#MedicalCoverage

Text

How to Choose the Best Private Medical Insurance

"Health is a crown that the healthy wear but only the sick can see."

- Imam Shafi'i

When it comes to safeguarding your health, having the right private medical insurance is essential. With the rising costs of healthcare, it's crucial to ensure that you have adequate health insurance coverage that meets your specific needs. Whether you're considering an individual health plan or exploring options for your family, understanding the factors to consider when choosing the best private medical insurance is paramount.

In this article, we will guide you through the process of selecting the right private medical insurance for your needs. We will explore the different types of plans available, the importance of assessing your health insurance needs, and how to compare different options. Additionally, we will provide tips on researching insurance providers, understanding insurance terminology, and navigating the application process.

By the end of this article, you will have the knowledge and tools necessary to make an informed decision when it comes to private medical insurance. Protecting your health is a vital investment, and with the right coverage, you can have peace of mind knowing that you have access to quality healthcare.

Key Takeaways:

- Choosing the best private medical insurance is crucial for safeguarding your health.

- Assess your health insurance needs based on factors like your current health status, budget, and coverage preferences.

- Understand the different types of private medical insurance plans available, such as individual health plans and family health plans.

- Compare plans based on factors like cost, network of providers, customer service, and additional benefits.

- Research insurance providers to ensure their reputation, financial stability, and customer satisfaction.

Understanding Private Medical Insurance

In today's ever-changing healthcare landscape, having private medical insurance can provide you with essential coverage and peace of mind. Private medical insurance, also known as a healthcare plan or private healthcare policy, offers numerous advantages over other types of insurance. Let's explore what private medical insurance is and why it's a valuable investment for you and your family.

What is Private Medical Insurance?

Private medical insurance is a type of health insurance coverage that allows individuals to access private healthcare services and facilities. Unlike public healthcare systems, private medical insurance offers benefits such as shorter waiting times for consultations, access to specialists, and a wider range of treatment options.

How Private Medical Insurance Differs

Private medical insurance differs from other types of insurance, such as life or car insurance, in that it specifically focuses on providing coverage for medical expenses. While other insurance types may offer some degree of healthcare coverage, private medical insurance is designed to cater specifically to your healthcare needs. It ensures that you receive the medical attention you need when you need it, without relying solely on public healthcare resources.

The Benefits of having Private Medical Insurance

Having a private medical policy offers several advantages that can greatly benefit you and your family. Some of these advantages include:

- Quick access to healthcare: With private medical insurance, you can avoid long waiting times for appointments and treatments.

- Choice and flexibility: Private medical insurance allows you to choose your preferred healthcare providers and specialists.

- Comprehensive coverage: Private medical insurance provides coverage for a wide range of medical services, including consultations, surgeries, hospital stays, and specialized treatments.

- Personalized care: Private medical insurance allows you to receive personalized medical attention tailored to your specific needs and preferences.

- Peace of mind: Knowing that you have private medical insurance can provide financial security and peace of mind, especially during unexpected health crises.

Assessing Your Health Insurance Needs

When it comes to choosing the right private medical insurance plan for yourself, it's essential to assess your specific health insurance needs. Evaluating factors such as your current health status, budget, and coverage preferences will help you make an informed decision that aligns with your requirements and ensures adequate protection.

First, consider your current health status. Take into account any pre-existing conditions or ongoing medical treatments that require coverage. If you have a chronic illness or require specialized care, you may prioritize a private medical insurance plan that offers comprehensive coverage for these specific needs.

Next, evaluate your budget. Determine how much you can comfortably allocate toward health insurance coverage. It's important to strike a balance between affordability and comprehensive coverage. Consider factors such as monthly premiums, deductibles, and co-payments when assessing different private medical insurance plans.

Assessing Your Health Insurance Needs:

- Evaluate your current health status and any specific medical needs.

- Determine your budget and financial capabilities.

- Consider your coverage preferences and priorities.

Lastly, carefully consider your coverage preferences. Are you looking for a private medical insurance plan that covers a broad range of healthcare services, including hospital stays, doctor visits, and prescription drugs? Or do you have specific coverage priorities, such as maternity care or mental health services? Identifying your coverage preferences will help you narrow down the options and choose a plan that meets your unique needs.

