#Payment processors

Text

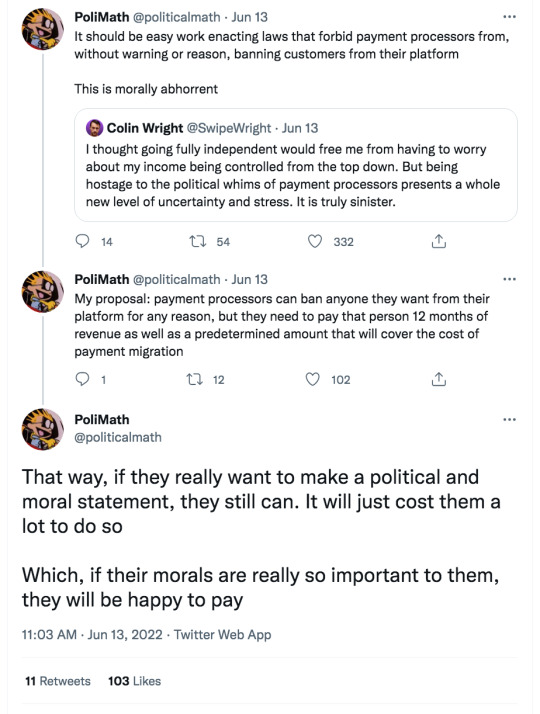

So, you know all those bad laws I tell y'all to call your senators to kill? Well here's a good one for you to promote!

Basically, you know how payment processors freak the fuck out if even the slightest whiff of adult content shows up on a website, which has lead to the widespread sanitization of the internet?

Well, this bill, S.293; aims to prevent that crap!

And, it's currently in the Committee of Banking, Housing, and Urban Affairs, so if your Senator is one of the following, call them and tell them to vote yes on it:

Sherrod Brown, Ohio, Chairman

Jack Reed, Rhode Island

Bob Menendez, New Jersey

Jon Tester, Montana

Mark Warner, Virginia

Elizabeth Warren, Massachusetts (Tell her it would be a start on apologizing for voting yes on FOSTA/SESTA)

Chris Van Hollen, Maryland

Catherine Cortez Masto, Nevada

Tina Smith, Minnesota

Kyrsten Sinema, Arizona (ugh)

Raphael Warnock, Georgia

John Fetterman, Pennsylvania

Tim Scott, South Carolina, Ranking Member

Mike Crapo, Idaho

Mike Rounds, South Dakota

Thom Tillis, North Carolina (Probably not reaching this asshole)

John Kennedy, Louisiana

Bill Hagerty, Tennessee

Cynthia Lummis, Wyoming

J.D. Vance, Ohio (Ugh)

Katie Britt, Alabama

Kevin Cramer, North Dakota

Steve Daines, Montana

If they're one of those right-wing dipshits, tell them it would help them prevent "cancel culture" via socially-conscious payment processors. Because subterfugue towards conservatives is always cool and good! Always!

Also mention that, in a happy irony, this would actually make kids safer by allowing platforms to acknowlege that, yes, people make a living selling well-endowed monoecious horsegirl drawings on their platform, and actually put properly finetuned safeguards in place.

As opposed to now, where they have to dance around it and put it in a grey-area hell so that Peter "Dracula" Thiel doesn't get his seastead in a shoal and ban them, which nobody likes!

So, call 'em if you can, boost even if you can't!

118 notes

·

View notes

Text

Making payment prcoessors allow sex work/porn but debank religious institutions is looking really good.

2 notes

·

View notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Link

On November 17, 2021, the Women’s Liberation Front, or WoLF, filed a civil rights lawsuit in California that drew almost no coverage. A press corps gearing up to be outraged en masse by the Amber Heard-Johnny Depp defamation case had zero interest in a lawsuit filed by far poorer female abuse victims.

Janine Chandler et al vs. California Department of Corrections targeted a new California state law, the “The Transgender Respect, Agency, and Dignity Act,” a.k.a. S.B. 132. The statute allows any prisoner who self-identifies as a woman — including prisoners with penises who may have stopped taking hormones — into women’s prisons. There was nothing TV-friendly about the scenes depicted in the complaint:

…

After a week spent denounced for reviewing the Matt Walsh documentary What is a Woman?, and for saying things I think will be boring conventional wisdom within a year, I was ready to never go near trans issues again and move to the impending financial disaster. But accident sucked me back. I’d made a point of pride of not reading a line of commentary about Heard-Depp, but listened to an episode of Blocked and Reported that touched on it after it was over, and learned three things that made me furious and think immediately of Chandler.

