#Market Research Report BNPL

Text

Opportunities in the global prepaid card and digital wallet market

Digitalization, rising e-commerce activities, and a tech-savvy population are the key factors aiding the growth of the global prepaid card and digital wallet market in 2023. The trend is projected to further continue over the next five years, as PayNXT360 estimates that the market will grow at a compound annual growth rate (CAGR) of 10.3% from 2023 to 2027, increasing from US$1.5 trillion in 2022 to reach US$2.5 trillion by 2027. The data clearly indicates that there is plenty of headroom for growth in the global prepaid card and digital wallet market.

#Market Research Report BNPL#Social Commerce market size#Global Social Commerce Industry#Social Commerce market research#Loyalty Market Share#Report on Loyalty Management Market#Loyalty Management Market Size#U.S. Loyalty Management Market#Global Loyalty Management Market Forecast#Global Remittance Market#Digital Remittance Market Analysis#Industry Outlook on Remittance#Growth of B2B Ecommerce Market#B2B Ecommerce Industry size#B2B Ecommerce Market Analysis#Global B2C Ecommerce Market#B2C Ecommerce research report#Alternative lending market size#Digital lending market size#Alternative lending research report#Fintech market research#Fintech research report#Fintech industry analysis

0 notes

Text

BNPL is dramatically uplifting the e-commerce business through AI and ML integrations

Though the short-term point of sale loans is not new, BNPL has been possible because of the recent maturity of artificial intelligence and machine learning. Specifically, by taking advantage of AI/ML, BNPL platforms are empowered to collect and analyze customer data, thereby helping companies to take more sophisticated decisions and generate revenue over the longer run. Thus, this innovative payment method is facilitating companies to take advantage of data-driven strategies to unlock value in a sales environment that is shifting online.

Future of BNPL- AI/ML driven business models driving growth across organizations

With the adoption of BNPL payments, key market players need to infuse their go-to-market strategies with advanced technology, AI/ML, to make these programs sustainable. Specifically, to manage risk and respond quickly to market needs, these BNPL providers need to harness data, respond to the shift as needed, and keep pace with the evolving regulatory environment. These data-driven decisions will help the key market players to have a direct and tangible impact on the future adaptability, growth and longevity of the BNPL offering over the long run.

BNPL providers are partnering up with AI-powered technology providers to verify their identities

The BNPL payments space is highly regulated, and therefore, BNPL providers need to emphasize 'know your customer' (KYC) and anti-money laundering (AML) regulations. Therefore, BNPL platforms are partnering up with AI-based tech platforms to curb the growing fintech fraud rates. For instance,

In June 2022, Twisto, a Zip Company, a BNPL provider, announced its partnership with Veriff, a global identity verification provider, to provide identity verification (IDV) services for online merchants. Through this partnership, Veriff will enable the consumers to quickly and seamlessly verify their identities via Twisto's platform.

This partnership expedites the IDV process, ensuring compliance with know your customer (KYC) regulations. Notably, Veriff provides KYC verification with its video-first technology and offers users extra protection through location verification.

Since post integration of Veriff's technology, Twisto noticed a significant increase in the customer conversion rate; PayNXT360 expects this partnership to continue in the long run with increased benefits to both companies.

Banking software companies are launching AI-Driven Buy-Now-Pay-Later Banking Service

With the rising popularity of BNPL loans, Banking-as-a-Service (BaaS) also got revolutionized. This became important since consumers now need a frictionless digital experience and easy access to finance at the point of sale. Therefore, software companies are launching AI-based BNPL banking services to attract more customers. For instance,

In January 2022, Temenos, the banking software company, launched its BNPL banking service. Now, Temenos BNPL, combined with patented Explainable AI (XAI), will be able to help banks create ethically-driven lending programs.

Moreover, post embedding XAI, Temenos will enable banks and fintech firms to pre-approve loan applications in real-time based on pre-determined criteria, including soft and hard credit scoring.

Since this AI-based BNPL service is innovative, it is expected that the banks and fintechs will be attracted, acquiring significant customers over the long run.

To know more and gain a deeper understanding of the global BNPL market, click here.

0 notes

Text

Embedded Finance Market Surges with a 16.5% CAGR, Set to Reach US$ 291.3 Billion by 2033

It is projected that the embedded finance industry would grow at a robust 16.5% compound annual growth rate (CAGR) from 2023 to 2033. The market is anticipated to be valued at US$ 63.2 billion in 2023 and to have a market share of US$ 291.3 billion by 2033.

The technical advantages along with the expanding financial services including banking and non-banking options are flourishing the market growth. Furthermore, the rapid automation and adoption of smart platforms of different spaces for high productivity and efficiency are propelling growth.