Remember, private medical insurance plans can vary in coverage options, cost, and additional benefits offered. By assessing your health insurance needs, you can ensure that you select a plan that provides the right level of coverage and aligns with your budgetary constraints.

By assessing your health insurance needs, you'll have a clear understanding of the coverage and benefits you require. This evaluation will serve as a valuable guide when comparing and selecting a private medical insurance plan that offers the most suitable coverage for you.

Types of Private Medical Insurance Plans

When it comes to private medical insurance, there are various options available to meet your specific needs. Understanding the different types of plans can help you make an informed decision. Let's take a closer look at the three main types of private medical insurance plans: individual health plans, family health plans, and group health plans.

1. Individual Health Plans

An individual health plan is designed to provide coverage for an individual person. Whether you are self-employed, unemployed, or do not have access to employer-sponsored coverage, an individual health plan can offer you the protection and benefits you need. These plans can be customized to meet your specific healthcare requirements and budget.

2. Family Health Plans

Family health plans are designed to provide coverage for your entire family. Whether you have a spouse, children, or dependents, these plans ensure that all members of your family have access to quality healthcare. Family health plans often offer comprehensive coverage and can be a cost-effective option for families compared to individual plans for each family member.

3. Group Health Plans

Group health plans are typically offered by employers or organizations to provide coverage for a group of individuals, such as employees or members of an association. These plans often provide a range of benefits and may offer more affordable premiums due to the collective purchasing power of the group. Group health plans can also have additional features like wellness programs and preventive care services.

Now that you are familiar with the different types of private medical insurance plans, it's important to compare different options to find the one that best suits your needs. You may want to consider factors like coverage benefits, premiums, network of healthcare providers, and any additional perks or features offered. To help you in this process, let's compare the key features of individual health plans, family health plans, and group health plans in the table below:

Insurance PlanCoverage BenefitsPremiumsNetwork of Healthcare ProvidersAdditional FeaturesIndividual Health PlansCustomized coverage for individualsVaries based on individual factorsAccess to a wide network of providersOptions for personalized careFamily Health PlansComprehensive coverage for the entire familyVaries based on family size and compositionAccess to a wide network of providersDependent coverage and family-focused benefitsGroup Health PlansCoverage for groups of individualsShared between employer and employees/membersAccess to a network of providers specific to the groupCollective bargaining power and additional benefits for the group

Comparing the features of different private medical insurance plans can help you determine which one aligns with your healthcare needs and financial situation. Take the time to research and evaluate your options to find the plan that offers the best value for you and your family.

Understanding Health Insurance Coverage

When it comes to selecting the right private medical insurance plan, understanding health insurance coverage is essential. By exploring the various aspects of coverage options, you can make an informed decision that aligns with your specific needs.

Hospitalization

One crucial aspect of health insurance coverage is hospitalization. A comprehensive private medical insurance plan will provide coverage for hospital stays, including room charges, surgical procedures, and specialist consultations.

Doctor Visits

Another important element of health insurance coverage is doctor visits. Whether you need regular check-ups or have a specific medical condition, a good private medical insurance plan will include coverage for consultations with doctors, specialists, and other healthcare professionals.

Prescription Drugs

Prescription drugs can often be a significant expense. To ensure adequate medical coverage, it is essential to choose a private medical insurance plan that includes coverage for prescription drugs. This will help alleviate the financial burden of necessary medications.

Preventive Care

Preventive care is an essential part of maintaining your overall health and well-being. Many private medical insurance plans offer coverage for preventive services such as vaccinations, screenings, and wellness visits. This coverage is crucial in catching potential health issues early on and preventing them from becoming more severe.

By considering these key aspects of health insurance coverage, you can compare different private medical insurance plans more effectively. It's important to choose a plan that provides comprehensive coverage for hospitalization, doctor visits, prescription drugs, and preventive care to ensure the best possible medical support for you and your family.

Factors to Consider When Comparing Plans

When comparing private medical insurance plans, it's important to keep several factors in mind. By carefully considering these aspects, you can make an informed decision and choose a plan that suits your needs. Here are some key factors to evaluate when comparing health insurance plans:

1. Cost

One of the most crucial factors to consider is the cost of the insurance plan. Compare the monthly premiums, deductibles, and out-of-pocket expenses for each plan. Be sure to assess whether the coverage justifies the cost and fits within your budget.

