#London Stock Exchange (LSE)

Text

I'm not sure how much people are talking about Aaron Bushnell having engaged with online leftist media, but the records show that they were a viewer of a bunch of different twitch streams, including mine, and subscribed to a bunch of patreons, including mine. I'm not going to inflate my importance here, the livestream link was sent directly to Talia Jane and Anark, so those are probably the voices Bushnell felt the most connected to and followed the most directly, like idk if they also subscribed to someone's patreon after watching a video abt Cars 2 or whatever, I'm not trying to examine whether social media drove the self immolation because I think that's disrespectful to the memory of someone who literally died screaming Free Palestine. I don't personally know of any leftist creators who directly advocate political suicide, and I know that we all share in the political understanding that underscored Bushnell's decision.

I've already made a point of telling my patreon server that my politics are about growing into each other and supporting one another and that if anyone asked me if I thought they should do what Bushnell did I would say no absolutely not.

I'm ruminating a bit on the nature and meaning of the protest, because a lot of people are engaging with the image of a man in fatigues on fire, standing proud and declaring "FREE PALESTINE", while I've seen others talking about the fact Bushnell's username on several platforms was LillyAnarKitty, mourning the loss of a potential trans sister, talking in depressive terms about the act of suicide, to which I think the people who are engaging in the more macho interpretation of the protest are saying "no it was cool and masculine, it wasn't suicide in the conventional sense it was about principle!" I think there's room for plenty of both. For the record LillyAnarKitty used he and she pronouns in discord servers.

Andreas Malm's approach to self-sacrifice and self-endangerment is that we as subjects of the imperial core are in a sense, precious. Valuable. We are supposedly what it is all for. The imperialist project must be doing it for the citizens of the imperialist nations because if it isn't, then it has to nakedly admit that it is doing it all for the intense power and wealth consolidation of a tiny tiny number of soulless ghouls. Therefore when we put ourselves in harm's way in a way that says you would have to destroy me to get to the thing I care about, we leverage the implicit value of ourselves for our principles. A planned protest by Palestine Action against the London Stock Exchange was allegedly going to involve locking the actionists' necks onto the mechanism of the door into the LSE making it impossible to enter or leave without probably killing them, for example. I think that Bushnell's self immolation sits on a sort of dissonance, my life is precious and my life is worthless. My life is precious and so you should care about the obvious tragedy that I am enacting and my life is worthless if thousands upon thousands of Palestinians are killed as part of the project that enables the life that I lead.

There is also the way that people have debated the meaning of "complicit in genocide" - Bushnell worked in USAF Intelligence and the US has active troops in Palestine, it's possible that they were already culpable in an unknowable number of deaths without having set foot there.

In one sense it's a little pointless to debate the fine details of the meaning of Bushnell's protest in the same way that it's pointless to pick over any feelings of responsibility that I and I know other people that we know they watched are feeling. When I first saw the video I was struck by the language, by their concise and astute analysis and I knew, without knowing just how closely that they were plugged into the same intellectual and political milieu as us. In that same sense I think that they already described what they did the best that any of us are going to be able to:

“My name is Aaron Bushnell. I am an active-duty member of the United States Air Force, and I will no longer be complicit in genocide.”

“I’m about to engage in an extreme act of protest. But compared to what people have been experiencing in Palestine at the hands of their colonizers, it’s not extreme at all. This is what our ruling class has decided will be normal.”

"Free Palestine."

288 notes

·

View notes

Text

Exciting news! https://markets.tradermade.com/cryptocurrency/crypto-etps-debut-on-lse. The FCA has approved WisdomTree's Bitcoin and Ethereum ETPs for trading on the London Stock Exchange starting May 28.

0 notes

Text

Bitcoin ETPS Approved To Be Listed On The LSE

The UK's Financial Conduct Authority (FCA) has approved asset manager WisdomTree to list Bitcoin and Ethereum exchange-traded products (ETPs) on the London Stock Exchange (LSE).

