#Offshore accounting services India

Text

Offshore accounting services India

Why Offshore accounting services India a Better Choice for Your Business?

Offshore accounting services India, or outsourced accounting services from India, are becoming increasingly popular among small-business owners around the world. With good reason! While outsourcing your bookkeeping and accounting may seem like a daunting task, especially if you’re new to running your own business, outsourcing to an offshore accounting service in India can be the best choice for your business because of the following reasons: ...

Security

When it comes to outsourcing accounting, there are many benefits to consider. The cost of Offshore accounting services India is much less than the cost of employing an accountant on-site and having them travel. The accounting outsourcing hub in India has educated, experienced accountants who specialize in all fields of accounting. This means that you don't need to spend time training your new staff and the outsourced team will be better able to meet your business needs as they change over time.

Regulations

India has been an accounting and outsourcing hub ever since the country began its economic reforms. With the opening of trade restrictions, many multinational corporations began to send their work to Indian companies. Plus, the country's strong English language skills and low labor costs make it an ideal place to outsource accounting services. With so many benefits at your disposal, why not consider Offshore accounting services India?

Reliable Service

Offshore accounting services India, Accounting outsource hub, offers reliable services that meet the needs of businesses and entrepreneurs. We provide Offshore accounting services in India and other services such as Bookkeeping, Taxation Services, and more. Our offshore accounting services are reliable and efficient, allowing you to focus on your business while we take care of the day-to-day accounting tasks.

Affordable Prices

Offshore accounting services India is a better-quality Bookkeeping and Accounting outsourcing company, we support its customers in improving efficiency and decreasing expenses. Here are some of the services that they offer: small business accounting, outsourced bookkeeping, tax preparation, and payroll services.

It's not just the price that makes these services affordable. What you save on upfront costs can be used to invest elsewhere.

Reliable Support

Offshore accounting services India is the best choice to get reliable support. Accounting outsource hub of offshore accounting, Taxation Services, and other services are being provided by us. We have 10+ years of experience in this field. Our team of Bookkeeping and Accounting experts assists you with improving efficiency and decreasing expenses.

Honest Approach

India as an accounting outsourcing hub has many advantages, including lower costs and higher quality. However, it also has some disadvantages that you should be aware of, such as language barriers and lack of process standardization. If your company needs to send frequent tax reports to the IRS then you may want to consider looking at other options. But if you have an accounting team that speaks English and does not need to file taxes on a frequent basis then Offshore accounting services India could be the perfect solution for your business!

Visit Here:- https://www.accountingoutsourcehub.com/service/offshore-accounting-services-india/

0 notes

Text

Outsource Accounting Services | Safebooks Global Pvt. Ltd.

SafeBooks Global is a leading provider of outsourcing accounting Services for businesses seeking reliable & efficient accounting services. Specializing in outsource accounting, offshore accounting & offshore accounting services, outsource accounting to india

0 notes

Text

Unlocking Insights: The Power of Data Visualization Services

In today's data-driven world, businesses are constantly seeking innovative ways to extract meaningful insights from the vast amount of information at their disposal. One increasingly popular solution to this challenge is leveraging data visualization services, which specialize in translating complex data sets into clear and actionable visual representations. These firms play a crucial role in helping organizations make informed decisions, identify trends, and communicate findings effectively.

By partnering with a data visualization agency, companies can tap into a wealth of expertise and technology to unlock the full potential of their data. Whether it's creating interactive dashboards, dynamic charts, or custom reports, these services cater to a wide range of needs and requirements. Moreover, outsourcing data visualization projects to dedicated professionals ensures a high level of accuracy and efficiency, allowing businesses to focus on leveraging insights rather than getting bogged down by data entry tasks.

Importance of Data Visualization

Data visualization plays a crucial role in transforming complex datasets into easily understandable visual representations. By utilizing Best Salesforce data entry services , graphs, and interactive dashboards, businesses can gain valuable insights from their data at a glance. This visual approach enables decision-makers to identify patterns, trends, and correlations efficiently, leading to informed strategic decisions.

One of the key benefits of data visualization is its ability to reveal hidden patterns and relationships within data that may not be immediately apparent. Through visually presenting information, businesses can uncover actionable insights that drive innovation, improve operational efficiency, and enhance overall performance. This intuitive way of presenting data fosters a deeper understanding of the underlying information, empowering organizations to make data-driven decisions with confidence.

Moreover, data visualization enhances communication by presenting complex information in a clear and visually appealing manner. By transforming raw data into visual elements that can be easily interpreted, organizations can effectively convey their findings to stakeholders, clients, and team members. This facilitates better collaboration, facilitates knowledge sharing, and ensures that everyone is on the same page when it comes to understanding and leveraging data insights.

Benefits of Outsourcing Data Entry Services

Outsourcing data entry services can greatly enhance efficiency within a company. By partnering with a dedicated data entry expert, businesses can ensure data entry accuracy and timely completion of tasks. This leads to streamlined processes and allows the internal team to focus on core activities without being burdened by tedious data entry work.

Online data entry service providers offer specialized expertise, advanced technology, and round-the-clock support to meet the data entry needs of companies. This ensures efficient data entry handling and high levels of accuracy, ultimately resulting in improved data quality and decision-making processes. Additionally, outsourcing data entry projects to reputable companies in the USA can help in overcoming resource constraints and accessing a larger talent pool for specialized tasks.

