#MARKET OUTLOOK

Text

Bangladesh QSR Market Report: Trends, Analysis, and Growth Insights | P&S Intelligence

The value of the Bangladeshi quick-service restaurants market stood at USD 1,712.4 million in 2023, and this number is projected to reach USD 2,653.4 million by 2030, advancing at a CAGR of 7.1% during 2023–2030. This growth can be credited to the developing lifestyle of the adult populace, the increasing count of QSRs in the nation, the growing demand for fast food among the urban populace, and the rising working populace in the city and semi-urban areas of the country.

The demand for easy foods is increasing quickly among customers in Bangladesh, due to the parallel variations in the working and social lives and the mounting habit of dining out. People these days like to socialize over good food, away from the house. Therefore, because of the shortage of time, numerous contemporary nuclear families tend to choose convenient, quick meals over old-style meals.

American cuisine is likely to advance at the highest rate during this decade. This is because of the high requirement for fries, pizzas, and burgers among the young populace as well as the busy lifestyle of adults, which makes a requirement for convenience foods. Furthermore, other cuisines like Italian, Mexican, and Chinese, are also broadly prevalent among Bangladeshi citizens.

Moreover, the rising purchasing power of customers with their increasing per capita income, particularly in Dhaka, has boosted the sale of prepared food from QSRs in this nation. Bangladesh's economy is facing an era of low inflation, rising household income, and speedy progress.

As per the World Bank, Bangladesh has a purchasing power parity of 32.1 LCU per international dollar in 2021, in comparison to 16.3 LCU in 2002, advancing at a 3.63% average annual rate.

Furthermore, people, now, socialize with friends, neighbors, or colleagues, as compared to before for social or business purposes. This led to the increasing consumption of meals in fast food settings, which further boosted the industry.

#Bangladesh QSR Market#Market Report#P&S Intelligence#Fast Food Industry#Trends#Analysis#Growth Insights#Quick Service Restaurants#Market Dynamics#Food and Beverage Market#Market Research#Industry Overview#Competitive Analysis#Regional Analysis#QSR Market Size#Market Outlook#Dining Trends

2 notes

·

View notes

Text

#marketing#market research#astute analytica#market growth#market size#market forecast#market trends#market outlook

2 notes

·

View notes

Text

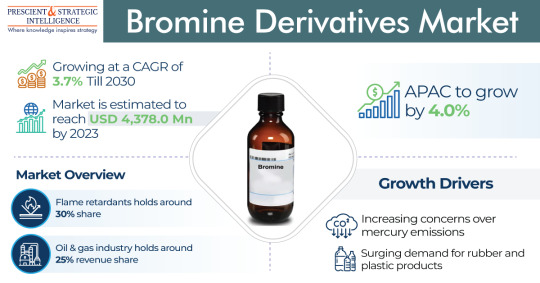

Bromine Derivatives Market Report: Demand Analysis, and Growth Forecasts | P&S Intelligence

The bromine derivatives market was USD 4,378.0 million in 2023, which will rise to USD 5,614.1 million, powering at a 3.7% compound annual growth rate, by 2030.This is because of the extensive use of these chemicals in the pharmaceutical, construction, oil & gas, electronics, and automotive sectors, coupled with the growing requirement for plastic & rubber products.

Moreover, the calcium bromide…

View On WordPress

#analysis#Bromine Derivatives Demand#Bromine Derivatives Market#Bromine Industry#Competitive Analysis#Global Bromine Derivatives Market#Growth Forecasts#Industry Overview#industry trends#Market dynamics#Market Insights#market outlook#Market Report#Market Research#P&S Intelligence#regional analysis

0 notes

Text

Medical Device Market

The global Medical Device Market is witnessing rapid growth, driven by advancements in technology and increasing healthcare demands. This dynamic sector encompasses a wide range of products, from diagnostic devices to surgical instruments, offering immense opportunities for innovation and investment. With a focus on patient care and improved outcomes, the Medical Device Market continues to expand and evolve.

