#IRS can request your bank transaction details

Text

Join A Bookkeeping Specialist Course In The Bronx And Improve Your Career Prospects!

Bookkeeping is a secure and profitable career that creates a path for you to work in any industry worldwide, from local businesses to multinational corporations. Jobs in accounting, finance, and business administration often require bookkeeping skills, and getting enrollment in a bookkeeping specialist course in the Bronx is an excellent way to start your career with a great skill set. Once you master the required skills and achieve the bookkeeping certification, you will get immense job opportunities in numerous fields to prove your value.

This write-up will explain- who the bookkeeper is, what the responsibilities are, and what skills are required to kick-start this career.

Who is the Bookkeeper?

A bookkeeper prepares and maintains an account, documents financial transactions, and checks how finances flow into and out of an entity, such as purchases, expenses, invoices, sales revenue, and payments. If you have skills and an interest in accounting measurements, then bookkeeping certification is an ideal professional designation. So, you can become a bookkeeper specialist after completing an accredited bookkeeping specialist training program in the Bronx.

What are the primary responsibilities of a bookkeeper?

If you know accounting and its software systems, then you take a step toward becoming an accounting professional. One of the major responsibilities of a bookkeeper is maintaining a general ledger to record the amounts from sales and expense receipts. In larger businesses, a bookkeeper oversees and reconciles numerous financial transactions with the assistance of accounting software systems.

You must learn in a bookkeeping specialist course to record each sale and purchase that your business conducts and handle other administrative tasks as needed. Apart from this, here are some additional responsibilities that need to be fulfilled by a bookkeeper:

Keep accurate records, general ledgers, receipts, and invoices.

Thoroughly generate and distribute yearly IRS forms.

Handle accounts payable, receivable, and payroll.

Process and reconcile financial statements.

Make bank deposits.

Handle payments by check, credit card, and EFT

Create and review monthly financial reports.

Ensure compliance with the accounting process.

Guide preparation for annual audits.

Communicate with vendors and suppliers to ensure that charges are accurate and payments are received on time.

Keep learning about industry trends and developments.

Important skills you need to become a bookkeeper:

Bookkeeping is more than just being good with numbers and handling accounts. You may develop many soft skills and other abilities to become a successful bookkeeper while taking bookkeeping specialist training in the Bronx:

Time management and organization-

Every day is a new day for a bookkeeper, and organizing skills help them with pre-planned projects to last-minute requests that require urgent action. So it is necessary to have effective organization and time management skills to stay on track and handle your workload without much hassle.

Attention to detail-

Attention to detail helps you to be accurate while dealing with a client’s financial data to avoid errors in the record. You need to monitor financial transactions keenly to ensure financial policies are being adhered to. It is crucial to present businesses with accurate data before making any critical business decisions.

Problem-solving-

A successful bookkeeper can identify and correct errors promptly. You must have analytical skills to find the solution for your client’s financial well-being and handle the situation with a productive approach.

Therefore, if you possess these skills and are considering enrolling in a bookkeeping specialist training program in the Bronx, then you must contact Alliance computing solutions(ACS) to get the highest level of a training program. So why wait any longer? Call us at 718-661-9771 and schedule a consultation with our experts today!

#Bookkeeping Training Programs#Bookkeeping Training Bronx#Bookkeeping Specialist Training Program Bronx#Bookkeeping Specialist Course Bronx

2 notes

·

View notes

Text

IRS Issues Tips for Speeding Up Tax Refunds

— Published March 19, 2024 | Newsweek

A file photo of a tax form with three $100 bills. Taxes are due on April 15, 2024, for the 2023 year. Getty Images

The Internal Revenue Service (IRS) has issued advice on avoiding delays to tax refunds as the filing season deadline approaches next month.

Tax returns for 2023 are due across the U.S. on April 15, 2024. The IRS put out new advice on avoiding the "typical errors" that can hinder the timely payment of refunds for excess amounts paid and any tax credit refunds.

If there are no issues with your tax return this year, filers can expect to wait up to 21 days for any refunds if they filed online. However, filing via mail or with amended returns means that the process can take four weeks or longer for your refund to become available. The IRS warns the process can take even longer than this if your tax return requires corrections or additional reviewing.

How Can I Avoid a Late Refund?

— Use Electronic Filing

Electronic filing, using the IRS Direct File, Free File or an alternative e-service provider, is the easiest way to file your return, the IRS has said, as " electronic filing minimizes mathematical errors and identifies potential tax credits or deductions for which the taxpayer qualifies."

Whatever the filing method used, the IRS has said it is essential that returns are carefully reviewed.

— Ensure Filing Status Is Correct

If you are unsure of your filing status or have multiple statuses, the IRS advises using its interactive tax assistant.

Make sure names, birthdates and Social Security numbers are correct - names, dates of birth and Social Security numbers must be entered exactly as they are on a person's Social Security card.

— Answer the Digital Assets Question

Those filing Forms 1040, 1040-SR, 1040-NR, 1041, 1065, 1120 and 1120S must check one box answering either "yes" or "no" to the digital asset question. The IRS reminds filers they are required to report all income related to digital asset transactions.

— Report All Taxable Income

The IRS has said that most income is subject to taxation, and any failures to report income streams can result in penalties and interest.

Make sure bank routing and account numbers are correct. If selecting direct deposit as the way to receive your refund, filers should ensure that any account details registered are up to date.

— Remember to Sign and Date the Return

Single filers returning their taxes online can electronically sign their returns by inputting their adjusted gross income from the year prior. Joint returns filed by married couples must be signed and dated by both parties.

— Ensure Address Is Correct If Mailing Paper Returns

While electronic filing is advised, those who file by paper are urged to check their mailing address to prevent delays.

According to the IRS, millions of people are still filing using paper, with around 24 million individual and estate and trust income tax returns completed via paper filings in 2022. In the same year, 153 million returns were filed electronically.

— Keep a Copy of the Tax Return

A signed copy of your tax return should be kept on record, particularly in case a return needs to be amended. The IRS advises that "taxpayers should retain records supporting income, deductions or credits claimed on their tax return until the period of limitations for that specific tax return expires.

— Request an Extension, If Needed

If you are unable to complete your returns prior to the April 15 deadline, the IRS urges taxpayers to request an extension, valid until October 15, to avoid late filing penalties. Even if an extension is approved, tax payments are still due on April 15 for the majority.

— Aliss Higham is a Newsweek reporter based in Glasgow, Scotland. Her focus is reporting on issues across the U.S., including state benefits, national and local politics, and crime. She has previously extensively covered U.S. and European politics, Russia's invasion of Ukraine and the British Royal Family. Aliss joined Newsweek full time in January 2024 after a year of freelance reporting and has previously worked at digital Reach titles The Express and The Mirror. She is a graduate in English and Creative Writing from Goldsmiths, University of London.

0 notes

Text

Why Is My Cash App Direct Deposit Tax Refund Pending ?

The anticipation of receiving a tax refund can quickly become frustrating when it's delayed, especially if you expect the funds to arrive promptly. In today's digital age, many individuals rely on platforms like Cash App for the convenience of direct deposits, including tax refunds. However, if you wonder, "Why is my tax refund still pending on Cash App?" you're not alone. In this comprehensive guide, we'll delve into the common reasons behind tax refund delays on Cash App and provide actionable solutions to expedite the process.

Unpacking Tax Refund Delays on Cash App:

Tax refunds are typically processed by the Internal Revenue Service (IRS) and disbursed to taxpayers via direct deposit or paper check. While direct deposit offers faster access to funds, delays can still occur for various reasons. Understanding these factors is crucial for managing expectations and effectively navigating the tax refund process.