For e-commerce businesses, outsourcing data entry services, such as Amazon product entry and ebook data entry, can be particularly beneficial. Professional Amazon listing services providers can help in optimizing product listings, enhancing visibility, and reaching a wider audience. Similarly, outsourcing ebook data entry projects can expedite the digitization process and ensure error-free data conversion, allowing businesses to focus on creating valuable content for their readers.

Maximizing Amazon Product Entry

In today's competitive e-commerce landscape, the importance of accurate and efficient Amazon product entry cannot be overstated. By enlisting the services of a dedicated data entry expert, businesses can ensure that their product listings are precise and up-to-date. These experts possess the skills and attention to detail necessary to maintain data entry accuracy, contributing to a positive customer experience and ultimately driving sales.

Outsourcing Amazon product entry services to a reputable online data entry service provider can streamline operations for businesses of all sizes. This approach allows companies to focus on core competencies while entrusting the meticulous task of data entry to specialists. With Salesforce data entry for small businesses handling the workload, organizations in the USA and beyond can achieve greater efficiency in managing their Amazon product entry projects.

Partnering with a reliable data entry provider company for Amazon tasks such as product listing and data entry can yield significant benefits. Amazon product entry services cover a range of needs, including Amazon product data entry, Amazon product listing services, and Amazon product entry. Through outsourcing How to choose Salesforce data entry services , businesses can access professional Amazon listing services that enhance the visibility and appeal of their products on the platform.

#crm data cleansing services for private equity#crm data cleansing services#data cleansing services#crm data cleansing solutions#contact data cleansing#crm data cleaning consultants#crm data cleansing#data cleansing for accounting firms#b2b data cleansing services#shopify bulk product upload services#product data entry services shopify#shopify product database#shopify product data entry#shopify product data entry services#outsource shopify data entry services#shopify data entry services#shopify data entry#shopify product listing services#shopify product upload services#offshore data entry#offshore data services#offshore data entry services#offshore data entry projects#offshore data entry company#premier offshore solutions#data entry offshore outsourcing#offshore data processing#offshore online data entry#offshore india data entry#emr data conversion services

1 note

·

View note

Link

As per Equifax, poor billing practices cause doctors in the US to lose an estimated $125 billion each year. To ensure that the billing collections are improved it is significant to identify the reasons which result in claim denials.

A few of the reasons for claim denial are mentioned below:

1) Data error in registration

2) Lack of necessary information

3) Duplication of claims

4) Incorrect patient information in the records

5) Credentialing errors

Know how to tackle the AR in the RCM system>>

https://bit.ly/3dLvTfD

#Medical Billing Services#offshore medical billing company in India#Outsourcing Medical Billing Services to India#offshore medical billing services in India#Offshore Medical billing Agency in India#Outsourcing Medical billing company#Outsource Medical Billing Company#revenue cycle management#Outsource account receivable billing#claim denials#Denial Managemnt

0 notes

Text

The best strategy to expand the company’s reach is always to outsource medical billing services. In addition to a demanding schedule, managing the problems of medical bills would be riskier. India is the #1 country that most US healthcare organizations consider when they are looking to outsource medical billing and coding services.

#Medical Billing Services#offshore medical billing company in India#Outsourcing Medical Billing Services to India#offshore medical billing services in India#Offshore Medical billing Agency in India#Outsourcing Medical billing company#Outsourcing medical billing Agency#Outsource Medical Billing Company#Outsource Medical billing Agency#Outsource medical billing services#healthcare rcm#revenue cycle management#account receivable

0 notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda

Bank of Baroda (BOB) offers retail, agriculture, private and commercial banking, and other related financial solutions. It includes loans, deposit services, and payment cards. The bank offers loans for homes, vehicles, education, agriculture, personal and corporate requirements, mortgage, securities, and rent receivables, among others. It provides current and savings accounts; fixed and recurring deposits; debit, credit, and prepaid cards. The bank also provides insurance coverage for life, health, and general purposes. It offers services such as treasury, financing, mutual funds, cash management, international banking, digital banking, internet banking, start-Up banking, and wealth management. The bank has operations in Asia-Pacific, Europe, North America, and the Middle East and Africa. BOB is headquartered in Baroda, Gujarat, India.

Industry Performance

The health of the banking system in India has shown steady improvement, according to the Reserve Bank of India’s latest report on trends in the sector. From capital adequacy ratio to profitability metrics to bad loans, both public and private sector banks have shown visible improvement. And as credit growth has also witnessed an acceleration in 2021-22, banks have seen an expansion in their balance sheet at a pace that is a multi-year high. As of November 4, 2022, bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion). As of November 4, 2022, credit to non-food industries stood at Rs. 128.87 lakh crore (US$ 1.58 trillion).

Given the increasing intensity, spread, and duration of the pandemic, economic recovery the performances of key companies in the industry was positive. The reported margin of the industry by analyzing the key players was around 13.7% by taking into consideration the last 3 years’ data. Details are as follows.