The FCA gave the green light for WisdomTree's Physical Bitcoin ETPs to begin trading on May 28. The $111 billion AUM firm will initially offer the products exclusively to professional investors.

https://bitcoinmagazine.com/business/bitcoin-etps-get-approval-to-list-on-the-london-stock-exchange

0 notes

Text

In the sprawling metropolis of Neo-London, a city that never sleeps, the skyline is dominated by the gleaming towers of the London Stock Exchange (LSE). The LSE had transformed over the centuries into a massive, interconnected network of digital and physical trading hubs, pulsating with the heartbeat of global finance. Within this futuristic city, where technology and tradition coexisted in a delicate balance, lived a woman known only as Lady Aurelia.

Lady Aurelia was a legend. Her appearance alone was enough to command attention and respect: her hair, once raven-black, had turned a regal silver, flowing like liquid mercury. Deep wrinkles etched into her face told tales of countless battles fought and won in the ruthless world of corporate espionage. Her body bore intricate tattoos, each marking a significant achievement or loss, like a living tapestry of her storied past. The heavy necklace and earrings she wore were not just ornaments but remnants of a bygone era, each piece a relic with its own history.

Lady Aurelia's life had been inextricably linked with the London Stock Exchange. As a young woman, she had risen through the ranks, starting as a brilliant trader with a penchant for high-risk, high-reward maneuvers. Her uncanny ability to predict market trends earned her the nickname "The Oracle of LSE." However, her success came at a cost. Betrayals, hostile takeovers, and corporate wars left her with scars, both physical and emotional.

In the heart of Neo-London, Lady Aurelia's residence was an old-world mansion juxtaposed against the futuristic cityscape. The mansion, filled with antique furnishings and advanced AI systems, served as her command center. Here, she planned her moves with the precision of a chess grandmaster, always staying ten steps ahead of her rivals.

One day, a cryptic message appeared on her private terminal. It was an invitation to a clandestine meeting at the top of the tallest tower of the LSE, known as the Pinnacle. The message was signed with a symbol she hadn't seen in decades—a phoenix rising from the ashes, the emblem of an old ally, Marcus Blackwood, presumed dead years ago.

Intrigued and cautious, Lady Aurelia decided to attend. Clad in her signature dark attire, she made her way to the Pinnacle. The elevator ride seemed endless, filled with the hum of machinery and the weight of anticipation. As the doors opened, she stepped into a dimly lit room where Marcus awaited, older and wearier but unmistakably him.

Marcus revealed a staggering secret: a hidden AI, embedded deep within the LSE's systems, capable of manipulating global markets with unprecedented accuracy. This AI, named "Helios," had been Marcus's creation, designed to bring stability but now threatened by those who sought to exploit it for personal gain. Marcus needed Aurelia's help to protect Helios and ensure it remained a force for good.

Together, they devised a plan to expose and neutralize the corrupt elements within the LSE. Aurelia's intimate knowledge of the Exchange's inner workings and Marcus's technical prowess made them a formidable team. Their mission led them through a labyrinth of corporate deceit, underground trading floors, and cyber warfare, testing their limits at every turn.

In a climactic showdown atop the Pinnacle, they confronted the cabal of rogue traders who sought to control Helios. The battle was fierce, blending physical combat with high-tech gadgetry. In the end, Aurelia's wisdom and Marcus's ingenuity prevailed. Helios was secured, its algorithms safeguarded from misuse.

As the sun rose over Neo-London, casting a golden glow on the city, Lady Aurelia stood at the Pinnacle's edge, looking out at the skyline. She knew the fight for justice was never truly over, but for now, she had won a significant victory. The London Stock Exchange, with all its power and peril, remained in capable hands.

And so, Lady Aurelia, the silver-haired guardian of the LSE, continued her vigil, ready to face whatever challenges the future held, her story a testament to resilience, intelligence, and the indomitable spirit of a true warrior.

0 notes

Note

Probably a dumb question, but what is LSE? Cause despite how much I try the only thing I can think of that could stand for is "Loves sex especially" and I know that is definitely wrong and google thinks I'm looking for either "London Stock Exchange" or "London School of Economics."

…… Love Suite Event. It’s a special event in DRv3 where the protagonist meets their classmates in the Love Hotel.

0 notes

Text

Anger Over ‘Shambolic’ Phone App Shares Sale

Britain’s financial regulator faces criticism this weekend over the “shambolic” listing on the London Stock Exchange of a healthcare company facing allegations that some of its shares were traded fraudulently.