Common Causes of Tax Refund Delays on Cash App:

IRS Processing Times: The IRS processes millions of tax returns each year, and the volume of requests can lead to delays in refunding. Depending on factors such as filing method, tax credits, and errors on the return, it may take additional time for the IRS to process and approve refunds.

Incomplete or Incorrect Information: Errors or discrepancies on your tax return, such as incorrect bank account information or missing documents, can delay receiving your refund. It's essential to double-check your tax return for accuracy before submitting it to the IRS.

Verification and Review Processes: Sometimes, the IRS may flag certain tax returns for additional verification or review. This can happen if your return triggers red flags, such as substantial deductions or discrepancies in income reported. As a result, your refund may be delayed while the IRS conducts further investigation.

Bank Processing Times: Once the IRS releases your tax refund, it must be processed by your bank or financial institution before it can be deposited into your Cash App account. Bank processing times can vary, and delays may occur depending on factors such as weekends, holidays, and your bank's policies.

Technical Glitches or Network Issues: Occasionally, technical glitches or network disruptions on Cash App's end can also contribute to delays in receiving tax refunds. These issues may arise due to server maintenance, software updates, or other unforeseen circumstances.

Solutions to Address Tax Refund Delays on Cash App:

Verify Tax Return Information: Double-check your tax return for accuracy, ensuring that all information provided is correct and up-to-date. Verify your bank account details, including account numbers and routing numbers, to prevent delays due to incorrect information.

Monitor Your Bank Account: Keep an eye on your bank account linked to the Cash App to track the status of your tax refund. Once the refund is processed by the IRS and deposited into your bank account, it should appear in your Cash App account shortly after that.

Contact the IRS: If you suspect your tax refund is delayed due to an issue with your tax return, contact the IRS for assistance. The IRS can provide information on the status of your refund and offer guidance on any necessary steps to resolve the issue.

Contact Cash App Support: If your Cash App tax refund pending, contact Cash App support for assistance. The support team can provide insights into your transaction's status and offer guidance on potential solutions.

FAQs:

Q: How long does it take for a tax refund to show up on Cash App?

A: Once the IRS releases your tax refund, it typically takes 1-5 business days for the funds to be deposited into your Cash App account, depending on bank processing times and network conditions.

Q: Can I cancel a pending tax refund on Cash App?

A: A tax refund on the Cash App cannot be cancelled once a tax refund is pending. However, you can contact Cash App support for assistance in resolving any issues or concerns related to the refund.

Q: Will I be notified if my tax refund is delayed on Cash App?

A: Cash App may send notifications or updates regarding the status of your tax refund. However, if you're concerned about a delay, check your transaction history or contact customer support for more information.

Conclusion:

While waiting for a tax refund can be an anxious time, understanding the common causes of delays and taking proactive steps can help expedite the process. By verifying tax return information, monitoring bank account activity, and seeking assistance from the IRS or Cash App support, users can confidently navigate the tax refund process and ensure timely receipt of their funds. Remember, patience and proactive communication are critical when dealing with tax refund delays, and staying informed about the Cash App tax return status can help alleviate concerns and facilitate a smooth transaction experience on Cash App.

#How Long Does It Take to Get a Tax Refund on Cash App#Cash App tax refund#Cash App tax refund time#Cash App taxes#Cash App tax refund pending#cash app tax refund accepted#cash app tax refund deposit#What Time Does Cash App IRS Direct Deposit Hit#Cash App tax refund deposit#Cash App direct deposit pending#Cash App IRS deposit pending

0 notes

Text

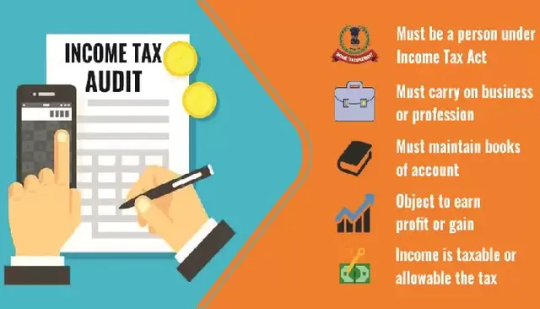

Navigating Income Tax Audits: Understanding, Preparation, and Resolution

Income tax audits are an essential part of the taxation process, ensuring compliance and accuracy in financial reporting for individuals and entities. They involve a detailed examination of a taxpayer's financial records and transactions to verify the reported income, deductions, and other related information. While the mere mention of an audit might evoke anxiety, understanding the process and preparing adequately can significantly ease the experience.

What Triggers an Income Tax Audit?

Audits are triggered by various factors, not necessarily indicating non-compliance. Sometimes, the IRS or relevant tax authority selects returns randomly for review. However, certain red flags might increase the chances of an audit, such as:

Discrepancies or inconsistencies: Large discrepancies between reported income and previous filings might raise concerns.

High deductions or losses: Unusually high deductions or losses in comparison to income might attract attention.

Self-employment: Business owners and self-employed individuals are subject to more scrutiny due to complexities in income reporting.

Unreported income: Failure to report income, whether intentionally or inadvertently, can trigger an audit.

Frequent amendments: Numerous amendments to tax returns might prompt closer inspection.

Understanding the Audit Process

Types of Audits

Correspondence Audit: This is the least intrusive type, conducted via mail, requesting specific documentation or clarification on certain entries.

Office Audit: Taxpayers are summoned to an IRS office for a face-to-face review of records, usually for more complex issues.

Field Audit: The most comprehensive and invasive type, conducted at the taxpayer's premises, delving deep into financial records.

Documentation and Preparation

Thorough documentation is crucial. Keep records of income, expenses, deductions, and receipts meticulously organized. Good record-keeping not only simplifies the audit process but also demonstrates credibility and compliance.

Professional Assistance

Seeking guidance from tax professionals or CPAs can be immensely beneficial. They can navigate the audit process efficiently, ensuring compliance with tax laws and regulations.

Steps to Prepare for an Audit

Gather Records: Collect and organize all relevant documents—tax returns, receipts, invoices, bank statements, etc.

Understand the Concerns: Review the audit notice carefully, understanding the specific areas of concern.

Consult a Professional: Consider consulting a tax professional to review your documents and provide guidance.

Prepare Responses: Anticipate questions and prepare comprehensive, accurate answers to the auditor's queries.

Be Punctual: Timely responses and cooperation can streamline the process and reflect positively on your compliance.

During the Audit

Maintain composure and transparency during the audit. Answer questions honestly and provide requested documentation promptly. It's crucial to be respectful and cooperative, even if disagreements arise.

Resolving the Audit

Upon completion, the auditor presents findings. If discrepancies are identified, options include:

Agreeing with Findings: Agreeing to proposed changes and paying additional taxes or penalties if applicable.

Disagreeing with Findings: If you disagree, you can appeal within the tax agency or judicial system.

Negotiation: Negotiating a settlement, such as a payment plan, to resolve the discrepancies.

Conclusion

Income tax audits, while often nerve-wracking, are a standard procedure to ensure tax compliance. Being organized, maintaining accurate records, and seeking professional guidance can alleviate the stress associated with audits. Understanding the process and cooperating with auditors go a long way in ensuring a smoother and more favorable outcome. Remember, being prepared is key to navigating the audit process successfully.