Companies Net Margin EBITDA/Sales

HDFC Bank Ltd. 23.5% 31.2%

ICICI Bank Ltd. 22.3% 30.4%

State Bank of India 10.0% 25.7%

Punjab National Bank 4.0% 10.0%

Bank of Baroda 8.9% 13.9%

Industry Margins 13.7% 22.2%

Industry Trends

The macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits.

Over the long term, banks will need to pursue new sources of value beyond product, industry, or business model boundaries. The new economic order that will likely emerge over the next few years will require bank leaders to forge ahead with conviction and remain true to their purpose as guardians and facilitators of capital flows. With these factors in mind, the industry is still showing huge growth potential, some of the growth divers that is propelling the industry are:

Rising rural income pushing up demand for banking

Rapid urbanisation, decreasing household size & easier availability of home loans has been driving demand for housing.

Growth in disposable income has been encouraging households to raise their standard of living and boost demand for personal credit.

The industry is attracting major investments as follows.

On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

Some of the major initiatives taken by the government to promote the industry in India are as follows:

As per the Union Budget 2022-23:

National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crores (US$ 6.70 billion) from the banks.

National payments corporation India (NPCI) has plans to launch UPI lite this will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly know as Digital Rupee.

Through analyzing the performance of the contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 9.9% at the end of 2022. Details are as below.

Companies CAGR

HDFC Bank Ltd. 14.02%

ICICI Bank Ltd. 7.3%

State Bank of India 8.4%

Punjab National Bank 9.2%

Bank of Baroda 10.7%

Industry CAGR 9.9%

Working through partnerships both with NBFCs and FinTech is high on the agenda of the Indian banking sector, and this is an area of focus of the FICCI National Committee on Banking. Banks will have to play a very constructive role as India aspires to be the leading economy in future. The strengthened banking sector has the potential to contribute directly and indirectly to GDP, increase job creation and enhance median income. Technology interventions to strengthen the quality and quantity of credit flow to the priority sector will be an important aspect. The need for sustainable finance / green financing is also gaining importance.

With these attributes boosting the sector, the Indian banking industry is likely to grow 5% more than the reported growth rate and is expected to exhibit CAGR of 10.4% in the next five years from 2023 to 2027.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

Understanding the Distinction Between Data Entry and Business Process Outsourcing (BPO)

In the realm of modern business operations, efficiency, accuracy, and streamlined processes are paramount. To achieve these goals, companies often rely on various support services, two of which are data entry and business process outsourcing (BPO). While these terms are sometimes used interchangeably, they represent distinct functions within the broader spectrum of organizational tasks. Let’s delve into the nuances of each to understand their differences and how they contribute to organizational success.

Data Entry:

Data entry is the process of inputting, updating, or managing data within a computer system or database. It involves the meticulous task of transferring information from various sources into digital formats, such as spreadsheets, databases, or specialized software applications. Data entry operators are responsible for accurately entering data while adhering to specific guidelines and protocols set by the organization.

Key Characteristics of Data Entry:

Accuracy: Data entry requires meticulous attention to detail to ensure that information is entered correctly without errors.

Repetitive Tasks: Data entry often involves repetitive tasks, such as typing or copying information from one source to another.

Focused on Input: The primary focus of data entry is on the input of data into a system rather than processing or analyzing it.

Specific Skill Set: While data entry doesn’t necessarily require advanced skills, proficiency in typing, attention to detail, and familiarity with relevant software are essential.

https://www.bark.com/en/in/company/zoetic-bpo-services-opc-private-limited/ZmenQ/

Examples of Data Entry Tasks:

Transcribing handwritten documents into digital formats.

Inputting customer information into a CRM system.

Updating inventory records in an e-commerce platform.

https://www.linkedin.com/posts/zoetic-bpo-services-private-limited_httpslnkdingnucwptk-activity-7165268393502212097-84dB

Business Process Outsourcing (BPO):

Business Process Outsourcing (BPO) involves contracting specific business tasks or processes to external service providers. These processes can range from customer support and human resources to finance and accounting, among others. BPO aims to streamline operations, reduce costs, and leverage specialized expertise by entrusting certain non-core functions to third-party vendors.

Key Characteristics of BPO:

Strategic Partnership: BPO engagements involve strategic partnerships between organizations and external service providers.

Focus on Efficiency: BPO aims to optimize business processes, improve efficiency, and enhance overall productivity.

Diverse Services: BPO providers offer a wide range of services tailored to meet the unique needs of their clients.

Global Reach: BPO services are often delivered from offshore locations, offering cost advantages and access to a global talent pool.

https://www.ambitionbox.com/overview/zoetic-bpo-services-overview

Examples of BPO Services:

Customer support and helpdesk services.

Payroll processing and human resources management.

Financial accounting and bookkeeping.

Key Differences:

Scope of Work: Data entry focuses specifically on inputting and managing data, while BPO encompasses a broader range of business processes outsourced to external providers.

Level of Complexity: BPO involves more complex business functions that require specialized knowledge and expertise, whereas data entry tasks are relatively straightforward and repetitive.

https://www.youtube.com/channel/UCt0V5uZ74FZWD64n3rbxzpQ

Strategic Importance: BPO engagements are strategic partnerships aimed at enhancing organizational efficiency and performance, whereas data entry is often considered a routine administrative task.