The Financial Conduct Authority (FCA) approved Umuthi Healthcare Solutions for admission to the London Stock Exchange (LSE) in March. The company has developed a smartphone app to help medicines reach doctors in remote rural areas.

Trading is now suspended in the firm. Police in South Africa are investigating claims that millions of nonexistent shares were sold to investors for about £2.45m before the flotation.

Anthony Morris, of the Umuthi major shareholder group, said: “This listing has been a complete shambles and should never have been allowed. There has been an abject failure by the Financial Conduct Authority.”

The firm denies any wrongdoing. It said the claims concerned share sales prior to its public listing between private individuals that “do not involve the company or its directors”.

The LSE’s main market has about 1,300 companies from more than 70 countries. Listing is described as a “badge of quality”.

The FCA, which reviews company prospectuses before admission to the LSE, has faced criticism of its performance and effectiveness over the last year after a string of financial scandals. Campaigners described the disclosure earlier this month by the Observer that the regulator has paid staff more than £125m in bonuses since 2016 as an “absolute insult”.

Umuthi has operations in South Africa, but wants to expand to other African countries and Europe.

The South African Police Service said last week that the company’s chief executive, Gert Viljoen, and a female consultant, Connie van Nieuwkerk, were arrested over fraud allegations earlier this month.

A police spokesman said: “It is alleged that the CEO with another executive persuaded the shareholders to buy shares that did not exist. Thirty shareholders lost R50m [£2.45m] due to misrepresentation. The investigation is continuing.”

Investors claim the FCA missed a series of red flags that should have blocked the listing. Van Nieuwkerk was fined by financial watchdogs last year in South Africa for the publication of financial statements that were false or misleading.

One of Umuthi’s non-executive directors, Colin Bloom, a prominent Conservative party supporter and a government adviser on faith, said he had resigned from the company last month. He said he had no knowledge of any suspicious activity and has asked the Serious Fraud Office to investigate.

Umuthi has developed a smartphone app that allows doctors and pharmacies in remote areas to directly order drugs from healthcare suppliers. It was listed on the LSE on 4 March, but trading is now suspended.

Umuthi said in a trading update on Thursday: “Mr Viljoen has been released on bail. The allegations appear to relate to over-the-counter sale of Umuthi shares, transactions over which the company and Mr Viljoen had no control or involvement.

“In addition, a consultant to the company, Connie van Nieuwkerk, was arrested as part of the same allegation.

“Ms van Nieuwkerk had no operational role at the company.

“As a result of the arrest, the company has terminated forthwith the consultancy agreement with Ms van Nieuwkerk.”

Viljoen has denied any wrongdoing and says the listing went through “rigorous verification processes”. Van Nieuwkerk did not respond to a request for comment.

An FCA spokesperson said: “We are aware of the issues raised here and are liaising with the relevant authorities in South Africa. As issues relating to the company emerged, we immediately suspended the listing to protect investors, and at the current time it remains suspended.”

This footnote was added on 8 November 2022: The FCA recorded that in October 2021, a director of the Company (“the Director”) was arrested and charged by South African police on suspicion of fraud. The charges against him were dropped in December 2021.

0 notes

Text

Two LSE-listed Umuthi Healthcare execs Arrested on Charges of Fraud

London Stock Exchange-listed Umuthi Healthcare Solutions CEO Gert Viljoen (42) and Connie van Nieuwkerk (52) were arrested last week and appeared in the Palm Ridge Magistrate Court, south of Johannesburg, on charges of fraud.

It is alleged shareholders were defrauded of millions of rands between March 2019 and May 2021 after being enticed to purchase shares that in many cases did not exist. Shareholders claim 28 million shares are missing.

Though the company was listed on the LSE, the two arrested executives are South African, as are the majority of shareholders who say they have been defrauded.

Viljoen was released on R20 000 bail, and his hearing was postponed to December 1, 2021.

Van Nieuwkerk, who also goes under the name Connie van Vliet, remains in custody, and her bail hearing has been postponed to November. She was previously arrested on a R5.5 million fraud charge that pre-dated the alleged sale of these shares in Umuthi. She was formerly a director and CFO of African Dawn and Alliance Mining. In March 2020, she was fined a total of R46 million by the Financial Sector Conduct Authority (FSCA) for misrepresenting the African Dawn’s financial statements by R274 million, and for similar financial deceptions at Alliance Mining. Van Nieuwkerk then moved on to Umuthi Healthcare Solutions and was in charge of the London listing process.