#Medical Device Market#Medical Devices#Market Research Reports#Industry Analysis#Market Outlook#Market Forecast

1 note

·

View note

Text

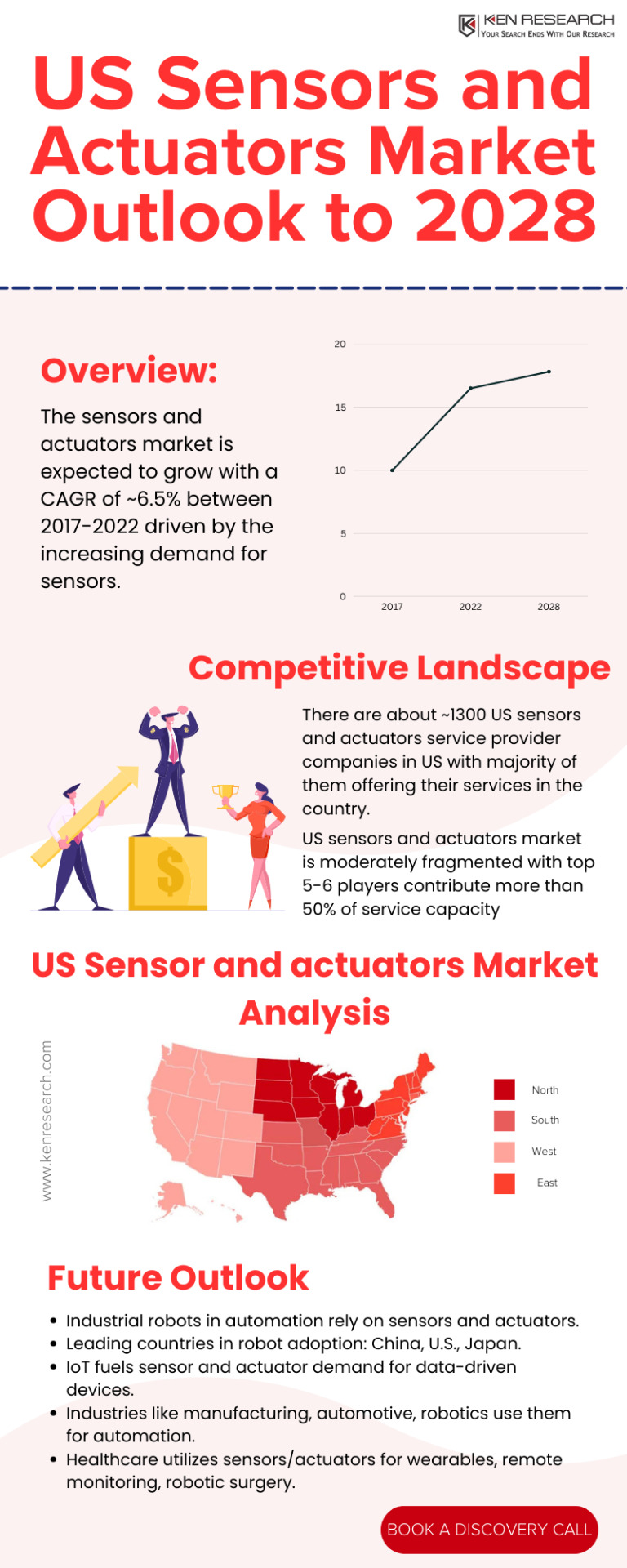

Forecast for the US Sensors and Actuators Market up to 2028

#Market Trends#Market Size#Market Share#Market Growth#Industry Developments#Companies Revenue#Market Outlook#Industry Size#Market Analysis#Market Forecast#Future Projections#Market Insight#Competition Analysis#Sales Growth#Market Segmentation#Market CAGR#Sector Growth#Future Analysis#Industry Outlook#Import Export Scenario Company Profiles#Customer preference#Competitive Landscape

0 notes

Text

The Growing Demand for ESG Data: Trends and Market Outlook

Profitability is no longer the only method investors use to assess whether a business is a secure opportunity. With growing scrutiny around ethical organizational practices, the link between sustainable operations and 21st-century investors has never been stronger.

Businesses are now quick to incorporate ESG factors into their ethos. As a result, their impact on their surrounding environment propels further business growth and cements the business as a lucrative long-term investment.

How is ESG data used in investment decision-making?

The ESG (Environmental, Social and Governance) framework is utilized to understand an organization's activities and its understanding of ethical and sustainability concerns.

Environmental

When businesses account for Environmental factors, the organization understands how their day-to-day and long-term activities affect the surrounding environment. This includes understanding how processes negatively or positively impact global challenges such as climate change or communal issues such as waste management or pollution.

Social

Social factors help businesses introduce and sustain internal ethical practices to ensure stakeholders are treated fairly. Social factors ensure businesses do not propagate discriminatory practices and ensure all individuals are affected by organizational activities.

Governance

Governance factors ensure the business stays compliant with legal requirements and practices. This means incorporating recognized industry practices and policies into corporate culture and ensuring activities could not be scrutinized or fined at a later date.