2. Network of Providers

Check the network of healthcare providers included in each plan. Ensure that your preferred doctors, specialists, hospitals, and clinics are within the network. Having access to a wide network of providers ensures convenience and quality care.

3. Customer Service

The level of customer service offered by the insurance provider is important. Read customer reviews and ratings to gauge how responsive and helpful the insurer's customer service department is. Prompt and efficient customer service can make a significant difference when dealing with claims and any other inquiries.

4. Additional Benefits

Many private medical insurance plans offer additional benefits that can enhance your coverage. These benefits may include wellness programs, telemedicine services, maternity coverage, or prescription drug coverage. Assess what additional benefits are included in each plan and determine their value based on your specific needs.

"By carefully considering the cost, network of providers, customer service, and additional benefits, you can make an informed decision and choose a private medical insurance plan that meets your needs."

It's important to take the time to compare health insurance plans thoroughly. By evaluating these factors, you can ensure that you have the right coverage and peace of mind when it comes to your healthcare needs.

Researching Insurance Providers

When it comes to private medical insurance, it's important to choose a reliable provider that offers the right coverage for your needs. With so many options available, researching different insurance providers is a crucial step in making an informed decision. In this section, we will guide you on how to research insurance providers and evaluate their reputation, financial stability, and customer satisfaction.

Evaluating Reputation

One way to assess an insurance provider's reputation is by checking online reviews and ratings. Look for feedback from policyholders to gain insights into their experiences with the company. Additionally, consider consulting independent third-party ratings and rankings that evaluate the performance and reliability of insurance providers.

Assessing Financial Stability

It's important to choose an insurance provider that is financially stable and capable of honoring their commitments. Check the insurer's financial strength ratings from reputable rating agencies such as Standard & Poor's, Moody's, and A.M. Best. These ratings will give you an idea of the company's ability to pay claims and its long-term financial stability.

Measuring Customer Satisfaction

A satisfied customer base is a good indicator of an insurance provider's reliability and quality of service. Look for customer satisfaction surveys or ratings that measure policyholders' satisfaction levels. You can also inquire about the provider's complaint resolution process and their responsiveness to customer inquiries and concerns.

By conducting thorough research and considering factors such as reputation, financial stability, and customer satisfaction, you can gain confidence in your choice of a private medical insurance provider. Now that you have a clear understanding of how to research insurance providers, you can move forward in comparing different options and selecting the best coverage for your needs.

Factors to ConsiderPoints to EvaluateReputation- Check online reviews and ratings.

- Consult independent third-party ratings and rankings.Financial Stability- Check the insurer's financial strength ratings from reputable rating agencies.

- Assess the company's ability to pay claims and financial stability for the long term.Customer Satisfaction- Look for customer satisfaction surveys or ratings.

- Inquire about the complaint resolution process and responsiveness to customer inquiries and concerns.

Understanding Insurance Terminology

When navigating the world of private medical insurance, it's essential to familiarize yourself with the terminology commonly used in insurance policies. Understanding these terms will help you make informed decisions about your health insurance coverage. Below, we've compiled a list of key insurance terms you should know:

Deductibles

The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if your deductible is $1,000 and you have a medical bill of $2,500, you will need to pay $1,000, and the insurance company will cover the remaining $1,500.

Copayments

A copayment, or copay, is a fixed amount you must pay for certain medical services. For instance, your insurance policy might require a $20 copayment for each doctor's visit. The remaining cost of the visit will be covered by your insurance provider.

Out-of-Pocket Maximums

The out-of-pocket maximum is the maximum amount you will have to pay for covered medical services in a given year. Once you reach this limit, your insurance company will cover 100% of the remaining costs.

Exclusions

Exclusions are specific medical conditions, treatments, or services that are not covered by your insurance policy. It's crucial to review the exclusions section carefully to understand any limitations or restrictions on your coverage.

"Understanding insurance terminology is key to making informed decisions about your health coverage."

By familiarizing yourself with these insurance terms, you can effectively compare policies, understand the costs involved, and make the right choices for your personal health insurance needs. To further illustrate how these terms impact your coverage, refer to the table below:

TermDefinitionImportanceDeductiblesThe amount you pay before insurance coverage beginsUnderstanding deductibles helps you plan for out-of-pocket expenses and budget accordingly.CopaymentsA fixed amount you pay for specific medical servicesCopayments help manage the costs of routine doctor visits or prescription medications.Out-of-Pocket MaximumsThe limit on the amount you have to pay for covered servicesKnowing the out-of-pocket maximum protects you from excessive medical costs.ExclusionsConditions, treatments, or services not covered by the insurance policyUnderstanding exclusions helps you plan for potential out-of-pocket expenses for specific medical needs.