0 notes

Text

Steps for fraud prevention - IT Services in Dubai by Chipin

According to reports, 33% of organisations encounter increased fraud every year. Internal concerns such as embezzlement and asset theft that go undiscovered might expose your organization to additional deceptive financial information, resulting in IRS engagement and significant revenue losses.It is critical to use fraud prevention and detection measures to reduce this loss. Every firm should have a strategy in place since avoiding fraud is considerably easier than recovering damages after the fact. Accounting and audit services can help to avoid such scenarios and detect financial fraud. It can assist you in determining wherever the money has gone and how to recover it.

The consequences of retail fraud

Retailers risk losing money, consumer confidence, and reputational harm if a major attack or breach of security occurs without the proper fraud protection services. In an omnichannel retail market, businesses of all levels are exposed.

Consider the damage done to your company and consumers once credit card data is hacked or login accounts are compromised. These occurrences might result in lost income and long-term brand harm. Furthermore, stolen private details can lead to negative credit scores and can follow your clients for years by affecting their ability to qualify for loans, mortgages, and other kinds of credit.

Steps for Fraud Prevention

While building an omni – channel strategy is crucial in today’s retail world, it is critical to do so while simultaneously concentrating on fraud protection. Keeping this mind, the following quick procedures can assist you in detecting red signs and discouraging fraudulent actors:

When making payments, confirm credit card information, including security codes.Keep meticulous documents of all transactions, regardless of where they occur.Learn about the many forms of fraud and how fraud protection services may safeguard your company.

If you see any questionable activity or transactions, contact the credit card company.

Although people want to have a similar buying experience through all channels, businesses require a consistent method of authenticating customers’ identities. This form of authentication is still in the works, although there are advanced fraud prevention tools available right now.

Types of fraud in business

Understanding the many forms of corporate fraud is helpful in combating and investigating it. The most prevalent kinds are as follows:

1.Identity Theft

Due to the large amount of unlawful currency floating around, you may stumble across bogus banknotes. Money fraud might occur without your or the customer’s knowledge. When you attempt to transfer the money at the bank, however, counterfeit money is useless.

The most prevalent counterfeit banknotes are high-value denominations, such as $100 bills. If you accept fake money, you will not profit from the deal. Worse, you can wind up handing genuine money as exchange for a forged bill.

2.Financial Crimes

Money scam might occur without your or the client’s knowledge. When you attempt to transfer the money at the bank, however, fake money is useless.

Learn how to identify whether money is phony to guard your new business from money fraud. Embossed printing, essential part of overall, watermarks, and colour scheme ink are all elements that should be visible on lawful cash. Additionally, train your personnel to double-check cash before taking it.

3.Payroll

Employees may request wage bonuses without repaying them. Employees may also lie about the amount of time spent on their timesheets. Employees might also request that coworkers clock in for them despite the fact that they aren’t there.

Conduct background checks on all new workers before hiring them. You should also examine payroll accounts to detect fraudulent activities early on.

Use SaaS payroll services to approve payroll before paying employees and to process and report of their salary level and hours in your system. Don’t wait until your company has spent a lot of money to begin keeping a close eye on things!

Looking for fraud prevention and detection services that use machine learning, for example. Deep learning technology is capable of recognizing and learning from complicated patterns. It discovers relationships by taking a comprehensive look at fraudulent behaviour and is significantly more reliable than laws technologies.

Picking a Fraud Prevention Strategy

What skills must you search for once you’ve decided to use a fraud protection solution? And how will this contribute to the protection of your company and its customers? Consider the following features

Purchase security: Aids in the protection of your online income by raising bank acceptance rates and lowering checkout friction, which can lead to abandoned carts.

Loss avoidance:Provides store managers and investigators with ways for preventing loss and taking action by spotting probable fraud on returns and reductions for omnichannel transactions rapidly.

Account safety: Protects your reputation, income, and client accounts by blocking unauthorised account access, account number, and account takeovers.

In addition to these issues, you should consider if a suspected fraud security company is a self contained solution, how it combines with your other general merchandise technologies, and which type of trying to report it creates, how it claims to support a seamless user experience, and whether technical support is available in the event you require it.

0 notes

Text

6 Different Types of IRS Transcripts

The Internal Revenue Service (IRS) provides taxpayers with various transcripts to help them understand their tax situation. These transcripts are important documents that provide information about a taxpayer's income, taxes, and other financial information. There are six types of IRS transcripts: Tax Return Transcript, Account Transcript, Record of Account Transcript, Wage and Income Transcript, Verification of Non-filing Letter, and Tax Account Transcript.

Tax Return IRS Transcript

The Tax Return Transcript is a document that contains information from a taxpayer's original tax return. This IRS Transcript includes line-by-line details of the return, including any adjustments made after the return was filed. This transcript is typically used to verify income and tax filing status for loan applications, student aid applications, and other financial transactions.

Account Transcript

An Account Transcript from the IRS provides a detailed summary of the activity that has taken place on your account over the past three years. It includes information such as balance due, payments, penalties, adjustments, and other changes. This IRS transcript can help resolve tax disputes, understand past tax returns, and verify tax payments.

Record of Account Transcript

The Record of Account Transcript summarises an individual's tax account information, including tax return information, current balance details, payment history, and other tax-related transactions. This transcript provides an overview of all taxes owed or paid by the taxpayer and any adjustments made to the account. It is an important document to review when filing taxes, as it can help taxpayers ensure that all taxes have been paid and that their records are accurate. It can be used to determine whether a taxpayer is eligible for certain tax credits or deductions.

Wage and Income Transcript 1098, 1099, and 5498

The Wage and Income Transcript summarises the information reported to the IRS from various sources such as employers, banks, and other payers. This IRS transcript includes all wages, salaries, tips, and other taxable income reported to the IRS on Form W-2, 1098, 1099, and 5498, and other information returns. It also includes certain adjustments to income, such as student loan interest deductions and IRA contributions. The Wage and Income Transcript is a valuable tool for verifying income and ensuring accuracy when filing taxes.

Verification of Non-filing Letter

A Verification of Non-filing Letter is an official document from the Internal Revenue Service (IRS) that confirms that the IRS has no record of a filed Form 1040, 1040A, or 1040EZ for the year requested. This letter is used to verify that an individual did not file a federal income tax return for the specified tax year. Individuals and organizations can request this letter for various reasons, such as providing proof of non-filing for student loan deferment, demonstrating eligibility for public assistance programs, or proving income for mortgage or loan applications.

Tax Account Transcript

The Tax Account Transcript is an IRS document that summarises an individual's tax account information. It includes details such as the amount of taxes due, payments made, and adjustments to the account. It is important to note that the Tax Account Transcript does not include any information about refunds or credits.

To Conclude

It is important to understand the different types of IRS transcripts available as they can be used to verify income, apply for loans, and meet other financial needs. Knowing the type of transcript you need and how to obtain it can save you time and effort. Ultimately, it is important to remember that IRS transcripts are a valuable tool for managing your finances.

#irs solutions tax resolution software#Tax Practice Management Software#tax resolution software#irs resolution software#irs transcripts#IRS resolution

0 notes

Text

How long will my direct deposit tax refund pending in Cash App?

Sometimes your request for cash doesn’t reach your account when you expect it to. If this is the case, consider re-sending your request after a specified time. You can also check your internet connection and account details to see if there is an issue. If these steps fail to resolve your issue, contact Cash App support.

Why is my IRS deposit pending on the Cash App?

If you’ve received your tax refund via direct deposit and haven’t received it on your Cash App, there are a few reasons why direct deposit pending on Cash App. In most cases, the problem is related to a routing number error. If this is the case, you need to contact your employer. They can help you identify the problem.

The most common cause of delayed IRS direct deposit on Cash App is an incorrect routing number or server error. These issues can be solved by contacting your bank or IRS and providing them with the correct account and routing numbers.