Integration of ESG Factors in Investment Decision-Making

ESG is not just a buzzword. A growing number of investors are using ESG metrics as a non-financial metric to understand where potential risks lie and how strong prospects for growth are.

As of 2022, 89% of investors considered ESG data and issues in their investment approach. 31% of European investors and 18% of North American investors have revealed ESG data to be the most critical factor when considering investments.

Growing interest has prompted the development of a number of reputed institutions whose sole purpose is to standardize ESG assessment factors. As a result, the new era of investors is able to access information critical to their decision-making process and long/short-term goals.

The Role of Data Providers and Research Firms in the ESG Data Market

With the growing standardization of ESG assessment metrics, investors are looking to widely known data providers and research firms for validated information. Market Data providers such as Bloomberg and Thomson Reuters now offer information about ESG topics using proprietary methods. The data providers also offer businesses statistics around the social aspect of ESG, allowing them to better understand industry trends and changes to be made.

The rising demand for ESG information has also created specialized data suppliers. Companies, including Ethos and Convalence, offer end-to-end ESG data services. They customize their assessment techniques based on the information needed and assist investors with risk analysis tools for better decision-making.

Finally, specialized data providers help investors detect new opportunities or assess risk by offering comprehensive data around one or two ESG factors.

It is important to understand there is minimal information about how ESG factors directly affect finances. Data providers and research firms offer an abundance of verified supplementary information to prevent irrelevant comparisons and account for disparities.

Emerging Trends in ESG Data and Reporting

The growing popularity of ESG investing has risen to assets worth USD $2.5 trillion as of 2022. Observing ESG data trends and market trends simultaneously allows investors to minimize risks while maximizing returns.

Here are the trends ESG investors are looking at in 2023:

Impact of Climate Change

While climate change has been a global issue for years, 2023 is likely to see an increased focus. Companies are assessing their carbon footprint and adjusting their day-to-day activities accordingly.

The post-COVID global economy, with all its negatives, showcased that companies are still able to operate and lower overall running costs while introducing new practices. Larger scale industries, including construction, transport, aerospace, and defence, are able to adjust their activities to join the green movement. As this trend grows, ESG-based investments grow, and businesses can adhere to newly established market trends to stay appealing.

The Ethics Behind Supply Chains

This generation of customers wants answers. It is no longer just about the efficacy of a product but the steps taken to create it. Customers are now looking into the role of human rights, working conditions, child labour law, and other critical codes of conduct in order to decide whether to purchase.

Companies working in fast fashion, for example, have been the centre of news headlines describing how low costs are translated down to customers leading to protests and boycotts.

ESG investors now require regular audits, a thorough understanding of conduct codes, and demonstrations around training for employees. Companies that are not ESG compliant have a hard time gathering investment. In this case, slow fashion companies that work with upcycled garments, recycled fabrics, and ethical practices not only receive hefty investments but a strong customer base as a result of their conscientiousness.

Diversity, Equality and Inclusion (DEI)

The conscious consumer is less likely to support businesses with unfair internal practices or compliance with discrimination. As organizations focus on including diversity and understanding subconscious bias, customers are more likely to feel comfortable engaging with the organization and its products.

As a result, businesses are more likely to share information about the lack of gender bias, equal pay policies, annual training and introducing more diversity in positions of leadership.

ESG investors invest in companies that consciously include diversity and equality as new demographics open, more customer-friendly practices are in place, and employees content with their workplace put out higher quality products and services.

Reduce, Reuse, Recycle

The slogan has circulated the globe with ideas around minimizing waste and upcycling items that no longer serve their original purpose. ESG investors are constantly on the lookout for businesses that have disrupted traditional models and introduced better practices around consumption and waste.

A strong force for 2023 is businesses introducing new methods to harness any unwanted material as a result of their activities and repurposing the same not only to assist the business but surrounding communities.

ESG investors identify an organization's willingness to maintain profitability while being conscious and ethical as an ideal candidate for investment.

Keeping Digital Identities Safe

We live in the age of technology. Your virtual identity can do anything from creating social structures to handling finances. As more businesses have migrated to e-commerce, there is a growing concern about customer information staying private as opposed to being repurposed or stolen.

Businesses factoring in ESG often have transparent information about collecting customer data on their websites. This allows customers to understand what purchasing from a website means and make an educated decision to complete the transaction or purchase from elsewhere.

ESG investors have witnessed many of an organization's downfalls as a result of selling customer information to 3rd parties or a lack of adequate cyber security measures. Businesses with strong data protection policies in place automatically become more appealing to ESG investors. Non-compliant businesses are likely to be on the receiving end of strong legal action and build a lack of trust with prospective customers.

