structure, regulation, and trading characteristics. ETFs, subject to stringent oversight, often exhibit superior liquidity and narrower bid-ask spreads compared to ETPs.

Structure and Regulation: ETFs, registered and regulated by the SEC under the Investment Company Act of 1940, adhere to strict oversight. Other ETPs, like ETNs, may lack board oversight, presenting a less rigorous regulatory framework.

Trading and Liquidity: ETFs generally boast higher liquidity and narrower bid-ask spreads than ETPs. The popularity, trading volume, and underlying securities influence the bid-ask spread, making ETFs more appealing for their trading flexibility.

Diversification and Risk Management: Both ETPs and ETFs offer diversification, but the extent depends on the specific product. ETFs, with broad underlying assets, usually provide extensive diversification. However, risks arise, particularly with leveraged or inverse ETFs impacting tax efficiency.

Types of ETPs and ETFs: Passive and active management options cater to diverse investment strategies. Passive ETFs replicate index performance, offering cost-effectiveness, while active ETFs aim to outperform by adjusting portfolios based on market conditions.

Sector and Industry Focus: ETFs and ETPs enable targeted investments in sectors or industries. Sector ETFs cover broader categories, while industry ETFs concentrate on specific industries within sectors, allowing focused exposure.

Leveraged and Inverse Products: Leveraged ETPs amplify underlying index performance using financial derivatives, presenting higher returns and risks. Inverse ETPs aim for returns inversely correlated to specific benchmarks, suitable for sophisticated investors.

Costs and Fees: Expense ratios, covering operating costs, vary between ETPs and ETFs. ETFs generally incur lower fees, with expense ratios around 0.16% for index ETFs. Consideration of brokerage commissions and transparent/hidden fees is crucial for cost-effective investing.

Choosing Between ETPs and ETFs: Deciding between ETPs and ETFs hinges on investment goals, risk tolerance, and exposure preferences. ETFs suit lower risk appetites, providing diversified options, while certain ETPs, like leveraged products, cater to investors comfortable with higher risk levels.

Advantages and Disadvantages: ETFs, as a subset of ETPs, offer benefits such as diversification, liquidity, and tax efficiency. Other ETPs, like ETNs or ETCs, present different cost structures and risks. Understanding their advantages and disadvantages aids in informed decision-making.

Real-Life Examples: Examples like SPDR® S&P 500® ETF Trust (SPY) and Bitcoin spot ETFs illustrate the diversity and innovation within ETPs and ETFs, showcasing varied investment options in the market. Moreover, Investors can now gain exposure to the world's largest cryptocurrency, Bitcoin, through recently approved spot ETFs. These cutting-edge ETFs showcase the extensive array of investment opportunities in the realm of ETPs and ETFs.

Potential Risks and Rewards: ETPs and ETFs carry market risks, influenced by volatility, socioeconomic factors, and geopolitical risks. Understanding the inherent risks and potential rewards, including attractive returns from ETNs tied to underlying indices, is vital for investors.

In Conclusion:

Both ETPs and ETFs contribute to effective portfolio diversification, each with unique characteristics. While ETFs are favored for liquidity and low-cost options, a broader spectrum of ETPs caters to specific investment needs. Choosing between them necessitates aligning with overall investment strategies.

3 notes

·

View notes

Text

#Cryptocurrency Trading Made Easy….

On 10 January, the #SEC approved the first 11 applications to list and trade spot #Bitcoin Exchange-Traded Funds (ETFs).

The approved list includes BlackRock iShares Bitcoin Trust, Fidelity Wise Origin Bitcoin Trust and VanEck Bitcoin Trust, as well as a number of #crypto native firms and crypto asset managers such as Grayscale Bitcoin Trust.

• Six of the ETFs will be listed on the Chicago Board Options Exchange (Cboe, A3 stable),

• three on the NYSE (A3 stable) and

• two on Nasdaq (Baa2 stable).

-MCO

3 notes

·

View notes

Text

Chamber of Digital Commerce Takes a Stance in Kraken vs. SEC Legal Battle

In the ongoing legal tussle between Kraken, a prominent cryptocurrency exchange, and the U.S. Securities and Exchange Commission (SEC), the Chamber of Digital Commerce has entered the fray. The Chamber filed an amicus curiae brief on February 27, challenging the SEC's regulatory stance on digital assets. This move signifies a pivotal moment in the broader discourse on the regulatory framework for digital assets in the United States.