One, the ACLU, in apparent exchange for a pledge of $3.5 million, ghost-wrote Heard’s offending editorial, and in particular a line about her having “felt the full force of our culture’s wrath for women who speak out.” Two: Guardian writer Moira Donegan declared, “We are in a moment of virulent antifeminist backlash.” Three: Vice proclaimed without irony, “We’ve all failed Amber Heard.” Almost as one, the establishment press declared itself concerned with the suffering of a rich actress. However, there’s a gaping loophole in their concern for women, and Chandler sits in the middle of it.

Let’s talk about “the full force of our culture’s wrath for women who speak out” in the context of this case:

…

The group bringing the suit, WoLF, has been targeted from every conceivable angle by pressure and censorship campaigns. While we at least heard about protesting Canadian truckers having their GoFundMe campaigns frozen, WoLF didn’t even bother trying to raise money on that platform, “because they just ban you really easily,” as legal director Lauren Adams put it.

They moved to a purportedly speechier platform, GiveButter, hoping they would have “less of a censorious kind of view.” But even GiveButter soon gave WoLF the boot (I reached out to the company, which hasn’t provided public comment yet). “It was just a general fundraiser,” Adams explains. “And they said we violated their community standards. So now we’re on GiveSendGo, which is a Christian crowdfunding site.”

If there’s a better illustration of the upside-down state of politics in 2022 America, it’s a feminist activist group forced to seek cyber-refuge in a Christian fundraising company.

…

Even people who submit declarations in WoLF’s prison case may not be immune. On May 31st, biologist and Substack author Colin Wright submitted a declaration in the Chandler case essentially testifying to the biological difference between men and women. “Being male or female is an immutable characteristic of each human,” he wrote.

On June 10th, Wright was informed by the online commerce platform Etsy that, after a “comprehensive review,” his account was permanently closed. A letter from the firm’s “content moderation team” deemed him guilty of “glorifying hatred or violence towards protected groups.”

Wright, known for writing on Quillette about gender, science, and speech, and for being one of the few PhDs still willing to publicly endorse “biological sex” — the iron unanimity on the cultural left against this once uncontroversial scientific tenet goes beyond anything I remember from the winger anti-evolutionists of the eighties and nineties — started selling merchandise on Etsy as a secondary revenue stream. His products included stickers and hats marked with the logo, “Reality’s Last Stand.”

…

Clearly, Wright’s merchandise reflects a point of view about a controversial topic. But his ban came from a company that also sells “Fuck TERFs Skateboarding Cat” stickers and “Fuck J.K. Rowling / STFU TERFs” handmade greeting cards. Etsy did not respond to requests for comment.

…

The payment processing company PayPal also told Wright it had “decided to permanently limit your account.” This ban chronologically took place before Etsy’s move, and the company denies it had anything to do with his editorial stances. There have been cases where PayPal has been open about suspending service over content, for instance in the historic decision to stop transfers to Wikileaks in 2010 after urging from the U.S. State Department. This instance is less clear, but that’s part of the problem with the content moderation era: the processes are so opaque that even in cases where reasons aren’t announced, service terminations still end up having a chilling effect on speakers.

“There have been organizations who’ve made promises,” says Wright. “They said, ‘We’re pro-free speech,’ only have to have them update their terms-of-service and retroactively start banning people,” says Wright.

…

The Green declaration highlighted a growing schism on what was once the political left. The ACLU just proudly announced an attempt to challenge Chandler with other “LGBTQ organizations.” It’s weird enough to see the ACLU — which historically has used most careful language in defending everyone from Neo-Nazis to NAMBLA — issue a press release bluntly describing a feminist organization like WoLF as “bigoted.” It’s weirder still when the complainants are women, many with extensive histories of sexual abuse, suing on behalf of a community that is disproportionately LGB, as 42% of incarcerated women identify as lesbian or bisexual.

“It’s a huge disproportionate number,” says Adams. “Almost half. So it’s concerning when you have these publications who are supposed to be speaking for this population, who are dragging them for even speaking up about documented incidents.”