Financial giants are partnering with technological platforms for innovative solutions. For example, Mastercard and Fabrick have signed a partnership to boost embedded finance. New services like buy now pay later (BNPL) and credit reporting are good examples of embedded finance.

The expanding sales and extended chains of banks and financial companies are expected to adopt these new systems in to improve the services offered. Alongside this, the increased convenience, quick transaction, and highly accessible interface is making embedded finance systems future-ready.

The growing sales of financial services have also increased the importance of data. Thus, the embedded finance systems also deliver a relevant collection of data while adding inclusion and convenience to the end user’s plate.

The other benefits include the generation of additional revenue streams while increasing the product’s stickiness, and enhanced customer experience.

Get an overview of the market from industry experts to evaluate and develop growth strategies. Get your sample report here

https://www.futuremarketinsights.com/reports/sample/rep-gb-14548

Key Takeaways:

The United States market leads the embedded finance market in terms of market share in North America. The United States region held a market share of 22.3% in 2023. The growth in this region is attributed to expanding financial firms, and the government’s adoption of the latest technologies. North American region held a significant market share of 32.5% in 2022.

Germany’s market is another successful market in the Europe region. The market holds a market share of 12.3% in 2022. The growth is attributed to the presence of new embedded finance platforms such as Plaid, and Alviere Hive. Europe region held a market share of 25.4% in 2022

India embedded finance market booms at a CAGR of 19.5% during the forecast period. The market’s growth is attributed to the new banking policies, enlarged non-banking policies, and high penetration of non-banking platforms.

China’s market also thrives at a CAGR of 17.7% between 2023 and 2033. The growth is caused by the banking reforms and increased focus on consumer inclusivity.

Based on type, the embedded banking segment held a leading market share of 32.1% in 2022.

Based on end-user type, the investment banks and investments company segment perform well as it held a leading market share of 27.2% in 2022.

Competitive Landscape:

The key vendors focus on adding value to the embedded finance systems and easy deployment procedures. Moreover, key competitors also merge, acquire, and partner with other companies to increase their supply chain and distribution channel.

Major Players in this Market:

Bankable

Banxware

Cross River

Resolve

Parafin

TreviPay

Balance

Stripe

Speak to Our Research Expert https://www.futuremarketinsights.com/ask-question/rep-gb-14548

Recent Market Developments:

Finix has introduced embedded payments and the vertical SaaS conundrum. The addition of embedded payments is increasing revenue, reducing the payment strike, and easy customer engagement.

Flywire embedded experience is using smart technologies to secure payments without leaving the website.

Key Segments Covered are:

By Type:

Embedded Banking

Embedded Insurance

Embedded Investments

Embedded Lending

Embedded Payment

By End User:

Loans Associations

Investment Banks & Investment Companies

Brokerage Firms

Insurance Companies

Mortgage Companies

By Key Regions:

North America

Latin America

Europe

Japan

Asia Pacific Excluding Japan

The Middle East and Africa

0 notes

Text

Buy Now Pay Later Platforms Market to Witness Excellent Revenue Growth Owing to Rapid Increase in Demand

The term ‘Buy now pay later is referring to the customer taking home their purchase but paying for it over time. Pay later shopping typically referred to an interest-free period following the purchase, during which no payments were made and no interest charged. However, after this interest-free period, payment in full was expected otherwise the interest from the original time of purchase was added. The advantage of Buy Now Pay Later (BNPL) for shoppers is the potential to pay no interest if payments met on time or the entire amount is paid off by the time the loan period ends which is boosting the market.

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/153653-global-buy-now-pay-later-platforms-market?utm_source=Organic&utm_medium=Vinay

Latest released the research study on Global Buy Now Pay Later Platforms Market, offers a detailed overview of the factors influencing the global business scope. Buy Now Pay Later Platforms Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Buy Now Pay Later Platforms The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are Afterpay (Australia), Zippay (Australia), VISA (United States), Sezzle (United States), Affirm (United States), Paypal (United States), Splitit (United States), Latitude Financial Services (Australia), Klarna (Sweden), Flexigroup (Australia), Openpay (Australia)

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

0 notes

Text

A few years ago, a lot of people believed that crypto doesn’t have a future. While their perception was utterly wrong, they were right about one thing. All those folks said that the world should adopt blockchain but abandon crypto. That didn’t happen but many firms actually inducted the technology into their operations. Today, some leading organizations have made it an integral part of their numerous projects. Moreover, investors have started classifying them as blockchain stocks.

As the adoption of this technology is growing, these companies are also getting popular. They are already renowned names in their domain, but now, they’re being associated with blockchain. Thus, the experts are recommending their picks from this fledging niche. Moreover, putting money in these stocks is like investing in the future. Thus, market participants are keen on them.