Read also: The Evolution of ESG Data and its Future Outlook

What is the market outlook for ESG data?

ESG factors are critical to business success in the 21st century. In an era of cancel culture and accountability, investors are looking for longevity. Investing in a business that is supported by surrounding communities and the government and minimizes collateral damage has never been more critical. As more standardized information is shared around the ESG metric, businesses are left with no choice but to introduce better internal and external practices to ensure survival.

As the number of ESG-centric investors grows and the value of ESG assets rises, the global economy can look forward to being fueled by companies that approach business with a more holistic perspective.

SG Analytics is an industry leader in ESG services, providing custom sustainability advice and research to aid deliberation. Contact us today if you are looking for an effective ESG integration and management solution provider to improve your company's long-term viability.

0 notes

Text

The Growing Demand for ESG Data: Trends and Market Outlook

Published on Jun 23, 2023

Profitability is no longer the only method investors use to assess whether a business is a secure opportunity. With growing scrutiny around ethical organizational practices, the link between sustainable operations and 21st-century investors has never been stronger.

Businesses are now quick to incorporate ESG factors into their ethos. As a result, their impact on their surrounding environment propels further business growth and cements the business as a lucrative long-term investment.

How is ESG data used in investment decision-making?

The ESG (Environmental, Social and Governance) framework is utilized to understand an organization's activities and its understanding of ethical and sustainability concerns.

Environmental

When businesses account for Environmental factors, the organization understands how their day-to-day and long-term activities affect the surrounding environment. This includes understanding how processes negatively or positively impact global challenges such as climate change or communal issues such as waste management or pollution.

Social

Social factors help businesses introduce and sustain internal ethical practices to ensure stakeholders are treated fairly. Social factors ensure businesses do not propagate discriminatory practices and ensure all individuals are affected by organizational activities.

Governance

Governance factors ensure the business stays compliant with legal requirements and practices. This means incorporating recognized industry practices and policies into corporate culture and ensuring activities could not be scrutinized or fined at a later date.

Integration of ESG Factors in Investment Decision-Making

ESG is not just a buzzword. A growing number of investors are using ESG metrics as a non-financial metric to understand where potential risks lie and how strong prospects for growth are.

As of 2022, 89% of investors considered ESG data and issues in their investment approach. 31% of European investors and 18% of North American investors have revealed ESG data to be the most critical factor when considering investments.

Growing interest has prompted the development of a number of reputed institutions whose sole purpose is to standardize ESG assessment factors. As a result, the new era of investors is able to access information critical to their decision-making process and long/short-term goals.

The Role of Data Providers and Research Firms in the ESG Data Market

With the growing standardization of ESG assessment metrics, investors are looking to widely known data providers and research firms for validated information. Market Data providers such as Bloomberg and Thomson Reuters now offer information about ESG topics using proprietary methods. The data providers also offer businesses statistics around the social aspect of ESG, allowing them to better understand industry trends and changes to be made.

The rising demand for ESG information has also created specialized data suppliers. Companies, including Ethos and Convalence, offer end-to-end ESG data services. They customize their assessment techniques based on the information needed and assist investors with risk analysis tools for better decision-making.

Finally, specialized data providers help investors detect new opportunities or assess risk by offering comprehensive data around one or two ESG factors.

It is important to understand there is minimal information about how ESG factors directly affect finances. Data providers and research firms offer an abundance of verified supplementary information to prevent irrelevant comparisons and account for disparities.

Emerging Trends in ESG Data and Reporting

The growing popularity of ESG investing has risen to assets worth USD $2.5 trillion as of 2022. Observing ESG data trends and market trends simultaneously allows investors to minimize risks while maximizing returns.

Here are the trends ESG investors are looking at in 2023:

Impact of Climate Change

While climate change has been a global issue for years, 2023 is likely to see an increased focus. Companies are assessing their carbon footprint and adjusting their day-to-day activities accordingly.

The post-COVID global economy, with all its negatives, showcased that companies are still able to operate and lower overall running costs while introducing new practices. Larger scale industries, including construction, transport, aerospace, and defence, are able to adjust their activities to join the green movement. As this trend grows, ESG-based investments grow, and businesses can adhere to newly established market trends to stay appealing.

The Ethics Behind Supply Chains

This generation of customers wants answers. It is no longer just about the efficacy of a product but the steps taken to create it. Customers are now looking into the role of human rights, working conditions, child labour law, and other critical codes of conduct in order to decide whether to purchase.