…

A prison case like Chandler will be the last taboo to fall, as that issue getting real coverage would punch a big hole in the mania. Even if you believe that transgender people need a full complement of rights and better protection in prison, and I’m in that category, there can’t be that many people willing to stand up and argue in favor of housing un-transitioned inmates with penises and criminal sex-abuse records in cells with women. Can there? If agitating against that is bigotry, what’s progress?

#matt taibbi#substack#chandler v ca doc#women’s liberation front#colin wright#payment processors#aclu

4 notes

·

View notes

Text

High Risk Payment processors play a vital role in ensuring senior citizens have access to healthy food options. By facilitating secure transactions for meal delivery services, online grocery shopping, and healthy food subscription services, payment processors enable seniors to maintain a balanced diet without the need for physical exertion. With features like mobile payments, automated billing, and robust security measures, payment processors make it easier for seniors to purchase nutritious food conveniently, promoting their overall health and well-being.

#high risk payment processors#payment processors#best payment gateway processors#online payment gateway processors

0 notes

Text

A Look Into the Future: How Payment Processing Technology Will Be Evolving in 2024

Payment processing technology is constantly evolving, and things can change so rapidly that trying to keep up with it all can be incredibly overwhelming.

But as a business owner, if you want to give your customers what they want, and be able to compete with others in your industry, you can’t just ignore this stuff.

You’ve got to do what you can to stay up to date on the latest technologies and trends in payment processing, otherwise, competitors who are paying attention to this stuff could gain a significant advantage.

And as much as possible, you’ve got to facilitate the forms of payment that consumers want to use, regardless of what they might be.

What’s more, being informed on payment processing industry trends can help you to understand where this technology is going, allowing you to know how your business may need to adapt in the future, and what you can do now to prepare for those changes.

With that in mind, we wanted to help make things easier for you by publishing an article on how payment processing technology will be evolving in 2024.

So, if you’re wondering where payment processing technology is headed, and you want to stay up to date on the latest payment processing trends, then this is one article you’re not going to want to miss.

Trends in Payment Processing Technology for 2024

As we already mentioned, trying to stay on top of this stuff can feel like a full-time job, and believe it or not, sometimes we even struggle to keep up.

But we’ve given it some thought, done some research, and below, we’ve listed what we believe will be the dominant trends in payment processing technology for 2024.

Increasing Popularity of Smart Terminals

Nearly everyone with a cell phone today is using some sort of smartphone.

There are still a few holdouts who will choose to use an old flip phone, for instance, but they’re few and far between, and becoming increasingly fewer.

Similarly, there will come a day when nearly all businesses are using smart terminals, and the popularity of these devices will undoubtedly continue to soar in 2024.

Smart terminals enhance the user experience with intuitive touchscreen interfaces and offer many different functionalities, including things like apps for inventory management, sales tracking, and loyalty programs.

And with all the apps you can download on these things, and all the apps that are currently in development, the functionality of these devices is only going to expand exponentially, and so it’s no wonder they’re becoming so popular and will continue to do so.

Smart terminals continue to stand out for their seamless connectivity, allowing for real-time data synchronization with cloud-based services, CRM systems, e-commerce platforms, and accounting software, which not only streamlines operations but also provides businesses with valuable insights into their performance.

What’s more, their adaptability and ongoing technological advancements position them as an integral tool for the future of retail and service industries, as they do a great job of catering to the dynamic needs of businesses in a marketplace that’s becoming more and more digital.

At any rate, the evolution of smart terminals in 2024 and beyond will also include a focus on sustainability by using things like energy-efficient designs and sustainable materials, which align with the growing consumer demand for more eco-friendly practices.

Terminals with Both Mobile Data and Wi-Fi Capability

In 2024, payment terminals with both mobile data and Wi-Fi capability will continue to gain popularity due to their ability to provide consistent, flexible, and reliable payment processing in many different environments.

This dual connectivity offers unparalleled flexibility by letting businesses operate seamlessly in areas with spotty Wi-Fi by switching to mobile data, allowing transactions to proceed without interruption.

These kinds of terminals are especially beneficial for mobile businesses like food trucks, pop-up shops, and service providers who work across multiple locations, as they can help enhance their ability to offer seamless experiences for customers, regardless of location.

Moreover, having two connectivity options reduces the risk of transaction failures, which is incredibly important for maintaining customer satisfaction, particularly during peak times. This adaptability not only improves operational efficiency but also gives businesses a competitive edge by meeting consumer expectations for hassle-free, quick payments.