If you are using a payment card, ensure it has sufficient funds to receive the direct deposit from the IRS. You can manually transfer the money from the IRS to your Cash App if it isn’t.

In some rare cases, you might experience a delay if you have the wrong routing number, bank name, or account number.

Using an outdated Cash App version may also result in delays. However, these problems can be avoided by ensuring that your Cash App has a current version of the IRS website and the IRS’s system.

How long will my tax be pending in the Cash App?

You can check the status of your refund on the Cash App website and find out how long it will take to be posted in your bank account. It may take up to five business days to process your refund. You can also choose to receive your refund through the mail or by sending a check if you have no access to an online bank. However, if you are concerned that your refund will not be deposited in time, you should contact your employer or tax agency to get it resolved.

There are a few reasons why Cash App direct deposit tax refund pending. You may have entered outdated information, or your device might have network problems. Another reason is that the tax refund may not have been processed after you updated your app.

What time does direct deposit hit Cash App?

When you receive a direct deposit in Cash App, you may wonder how long the funds will take to hit your account. Sometimes, your deposit could come two days early, while it might take longer. You can determine what time does direct deposit hit Cash App by following simple steps.

First of all, direct deposit times may differ from one bank to another. The funds should hit your Cash App account between two and four a.m. PT on the scheduled payday. However, depending on your financial institution and your employer’s processing schedule, they may arrive earlier or later. To avoid problems, you should check your banking account settings to see when your deposit is scheduled to hit your account.

If you have a slow connection, processing your transaction may take a while. Additionally, if you have more than one account open simultaneously, you may experience delays. Contact the Cash App support team for assistance if you have trouble receiving your deposit.

0 notes

Text

What Time of Day Does Cash App Deposit Typically Hit?

If you're working for a company that uses Cash App, you may wonder when your paycheck will be deposited. While the exact Cash App direct deposit time may vary from bank to bank, the general rule is that your direct deposit will hit your bank between two and four a.m. PT on the scheduled payday. However, reaching your bank may take up to a day if you need to get your paycheck earlier. In that case, you'll want to check the time of your direct deposit so you can access your funds the same day.

The time that your Cash App direct deposit will hit your account depends on the payor. However, most direct deposits are posted between noon and six a.m. on your scheduled payday, so be sure to verify the timing with your payroll department or other employees, especially if you work at more than one location.

Usually, your deposit will hit your bank account between 12 am and 3 am. However, there are times when it will hit at a different time of day. Most bank accounts update between 1 am and 4 am, while deposits from the IRS, SSI, and tax refunds post between 2 am and 5 am.

How to view your Cash App direct deposit?

Once you've signed in to your bank account, you can quickly check to see if your direct deposit has been received. To do this, visit the Transactions section of your bank website. You'll find a list of your direct deposits, including Cash App deposits.

You can edit and save the information you need to receive the deposit on the deposit form. You can also print or email the form. If you don't have an email address for your bank, you can use a screenshot to save it. You can type in the information needed if you'd prefer to use a pre-filled form.

In most cases, your Cash App direct deposit hit your bank account within a day or two of receipt. However, depending on your employer, the first deposit may take longer than the rest.

Why is direct deposit pending on Cash App?

If you've requested a direct deposit through Cash App and haven't yet received it, you may wonder why it's pending. This Cash App direct deposit pending issue can occur because of connectivity problems, or the payroll provider may have entered the wrong details.

First, make sure that your bank account is active.

Check to see if you have more than $1,000 in it. If the balance is below $1,000, then the direct deposit may be unable to process the transaction.

If you still need help receiving your payment, contact your employer and ask them to recheck the details.

You can also contact Cash App support to resolve a pending payment.

0 notes

Text

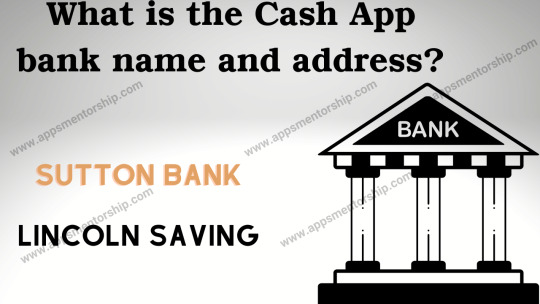

What is Cash App Bank Name? Know About Cash App Bank

If you're wondering, "What is the Cash App bank name?" you've come to the right place. This article will explain what a bank account is and whether or not Cash App is a bank. We'll also talk about Lincoln bank and how to set up your Cash App direct deposit account. Read more information on the Cash App bank name and other features. Hopefully, you'll be able to use this service without any problems.

Is a Cash App a Bank Account?

Peer-to-peer mobile payment apps have become a popular digital solution for everyday consumers. They provide a way to pay friends, make payments, and invest your money without having a traditional bank account. Cash App is one of these services and has recently been the subject of several fraudulent activities. What are the benefits of the Cash App? Read on to learn about this peer-to-peer payment app.

Cash App allows you to send and receive money without a traditional bank account, which makes it ideal for small-scale transactions. Cash App is also a convenient way to request payments from friends and roommates. However, it does have several limitations. The cash you receive or send is limited to $1,000 a month, and you must verify your account before using it.

What is the relation between Cash App And Lincoln bank?

Lincoln Savings Bank is a state-chartered, federally-insured bank in Iowa. Founded in 1865, the bank has a long history in the area. As the central bank for Iowa, it was known for its support of agriculture. Cash App allows its customers to transfer money from one account to another, perform online banking transactions, and even make ATM withdrawals. The company also offers an associated debit card called the Cash Card. Lincoln Savings Bank also supports the Cash App by partnering with Square Incorporation, an international provider of financial services. Cash App users can perform basic financial transactions through this partnership and extend their operations to new areas.

While Cash App and Lincoln Savings Bank are not the same, they are complementary and can be used for the same purpose. For example, Cash App users can receive and send money to each other without visiting a bank, while those who use Cash App can buy and sell stocks, transfer money, and accept Bitcoin payments. Lincoln Savings Bank and Cash App are different, but they can work together to provide customers with an innovative and convenient experience.

How to Enable Direct Deposit Account on Cash App?

You can enable direct deposit on Cash App by following a few steps. First, you need to activate your Cash App card. Make sure you use a secure browser. Then, go to the Cash App's settings page and click "Set Up Direct Deposit". Be sure to enter your account number and routing number. You can contact the Cash App support team if you have any questions. If you have problems, follow these steps:

You must first set up your Cash App account. This is done by providing your employer's routing and account numbers. After this, you should update your payment details with the IRS. You can find this tool on the IRS's website. Then, you can receive your stimulus check. Hopefully, this article will help you get started with your new account. We hope you enjoy the new features and benefits of the Cash App.

0 notes

Text

How to get a Cash App direct deposit on time when it is pending?

If you receive a direct deposit notice from your employer through Cash App, but it says that it is pending, there are several possible causes. For example, your software may be corrupt or outdated, and your employer’s information may not be accurate. If this is the case, you can try re-installing the software. Ensure all the details are correct, and try re-entering your employer’s information.

Also, check your routing number. If it’s incorrect, it could be due to several different reasons, including outdated or inactive payment cards, an invalid CVV code, or a violation of the Cash App terms of service. Ensure all your personal and banking information is correct to ensure your Cash App direct deposit will be received. Contact your employer or Cash App support if you still have Cash App direct deposit issues.

Why does the Cash App say the direct deposit is pending?

