#RVinsurance

Photo

RV Insurance Coverage: What Is Legally Required?

0 notes

Link

RV insurance helps you protect one of your most valuable assets. If you have questions or are looking for personalized RV insurance in McKinney, Texas, contact our team at Amity Insurance Group for assistance.

#Auto insurance claims#rvinsurance#motorhomeinsurance#rvinsuranceguide#insurancepolicy#AmityinsuranceGroup

0 notes

Text

RV Insurance: DMVGO.com is Here To Help!

Your current insurance provider may or may not offer recreational vehicle coverage. You may want to first contact your insurance company to see if they provide RV insurance.

RV Insurance - Motor Home:

To qualify, most RV insurance providers require specific features on an RV such as:

Restroom

Warming or AC

Filtering system for drinkable water

An electrical system of between 110-125 volts

Refrigeration and cooking machines

In the event your RV does not have all of these features, it probably will not meet all requirements for RV insurance.

Types of Coverage:

Liability: Liability insurance is a requirement in all states. If you are found at fault for an RV-related incident, liability insurance can help cover legal fees, property damage, and medical expenses to the other party or parties. This is especially important for RVs because motorhomes can do more damage (and pose a higher risk) than the average car. RVs generally need a higher e line of liability coverage.

Collision: Collision coverage will help pay for damages to your own RV if you get into a collision with another car or a stationary object.

Comprehensive: Comprehensive coverage will cover losses and damages to your RV that are not collision-related. This can include natural disasters, animal damage, theft, vandalism, and more.

Get the right coverage information for your RV and compare quotes at DMVGO.com!

#RVinsurance#Autoinsurance#Motorcycleinsurance#Traveltrailer#Motorhomelife#Trailerlife#RVcoverage#Insurance#DMVservices#DMV

0 notes

Link

Recreational vehicles, such as RVs, can present unique difficulties. RVs are more significant than the cars that we are used to regularly driving. Due to their size, RVs are difficult to navigate and require insurance. RV insurance claims tend to be massive.

When operating an RV, it’s simple to underestimate the space available for swinging or fitting below objects. It’s crucial to travel with extra care to prevent RV insurance claims. Read on to learn about various RV claims and how you can avoid them in this blog.

0 notes

Text

Does RV insurance cover water damage?

If you own an RV, you already know how much fun they can be. But there are many safety issues to contend with as well. For example, does RV insurance cover water damage?

Many RV owners wonder if the insurance covers water damage, and if so, what aspects of water damage are actually covered and what types of damage are excluded from coverage, or if it makes any difference from the insurance point of view how often you use your RV, or how old it is and what make.

If you are looking for answers to these questions and more, then read on – this article is for you!

So, does RV insurance cover water damage?

Yes it does, but there are some caveats:

Only the RV Comprehensive Coverage insurance option covers water damage and only under certain circumstances. This option protects your RV from damages not due to an accident, such as water damage, fire damage, storms,floods, hail, vandalism, theft, certain natural disasters.

Not all comprehensive policies guarantee that water damage is protected.

Water damage can happen in many ways, out of which some are not covered. Exclusions depends on your individual policy.

What RV insurance options are available?

The main coverage options are: liability, collision, uninsured motorist, comprehensive coverage, medical.

Type of Insurance

Coverage offered

LiabilityDamage to other's property, bodily injury to others, protection from lawsuits after an accident, claims from visitorsCollisionAccidents occurring with another vehicle or objectUninsured motoristProtects you in case of an accident with a person that does not have proper automobile insuranceComprehensiveCovers repairs and replacements of any damage that is not the result of an accident.Medical Helps cover medical bills for you and your passengers, if your RV is involved in an accident, no matter who is at fault

Why is water damage insurance important for a RV owner?

Besides collisions, water leaks are one of the most important causes of damage and loss of value for a RV. Typically a RV stays most of the time outside, being exposed to rain and snow. Sooner or later a water damage will happen. Checking for stains and water is important because it allows you to find the leak as soon as it happens and prevent more damage and higher repair costs. In case you do find a leak, you will definitely prefer to have the repair covered by the insurance.

The costs of such a water damage coverage depend on your specific risk of having such a damage. This in turn mainly depends on the time you spend in your RV, full-time or part-time, and the make, model and age of your RV.

Does Comprehensive insurance cover all types of water damage?

No, the comprehensive insurance does not cover all types of water damage. Specific circumstances that lead to water damage are taken in account and in some cases, the insurance will not pay for the damage. Several circumstances related to water damage are typically excluded from the coverage of the Comprehensive insurance.

Typical water damage exclusions are:

Damage originating from the manufacturer defects

Prior damage, particularly if your RV was purchased used

Usual wear and tear

Poor maintenance over the years, lack of routine maintenance as recommended by manufacturer

Repeated exposure to temperature extremes like excessive dampness, freezing, or heat

Build-up of snow and ice

Water leaks

Dry rot, corrosion, or rust

Typical circumstances when water damage is covered:

If a rainstorm sends a tree branch through your RV’s window and rain comes through the broken window, causing water damage, your RV should be covered by the comprehensive coverage policy.