Furthermore, the expansion of global mobile networks, including the rollout of 5G technology, will improve the performance of these terminals even more, making them an increasingly attractive option for businesses, especially those that operate across multiple locations.

Better Inventory Management

Inventory management on smart terminals is advancing rapidly, integrating real-time tracking, enhanced data analytics, and seamless supply chain integration, and will continue to do so throughout 2024.

Smart terminals are becoming much more sophisticated, using AI and machine learning to provide predictive insights, automate restocking, and optimize inventory levels based on sales patterns and demand forecasts.

User interfaces are also evolving to be more intuitive, with simplified navigation and customizable dashboards, making inventory management increasingly accessible to businesses of all sizes.

The integration of Internet of Things (IoT) devices, such as RFID tags and sensors, offers detailed tracking of goods, improving inventory accuracy and visibility throughout the supply chain.

In addition, cloud-based solutions are usually a standard feature of these devices, which help to ensure secure, scalable storage and remote management capabilities, and allow businesses to monitor inventory from anywhere.

Furthermore, an increasing number of smart terminals now support sustainable inventory practices, helping businesses to reduce waste and manage eco-friendly products more effectively.

All things considered, the evolution of inventory management on smart terminals in 2024 will be characterized by greater efficiency, intelligence, and integration, empowering businesses to respond more dynamically to market demands and manage their inventory in a more informed and sustainable manner.

Enhanced Security Measures

When it comes to payment processing technology, security remains a major concern.

The surge in digital transactions, not to mention the massive increase in data breaches over the last decade, has necessitated the development of more sophisticated security protocols to protect against fraud and other threats.

As a result, security measures for payment processing are continuously evolving, and the improvement of these safeguards will no doubt continue in 2024.

Technologies like tokenization and end-to-end encryption will continue to become more advanced, ensuring that sensitive information is securely transmitted and stored.

Furthermore, the adoption of blockchain technology for payment processing provides an added layer of security through decentralized ledgers, making transactions virtually tamper-proof.

Moreover, biometric authentication methods, such as fingerprint scanning, facial recognition, and voice authentication, are also becoming more prevalent, offering a seamless yet secure way to verify transactions.

These methods help to not only enhance security but also improve the user experience by simplifying the authentication process, and they will continue to evolve throughout 2024 and beyond.

Integration of Artificial Intelligence (AI)

It seems like every single industry has been disrupted by artificial intelligence technology, and the payment processing industry is no different.

AI already plays a crucial role in the evolution of payment processing technology, as AI algorithms are increasingly used to detect fraudulent activities and analyze spending patterns, offering real-time insights and proactive fraud prevention.

Machine learning models can also adapt and learn from transaction data, continuously improving their accuracy in detecting anomalies and suspicious behaviours.

In addition, AI can help to enhance customer service on payment processing platforms, as chatbots and virtual assistants, powered by natural language processing, provide instant support and guidance, facilitating smoother transactions, resolving issues, and answering questions more efficiently.

That being said, with all the benefits offered by AI, it will undoubtedly become a key element in the evolution of payment processing technology, both in 2024 and into the future.

Contactless and Mobile Payments Expansion

The trend toward contactless and mobile payments continues to accelerate in 2024, driven by consumer demand for convenience and speed.

Near Field Communication (NFC) technology has evolved, allowing for quicker and more reliable contactless transactions, and mobile wallets and payment apps have become more sophisticated, integrating loyalty programs, personalized offers, and financial management tools, which further enrich the experience of users.

Wearable technology has also entered the payment processing arena, with smartwatches and fitness bands equipped with payment capabilities becoming more and more common.

These technologies offer users an unprecedented level of convenience, allowing for seamless transactions with a simple tap or gesture, so it’s no wonder they’re becoming so popular.

If you want to learn more about contactless and mobile payment technology, you can check out our article on The Evolution of Mobile Payment Processing: A Look at the Latest Trends and Innovations.

Cross-Border Payment Innovations

As the global economy becomes more and more interconnected, the need for efficient cross-border payments has become more pressing.

That being said, in 2024, blockchain-based payment systems will be increasingly adopted for international transactions, offering faster, cheaper, and more transparent payment solutions compared to traditional banking systems.

These blockchain platforms can handle multiple currencies and automatically comply with various international regulations, simplifying the complexities of cross-border transactions.