If you are using a Cash App to receive your paychecks, you may wonder why your direct deposit is “pending.” This error usually happens when the routing number is incorrect, and you will need to contact your bank or the app’s support team for assistance. Most transactions via Cash App are instant, but you may have to wait for a few days if your Cash App direct deposit is pending.

The first step is to check your account to see if the payment has gone through. If not, there could be a security issue or another reason.

You may not have enough funds or an older device that hasn’t been updated or charged.

If your bank limits payments to unverified accounts, consider limiting payments to this account.

Another common cause of this error is a lack of connectivity. When the Cash App server is down or not responding to your requests, your payment may be delayed or not reach your bank.

This is dangerous, and you should check that your internet connection is stable and up-to-date.

Why is Cash App direct deposit IRS tax refund pending?

There are a few reasons why you may not be able to receive your direct deposit from the IRS. These include a bug, a compromised account, and adding an unauthorised person to your account. Fortunately, there are easy solutions to fix these problems. The Cash App direct deposit tax refund pending could be due to several reasons, including a problem with your mobile phone, a network problem, or a temporary problem. Follow the steps below to make sure your direct deposit is being processed properly.

You may be experiencing network errors — the most common reason for this problem.

Make sure your banking information is up-to-date, and the app is updated.

Also, check your internet connection and contact your employer or the IRS to find out what is causing the problem.

If you still cannot receive your tax refund, contact the IRS and ask for further assistance.

Your bank or employer might have entered your routing number incorrectly.

If your direct deposit is delayed, contact your employer and ask them to verify your details.

How to get a Cash App direct deposit on time?

If you use a Cash App to pay your bills, you want to ensure you get your money on time. This way, you won’t be stuck with late payments. However, sometimes there are issues with the server that cause your Cash App transaction to be delayed. One example of this is if another account is open at the same time. If this happens to you, receiving your money can take several days.

0 notes

Text

What is Cash App Bank Name? Know About Cash App Bank

If you're wondering, "What is the Cash App bank name?" you've come to the right place. This article will explain what a bank account is and whether or not Cash App is a bank. We'll also talk about Lincoln bank and how to set up your Cash App direct deposit account. Read more information on the Cash App bank name and other features. Hopefully, you'll be able to use this service without any problems.

Is a Cash App a Bank Account?

Peer-to-peer mobile payment apps have become a popular digital solution for everyday consumers. They provide a way to pay friends, make payments, and invest your money without having a traditional bank account. Cash App is one of these services and has recently been the subject of several fraudulent activities. What are the benefits of the Cash App? Read on to learn about this peer-to-peer payment app.

Cash App allows you to send and receive money without a traditional bank account, which makes it ideal for small-scale transactions. Cash App is also a convenient way to request payments from friends and roommates. However, it does have several limitations. The cash you receive or send is limited to $1,000 a month, and you must verify your account before using it. For more significant transactions, you should consider using PayPal or TransferWise.

What is the relation between Cash App And Lincoln bank?

Lincoln Savings Bank is a state-chartered, federally-insured bank in Iowa. Founded in 1865, the bank has a long history in the area. As the central bank for Iowa, it was known for its support of agriculture. Cash App allows its customers to transfer money from one account to another, perform online banking transactions, and even make ATM withdrawals. The company also offers an associated debit card called the Cash Card. Lincoln Savings Bank also supports the Cash App by partnering with Square Incorporation, an international provider of financial services. Cash App users can perform basic financial transactions through this partnership and extend their operations to new areas.

While Cash App and Lincoln Savings Bank are not the same, they are complementary and can be used for the same purpose. For example, Cash App users can receive and send money to each other without visiting a bank, while those who use Cash App can buy and sell stocks, transfer money, and accept Bitcoin payments. Lincoln Savings Bank and Cash App are different, but they can work together to provide customers with an innovative and convenient experience.

How to Enable Direct Deposit Account on Cash App?

You can enable direct deposit on Cash App by following a few steps. First, you need to activate your Cash App card. Make sure you use a secure browser. Then, go to the Cash App's settings page and click "Set Up Direct Deposit". Be sure to enter your account number and routing number. You can contact the Cash App support team if you have any questions. If you have problems, follow these steps:

You must first set up your Cash App account. This is done by providing your employer's routing and account numbers. After this, you should update your payment details with the IRS. You can find this tool on the IRS's website. Then, you can receive your stimulus check. Hopefully, this article will help you get started with your new account. We hope you enjoy the new features and benefits of the Cash App.

#Cash App bank and address#cash app institution name#direct deposit cash app bank name#How to Find Cash App Bank Name Routing and Account number#Sutton Bank and Lincoln Savings Bank#enable direct deposit on Cash App#What is a Cash App bank name and address

0 notes

Text

How Long Does It Take To Obtain A Vessel Abstract Of Title?

If you are the owner of a boat owned by the US Coast Guard, you are aware of the significance of maintaining your vessel’s documentation. The amount of time necessary to acquire an abstract of title for a vessel is a topic of inquiry for many owners. In the following blog post, we will explain the procedure in detail and provide you with an anticipated completion time frame. It is essential to keep in mind that the difficulty of your situation may cause this time frame to shift in some way. You may be a USCG boat owner curious about the requirements necessary to acquire an abstract of title for their vessel. Although the procedure might be slightly different depending on the state in which you live, some requirements are universally necessary. Having this information at your disposal in advance can assist in making the process run more efficiently. Here is the information that you require.

You Must Be the Legal Owner of The Vessel

Ensure to be the ship’s legal owner to charter it (or, at the very least, an authorized representative). This indicates that you must have the appropriate papers, such as the bill of sale or title that is officially issued. A bill of sale for any autos involved in the transaction is also necessary. For a third-party refinance of your boat, the bank must also grant the third-request party authorization. In other words, if you have a purchase bill of sale from a prior owner who is ready to transfer ownership upon the vessel’s delivery, and if that agreement contains a section titled “Assignment of Title,” then the procedure will be more straightforward for you to complete.

The Vessel Must Have a Hull Identification Number (HIN)

When it comes to titling, boats that do not have a hull identification number, also known as a HIN, are not allowed. When a vessel is registered with the state, the United States Coast Guard will assign it a unique and identifiable number. This number is called the HIN. Nevertheless, the application and acquisition of a HIN for your vessel may take a somewhat different course of action depending on the state in which you make your primary residence. According to defense.gov, if you have just acquired a new vessel, the HIN will have been installed on it before your purchase. You may apply for the HIN by contacting the local office of the Department of Natural Resources or the title office of your state; alternatively, you can register your vessel with your state, as is necessary.

There Is a Processing Fee Associated with Obtaining a Vessel Abstract of Title.

If you have never had to get a Vessel Abstract of Title before, the process may seem like a mystery to you. This is particularly true if you have never had to do it before. It’s possible that you’re confused about where you should go or who you should speak to. The good news is that the procedure is relatively easy and uncomplicated; nevertheless, there are a few conditions that you will need to complete to receive an abstract of title for a vessel. From beginning to end, the whole procedure takes around one month, with new acquisitions being the sole exception to this rule. If you seek to acquire an abstract for a vessel that is already in existence, the process will take more time since the state agency responsible for maintaining such records will need to fulfill your request. The application cost is usually paid in full when the application is submitted; however, the processing charge might vary from state to state.