Applying for Private Medical Insurance

When it comes to securing the right private medical insurance for your needs, applying for an individual health plan is an essential step. This section will guide you through the application process, ensuring you have all the necessary documents and understand the eligibility criteria.

Before you begin your application, it's important to collect the following documents:

- Proof of identification

- Proof of residency

- Tax identification number

- Employment information

- Recent medical records

Once you have your documents ready, you can proceed with the application process. Here are the steps to follow:

- Research and compare different private medical insurance plans to find the one that suits your needs best. Consider factors such as coverage options, network of providers, and cost.

Read the full article

#comparehealthinsuranceplans#healthinsurancecoverage#healthcareplan#individualhealthplan#medicalcoverage#medicalinsurancequote#personalhealthinsurance#privatehealthcarepolicy#privatemedicalinsurance

0 notes

Text

Thailand Traveller Safety Scheme offers tourists visa-free access and in addition, medical coverage worth $14,000 (500,000 baht) for accidents. The scheme excludes accidents due to negligence, intent, illegal activities, or risky behaviour. In the event of death, it offers compensation of up to one million baht. The Thailand Traveller Safety scheme will run from Jan 1st, 2024 till Aug 31st 2024.

#ThailandHealthcare#MedicalCoverage#TouristSafety#ThailandWellness#TouristInsurance#ThailandMedicalCoverage#SafeTravels#ThailandTourism#TouristInsuranceCoverage#SafeTourism

0 notes

Text

What is Denials and Appeals Management Services?

Denials and appeals management services in the healthcare industry refer to outsourced or specialized services that help healthcare providers address and rectify denied insurance claims efficiently.

If you have any questions, Don't hesitate to get in touch at [email protected] or +1-9175252370

Contact us :

📞 +1-9175252370

🌐 www.anviamhealthcare.com

#Medical #healthcare #USAToday #RCM #healthtips #insuranceclaim #insuranceadvisor #medicalbilling #HealthcareForAll #medicalcare #MedicalCover #doctor #hospital #denialmanagement #Appeal #Appealing

#healthcare#anviamhealthcare#medical coding#medicalbillingservices#usa#health#medical care#claims#revenue cycle management#marketing#denial management#appeal#insurance claims#expert claims#doctors#prevention#medicalcoverage#medicine#medical billing services

0 notes

Text

ग्रुप मेडिकल इंश्योरेंस के लाभ | स्वास्थ्य सुरक्षा की गारंटी

कंपनियां या संगठन अपने कर्मचारियों की सुविधा के लिए ग्रुप मेडिकल कवरेज (जीएमसी) प्रदान करते हैं। यह कंपनियों के कुल मुआवजा पैकेज का एक महत्त्वपूर्ण हिस्सा है। जीएमसी पॉलिसी वेतनभोगी लोगों के लिए बुनियादी स्वास्थ्य बीमा सुरक्षा पाने का एक अच्छा तरीक़ा है। आमतौर पर, जीएमसी का लाभ तभी मिलता है जब आप किसी कंपनी … Read more

#GroupMedicalInsurance#HealthProtection#InsuranceBenefits#MedicalCoverage#GroupHealthPlan#HealthSecurity#InsuranceGuarantee#HealthcareProtection#GroupInsuranceAdvantages#HealthCoverageBenefits

0 notes

Text

NTUC Health Insurance: Your Comprehensive Guide to Understanding the Basics

If there's one thing that tops the list of priorities in today's fast-paced world, it's our health. Ensuring that we have adequate health insurance is essential to safeguarding our well-being and providing financial security during medical emergencies.

Read the full article

#elderlycare#familyhealthinsurance#healthinsurance#healthinsuranceclaims#healthinsuranceFAQs#healthinsuranceproviders#healthinsurancerenewal#healthinsurancetips#hospitalizationcoverage#individualhealthinsurance#insurancecoverage#insuranceenrollment#maternitycoverage#medicalcoverage#NTUCbenefits#NTUCexclusions#NTUCHealthInsurance#outpatientcare#preventivehealthcare#Singaporehealthcare#Singaporeinsurance#specialistconsultations

0 notes

Text

What is medical health insurance for children?