In addition, these platforms will help to facilitate the use of digital currencies, including central bank digital currencies (CBDCs) and stablecoins, which can streamline global trade and commerce by facilitating quicker international transactions and reducing the dependency on conventional banking infrastructures.

These currencies, which will be more and more common as we move into the future, are becoming more integrated into payment processing systems, and that will continue to be the case this year.

Regulatory Evolution and Compliance

As payment processing technology evolves, so does the regulatory landscape.

With that in mind, in 2024, regulatory bodies worldwide will be adapting to the rapid technological advancements in payment processing, implementing new guidelines and standards to ensure consumer protection and the integrity of payment systems.

Regulators will also be focusing on open banking standards, which promote greater transparency and interoperability among financial institutions.

This regulatory environment will help to foster innovation while ensuring that new payment technologies adhere to strict security and privacy standards.

Emergence of Super Apps

The concept of super apps, which consolidate a wide range of services within a single platform, has significantly impacted payment processing technology, and there’s no sign of this slowing down in 2024.

These apps integrate payment functions alongside other services, such as messaging, social media, and e-commerce, creating a comprehensive ecosystem for users.

This integration offers a seamless experience, allowing users to perform multiple functions, including financial transactions, without switching between different apps.

Sustainable Payment Solutions

As is the case with practically everything else, in the world of payment processing technology, sustainability has become a significant consideration, and in 2024, that trend will certainly continue.

Keeping that in mind, this year, and into the future, there will be a growing emphasis on things like eco-friendly payment solutions, including digital receipts and more sustainable payment cards made from recycled materials.

What’s more, the shift toward digital transactions will also contribute to reducing the environmental impact associated with traditional paper-based payment methods.

Looking to upgrade to the latest payment processing technology? Give us a call today to learn more and find out how we can help.

0 notes

Text

Navigating High-Risk: The Advantages of Using High-Risk Payment Processors for High-Transaction…

#Navigating High-Risk: The Advantages of Using High-Risk Payment Processors for High-Transaction…#high risk payment processors#payment processor#high-risk payment processing#payment processing#high risk payment processing#high risk payment processor#high risk payment gateway#high-risk payment gateway#online payment processing company#payment gateway#online payment processing#high-risk payment processing for cbd business#payment processor for high risk merchants#payment processors#merchant account for high risk business

1 note

·

View note

Text

https://www.cardz3n.com/payments/

Merchant Services Credit Card Processor | Payment Processors | CARDZ3N

Are you searching online for merchant services credit card processors? You're at the right place. The purpose of a merchant account is to enable you to accept credit card payments. We offer merchant services - credit card processing, online payroll, HR and benefits.

0 notes

Text

#Echecks#Electronic checks#Merchant services#Payment processing#Digital payments#ACH (Automated Clearing House)#Online payments#Payment gateways#Payment solutions#E-commerce payments#Payment processors#Secure transactions#Electronic funds transfer#Payment technology#Payment verification#Payment acceptance#Digital banking#Transaction fees#Fraud prevention#Payment authorization

2 notes

·

View notes

Photo

(link)

0 notes

Text

Just spent an hour trying to sign up for DC Infinite and their billing system is jacked to hell and back and simply would not accept any payment methods on any device.

And like, look I was trying to do this the "correct" way and all that shit. Physical comics are expensive and I've found that I have a harder time reading them in physical format than digital these days, idk blame the adhd. But like, Firefox's VPN is less expensive than their monthly option and I've been meaning to get a virtual machine setup anyway.

All of which to say, it's time to raise the flag methinks.

#fuck this shit#i'm like 99% sure they fucked up the connection with their payment processor on the back end#its either that or they're using some second rate processor because its cheap and finding out that was a bad idea#either way time to raise the flag and set out to sail the seas

44 notes

·

View notes

Text

tumblr has always guessed your location based on your ip, you can see it when you go to your settings to view your active logins

that's not the same as geolocation or location tracking, which uses a GPS to pinpoint your actual location

#original#i really need to go through and log out of everything and then wonder why i'm logged out of everything again#something about my firefox logins result in like twenty active sessions idk why#anyway this is why i looked up who was doing the tumblr live thing#because people yelling about third party data collection on tumblr are not convincing#on account of when posts+ and the tip jar came out people were fearmongering about. stripe.#stripe the payment processor that everyone uses all over the internet#so i could not trust anyone complaining to have any idea what the fuck they were talking about and had to look it up myself#but i have found no evidence that livebox is actually widely used in other social apps so i don't trust them lol#if you're going to complain do it about things that are actually real#and not your recent discovery that payment processors and ip addresses exist

168 notes

·

View notes

Text

How to Protect Your Business from Payment Fraud During the Holidays

For most of us, the holiday season tends to be a particularly positive time of year.