Central to the Chamber's argument is its opposition to the SEC's broad classification of all digital asset transactions as securities transactions. The Chamber contends that digital assets, essentially lines of code facilitating functionality on blockchain networks, should not be automatically treated as investment contracts. Drawing on legal precedents where digital tokens were not categorically considered securities, the Chamber advocates for a nuanced, transaction-specific assessment.

Moreover, the Chamber critiques the SEC's regulatory strategy, characterizing it as an overreach without sufficient legislative backing. It argues that such enforcement actions impede innovation and pose potential risks to the trillion-dollar digital asset space and the broader U.S. economy. The filing references past cases, including those involving Ripple and Terraform Labs, where the SEC's position did not yield an entirely favorable outcome for the regulator.

This development underscores the larger trend of regulatory scrutiny within the digital asset industry. Similar allegations have been levied by the SEC against other crypto exchanges such as Coinbase and Binance since June 2023. These cases suggest the SEC's intention to impose tighter regulations on the digital asset space, defaulting to the classification of digital assets as securities.

2 notes

·

View notes

Text

The US crypto business is having an identity crisis, which could become an existential one. Are cryptocurrencies commodities, like gold and pork bellies? Or securities, like stocks and futures? The Securities and Exchange Commission, America’s top financial regulator, is so convinced that cryptocurrencies are the latter that it’s suing one of the world’s largest crypto exchanges, Coinbase, for breaking securities laws. The SEC has instigated an aggressive campaign of “regulation by enforcement,” going after companies for all kinds of alleged violations and insisting that they register with the agency—something crypto businesses say is all but impossible.

But another regulator, the Commodity Futures Trading Commission, has also sued one of the industry’s biggest players, Binance, alleging it has broken commodity trading laws.

The confusion over what crypto is and who sets its rules has left the industry on edge. On Wednesday, senators Cynthia Lummis and Kirsten Gillibrand—a Wyoming Republican and New York Democrat, respectively—will unveil a new version of their proposed regulatory regime for the fintech industry, which hopes to settle the question.

While there’s plenty new in the revamped Lummis-Gillibrand Responsible Financial Innovation Act, its centerpiece is a measure that would classify most cryptocurrencies as commodities, putting them under the purview of the CFTC. It’s a clear rebuke to the SEC, which, Lummis and others say, is stifling innovation in financial technologies.

“The domestic industries really are trying to comply, for the most part, and they’re just getting the cold shoulder,” Lummis says. “That’s not how we regulate in this country.”

The content of the legislation seeks to prevent a repeat of the apparent failings in the crypto industry, which led to a series of high-profile collapses in the industry over the past two years that have left many investors with losses.

According to a person with knowledge of the act, the legislation, if passed, would compel crypto exchanges to keep their customers’ assets in third-party trusts and stop them from so-called “proprietary trading”—essentially, trading with their own funds on their own exchange. It would also give the CFTC the power to supervise “material affiliates” of exchanges—such as Alameda Research, the sister company of the collapsed FTX exchange, whose founder, Sam Bankman-Fried, is awaiting trial on fraud charges. FTX allegedly lent large amounts of customer funds to Alameda to cover its investment losses, ahead of a liquidity crisis on the exchange that led to its downfall.

The act also bans “rehypothecation,” which essentially outlaws lenders’ ability to finance digital assets with collateral already pledged for different loans, the person says.

The SEC and other agencies were consulted on the content of the legislation, according to Lummis, who still worries they’ll try to kill the measure. “They have seen it. We asked them to tweak it, and we’ve incorporated some of their changes,” she says. “After all of our efforts to reach out to them and work with them, I do not want them to come in at the last minute to put their kibosh on this.”

The proposal comes at a point where there is significant animosity toward SEC chair Gary Gensler within the Republican-controlled House. Republicans have even introduced a bill meant to dilute Gensler’s power by adding a sixth SEC commissioner and killing the chair position altogether. But lawmakers admit that they’ve created the space for the regulator to act—often unilaterally—on crypto because of inaction on the subject in Congress.

“The reason [Gensler] is having this opportunity is because Congress hasn’t acted,” says Senator John Boozman of Arkansas, the top Republican on the Agriculture Committee.

After the senators drop their bill Wednesday, the hard legislative work begins. Digital assets fall under the jurisdictions of numerous committees—Banking (which Lummis serves on), Agriculture (one of Gillibrand’s committees), and Finance. Even the Environment Committee wants a say on crypto mining. That’s just in the Senate.