Subtitle - What Is Health Insurance for Kids and Why It's Essential

Subtitle - A Parent's Guide to Understanding Health Insurance for Kids: Everything You Need to Know

Health coverage for kids is sort of a safety internet for his or her health. It's a special form of coverage that helps cover the price of scientific take care of children.

When children get ill or harmed, having medical health insurance way dad and mom do not fear purchasing high-priced health practitioner visits or remedies. It helps make sure children can get the care they want without inflicting economic strain on his or her households.

Health coverage for children generally covers things like physician visits, vaccinations, prescription medications, or even sanatorium remains if they're sincerely unwell or injured. It's like having a safety cushion that enables families to deal with unexpected health issues without breaking the bank.

In the subsequent sections, we will delve deeper into why medical health insurance for kids is essential, the distinctive forms of plans available, and how dads and moms can make certain their children are covered.

Insurance dates back to historical civilizations in which merchants shared the chance of losses from shipwrecks and robberies. Over time, it evolved into formal contracts to defend people and businesses from economic losses due to unexpected activities.

Description: Insurance is a monetary association wherein individuals or businesses pay charges to an insurer in trade for safety against specific risks. It affords peace of mind with the aid of transferring the load of capability losses to the insurer.

Importance: Insurance performs a critical role in cutting-edge society using mitigating financial risks and uncertainties. It guarantees economic balance by way of masking losses bobbing up from accidents, ailments, natural disasters, and different sudden occasions.

Advantages: Insurance offers several blessings, which include monetary safety, hazard management, and asset renovation. It promotes economic stability with the aid of enabling people and organizations to recover from setbacks without going through catastrophic economic results.

2 - Importance of Health Insurance for Kids

Health coverage for kids is exceptionally critical! It's like a protection that protects them whilst they are unwell or harmed. Here's why it's the sort of massive deal:

First off, medical insurance enables dads and moms to find the money for scientific take care of their kids. You realize, like whilst you want to see the doctor because you are no longer feeling nice or while you by accident damage your arm. Without coverage, these visits can cost a whole lot of money!

Also, having a coverage approach children can get regular United States of America vaccinations to live healthily. It's like giving their bodies extra superpowers to combat off germs and live strong!

Plus, if something severe happens, like if they want to stay within the medical institution, insurance enables them to cover the charges too. It's like having a protection net that catches you whilst you fall.

So, medical insurance for youngsters isn't pretty much going to the medical doctor whilst you're ill. It's approximately making sure they stay healthful, sturdy, and secure no matter what existence throws their manner!

3 - Sorts of Health care coverage Plans for Kids

How about we talk about the various assortments of medical coverage plans for youngsters? There are a couple of choices, each with its own advantages:

Boss Supported Plans: These are frequently provided by the father and mother's businesses. They're like a process gain, which means that the employer helps pay for the insurance. It's a bargain as it usually prices less.

Government Programs: Some children can get coverage through packages like Medicaid or the Children's Health Insurance Program (CHIP). These programs help families who won't be able to have enough money for private insurance.

Individual Plans: These are offered directly from coverage corporations. They're excellent for families who don't have access to company-sponsored plans or qualify for government programs. They may be greater expensive but provide flexibility.

No, depends on which kind of plan you pick, the critical component is making sure your youngsters have the coverage they need to stay healthful and happy!

4 - Types of Health Insurance Plans for Children

Coverage Options and Benefits

Let's discover the coverage alternatives and benefits of health insurance plans for children. These plans provide distinctive kinds of insurance to preserve children's health and satisfy:

Doctor Visits: Most medical health insurance plans cover ordinary check-united states of America with a medical doctor. This allows seize any health issues early and keeps youngsters on course with their increase and improvement.

Prescription Medications: If youngsters want remedy to assist them feel higher, insurance can assist cover the cost. This guarantees they get the proper treatment without disturbing about the charge.

Hospital Stays: In case of significant illness or harm, insurance facilitates pay for health center visits and remains. This offers dad and mom peace of mind knowing their baby can get the care they want without monetary pressure.