We get to spend time with family and friends, give gifts to our friends and loved ones, and enjoy all the festivities that this time of year has to offer.

For business owners, the holidays are also filled with positive vibes, not least because they tend to be the most productive and lucrative time of year.

Unfortunately, the holidays are also a time when things like theft and payment fraud become more prevalent.

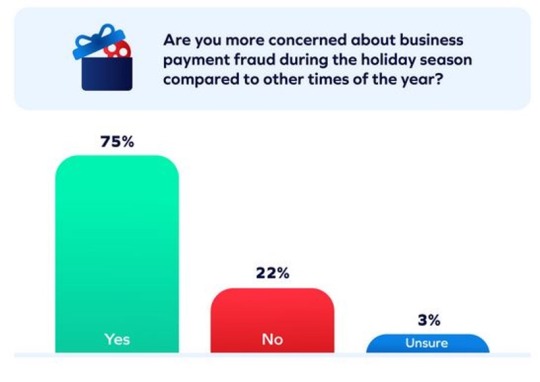

According to a report from Visa, during last year’s holiday season, the merchants who tend to be most targeted by fraud, including home improvement and supply, telecommunications, business-to-business, healthcare, automotive, entertainment, education, government, lodging, insurance, airlines, drug stores, and pharmacies, saw a significant increase in this kind of nefarious activity.

For these unlucky merchants, payment fraud increased by 11 per cent compared to the rest of the year, and actually went up 8 per cent compared to what we saw during the 2021 holiday season.

Clearly, the incidence of these crimes is becoming more common, and sadly, most businesses have pretty much come to expect this sort of thing around this time of year.

A survey from Trustmi confirms this, as it found that the vast majority of businesses are more concerned about payment fraud during the holiday season.

We’ve also been seeing this happening more frequently in our own backyard, and it breaks our hearts to see small business owners getting scammed like this.

According to an article from Global News, Exile Electronics, which is a Vancouver-based music store, was hit by three fraudulent transactions last year, totalling more than $20,000.

The article reports that “the credit card owner disputed the charges and was granted refunds, even though the equipment was long gone. The credit card company then came after Exile for the money.”

At this point, they’re on the verge of bankruptcy, but thanks to a GoFundMe they started, they’ve been able to raise even more than their goal of $13,955 thanks to about 250 generous donations.

All things considered, we want to offer some advice on how you can protect your business from payment fraud during the holidays, so we can do our part to help prevent these heinous crimes.

So, if you’re looking to learn about fraud prevention and want to protect your business against fraud this holiday season, then this is an article you’re not going to want to miss.

Why Does Payment Fraud Increase During the Holidays?

If you want to understand how to prevent payment fraud during the holidays, it’s important to know why these crimes are more common at this time of year.

That being said, there are many reasons why payment fraud tends to increase during the holidays, and this includes things like:

Increased Transaction Volume

The holiday season sees a surge in shopping and transactions, both in-store and online, and this higher volume of transactions creates more opportunities for fraudsters to exploit vulnerabilities.

eCommerce Growth

Online shopping continues to grow, especially during the holiday season, and this increase in online transactions provides more opportunities for cybercriminals to execute various types of fraud, such as card-not-present fraud or account takeovers.

New Account Openings

Some people open new accounts (credit cards, store accounts, etc.) during the holidays to take advantage of discounts or offers, and this presents an opportunity for fraudsters to create fake accounts or steal identities.

Fraudulent Gift Cards

Criminals may tamper with or use stolen credit card information to buy gift cards, which can be used for personal use or sold for cash, making them a target during the holiday season.

Lack of Vigilance

With the holiday rush and excitement, people may let their guard down or overlook suspicious activities, making it easier for fraudsters, as they can exploit this lapse in vigilance.

How to Protect Against Payment Fraud During the Holidays

All this talk about holiday payment fraud can be pretty depressing, especially if you own a business.