The Vessel Must Have Been Registered with Such

A title must be procured from either the United States Coast Guard (USCG) or the Nevada Department of Business and Professional Regulation (NVDB) for it to be regarded as legitimate and immune to dispute by the Internal Revenue Service (IRS) (National Vessel Documentation Bureau). Unfortunately, many registered boats do not own a title, which may create significant difficulties for prospective buyers. The boats you are searching for also need to have “documentation” under the law to be legal. The majority of vessels that operate inside the United States must have their documentation on file with the United States Coast Guard (USCG). This stipulates that boats whose owners have insurance will have a record of ownership, which will contain information about the vessel and details of its travels. The information will be kept for a certain amount of time.

Call the specialists at the U.S. Vessel Documentation Center for a free vessel abstract of title quotation if you’re interested in transferring a boat but need assistance obtaining the proper paperwork. We have identified dozens of boats throughout the years and can assist in discovering your boat’s papers or get you started on your hunt! Call us immediately at (800) 340-7580 to begin searching for your vessel’s documentation.

0 notes

Text

Tips On How To Do Financial Institution Reconciliations

The first thing you’ll want to do is a side-by-side comparability of your financial institution assertion and your bookkeeping record. Look at each transaction after which at the finish steadiness to see if they match perfectly. There are two sides to a bank reconciliation - the bank facet and the e-book side. Most accounting software solutions don’t have detailed native integrations with all the fee platforms you may be using. Synder provides you with such an option and helps you cover the opposite half of account reconciliation. Use Synder to attach your fee platforms, corresponding to Stripe, Square, Shopify Payments, or PayPal, amongst others, with your accounting software.

For any transactions which have yet to display in your bank assertion, remember to take them into consideration. These may embody deposit in transit, bank errors, and excellent checks, for instance. These errors could possibly be these of omission or entering the mistaken quantity. We’ll go over every step of the bank reconciliation process in additional detail, but first—are your books up to date?

While this variance analysis may be conducted manually, by the point you recognise the distinction between actuals and anticipated quantities, it could be too late to resolve them. While the reconciliation is operating, they’ll both be notified of a clear completion or alerted to any anomalies which will exist for correction. To keep away from double cost, you would possibly also need to void the potential replacement examine that may have been created. At the underside of your spreadsheet for February, add this note, tracking adjustments to your balance. Free Financial Modeling Guide A Complete Guide to Financial Modeling This resource is designed to be the most effective free guide to financial modeling!

With that data, now you can regulate each the balance out of your bank and the balance out of your books so that every displays how much cash you actually have. If there’s a discrepancy between your accounts and the bank’s information that you can’t clarify another way, it might be time to speak to somebody on the bank. We’re going to take a look at what financial institution assertion reconciliation is, how it works, when you have to do it, and the finest way to handle the duty.

Income Tax Planning & Return Preparation

The skilled accounting groups at Haskell & White present innovative and reliable tax solutions that can assist you confidently meet the longer term. At Korhorn Financial Group, our tax planning and accounting group goes beyond the numbers to supply proactive advice and steerage to help preserve your assets by way of tax-efficient investing and long-term planning. To greatest meet your private and business needs, our Tax Planners work in live performance with our Values-Based Financial Planners to make sure all pieces of your financial life are aligned to help support your success.

Why give Uncle Sam extra when there are methods to handle and to plan for a taxpayer’s financial and tax situation more effectively? At Perelson Weiner, we're in constant contact with our clients about personal situations that arise as nicely as updating them on the new tax laws . Kindred CPA is an accounting firm based in Lawrence, Kansas that serves individuals and organizations nationwide. Our specialty is in services to restaurants, small businesses and nonprofit organizations. With over one hundred years of mixed expertise from our leaders, we take satisfaction within the high quality service we provide and in serving to our shoppers stay on high of their accounting, payroll, tax and consulting wants.

212 Tax also provides handy, attentive service to UN staff working abroad. We are full-time service providers, not just seasonal tax return preparers, so we’ll be there if you need us. Request a consultation today to debate how 212 Tax & Accounting Services might help you meet IRS compliance requirements, reduce tax funds, and accomplish your tax targets. At Nolan Accounting Center, we satisfaction ourselves on constructing strong relationships centered on success.

Variations Between Auditing And Accounting

Whether there have been adjustments within the control or the method during which it operates for the reason that earlier audit. Controls that mitigate incentives for, and pressures on, administration to falsify or inappropriately handle monetary results. The complexity of a bookkeeping system usually depends on the size of the enterprise and the number of transactions completed every day, weekly, and monthly. All gross sales and purchases made by your corporation must be recorded within the ledger, and sure gadgets want supporting paperwork. The IRS lays out which enterprise transactions require supporting documents on their web site. Advance your profession in funding banking, personal fairness, FP&A, treasury, corporate development and different areas of corporate finance.

The statement of stockholders' (or shareholders') fairness lists the modifications in stockholders' fairness for a similar period because the earnings statement and the money flow assertion. The modifications will include gadgets corresponding to web revenue, other comprehensive income, dividends, the repurchase of widespread inventory, and the train of inventory options. The revenue assertion reviews a company's profitability during a specified time period. The time frame could presumably be one year, one month, three months, thirteen weeks, or another time interval chosen by the corporate. It contains some very complicated standards that have been issued in response to some very complicated business transactions. GAAP additionally addresses accounting practices that might be unique to particular industries, similar to utility, banking, and insurance coverage.

An effective monetary reporting construction begins with a reporting firm's management, which is answerable for implementing and properly applying generally accepted accounting requirements. Auditors then have the duty to test and opine on whether or not the financial statements are fairly offered in accordance with those accounting requirements. If these responsibilities are not met, accounting standards, regardless of their high quality, may not be correctly utilized, resulting in an absence of transparent, comparable, consistent financial info.

30 See "The FT International Accounting Standards Survey 1999, an assessment of the usage of IAS's by companies, national standard setting our bodies, regulators and stock exchanges," by David Cairns, revealed by The Financial Times, London, 1999. 23 See Appendix C for a dialogue of the development of the core standards work program. Examples of other areas identified within the comparative analyses that illustrate the availability of alternate options within IASC standards, U.S. IAS 37 provides a variety of recognition criteria for various items which will enter into the measurement of a provision.

Inside Auditor Ia Definition

The CPA’s goal in a evaluate engagement is to offer limited assurance that there aren't any materials modifications that ought to be made to the monetary statements. The CPA will make inquiries of administration and perform analytical procedures over the accounting data to obtain this level of assurance. The CPA may even problem a report that describes management’s duties with respect to the financial statements, the CPA’s responsibilities, and what the CPA’s conclusion is regarding whether or not the CPA is aware of any material modifications that ought to be made to the monetary statements. If the CPA identifies materials modifications in the course of the review, the CPA will bring these to the eye of management and give them the chance to appropriate those issues before the ultimate report is issued. In planning the audit, the auditor develops an audit program that identifies and schedules audit procedures which might be to be performed to obtain the proof. Audit procedures embrace these activities undertaken by the auditor to acquire the evidence.

As the Association of Certified Fraud Examiners explains it, “The inner audit function helps a corporation accomplish its aims by bringing a scientific, disciplined strategy to judge and enhance the effectiveness of risk management, control, and governance processes. The stage of service a corporation needs is decided by the wants of the monetary assertion users (management & board of administrators, external company, etc.). Each service provides a different degree of assurance (or “reliability”), to the users of the financial statements. The four providers to suppose about are preparation, compilation, review, and audit. Compilations – Financial assertion compilation services provide for the meeting of your organization’s monetary data out of your accounting data into the type of financial statements.

