#Payro

Text

...so, yeah, uhm, new brainrot? Nobody's claiming these two so here I am.

Just a jokey comic cos I want Tauro to have a search doggy

also dont mind me not being able to draw dogs at all.

Pets all around

#legend of zelda#legend of zelda breath of the wild#legend of zelda tears of the kingdom#paya#tauro#fanart#botw#totk#comic#paya x tauro#do they have a ship name#Payro#sounds bout right#give the man a doggy#also I need paya be kinda awkward and an overachiever as the chieftain#she totally is a people pleaser

4K notes

·

View notes

Text

How Modern Payroll Software Enhances Workers' Rights

Modern payroll software stands at the forefront of transforming workplace dynamics, ensuring that workers' rights are prioritised and protected. By automating and refining payroll processes, these systems offer a more transparent, accurate and compliant approach to managing employee compensation. The significance of these technological tools in fostering a fair work environment cannot be overstated, as they play a crucial role in safeguarding the rights of employees across various sectors. This article delves into the specific ways in which contemporary payroll solutions contribute to upholding workers' rights, highlighting the benefits for both employees and employers.

Guaranteeing Accurate Compensation

One of the fundamental rights of employees is receiving fair and accurate compensation for their labour. Modern payroll systems automate the calculation of wages, taxes and deductions, significantly reducing the likelihood of errors. This precision ensures employees are paid exactly what they are owed, on time, thereby upholding their rights and maintaining trust between the employee and employer.

Promoting Transparency in Payroll Processes

Transparency in payroll processing plays a crucial role in protecting workers' rights. Advanced payroll solutions offer employees direct access to their pay records, tax deductions and other payroll-related information through secure online portals. This accessibility empowers employees, enabling them to verify their financial data and fostering a culture of openness and accountability within the organisation.

Supporting Flexible Work Arrangements

The flexibility to support various employment contracts and work arrangements is another advantage of contemporary payroll systems. Whether employees are full-time, part-time, or on flexible schedules, modern software can accurately track hours worked and calculate appropriate pay. This adaptability is essential for respecting the diverse needs and rights of a modern workforce.

Ensuring Compliance with Employment Laws

Modern payroll software plays a pivotal role in aiding organisations to navigate the complex landscape of employment laws. While these systems provide tools and frameworks designed to assist in compliance, the responsibility for staying informed and adhering to current legislation ultimately rests with the employer. By facilitating accurate record-keeping and offering configurable settings to align with various legal requirements, such software becomes an invaluable ally in the pursuit of compliance, underscoring the importance of diligent oversight by HR professionals.

Enhancing Workers' Rights Through Technology

The integration of advanced payroll technologies into HR practices has been instrumental in enhancing workers' rights. By automating complex processes and ensuring accuracy and compliance, these systems play a pivotal role in protecting employees. Organisations looking to adopt such solutions can turn to Yomly’s HR & payroll solutions, which are tailored to meet the unique needs of businesses while upholding the highest standards of workers' rights.

Embracing these technologies is a step towards creating a more equitable and transparent work environment where the rights of every worker are acknowledged and protected. Companies are encouraged to consider the long-term benefits of these systems, not only for operational efficiency but also for the profound impact they have on fostering a respectful and compliant workplace.

Request a FREE product tour of Yomly’s software to see its efficacy for yourself.

Additional FAQs

Are wage slips a legal requirement?

Wage slips, serving as a record of payment details, are considered a fundamental component of transparent and fair employment practices. They provide employees with a breakdown of their earnings, deductions and net pay, facilitating a clear understanding of their compensation. Ensuring the issuance of wage slips is not only a best practice but also a requirement that aligns with standards for maintaining accurate and transparent payroll records.

Is payroll different in small businesses?

In small businesses, the approach to payroll might be tailored to suit the scale and specific needs of the organisation. While the fundamental principles of payroll processing remain consistent, smaller entities may adopt more streamlined processes or utilise simplified payroll software solutions. Despite the size, the importance of accuracy, compliance and employee satisfaction in payroll practices remains paramount.

Can an employer deduct wages without the employee's consent?