US Blockchain Stocks To Look Out For

These companies are deploying blockchain on a large scale in many of their projects.

Nvidia

Nvidia is a major GPU manufacturer that leads the front on many technologies. It provides chips to companies that make games, self-driving vehicles, and AI-based applications. Its products are essential elements for cryptocurrency mining firms. Without the chips, the process of mining can not take place. Therefore, it has a strong potential as a blockchain stock.

Block

Formerly known as Square, the company operates in the payment processing and personal finance niches. It provides a range of solutions including BNPL, stock trading, and business lending. Furthermore, it offers help in building e-commerce and omnichannel platforms. It associates with blockchain by offering Bitcoin sales and purchases. In 2021, it reported more than $10 Billion in crypto sales.

IBM

IBM is a leading software and IT solutions provider. Recently, the company started offering help with decentralized projects. It also acquired an open-source software developer Red Hat. Besides all that, it is assisting companies that directly deal with blockchain or cryptocurrency. Its developers and project managers have great knowledge of decentralized ledgers.

Mastercard

The inclination of fintech companies towards blockchain shouldn’t really surprise anyone. Mastercard is a payment processing giant that has acknowledged the potential of blockchain. The company has been endeavoring to make its cashless services more efficient. It also aspires to make cross-border payments faster. For that purpose, it has joined hands with blockchain companies.

Amazon

Apart from being an e-commerce giant, Amazon is a prominent player in cloud technology. That’s where it integrates blockchain technology into its operations. The Amazon Web Services (AWS) offers Amazon Managed Blockchain. It allows the customers to manage their own blockchain networks.

Conclusion

With these blockchain stocks, investors can certainly ensure solid profits as they belong to giants of their domains. The companies have a diversified line of products and their reach is ubiquitous. Besides blockchain, they can be categorized as regular tech stocks as well. Hence, investing in them is certainly a wise choice for traders. However, volatility and certain market conditions can impact the biggest stocks too. Investors are advised to do thorough research before making any decision.

0 notes

Text

Empowering Consumers: Exploring the Benefits of E-commerce Buy Now, Pay Later

The e-commerce buy now pay later (BNPL) market has seen significant growth over the years, driven by several key trends and growth factors. One major trend is the increasing in the e-commerce buy now pay later market is the growing partnership between buy now pay later providers and merchants. This allows merchants to offer BNPL options to their customers, and also allows BNPL providers to expand their reach and customer base. Furthermore, BNPL options have become more popular as a result of the expansion of mobile payments, particularly in developing nations where mobile phones are the main method of internet access. Moreover, in order to serve these markets, BNPL companies put more and more effort into creating mobile-friendly solutions. In addition, consumers may now access buy now pay later choices more easily through e-commerce sites that incorporate them into their checkout procedures. Moreover, this has led to a rise in the use of BNPL alternatives and improved conversion rates for e-commerce platforms. These e-commerce buy now pay later market trends and growth factors thus shape the future of the e-commerce buy now pay later market and is anticipated to continue to drive growth and innovation in the coming years

According to a new report published by Allied Market Research, titled, “E-Commerce Buy Now Pay Later Market," The e-commerce buy now pay later market was valued at $4.2 billion in 2022, and is estimated to reach $57.8 billion by 2032, growing at a CAGR of 30.4% from 2023 to 2032.

The E-commerce buy now pay later market is expected to continue growing in the coming years, driven by factors such as the increasing adoption of buy now pay later option by retailers, and collaborating with financial institutions, such as banks and payment processors, and the E-commerce buy now pay later market is expanding into new markets, particularly in emerging markets where traditional credit options are less prevalent.

The world of online shopping is constantly evolving, and one trend that has gained significant traction in recent years is the concept of "Buy Now, Pay Later" (BNPL) services. This innovative payment model has reshaped the way consumers make purchases and has also provided retailers with a valuable tool for boosting sales and customer loyalty.

The Rise of BNPL:

Buy Now, Pay Later services have rapidly transformed from a niche offering to a mainstream payment option. This growth can be attributed to several factors, including changing consumer preferences, the ease of online shopping, and the desire for flexible payment solutions. BNPL platforms like Klarna, Afterpay, and Affirm have gained immense popularity by allowing shoppers to split their payments into smaller, interest-free installments over time.

The Consumer Appeal:

One of the key reasons for the widespread adoption of BNPL services is the appeal they hold for consumers. Traditional credit cards often come with high-interest rates and the risk of accumulating debt, whereas BNPL offers a more controlled and transparent approach to budgeting. With the ability to spread out payments, shoppers can enjoy immediate gratification without the worry of hefty interest charges.