Each of these committees comes at crypto from a different angle. Take the Senate Banking Committee. Its Democratic chair, Sherrod Brown of Ohio, has focused on risks to consumers, while Senator Elizabeth Warren, a Massachussettes Democrat, has found the issue a bridge to the other side. Last year she teamed up with first-term senator Roger Marshall, a Republican from Kansas, on the Digital Asset Anti-Money Laundering Act of 2022, which would place crypto firms under the Bank Secrecy Act—a 1970 law that requires financial institutions to monitor and report money laundering, among other regulations critics say would crush the crypto industry.

That measure hasn’t been introduced in this 118th Congress, possibly because Gensler and the Department of Justice are all but implementing the bipartisan legislation in real time. Even as industry leaders, investors and their congressional allies accuse the SEC of crippling crypto, what’s become clear in recent months is, if Congress fails to act, again, securities regulators will aggressively go it alone.

5 notes

·

View notes

Text

Crypto collapse: SEC takes on Terraform and Coinbase, ETF fallout continues, Tether is for crime

by Amy Castor and David Gerard

* SEC wins a lot of their claims against Terraform

* Coinbase motion to dismiss hearing, with yet more Beanie Babies. (“funding my new startup by selling Stock Babies which are an asset just like a parcel of land, the value of which may reasonably fluctuate.” — Andrew Molitor)

* ETF nonsense: Collateralized Rugpull Obligations

* Tether is for crime

3 notes

·

View notes

Text

The Securities and Exchange Commission sued crypto exchange Coinbase

in New York federal court on Tuesday morning, alleging that the company was acting as an unregistered broker and exchange and demanding that the company be “permanently restrained and enjoined” from continuing to do so.

Shares closed down 12% Tuesday. Coinbase stock had already fallen 9% on Monday, after the SEC unveiled charges against rival crypto exchange Binance and its founder Changpeng Zhao.

“These trading platforms, they call themselves exchanges, are commingling a number of functions,” SEC chair Gary Gensler said on CNBC Tuesday. “We don’t see the New York Stock Exchange operating a hedge fund,” Gensler continued.

Coinbase’s flagship prime brokerage, exchange and staking programs violate securities laws, the regulator alleged in its complaint. The company “has for years defied the regulatory structures and evaded the disclosure requirements” of U.S. securities law.

8 notes

·

View notes

Text

Bitcoin’s Price Surge and Subsequent Apology: The Spot ETF Approval Mix-Up.

In the world of cryptocurrency, a recent episode involving Bitcoin’s price surge and an apology from a major crypto news site has captured the attention of the crypto community. The incident revolved around false claims of a spot Bitcoin exchange-traded fund (ETF) approval, triggering significant market fluctuations.

Bitcoin enthusiasts had their hopes briefly elevated when Cointelegraph, a prominent crypto news outlet, posted on its X (formerly Twitter) account that the U.S. Securities and Exchange Commission (SEC) had granted approval for BlackRock’s spot Bitcoin ETF application. This news sparked excitement among traders and investors.

However, the enthusiasm was short-lived. Other media outlets and even BlackRock itself promptly refuted the claim. The announcement turned out to be inaccurate, and the SEC had not approved the spot Bitcoin ETF. In that short period of misinformation, the price of Bitcoin surged up with almost 10% above $29,300. Reality ensued thereafter and price retraces back at around $28,100.

Cointelegraph, in a measure of honesty and transparency, had resolved to take responsibility for having propagated the wrong information. The news site expressed public apologies and even launched an internal investigation on how such wrong information had disseminated. Cointelegraph would later report that the wrong information had emanated from an “unconfirmed screenshot posted by an X user who claimed it was from the Bloomberg Terminal.” The social media protocol breach happened when the unverified information got posted on X without the editorial verification as required. Most importantly, no article was the official one by Cointelegraph posting this news. Worth nothing is the fact that Cointelegraph has quite a significant following of roughly 1.9 million users on X.

This is what a spot Bitcoin ETF could imply if streamlined. However, the concept has garnered immense anticipation amidst crypto community and it’s expected that it can further open the doors for the traditional institutional investors to enter the volatile one, under more regulated conditions, licensed by some entity. This is in contrast to the navigations on the more perilous decentralized set of platforms.

Currently, sundry spot Bitcoin ETF applications are awaiting review by the SEC as the regulator makes overall cautious steps towards the wider cryptoverse. That above situation was even responded to by U.S. SEC warning people about being keen on consuming the on-line contents. They noted it is always better to refer, or get information about the SEC, from authoritative sources. This incident exposes essentials cryptocurrency volatility levels. Even the most stable digital currencies like Bitcoin can demonstrate sudden and drastic changes in prices because of investor emotion, technical factors, and world events.