Deductions from wages without the explicit consent of the employee are typically subject to strict regulations to protect workers' rights. Such deductions are generally permissible only under specific conditions, such as recovery of overpayments or contributions to state-mandated schemes and must be clearly outlined in the employment agreement or comply with legal stipulations. Transparent communication and adherence to legal guidelines are crucial in managing wage deductions to ensure fairness and compliance.

0 notes

Photo

Looking to improve your #HR #strategy? This comprehensive guide covers everything you need to know about strategic #management for HR.

Read More : https://lnkd.in/dgdHQTsk

#hr #strategichr #management #hrmssoftware #hrsoftware #goal #employeeengagement #goalsetting #action #performance #recruitment #payrollmanagement #payroll #social #attendance

0 notes

Photo

Joseph C. Payro. The Payro family cat directs a portrait, Wakefield, Massachusetts, 1909.

426 notes

·

View notes

Text

The payroll process is a critical aspect of managing any business. However, for small businesses, the complexity and time-consuming nature of payroll activities can be especially demanding. This is where HRMS (Human Resource Management System) Payroll comes into play – creative ideas that offer efficiency, accuracy, and compliance, all finished up in an enhanced technology package you want for the modern companies environments.

Pricing and ordering the product or service:

For Kathmandu Nepal: 300 m inside on Narrow Road, Left To Siwakoti Rumpum Chatpate,

House with NTC Tower, on the second, left-turning of Narrow Road,

Mid Baneswor, Kathmandu, 44600, Nepal

Email: [email protected]

For UAE: Vacker LLC, Suite 306, Sheikh Rashid Building Deira, Ittihad Road Next to Al Qiyadah Metro Station (Green Line) Opposite to Dubai Police HQ Po Box. 92438 Dubai, UAE

Tel: +971 42 66 11 44

Fax: +971 42 66 11 55

Email: [email protected]

#vackerglobal#hrms360#uae#nepal#kathmandu#hrmsbusiness#hrprofessionals#hrms#righthrms#hrmsbusinessneeds

0 notes

Text

Unlocking Efficiency and Accuracy: The Top Benefits of Payroll Services

In the complex and ever-evolving business landscape, managing payroll can be a challenging task for companies of all sizes. Payroll is not just about calculating wages; it involves tax withholdings, benefits administration, compliance with labor laws, and much more. This is where payroll services come into play, offering a solution that brings numerous benefits to businesses, helping them streamline operations, enhance accuracy, and focus on their core activities. Let's delve into the top benefits of utilizing payroll services.

1. Cost-Effectiveness: For many small to medium-sized enterprises (SMEs), maintaining an in-house payroll department can be prohibitively expensive. Payroll services can significantly reduce these costs by eliminating the need for dedicated staff, software, and training. By outsourcing payroll, businesses can enjoy the benefits of expert services without the overhead costs associated with employing a full-time payroll manager or team.

2. Time-Saving: Payroll management is time-consuming. It involves keeping up-to-date with the latest tax laws, calculating employee hours, deductions, and ensuring all data is accurately entered. Payroll services take this burden off your shoulders, freeing up valuable time that can be better spent on strategic planning and growing your business. Automation and expert handling streamline the process, drastically reducing the time spent on payroll tasks.

3. Enhanced Accuracy: Payroll errors can be costly, leading to employee dissatisfaction and potential legal complications. Professional payroll services are equipped with state-of-the-art software and experienced professionals who ensure accuracy in payroll processing. With systematic checks and balances, the risk of errors is minimized, ensuring employees are paid correctly and on time.

4. Compliance and Risk Management: Keeping abreast of tax laws and regulatory compliance is a daunting task, especially for businesses operating in multiple jurisdictions. Payroll services are well-versed in local and international tax laws, helping businesses navigate the complexities of compliance. They help mitigate risks associated with tax errors and ensure that filings and payments are completed accurately and timely, reducing the chance of penalties or audits.

5. Access to Expertise: When you opt for a payroll service, you gain access to expertise and technology that might not be available in-house. Payroll providers are specialists in their field, offering a wealth of knowledge and experience. This expertise can be invaluable, particularly for businesses expanding into new markets or navigating complex tax scenarios.