Click Here to Download a Sample Report of E-Commerce Buy Now Pay Later Market

Benefits for Retailers:

Retailers have been quick to recognize the advantages of integrating BNPL options into their online stores. This payment model can significantly increase conversion rates, as customers are more likely to complete purchases when given the option to pay in installments. Additionally, BNPL can attract new customers who might have otherwise been deterred by upfront costs. The seamless checkout process associated with BNPL services can also reduce cart abandonment rates, boosting overall sales.

Building Customer Loyalty:

Beyond just boosting sales, BNPL services can foster long-term customer loyalty. By providing flexible payment solutions, retailers show that they understand and cater to their customers' financial preferences. This positive shopping experience encourages repeat business and referrals. Customers are more likely to return to a retailer that offers a smooth and convenient purchasing process.

Challenges and Considerations:

While the BNPL model offers significant benefits, it's not without its challenges. Some critics argue that it could potentially encourage overspending and financial irresponsibility among consumers. To address this concern, responsible lending practices and clear communication about repayment terms are essential. Additionally, retailers must carefully evaluate the costs associated with offering BNPL options, as there are fees involved for using these services.

Regulatory Scrutiny:

The rapid growth of BNPL services has prompted regulatory scrutiny in various regions. Authorities are keen to ensure that consumer rights are protected and that lending practices are fair and transparent. As a result, BNPL providers and retailers must stay informed about the evolving regulatory landscape and adapt their practices accordingly.

Conclusion:

The Buy Now, Pay Later trend has undoubtedly transformed the e-commerce landscape, offering benefits for both consumers and retailers. With its ability to enhance customer satisfaction, drive sales, and build loyalty, it's clear that BNPL is here to stay. However, responsible implementation, transparent communication, and adherence to regulatory guidelines will be crucial in maintaining the integrity of this payment model as it continues to evolve.

0 notes

Text

India Digital Lending Market is in Growing Stage, Being Driven by Digitization in the country along with the presence of 100+ Players in the Industry: Ken Research

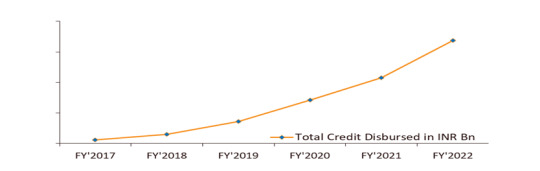

Digital Lending Platforms are addressing the huge unmet demand for credit as the Market has grown @ CAGR 131.9% During FY’2017-FY’2022.

To Know More on this report, Download free Sample Report

India’s market for digital lending has grown from INR 116.7 billion in FY’2017 to INR 3,377.7 billion in FY’2022P. The growth is supported by the need for superior customer experience, emerging business models, faster turn-around time, and adoption of technology like AI. Customers are adopting digital avenues as a result of the rise in smartphone usage and internet penetration. Digital channels influence 40 to 60% of loan purchase transactions across loan types.

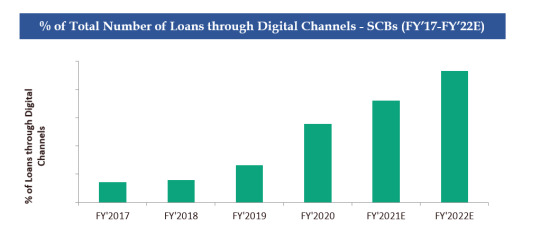

2. Loans through Digital Channels on NBFCs has increased from 0.6% in FY’2017 to 53.0% in Dec, 2020 owing to the rise in BNPL schemes and lower interest rates offered by the Lending Platforms.

Visit this Link Request for custom report

Commercial banks are rapidly joining the genre of financial intermediaries either lending digitally on their own or joining with NBFCs to share the synergies. The Digital Lending Company’s requirements are lower, and the process is significantly quicker. They need just a bank account as a reference point where loans can be credited and therefore % of Loans through Digital Channels are higher with NBFCs. The flexibility that BNPL schemes offer has completely transformed the digital lending market, particularly for younger shoppers, who are happy to trade traditional credit cards for more user-friendly BNPL schemes. The rapid uptake of Buy Now, Pay Later (BNPL) propositions, particularly within the retail sector, continues to drive major growth and new opportunities for NBFCs in India.