Damage due to flooding – a natural disaster – is typically covered. Some insurance companies even consider a broken pipe as a flood, although in this case it is not a natural disaster. You will have to check first with the insurance company about what exactly is considered a flood.

What is a Full water coverage option“?

Most of the issues listed above under typical exclusions are related with ageing of the RV and lack of maintenance and are not included in the Comprehensive insurance for water damage.

However, if you feel you need coverage for these risks as well, the insurance companies may offer you a so called ,Full water coverage option“.

Is it worth getting a Full water coverage option“?

Getting a Full water coverage option is not an easy decision to take, specially due to the costs involved.

On the other hand, the price of repairing a water damage may also be quite high. Damage through water has serious consequences, no matter if it happens in a house or a RV.

Some of the typical consequences of water damage are:

Health issues: water generates mold and fungus, which are very bad for the health of those living in such an environment. Mold and fungus represents a great risk for your respiratory system and for your immunity.

Loss of value: eventually, it makes it difficult to re-sale your RV for a good price

Progressive, further damage: humidity and exposure to water bears a great risk of damaging the moving parts of the RV. Water leads to rust or rot and repair costs can quickly escalate out of control.

The price of a Full water coverage option varies from one insurance to another and depends on several factors:

age of the RV

how much time you spend in the RV: full-time living in RV vs. part-time

your driving experience

the number of claims you previously claimed

the state you are in

For whom does Full water damage coverage make sense?

You will definitely be better off having a Full water damage coverage if:

you live full-time in your RV

you plan to travel in regions with lots of rain or snow

you are driving an old RV

you are storing your RV outdoors

Ask your insurance about water damage coverage

Policies are very different, so it is not possible to estimate how much a Full water coverage option costs. The best thing to do is to directly ask your insurance company about their water damage coverage and their prices. Reading the policy down to the fine prints is very important, as it may save you from having to pay costly water damages from your own pocket.

1 note

·

View note

Link

RV insurance is not for everyone. But for those who love travelling and need to be on-the-go in vehicles, buying an RV is a smart choice. And RV Insurance serves people who own an RV.

1 note

·

View note

Photo

Do you own an RV? We’ve got you covered. #oakhillohio #wellstonohio #waverlyohio #beaverohio #rvinsurance (at Jackson, Ohio) https://www.instagram.com/p/B0gdQaoF5nP/?igshid=zvy402c0w9pj

0 notes

Photo

Here For You Insurance. Free California Insurance Quotes! Ask for Ashley Lord! http://Here4YouIns.com #insurance #insuranceforall #highriskdriverinsurance #teendriverinsurance #autoinsurance #carinsurance #homeownersinsurance #rvinsurance #generalliabilityinsurance #nonownerinsurance #uberdriverinsurance #lyftdriverinsurance https://www.instagram.com/p/BzqBnN5nXT4/?igshid=o0yjamuk9uei

#insurance#insuranceforall#highriskdriverinsurance#teendriverinsurance#autoinsurance#carinsurance#homeownersinsurance#rvinsurance#generalliabilityinsurance#nonownerinsurance#uberdriverinsurance#lyftdriverinsurance

0 notes

Text

0 notes

Photo

Baldwin Insurance Agency, LLC was founded in 1999 by James Steven Baldwin to provide world-class protection insurance policy. Baldwin Insurance Agency, LLC identifies the needs and problems of customers and presents with the renowned companies that offer tested, reliable insurance products and excellent customer service.

We will assist you in securing the RV insurance policy.

Recreational vehicle coverage can include financial compensation in the event of physical damage, vandalism, theft, and collision. The company provides services in competitive rates and focuses on what is required for the customer.

Begin your quote today!: http://bit.ly/2ykYDUV

0 notes

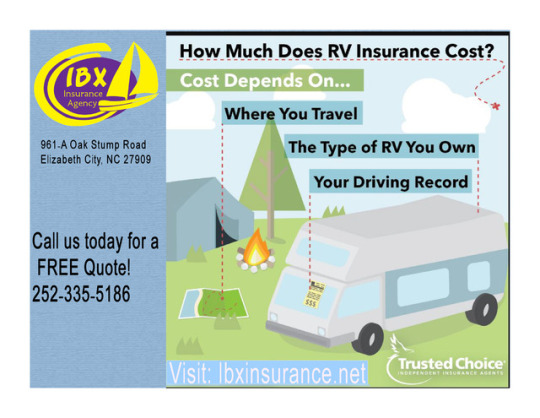

Photo

RV Insurance...... It it that time of year! Vacations & Camping Season is here!

Call IBX Insurance for your Recreational Insurance needs! 252-335-5186

0 notes

Link

0 notes

Link

RV insurance is essentially an agreement between you, your insurer, and your insurance provider that cover your recreational vehicle, travel trailer, fifth wheel, camping trailer or whatever type of recreational vehicle you own. You will typically take out a wide variety of coverage plans designed to cover your vehicle in the event that you use it as a home or as a recreational vehicle for leisure and pleasure.

0 notes

Text

0 notes