Companies working in fast fashion, for example, have been the centre of news headlines describing how low costs are translated down to customers leading to protests and boycotts.

ESG investors now require regular audits, a thorough understanding of conduct codes, and demonstrations around training for employees. Companies that are not ESG compliant have a hard time gathering investment. In this case, slow fashion companies that work with upcycled garments, recycled fabrics, and ethical practices not only receive hefty investments but a strong customer base as a result of their conscientiousness.

Diversity, Equality and Inclusion (DEI)

The conscious consumer is less likely to support businesses with unfair internal practices or compliance with discrimination. As organizations focus on including diversity and understanding subconscious bias, customers are more likely to feel comfortable engaging with the organization and its products.

As a result, businesses are more likely to share information about the lack of gender bias, equal pay policies, annual training and introducing more diversity in positions of leadership.

ESG investors invest in companies that consciously include diversity and equality as new demographics open, more customer-friendly practices are in place, and employees content with their workplace put out higher quality products and services.

Reduce, Reuse, Recycle

The slogan has circulated the globe with ideas around minimizing waste and upcycling items that no longer serve their original purpose. ESG investors are constantly on the lookout for businesses that have disrupted traditional models and introduced better practices around consumption and waste.

A strong force for 2023 is businesses introducing new methods to harness any unwanted material as a result of their activities and repurposing the same not only to assist the business but surrounding communities.

ESG investors identify an organization's willingness to maintain profitability while being conscious and ethical as an ideal candidate for investment.

Keeping Digital Identities Safe

We live in the age of technology. Your virtual identity can do anything from creating social structures to handling finances. As more businesses have migrated to e-commerce, there is a growing concern about customer information staying private as opposed to being repurposed or stolen.

Businesses factoring in ESG often have transparent information about collecting customer data on their websites. This allows customers to understand what purchasing from a website means and make an educated decision to complete the transaction or purchase from elsewhere.

ESG investors have witnessed many of an organization's downfalls as a result of selling customer information to 3rd parties or a lack of adequate cyber security measures. Businesses with strong data protection policies in place automatically become more appealing to ESG investors. Non-compliant businesses are likely to be on the receiving end of strong legal action and build a lack of trust with prospective customers.

Read also: The Evolution of ESG Data and its Future Outlook

What is the market outlook for ESG data?

ESG factors are critical to business success in the 21st century. In an era of cancel culture and accountability, investors are looking for longevity. Investing in a business that is supported by surrounding communities and the government and minimizes collateral damage has never been more critical. As more standardized information is shared around the ESG metric, businesses are left with no choice but to introduce better internal and external practices to ensure survival.

As the number of ESG-centric investors grows and the value of ESG assets rises, the global economy can look forward to being fueled by companies that approach business with a more holistic perspective.

SG Analytics is an industry leader in ESG services, providing custom sustainability advice and research to aid deliberation. Contact us today if you are looking for an effective ESG integration and management solution provider to improve your company's long-term viability.

0 notes

Text

Electrical Submersible Pump Power Cable Market Report Includes Business Strategies and Huge Demand by 2032

Overview:

The Electrical Submersible Pump (ESP) Power Cable Market refers to the market for power cables specifically designed for electrical submersible pumps used in various applications such as oil and gas, mining, water management, and other industrial sectors. These power cables are designed to withstand the harsh conditions of submersible environments and deliver reliable power to submersible pumps. Electric Submersible Cables (ESP) Market size is expected to reach US$ 5221.58 Mn. by 2029, growing at a CAGR of 3.1% during the forecast period.

Trends:

Growing Oil and Gas Industry: The demand for ESP power cables is driven by the increasing exploration and production activities in the oil and gas sector. As the industry continues to expand, the need for efficient and reliable submersible pumping systems, supported by high-quality power cables, is expected to rise.

Technological Advancements: The ESP power cable market is witnessing continuous advancements in terms of cable materials, insulation technologies, and cable design. These advancements aim to enhance the durability, efficiency, and performance of the cables, allowing for higher power transmission and longer service life.

Rising Focus on Energy Efficiency: With a growing emphasis on energy efficiency and sustainability, there is an increasing demand for ESP power cables that offer improved electrical conductivity and reduced power losses. Energy-efficient cables help optimize power consumption and reduce operational costs.

Demand: The demand for ESP power cables is driven by several factors, including:

Increasing Submersible Pump Installations: The installation of electrical submersible pumps is expanding across various industries due to their efficiency and ability to handle high volumes of fluid. This, in turn, drives the demand for power cables specifically designed for these pumps.