6. Scalability: As businesses grow, their payroll needs evolve. Payroll services offer scalability, allowing businesses to easily adjust their payroll services according to their current needs. Whether it's hiring more employees, expanding into new territories, or adjusting to seasonal workforce changes, payroll services can adapt quickly, providing a seamless experience.

7. Enhanced Security: Payroll processing involves handling sensitive financial and personal information. Payroll services offer robust security measures to protect this data, including secure data storage, encryption, and multi-factor authentication. This level of security is often beyond what businesses can feasibly implement on their own, offering peace of mind that employee data is protected against breaches.

8. Focus on Core Business Activities: Perhaps one of the most significant benefits of outsourcing payroll is the ability to focus on core business activities. With the complexities of payroll management handled by experts, business leaders can direct their energy towards strategic goals, innovation, and growth. This focus can lead to improved efficiency, better service, and ultimately, a more competitive position in the market.

In conclusion, the benefits of utilizing payroll services are multifaceted, offering businesses a solution that not only saves time and money but also enhances accuracy, compliance, and security. By outsourcing payroll, companies can leverage expert knowledge and technology, allowing them to focus on what they do best – growing their business and serving their customers. In an era where efficiency and compliance are paramount, payroll services emerge as a strategic asset for businesses looking to thrive and excel.

0 notes

Text

Streamlining Payroll Processes with Eazyscholar: A Comprehensive Guide to Payroll Management Software

Introduction:

In the ever-evolving landscape of business operations, the need for efficient and error-free payroll management has become paramount. Payroll processing is a complex task that involves calculating salaries, taxes, deductions, and more, all while adhering to ever-changing regulations. To alleviate the challenges associated with payroll management, businesses are increasingly turning to advanced payroll management software solutions, with Eazyscholar emerging as a prominent player in this domain.

I. Understanding the Importance of Payroll Management Software:

A. Accuracy and Compliance:

One of the primary advantages of using payroll management software like Eazyscholar is the enhanced accuracy it brings to payroll calculations. Human errors in manual calculations can lead to discrepancies in employee pay, resulting in dissatisfaction and potential legal issues. Eazyscholar's automated system minimizes errors, ensuring accurate and compliant payroll processing.

B. Time and Cost Efficiency:

Traditional payroll processing methods can be time-consuming and labor-intensive. Payroll management software streamlines the entire process, reducing the time spent on calculations, data entry, and corrections. This, in turn, leads to cost savings by optimizing human resources and preventing potential financial errors.

C. Customization and Scalability:

Eazyscholar offers customizable features that cater to the specific needs of different businesses. Whether a company has a simple or complex payroll structure, Eazyscholar can adapt to diverse requirements. Additionally, its scalability allows businesses to seamlessly accommodate growth and changing payroll complexities.

II. Features and Functionality of Eazyscholar:

A. Automated Payroll Processing:

Eazyscholar automates payroll calculations, taking into account various factors such as employee salaries, taxes, benefits, and deductions. This automation not only ensures accuracy but also significantly reduces the time spent on manual payroll processing.

B. Tax Compliance:

Tax regulations are dynamic and subject to frequent changes. Eazyscholar stays up-to-date with the latest tax laws, automatically adjusting calculations to ensure businesses remain compliant. This feature alleviates the burden of constantly monitoring and adapting to tax code changes.

C. Employee Self-Service Portals:

Eazyscholar provides employee self-service portals, allowing employees to access their payroll information, tax documents, and pay stubs online. This not only enhances transparency but also reduces the administrative workload on HR teams.

D. Reporting and Analytics:

Comprehensive reporting and analytics tools offered by Eazyscholar empower businesses to gain valuable insights into their payroll data. These insights can inform strategic decision-making, budgeting, and workforce planning.

E. Integration with HR and Accounting Systems:

Eazyscholar seamlessly integrates with existing HR and accounting systems, creating a unified platform for managing employee data and financial transactions. This integration eliminates data silos, enhances data accuracy, and improves overall organizational efficiency.

III. Implementation Process and User-Friendly Interface:

A. Easy Setup and Onboarding:

Eazyscholar prides itself on its user-friendly interface and straightforward setup process. The software's intuitive design ensures a smooth onboarding experience, allowing businesses to quickly transition from manual payroll processing to an automated system.