Service Providers: Data entry tasks are typically performed in-house by dedicated personnel, while BPO services are outsourced to specialized third-party vendors.

In conclusion, while data entry and business process outsourcing (BPO) both play integral roles in modern business operations, they serve distinct purposes and require different approaches. Understanding the differences between these two functions is crucial for organizations seeking to optimize their workflows and leverage external resources effectively. By recognizing the

https://www.indiamart.com/zoetic-bpo-services-opc-private-limited/profile.html

unique benefits and characteristics of each, businesses can make informed decisions regarding the allocation of resources and the outsourcing of specific tasks to drive operational excellence and achieve strategic objectives.

#DataEntryProjects, #DataProjectsOutsourcing, #nonVoiceProjects, #dataentryworks, #nonvoiceprocess, #BPOdataentryprojects, #DataEntryProcess, #dataentrywork

0 notes

Text

Navigating Efficiency and Global Reach: Exploring the Benefits of Offshore Accounting

In an increasingly interconnected world, businesses are constantly seeking ways to optimize their operations, reduce costs, and gain a competitive edge. One strategy that has gained prominence in recent years is offshore accounting. This practice involves outsourcing accounting functions to service providers located in offshore destinations, typically countries with lower labor costs and favorable regulatory environments. In this blog post, we'll delve into the concept of offshore accounting, its advantages, considerations, and how it can empower businesses to thrive in the global economy.

Understanding Offshore Accounting

Offshore accounting, also known as offshore outsourcing or offshoring, refers to the delegation of accounting tasks to service providers located in foreign countries. These tasks can range from routine bookkeeping and financial reporting to more complex functions such as tax preparation, payroll processing, and compliance services. Offshore destinations commonly chosen for accounting outsourcing include countries like India, the Philippines, Malaysia, and Eastern European nations.

Advantages of Offshore Accounting

1. Cost Savings:

One of the primary reasons businesses opt for offshore accounting is the potential for significant cost savings. Offshore destinations often offer lower labor costs compared to domestic markets, allowing businesses to access skilled accounting professionals at a fraction of the cost. This can result in substantial savings on salaries, benefits, office space, and overhead expenses.

2. Access to Talent Pool:

Offshore accounting provides access to a vast talent pool of skilled professionals with expertise in accounting, finance, and related fields. Many offshore service providers employ qualified accountants, CPAs (Certified Public Accountants), and finance professionals who possess specialized knowledge and experience. By tapping into this talent pool, businesses can benefit from high-quality services and specialized expertise without the need for extensive recruitment efforts or training programs.

3. Scalability and Flexibility:

Offshore accounting offers scalability and flexibility to businesses, allowing them to adjust resources and capacities according to fluctuating demand and business growth. Whether it's scaling up during peak periods or downsizing during slower seasons, offshore service providers can accommodate changing needs and provide tailored solutions to meet business requirements.

4. Focus on Core Activities:

By outsourcing accounting functions offshore, businesses can free up valuable time and resources to focus on core activities and strategic initiatives. Rather than being bogged down by administrative tasks, finance teams can redirect their efforts towards driving innovation, expanding market reach, and delivering value to customers. Offshore accounting allows businesses to streamline operations, improve efficiency, and optimize resource allocation.

5. Time Zone Advantage:

Offshore accounting can provide a time zone advantage for businesses operating in different regions or serving international clients. By leveraging offshore service providers in distant locations, businesses can ensure round-the-clock coverage and faster turnaround times for critical accounting tasks. This can enhance responsiveness, improve customer service, and facilitate smoother collaboration across global teams.

Considerations for Offshore Accounting

While the benefits of offshore accounting are compelling, it's essential for businesses to carefully consider several factors before embarking on an offshore outsourcing journey:

1. Security and Data Privacy:

Offshore accounting involves sharing sensitive financial information with service providers located in foreign countries. Therefore, businesses must prioritize data security and privacy to protect against potential risks such as data breaches, unauthorized access, and compliance violations. Partnering with reputable offshore providers with robust security measures and compliance frameworks is essential to safeguarding confidential information.

2. Regulatory Compliance:

Compliance with regulatory requirements and international standards is critical in offshore accounting operations. Businesses must ensure that offshore service providers adhere to relevant regulations such as GDPR (General Data Protection Regulation), SOX (Sarbanes-Oxley Act), and industry-specific mandates. Conducting due diligence, assessing compliance frameworks, and implementing contractual safeguards can help mitigate compliance risks.

3. Communication and Collaboration:

Effective communication and collaboration are essential for successful offshore accounting relationships. Businesses should establish clear communication channels, set expectations, and maintain regular contact with offshore service providers to ensure alignment on goals, priorities, and project timelines. Leveraging collaboration tools, video conferencing, and project management platforms can facilitate seamless communication across geographically dispersed teams.

4. Cultural and Language Differences:

Offshore accounting may involve working with service providers from different cultural backgrounds and language preferences. Businesses must be mindful of cultural nuances, communication styles, and language barriers that may impact collaboration and teamwork. Promoting cultural awareness, providing cross-cultural training, and fostering a culture of inclusivity can help bridge the gap and strengthen offshore partnerships.