But the silver lining to all of this is that there’s actually a lot you can do to protect against payment fraud during the holidays, including:

Password-Protecting Refunds

We’ve heard horror stories of business owners hiring a new employee, only to find out after they’ve quit that they were handing out refunds to their buddies left, right, and centre.

With that in mind, make sure to password protect the ability to give refunds, and only provide that password to people whom you know you can trust.

Otherwise, you’re leaving yourself open to a scam that seems like it’s becoming increasingly common.

Prioritizing Card-Present Transactions

For some businesses, this won’t be possible, but one of the best things you can do to protect against payment fraud is to prioritize card-present transactions and limit card-not-present transactions.

Card-present transactions are one of the most secure forms of payment, as they utilize chip-and-PIN technology, so whoever’s using this form of payment will need to have the card in their possession and also know its PIN.

Again, this may not be practical for some businesses, but, if at all possible, you should try to limit the number of phone and online orders you’re doing, and if it’s applicable, you can even incentivize customers to make in-store purchases by offering them discounts if they make a purchase from your store in-person.

Batching Out More Frequently

Some merchants are used to only batching out their terminals once a week, but this can expose your business to serious risks, especially during the holidays, when you’ll probably be doing a much higher volume of sales.

Because if someone decides to steal your terminal before you’ve batched out, the transactions that are still on there probably won’t get processed, and you’ll lose all that money.

Moreover, all the payment data will remain on your terminal until you’ve batched out, and this puts your customers at risk for fraud, as well, as criminals can steal their information.

That being said, during the holidays, or whenever you’re doing a significantly higher volume of sales, make sure to batch out every day, as once the information is sent to your processor, it’s essentially locked in, and you don’t have to worry about anything being taken or lost.

Using Multi-Factor Authentication

If you enforce multi-factor authentication for online transactions, it can add an extra layer of security by forcing customers to use a combination of passwords, SMS verification, biometrics, or one-time codes.

Regular Security Updates and Patching

One thing that you’ll want to do all year round, not least during the holiday season, is to ensure software, systems, and applications are updated with the latest security patches, as outdated software can have vulnerabilities that criminals can exploit.

Using Advanced Fraud Detection Tools

Another thing you can do to protect against payment fraud all year round is to employ robust fraud detection systems, which can use machine learning and AI to analyze patterns, detect anomalies, and flag potentially fraudulent transactions in real time.

Monitoring Transactions and Setting Up Alerts

Something else you can do to prevent payment fraud is make a point of monitoring transactions regularly for any unusual or suspicious activity and setting up alerts for large transactions, multiple purchases within a short time, or transactions from new or unusual locations.

Customer Verification Processes

Implementing strong identity verification methods for new accounts or high-value transactions offers another way to protect against payment fraud. This could involve verifying personal information, sending confirmation emails, or requiring additional documentation.

Educating Employees

No matter what time of year it is, you should also make sure to educate your employees so that they can recognize potentially fraudulent activity, and create protocols for handling suspicious activities and reporting them promptly.

Secure Payment Processing Systems

It’s unlikely that you’ll ever come across a company with payment processing systems that aren’t secure, but it doesn’t hurt to ensure your processor is using secure and encrypted systems that comply with industry standards and protect customer data, both during transmission and storage.

The holiday season is here, and that means now is a great time to weigh your options and get a reduction on your fees! Give us a call today to find out how much you can save with Lucid Payments.

0 notes

Text

So I bought some cheap stuff on gumroad that would have potentially become lost media otherwise. Made an account so that it would stay in my profile’s library. Let’s see if the ban of content retroactively takes this stuff out of people’s accounts or not. I’ll be a guinea pig. Stay tuned into tomorrow & I’ll update this after the 24 hour window is up.

#gumroad & patreon are cowards#these MasterCard & stripe & other companies are too#let’s see if they take away the stuff I bought even though I paid for it#wouldn’t that be messed up?#I’ll update this later after the 24 hour window#something something digital ownership isn’t even actual ownership these days; we’ll see#I’ve already uploaded the zip files to my private google drive just to be safe#let’s see how this goes#payment processors suck my tentacle#mine#op#gumroad#patreon

8 notes

·

View notes

Text

In this article, we will tackle what payment processors do and how they work so that you can choose the best one for your business’s needs.

Read More https://techannouncer.com/platformpay-shares-4-things-business-owners-need-to-know-about-payment-processors/

1 note

·

View note