3. Rising Internet Penetration, Rise of innovative Models and an enabling regulatory environment are some of the Major Driving Factors for Digital Lending in India

To Know More on this report, Download free Sample Report

Higher penetration of smartphones, increasing number of mobile phone subscriptions coupled with inexpensive data has result in the growth and also supported the awareness and adoption rate of Digital Lending in India’s population. The popularity of Digital Lending has increased in India owing to NBFCs platforms collaborating with other digital platforms such as e-commerce, ride hailing, travel, logistics and more, resulting in higher acceptance of digital lending from various customer segments in the country. Digital Lending Pioneered by NBFCs, have now resulted in Companies from various segments coming up with multiple new models of doing business such as Digital Lending Marketplaces, POS Transaction Lending, Bank and NBFCs partnership models and more.2

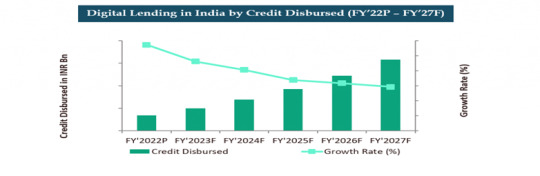

4. Digital Lending Market to Reach INR ~15,000 billion by FY’2027 Making Digital Lending a Sector with the Highest Penetration by Digital Channels in the Country.

To more about industry trends, Request a free Expert call

Strategic partnerships and collaborations between traditional financial institutions and new-age Lending Platforms. Plus, easy market entry and targeted loan offerings due to availability of large sets of customer data, which can give collective and individual insights. Changing consumer behavior and expectations shaped by purchase/ transaction experiences offered by e-marketplaces like food delivery, e-commerce and travel portals.

#b2b lending companies in india#Capital Float Digital Lending Market Revenue#Challenges in India’s Digital Lending Market#commercial loan Providers in India#Competitors in Digital Lending Market India#consumer durable loan market in india#redit disbursement in India#Credit lending startups in India#emand of Digital Lending in India#digital channels in India#digital credit industry in India#Digital lending ecosystem in India#digital lending growth in india#digital lending in India#digital lending market size in india#digital lending platform market#Digital lending value in India#digital loans Providers in India#Emerging Players in India Digital Lending Market#fastest-growing fintech in India#Financial Services Sector in India#fintech Compnanies in India#future trends for financial services sector in india#Impact of digital lending on MSME in india#India Digital Lending Industry#India Digital Lending Market#India Digital Lending Market Major Players#India Digital Lending Sector#India's retail loan Providers#India's Road Map for Digital Lending

0 notes

Text

Buy Now Pay Later Market Size Worth $38.57 Billion By 2030

Buy Now Pay Later Market Growth & Trends

The global buy now pay later market size is expected to reach USD 38.57 billion by 2030, registering a CAGR of 26.1% from 2023 to 2030, according to a new report by Grand View Research, Inc. The market growth can be attributed to the high purchasing power offered by the BNPL platforms, coupled with benefits, such as interest-free and convenient payments.…

View On WordPress

0 notes

Text

Buy Now Pay Later Platforms Market to Scale New Heights as Buy Now Pay Later Platforms Market Players Focus on Innovations 2022 – 2027

Latest Report Available at Advance Market Analytics, “Buy Now Pay Later Platforms Market” provides pin-point analysis for changing competitive dynamics and a forward looking perspective on different factors driving or restraining industry growth.

The global Buy Now Pay Later Platforms market focuses on encompassing major statistical evidence for the Buy Now Pay Later Platforms industry as it offers our readers a value addition on guiding them in encountering the obstacles surrounding the market. A comprehensive addition of several factors such as global distribution, manufacturers, market size, and market factors that affect the global contributions are reported in the study. In addition the Buy Now Pay Later Platforms study also shifts its attention with an in-depth competitive landscape, defined growth opportunities, market share coupled with product type and applications, key companies responsible for the production, and utilized strategies are also marked.Some key players in the global Buy Now Pay Later Platforms market are

Afterpay (Australia)

Zippay (Australia)

VISA (United States)

Sezzle (United States)

Affirm (United States)

Paypal (United States)

Splitit (United States)

Latitude Financial Services (Australia)

Klarna (Sweden)

Flexigroup (Australia)

Openpay (Australia)

The term ‘Buy now pay later is referring to the customer taking home their purchase but paying for it over time. Pay later shopping typically referred to an interest-free period following the purchase, during which no payments were made and no interest charged. However, after this interest-free period, payment in full was expected otherwise the interest from the original time of purchase was added. The advantage of Buy Now Pay Later (BNPL) for shoppers is the potential to pay no interest if payments met on time or the entire amount is paid off by the time the loan period ends which is boosting the market.What's Trending in Market: Advancement in Technology

Challenges: Lack of Awareness among the User

Market Growth Drivers: Increased Number of Internet Users

Wide Number of Benefits offered by BNPL Platforms

The Global Buy Now Pay Later Platforms Market segments and Market Data Break Downby End User Industry (Fashion & Garment Industry, Consumer Electronics, Cosmetic Industry, Healthcare, Others), End User (SMEs, Large Enterprises)

Presented By

AMA Research & Media LLP

0 notes

Text

Buy Now Pay Later Market to Observe Strong Growth to Generate Massive Revenue in Coming Years

Latest edition released by AMA on Global Buy Now Pay Later Platforms Market to regulate the balance of demand and supply. This intelligence report on Buy Now Pay Later Platforms includes Investigation of past progress, ongoing market scenarios, and future prospects. Data True to market on the products, strategies and market share of leading companies of this particular market are mentioned. It’s a 360-degree overview of the global market’s competitive landscape. The report further predicts the size and valuation of the global market during the forecast period.