5. Quality Assurance:

Ensuring quality assurance and service delivery standards is essential in offshore accounting engagements. Businesses should establish performance metrics, SLAs (Service Level Agreements), and quality control processes to monitor the accuracy, timeliness, and consistency of deliverables. Conducting regular performance reviews, soliciting client feedback, and addressing any issues promptly are key to maintaining service quality and client satisfaction.

Embracing Offshore Accounting for Growth and Global Success

In conclusion, offshore accounting offers compelling benefits for businesses seeking to optimize their accounting functions, reduce costs, and gain a competitive advantage in the global marketplace. By leveraging the cost-effectiveness, access to talent, scalability, and time zone advantages offered by offshore outsourcing, businesses can streamline operations, enhance efficiency, and focus on strategic priorities. However, it's crucial for businesses to carefully evaluate the potential risks, compliance considerations, and communication challenges associated with offshore accounting and choose reputable providers that align with their specific needs and objectives. With the right offshore accounting partner and a well-defined strategy in place, businesses can navigate the complexities of global accounting outsourcing and unlock opportunities for growth and success in today's interconnected world.

1 note

·

View note

Text

Offshore accounting services India

Accounting outsourcing hub is a business process offshoring company providing quality accounting, payroll, finance, taxation, corporate advisory, and some other financial services at affordable rates directly to customers and accounting firms across the globe. Offshore accounting in India, or outsourced accounting services from India, are becoming increasingly popular among small-business owners around the world. With good reason! While outsourcing your bookkeeping and accounting may seem like a daunting task, especially if you’re new to running your own business, outsourcing to an offshore accounting service in India can be the best choice for your business because of the following reasons.

Benefits of Offshore Accounting Services India.

Reduced Costs:- Offshore accounting services in India help keep costs down. Companies that have their accounting, finance, and payroll processed offshore can be sure they are paying a fair market rate for their services, which would never be the case if they chose to go with an account located locally.

Security:- When it comes to outsourcing accounting, there are many benefits to consider. The cost of offshore accounting in India is much less than the cost of employing an accountant on-site and having them travel. The accounting outsourcing hub in India has educated, experienced accountants who specialize in all fields of accounting. This means that you don't need to spend time training your new staff and the outsourced team will be better able to meet your business needs as they change over time.

Accessible to Both SMBs & Large Businesses:- Accounting outsourcing hub is a business process offshoring company providing quality accounting, payroll, finance, taxation, corporate advisory, and a variety of other financial services directly to customers and accounting firms worldwide at affordable prices. Apart from this hub also renders offshore accounting services in India to both SMBs as well as large businesses. One such popular service that clients opt for is the Income Tax filing for Individuals & Firms.

Enhanced Cash Flow:-The company in India will improve your cash flow as a result of outsourcing your accounting functions. With this benefit, you can rest assured knowing that you will always have enough money on hand, no matter what month it may be. There are many advantages to offshoring your accounting processes but one of the biggest ones is being able to say goodbye to worries about having enough funds.

Visit here:- https://www.accountingoutsourcehub.com/service/offshore-accounting-services-india/

#Offshore accounting services India#offshore accounting services#accouting#Accounting outsourcing services

0 notes

Text

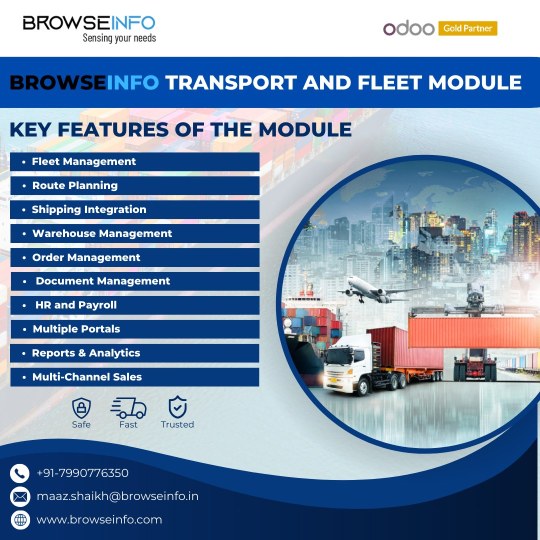

Odoo in the Cloud: Benefits and Considerations for Businesses

BrowseInfo is known as one of the best Odoo company in India for its top-notch Odoo services with customization services .It is a foreign business application services company that has been in business since 2012.

With a track record of success, they are experts in Odoo implementation, Odoo Maintenance, Odoo Offshore Development, Migration, Consulting, Training, Support, and Installation. This helps businesses run more efficiently. Our main services are making software, giving IT advice, and helping businesses all over the world outsource their work to other countries.

As a well-known Odoo Gold Partner in India the UK, USA and Canada. We use the best Open-ERP tools to help your business stand out in the right fields.

Browseinfo is a trusted Odoo company partner for businesses in India that want the best Odoo customization services because their expert teams focus on integration, full support, transparency, and customer happiness that can't be beat.

Odoo is in application development a suite of flexible commercial company packages that has become incredibly popular because it makes enterprise systems easier to use. Moving Odoo to the cloud has become popular among businesses all over the world as the cloud era has grown.

Odoo's application development based solutions come with a subscription plan that makes them affordable. This means that you don't have to spend a lot of money on hardware and infrastructure up front. It can be used by groups of all sizes because it is so cheap.