Shareholders were given bank accounts where the monies were to be deposited, which turned out to be the suspects’ personal bank accounts.

Thirty shareholders lost R50 million due to misrepresentation, says the SAPS.

The matter was reported to the Hawks’ Serious Commercial Crime Investigation team in Johannesburg for investigation.

The SAPS says its investigations are continuing and more arrests are imminent.

Umuthi was listed on the Standard Board of the London Stock Exchange (LSE) in March, but trading in the shares was suspended six days later, after questions were raised about alleged misrepresentations in the listing prospectus.

Morris says this wording is setting up shareholders for blame for the collapse of the listing.

In response to questions sent by Moneycontrolview surrounding the arrests and the background to Umuthi’s suspended listing, Viljoen replied that he could not comment as the matter is sub judice.

According to , Viljoen denied the charges of fraud as claimed by SharePropets.com, a market-related website, and others. He claims the listing went through a rigorous verification process and was scrutinised by the UK regulator, the Financial Conduct Authority (FCA).

Morris claims that various members of their group have irrefutable evidence that the FCA’s systems and processes were completely compromised throughout the Umuthi engagement. A shareholder group’s Facebook page will go live in the coming week where evidence of alleged wrongdoing at Umuthi will reportedly be displayed.

0 notes

Text

Stock Market: Definition and How It Works

The stock market, also known as the equity market, is a financial marketplace where individuals and institutions can buy, sell, and trade shares of publicly listed companies. Shares, also referred to as stocks or equities, represent ownership in a company. The stock market serves as a platform for companies to raise capital and for investors to participate in the growth of businesses.

How the Stock Market Works

The stock market operates through exchanges, where buyers and sellers come together to trade shares. Here's how the stock market works in detail:

Stock Exchanges:

Stock exchanges are organized markets where shares of publicly traded companies are bought and sold. Examples of stock exchanges include the New York Stock Exchange (NYSE), the Nasdaq, and the London Stock Exchange (LSE).

Companies list their shares on an exchange through an initial public offering (IPO) to raise capital and allow their shares to be traded.

Trading Process:

Trading in the stock market is facilitated by brokers who execute buy and sell orders on behalf of investors.

Orders can be placed in various ways, including market orders (buying or selling at the current market price) and limit orders (buying or selling at a specified price).

Stock Prices:

Stock prices fluctuate based on supply and demand. When demand for a stock exceeds supply, the price rises; when supply exceeds demand, the price falls.

Prices are influenced by various factors such as a company's financial performance, economic conditions, market sentiment, interest rates, and geopolitical events.

Market Indices:

Market indices are benchmarks that track the performance of a group of stocks. Popular indices include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite in the United States.

Indices provide a snapshot of the overall market's performance and are often used as indicators of economic health.

Investor Participation:

Investors participate in the stock market by buying shares of companies. They can hold these shares for the long term, hoping for capital appreciation and dividends, or trade them for short-term gains.

Institutional investors such as mutual funds, pension funds, and hedge funds also play a significant role in the market.

Market Regulation:

Stock markets are regulated by government agencies to ensure fair and transparent trading. In the United States, the Securities and Exchange Commission (SEC) oversees the market.

Regulations aim to protect investors and maintain market integrity.

Impact on Economy:

The stock market plays a crucial role in the economy by enabling companies to raise capital and investors to earn returns on their investments.

The market's performance is often seen as an indicator of economic health and can influence consumer and business confidence.

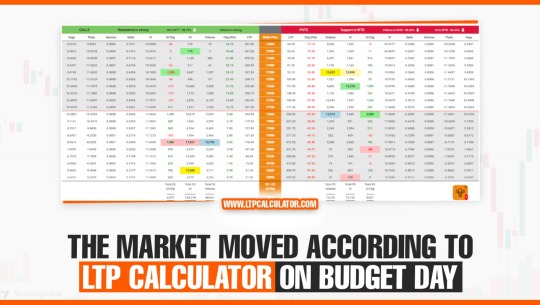

One of the best way to start studying the stock market to Join India’s best comunity classes Investing daddy invented by Dr. Vinay prakash tiwari . The Governor of Rajasthan, the Honourable Sri Kalraj Mishra, presented Dr. Vinay Prakash Tiwari with an appreciation for creating the LTP Calculator.