B. Training and Support:

Eazyscholar provides training resources and customer support to assist businesses in maximizing the benefits of the software. Whether it's through tutorials, documentation, or responsive customer support, Eazyscholar ensures that users can navigate the software effortlessly.

C. Data Migration:

The process of migrating data from existing payroll systems to Eazyscholar is streamlined to minimize disruptions. The software facilitates a secure and efficient transfer of historical payroll data, ensuring continuity in payroll operations.

IV. Security and Compliance:

A. Data Security Measures:

Eazyscholar prioritizes data security, employing robust encryption protocols and secure servers to safeguard sensitive payroll information. Regular security updates and compliance with industry standards contribute to a secure payroll management environment.

B. GDPR and Legal Compliance:

In an era where data privacy regulations, such as the General Data Protection Regulation (GDPR), are stringent, Eazyscholar ensures compliance with these standards. This commitment to legal compliance protects businesses from potential legal repercussions related to mishandling sensitive employee information.

V. Real-world Benefits and Case Studies:

A. Enhanced Productivity and Efficiency:

Companies that have implemented Eazyscholar often report increased productivity and efficiency within their payroll departments. Automation reduces manual workload, allowing payroll professionals to focus on strategic tasks rather than repetitive calculations.

B. Cost Savings and Return on Investment (ROI):

The initial investment in payroll management software like Eazyscholar is often outweighed by the long-term cost savings. Businesses can realize significant ROI through reduced labor costs, minimized errors, and improved overall operational efficiency.

C. Improved Employee Satisfaction:

Accurate and timely payroll processing contributes to higher employee satisfaction. Eazyscholar's self-service portals empower employees to access their payroll information conveniently, fostering transparency and trust within the organization.

VI. Future Trends and Updates:

A. Artificial Intelligence (AI) Integration:

As technology continues to evolve, the integration of artificial intelligence in payroll management software is becoming a trend. Eazyscholar is well-positioned to adapt to these changes, enhancing its capabilities through AI to provide even more intelligent and predictive payroll solutions.

B. Mobile Accessibility:

The demand for mobile accessibility in payroll management is growing, with employees and employers seeking the flexibility to access payroll information on-the-go. Eazyscholar is expected to prioritize mobile-friendly features to meet this evolving need.

C. Continuous Regulatory Compliance:

Given the dynamic nature of tax and labor regulations, Eazyscholar will continue to prioritize staying current with legislative changes. Regular software updates will ensure that businesses using Eazyscholar remain compliant with the latest legal requirements.

Conclusion: Eazyscholar stands out as a reliable and comprehensive payroll management software solution, offering a range of features to streamline and enhance the payroll processing experience for businesses of all sizes. From automated calculations to robust security measures, Eazyscholar provides a holistic approach to payroll management, contributing to increased efficiency, reduced costs, and overall organizational success. As the business landscape continues to evolve, Eazyscholar is poised to adapt and innovate, ensuring that its users stay at the forefront of payroll management excellence

#best payroll management software#library management system software#erp software for education#online library management system#fee management software

0 notes

Link

0 notes

Text

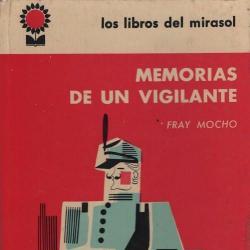

Linea del tiempo sobre el Modernismo de Argentina

En esta Linea del tiempo se puede evidenciar Autores , Libros y Hechos Históricos

1880/ empieza el movimiento literario

1884/ Calixto Oyuela escrito, poeta y ensayista abandona esta profesion.

1885/ el escritor Fray Mocho, escribe cuentos mundanos.

1893/ Ruben Dario llega a Argentina Buenos Aires por primera vez

1897/ Fray Mocho escribe Memorias de un Vigilante.

1898/ nace la revista Caras y Caretas.

1904/ Gregorio De Laferrere puso en escena sus obras de teatro.

1908/ Evaristo Carriego publica Misas Herejes, uno de los libros mas famosos.

1911/ Enrique Banchs publica la Urna.

1917/ Horacio Quiroga publica amor de locura y muerte.

1918/ Ricardo Rojas publica los coloniales

1921/ Nosotros publico el Manifiesto del Ultarismo de Borgues.