Find out if the assistant can change Odoo answers to fit the needs of your business. You can change Odoo packages to fit your specific strategies and processes if you have a more knowledgeable partner in customization. This makes the platform more useful.

Cloud systems let businesses make their Odoo times affects bigger or smaller. Companies can easily adjust to changes in demand thanks to the flexibility of cloud deployments. This is true whether the demand is for more usage or for the changing seasons.

The best thing about Odoo being fully cloud-based is that it is easy for anyone to use. Employees can connect to Odoo systems from anywhere with an internet link, which makes it easy for them to work together and see big picture information.

Trustworthy cloud service providers offer strong security features to keep data saved in the cloud safe. With controls for viewing user rights and encryption, businesses can be sure that their private information is safe.

Cloud platforms have both redundancy and backup talent, which lowers the risk of losing records because of hardware problems or problems that come up out of the blue. This helps businesses stay on track and gives information about the honesty of the Thoughts.

Odoo can be changed in a lot of ways, but companies can run into problems when they try to make some parts of their cloud-based deployments work better. It's important to know how flexible the cloud tool you choose is.

Information security and following the rules: All kinds of companies must follow basic account privacy rules, like GDPR in Europe or HIPAA in the US.

Being able to easily connect to other systems and systems is very important for work. Before you pick a cloud-based Odoo solution, make sure it works well with the tools and programs you already have.

When picking a cloud provider for Odoo deployment, look at things like latency, uptime promise, responsiveness, and support. When you use a solid cloud platform, it always works properly and has less downtime. Odoo packages to fit your specific strategies and processes if you have a more knowledgeable partner in customization.

0 notes

Text

Safebooks: Elevating Businesses with Comprehensive Outsourced Bookkeeping Services

Discover the benefits of Safebooks' comprehensive outsourced bookkeeping services tailored to meet your specific needs. Our end-to-end solutions not only save you time and money but also enhance the efficiency of your virtual bookkeeping services.

By opting for our outsourced bookkeeping services, you can redirect your time and resources towards acquiring new clients. We ensure timely task completion, heightened accuracy, and cost savings. Safebooks goes beyond routine bookkeeping, providing you with in-depth data, information, and facts to empower better decision-making.

Our diverse bookkeeping services for business encompass day-to-day bookkeeping, bank reconciliations, regular reporting, cash flow management, budgeting, accounts payable and receivable management, and debtors monitoring. As your trusted offshore bookkeeper, Safebooks manages all aspects of bookkeeping, freeing up your team to offer more lucrative services, ranging from wealth advice to business advisory.

Benefit from our streamlined and automated workflows, accessible 24/7 via cloud-based software. We prioritize data security, holding ISO 27001 certification and ensuring compliance with regional data protection laws. Our expert team is well-versed in utilizing custom software and cloud-based systems, staying technically sound with the latest advancements. Choose Safebooks for seamless and efficient outsource bookkeeping services India, delivered by knowledgeable staff updated on the latest Australian laws and regulations.

0 notes

Link

Are you a solo practitioner or a small practice looking for an expert’s opinion on offshoring / outsourcing medical billing? Call us at +1-888-694-8634.

#Offshore Ambulance billing#Offshore Ambulance billing in India#Outsource Ambulance Billing#account receivable#revenue cycle management#Ambulance medical billing#offshore Ambulance billing company#offshore Ambulance billing company in India#Ambulance billing services Outsourcing#Outsourcing Ambulance billing services#Outsource Ambulance billing services#Outsource Medical billing Agency#Outsource Medical Billing Company#Outsourcing medical billing Agency#Outsourcing Medical billing company#Offshore Medical billing Agency in India#offshore medical billing services in India#Outsourcing Medical Billing Services to India#Medical Billing Services

0 notes

Text

Are there loopholes in your AR process? Is your practice facing revenue losses? It goes without saying that unpaid accounts receivable stifle cash flow and rob you of the funds you need to invest in expansion prospects, purchase new machinery, and recruit staff, and that’s just the tip of the iceberg.

#Medical Billing Services#offshore medical billing company in India#Outsourcing Medical Billing Services to India#offshore medical billing services in India#Offshore Medical billing Agency in India#Outsourcing Medical billing company#Outsourcing medical billing Agency#Outsource Medical Billing Company#Outsource Medical billing Agency#Outsource medical billing services#healthcare rcm#revenue cycle management#A/R follw up#account receivable

0 notes

Text

Benefits of Offshoring Finance and Accounting for CPAs

Offshoring finance and accounting functions for Certified Public Accountants (CPAs) can offer several benefits, although it's important to note that the decision to offshore should be made carefully, considering the specific needs and circumstances of the CPA firm.

Here are some potential benefits of Accounting Offshoring :

Cost Savings: One of the primary reasons for offshoring is cost reduction. Labor costs in certain offshore locations may be significantly lower than in the home country, allowing CPAs to save on salaries and related expenses.

Access to Skilled Talent: Offshoring provides access to a global talent pool, allowing CPA firms to tap into skilled professionals with expertise in finance and accounting. This can lead to increased efficiency and higher-quality output.

Focus on Core Competencies: By outsourcing routine finance and accounting tasks, CPAs can free up time and resources to focus on core competencies such as client relations, strategic planning, and value-added services.