LTP Calculator the best trading application in India.

You can also downloadLTP Calculator app by clicking on download button.

Conclusion

The stock market is a dynamic and complex marketplace where companies and investors interact. It provides opportunities for wealth creation and economic growth but also carries risks due to market volatility and unpredictability. Investors should approach the stock market with a clear understanding of its workings and their investment goals.

0 notes

Text

FY2023: GTCO Posts N609.3 Billion Profit

Guaranty Trust Holding Company (GTCO) has released its Audited Consolidated and Separate Financial Statements for the year ended December 31, 2023, to the Nigerian Exchange Group (NGX) and London Stock Exchange (LSE).

The Group reported profit before tax of N609.3billion, representing an increase of 184.5% over N214.2 billion recorded in the corresponding year ended December 2023.

GTCO’s loan…

View On WordPress

#FY2023#GTCO#Guaranty Trust Holding Company (GTCO)#Nigerian Exchange Group (NGX)#Stock Exchange (LSE)

0 notes

Text

Understanding Financial Markets: An In-depth Exploration

Financial markets are the backbone of modern economies, serving as crucial platforms for the exchange of financial assets, including stocks, bonds, currencies, and commodities. These markets play a pivotal role in allocating capital efficiently, facilitating investment, and managing risks. In this comprehensive article, we delve into the definition, types, importance, examples, functions, and components of financial markets, shedding light on their profound impact on global economic dynamics.

Definition of Financial Markets:

Financial markets refer to platforms where buyers and sellers come together to trade financial assets such as stocks, bonds, currencies, derivatives, and commodities. These markets enable the transfer of funds from those who have surplus funds (savers) to those who need them (borrowers), thereby facilitating investment and economic growth. Financial markets can be physical locations like stock exchanges or virtual platforms like electronic trading networks.

Types of Financial Markets:

Capital Markets: Capital markets facilitate the buying and selling of long-term financial instruments such as stocks and bonds. They are further divided into primary markets (where new securities are issued) and secondary markets (where existing securities are traded among investors).

Money Markets: Money markets deal with short-term debt instruments with maturities typically ranging from overnight to one year. Examples include treasury bills, commercial paper, and certificates of deposit. Money markets provide liquidity and short-term funding for financial institutions and corporations.

Foreign Exchange Markets: Also known as forex markets, they involve the trading of currencies. Foreign exchange markets determine exchange rates between different currencies, enabling international trade and investment.

Derivatives Markets: Derivatives markets involve contracts whose value is derived from the performance of an underlying asset, index, or interest rate. Examples include futures, options, and swaps. Derivatives are used for risk management, speculation, and hedging purposes.

Importance of Financial Markets:

Financial markets play several crucial roles in the economy:

Capital Allocation: They allocate financial resources to their most productive uses by channeling savings into investment opportunities. This process promotes economic growth and development.

Price Discovery: Financial markets determine the prices of financial assets based on supply and demand dynamics, reflecting the collective wisdom of market participants. Accurate pricing ensures efficient allocation of resources.

Liquidity Provision: Financial markets provide liquidity by offering platforms for buying and selling financial assets. Liquidity ensures that investors can easily enter and exit positions without significantly impacting asset prices.

Risk Management: Through the trading of derivatives and other risk management instruments, financial markets allow investors to hedge against various risks, including interest rate risk, currency risk, and commodity price risk.

Facilitating Monetary Policy: Central banks use financial markets to implement monetary policy objectives, such as controlling inflation and stabilizing economic growth. Open market operations, for instance, involve buying or selling government securities to influence interest rates and money supply.

Examples of Financial Markets:

New York Stock Exchange (NYSE): One of the world's largest stock exchanges, the NYSE facilitates the trading of equities of publicly-listed companies.

London Stock Exchange (LSE): The LSE is a major stock exchange in the United Kingdom, offering trading in equities, bonds, and derivatives.

Chicago Mercantile Exchange (CME): A leading derivatives exchange, the CME provides a platform for trading futures and options contracts on various asset classes, including commodities, currencies, and interest rates.