Specialist Care: Sometimes youngsters need to see a specialist, like a pediatrician or a dermatologist. Insurance can cover these visits too, making sure youngsters get specialized care whilst important.

With those protection choices, fathers and mothers can unwind certain that their child's medical care wants are met, advancing their prosperity and ensuring a splendid and healthy predetermination.

5 - How to Obtain Health Insurance for Kids/How to Get Health Care Coverage for Youngsters

We should talk about a method for getting clinical protection for youngsters. It's critical to make sure youngsters have the insurance they want to live wholesome and happy. Here's how dad and mom can do it:

Through Employers: Many mothers and fathers can get medical insurance for their children through their jobs. They simply want to check with their business enterprise to see if they provide a circle of relatives coverage.

Through Government Programs: Some families can also qualify for authorities programs like Medicaid or CHIP. These applications offer low-value or free medical health insurance for kids.

Buying Individual Plans: If parents do not have access to business enterprise-sponsored plans or authority programs, they should purchase personal insurance plans immediately from coverage businesses.

Using Health Insurance Marketplaces: Some states have medical health insurance marketplaces wherein dads and moms can evaluate and purchase exceptional insurance plans for their youngsters. These marketplaces make it easy to discover affordable options.

By exploring those alternatives, parents can discover a nice health insurance plan for their children, making sure they have get right of entry to to the hospital therapy they need to thrive.

6 - Government Programs for Child Health Insurance

Let's communicate about government packages that assist offer medical insurance for kids. These programs are like a helping hand for households who won't be able to have the funds for personal coverage. Here are some options:

Medicaid: This program enables families with low income to have the funds for healthcare. It covers kids, pregnant girls, or even some adults. Families can observe via their nation's Medicaid workplace.

Children's Health Insurance Program (CHIP): CHIP offers minimal-expense health care coverage to adolescents in families who don't meet all requirements for Medicaid anyway can't have sufficient cash for individual inclusion. It's an outstanding choice for families who want greater assistance.

State-Specific Programs: Some states provide their very own programs to help uninsured children get health coverage. These programs vary using the kingdom but usually, the purpose is to offer cheap insurance alternatives for youngsters.

By enrolling in those government packages, families can make sure their youngsters have get admitted to to the hospital treatment they need, irrespective of their economic scenario.

7 - Tips for Choosing the Right Plan

Choosing the right health insurance plan for your kids may be complicated, but these hints can assist make the choice simpler:

Know Your Needs: Think approximately what sort of insurance your youngsters want. Do they have any ongoing health problems or want regular take-a-look-ups? Make sure the plan you choose covers this stuff.

Check the Network: Look at the list of doctors and hospitals that are a part of the plan's community. Make sure your child's contemporary doctor is protected, or discover in case you're k with switching to a brand new one.

Consider Costs/Think about Expenses: Analyze the charges of various plans, like month-to-month charges, deductibles, and copayments. Pick an arrangement that accommodates your financial plan anyway regardless gives satisfactory protection.

Think About Extras: Some plans provide greater blessings like dental or imaginative and prescient insurance. Consider whether these extras are crucial for your children and if they're worth paying more for.

Peruse the Fine Print: Get some margin to study through the arrangement's subtleties, which incorporate protection restrictions and prohibitions. Cause positive you to figure out what's covered and what's no more.

By following those clues, you could choose the quality clinical health care coverage anticipate your children, ensuring they have admission to the consideration they need to remain energizing and blissful.

8 - Frequently Asked Questions about Children's Health Insurance/Habitually Posed Inquiries about Kids' Health care coverage

Here are a few to-be-expected inquiries about father and mother might have roughly youngsters' medical coverage, alongside straightforward arrangements:

What is children's medical insurance?

Children's medical health insurance is a type of insurance that covers the price of scientific care for children. It ensures they can get the healthcare they want without parents demanding approximately the expenses.

Why do children want medical health insurance?

Kids need medical insurance to ensure they might see a doctor whilst they're ill, get vaccines to stay healthy, and attain remedy if they are injured or have a scientific circumstance.

How can I get medical health insurance for my child?

Parents can get medical insurance for his or her toddler through their corporation, government packages like Medicaid or CHIP, or via shopping for a plan at once from a coverage organization.

What does a kid's medical insurance cowl?