Scalability: Offshoring allows CPA firms to scale their operations up or down more easily in response to fluctuations in workload or business demands. This scalability can enhance flexibility and adaptability.

24/7 Operations: Offshoring to locations in different time zones can enable round-the-clock operations. This can lead to faster turnaround times for tasks and better responsiveness to client needs.

Client Satisfaction: With efficient and cost-effective operations, CPAs may be able to offer more competitive pricing to clients, leading to increased client satisfaction and loyalty.

Finsmart Accounting believes that it's crucial to approach offshoring with careful planning, clear communication, and a focus on maintaining the quality of service. The choice of an offshore location, the selection of a reliable service provider, and ongoing monitoring are essential components of a successful offshoring strategy for CPAs.

Explore most subscribed services.

India entry consulting services for global MNCs

Accounts payable outsourcing services

Tax software for small CPA firms

Also read:

Everything about nonprofit accounting

Emerging accounting trends and bookkeeping tips

0 notes

Text

Broker In Focus: Fxglory - Is It Worth Giving A Try?

Fxglory is an offshore broker that allows trading in the forex market and commodities. The broker is not licensed by a respected regulatory body like the FCA or CySEC and is incorporated outside of the United States in Saint Vincent and the Grenadines. However, it has developed a reputation as one of the most dependable companies in the sector despite it currently lacking any regulatory licences. Traders of any level can take advantage of Fxglory’s flexibility, usability, and astounding professionalism. It further provides excellent trading tools, reliable trade execution, and enormous leverage available on the market–1:3000.

Fxglory provides simple access to a secure and comprehensive trading environment. Established in 2011, it has offices in Malaysia, Cyprus, Spain, and the UK. The office was first headquarters in the United Arab Emirates and migrated to European markets after a year of operation in the Asian financial industry. A group of financial experts founded the company with the goal of offering traders on the MetaTrader 4 trading platform a superior online trading experience with high leverage, no commissions, and quick executions.

Features Provided by Fxglory

Trading Instruments– Clients of FxGlory have access to a limited number of trading instruments. You can trade 34 currency pairings, including GBP/USD and EUR/USD. Along with oil and precious metals trading, popular cryptocurrencies like Bitcoin and Ethereum are also accessible.

Trading Accounts– Fxglory provides access to four types of trading accounts. Standard, Premium, VIP, and CIP accounts. Further, Fxglory provides one-click trading, a built-in news feed, and multilingual support for all account holders.

Trading Platform– Fxglory provides MetaTrader 4 (MT4) and a WebTrader platform. MT4 is user-friendly, sophisticated, and customisable. Additionally, FxGlory provides a web-based trading platform. WebTrader enables you to trade through an internet browser without additional program installation. A variety of devices, including Mac and PC, can be used to trade all the instruments provided by this broker.

Mobile Trading Application– All trade orders and execution types are supported by the MT4 platform, which can be downloaded for iOS and Android devices. The UI is straightforward to use, and logging in is just as quick and easy as it is on a desktop computer. You have access to trade at your fingertips.

Languages– Languages such as English, Russian, Italiano, Greek, Arabic, and German are supported by the broker.

Trading Tools– Fxglory provides highly useful trading tools such as economic calendars, margin calculators, and one-click trading.

Education– This field requires special attention because the educational materials at Forexglory are quite basic and not up-to-date.

Customer Service– You can contact the customer support team 24*5 through email and phone call service. You also have to connect to the team via live chat.

Clients– Fxglory accepts clients from countries such as Australia, Thailand, Canada, the United States, the United Kingdom, South Africa, Singapore, Hong Kong, India, France, Germany, Norway, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, etc.

Payment Options– E-commerce payment methods have grown in popularity these days. So, the broker provides a variety of deposit choices. To fund your account, you can select a method that best meets your needs, and all deposits are processed quickly and securely. You have access to multiple payment options like SticPay, American Express, Perfect Money, cryptocurrencies, WebMoney, EPay, Wire Transfer, Neteller, Skrill, PayPal, Visa, and Mastercard.

Trading Conditions

Standard Account

Commission – $0

Minimum Deposit – $1

Spread – Floating from 2 pips

Step lot size – 0.01

Leverage – Up to 1:3000

Maximum bonus – $500

Deposit bonus percentage – 50%

Minimum lot size – 0.01

Maximum lot size – 1.00

Hedge margin – 50%

Maximum position – 20

Premium Account

Commission –$0

Minimum Deposit – $1,000

Spread – Floating from 2 pips

Step lot size – 0.10

Leverage – 1:2000

Maximum bonus – $1,000

Deposit bonus percentage – 50%

Minimum lot size – 0.10

Maximum lot size – 10.00

Hedge margin – 50%

Maximum position – 100

VIP Account

Commission – $0

Minimum Deposit – $5,000

Spread – Floating from 0.7 pips

Step lot size – 0.10

Leverage – 1:300

Maximum bonus – $2,000

Deposit bonus percentage – 40%

Minimum lot size – 0.10

Maximum lot size – 1,000.00

Hedge margin – 25%

Maximum position – 1000

CIP Account

Commission – $0

Minimum Deposit – $50,000

Spread – Floating from 0.1 pips

Step lot size – 1.00

Leverage – 1:50

Maximum bonus – $0

Deposit bonus percentage – 0%

Minimum lot size – 1.00

Maximum lot size – 5.00

Hedge margin – 100%

Maximum position – 10

Pros of Trading with Fxglory

Low minimum deposit ($1)

Provides varieties of strategies like scalping, hedging, algorithmic trading

Spreads are fixed

Clients have access to a handful of tradable instruments

The MT4 platform is available for iOS and Android devices and supports all trade orders and execution modes.