FOREX Market: The global foreign exchange market, with hubs in London, New York, Tokyo, and Singapore, facilitates the trading of currencies among banks, corporations, and institutional investors.

Over-the-Counter (OTC) Markets: OTC markets involve the decentralized trading of financial instruments outside traditional exchanges. They include markets for bonds, derivatives, and unlisted stocks.

Functions of Financial Markets:

Facilitating Savings and Investment: Financial markets allow individuals and institutions to invest their savings in various financial instruments, thereby fostering capital formation and economic growth.

Price Determination: Financial markets determine the prices of financial assets based on supply and demand forces, reflecting market participants' expectations and perceptions of risk and return.

Risk Transfer: Financial markets enable the transfer of financial risks from those unwilling or unable to bear them to those willing to do so, thereby enhancing overall risk management in the economy.

Providing Liquidity: By offering platforms for buying and selling financial assets, financial markets ensure liquidity, enabling investors to convert their assets into cash quickly and efficiently.

Information Transmission: Financial markets serve as channels for the dissemination of information regarding companies, economies, and financial instruments, facilitating informed decision-making by investors and policymakers.

Components of Financial Markets:

Market Participants: These include individual investors, institutional investors (such as pension funds and mutual funds), corporations, banks, and government entities.

Financial Instruments: Financial markets trade various instruments such as stocks, bonds, currencies, commodities, futures, options, and swaps.

Market Infrastructure: This encompasses physical and electronic platforms, including stock exchanges, electronic trading networks, clearinghouses, and settlement systems.

Regulatory Framework: Financial markets operate within regulatory frameworks established by government authorities to ensure transparency, fairness, and stability.

Information Systems: These include data providers, news agencies, and financial publications that disseminate information relevant to market participants.

In conclusion, financial markets are vital components of modern economies, facilitating the efficient allocation of capital, risk management, and economic growth. Understanding their intricacies is essential for investors, policymakers, and anyone interested in comprehending the dynamics of global financial systems. By recognizing the role and significance of financial markets, individuals and societies can navigate the complexities of the financial world more effectively, contributing to overall prosperity and stability.

0 notes

Text

Bitcoin, Ether ETNs to Launch on London Stock Exchange, Here’s What That Means

The UK, in another crypto-friendly development, has decided to merge its traditional regulated market with crypto. Starting May 28, the London Stock Exchange (LSE) will launch exchange traded notes (ETNs) for Bitcoin and Ether. It is notable, that these ETNs will only be made available to professional investors and traders. With this, the UK has again portrayed itself as a lucrative destination…

View On WordPress

0 notes

Text

First Mover Americas: Bitcoin ETNs to Debut on LSE

This article originally appeared in First Mover, CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

Top Stories

The London Stock Exchange will roll out a market for bitcoin (BTC) and ether (ETH) exchange-traded notes (ETN) on May 28, it said on Monday. The stock exchange will accept applications for…

View On WordPress

0 notes

Text

EU-regulering, SEC-boete voor Ripple en LSE bereidt zich voor op Bitcoin en Ethereum ETN's

Beste Crypto-gids lezers,

Wat een dag vol opmerkelijke ontwikkelingen in de wereld van crypto! Laten we samen een blik werpen op de belangrijkste gebeurtenissen van de afgelopen 24 uur.

EU zet belangrijke stap in Crypto-regulering: Nieuwe regels voor Crypto-bedrijven

De Europese Unie heeft haar ambities om de crypto-sector te reguleren kracht bijgezet door de aankondiging van nieuwe regels voor cryptobedrijven onder de MiCA-wetgeving. Dit baanbrekende initiatief, dat tot doel heeft transparantie en veiligheid te vergroten, markeert een cruciale stap voorwaarts in het creëren van een geharmoniseerd regelgevend kader voor de crypto-markt in Europa. Met deze regels wil de EU niet alleen investeerders beschermen, maar ook het vertrouwen in de cryptosector vergroten en innovatie stimuleren.