Children's clinical medical health insurance normally covers such things as doctor visits, medical institution stays, prescription drugs, and preventive care like vaccines and test-ups.

How a lot does children's medical insurance cost?

The price of children's medical health insurance varies depending on factors just as the sort of plan, the circle of relatives's earnings, and in which they stay. Some families may additionally qualify for low-fee or unfastened insurance through government packages.

These solutions need to help mothers and fathers understand the fundamentals of children's medical health insurance and a manner to ensure their youngsters are covered for their healthcare desires.

9 - Conclusion: Ensuring a Healthy Future for

In conclusion, ensuring a wholesome destiny for kids starts with having the proper medical health insurance. By offering youngsters with get entry to to hospital treatment via coverage, dads and moms can guard their well-being and sell their boom and improvement.

With medical insurance, youngsters can receive timely check-ups, vaccinations, and treatments, supporting them to live healthy and strong. This not simplest prevents illnesses but additionally ensures that any health problems are addressed right away, minimizing their effect on children's lives.

Furthermore, health insurance offers economic safety for families, relieving the weight of clinical costs and permitting mothers and fathers to be cognizant of imparting a nurturing environment for their kids to thrive in.

In essence, by prioritizing kid's medical health insurance, mother and father can lay the foundation for a vibrant future for their little ones. With access to the best healthcare, children can grow up healthy, satisfied, and prepared to conquer the arena.

#<#KidsHealthInsurance> <#ChildCoverage> <#PediatricInsurance>#FamilyWellness> <#HealthcareProtection> <#ParentingEssentials>#ChildHealthcare> <#InsuranceExplained> <#FinancialSecurity>#KidsWellness> <#MedicalCoverage> <#ParentalPeaceOfMind>#HealthcareForKids> <#InsuranceBenefits> <#FutureProtection>

0 notes

Photo

In search of better rates for Super Visa insurance? Head to www.quotescanada.ca to get instant, obligation-free quotes. If you find it challenging to understand, don't hesitate to call 905-906-7000 for assistance. #SuperVisaInsurance #VisitorsInsurance #MedicalCoverage...

0 notes

Photo

#antidiscrimination #documentation #medicalcoverage I do recognize the that forgot the word “need” in the second part. https://www.instagram.com/p/B4kdZfpAaBL/?igshid=rt8qeiysfbga

0 notes

Photo

☮️💟🕉☯️ #InfusionTreatment #RheumatoidArthritis #Fibromyalgia #ChronicPain #Lupus #Kaiser #Gratitude #MedicalCoverage #PeaceLoveOm ☮💟🕉 (at Kaiser Permanente Hospital) https://www.instagram.com/p/BwIhhx6Awb6hXpyZkHmnEVXO_wqVJHRjPBZHtQ0/?utm_source=ig_tumblr_share&igshid=sxswoc95oexj

#infusiontreatment#rheumatoidarthritis#fibromyalgia#chronicpain#lupus#kaiser#gratitude#medicalcoverage#peaceloveom

0 notes

Video

Did you know today is "World Health Day"?! . . . The World Health Day is a global health awareness day celebrated every year on 7 April. ❤️🗺 🌎 ❤️ . . The World Health Organization (WHO) is dedicated to this theme: "Universal health coverage: everyone, everywhere." Their slogan is "Health For All," which you will probably see all over social media in hashtag form as #HealthForAll, often in conjunction with #WorldHealthDay. Health Care Professionals: Now is the time to take a stand with the world and preach #HealthForAll. If your clinic, practice, or you personally work hard to ensure health care coverage for all or would like to, you can use today to your advantage and offer visibility. Not only will you benefit from the exposure, but so will local patients who are looking for health care that doesn't cost an arm or a leg. Educate: You can show your followers why promoting awareness for World Health Day is so important. You can come up with a couple of facts that drive the point home in a short 15-25 second clip, optimized for multiple social platforms. Hashtags to use: #WorldHealthDay, #WorldHealthOrganization, #Health, #Healthcare, #HealthForAll, #HealthcareForAll, #MedicalCoverage, #Medicine, #Doctors, #Nurses, #CheckUp, #HealthServices, #Finances, #Coverage, #Inspire, #Motivate, Guide, #UHC, #UnitedHealthCoverage, #EveryoneEverywhere, #WorldHealthDay20, #HealthForAll20 #praguian #praguiantour #praguianphotographer #prague 🇨🇿 #czechrepublic #videooftheday #bestvideoofday #contentmedia #instagram (at Europe/Prague) https://www.instagram.com/p/B-sXiJGH2Rn/?igshid=erchxdgcjtfi