In Part 2, the term “professional accountant” refers to professional accountants in business. This term is used in the Code to denote the possibility of a matter arising, an event occurring or a course of action being taken. The time period doesn't ascribe any specific stage of risk or chance when used at the aspect of a threat, because the analysis of the extent of a threat is decided by the facts and circumstances of any specific matter, event or plan of action. An interest in an fairness or different safety, debenture, mortgage or other debt instrument of an entity, including rights and obligations to acquire such an curiosity and derivatives directly associated to such interest. Beneficially owned through a collective investment car, property, trust or other middleman over which the person or entity has management, or the flexibility to affect funding choices. In this Glossary, explanations of defined terms are proven in common font; italics are used for explanations of described phrases which have a particular which means in certain components of the Code or for added explanations of outlined terms.

These representations are generally referred to as Audit Assertions, Management Assertions, and Financial Statement Assertions. Performed by exterior organizations and third parties, external audits provide an unbiased opinion that inner auditors might not have the ability to give. External monetary audits are utilized to discover out any material misstatements or errors in a company’s monetary statements.

Tips On How To Start A Consulting Business In 15 Steps

Industry evaluation reviews assist shoppers perceive the future of their enterprise. As a outcome, a business case research helps convert potential purchasers to new projects. Companies that use good methods and software program facilitate course of control and shield “the ROI” of operations.

Design Thinking, the core business service of MJV, is on the coronary heart of innovation processes. And, as you saw here, we strongly consider in innovation via processes. In the earlier merchandise, you got a glimpse of the process consultancy step-by-step. As we've seen, the service is able to making a company more productive through dynamic diagnostics, changes and monitoring of routines. Process consulting then comes into play, combining problem-solving, technology and administration approaches to create optimum strategies in corporate routines.

There are many options when it comes time to determine should you need help along with your paperwork. For example, a quick look through the Yellow Pages will reveal a variety of small secretarial help corporations. The rates will depend on quite a lot of elements, including how large or small an organization it is and what kinds of providers it provides. Not everyone, although, has the flexibility to conceive an thought and develop a sport plan. These days in case you are a computer consultant who can present staff how to master a new program, then your telephone in all probability hasn't stopped ringing for a while. A advisor could additionally be asked to show employees any variety of completely different abilities.

8 Financial Accounting Abilities For Enterprise Success

This article discusses methods you possibly can informally decide the worth of your business that you're considering promoting. Jay has greater than 20 years valuation and forensic accounting experience in each NZ and within the UK. His experience contains quite a few enterprise and intangible asset valuations ready for varied business purposes, including financial reporting, tax, restructuring, disputes and M&A. There are three widely accepted elementary strategies utilized in valuing closely held enterprise pursuits, the asset, income, and market strategy.

Several methods of valuing a enterprise exist, such as taking a glance at its market cap, earnings multipliers, or book value, among others. Business valuation determines the economic worth of a enterprise or enterprise unit. Adam Hayes, Ph.D., CFA, is a monetary writer with 15+ years Wall Street experience as a derivatives dealer. Besides his in depth spinoff buying and selling expertise, Adam is an skilled in economics and behavioral finance.

The work of a business valuation specialist is to determine the financial worth of a enterprise or company. They produce an in depth report that is used in a business sale, litigation matters, divorce proceedings, or in establishing partner ownership. Terminal worth determines the worth of a enterprise or project beyond the forecast period when future money flows may be estimated.

Another issue to contemplate is that the variety of publicly listed firms within the United States is going down. This can partially be attributed to non-public corporations taking longer to go public, however different elements embody widespread consolidation and an rising willingness and ability for big firms to operate privately. Over 會計師事務所 in the United States, the number of public firms has dropped roughly 45 percent . This drop challenges deal circulate, especially for entities which have historically appeared to public markets for deal sourcing, including larger fund managers and strategic acquirers. While a enterprise developer need not be succesful of provide IT assist this present day, communication, analysis, and evaluation all rely upon utilizing computer systems.

Accounting & Consulting Agency

Bookkeeping is certainly one of the most simple providers that accounting corporations supply. It largely entails the recording of the monetary transactions that a shopper or business does. Furthermore, bookkeepers are responsible for determining which accounts every transaction affects.

"With Raymond Lyle CPA PLLC, every shopper receives close personal and professional consideration." Promote thought leadership, develop long-term enterprise relationships, and maximize your small business opportunities — all whereas rising your firm’s backside line. Auto-posting any related story or information can help create a brand on social media – one the place you’re seen as an authority on tax and accounting topics.

If you dive into the social media area, it’s important that you simply embed it into your strategy, making sure to submit content material frequently and work together regularly with followers. Putting your agency in an surroundings where people are sharing, liking and ‘talking’ improves your visibility and may enhance traffic back to your web site. Included in updating your accounting firm’s web site is having keywords for Search Engine Optimization . SEO is the method of maximizing the number of guests to an web site by making certain that the location seems high on the list of results returned by a search engine.

We get pleasure from providing tangible worth to our purchasers and are deeply invested in your success. No matter your corporation targets, we've the experience and abilities to help you achieve them in a practical timeframe. We're more than pleased to give you a single service or package multiple companies together into one handy bundle.

Ultimate Guide For Small Business Bookkeeping

Wave hyperlinks with financial institution accounts and bank cards, so you can track bills mechanically. Although many companies start small, they do not always stay that way. You want accounting software program that can develop alongside your corporation, and Xero does exactly that.

These entities are defined to include PublicCo and all entities consolidated in the PublicCo monetary statements that aren't subject to rule a hundred and one [ET part 101.01] and its interpretations and rulings in their entirety. The former associate or professional worker just isn't in a position to affect the accounting firm's operations or monetary insurance policies. If customized software sold to a single purchaser is later bought to others, the later gross sales are sales of prewritten software program. The sale of customized software program to a subsequent purchaser that meets the requirements for a customized modification under 830 CMR 64H.1.three isn't taxable.

Monitoring may be completed through ongoing actions, separate evaluations or a combination of both. However, if a covered member's monetary interest in a nonclient investee is material, the coated member could be influenced by the nonclient investor, thereby impairing independence with respect to the shopper investee. If the nonclient investee is immaterial to the client investor, a lined member's material investment in the nonclient investee would trigger an impairment of independence. The graduation of litigation by the present administration alleging deficiencies in audit work for the shopper could be thought of to impair independence. Accept duty to authorize cost of shopper funds, electronically or in any other case, except as specifically offered for with respect to electronic payroll tax payments.

0 notes

Text

Watch "IRS Able to Look at Your Bank Account - Details | BIG CHANGES to $2 Trillion Spending Bill | News" on YouTube

Watch “IRS Able to Look at Your Bank Account – Details | BIG CHANGES to $2 Trillion Spending Bill | News” on YouTube

View On WordPress

#96% of USA doesn&039;t want IRS looking into their bank transactions#Biden admin wants National guard to unload barges and drive#food and supply shortages#home funds taken away from seniors#human infrastructure bill update#IRS can request your bank transaction details#IRS can see your deposits and withdrawals#IRS changes allow looking at your bank transactions#missionarys 17 kidnapped

0 notes

Text

What are the reasons for cash app not working

Some users from different states in the US were panicked since the Cash App is not working. Because of the enormous mistakes made as many users wonder why isn't my cash app working. But understand that this is not the only issue; users often face many common problems.

Keeping this in mind and in resolving the issues of users, I decided to write this blog and help users to resolve the most common Cash App issues:

cash app money not showing up in bank account

cash app borrow not showing up

cash app direct deposit not showing up

cash app instant deposit not working

cash app referral not working

cash app not scanning back of the id

cash app refund not showing up

Those mentioned above are some of the typical functioning issues on the Cash App. If the truth is known, a few issues include the Cash App payment issues, cash app instant deposit not working, Cash App login issues, or issue activating the Cash App and issues when loading money into a cash card are pretty common. However, it doesn't mean that these issues always occur on the Cash App. The Cash App, not working problems merely a result of small mistakes made by users and issues with the internet.