Some of the key players profiled in the study are:

Afterpay (Australia)

Zippay (Australia)

VISA (United States)

Sezzle (United States)

Affirm (United States)

Paypal (United States)

Splitit (United States)

Latitude Financial Services (Australia)

Klarna (Sweden)

Flexigroup (Australia)

Openpay (Australia)

The term ‘Buy now pay later is referring to the customer taking home their purchase but paying for it over time. Pay later shopping typically referred to an interest-free period following the purchase, during which no payments were made and no interest charged. However, after this interest-free period, payment in full was expected otherwise the interest from the original time of purchase was added. The advantage of Buy Now Pay Later (BNPL) for shoppers is the potential to pay no interest if payments met on time or the entire amount is paid off by the time the loan period ends which is boosting the market.

Market Trends: Advancement in Technology

Opportunities: Growth in E-commerce Industry

Growth in Developing Countries

Market Drivers: Increased Number of Internet Users

Wide Number of Benefits offered by BNPL Platforms

Challenges: Lack of Awareness among the User

Presented By

AMA Research & Media LLP

0 notes

Text

0 notes

Text

Starbucks reshaping its loyalty program through prepaid card system

Starbucks is all set to launch its new loyalty program effective from April this year. The major change which has been implemented in the new loyalty program is the earning of stars. In the old system, the number of stars earned was based on the count of transactions of a customer. In the new system, the stars would be awarded based on the amount spent at each transaction. Another significant aspect of the loyalty program is that, the prepaid card system will be launched by the end of 2016, which would function like a Visa Card and would be acceptable at other retail outlets too. The reward point structure on the card usage outside of Starbucks has yet not been structured, but it will soon be in place.

#Embedded finance Industry size#Global Prepaid card market size#Industry outlook on BNPL#Prepaid card report#Report on Embedded Finance#Market Research Report BNPL#Social Commerce market size#Global Social Commerce Industry#Social Commerce market research#Loyalty Market Share#Report on Loyalty Management Market#Loyalty Management Market Size#U.S. Loyalty Management Market#Global Loyalty Management Market Forecast#Global Remittance Market#Digital Remittance Market Analysis#Industry Outlook on Remittance

0 notes

Text

The credit disbursed in KSA Car Finance Market is expected to grow to ~SAR 70 Bn by 2026F, driven by entry of women drivers and increasing employment opportunities: Ken Research

KSA Car Finance Market is in the growing stage, being driven by banks and NBC’s along with introduction of Fin-Tech companies and online personal loan aggregator platforms. Major entities in the market are Banks and Captives that are 70-80 years old offering variety of financing services.

Growth rate of total cars financed is going to increase over the period as financing becomes easier, market penetration rates increase.

The Vision 2030 project in KSA has massive plans for the economy in terms of infrastructure and investment which will improve employment figures and increase incomes.

Entry of women drivers in the market has led to an increase in the total cars sold and hence the credit disbursed in car finance sector. This trend is expected to continue to 2026.

Increase in Private Entities: The Government stake in the Saudi Arabia Car finance market is decreasing, hence the percentage share of government to private might shift to private. Government stake in SNB has gone down from 44.2% in 2016 to 37.2% in 2022. Finance companies are partnering with Banks so they can offer loan more than 33% of customer’s salary. For example- Riyad Bank works with Al Amthal Financing. It is not a sister company, but they have collaborated together. Both share the profits from customers.

New Players in the Market and Partnership with Finance Companies: New players entering the KSA Car finance market are Fin-tech companies. Around 38 companies have received approval from the Central Bank and have started garnering database by entering into the market with digital wallets and offering products like BNPL. Also, Finance companies are partnering with Banks so they can offer loan more than 33% of customer’s salary. For example- Riyad Bank works with Al Amthal Financing. It is not a sister company, but they have collaborated together. Both share the profits from customers.

Get in front of Prospects through AI: When customers shop for a car, they need information about two things the car itself and how to finance it. A tighter online integration of information gathering for car buying and car financing can help move a consumer to the next stage of the purchasing process. The solution is an interactive online interface embedded with AI. The online experience must extend seamlessly into the dealership – for instance, by giving the customer access to terms and pricing details on their mobile app rather than having to rely on the dealer.