#healthforall#worldhealthday#worldhealthorganization#health#healthcare#healthcareforall#medicalcoverage#medicine#doctors#nurses#checkup#healthservices#finances#coverage#inspire#motivate#uhc#unitedhealthcoverage#everyoneeverywhere#worldhealthday20#healthforall20#praguian#praguiantour#praguianphotographer#prague#czechrepublic#videooftheday#bestvideoofday#contentmedia#instagram

0 notes

Video

Hola mi gente! Ya es tiempo para hacer su Cita con migó para ver sus opciones de su nuevo plan médico. Mi número directo es 817-962-9062. #seguromedico #medico #ayuda #educacion #theinsurancequeen #familia #mama #medicalcoverage #coverage #health #helpingothers #heretohelp #familytime #savemoney #savetime #freequote https://www.instagram.com/p/B34rM-ZpFXM/?igshid=6lfi1cr07tec

#seguromedico#medico#ayuda#educacion#theinsurancequeen#familia#mama#medicalcoverage#coverage#health#helpingothers#heretohelp#familytime#savemoney#savetime#freequote

0 notes

Link

Auto crashes and medical payment coverage with auto insurance getting the right type of coverage when it comes to your auto insurance policy is important. Learn here: https://goo.gl/i82BJN

#texas#insurance#auto#car#insurancetexas#carinsurance#autoinsurance#cheapautoinsurance#cheapcarinsurance#insurancepolicy#medicalcoverage#medicalpayment

0 notes

Text

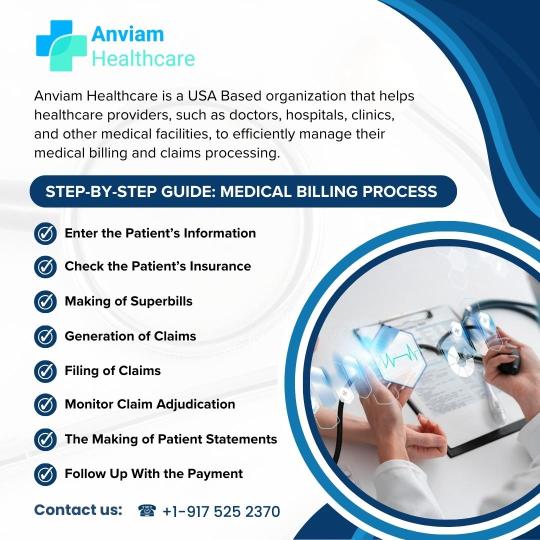

Anviam Healthcare is a USA Based organization that helps healthcare providers, such as doctors, hospitals, clinics, and other medical facilities, to efficiently manage their medical billing and claims processing.

Step-By-Step Guide: Medical Billing Process

1. Enter the Patient’s Information

2. Check the Patient’s Insurance

3. Making of Superbills

4. Generation of Claims

5. Filing of Claims

6. Monitor Claim Adjudication

7. The Making of Patient Statements

8. Follow Up With the Payment

For More Info:-

Contact us :

📞 +1-9175252370

🌐 www.anviamhealthcare.com

#medical coding#medicalbillingservices#healthcare#usa#health#medical care#revenue cycle management#anviamhealthcare#hospitals#claims#medicalcoverage#usa today#insurance claims#medical billing company

0 notes

Video

youtube

Me talking about my transition and how many struggles im having with my medical coverage and transitioning services

#transgender#ftm transgender#ftm#transitioningupdates#medicaid#medicalcoverage#trans#ftm progress#ftm problems

0 notes

Photo

Star Health Insurance | Start early to enjoy more benefits Start early, it’s always a good idea t... #blogema #affordablehealthinsuranceplan #affordablehealthinsurancepolicy #besthealthinsuranceplan #besthealthinsurancepolicy #floaterpolicy #healthinsurance #healthinsuranceplan #healthinsurancepolicy #healthcare #healthcarecoverage #individualpolicy #insurance #insuranceplan #insurancepolicy #medicalcoverage #medicalinsurance #starhealth #starhealthinsurance

0 notes