The interface is easy to navigate

Offers a wide range of payment methods, including cryptocurrency

Offers 4 types of trading accounts

Live chat is available

To protect client data, the company's website and platform employ 256-bit SSL encryption technology.

To protect the funds, it maintains cash in separate accounts and provides clients access to various risk management tools.

All accounts are swap-free

Clients from the US are accepted

Micro-lot trading is available

Cons of Trading with Fxglory

The website supports only the English language

It is unregulated

Cent accounts are not available

Customer support service is not upto the mark

Spreads are high

Complex fee structure

Does not provide an MT5 platform

Educational materials are average

Verdict

Overall, Fxglory is a reliable forex broker which provides a unique trading system and environment. Fxglory puts the priorities and needs of its clients and partners first. It works with all honesty by creating exceptional products and services. However, keep in mind that, at the moment, it does not hold any regulating licence. Always do some background checks before signing up with any broker. Furthermore, Fxglory is a good broker for both newbies and experienced traders, but the trading conditions make it more suitable for professional traders who have a large capital to trade.

0 notes

Text

Unlocking Efficiency and Global Opportunities Offshore Business Process Outsourcing

In today's rapidly evolving business landscape, companies are constantly seeking ways to enhance efficiency, reduce costs, and stay competitive. One strategic approach that has gained immense popularity is Offshore Business Process Outsourcing (BPO). This transformative practice involves contracting out specific business functions to third-party service providers located in different countries. Offshore BPO enables organizations to leverage the advantages of global talent, cost savings, and increased focus on core competencies. In this article, offshore business process outsourcing we will delve into the key aspects of offshore BPO and explore how it has become an integral part of the modern business ecosystem.

Understanding Offshore BPO:Offshore BPO is a business strategy where companies delegate non-core tasks or processes to external service providers situated in offshore locations. These offshore locations are typically chosen based on factors such as labor costs, skill availability, and time zone differences. Commonly outsourced business processes include customer support, IT services, finance and accounting, human resources, and more.

Key Benefits:a. Cost Efficiency: One of the primary motivations for offshore BPO is the cost advantage offered by outsourcing to countries with lower labor costs. This allows businesses to allocate resources more strategically and invest in core functions that contribute directly to their growth.b. Access to Global Talent: Offshore outsourcing provides access to a diverse pool of skilled professionals and experts in various domains. Companies can tap into specialized skills that may not be readily available or affordable in their home countries, thereby fostering innovation and efficiency.c. Focus on Core Competencies: By outsourcing non-core functions, companies can concentrate on their core competencies and strategic goals. This not only enhances overall productivity but also allows organizations to adapt more quickly to market changes and emerging opportunities.d. Scalability and Flexibility: Offshore BPO enables businesses to scale their operations up or down based on fluctuating workloads. This flexibility is crucial in dynamic industries where adaptability is key to survival.

Challenges and Risks:a. Communication and Cultural Differences: Effective communication is vital in any business relationship. Offshore outsourcing may face challenges due to differences in language and cultural nuances. However, these challenges can be mitigated through proper communication channels and cultural awareness training.b. Data Security Concerns: Entrusting sensitive data to an external partner requires stringent security measures. Companies must carefully vet their offshore BPO providers and establish robust data protection protocols to safeguard their information.c. Regulatory Compliance: Different countries have varying regulations and compliance standards. It is essential for businesses to ensure that their offshore partners adhere to the relevant legal and industry-specific guidelines to avoid potential legal issues.

Popular Offshore BPO Destinations:a. India: Renowned for its IT and software development services, India is a top destination for offshore BPO, offering a vast pool of skilled professionals proficient in various domains.b. The Philippines: Known for its English-speaking workforce and strong customer service capabilities, the Philippines is a preferred choice for customer support and business process outsourcing.c. Eastern Europe: Countries like Ukraine, Poland, and Romania have emerged as attractive destinations for IT outsourcing due to their highly skilled workforce and cultural proximity to Western Europe.

The Future of Offshore BPO:Offshore BPO is poised to continue evolving as technology advances and the global business landscape transforms. The integration of artificial intelligence, automation, and data analytics is expected to enhance the efficiency and scope of offshore outsourcing, making it an even more integral part of business strategies worldwide.

Conclusion:

Offshore Business Process Outsourcing has become a strategic imperative for businesses aiming to stay competitive in a globalized economy. By leveraging the benefits of cost efficiency, access to global talent, and increased flexibility, companies can streamline their operations and focus on core competencies. While challenges exist, proactive management and adherence to best practices can help mitigate risks and ensure a successful offshore outsourcing experience. As the business world continues to evolve, offshore BPO remains a powerful tool for organizations seeking sustainable growth and competitiveness.

0 notes