Analysts at Ken Research in their latest publication “KSA Car Finance Market Outlook to 2026F- Driven by Women Entering the Market, Increasing Employment Opportunities in the Kingdom” by Ken Research observed that KSA Car Finance Market is in the growing phase. Enhancing Service Offerings, collaborations with partners, expand pipeline with predictive analysis and getting in front of prospects through AI are some of the factors that will contributed to the KSA Car Finance market growth over the period of 2021-2026F. It is expected that KSA Car Finance Market will grow at a CAGR of 11.7% for the above forecasted period.

Key Segments Covered in the report:-

KSA Car Finance Market

By Type of Vehicle Financing

New car financing

Used car financing

By Type of Car Financed

Hatchbacks

Sedans

Sports Utility Vehicle

Multi-Purpose Vehicle

By Price

High (500,000+)

Medium (200k-500k)

Low (below 200K)

To learn more about this report Download a Free Sample Report

By Type of Institution

Banks

NBFC's

Captives

By Tenure of Loans

<2 years

3-4 years

4-5 years

By Major Cities

Riyadh

Jeddah

Dammam

Others

By Booking Mode

Online

Offline

Key Target Audience

Banks and its Subsidiaries

NBFCs

Captive Finance Companies

Government and Institutions

Automobile Companies

Car Dealers

Government and Institutions

Existing Car Finance Companies

OEM Dealerships

New Market Entrants

Investors

Auto mobile Associations

Visit this Link :- Request for custom report

Time Period Captured in the Report:-

Historical Period: 2017-2021

Base Period: 2021

Forecast Period: 2022-2026F

Companies Covered:-

Banks

Al Rajhi Bank

Riyad Bank

Al Jazeera Bank

Alinma Bank

Arab National Bank

NBFC’s

Al Yusr Leasing and Financing

Al Amthal Financing Company

National Finance House

Tajeer Finance

National Finance Company

Murabaha Marina Finance Company

OEM’s

Abdul Latif Jameel United Finance Co. (Toyota Distributor)

ALJABR FINANCE (KIA Distributor)

Walan finance company (hyundai)

Geely Finance (Geely Distributor)

Key Topics Covered in the Report:-

KSA Automotive Market Overview

Ecosystem, Business Cycle and Evolution of KSA Car Finance Market

KSA Car Finance Value Chain Analysis

Islamic Banking and Car Finance in KSA

KSA Car Finance Market by Credit Disbursed, 2017-2021

KSA Car Finance Market by Outstanding loans, 2017-2021

KSA Car Finance Market Segmentation, 2021

SWOT Analysis of KSA Car Finance Industry

Infrastructure Development Overview of KSA

Trends and Developments in KSA Car Finance Industry

Operational Strategies for KSA Car Finance Services Market

Issues and Challenges in KSA Car Finance Industry

Government Policies and Initiatives for Automotive Industry

Growth Drivers of KSA Car Finance Market

KSA Car Finance Market Competition Overview

Cross Comparison of Major Players in KSA Car Finance Market

Strengths and Weakness of Major Players in KSA Car finance market

Future Outlook and Market Projections, 2026F

Case Study on Al Rajhi Bank

Growth strategies for KSA Car Finance Market

For more insights on the market intelligence, refer to below link:-

KSA Car Finance Market

Related Reports by Ken Research:-

Malaysia Automotive Finance Market Outlook to 2026-Driven by exorbitant car prices, growing digital penetration, preference for owning passenger cars amidst systematically regulated car ownership policies by the Government

Qatar Auto Finance Market Outlook to 2026F– Driven by Increasing Vehicle Prices and Low-Interest Rate In The Country

Philippines Auto Finance Market Outlook to 2026- Driven by change in consumer spending, ease in provision of loans, improving technology and government support

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

0 notes

Text

Buy Now Pay Later Platforms Market Will Hit Big Revenues In Future | Biggest Opportunity Of 2022

Latest business intelligence report released on Global Buy Now Pay Later Platforms Market, covers different industry elements and growth inclinations that helps in predicting market forecast. The report allows complete assessment of current and future scenario scaling top to bottom investigation about the market size, % share of key and emerging segment, major development, and technological advancements. Also, the statistical survey elaborates detailed commentary on changing market dynamics that includes market growth drivers, roadblocks and challenges, future opportunities, and influencing trends to better understand Buy Now Pay Later Platforms market outlook.