Replacement and Retrofitting: As older submersible pump systems reach the end of their lifecycle, there is a demand for replacement cables. Retrofitting existing systems with advanced power cables can improve performance and extend the overall lifespan of the pumping systems.

Outlook:

The ESP power cable market is expected to grow steadily in the coming years. Factors such as increasing oil and gas exploration activities, growing industrialization, and the need for efficient water management systems contribute to the market's positive outlook.

Furthermore, the development of advanced materials, insulation technologies, and manufacturing techniques will likely result in the introduction of more reliable and durable ESP power cables. As the demand for energy-efficient solutions continues to rise, the market is expected to witness an increasing focus on cables that offer enhanced conductivity and reduced power losses.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/electrical-submersible-pump-power-cable-market/4129/

Market Segmentations:

Global Electrical Submersible Pump Power Cable Market: By Company

• Hitachi

• Borets

• GE

• Kerite

• Schlumberger

• Prysmian

• Halliburton

• Weatherford

• General Cable

Global Electrical Submersible Pump Power Cable Market: By Type

• Polypropylene

• Ethylene Propylene Diene

Global Electrical Submersible Pump Power Cable Market: By Application

• Offshore

• Onshore

Global Electrical Submersible Pump Power Cable Market: Regional Analysis

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Electrical Submersible Pump Power Cable market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Visit Report Page for More Details: https://stringentdatalytics.com/reports/electrical-submersible-pump-power-cable-market/4129/

Reasons to Purchase Electrical Submersible Pump Power Cable Market Report:

• To obtain insights into industry trends and dynamics, including market size, growth rates, and important factors and difficulties. This study offers insightful information on these topics.

• To identify important participants and rivals: This research studies can assist companies in identifying key participants and rivals in their sector, along with their market share, business plans, and strengths and weaknesses.

• To comprehend consumer behaviour: these research studies can offer insightful information about customer behaviour, including preferences, spending patterns, and demographics.

• To assess market opportunities: These research studies can aid companies in assessing market chances, such as prospective new goods or services, fresh markets, and new trends.

• To make well-informed business decisions: These research reports give companies data-driven insights that they may use to plan their strategy, develop new products, and devise marketing and advertising plans.

In general, market research studies offer companies and organisations useful data that can aid in making decisions and maintaining competitiveness in their industry. They can offer a strong basis for decision-making, strategy formulation, and company planning.

Click Here, To Buy Premium Report: https://stringentdatalytics.com/purchase/electrical-submersible-pump-power-cable-market/4129/?license=single

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#Power Losses#Retrofitting#Replacement Cables#Advanced Cable Design#Durability#Efficiency#Energy Consumption#Market Demand#Market Trends#Market Outlook#Power Cable Market#Electrical Industry.

0 notes

Link

The report "Chromatography Resin Market by Type, Technique (Ion Exchange, Affinity, Hydrophobic Interaction, Size Exclusion, Mixed Mode), Application (Pharmaceutical & Biotechnology, Food & Beverage) and Region - Global Forecasts to 2027" The global chromatography resin market will grow to USD 3.8 billion by 2027, at a CAGR of 8.0% from USD 2.6 billion in 2022. This growth is primarily triggered by the increasing demand for therapeutic antibodies. Almost all the major pharmaceutical companies have undertaken R&D on therapeutic antibodies. In the purification of monoclonal antibodies, anionic impurities such as nucleic acids and endotoxins are removed through anion exchange chromatography. Thus, the integral role of chromatography techniques in the development of monoclonal antibodies is expected to drive the chromatography resin market.

0 notes

Video

youtube

Federal Reserve, Weight Loss, The Power of Medication, Mortgage Rates, Warren Buffett, McDonalds, Market Outlook

0 notes

Text

‘Buy on dips’ strategy the way forward for 2023

Shrikant Chouhan, Executive Vice President and Head of Research - Kotak Securities

The markets in 2022 witnessed upheavals owing to geopolitical tensions, inflation, and surging commodity prices. Thereafter, the US FED embarked on a rate hike journey to tame inflation, fanning recession fears. With the financial year 2022-2023 being tricky, investors hoped for a strong outlook for FY 23-24. However, the expectation for the market in the coming year will remain moderate owing to the current high valuations, allowing investors to buy on dips.

Continue reading...