SEC eist $2 miljard boete van Ripple (XRP)

In een schokkende wending heeft de Securities and Exchange Commission (SEC) aangekondigd dat zij een boete van maar liefst $2 miljard zal eisen van Ripple Labs, de ontwikkelaar van de populaire cryptocurrency Ripple (XRP). Deze aankondiging komt als een harde klap voor Ripple en werpt serieuze vragen op over de toekomst van het bedrijf en de bredere crypto-industrie in de Verenigde Staten. Terwijl Ripple en de SEC zich voorbereiden op een juridische strijd van epische proporties, blijft de crypto-gemeenschap gespannen afwachten op het uiteindelijke oordeel van de rechtbank en de mogelijke implicaties ervan voor de regulering van cryptocurrencies.

Grayscale blijft optimistisch over Ether ETF-goedkeuringen ondanks 'gebrek aan betrokkenheid' van de SEC

Ondanks zorgen over een vermeend gebrek aan betrokkenheid van de Amerikaanse Securities and Exchange Commission (SEC), blijft Grayscale Investments optimistisch over de goedkeuring van exchange-traded funds (ETF's) voor Ethereum (ETH). Craig Salm, Chief Legal Officer bij Grayscale, benadrukt dat de sterke argumenten voor spot Ether ETF's vergelijkbaar zijn met die voor spot Bitcoin ETF's, en dat de huidige situatie geen reden tot ontmoediging is. Met institutionele interesse in Ethereum die blijft groeien, zou de goedkeuring van een Ether ETF een enorme mijlpaal zijn voor de acceptatie en integratie van Ethereum in de traditionele financiële wereld.

Bitcoin en Ethereum ETN's debuteren op London Stock Exchange in mei

Op 28 mei zal de London Stock Exchange (LSE), een van 's werelds meest toonaangevende beurzen, de primeur hebben voor Bitcoin en Ethereum exchange-traded notes (ETN's). Deze langverwachte stap, te midden van uitdagingen en afnemende handelsactiviteit op de beurs, onderstreept de groeiende acceptatie en legitimiteit van crypto-activa in de traditionele financiële sector. Met institutionele beleggers die steeds meer interesse tonen in Bitcoin en Ethereum, belooft de introductie van ETN's op de LSE een opwindende nieuwe fase in de evolutie van de crypto-markt te markeren.

Het is een opwindende tijd om in crypto te zijn, vol met kansen en uitdagingen. Deze recente ontwikkelingen laten zien dat de crypto-markt steeds volwassener wordt en een steeds grotere rol begint te spelen in het mondiale financiële landschap. Blijf op de hoogte van Crypto-gids voor het laatste nieuws, analyses en inzichten over deze snel veranderende markt.

Een cryptische groet,

CryptoKimmy

Read the full article

1 note

·

View note

Text

London Bourse to Debut Bitcoin and Ethereum ETNs in May

The London Stock Exchange (LSE) is poised to commence the trading of Bitcoin and Ethereum exchange-traded notes (ETNs) starting May 28, contingent on the approval of the Financial Conduct Authority (FCA). This development is preceded by the LSE's announcement to accept listing applications for cryptocurrency ETNs from April 8, representing a pivotal integration of digital currencies into the United Kingdom's financial marketscape. This innovative initiative aims to draw a broad spectrum of issuers and investors, mirroring the success Bitcoin ETFs have garnered in the United States since their inception in January. The LSE has delineated clear guidelines for potential issuers, stipulating an April 15 deadline for the submission of requisite documentation, including a base prospectus for FCA evaluation. ETNs and ETFs, while both

Read more on London Bourse to Debut Bitcoin and Ethereum ETNs in May

0 notes

Text

0 notes

Text

London Stock Exchange Accepting Applications For Bitcoin ETNs

The London Stock Exchange (LSE) announced that it will start accepting applications for Bitcoin and Ether crypto exchange-traded notes (ETNs) in the second quarter of 2024.

On March 11, the exchange confirmed that it would accept applications following the guidelines specified in its Crypto ETN Admission Factsheet. However, the exchange did not provide the exact date that it will start accepting applications.

In the factsheet, the exchange said that crypto ETNs should be physically backed and non-leveraged. They should have a market price or value measure of the underlying asset that is publicly available and must be backed by Bitcoin.

The exchange also highlighted that the underlying crypto assets should be “wholly or principally” held in a cold wallet or something similar. In addition, the assets should be held by a custodian subject to Anti-Money Laundering laws in the United Kingdom, the European Union, Switzerland or the United States.

https://cointelegraph.com/news/london-stock-exchange-bitcoin-ethereum-etn

0 notes