1930/ Roberto Payro publica Chamijo.

1857/ se construye el primer ferrocarril.

1880/ se consolido el modelo Agroexportador.

1912/ La primera implantación del Sufragio Universal para Varones.

1930/ el proceso de ampliación de la participación política, fue el golpe de Estado Cívico Militar.

1951/ Sufragio a las mujeres.

0 notes

Text

Mocasines Plata Sashi Cuero Ecológico – Payro

https://payroperu.com/tienda/mocasines-plata-sashi-cuero-ecologico-payro/

🚨Combínalas a 3xS/140 🚨

🟡Solicita catalogo en el link 👇

👉https://wa.link/91oi0b

📌Envíos a todo el Perú.

1 note

·

View note

Text

This photograph was taken in November 1909. It shows three members of the Payro family being “photographed” by their cat: Edmund, age 12, Ernest, age 8, and Cecilia, age 5.

0 notes

Text

What are the advantages of payroll on the cloud?

Every organization or company has separate software for handling financial chores has become a basic and major requirement. It is very essential for both big and small companies to have a useful and effective payroll system for all accounting or payment-related tasks to be fulfilled efficiently.

Have you ever wondered if using payroll on the cloud or having a cloud computing payroll system can bring a great performance-driven result for your company?

In order to go through this conversation, let us first understand what is cloud payroll system and how it is beneficial for any enterprise.

The simple meaning of Cloud Payroll

We all know that payroll means providing salaries to the employees and the system that makes the whole data is known as the payroll system which makes a list of employees with thor particular salaries along with some other desired information. Cloud -computing on other hand means when things are stored and accessed from the internet server in spite of the computer’s hardware.

Combined together, cloud payroll systems will effectively work and provide the information and transaction process easily with the help of an internet server.

The topmost benefits of using payroll on the cloud

Accessibility

The major advantage of this system is it is easily accessible. Employees have direct access to payroll systems where they may enter information about their working hours. They may change any personal information, including their address, date of birth, marital status, and other details, as well as track personal milestones like accrual calculations. Another feature allows users to submit leave requests and receive permission directly from the system. Additionally, users may access a payroll's capabilities at any time and from any location, including processing and approving tasks and documents.

Low upfront-cost

Implementing cloud-based payroll software relieves companies of the difficulties and costs associated with buying, maintaining, and upgrading outdated on-premises systems. Regardless of the size of your firm, your head of finance will see no capital expenditure and significant cost savings.

Your IT team will find cloud technologies to be more convenient.

Feasibility

The cloud-based payroll solution makes calculating monthly paychecks very simple and quick. Additionally, the system considers an employee's entry and leave timings, vacation days, holidays, pay, and potential tax deductions. The convenience for both employers and employees is ensured by its assistance in acquiring and distributing checks to the appropriate personnel as needed.

With the help of this cloud-based technology, the HR division may do away with the requirement to set aside several days to compute paychecks.

Data Security

The cloud-based payroll solution makes calculating monthly paychecks very simple and quick. Additionally, the system considers an employee's entry and leave timings, vacation days, holidays, pay, and potential tax deductions. The convenience for both employers and employees is ensured by its assistance in acquiring and distributing checks to the appropriate personnel as needed.

With the help of this cloud-based technology, the HR division may do away with the requirement to set aside several days to compute paychecks.

Centralized Employee data

Payroll involves more than just figuring out the salaries of your employees. The accuracy of the paychecks may be impacted if all of your employee records are not centralized from the moment an employee starts working for you.

Using a single, centralized source of data, you can track and manage the details of all the life cycle events that affect your workers, such as onboarding, benefits, salary adjustments, leaves, and investment declarations, with cloud payroll software. Additionally, you may control all employee communication from a single spot.

Glance At The End

All the above advantages have been possessed by the payroll cloud-based software that will really help you to have a systematic way of payroll. Cloud payroll is meant for functioning effectively which is implemented by the people for their safe, secure, and fastest payrolls.