0 notes

Text

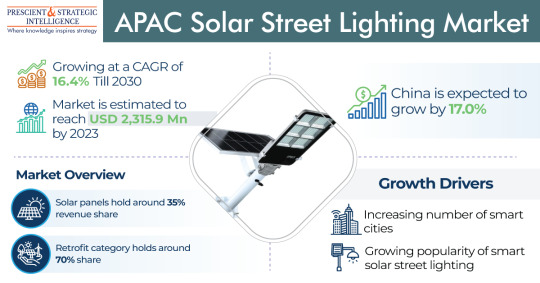

APAC Solar Street Lighting Market Will Advance at a 16.4% CAGR

The APAC solar street lighting market was USD 2,315.9 million in 2023, which will rise to USD 6,691.2 million, advancing at a 16.4% CAGR, by 2030.

A key trend observed in this industry is the increasing acceptance of smart solar streetlights. Moreover, smart lighting systems are power-effective because they employ LED lights and offer distinctive sensors and control units in every lamp, which allow data communication to central controlling systems.

The centralized category, on the basis of structure type, led the industry. This can be because of the increasing on-grid based solar streetlight disposition that gets a constant electric source from a grid to fuel lights at a great illumination.

The solar panel category, based on component, was the largest contributor to the APAC solar street lighting market in 2023, with a 35% share. This can be because it is essential for the operation of entire street lighting via renewable energy.

The lamp category, on the other hand, will advance at the fastest compound annual growth rate in the coming years. This is mainly because of the increasing acceptance of LEDs in solar streetlights. The increasing emphasis on adopting LEDs is because of the rising government proposals in nations, such as China and India, for the acceptance of energy-effective LED lights.

China led the industry, and it is likely to advance at a 17.0% compound annual growth rate, in the coming years. This can be mainly because of the continuing building of several highways, streets, flyovers, and airports; and the increasing urbanization.

With the growing number of smart cities in this region, the APAC solar street lighting industry will advance continuously in the coming years.

#APAC Solar Street Lighting Market#Market Report#P&S Intelligence#Renewable Energy#Trends#Analysis#Growth Forecasts#Solar Lighting Solutions#Market Dynamics#Asia-Pacific Solar Market#Market Research#Industry Overview#Competitive Analysis#Regional Analysis#Solar Street Light Manufacturers#Market Outlook

0 notes

Text

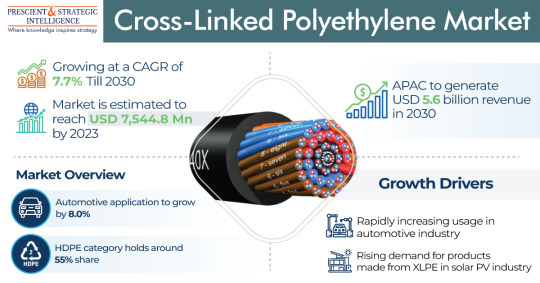

Cross-Linked Polyethylene Market Report: Trends Analysis, and Growth Forecasts | P&S Intelligence

The cross-linked polyethylene market is anticipated to achieve a revenue of USD 7,544.8 million by the conclusion of 2023. It is projected to experience a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030, reaching a total of USD 12,587.5 million by 2030.

During the projection period, the automotive is projected to be the fastest-growing category, with a CAGR of 8.0%, on the basis of…

View On WordPress

#analysis#Competitive Analysis#Cross-Linked Polyethylene Demand#Cross-Linked Polyethylene Market#Global Cross-Linked Polyethylene Market#Growth Forecasts#Industry Overview#industry trends#Market dynamics#Market Insights#market outlook#Market Report#Market Research#P&S Intelligence#Polyethylene Industry#regional analysis

0 notes

Text

Craft Beer Market

The Craft Beer Market has witnessed remarkable growth in recent years, driven by a surge in demand for unique and artisanal brews. This booming industry showcases a diverse range of flavors, styles, and breweries, catering to beer enthusiasts seeking quality and creativity. Craft beer's popularity continues to soar globally.

#craft beer market#craft beer#market research reports#industry analysis#market forecast#market outlook

0 notes

Text

Skin Care Product Market by Competitive Analysis| 2022-2030

The Global Skin Care Product Market report provides business perspectives on various aspects of the macroeconomic environment that affects the market as well as an overview of the world economies. Additionally, the report includes detailed information on the market structure that focuses on the most significant business trends and challenges of the industry. This study also assesses historical data and future opportunities for businesses in the global skin care product market.

For a comprehensive understanding of the global skin care product market, a number of factors have been evaluated, including business cycles, demographics, and microeconomic factors. A detailed analysis of the current business circumstances is also included in the global skin care product market study. The study report also evaluates a wide range of financial factors, including production value, growth rate, and key regions, in order to provide several ways to increase revenue for the company.