List of Key Players Profiled in the study includes market overview, business strategies, financials, Development activities, Market Share and SWOT analysis are:

Afterpay (Australia)

Zippay (Australia)

VISA (United States)

Sezzle (United States)

Affirm (United States)

Paypal (United States)

Splitit (United States)

Latitude Financial Services (Australia)

Klarna (Sweden)

Flexigroup (Australia)

Openpay (Australia)

The term ‘Buy now pay later is referring to the customer taking home their purchase but paying for it over time. Pay later shopping typically referred to an interest-free period following the purchase, during which no payments were made and no interest charged. However, after this interest-free period, payment in full was expected otherwise the interest from the original time of purchase was added. The advantage of Buy Now Pay Later (BNPL) for shoppers is the potential to pay no interest if payments met on time or the entire amount is paid off by the time the loan period ends which is boosting the market.

Key Market Trends: Advancement in Technology

Opportunities: Growth in E-commerce Industry

Growth in Developing Countries

Market Growth Drivers: Increased Number of Internet Users

Wide Number of Benefits offered by BNPL Platforms

Challenges: Lack of Awareness among the User

The Global Buy Now Pay Later Platforms Market segments and Market Data Break Down by End User Industry (Fashion & Garment Industry, Consumer Electronics, Cosmetic Industry, Healthcare, Others), End User (SMEs, Large Enterprises)

Presented By

AMA Research & Media LLP

0 notes

Text

: More people use ‘buy now, pay later’ for holiday shopping, but experts say that’s a double-edged sword

: More people use ‘buy now, pay later’ for holiday shopping, but experts say that’s a double-edged sword

Online purchases using the BNPL rose by 13% year-on-year in November, according to Adobe Analytics. That figure does not take into account Thanksgiving or Black Friday spending.

“In an uncertain economic environment, a more cautious consumer is embracing more flexible ways to manage their budget,” Adobe ADBE, the software and market-research company, said in a report Friday.

This form of online…

View On WordPress

0 notes

Text

Trends in Digital Money and Payments

Digital transformation continues to impact all industry sectors, and online payments are no exception. Before COVID-19 digital payments were already growing, and this growth accelerated during the pandemic. According to a McKinsey report, in 2021, 82 percent of Americans used digital payments, up from 72 percent five years earlier.

Other commerce areas have also witnessed significant change. For example, consumer interest in installment-based payment solutions such as the buy now pay later (BNPL) model has increased rapidly in recent years. In particular, the BNPL online payment trend is gaining more popularity among younger generations.

According to Insider Intelligence data, in 2025, the global BNPL industry will hit $680 billion in transaction volume. Similar to credit cards, BNPL offers consumers unsecured credit. The difference, however, is in the accessibility and placement of the BNPL service itself, which occurs at the checkout point for both physical stores and online platforms.

And it’s not just the diversity of payment options that are behind the e-commerce payment revolution, but also their prevalence. The use of omnichannel digital payments continues to expand, and will be a significant driver of e-commerce payment transactions. For example, this means that payment options like cryptocurrency or Amazon Pay will expand beyond online shopping. Going forward, consumers will have access to the same payment options in a physical store as they would on a mobile app or online.

Even in traditional banking, innovation has transformed what was once an expensive and complex banking infrastructure into a more simplified and accessible one. Innovation now allows any company to venture into the FinTech sector. FinTech involves the creation of new financial products and services that are cheaper and that often contribute to a better customer experience. Early examples of FinTech payment solutions include PayPal and Amazon Pay.

The e-commerce world is set to have a broad range of currencies operating alongside fiat currencies. Many of them will be quasi-fiat currencies such as stablecoins. Increasingly, money will be smart, private, public, local, international, and everything in between. Although most of these currencies will primarily be digital, there will be a continued representation of the physical, particularly in sovereign currencies.

Over the coming years, cryptocurrencies will continue to flourish with some falling by the wayside equally quickly. One trend that will gain more prominence is the integration of cryptocurrencies into mainstream financial services. Already, experiments with diverse stablecoins and tokens are widespread in different capital markets. Regulators will step up efforts at developing mechanisms to oversee crypto-related financial activities, with some central banks even joining the digital currency bandwagon.

However, in designing, launching, and running central bank digital currencies (CBDCs), there must be cooperation and partnership between the public and private sectors. CBDCs are digital versions of cash, designed, issued, and regulated by central banks. However, the balance of power, functions, and activities between the public and private sectors may vary widely between countries.

Sustainably and eco-friendly issues have also found their way into payment systems. Consumer awareness about sustainable and green payment products is growing. According to research by Visa, 62 percent of consumers expressed their willingness to continue using a bank if it demonstrated sustainable benefits. For example, new solutions like Visa Eco Benefits may help integrate green features into card payments that help users appreciate how their spending habits impact the environment.

1 note

·

View note