0 notes

Text

Note: Within 60 days from the time you create your QuickBooks Online account to move your data

Important: Ensure that QuickBooks is up-to-date In Desktop or Laptop, press F2 (or Ctrl+1) to open the Product Information window in your device. Check your current version and release. You’ll have greater success if you have the following QuickBooks versions and releases or higher: 2019 R17, 2020 R15, 2021 R10, and 2022 R5.

Ensure that your company file isn’t too big to export.

Learn what does and doesn’t move to QuickBooks online.

1.Ensure that QuickBooks is up-to-date.

2.To ensure your Total Targets is less than 750,000, hit Ctrl + 1 on your keyboard.

Note: If the company file exceeds the target limit (750,000) it can’t be converted to QuickBooks Online. The only option is, you can only import lists and balances into QuickBooks Online or start fresh.

Print a copy of your Sales Tax Liability report. You’ll need it to enter adjustment entries after your move.

Go to the Reports menu, then select Vendors & Payables. Select Sales Tax Liability.

From the Dates▼ dropdown, select All.

At the top, from the Print▼ dropdown, select Save as PDF.

Choose the folder you want to save it in, name the file, and select Save.

Step 2: Move your QuickBooks Desktop file to QuickBooks Online

Note: If you’re using QuickBooks Desktop version is 2018 or older, use the QuickBooks Desktop file restoration tool to upgrade your Quickbooks company file. You can then move your company data to QuickBooks Online.Note: If you use an older version of QuickBooks Desktop (Pro, Premier) or you don’t have access to QuickBooks Desktop, install a trial version of QuickBooks desktop 2021 and open your company file.

QuickBooks Desktop Pro or Premier

Sign in as an admin to the company file you need to import.

Go to File > Utilities, then select Copy Company file for QuickBooks Online.

Select Start your export.

Sign in as an admin to your QuickBooks Online company. Using E-mail and Password.

Select Choose online company, and choose the QuickBooks Online company you want to replace with your company file.

Select Continue.

If you track inventory in QuickBooks Desktop:

Select Yes to bring them over, then enter the as of date.

Select No if you want to set up new items later in QuickBooks Online.

Enter Agree in the text field, then select Replace.

Select Yes, go ahead and replace the data, then select Replace.

QuickBooks Desktop Enterprise

Note: If you use advanced features (such as advanced reporting and advanced inventory), we recommend starting fresh because some of your data won’t move to QuickBooks Online. If you want to keep using these features in Enterprise, learn about cloud-enabled QuickBooks Desktop Enterprise.

Sign in as an admin to the desktop company file you want to move.

On your keyboard, press Ctrl + 1 on Quickbooks Desktop home page to open the Product Information window.

Press Ctrl + B + Q on Quickbooks Desktop home page, then select OK to display the export window.

On the export window on Quickbooks Desktop, select Get started.

Sign in as an admin to your QuickBooks Online company on your browser.

Select Choose online company, then select the QuickBooks Online company you want to replace with your company file.

Select Continue.

If you track inventory in QuickBooks Desktop:

Select Yes to bring them over, then specify the as of date.

Select No if you need to set up new items later in QuickBooks Online.

Enter “Agree” in the text field, then select Replace.

Select Yes, go ahead and replace the data, then select Replace.

Step 3: Get ready to use QuickBooks Online

Check out What to do after converting from QuickBooks Desktop for Windows or Mac to QuickBooks Online.

With your company all set up, let’s get you started with QuickBooks Online.

Connect your bank or credit card account.

Create and send invoices to your customer.

Note: If you track sales tax, set up location-based sales tax in QuickBooks first.

Track your bills and learn how to pay them in QuickBooks.

If you use payroll, check out this guide to set up and run your payroll in QuickBooks Online.

Note: To view the guide, you’ll need to sign in to QuickBooks Online.

0 notes

Text

hotel payro en milladoiro

hotel payro en milladoiro

#hotelpayroenmilladoiro #hotel #hoteles

Reservar de hoteles en hotel payro en milladoiro.

¿Estás planeando un descanso en hotel payro en milladoiro? ¿qué opciones de hospedaje se encuentran disponibles para usted? ¿ahora ya ha realizado su selección y recatado su complejo turístico, o quiere pedir más? Es simple de transportar en la emoción de la planificación de unas vacaciones y finalizar…

View On WordPress

0 notes