Key players in the skin care product market include:

Johnson & Johnson, Unilever PLC, Avon Products Inc., The Estee Lauder Companies Inc., L’Oreal S.A., Kao Corporation, Shiseido Company, Beiersdorf AG, Colgate-Palmolive Company, Procter & Gamble.

Request Sample Report: https://www.nextmsc.com/skin-care-product-market/request-sample

In this report, you will find a list of the industry's leading companies, allowing you to understand them better. By providing businesses with diverse market strategies, this data will be beneficial to both existing and emerging companies to help them grow their businesses.

Global businesses have been affected by the COVID-19 pandemic, as strict lockdowns have affected production facilities everywhere.

Additionally, certain prominent players experienced a reduction in demand for their products due to changes in consumer behavior toward their spending patterns. However, as the industry recovers from the pandemic, revenue for the global skin care product market is expected to increase significantly in the near future as it begins to recover.

Research methodologies used for this study include primary and secondary research, PESTEL and SWOT analysis, Porter's five forces model, along with other methodologies. statistics and figures, along with tables, to provide a better understanding of prices, costs, revenues, and numbers.

Using sales, demand, product advances, and production capacity, the report provides a general overview of the skin care product market. In addition, the report analyzes a variety of segments within the global skin care product market, including supplier chains, distribution chains, and company execution across regional markets. Using the data from this study, prominent players and other emerging players in this industry can evaluate production, marketing, and sales strategies.

By product, the skin care product market can be categorized into:

Face Cream

Skin Brightening

Antiaging

Sun Protection

Body Lotion

Mass Body Care

Premium Body Care

The skin care product market is further classified based on region as follows:

North America

U.S.

Canada

Mexico

Europe

UK

Germany

France

Italy

Rest of Europe

Asia-Pacific

China

India

Japan

Rest of Asia-Pacific

RoW

Latin America

Middle East

Africa

Our global skin care product market research report examines several aspects of the industry, including future growth opportunities, business plans, and sales. Moreover, it comprises several economic and social factors that significantly impact the business, as well as forecasted market size as well as market shares among the companies in the skin care product industry. In this study report, important data will be provided to assist businesses in developing appropriate growth strategies.

Using this report, companies can execute their business plans and strategies based on the changing market trends by studying market dynamics and its different perspectives. As a result of having a better understanding of the market trends and dynamics, companies will be able to grow and compete more effectively. A review of scientific papers and other credible sources has been conducted to ensure the validity of the data cited in this report.

According to their region segmentation, the study report also includes forecasts regarding the fastest-growing companies in the industry. As a result of the global market analysis, businesses can learn how to benefit from technological advancements in North America, Europe, Asia-Pacific, Latin America, Africa, and the Middle East. It emphasizes future revenue potential and the latest trends and concepts in the business world.

About Us

Next Move Strategy Consulting is an independent and trusted third-platform market intelligence provider, committed to deliver high quality, market research reports that help multinational companies to triumph over their competitions and increase industry footprint by capturing greater market share. Our research model is a unique collaboration of primary research, secondary research, data mining and data analytics.

We have been servicing over 1000 customers globally that includes 90% of the Fortune 500 companies over a decade. Our analysts are constantly tracking various high growth markets and identifying hidden opportunities in each sector or the industry. We provide one of the industry’s best quality syndicates as well as custom research reports across 10 different industry verticals. We are committed to deliver high quality research solutions in accordance to your business needs. Our industry standard delivery solution that ranges from the pre consultation to after-sales services, provide an excellent client experience and ensure right strategic decision making for businesses.

For more insights, please visit, https://www.nextmsc.com

#skin care products#global markets#skin care#moisturizer#body lotion#market forecast#market growth#market size#market share#market analysis#market research#market outlook

0 notes

Text

The report "BOPP Films Market by Type (Wraps, Bags & Pouches, Tapes, Labels), Thickness (Below 15 Microns, 15-30 Microns, 30-45 Microns, More Tham 45 Microns), Production Process (Tenter, Tubular), Application, and Region - Global Forecast to 2025", size is projected to grow from USD 24.2 billion in 2020 to USD 31.4 billion by 2025, at a CAGR of 5.3% from 2020 to 2025. The market is projected to grow in accordance with the growth of the packaging industry across the globe. BOPP film products are known for their properties, such as increased toughness, improved oil and grease resistance, enhanced clarity, increased stiffness, and enhanced barrier properties to water vapor and oxygen. These properties of BOPP film products increase their preference in a wide range of applications.

#Global BOPP Films Market#market analysis#market growth#market size#market trends#market outlook#market forecast#marble market

0 notes