Furthermore, it should be noted that there might be knock-on effects which spot ETFs would create in the cryptocurrency market. As long as issuers put aside a percentage of their Assets Under Management (AUM) to invest in such ETFs, its impact shall only be more money being made accessible to flow into the Bitcoin market. This influx has the potential to impact Bitcoin’s price, potentially driving it to new heights Besides, historical data points out that Bitcoin’s market capitalization tends to increase greatly in every bull-market. In this sense, for every dollar invested is the cryptocurrency, the market capitalization could grow with a multiple of that figure heightening the extent of stages by much.

In conclusion

The recent incident on how Bitcoin’s price surged and Cointelegraph had to apologize over it brings to light the awareness in being cautious to and verify cryptocurrency news. With prospect of spot ETF approval, the crypto community has to be ultra-cautious by relying on verified sources plus enough due diligence in deriving meaning from market information. During the continuously changing way of the crypto market, keeping updated and wise is the mainstay not only for experienced traders but also just a real necessity to become only a part of it for newbies.

2 notes

·

View notes

Text

cryptocurrency does at least have a simple value proposition: it's a speculative asset / ponzi scheme and so there's a ready supply of people willing to exchange real money for it in the hope of getting rich / selling it to some other sucker later, which keeps the whole ecosystem growing (and collapsing, and growing again and then collapsing, and so on).

but if a debt trading market is "real money done better but without the backing of a sovereign government", what's the use case for it that drives adoption?

you can't use it to pay your taxes, you might use it to avoid taxes but that's obviously a lightning rod for trouble, and while you would happily use it to buy things there's no situation in which you would rather accept it over real money when selling things unless those things are illegal or socially sanctioned in some way (drugs, sex, assassinations, and so on) such that regular payment providers keep their distance.

so you can seed a crypto trading market by taking real money and giving away magic beans but you would need to seed a debt trading market by doing the exact opposite: giving people goods and services worth real money in exchange for magic beans from them, which is obviously a less appealing proposition for an investor.

(now you could say that some venture capitalists are indirectly doing this, for example subsidising grocery delivery services that lose money in the hope of building market share for some future enterprise that might be worth something one day, but that seems more like a semi-fraudulent quirk of the low interest rate environment rather than any kind of sound business plan).

one possibility is to boostrap the market by selling intangible things such that early adopters aren't running the risk of bankruptcy, for example you could "sell" a web comic or podcast in which case there's a progression from people giving you "likes" and other forms of attention that cannot be redeemed for cash and people subscribing to your patreon or hitting your tip jar, where perhaps debt trading could offer a smooth gradient across that spectrum from "I owe you a notional favour" to "I am literally buying you a coffee".

but it does seem like that use case could be achieved by simpler methods, like the clever infrastructure isn't really contributing much to this specific example and is only there in the opportunistic hope that the market would grow into something more than that (without being exploited for criminal ends or promptly shut down by the SEC).

12 notes

·

View notes

Text

crypto guys will literally be like

on twitter but then spell out the whole rugpull in their SEC filing like

Finally, as intangible assets without centralized issuers or governing bodies, digital assets have been, and may in the future be, subject to security breaches, cyberattacks or other malicious activities, as well as human errors or computer malfunctions that may result in the loss or destruction of private keys needed to access such assets. While we intend to take all reasonable measures to secure any digital assets, if such threats are realized or the measures or controls we create or implement to secure our digital assets fail, it could result in a partial or total misappropriation or loss of our digital assets, and our financial condition and operating results may be harmed.

31 notes

·

View notes

Text

Brazil’s Rio de Janeiro will accept crypto-payments for property taxes

The city will allow taxpayers to make crypto payments through third-party service providers.

The city of Rio de Janeiro is seeking crypto firms to operate its tax property seasoning in 2023, according to a decree published on Oct. 11, allowing taxpayers to use crypto alongside fiat currency to pay tributes. The move makes Rio the first Brazilian city to accept digital assets as payment for taxes.

It is expected that taxpayers will be able to pay with more than one crypto asset and that other types of taxes will be enabled in the future, the city stated. The decree also states that companies willing to provide the services must be registered with the city and comply with the Brazilian Securities and Exchange Commission (SEC) requirements.

The hired companies will provide cryptocurrency payment services and convert crypto into fiat currency. Funds will be transferred to the city in local fiat currency without any additional cost to taxpayers.

Continue reading.

#brazil#politics#brazilian politics#economy#cryptocurrency#eduardo paes#mod nise da silveira#image description in alt

6 notes

·

View notes