If you're an experienced user of Cash App, the idea is to address some things to avoid Cash App down problem. So let's begin to discuss so common issues and how to resolve this Cash App not working issue.

Cash app money is not showing in the bank account.

If you cannot transfer or receive money via those Cash App contacts, there are various possible reasons. For instance, it could be a possibility you have an internet issue or your connection isn't functioning correctly. Don't forget that there's a Cash App limit on the amount you can transfer. Moreover, ensure you have an internet connection that works perfectly.

Also, ensure that you're not any server in your bank while you transfer money via Cash App. However, if your area concerns not being able to receive or make a request for money, this means that the person you are asking for money isn't able to accept your request. In addition, you may be blocked by the contact.

Cash App Refund not showing up, What can I do to get an amount back through Cash App?

Generally speaking, if a payment is not successful due to a Cash App down issue, refunds are processed automatically within the next day. These are steps to address refund issues with Cash App:

Unlock your mobile and sign access to your account.

Click on your profile and scroll down to the bottom.

On the bottom there is on the far side, there is a "Cash Help" button. Tap it to move on.

To connect to the Cash App representative, select an alternative motive.

In this section, write down the reason for your failed payment and click the Contact Support button.

Then wait for a response from your Cash App representative.

To get immediate assistance and a refund, you can reach us at any time.

Cash App direct deposit not showing up. How do I fix this issue?

It is essential to know that to access the direct deposit on Cash App. Users have to, first of all, enable it via their account. In particular, that Cash App direct deposit activation procedure requires users to locate the Cash App routing number, bank account number, and the bank's name. Not only that, they have to provide all information to the bank that issued the check as well. Therefore, it is crucial to disclose the correct details to your employers, IRS, or other federal agencies.

Remember that you could receive up to $10,000 in just 24 hours. However, any attempt to send an amount greater than $10, 000 may cause an issue- Cash App direct deposit not showing up. Therefore, the goal is to complete two transactions within two days if you need to send or receive $10,000 via direct deposit.

What can you do to fix the Cash App instant transfer not working?

Follow the below-mentioned steps to fix the Cash App instant transfer not working:

Make sure that your device has an adequate internet signal.

Also, make sure the debit or credit card you're using to make a payment is not blocked or not functioning.

Another essential thing to keep in mind is that anyone can make a payment of up to $7500 per week. Therefore, ensure that you're not exceeding the limit.

Cash App can't verify my identity. A quick solution is available!

On Cash App, it is essential to confirm your identity. It is good to know that verifying your identity in the Cash App is very simple and fast. All you need to do is to give your SSN together with your other personal information.

If you've done this and still can’t verify your Cash App account, ensure that you're not violating the guidelines. For instance, the user must be older than 18 years old and citizens of both the US and the UK to access the Cash App in their own country. Beware of sending too many money requests to avoid being banned from Cash App.

#cash app not working#why is my cash app not working#how to use cash app boost#cash app money not showing up in bank account#why isn't my cash app working#cash app borrow not showing up

2 notes

·

View notes

Text

Cash App Direct Deposit: Features, Benefits, Use, and Failed/Pending

If you want to get paid on time from your employer, you can follow a few simple steps and set up a Cash App direct deposit. This is only a one time process in which you need to find your Cash App bank name and routing number for direct deposit. Lastly, you need to download and fill up the direct deposit form.

If you have not used Cash App or are a new Cash App user, you might be doubtful about Cash App performance. So, you might have such questions in your mind: can I use a Cash App for unemployment direct deposit? How long does Cash App direct deposit take? Hence, it's better to first contact us to understand everything about direct deposit service on Cash App. Alternatively, you can read this helping post and educate yourself.

Introduction to Cash App direct deposit

Is Cash App good for direct deposit? Yes, certainly, the Cash App is good for direct deposit. And to support this claim, there are many reasons. As the name suggests, Cash App direct deposit is a straight and direct way to receive money to your Cash App account. Once you set up a direct deposit feature on Cash App, you can receive a broad range of payments such as salary from your employer, tax refund & stimulus paychecks from IRS, interest, pensions, and so many other types of payments.

Direct deposit is a free service on Square Cash App. To enjoy this amazing feature, you need only two things. One is a verified Cash App account and second is an activated Cash App card. Read more about Cash App card. If are okay with these two things, you can enable direct deposit service on Cash App and reduce the risk of paychecks fraud, lost or stolen. Also, it is fast, simple, and hassle-free than traditional banks.

So, the million-dollar question is: how to set up direct deposit service on Cash App? Answer is simple. You need to press a few buttons and find the Cash App routing number for direct deposit and Cash App bank name.

What is a Cash App routing number and bank name for direct deposit?

You can think of the routing number as a nine digit code which secretly holds the information about bank name and location. Every authorized bank's branch has its own routing number. Though Cash App is not a bank, it has a routing number.

If the truth be told, Cash App has partnered with two banks. One is Lincoln Savings Bank and second is Sutton bank. As a result, Cash App is entitled to use their routing number. To find the exact bank name on your account you need to navigate through the Cash App mobile application on your phone.

The same is true with Cash App routing numbers. Upon checking the Cash App you can find your routing number. Either it might be of Sutton bank or Lincoln Saving Bank. Find below the more information.

How to enable direct deposit on Cash App? Get form for direct deposit

If you have already set up your Cash App account then you can follow the below mentioned steps to enable direct deposit service on Cash App:

Press the banking tab on your Cash App home screen.

Now choose Deposit & Transfers.

Choose copy details to your both routing number and account number.

On the same screen, in little words Cash App bank name for direct deposit will be written.

Now follow the simple steps and share your details.

Again tap on the banking tab and choose deposit and transfers.

Tap get Cash App direct deposit form.

Fill out all the required details about you and your employer.

Lastly, sign the form and email it.

Benefits of Cash App direct deposit unemployment

World is facing the wrath of the Covid-19. Millions of people have lost their jobs due to the adverse effects of Covid-19. Taking it on a serious note, the US Government, in the month of March 2020, announced the financial aid to eligible citizens of the US. More specifically, the US Government announced to send the paychecks in three installments. Good news is that a large number of people preferred to use Cash App over their traditional bank accounts. As of now, most of the eligible paychecks have been received by the eligible applicants.

If you have not received unemployment Cash App direct deposit, you don't need to worry. With the help of a Cash App representative, you can fix the issue. Cash App unemployment direct deposit is safer and faster than the banks. Cash App has deposited the payments through unemployment check two days earlier than the banks. If the US Government is ready to issue fourth unemployment aid, you can use your Cash App account.

Why did my unemployment direct deposit fail on Cash App? It might be your next question!

Cash App direct deposit unemployment might take up to 4-5 business days to deposit unemployment funds to your wallet. But, if you have not received your last stimulus check then chances are high that you have shared the incorrect details. For example, you might have forgotten to share your SSN. Any mistake in filling up a form and lack of documents in the process of tax return can prevent you from receiving your unemployment payment. Get more explanation about Cash App unemployment direct deposit problems in the next section.

Cash App direct deposit problems

Cash App direct deposit pending: As we all know that most of the government offices are working with insufficient manpower, the efficiency and quality of work has dropped to a drastic level. The same is true with the IRS. Due to millions of requests, a bottleneck has formed and thousands of eligible applicants are unable to get paid on time. So, the idea here is to just wait. Government has set the deadline up to December 2021.